Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - STORE CAPITAL Corp | s001810x1_ex99-1.htm |

| 8-K - FORM 8-K - STORE CAPITAL Corp | s001810x1_8k.htm |

Exhibit 99.2

SINGLE | TENANT | OPERATIONAL | REAL | ESTATE NYSE: STORir.storecapital.com 2Q17 Supplemental InformationAugust 3, 2017

STORE is Single Tenant Operational Real Estate 2 STORE is a Growth REIT addressing a Large Market 3 Financial Condensed Consolidated Statements of Income 4 Funds from Operations and Adjusted Funds from Operations 5 Condensed Consolidated Balance Sheets 6 Adjusted Debt to Adjusted EBITDA 7 Debt Summary and Maturities 8 Portfolio Portfolio At A Glance 9 Portfolio Contract Quality 10 Diversification Across Customers and Concepts 11 Diversification Across Industry Groups 12 Diversification Across Geographies 14 Contract Expirations and Occupancy 15 Rent Escalations 16 2017 Guidance 17 Definitions and Footnotes 18 Supplemental Reporting Measures 19 Forward-Looking Statements 21 This Supplemental Information should be read together with the Company’s second quarter 2017 earnings press release (included as Exhibit 99.1 of the Company’s current report on Form 8-K, filed on August 3, 2017) as certain disclosures, definitions and reconciliations in such release have not been included in this Supplemental Information. 1 Table of Contents

STORE is Single Tenant Operational Real Estate About STORE CapitalSTORE Capital Corporation is an internally managed net-lease real estate investment trust, or REIT, that is the leader in the acquisition, investment and management of Single Tenant Operational Real Estate, or STORE Properties, which is our target market and the inspiration for our name. STORE continues the investment activities of our senior leadership team, which has been investing in single-tenant operational, or profit-center, real estate for over three decades. We are one of the largest and fastest growing net-lease REITs and own a large, well-diversified portfolio that consists of investments in 1,770 property locations aggregating $5.5 billion in gross investment dollars at June 30, 2017. Our customers operate across a wide variety of industries within the service, retail and manufacturing sectors of the U.S. economy, with restaurants, early childhood education centers, furniture stores, movie theaters and health clubs representing the top industries in our portfolio. We estimate the market for STORE Properties to be among the nation’s largest real estate sectors, exceeding $2.6 trillion in market value and including more than 1.6 million properties. For more information about STORE Capital, please visit our website at www.storecapital.com. What We DoWe were formed to fill the needs of thousands of middle market and larger companies for efficient long-term capital for their profit-center real estate. In addressing this large market, we have maintained a significant investment pipeline of targeted investment opportunities since the day we opened our doors. These opportunities allow us to be selective, choosing strong tenants and investments that offer attractive risk-adjusted returns. STORE Senior Leadership TeamChristopher H. Volk, President, Chief Executive Officer & DirectorMary Fedewa, Executive Vice President – Acquisitions & DirectorCatherine Long, Executive Vice President, Chief Financial Officer & TreasurerMichael T. Bennett, Executive Vice President and General CounselChristopher K. Burbach, Executive Vice President – UnderwritingMichael J. Zieg, Executive Vice President – Portfolio Management Common Stock Our common stock is traded on the New York Stock Exchange under the symbol “STOR”Closing price on June 30, 2017: $22.45Corporate Headquarters8377 East Hartford Drive, Suite 100Scottsdale, Arizona 85255480.256.1100 2

STORE is a Growth REIT addressing a Large Market TOTAL TARGET MARKET SIZE ($2.6 TRILLION) KEY GROWTH DRIVERS We Create DemandWe create stockholder value through more than real estate aggregation. We originate approximately 80% of our real estate investments through direct customer relationships, which offer both our customers and investors superior value. Further, 92% of our contracts were created by us or contain our preferred contract terms.We are Scalable in our OperationsAs we grow, we expect the cost to manage our portfolio to decline as a percentage of investment value. We built STORE with highly efficient systems to enable this operating leverage. We Have an Efficient Capital StructureOur financial flexibility starts with balanced access to multiple debt markets. We use senior unsecured investment-grade debt as an ideal complement to the A+ rated long-term mortgage notes in a program we call STORE Master Funding. These long-term debt strategies, along with our short-term unsecured borrowing capacity and over $2.5 billion in unencumbered assets, provide us with access to long-term, low-cost capital. MARKET OVERVIEW The market for STORE Properties exceeds $2.6 trillion in market value and includes more than 1.6 million properties. Despite the market's size, the financing marketplace for STORE Properties is highly fragmented, with few participants addressing the long-term capital needs of middle market and larger nonrated companies. 3

Condensed Consolidated Statements of Income 4 Three Months Ended Six Months Ended June 30, June 30, $ thousands, except share and per share data 2017 2016 2017 2016 Revenues: (unaudited) (unaudited) Rental revenues $ 108,149 $ 87,140 $ 210,054 $ 167,907 Interest income on loans and direct financing receivables 5,447 4,663 11,227 9,078 Other income 612 167 898 219 Total revenues 114,208 91,970 222,179 177,204 Expenses: Interest 30,919 25,871 60,559 49,306 Transaction costs - 101 - 335 Property costs 1,131 1,226 1,937 1,712 General and administrative 9,289 8,545 19,532 17,136 Selling stockholder costs - - - 800 Depreciation and amortization 37,396 29,035 72,611 55,514 Provision for impairment of real estate - - 4,270 - Total expenses 78,735 64,778 158,909 124,803 Income from operations before income taxes 35,473 27,192 63,270 52,401 Income tax expense 147 90 253 159 Income before gain on dispositions of real estate 35,326 27,102 63,017 52,242 Gain on dispositions of real estate 25,734 3,147 29,433 2,800 Net income $ 61,060 $ 30,249 $ 92,450 $ 55,042 Net income per share of common stock - basic and diluted $ 0.35 $ 0.21 $ 0.55 $ 0.38 Dividends declared per common share $ 0.29 $ 0.27 $ 0.58 $ 0.54 Weighted average common shares outstanding – basic 172,661,739 145,903,881 166,768,835 143,129,012 Weighted average common share outstanding – diluted 172,661,739 146,116,422 166,768,835 143,348,134

Funds From Operations and Adjusted Funds from Operations1 Three Months Ended Six Months Ended June 30, June 30, $ thousands, except per share data 2017 2016 2017 2016 (unaudited) (unaudited) Net Income $ 61,060 $ 30,249 $ 92,450 $ 55,042 Depreciation and amortization of real estate assets 37,227 28,908 72,301 55,280 Provision for impairment of real estate - - 4,270 - Gain on dispositions of real estate (25,734 ) (3,147 ) (29,433 ) (2,800 ) Funds From Operations (FFO) $ 72,553 $ 56,010 $ 139,588 $ 107,522 Adjustments: Straight-line rental revenue, net (622 ) (1,115 ) (1,777 ) (1,585 ) Transaction costs - 101 - 335 Amortization of: Equity-based compensation 1,994 1,762 3,868 3,423 Deferred financing costs and other noncash interest expense 2,081 1,791 4,090 3,487 Lease-related intangibles and costs 422 489 617 903 Selling stockholder costs - - - 800 Adjusted Funds From Operations (AFFO) $ 76,428 $ 59,038 $ 146,386 $ 114,885 Net Income per share of common stock - basic and diluted2 $ 0.35 $ 0.21 $ 0.55 $ 0.38 FFO per share of common stock – basic and diluted2 $ 0.42 $ 0.38 $ 0.84 $ 0.75 AFFO per share of common stock – basic and diluted2 $ 0.44 $ 0.40 $ 0.88 $ 0.80 1 See page 19 for discussion regarding use of Funds From Operations and Adjusted Funds from Operations.2 Under the two-class method, earnings attributable to unvested restricted stock are deducted from earnings in the computation of per share amounts where applicable. 5

Condensed Consolidated Balance Sheets $ thousands, except share and per share data June 30, 2017 December 31, 2016 (unaudited) (audited) Assets Investments: Real estate investments: Land and improvements $ 1,663,864 $ 1,536,178 Buildings and improvements 3,522,055 3,226,791 Intangible lease assets 89,190 92,337 Total real estate investments 5,275,109 4,855,306 Less accumulated depreciation and amortization (357,426 ) (298,984 ) 4,917,683 4,556,322 Real estate investments held for sale, net 4,255 - Loans and direct financing receivables 267,958 269,210 Net investments 5,189,896 4,825,532 Cash and cash equivalents 468,510 54,200 Other assets, net 77,984 61,936 Total assets $ 5,736,390 $ 4,941,668 Liabilities and stockholders' equity Liabilities: Credit facility $ - $ 48,000 Unsecured notes and term loans payable, net 570,157 470,190 Non-recourse debt obligations of consolidated special purpose entities, net 1,943,058 1,833,481 Dividends payable 55,105 46,209 Accounts payable, accrued expenses and other liabilities 46,615 60,533 Total liabilities 2,614,935 2,458,413 Stockholders' equity: Common stock, $0.01 par value per share, 375,000,000 shares authorized, 190,017,089 and 159,341,955 shares issued and outstanding, respectively 1,900 1,593 Capital in excess of par 3,282,434 2,631,845 Distributions in excess of retained earnings (164,353 ) (151,592 ) Accumulated other comprehensive income 1,474 1,409 Total stockholders' equity 3,121,455 2,483,255 Total liabilities and stockholders' equity $ 5,736,390 $ 4,941,668 6

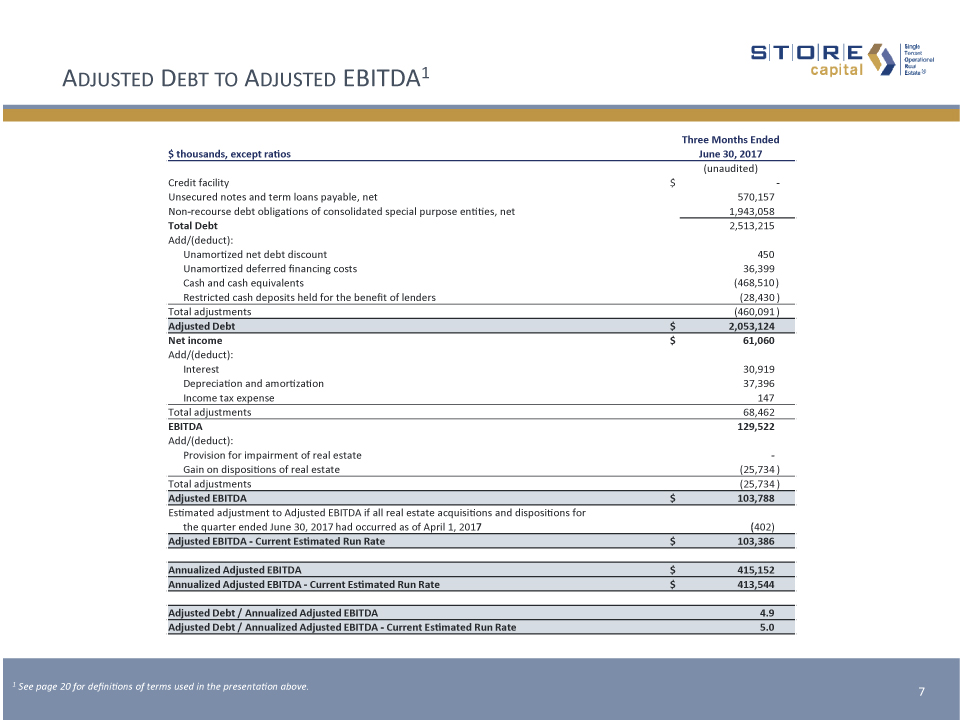

Adjusted Debt to Adjusted EBITDA1 Three Months Ended $ thousands, except ratios June 30, 2017 (unaudited) Credit facility $ - Unsecured notes and term loans payable, net 570,157 Non-recourse debt obligations of consolidated special purpose entities, net 1,943,058 Total Debt 2,513,215 Add/(deduct): Unamortized net debt discount 450 Unamortized deferred financing costs 36,399 Cash and cash equivalents (468,510 ) Restricted cash deposits held for the benefit of lenders (28,430 ) Total adjustments (460,091 ) Adjusted Debt $ 2,053,124 Net income $ 61,060 Add/(deduct): Interest 30,919 Depreciation and amortization 37,396 Income tax expense 147 Total adjustments 68,462 EBITDA 129,522 Add/(deduct): Provision for impairment of real estate - Gain on dispositions of real estate (25,734 ) Total adjustments (25,734 ) Adjusted EBITDA $ 103,788 Estimated adjustment to Adjusted EBITDA if all real estate acquisitions and dispositions for the quarter ended June 30, 2017 had occurred as of April 1, 2017 (402) Adjusted EBITDA - Current Estimated Run Rate $ 103,386 Annualized Adjusted EBITDA $ 415,152 Annualized Adjusted EBITDA - Current Estimated Run Rate $ 413,544 Adjusted Debt / Annualized Adjusted EBITDA 4.9 Adjusted Debt / Annualized Adjusted EBITDA - Current Estimated Run Rate 5.0 1 See page 20 for definitions of terms used in the presentation above. 7

Debt Summary and Maturities 8 Debt summary $ millions Weighted Average Interest Rate Expiration/ Maturity Date Outstanding Borrowings Gross Investment Amount of Collateral $500MM unsecured credit facility LIBOR + spread Sept. 2019 $ - - Total short-term debt - - Unsecured notes and term loans payable 4.15% 2019 to 2026 575 - STORE Master Funding net-lease mortgage notes payable 4.54% 2019 to 2027 1,741 2,510 Other mortgage notes payable 4.88% 2018 to 2038 234 399 Total long-term debt 4.49% 2,550 2,909 Unencumbered real estate assets 2,639 Totals $ 2,550 5,548 Debt maturities store master funding S&P rated A+Dedicated asset-backed securities conduitNon-recourse with minimal covenants Moody’s rated Baa2, stable outlookS&P and Fitch Ratings rated BBB-, positive outlookEnhances capital efficiency * Represents the weighted average interest rate on balloon payments due in the respective years. unsecured term borrowings

* Based on annualized base rent and interest.Note: See page 18 for the definitions and numerical footnotes referenced. Portfolio at a Glance 6/30/17 6/30/16 Investment property locations 1,770 1,508 States 48 48 Customers 371 331 Industries in which our customers operate 102 95 Proportion of portfolio from direct origination ~80% ~75% Contracts with STORE-preferred terms*1 92% 90% Weighted average annual lease escalation2 1.8% 1.7% Weighted average remaining lease contract term ~14 years ~14 years Occupancy3 99.5% 99.8% Properties not operating but subject to a lease4 13 7 Investment locations subject to a ground lease 18 15 Investment portfolio subject to NNN leases* 97% 97% Investment portfolio subject to Master Leases*5 86% 80% Average investment amount / replacement cost (new)6 82% 82% Locations subject to unit-level financial reporting 97% 97% Median unit FCCR / 4-wall FCCR7 2.1x / 2.6x 2.2x / 2.6x Contracts rated investment grade8 ~75% ~75% 9

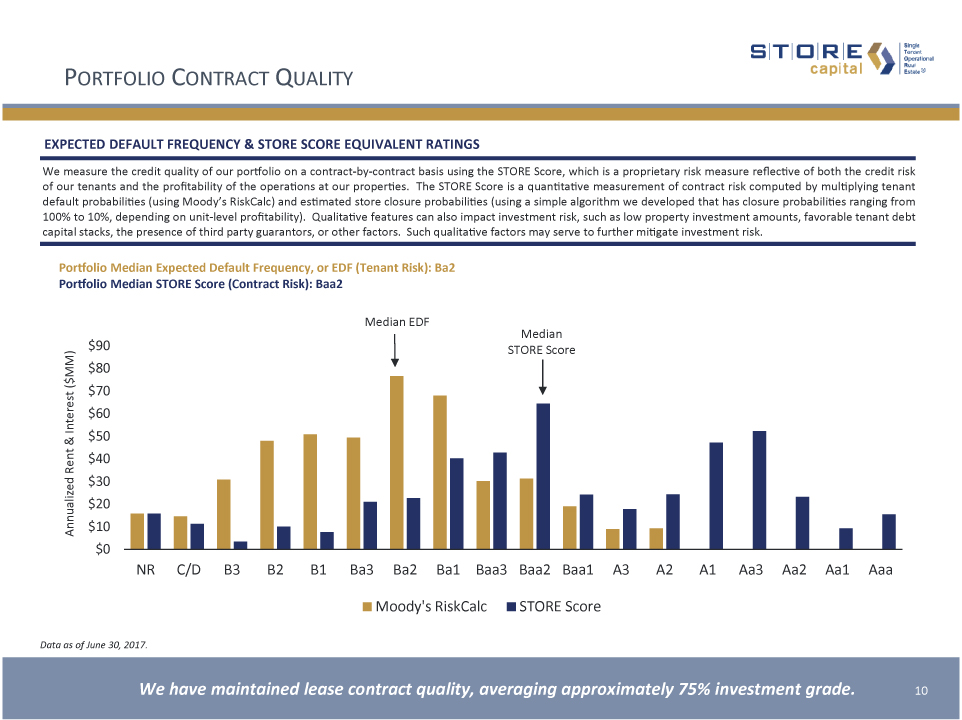

Portfolio Contract Quality Expected default frequency & STORE score equivalent Ratings We measure the credit quality of our portfolio on a contract-by-contract basis using the STORE Score, which is a proprietary risk measure reflective of both the credit risk of our tenants and the profitability of the operations at our properties. The STORE Score is a quantitative measurement of contract risk computed by multiplying tenant default probabilities (using Moody’s RiskCalc) and estimated store closure probabilities (using a simple algorithm we developed that has closure probabilities ranging from 100% to 10%, depending on unit-level profitability). Qualitative features can also impact investment risk, such as low property investment amounts, favorable tenant debt capital stacks, the presence of third party guarantors, or other factors. Such qualitative factors may serve to further mitigate investment risk. We have maintained lease contract quality, averaging approximately 75% investment grade. 10 Data as of June 30, 2017.

Diversification Across Customers and Concepts Total Customer Revenues1,2 Top Ten Concepts Customer Business Concept % Base Rent and Interest1 # of Properties Art Van Furniture 3.1% 17 Ashley Furniture HomeStore 2.9% 25 Applebee’s 2.0% 47 Mills Fleet Farm 2.0% 6 Gander Mountain 1.9% 12 Popeyes Louisiana Kitchen 1.5% 63 Starplex Cinemas 1.4% 8 O’Charley’s 1.3% 30 Stratford School 1.1% 4 Sonic Drive-in 1.1% 58 Top Ten Concepts 18.3% 270 All other (438 concepts) 81.7% 1,500 Total 100.0% 1,770 11 1 Shown as of June 30, 2017 by % of annualized base rent and interest (annualized based on rates in effect on June 30, 2017, for all leases, loans and direct financing receivables in place as of that date).2 Excludes customers, representing approximately 3.9% of annualized base rent and interest, that do not report corporate revenues. Median: $47.0M | Weighted average: $704.9M % Of Total Rent & Interest $5 -$20M $20 -$50M $50 -$200M <$5M $200 -$500M $500M -$1B >$1B Top Ten Customers Customer % Base Rent and Interest1 # of Properties AVF Parent 3.1% 17 American Multi-Cinema 2.4% 15 Cadence Education 2.1% 32 Mills Fleet Farm 2.0% 6 Gander Mountain 1.9% 12 RMH Franchise Holdings 1.5% 33 O’Charley’s 1.3% 30 Automotive Remarketing Group 1.2% 6 Stratford School 1.1% 4 FreedomRoads 1.0% 8 Top Ten Customers 17.6% 163 All other (361 customers) 82.4% 1,607 Total 100.0% 1,770

Diversification Across Industry Groups 12 1 Shown as of June 30, 2017 by % of annualized base rent and interest (annualized based on rates in effect on June 30, 2017, for all leases, loans and direct financing receivables in place as of that date). 86% of Portfolio is in Customer-Facing Industries Located near target customers Not readily available onlineBroad array of everyday services Located in retail corridorsInternet resistantHigh experiential component service retail manufacturing Primarily located in industrial parksStrategically near customers/suppliersBroad array of industriesMaking everyday necessities Customer Industry Group % Base Rent and Interest1 # of Properties BuildingSq. Ft.(thousands) Restaurants – full service 13.7% 342 2,375 Restaurants – limited service 7.9% 395 1,046 Early childhood education 7.1% 172 1,889 Movie theaters 6.6% 39 1,873 Health clubs 5.6% 61 1,723 Family entertainment 3.8% 23 822 Pet care 2.9% 95 1,056 Automotive repair and maintenance 2.7% 85 406 Career education 2.1% 7 584 Behavioral health 1.9% 35 472 Medical and dental 1.5% 28 272 Elementary and secondary schools 1.5% 7 256 Equipment sales and leasing 1.5% 17 543 Lumber wholesalers 1.4% 33 1,394 Wholesale automobile auction 1.2% 6 223 Consumer goods rental 1.1% 39 537 All other service (22 industry groups) 6.6% 74 4,272 Total service 69.1% 1,458 19,743 As of June 30, 2017, our portfolio is diversified across 102 different industries in the service, retail and manufacturing sectors of the U.S. economy. We group these industries into 74 different industry groups as shown in the following tables.

Diversification Across Industry Groups (continued) 13 1 Shown as of June 30, 2017 by % of annualized base rent and interest (annualized based on rates in effect on June 30, 2017, for all leases, loans and direct financing receivables in place as of that date). Customer Industry Group % Base Rent and Interest1 # of Properties Building Sq. Ft.(thousands) Furniture 6.7% 49 3,096 Farm and ranch supply 3.2% 22 1,859 Hunting and fishing 1.9% 13 814 Recreational vehicle dealers 1.1% 8 222 Home furnishings 1.0% 5 691 Electronics and appliances 0.8% 7 331 Used car dealers 0.6% 11 138 Grocery 0.5% 12 524 All other retail (8 industry groups) 1.6% 33 1,220 Total retail 17.4% 160 8,895 Customer Industry Group % Base Rent and Interest1 # of Properties Building Sq. Ft.(thousands) Metal fabrication 3.5% 47 4,512 Plastic and rubber products 2.8% 27 3,299 Medical and pharmaceutical 0.9% 6 431 Electronics equipment 0.8% 5 619 Paper and packaging 0.8% 6 969 Food processing 0.6% 4 396 Chemical products 0.6% 7 631 All other manufacturing (13 industry groups) 3.5% 50 4,241 Total manufacturing 13.5% 152 15,098 Total Portfolio 100.0% 1,770 43,736 Service(69%) Retail(17%) Manufacturing(14%)

Diversification Across Geographies* 14 * Shown as of June 30, 2017 by % of annualized base rent and interest (annualized based on rates in effect on June 30, 2017, for all leases, loans and direct financing receivables in place as of that date).

Contract Expirations and Occupancy CONTRACT EXPIRATIONS1 - by year of lease expiration or loan maturity As of June 30, 2017, leases and loans representing approximately 11% of annualized base rent and interest will expire within the next ten years (before 2027). Approximately 99% of our leases, based on annualized base rent, provide for tenant renewal options; typically, there are two to four five-year option periods in our leases. OCCUPANCY2 15 1 Shown as of June 30, 2017 by % of annualized base rent and interest (annualized based on rates in effect on June 30, 2017, for all leases, loans and direct financing receivables in place as of that date).2 See definition of Occupancy on page 18.

Rent Escalations FREQUENT RENT ESCALATIONS PROVIDE A MEASURE OF INFLATION PROTECTION AND A STRONG POTENTIAL SOURCE OF INTERNAL GROWTH Lease Escalation Frequency % Base Rent and Interest1 Weighted Average Annual Escalation Rate 1,2 Annually 68% 1.8% Every 5 years 27% 1.8% Other escalation frequencies 3% 2.2% Flat 2% NA Total / Weighted Average 100% 1.8% At June 30, 2017, approximately 68% of our leases provided for annual escalations, which is more frequent than is usually the case in the net lease real estate auction marketplace. The majority of our other leases provided for payment escalation every five years. 16 1 Shown as of June 30, 2017 by % of annualized base rent and interest (annualized based on rates in effect on June 30, 2017, for all leases, loans and direct financing receivables in place as of that date). Excludes contracts representing less than 0.2% of annualized base rent and interest where there are no further escalations remaining in the current lease term and there are no extension options.2 Represents the weighted average annual escalation rate of the entire portfolio as if all escalations occurred annually. For escalations based on a formula including CPI, assumes the stated fixed percentage in the contract or assumes 1.5% if no fixed percentage is in the contract. For contracts with no escalations remaining in the current lease term, assumes the escalation in the extension term.

2017 Guidance 2017 Guidance Net income per share (excluding gains or losses on sales of property) $0.79 - $0.80 Depreciation and amortization of real estate assets per share $0.82 - $0.83 FFO per share $1.61 - $1.63 Straight-line rent and other amortization adjustments per share $0.08 AFFO per share1 $1.69 - $1.71 Estimated run-rate funded debt / adjusted EBITDA2 5.5x – 6.0x Real estate acquisition volume, net of projected property sales in the range of $200 million to $300 million ~$900 million Weighted average cap rate on new acquisitions 7.75% 1 AFFO per share is sensitive to the timing and amount of real estate acquisitions and capital markets activities during the year, as well as to the spread achieved between the lease rates on new acquisitions and the interest rates on borrowings used to finance those acquisitions. See page 19 for further discussion regarding use of FFO and AFFO.2 See page 20 for the definition of Adjusted EBITDA. 17

Definitions and Footnotes 18 See Page 91 Represents the percentage of our lease contracts that were created by S|T|O|R|E or contain preferred contract terms such as unit-level financial reporting, triple-net lease provisions and, when applicable, master lease provisions.2 Weighted average annual lease escalation represents the weighted average annual escalation rate of the entire portfolio as if all escalations occurred annually. For escalations based on a formula including CPI, assumes the stated fixed percentage in the contract orassumes 1.5% if no fixed percentage is in the contract. For contracts with no escalations remaining in the current lease term, assumes the escalation in the extension term. Calculation excludes contracts representing less than 0.2% of annualized base rent and interest where there are no further escalations remaining in the current lease term and there are no extension options.3 S|T|O|R|E defines occupancy as a property being subject to a lease or loan contract. 4 The number of properties not currently operating but subject to a lease represents the number of our investment locations that have been closed by the tenant but remain subject to a lease. 5 The percentage of investment portfolio subject to master leases represents the percentage of the investment portfolio in multiple properties with a single customer subject to master leases. Based on annualized base rent and interest, 83% of the investment portfolio involves multiple properties with a single customer, whether or not subject to a master lease.6 The average investment amount/replacement cost (new) represents the ratio of purchase price to replacement cost (new) at acquisition.7 S|T|O|R|E calculates unit fixed charge coverage ratio generally as the ratio of (i) the unit’s EBITDAR, less a standardized corporate overhead expense based on estimated industry standards, to (ii) the unit’s total fixed charges, which are its lease expense, interest expense and scheduled principal payments on indebtedness. The 4-Wall coverage ratio refers to a unit’s FCCR before taking into account standardized corporate overhead expense.8 The proportion of investment contracts rated investment grade represents the percentage of our contracts that have a STORE Score that is investment grade. We measure the credit quality of our portfolio on a contract-by-contract basis using the STORE Score, which is a risk measure reflective of both the credit risk of our tenants and the profitability of the operations at the properties.

Supplemental Reporting Measures Funds from Operations, or FFO, and Adjusted Funds from Operations, or AFFO Our reported results are presented in accordance with U.S. generally accepted accounting principles, or GAAP. We also disclose Funds from Operations, or FFO, and Adjusted Funds from Operations, or AFFO, both of which are non‑GAAP measures. We believe these two non‑GAAP financial measures are useful to investors because they are widely accepted industry measures used by analysts and investors to compare the operating performance of REITs. FFO and AFFO do not represent cash generated from operating activities and are not necessarily indicative of cash available to fund cash requirements; accordingly, they should not be considered alternatives to net income as a performance measure or to cash flows from operations as reported on a statement of cash flows as a liquidity measure and should be considered in addition to, and not in lieu of, GAAP financial measures. We compute FFO in accordance with the definition adopted by the Board of Governors of the National Association of Real Estate Investment Trusts, or NAREIT. NAREIT defines FFO as GAAP net income, excluding gains (or losses) from extraordinary items and sales of depreciable property, real estate impairment losses and depreciation and amortization expense from real estate assets, including the pro rata share of such adjustments of unconsolidated subsidiaries. To derive AFFO, we modify the NAREIT computation of FFO to include other adjustments to GAAP net income related to certain non‑cash revenues and expenses that have no impact on our long-term operating performance, such as straight‑line rents, amortization of deferred financing costs and stock‑based compensation. In addition, in deriving AFFO, we exclude certain other costs not related to ongoing operations, such as the amortization of lease-related intangibles and, historically, transaction costs associated with acquiring real estate subject to existing leases. FFO is used by management, investors and analysts to facilitate meaningful comparisons of operating performance between periods and among our peers primarily because it excludes the effect of real estate depreciation and amortization and net gains on sales, which are based on historical costs and implicitly assume that the value of real estate diminishes predictably over time, rather than fluctuating based on existing market conditions. Management believes that AFFO provides more useful information to investors and analysts because it modifies FFO to exclude certain additional non-cash revenues and expenses such as straight‑line rents, amortization of deferred financing costs and stock‑based compensation as such items may cause short-term fluctuations in net income but have no impact on long-term operating performance. Additionally, in deriving AFFO, we exclude certain other costs, such as the amortization of lease-related intangibles and, historically, transaction costs associated with acquiring real estate subject to existing leases. We believe that these costs are not an ongoing cost of the portfolio in place at the end of each reporting period and, for these reasons, we add back the portion expensed when computing AFFO. Similarly, in 2016 we excluded the offering expenses incurred on behalf of our selling stockholder, STORE Holding, when it exited all of its holdings of STORE Capital common stock, as those costs are not related to our ongoing operations. As a result, we believe AFFO to be a more meaningful measurement of ongoing performance that allows for greater performance comparability. Therefore, we disclose both FFO and AFFO and reconcile them to the most appropriate GAAP performance metric, which is net income. STORE Capital’s FFO and AFFO may not be comparable to similarly titled measures employed by other companies. 19

Supplemental Reporting Measures We believe that presenting supplemental reporting measures, or non-GAAP measures, such as EBITDA and Adjusted EBITDA, is useful to investors and analysts because it provides important information concerning our operating performance exclusive of certain non-cash and other costs. These non-GAAP measures have limitations as they do not include all items of income and expense that affect operations. Accordingly, they should not be considered alternatives to net income as a performance measure and should be considered in addition to, and not in lieu of, GAAP financial measures. Our presentation of such non-GAAP measures may not be comparable to similarly titled measures employed by other companies. The following is a summary of the primary inputs into our presentation of these measures. EBITDA, Adjusted EBITDA, Annualized Adjusted EBITDA and Adjusted DebtEBITDA represents earnings before interest, taxes, depreciation and amortization.Adjusted EBITDA represents EBITDA modified to include other adjustments to GAAP net income for transaction costs, non-cash impairment charges, gains/losses on dispositions of real estate and certain other expenses not related to our ongoing operations.Annualized Adjusted EBITDA is calculated by multiplying Adjusted EBITDA for the quarter by four. Annualized Adjusted EBITDA – Current Estimated Run Rate is calculated based on an estimated Adjusted EBITDA as if all leases and loans in place as of June 30, 2017 had been in place as of April 1, 2017; then annualizing the Adjusted EBITDA for the quarter by multiplying it by four. You should not unduly rely on this metric as it is based on several assumptions and estimates that may prove to be inaccurate. Our actual reported Adjusted EBITDA for future periods may be significantly less than that implied by our reported Annualized Adjusted EBITDA – Current Estimated Run Rate for a variety of reasons. Adjusted Debt represents our outstanding debt obligations excluding unamortized deferred financing costs and net debt premium, further reduced for cash and cash equivalents and restricted cash deposits held for the benefit of lenders. We believe excluding unamortized deferred financing costs and net debt premium, cash and cash equivalents and restricted cash deposits held for the benefit of lenders provides an estimate of the net contractual amount of borrowed capital to be repaid, which we believe is a beneficial disclosure to investors and analysts. Adjusted Debt to Annualized Adjusted EBITDA Adjusted Debt to Annualized Adjusted EBITDA, or leverage, is a supplemental non-GAAP financial measure we use to evaluate the level of borrowed capital being used to increase the potential return of our real estate investments. We calculate leverage by dividing Adjusted Debt by Annualized Adjusted EBITDA. Because our portfolio growth level is significant to the overall size of the Company, we believe that presenting this leverage metric on a run rate basis is more meaningful than presenting the metric for the historical quarterly period, and we refer to this metric as Adjusted Debt to Annualized Adjusted EBITDA—Current Estimated Run Rate. Leverage should be considered as a supplemental measure of the level of risk to which stockholder value may be exposed. Our computation of leverage may differ from the methodology employed by other companies and, therefore, may not be comparable to other measures. 20

21 Forward-Looking StatementsCertain statements contained in this document that are not historical facts contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to the “safe harbor” created by those sections. Forward-looking statements can be identified by the use of words such as "estimate," "anticipate," "expect," "believe," "intend," "may," "will," "should," "seek," "approximate" or "plan," or the negative of these words and phrases or similar words or phrases. Forward-looking statements, by their nature, involve estimates, projections, goals, forecasts and assumptions and are subject to risks and uncertainties that could cause actual results or outcomes to differ materially from those expressed in the forward-looking statements. For more information on risk factors for our business, please refer to the periodic reports we file with the Securities and Exchange Commission from time to time. These forward-looking statements herein speak only as of the date of this document and should not be relied upon as predictions of future events. STORE Capital expressly disclaims any obligation or undertaking to update or revise any forward-looking statements contained herein, to reflect any change in STORE Capital’s expectations with regard thereto, or any other change in events, conditions or circumstances on which any such statement is based, except as required by law. Forward-Looking Statements Investor and Media Contacts:Financial Profiles, Inc.Moira Conlon, (310) 622-8220Tricia Ross, (310) 622-8226STORECapital@finprofiles.com