Attached files

| file | filename |

|---|---|

| EX-24 - SOLITARIO ZINC CORP. | exh24.htm |

| EX-21 - SOLITARIO ZINC CORP. | exh21.htm |

| EX-23.2 - SOLITARIO ZINC CORP. | exh232.htm |

| EX-23.1 - SOLITARIO ZINC CORP. | exh231.htm |

| EX-31.2 - SOLITARIO ZINC CORP. | exh312.htm |

| EX-31.1 - SOLITARIO ZINC CORP. | exh311.htm |

| EX-32.2 - SOLITARIO ZINC CORP. | exh322.htm |

| EX-32.1 - SOLITARIO ZINC CORP. | exh321.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark One)

X Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended

December 31, 2010

or

Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from to

Commission file number 001-32978

SOLITARIO EXPLORATION & ROYALTY CORP.

(Exact name of registrant as specified in charter)

|

Colorado |

84-1285791 |

|

|

4251 Kipling St. Suite 390, Wheat Ridge, CO |

80033 |

|

|

Registrant's telephone number, including area code |

(303) 534-1030 |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Name of exchange on which registered |

|

Common Stock, $0.01 par value |

NYSE Amex Equities |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES [ ] NO [X ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES [ ] NO [ X ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES [X] NO [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (SS 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YES [ ] NO [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained to the best of registrant's knowledge in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer [ ] |

Accelerated filer [ ] |

Non accelerated Filer [ ] |

Smaller Reporting Company [X] |

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

YES [ ] NO [ X ]

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant as of the last business day of the registrant's most recently completed second fiscal quarter, based upon the closing sale price of the registrant's common stock on June 30, 2010 as reported on NYSE Amex Equities was approximately $50,271,000.

There were 29,775,242 shares of common stock, $0.01 par value, outstanding on March 8, 2011.

DOCUMENTS INCORPORATED BY REFERENCE

None

1

<PAGE>

TABLE OF CONTENTS

2

<PAGE>

PART I

This Annual Report on Form 10-K contains statements that constitute "forward-looking statements" within the meaning of section 27A of the Securities Act of 1933 and section 21E of the Securities Exchange Act of 1934. These statements can be identified by the fact that they do not relate strictly to historical information and include the words "expects", "believes", "anticipates", "plans", "may", "will", "intend", "estimate", "continue" or other similar expressions. These forward-looking statements are subject to various risks and uncertainties that could cause actual results to differ materially from those currently anticipated. These risks and uncertainties include, but are not limited to, items discussed below in Item 1A "Risk Factors" in this Form 10-K. Forward-looking statements speak only as of the date made. We undertake no obligation to publicly release or update forward-looking statements, whether as a result of new information, future events or otherwise. You are, however, advised to consult any further disclosures we make on related subjects in our quarterly reports on Form 10-Q and any reports made on Form 8-K to the United States Securities and Exchange Commission (the "SEC").

Item 1. Business

The Company

Solitario Exploration & Royalty Corp. ("Solitario") is an exploration stage company with a focus on the acquisition of precious and base metal properties with exploration potential and the development or purchase of royalty interests. We acquire and hold a portfolio of exploration properties for future sale, joint venture, or to create a royalty prior to the establishment of proven and probable reserves. Although our mineral properties may be developed in the future on our own or through a joint venture, Solitario has never developed a mineral property. However, in August 2010 and December 2010, respectively, Solitario signed a Letter of Intent and a Limited Liability Company Operating Agreement to earn up to an 80% interest in and develop the Mt. Hamilton project located in Nevada, discussed below under "Ely Gold Investment and the Mt. Hamilton Joint Venture" and we intend to develop the Mt. Hamilton project. Solitario may also evaluate mineral properties to potentially buy a royalty. At December 31, 2010, Solitario's mineral properties are located in the State of Nevada in the United States and in Mexico, Brazil, Bolivia and Peru.

Solitario was incorporated in the state of Colorado on November 15, 1984 as a wholly owned subsidiary of Crown Resources Corporation ("Crown"). In July 1994, Solitario became a publicly traded company on the Toronto Stock Exchange (the "TSX") through its Initial Public Offering. On July 26, 2004, Crown completed a spin-off of its holdings of our shares to its shareholders as part of the acquisition of Crown (the "Crown - Kinross Merger") by Kinross Gold Corporation ("Kinross"). On June 12, 2008, our shareholders approved an amendment to the Articles of Incorporation to change our name from Solitario Resources Corporation to Solitario Exploration & Royalty Corp.

Our corporate structure is as follows - all of the subsidiaries are 100%-owned, with the exception of Minera Chambara, which is 85%,-owned by Solitario, and Mt. Hamilton LLC, which is 10% owned by Solitario.

Solitario Exploration & Royalty Corp. [Colorado]

- Altoro Gold Corp. [British Columbia, Canada]

- Altoro Gold (BVI) Corp. [British Virgin Islands]

- Minera Altoro (BVI) Ltd. [British Virgin Islands]

- Minera Andes (BVI) Corp. [British Virgin Islands]

- Compania Minera Andes del Sur S.A. [Bolivia]

- Minera Altoro Brazil (BVI) Corp. [British Virgin Islands]

- Altoro Mineracao, Ltda. [Brazil]

- Minera Chambara, S.A. [Peru] (85%-owned)

- Minera Solitario Peru, S.A. [Peru]

- Minera Bongara, S.A. [Peru]

- Minera Soloco, S.A. [Peru]

- Mineracao Solitario Brazil, Ltd [Brazil]

- Minera Solitario Mexico, S.A. [Mexico] - 100%

- Mt. Hamilton, LLC [Colorado] - 10%

3

<PAGE>

General

Our principal expertise is in identifying mineral properties with promising mineral potential, acquiring these mineral properties and exploring them to enable us to sell, joint venture or create a royalty on these properties prior to the establishment of proven and probable reserves. We also have used the same expertise to obtain royalty interests. Currently we have no mineral properties with reserves. During 2010 we entered into the Limited Liability Company Operating Agreement for Mt. Hamilton, LLC. We currently working on feasibility related activities related to Mt. Hamilton and intend to develop the Mt. Hamilton project, but we have never developed a property in our history. In addition to our activities at Mt. Hamilton, one of our primary goals is to discover economic deposits on our mineral properties and advance these deposits, either on our own or through joint ventures, up to the development stage (development activities include, among other things, completion of a feasibility study for the identification of proven and probable reserves, as well as permitting and preparing a deposit for mining). At that point, or sometime prior to that point, we would attempt to either sell our mineral properties, or pursue their development either on our own or through a joint venture with a partner that has expertise in mining operations, or create a royalty with a third-party that continues to advance the property.

In analyzing our activities, the most significant aspect relates to results of our exploration activities and those of our joint venture partners' on a property-by-property basis. When our exploration activities, including drilling, sampling and geologic testing indicate a project may not be economic or contain sufficient geologic or economic potential we may impair or completely write-off the property. Another significant factor in the success or failure of our activities is the price of commodities. For example, when the price of gold is up, the value of gold-bearing mineral properties increases, however, it may also become more difficult and expensive to locate and acquire new gold-bearing mineral properties with potential to have economic deposits.

The potential sale, joint venture or development, either on our own or through a joint venture of our mineral properties will occur, if at all, on an infrequent basis. Accordingly, while we conduct exploration activities and planned development of the Mt. Hamilton project, we need to maintain and replenish our capital resources. We have met our need for capital in the past through (i) sale of our investment in Kinross common stock; ii) issuance of short-term margin debt secured by our investment in Kinross; (iii) joint venture delay rental payments, including payments of $200,000 each year, respectively, in 2010, 2009 and 2008 on our Bongara property and previous payments on our exploration properties which occurred during the years from 1996 through 2000; (iv) the sale of properties, which last occurred in 2000 with the sale of our Yanacocha property for $6,000,000, (v) issuance of common stock, including the exercise of options. We have reduced our exposure to the costs of our exploration activities through the use of joint ventures. We anticipate these practices will continue for the foreseeable future.

We operate in one segment, mining geology and mineral exploration. We currently conduct exploration in Peru, Brazil, Mexico, Nevada in the United States and, to a limited extent, Bolivia. As of March 8, 2011, we had five full-time employees, located in the United States and 23 full-time employees, located in Latin America outside of the United States. We extensively utilize contract employees and laborers to assist us in the exploration on most of our projects.

A large number of companies are engaged in the exploration and development of mineral properties, many of which have substantially greater technical and financial resources than we have and, accordingly, we may be at a disadvantage in being able to compete effectively for the acquisition, exploration and development of mineral properties. We are not aware of any single competitor or group of competitors that dominate the exploration and development of mineral properties. In acquiring mineral properties for exploration and development, we rely on the experience, technical expertise and knowledge of our employees, which is limited by the size of our company compared to many of our competitors who may have either more employees or employees with more specialized knowledge and experience.

4

<PAGE>

Ely Gold Investment and the Mt. Hamilton Joint Venture.

On August 26, 2010, we signed a Letter of Intent ("LOI") with Ely Gold and Minerals, Inc., ("Ely") to make certain equity investments into Ely and to joint venture Ely's Mt. Hamilton gold project, which was wholly-owned by DHI-Minerals (US) Ltd. ("DHI-US") an indirect wholly-owned subsidiary of Ely. On August 26, 2010 and October 19, 2010, we made private placement investments of Cdn$250,000 each in Ely securities. We received a total of 3,333,333 shares of Ely common stock and warrants to purchase a total of 1,666,667 shares of Ely common stock (the "Ely Warrants") for an exercise price of Cdn$0.25 per share, which expire two years from the date of purchase. The private placements were pursuant to the LOI to joint venture Ely's Mt. Hamilton gold project. On November 12, 2010 we made an initial contribution of $300,000 for a 10% membership interest in, upon the formation, of Mt. Hamilton LLC ("MH-LLC") which was formed in December 2010. The terms of the joint venture are set forth in the Limited Liability Company Operating Agreement of MH-LLC between Solitario and DHI-US (the "MH Agreement"). MH-LLC owns 100% of the Mt. Hamilton Gold project. Pursuant to the MH Agreement, we may earn up to an 80% interest in MH-LLC, and indirectly, the Mt. Hamilton project, by completing various staged commitments. See a more complete discussion of Ely and MH-LLC below in Note 12 to the consolidated financial statements, "Ely Gold investment and the Mt. Hamilton Joint Venture" in Item 8 "Financial Statements and Supplementary Data."

Investment in Kinross

We have a significant investment in Kinross at December 31, 2010, which consists of 980,000 shares of Kinross common stock. In August 2006, Solitario received 1,942,920 shares in exchange for 6,071,626 shares of Crown common stock it owned on the date of the Crown - Kinross Merger. Subsequent to the Crown - Kinross Merger, we have sold 982,920shares of Kinross common stock to fund our operations. As of March 8, 2011, Solitario owns 960,000 of Kinross common stock. In October 2007, Solitario entered into a Zero-Premium Equity Collar (the "Kinross Collar") with UBS Securities, LLC ("UBS"), which currently limits our ability to sell 100,000 of these shares until April 12, 2011, when the Kinross Collar expires. Under the Kinross Collar, upon termination on April 12, 2011, if the price of a share of Kinross common stock falls below $13.69 per share UBS will buy the shares for that amount. Furthermore, the Kinross Collar provides for an upper limit that we would receive of $27.50 per share on that date for the sale of those shares. As of March 8, 2011, the 860,000 shares of Kinross common stock that are not subject to the Kinross Collar have a value of approximately $13.36 million based upon the market price of $15.54 per Kinross share. Any significant fluctuation in the market value of Kinross common stock could have a material impact on Solitario's liquidity and capital resources.

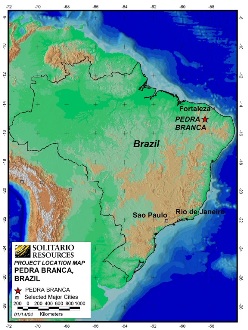

Pedra Branca do Minercao, Ltd., ("PBM")

On July 21, 2010, Anglo Platinum Limited ("Anglo") earned an additional 21% interest in PBM and now holds a 51% interest in PBM. Accordingly, we have deconsolidated our interest in PBM and have recorded our 49% interest in the fair market value of PBM as an equity investment in our consolidated balance sheet as of December 31, 2010. We recorded a gain on deconsolidation as of July 21, 2010 of $724,000 and have recorded our equity in the net loss of PBM from that date as other income in the condensed consolidated statement of operations. Please see Note 11 to the consolidated financial statements "Deconsolidation of PBM" in Item 8 "Financial Statements and Supplementary Data."

Short-term debt

During the year ended December 31, 2010, we borrowed $2,800,000 in short-term margin loans using our investment in Kinross as collateral for the short-term margin loan. At December 31, 2010, we have recorded $2,823,000 of short-term debt including $23,000 of accrued interest. See Note 3, to the consolidated financial statements "Short Term Debt" in Item 8 "Financial Statements and Supplementary Data."

Mineral properties - General

We have been involved in the exploration for minerals in Latin America, focusing on precious and base metals, including gold, silver, platinum, palladium, copper, lead and zinc. We have held concessions in Peru since 1993 and in Bolivia and Brazil since 2000. During 2004, we began a reconnaissance exploration program in Mexico and acquired mineral interests there in 2005. In 2010 we acquired a 10% interest in MH-LLC with an option to earn up to an 80% interest. MH-LLC owns the Mt. Hamilton mining claims located in Nevada, USA.

Financial information about geographic areas

Included in the consolidated balance sheet at December 31, 2010 and 2009 are total assets of $515,000 and $3,310,000, respectively, related to Solitario's foreign operations, located in Brazil, Peru, Mexico and Bolivia. Included in mineral properties in the consolidated balance sheet at December 31, 2009 are net capitalized costs related to the Pedra Branca Property, located in Brazil, of $2,607,000, which was deconsolidated during 2010.

5

<PAGE>

Available Information

We file our Annual Report on Form 10-K, our quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports electronically with the SEC. The public may read and copy any materials we file with the SEC at the SEC's public reference room at 100 F Street NE, Washington, DC 20549 or by calling the SEC at 1-800-SEC-0330. In addition the SEC maintains an internet website, http://www.sec.gov, which contains reports, proxy information and other information regarding issuers that file electronically with the SEC.

Paper copies of our Annual Report to Shareholders, our Annual Report on Form 10-K, our quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports are available free of charge by writing to Solitario at its address on the front of this Form 10-K. In addition, electronic versions of the reports we file with the SEC are available on our website, www.solitarioxr.com, as soon as practicable, after filing with the United States Securities and Exchange Commission.

In addition to considering the other information in this Form 10-K, you should consider carefully the following factors. The risks described below are the significant risks we face and include all material risks. Additional risks not presently known to us or risks that we currently consider immaterial may also adversely affect our business.

During 2010, we entered into an agreement with Ely to acquire up to 80% of the Mt. Hamilton project through our membership interest in MH-LLC. We currently intend to develop this property. The potential development of the Mt. Hamilton project adds new risks to Solitario including permitting, finance, mining operations and closure, for which Solitario has limited experience, resources and personnel. Failure on any of these or other components of the planned development of the Mt. Hamilton project could contribute to our inability to profitably develop, operate and close the Mt. Hamilton project, which could result in the loss of our investment in MH-LLC, and the loss of all or a significant portion of our financial reserves.

The development of mining properties involves a high degree of risk including the requirement to obtain permits, significant financial resources for the construction and development of an operating mine, operational expertise and reclamation. Permitting of a mine for development can be an expensive and uncertain endeavor, with no assurance of receiving required permits in a timely manner, if ever. We do not have a history of developing or operating mines and may not be able to acquire the additional personnel to adequately manage such operations. In addition, the financial resources required to put a mine into production and to sustain profitable operating mines is significant and far exceed our existing financial resources and there can be no assurance that we could obtain such financial resources. Should we fail to timely complete any of the activities required for the planned development of the Mt. Hamilton project or if upon completion of the development of the Mt. Hamilton project we are unable to operate the project profitably, it could result in the loss of our investment in Mt. Hamilton, the loss of all or a significant portion of our financial reserves and be a detriment to our other exploration assets. The failure to permit, develop, operate and close the Mt. Hamilton project on a timely and profitable basis could negatively affect our stock price and our financial position and operational results.

Our mineral exploration activities involve a high degree of risk; a significant portion of our business model envisions the sale or joint venture of mineral property, prior to the establishment of reserves. If we are unable to sell or joint venture these properties, the money spent on exploration may never be recovered and we could incur an impairment on our investments in our projects.

The exploration for mineral deposits involves significant financial and other risks over an extended period of time. Few properties that are explored are ultimately developed into producing mines. Major expenses are required to determine if any of our mineral properties may have the potential to be commercially viable and be salable or joint ventured. We have never established reserves on any of our properties. Significant additional expense and risks, including drilling and determining the feasibility of a project, are required prior to the establishment of reserves. These additional costs potentially diminish the value of our properties for sale or joint venture. It is impossible to ensure that the current or proposed exploration programs on properties in which we have an interest will be commercially viable or that we will be able to sell, joint venture or develop our properties. Whether a mineral deposit will be commercially viable depends on a number of factors, some of which are the particular attributes of the deposit, such as its size and grade, costs and efficiency of the recovery methods that can be employed, proximity to infrastructure, financing costs and governmental regulations, including regulations relating to prices, taxes, royalties, infrastructure, land use, importing and exporting of gold or other minerals, and environmental protection.

6

<PAGE>

>

We believe the data obtained from our own exploration activities or our partners' activities to be reliable, however the nature of exploration of mineral properties and analysis of geological information is subjective and data and conclusions are subject to uncertainty including invalid data as a result of many reasons, including sample contamination, analysis variation, extrapolation, undetected instrumentation malfunctions and the use of geologic and economic assumptions.

Even if our exploration activities determine that a project is commercially viable, it is impossible to ensure that such determination will result in a profitable sale of the project or development by a joint venture in the future and that such project will result in profitable commercial mining operations. If we determine that capitalized costs associated with any of our mineral interests are not likely to be recovered, we would incur an impairment of our investment in such property interest. All of these factors may result in losses in relation to amounts spent, which are not recoverable. We have experienced losses of this type from time to time including during 2010 when we wrote down our investment in our Santiago, Cajatambo, La Noria and Palmira projects, recording mineral property impairment of $55,000. We recorded mineral property impairment of $51,000 during 2009.

We have a significant investment in Kinross common stock. We have no control over fluctuations in the price of Kinross common stock and reductions in the value of this investment could have a negative impact on the market price of our common stock.

We have a significant investment in Kinross as of March 8, 2011. A significant fluctuation in the market value of Kinross common shares could have a material impact on our investment in Kinross, the market price of our common stock and our liquidity and capital resources.

During 2010 and 2011 we have borrowed money using short-term margin accounts, secured by our investment in Kinross. In the event this borrowing increases, or the price of a share of Kinross common stock decreases, we may be subject to a margin call against our investment in Kinross.

As of March 8, 2011 we have borrowed $3,875,000 in short term margin loans, secured by our investment in Kinross. These margin loans provide that if the net equity in our investment in Kinross, defined as the market value our equity holdings, consisting primarily of Kinross common stock, falls below a minimum margin equity level of between 35% and 40%, the lender of the short term margin loans may demand immediate payment or sell as much Kinross stock to repay the margin loan (a "Margin Call"). A significant decline in the market value of Kinross could result in the sale of some or all our investment in Kinross at a steep discount to the current investment balance. Such a Margin Call could have a negative effect on our liquidity, capital resources and results of operations.

The market for shares of our common stock has limited liquidity and the market price of our common stock has fluctuated and may decline.

An investment in our common stock involves a high degree of risk. The liquidity of our shares, or ability of the shareholder to buy or sell our common stock, may be significantly limited for various unforeseeable periods. The average combined daily volume of our shares traded on the Toronto Stock Exchange (the "TSX") and the NYSE Amex Equities ("NYSE Amex") during 2010 was approximately 30,000 shares, with no shares traded on many days. The market price of our shares has historically fluctuated in a wide range. Please see Item 5 - "Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities." The price of our common stock may be affected by many factors, including adverse change in our business, a decline in gold or other commodity prices, and general economic trends.

Our mineral exploration activities are inherently dangerous and could cause us to incur significant unexpected costs including legal liability for loss of life, damage to property and environmental damage; any of which could materially adversely affect our financial position or results of operations.

Our operations are subject to the hazards and risks normally related to exploration of a mineral deposit including mapping and sampling, drilling, road building, trenching, assaying and analyzing rock samples, transportation over primitive roads or via small contract aircraft or helicopters and severe weather conditions, any of which could result in damage to life or property, environmental damage and possible legal liability for such damage. Any of these risks could cause us to incur significant unexpected costs that could have a material adverse effect on our financial condition and ability to finance our exploration activities.

7

<PAGE>

We have a history of losses and if we do not operate profitably in the future it could have a material adverse affect on our financial position or results of operations and the trading price of our common stock would likely decline.

We have reported losses in 15 of our 17 years of operations. We reported losses of $4,066,000 and $1,786,000 for the years ended December 31, 2010 and 2009, respectively. We can provide no assurance that we will be able to operate profitably in the future. We have had net income in only two years in our history, during 2003, as a result of a $5,438,000 gain on derivative instrument related to our investment in certain Crown warrants and during 2000, when we sold our Yanacocha property. We cannot predict when, if ever, we will be profitable again. If we do not operate profitably, the trading price of our common stock will likely decline.

Our operations outside of the United States of America may be adversely affected by factors outside our control, such as changing political, local and economic conditions; any of which could materially adversely affect our financial position or results of operations.

Our

mineral properties located in Latin America consist primarily of mineral concessions granted by national governmental agencies and are held 100% by us or under lease, option or purchase agreements. Our mineral properties are located in Peru, Bolivia, Mexico and Brazil. We act as operator on all of our mineral properties that are not held in joint ventures. The success of projects held under joint ventures that are not operated by us is substantially dependent on the joint venture partner, over which we have limited or no control.Our exploration activities and mineral properties located outside of the United States of America ("United States") are subject to the laws of Peru, Bolivia, Brazil and Mexico, where we operate. Exploration and potential development activities in these countries are potentially subject to political and economic risks, including:

cancellation or renegotiation of contracts;

disadvantages of competing against companies from countries that are not subject to US laws and regulations,

including the Foreign Corrupt Practices Act;

changes in foreign laws or regulations;

changes in tax laws;

royalty and tax increases or claims by governmental entities, including retroactive claims;

expropriation or nationalization of property;

currency fluctuations (particularly related to declines in the US dollar compared to local currencies);

foreign exchange controls;

restrictions on the ability for us to hold US dollars or other foreign currencies in offshore bank accounts;

import and export regulations;

environmental controls;

risks of loss due to civil strife, acts of war, guerrilla activities, insurrection and terrorism; and

other risks arising out of foreign sovereignty over the areas in which our exploration activities are conducted.

During 2006, the government of Bolivia took steps toward the nationalization of its oil and gas industry by unilaterally increasing taxes payable by private owners of oil and gas properties. In 2007 the government effectively increased corporate taxes on mining companies from 25% to 37.5% of profits. More recently, the government has proposed sweeping changes in the mining law concerning the amount of mining rights private companies may own, and the potential for the Bolivian government to effectively become a carried 50% partner in mining operations. These political and legal uncertainties could have an adverse effect upon our projects in Bolivia. We have significantly reduced our activities in Bolivia, while monitoring this situation. Our capitalized costs in Bolivia are approximately $25,000 as of December 31, 2010 and 2009.

Consequently, our current exploration activities outside of the United States may be substantially affected by factors beyond our control, any of which could materially adversely affect our financial position or results of operations. Furthermore, in the event of a dispute arising from such activities, we may be subject to the exclusive jurisdiction of courts outside of the United States or may not be successful in subjecting persons to the jurisdictions of the courts in the United States, which could adversely affect the outcome of a dispute.

8

<PAGE>

We may not have sufficient funding for exploration and potential development; which may impair our profitability and growth.

The capital required for exploration and potential development of mineral properties is substantial. We have financed operations through utilization of joint venture arrangements with third parties (generally providing that the third party will obtain a specified percentage of our interest in a certain property or a subsidiary owning a property in exchange for the expenditure of a specified amount), the sale of interests in properties or other assets, the sale of strategic investments in other companies such as Kinross, short-term margin loans and the issuance of common stock. At some point in the future, we will need to raise additional cash, or enter into joint venture arrangements, in order to fund the exploration activities required to determine whether mineral deposits on our projects are commercially viable and in the case of MH-LLC, potential funding for development activities to place the project into production. New financing or acceptable joint venture partners may or may not be available on a basis that is acceptable to us. Inability to obtain new financing or joint venture partners on acceptable terms may prohibit us from continued exploration or potential development of such mineral properties. Without successful sale or future development of our mineral properties through joint ventures, or on our own, we will not be able to realize any profit from our interests in such properties, which could have a material adverse effect on our financial position and results of operations.

Our investment in MH-LLC includes the obligation to make payments necessary to provide Ely with the funds for Ely to repay a long-term loan secured by the assets of the Mt. Hamilton project; failure to make all of the payments associated with MH-LLC including those due to underlying leaseholders may result in losing all of our interest in the Mt. Hamilton project.

In connection with the formation of MH-LLC, the Mt. Hamilton properties contributed by DHI-US to MH-LLC were subject to a security interest granted to Augusta Resource Corporation ("Augusta") related to Ely's acquisition of the Mt. Hamilton properties. Pursuant to the MH Agreement, as part of our earn-in, we agreed to make payments of $3,750,000, with $1,250,000 of that in cash to DHI-US and $2,500,000 of that in the form of private placement investments in Ely common stock, all to provide Ely with the funds necessary for Ely to make the loan payments due to Augusta. Failure to make any of the payments or investments necessary to provide Ely with funds to make the required payments due to Augusta may result in the loss of all of our interest in the Mt. Hamilton project.

A large number of companies are engaged in the exploration of mineral properties, many of which have substantially greater technical and financial resources than us and, accordingly, we may be unable to compete effectively in the mining industry which could have a material adverse effect on our financial position or results of operations.

We may be at a disadvantage with respect to many of our competitors in the acquisition and exploration of mining projects. The marketing of mineral properties is affected by numerous factors, many of which are beyond our control. These include the price of the raw or refined minerals in the marketplace, imports of minerals from other countries, the availability of adequate milling and smelting facilities, the number and quality of other mineral properties that may be for sale or are being explored. Our competitors with greater financial resources than us will be better able to withstand the uncertainties and fluctuations associated with the marketing of exploration projects. In addition, we compete with other mining companies to attract and retain key executives and other employees with technical skills and experience in the mineral exploration business. We also compete with other mineral exploration and development companies for exploration projects. There can be no assurance that we will continue to attract and retain skilled and experienced employees or to acquire additional exploration projects. The realization of any of these risks from competitors could have a material adverse affect on our financial position or results of operations.

The title to our mineral properties may be defective or challenged which could have a material adverse effect on our financial position or results of operations.

In connection with the acquisition of our mineral properties, we conduct limited reviews of title and related matters, and obtain certain representations regarding ownership. These limited reviews do not necessarily preclude third parties from challenging our title and, furthermore, our title may be defective. Consequently, there can be no assurance that we hold good and marketable title to all of our mineral interests. If any of our mineral interests were challenged, we could incur significant costs in defending such a challenge. These costs or an adverse ruling with regards to any challenge of our titles could have a material adverse effect on our financial position or results of operations.

9

<PAGE>

We have no reported mineral reserves and if we are unsuccessful in identifying mineral reserves in the future, we may not be able to realize any profit from our property interests.

We are an exploration stage company and have no reported mineral reserves. Any mineral reserves will only come from extensive additional exploration, engineering and evaluation of existing or future mineral properties. The lack of reserves on our mineral properties could prohibit us from sale or joint venture of our mineral properties. If we are unable to sell or develop either on our own or through a joint venture our mineral properties, we will not be able to realize any profit from our interests in such mineral properties, which could materially adversely affect our financial position or results of operations. Additionally, if we or partners to whom we may joint venture our mineral properties are unable to develop reserves on our mineral properties we may be unable to realize any profit from our interests in such properties, which could have a material adverse effect on our financial position or results of operations.

Our operations could be negatively affected by existing as well as potential changes in laws and regulatory requirements that we are subject to, including regulation of mineral exploration and land ownership, environmental regulations and taxation.

The exploration and potential development of mineral properties is subject to federal, state, provincial and local laws and regulations in the countries in which we operate in a variety of ways, including regulation of mineral exploration and land ownership, environmental regulation and taxation. These laws and regulations, as well as future interpretation of or changes to existing laws and regulations may require substantial increases in capital and operating costs to us and delays, interruptions, or a termination of operations.

In the countries in which we operate, in order to obtain permits for exploration or potential future development of mineral properties environmental regulations generally require a description of the existing environment, both natural, archeological and socio-economic, at the project site and in the region; an interpretation of the nature and magnitude of potential environmental impacts that might result from such activities; and a description and evaluation of the effectiveness of the operational measures planned to mitigate the environmental impacts. Currently the expenditures to obtain exploration permits to conduct our exploration activities are not material to our total exploration cost.

The laws and regulations in all the countries in which we operate are continually changing and are generally becoming more restrictive, especially environmental laws and regulations. As part of our ongoing exploration activities, we have made expenditures to comply with such laws and regulations, but we cannot predict that the regulatory environment in which we operate could change in ways that would substantially increase our costs to achieve compliance. Delays in obtaining or failure to obtain government permits and approvals or significant changes in regulation could have a material adverse effect on our exploration activities, our ability to locate economic mineral deposits, and our potential to sell, joint venture or eventually develop our properties, which could have a material adverse effect on our financial position or results of operations.

Occurrence of events for which we are not insured may materially adversely affect our business.

Mineral exploration is subject to risks of human injury, environmental liability and loss of assets. We maintain limited insurance coverage to protect ourselves against certain risks related to loss of assets for equipment in our operations; however, we have elected not to have insurance for other risks because of the high premiums associated with insuring those risks or for various other reasons including those risks where insurance may not be available. There are additional risks in connection with investments in parts of the world where civil unrest, war, nationalist movements, political violence or economic crisis are possible. These countries may also pose heightened risks of expropriation of assets, business interruption, increased taxation and a unilateral modification of concessions and contracts. We do not maintain insurance against political risk. Occurrence of events for which we are not insured could have a material adverse effect on our financial position or results of operations.

Severe weather or violent storms could materially affect our operations due to damage or delays caused by such weather.

Our exploration activities in Peru, Bolivia, Brazil and Mexico as well as our activities associated with the exploration and potential development of the Mt. Hamilton project are subject to normal seasonal weather conditions that often hamper and may temporarily prevent exploration or development activities. There is a risk that unexpectedly harsh weather or violent storms could affect areas where we conduct these activities. Delays or damage caused by severe weather could materially affect our operations or our financial position.

10

<PAGE>

Our business is extremely dependent on gold, commodity prices and currency exchange rates over which we have no control.

Our operations are significantly affected by changes in the market price of gold and other commodities since the evaluation of whether a mineral deposit is commercially viable is heavily dependent upon the market price of gold and other commodities. The price of commodities also affects the value of exploration projects we own or may wish to acquire. These prices of commodities fluctuate on a daily basis and are affected by numerous factors beyond our control. The supply and demand for gold and other commodities, the level of interest rates, the rate of inflation, investment decisions by large holders of these commodities, including governmental reserves, and stability of exchange rates can all cause significant fluctuations in prices. Such external economic factors are in turn influenced by changes in international investment patterns and monetary systems and political developments. Currency exchange rates relative to the Unite States dollar can affect the cost of doing business in a foreign country in United States dollar terms, which is our functional currency. Consequently, the cost of conducting exploration in the countries where we operate, accounted for in United States dollars, can fluctuate based upon changes in currency exchange rates and may be higher than we anticipate in terms of United States dollars because of a decrease in the relative strength of the United States dollar to currencies of the countries where we operate. We currently do not hedge against currency fluctuations. The prices of commodities have fluctuated widely and future serious price declines could have a material adverse effect on our financial position or results of operations.

Our business is dependent on key executives and the loss of any of our key executives could adversely affect our business, future operations and financial condition.

We are dependent on the services of key executives, including our Chief Executive Officer, Christopher E. Herald, our Chief Financial Officer, James R. Maronick, and our Chief Operating Officer, Walter H. Hunt. All of the above named officers have many years of experience and an extensive background in Solitario and the mining industry in general. We may not be able to replace that experience and knowledge with other individuals. We do not have "Key-Man" life insurance policies on any of our key executives. The loss of these persons or our inability to attract and retain additional highly skilled employees may adversely affect our business, future operations and financial condition.

In addition to our Mt. Hamilton project, we may look to joint venture with another mining company in the future to develop and or operate one of our foreign projects, therefore, in the future, our results may become subject to additional risks associated with development and production of our foreign mining projects.

We are not currently involved in mining development or operating activities at any of our properties located outside of the United States. In order to realize a profit from these mineral interests we either have to: (1) sell such properties outright at a profit; (2) form a joint venture for the project with a larger mining company with greater resources, both technical and financial, to further develop and/or operate the project at a profit; (3) develop and operate such projects at a profit on our own; or, 4) create and retain a royalty interest in a property with a third-party that agrees to advance the property. However, we have never developed a mineral property. In the future, if our exploration activities show sufficient promise in one of our foreign projects, we may either look to form a joint venture with another mining company to develop and or operate the project, or sell the property outright and retain partial ownership or a retained royalty based on the success of such project. Therefore, in the future, our results may become subject to the additional risks associated with development and production of mining projects in general.

In the future, we may participate in a transaction to acquire a property, royalty or another company that requires a substantial amount of capital or Solitario equity to complete. Our acquisition costs may never be recovered due to changing market conditions, or our own miscalculation concerning the recoverability of our acquisition investment. Such an occurrence could adversely affect our business, future operations and financial condition.

We are currently involved in evaluating a wide variety of acquisition opportunities involving mineral properties and companies for acquisition. Some of these opportunities may involve a substantial amount of capital or Solitario equity to successfully acquire. As many of these opportunities do not have reliable feasibility-level studies, we may have to rely on our own estimates for investment analysis. Such estimates, by their very nature, contain substantial uncertainty. In addition, economic assumptions, such as future costs and commodity prices, also contain significant uncertainty. Consequently, if our estimates prove to be in error, either through miscalculations or changing market conditions, this could have a material adverse effect on our financial position or results of operations.

11

Item 1B. Unresolved Staff Comments

None

Item 2. Properties

Joint Ventures and Strategic Alliance Properties

Mt. Hamilton Gold Project (Nevada, USA)

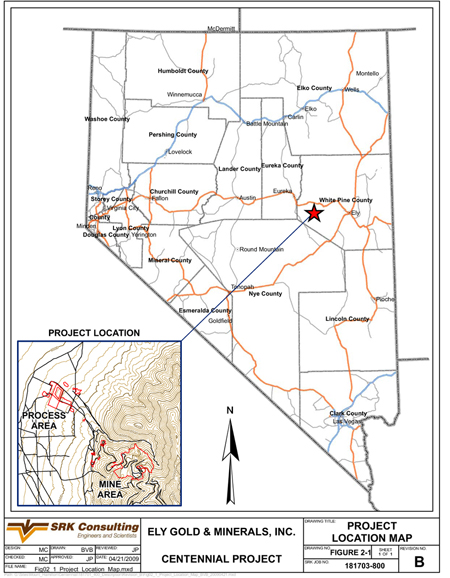

1. Property Description and Location

The consolidated Mt. Hamilton project property consists of 120 unpatented mining claims, 9 patented mining claims and 200 acres of fee land. Ninety-nine of these claims and all of the private surface rights are subject to underlying leases. The unpatented claims are also subject to the US Mining Law of 1872 and US Department of Agriculture - Forest Service administration. The property is located in White Pine County, eastern Nevada.

On August 26, 2010, we signed the LOI with Ely to earn up to an 80% interest in DHI-US's Mt. Hamilton property. Subsequently, we entered into the MH Agreement with DHI-US with respect to MH-LLC, which now holds the Mt. Hamilton project assets. Per the terms of the MH Agreement, DHI-US contributed all of its interests in the Mt. Hamilton project to MH-LLC for a 90% initial interest in MH-LLC and Solitario has a 10% initial interest in MH-LLC by virtue of its initial $300,000 advance royalty payment in November 2010 to one of the underlying property owners. On signing the LOI, Solitario subscribed for a private placement of 3,333,333 units of Ely at a price of CDN$0.15 per Unit for an aggregate consideration of approximately CDN$500,000. Each unit consists of one common share and one-half share purchase warrant entitling the holder of a whole warrant to purchase an additional share of Ely for CDN$0.25, with such warrant expiring two years from the subscription date. The private placement consisted of two tranches. The first tranche of CDN$250,000 was funded on August 31, 2010, the second tranche of CDN$250,000 was funded on October 19, 2010. Solitario also committed to spend $1.0 million on exploration and feasibility work during the first year and has met this spending requirement as of February 28, 2011. Solitario may elect to terminate its interest in the Mt. Hamilton project at any time and have no further earn-in obligations on the project.

To earn its full 80% interest in the project, Solitario is further required to fund the following:

|

Year |

Cash Payments to |

Private Placement |

Shares of Solitario |

Cash payments to |

|

2011 |

$700,000(1) |

50,000 |

$300,000 |

|

|

2012 |

$1,050,000(2) |

50,000 |

$300,000 |

|

|

2013 |

$500,000 |

$750,000 |

100,000 |

$300,000 |

|

2014 |

$500,000 |

$750,000 |

100,000 |

$300,000 |

|

2015 |

$1,000,000 |

$300,000 |

||

|

Royalty reduction (8.0% to 4.75% NSR) payment paid prior to |

$3,500,000 |

|||

|

Royalty reduction (4.75% to 3.0%) payment paid within one-year after |

$1,500,000 |

|||

(1) Includes $500,000 to be distributed by DHI-US to Ely to enable Ely to make payment to Augusta on

long-term debt

(2) Includes $750,000 to be distributed by DHI-US to Ely to enable Ely to make payment to Augusta on

long-term debt

(3) Payments are to enable Ely to make payment to Augusta for long-term debt, see Note 4, to the

consolidated financial statements, in Item 8, below.

(4) Annual minimum advance royalty payments are due through production

12

<PAGE>

Alternatively, upon completion of a bankable feasibility study we will earn an 80% interest in MH-LLC, but we will still be required to make all of the payments listed above pursuant to the MH Agreement and the LOI.

Upon completion of a bankable feasibility study, all construction and permitting costs will be shared pro-rata. However, DHI-US may elect to have Solitario fund DHI-US's 20% share of all such costs, with Solitario to be repaid by DHI-US, with interest, out of 80% of DHI-US's share of net proceeds from MH-LLC.

We are the manager of MH-LLC under the terms of the MH Agreement, which provides that prior to our earn-in we have authority for all significant operating decisions. After earn-in, with a few limited exceptions that require unanimous consent, we will control all decisions under the MH Agreement, as a result of our ownership of a majority of the voting membership interests in MH-LLC.

2. Accessibility, Climate, Local Resources, Infrastructure and Physiology

Access to the Mt. Hamilton Project is relatively good from either of the two closest towns; Ely, Nevada or Eureka, Nevada. From Ely, Nevada the property is accessed by traveling 45 miles west on paved Highway 50 and then traveling 10 miles south via a County maintained gravel road. From Eureka, Nevada the property is accessed by traveling 50 miles east on Highway 50 and then traveling 10 miles south via a County maintained gravel road.

The climate is typical for high-desert, semiarid regions of Nevada with summer high-temperatures averaging around 85 degrees F and the winter lows averaging 10 degrees F. Average precipitation is approximately 10 inches per year, and occurs mainly in the winter and spring seasons. Ely, Nevada, the County Seat of White Pine County, has a population estimated at about 4,000 and offers the most services to the project area, with sufficient housing, schools, hospital and commercial business capable of servicing the needs of a mine at Mt. Hamilton. Quadra FNX Mining operates the Robinson open pit copper mine with over 500 employees eleven miles east of Ely, Nevada. Additionally, Eureka, Nevada with a population of about 2,000, offers services and is also host to other mining operations.

With the exception of relatively good road access to the Mt. Hamilton property, and existing water wells with sufficient water to supply anticipated processing needs, there is no other infrastructure at the project site. The nearest power line to the property is approximately 17 miles away.

The property lies within the Basin and Range physiographic province of Nevada on the western flanks of the White Pine Mountains and the eastern margin of the topographically flat and broad Newark Valley. The Centennial gold deposit, which constitutes the main area of interest, is situated at an elevation of about 8,700 feet. The location of the proposed heap leach pads is located about 1.5 miles northwest of the Centennial gold deposit at an elevation of approximately 7,000 feet in a relatively flat area.

3. History

The general area reportedly produced 20 to 40 million ounces of silver and a limited amount of gold from 1868 to 1880. Phillips Petroleum acquired the property in 1968 and explored for tungsten, molybdenum and copper. In 1984 Westmont Gold Inc. entered into a joint venture with Phillips and Queenstake Resources Ltd. and commenced a large-scale exploration program focused on gold. In 1993 the property was fully transferred to Westmont. In June 1994 Rea Gold Corp. acquired the property and began production of the NE Seligman deposits in November 1994. Rea mined five small Seligman area deposits to June 1997, when Rea suspended mining. Rea filed for bankruptcy in November 1997.

In 2002, the US Bankruptcy Trustee abandoned all of the unpatented claims allowing them to lapse for failure to pay the annual maintenance fees. Centennial Minerals Company LLC ("Centennial") staked the claims covering the Centennial deposit in late-2002, and in 2003 purchased all of the patented and fee lands. . Augusta acquired a 100% leasehold interest in the property, subject to an underlying royalty, from Centennial in late-2003. In November 2007, Augusta sold 100% of the shares of DHI Minerals, Ltd., of which DHI-US, its wholly-owned subsidiary that held the Mt. Hamilton property to Ely. From 2008 through August 2010, Ely engaged SRK Consulting (US), Inc. ("SRK"), an independent full-service mining engineering consulting company, to complete a detailed NI 43-101 compliant Preliminary Economic Assessment Study of the Centennial gold and silver deposit. The study was completed in May 2009, and updated in July 2010. In August 2010, Solitario signed the LOI to joint venture the Mt. Hamilton property with Ely, through DHI-US.

13

<PAGE>

4. Geologic Setting

The Mt. Hamilton property is located near the southern end of the Battle Mountain Gold Trend, a northwest-oriented trend that contains several major gold mines as well as dozens of smaller mines and prospects. The property's underlying geology is dominated by Cambrian-age sedimentary rocks that include the Eldorado Dolomite, Secret Canyon Shale and Dunderberg Shale. The sedimentary sequence has been intruded by two igneous stocks of Cretaceous-age: the Seligman granodiorite stock and the Monte Cristo granite stock; both of which are slightly over 100 million years in age. These two stocks variably altered the surrounding sedimentary rocks by metamorphic processes to skarn (calc-silicate mineral assemblage).

5. Prior Exploration

Prior to 1968, very little is known about exploration activities on the property. Phillips Petroleum acquired the property in 1968 and drilled over 100,000 feet by the early 1980's. The focus of Phillips' work was to evaluate tungsten-molybdenum-copper mineralization in a skarn geologic setting. A study prepared for Phillips in June 1978 quoted an estimate of mineralized material of 6.2 million tons at a grade of 0.42% WO3 (tungsten), 0.37% Mo and 0.6% Cu. These data are historical and have not been reviewed by a qualified person nor reconciled for a 43-101 compliant resource estimate and have not been shown to have economic viability within present day parameters.

In 1984 Westmont Gold Inc. entered into a joint venture with Phillips and Queenstake Resources Ltd. and commenced a large-scale exploration program focused on gold. By early 1989, this work defined the NE Seligman deposits and the Centennial deposit. Westmont conducted feasibility and permitting studies from 1990 through 1994, when the property was sold to Rea Gold Corp. Rea did not conduct any exploration on the project, but focused solely on placing the NE Seligman deposits into production and mining activities. Augusta, after acquiring the project in late-2003, conducted a limited confirmation drilling program and pre-feasibility related studies on the property for the next several years. Solitario conducted a limited infill and extension drilling program from November 2010 to the end of January 2011, as well as geotechnical, metallurgical and hydrologic drilling for feasibility-related issues.

6. Mineralization

There are two primary styles of mineralization at Mt. Hamilton: early skarn-hosted tungsten +/- molybdenum +/- copper ("WO3-Mo-Cu") style; and, a later-stage epithermal gold style of mineralization. The likely source for both the WO3-Mo-Cu skarn mineralization and precious metal bearing late-stage hydrothermal fluids was the Seligman granodiorite stock that is Cretaceous in age (105 million years). Early metasomatic alteration converted shales to hornfels and silty carbonates to calc-silicate skarn. Mineralization is primarily hosted in a 200-300 foot thick skarn horizon.

Mineralization at the Centennial gold deposit, which is the primary focus of current Solitario activities, is controlled by stratigraphy, structure and magmatic hydrothermal alteration. Gold and silver are concentrated along two shallowly dipping sub-parallel faults and associated fracture zones that penetrate the skarn horizon and provided pathways for hydrothermal fluids from the Seligman stock situated to the north. The faulting also appears to have controlled oxidation of the gold zone. The Centennial gold deposit is a north-south oriented body that is about 1,500 feet long and approximately 700 feet wide.

7. Drilling

The Centennial gold deposit has been defined by 303 reverse circulation ("RC") drill holes totaling approximately 137,140 feet and 11 core holes totaling 4,120feet. These drill totals do not include Ely's 2008 drilling program consisting of five core holes totaling 2,241 feet nor Solitario's late-2010 and early 2011 core drilling program totaling eleven holes and 6,250 feet. RC recovery is reported to be in excess of 90% and core recovery is generally near 100%, with few exceptions.

Drill data included in resource modeling by SRK utilized historical data generated by Phillips Petroleum, Westmont Gold Inc. and Rea Gold. SRK concluded that the data from all three previous operators of the project to be valid and sufficiently well documented to provide a reasonable representation of the Centennial gold deposit and sufficiently verifiable for use in a Canadian Institute of Mining ("CIM")-compliant resource estimate.

14

<PAGE>

8. Sampling, Analysis and Sample Security

SRK reviewed in detail procedures utilized by all prior managers of the project for drill hole sampling methods, including RC and core splitting, and sample preparation and analyses, including check assay procedures and qualifications of the laboratories used for assay analyses. Methodology used by previous project managers included check assays by a second laboratory, insertion of standard and duplicate samples to the assay lab, and photography of core samples. SRK also undertook an independent program to verify data. This program consisted of field verifications, independent assay analysis, comparison of electronic drill-hole data to paper data, and checking the electronic assay data base against original assay certificates.

SRK opined that the sampling and analyses methodology utilized for both RC and core drilling were appropriate for the style of mineralization at the Centennial gold deposit and of sufficient quality to incorporate into a NI 43-101 compliant resource estimate. Furthermore, SRK believes the Centennial gold deposit drill hole assay database has been verified with substantial QA/QC checks, by both the original project managers and SRK's independent work, including the location of drill cuttings, core, analytical laboratory assay certificates, and that all aspects of the data base are satisfactory for use in resource estimation. Solitario's work to date supports SRK's opinions concerning the quality of the Centennial gold deposit data base.

Because much of the work at Mt. Hamilton was conducted prior to chain-of-custody/sample security methodology becoming an integral part of standard industry practice quality control procedures, it is difficult to assess pre-1998 sample security. However, Solitario believes that no serious sample security breaches occurred or are known to have occurred based upon other sample quality control procedures that all past project managers employed, such as splitting of core and splitting of RC course rejects and pulp samples to allow for subsequent new independent assay verification.

9. Feasibility Studies

Solitario has engaged SRK to complete a bankable feasibility study on the Centennial gold and silver deposit located on the Mt. Hamilton property. Work began in November 2010 and is currently ongoing. See section "12. Planned Exploration and Development," for the details of completed and planned feasibility activities. We estimate that the feasibility report will be completed during the third quarter of 2011.

On May 13, 2009, SRK on behalf of Ely, completed a Preliminary Economic Assessment for the Centennial Gold and Silver Deposit on the Mt. Hamilton Property using Canadian industry accepted CIM "Best Practices and Reporting Guidelines" for disclosing mineral exploration information, the Canadian Securities Administrators revised regulations in NI 43-101 (Standards of Disclosure For Mineral Projects) and Companion Policy 43-101CP, and CIM Definition Standards for Mineral Resources and Mineral Reserves (December 11, 2005).

10. Mineral Resource Estimations

There are no reported mineral reserves.

11. Mining Operations

No mining operations have occurred on the project within the past 13 years.

12. Planned Exploration and Development

Solitario's focus for 2011 is completion of a bankable feasibility report and a plan of operations that will be filed with the US Department of Agriculture - Forest Service. Feasibility field work began in November 2010 and consisted of feasibility-level geotechnical, metallurgical, and hydro-geologic drilling, and a limited amount of drilling to provide additional resource information. This eleven-hole, 6,250-foot core drilling program was completed in January 2011.

Auger drilling is planned in March 2011 for the proposed leach pad area for design purposes. Additional metallurgical testing began in February 2011 to test several areas within the Centennial gold deposit that have not been adequately studied. Heap and waste rock geochemical characterization also began in the first quarter of 2011. Feasibility level economic evaluation is underway by SRK and will continue until the feasibility study is completed.

15

<PAGE>

Bongara Zinc Project (Peru)

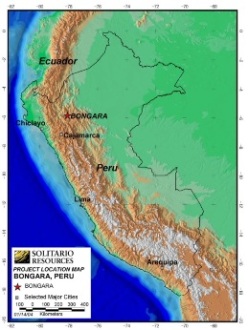

1. Property Description and Location

The Bongara project consists of 16 concessions comprising 12,800 hectares of mineral rights granted to or under option to Minera Bongara S.A., a subsidiary of ours incorporated in Peru. The property is located in the Department of Amazonas, northern Peru. On August 15, 2006 Solitario signed a Letter Agreement with Votorantim Metais Cajamarquilla, S.A., a wholly owned subsidiary of Votorantim Metais (both companies referred to as "Votorantim"), on Solitario's 100%-owned Bongara zinc project. On March 24, 2007, Solitario signed a definitive agreement, the Framework Agreement for the Exploration and Potential Development of Mining Properties, (the "Framework Agreement") pursuant to, and replacing, the previously signed Bongara Letter Agreement with Votorantim Metais. Solitario's and Votorantim's property interests are held through the ownership of shares in Minera Bongara S.A., a joint operating company that holds a 100% interest in the mineral rights and other project assets. Solitario currently owns 100% of the shares in Minera Bongara S.A.

Votorantim can earn up to a 70% shareholding interest in the joint operating company by funding an initial $1.0 million exploration program (completed), by completing future annual exploration and development expenditures until a production decision is made or the agreement is terminated. The option to earn the 70% interest can be exercised by Votorantim any time after the first year commitment by committing to place the project into production based upon a feasibility study. The Framework Agreement calls for Votorantim to have minimum annual exploration and development expenditures of $1.5 million in each of years two and three, and $2.5 million in all subsequent years until a minimum of $18.0 million has been expended by Votorantim. Through December 31, 2010, Votorantim has met all minimum annual exploration and development commitments. Votorantim is the project manager. Votorantim, in its sole discretion, may elect to terminate the option to earn the 70% interest at any time after the first year commitment. In addition, Votorantim was required to make annual delay rental payments of $100,000 to Solitario on August 15, 2007 (completed) and cash payments of $200,000 on August 15, 2008, 2009 and 2010 (completed), and by making further payments to Solitario of $200,000 on all subsequent anniversaries, until Solitario receives notice that $18 million has been spent by Votorantim or a production decision is made. Once Votorantim has fully funded its $18.0 million work commitment and committed to place the project into production based upon a feasibility study, it has further agreed to finance Solitario's 30% participating interest through production. Solitario will repay the loan facility through 50% of Solitario's cash flow distributions from the joint operating company.

According to Peruvian law, concessions may be held indefinitely, subject only to payment of annual fees to the government. Each year a payment of $3.00 per hectare must be made by the last day of June to keep the claims in good standing. Because some of the Bongara concessions are more than 6 years old beginning in 2005, there is a $6.00 surcharge per hectare, if less than $100 per hectare is invested in exploration and development of the claim. Peru also imposes a sliding scale net smelter return royalty (NSR) on all precious and base metal production. This NSR assesses a tax of 1% on all gross proceeds from production up to $60,000,000, a 2% NSR on proceeds between $60,000,000 and $120,000,000 and a 3% NSR on proceeds in excess of $120,000,000. In June, 2011 payments of approximately $51,000 to the Peruvian government will be due in order to maintain the mineral rights of Minera Bongara.

Votorantim signed a new surface rights agreement with the local community in 2009, which controls the surface of the primary area of interest of our Bongara joint venture. This agreement provides for an annual payment of $31,250 and funding for mutually agreed social development programs in return for the right to perform exploration work including road building and drilling. From time to time we enter into surface rights agreements with individual landowners or communities to provide access for exploration work. Generally, these are short term agreements. Votorantim is responsible for all joint venture costs as part of the Framework Agreement.

Environmental permits are required for exploration and development projects in Peru that involve drilling, road building or underground mining. The requisite environmental and archeological studies were completed for all past work, but new studies are ongoing to allow for the expanded activities planned for future years. Although we believe that these permits will be obtained in a timely fashion, the timing of government approval of permits remains beyond our control.

16

<PAGE>

2. Accessibility, Climate, Local Resources, Infrastructure and Physiology

The Bongara property is accessed by the paved Carretera Marginal road, which provides access from the coastal city of Chiclayo. The nearest town is Pedro Ruiz located 15 kilometers southeast of the property and the Carretera Marginal is situated approximately eight kilometers south of the deposit. The area of the majority of past drilling and the most prospective mineralization, Florida Canyon, is currently inaccessible by road, the work to date having been done by either foot or helicopter access. Votorantim began construction of a road to the deposit in October 2010. Work is continuing on the road with approximately nine kilometers completed as of March 8, 2011. Votorantim maintains project field offices in Pedro Ruiz and a drill core processing facility and operations office in the nearby community of Shipasbamba. The climate is tropical and the terrain is mountainous and jungle covered. Seasonal rains hamper exploration work for four to five months of the year by limiting access. Several small villages are located within five kilometers of the drilling area.

3. History

We discovered the Florida Canyon mineralized zone of the Bongara Project in 1996. Subsequently, we optioned the property in December 1996 to Cominco (now Teck Resources). Cominco withdrew from the joint venture in February 2001. We maintained the most important claims from 2001 to 2006, until the Votorantim Letter Agreement was signed. All of the significant work on the property has been conducted by Cominco, and more recently by Votorantim, and is described below in section 5, "Prior Exploration."

4. Geological Setting

The geology of the Bongara area is relatively simple consisting of a sequence of Jurassic and Triassic clastic and carbonate rocks which are gently deformed. The Mississippi Valley type mineralization occurs in the carbonate facies of the Chambara (rock) Formation. This sedimentary sequence is part of what is referred to as the Pucura Group that hosts mineral deposits throughout Peru.

5. Prior Exploration

We conducted a regional stream sediment survey and reconnaissance geological surveys leading to the discovery of the Florida Canyon area in 1996. The discovered outcropping mineralization is located in two deeply incised canyons within the limestone stratigraphy.

Subsequent to our initial work, Cominco conducted extensive mapping, soil and rock sampling, stream sediment surveys and drilling. This work was designed to determine the extent and grade of the zinc-lead mineralization, the controls of deposition and to identify areas of potential new mineralization. All work performed by us, Cominco or Votorantim was done by direct employees of the respective companies with the exception of the drilling which was performed by a third-party drilling company.

6. Mineralization

Mineralization occurs as massive to semi-massive replacements of sphalerite and galena localized by specific sedimentary facies (rock strata) within the limestone stratigraphy and by structural feeders and karst breccias. A total of eleven preferred beds for replacement mineralization have been located within the middle unit of the Chambara Formation. Mineralization is associated with the conversion of limestone to dolomite, which creates porosity and permeability within the rock formations, promoting the passage of mineralizing fluids through the rock formations forming stratigraphically controlled manto deposits. Drilling of stratigraphic targets has shown that certain coarser facies of the stratigraphy are the best hosts for mineralization.

Karst features are localized along faults and locally produce "breakout zones" where mineralization may extend vertically across thick stratigraphic intervals along the faults where collapse breccias have been replaced by ore minerals. Mineralized karst structures are up to fifty meters in width. The stratigraphically controlled mineralization is typically one to several meters in thickness, but locally attains thicknesses of eight to ten meters. Generally the stratigraphic mineralization, while thinner, is of higher grade and laterally more extensive. Evidence for these breakout zones are provided by the following drill holes from various locations on the property:

17

<PAGE>

|

Breakout |

Drill Hole |

Intercepts |

Zinc |

Lead |

Zinc+Lead |

|

Sam |

GC-17* |

58.8 |

12.0 |

2.8 |

14.8 |

|

Karen |

A-1* |

36.2 |

12.8 |

2.7 |

15.5 |

|

North Zone |

V-21 |

92.0 |

5.5 |

1.7 |

7.2 |

|

South Zone |

V-44 |

28.3 |

15.2 |

0.8 |

16.0 |

The middle unit of the Chambara formation, where mineralized, is commonly dolomitized within the zone of highest sedimentary-induced permeability. Dolomitization reaches stratigraphic thicknesses in excess of 100 meters locally. This alteration is thought to be related to the mineralizing event in most cases and is an important exploration tool. Continuity of the mineralization is thought to be demonstrable in areas of highest drilling density by correlation of mineralization within characteristic sedimentary facies typical of specific stratigraphic intervals.

7. Drilling

A total of 247 diamond drill holes (HQ and NQ size) have been completed by Cominco and Votorantim since the project's inception. These holes vary in depth up to 610 meters. Total meters drilled through the end of 2010 are 72,814 meters. A summary of drilling by year is provided in the table below:

|

Operator |

Year |

Number of Holes |

Meters Drilled |

|

Cominco |

Pre-2006 |

80 |

24,696 |

|

Votorantim |

2006 |

26 |

4,354 |

|

2007 |

32 |

11,443 |

|

|

2008 |

54 |

16,468 |

|

|

2009 |

13 |

3,611 |

|

|

2010 |

42 |

12,242 |

|

|

Project Total |

247 |

72814 |

The mineralized area that has been drilled measures approximately two by two kilometers. Votorantim's drilling during 2010 was both infill drilling designed to better define mineralization and demonstrate continuity and also step-out drilling to define new resources. The infill drilling program has served to better define the quality and spatial distribution of mineralization, but additional infill drilling will be required to establish reserves. All drilling was done by LF-70 core-drilling rigs.

8. Sampling, Analysis and Security of Samples

Core samples were transported from the drill by helicopter in sealed boxes to the processing facility in Shipasbamba where they were split by a diamond saw. Half of the core was taken of intervals selected according to geologic criteria under the supervision of the geologist in charge and shipped in sealed bags by land. Cominco used SGS Laboratories and Votorantim used ALS-Chemex, both in Lima, Peru, where all samples were analyzed by ICP. Any samples that contained greater than 1% zinc were then analyzed by wet chemistry assay for zinc and lead to provide a more accurate analysis of grade.

Since August 2006, Votorantim has been in control of all field activities on the project and is responsible for the security of samples. Votorantim has indicated to us that there have been no breaches in the security of the samples. We have reviewed Votorantim's sampling procedures and believe that adequate procedures are in place to ensure the future security and integrity of samples. No breaches of security of samples are known to have occurred prior to Votorantim's work on the project.

18

<PAGE>

9. Pre-Feasibility Studies

Votorantim has engaged independent mining engineering and metallurgical firms to conduct and update a scoping-level study to provide order-of-magnitude estimates of deposit size and grade, sizing of appropriate scale of operations, infrastructure, and capital and operating cost estimates. The metallurgical testing has provided an evaluation of the mineralized material at Florida Canyon. Votorantim has reported to us that the results of this work has indicated that a standard flotation process on sulfide ore would achieve zinc recoveries of 93% and lead recoveries of 85% with 88% of the recoverable silver reporting to the lead concentrate. Votorantim is planning further independent analysis and studies to optimize overall recovery of metals.

10. Mineralized Material Estimations