Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - LILIS ENERGY, INC. | v472421_ex99-1.htm |

| EX-10.2 - EXHIBIT 10.2 - LILIS ENERGY, INC. | v472421_ex10-2.htm |

| 8-K - 8-K - LILIS ENERGY, INC. | v472421_8k.htm |

Exhibit 10.1

SEPARATION AND CONSULTING AGREEMENT

THIS SEPARATION AND CONSULTING AGREEMENT (the “Agreement”) is made and entered into effective as of August 3, 2017 (the “Effective Date”), by and between Lilis Energy, Inc., a Nevada corporation (the “Company”), and Abraham Mirman (the “Executive”).

WITNESSETH:

WHEREAS, the Executive and the Company are parties to that certain Employment Agreement effective as of July 5, 2016 and since amended effective as of March 8, 2017 and May 4, 2017 (the “Employment Agreement”); and

WHEREAS, the Executive intends to resign from the Company, and the parties mutually desire to arrange for a separation from the Company and its affiliates and subsidiaries under certain terms; and

WHEREAS, the Executive possesses business knowledge and expertise which may be of substantial assistance to the Company following his employment in a consulting role; and

WHEREAS, in consideration of the mutual promises contained herein, the parties hereto are willing to enter into this Agreement upon the terms and conditions herein set forth.

NOW, THEREFORE, in consideration of the premises, the terms and provisions set forth herein, the mutual benefits to be gained by the performance thereof and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1. Resignation as Officer; Separation. As of August 4, 2017, the Executive shall resign all officer and director positions with the Company and its affiliates and shall resign from his position as an employee of the Company (the “Separation Date”). The Executive agrees to timely execute such further documentation as may be necessary to effectuate such resignations.

2. Separation Benefits. The Company agrees to pay or provide, and the Executive agrees to accept, the benefits set forth in this Section 2 in consideration for the Executive’s service through the Separation Date, satisfaction of any and all obligations under the Employment Agreement, and the Executive’s execution (without revocation) of the Waiver and Release on or after the Separation Date as described in Section 5 below.

A. Accrued Benefits. The Company shall pay to the Executive all base salary, vacation pay and properly documented expense reimbursements that are accrued and unpaid as of the Separation Date within 15 days following the Separation Date.

B. Lump-sum Severance Payment. The Company shall pay to the Executive a lump-sum cash payment equal to $1,000,000 within three days following the Waiver Effective Date (as defined below).

| 1 |

C. Equity Compensation. Any stock option previously granted to the Executive that is outstanding and unvested as of the Separation Date shall become fully vested and exercisable as of the Waiver Effective Date and shall, notwithstanding the Executive’s intervening separation, remain exercisable for the maximum original term as set forth in the applicable award agreement. Any shares of restricted stock previously granted to the Executive that are outstanding and unvested as of the Separation Date shall become fully vested as of the Waiver Effective Date.

D. Warrants. Any outstanding warrant held by the Executive, each of which was acquired in his capacity as an investor in the Company, shall be amended to the extent necessary to allow the Executive to exercise such warrant via a “cashless” net exercise procedure or the Company shall take such actions as may be necessary to provide an equivalent economic benefit to the Executive.

E. Medical Continuation Subsidy. The Company shall timely pay the Executive’s premiums for family medical, dental and vision continuation coverage under Section 4890B of the Internal Revenue Code (“COBRA”) for 18 months or until the Executive obtains alternative coverage, whichever is the shorter time period.

F. Reimbursement of Attorneys Fees. The Executive shall be entitled to the reimbursement of his reasonable attorneys fees incurred in connection with the review and preparation of the documents related to his separation. Such reimbursement shall be made no later than 15 days following receipt of appropriate documentation of such expenses.

G. Withholding. All payments in this Section 2 shall be subject to applicable withholdings and the Company shall issue to the Executive a Form W-2 as required by law.

3. Engagement as Consultant: Following the Separation Date, the Company agrees to retain the Executive commencing on the day following his separation as an independent consultant, and the Executive agrees to render consulting services for the one year period commencing on the day following the Separation Date, unless such consulting arrangement is terminated earlier pursuant to Section 3(E) hereof or is extended by mutual agreement of the parties (the “Consulting Term”).

A. Terms and Responsibilities. During the Consulting Term, the Executive shall devote such of his time and his efforts as may be mutually agreed are required from time to time to perform his duties hereunder.

B. Duties. The Company hereby engages the Executive to provide during the Consulting Term such services of a consulting or advisory nature as the Company may reasonably request with respect to its business. The Executive will primarily provide consulting services with respect to the transition of leadership to a new Chief Executive Officer. The Executive shall act solely in a consulting capacity hereunder and shall not have authority to act for the Company or to give instructions or orders on behalf of the Company or otherwise to make commitments for or on behalf of the Company. The Executive shall not be an employee of the Company during the Consulting Term, but shall act in the capacity of an independent contractor. The Company shall not exercise control over the detail, manner or methods of the performance of the services by the Executive during the Consulting Term.

| 2 |

C. Compensation and Benefits. As full and complete compensation for any and all services which the Executive may render during the Consulting Term:

i. The Company shall pay the Executive a monthly consulting fee at the rate of $41,660.67 per month, for which the Company shall issue the Executive a Form 1099, as required by law.

ii. The Company shall make available for the Executive’s use during the Consulting Term an office reasonably comparable to the offices of senior executives of the Company and shall make available for assistance to the Executive for Company business an administrative assistant with experience working with senior executive of the Company, which the parties expect to be the Executive’s currently assigned assistant.

iii. The Executive shall not receive nor be entitled to participate in any benefits or benefit plans with respect to the work done during the Consulting Term, and Executive agrees to waive any claims to such benefits.

D. Reimbursement. The Executive shall be entitled to receive reimbursement for all reasonable and documented expenses incurred by the Executive during the Consulting Term in furtherance of Executive’s consulting duties. All reimbursable expenses shall be appropriately documented in reasonable detail by the Executive upon submission of any request for reimbursement and in a format and manner consistent with the Company’s expense reporting policy. Payment for said invoiced amounts shall be paid by the Company within 15 days after receipt of invoice by the Company. Should the Company dispute any portion of the Executive’s monthly invoice, the Company shall pay the undisputed portion of the invoice and advise the Executive in writing of the disputed portion. The parties will cooperate in good faith to resolve any disputed portions.

E. Termination of Service. The Executive’s engagement as a consultant will terminate automatically upon the Executive’s timely revocation of this Agreement as provided for in Section 5 hereof, Executive’s death, or upon the Executive’s disability rendering him unable to perform services hereunder for a period of 90 days and, except as otherwise provided in this Section 3(E), the Executive shall be entitled to no further compensation or benefits provided for in this Section 3. Either the Company or the Executive may terminate the Executive’s engagement as a consultant hereunder for any reason upon fourteen days written notice for any reason; provided, however, that if a Change in Control (as defined in the Lilis Energy, Inc. 2016 Omnibus Incentive Plan or any plan approved by the shareholders of the Company to replace such incentive plan) occurs, the Company terminates the Executive’s engagement as a consultant prior to the end of the full original Consulting Term without cause, or if the Executive’s services terminate due to death or disability, the Company shall pay to the Executive (or the Executive’s estate or representative, as applicable) within 10 days following such termination, a lump sum equal to all amounts that, notwithstanding such termination, would have been paid during the full original Consulting Term pursuant to Section 3(C)(i).

| 3 |

4. Restrictive Covenants.

A. The Executive’s Obligations.

i. The Executive agrees that for the period beginning on the Separation Date and extending through the Consulting Term (the “Restricted Period”) he shall not (a) criticize or disparage, publicly or privately, the Company or any affiliate in a manner intended or reasonably calculated to result in substantial public embarrassment to, or material injury to the reputation of, the Company or any affiliate in any community in which the Company or any affiliate is engaged in business or (b) intentionally commit damage to the property of the Company or any affiliate or otherwise engage in any misconduct which is intentionally injurious to the business or reputation of the Company or any affiliate; provided, however, that the Executive will not be in breach of the covenant contained in (a) above solely by reason of his testimony which is compelled by process of law or in taking any action to secure his rights under this Agreement as otherwise contemplated herein.

ii. The Executive agrees that during the Restricted Period, the Executive will not engage or employ, or solicit or contact with a view to the engagement or employment of, any person who is an officer or employee of the Company or any of its Affiliates.

iii. During the Restricted Period, the Executive shall not, without prior consent of the Board of Directors of the Company, directly or indirectly (whether as proprietor, stockholder, director, partner, employee, independent contractor, consultant, trustee or in any other capacity), perform services or acquire an ownership interest in any area of interest in which the Company participates or is actively considering participating as of the Effective Date as identified on Exhibit B attached hereto (each an "Area of Interest"); provided, however, that the Executive shall not be deemed to violate this restriction solely by virtue of the Executive's ownership of not more than 4.9% of any class of stock or other securities which are publicly traded on a national securities exchange or in a recognized over-the-counter market. Any Area of Interest that the Company declines to pursue may be pursued by the Executive without violating this section.

iv. The Company agrees that the restrictive covenants regarding competition set forth in Section 12.1 of the Employment Agreement shall be null and shall not apply on or after the Separation Date.

v. The covenants set forth in this Section 4(A) shall be null and shall not apply on or after the date on which occurs a “Change in Control” (as defined in the Lilis Energy, Inc. 2016 Omnibus Incentive Plan or any plan approved by the shareholders of the Company to replace such incentive plan).

| 4 |

B. The Company’s Obligations.

i. The Company agrees, from and after the Separation Date, not to, and to take commercially reasonable efforts to cause its directors, officers, employees and agents not to, (a) criticize or disparage, publicly or privately, the Executive in a manner intended or reasonably calculated to result in substantial public embarrassment to, or material injury to the reputation of, the Executive in any community in which the Executive is engaged in business or (b) intentionally commit damage to the property of the Company or any affiliate or otherwise engage in any misconduct which is intentionally injurious to the business or reputation of the Company or any affiliate; provided, however, that the Company will not be in breach of the covenant contained in (a) above solely by reason of the testimony of an officer, director, employee or agent of the Company which is compelled by process of law or by reason of taking any action to secure the Company’s rights under this Agreement as otherwise contemplated herein.

ii. The Company agrees that during the Restricted Period, the Company will not, and will cause its directors, officers, employees and agents to not, engage or employ, or solicit or contact with a view to the engagement or employment of, any person who is an officer or employee of an entity controlled by the Executive.

C. Protected Disclosures. Notwithstanding any provision to the contrary in this Agreement, nothing in this Agreement prohibits the Executive from reporting possible violations of law or regulation to any governmental agency or entity, including but not limited to the Department of Justice, the Securities and Exchange Commission, the Congress, and any agency Inspector General, or making other disclosures that are protected under the whistleblower provisions of federal law or regulation. Additionally, the parties acknowledge and agree that Executive does not need the prior authorization of the Company to make any such reports or disclosures and Executive is not required to notify the Company that Executive has made such reports or disclosures.

5. Waiver and Release. In consideration for the Executive’s execution of and compliance with this Agreement, including but not limited to the provisions of Section 4, and the execution of the Waiver and Release attached hereto as Exhibit A, the Company shall provide the consideration set forth above in Section 2(B) through (F). This consideration is provided subject to the binding execution, without revocation prior to the 8th day following execution (the “Waiver Effective Date”), by the Executive of the attached Waiver and Release agreement, no earlier than the Separation Date and no later than the date 21 days after the Separation Date. The Company’s obligation to make any payments otherwise due under Section 2(B) through (F) shall cease in the event the Executive fails to comply with the terms of this Agreement or the Waiver and Release, and no payment shall be made until the expiration of the seven-day revocation period following execution of the Waiver and Release agreement, provided that such payments shall accrue from the Separation Date.

In consideration of the premises and promises contained herein, the Company releases and discharges Executive from any and all causes of action, claims, liabilities, obligations, promises, agreements, controversies, damages, and expenses, whether in law or equity, arising prior to the Separation Date other than claims that cannot be released as a matter of law.

| 5 |

The Company and the Executive hereby agree that at the conclusion of the Consulting Term they will enter into a mutual release of claims of the same breadth as the release contained in the Waiver and Release attached hereto as Exhibit A and this Section 5.

6. Return of Company Property. All records, designs, patents, business plans, financial statements, manuals, memoranda, lists and other property delivered to or compiled by the Executive by or on behalf of the Company, or any of its affiliates or the representatives, vendors or customers thereof that pertain to the business of the Company or any of its affiliates shall be and remain the property of the Company or any such affiliate, as the case may be, and be subject at all times to the discretion and control thereof. Likewise, all correspondence, reports, records, charts, advertising materials and other similar data pertaining to the business, activities or future plans of the Company or its affiliates that are collected or held by the Executive shall be delivered promptly to the Company or its affiliate, as the case may be, on or prior to the Separation Date or such other date as the Company may indicate. Notwithstanding anything in this Section 6, the Executive shall be permitted to continue use of his Company email account throughout the Consulting Term.

7. Indemnification. In the event that the Executive is made a party or threatened to be made a party to any action, suit, or proceeding (a “Proceeding”), other than any Proceeding initiated by the Executive or the Company related to any contest or dispute between Executive and the Company or any of its subsidiaries, by reason of the fact that the Executive is or was a director or officer of, an employee or consultant of, or was otherwise acting on behalf of, the Company, any affiliate of the Company, any employee benefit plan or any other entity at the request of the Company, the Executive shall be indemnified and held harmless by the Company, to the maximum extent permitted under applicable law, from and against any and all liabilities, costs, claims and expenses, including any and all costs and expenses incurred in defense of any Proceeding, and all amounts paid in settlement thereof after consultation with, and receipt of approval from, the Company, which approval shall not be unreasonably withheld, conditioned or delayed. Costs and expenses incurred by the Executive in defense of such Proceeding shall be paid by the Company in advance of the final disposition of such litigation upon receipt by the Company of: (i) a written request for payment; (ii) appropriate documentation evidencing the incurrence, amount and nature of the costs and expenses for which payment is being sought; and (iii) an undertaking adequate under applicable law made by or on behalf of the Executive to repay the amounts so paid if it shall ultimately be determined that the Executive is not entitled to be indemnified by the Company under this Agreement. The rights to indemnification and advancement of costs and expenses provided in this Section 7 are not and will not be deemed exclusive of any other rights or remedies to which the Executive may at any time be entitled under applicable law, the organizational documents of the Company or any of its subsidiaries, any agreement or otherwise, and each such right under this Section 7 will be cumulative with all such other rights, if any. During the Consulting Period and for a period of six years thereafter, the Company or any successor to the Company hereunder shall maintain, at its own expense, liability insurance providing coverage to the Executive on terms that are no less favorable than the coverage provided to directors and senior officers of the Company as of the Effective Date.

| 6 |

8. Nonassignability. Except for those rights that may accrue to the Executive’s family or estate in the event of his death or disability, neither this Agreement nor any right or interest hereunder shall be subject, in any manner, to anticipation, alienation, sale, transfer, assignment, pledge, encumbrance or charge, whether voluntary or involuntary, by operation of law or otherwise, any attempt at such shall be void; provided, that any such benefit shall not in any way be subject to the debts, contract, liabilities, engagements or torts of the Executive, nor shall it be subject to attachment or legal process for or against the Executive.

9. Entire Agreement; Modification. This Agreement, together with the agreements applicable to the Executive’s outstanding stock options and warrants, as amended pursuant to this Agreement, sets forth the entire agreement and understanding of the parties concerning the subject matter hereof, and supersedes all prior agreements, arrangements and understandings relative to that subject matter including, without limitation, the Employment Agreement, except to the extent of specific provisions thereof expressly incorporated into this Agreement. No term or provision hereof may be modified or extinguished, in whole or in part, except by a writing which is dated and signed by the parties to this Agreement. No waiver of any of the provisions or conditions of this Agreement or of any of the rights, powers or privileges of a party will be effective or binding unless in writing and signed by the party claimed to have given or consented to such waiver. No representation, promise or inducement has been made to or relied upon by or on behalf of either party concerning the subject matter hereof which is not set forth in this Agreement. In particular, the Executive acknowledges and agrees that he is not entitled to receive from the Company any incentive or other compensation or payment related to his services to the Company or the termination thereof, other than the consideration specifically set forth herein. Notwithstanding the foregoing, to the extent that any matter is not specifically addressed in this Agreement, then any terms of the Employment Agreement which address such matter shall remain in effect and be incorporated into this Agreement up to and until the Separation Date.

10. Waiver. No term or condition of this Agreement shall be deemed to have been waived, nor shall there be an estoppel against the enforcement of any provision of this Agreement, except by written instrument of the party charged with such waiver or estoppel.

11. Set-Off. The Company’s obligation to make payments provided for in this Agreement and otherwise to perform its obligations hereunder shall not be affected by any setoff, counterclaim, recoupment, defense, mitigation or other claim, right or action which the Company may have against the Executive or others

12. Notices. All notices or communications hereunder shall be in writing, addressed as follows:

To the Company:

Lilis Energy, Inc.

300 E. Sonterra Blvd.

Suite 1220

San Antonio, Texas 78258

Attn: General Counsel

To the Executive, at the address and fax number of record in the Company’s file.

| 7 |

All such notices shall be conclusively deemed to be received and shall be effective; (i) if sent by hand delivery, upon receipt, (ii) if sent by telecopy or facsimile transmission, upon confirmation of receipt by the sender of such transmission, or (iii) if sent by registered or certified mail, on the fifth day after the day on which such notice is mailed.

13. Source of Payments. All cash payments provided in this Agreement will be paid from the general funds of the Company. The Executive’s status with respect to amounts owed under this Agreement will be that of a general unsecured creditor of the Company.

14. Tax Withholding. The Company may withhold from any benefits payable under this Agreement all federal, state, city or other income or employment taxes to the extent required pursuant to any law or governmental regulation or ruling. The parties agree that the amounts paid pursuant to Section 3 on account of the Executive’s consulting services shall not be subject to income or employment tax withholding, and the Executive will be responsible for all income and employment taxes associated with such payments.

15. Severability. If any provision of this Agreement is held to be invalid, illegal or unenforceable, in whole or part, such invalidity will not affect any otherwise valid provision, and all other valid provisions will remain in full force and effect.

16. Counterparts. This Agreement may be executed in two or more counterparts, each of which will be deemed an original, and all of which together will constitute one document.

17. Titles. The titles and headings preceding the text of the paragraphs and subparagraphs of this Agreement have been inserted solely for convenience of reference and do not constitute a part of this Agreement or affect its meaning, interpretation or effect.

18. Section 409A Compliance.

A. Each payment under this Agreement, including each payment in a series of installment payments, is intended to be a separate payment for purposes of Treas. Reg. § 1.409A-2(b), and is intended to be: (i) exempt from Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”), the regulations and other binding guidance promulgated thereunder (“Section 409A”), including, but not limited to, by compliance with the short-term deferral exemption as specified in Treas. Reg. § 1.409A-1(b)(4) and the involuntary separation pay exception within the meaning of Treas. Reg. § 1.409A-1(b)(9)(iii), or (ii) in compliance with Section 409A, including, but not limited to, being paid pursuant to a fixed schedule or specified date pursuant to Treas. Reg. § 1.409A-3(a) and the provisions of this Agreement will be administered, interpreted and construed accordingly. Notwithstanding the foregoing provisions of this Agreement, if the payment of any compensation or benefits under this Agreement would be subject to additional taxes and interest under Section 409A because the timing of such payment is not delayed as provided in Section 409A(a)(2)(B)(i) of the Code, and Executive constitutes a specified employee within the meaning of Section 409A(a)(2)(B)(i) of the Code, then any such payments that Executive would otherwise be entitled to during the first six months following Executive’s separation from service within the meaning of Section 409A(a)(2)(A)(i) of the Code shall be accumulated and paid on the date that is six months after Executive’s separation from service (or if such payment date does not fall on a business day of the Company, the next following business day of the Company), or such earlier date upon which such amount can be paid under Section 409A without being subject to such additional taxes and interest.

| 8 |

B. All reimbursements pursuant to this Agreement shall be made in accordance with Treas. Reg. § 1.409A-3(i)(1)(iv) such that the reimbursements will be deemed payable at a specified time or on a fixed schedule relative to a permissible payment event. Specifically, the amounts reimbursed under this Agreement during the Executive’s taxable year may not affect the amounts reimbursed in any other taxable year (except that total reimbursements may be limited by a lifetime maximum under a group health plan), the reimbursement of an eligible expense shall be made on or before the last day of the Executive’s taxable year following the taxable year in which the expense was incurred, and the right to reimbursement is not subject to liquidation or exchange for another benefit.

19. Governing Law; Venue. This Agreement shall be construed and interpreted in accordance with the internal laws of the State of New York without regard to principles of conflicts of law thereof, or principles of conflicts of laws of any other jurisdiction that could cause the application of the laws of any jurisdiction other than the State of New York. For purposes of resolving any dispute that arises directly or indirectly from the relationship of the parties evidenced by this Agreement, the parties hereby submit to and consent to the exclusive jurisdiction of the State of New York and agree that any related litigation shall be conducted solely in the courts of New York County, New York or the federal courts for the United States for the Southern District of New York, where this Agreement is made and/or to be performed, and no other courts. Each Party may be served with process in any manner permitted under State of New York law, or by United States registered or certified mail, return receipt requested.

20. Waiver of Jury Trial. EACH OF THE EXECUTIVE AND THE COMPANY HEREBY VOLUNTARILY AND IRREVOCABLY WAIVES ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN ANY ACTION OR OTHER PROCEEDING BROUGHT IN CONNECTION WITH THIS AGREEMENT OR ANY OF THE TRANSACTIONS CONTEMPLATED HEREBY.

21. Terms. The term “affiliate” means any subsidiary, any officer, director or employee of the Company or any subsidiary, and any former officer, director or employee of the Company or any subsidiary.

22. Successor Obligations. The Company will require any successor (whether direct or indirect, by purchase, merger, consolidation or otherwise) to all or substantially all of the business and/or assets of the Company to assume expressly and agree to perform this Agreement in the same manner and to the same extent that the Company would be required to perform it if no such succession had taken place. As used in this Agreement, “Company” shall mean the Company as hereinbefore defined and any successor to its business and/or assets as aforesaid which assumes and agrees to perform this Agreement by operation of law, or otherwise.

[END OF PAGE]

| 9 |

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

| LILIS ENERGY, INC. | ||

| By: | /s/ Ronald D. Ormand | |

| Ronald D. Ormand | ||

| Executive Chairman of the Board | ||

| EXECUTIVE | ||

| /s/ Abraham Mirman | ||

| Abraham Mirman | ||

| 10 |

Exhibit A

Dated: August 4, 2017

WAIVER AND RELEASE

In exchange for the consideration (the “Separation Benefits”) offered under Section 2(B) through (F) the Separation and Consulting Agreement between me and Lilis Energy, Inc., dated August 3, 2017 (the “Separation Agreement”), which were offered to me in exchange for my agreement, among other things, to waive all of my claims against and release Lilis Energy, Inc. and its predecessors, successors and assigns (collectively referred to as the “Company”), all of the affiliates (including parents and subsidiaries) of the Company (collectively referred to as the “Affiliates”) and the Company’s and Affiliates’ directors and officers, employees and agents, insurers, employee benefit plans and the fiduciaries and agents of said plans (collectively, with the Company and Affiliates, referred to as the “Corporate Group”) from any and all claims, demands, actions, liabilities and damages arising out of or relating in any way to my employment with or separation from the Company or the Affiliates; provided, however, that this Waiver and Release shall not apply to (1) any existing right I have to indemnification, contribution and a defense, (2) any directors and officers and general liability insurance coverage, (3) any rights I may have as a shareholder of the Company and (4) any rights which cannot be waived or released as a matter of law.

I understand that signing this Waiver and Release is an important legal act. I acknowledge that the Company has advised me in writing to consult an attorney before signing this Waiver and Release and has given me at least 21 days from the day I received a copy of this Waiver and Release to sign it.

In exchange for the payment to me of the Separation Benefits, I, among other things, (1) agree not to sue in any local, state and/or federal court regarding or relating in any way to my employment with or separation from the Company or the Affiliates, (2) knowingly and voluntarily waive all claims and release the Corporate Group from any and all claims, demands, actions, liabilities, and damages, whether known or unknown, arising out of or relating in any way to my employment with or separation from the Company or the Affiliates and (3) waive any rights that I may have under any of the Company’s involuntary severance benefit plans, except to the extent that my rights are vested under the terms of employee benefit plans sponsored by the Company or the Affiliates and except with respect to such rights or claims as may arise after the date this Waiver and Release is executed. This Waiver and Release includes, but is not limited to, claims and causes of action under: Title VII of the Civil Rights Act of 1964, as amended (“Title VII”); the Age Discrimination in Employment Act of 1967, as amended, including the Older Workers Benefit Protection Act of 1990 (“ADEA”); the Civil Rights Act of 1866, as amended; the Civil Rights Act of 1991; the Americans with Disabilities Act of 1990 (“ADA”); the Energy Reorganization Act, as amended, 42 U.S.C. §§ 5851; the Workers Adjustment and Retraining Notification Act of 1988; the Sarbanes-Oxley Act of 2002; the Employee Retirement Income Security Act of 1974, as amended; the Family and Medical Leave Act of 1993; the Fair Labor Standards Act; the Occupational Safety and Health Act; claims in connection with workers’ compensation or “whistle blower” statutes; and/or contract, tort, defamation, slander, wrongful termination or any other state or federal regulatory, statutory or common law. Further, I expressly represent that no promise or agreement which is not expressed in the Separation Agreement has been made to me in executing this Waiver and Release, and that I am relying on my own judgment in executing this Waiver and Release, and that I am not relying on any statement or representation of the Company, any of the Affiliates or any other member of the Corporate Group or any of their agents. I agree that this Waiver and Release is valid, fair, adequate and reasonable, is entered into with my full knowledge and consent, was not procured through fraud, duress or mistake and has not had the effect of misleading, misinforming or failing to inform me.

| A-1 |

This release does not apply to any claims for unemployment compensation or any other claims or rights which, by law, cannot be waived, including the right to file an administrative charge or participate in an administrative investigation or proceeding; provided, however that I agree that I disclaim and waive any right to share or participate in any monetary award from the Company resulting from the prosecution of such charge or investigation or proceeding. Notwithstanding the foregoing or any other provision in this Waiver and Release or the Separation Agreement to the contrary, the Company and I further agree that nothing in this Waiver and Release or the Separation Agreement (i) limits my ability to file a charge or complaint with the EEOC, the NLRB, OSHA, the SEC or any other federal, state or local governmental agency or commission (each a “Government Agency” and collectively “Government Agencies”); (ii) limits my ability to communicate with any Government Agencies or otherwise participate in any investigation or proceeding that may be conducted by any Government Agency, including providing documents or other information and reporting possible violations of law or regulation or other disclosures protected under the whistleblower provisions of applicable law or regulation, without notice to the Company; or (iii) limits my right to receive an award for information provided to any Government Agencies.

Should any of the provisions set forth in this Waiver and Release be determined to be invalid by a court, agency or other tribunal of competent jurisdiction, it is agreed that such determination shall not affect the enforceability of other provisions of this Waiver and Release. I acknowledge that this Waiver and Release and the Agreement set forth the entire understanding and agreement between me and the Company or any other member of the Corporate Group concerning the subject matter of this Waiver and Release and supersede any prior or contemporaneous oral and/or written agreements or representations, if any, between me and the Company or any other member of the Corporate Group. I understand that for a period of 7 calendar days following the date that I sign this Waiver and Release, I may revoke my acceptance of the offer, provided that my written statement of revocation is received on or before that seventh day by the General Counsel, Lilis Energy, Inc., 300 E. Sonterra Blvd., Suite 1220, San Antonio, Texas 78258, email: afuchs@lilisenergy.com, in which case the Waiver and Release will not become effective. In the event I revoke my acceptance of this offer, the Company shall have no obligation to provide me the Separation Benefits. I understand that failure to revoke my acceptance of the offer within 7 calendar days from the date I sign this Waiver and Release will result in this Waiver and Release being permanent and irrevocable.

I acknowledge that I have read this Waiver and Release, have had an opportunity to ask questions and have it explained to me and that I understand that this Waiver and Release will have the effect of knowingly and voluntarily waiving any action I might pursue, including breach of contract, personal injury, retaliation, discrimination on the basis of race, age, sex, national origin, or disability and any other claims arising prior to the date of this Waiver and Release. By execution of this document, I do not waive or release or otherwise relinquish any legal rights I may have which are attributable to or arise out of acts, omissions, or events of the Company or any other member of the Corporate Group which occur after the date of the execution of this Waiver and Release.

| A-2 |

| Executive’s Signature | Ronald D. Ormand | |

| Executive Chairman of the Board | ||

| Executive’s Signature Date | Company’s Execution Date |

| A-3 |

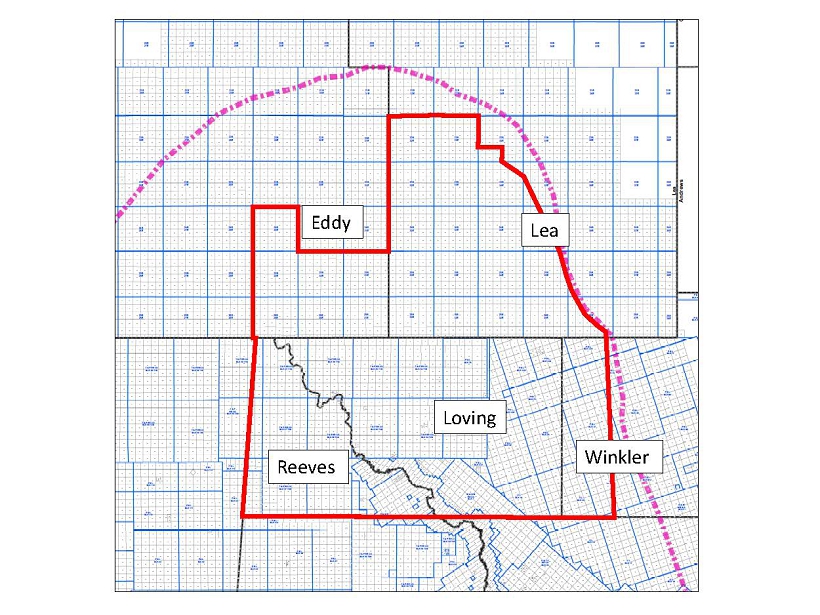

Exhibit B

AREAS OF INTEREST

B-1 |