Attached files

| file | filename |

|---|---|

| EX-99.2 - SOLITARIO ZINC CORP. | exh992.htm |

| 8-K - SOLITARIO ZINC CORP. | frm8kpea.htm |

NI 43-101 Technical Report Preliminary Economic Assessment Florida Canyon Zinc Project Amazonas Department, Peru

Effective Date: July 13, 2017

Report Date: August 3, 2017

Report Prepared for

Votorantim Metais Holding S.A. Solitario Zinc Corp.

43 John F. Kennedy Ave., 3rd floor 4251 Kipling Street. Suite 390

Luxembourg, L-1855 Wheat Ridge, Colorado 80033

Report prepared by

SRK Consulting (U.S.), Inc.

1125 Seventeenth Street, Suite 600

Denver, CO 80202

SRK Project Number: 181700.110

Signed by Qualified Persons:

Walter Hunt, CPG / Solitario Zinc Corp, COO

J.B. Pennington, MSc, CPG, AIPG / SRK Principal Mining Geologist Daniel H. Sepulveda / SRK Associate Consultant (Metallurgist)

Joanna Poeck, BEng Mining, SME-RM, MMSAQP / SRK Senior Consultant (Mining Engineer) Jeff Osborn, BEng Mining, MMSAQP / SRK Principal Consultant (Mining Engineer)

James Gilbertson, MCSM, CGeol, FGS / SRK Principal Exploration Geologist John Tinucci, PhD, PE / SRK Principal Consultant (Geotechnical Engineer)

Reviewed by:

Kent Hartley, P.E. (Mining Engineer)

| 1 |

Table of Contents

| 1 | Summary 13 |

| 1.1 | Technical Economics 13 |

| 1.2 | Property Description and Ownership 16 |

| 1.3 | Geology and Mineralization 16 |

| 1.4 | Status of Exploration, Development and Operations 17 |

1.4.1 History 17

1.4.2 Exploration Status 17

1.4.3 Development and Operations 18

| 1.5 | Mineral Processing and Metallurgical Testing 18 |

| 1.6 | Mineral Resource Estimate 19 |

| 1.7 | Mineral Reserve Estimate 21 |

| 1.8 | Mining 21 |

| 1.9 | Recovery Methods 23 |

| 1.10 | Project Infrastructure 23 |

| 1.11 | Environmental Studies and Permitting 24 |

| 1.12 | Conclusions and Recommendations 24 |

1.12.1 General 24

1.12.2 Mineral Resource Estimate 25

1.12.3 Mineral Processing and Metallurgical Testing 25

1.12.4 Mineral Reserve Estimate 26

1.12.5 Mining Methods 26

1.12.6 Recovery Methods 27

1.12.7 Project Infrastructure 27

1.12.8 Environmental Studies and Permitting 27

1.12.8 Recommendations – Work Programs and Costs 28

| 2 | Introduction 29 |

| 2.1 | Terms of Reference and Purpose of the Report 29 |

| 2.2 | Qualifications of Consultants (SRK) 29 |

| 2.3 | Details of Inspection 30 |

| 2.4 | Sources of Information 30 |

| 2.5 | Effective Date 30 |

| 2.6 | Units of Measure 30 |

| 3 | Reliance on Other Experts 31 |

| 4 | Property Description and Location 32 |

| 4.1 | Property Location 32 |

| 2 |

| 4.2 | Mineral Titles 34 |

4.2.1 Nature and Extent of Issuer’s Interest 39

4.2.2 Property and Title in Peru 39

| 4.3 | Royalties, Agreements and Encumbrances 40 |

| 4.4 | Environmental Liabilities and Permitting 40 |

4.4.1 Required Exploration Permits and Status 40

4.4.2 Required Mining Permits 40

| 4.5 | Other Significant Factors and Risks 41 |

| 5 | Accessibility, Climate, Local Resources, Infrastructure and Physiography 42 |

| 5.1 | Topography, Elevation and Vegetation 42 |

| 5.2 | Accessibility and Transportation to the Property 42 |

| 5.3 | Climate and Length of Operating Season 43 |

| 5.4 | Sufficiency of Surface Rights 43 |

| 5.5 | Infrastructure Availability and Sources 43 |

5.5.1 Proximity to Population Center 45

5.5.2 Power 45

5.5.3 Water 45

5.5.4 Mining Personnel 45

5.5.5 Potential Mine Infrastructure Areas 46

| 6 | History 48 |

| 6.1 | Prior Ownership and Ownership Changes 48 |

| 6.2 | Previous Exploration and Development Results 48 |

| 6.3 | Historical Mineral Resource and Reserve Estimates 48 |

| 6.4 | Historical Production 49 |

| 7 | Geological Setting and Mineralization 50 |

| 7.1 | Regional Geology 50 |

| 7.2 | Local Geology 52 |

7.2.1 Lithology and Stratigraphy 52

7.2.2 Structure 53

7.2.3 Alteration 54

7.2.4 Mineralization 54

| 7.3 | Property Geology 55 |

| 7.4 | Significant Mineralized Zones 57 |

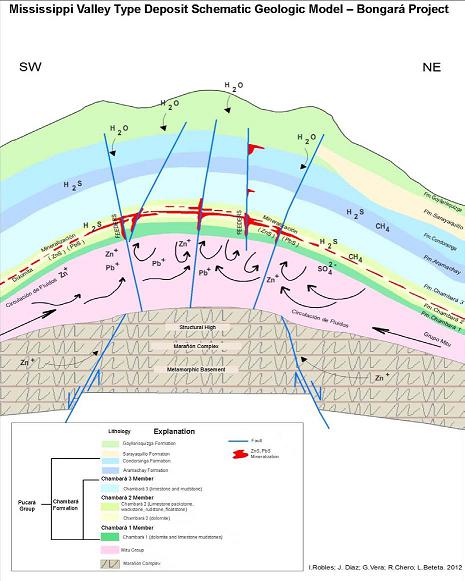

| 8 | Deposit Type 58 |

| 8.1 | Mineral Deposit 58 |

| 8.2 | Geological Model 58 |

| 3 |

| 9 | Exploration 60 |

| 9.1 | Relevant Exploration Work 60 |

| 9.2 | Surveys and Investigations 60 |

| 9.3 | Sampling Methods and Sample Quality 60 |

| 9.4 | Significant Results and Interpretation 60 |

| 10 Drilling | 66 |

| 10.1 | Type and Extent 66 |

| 10.2 | Procedures 68 |

| 10.3 | Interpretation and Relevant Results 68 |

| 11 | Sample Preparation, Analysis and Security 70 |

| 11.1 | Sampling Methods 70 |

11.1.1 Sampling for Geochemical Analysis 70

11.1.2 Sampling for Density Measurement 70

| 11.2 | Security Measures 70 |

| 11.3 | Sample Preparation for Analysis 71 |

| 11.4 | QA/QC Procedures 73 |

11.4.1 Standards 73

11.4.2 Blanks 74

11.4.3 Duplicates 74

11.4.4 Actions 75

| 11.5 | Opinion on Adequacy 75 |

| 12 | Data Verification 76 |

| 12.1 | Procedures 76 |

| 12.2 | Limitations 76 |

| 12.3 | Opinion on Data Adequacy 77 |

| 13 | Mineral Processing and Metallurgical Testing 78 |

| 13.1 | Testing and Procedures 78 |

| 13.2 | Relevant Results 78 |

13.2.1 Mineralogy 78

13.2.2 Recovery and Concentrate Grades 79

13.2.3 Hardness 82

13.2.4 Reagents 83

| 13.3 | Recovery Projections 83 |

| 13.4 | Significant Factors and Recommendations 84 |

| 14 | Mineral Resource Estimate 85 |

| 14.1 | Geology and Mineral Domain Modeling 86 |

| 14.2 | Drillhole Database 88 |

14.2.1 Database 88

| 4 |

14.2.2 Topography and Sample Locations 89

14.2.3 Oxidation Classification in Drillhole Logging 89

| 14.3 | Drilling Data Analysis 89 |

14.3.1 Capping 90

14.3.2 Compositing 90

| 14.4 | Density 91 |

| 14.5 | Variogram Analysis and Modeling 92 |

| 14.6 | Block Model 92 |

14.6.1 Model Specifications 92

14.6.2 Model Construction 93

| 14.7 | Grade Estimation 94 |

| 14.8 | Zinc, Lead, and Silver Recovery Calculation 96 |

| 14.9 | Zinc Equivalent Grade Calculation 96 |

| 14.10 | Model Validation 97 |

14.10.1 SRK Grade Estimate vs Votorantim Grade Estimate 97

14.10.2 Visual Comparison 97

14.10.3 Comparative Statistics 98

| 14.11 | Resource Classification 98 |

| 14.12 | Mineral Resource Statement 99 |

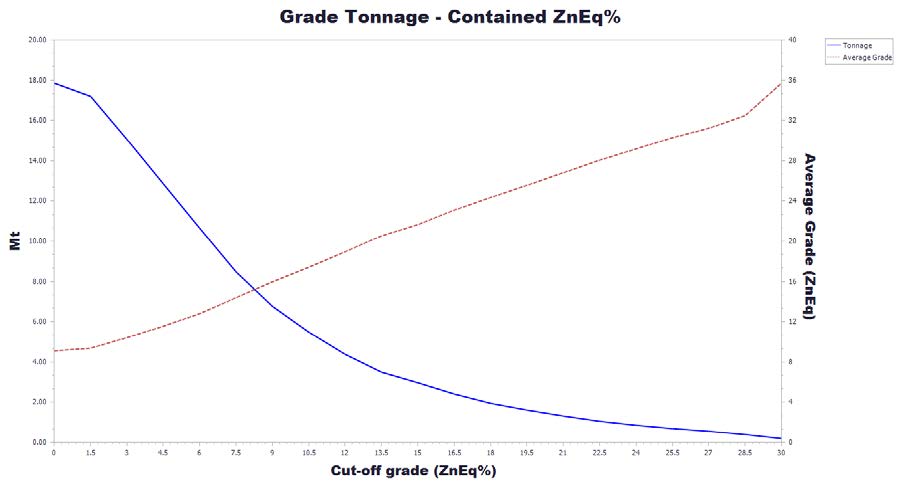

| 14.13 | Mineral Resource Cut-off Grade Determination 99 |

| 14.14 | Mineral Resource Sensitivity 100 |

| 14.15 | Relevant Factors 100 |

| 15 | Mineral Reserve Estimate 101 |

| 16 | Mining Methods 102 |

| 16.1 | Proposed Mining Methods 107 |

| 16.2 | Geotechnical Input for Mine Design 108 |

16.2.1 Geotechnical Characterization 108

16.2.2 Stress Field and topography 110

16.2.3 Cut and Fill parameters 110

16.2.4 Sub-level Open Stoping Parameters 111

16.2.5 Crown Pillar 113

16.2.6 Sill Pillar Dimensioning 113

16.2.7 Ground Support 114

16.2.8 Tailings Backfill 117

| 16.3 | Mine Design 117 |

16.3.1 Net Smelter Return 118

16.3.2 Operating Costs 120

| 5 |

16.3.2 Stope Optimization 121

16.3.4 Mining Recovery and Dilution 122

16.3.5 Cut-off Evaluation 123

16.3.6 Mining Methods 124

16.3.7 Mine Plan Resource 128

16.3.8 Development Layout 129

16.3.8 Waste Rock Management and Backfilling 136

| 16.4 | Mine Production Schedule 136 |

| 16.5 | Mine Services 139 |

16.2.1 Underground Mine Equipment 139

16.2.2 Electrical 139

16.5.3 Ventilation 139

16.2.4 Mine Personnel 141

16.2.5 Health and Safety 141

| 17 | Recovery Methods 142 |

| 17.1 | Processing Projections and Methods 142 |

| 17.2 | Processing Methods and Flow Sheet 142 |

| 17.3 | Consumables Requirement 144 |

| 18 | Project Infrastructure 146 |

| 18.1 | Infrastructure and Logistics Requirements 146 |

18.1.1 Access and Local Communities 146

18.1.2 Site Water Management 147

18.1.3 Project Facilities 148

18.1.4 Power Supply and Distribution 150

| 18.2 | Project Logistics 152 |

| 18.3 | Tailings Management 153 |

| 19 | Market Studies and Contracts 155 |

| 19.1 | Contracts and Status 155 |

| 20 | Environmental Studies, Permitting and Social or Community Impact 156 |

| 20.1 | Required Permits and Status 156 |

20.1.1 Required Exploration Permits and Status 156

20.1.2 Required Mining Permits 156

| 20.2 | Environmental Monitoring Results 157 |

| 20.3 | Groundwater 159 |

| 20.4 | Environmental Issues 159 |

| 20.5 | Mine Closure 160 |

| 20.3.1 | Post Mining Land Use 160 |

| 6 |

| 20.3.2 | Portals and Vents 160 |

| 20.3.3 | Buildings and Infrastructure 160 |

| 20.3.4 | Roads and Miscellaneous Disturbance 161 |

| 20.3.5 | Tailings Facility 161 |

| 20.6 | Post Closure Plans 161 |

| 20.7 | Reclamation and Closure Cost Estimate 162 |

| 20.8 | Post-Performance or Reclamations Bonds 162 |

| 20.9 | Social and Community 162 |

| 21 | Capital and Operating Costs 164 |

| 21.1 | Capital Cost Estimates 164 |

21.1.1 Basis for Capital Cost Estimates 165

| 21.2 | Operating Cost Estimates 168 |

21.2.1 Basis for Operating Cost Estimates 168

| 22 | Economic Analysis 170 |

| 22.1 | External Factors 170 |

| 22.2 | Main Assumptions 171 |

| 22.3 | Taxes, Royalties and Other Interests 172 |

| 22.4 | Results 173 |

| 22.5 | Base Case Sensitivity Analysis 179 |

| 22.6 | Conservative Metal Price Alternative Analysis 181 |

22.6.1 Impact to Mine Planning 182

22.6.2 Impact to Economics 183

| 23 | Adjacent Properties 189 |

| 24 | Other Relevant Data and Information 190 |

| 25 | Interpretation and Conclusions 191 |

| 25.1 | General 191 |

| 25.2 | Mineral Resource Estimate 191 |

| 25.3 | Mineral Processing and Metallurgical Testing 192 |

| 25.4 | Mineral Reserve Estimate 193 |

| 25.5 | Mining 193 |

| 25.6 | Recovery Methods 193 |

| 25.7 | Project Infrastructure 193 |

| 25.8 | Environmental Studies and Permitting 194 |

| 25.9 | Capital and Operating Costs 194 |

| 25.10 | Economics 195 |

| 26 | Recommendations 196 |

| 7 |

| 26.1 | Recommended Work Programs 196 |

26.1.1 Engineering Studies (Prefeasibility Level) 196

26.1.2 Drilling 197

26.1.3 Mining 197

| 26.2 | Work Program Costs 197 |

| 27 References | 199 |

| 28 Glossary | 201 |

| 28.1 | Mineral Resources 201 |

| 28.2 | Mineral Reserves 201 |

| 28.3 | Definition of Terms 202 |

| 28.4 | Abbreviations 203 |

List of Tables

Table 1-1: Indicative Economic Results (US$) 14

Table 1-2: Capital Costs 15

Table 1-3: Operating Costs 15

Table 1-4: Operating Costs 15

Table 1-5: Florida Canyon Metal Recoveries by Material Type 18

Table 1-6: Mineral Resource Statement for the Florida Canyon Zn-Pb-Ag Deposit, Amazonas Department, Peru, SRK Consulting (U.S.), Inc., July 13, 2017 21

Table 1-7: Mine Plan Resource for the Florida Canyon Zn-Pb-Ag Deposit, Amazonas Department, Peru, SRK Consulting (U.S.), Inc., July 21, 2017 22

Table 1-8: Mine Plan Resource Average Process Recovery 22

Table 1-9: Summary of Costs for Recommended Work 28

Table 4-1: List of Minera Bongará Mineral Claims 35

Table 4-2: List of Minera Chambara Mineral Claims 36

Table 5-1: Distance and Travel Time to Florida Canyon Project from Lima, Peru 43

Table 6-1: Mineral Resource Statement for the Florida Canyon Zn-Pb-Ag Deposit, Amazonas Department, Peru, SRK Consulting (U.S.), Inc., 05 June, 2014 49

Table 10-1: Downhole Survey Data Point Spacing 68

Table 11-1: Analytical Codes and Methods 71

Table 11-2: Analyzed Elements and Method Detection Limits 72

Table 11-3: Summary of SRM Statistics for Lead 73

Table 11-4: Summary of SRM Statistics for Zinc 73

Table 11-5: Summary of Duplicate Samples 74

Table 13-1: Summary of Florida Canyon Metallurgical Test Work 78

Table 13-2: Mineralogy of Sulfide Composite 79

| 8 |

Table 13-3: Mineralogy of Oxide Composite 79

Table 13-4: Metallurgical Tests – Selected Results 81

Table 13-5: Hardness Test Results 82

Table 13-6: Florida Canyon Metal Recoveries by Material Type 83

Table 14-1: Statistics of Raw Assays – All Intervals 89

Table 14-2: Statistics of Raw Assays – Manto Intervals Only 90

Table 14-3: Item ID’s and Descriptions 91

Table 14-4: Statistics of All Composites Inside Mantos 91

Table 14-5: Block Model Specifications 92

Table 14-6: Block Model Item Descriptions 93

Table 14-7: Additional SRK Block Model Item Descriptions 93

Table 14-8: Variogram and Grade Estimation Parameters 95

Table 14-9: Comparison of Composite and Block Grades 98

Table 14-10: Mineral Resource Statement for the Florida Canyon Zn-Pb-Ag Deposit, Amazonas Department, Peru, SRK Consulting (U.S.), Inc., July 13, 2017 99

Table 16-1: Rock Mass Classification Parameters 109

Table 16-2: Stope Stability Graph Input Parameters 112

Table 16-3: Proposed Stope Dimensions 113

Table 16-4: Parameters for the Barton Method 115

Table 16-5: Estimated Support According to the Barton Method 116

Table 16-6: Expected Processing Recoveries 118

Table 16-7: NSR Calculation Parameters for Stope Optimization 119

Table 16-8: Example NSR Calculation 120

Table 16-9: Operating Costs Used for Determining Potential Mining Shapes 121

Table 16-10: Stope Optimization Parameters for Base Case Analysis 121

Table 16-11: Mine Plan Resource for the Florida Canyon Zn-Pb-Ag Deposit, Amazonas Department, Peru, SRK Consulting (U.S.), Inc., July 21, 2017 128

Table 16-12: Mine Plan Resource Average Process Recovery 128

Table 16-13: Development Design Assumptions 130

Table 16-14: Development Quantities 130

Table 16-15: LoM Backfill and Cement Quantities by Type 136

Table 16-16: Florida Canyon Production Schedule 138

Table 16-17: Mine Equipment 139

Table 16-18: Estimated Airflow Requirements – Central/North and Northwest Areas 140

Table 16-19: Estimated Airflow Requirements – F1 (San Jorge) 140

Table 16-20: Estimated Airflow Requirements - SAM 140

Table 16-21: Hourly and Salaried Personnel (On Site) 141

Table 17-1: Florida Canyon PEA Level Throughput and Concentrate Production Projections 142

| 9 |

Table 17-2: Overland Conveying from Underground Portals to the Process Plant 143

Table 20-1: Environmental Monitoring During Mining Exploration 158

Table 21-1: Florida Canyon Capital Estimate Summary 165

Table 21-2: Florida Canyon Underground Mine Equipment Acquisition Schedule 166

Table 21-3: Florida Canyon Offsite, Site, Power, Water and Backfill Infrastructure 167

Table 21-4: Florida Canyon Operating Costs Summary 168

Table 22-1: Florida Canyon Price Assumptions 170

Table 22-2: Florida Canyon Net Smelter Return Terms 170

Table 22-3: Florida Canyon Product Logistics Cost 171

Table 22-4: Florida Canyon Mine Production Assumptions 171

Table 22-5: Florida Canyon Mill Production Assumptions 172

Table 22-6: Florida Canyon Royalty Rates 173

Table 22-7: Florida Canyon Indicative Economic Results (Dry Basis) 175

Table 22-8: Florida Canyon LoM Annual Production and Revenues 176

Table 22-9: Florida Canyon Cash Costs 178

Table 22-10: Alternate Market Forecast Metal Prices 181

Table 22-11: Florida Canyon Alternate Case Indicative Economic Results (Dry Basis) 185

Table 22-12: Florida Canyon Alternate Case LoM Annual Production and Revenues 186

Table 22-13: Florida Canyon Cash Costs 188

Table 25-1: Florida Canyon Operating Costs Summary 194

Table 26-1: Summary of Costs for Recommended Work 198

Table 28-1: Definition of Terms 202

Table 28-2: Abbreviations 203

List of Figures

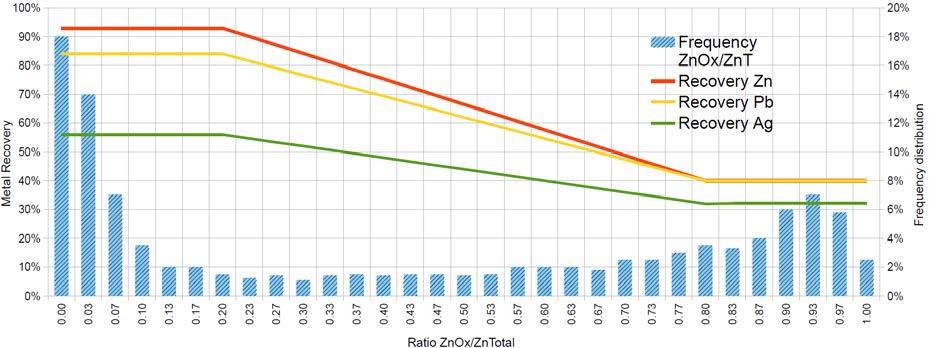

Figure 1-1: Florida Canyon Metal Recoveries Relative to ZnO/ZnT Ratio 19

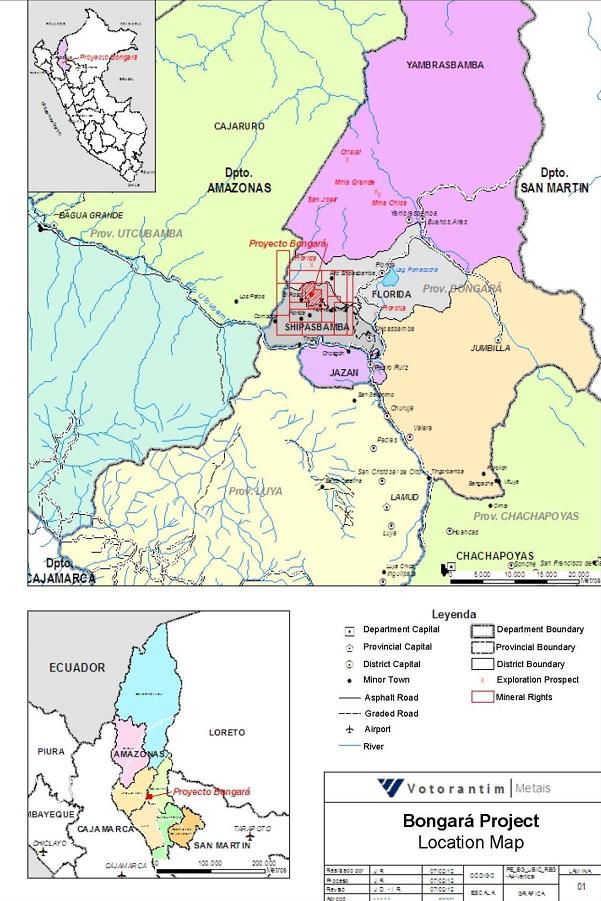

Figure 4-1: Project Location Map 33

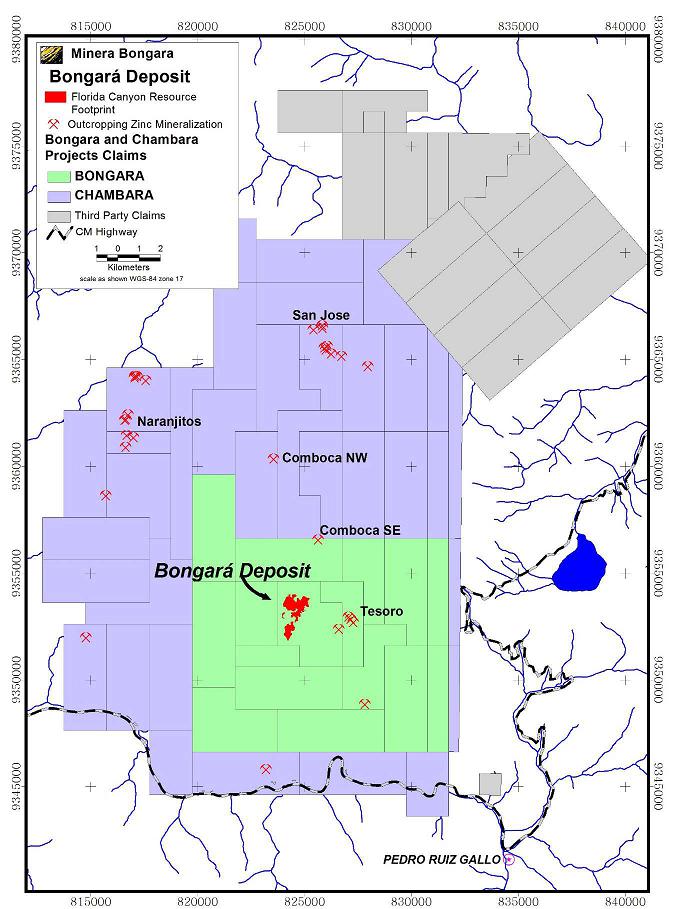

Figure 4-2: Map of Mineral Claims 38

Figure 5-1: Photograph of the Florida Canyon Project Area 42

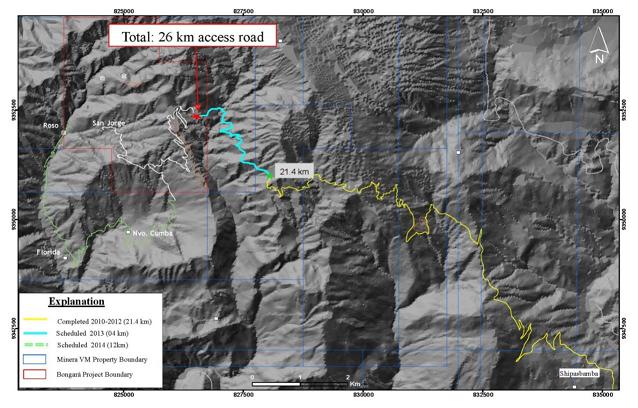

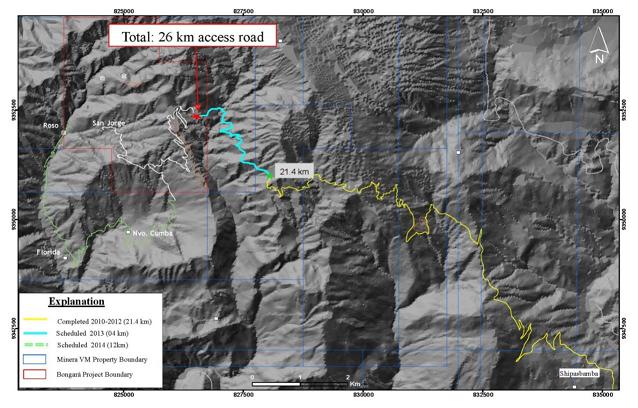

Figure 5-2: Project Access Road 44

Figure 5-3: Photograph of Drilling Camp at Project Site 44

Figure 5-4: Potential Mine Infrastructure Locations 47

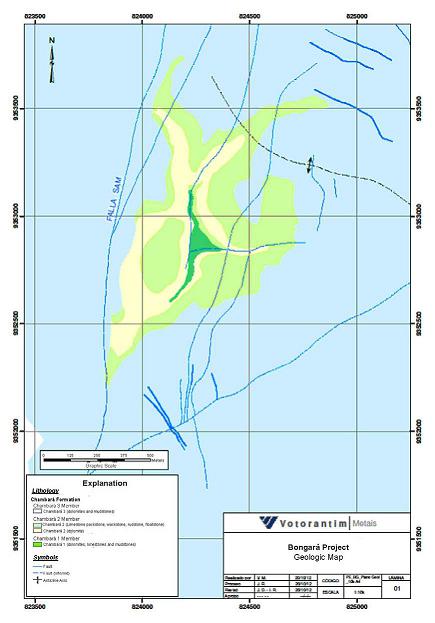

Figure 7-1: Regional Geologic Map 51

Figure 7-2: Project Area Stratigraphic Column 52

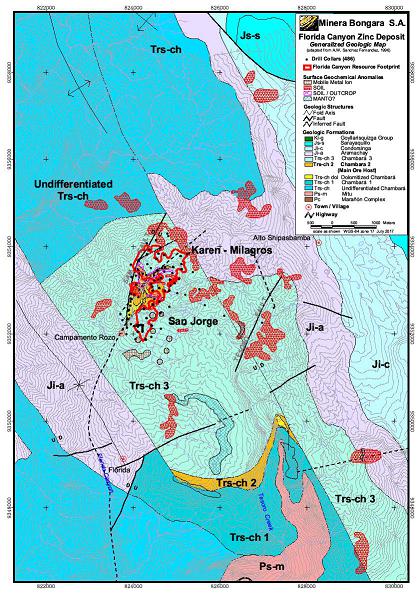

Figure 7-3: Florida Canyon Project Geologic Map 56

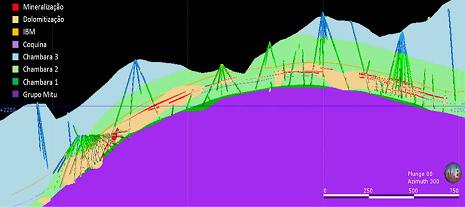

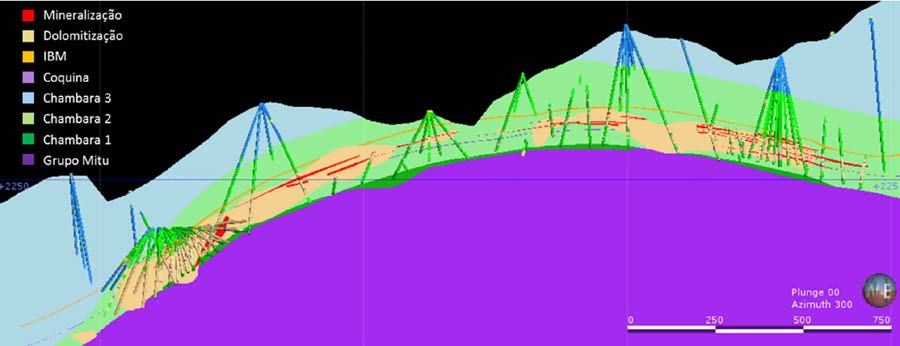

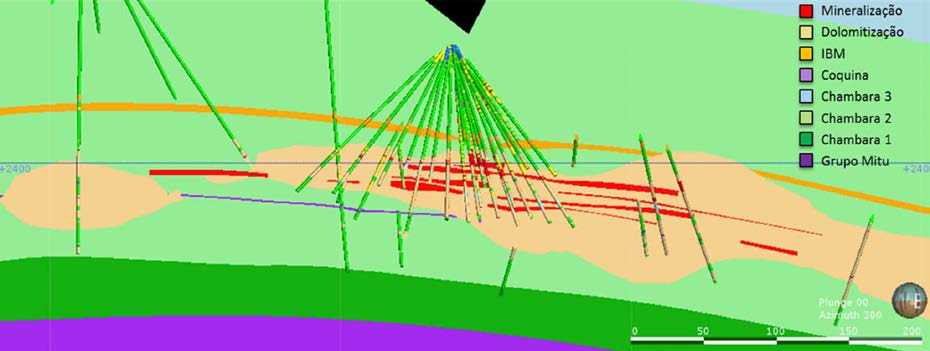

Figure 7-4: Cross Section of the Project Geologic Model 57

| 10 |

Figure 8-1: Mississippi Valley-Type Deposit Schematic Model 59

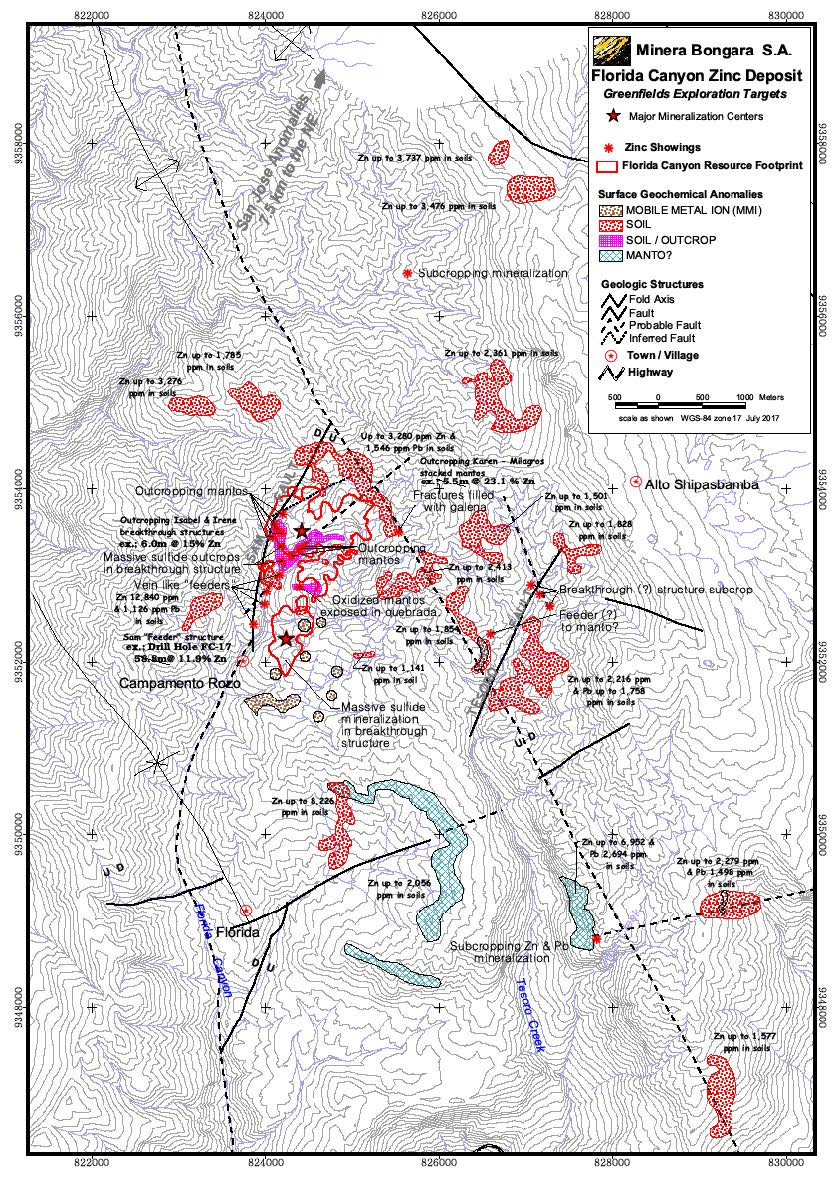

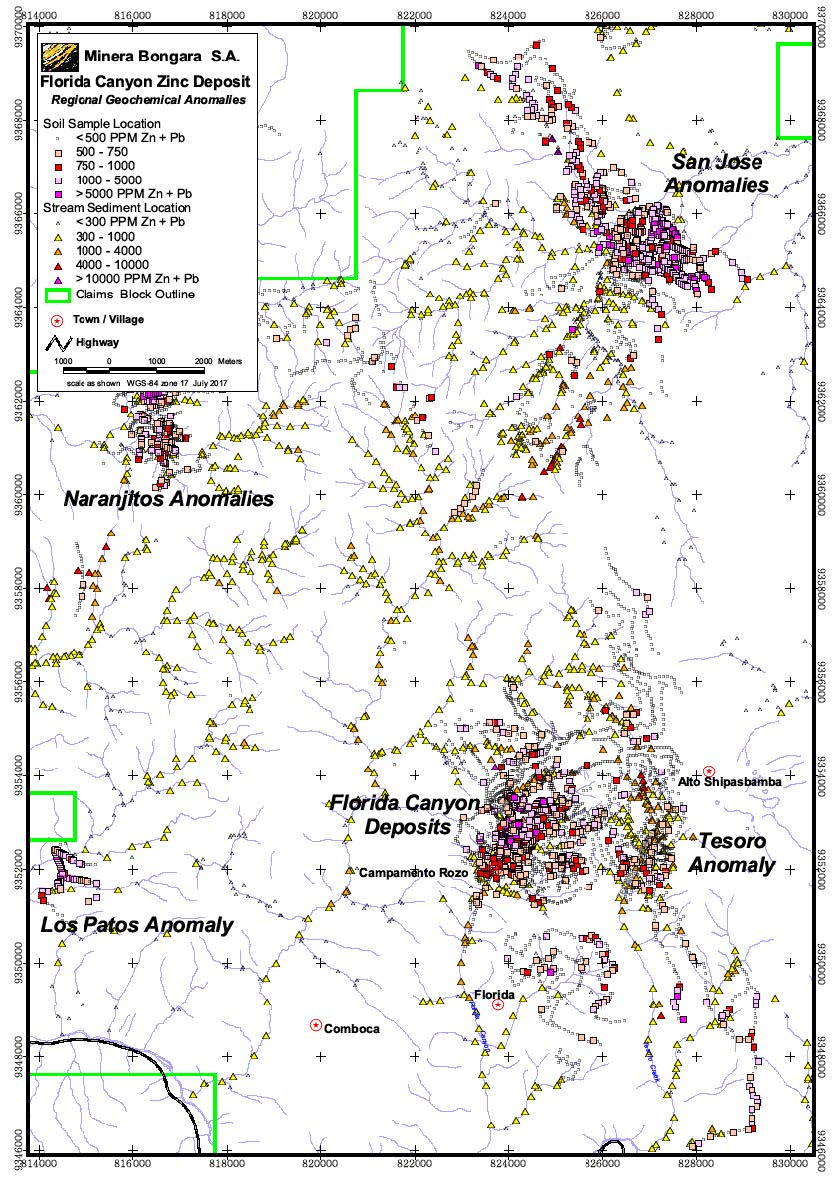

Figure 9-1: Florida Canyon Area Prospect and Geochemistry Map 62

Figure 9-2: Regional Geochemical Results 64

Figure 9-3: Florida Canyon Area Simplified Geology, Resource and Drillhole Map 65

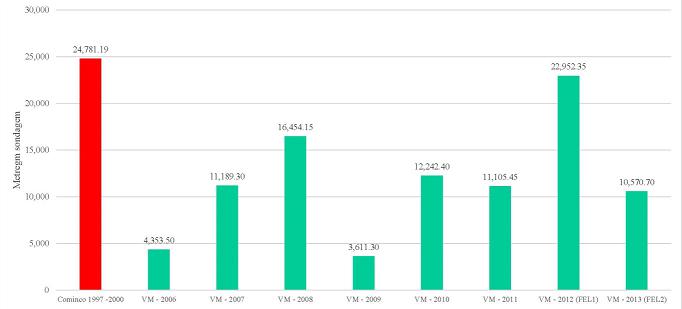

Figure 10-1: Project Drilling History 66

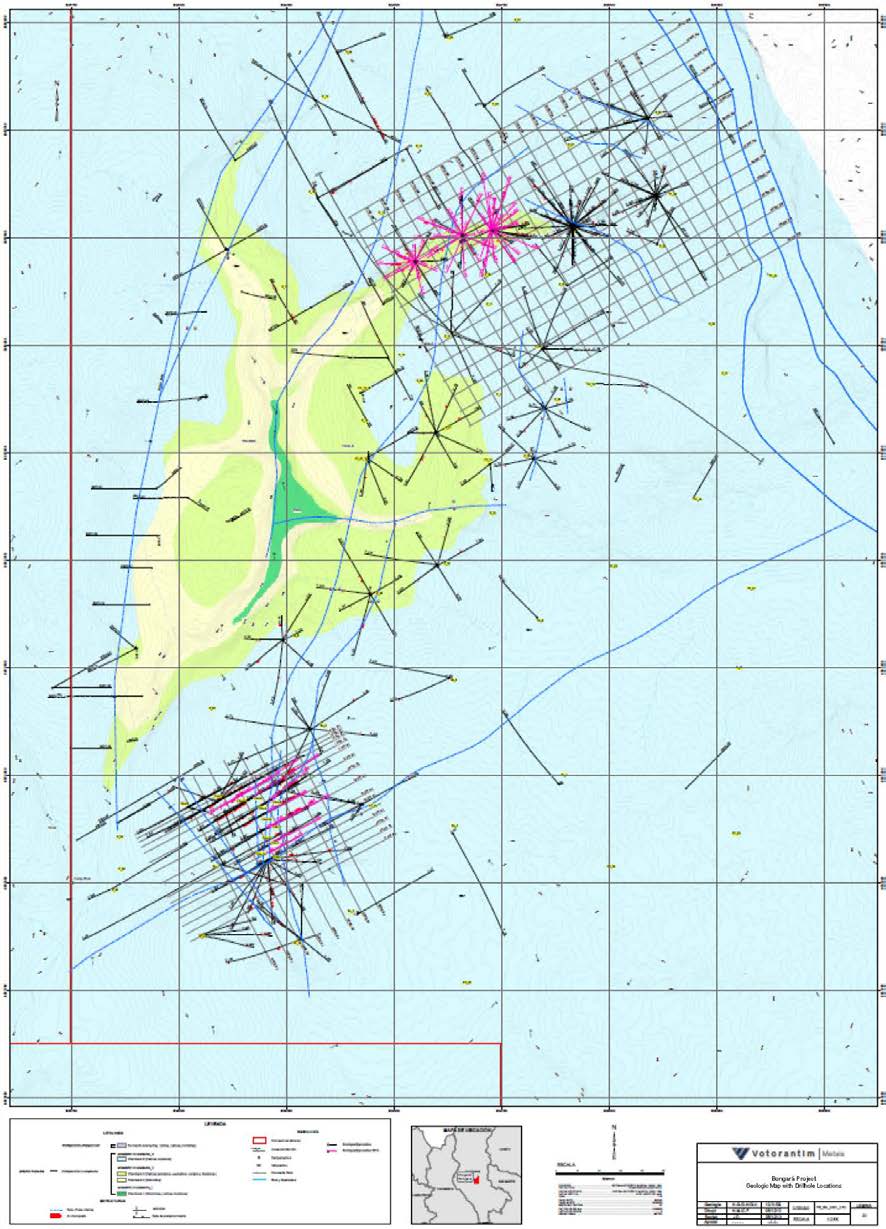

Figure 10-2: Geologic Map with Drillhole Locations 67

Figure 12-1: Photograph of Project Core Lithology Reference Sample Library 76

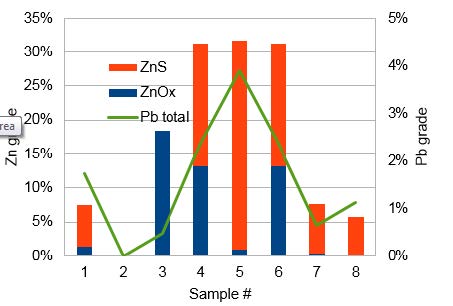

Figure 13-1: Metallurgical Sample Results – Zinc and Lead Head Grades 80

Figure 13-2: Florida Canyon Metal Recoveries Relative to ZnO/ZnT Ratio 83

Figure 14-1: North-South Longitudinal Section of Geologic Model 87

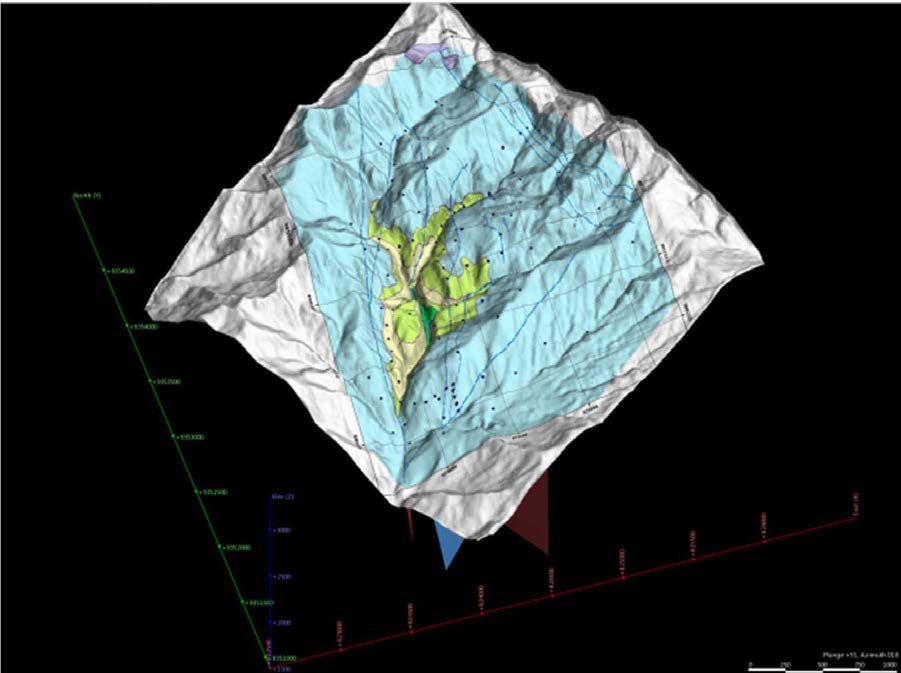

Figure 14-2: Florida Canyon Geological and Structural Map Projected on Topography 87

Figure 14-3: Geological Cross Section of Karen-Milagros Domain 88

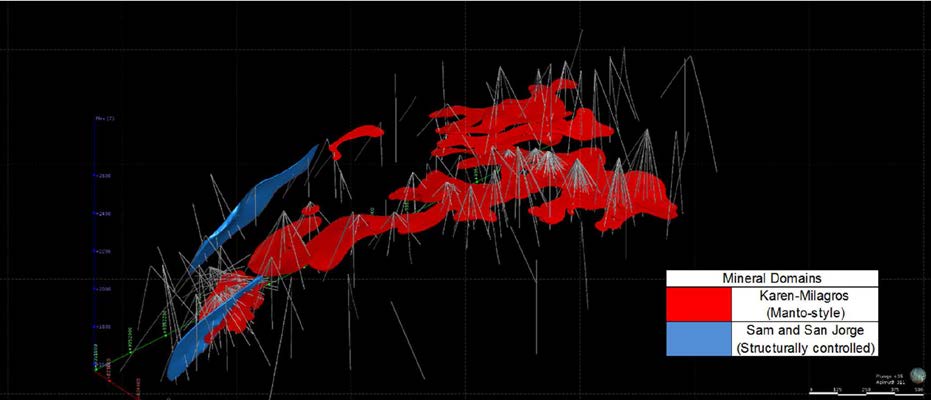

Figure 14-4: Oblique View of Mineral Domains 88

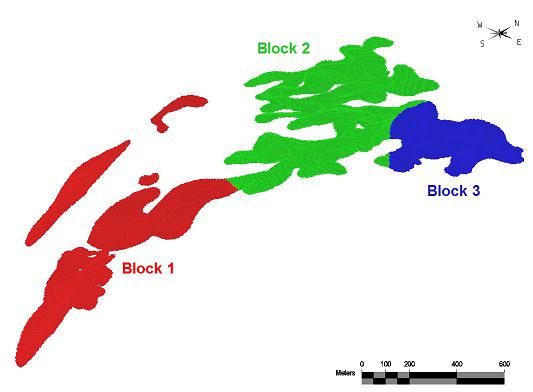

Figure 14-5: Estimation BLOCK Zones 94

Figure 14-6: Grade-Tonnage Curve for Contained ZnEq% 100

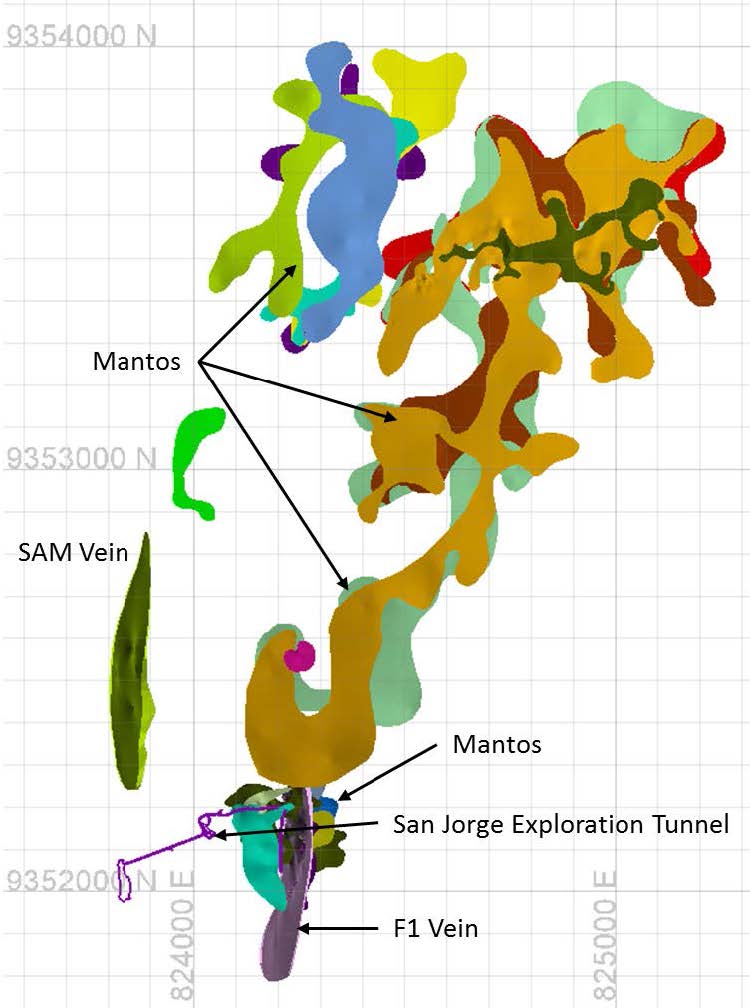

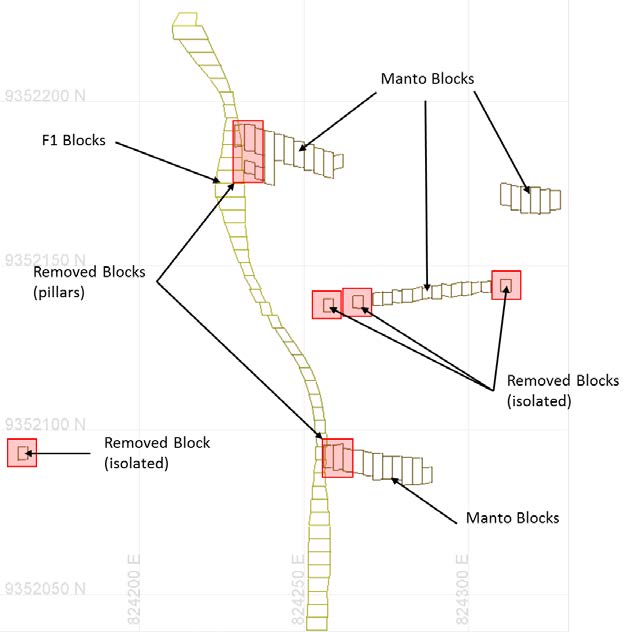

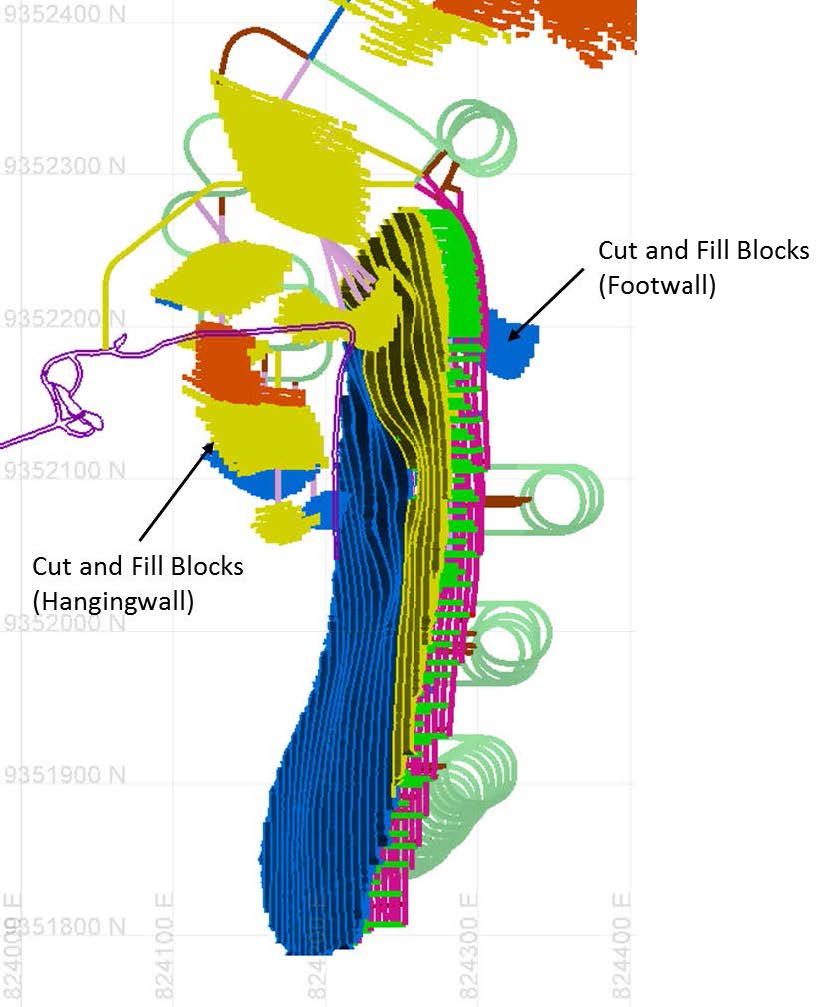

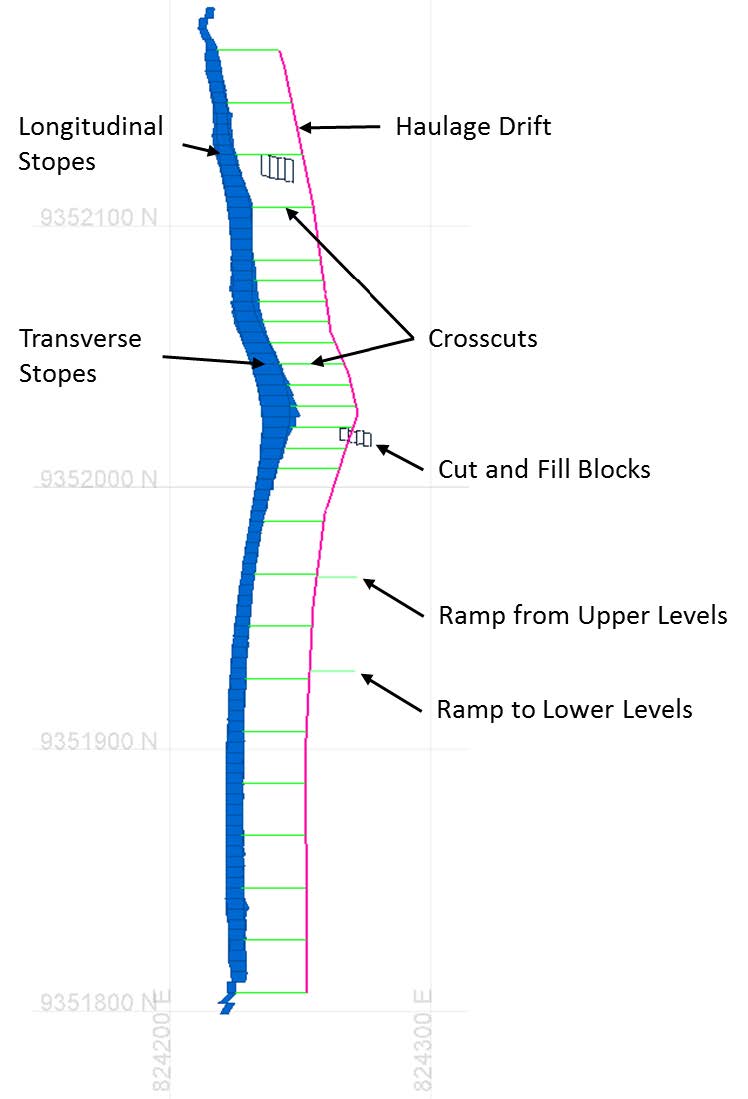

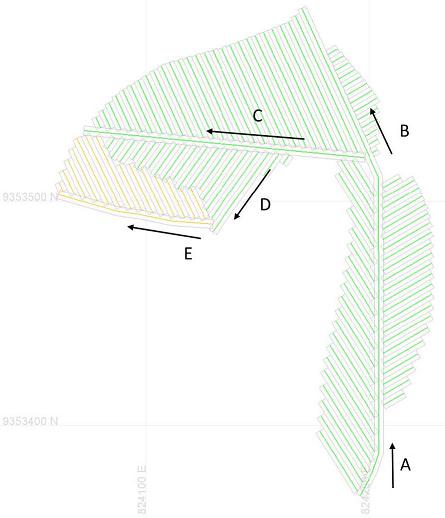

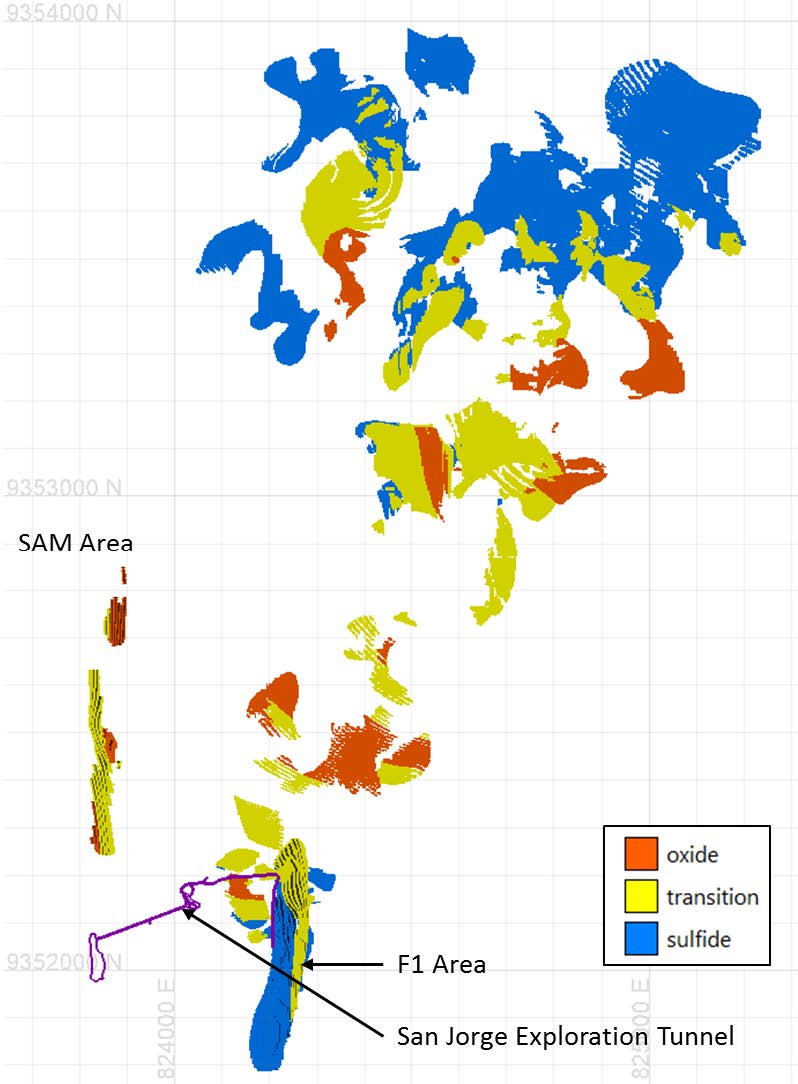

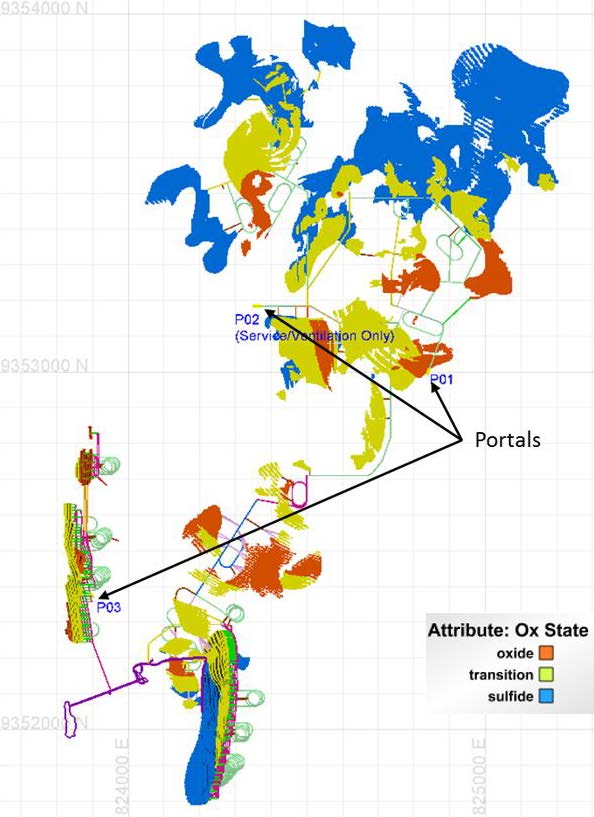

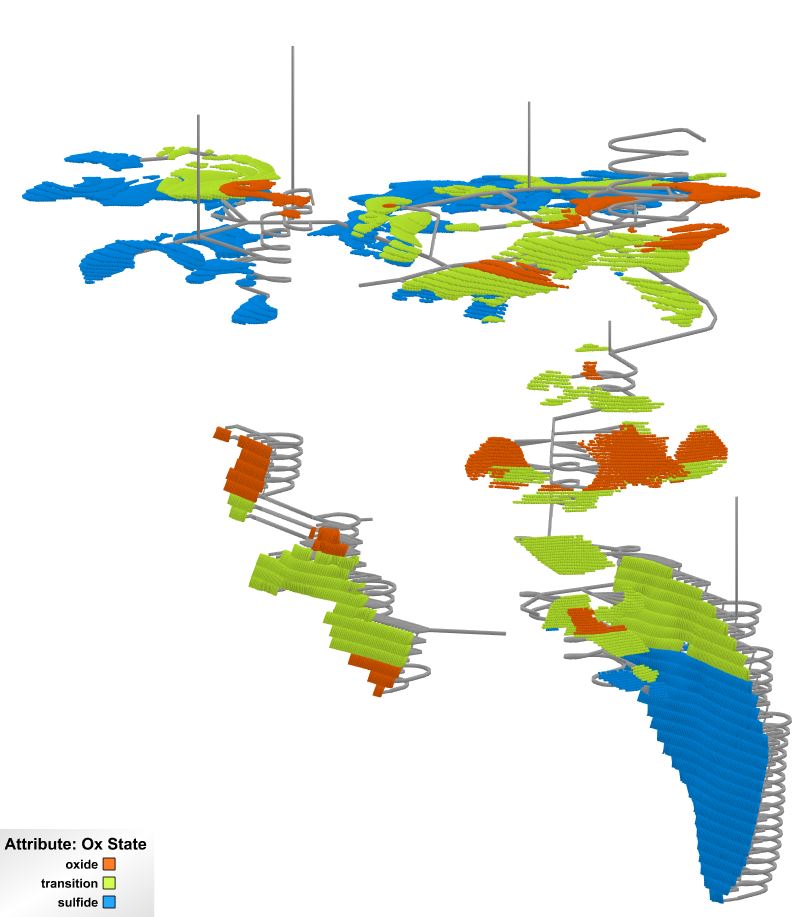

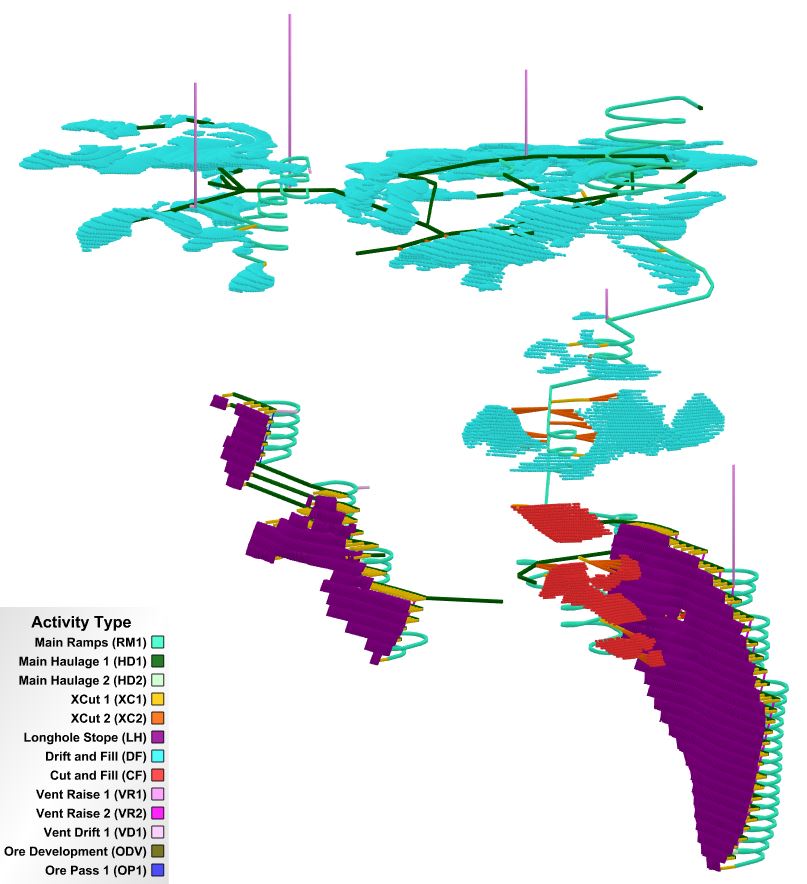

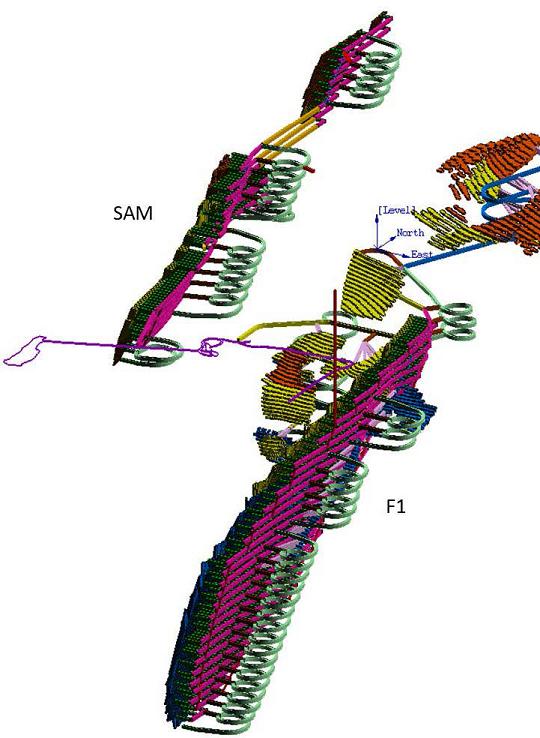

Figure 16-1: Overview of Florida Canyon Mineralized Bodies 104

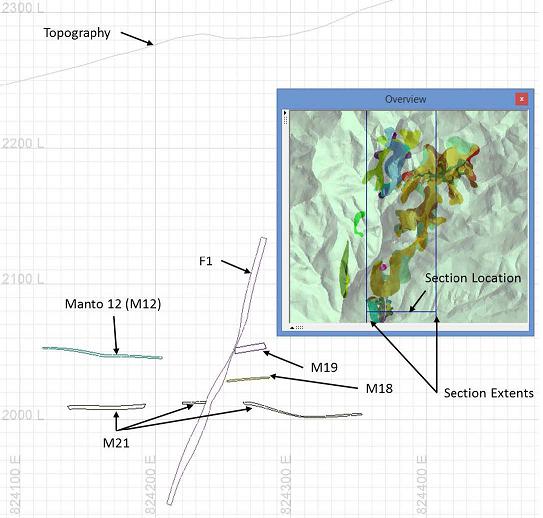

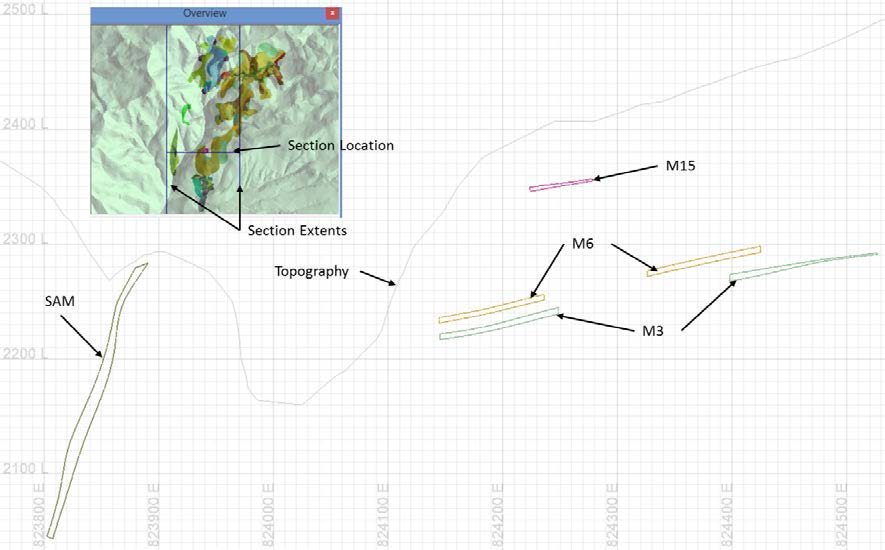

Figure 16-2: Section View of the F1 Mineralized Body and Nearby Mantos (9,352,100N - Looking North) ..105 Figure 16-3: Section View of the SAM Mineralized Body and Nearby Mantos (9,352,530N - Looking North)

...........................................................................................................................................................106

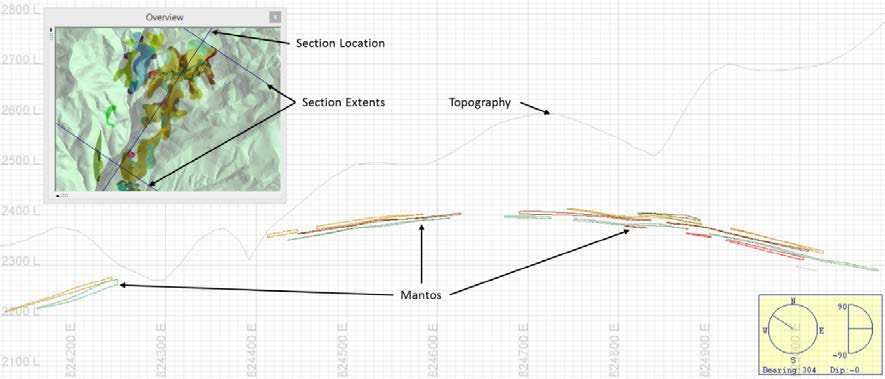

Figure 16-4: Southwest to Northeast Section View Showing the Dome Structure of Mantos (Looking Northwest)

...........................................................................................................................................................106

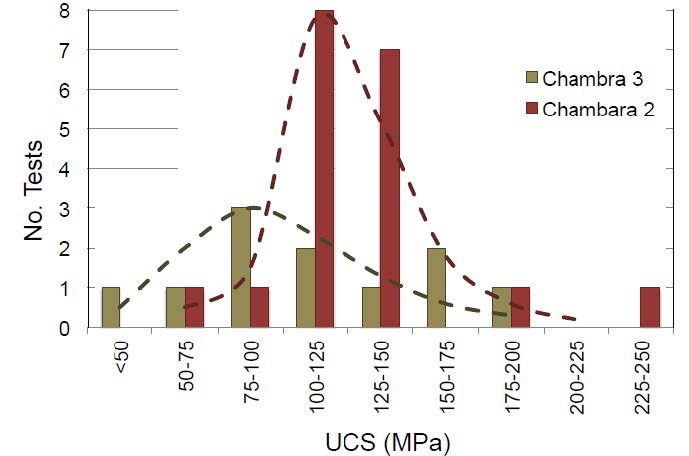

Figure 16-5: UCS Strength Testing Summary 110

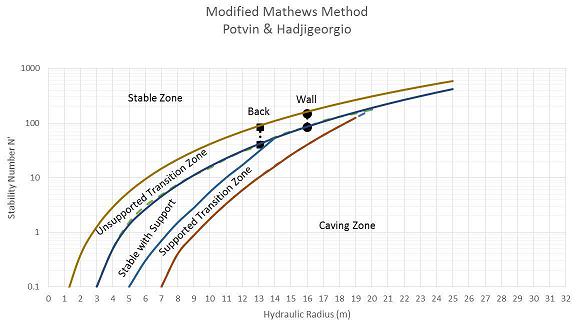

Figure 16-6: Empirical Stability Graph for Stope Geometries in Chambara 2 112

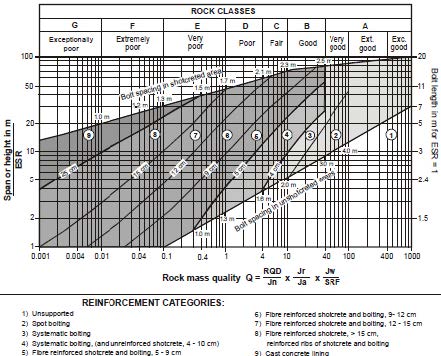

Figure 16-7: Grimstad and Barton Ground Support Estimate 114

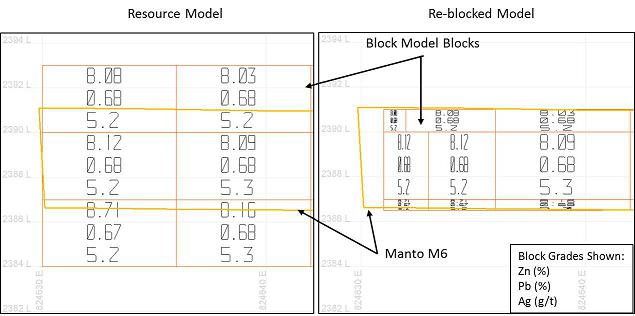

Figure 16-8: Section View Showing Resource and Re-blocked Model (9,353,600N - Looking North) 117

Figure 16-9: Section View Showing Blocks Removed from Inventory 122

Figure 16-10: Plan View of F1 Area Showing Cut and Fill and Longhole Blocks 125

Figure 16-11: Section View Showing Typical Longhole Level Layout (Elevation 1981) 126

Figure 16-12: Example Drift and Fill Layout, M10 Manto 127

Figure 16-13: Florida Canyon Mining Inventory 129

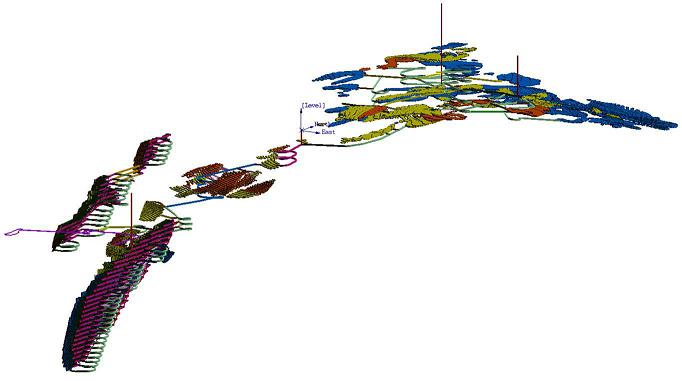

Figure 16-14: Plan View of Mining Blocks and Development Layout 131

Figure 16-15: Rotated View of Mining Blocks and Development Layout – All Areas (Looking Northeast) 132

Figure 16-16: Rotated View of Mining Blocks and Development Layout – All Areas (Looking Northwest) ...133

Figure 16-17: Rotated View of Mining Blocks and Development Layout – Drift and Fill/Cut and Fill (Looking Northeast) 134

Figure 16-18: Rotated View of Mining Blocks and Development Layout – F1 and SAM (Looking Northwest)

...........................................................................................................................................................135

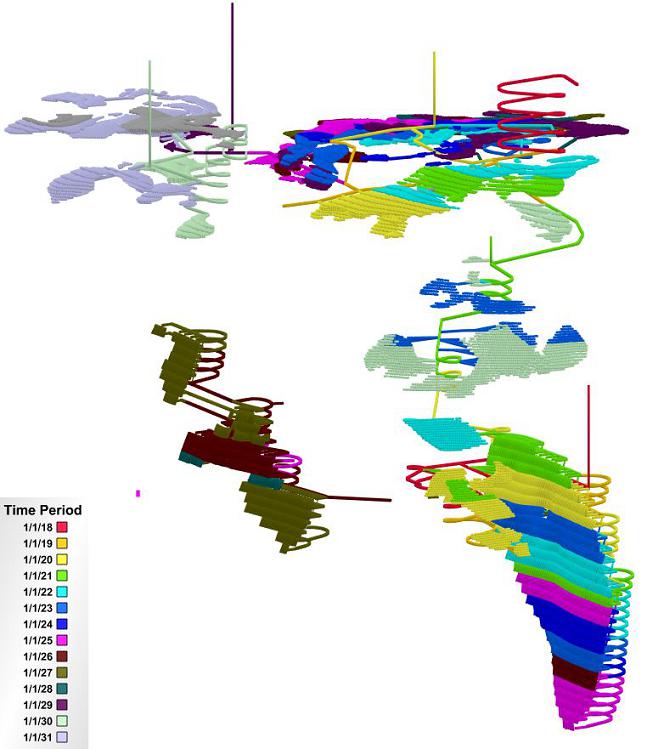

Figure 16-19: Rotated View of Mining Blocks Showing Production Schedule 137

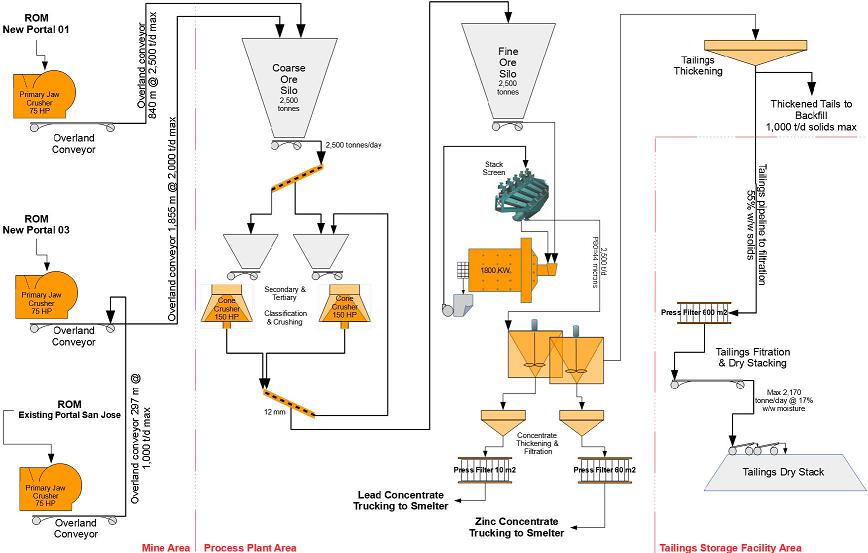

Figure 17-1: Florida Canyon PEA Level Process Flow Sheet 145

| 11 |

Figure 18-1: Florida Canyon General Location 146

Figure 18-2: Florida Canyon Existing and New Road Construction 147

Figure 18-3: Florida Canyon Site General Arrangement 149

Figure 18-4: Florida Canyon Third Power Supply Alternative 151

Figure 18-5: Typical 30 Tonne Concentrate Transport Truck 152

Figure 18-6: Port and Smelter Locations 153

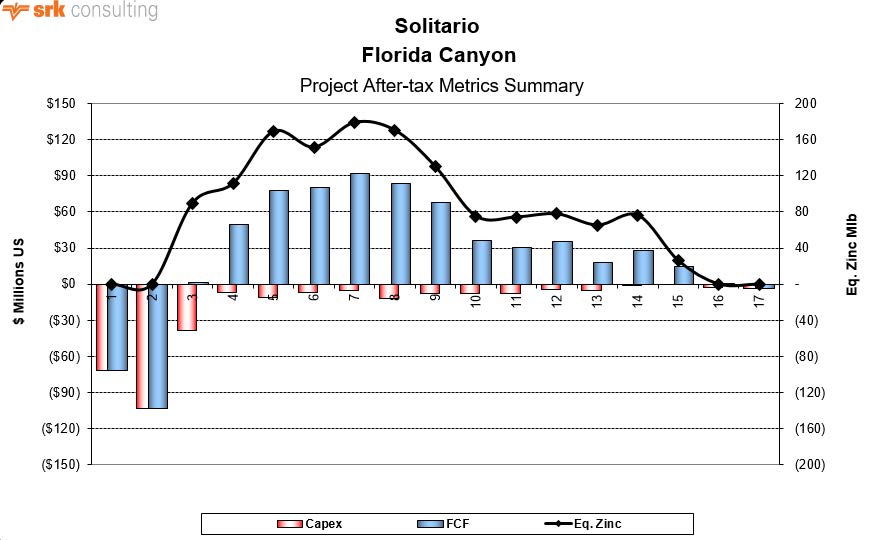

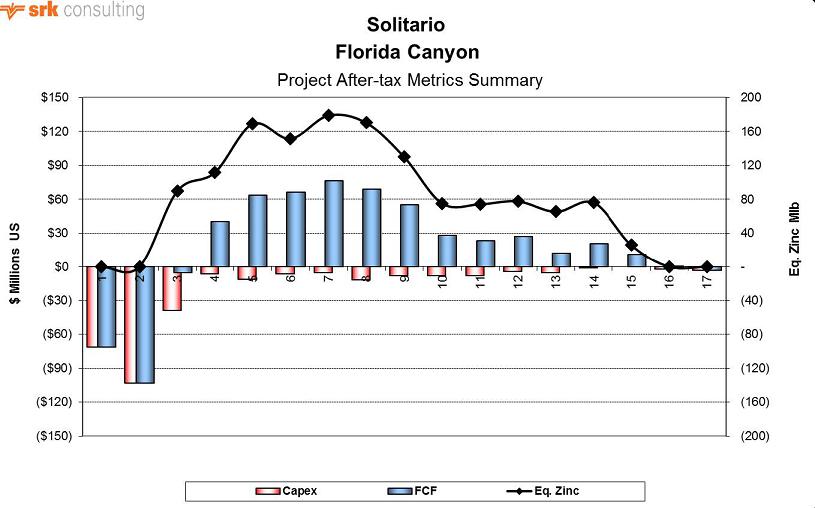

Figure 22-1: Florida Canyon After-Tax Free Cash Flow and Equivalent Metal Production 174

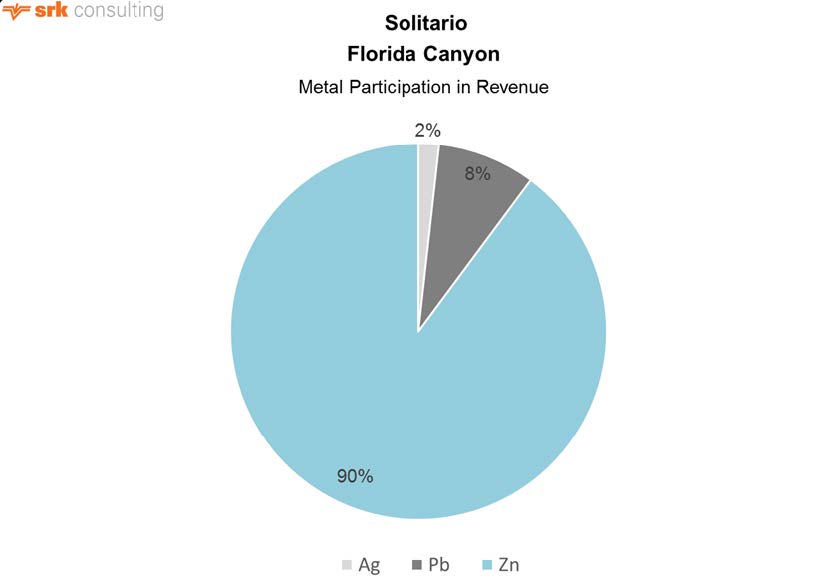

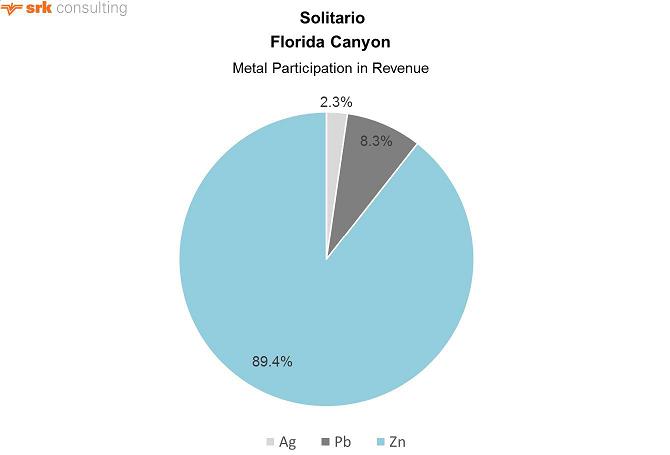

Figure 22-2: Metal Participation in Revenue – Florida Canyon 177

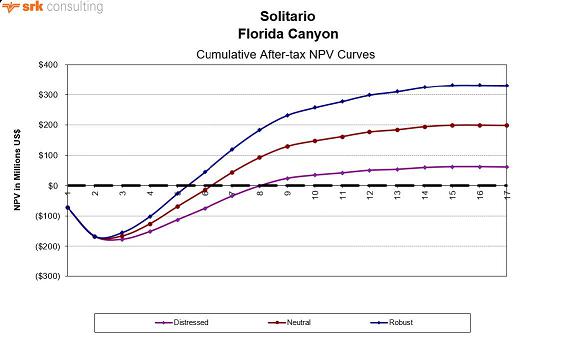

Figure 22-3: Florida Canyon Cumulative NPV Curves (after tax) 179

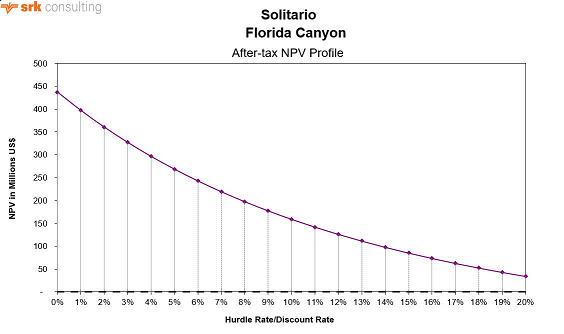

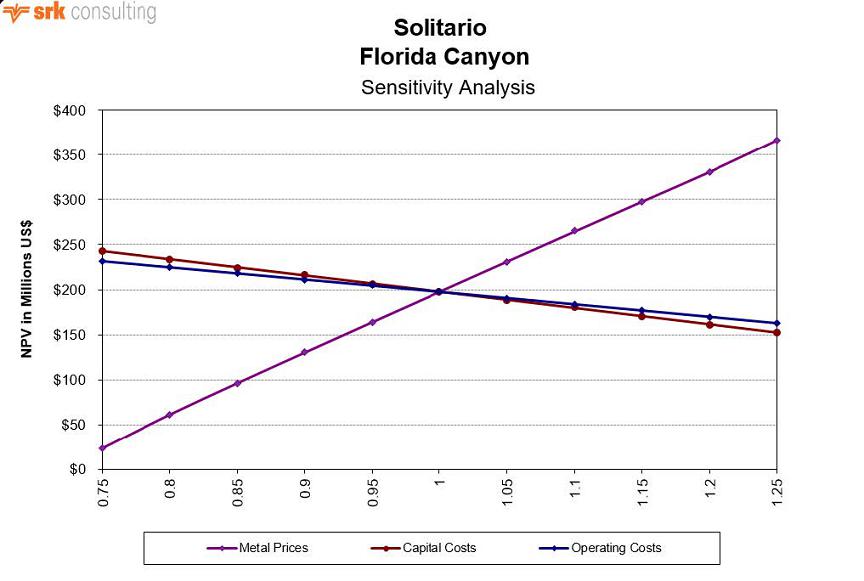

Figure 22-4: Florida Canyon NPV Sensitivity to Hurdle Rate 180

Figure 22-5: Florida Canyon NPV Sensitivity (US$000’s) 181

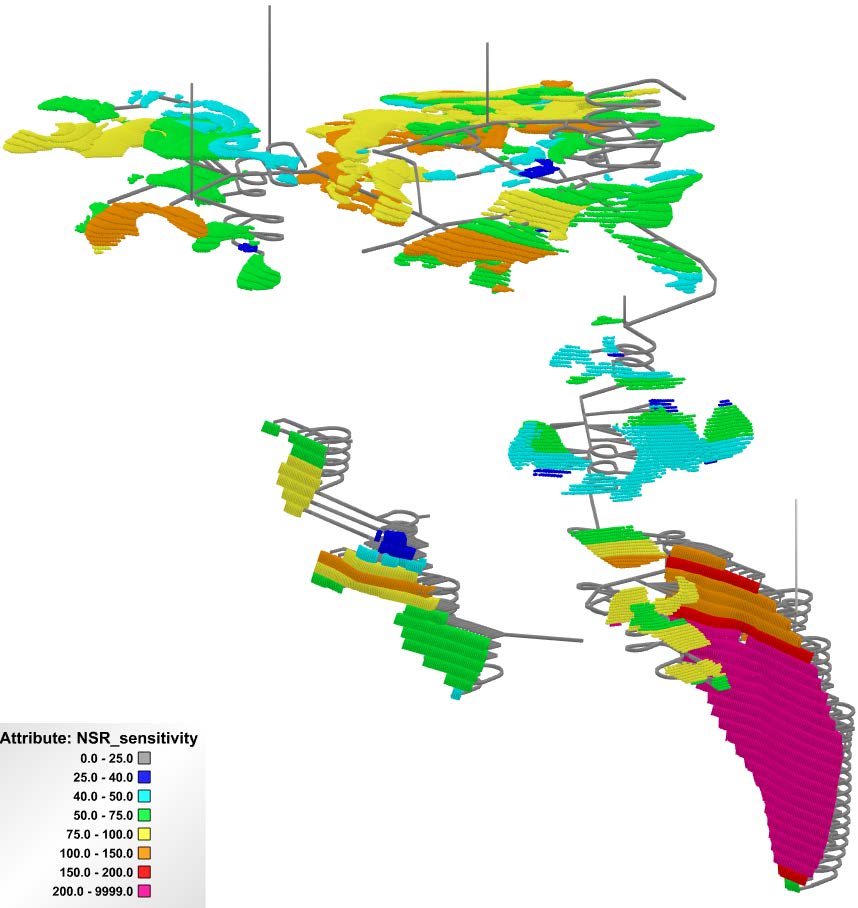

Figure 22-6: Mine Plan Resource colored by Sensitivity NSR (rotated view, looking Northeast) 183

Figure 22-7: Florida Canyon Alternate Case After-Tax FCF and Equivalent Metal Production 184

Appendices

Appendix A: Certificates of Qualified Persons

| 12 |

| 1 | Summary |

This report was prepared as a National Instrument 43-101 (NI 43-101) Technical Report, Preliminary Economic Assessment (Technical Report or PEA) by SRK Consulting (U.S.), Inc. (SRK), for Votorantim Metais Holding S.A. (Votorantim) with Solitario Zinc Corp. (Solitario), (collectively, owners) on the Florida Canyon Zinc Project located in Amazonas Department, Peru (Florida Canyon or Project). The Project name was changed in 2017 from Bongará, as it was called previously, to Florida Canyon.

This study represents the advancement of the Project from a 2014 Technical Report on Resources, to this 2017 PEA. Highlights of this PEA include a thirteen-year life-of-mine underground mine plan, comminution and flotation of zinc and lead concentrates at a nominal production rate of 2,500 mill throughput tonnes per day followed by dry-stack tailings storage. Site infrastructure includes line power to the site, water distribution systems, a townsite and access roads for construction and re-supply as well as for concentrate transport to the point of sale.

A key development in the preparation of this PEA was the addition of new metallurgical data that provided an accurate ratio of zinc oxide to zinc sulfide. The ratio allowed block-by-block recovery to be estimated. For each block in this polymetallic (zinc-lead-silver) deposit a Net Smelter Return value was calculated, making the definition of mineable mineralization independent of material type. The deposit naturally contains a high percentage of zinc sulfide mineralization; but using the new approach, most of the transition and some of the oxide materials are also suitable for flotation processing when they carry sufficient recoverable metal.

This Technical Report was prepared in support of a press release issued by the owners on August 2, 2017, in which economic results were reported. Those economic results are summarized herein.

| 1.1 | Technical Economics |

Technical economic results for this PEA are summarized below and in Table 1-1 through Table 1-4.

| · | Mill Throughput Rate: 2,500 tonnes per day (t/d); |

| · | Mine Life: 12.5 years; |

| · | Recoverable Metal of 1.643 billion pounds zinc, 165 million pounds (Mlb) lead and 2 million ounces (Moz) silver; |

| · | Average Recovery: 80% for zinc 74% for lead, 52% for silver; |

| · | Initial Capital Cost: US$214 million; |

| · | Life of Mine Capital Cost: US$296 million and Sustaining Capital of US$83 million; |

| · | Underlying NSR-Royalty: 1.0%; |

| · | All-in Cost per Zinc-Equivalent Payable Pound: US$0.73; |

| · | Average Payable Annual Zinc Production: 131.4 Mlb; Average run-of Mine Zinc Grade: 8.34%; |

| · | Average Payable Annual Lead Production: 13.2 Mlb; Average Lead Grade: 0.90%; |

| · | Average Payable Annual Silver Production: 168 thousand ounces (koz); Average Silver Grade: 11.31 grams per tonne (g/t); |

| · | After tax NPV at 8%: US$198 million; |

| · | After tax Internal Rate of Return (IRR): 24.7%; and |

| · | After tax payback Period: 2.6 years. |

| 13 |

Table 1-1: Indicative Economic Results (US$)

| Description | Value | Units |

| Market Prices | ||

| Silver | 16.50 | US$/oz |

| Lead | 1.00 | US$/lb |

| Zinc | $1.20 | US$/lb |

| Estimate of Cash Flow (all values in $000s) | ||

| Concentrate Net Return | $/oz-Ag | |

| Silver Sales | $32,957 | $0.02 |

| Lead Sales | $156,937 | $0.11 |

| Zinc Sales | $1,675,977 | $1.20 |

| Total Revenue | $1,865,871 | $1.34 |

| Treatment, Smelting and Refining Charges | ($337,076) | |

| Freight, Impurities & Third Parties | ($96,935) | ($0.07) |

| Gross Revenue | $1,431,860 | |

| Royalties | ($61,734) | ($0.04) |

| Net Revenue | $1,370,126 | |

| Operating Costs | ||

| Open Pit Mining | $0 | $0.00 |

| Underground Mining | ($228,547) | ($0.16) |

| Process | ($144,063) | ($0.10) |

| G&A | ($39,153) | ($0.03) |

| Ordinary Rights | $0 | $0.00 |

| Total Operating | ($411,764) | ($0.29) |

| Operating Margin (EBITDA) | $958,362 | |

| Initial Capital | ($213,667) | |

| LoM Sustaining Capital | ($82,722) | |

| Income Tax | ($224,873) | |

| After Tax Free Cash Flow | $437,100 | |

| Payback | 2.59 | years |

| After-Tax IRR | 24.7% | |

| NPV @: 8% | $197,521 |

Source: SRK, 2017

| 14 |

Table 1-2: Capital Costs

| Description | Initial (US$000’s) | Sustaining (US$000’s) | LoM (US$000’s) |

| Development | 12,293 | 35,741 | 48,033 |

| Vent Raises | 686 | 672 | 1,358 |

| Underground Mining Equipment | 24,625 | 2,474 | 27,099 |

| Surface Crushing & Conveying | 1,430 | 0 | 1,430 |

| Offsite Infrastructure | 16,227 | 0 | 16,227 |

| Site Facilities | 14,697 | 0 | 14,697 |

| Process Plant | 60,000 | 0 | 60,000 |

| Power Supply | 2,472 | 0 | 2,472 |

| Water Supply | 250 | 0 | 250 |

| BackFill Infrastructure | 13,200 | 0 | 13,200 |

| Cement Rockfill Infrastructure | 200 | 0 | 200 |

| Tailings Storage Facility | 12,854 | 11,814 | 24,668 |

| Owner's | 14,595 | 0 | 14,595 |

| Contingencies | 40,138 | 0 | 40,138 |

| Sustaining Capital | 0 | 26,272 | 26,272 |

| Closure | 0 | 4,920 | 4,920 |

| Total Capital | $213,667 | $81,893 | $295,559 |

Source: SRK, 2017

Table 1-3: Operating Costs

| Period | Total Cost (US$/t-Ore) |

| Underground Mining | 20.43 |

| Process | 12.88 |

| G&A | 3.50 |

| Total | $36.81 |

Source: SRK, 2017

Table 1-4: Operating Costs

|

Description |

LoM (US$000’s) | LoM (US$/t-Ore) | LoM (US$/lb-Zn) |

| Underground Mining | 228,547 | 20.43 | 0.16 |

| Process | 144,063 | 12.88 | 0.10 |

| G&A | 39,153 | 3.50 | 0.03 |

| Total Operating | $411,764 | $36.81 | $0.29 |

Source: SRK, 2017

Alternative Economic Case Study

The owners also requested SRK to evaluate the Project economics under a specific alternative metal price structure. This alternative used a pricing of US$1.06/lb, US$0.88/lb, and US$18.19/oz for zinc, lead, and silver respectively. The alternative case also used a higher discount rate of 9%. All other economic inputs were kept the same as the base case.

| 15 |

Results of the alternative case study:

| · | All-in Cost per Zinc Pound Recovered: US$0.72; |

| · | After tax NPV at 9%: US$106 million; |

| · | After tax Internal Rate of Return (IRR): 19.1%; and |

| · | After tax payback Period: 3.2 years. |

Both the base case and alternative case economics are detailed in Section 22 of this report.

| 1.2 | Property Description and Ownership |

The Florida Canyon Zinc Project (the Project) is owned and operated by Minera Bongará S.A., a joint venture between Solitario and Votorantim in existence since 2006. Florida Canyon is an advanced mineral exploration project comprised of sixteen contiguous mining concessions, covering approximately 12,600 hectares (ha). The concession titles are in the name of Minera Bongará. All of these concessions are currently titled.

The Minera Bongará concessions are completely enveloped by a second group of thirty-seven contiguous mining concessions, covering approximately 30,700 ha. The concession titles are in the name of Minera Chambara, also owned by the Owners. Of the thirty-seven concessions, twelve titles are pending.

Votorantim, as operator of the joint venture company Minera Bongará, has entered into a surface rights agreement with the local community of Shipasbamba which controls the surface rights of the Project. This agreement provides for annual payments and funding for mutually agreed upon social development programs in return for the right to perform exploration work including road building and drilling. From time to time, Votorantim also enters into surface rights agreements with individual private landowners within the community to provide access for exploration work.

The Project is located in the Eastern Cordillera of Peru at the sub-Andean front in the upper Amazon River Basin. It is within the boundary of the Shipasbamba community, 680 kilometer (km) north- northeast of Lima and and 245 km northeast of Chiclayo, Peru, in the District of Shipasbamba, Bongará Province, Amazonas Department. The Project area can be reached from the coastal city of Chiclayo by the paved Carretera Marginal road. The central point coordinates of the Project are approximately 825,248 East and, 9,352,626 North (UTM Zone 17S, Datum WGS 84). Elevation ranges from 1,800 meters above sea level (masl) to approximately 3,200 masl. The climate is classified as high altitude tropical jungle in the upper regions of the Amazon basin. The annual rainfall average exceeds 1 meter

(m) with up to 2 m in the cloud forest at higher elevations.

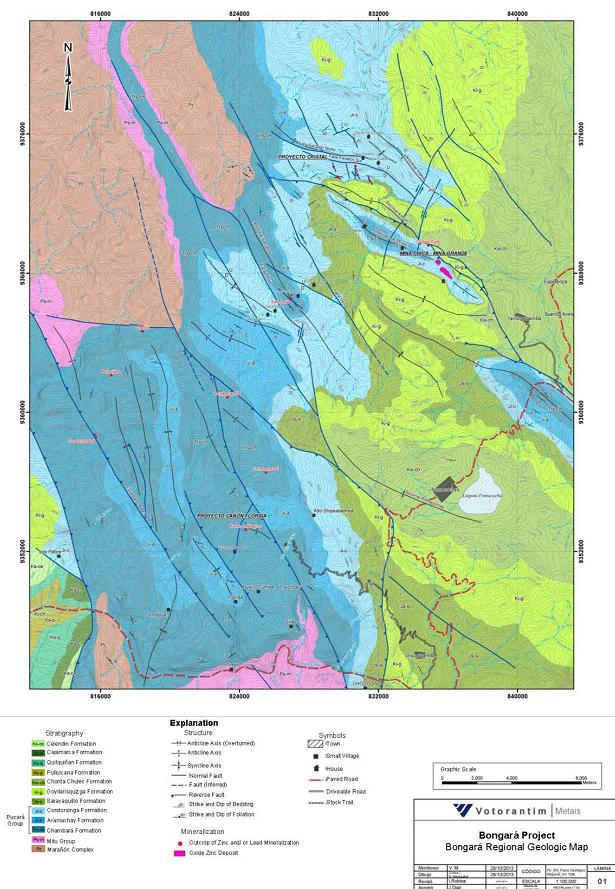

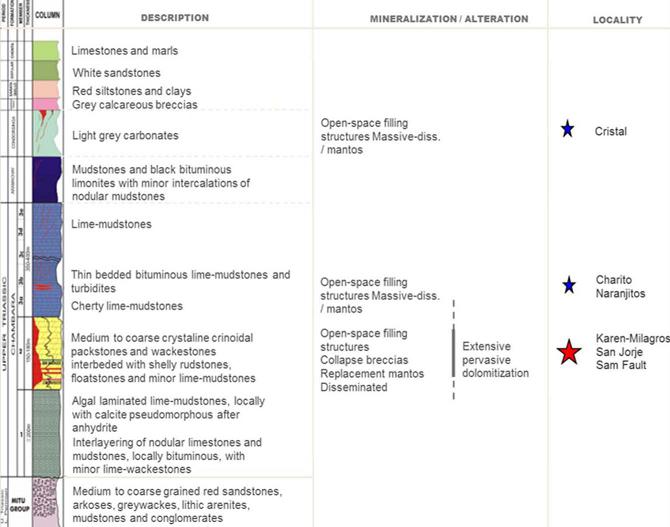

| 1.3 | Geology and Mineralization |

The Project is located within an extensive belt of Mesozoic carbonate rocks belonging to the Upper Triassic to Lower Jurassic Pucará Group and equivalents. This belt extends through the central and eastern extent of the Peruvian Andes for nearly 1000 km and which is the host for many polymetallic and base metal vein and replacement deposits in the Peruvian Mineral Belt. Among these is the San Vicente Mississippi Valley Type (MVT) zinc-lead deposit that has many similarities to the Florida Canyon deposit and other MVT occurrences in the Project area.

| 16 |

Known zinc, lead and silver mineralization in the Project area is hosted in dolomitized limestone of the Chambara Formation subunit 2 in the Pucará Group. The structure at Florida Canyon is dominated by a N50º-60ºW trending domal anticline cut on the west by the Sam Fault and to the east by the Tesoro- Florida Fault. In the Project area, the three prospective corridors for economic mineralization studied in detail are San Jorge, Karen-Milagros, and Sam. In these areas, dolomitization and karsting is best developed in proximity to faulting and fracturing associated with each structural zone. In turn, these structures provided access for the altering fluids to flow laterally into stratigraphic horizons with more permeable sedimentary characteristics.

The primary zinc-lead-silver mineralization of the Florida Canyon deposit occurs as sphalerite and galena. Sphalerite is low iron and together, zinc and lead sulfide is 70% of the mineable material. At shallow depths, these sulfide minerals are altered to smithsonite, hemimorphite, and cerussite and collectively referred to as oxides. The mineral suite is low in pyrite.

| 1.4 | Status of Exploration, Development and Operations |

1.4.1 History

Prior to the discovery of mineral occurrences by Solitario in 1994, no mineral prospecting had been done on the Property and no concessions had been historically recorded. In 1995 and later, Solitario and its joint venture partners staked the current mineral concessions in the Project area.

In 1996, Cominco Ltd. formed a joint venture partnership (JV) with Solitario. This agreement was terminated in 2000 and Solitario retained ownership of the property. Between 1997 and 1999, Cominco completed geologic mapping, geophysical surveys, surface sampling, and 82 diamond drillholes.

In 2006, Votorantim and Solitario formed a JV for the exploration and possible development of the property. As the operator of the JV company, Votorantim has carried out surface diamond core drilling, geologic mapping, surface outcrop sampling, underground exploration and drifting and underground drilling programs. As of August 15, 2013, Votorantim had completed 404 diamond drillholes which, when combined with the previous drilling of Cominco, totals 117,260 m.

There has not been any commercial mining in the Project area. The only underground excavation has been 700 m of underground drifting by Votorantim to provide drill platforms at the San Jorge area. A subsidiary of Hochschild Mining PLC tested open pit mining for a short time at the Mina Grande deposit off of Project properties near the village of Yambrasbamba, 18 km northeast of Florida Canyon, where Solitario had previously defined an oxidized zinc resource by pitting.

1.4.2 Exploration Status

The focus of Votorantim’s most recent exploration work at the Project has been resource definition drilling with HQ-diameter core in the San Jorge and Karen-Milagros areas. Drilling in the San Jorge area was completed underground from an adit, while drilling in the Karen-Milagros area was completed from surface.

Future exploration work will focus on infill drilling between the Karen-Milagros, San Jorge and Sam areas. Mineralization is open to the north and south and remains largely untested to the east of the Tesoro Fault and west of the Sam fault where greater target depths have lowered the near-term drilling priority.

| 17 |

1.4.3 Development and Operations

Road access to the Bongará region is provided primarily by the Carretera Marginal paved highway connecting the port city of Chiclayo to Pedro Ruiz (inland). Travel time to Pedro Ruiz takes on average 6 hours by car. It is a regional commerce center with hotels, restaurants, communication and a population estimated to be 10,000. The immediate Project area is not populated but there are several small villages nearby, which are supported by subsistence farming.

Current access to the Project is by foot, mule or helicopter. A road is under construction from the community of Shipasbamba. The Project area has little existing infrastructure with only an access road under construction and a number of primitive camps and drill pads. Drilling has been accomplished using helicopter support from the village of Shipasbamba which lies 10 km to the southeast. A Project core shed, office and sample storage facility is located in Shipasbamba.

| 1.5 | Mineral Processing and Metallurgical Testing |

Votorantim retained a metallurgical consultant, Smallvill S.A.C. of Lima, Peru (Smallvill) to perform metallurgical studies on Florida Canyon mineralization types in 2010, 2011 and 2014. All the metallurgical testing programs aimed to produce commercial quality concentrates from a polymetalic lead-zinc mineralization. The tested samples show heads grades significantly higher when compared to other known mineral deposits in the region. SRK has relied heavily on these studies for recovery and cost forecasting to develop cut-off grades for resource reporting.

The majority of the resource is sulfide. The Florida Canyon sulfide resource consists of zinc and lead sulfides in a limestone matrix where zinc is in higher proportions than lead. There are no deleterious elements present in concentrates in high enough levels to trigger smelter penalties.

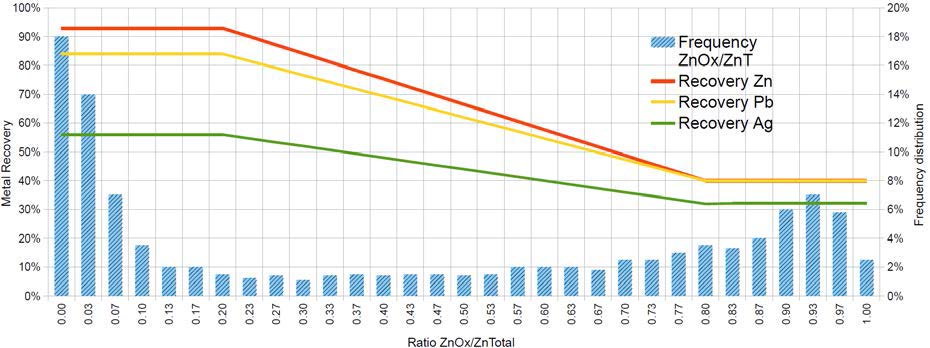

The 2014 metallurgical testing focused on quantifying recovery in the transitional and oxide material as it relates to a measurable zinc oxide:zinc total ratio (ZnO/ZnT). The ratio was determined from 2,813 samples from 423 drillholes with good spatial representation. Depending on their availability and applicability, samples were taken from either coarse rejects or pulp samples. The ratio was estimated into the block model for each metal of interest. SRK developed a sliding-scale recovery curve for each metal using the ratio.

The recovery estimates for Florida Canyon relative to ZnO/ZnT are illustrated in Figure 1-1. Table 1-5 provides the recovery estimates by material type.

Table 1-5: Florida Canyon Metal Recoveries by Material Type

| Parameter | Material Type | ||

| Sulfide | Mixed | Oxide | |

| ZnOx/ZnT Ratio | <= 0.2 | 0.2 to 0.8 | >= 0.8 |

| Zn Recovery | 93% | (-0.8833 (ZnOx/ZnT) + 1.1067) * 100 | 40% |

| Pb Recovery | 84% | (-0.7333 (ZnOx/ZnT) + 0.9867) * 100 | 40% |

| Ag Recovery | 56% | (-0.4 (ZnOx/ZnT) + 0.64) * 100 | 32% |

Source: SRK, 2017

| 18 |

Source: SRK, 2017

Figure 1-1: Florida Canyon Metal Recoveries Relative to ZnO/ZnT Ratio

Anticipated concentrate grades used in cut-off grade calculations are 50% for both zinc and lead concentrates, the latter containing associated silver.

SRK sees opportunities for more advanced test work to optimize the metallurgical flow sheet. Previous test work used conventional procedures that were not specific to Florida Canyon material types. Similarly, fines encountered in previous work were not handled appropriately, resulting in sub-optimal flotation. Sample selection is a key element and more site-specific test work is expected to enhance overall recovery projections at the next level of study.

| 1.6 | Mineral Resource Estimate |

Since the 2013 resource estimate (SRK, 2013), Millpo conducted a considerable amount of resampling and metallurgical test work to determine recoverable sulfide and oxide grades for both zinc and lead to better understand recoverable metal in the deposit. This work led to a change in the definition of oxide, transition, and sulfide domains. In the 2013 model, oxide, transition, and sulfide domains were developed based on core logging and then individual metallurgical recoveries were assigned as to each domain. Following the 2014 metallurgical test work, it was determined that a quantitative approach utilizing the ratio of estimated oxide zinc grade to estimated total zinc grade would provide the best representation of the recoverable resource.

The 2017 resource model was built by Votorantim and validated by SRK. Development of the 2017 resource estimate involved two separate grade estimations. First, primary reporting grades were estimated using the same samples as the 2013 resource estimate. This estimate assigned the grades from which metal quantities were calculated in the resource. A second resource estimate was conducted using the Votorantim 2014 sample program to assign sulfide and oxide grades for both zinc and lead. These grades were used to calculate a zinc oxide to total zinc ratio (ZnOx/ZnT), which was then used to determine if material was oxide, sulfide, or mixed and to assign a recovery to each modeled block based on that ratio.

| 19 |

The Mineral Resource estimate was based on a 3-D geological model of major structural features and stratigraphically controlled alteration and mineralization. A total of 23 mineral domains were interpreted from mineralized drill intercepts, comprised mostly of 1 m core samples. The project is in metric units. Zinc, lead and silver were estimated into model blocks using Ordinary Kriging (OK). Oxide, Sulfide and Mixed material types were determined based on the ZnOx/ZnT ratio. Density was determined from a large percentage (55%) of measured values, which were used to develop equations for density assignment based on rock type and kriged metal content of the samples.

Resources were reported to Measured, Indicated and Inferred classification compliant with CIM definitions according to NI 43-101 guidance. Blocks classified as Measured were estimated by Ordinary Kriging using at least three composites within 25 m in the major and semi-major search directions and 10 m in the minor search direction. Blocks classified as Indicated were estimated by Ordinary Kriging using at least three composites within 50 m in the major and semi-major search directions and 20 m in the minor search direction. Blocks classified as inferred were estimated by Ordinary Kriging using at least two composites within 100 m in the major and semi-major search directions and 40 m in the minor search direction. A fourth category was flagged in the model including blocks estimated beyond the limits above.

SRK validated the Votorantim model using the following criteria:

| · | SRK independent grade estimate compared to the Votorantim grade estimate; |

| · | Visual comparative analysis between composite and block grades; and |

| · | Statistical comparison of global averages of the original composite values and the model estimates. |

SRK concludes that the model is adequate if not slightly conservative for the deposit and is suitable for use in preliminary mine planning.

The Mineral Resource estimate for the Florida Canyon zinc-lead-silver deposit is presented in Table 1-6.

| 20 |

Table 1-6: Mineral Resource Statement for the Florida Canyon Zn-Pb-Ag Deposit, Amazonas Department, Peru, SRK Consulting (U.S.), Inc., July 13, 2017

Zn Eq Contained

|

Category |

Mass (kt) |

Zn Grade | Pb Grade |

Ag Grade |

ZnEq Grade | Zn Contained | Pb Contained | Ag Contained | Zn Eq Contained | ||||

| (%) | (%) | (g/t) | (%) | (kt) | (klb) | (kt) | (klb) | (kg) | (koz) | (kt) | (klb) | ||

| Measured | 1,285 | 13.13 | 1.66 | 19.42 | 14.68 | 169 | 372,200 | 21 | 46,900 | 25,000 | 800 | 189 | 415,900 |

| Indicated | 1,970 | 11.59 | 1.45 | 17.91 | 12.95 | 228 | 503,500 | 29 | 63,200 | 35,300 | 1,130 | 255 | 562,700 |

|

Measured + Indicated |

3,256 |

12.2 |

1.53 |

18.51 |

13.63 |

397 |

875,700 |

50 |

110,100 |

60,300 |

1,930 |

444 |

978,600 |

| Inferred | 8,843 | 10.15 | 1.05 | 13.21 | 11.16 | 898 | 1,978,900 | 93 | 204,900 | 116,900 | 3,760 | 986 |

2,174,80 0 |

Source: SRK, 2017

| · | Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources estimated will be converted into Mineral Reserves. |

| · | Grades reported in this table are "contained" and do not include recovery. |

| · | Mineral resources are reported to a 2.8% recovered zinc-equivalent (RecZnEq%) cut-off grade. |

| o | Assuming the average recoveries for the resource, this corresponds to non-recovered cut-off grade of 3.6% contained ZnEq%. |

| · | RecZnEq% was calculated by multiplying each block grade by its estimated recovery, then applying mining costs, processing costs, general and administrative (G&A) costs, smelting costs, and transportation costs to determine an equivalent contribution of each grade item to the Net Smelter Return. |

| o | Mining costs, processing, G&A, smelting, and transportation costs total US$74.70/t. |

| o | Metal price assumptions were: Zinc (US$/lb 1.20), Lead (US$/lb 1.0) and Silver (US$/oz 17.50), |

| o | As the recovery for each element was accounted for in the RecZnEq%, recoveries were not factored into the calculation of the 2.8% cut-off grade. |

| o | Average metallurgical recoveries for the resource are: Zinc (79%), Lead (72%) and Silver (50%) |

| o | The equivalent grade contribution factors used for calculating RecZnEq% were: (1.0 x recovered Zn%) + (0.807 x recovered Pb%) + (0.026 x recovered Ag ppm). |

| · | The contained ZnEq% grade reported above was calculated by dividing the RecZnEq% grade by the calculated zinc recovery. |

| · | Density was calculated based on material types and metal grades. The average density in the mineralized zone was |

3.01 g/cm3.

| · | Mineral Resources, as reported, are undiluted. |

| · | Mineral Resource tonnage and contained metal have been rounded to reflect the precision of the estimate and numbers may not add due to rounding. |

| 1.7 | Mineral Reserve Estimate |

No Mineral Reserves were estimated as part of this PEA.

| 1.8 | Mining |

Both longhole open stoping with backfill and cut and fill mining methods have been selected for the mine planning work. The mining method selection was based on the mineralization shape, orientation, and the desire to put tailing material underground. Geotechnical assessment of the orebody shape and ground conditions confirmed the mining method selection. The design parameters have been laid out using empirical design methods based on similar case histories. Cut and fill opening sizes are 3 m x 3 m and stopes are 3 m wide x 16 m in height.

An NSR approach was used to calculate the value of a block. Two products will be produced, lead and zinc concentrates. The lead concentrate will contain a payable amount silver. Stope optimization within VulcanTM software was used to determine potentially economically minable material, based on the NSR value and a cut-off of US$42.93 for cut and fill areas, and a cut-off of US$41.40 for longhole areas. The stope optimizer output shapes were visually inspected and isolated blocks (i.e., small blocks far from larger groups of blocks or where additional development is not practical or economically feasible) were removed from the mining block inventory. The resource model was queried against the final stope optimization shapes to determine tonnes and grade of material inside the shapes and mining dilution and recovery factors were applied.

| 21 |

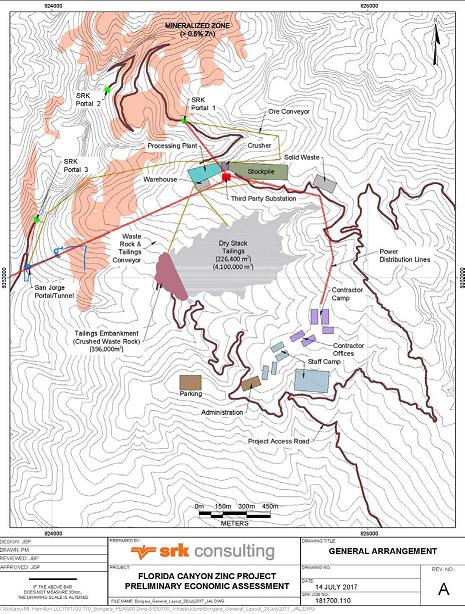

A development layout was created to provide access to the mining levels and to tie levels into ramps. Access to the underground workings will be via three main portals (San Jorge, P01 and P03). An additional portal (P02) will be used primarily for ventilation, and three additional drifts will daylight to facilitate ventilation.

The tonnes and grade of the resource material contained within the mining blocks, adjusted by recovery and dilution, and categorized by the resource classification is provided in Table 1-7. The mine plan resource consists of a total of 11.2 Mt with an average grade of 8.34% Zn, 0.90% Pb, and

11.3 g/t Ag and is made up of Measured, Indicated, and Inferred material. Estimated average dilution, processing recoveries and the ZnOx/ZnT ratio is also provided in Table 1-8.

Table 1-7: Mine Plan Resource for the Florida Canyon Zn-Pb-Ag Deposit, Amazonas Department, Peru, SRK Consulting (U.S.), Inc., July 21, 2017

|

Category |

Mass | Zn Grade | Pb Grade | Ag Grade | NSR * |

ZnEq ** |

Zn Contained | Pb Contained | Ag Contained | ZnEq ** Contained |

| (kt) | (%) | (%) | (g/t) | (US$/t) | (%) | (kt) | (kt) | (kg) | (kt) | |

| Measured | 1,293 | 10.64 | 1.33 | 15.60 | 197.12 | 12.38 | 138 | 17 | 20,157 | 160 |

| Indicated | 2,011 | 8.77 | 1.08 | 13.44 | 166.85 | 10.22 | 176 | 22 | 27,026 | 206 |

| M&I | 3,303 | 9.51 | 1.18 | 14.28 | 178.69 | 11.05 | 314 | 39 | 47,182 | 365 |

| Inferred | 7,883 | 7.86 | 0.78 | 10.07 | 135.36 | 9.03 | 619 | 62 | 79,354 | 712 |

| Total Mine Design |

11,187 |

8.34 |

0.90 |

11.31 |

148.16 |

9.66 |

933 |

101 |

126,536 |

1,081 |

Source: SRK, 2017

* NSR is calucalted using variable recoveries based on sulfide/oxide ratios (recovery ranging from 32%-93%), a Zn price of US$1.20/lb, a Pb price of US$1.00/lb, an Ag price of US$17.50/oz. The transportation charge is US$70.00/t conc, Zn treatment charge of US$115/t conc, Pb treatment charge of US$100/t conc, Zn refining charge of US$0.115/lb Zn, and Pb refining charge of US$0.1/lb Pb. These factors were used for mine planning and vary somewhat from the final economic model.

** ZnEq estimate is based on a NSR value of US$19.62 per 1% Zn. The US$19.62 is calculated using a Zn price of US$1.20/lb, a Pb price of US$1.00/lb, an Ag price of US$17.50/oz. The ZnEq also includes TC/RC and transportation costs and assumes an average Zn recovery of 78.15% which differs somewhat from that presented in the economic model. An example of the NSR to ZnEq calculation is (148.16/19.62)/0.7815.

Table 1-8: Mine Plan Resource Average Process Recovery

| Process Recovery | |||||

| Ag (%) | Pb (%) | Zn (%) | ZnOx/ZnT Ratio | Dilution | |

| Mine Plan Resource | 51.7 | 74.3 | 79.8 | 0.26 | 34% |

Source: SRK, 2017

The PEA is preliminary in nature, that it includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the PEA will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

A production schedule was generated using iGantt software. The schedule targeted a production rate of 2,500 t/d (912,500 mineralized tonnes per year).

| 22 |

| 1.9 | Recovery Methods |

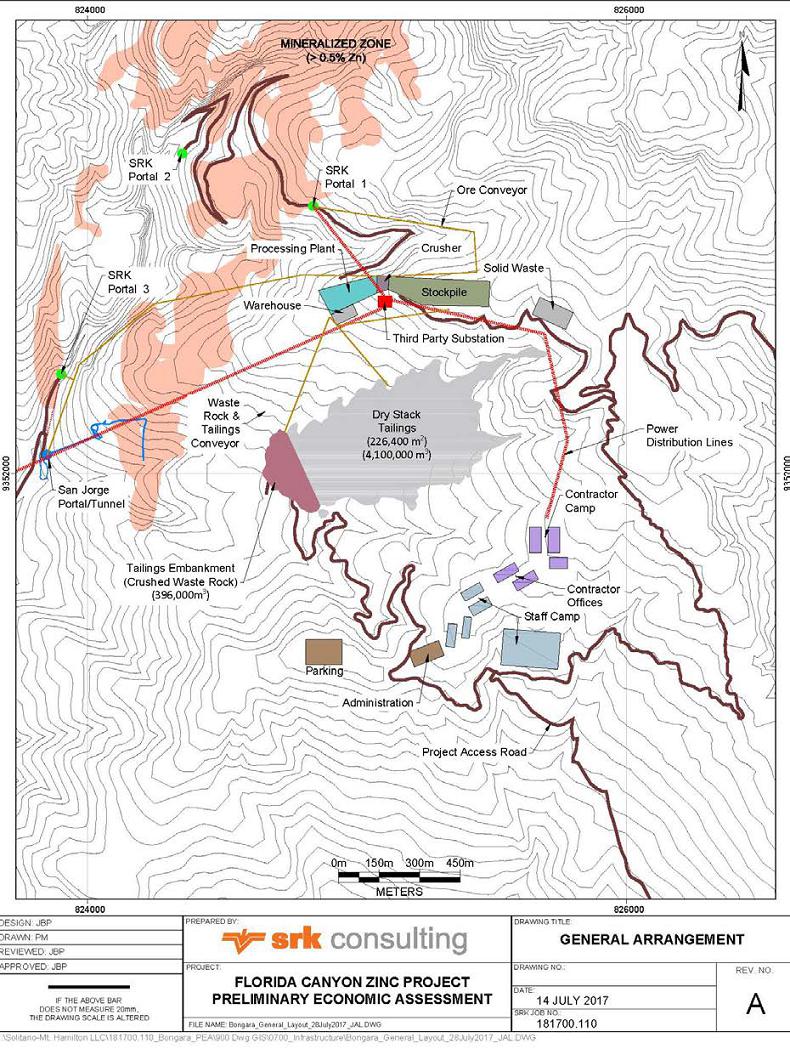

Given the location of the deposit, it is anticipated three underground portals will be producing mineralized material at any given time. Because of the challenging topography and road conditions, trucking Run-of-Mine (ROM) mineralized material would demand a lengthy route from the underground portals to the plant’s location. Instead, SRK has designed a set of conventional overland conveyors with a maximum slope of 20° to simplify the operation and significantly reduce the cost of transferring mineralized material from the mine portals to the process plant. A portable, primary jaw crusher is to be installed at each underground mine portal to ensure the ROM is adequately sized for the conveying system.

Florida Canyon mineralized material will be processed using a conventional concentration plant consisting of three stage crushing, grinding using a single-stage ball mill to 80% minus 44 microns, and differential flotation to produce two final products: a zinc concentrate and a lead concentrate containing payable silver. The concentrate will be truck transported to the point of sale. Tailings will be used as backfill or filtered and conveyed to a dry stack tailings storage facility.

The mill will process 2,500 t/d of fresh mineralized material, and produce approximately 287 t of zinc concentrate grading 50% Zn, 1% Pb, and 0.6 g/t Ag and approximately 46 t of lead concentrate grading 50% Pb, 8.4 g/t Ag, and 6% Zn.

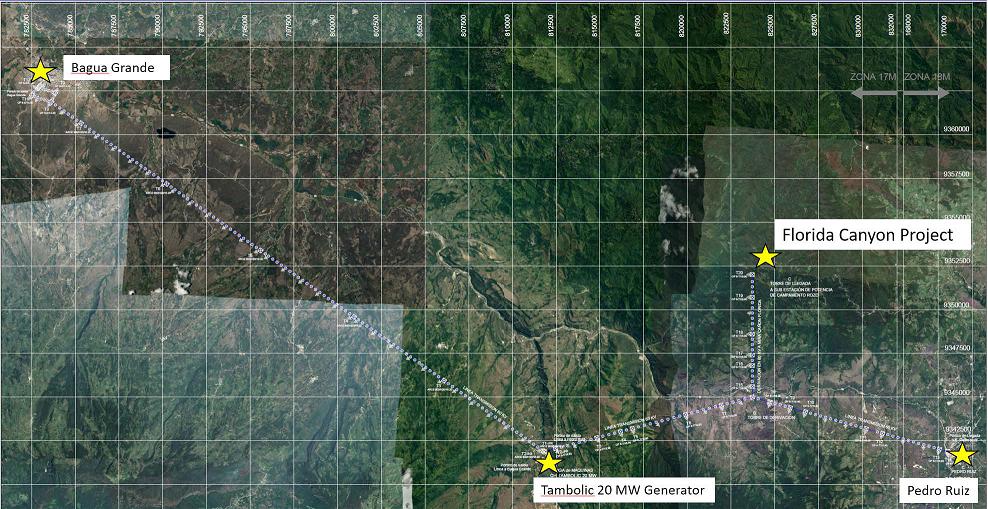

The power requirements for the projected milling operation is estimated at maximum 3.5 MW. Power for milling operations will be supplied by a third-party as line power at an estimated cost of US$0.084/kWh. The water requirement for the mill at a capacity of 2,500 t/d is estimated at maximum 20 liters per second. Water for processing will be acquired from surface water sources and as recycled water from tailings dewatering operations. Reagents and grinding balls, will be supplied by road from Pedro Ruiz and stored locally.

There are potential synergies for processing oxide mineralization at Florida Canyon using expertise that Votorantim has gained at the Vazante and Morro Agudo mines in Brazil. These other existing operations have demonstrated success recovering hemimorphite, smithsonite, and hydrozincite, which may improve future recovery projections for Florida Canyon.

| 1.10 | Project Infrastructure |

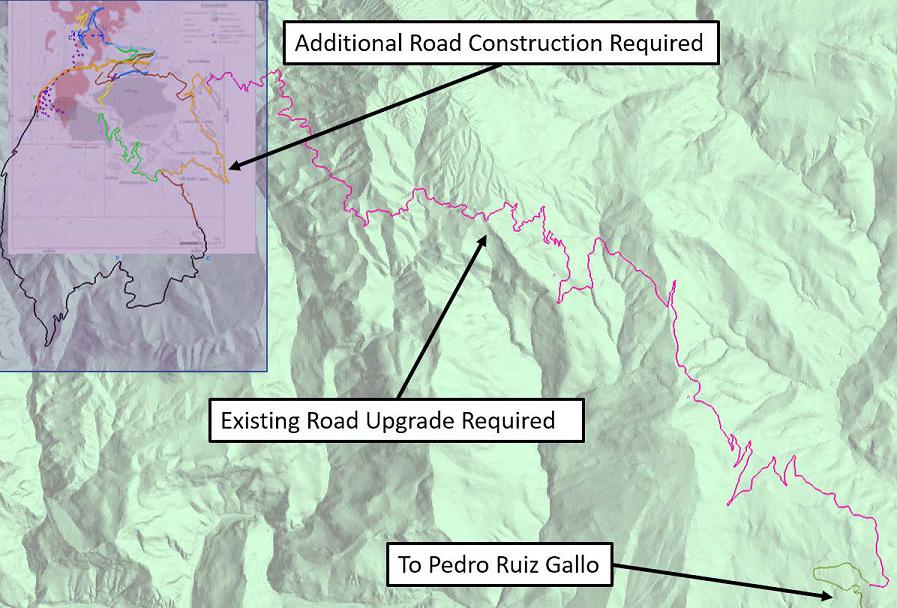

Florida Canyon is a greenfield project with no substantive existing infrastructure. The communities in the region are small and cannot support the operation from an infrastructure standpoint so a camp will be required. The infrastructure requirements for the Project will include an upgrade to the existing 26 km access road and the construction of an additional 24 km of support roads for access to mine portals, plant, and other infrastructure.

Site facilities will include the processing plant, mine, crushers and conveyors for ore/waste transportation, mine backfill systems including a paste backfill plant and cemented rock fill plant, water supply piping and tank, a dry stack TSF, 400 person camp, septic system, potable water treatment system, site power distribution, health/safety environmental office, mine office, mine dry, rescue and first aid building, security gate house, truck scale, truck wash, laboratory, incinerator system, fuel storage and pumping system.

| 23 |

Makeup water for the processing plant will be supplied from a local creek through a piping system to a storage tank that will also provide fire system water. The majority of the water requirements will be provided by rainfall and recycle water from the dry stack tailings storage facility (TSF) returned to the processing plant facility. A third-party will supply line power through a hydroelectric power generator, transmission line, and substation owned by the third party with costs recovered through an electricity surcharge over the life of the Project. Zinc concentrate will be transported by 30 t over the road trucks to the Votorantim Cajamarquilla smelter near Lima. Lead concentrate will be trucked to the Port of Callao near Lima, and shipped to an overseas lead smelter.

| 1.11 | Environmental Studies and Permitting |

Environmental permits for mineral exploration programs are divided into two classes. Class I permits allow construction and drilling for up to 20 platforms with a maximum disturbance of 10 ha. A Class II permit provides for more than 20 drill locations or for a disturbance area of greater than 10 ha. Votorantim has filed applications for and received Class II permits for various phases of the Project and has filed and received the required associated permits.

Permitting requirements for mining include an Estudio de Impacto Ambiental (EIA) that describes in detail the mining plan and evaluates the impacts of the plan on environmental and social attributes of the property. Baseline studies include air quality, surface and groundwater quality, flora and fauna surveys, archeological surveys and a study of the social conditions of the immediate property and an area of interest that includes local communities. Public meetings are required in order that local community members can learn about and comment on the proposed operation. Many of the baseline studies required for mining have been completed by Votorantim.

| 1.12 | Conclusions and Recommendations |

1.12.1 General

The Florida Canyon Zinc Project is a significant greenfields potentially underground mineable high- grade zinc deposit containing associated lead and silver. The Project has a large land position and strong technical and financial backing through Solitario’s earn-in JV partner Votorantim. While this document represents the first formal economic evaluation of the Project, Votorantim and Cominco report having previously spent over US$60 million on drilling, test work and strategic planning for development (Solitario, 2014). Current projections in the zinc metal market suggest a near-term reduction in zinc supply as current major producers exhaust reserves.

SRK’s site visit to the project on the ground in northern Peru found it to be a well-organized facility, with current QA/QC protocols in place for drilling data verification and validation. Material handling, core storage and security were all at or above industry standards.

SRK used a number of methods to validate the Votorantim resource block model starting with a face-to-face meeting with the modeler and following on with a thorough audit of the model source data, geologic modeling techniques, grade and tonnage estimation methods and classification protocols. SRK found these to be in line with industry standards, having been produced with recognized mining software, defensible data and reasonable assumptions. SRK was able to independently validate the model results.

A significant component of the SRK input to this PEA was the development of the underground mine plan. Because Florida Canyon is a polymetallic zinc-lead-silver deposit, each model block in the mine model was evaluated on an NSR basis, which included an estimate of recovery. Recovery was developed from a robust 2014 metallurgical campaign that characterized all expected material types. A recovered grade by block was used to build the underground stoping plan, complete with access, ventilation and an assessment of mine recovery and dilution.

| 24 |

SRK is unaware of any environmental, permitting, legal, title, taxation or marketing factors that could limit or affect the resource stated in this document. The project will benefit from additional infill and exploration drilling, additional process-metallurgical test work, detailed engineering studies for infrastructure and tailings management and forward planning to clearly define concentrate transport and smelter costs.

1.12.2 Mineral Resource Estimate

The current exploration model for the Project has been applied successfully in drillhole planning and resource definition. There is low risk to the Project if no additional exploration is completed. However, additional drilling for resource definition has a strong potential to expand the known resource extent and upgrade Inferred resources to Measured and Indicated. The most prospective targets include:

| · | Extension drilling south of the San Jorge zone and northeast of the Karen-Milagros zones are considered the highest priority to increase high-grade zinc sulfide mineralization. Both zones are open in the recommended areas of drill testing; |

| · | Infill drilling several large un-drill tested areas surrounded by mineralized zones within the mineralized footprint has the potential to significantly increase resources; |

| · | Extension drilling peripheral to the currently defined mineralized footprint; and |

| · | Further develop drill targets over the 20 km long northern Florida Canyon mineralized corridor where large areas of strong zinc in soil and rock chip geochemistry indicate the potential for additional mineralized zones. |

At present, the deposit is open laterally to the north and south as well as to the west and east on the downthrown sides of the horst that defines the limits of exploration to date. Gaps in the drill pattern within the footprint of the existing drilling provide another opportunity to increase resources where drill spacing limits the continuity of stratigraphically controlled mineralization. A constraint on effective exploration and delineation drilling in these areas is the access to drilling stations due to the rugged terrain. The completion of a road into the area will help to expedite future drilling and development programs by providing increased access and lowering costs.

The discovery of the high-angle, high-grade San Jorge zone has prompted more emphasis on angled drilling, where most of the historic drilling is vertical to near-vertical and is therefore ineffective at locating and defining near-vertical structures. These “break-through” structures have been mapped on surface in several locations, but due to logistical constraints, have not been adequately drill tested for their down-dip continuity. Similarly, there appear to be additional drill targets at the intersection of the high-angle structures and the flat manto zones, where grades are locally enhanced. These concentrations may be present within the existing drilling footprint, but require additional drilling to delineate. The high grade and potential tonnage of such targets provide an incentive to locate and further define resources of this geometry.

| 25 |

1.12.3 Mineral Processing and Metallurgical Testing

Processing of sulfide mineralization (zinc-lead-silver) from the Florida Canyon deposit is straight forward using conventional flotation to a concentrate followed by offsite smelting. Producing a commercial quality zinc concentrate from mixed material needed to incorporate Dense Media Separation methods (DMS) in order to maintain high recoveries (80+%). A conventional flotation approach reached commercial quality (about 50% Zn) at the expense of lower metal recovery, with a similar outcome for the lead concentrate. It is SRK’s opinion that conventional flotation should be able to achieve enhanced commercial level results (grade and recovery) under improved crushing, grinding, and flotation conditions.

Available information about silver is very limited. The laboratory developed a relationship between lead's head grade and silver grade in the final lead concentrate. This relationship follows what is typically observed in this type of deposit, therefore as this stage of development it is assumed to be valid, but SRK recommends confirming it in the next testing phase of the project.

To optimize recovery and grade when attempting to reach separation of the zinc and lead minerals into their respective commercial quality concentrates, SRK recommends approaching the selection of samples for the next phase of metallurgical sampling and testing:

| · | The core logging needs to incorporate attributes like clay percent, clay type, RQD, oxide content, sulfide content; |

| · | Assaying of the core should include whole rock analysis; and |

| · | Collect samples for metallurgical testing representing distinctive zones in the deposit. Grade variability should be secondary criteria when selecting samples, but they must be reasonably close to what a potential mining operation would be able to deliver to the mill. |

1.12.4 Mineral Reserve Estimate

There were no Mineral Reserves estimated for this PEA.

1.12.5 Mining Methods

Depending upon the geometry of the mineralized zones, SRK selected longhole stoping to be used in steeply dipping zones and mechanized drift-and-fill extraction methods in shallowly dipping mantos. Conventional room and pillar mining on a checkerboard pattern could be applied to specific zones of the Florida Canyon project, particularly in lower grade areas, and should be considered in future trade- off studies at the prefeasibility level. Cemented paste backfill will be placed underground to increase mining recovery and to stabilize mined-out areas. Adits will provide access from the surface to the mineralized zones currently defined in the mine plan.

Sub-level open stoping parameters for this study were based on empirical relations from case histories. As the project advances, additional geotechnical stability modeling using numerical methods is recommended. Karst topography is prevalent in the district and karst caverns were encountered during the excavation of the San Jorge Adit. Additional geotechnical and hydrogeological evaluation of this condition is required to ensure safe operating conditions in the underground mining. A crown pillar of 30 m has been used for planning. This assumption should be reevaluated in future work. Overall, a cost-benefit analysis of ground support, dilution, mine recovery, and ventilation should be undertaken at the next level of study.

Operating costs, which ultimately define NSR value and drive stope designs, were developed from benchmarks, analogous projects in the region, and commercial cost sources. SRK recommends a revision of these costs from first principles as the project advances.

| 26 |

SRK notes that there are likely opportunities to improve the production schedule. Opportunities include improved sequencing of high grade material and, potentially, a decrease in the pre-production timeframe. A more detailed design and schedule with corresponding trade-off studies, as well as more detailed construction timeframe estimates, would be required for the next phase of study.

1.12.6 Recovery Methods

The Florida Canyon polymetallic zinc-lead-silver deposit can be processed using a conventional concentration plant consisting of three-stage crushing, grinding using ball mill, and differential flotation to produce two final products: a zinc concentrate and a lead concentrate. Detailed sizing and costing of the processing plant components will follow additional metallurgical testing proposed in this study. Power supply and water supply appear to be fairly well defined for the project, though additional studies may be needed to refine these services and the costs of these services to the project.

1.12.7 Project Infrastructure

The Florida Canyon deposit is located in steep terrain in a remote part of northern Peru with moderate to high rainfall. These geographic and climatic conditions pose challenges to both access and infrastructure development.

As presently understood, the key support services of power supply and water supply are available and part of a district-wide infrastructure improvement campaign being implemented by the Peruvian government and related third-party providers. The most significant advancement in the infrastructure investigation for the PEA was identifying the probability of hydroelectric power distribution to the site, as a lower cost alternative to on-site power generation. Water supply for operations appears to be straight forward, with abundant surface water available for mineral processing and camp support.

The infrastructure component with the largest footprint and projected cost is the tailings storage facility. As part of this study, SRK has evaluated this as a dry stack facility in order to achieve geotechnical stability and reduce the area requiring reclamation. Trade-off studies are warranted to optimize moisture content, binding characteristics, and placement and compaction methods during tailings placement.

1.12.8 Environmental Studies and Permitting

Additional environmental baseline studies are required for further project development.

Impact to groundwater is expected to be minimal as underground surface exposures are minor and future exposed sulfides are not acid generating. There are no groundwater wells required for processing or potable water supply. There will be little or no surface area disturbance related to waste rock placement.

Tailings are predicted to have low amounts of iron sulfide and to be geochemically stable with respect to acid rock drainage. There is also substantial neutralization capacity in the carbonate host rocks to mitigate acid generation. Residual lead and zinc sulfides have low acid-generating capacity; however, they are subject to metal leaching and therefore require compaction during placement.

SRK recommends in future studies to design the tailings surface and spillway stormwater structure and evaluate options to reduce or eliminate the long-term obligation for monitoring and maintenance.

| 27 |

1.12.8 Recommendations – Work Programs and Costs

SRK acknowledges, after examination of the Project data set, that there have been a significant number of technical studies completed by Votorantim, many of which are beyond PEA. Therefore, the work elements listed in Table 1-9 represent mostly prefeasibility and feasibility level engineering and drilling to support those studies.

At the juncture where prefeasibility level engineering has been completed, the Project will likely warrant further public reporting to an international standard (JORC, or NI 43-101). Technical information required to achieve this level of project development are listed in Table 1-9. A cost estimate for these work elements is included in the table.

Table 1-9: Summary of Costs for Recommended Work

| Work Program | Estimated | Assumptions/Comments |

| Engineering Studies | Cost US$ | |

| Metallugical variability and recovery optimization test work | 500,000 | Commercial Laboratory |

| Prefeasibility Study (PFS) and Trade-off Studies | 600,000 | Votorantim or consultant engineer |

| Subtotal Studies | $1,100,000 | |

| Drilling | Salaried new hire or contract PM | |

| Exploration Drilling | 2,100,000 | 20 holes to 350 m at US$300/m |

| Resource Conversion Drilling | 2,100,000 | 20 holes to 350 m at US$300/m |

| Metallurgical Drilling for Flotation and Comminution | 1,225,000 | 10 PQ holes to 350 m at US$350/m |

| Geotechical Drilling for Mining | 500,000 | 10 holes oriented to 100 m at US$500/m |

| Geotechnical Drilling for Foundation Stability | 225,000 | 50 holes to 30 m at US$150/m |

| Hydrogeological Drilling | 600,000 | 4 holes to 300 m at US$500/m |

| Subtotal Drilling | $6,750,000 | |

| Studies + Drilling | 7,600,000 | |

| Contingency at 15% | 1,435,000 | |

| Total | $9,285,000 |

Source: SRK, 2017

| 28 |

| 2 | Introduction |

| 2.1 | Terms of Reference and Purpose of the Report |

This report was prepared as a National Instrument 43-101 (NI 43-101) Technical Report, Preliminary Economic Assessment (Technical Report or PEA) by SRK Consulting (U.S.), Inc. (SRK), with Votorantim Metais Holding S.A. (Votorantim) with Solitario Zinc Corp. (Solitario), (collectively, owners) on the Florida Canyon Zinc Project located in Amazonas Department, Peru (Florida Canyon or Project). The Project name was changed in 2017 from Bongará, as it was called previously, to Florida Canyon. Some of the figures in this report still reference Bongará. The reader is advised to use Bongará interchangeably with Florida Canyonwhen reviewing those figures.

This study represents the advancement of the Project from a 2014 Technical Report on Resources, to this 2017 PEA. Highlights of this PEA include a thirteen-year life-of-mine underground mine plan, comminution and flotation of zinc and lead concentrates with at a production rate of 2,500 t/d followed by dry-stack tailings storage. Site infrastructure includes line power to the site, water distribution systems, a townsite and access roads for construction and re-supply as well as for zinc concentrate transport to a point of sale at the Cajamarquilla smelter.

The quality of information, conclusions, and estimates contained herein is consistent with the level of effort involved in SRK’s services, based on: i) information available at the time of preparation, ii) data supplied by outside sources, and iii) the assumptions, conditions, and qualifications set forth in this report. This report is intended for use by the owners subject to the terms and conditions of its contract with SRK and relevant securities legislation. The contract permits the owners to file this report as a Technical Report with Canadian securities regulatory authorities pursuant to NI 43-101, Standards of Disclosure for Mineral Projects. Except for the purposes legislated under provincial securities law, any other uses of this report by any third party is at that party’s sole risk. The responsibility for this disclosure remains with the issuing companies. The user of this document should ensure that this is the most recent Technical Report for the property as it is not valid if a new Technical Report has been issued.

The PEA is preliminary in nature, that it includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the PEA will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

This report provides Mineral Resources, and a classification of resources prepared in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum Standards on Mineral Resources and Reserves: Definitions and Guidelines, May 10, 2014 (CIM, 2014).

| 2.2 | Qualifications of Consultants (SRK) |

The Consultants preparing this technical report are specialists in the fields of geology, exploration, Mineral Resource and Mineral Reserve estimation and classification, underground mining, geotechnical, environmental, permitting, metallurgical testing, mineral processing, processing design, capital and operating cost estimation, and mineral economics.

The following individuals, by virtue of their education, experience and professional association, are considered Qualified Persons (QP) as defined in the NI 43-101 standard, for this report, and are members in good standing of appropriate professional institutions. QP certificates of authors are provided in Appendix A. The QP’s are responsible for specific sections as follows:

| 29 |

| · | Walter Hunt, CPG, an employee of Solitario, is the QP responsible for Sections 2, 4 and parts of 20; |

| · | J.B. Pennington, CPG is the QP responsible for Sections 5-10, 12, 14, 23, 24 and part of 1, 20, 25, and 26; |

| · | Joanna Poeck, PE, MMSA is the QP responsible for Sections 15-16 and part of 1, 25 and 26; |

| · | Jeff Osborn BEng Mining, MMSA is the QP responsible for Section 18-19, 21-22 and part of 1, 25 and 26; |

| · | Daniel Sepulveda, RM-SME is the QP responsible for Sections 13, 17, the capital and operating cost for processing in Section 21, and part of 1, 25 and 26; and |

| · | James Gilbertson, CGeol is the QP responsible for Section 11, the site visit, inspection of geological sampling and data collection practices, and review of resource estimation practices. |

| · | John Tinucci, PhD, PE is the QP responsible for Section 16.2. |

| 2.3 | Details of Inspection |

James Gilbertson, C. Geol., of SRK Exploration Services (U.K.), visited the Florida Canyon Project site and core storage facility in Shipasbamba, Peru on May 5 to 7, 2014. This trip included a follow-up visit to Votorantim’s Lima, Peru office on May 9, 2014. Mr. Gilbertson is a Chartered Geologist in the Geological Society of London, and a Qualified Person in the discipline of resource geology, according to NI 43-101 requirements.

| 2.4 | Sources of Information |

The sources of information include data and reports supplied by Solitario personnel and representatives of Votorantim, as well as documents cited throughout the report and referenced in Section 27.

| 2.5 | Effective Date |

The effective date of this report is July 13, 2017.

| 2.6 | Units of Measure |

The metric system has been used throughout this report. Tonnes are metric of 1,000 kg, or 2,204.6 lb. All currency is in U.S. dollars (US$) unless otherwise stated.

| 30 |

| 3 | Reliance on Other Experts |

The Consultants used their experience to determine if the information from previous reports was suitable for inclusion in this technical report and adjusted information that required amending. This report includes technical information, which required subsequent calculations to derive subtotals, totals and weighted averages. Such calculations inherently involve a degree of rounding and consequently introduce a margin of error. Where these occur, the Consultants do not consider them to be material.

Items such as mineral titles and agreements have not been independently reviewed by SRK and SRK did not seek an independent legal opinion of these items.

| 31 |

| 4 | Property Description and Location |

| 4.1 | Property Location |

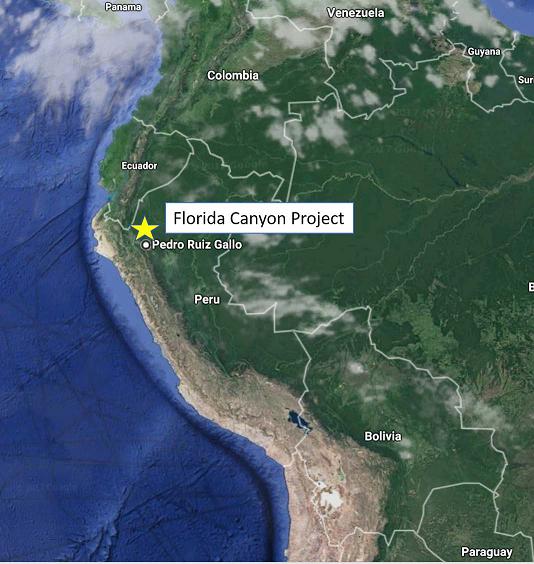

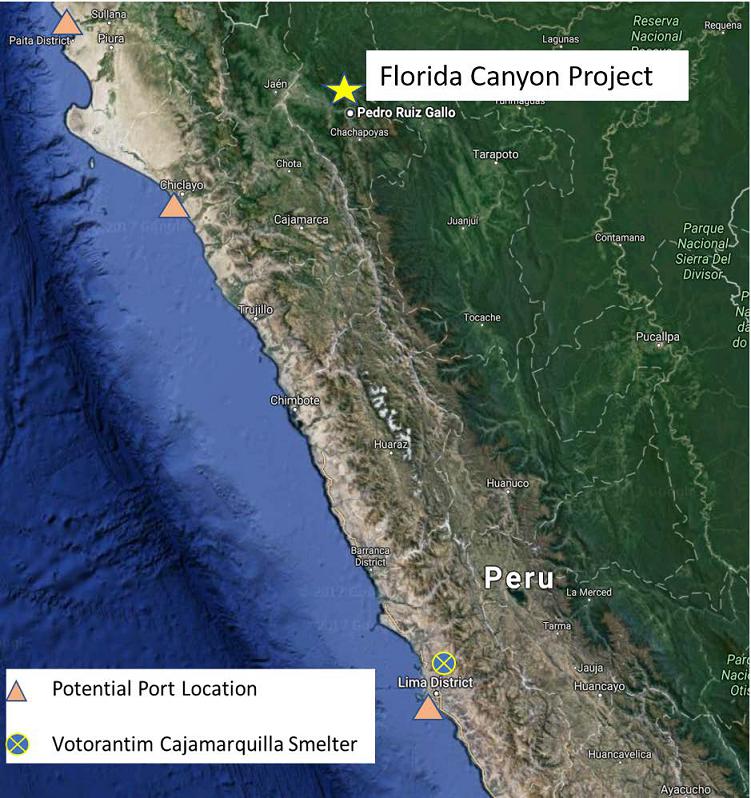

The Florida Canyon Zinc Project (the Project, formerly called Bongará) is located in the Eastern Cordillera of Peru at the sub-Andean front in the upper Amazon River Basin. It is within the boundary of the Shipasbamba community, 680 km north-northeast of Lima and and 245 km northeast of Chiclayo, Peru, in the District of Shipasbamba, Bongará Province, Amazonas Department (Figure 4-1). The Project area can be reached from the coastal city of Chiclayo by the paved Carretera Marginal road. The central point coordinates of the Project are approximately 825,248 East and, 9,352,626 North (UTM Zone 17S, Datum WGS 84). Elevation ranges from 1,800 masl to approximately 3,200 masl. The climate is classified as high altitude tropical jungle in the upper regions of the Amazon basin. The annual rainfall average exceeds 1 m with up to 2 m in the cloud forest at higher elevations.

| 32 |

Source: Votorantim, 2013b

Figure 4-1: Project Location Map

| 33 |

| 4.2 | Mineral Titles |

Florida Canyonis a mineral exploration project comprised of sixteen contiguous mining concessions covering approximately 12,600 ha (Table 4-1). The concession titles are in the name of Minera Bongará and are subject to the Minera Bongará joint venture agreement between Solitario and Votorantim. All of these concessions are currently titled.

The Minera Bongará concessions are completely enveloped by a second group of thirty-seven contiguous mining concessions, covering approximately 30,700 ha (Table 4-2). The concession titles are in the name of Minera Chambara. Of the thirty-seven concessions, twelve titles are pending. Claim areas are shown in Figure 4-2.

According to Peruvian law, concessions may be held indefinitely, subject only to payment of annual fees to the government. At the time of this study, concession payments were current for Minera Bongará claims, with 2017 fees of US$122,600 (Table 4-1). The fees for Minera Chambara total US$140,530 and these fees do not include the additional nine Charlita claims filed in January, 2017, which are still pending (Table 4-2). Minera Chambara, a Peruvian company also subject of a separate joint venture agreement between Votorantim and Solitario, holds mineral concessions surrounding the Minera Bongará claims but which do not contain any of the resources subject of this economic analysis.

Votorantim, who has served as operator of the joint venture company Minera Bongará, entered into a surface rights agreement with the local community of Shipasbamba which controls the surface rights of the Project. This agreement provides for annual payments and funding for mutually agreed upon social development programs in return for the right to perform exploration work including road building and drilling.

| 34 |

Table 4-1: List of Minera Bongará Mineral Claims

| Concession Name | Number | Status | Hectares | Claim Date | 2017 Holding Fees (US$) | District |

| BONGARA CINCUENTICINCO | 10233396 | Titled | 1,000 | 8/7/1996 | 23,000.00 | FLORIDA/SHIPASBAMBA |

| BONGARA CINCUENTICUATRO | 10233296 | Titled | 600 | 8/7/1996 | 13,800.00 | FLORIDA/SHIPASBAMBA |