Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Prestige Consumer Healthcare Inc. | exhibit991fy18-q1earningsr.htm |

| 8-K - 8-K - Prestige Consumer Healthcare Inc. | a8-kpressreleasejune302017.htm |

Exhibit 99.2

This presentation contains certain “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, such

as statements regarding the Company’s expected financial performance, including revenue growth, adjusted EPS, and adjusted free cash flow;

the Company’s expected leverage; the Company’s focus on brand-building, supply chain and product development initiatives; and the ability to

achieve synergies from the Fleet acquisition. Words such as “trend,” “continue,” “will,” “expect,” “project,” “anticipate,” “likely,” “estimate,” “may,”

“should,” “could,” “would,” and similar expressions identify forward-looking statements. Such forward-looking statements represent the

Company’s expectations and beliefs and involve a number of known and unknown risks, uncertainties and other factors that may cause actual

results to differ materially from those expressed or implied by such forward-looking statements. These factors include, among others, general

economic and business conditions, regulatory matters, competitive pressures, difficulties successfully integrating the Fleet brands, manufacturing

facility and R&D resources, supplier issues, unexpected costs or liabilities, and other risks set forth in Part I, Item 1A. Risk Factors in the Company’s

Annual Report on Form 10-K for the year ended March 31, 2017. You are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date this presentation. Except to the extent required by applicable law, the Company undertakes no

obligation to update any forward-looking statement contained in this presentation, whether as a result of new information, future events, or

otherwise.

All adjusted GAAP numbers presented are footnoted and reconciled to their closest GAAP measurement in the attached reconciliation schedule

or in our earnings release in the “About Non-GAAP Financial Measures” section.

Q1 Revenue of $256.6 million, up 22.4% versus prior year Q1

Revenue growth of 3.0%(1) pro forma for the Fleet acquisition

Excluding Fleet, organic Revenue growth of 2.0%(1) (ex-Fx)

Gross margin slightly ahead of expectations

Adjusted EPS of $0.66(2), up 11.9% versus prior year Q1

Continued solid Adjusted Free Cash Flow of $56.5 million(2), resulting in leverage of 5.6x(3)

Fleet integration largely completed

Fleet business performance in-line with expectations

FY 18 priorities include brand building and supply chain opportunities

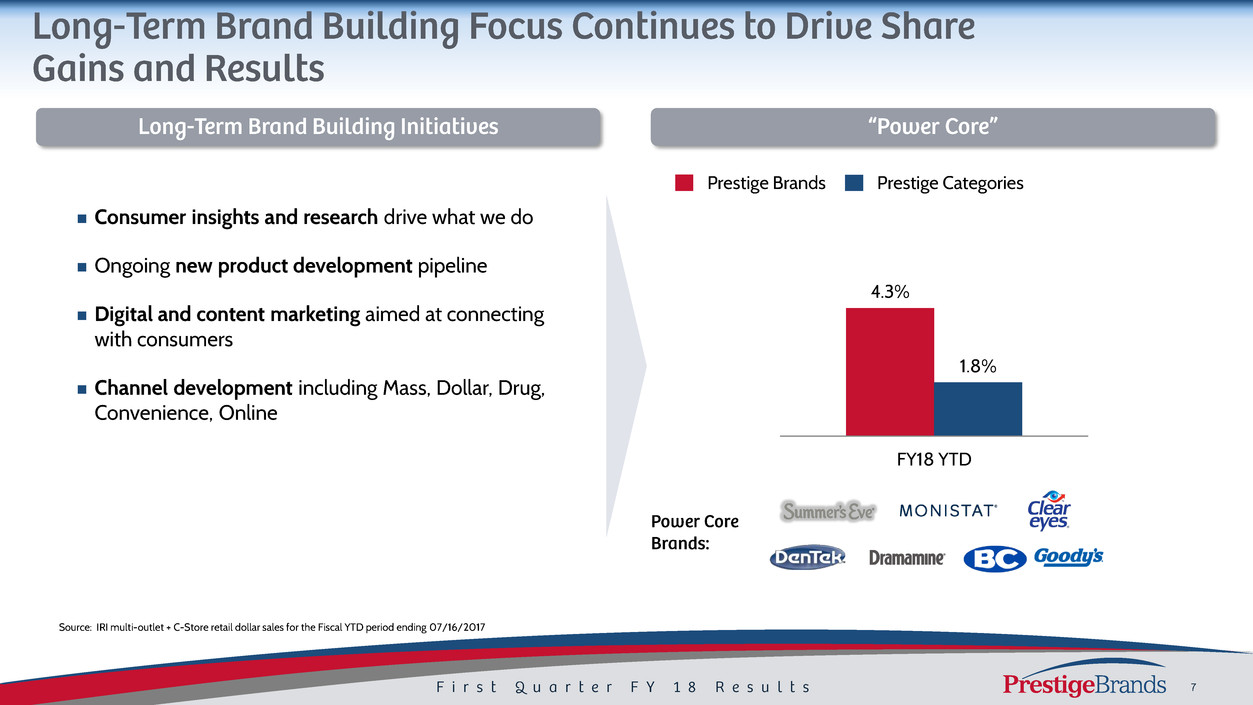

4.3%

1.8%

FY18 YTD

Prestige Brands Prestige Categories

Source: IRI multi-outlet + C-Store retail dollar sales for the Fiscal YTD period ending 07/16/2017

Consumer insights and research drive what we do

Ongoing new product development pipeline

Digital and content marketing aimed at connecting

with consumers

Channel development including Mass, Dollar, Drug,

Convenience, Online

Source: IRI MULO through latest period

Connecting with a new generation of consumers

Target is sensory oriented consumer: Flavors, Colors, Music

Experiential, lifestyle, and entertainment focused

Collaborative flavor development

Mass

Dollar

Club

Drug

Convenience

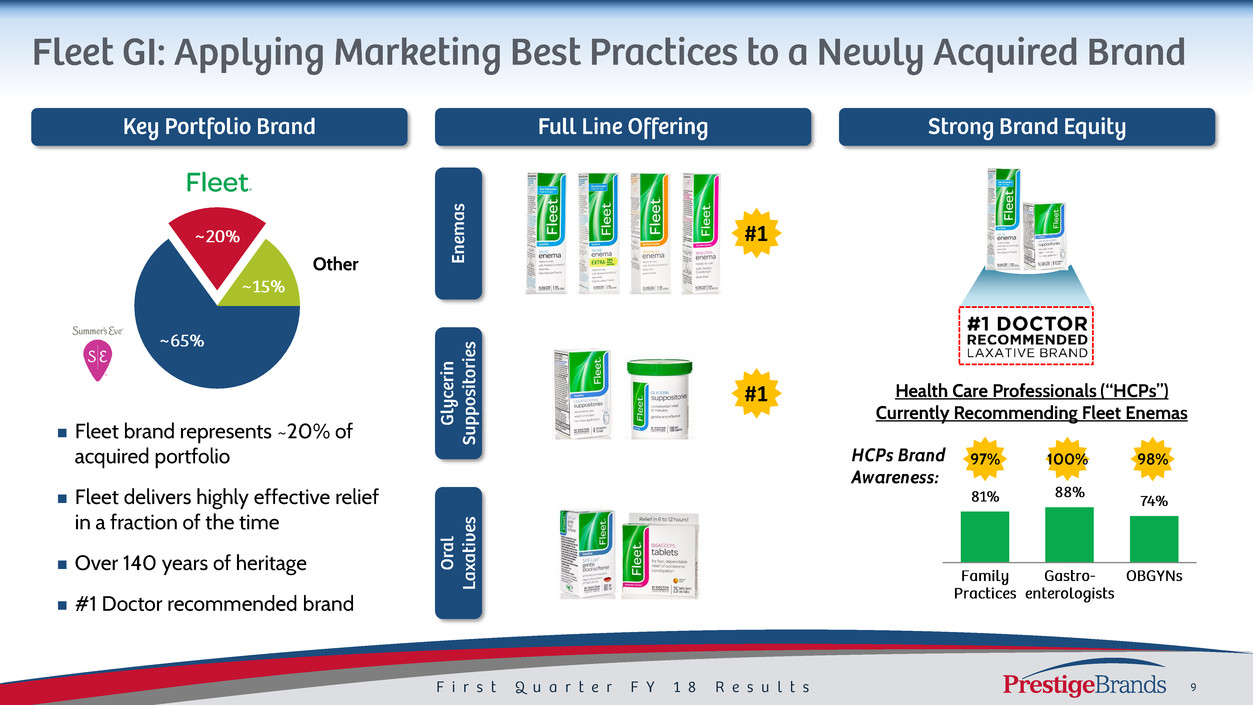

Fleet brand represents ~20% of

acquired portfolio

Fleet delivers highly effective relief

in a fraction of the time

Over 140 years of heritage

#1 Doctor recommended brand

#1

#1

Other

Health Care Professionals (“HCPs”)

Currently Recommending Fleet Enemas

97% 100% 98%HCPs Brand

Awareness:

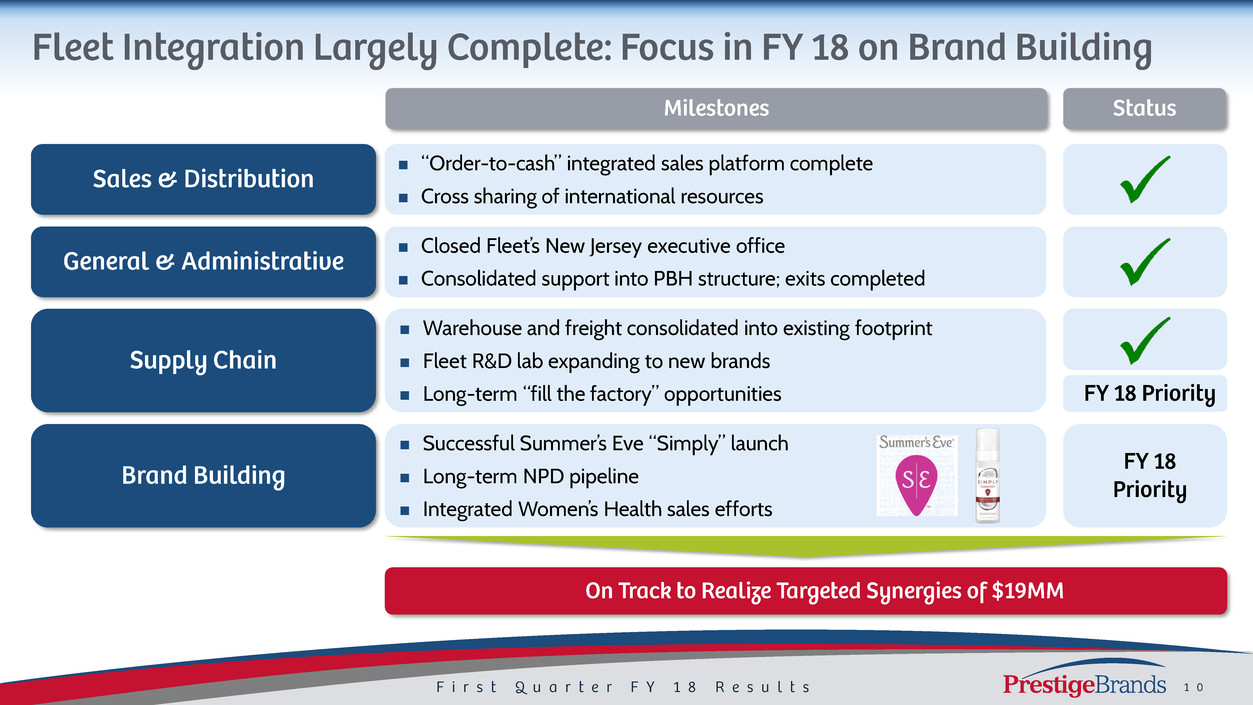

“Order-to-cash” integrated sales platform complete

Cross sharing of international resources

Successful Summer’s Eve “Simply” launch

Long-term NPD pipeline

Integrated Women’s Health sales efforts

Warehouse and freight consolidated into existing footprint

Fleet R&D lab expanding to new brands

Long-term “fill the factory” opportunities

Closed Fleet’s New Jersey executive office

Consolidated support into PBH structure; exits completed

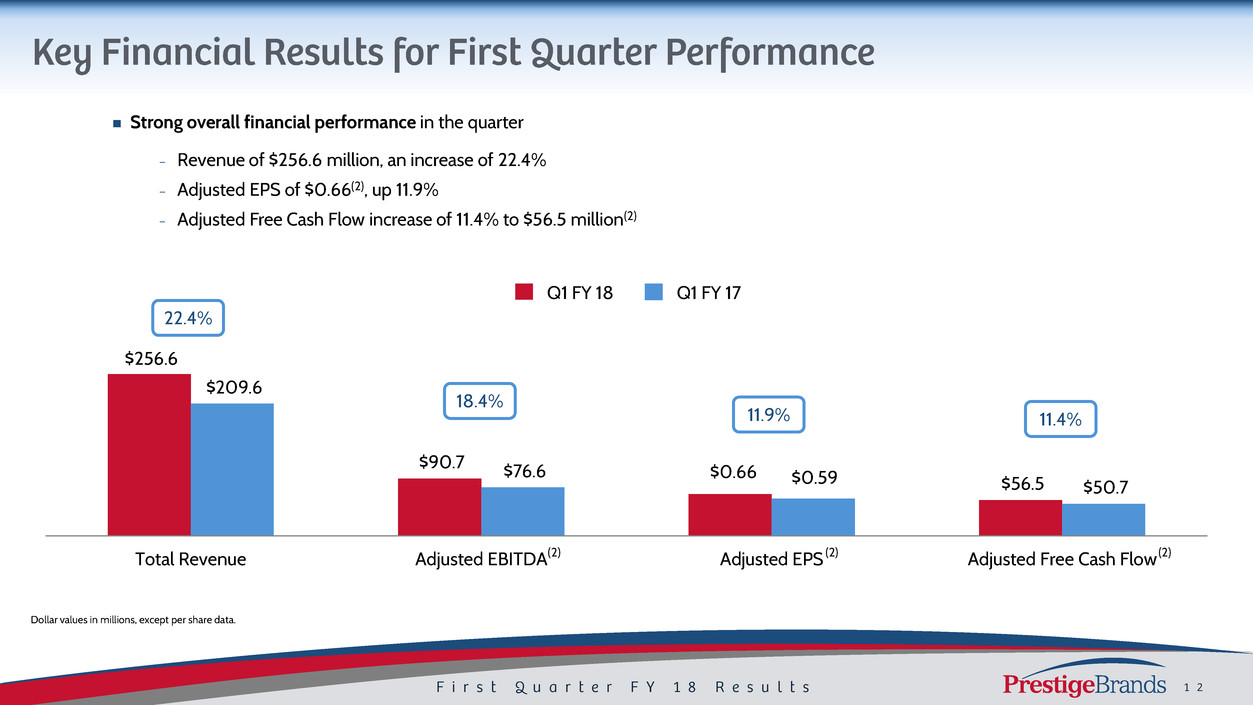

Strong overall financial performance in the quarter

− Revenue of $256.6 million, an increase of 22.4%

− Adjusted EPS of $0.66(2), up 11.9%

− Adjusted Free Cash Flow increase of 11.4% to $56.5 million(2)

$256.6

$90.7

$56.5

$209.6

$76.6

$50.7

Total Revenue Adjusted EBITDA Adjusted EPS Adjusted Free Cash Flow

Q1 FY 17Q1 FY 18

22.4%

18.4%

11.9% 11.4%

$0.59$0.66

(2) (2) (2)

Dollar values in millions, except per share data.

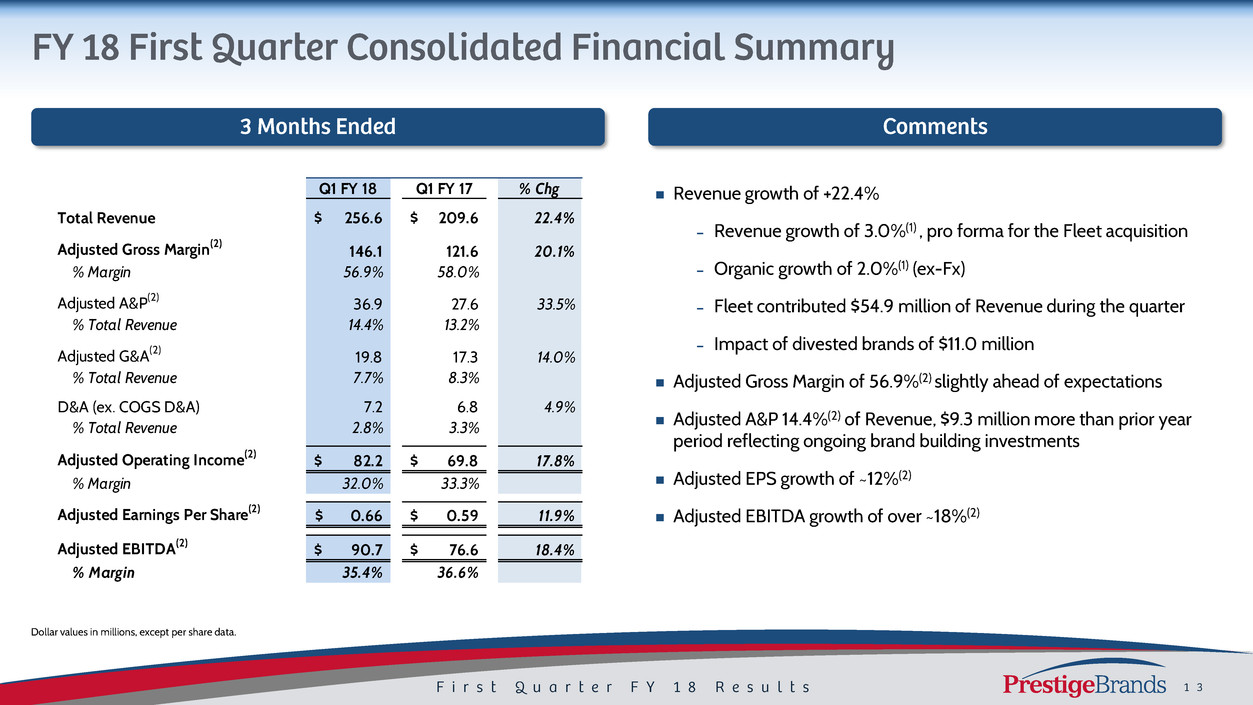

Revenue growth of +22.4%

– Revenue growth of 3.0%(1) , pro forma for the Fleet acquisition

– Organic growth of 2.0%(1) (ex-Fx)

– Fleet contributed $54.9 million of Revenue during the quarter

– Impact of divested brands of $11.0 million

Adjusted Gross Margin of 56.9%(2) slightly ahead of expectations

Adjusted A&P 14.4%(2) of Revenue, $9.3 million more than prior year

period reflecting ongoing brand building investments

Adjusted EPS growth of ~12%(2)

Adjusted EBITDA growth of over ~18%(2)

Dollar values in millions, except per share data.

Q1 FY 18 Q1 FY 17 % Chg

Total Revenue 256.6$ 209.6$ 22.4%

Adjusted Gross Margin(2) 146.1 121.6 20.1%

% Margin 56.9% 58.0%

Adjusted A&P(2) 36.9 27.6 33.5%

% Total Revenue 14.4% 13.2%

Adjusted G&A(2) 19.8 17.3 14.0%

% Total Revenue 7.7% 8.3%

D&A (ex. COGS D&A) 7.2 6.8 4.9%

% Total Revenue 2.8% 3.3%

Adjusted Operating Income(2) 82.2$ 69.8$ 17.8%

% Margin 32.0% 33.3%

Adjusted Earnings Per Share(2) 0.66$ 0.59$ 11.9%

Adjusted EBITDA(2) 90.7$ 76.6$ 18.4%

% Margin 35.4% 36.6%

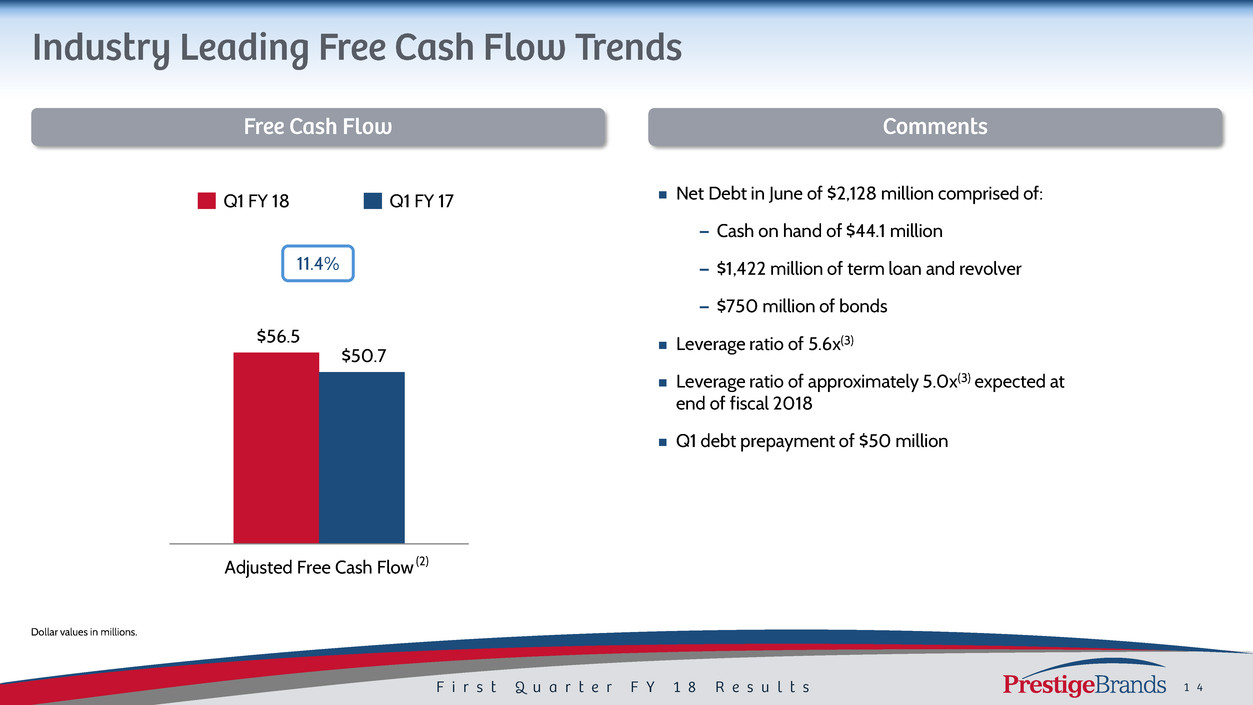

Net Debt in June of $2,128 million comprised of:

– Cash on hand of $44.1 million

– $1,422 million of term loan and revolver

– $750 million of bonds

Leverage ratio of 5.6x(3)

Leverage ratio of approximately 5.0x(3) expected at

end of fiscal 2018

Q1 debt prepayment of $50 million

$56.5

$50.7

Adjusted Free Cash Flow

11.4%

Q1 FY 18 Q1 FY 17

Dollar values in millions.

(2)

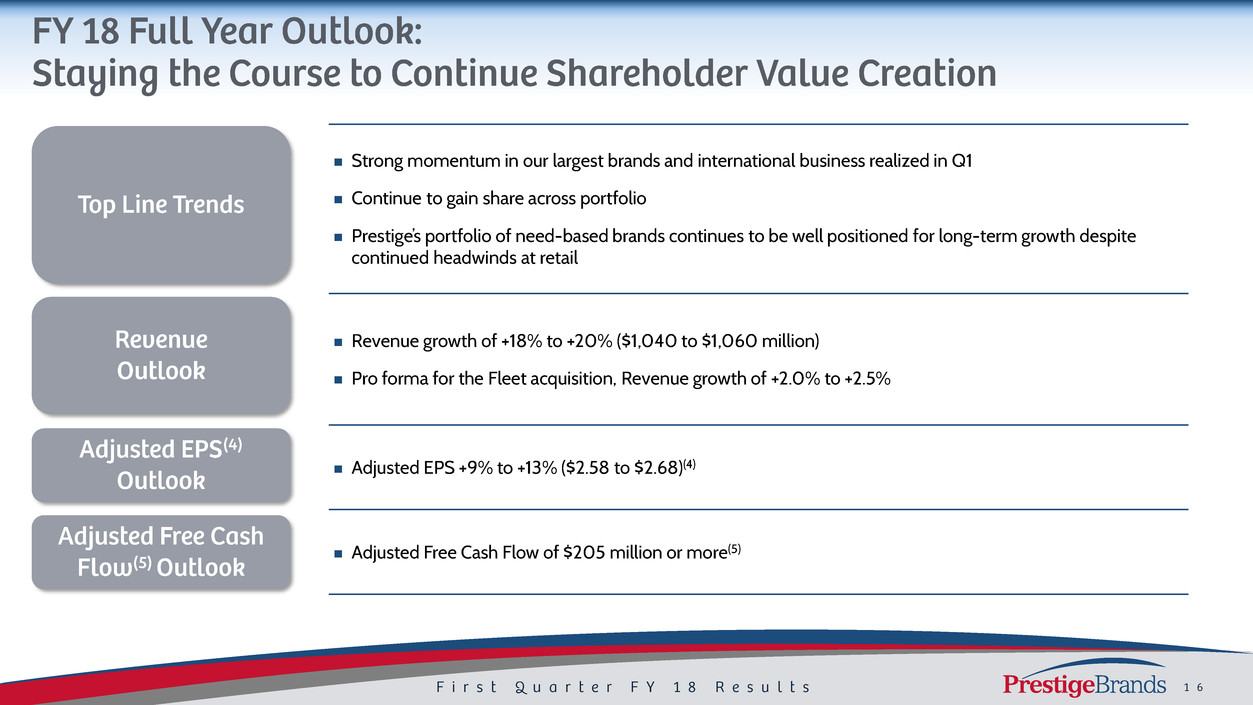

Strong momentum in our largest brands and international business realized in Q1

Continue to gain share across portfolio

Prestige’s portfolio of need-based brands continues to be well positioned for long-term growth despite

continued headwinds at retail

Revenue growth of +18% to +20% ($1,040 to $1,060 million)

Pro forma for the Fleet acquisition, Revenue growth of +2.0% to +2.5%

Adjusted EPS +9% to +13% ($2.58 to $2.68)(4)

Adjusted Free Cash Flow of $205 million or more(5)

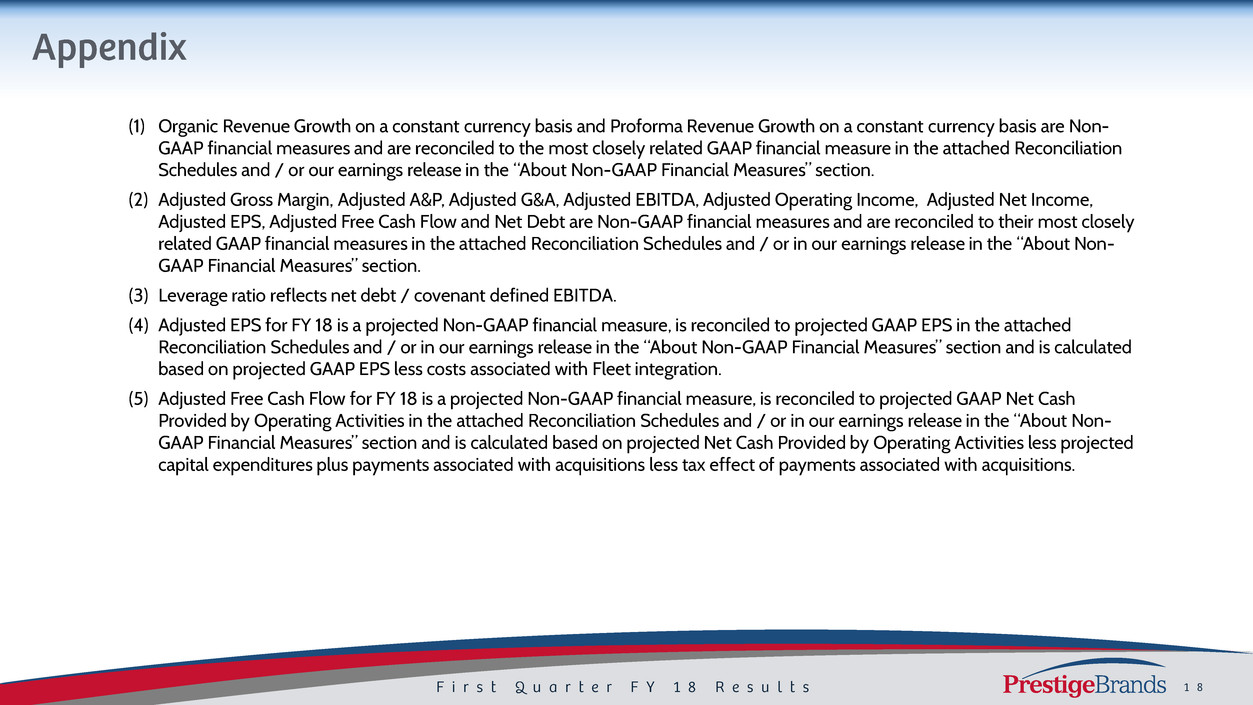

(1) Organic Revenue Growth on a constant currency basis and Proforma Revenue Growth on a constant currency basis are Non-

GAAP financial measures and are reconciled to the most closely related GAAP financial measure in the attached Reconciliation

Schedules and / or our earnings release in the “About Non-GAAP Financial Measures” section.

(2) Adjusted Gross Margin, Adjusted A&P, Adjusted G&A, Adjusted EBITDA, Adjusted Operating Income, Adjusted Net Income,

Adjusted EPS, Adjusted Free Cash Flow and Net Debt are Non-GAAP financial measures and are reconciled to their most closely

related GAAP financial measures in the attached Reconciliation Schedules and / or in our earnings release in the “About Non-

GAAP Financial Measures” section.

(3) Leverage ratio reflects net debt / covenant defined EBITDA.

(4) Adjusted EPS for FY 18 is a projected Non-GAAP financial measure, is reconciled to projected GAAP EPS in the attached

Reconciliation Schedules and / or in our earnings release in the “About Non-GAAP Financial Measures” section and is calculated

based on projected GAAP EPS less costs associated with Fleet integration.

(5) Adjusted Free Cash Flow for FY 18 is a projected Non-GAAP financial measure, is reconciled to projected GAAP Net Cash

Provided by Operating Activities in the attached Reconciliation Schedules and / or in our earnings release in the “About Non-

GAAP Financial Measures” section and is calculated based on projected Net Cash Provided by Operating Activities less projected

capital expenditures plus payments associated with acquisitions less tax effect of payments associated with acquisitions.

Three Months Ended Jun. 30,

2017 2016

(In Thousands)

GAAP Total Revenues 256,573$ 209,575$

Revenue Growth 22.4%

Adjustments:

Revenues associated with acquisitions (54,887) -

Revenues associated with divested brands - (11,039)

Impact of foregn currency exchange rates - (752)

Non-GAAP Organic Revenues on a constant currency basis 201,686 197,784

Constant Currency Non-GAAP Organic Revenue Growth 2.0%

Non-GAAP Organic Revenues on a constant currency basis 201,686 197,784

Revenues associated with acquisitions 54,887 51,201

Non-GAAP Proforma Revenues on a constant currency basis 256,573 248,985

Constant Currency Non-GAAP Proforma Revenue Growth 3.0%

Three Months Ended Jun. 30,

2017 2016

(In Thousands)

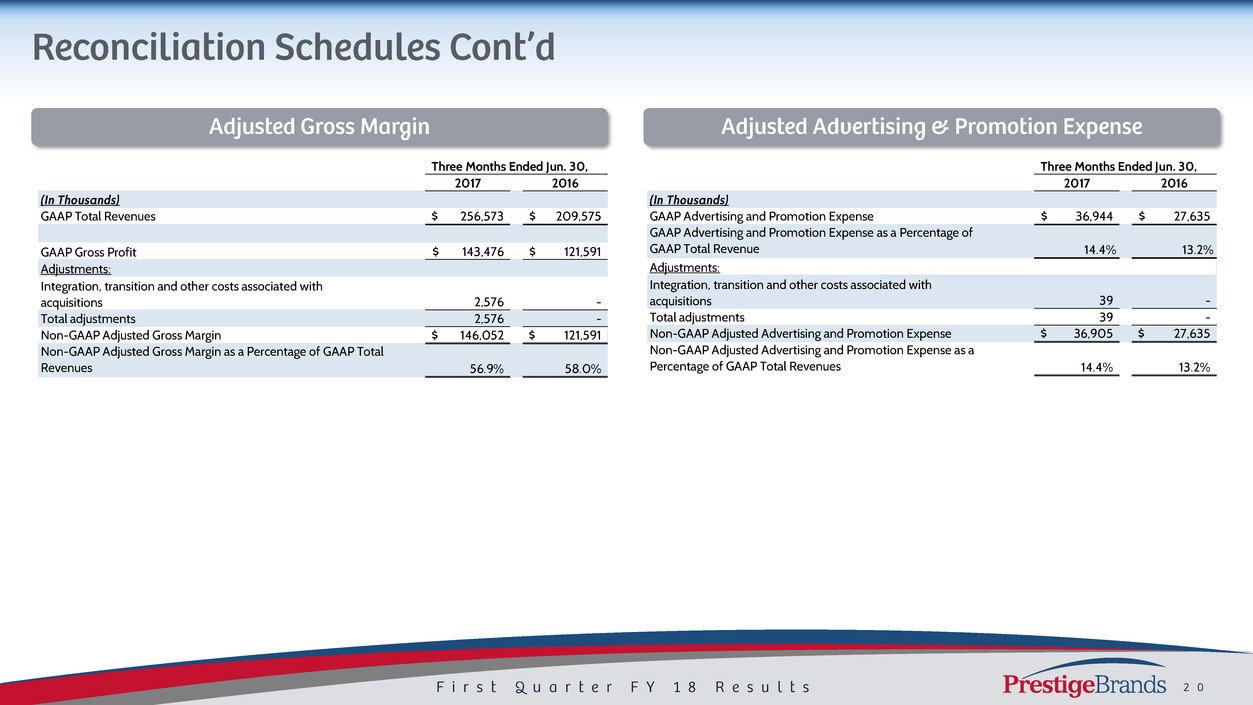

GAAP Total Revenues 256,573$ 209,575$

GAAP Gross Profit 143,476$ 121,591$

Adjustments:

Integration, transition and other costs associated with

acquisitions 2,576 -

Total adjustments 2,576 -

Non-GAAP Adjusted Gross Margin 146,052$ 121,591$

Non-GAAP Adjusted Gross Margin as a Percentage of GAAP Total

Revenues 56.9% 58.0%

Three Months Ended Jun. 30,

7 2016

(In Thousands)

GAAP Advertising and Promotion Expense 36,944 27,635$

GAAP Advertising and Promotion Expense as a Percentage of

GAAP Total Revenue 14.4% 13.2%

Adjustments:

Integrati n, t ansi ion and other costs associated with

acquisitions 39 -

Total adjustments 39 -

Non-GAAP Adjusted Advertising and Promotion Expense 36,905 27,635$

Non-GAAP Adjusted Adv rtising and Prom ion Expense as a

Percentage of GAAP Total Revenues 14 4 13.2%

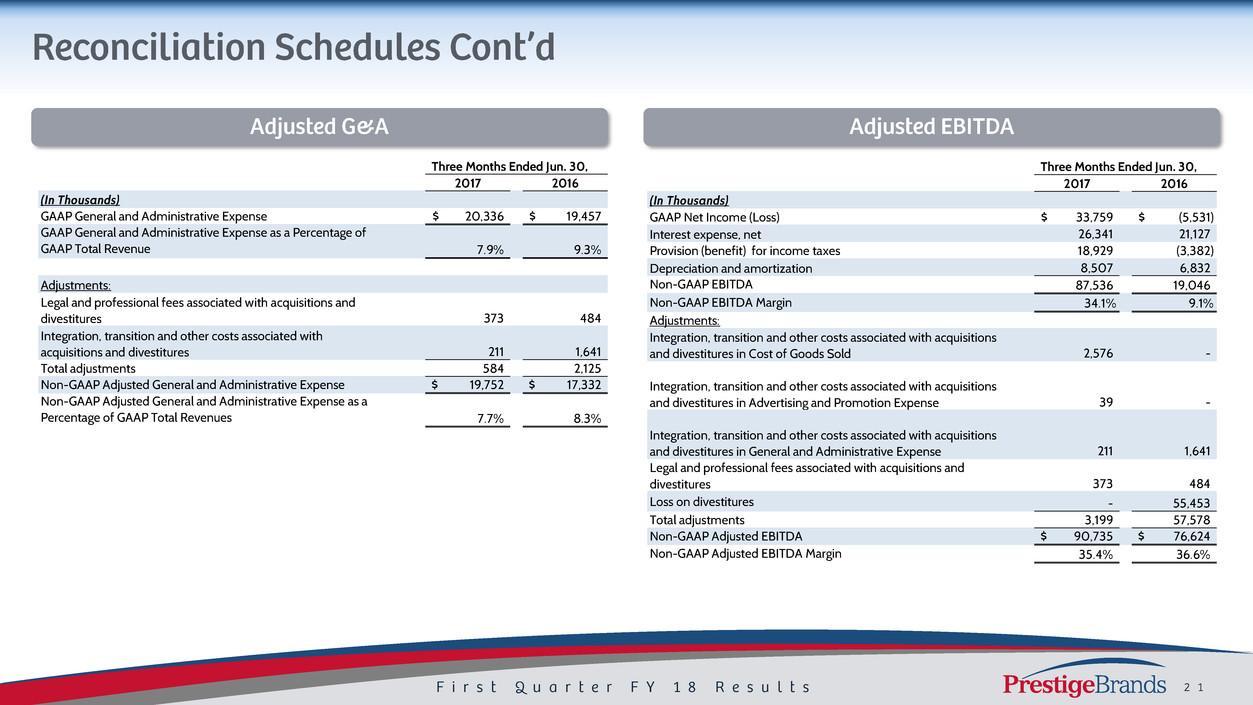

Three Months Ended Jun. 30,

2017 2016

(In Thousands)

GAAP General and Administrative Expense 20,336$ 19,457$

GAAP General and Administrative Expense as a Percentage of

GAAP Total Revenue 7.9% 9.3%

Adjustments:

Legal and professional fees associated with acquisitions and

divestitures 373 484

Integration, transition and other costs associated with

acquisitions and divestitures 211 1,641

Total adjustments 584 2,125

Non-GAAP Adjusted General and Administrative Expense 19,752$ 17,332$

Non-GAAP Adjusted General and Administrative Expense as a

Percentage of GAAP Total Revenues 7.7% 8.3%

Three Months Ended Jun. 30,

2017 2016

(In Thousands)

GAAP Net Income (Loss) 33,759$ (5,531)$

Interest expense, net 26,341 21,127

Provision (benefit) for income taxes 18,929 (3,382)

Depreciation and amortization 8,507 6,832

Non-GAAP EBITDA 87,536 19,046

Non-GAAP EBITDA Margin 34.1% 9.1%

Adjustments:

Integration, transition and other costs associated with acquisitions

and divestitures in Cost of Goods Sold 2,576 -

Integration, transition and other costs associated with acquisitions

and divestitures in Advertising and Promotion Expense 39 -

Integration, transition and other costs associated with acquisitions

and divestitures in General and Administrative Expense 211 1,641

Legal and professional fees associated with acquisitions and

divestitures 373 484

Loss on divestitures - 55,453

Total adjustments 3,199 57,578

Non-GAAP Adjusted EBITDA 90,735$ 76,624$

Non-GAAP Adjusted EBITDA Margin 35.4% 36.6%

Three Months Ended June 30,

2017

2017

Adjusted

EPS 2016

2016

Adjusted

EPS

(In Thousands)

GAAP Net Income (Loss) 33,759$ 0.63$ (5,531)$ (0.10)$

Adjustments:

Integration, transition and other costs associated

with acquisitions and divestitures in Cost of Goods

Sold 2,576 0.05 - -

Integration, transition and other costs associated

with acquisitions and divestitures in Advertising and

Promotion Expense 39 - - -

Integration, transition and other costs associated

with acquisitions and divestitures in General and

Administrative Expense 211 - 1,641 0.03

Legal and professional fees associated with

acquisitions and divestitures 373 0.01 484 0.01

Loss on divestitures - - 55,453 1.04

Tax impact of adjustments (1,167) (0.02) (20,658) (0.39)

Normalized tax rate adjustment (302) (0.01) - -

Total adjustments 1,730 0.03 36,920 0.69

Non-GAAP Adjusted Net Income and Adjusted EPS 35,489$ 0.66$ 31,389$ 0.59$

Three Months Ended Jun. 30,

2017 2016

(In Thousands)

GAAP Net Income (Loss) 33,759$ (5,531)$

Adjustments:

A justments to reconcile net income (loss) to net

cash provided by operating activities as shown in

the Statement of Cash Flows 21,983 57,346

Changes in operating assets and liabilities, net of

effects from acquisitions as shown in the

Statement of Cash Flows

(1,621) (514)

Total Adjustments 20,362 56,832

GAAP N t cash provided by operating activities 54,121 51,301

Purchase of property and equipment (2,554) (895)

Non-GAAP Free Cash Flow 51,567 50,406

Integration, transition and other payments

associated with acquisitions and divestitures 4,948 331

Non-GAAP Adjusted Free Cash Flow 56,515$ 50,737$

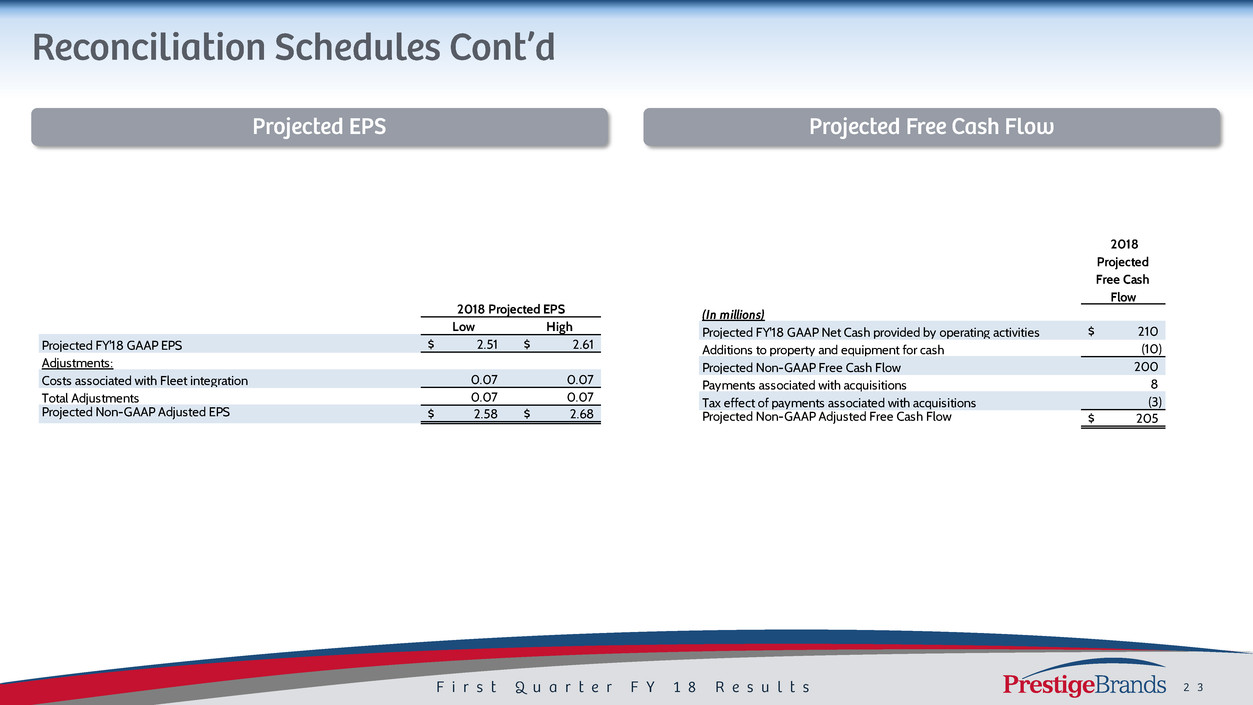

2018 Projected EPS

Low High

Projected FY'18 GAAP EPS 2.51$ 2.61$

Adjustments:

Costs associated with Fleet integration 0.07 0.07

Total Adjustments 0.07 0.07

Projected Non-GAAP Adjusted EPS 2.58$ 2.68$

2018

Projected

Free Cash

Flow

(In millions)

Projected FY'18 GAAP Net Cash provided by operating activities 210$

Additions to property and equipment for cash (10)

Projected Non-GAAP Free Cash Flow 200

ayments associated with acquisitions 8

Tax ffect of payme ts associated with acquisitions (3)

Projected Non-GAAP Adjusted Free Cash Flow 205$