Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WSFS FINANCIAL CORP | form8-k848017.htm |

WSFS Financial Corporation

2Q 2017 Investor Update

August 4, 2017

EXHIBIT 99.1

Stockholders or others seeking information regarding the Company may call or write:

WSFS Financial Corporation

Investor Relations

WSFS Bank Center

500 Delaware Avenue

Wilmington, DE 19801

302-571-7264

stockholderrelations@wsfsbank.com

www.wsfsbank.com

Mark A. Turner

President and CEO

302-571-7160

mturner@wsfsbank.com

Rodger Levenson

Chief Operating Officer

302-571-7296

rlevenson@wsfsbank.com

2

Dominic Canuso

Chief Financial Officer

302-571-6833

dcanuso@wsfsbank.com

Table of Contents

Forward-Looking Statements / Non-GAAP Information / Reported Financial Results

2017 Outlook & 2016 – 2018 Strategic Plan

The WSFS Franchise

Page 4

Page 10

Page 14

3

2Q 2017 Highlights Page 7

Selected Financial Information Page 25

Appendix 1 – Management Team Page 36

Appendix 2 – Business Model Page 38

Appendix 3 – Non-GAAP Financial Information Page 39

Forward-Looking Statements

This presentation contains estimates, predictions, opinions, projections and other "forward-looking statements" as that phrase is defined in the Private

Securities Litigation Reform Act of 1995. Such statements include, without limitation, references to the Company's predictions or expectations of future

business or financial performance as well as its goals and objectives for future operations, financial and business trends, business prospects, and

management's outlook or expectations for earnings, revenues, expenses, capital levels, liquidity levels, asset quality or other future financial or business

performance, strategies or expectations. Such forward-looking statements are based on various assumptions (some of which may be beyond the

Company's control) and are subject to risks and uncertainties (which change over time) and other factors which could cause actual results to differ

materially from those currently anticipated. Such risks and uncertainties include, but are not limited to, those related to difficult market conditions and

unfavorable economic trends in the United States generally, and particularly in the market areas in which the Company operates and in which its loans are

concentrated, including the effects of declines in housing markets, an increase in unemployment levels and slowdowns in economic growth; the

Company's level of nonperforming assets and the costs associated with resolving any problem loans including litigation and other costs; changes in

market interest rates may increase funding costs and reduce earning asset yields thus reducing margin; the impact of changes in interest rates and the

credit quality and strength of underlying collateral and the effect of such changes on the market value of the Company's investment securities portfolio; the

credit risk associated with the substantial amount of commercial real estate, construction and land development, and commercial and industrial loans in

our loan portfolio; the extensive federal and state regulation, supervision and examination governing almost every aspect of the Company's operations

including changes in regulations affecting financial institutions, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and the rules

and regulations being issued in accordance with this statute and potential expenses associated with complying with such regulations; possible additional

loan losses and impairment of the collectability of loans; the Company's ability to comply with applicable capital and liquidity requirements (including the

finalized Basel III capital standards), including our ability to generate liquidity internally or raise capital on favorable terms; possible changes in trade,

monetary and fiscal policies, laws and regulations and other activities of governments, agencies, and similar organizations; any impairment of the

Company's goodwill or other intangible assets; failure of the financial and operational controls of the Company's Cash Connect division; conditions in the

financial markets that may limit the Company's access to additional funding to meet its liquidity needs; the success of the Company's growth plans,

including the successful integration of past and future acquisitions; negative perceptions or publicity with respect to the Company's trust and wealth

management business; system failure or cybersecurity breaches of the Company's network security; the Company's ability to recruit and retain key

employees; the effects of problems encountered by other financial institutions that adversely affect the Company or the banking industry generally; the

effects of weather and natural disasters such as floods, droughts, wind, tornadoes and hurricanes as well as effects from geopolitical instability and

manmade disasters including terrorist attacks; possible changes in the speed of loan prepayments by the Company's customers and loan origination or

sales volumes; possible acceleration of prepayments of mortgage-backed securities due to low interest rates, and the related acceleration of premium

amortization on prepayments on mortgage-backed securities due to low interest rates; regulatory limits on the Company's ability to receive dividends from

its subsidiaries and pay dividends to its shareholders; the effects of any reputational, credit, interest rate, market, operational, legal, liquidity, regulatory

and compliance risk resulting from developments related to any of the risks discussed above; and the costs associated with resolving any problem loans,

litigation and other risks and uncertainties, discussed in the Company's Form 10-K for the year ended December 31, 2016 and other documents filed by

the Company with the Securities and Exchange Commission from time to time. Forward-looking statements are as of the date they are made, and the

Company does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the

Company.

Non-GAAP Information

This presentation contains financial information and performance measures determined by methods other than in accordance with accounting

principles generally accepted in the United States (“GAAP”). The Company’s management uses these non-GAAP measures to measure the

Company’s performance and believes that these non-GAAP measures provide a greater understanding of ongoing operations, enhance

comparability of results of operations with prior periods and show the effects of significant gains and charges in the periods presented without the

impact of unusual items or events that may obscure trends in the Company’s underlying performance. These disclosures should not be viewed as a

substitute for financial measures determined in accordance with GAAP. For a reconciliation of these non-GAAP to their comparable GAAP

measures, see Appendix 3. The following are the non-GAAP measures used in this presentation:

Core net income is a non-GAAP measure that adjusts net income determined in accordance with GAAP to exclude the impact of

securities gains (losses), corporate development expenses, debt extinguishment costs, and other extraordinary items

Core noninterest income, also called core fee income, is a non-GAAP measure that adjusts noninterest income as determined in

accordance with GAAP to exclude the impact of securities gains (losses)

Core earnings per share (EPS) is a non-GAAP measure that divides (i) core net income by (ii) weighted average shares of common

stock outstanding for the applicable period

Core net revenue is a non-GAAP measure that is determined by adding core net interest income plus core noninterest income

Core noninterest expense is a non-GAAP measure that adjusts noninterest expense as determined in accordance with GAAP to

exclude corporate development expenses and debt extinguishment costs

Core efficiency ratio is a non-GAAP measure that is determined by dividing core noninterest expense by the sum of core interest

income and core noninterest income

Core fee income to total revenue is a non-GAAP measure that divides (i) core non interest income by (ii) (tax equivalent) core net

interest income and core noninterest income

Core return on assets (ROA) is a non-GAAP measure that divides (i) core net income by (ii) average assets for the applicable

period

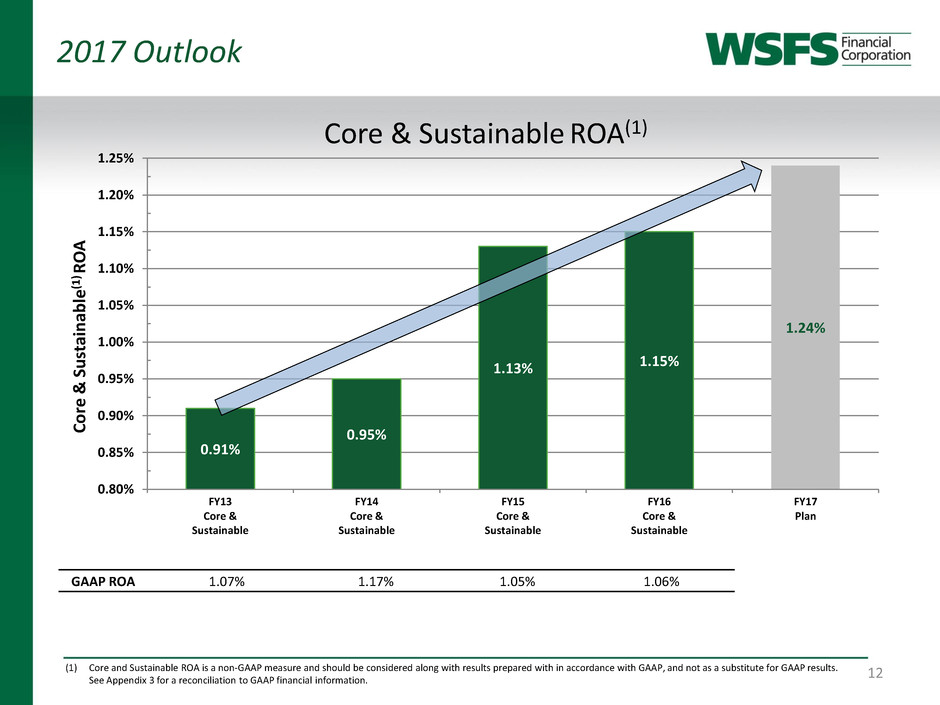

Core and Sustainable ROA is a non-GAAP measure that divides (i) net income determined in accordance with GAAP and

adjusting it by taking core net income and normalizing for long-term credit costs, non-recurring accretion from purchased credit

impaired loans (“PCI”), and a normal tax rate by (ii) average assets for the applicable period

Tangible common equity is a non-GAAP measure and is defined as total average stockholders’ equity less goodwill, other

intangible assets and preferred stock

Return on average tangible common equity (ROTCE) is a non-GAAP measure and is defined as net income allocable to common

stockholders divided by tangible common equity

5

Reported Financial Results

6

2Q 2017 Reported Results:

• Reported net income was $20.6 million, or $0.64 per diluted common share for 2Q 2017

compared to net income of $17.5 million, or $0.58 per share for 2Q 2016 and net income

of $18.9 million, or $0.59 per share for 1Q 2017

• Net revenues were $86.0 million an increase of $14.1 million, or 20% from 2Q 2016

• Net interest income was $54.3 million, an increase of $7.9 million, or 17% from 2Q 2016

and noninterest income was $31.7 million, an increase of $6.2 million, or 24% from 2Q

2016

• Noninterest expenses were $52.7 million, an increase of $8.0 million, or 18% from 2Q

2016. This resulted in positive operating leverage and an efficiency ratio of 60.8% in 2Q

2017 compared with 61.5% in 2Q 2016

• EPS $0.64 • NIM 3.93%

• ROA 1.23% • Fee Income / Total Revenue 36.5%

• ROTCE 16.12% • Efficiency Ratio 60.8%

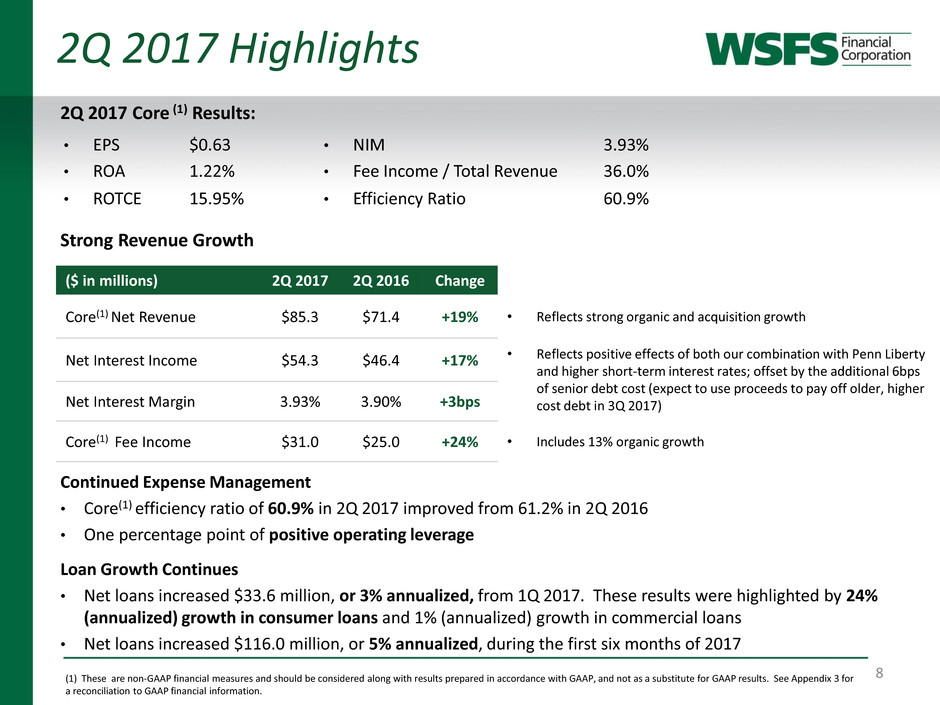

2Q 2017 Highlights

2Q 2017 Core (1) Results:

Strong Revenue Growth

Continued Expense Management

• Core(1) efficiency ratio of 60.9% in 2Q 2017 improved from 61.2% in 2Q 2016

• One percentage point of positive operating leverage

Loan Growth Continues

• Net loans increased $33.6 million, or 3% annualized, from 1Q 2017. These results were highlighted by 24%

(annualized) growth in consumer loans and 1% (annualized) growth in commercial loans

• Net loans increased $116.0 million, or 5% annualized, during the first six months of 2017

• EPS $0.63 • NIM 3.93%

• ROA 1.22% • Fee Income / Total Revenue 36.0%

• ROTCE 15.95% • Efficiency Ratio 60.9%

2Q 2017 Highlights

8 (1) These are non-GAAP financial measures and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix 3 for

a reconciliation to GAAP financial information.

($ in millions) 2Q 2017 2Q 2016 Change

Core(1) Net Revenue $85.3 $71.4 +19% • Reflects strong organic and acquisition growth

Net Interest Income $54.3 $46.4 +17% • Reflects positive effects of both our combination with Penn Liberty

and higher short-term interest rates; offset by the additional 6bps

of senior debt cost (expect to use proceeds to pay off older, higher

cost debt in 3Q 2017) Net Interest Margin 3.93% 3.90% +3bps

Core(1) Fee Income $31.0 $25.0 +24% • Includes 13% organic growth

2Q 2017 Highlights

Customer Funding

• Total customer funding decreased $448.4 million from 1Q 2017. The decrease included the expected departure of

a short-term trust deposit of $352.4 million, $40.7 million of seasonal declines in public funding accounts and the

purposeful decrease of higher-cost CDs

• Core deposits increased $110.3 million, or 5% annualized, during the first six months of 2017

Credit Costs

• Total credit costs (provision for loan losses, loan workout expenses, OREO expenses, and other credit reserves)

were $2.3 million for 2Q 2017, a decrease from $2.8 million during 1Q 2017, and an increase from $1.3 million

during 2Q 2016

Asset Quality Trends Improve and Remain Favorable

• Total problem loans decreased to $161.7 million or 23.2% of Tier 1 Capital plus ALLL, compared to $184.0 million

or 27.1% at 3/31/17

• Delinquencies (including nonperforming delinquencies) were $23.9 million, a low 0.52% of gross loans, and a

slight decrease from $24.2 million and 0.53% of gross loans at 3/31/17

• Total NPAs to total assets were 0.86%, compared to 0.88% at 3/31/17. The past two quarters included the impact

of a $9.7 million locally-based C&I participation that was downgraded during 1Q 2017 after a targeted energy

sector review

• This loan relationship has been and continues to be current and well-secured; Positive resolution is expected

• Net charge offs were $1.7 million or only 0.15% of total net loans on an annualized basis and a decrease of $2.1

million or 0.19% (annualized) in 1Q 2017

9

2017 Outlook & 2016-2018 Strategic Plan

2017 Outlook / “Plan” – Driving Factors

11

• Mid-to-high single digit loan and core deposit growth

• Net interest margin in the mid 3.90%s

• Assumes no additional rate hikes in 2017

• Expected payoff of $55 million in 6.25% senior notes in September

2017 will enhance 4Q 2017 NIM and thereafter

• Total credit costs (provision, loan workout expenses, OREO expenses, and

other credit reserves) between $12 – $14 million for the year (can be

uneven), up from last year given organic and acquisition growth in franchise

• 20%+ non-interest income growth

• Organic growth in the mid-teens, supplemented by growth from recent

Wealth acquisitions

• Efficiency ratio around 60%

• Effective tax rate of around 35%

0.91%

0.95%

1.13% 1.15%

1.24%

0.80%

0.85%

0.90%

0.95%

1.00%

1.05%

1.10%

1.15%

1.20%

1.25%

FY13

Core &

Sustainable

FY14

Core &

Sustainable

FY15

Core &

Sustainable

FY16

Core &

Sustainable

FY17

Plan

12

Co

re

&

Su

st

ai

n

ab

le

(1

) R

O

A

Core & Sustainable ROA(1)

GAAP ROA 1.07% 1.17% 1.05% 1.06%

2017 Outlook

(1) Core and Sustainable ROA is a non-GAAP measure and should be considered along with results prepared with in accordance with GAAP, and not as a substitute for GAAP results.

See Appendix 3 for a reconciliation to GAAP financial information.

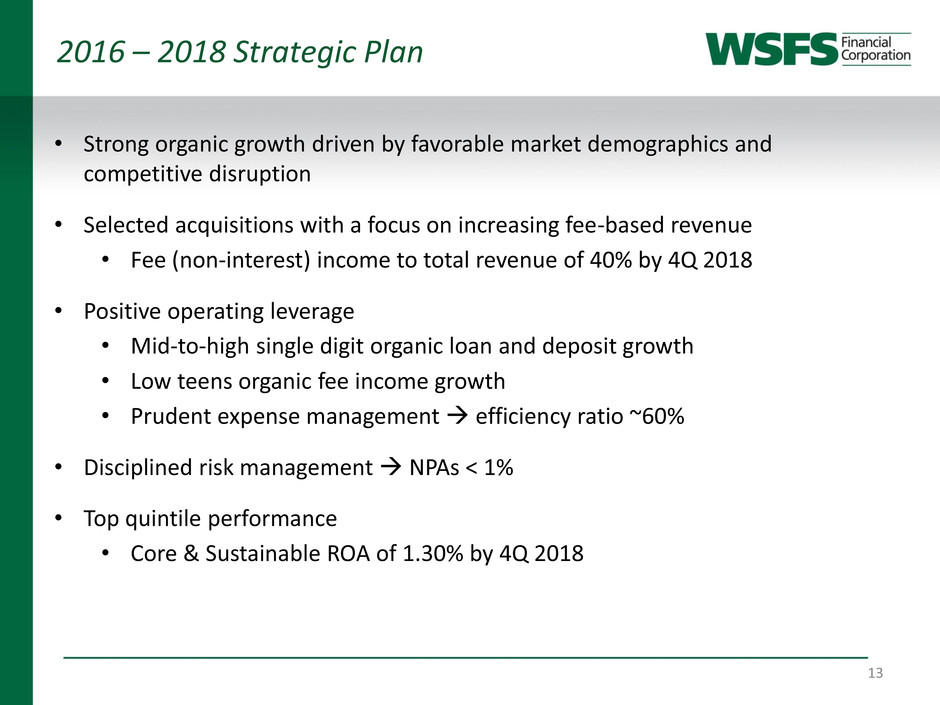

2016 – 2018 Strategic Plan

13

• Strong organic growth driven by favorable market demographics and

competitive disruption

• Selected acquisitions with a focus on increasing fee-based revenue

• Fee (non-interest) income to total revenue of 40% by 4Q 2018

• Positive operating leverage

• Mid-to-high single digit organic loan and deposit growth

• Low teens organic fee income growth

• Prudent expense management efficiency ratio ~60%

• Disciplined risk management NPAs < 1%

• Top quintile performance

• Core & Sustainable ROA of 1.30% by 4Q 2018

The WSFS Franchise

• Largest independent bank and

trust co. HQ in the Del. Valley

• $6.8 billion in assets

• $17.4 billion in fiduciary

assets, including $2.2 billion

in assets under management

• 77 offices

• Founded in 1832, WSFS is one of

the ten oldest banks in the U.S.

• Major business lines

• Retail

• Commercial

• Wealth Management (1)

• Cash Connect® (ATM cash

and related businesses) (1)

The WSFS Franchise

15 (1) Wealth and Cash Connect businesses conducted on a national basis

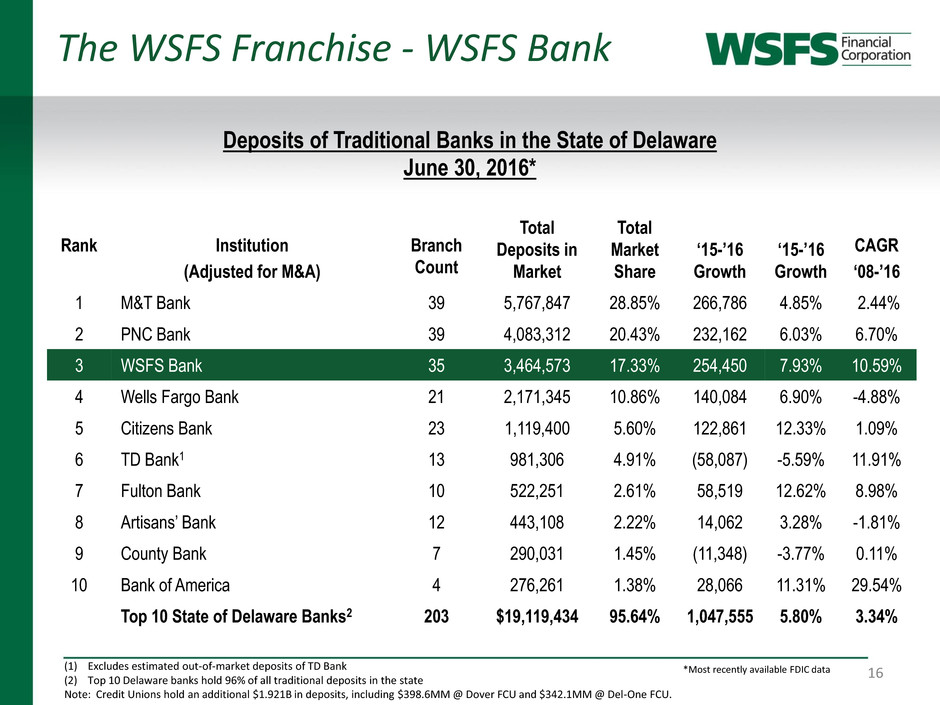

*Most recently available FDIC data 16

The WSFS Franchise - WSFS Bank

Deposits of Traditional Banks in the State of Delaware

June 30, 2016*

Rank

Institution

(Adjusted for M&A)

Branch

Count

Total

Deposits in

Market

Total

Market

Share

‘15-’16

Growth

‘15-’16

Growth

CAGR

‘08-’16

1 M&T Bank 39 5,767,847 28.85% 266,786 4.85% 2.44%

2 PNC Bank 39 4,083,312 20.43% 232,162 6.03% 6.70%

3 WSFS Bank 35 3,464,573 17.33% 254,450 7.93% 10.59%

4 Wells Fargo Bank 21 2,171,345 10.86% 140,084 6.90% -4.88%

5 Citizens Bank 23 1,119,400 5.60% 122,861 12.33% 1.09%

6 TD Bank1 13 981,306 4.91% (58,087) -5.59% 11.91%

7 Fulton Bank 10 522,251 2.61% 58,519 12.62% 8.98%

8 Artisans’ Bank 12 443,108 2.22% 14,062 3.28% -1.81%

9 County Bank 7 290,031 1.45% (11,348) -3.77% 0.11%

10 Bank of America 4 276,261 1.38% 28,066 11.31% 29.54%

Top 10 State of Delaware Banks2 203 $19,119,434 95.64% 1,047,555 5.80% 3.34%

(1) Excludes estimated out-of-market deposits of TD Bank

(2) Top 10 Delaware banks hold 96% of all traditional deposits in the state

Note: Credit Unions hold an additional $1.921B in deposits, including $398.6MM @ Dover FCU and $342.1MM @ Del-One FCU.

The WSFS Franchise – PA Expansion

17

Over the past 5 years, WSFS has successfully

expanded its franchise into Pennsylvania

through:

• De novo branches; hiring local lenders

• Acquisition of Array / Arrow

• Acquisition of Alliance Bank

• Acquisition of Penn Liberty Bank

• Acquisition of West Capital Management

Strong position as one of the few remaining

super-community banks in the attractive and

rapidly consolidating southeastern PA markets

• Approximately $5.4 billion(1) of potential

relationship dislocation in three key southeastern

PA counties(2) as a result of recent acquisitions

(SUSQ, NPBC and FNFG) by large, out-of-state

super-regionals

29 total offices in southeastern PA, focused

within a very tight geography in Chester,

Delaware and Montgomery Counties

Source: SNL Financial.

1) Estimate as of the time of the Penn Liberty acquisition announcement

2) Chester, Delaware and Montgomery. Measured by deposits.

*Most recently available FDIC data 18 (1) Ally Bank (f/k/a GMAC Bank) is not considered traditional deposits and therefore excluded for 2008.

(2) WSFS deposits include the acquisition of Penn Liberty .

(3) Credit Unions represent an additional $6.412B in deposits, including $2.171B @ Citadel FCU, $1.616B @ TruMark FCU and $878.8MM @ Franklin Mint FCU.

Deposits of Traditional Banks in Chester, Delaware and Montgomery Counties in Pennsylvania

June 30, 2016*

Rank

Institution

(Adjusted for M&A)

Branch

Count

Total

Deposits in

Market

Total

Market

Share

‘15-’16

Growth

‘15-’16

Growth

CAGR

‘08-’16

1 Wells Fargo Bank 81 $9,998,026 18.54% $717,580 7.18% 37.89%

2 Citizens Bank of Pennsylvania 78 $6,716,543 12.45% $227,891 3.39% 26.87%

3 TD Bank 47 $6,557,250 12.16% -$70,991 -1.08% 25.87%

4 PNC Bank 43 $5,149,275 9.55% $446,431 8.67% 44.00%

5 BB&T 65 $3,369,044 6.25% -$378,973 -11.25% 1.38%

6 Bank of America 23 $2,319,933 4.30% $334,466 14.42% 68.63%

7 The Bryn Mawr Trust Company 33 $2,316,091 4.29% $113,774 4.91% 38.87%

8 KeyBank 36 $1,916,222 3.55% $96,228 5.02% -39.68%

9 Santander Bank 37 $1,861,093 3.45% $95,537 5.13% 5.26%

10 Univest Bank and Trust Co. 21 $1,495,155 2.77% $110,022 7.36% 27.04%

11 WSFS Bank2 24 $1,060,811 1.97% $480 0.05% 43.29%

Other banks 204 $12,235,329 22.69% $842,537 6.89% -39.38%

Total Ches/Del/Mont Counties1 668 $53,933,961 100.00% $2,534,502 4.93% 38.37%

The WSFS Franchise – PA Expansion

The WSFS Franchise - Attractive Markets

19 Sources: SNL Financial, U.S. Census Bureau, Zillow

Note: No Zillow Home Value Index was available for Sussex County; information shown details median listing price in Sussex County, DE.

-

100,000

200,000

300,000

400,000

500,000

600,000

700,000

800,000

900,000

Sussex Kent New Castle Delaware Chester Montgomery

Population

Delaware Southeastern PA

-

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

90,000

100,000

Sussex Kent New Castle Delaware Chester Montgomery

Median Household Income

National Average

Delaware Southeastern PA

-

50,000

100,000

150,000

200,000

250,000

300,000

350,000

Sussex Kent New Castle Delaware Chester Montgomery

Median Home Value

National Average

Delaware Southeastern PA

-

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

90,000

Sussex Kent New Castle Delaware Chester Montgomery

Number of Businesses

Delaware Southeastern PA

Regional Employment Composition

Philadelphia-Camden-Wilmington MSA

20 Source: Bureau of Labor Statistics: Employees on nonfarm payrolls by industry supersector, Philadelphia-Camden-Wilmington MSA, not seasonally adjusted; January 2017

Unemployment rate is for the Philadelphia-Camden-Wilmington MSA – preliminary March 2017

Mining, logging,

and construction

4% Manufacturing

6%

Trade, transportation,

and utilities

18%

Information

2%

Financial activities

7%

Professional and

business services

16%

Education and

health services

22%

Leisure and hospitality

9%

Other services

4%

Government

12%

Diversity of industries drives stable & favorable employment in our markets

Unemployment of 4.6%

WSFS Strategic Plan goal of fee (non-interest) income to total revenue of 40% by 4Q 2018

$31 $30 $32 $33

$33 $36

$40

$13 $16

$19

$24 $26

$28

$33

$5

$13

$14

$16

$18

$23

$27

29%

32%

33%

35%

34%

34%

34%

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

$100

2010 2011 2012 2013 2014 2015 2016

To

ta

l Co

re

F

ee in

com

e

(1

)

$

in

Mi

ll

io

n

s

Trust & Wealth

Cash Connect

Bank Segment

The WSFS Franchise – Diversified & Robust Fee Income

21

%’s represent fee (non-interest) income / total revenue

(1) These are non-GAAP financial measures and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See

Appendix 3 for reconciliation to GAAP financial information.

35% YTD

2017

5 Year CAGR

Trust & Wealth: 15%

Cash Connect: 16%

Bank: 6%

The WSFS Franchise – WSFS Wealth

A Full-Service Wealth Management Offering

22

Net Revenue of $12.7 million in 2Q 2017;

Pre-tax profit of $3.6 million

The WSFS Franchise – Cash Connect®

• Leading provider of ATM vault cash, armored carrier management, cash forecasting services,

insurance and equipment services

• More than $900 million in vault cash managed

• Over 21,000 non-bank ATMs in all 50 States

• Vault cash margin pressure offset by additional managed services

• Operates over 440 ATMs for WSFS Bank; largest in-market ATM franchise

• $9.1 million in net revenue (fee income less funding costs) and

$1.9 million in pre-tax profitability in 2Q 2017

• 5 year CAGR for net revenue is 16%

• Also serves as an innovation center for the company, both

expanding core ATM offerings and additional payment-, processing-

and software-related activities; e.g., launched WSFS Mobile Cash –

allows Customers to securely withdraw cash from ATMs by using

their WSFS Mobile Banking App

• Growing smart safe pipeline generated by several smart safe

distribution partners that are actively marketing our program, in

addition to over 1,000 smart safes as of 6/30/17, up from just over

100 safes at the end of 2015

23

Embracing Innovation as a Catalyst for Growth

24

Selected Financial Information

Cash

Connect

9%

Investments

15%

BOLI 1%

Non-

Earning

Assets 7%

Net Loans

68%

The WSFS Franchise - WSFS Bank

Assets $6.8 Billion; Net Loans $4.6 Billion

Asset Composition – June 30, 2017

6%

11%

6%

52%

25%

CRE

C&I

Residential

Mortgages

Consumer

Construction

• Commercial loans

comprise 83% of the

loan portfolio

• C&I (including owner-

occupied real estate),

the largest component,

makes up 52% of the

loan portfolio

26

Total Funding – $6.8 Billion; Customer Deposits- $4.7 Billion

Funding Composition – June 30, 2017

Other

Liabilities

1.5%

Wholesale

Deposits

2.7%

Borrowings

17.0%

Equity

10.6%

Customer

Deposits

68.2%

Non-

interest

DDA

28.4%

Interest

DDA

19.9%

Money

Market

&

Savings

40.2%

Time

11.5%

• Core deposits represent

88% of total customer

deposits and non-interest

and very low interest

DDA (WAC 20bps) stand

at 48% of customer

funding

27

The WSFS Franchise - WSFS Bank

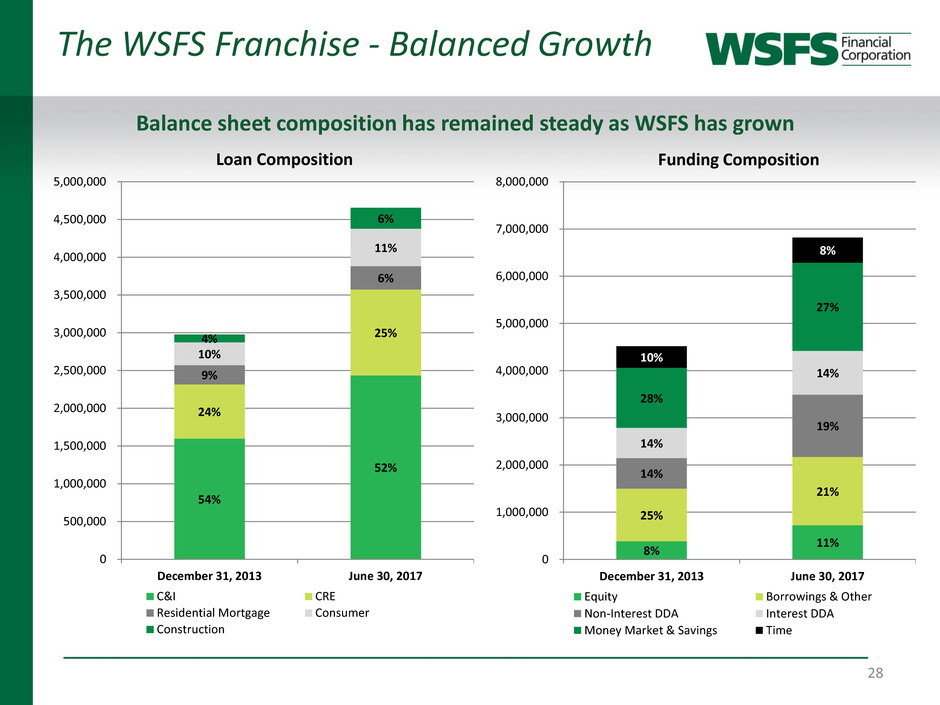

The WSFS Franchise - Balanced Growth

28

Balance sheet composition has remained steady as WSFS has grown

54%

52%

24%

25%

9%

6%

10%

11%

4%

6%

0

500,000

1,000,000

1,500,000

2,000,000

2,500,000

3,000,000

3,500,000

4,000,000

4,500,000

5,000,000

December 31, 2013 June 30, 2017

Loan Composition

C&I CRE

Residential Mortgage Consumer

Construction

8%

11%

25%

21%

14%

19%

14%

14%

28%

27%

10%

8%

0

1,000,000

2,000,000

3,000,000

4,000,000

5,000,000

6,000,000

7,000,000

8,000,000

December 31, 2013 June 30, 2017

Funding Composition

Equity Borrowings & Other

Non-Interest DDA Interest DDA

Money Market & Savings Time

Well Positioned for Rising Rates

As of 6/30/17 (WSJ Prime @ 4.25%)

BPS Change(1)

NII

% Impact

NII

$ Impact

+25 0.4% +0.9mm

+50 0.8% +$1.8mm

+100 1.8% +$3.8mm

+200 3.4% +$7.4mm

+300 5.0% +$11.0mm

+400 6.4% +$14.1mm

Balance Sheet Drivers

• High % of variable/adjustable rate total loan portfolio: 66%

• High % core deposits: 88%; High % non-interest bearing and low-interest DDA: 48%

• Solid brand and position / WSFS is a market “price leader”

(1) WSFS IRR model estimates: Static Balance Sheet / Instantaneous Rate Shocks 29

Overall Credit Trends Remain Strong

0.52%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

1.40%

1.60%

1.80%

2.00%

1Q

13

2Q

13

3Q

13

4Q

13

1Q

14

2Q

14

3Q

14

4Q

14

1Q

15

2Q

15

3Q

15

4Q

15

1Q

16

2Q

16

3Q

16

4Q

16

1Q

17

2Q

17

Delinquencies Large Relationship (2)

Delinquencies (1) / Gross Loans

Weighted Average Risk Rating (3)

(1) Includes non-accruing loans

(2) One large $15.4 million, highly-seasonal relationship that was exited in 3Q 2016

(3) 10 point scale; 1 is substantially risk-free, 10 is a loss. Figures are based on loan outstandings. High point of 5.53 represents the high point since WSFS converted to a 10 point scale in 1Q12.

30

4.96

4.00

4.20

4.40

4.60

4.80

5.00

5.20

5.40

5.60

5.80

6.00

1Q

13

2Q

13

3Q

13

4Q

13

1Q

14

2Q

14

3Q

14

4Q

14

1Q

15

2Q

15

3Q

15

4Q

15

1Q

16

2Q

16

3Q

16

4Q

16

1Q

17

2Q

17

18.21%

23.20%

10%

15%

20%

25%

30%

35%

40%

45%

50%

1Q

13

2Q

13

3Q

13

4Q

13

1Q

14

2Q

14

3Q

14

4Q

14

1Q

15

2Q

15

3Q

15

4Q

15

1Q

16

2Q

16

3Q

16

4Q

16

1Q

17

2Q

17

Classified Loans Criticized Loans

Criticized & Classified Loans / Tier-1 + ALLL

NPAs / Total Assets

0.86%

0.20%

0.70%

1.20%

1.70%

2.20%

1Q

13

2Q

13

3Q

13

4Q

13

1Q

14

2Q

14

3Q

14

4Q

14

1Q

15

2Q

15

3Q

15

4Q

15

1Q

16

2Q

16

3Q

16

4Q

16

1Q

17

2Q

17

High point during

the cycle of 3.03%

in 1Q12

High point during

the cycle of 2.61%

in 3Q09

High point during

the cycle of 5.53 in

1Q12

High point during the cycle

of:

Criticized: 105.6% in 1Q10

Classified: 70.5% in 3Q09

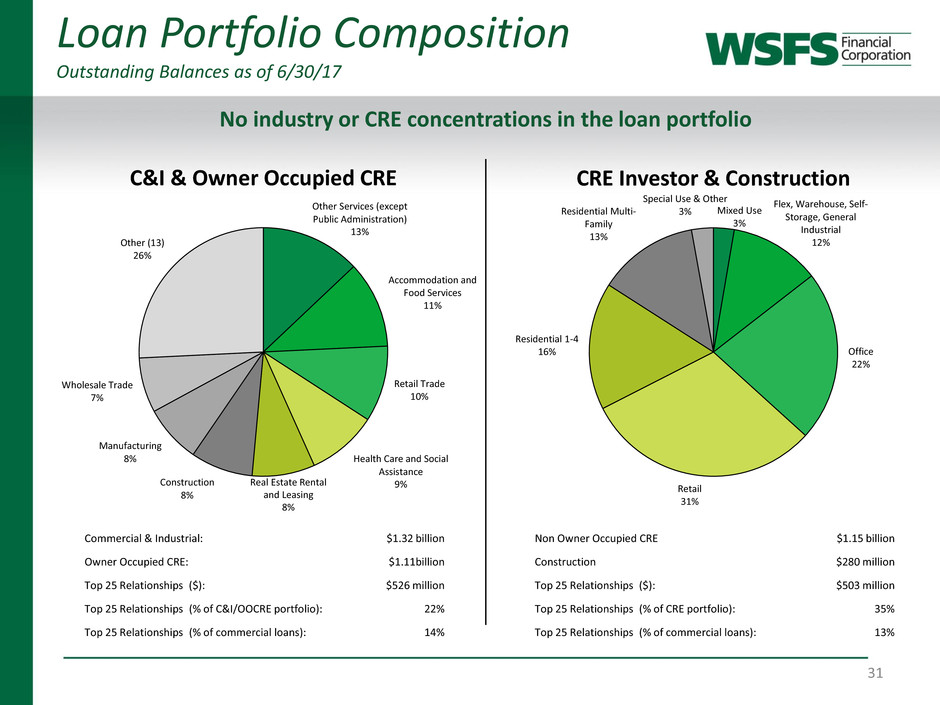

Loan Portfolio Composition

Outstanding Balances as of 6/30/17

31

No industry or CRE concentrations in the loan portfolio

Commercial & Industrial: $1.32 billion

Owner Occupied CRE: $1.11billion

Top 25 Relationships ($): $526 million

Top 25 Relationships (% of C&I/OOCRE portfolio): 22%

Top 25 Relationships (% of commercial loans): 14%

Non Owner Occupied CRE $1.15 billion

Construction $280 million

Top 25 Relationships ($): $503 million

Top 25 Relationships (% of CRE portfolio): 35%

Top 25 Relationships (% of commercial loans): 13%

Real Estate Rental

and Leasing

8%

Other Services (except

Public Administration)

13%

Accommodation and

Food Services

11%

Retail Trade

10%

Health Care and Social

Assistance

9% Construction

8%

Manufacturing

8%

Wholesale Trade

7%

Other (13)

26%

C&I & Owner Occupied CRE

Mixed Use

3%

Flex, Warehouse, Self-

Storage, General

Industrial

12%

Office

22%

Retail

31%

Residential 1-4

16%

Residential Multi-

Family

13%

Special Use & Other

3%

CRE Investor & Construction

12/12 12/13 12/14 12/15 12/16 6/17

TRBC 14.29% 14.36% 13.83% 13.11% 11.93% 12.14%

Tier-1 Capital 13.04% 13.16% 12.79% 12.31% 11.19% 11.42%

Excess RBC (above 10%) $140,117 $153,542 $147,186 $146,788 $66,939 $77,394

TCE(1) 7.72% 7.69% 9.00% 8.84% 7.55% 8.03%

TBV/Share $12.74 $12.89 $15.30 $16.30 $15.80 $16.94

Robust Capital to Grow and to Return to Shareholders

$250,000

$300,000

$350,000

$400,000

$450,000

$500,000

$550,000

$600,000

$650,000

12/12 12/13 12/14 12/15 12/16 6/17

Total Risk-Based Capital Well Capitalized Requirement

Total Risk Based Capital (TRBC) 000’s

32 (1) Holding Company ratio. This is a non-GAAP financial measure and should be considered along with results prepared in accordance with GAAP, and not as a substitute for

GAAP results. See Appendix 3 for reconciliation to GAAP financial information.

Strong Alignment / Capital Management

• Executive management bonuses and equity awards based on bottom-line

performance

• ROA, ROTCE and EPS growth

• Insider ownership1 is over 5%

• Board of Directors and Executive Management ownership guidelines in place

and followed

• In 2Q 2017, WSFS repurchased 71,000 shares of common stock at an average price

of $45.18 as part of our 5% buyback program approved by the Board of Directors

in 4Q 2015

• 821,194 shares remaining to purchase under the current authorization

• $87.5 million in cash remains in the Holding Company as of 6/30/17

• The Board of Directors approved a quarterly cash dividend of $0.07 / share of

common stock. This will be paid on 8/25/17 to shareholders of record on 8/11/17

(1) As defined in our most recent proxy statement, as adjusted for unvested stock options approved by shareholders and awarded to the CEO and EVPs

in April 2013.

33

Appendices

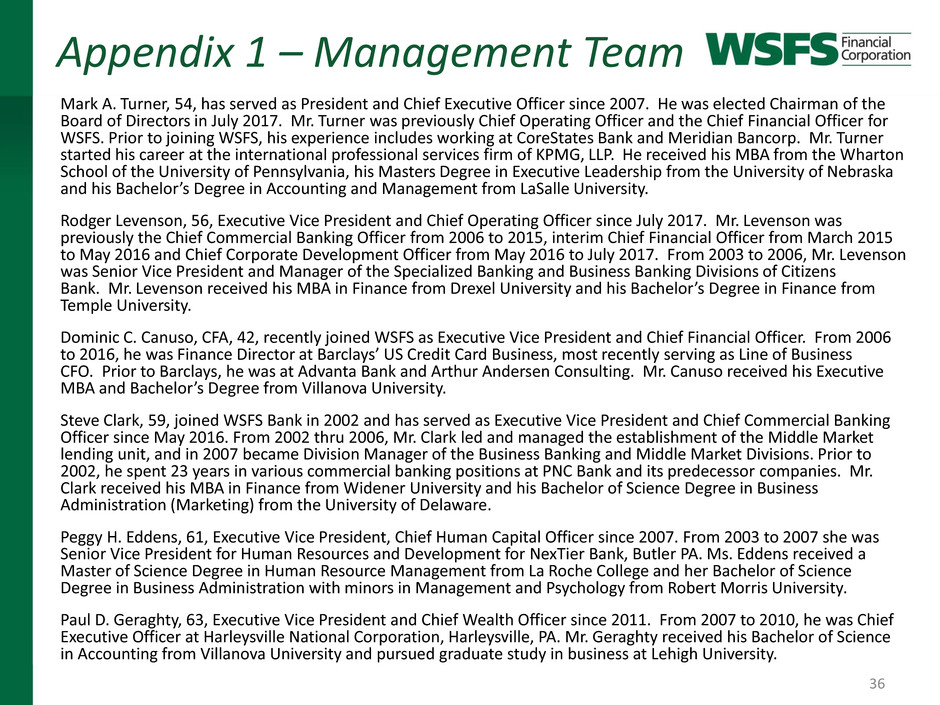

Appendix 1 – Management Team

36

Mark A. Turner, 54, has served as President and Chief Executive Officer since 2007. He was elected Chairman of the

Board of Directors in July 2017. Mr. Turner was previously Chief Operating Officer and the Chief Financial Officer for

WSFS. Prior to joining WSFS, his experience includes working at CoreStates Bank and Meridian Bancorp. Mr. Turner

started his career at the international professional services firm of KPMG, LLP. He received his MBA from the Wharton

School of the University of Pennsylvania, his Masters Degree in Executive Leadership from the University of Nebraska

and his Bachelor’s Degree in Accounting and Management from LaSalle University.

Rodger Levenson, 56, Executive Vice President and Chief Operating Officer since July 2017. Mr. Levenson was

previously the Chief Commercial Banking Officer from 2006 to 2015, interim Chief Financial Officer from March 2015

to May 2016 and Chief Corporate Development Officer from May 2016 to July 2017. From 2003 to 2006, Mr. Levenson

was Senior Vice President and Manager of the Specialized Banking and Business Banking Divisions of Citizens

Bank. Mr. Levenson received his MBA in Finance from Drexel University and his Bachelor’s Degree in Finance from

Temple University.

Dominic C. Canuso, CFA, 42, recently joined WSFS as Executive Vice President and Chief Financial Officer. From 2006

to 2016, he was Finance Director at Barclays’ US Credit Card Business, most recently serving as Line of Business

CFO. Prior to Barclays, he was at Advanta Bank and Arthur Andersen Consulting. Mr. Canuso received his Executive

MBA and Bachelor’s Degree from Villanova University.

Steve Clark, 59, joined WSFS Bank in 2002 and has served as Executive Vice President and Chief Commercial Banking

Officer since May 2016. From 2002 thru 2006, Mr. Clark led and managed the establishment of the Middle Market

lending unit, and in 2007 became Division Manager of the Business Banking and Middle Market Divisions. Prior to

2002, he spent 23 years in various commercial banking positions at PNC Bank and its predecessor companies. Mr.

Clark received his MBA in Finance from Widener University and his Bachelor of Science Degree in Business

Administration (Marketing) from the University of Delaware.

Peggy H. Eddens, 61, Executive Vice President, Chief Human Capital Officer since 2007. From 2003 to 2007 she was

Senior Vice President for Human Resources and Development for NexTier Bank, Butler PA. Ms. Eddens received a

Master of Science Degree in Human Resource Management from La Roche College and her Bachelor of Science

Degree in Business Administration with minors in Management and Psychology from Robert Morris University.

Paul D. Geraghty, 63, Executive Vice President and Chief Wealth Officer since 2011. From 2007 to 2010, he was Chief

Executive Officer at Harleysville National Corporation, Harleysville, PA. Mr. Geraghty received his Bachelor of Science

in Accounting from Villanova University and pursued graduate study in business at Lehigh University.

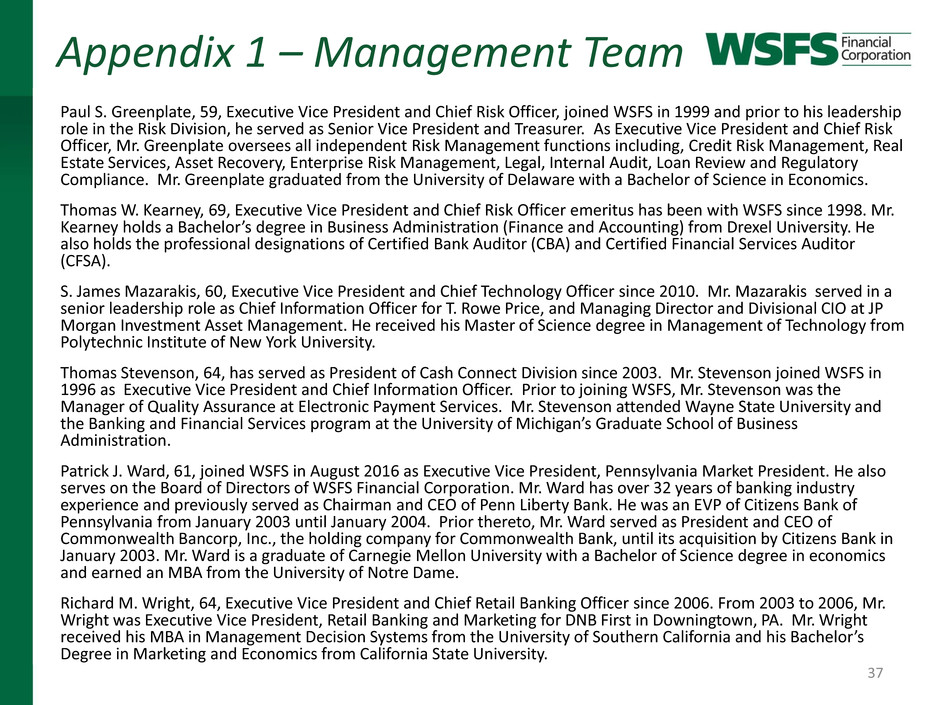

Appendix 1 – Management Team

37

Paul S. Greenplate, 59, Executive Vice President and Chief Risk Officer, joined WSFS in 1999 and prior to his leadership

role in the Risk Division, he served as Senior Vice President and Treasurer. As Executive Vice President and Chief Risk

Officer, Mr. Greenplate oversees all independent Risk Management functions including, Credit Risk Management, Real

Estate Services, Asset Recovery, Enterprise Risk Management, Legal, Internal Audit, Loan Review and Regulatory

Compliance. Mr. Greenplate graduated from the University of Delaware with a Bachelor of Science in Economics.

Thomas W. Kearney, 69, Executive Vice President and Chief Risk Officer emeritus has been with WSFS since 1998. Mr.

Kearney holds a Bachelor’s degree in Business Administration (Finance and Accounting) from Drexel University. He

also holds the professional designations of Certified Bank Auditor (CBA) and Certified Financial Services Auditor

(CFSA).

S. James Mazarakis, 60, Executive Vice President and Chief Technology Officer since 2010. Mr. Mazarakis served in a

senior leadership role as Chief Information Officer for T. Rowe Price, and Managing Director and Divisional CIO at JP

Morgan Investment Asset Management. He received his Master of Science degree in Management of Technology from

Polytechnic Institute of New York University.

Thomas Stevenson, 64, has served as President of Cash Connect Division since 2003. Mr. Stevenson joined WSFS in

1996 as Executive Vice President and Chief Information Officer. Prior to joining WSFS, Mr. Stevenson was the

Manager of Quality Assurance at Electronic Payment Services. Mr. Stevenson attended Wayne State University and

the Banking and Financial Services program at the University of Michigan’s Graduate School of Business

Administration.

Patrick J. Ward, 61, joined WSFS in August 2016 as Executive Vice President, Pennsylvania Market President. He also

serves on the Board of Directors of WSFS Financial Corporation. Mr. Ward has over 32 years of banking industry

experience and previously served as Chairman and CEO of Penn Liberty Bank. He was an EVP of Citizens Bank of

Pennsylvania from January 2003 until January 2004. Prior thereto, Mr. Ward served as President and CEO of

Commonwealth Bancorp, Inc., the holding company for Commonwealth Bank, until its acquisition by Citizens Bank in

January 2003. Mr. Ward is a graduate of Carnegie Mellon University with a Bachelor of Science degree in economics

and earned an MBA from the University of Notre Dame.

Richard M. Wright, 64, Executive Vice President and Chief Retail Banking Officer since 2006. From 2003 to 2006, Mr.

Wright was Executive Vice President, Retail Banking and Marketing for DNB First in Downingtown, PA. Mr. Wright

received his MBA in Management Decision Systems from the University of Southern California and his Bachelor’s

Degree in Marketing and Economics from California State University.

Appendix 2 – Business Model

38

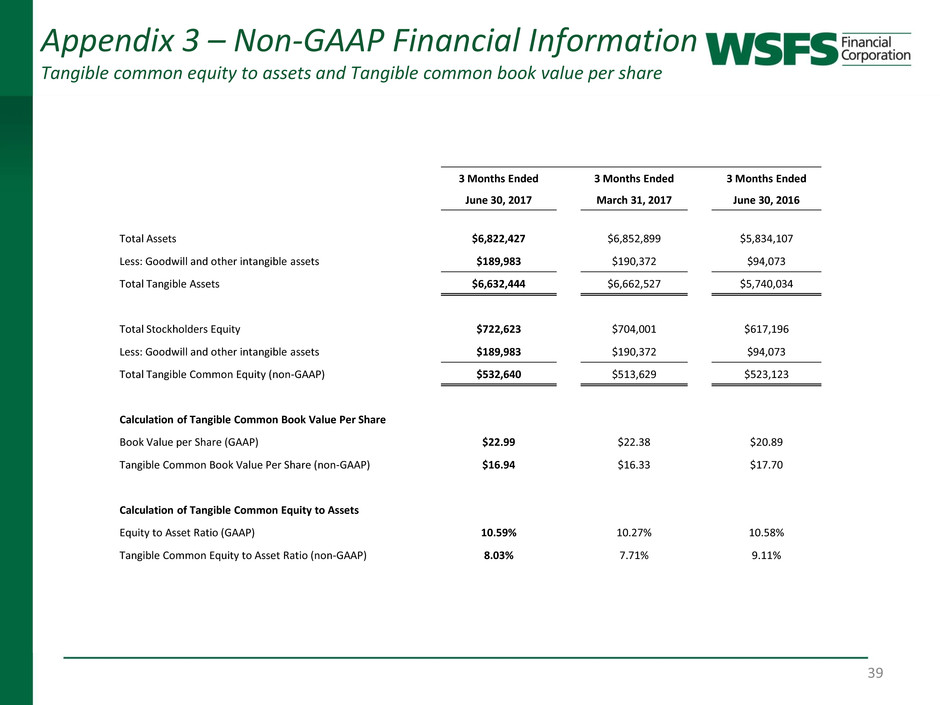

Appendix 3 – Non-GAAP Financial Information

Tangible common equity to assets and Tangible common book value per share

39

3 Months Ended 3 Months Ended 3 Months Ended

June 30, 2017 March 31, 2017 June 30, 2016

Total Assets $6,822,427 $6,852,899 $5,834,107

Less: Goodwill and other intangible assets $189,983 $190,372 $94,073

Total Tangible Assets $6,632,444 $6,662,527 $5,740,034

Total Stockholders Equity $722,623 $704,001 $617,196

Less: Goodwill and other intangible assets $189,983 $190,372 $94,073

Total Tangible Common Equity (non-GAAP) $532,640 $513,629 $523,123

Calculation of Tangible Common Book Value Per Share

Book Value per Share (GAAP) $22.99 $22.38 $20.89

Tangible Common Book Value Per Share (non-GAAP) $16.94 $16.33 $17.70

Calculation of Tangible Common Equity to Assets

Equity to Asset Ratio (GAAP) 10.59% 10.27% 10.58%

Tangible Common Equity to Asset Ratio (non-GAAP) 8.03% 7.71% 9.11%

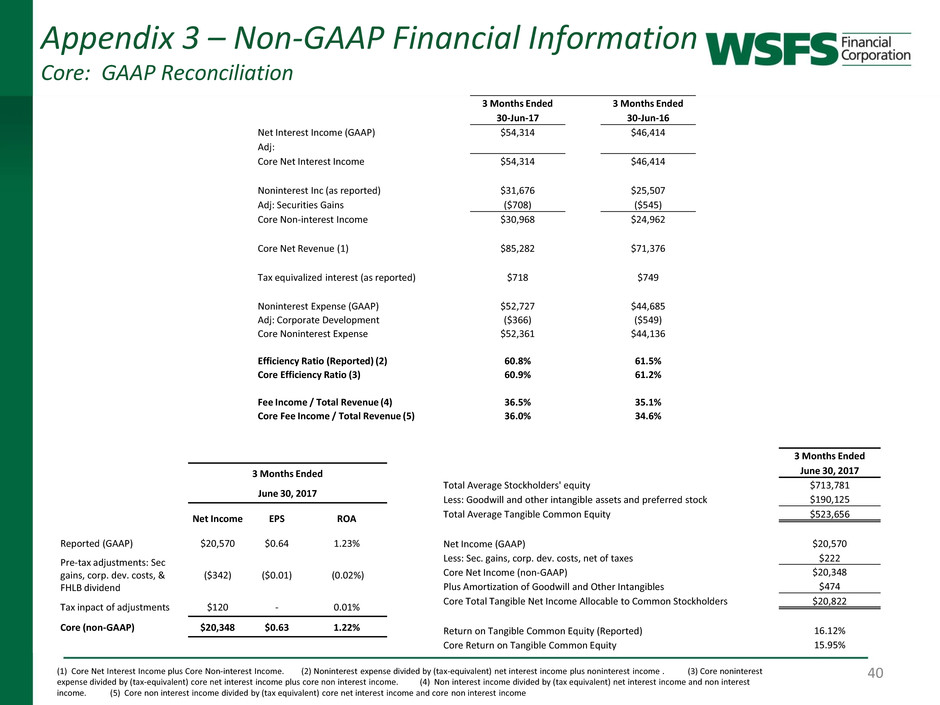

Appendix 3 – Non-GAAP Financial Information

Core: GAAP Reconciliation

40 (1) Core Net Interest Income plus Core Non-interest Income. (2) Noninterest expense divided by (tax-equivalent) net interest income plus noninterest income . (3) Core noninterest

expense divided by (tax-equivalent) core net interest income plus core non interest income. (4) Non interest income divided by (tax equivalent) net interest income and non interest

income. (5) Core non interest income divided by (tax equivalent) core net interest income and core non interest income

3 Months Ended 3 Months Ended

30-Jun-17 30-Jun-16

Net Interest Income (GAAP) $54,314 $46,414

Adj:

Core Net Interest Income $54,314 $46,414

Noninterest Inc (as reported) $31,676 $25,507

Adj: Securities Gains ($708) ($545)

Core Non-interest Income $30,968 $24,962

Core Net Revenue (1) $85,282 $71,376

Tax equivalized interest (as reported) $718 $749

Noninterest Expense (GAAP) $52,727 $44,685

Adj: Corporate Development ($366) ($549)

Core Noninterest Expense $52,361 $44,136

Efficiency Ratio (Reported) (2) 60.8% 61.5%

Core Efficiency Ratio (3) 60.9% 61.2%

Fee Income / Total Revenue (4) 36.5% 35.1%

Core Fee Income / Total Revenue (5) 36.0% 34.6%

3 Months Ended

June 30, 2017

Net Income EPS ROA

Reported (GAAP) $20,570 $0.64 1.23%

Pre-tax adjustments: Sec

gains, corp. dev. costs, &

FHLB dividend

($342) ($0.01) (0.02%)

Tax inpact of adjustments $120 - 0.01%

Core (non-GAAP) $20,348 $0.63 1.22%

3 Months Ended

June 30, 2017

Total Average Stockholders' equity $713,781

Less: Goodwill and other intangible assets and preferred stock $190,125

Total Average Tangible Common Equity $523,656

Net Income (GAAP) $20,570

Less: Sec. gains, corp. dev. costs, net of taxes $222

Core Net Income (non-GAAP) $20,348

Plus Amortization of Goodwill and Other Intangibles $474

Core Total Tangible Net Income Allocable to Common Stockholders $20,822

Return on Tangible Common Equity (Reported) 16.12%

Core Return on Tangible Common Equity 15.95%

Appendix 3 -Non-GAAP Financial Information

Core: GAAP Reconciliation

41

FY16

Pre-Tax

Adjustments

FY16

FY15

Pre-Tax

Adjustments

FY15

FY14

Pre-Tax

Adjustments

FY14

FY13

Pre-Tax

Adjustments

FY13

FY12

Pre-Tax

Adjustments

FY12

FY11

Pre-Tax

Adjustments

FY11

Reported (GAAP) Net Income $64,079 $53,533 $53,757 $46,882 $31,311 $22,677

Adj: FHLB Dividend (808) (525)

Adj: Securities Gains (2,369) (1,528) (1,478) (961) (1,037) (674) (3,516) (2,285) (21,425) (13,926) (4,878) (3,171)

Adj: Rev mtg consol gain (3,801) (2,471)

Adj: BOLI Gain (1,006) (654)

Adj: Corp Development 8,529 5,828 7,620 5,469 4,031 2,741 717 538 3,662 2,454 780 507

Adj: Debt Extinguishment 651 423

Adj: Extraordinary tax benefit (6,604) (6,604)

Core Net Income $68,380 $57,940 $49,220 $42,664 $19,184 $20,013

Appendix 3 – Non-GAAP Financial Information

Core & Sustainable ROA: GAAP Reconciliation

42

FY16 FY15 FY14 FY13 FY12

Reported (GAAP) ROA 1.06% 1.05% 1.17% 1.07% 0.73%

Non-recurring PCI accretion (0.02) - - -

Long-term credit normalization 0.04 - (0.09) (0.05) 0.33

Securities Gains (0.03) (0.02) (0.01) (0.05) (0.33)

SASCO write up - - (0.06) -

Corporate Development expense 0.09 0.10 0.06 0.01 -

Debt Extinguishment 0.01 - - 0.06

FHLB Dividend (0.01) - - -

BOLI - - - (0.02)

Tax Normalization (0.01) 0.02 (0.18) (0.01) -

Core & Sustainable ROA 1.15% 1.13% 0.95% 0.91% 0.77%

2Q17 1Q17 4Q16 3Q16 2Q16 1Q16 4Q15 3Q15 2Q15 1Q15 4Q14 3Q14 2Q14 1Q14 4Q13 3Q13 2Q13 1Q13 4Q12

Reported (GAAP) ROA 1.23% 1.12% 1.08% 0.82% 1.23% 1.13% 1.03% 1.14% 0.98% 1.06% 1.07% 0.99% 1.12% 1.52% 1.09% 1.29% 1.00% 0.91% 0.70%

Non-recurring PCI accretion (0.07)

Long-term credit normalization (0.03) (0.02) 0.10 0.14 (0.05) (0.05) 0.00 (0.04) 0.10 (0.07) (0.11) (0.12) (0.13) 0.01 (0.04) (0.03) (0.03) (0.11) 0.08

Securities Gains (0.03) (0.01) (0.02) (0.04) (0.03) (0.01) (0.02) (0.01) (0.02) (0.03) 0.00 0.00 (0.02) (0.03) (0.04) (0.02) (0.05) (0.10) (0.22)

SASCO write up (0.22)

Corporate Development expense 0.02 0.01 0.06 0.27 0.03 0.02 0.27 0.05 0.05 0.03 0.06 0.15 0.01 0.02 0.03

Debt Extinguishment 0.03 0.22

FHLB Dividend (0.05)

Tax Normalization (0.02) (0.06) (0.02) 0.00 (0.04) 0.01 0.00 0.02 0.00 0.04 (0.04) (0.02) (0.01) (0.62) (0.03)

Core & Sustainable ROA 1.17% 1.04% 1.20% 1.19% 1.14% 1.10% 1.24% 1.16% 1.11% 0.98% 0.98% 1.00% 0.97% 0.90% 1.04% 0.99% 0.92% 0.70% 0.78%

For more information please contact:

Investor Relations: Dominic Canuso (302) 571-6833 or

dcanuso@wsfsbank.com

www.wsfsbank.com

Corporate Headquarters

500 Delaware Avenue

Wilmington, DE 19801

43