Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - SusGlobal Energy Corp. | exhibit32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - SusGlobal Energy Corp. | exhibit31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - SusGlobal Energy Corp. | exhibit31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-Q

(Mark One)

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2017

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________ to ________________

Commission file number 333-209143

SUSGLOBAL ENERGY CORP.

(Exact name of registrant as specified in its charter)

| Delaware | 38-4039116 |

| (State or other jurisdiction of incorporation or | (I. R. S. Employer Identification No.) |

| organization) | |

| 200 Davenport Road | M5R 1J2 |

| Toronto, ON | |

| (Address of principal executive offices) | (Zip Code) |

416-223-8500

(Registrant’s telephone number,

including area code)

Not applicable

(Former name, former

address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes [

] No [ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such

files).

Yes [ ] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

| (Do not check if a smaller reporting company) | |

| Emerging growth company [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. [ ]

Indicate by check mark whether the registrant is a shell

company (as defined in rule 12b-2 of the Exchange Act).

Yes [

] No [X]

The number of shares of the registrant’s common stock outstanding as of August 14, 2017 was 36,486,861 shares.

| SusGlobal Energy Corp. |

| INDEX TO FORM 10-Q |

| For the Three and Six-Month Periods Ended June 30, 2017 and 2016 |

| SusGlobal Energy Corp. |

| June 30, 2017 and 2016 |

| (Expressed in United States Dollars) |

| (unaudited) |

| Table of contents |

| SusGlobal Energy Corp. |

| Interim Condensed Consolidated Balance Sheets |

| As at June 30, 2017 and December 31, 2016 |

| (Expressed in United States Dollars) |

| (unaudited) |

| June 30, 2017 | December 31, 2016 | |||||

|

ASSETS |

||||||

|

Current Assets |

||||||

|

Cash |

$ | 31,998 | $ | 1,774 | ||

|

Term deposit |

- | 148,960 | ||||

|

Trade receivables, no allowance |

- | 9,127 | ||||

|

Harmonized sales taxes receivable |

4,856 | 16,084 | ||||

|

Prepaid expenses |

49,460 | 19,586 | ||||

|

|

||||||

|

Total Current Assets |

86,314 | 195,531 | ||||

|

|

||||||

|

Asset Purchase Commitment (note 6) |

462,360 | - | ||||

|

Intangible Asset (note 7) |

1,570 | 1,670 | ||||

|

|

||||||

|

Long-lived Assets, net (note 8) |

2,724 | 880 | ||||

|

Total Assets |

$ | 552,968 | $ | 198,081 | ||

|

|

||||||

|

LIABILITIES AND STOCKHOLDERS’ DEFICIENCY |

||||||

|

Current Liabilities |

||||||

|

Accounts payable (note 9) |

$ | 184,626 | $ | 292,595 | ||

|

Accrued liabilities (note 9) |

142,828 | 173,157 | ||||

|

Credit Facilities (note 10) |

1,232,960 | - | ||||

|

Loans payable to related party (note 11) |

161,826 | 217,482 | ||||

|

|

||||||

|

Total Liabilities |

1,722,240 | 683,234 | ||||

|

|

||||||

|

Stockholders’ Deficiency |

||||||

|

|

||||||

|

Preferred stock, $.0001 par value, 10,000,000

authorized, none issued and |

||||||

|

Common stock, $.0001 par

value, 150,000,000 authorized, 36,436,861 |

3,644 | 2,004,407 | ||||

|

Additional paid-in capital |

2,658,757 | - | ||||

|

Stock compensation reserve |

165,000 | - | ||||

|

Accumulated deficit |

(3,907,201 | ) | (2,447,815 | ) | ||

|

Accumulated other comprehensive loss |

(89,472 | ) | (41,745 | ) | ||

|

|

||||||

|

Stockholders’ deficiency |

(1,169,272 | ) | (485,153 | ) | ||

|

|

||||||

|

Total Liabilities and Stockholders’ Deficiency |

$ | 552,968 | $ | 198,081 |

Going concern (note 2)

Commitments (note 13)

The accompanying notes are an integral part of these consolidated financial statements.

Page | 04

| SusGlobal Energy Corp. |

| Interim Condensed Consolidated Statements of Loss and Comprehensive Loss |

| For the three and six-month periods ended June 30, 2017 and 2016 |

| (Expressed in United States Dollars) |

| (unaudited) |

| For the three-month periods | For the six-month periods | |||||||||||

| ended | ended | |||||||||||

| June 30, | June 30, | June 30, | June 30, | |||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||

| Operating expenses | ||||||||||||

| Financing costs (note 10) | $ | - | $ | - | $ | 882,153 | $ | - | ||||

| Contribution to Advanced Water Technology Program (note 13 (d)) | - | - | 71,017 | - | ||||||||

| Professional fees | 36,374 | 47,690 | 88,359 | 89,104 | ||||||||

| Office and administration (note 9) | 48,979 | 21,608 | 93,619 | 42,191 | ||||||||

| Management fees (note 9) | 40,149 | 32,634 | 80,946 | 63,252 | ||||||||

| Interest expense (note 9) | 22,096 | 1,910 | 42,686 | 3,816 | ||||||||

| Stock-based compensation (note 9) | 95,700 | - | 191,250 | - | ||||||||

| Filing fees | 5,467 | 2,268 | 9,356 | 3,159 | ||||||||

| Total operating expenses | 248,765 | 106,110 | 1,459,386 | 201,522 | ||||||||

| Net loss | (248,765 | ) | (106,110 | ) | (1,459,386 | ) | (201,522 | ) | ||||

| Other comprehensive loss | ||||||||||||

| Foreign exchange loss | (39,884 | ) | (5,529 | ) | (47,727 | ) | (25,467 | ) | ||||

| Comprehensive loss | $ | (288,649 | ) | $ | (111,639 | ) | $ | (1,507,113 | ) | $ | (226,989 | ) |

| Net loss per share-basic and diluted | $ | (0.01 | ) | $ | (0.00 | ) | $ | (0.04 | ) | $ | (0.01 | ) |

| Weighted average number of common shares outstanding- basic and diluted | 36,190,291 | 32,560,225 | 36,042,945 | 32,297,450 | ||||||||

The accompanying notes are an integral part of these consolidated financial statements.

Page | 05

| SusGlobal Energy Corp. |

| Interim Condensed Consolidated Statements of Changes in Stockholders’ Deficiency |

| For the six-month period ended June 30, 2017 and year ended December 31, 2016 |

| (Expressed in United States Dollars) |

| (unaudited) |

| Number of | Common | Additional Paid- | Stock | Accumulated | Accumulated Other | Stockholders’ | |||||||||||||||

| Shares | Shares | in Capital | Compensation | Deficit | Comprehensive Loss | Deficiency | |||||||||||||||

| Reserve | |||||||||||||||||||||

| Balance – December 31, 2015 | 31,547,346 | $ | 1,646,091 | $ | - | $ | - | $ | (1,896,286 | ) | $ | (8,538 | ) | $ | (258,733 | ) | |||||

| Shares issued on private placement, net of share issue costs | 2,581,564 | 358,316 | - | - | - | - | 358,316 | ||||||||||||||

| Shares issued for consulting services | - | - | - | - | - | - | - | ||||||||||||||

| Other comprehensive loss | - | - | - | - | - | (33,207 | ) | (33,207 | ) | ||||||||||||

| Net loss | - | - | - | - | (551,529 | ) | - | (551,529 | ) | ||||||||||||

| Balance – December 31, 2016 | 34,128,910 | $ | 2,004,407 | $ | - | $ | - | $ | (2,447,815 | ) | $ | (41,745 | ) | $ | (485,153 | ) | |||||

| Shares issued to directors | 80,000 | 11,604 | 13,196 | - | - | - | 24,800 | ||||||||||||||

| Shares issued to employee | 5,000 | 1,450 | - | - | - | - | 1,450 | ||||||||||||||

| Shares issued on private placement, net of share issue costs | 452,951 | 105,320 | 33,574 | - | - | - | 138,894 | ||||||||||||||

| Shares issued to agents on financing | 1,620,000 | 469,800 | - | - | - | - | 469,800 | ||||||||||||||

| Shares issued for consulting services | 15,000 | 4,950 | - | - | - | - | 4,950 | ||||||||||||||

| Shares issued on exercise of offer to acquire shares | 115,000 | 11,500 | - | - | - | - | 11,500 | ||||||||||||||

| Shares issued as compensation for director nomination | 20,000 | 2 | 6,598 | - | - | - | 6,600 | ||||||||||||||

| Stock compensation expensed on vesting of stock award | - | - | - | 165,000 | - | - | 165,000 | ||||||||||||||

| Reallocation between common shares and additional paid-in capital on domestication | - | (2,605,389 | ) | 2,605,309 | - | - | - | - | |||||||||||||

| Other comprehensive loss | - | - | - | - | - | (47,727 | ) | (47,727 | ) | ||||||||||||

| Net loss | - | - | - | - | (1,459,386 | ) | - | (1,459,386 | ) | ||||||||||||

| Balance – June 30, 2017 | 36,436,861 | $ | 3,644 | $ | 2,658,757 | $ | 165,000 | $ | (3,907,201 | ) | $ | (89,472 | ) | $ | (1,169,272 | ) |

The accompanying notes are an integral part of these consolidated financial statements.

Page | 06

| SusGlobal Energy Corp. |

| Interim Condensed Consolidated Statements of Cash Flows |

| For the six-month periods ended June 30, 2017 and 2016 |

| (Expressed in United States Dollars) |

| (unaudited) |

| For the six-month | For the six-month | |||||

| period ended June 30, | period ended June 30, | |||||

| 2017 | 2016 | |||||

| Cash flows from operating activities | ||||||

| Net loss | $ | (1,459,386 | ) | $ | (201,522 | ) |

| Adjustments for: | ||||||

| Depreciation | 292 | 326 | ||||

| Amortization of intangible asset | 100 | 94 | ||||

| Non-cash financing costs | 469,800 | - | ||||

| Stock-based compensation | 191,250 | - | ||||

| Changes in non-cash working capital: | ||||||

| Trade receivables | 9,184 | - | ||||

| Harmonized sales taxes receivable | 11,462 | 5,635 | ||||

| Prepaid expenses | (28,396 | ) | 12,425 | |||

| Accounts payable | (114,870 | ) | (10,152 | ) | ||

| Accrued liabilities | (35,334 | ) | 20,568 | |||

| Net cash used in operating activities | (955,898 | ) | (172,626 | ) | ||

| Cash flows from investing activities | ||||||

| Disposal of term deposit | 151,100 | - | ||||

| Asset purchase commitment | (451,680 | ) | - | |||

| Purchase of long-lived assets | (2,119 | ) | - | |||

| Net cash used in investing activities | (302,699 | ) | - | |||

| Cash flows from financing activities | ||||||

| Bank indebtedness | - | 47,219 | ||||

| Advances on credit facilities | 1,695,320 | - | ||||

| Repayment of credit facilities | (451,680 | ) | - | |||

| Repayments of loans payable to related parties | (61,951 | ) | - | |||

| Private placement proceeds (net of share issue costs) | 138,894 | 123,949 | ||||

| Subscriptions payable proceeds | - | 6,045 | ||||

| Net cash provided by financing activities | 1,320,583 | 177,213 | ||||

| Effect of exchange on cash | (31,762 | ) | (4,587 | ) | ||

| Increase in cash | 30,224 | - | ||||

| Cash-beginning of period | 1,774 | - | ||||

| Cash-end of period | $ | 31,998 | $ | - |

Other item-see note 12 for non-cash financing transaction relating to share based payment charged to financing costs

The accompanying notes are an integral part of these consolidated financial statements.

Page | 07

| SusGlobal Energy Corp. |

| Notes to the Interim Condensed Consolidated Financial Statements |

| June 30, 2017 and 2016 |

| (Expressed in United States Dollars) |

| (unaudited) |

1. Nature of Business and Basis of Presentation

SusGlobal Energy Corp. (“SusGlobal”) was formed by articles of amalgamation on December 3, 2014, in the Province of Ontario, Canada and its executive office is in Toronto, Ontario, Canada. SusGlobal Energy Corp., a company in the start-up stages and Commandcredit Corp. (“Commandcredit”), an inactive Canadian public company, amalgamated to continue business under the name of SusGlobal Energy Corp.

On May 23, 2017, SusGlobal Energy Corp. filed an Application for Authorization to continue in another Jurisdiction with the Ministry of Government Services in Ontario and a certificate of corporate domestication and certificate of incorporation with the Secretary of State of the State of Delaware under which it changed its jurisdiction of incorporation from Ontario to the State of Delaware (the “Domestication”). In connection with the Domestication each of our currently issued and outstanding common shares were automatically converted on a one-for-one basis into shares of SusGlobal Energy Delaware’s common stock (the “Shares”). As a result of the Domestication, pursuant to Section 388 of the General Corporation Law of the State of Delaware (the “DGCL”), the SusGlobal Energy Corp. continued its existence under the DGCL as a corporation incorporated in the State of Delaware. The business, assets and liabilities of the Company and its subsidiaries on a consolidated basis, as well as its principal location and fiscal year, were the same immediately after the Domestication as they were immediately prior to the Domestication. SusGlobal Energy Corp. filed a Registration Statement on Form S-4 to register the Shares and this registration statement was declared effective by the Securities and Exchange Commission on May, 23, 2017.

SusGlobal is a renewable energy company focused on acquiring, developing and monetizing a global portfolio of proprietary technologies in the waste to energy application.

These interim condensed consolidated financial statements of SusGlobal Energy Corp. and its wholly-owned subsidiaries, SusGlobal Energy Canada Corp. and SusGlobal Energy Canada I Ltd. (“SGECI”) (together, the “Company”), have been prepared following generally accepted accounting principles in the United States (“US GAAP”), and are expressed in United States Dollars. The Company’s functional currency is the Canadian Dollar (“CAD”). In the opinion of management, all adjustments necessary for a fair presentation have been included.

2. Going Concern

These interim condensed consolidated financial statements have been prepared in accordance with US GAAP, which assumes that the Company will be able to meet its obligations and continue its operations for the next twelve months.

As at June 30, 2017, the Company had a working capital deficit of $1,635,926 (December 31, 2016-$487,703), incurred a net loss of $1,459,386 (2016-$201,522) for the six-month period ended June 30, 2017 and had an accumulated deficit of $3,907,201 (December 31, 2016-$2,447,815) and expects to incur further losses in the development of its business. These factors and those noted below, cast substantial doubt as to the Company’s ability to continue as a going concern which is dependent upon its ability to obtain the necessary financing to further the development of its business and upon achieving profitable operations. Management believes that the Company will be able to obtain the necessary funding by equity or debt however, there is no assurance of funding being available on acceptable terms. Realization values may be substantially different from carrying values as shown.

Page | 08

| SusGlobal Energy Corp. |

| Notes to the Interim Condensed Consolidated Financial Statements |

| June 30, 2017 and 2016 |

| (Expressed in United States Dollars) |

| (unaudited) |

2. Going Concern, continued

On February 2, 2017, the Company received the first advance in the amount of $1,232,960 ($1,600,000 CAD) on its corporate line of credit (“Line of Credit”) of $4,238,300 ($5,500,000 CAD) with PACE Savings & Credit Union Limited (“PACE”). The Line of Credit was obtained to fund the BioGrid Project, which was a project described in the expansion and operation agreement (the “BioGrid Agreement”) between the Company and the Township of Georgian Bluffs and the Township of Chatsworth (the “Municipalities”), as described in note 15. The Municipalities terminated the Agreement on November 4, 2016 and the Company filed a Notice of Dispute with the Municipalities on March 1, 2017. The Company and representatives of the Municipalities met on March 31, 2017 and the Municipalities have since reiterated their position that the agreement is terminated. The Line of Credit is no longer available to be drawn against, and as such, the Company is re-negotiating the terms of the Line of Credit with PACE and it is expected that it will be replaced by a new Credit Facility for the commitment described in note 6.

These interim condensed consolidated financial statements do not include any adjustments to reflect the future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result if the Company was unable to continue as a going concern.

3. Significant Accounting Policies

These interim condensed consolidated financial statements should be read in conjunction with the consolidated financial statements of the Company for the years ended December 31, 2016 and 2015.

During the six months ended June 30, 2017, the Company adopted the following significant accounting policies:

Debt Issuance Costs

Debt issuance costs related to a recognized debt liability are presented in the balance sheet as a direct deduction from the carrying amount of the related debt liability.

Stock-based Compensation

The Company records compensation costs related to stock-based awards in accordance with Accounting Standards Codification 718, Compensation-Stock Compensation, whereby the Company measures stock-based compensation cost at the grant date based on the estimated fair value of the award. Compensation cost is recognized on a straight-line basis over the requisite service period of the award. The Company utilizes the Black-Scholes option-pricing model to estimate the fair value of stock options granted, which requires the input of highly subjective assumptions including: the expected option life, the risk-free rate, the dividend yield, the volatility of the Company’s stock price and an assumption for employee forfeitures. The risk-free rate is based on the U.S. treasury bill rate at the date of the grant with maturity dates approximately equal to the expected term of the option. The Company has not historically issued any dividends and does not expect to in the near future. Changes in any of these subjective input assumptions can materially affect the fair value estimates and the resulting stock-based compensation recognized.

Page | 09

| SusGlobal Energy Corp. |

| Notes to the Interim Condensed Consolidated Financial Statements |

| June 30, 2017 and 2016 |

| (Expressed in United States Dollars) |

| (unaudited) |

4. Recent Accounting Pronouncements

From time to time, new accounting pronouncements are issued by FASB or other standard setting bodies and adopted by the Company as of the specified effective date or possibly early adopted, where permitted. Unless otherwise discussed, the impact of recently issued standards that are not yet effective will not have a material impact on the Company’s financial position, results of operations or cash flows.

In February 2016, the FASB issued ASU No. 2016-02, “Leases.” The new standard establishes a right-of-use (ROU) model that requires a lessee to record a ROU asset and a lease liability on the balance sheet for all leases with terms longer than 12 months. Leases are to be classified as either finance or operating, with classification affecting the pattern of expense recognition in the income statement. The new standard is to be effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. A modified retrospective transition approach is required for lessees with capital and operating leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements, with certain practical expedients available. The adoption of this ASU is expected to result in all operating leases being capitalized in the Company’s financial statements. The Company is currently evaluating the impact of adopting ASU No. 2016-02.

In November 2016, the FASB issued ASU No. 2016-18, “Statement of Cash Flows (Topic 230): Restricted Cash”. This ASU requires that a statement of cash flows explain the change during the period in the total of cash, cash equivalents, and amounts generally described as restricted cash or restricted cash equivalents. Therefore, amounts generally described as restricted cash and restricted cash equivalents are to be included with cash and cash equivalents when reconciling the beginning-of-period and end-of-period total amounts shown on the statement of cash flows. This guidance is to be effective for the Company as of March 1, 2018, and requires a retrospective transition method. The Company is currently evaluating the impact of ASU No. 2016-18.

In January 2017, the FASB issued ASU No. 2017-04, “Intangibles-Goodwill and Other (Topic 350) - Simplifying the Test for Goodwill Impairment”. The new standard simplifies the accounting for goodwill impairments by eliminating step 2 from the goodwill quantitative impairment test. Instead, if the carrying amount of a reporting unit exceeds its fair value, an impairment loss is to be recognized in an amount equal to that excess, limited to the total amount of goodwill allocated to that reporting unit. The standard is to be effective for interim and annual periods beginning after December 15, 2019 and early adoption is permitted. The Company is currently evaluating the impact of adopting ASU No. 2017-04.

5. Financial Instruments

The carrying value of cash, term deposit, trade receivables, harmonized sales taxes receivable, accounts payable and accrued liabilities approximated their fair values as of June 30, 2017 and December 31, 2016 due to their short-term nature. The carrying value of the credit facilities and the loans payable to related party approximated their fair value due to their market interest rates.

Interest, Credit and Concentration Risk

In the opinion of management, the Company is exposed to significant interest rate risk on its variable rate credit facilities of $1,232,960 ($1,600,000 CAD) and is not exposed to credit risks arising from its other financial instruments. As at June 30, 2017, the Company had no trade receivables. As at December 31, 2016, the Company had two customers representing greater than 5% of total trade receivables and these two customers represented 99% of trade receivables. As at

Page | 10

| SusGlobal Energy Corp. |

| Notes to the Interim Condensed Consolidated Financial Statements |

| June 30, 2017 and 2016 |

| (Expressed in United States Dollars) |

| (unaudited) |

5. Financial Instruments, continued

December 31, 2016, the Company had certain customers whose revenue individually represented 10% or more of the Company’s total revenue. These customers accounted for 95% of total revenue.

Liquidity Risk

Liquidity risk is the risk that the Company is unable to meet its obligations as they fall due. The Company takes steps to ensure it has sufficient working capital and available sources of financing to meet future cash requirements for capital programs and operations. (At June 30, 2016 and December 31, 2016, the Company had a working capital deficit.)

The Company intends to continue to raise funds through the issuance of common shares under a private placement or debt, to ensure it has sufficient access to cash to meet current and foreseeable financial requirements. The Company actively monitors its liquidity to ensure that its cash flows and working capital are adequate to support its financial obligations and the Company’s capital programs.

Currency Risk

Although the Company’s functional currency is Canadian dollars (“CAD”), the Company realizes a portion of its expenses in United States dollars (“USD”). Consequently, certain assets and liabilities are exposed to foreign currency fluctuations. As at June 30, 2017, $10,439 (December 31, 2016-$5,108) of the Company’s net monetary liabilities were denominated in United States dollars. The Company has not entered into any hedging transactions to reduce the exposure to currency risk.

6. Asset Purchase Commitment

On June 15, 2017, the Company submitted its bid to BDO Canada Limited (the “Astoria Receiver”), the court appointed receiver for Astoria Organic Matters Limited and Astoria Organic Matters Canada LP (together “Astoria”), for the assets of Astoria. The bid, which was later revised on June 28, 2017, consisted of a cash amount, of which $462,360 ($600,000 CAD) was paid as a deposit and a reservation of 529,970 restricted common shares of the Company to be issued on closing. The principal assets of Astoria are a completed organic composting facility and a waste transfer station having an environmental compliance approval. The deposit was provided by PACE and the balance of the cash offer will be provided by PACE by way of a credit facility. On July 12, 2017, (see note 16(a)), the Company’s bid was accepted by the Astoria Receiver. On July 27, 2017, the Company entered into an Asset Purchase Agreement (the “APA”) which was then amended on August 1, 2017. The closing is subject to court approval, scheduled for August 24, 2017.

The Company is also required to provide a deposit to the ministry of the environment and climate change (“MOECC”) and to a local municipality, totaling approximately $253,000 (approximately $328,000 CAD) to operate the facility. In addition, the Company is also responsible to purchase the outstanding accounts receivable based on the book value of seventy percent of the accounts receivable under ninety days on closing.

Page | 11

| SusGlobal Energy Corp. |

| Notes to the Interim Condensed Consolidated Financial Statements |

| June 30, 2017 and 2016 |

| (Expressed in United States Dollars) |

| (unaudited) |

7. Intangible Asset

| June 30, 2017 | December 31 | |||||

| 2016 | ||||||

| Technology License (net of accumulated amortization of $431 (2016 - $331) | $ | 1,570 | $ | 1,670 |

On May 6, 2015, the Company acquired an exclusive license from Syngas SDN BHD (“Syngas”), a Malaysian company to use Syngas intellectual property within North America for a period of five years for $1 consideration, renewable every five years upon written request. Syngas manufactures equipment that produces liquid transportation fuel from plastic waste material. The Company issued 20,000 common shares of the Company to an introducing party, determined to be valued at $2,000.

8. Long-lived Assets, net

| June 30, 2017 | December 31, 2016 | |||||||||||

| Cost | Accumulated | Net book value | Net book value | |||||||||

| Depreciation | ||||||||||||

| Computer hardware | $ | 4,093 | $ | 1,369 | $ | 2,724 | $ | 880 | ||||

9. Related Party Transactions

During the six-month period ended June 30, 2017, the Company incurred $22,484 ($30,000 CAD) (2016-$22,590; $30,000 CAD) in management fees expense with Travellers International Inc. (“Travellers”), an Ontario company controlled by a director and president of the Company (the “President”) and $22,484 ($30,000 CAD) (2016-$22,590; $30,000 CAD) in management fees expense with Landfill Gas Canada Limited (“LFGC”), an Ontario company controlled by a director and chief executive officer of the Company (the “CEO”); $17,987 ($24,000 CAD) (2016-$18,072; $24,000 CAD) in management fees with the Company’s chief financial officer (the “CFO”); and $17,987 ($24,000 CAD) (2016-$nil) in management fees with the company’s vice-president of corporate development (the “VPCD”). As at June 30, 2017, unpaid remuneration and unpaid expenses payable to officers in the amount of $85,952 ($111,539 CAD) (December 31, 2016-$95,396; $128,083 CAD) is included in accounts payable and $77,831 ($101,000 CAD) (December 31, 2016-$61,982; $83,220 CAD) is included in accrued liabilities.

In addition, the Company incurred interest expense of $10,154 ($13,548 CAD) (2016-$3,675; $4,880 CAD) on the outstanding loans from Travellers.

Furthermore, the Company granted the CEO 3,000,000 restricted stock units (“RSU”), under a new consulting agreement effective January 1, 2017. The RSUs are to vest in three equal installments annually on January 1, 2018, 2019 and 2020. For the six-month period ended June 30, 2017, the Company recognized stock-based compensation expense of $165,000 on this award, representing one sixth of the total value of the award of $990,000, based on a recent private placement pricing.

For the six-month period ended June 30, 2017, the Company incurred $25,178 ($33,593 CAD) (2016-$15,813; $21,000 CAD) in rent expense under a rental agreement with Haute Inc. (“Haute”), an Ontario company controlled by a director and the Company’s President.

Page | 12

| SusGlobal Energy Corp. |

| Notes to the Interim Condensed Consolidated Financial Statements |

| June 30, 2017 and 2016 |

| (Expressed in United States Dollars) |

| (unaudited) |

10. Credit Facilities

| Line of | Credit | Total | |||||||

| Credit | Facility | ||||||||

| (a) | (b) | ||||||||

| Balance, December 31, 2016 | - | - | - | ||||||

| Advanced | $ | 1,232,960 | $ | 462,360 | $ | 1,695,320 | |||

| Debt issuance costs | 882,153 | - | 882,153 | ||||||

| Write-off of debt issuance costs | (882,153 | ) | - | (882,153 | ) | ||||

| Repayment of principal | (462,360 | ) | - | (462,360 | ) | ||||

| Balance-June 30, 2017 | $ | 770,600 | $ | 462,360 | $ | 1,232,960 |

| (a) |

Effective January 1, 2017, the Company obtained a Line of Credit of $4,238,300 ($5,500,000 CAD) with PACE. The Line of Credit was to be advanced in tranches to allow for the funding of engineering, permitting, construction costs and equipment purchases for the BioGrid Project (see note 15) located near Owen Sound, Ontario, Canada. On February 2, 2017, the company received the first advance in the amount of $1,232,960 ($1,600,000 CAD). The Line of Credit is no longer available to be drawn against, and, as such, the Company is re-negotiating the terms of the Line of Credit with PACE and it is expected that this Line of Credit will be replaced by a new Credit Facility for the commitment described in note 6. |

|

The Line of Credit bears interest at the PACE base rate +1.25% per annum, currently 8% per annum, payable on a monthly basis, interest only. The first advance, received on February 2, 2017 is due February 2, 2018 and is secured by a business loan general security agreement, a $1,232,960 ($1,600,000 CAD) personal guarantee from the President and a charge against the Company’s premises lease. Also pledged as security are the shares of the wholly-owned subsidiaries and a pledge of shares of the Company held by LFGC, the CFO and a director’s company, and a limited recourse guarantee by each. | |

|

During the construction period of the BioGrid Project, the Line of Credit was to be subject to monthly interest payments only. Once the expanded facility was fully operational, the Line of Credit was to be converted into a term facility and subject to blended monthly payments of principal and interest sufficient to repay the term loan within the specified amortization. The Line of Credit is fully open for prepayment at any time without notice or bonus. | |

|

A total commitment fee of $83,105 ($110,000 CAD) was paid to PACE. In addition, the agents who assisted in establishing the Line of Credit received 1,620,000 common shares of the Company determined to be valued at $469,800, based on the pricing of a recent private placement offering and cash of $300,000, on closing, for their services. Other closing costs in connection with the Line of Credit included legal fees of $29,248 ($38,713 CAD). During the six -month period ended June 30, 2017 the Company incurred interest charges of $30,981 ($41,336 CAD) on the Line of Credit. | |

| (b) |

On June 15, 2017, PACE loaned the Company $462,360 ($600,000 CAD) for its bid for the purchase of the assets of Astoria (see note 6), on the same terms and conditions to the Line of Credit above. Upon the Astoria Closing PACE has agreed to finance the balance of the purchase, subject to assignment of the Astoria property lease and the compliance approval from the MOECC along with other guarantees and security to be determined. PACE will also have claim to the assets included in the purchase. During the six-month period ended June 30, 2017, the Company incurred interest charges of $1,551 ($2,069 CAD) on this credit facility. |

Page | 13

| SusGlobal Energy Corp. |

| Notes to the Interim Condensed Consolidated Financial Statements |

| June 30, 2017 and 2016 |

| (Expressed in United States Dollars) |

| (unaudited) |

11. Loans Payable to Related Party

| June 30, | December 31, | |||||

| 2017 | 2016 | |||||

| Travellers | $ | 161,826 | $ | 217,482 |

Loans payable in the amount of $161,826 ($210,000 CAD) (December 31, 2016-$217,482; $292,000 CAD), owing to Travellers and bearing interest at the rate of 12% per annum are due on demand and unsecured. As at June 30, 2017, $16,759 ($21,748 CAD) (December 31, 2016-$15,043; $20,197 CAD), in interest is included in accrued liabilities. One of the loans owing to Travellers, in the amount of $61,074 ($82,000 CAD) was repaid on February 9, 2017, including accrued interest.

12. Capital Stock

At June 30, 2017, the Company had 150,000,000 authorized common shares, with a par value of $.0001 and 36,436,861 (December 31, 2016-34,128,910) issued and outstanding common shares and 10,000,000 preferred shares are authorized, with a par value of $.0001, none of which are issued and outstanding.

During the six-month period ended June 30, 2017, the Company raised $138,894 (December 31, 2016-$358,316) cash on a private placement, net of cash share issue costs of $9,380 (2016-$28,690), on the issuance of 452,951 (December 31, 2016-2,581,564) common shares of the Company.

In addition, the Company issued 1,620,000 common shares of the Company, determined to be valued at $469,800, to agents for their services in assisting in establishing the Line of Credit (see note 10(a)). The Company also issued a total of 80,000 common shares to four new directors and 5,000 commons shares to an employee, determined to be valued at $24,800 and $1,450, respectively, for their services, and issued 20,000 common shares to a consultant who assisted in identifying a board member, determined to be valued at $6,600 and 115,000 common shares on the exercise of the offer to acquire common shares at a price of $0.10 per common share by the VPCD. The services provided by the four new directors and the employee are included as share-based compensation in the interim condensed consolidated statements of loss and comprehensive loss. Further, 15,000 common shares of the Company were issued to a consultant for past services, determined to be valued at $4,950 and included in professional fees in the interim condensed consolidated statements of loss and comprehensive loss, along with the 20,000 common shares issued to a consultant, noted above, determined to be valued at $6,600.

The Company also granted the CEO 3,000,000 restricted stock units (“RSU”), under a new consulting agreement effective January 1, 2017. The RSUs are to vest in three equal installments annually on January 1, 2018, 2019 and 2020. As at June 30, 2017, the Company has recognized a stock compensation reserve of $165,000, representing one sixth of the total value of the award of $990,000, based on the pricing for a recent private placement offering.

Page | 14

| SusGlobal Energy Corp. |

| Notes to the Interim Condensed Consolidated Financial Statements |

| June 30, 2017 and 2016 |

| (Expressed in United States Dollars) |

| (unaudited) |

13. Commitments

| a) |

On October 21, 2016, the Company hired the services of a contractor to assume the role of vice president of corporate development, effective November 1, 2016, for a period of fourteen months, at the rate of $3,008 ($4,000 CAD) per month, plus applicable taxes. The future minimum commitment under this consulting agreement for the twelve months ending June 30th is as follows: |

| 2018 | $ | 18,494 |

| b) |

Effective January 1, 2017, new consulting agreements were finalized for the services of the President and the CEO. The consulting agreements are for a period of three years, commencing January 1, 2017. For each of these two executive officers, the monthly fees are to be as follows: $3,853 ($5,000 CAD) plus applicable taxes for 2017 and $11,559 ($15,000 CAD) plus applicable taxes for 2018 and 2019. In addition, the CEO was granted 3,000,000 Restricted Stock Units (“RSU”). The RSUs are to vest in three equal installments annually on January 1, 2018, 2019 and 2020. The future minimum commitment under these consulting agreements for each of the twelve months ending June 30th is as follows: |

| 2018 | $ | 184,944 | ||

| 2019 | 277,416 | |||

| 2020 | 138,708 | |||

| $ | 601,068 |

| c) |

Effective January 1, 2017, the Company entered into a new three-year premises lease agreement with Haute Inc., at a monthly amount of $3,082 ($4,000 CAD) for 2017, $3,853 ($5,000 CAD) for 2018 and $4,624 ($6,000 CAD) for 2019. The Company is also responsible for all expenses and outlays in connection with its occupancy of the leased premises, including, but not limited to utilities, realty taxes and maintenance. The future minimum commitment under this premises lease for each of the twelve months ending June 30th is as follows: |

| 2018 | $ | 41,612 | ||

| 2019 | 50,860 | |||

| 2020 | 27,742 | |||

| $ | 120,214 |

| d) |

The Company is a partner in business led collaboration in the water sector, a program known as the Advanced Water Technologies (“AWT”) Program. This program is administered by the Southern Ontario Water Consortium to assist small and medium sized business in the Province of Ontario, Canada, leverage world- class research facility and academic expertise to develop and demonstrate water technologies for successful introduction to market. The Company’s commitment under this program for each of the years ending June 30th is as follows: |

| 2018 | $ | 20,702 | ||

| 2019 | 12,256 | |||

| $ | 32,958 |

Page | 15

| SusGlobal Energy Corp. |

| Notes to the Interim Condensed Consolidated Financial Statements |

| June 30, 2017 and 2016 |

| (Expressed in United States Dollars) |

| (unaudited) |

13. Commitments, continued

|

The Company has already completed and provided its commitment for the first year of the program which ended March 31, 2017, which consisted of professional fees of $7,069 ($9,432 CAD) and a contribution to the capital requirements of the program, totaling $71,017 ($94,000 CAD), for equipment to be used in the AWT Program and to be retained by Fleming College, the academic institution. | |

| e) |

On May 11, 2017, the Company signed a posting agreement with CrowdVest LLC (“CrowdVest”), a Tennessee limited liability company to act as the Company’s online intermediary technology platform in connection with the Company’s offering of common stock under Rule 506 of Regulation D under the Securities Act of 1933. As compensation, CrowdVest will receive 20,000 restricted common shares of the Company, based on an issue price of $5 per share, once the 506(c)-general solicitation offering commences. The agreement is for a period of one year and can be terminated or extended upon written request. |

14. Segmented Information

The Company uses a management approach for determining segments. The management approach designates the internal organization that is used by management for making operating decisions and assessing performance as the source of the Company’s reportable segments. The Company’s management reporting structure provides for only one segment: renewable energy and operates in one country, Canada.

15. The BioGrid Project

Effective June 1, 2016, SGECI, entered into the BioGrid Agreement with the Municipalities to construct, maintain and operate the BioGrid Project which is automatically renewable for two additional five-year periods, unless either party provides written notice of termination. On August 13, 2016, SGECI took over operation of the BioGrid Project.

Approximately three weeks after assuming the operations of the BioGrid Project, the facility encountered a catastrophic gas engine failure. The repair of the engine took approximately three months. During this period, the Company invoked the Force Majeure provision under section 17 of the BioGrid Agreement. On November 4, 2016, the Company was informed by the Municipalities, that they rejected the Force Majeure and served the Company with Notice of Immediate Termination.

On March 1, 2017, the Company delivered a Notice of Dispute to the Municipalities.

The Company and representative of the Municipalities met on March 31, 2017 and the Municipalities have since reiterated their position that the BioGrid Agreement is terminated. The Company intends to settle its insurance claim for the catastrophic gas engine failure prior to considering any of its options regarding the Municipalities.

Page | 16

| SusGlobal Energy Corp. |

| Notes to the Interim Condensed Consolidated Financial Statements |

| June 30, 2017 and 2016 |

| (Expressed in United States Dollars) |

| (unaudited) |

16. Subsequent Events

| (a) |

On July 12, 2017, the Company was advised by the Astoria Receiver, that the Company’s bid was successful, subject to court approval. | |

| (b) |

On July 25, 2017, the Company incorporated SusGlobal Energy Belleville Ltd., under the laws of the Province of Ontario, Canada. | |

| (c) |

On July 27, 2017, the Company entered into an APA, which was later amended on August 1, 2017, for the assets of Astoria. | |

| (d) |

On July 25, 2017 and August 3, 2017, the Company raised $45,000 in private placement proceeds, net of share issue costs of $5,000, on the issuance of 50,000 common shares of the Company. | |

| (e) |

On August 3, 2017, the Company signed a work order with Creative Direct Marketing Group, Inc., (“CDMG”) in the amount of $126,037, for various direct marketing services to persons who qualify as accredited investors, in relation to the Company’s 506(c) general solicitation private placement offering. | |

| (f) |

On August 4, 2017, the Company received an additional advance from PACE in the amount of $38,530 ($50,000 CAD), to pay certain outstanding accounts payable. |

17. Comparative Figures

Certain of the prior period’s comparative figures have been reclassified to conform to the current period’s presentation.

Page | 17

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations.

Certain statements in this Management's Discussion and Analysis ("MD&A"), other than purely historical information, including estimates, projections, statements relating to our business plans, objectives and expected operating results, and the assumptions upon which those statements are based, are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements generally can be identified by the use of forward-looking terminology such as "may," "would," "expect," "intend," "could," "estimate," "should," "anticipate," or "believe," and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise. Readers should carefully review the risk factors and related notes included on our Registration Statement on Form S-4 filed with the Securities and Exchange Commission on April 5, 2017.

The following MD&A is intended to help readers understand the results of our operation and financial condition, and is provided as a supplement to, and should be read in conjunction with, our Interim Unaudited Financial Statements and the accompanying Notes to Interim Unaudited Financial Statements under Part 1, Item 1 of this Quarterly Report on Form 10-Q.

Growth and percentage comparisons made herein generally refer to the three and six-month periods ended June 30, 2017 compared with the three and six-month periods ended June 30, 2016 unless otherwise noted. Unless otherwise indicated or unless the context otherwise requires, all references in this document to "we, "us, "our," the "Company," and similar expressions refer to SusGlobal Energy Corp., and depending on the context, its subsidiaries.

SPECIAL NOTICE ABOUT GOING CONCERN AUDIT OPINION

OUR AUDITOR ISSUED AN OPINION EXPRESSING SUBSTANTIAL DOUBT AS TO OUR ABILITY TO CONTINUE IN BUSINESS AS A GOING CONCERN FOR THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2016 AND 2015. YOU SHOULD READ THIS QUARTERLY REPORT ON FORM 10-Q WITH THE “GOING CONCERN” ISSUES IN MIND.

This Management’s Discussion and Analysis should be read in conjunction with the financial statements included in this Quarterly Report on Form 10-Q (the “Financial Statements”). The financial statements have been prepared in accordance with generally accepted accounting policies in the United States (“GAAP”). Except as otherwise disclosed, all dollar figures included therein and in the following management discussion and analysis are quoted in United States dollars.

OVERVIEW

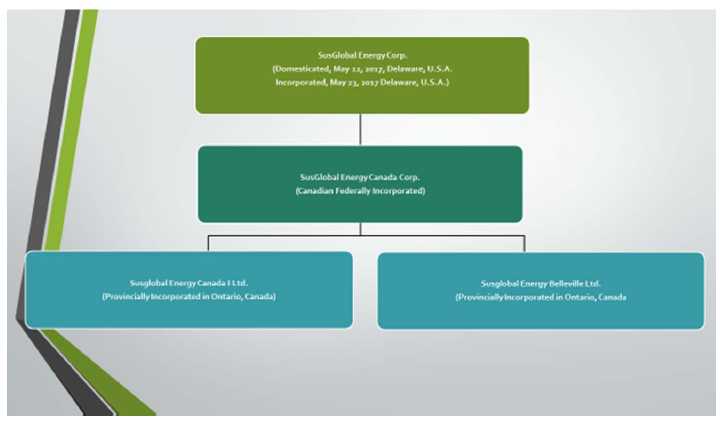

The following organization chart sets forth our wholly-owned subsidiaries:

Page | 18

SusGlobal Energy Corp. (“SusGlobal Energy Canada”) was formed by articles of amalgamation on December 3, 2014, in the Province of Ontario, Canada and its executive office is in Toronto, Ontario, Canada. SusGlobal Energy Corp. (“Old SusGlobal”, a company in the start-up stages and Commandcredit Corp. (“Commandcredit”), an inactive Canadian public shell company that was formed in Ontario, Canada on June 19, 2000 amalgamated to continue business under the name of SusGlobal Energy Corp. (“SusGlobal”). We are a renewable energy company focused on acquiring, developing and monetizing a global portfolio of proprietary technologies in the waste to energy application.

On January 29, 2016, the SusGlobal filed a Registration Statement on Form S-4 (the “Registration Statement”), which relates to the Company’s intent to change its jurisdiction of incorporation by discontinuing SusGlobal Energy Corp. from Ontario, Canada and continuing and domesticating as a corporation incorporated under the laws of the State of Delaware. The Registration Statement was declared effective on May 12, 2017.

On May 23, 2017, SusGlobal Energy Corp. filed an Application for Authorization to continue in another Jurisdiction with the Ministry of Government Services in Ontario and a certificate of corporate domestication and certificate of incorporation with the Secretary of State of the State of Delaware under which it changed its jurisdiction of incorporation from Ontario to the State of Delaware (the “Domestication”). In connection with the Domestication each of our currently issued and outstanding common shares were automatically converted on a one-for-one basis into shares of SusGlobal Energy Delaware’s common stock (the “Shares”). As a result of the Domestication, pursuant to Section 388 of the General Corporation Law of the State of Delaware (the “DGCL”), the SusGlobal Energy Corp. continued its existence under the DGCL as a corporation incorporated in the State of Delaware. The business, assets and liabilities of the Company and its subsidiaries on a consolidated basis, as well as its principal location and fiscal year, were the same immediately after the Domestication as they were immediately prior to the Domestication. SusGlobal Energy Corp. filed a Registration Statement on Form S-4 to register the Shares and this registration statement was declared effective by the Securities and Exchange Commission on May, 23, 2017.

Page | 19

With the growing amount of organic wastes being produced by society as a whole, a solution for sustainable global management of these wastes must be achieved. SusGlobal through its proprietary technology and processes is equipped and confident to deliver this objective.

We believe renewable energy is the energy of the future. Sources of this type of energy are more evenly distributed over the earth’s surface than finite energy sources, making it an attractive alternative to petroleum based energy. Biomass, one of the renewable resources, is derived from organic material such as forestry, food, plant and animal residuals. SusGlobal can therefore help you turn what many consider waste into precious energy. The portfolio will be comprised of four distinct types of technologies: (a) Process Source Separated Organics (“SSO”) in anaerobic digesters to divert from landfills and recover biogas. This biogas can be converted to gaseous fuel for industrial processes, electricity to the grid or cleaned for compressed renewable gas. (b) Increasing the capacity of existing infrastructure (anaerobic digesters) to allow processing of SSO to increase biogas yield. (c) Utilize recycled plastics to produce liquid fuels. (d) process digestate to produce a pathogen free organic fertilizer.

The convertibility of organic material into valuable end products such as biogas, liquid biofuels, organic fertilizers and compost shows the utility of renewable energy. These products can be converted into electricity, fuels and marketed to agricultural operations that are looking for an increase in crop yields, soil amendment and environmentally-sound practices. This practice also diverts these materials from landfills and reduces greenhouse gas emissions that result from landfilling organic wastes.

We can provide peace of mind that the full lifecycle of organic material is achieved, global benefits are realized and stewardship for total sustainability is upheld.

Our project and services offered can benefit the public and private markets. The following includes some of our work managing organic waste streams: Anaerobic Digestion, Dry Digestion, Biogas production, Wastewater Treatment, In- Vessel Composting, SSO Treatment, Biosolids Heat Treatment and Composting.

We provide a full range of services for handling organic residuals in a period where innovation and sustainability are paramount. From start to finish we offer in-depth knowledge, a wealth of experience and cutting-edge technology for handling organic waste.

The primary focus of the services we provide includes identifying idle or underutilized anaerobic digesters and integrating our technologies with capital investment to optimizing the operation of the existing digesters to reach their full capacity for processing SSO. Our processes not only divert significant organic waste from landfills, but also result in methane avoidance, with significant Greenhouse Gas (“GHG”) reductions from waste disposal. The processes also produce renewable energy through the conversion of wastewater biosolids and organic wastes in the same equipment (co-digestion) and valuable end products such as biogas, electricity and organic fertilizer, considered Class AA organic fertilizer.

Currently, our primary customers are municipalities in both rural and urban centers throughout southern and central Ontario, Canada. Much of the research and development that has been carried out has been completed by our CEO through multiple projects carried out on projects prior to the formation of SusGlobal. Where necessary, to be in compliance with Provincial and local environmental laws and regulations, we submit applications to the respective authorities for approval prior to any necessary engineering being carried out.

RECENT BUSINESS DEVELOPMENTS

Astoria Purchase Commitment

On June 15, 2017, the Company submitted its bid to BDO Canada Limited (the “Astoria Receiver”), the court appointed receiver for Astoria Organic Matters Limited and Astoria Organic Matters Canada LP (together “Astoria”), for the assets of Astoria. The bid, which was later revised on June 28, 2017, consisted of a cash amount, of which $462,360 ($600,000 CAD) was paid as a deposit and a reservation of 529,970 restricted common shares of the Company to be issued on closing. The principal assets of Astoria are a completed organic composting facility and a waste transfer station having an environmental compliance approval. The deposit was provided by PACE and the balance of the cash offer will be provided by PACE by way of a credit facility. On July 12, 2017, the Company’s bid was accepted by the Astoria Receiver. On July 27, 2017, the Company entered into an Asset Purchase Agreement (the “APA”) which was then amended on August 1, 2017. The closing is subject to court approval, scheduled for August 24, 2017.

Page | 20

The Company is also required to provide a deposit to the MOECC and to a local municipality, totaling approximately $253,000 (approximately $328,000 CAD) to operate the facility. In addition, the Company is responsible to purchase the outstanding accounts receivable based on the book value of seventy percent of the accounts receivable under ninety days, on closing.

Financing Agreement with PACE

Effective January 1, 2017, the Company obtained a Line of Credit of $4,238,300 ($5,500,000 CAD) with PACE. The Line of Credit was to be advanced in tranches to allow for the funding of engineering, permitting, construction costs and equipment purchases for the BioGrid Project located near Owen Sound, Ontario, Canada. The line of credit was obtained to fund the BioGrid Project, that effective, November 4, 2016 was terminated by the Municipalities.

The Line of Credit bears interest at the PACE base rate +1.25% per annum, currently 8% per annum, payable on a monthly basis, interest only. The first advance, received on February 2, 2017 is due February 2, 2018 and is secured by a business loan general security agreement, a $1,232,960 ($1,600,000 CAD) personal guarantee from the President and a charge against the Company’s premises lease. Also pledged as security are the shares of the wholly-owned subsidiaries and a pledge of shares of the Company held by LFGC, the CFO and by a director’s company, and a limited recourse guarantee by each. The Line of Credit is no longer available to be drawn against, and, as such, the Company is re-negotiating the terms of the Line of Credit with PACE and it is expected that this Line of Credit will be replaced by a new Credit Facility for the commitment described in note 6 to the interim condensed consolidated financial statements.

A total commitment fee of $83,105 ($110,000 CAD) was paid to PACE. In addition, the agents who assisted in establishing the Line of Credit received 1,620,000 common shares of the Company determined to be valued at $469,800, based on the pricing of a recent private placement offering and cash of $300,000, on closing, for their services. Other closing costs in connection with the Line of Credit included legal fees of $29,248 ($38,713 CAD). During the six -month period ended June 30, 2017 the Company incurred interest charges of $30,981 ($41,336 CAD) on the Line of Credit.

Other

On August 3, 2017, the Company signed a work order with CDMG in the amount of $126,037, for various direct marketing services to persons who qualify as accredited investors, in relation to the Company’s 506(c)-general solicitation private placement offering.

On May 11, 2017, the Company signed a posting agreement with CrowdVest, a Tennessee limited liability company to act as the Company’s online intermediary technology platform in connection with the Company’s offering of common stock under Rule 506 of Regulation D under the Securities Act of 1933. As compensation, CrowdVest will receive 20,000 restricted common shares of the Company, based on an issue price of $5 per share, once the 506(c)-general solicitation offering commences. The agreement is for a period of one year and can be terminated or extended upon written request.

The Company and the Municipalities for the BioGrid Project met on March 31, 2017 and the Municipalities have since reiterated their position that the agreement is terminated. The Company will settle its insurance claim for the catastrophic gas engine failure prior to considering any of its options regarding the Municipalities.

Page | 21

On November 4, 2016, the Company was informed by the Municipalities, that they have rejected the Company’s claim for Force Majeure and have served the Company with Notice of Immediate Termination. The Company continued to use commercially reasonable efforts to rectify the cause of the Force Majeure Event while the claim for Force Majeure was in effect and to attempt to resolve this issue with the Municipalities under the Disputes and Resolutions provision in section 19 of the biodigester expansion and operation agreement.

Effective June 1, 2016, SGECI entered into the BioGrid Agreement with the Municipalities to construct, maintain and operate the BioGrid Project which is automatically renewable for two additional five-year periods, unless either party provides written notice of termination. On August 13, 2016, SGECI took over operation of the BioGrid Project.

Approximately three weeks after assuming the operations of the BioGrid Project, the facility encountered a catastrophic gas engine failure. The repair of the engine took approximately three months. During this period, the Company invoked the Force Majeure provision under section 17 of the Agreement. On November 4, 2016, the Company was informed by the Municipalities, that they rejected the Force Majeure and served the Company with Notice of Immediate Termination.

On May 9, 2017, the company signed a memorandum of agreement (the “Agreement”) with Kentech, a corporation existing under the laws of the province of Ontario, Canada. The Agreement provides the Company the right to acquire and the right to use the equipment and innovative processes of Kentech in relation to the production of liquid fertilizer from organic waste material. The Agreement is for a period of five years, commencing on the date of the Agreement. The Agreement may be terminated by either party on providing six months’ notice.

Effective January 1, 2017, new consulting agreements were finalized for the services of the executive chairman and president and for the CEO. The consulting agreements are for a period of three years, commencing January 1, 2017. For each of these two executive officers, the monthly fees are to be as follows: $3,853 ($5,000 CAD) plus applicable taxes for 2017 and $11,559 ($15,000 CAD) plus applicable taxes for 2018 and 2019. In addition, the CEO was granted 3,000,000 Restricted Stock Units (“RSU”). The RSUs are to vest in three equal installments annually on January 1, 2018, 2019 and 2020.

On December 7, 2016, the Company was awarded funding for the AWT, a program for business led collaborations in the water sector. AWT is administered by the Southern Ontario Water Consortium to assist small and medium sized businesses in the Province of Ontario, Canada to leverage world-class research facilities and academic expertise to develop and demonstrate water technologies for successful introduction to market. In addition, the program is designed to enhance the Ontario water cluster and continue to build Ontario’s reputation for water excellence around the world. The Company’s academic partner is the CAWT at Fleming College in Lindsay, Ontario, Canada. The program budget is for $616,480 ($800,000 CAD), of which the Company contributes 50% in cash and in-kind contributions and CAWT contributes 50%.

On October 21, 2016, the Company hired the services of a contractor to assume the role of VPCD, effective November 1, 2016, for a period of fourteen months, at the rate of $3,082 ($4,000 CAD) per month, plus applicable taxes. In addition, the contractor was offered up to 115,000 common shares of the Company, at a price of $0.10 per common share, exercisable within 180 days of the effective date of the contract. On April 30, 2017, the contractor exercised the offer to purchase 115,000 common shares of the Company.

On August 19, 2016, Travellers, an Ontario company controlled by the President, provided a further loan in the amount of $161,826 ($210,000 CAD) which was required to initiate a letter of credit in the amount of $154,120 ($200,000 CAD), in favor of the Municipalities.

Page | 22

The letter of credit was a requirement of the BioGrid Agreement noted above. Fees for the letter of credit included $7,624 ($10,000 CAD) incurred and charged by Travellers and $2,287 ($3,000 CAD) charged by the Company’s chartered bank. There is no written agreement evidencing this loan or the previous loan with Travellers. The interest-bearing loans with Travellers are due on demand and were approved by the Board of Directors of the Company.

On August 3, 2016, the Company signed an agreement with Grimsby Energy Inc. from Grimsby, Ontario, Canada, to allow hydrolyzed and pasteurized organic wastes to be processed at their Anaerobic Biodigester. The agreement commences November 1, 2016 and can be terminated by either party within three hundred and sixty-five days minimum written notice. Up to the date of this filing, there has been no activity under this agreement.

On May 14, 2015, the Ontario Ministry of Environment and Climate Change announced formal targets to be met to satisfy a commitment necessary to join the WCI along with Quebec and California, who are in the WCI with Cap and Trade commitments since 2014. The Ontario targets are very ambitious, with

GHG emission reductions of 15% by 2020, 37% by 2030 and 80% by 2050, all from a 1990 baseline. Ontario achieved a 6% reduction in GHG emissions from 1990 levels in 2014, mainly by closing all coal-fired power plants. The targets announced will require a focused program to reduce GHG emissions. The Company’s activities all contribute to GHG reductions, so will be a key part of Ontario’s initiative. The Company has also contacted counterparties in Quebec and California to explore opportunities for relevant projects. SusGlobal is committed to making all its commercial activities carbon neutral. The new Cap and Trade regulations are effective January 2017.

On May 6, 2015, the Company finalized an agreement with Syngas, a company incorporated under the laws of Malaysia, providing an exclusive license for the Company to use Syngas Intellectual Property within North America for a period of five years from the date of this agreement, for $1 consideration, renewable every five years upon written request. Syngas produces equipment that uses an innovative process to produce liquid transportation fuel from plastic waste material. The Company issued 20,000 common shares of the Company to an introducing party, determined to be valued at $2,000. The technology license is being amortized on a straight-line basis, over a period of 10 years. There are no other obligations under this agreement.

The Company and Syngas intend to collaborate and cooperate with a view to achieving economic and financial success for their respective businesses. The Company will continue to pursue other similar intellectual property around the world as we combine this and other technologies in innovative configurations to monetize the portfolio of proprietary technologies and processes to deliver value to our customers and shareholders.

LIQUIDITY AND CAPITAL RESOURCES

As of June 30, 2017, the Company had a cash balance of $31,998 (December 31, 2016-$1,774) and current debt obligations in the amount of $1,722,240 (December 31, 2016-$683,234). As at June 30, 2017, the Company had a working capital deficit of $1,635,926 (December 31, 2016-$487,703). The Company does not currently have sufficient funds to satisfy the current debt obligations. Should the Company’s creditors seek or demand payment, the Company does not have the resources to pay or satisfy any such claims currently.

The Company’s total assets at June 30, 2017 were $552,968 and total current liabilities were $1,722,240. Significant losses from operations have been incurred since inception and there is an accumulated deficit of $3,907,201 as of June 30, 2017. Continuation as a going concern is dependent upon generating significant new revenue and generating external capital and securing debt to achieve profitable operations while maintaining current fixed expense levels.

To pay current debt obligations and to fund any future operations, the Company requires significant new funds, which the Company may not be able to obtain. In addition to the funds required to liquidate the $1,722,240 in current debt obligations, the Company estimates that approximately $5,000,000 must be raised to fund capital requirements and general corporate expenses for the next 12 months.

Page | 23

On August 4, 2017, the Company received an additional advance from PACE in the amount of $38,530 ($50,000 CAD), to pay certain outstanding accounts payable.

On June 15, 2017, PACE loaned the Company $462,360 ($600,000 CAD) for its bid for the purchase of the assets of Astoria. Upon the Astoria Closing, PACE has agreed to finance the balance of the purchase by way of a credit facility, subject to assignment of the Astoria property lease and the compliance approval from the MOECC along with other guarantees and security to be determined. PACE will also have claim to the assets included in the purchase.

Effective January 1, 2017, the Company obtained a Line of Credit of $4,238,300 ($5,500,000 CAD) with PACE. The first tranche was received on February 2, 2017, in the amount of $1,232,960 ($1,600,000 CAD). Effective March 21, 2017, the funds advanced on the Line of Credit from PACE were unavailable to use until the matter with the Municipalities related to the BioGrid Project was resolved. On June 2, 2017, the restriction on the advanced funds was removed. The Line of Credit is no longer available to be drawn against, and, as such, the Company is re-negotiating the terms of the Line of Credit with PACE and it is expected that this Line of Credit will be replaced by a new Credit Facility for the commitment described in note 6 to the interim condensed consolidated financial statements.

Refer to note 13 to the interim condensed consolidated financial statements for details on the commitments as at June 30, 2017.

CONSOLIDATED RESULTS OF OPERATIONS – FOR THE SIX MONTHS ENDED JUNE 30, 2017 COMPARED TO THE SIX MONTHS ENDED JUNE 30, 2016

There was no revenue for the six-month periods ended June 30, 2017 and 2016.

Operating expenses for the six-month periods ended June 30, 2017 and 2016 consisted of the following:

| For the Six Months Ended | ||||||

| June 30, | June 30, | |||||

| Operating expenses: | 2017 | 2016 | ||||

| Financing costs | $ | 882,153 | $ | - | ||

| Contribution to Advanced Water Technology Program | 71,017 | - | ||||

| Professional fees | 88,359 | 89,104 | ||||

| Office and administration | 93,619 | 42,191 | ||||

| Management fees | 80,946 | 63,252 | ||||

| Interest expense | 42,686 | 3,816 | ||||

| Stock-based compensation | 191,250 | - | ||||

| Filing fees | 9,356 | 3,159 | ||||

| Total | $ | 1,459,386 | $ | 201,522 | ||

The net loss for the six months ended June 30, 2017 was $1,459,386, significantly higher than the net loss of $201,522 in the prior six-month period, primarily due to the financing costs, the capital contribution to the Advanced Water Technology Program and the stock-based compensation expenses recorded.

Our operating expenses increased by $1,257,864 from $201,522 for the six months ended June 30, 2016 to $1,459,386 for the six months ended June 30, 2017. This was primarily due to the financing costs of $882,153 in connection with the PACE financing, the contribution of $71,017 to the Advanced Water Technology Program and the stock-based compensation of $191,250. Professional fees decreased slightly by $745 during the six months ended June 30, 2017 compared to the prior six-month period, primarily due to a reduction in legal services provided in connection with the Company’s BioGrid Project offset by professional fees in connection with the Advanced Water Technology Program. Office and administration increased by $51,428 during the six months ended June 30, 2017 compared to the prior six-month period, primarily due to an increase in insurance expense of $33,084, an increase in office rent of $9,365 and an increase in bookkeeping and payroll costs of $12,696 offset by a reduction in other office and administration expenses of $3,717. The increased insurance of $33,084 related primarily to the new insurance coverage for the BioGrid Project and liability insurance coverage for the directors and officers. Interest expense increased by $38,870 during the six months ended June 30, 2017 compared to the prior six-month period, as a result of the new term loan and credit facility interest of $32,532 and an increase in interest expense of $6,338 relating to the interest on the related party loans. Management fees increased by $17,694 for the six months ended June 30, 2017 compared to the prior six-month period, due to the hiring of the VPCD during the fourth quarter of 2016. During the six months ended June 30, 2017, stock-based compensation of $191,250 was recorded on the issuance of common shares of the Company to four new directors, an employee, and the stock-based compensation for the CEO’s RSUs. No stock-based compensation was recorded in the prior six-month period ended June 30, 2016. Filing fees increased by $6,197 for the six months ended June 30, 2017 compared to the prior six-month period, as a result of an increase in press releases and filings during the current six-month period ended June 30, 2017.

Page | 24

CONSOLIDATED RESULTS OF OPERATIONS – FOR THE THREE MONTHS ENDED JUNE 30, 2017 COMPARED TO THE THREE MONTHS ENDED JUNE 30, 2016

There was no revenue for the three-month periods ended June 30, 2017 and 2016.

Operating expenses for the three-month periods ended June 30, 2017 and 2016 consisted of the following:

| For the Three Months Ended | ||||||

| June 30, | June 30, | |||||

| Operating expenses: | 2017 | 2016 | ||||

| Financing costs | $ | - | $ | - | ||

| Contribution to Advanced Water Technology Program | - | - | ||||

| Professional fees | 36,374 | 47,690 | ||||

| Office and administration | 48,979 | 21,608 | ||||

| Management fees | 40,149 | 32,634 | ||||

| Interest expense | 22,096 | 1,910 | ||||

| Stock-based compensation | 95,700 | - | ||||

| Filing fees | 5,467 | 2,268 | ||||

| Total | $ | 248,765 | $ | 106,110 | ||

The net loss for the three months ended June 30, 2017 was $248,765, significantly higher than the net loss of $106,110 in the prior three-month period, primarily due to the increased office and administration, increased interest expense and stock-based compensation expenses.

Our operating expenses increased by $142,655 from $106,110 for the three months ended June 30, 2016 to $248,765 for the three months ended June 30, 2017. Professional fees decreased by $11,316 during the three months ended June 30, 2017 compared to the prior three-month period, primarily due to a reduction in legal services provided in connection with the Company’s BioGrid Project. Office and administration increased by $27,371 during the three months ended June 30, 2017 compared to the prior three-month period, primarily due to an increase in insurance expense of $20,017, an increase in office rent of $5,973 and an increase in bookkeeping and payroll costs of $7,013 offset by a reduction in other office and administration expenses of $5,632. The increased insurance of $20,017 related primarily to the new insurance coverage for the BioGrid Project and liability insurance coverage for the directors and officers. Interest expense increased by $20,186 during the three months ended June 30, 2017 compared to the prior three-month period, as a result of the new term loan and credit facility interest of $17,550 and an increase in interest expense of $2,636 relating to the interest on the related party loans. Management fees increased by $7,515 for the three months ended June 30, 2017 compared to the prior three-month period, primarily due to the hiring of the VPCD during the fourth quarter of 2016. During the three months ended June 30, 2017, stock-based compensation of $95,700 was recorded on the issuance of common shares of the Company to two new directors in the quarter and the stock-based compensation for the RSUs. No stock-based compensation was recorded in the prior three-month period ended June 30, 2016. Filing fees increased by $3,199 for the three months ended June 30, 2017 compared to the prior three-month period, as a result of an increase in press releases and filings during the current three-month period ended June 30, 2017.The Company’s interim condensed consolidated financial statements have been prepared in accordance with US GAAP, which assumes that the Company will be able to meet its obligations and continue its operations for the next twelve months.

Page | 25

As at June 30, 2017, the Company had a working capital deficit of $1,635,926 (December 31, 2016-$487,703), incurred a net loss of $1,459,386 (2016-$201,522) for the six-month period ended June 30, 2017 and had an accumulated deficit of $3,907,201 (December 31, 2016-$2,447,815) and expects to incur further losses in the development of its business. These factors and those noted below, cast substantial doubt as to the Company’s ability to continue as a going concern which is dependent upon its ability to obtain the necessary financing to further the development of its business and upon achieving profitable operations. Management believes that the Company will be able to obtain the necessary funding by equity or debt; however, there is no assurance of funding being available on acceptable terms. Realization values may be substantially different from carrying values as shown.

On February 2, 2017, the Company received the first advance in the amount of $1,232,960 ($1,600,000 CAD) on its Line of Credit of $4,238,300 ($5,500,000 CAD) with PACE. The Line of Credit was obtained to fund the BioGrid Project, which was a project described in the BioGrid Agreement between the Company and the Municipalities. The Municipalities terminated the BioGrid Agreement on November 4, 2016 and the Company filed a Notice of Dispute with the Municipalities on March 1, 2017. The Company and the Municipalities met on March 31, 2017 and the Municipalities have since reiterated their position that the agreement is terminated. Effective March 21, 2017, the funds advanced on the Line of Credit from PACE were unavailable to use until the matter with the Municipalities related to the BioGrid Project was resolved. On June 2, 2017, the restriction on the advanced funds was removed. The Line of Credit is no longer available to be drawn against, and, as such, the Company is re-negotiating the terms of the Line of Credit with PACE and it is expected that this Line of Credit will be replaced by a new Credit Facility for the commitment described in note 6 to the interim condensed consolidated financial statements.

The interim condensed consolidated financial statements do not include any adjustments to reflect the future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result if the Company was unable to continue as a going concern.

CRITICAL ACCOUNTING ESTIMATES

Use of estimates