Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - ProPetro Holding Corp. | exhibit991aaa.htm |

| 8-K - 8-K - ProPetro Holding Corp. | a8-kearningsreleaseaugust8.htm |

2017 Q2 Earnings Presentation

August 9, 2017

NYSE: PUMP

www.propetroservices.com

IBDROOT\PROJECTS\IBD-NY\GIDEON2016\595087_1\07. Roadshow\01. Presentation\ProPetro Roadshow

v184.pptx

231

231

231

209

32

45

102

148

178

89

89

92

187

187

187

102

102

102

2

Certain information included in this presentation constitutes forward-looking statements within the

meaning of the Private Securities Litigation Reform Act. These forward-looking statements are

subject to numerous risks and uncertainties, many of which are difficult to predict, and generally

beyond our control. Actual results may differ materially from those indicated or implied by such

forward-looking statements. For information on identified risks and uncertainties that could

impact our forecasts, expectations, and results of operations, please review the risk factors and

other information disclosed from time to time in our filings with the Securities and Exchange

Commission.

This presentation references “Adjusted EBITDA,” a non-GAAP financial measures. This non-

GAAP measure is not intended to be an alternative to any measure calculated in accordance with

GAAP. We believe the presentation of Adjusted EBITDA provides useful information to investors

in assessing our financial condition and results of operations. Net income is the GAAP measure

most directly comparable to Adjusted EBITDA. Non-GAAP financial measures have important

limitations as analytical tools because they exclude some, but not all, items that affect the most

directly comparable GAAP financial measures. You should not consider Adjusted EBITDA in

isolation or as a substitute for an analysis of our results as reported under GAAP. Further,

Adjusted EBITDA may be defined differently by other companies in our industry, and our

definition of Adjusted EBITDA may not be comparable to similarly titled measures of other

companies, thereby diminishing their utility. A reconciliation of non-GAAP measures to the most

directly comparable measures calculated in accordance with GAAP, is set forth on page 12

hereto.

FORWARD-LOOKING STATEMENTS

IBDROOT\PROJECTS\IBD-NY\GIDEON2016\595087_1\07. Roadshow\01. Presentation\ProPetro Roadshow

v184.pptx

231

231

231

209

32

45

102

148

178

89

89

92

187

187

187

102

102

102

3

Permian Basin Update

2017 Q2 Operational Highlights

Fleet Expansion Initiative

2017 Q2 Financial Review

2017 Capital Spending and Related Economics

Outlook

DISCUSSION TOPICS

IBDROOT\PROJECTS\IBD-NY\GIDEON2016\595087_1\07. Roadshow\01. Presentation\ProPetro Roadshow

v184.pptx

231

231

231

209

32

45

102

148

178

89

89

92

187

187

187

102

102

102

4

Healthy Frac Demand Outpacing HHP Capacity

– Driven by Recent E&P Acquisitions and Attractive Economics

Increasing Pricing Leverage for Services

– Driven by Rig Activity and Short Supply of HHP Capacity

Mature and Evolving Infrastructure

– Driven by Historical Activity Levels and New Regional Sand Mines

*Baker Hughes Rig Data, August 4, 2017

PERMIAN MACRO

Total U.S. Onshore

Oil Directed Rig Count: 765*

Total U.S. Onshore Oil Rigs Added

Since Trough (May 2016): 449*

Permian

Basin

49%

Permian

Basin

54%

Permian

Basin

50 %

Other

50 %

Permian

Basin

54 %

Other

46 %

IBDROOT\PROJECTS\IBD-NY\GIDEON2016\595087_1\07. Roadshow\01. Presentation\ProPetro Roadshow

v184.pptx

231

231

231

209

32

45

102

148

178

89

89

92

187

187

187

102

102

102

5

Significant financial improvement vs Q1

- Revenue of $213.5 MM (24% increase)

- Net income of $4.9 MM

- Adjusted EBITDA of $30.7 MM (89% higher)

- Adjusted EBITDA margin grew to 14% from 9%

Continued frac fleet utilization of 100%

- Average deployed HHP = 462,033 or 10.9 Crews

Fleet deployment ahead of schedule

- Deployed two new build fleets in Q2

- Post Q2, deployed additional new build fleet

Tier 2 engine commitments

Stainless fluid end conversion on schedule (fully converted in Q4)

2017 Q2 HIGHLIGHTS

IBDROOT\PROJECTS\IBD-NY\GIDEON2016\595087_1\07. Roadshow\01. Presentation\ProPetro Roadshow

v184.pptx

231

231

231

209

32

45

102

148

178

89

89

92

187

187

187

102

102

102

6

Hydraulic Fracturing (~690,000 HHP by Year End)

Cementing

– Deployed first new-build unit in June

– Second new-build unit to be deployed before Q4

– Brings total capacity to 14 units

FLEET EXPANSION

Deployed Fleets HHP Cum HHP

As of 9/1/16 1-10 420,000 420,000

5/2/16 11 45,000 465,000

6/6/17 12 45,000 510,000

7/14/17 13 45,000 555,000

End of August 14 45,000 600,000

Mid Q4 15 45,000 645,000

End of Q4 16 45,000 690,000

“Due to strong Permian demand within our superior customer base, we will continue

to expand our operations while maintaining industry leading performance.”

- Dale Redman, CEO

98

218

380

420

420

690

2012A

2013A

2014A

2015A

2016A

2017E

Frac Fleet HHP ('000s)

IBDROOT\PROJECTS\IBD-NY\GIDEON2016\595087_1\07. Roadshow\01. Presentation\ProPetro Roadshow

v184.pptx

231

231

231

209

32

45

102

148

178

89

89

92

187

187

187

102

102

102

7

Permian

97%

Non-

Permian

3%

Revenue: $213.5 MM

EPS: $0.06

Adjusted EBITDA: $30.7 MM

Conservative Leverage Profile(1)

– Cash: $25.1 MM

– Total Debt: $16.5 MM

– Total Liquidity: $175.1MM (2)

(1) As of June 30, 2017.

(2) Including an undrawn revolving credit facility with a borrowing capacity of $150 MM.

2017 Q2 FINANCIAL HIGHLIGHTS

2017 Q2 Revenue Mix

Frac

90%

Non-Frac

10%

Pressure

Pumping

95%

All Other

5%

IBDROOT\PROJECTS\IBD-NY\GIDEON2016\595087_1\07. Roadshow\01. Presentation\ProPetro Roadshow

v184.pptx

231

231

231

209

32

45

102

148

178

89

89

92

187

187

187

102

102

102

8

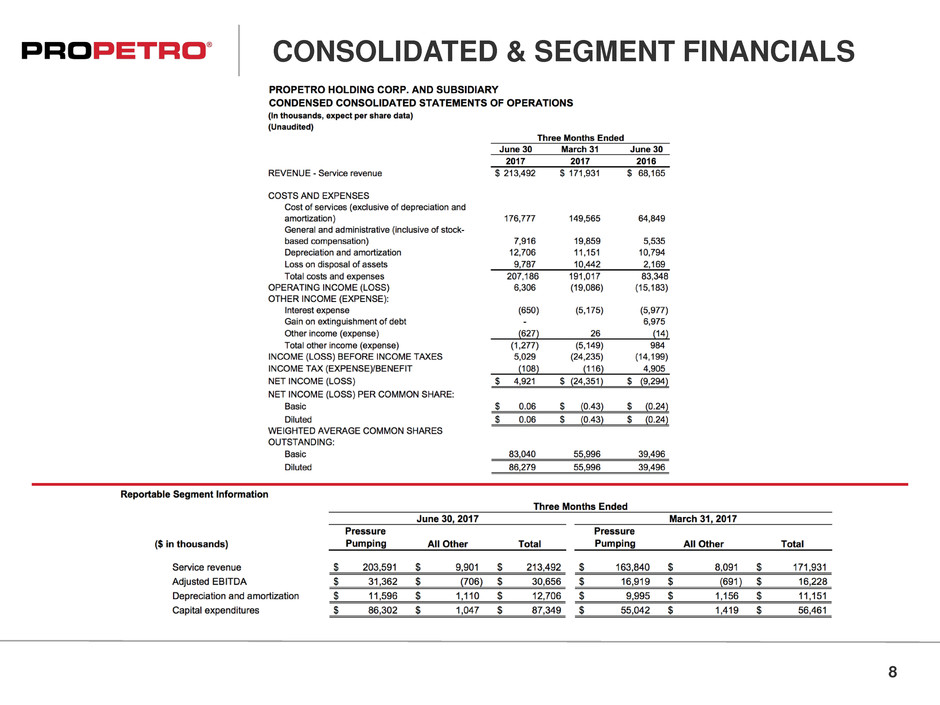

CONSOLIDATED & SEGMENT FINANCIALS

IBDROOT\PROJECTS\IBD-NY\GIDEON2016\595087_1\07. Roadshow\01. Presentation\ProPetro Roadshow

v184.pptx

231

231

231

209

32

45

102

148

178

89

89

92

187

187

187

102

102

102

9

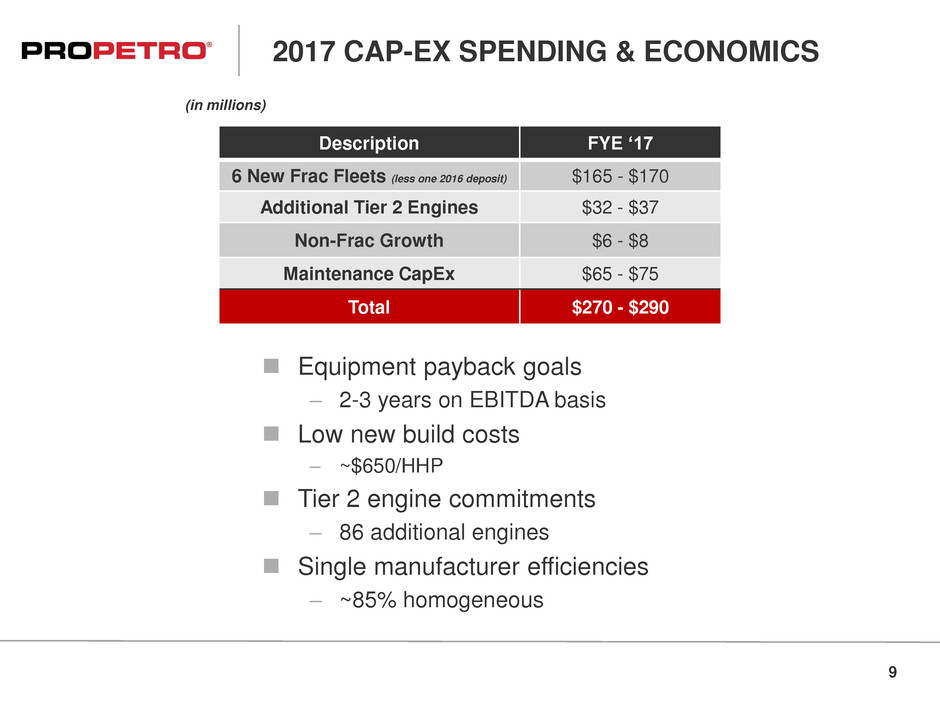

2017 CAP-EX SPENDING & ECONOMICS

Description FYE ‘17

6 New Frac Fleets (less one 2016 deposit) $165 - $170

Additional Tier 2 Engines $32 - $37

Non-Frac Growth $6 - $8

Maintenance CapEx $65 - $75

Total $270 - $290

(in millions)

Equipment payback goals

– 2-3 years on EBITDA basis

Low new build costs

– ~$650/HHP

Tier 2 engine commitments

– 86 additional engines

Single manufacturer efficiencies

– ~85% homogeneous

IBDROOT\PROJECTS\IBD-NY\GIDEON2016\595087_1\07. Roadshow\01. Presentation\ProPetro Roadshow

v184.pptx

231

231

231

209

32

45

102

148

178

89

89

92

187

187

187

102

102

102

10

Permian Focus

– Positioned in the low cost basin

Blue Chip Customers

– Large drilling inventories and sizeable rig programs

Superior Performance

– Consistently outperforming the competition on location

Full Calendar

– Fully booked calendar well into 2018

Strong Balance Sheet

– Minimal debt with disciplined capital allocation

No Speculative New Builds

– Strong customer commitments

High Utilization Through Cycles

– Great history of battling cyclicality

Delaware Upside

– Untapped opportunities with current customers and beyond

UNIQUELY POSITIONED FOR SUCCESS

IBDROOT\PROJECTS\IBD-NY\GIDEON2016\595087_1\07. Roadshow\01. Presentation\ProPetro Roadshow

v184.pptx

231

231

231

209

32

45

102

148

178

89

89

92

187

187

187

102

102

102

11

APPENDIX

IBDROOT\PROJECTS\IBD-NY\GIDEON2016\595087_1\07. Roadshow\01. Presentation\ProPetro Roadshow

v184.pptx

231

231

231

209

32

45

102

148

178

89

89

92

187

187

187

102

102

102

12

RECONCILIATION OF ADJUSTED EBITDA

IBDROOT\PROJECTS\IBD-NY\GIDEON2016\595087_1\07. Roadshow\01. Presentation\ProPetro Roadshow

v184.pptx

231

231

231

209

32

45

102

148

178

89

89

92

187

187

187

102

102

102

13

Corporate Headquarters:

1706 S. Midkiff, Bldg. B

Midland, TX 79701

432.688.0012

www.propetroservices.com

Investor Relations:

Sam Sledge

sam.sledge@propetroservices.com

Office Direct 432.253.5111

CONTACT