Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - ALIMERA SCIENCES INC | pr.htm |

| 8-K - 8-K - ALIMERA SCIENCES INC | alim8-k.htm |

Second Quarter 2017

Results Conference Call

Thursday, August 3, 2017

Exhibit 99.2

Safe Harbor Statement

This presentation contains ““forward-looking statements,”“ within the meaning of the Private Securities Litigation Reform Act of 1995,

regarding, among other things, the opportunity for further growth in 2017 for ILUVIEN and the ability of Alimera to achieve positive

operating cash flow. Such forward-looking statements are based on current expectations and involve inherent risks and uncertainties,

including factors that could delay, divert or change any of them, and could cause actual results to differ materially from those projected in its

forward-looking statements. Words such as ““anticipate,”“ “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “contemplate,”

“predict,” “project,” “target,” “likely,” “potential,” “continue,” “ongoing,” “will,” “would,” “should,” “could,” or the negative of these terms

and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these

identifying words. Such forward-looking statements are based on current expectations and involve inherent risks and uncertainties, including

factors that could delay, divert or change any of them, and could cause actual results to differ materially from those projected in its forward-

looking statements. Meaningful factors which could cause actual results to differ include, but are not limited to, continued market

acceptance of ILUVIEN in the U.S. and Europe, including physicians' ability to obtain reimbursement, as well as other factors discussed in the

“Risk Factors” and “Management's Discussion and Analysis of Financial Condition and Results of Operations” sections of Alimera's Annual

Report on Form 10-K for the year ended December 31, 2016 and for the quarter ended March 31, 2017, which are on file with the Securities

and Exchange Commission (SEC) and available on the SEC's website at http://www.sec.gov. Additional factors may also be set forth in those

sections of Alimera’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2017, to be filed with the SEC in the third quarter of

2017. In addition to the risks described above and in Alimera's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current

Reports on Form 8-K and other filings with the SEC, other unknown or unpredictable factors also could affect Alimera's results. There can be

no assurance that the actual results or developments anticipated by Alimera will be realized or, even if substantially realized, that they will

have the expected consequences to, or effects on, Alimera. Therefore, no assurance can be given that the outcomes stated in such forward-

looking statements and estimates will be achieved. All forward-looking statements contained in this presentation are expressly qualified by

the cautionary statements contained or referred to herein. Alimera cautions investors not to rely too heavily on the forward-looking

statements Alimera makes or that are made on its behalf. These forward-looking statements speak only as of the date of this presentation

(unless another date is indicated). Alimera undertakes no obligation, and specifically declines any obligation, to publicly update or revise any

such forward-looking statements, whether as a result of new information, future events or otherwise.

© 2017 Alimera Sciences, Inc., All Rights Reserved 2

3

2Q 2017 Highlights Revenue Growth

2Q17

$10.4M

2Q16

$9.6M

8%

• Positive Adjusted EBITDA* of $0.5

million Q2 2017

• 8% Global revenue growth Q2 2017

over Q2 2016

• Global End User Demand increased

6% Q2 2017 compared to Q2 2016

• ILUVIEN launched in Italy by our

Italian distributor in June

© 2017 Alimera Sciences, Inc., All Rights Reserved *Please see Non-GAAP financial information on slide 11 of this presentation

4

Positive Adjusted EBITDA* of $0.5M Achieved

© 2017 Alimera Sciences, Inc., All Rights Reserved

Achieved due to

Cost saving measures

Increases in end user

demand and revenue

• Management of operating expenses

• Increases in end user demand

• Revenue growth

*Please see Non-GAAP financial information on slide 11 of this presentation

5

Uveitis Indication for ILUVIEN

© 2017 Alimera Sciences, Inc., All Rights Reserved

July

2017

Licensed Territories for

Posterior Uveitis

• Europe

• Middle East

• Africa

Planned submission for uveitis in 17 EU countries (where

ILUVIEN is currently approved for DME) in Q1 2018

Announced transaction

that allows Alimera to

pursue posterior uveitis as

a second indication for

ILUVIEN

6

Positive Real World Data

© 2017 Alimera Sciences, Inc., All Rights Reserved

Medisoft

Audit

305 patients

345 eyes

United

Kingdom

Published in EYE,

July 2017

USER

Study

130 patients

160 eyes

U.S. To be Presented

Fall 2017,

Multiple Venues

Financial Overview

Rick Eiswirth, President & CFO

© 2017 Alimera Sciences, All Rights Reserved 8

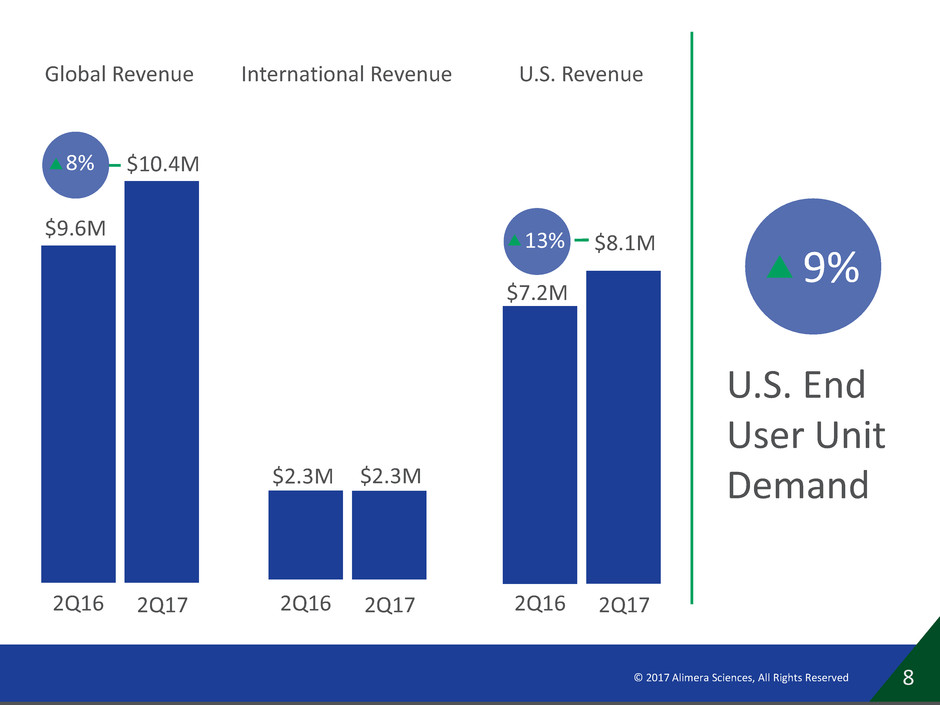

2Q17

$10.4M

2Q16

$9.6M

8%

Global Revenue

U.S. End

User Unit

Demand

2Q17

$8.1M

2Q16

$7.2M

U.S. Revenue

2Q16 2Q17

$2.3M $2.3M

International Revenue

13%

9%

9 © 2017 Alimera Sciences, Inc., All Rights Reserved

2Q16 2Q17

$11.0M

$15.5M 29%

Operating

Expenses

2Q16 2Q17

$2.8M

$6.9M 59%

GAAP

Net Loss

2Q16 2Q17

$0.5M

($4.4M)

Adj.

EBITDA*

2Q16 2Q17

$9.1M

$13.4M

32%

Adj. Operating

Expenses*

*Please see Non-GAAP financial information on slide 11 of this presentation

Closing Remarks

Dan Myers, CEO

11

Non-GAAP Financial Information

© 2017 Alimera Sciences, Inc., All Rights Reserved

Alimera believes that the non-GAAP financial information provided in this presentation can assist investors in the overall understanding of its

financial performance when considered together with GAAP figures.

This presentation contains a discussion of certain non-GAAP financial measures, as defined in Regulation G of the Securities Exchange Act of

1934, as amended. Alimera reports its financial results in compliance with GAAP, but believes that the non-GAAP measures of Adjusted

EBITDA and Adjusted Operating Expenses will be a more relevant measure of Alimera's operating performance. For the purpose of this

presentation, “Adjusted EBITDA” is adjusted earnings before interest, taxes, depreciation, amortization, non-cash stock-based compensation

expense, and to the extent they are included in the calculation of earnings, net unrealized gain (loss) from foreign currency exchange

transactions and gains (losses) from the change in the fair value of derivative warrant liability. “Adjusted Operating Expenses” is operating

expenses excluding depreciation, amortization and non-cash stock-based compensation expense. Alimera uses Adjusted EBITDA and Adjusted

Operating Expenses in the management of its business and Alimera's lender uses Adjusted EBITDA as a financial covenant measurement.

Accordingly, Adjusted EBITDA and Adjusted Operating Expenses for the second quarter of 2017 have been presented in certain instances

excluding items identified in the reconciliations provided.

These non-GAAP financial measures, as presented, may not be comparable to similarly titled measures reported by other companies since not

all companies may calculate these measures in an identical manner and, therefore, they are not necessarily an accurate measure of

comparison between companies.

The presentation of these non-GAAP financial measures is not intended to be considered in isolation or as a substitute for guidance prepared

in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude significant elements that are

required by GAAP to be recorded in Alimera's financial statements. In addition, they are subject to inherent limitations as they reflect the

exercise of judgments by management in determining these non-GAAP financial measures. In order to compensate for these limitations,

Alimera presents its non-GAAP financial results in connection with its GAAP results. Investors are encouraged to review the reconciliation of

our non-GAAP financial measures to their most directly comparable GAAP financial measure.

Second Quarter 2017

Results Conference Call

Thursday, August 3, 2017