Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - Evolution Blockchain Group Inc. | exhibit32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - Evolution Blockchain Group Inc. | exhibit31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended April 30, 2017

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to __________

Commission file number: 333-196921

GARMATEX HOLDINGS LTD.

(Exact name of registrant as specified in its charter)

| Nevada | 36-4752858 |

| (State or other jurisdiction of incorporation | (I.R.S. Employer Identification No.) |

| or organization) | |

| 7458 Allison Place | |

| Chilliwack, British Columbia, Canada | V4Z 1Z7 |

| (Address of principal executive offices) | (Zip Code) |

(778) 823-3104

Registrant’s telephone number,

including area code

7458 Allison Place, Chilliwack, British Columbia, Canada,

V4Z 1Z7

(Former name, former address and former fiscal year, if

changed since last report)

Securities registered pursuant to Section 12(b) of the Act

| Title of each class | Name of each exchange on which registered |

| None | N/A |

Securities registered pursuant to Section 12(g) of the Act:

Title of each class

None

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

[ ] No [X]

Indicate by check mark if the registrant is not required to

file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [X]

No [ ]

Indicate by checkmark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files).

Yes [ ] No [X]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Smaller reporting company [X] |

| Non-accelerated filer [ ] | Emerging growth company [X] |

| Accelerated filer [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes [ ] No [X]

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Exchange Act).

Yes [

] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrants most recently completed second fiscal quarter.

19,190,434 shares of common stock at a closing price of $0.36 per share based on the OTC Markets report as of October 31, 2016 for an aggregate market value of $6,908,556.

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: As of July 31, 2017, there were 35,690,434 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) of the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980). Not Applicable

2

TABLE OF CONTENTS

3

PART I

Item 1. Business

Forward-Looking Statements

This annual report contains “forward-looking statements”. All statements other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws, including, but not limited to, statements regarding: the plans, strategies and objections of management for future operations; the future plans or business of our company; future economic conditions or performance; and any statements of assumptions underlying any of the foregoing.

Forward-looking statements may include the words “may,” “could,” “estimate,” “intend,” “continue,” “believe,” “expect” or “anticipate” or other similar words. These forward-looking statements present our estimates and assumptions only as of the date of this report. Accordingly, readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the dates on which they are made. Except as required by applicable law, we do not intend, and undertake no obligation, to update any forward-looking statement.

Although we believe the expectations reflected in the forward-looking statements in this report are reasonable, actual results could differ materially from those projected or assumed in any forward-looking statements. All forward-looking statements are subject to change and inherent risks and uncertainties. The factors impacting these risks and uncertainties include, but are not limited to:

-

our current lack of working capital;

-

a possible inability to raise additional financing;

-

an inability to close the Arrangement with Garmatex (each as defined herein) on the terms expected or at all;

-

the fact that our accounting policies and methods are fundamental to how we report our financial condition and results of operations, and they may require our management to make estimates about matters that are inherently uncertain;

-

deterioration in general or regional economic conditions;

-

adverse state or federal legislation or regulations that increase the costs of compliance;

-

inability to efficiently manage our operations; and

-

the unavailability of funds for capital expenditures.

All financial information contained herein is shown in United States dollars unless otherwise stated. The dollar amounts provided at the date of this report assume that $1.00 Canadian dollar is equivalent to $0.732198 US dollars. Our financial statements are prepared in accordance with United States generally accepted accounting principles.

In this annual report, unless otherwise specified, all references to “shares” refer to shares of common stock in the capital of our company.

As used in this annual report on Form 10-K, the terms “we”, “us” “our” and “Garmatex Holdings” refer to Garmatex Holdings Ltd., a Nevada corporation, and our wholly-owned subsidiary, ORC Exploration LLC, a Nevada corporation, unless otherwise specified.

Our Corporate History and Background

We were incorporated under the laws of the State of Nevada on April 9, 2014. Our fiscal year end is April 30. Following incorporation, we commenced the business of a mineral exploration company. On May 8, 2014, we incorporated our wholly-owned subsidiary, ORC Exploration LLC, for the purposes of mineral exploration. On May 20, 2014, we acquired an option to acquire a 100% legal and beneficial ownership interest in the Elizabeth mineral claim, located in the Omineca Mining District in the central part of the Province of British Columbia. Our initial mining exploration program, which was scheduled to commence in the second quarter of the fiscal year ending April 30, 2015, was delayed until the fourth quarter due to forest fire concerns.

4

Due to a dearth of available financing options, which has affected many junior mining companies in recent years, we subsequently ran out of funds to proceed with our planned exploration program. As a result, our management decided to seek out other potential business operations and management skills for the continuation of our business. In connection therewith, effective June 8, 2015, our chief executive officer (“CEO”) and sole director, Jose Montes, resigned all positions as an officer and director of our company, and we appointed Mike Gilliland to serve as our sole officer and director. Effective March 14, 2016, Mr. Gilliland resigned all positions as an officer and director of our company, and we appointed Devon Loosdrecht to serve as our sole officer and director.

On April 8, 2016, we entered into an arrangement agreement (the “Arrangement Agreement”) with Garmatex Technologies, Inc. (“GTBC”), a private company incorporated under the laws of the Province of British Columbia, pursuant to which we agreed to acquire all of the outstanding securities of GTBC in exchange for the issuance of equivalent securities of our company by way of a statutory arrangement (the “Arrangement”) under the Business Corporations Act (British Columbia). The Arrangement Agreement contains customary representations, warranties, and conditions to closing. The Arrangement Agreement contains customary representations, warranties, and conditions to closing. The closing of the Arrangement Exchange (the “Closing”) would only occur once we complete a name change, forward stock-split and was provided with audited financial statements from Garmatex, with such financial statements being prepared by an independent accounting firm registered with the Public Company Accounting Oversight Board (PCAOB).

Effective August 15, 2016, we completed a merger with our wholly-owned subsidiary, Garmatex Holdings. Ltd., a Nevada corporation, which was incorporated solely to effect a change in our name. As a result, we have changed our name from “Oaxaca Resources Corp.” to “Garmatex Holdings Ltd.”. Also, effective August 15, 2016, we effected a twelve and one-half to one forward stock split of our authorized and issued and outstanding common stock. As a result, our authorized capital of common stock increased from 90,000,000 shares of common stock with a par value of $0.001 and 10,000,000 shares of preferred stock with a par value of $0.001 to 1,125,000,000 shares of common stock with a par value of $0.001 and 10,000,000 shares of preferred stock with a par value of $0.001 and our previously outstanding 2,520,000 shares of common stock increased to 31,500,000 shares of common stock outstanding. There are no shares of preferred stock currently outstanding. We changed our name and effected forward-split as per the terms and conditions of the Arrangement Agreement.

As of the date of this report, the Arrangement Agreement with GTBC has expired as conditions of the merger had not yet been satisfied. We continue to negotiate with GTBC with the intention of reaching a new agreement. All other agreements between us and GTBC remain intact.

We entered into and executed a non-exclusive Sublicense Agreement dated March 8, 2017 and the Garmatex Trademark & Technology License Agreement dated March 9, 2017 (collectively, “Master Sublicense Agreement”) with Garmatex Technologies, Inc. a company formed under the laws of the Province of British Columbia, Canada (“GTBC”) whereby we were granted various Intellectual Property Rights related to the design, development and manufacturing of various scientifically-engineered fabric technologies and performance technologies; including a patented T3® design, Bact-Out®, CoolSkin®, WarmSkin®, Kottinu™, ColdSkin™, SteelSkin™, Satinu™, CamoSkin™, RecoverySkin™, SlimSkin™, AbsorbSkin™ and IceSkin™ (collectively the foregoing are referred to hereinafter as the “Licensed IP”).

Pursuant to the terms of the agreement, we acquired the rights to further develop, commercialize, market and distribute certain proprietary inventions and know-how related to the Products. In exchange, we agreed to the following terms and conditions: (i) the Parties shall enter into Amendment No. 1 to the Arrangement Agreement; and (ii) we agreed to cancel various loans made pursuant to a Loan Agreement between us and GTBC in the aggregate amount of $953,988.00CDN.

Following the execution of the Master Sublicense Agreement and the grant of the license thereunder related to the Licensed IP, we are now able to fully implement our intended business plan and plan of operations.

5

Our Business

We plan to provide performance fabric solutions in virtually every sector that has textile applications. Our primary strategy is to deploy our performance fabrics as a premium ingredient brand, similar to Gore-Tex® in the outerwear market, or akin to Intel® in the computer space. We believe that our future fabrics will be superior in performance relative to current market “standards” and have a wide range of applications in multiple clothing and textile categories including, but not limited to, sports apparel, medical, sleepwear, linens, undergarments, military, designer wear, protective, industrial and first responders.

Our business model is to co-develop fabric with manufacturers to obtain exclusive licenses of technology and purchase fabric technology to build on our technology portfolio. We plan to commercialize these inventions by selling bolts of fabric directly to retailers and wholesalers. We plan to control the proprietary process of the technology for IP protection and do not intend to own any manufacturing facilities, which will effectively allow us to scale.

We are in the market to further acquire technologies from inventors looking for a commercialization partner.

Currently, we do not have a source of revenue. We are not able to fund our cash requirements through our current operations. Historically, we have been able to raise a limited amount of capital through private placements of our equity stock, but we are uncertain about our continued ability to raise funds privately.

Industry overview

In 2014, global exports for textiles and apparel totaled approximately US$797 bn. Of that total, $314bn totaled textile and world apparel totaled $483bn.

In 2014, the worldwide use of fibers amounted to 90.1 million tonnes, up by 4.4% . The sizeable acceleration in growth compared with a rise of 1.5% in 2011 was realized despite persistent economic uncertainties and still negative growth in Europe.

The market size of 90.1 million tonnes corresponds with an average per capita consumption of 12.7kg. The growth rate in 2014 of 4.4% succeeded in outperforming the long-term growth rate of 2.8% since 1970 and the short-term average annual growth of 3.5% since the year 2000. The recent acceleration of fiber demand reflects the impact of rapidly rising disposable incomes in populous nations like the BRIC- countries.

The market trend has unabatedly shifted toward manmade fibers that hold a 67% share at present, up from 54% in 2000. This trend will continue as the International Cotton Advisory Committee expects negative impacts from the Chinese cotton policy and the cost difference to polyester.

Increasing costs of production for cotton and a reduction of land for cotton will slow growth and present more opportunities for synthetic fibers to grow as a percentage of the market.

The most readily addressable consumer market segments for our company are the sporting apparel and medical verticals, where innovations in performance are critically needed.

Performance fabric and performance apparel market segment

6

Due to the competitive nature of the sports world, within which persists a constant need for extra advantage, performance-based product has skyrocketed in sales in recent years and will continue to see significant growth. Estimated at $150 billion today, Allied Market Research forecasts “the world sports apparel market is expected to generate revenue of $184.6 billion by 2020.”

Hospital linens and the medical segment

Hospital acquired infections are a major issue in hospitals and care facilities. In the United States, the Centers for Disease Control and Prevention estimated roughly 1.7 million hospital-associated infections, from all types of microorganisms, including bacteria and fungi, cause or contribute to 99,000 deaths each year. In Europe, where hospital surveys have been conducted, the category of gram-negative infections are estimated to account for two-thirds of the 25,000 deaths each year. Nosocomial infections can cause severe pneumonia and infections of the urinary tract, bloodstream and other parts of the body. Many types are difficult to treat with antibiotics. In addition, antibiotic resistance can complicate treatment. The spread of infection through bacteria is something that can be prevented with linens that stop bacteria growth.

Garmatex’s Kottinu® – with the antimicrobial properties of Bact-Out® – is poised to penetrate the medical segment as an alternative to non-performing, cotton-based materials or materials based on synthetics that are more susceptible to harbouring microbial growths.

Kottinu® linens wick away moisture and dry at a faster rate in comparison to charged cotton sheets. Faster drying times translate to energy savings in the laundering process. Kottinu® can extend the lifespan of the linen because it is a synthetic fabric while cotton break down faster. Minimal or no shrinkage, along with stain resistance, are also attributes of synthetic fabrics which outperform cotton over time and can lead to less product being taken out of circulation. With its “cotton-like” feel Kottinu® offers an aesthetic appeal and comfort for linen users.

Competitive environment and competitive strengths

The competitive environment is divided into two key categories. 1) Fabric mills that sell directly to manufacturers. These fabric mills are identified by some of the following characteristics: typically serve a geographic region, do not have consumer facing technology, and are typically low-cost producers. 2) Technology providers like Gore-Tex, Invista and Lenzing brand their fibers and sell their yarn directly to fabric mills, while ensuring that their branding is consumer facing with hangtags, and they sell to mills all over the world. In many instances, they work directly with the wholesaler or retailer who choose to use their technology in the apparel or other finished good. This second type of competitor closely resembles our competition.

Technology and Products

|

GTBC has coined and the term “FiberithmTM” to represent the dynamic methodology employed to develop its fabric technologies. FiberithmTM represents the testing, analysis and evaluation of fibers used in the manufacturing of fabrics and the resulting step-by-step protocols used to formulate the fabrics with particular qualities and performance characteristics. Each GTBC FiberithmTM is a building block, complete in itself, but with an open architecture enabling future development and improvement. To date, GTBC has developed over 40 distinct FiberithmTM protocols. |

|

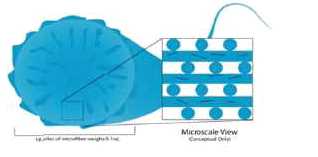

Moisture System Transference (“MST”) is the process which provides moisture management and at the core of our fabric technologies. MST microfiber technology bundles very fine, long-strand fibers called filaments to create performance threads. The unique blend and configuration of GTBC’s filaments within the threads creates a greater surface area for moisture to travel along. The specific knitting pattern increases the speed of moisture movement through the fabric.

7

Bact-Out® is GTBC’s antimicrobial protocol used in GTBC’s performance fabrics. Third party tested fabrics with Bact-Out® showed a control of fungi gram positive/gram negative bacteria up to 99.98% after 50 machine washes. Bact-Out® also helps to reduce the ongoing problem of body odour transference into the fabrics.

GTBC offers several performance fabric and design innovations: CoolSkin®, Kottinu®, ColdSkin, RecoverySkin, WarmSkin®, SteelSkin, T3® Technology, SlimSkin, AbsorbSkinTM, IceSkinTM and SurfSkin.

| • |

CoolSkin®, GTBC’s origin breakthrough product, is the genesis for most of our fabric technologies. It maximizes MST technology to move the skin’s moisture quickly to the surface of the fabric where it can evaporate. |

| • |

Kottinu® provides a remarkable ultra-soft, cotton-like feel to microfiber. Combined with Bact-Out®, this product is an ideal replacement for cotton. |

| • |

ColdSkin uses a thermal reduction process to promote extra cooling where excess heat is built up. Infused with a natural cooling agent, it promotes reduced skin temperature and assists the body to maintain a more moderate temperature while in activity. |

| • |

RecoverySkin is primarily used for compression fit garments. Studies suggest that compression garments promote blood flow to key muscle groups which can reduce fatigue and lactic acid buildup while accelerating muscle recovery. |

| • |

WarmSkin® increases retention of the body’s natural heat while removing unwanted moisture from the skin. It can promote blood flow to key muscle groups which allows for comfortable performance in cold weather while reducing injuries common during cold weather activities. |

| • |

SteelSkin is a soft, pliable, woven, anti-abrasion fabric sewn into garment areas that are prone to abrasion, laceration or heavy wear. The fabric is five times stronger than steel on an equal weight basis and provides unparalleled protection with minimal weight. |

| • |

The T3® patented design resulted from an understanding of proportion and motion in the human body. The triple gusset construction design addresses all muscle groups affiliated with arm and shoulder rotational movement enabling freedom of movement by alleviating the binding and body ride-up associated with close fitting apparel. |

| • |

SlimSkin is a body-hugging fabric that accentuates shape while allowing for comfort of movement. |

| • |

AbsorbSkinTM absorbs up to 6 times its weight in moisture and is used in areas where a cushioning component is desired. |

| • |

IceSkin™ is engineered through a multi-layered, three-dimensional, knitting process and combines a high percentage of natural jade mineral with our CoolSkin® microfiber technology. IceSkin™ has proven to be effective in reducing skin surface temperate and can improve wearer efficiency while in activity. |

| • |

SurfSkin is a lightweight, woven fabric and its fast-drying properties makes it an ideal fabric for board shorts and surf wear. |

8

Sales and Growth Strategy

We intend to deploy our unique fabric and apparel design technologies throughout multiple industry segments, especially high-growth market segments: sports, medical, industrial, lifestyle and promotional.

Emerging Growth Company Status

We are an “emerging growth company” as defined under the Jumpstart our Business Startups Act (the “JOBS Act”). We expect to remain an “emerging growth company” for up to five years. As an “emerging growth company”, we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies”, including, but not limited to:

-

not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes- Oxley Act (we also will not be subject to the auditor attestation requirements of Section 404(b) as long as we are a “smaller reporting company”, which includes issuers that had a public float of less than $75 million as of the last business day of their most recently completed second fiscal quarter);

-

reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements; and

-

exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved.

Employees

Our company is currently operated by Devon Loosdrecht, our CEO, president, chief financial officer, treasurer and sole director. We do not anticipate hiring employees in the near future.

Subsidiaries

As of April 30, 2017, we had one subsidiary, ORC Exploration LLC, a Nevada limited liability company.

Item 1A. Risk Factors.

An investment in our common stock involves a number of very significant risks. You should carefully consider the following risks and uncertainties in addition to other information in this report in evaluating our company before purchasing our securities. Our operating results and financial condition could be seriously harmed as a result of the occurrence of any of the following risks. You could lose all or part of your investment due to any of these risks.

Risks Related to Our Business

The sale of fabric is a new operation of ours with a limited operating history and history of business, revenue generation or production history.

We have never been engaged in the sale of fabric. There could be limited value to the current portfolio of technologies and raise significant doubt about our commercial viability. Our future operations are dependent upon many factors, including the ability to create sales from its current portfolio of technology.

Operating results may fluctuate depending on a number of factors which may cause the value of our shares to decrease significantly.

9

Operating results may fluctuate as a result of a number of factors, many of which will be outside of our control. As a result of these fluctuations, financial planning and forecasting may be more difficult and comparisons of operating results on a period-to-period basis may not necessarily be meaningful. Our business can be seasonal in nature, reflecting overall economic conditions as well as client budgeting and buying patterns in the textile and technical apparel industries. This may result in the fluctuation of operating results. Further, the cyclicality and seasonality of our business could become more pronounced and may cause operating results to fluctuate more widely.

Additional funds for our planned operations will be required.

We will need substantial funding for our planned operations. No assurances can be given that we will be able to raise the additional funding that will be required for such activities. To meet such funding requirements, we will be required to undertake additional equity financing, which would be dilutive to shareholders. Debt financing, if available, may also involve restrictions on financing and operating activities. There is no assurance that additional financing will be available on terms acceptable to us or at all. If we are unable to obtain additional financing as needed, we will be required to reduce the scope of our operations.

Third-party technology licenses may not continue to be available to us in the future.

We will rely on certain technology that we license from GTBC. These third-party technology licenses may not in the future be available to us on commercially reasonable terms, or at all. The loss of any of these technology licenses could result in delays in performance of work until our company identifies, licenses and integrates equivalent technology, and it may not be able to identify, license or integrate any such equivalent technology in a timely manner or at all. Any resulting delays in performance could damage our reputation, which could materially adversely affect our business, operating results or financial condition.

Others may assert intellectual property infringement claims against us.

Infringement or misappropriation claims (or claims for indemnification resulting from such claims) against us may be asserted or prosecuted, regardless of their merit, and any such assertions or prosecutions may adversely affect our business and/or operating results. Irrespective of the validity or the successful assertion of such claims, we would incur significant costs and diversion of resources relating to the defense of such claims, which could have an adverse effect on our business, operating results or both.

If any claims or actions are asserted against us, we may seek to obtain a license of a third-party’s intellectual property rights; however, under such circumstances such a license may not be available on reasonable terms or at all. Any such litigation could result in a material adverse effect on the business, prospects, and financial results of our company.

Adverse economic conditions may have an adverse effect on the business and financial results of our company.

Textiles and garments may be considered discretionary items for consumers. Factors affecting the level of consumer spending for such discretionary items include general economic conditions, particularly those in Canada and the United States, and other factors such as consumer confidence in future economic conditions, fears of recession, the availability of consumer credit, level of unemployment, tax rates and the cost of consumer credit. As global economic conditions continue to be volatile or economic uncertainty remains, trends in consumer discretionary spending also remain unpredictable. The current volatility in the United States economy in particular has resulted in an overall slowing in growth in the retail sector because of decreased consumer spending, which may remain depressed for the foreseeable future. These unfavorable economic conditions may lead consumers to delay or reduce purchase of fabric products and therefore have a material adverse effect on our financial condition.

Unpredictability of demand could negatively influence our product offerings, plans operations and strategies.

10

Our success depends on our ability to identify and originate product trends as well as to anticipate and react to changing consumer demands in a timely manner. All of our future products are subject to changing consumer preferences that cannot be predicted with certainty. If we are unable to introduce new products or novel technologies in a timely manner or our new products or technologies are not accepted by our customers, our competitors may introduce similar products in a timelier fashion, which could hurt our goal to be viewed as a leader in performance fabric innovation. Our new products may not receive consumer acceptance as consumer preferences could shift rapidly to different types of performance fabrics or away from these types of products altogether, and our future success depends in part on our ability to anticipate and respond to these changes. Failure to anticipate and respond in a timely manner to changing consumer preferences could lead to, among other things, lower sales and excess inventory levels. Even if we are successful in anticipating consumer preferences, our failure to effectively introduce new products that are accepted by consumers could result in a decrease in net revenue and excess inventory levels, which could have a material adverse effect on our financial condition.

A growing competitive market in technologically advanced textiles could affect our ability to gain market share.

The market for performance textiles is highly competitive. It includes increasing competition from established companies who are expanding their production and marketing of performance products, as well as from frequent new entrants to the market. There can be no assurance that other companies with greater financial and technological resources will not develop similar scientifically advance fabric technologies similar to our company’s or with greater perceived benefits which would affect our ability to compete successfully against existing competitors or future entrants into the market.

Raw materials required in the manufacture of products may be susceptible availability and pricing and quality fluctuations and may adversely affect our financial results.

Our business will rely on externally sourced raw materials in our manufacturing operations, and will business with a broad range of suppliers to ensure steady supplies of high-quality raw materials at competitive prices. Many of the parts or materials used in manufacturing of our textiles are anticipated to be made from oil. If the price of crude oil rises, the purchase price of such parts or materials may increase as well. Further, unanticipated contingencies among these suppliers or if parts and materials procured by these suppliers suffer from quality problems or are in short supply, we may be forced to discontinue production. Such events, if occurred, may adversely affect our financial position and results of operations.

Brand leaders are slow to adopt new technologies and the long business development cycle could delay the return on investment of resources required to develop our business.

Textile innovation for customized product development is a collaborative effort between suppliers, our company and the customer. All play a key role to ensure the functionality and performance of the products are developed to meet the customer’s specific technical textile requirements. Technological advances in textiles are slow to be adopted by large multinational companies and approvals must be had at many stages of the buying process. As a result, the extended business development cycle and delayed of return on investment may have an adverse effect our financial condition.

We Have Limited Resources For Marketing Of Our Products And We May Not Be Able To Attract Sufficient Paying Customers To Make Our Business Sustainable.

We have limited resources for marketing of our products. Our future sales will depend in large part on our ability to attract sufficient paying customers to make our business profitable and sustainable. Also, we may not be able to attract and retain personnel or be able to build an efficient and effective marketing force, which could negatively impact sales of our products, and reduce our revenues and profitability.

Our Ability To Implement our Business And Marketing Strategy

11

The implementation of our business and marketing strategy will depend on a number of factors. These include our ability to (i) find and hire reliable and sufficiently skilled third-party marketing personnel, (ii) make our products known and establish a trusted brand to our potential end user customers, (iii) establish a significant paying customer base, (iv) obtain adequate financing on favorable terms in order to fund our business, (v) maintain appropriate procedures, policies and systems; (vi) hire, train and retain skilled employees, and (vii) operate successfully and profitably within an environment of increasing competition. Our inability to manage any or all of these factors could impair our ability to implement our business strategy successfully, which could have a material adverse effect on our business, financial condition and the results of our operations.

Our Operating Results May Prove Unpredictable

Our operating results are likely to fluctuate significantly in the future due to a variety of factors, many of which we have no control over. Factors that may cause our operating results to fluctuate significantly include: the level of commercial acceptance by the public of our products; fluctuations in the demand for our products; the amount and timing of operating costs and capital expenditures relating to the operation of and/or expansion of our business, operations, infrastructure and general economic conditions. If realized, any of these risks could have a material adverse effect on our business, financial condition and the results of operations.

The current state of capital markets, particularly for small companies, is expected to reduce our ability to obtain the financing necessary to continue our business. If we cannot raise the funds that we need to continue acquisitions and fund future business opportunities, we will go out of business and investors will lose their entire investment in our company.

Like other smaller companies, we face difficulties in raising capital for our continued operations and to consummate a business opportunity with a viable business. We may not be able to raise money through the sale of our equity securities or through borrowing funds on terms we find acceptable.

Because Devon Loosdrecht controls a large percentage of our voting stock, he has the ability to influence matters affecting our stockholders.

Devon Loosdrecht, our CEO, president, chief financial officer, treasurer and sole director, owns over 46% of our common stock and controls a majority of the votes attached to our outstanding voting securities. As a result, he has the ability to influence matters affecting our stockholders, including the election of directors, the acquisition of assets, and the issuance of securities. Because he controls a majority of votes, it would be very difficult for investors to replace our management if they disagree with the way our business is being operated. Because the influence by Mr. Loosdrecht could result in management making decisions that are in the best interest of Mr. Loosdrecht and not in the best interest of the investors, you may lose some or all of the value of your investment in our common stock.

Our Articles of Incorporation exculpate our officers and directors from certain liability to our company or our stockholders.

Our Articles of Incorporation contain a provision limiting the liability of our officers and directors for their acts or failures to act, except for acts involving intentional misconduct, fraud or a knowing violation of law. This limitation on liability may reduce the likelihood of derivative litigation against our officers and directors and may discourage or deter our stockholders from suing our officers and directors based upon breaches of their duties to our company.

Risks Associated with our Common Stock

Our stock price may be volatile, which may result in losses to our shareholders.

The stock markets have experienced significant price and trading volume fluctuations, and the market prices of companies listed on the OTC Markets quotation system in which shares of our common stock are traded, have been volatile in the past and have experienced sharp share price and trading volume changes. The trading price of our common stock is likely to be volatile and could fluctuate widely in response to many factors, including the following, some of which are beyond our control:

12

- variations in our operating results;

- changes in expectations of our future financial performance, including financial estimates by securities analysts and investors;

- changes in operating and stock price performance of other companies in our industry;

- additions or departures of key personnel; and

- future sales of our common stock.

Domestic and international stock markets often experience significant price and volume fluctuations. These fluctuations, as well as general economic and political conditions unrelated to our performance, may adversely affect the price of our common stock.

Our common shares may become thinly traded and you may be unable to sell at or near ask prices, or at all.

We cannot predict the extent to which an active public market for trading our common stock will be sustained. Although the trading price of our common shares increased significantly recently, it has historically been sporadically or “thinly-traded” meaning that the number of persons interested in purchasing our common shares at or near bid prices at certain given time may be relatively small or non-existent.

This situation is attributable to a number of factors, including the fact that we are a small company which is relatively unknown to stock analysts, stock brokers, institutional investors and others in the investment community who generate or influence sales volume. Even if we came to the attention of such persons, those persons tend to be risk-averse and may be reluctant to follow, purchase, or recommend the purchase of shares of an unproven company such as ours until such time as we become more seasoned and viable. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more active public trading market for our common stock will develop or be sustained, or that current trading levels will be sustained.

The market price for our common stock is particularly volatile given our status as a relatively small company, which could lead to wide fluctuations in our share price. You may be unable to sell your common stock at or above your purchase price if at all, which may result in substantial losses to you.

Shareholders should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include (1) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (2) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (3) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (4) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and (5) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities. The occurrence of these patterns or practices could increase the volatility of our share price.

Because we can issue additional shares of common stock, our stockholders may experience dilution in the future.

We are authorized to issue up to 1,125,000,000 shares of common stock, of which 35,690,434 shares of common stock were issued and outstanding as of July 31, 2017. As of April 30, 2017, we have 2,063,967 warrants outstanding which could further dilution in the future if exercised. Our board of directors has the authority to cause us to issue additional shares of common stock without consent of our stockholders. Consequently, stockholders may experience dilution in their ownership of our stock in the future.

13

There is currently no established public trading market for our common stock, which makes it difficult for our stockholders to resell their shares.

There is currently no established public trading market for our common stock. There is a limited public market for our common stock through its quotation on the OTCPink quotation system operated by the OTC Markets Group. Trading in stocks quoted on the OTCPink is often thin and is characterized by wide fluctuations in trading prices due to many factors that may be unrelated or have little to do with a company's operations or business prospects. Moreover, the OTCPink is not a stock exchange, and trading of securities on the OTCPink is often more sporadic than the trading of securities listed on a national securities exchange like the NASDAQ or the NYSE. Accordingly, stockholders may have difficulty reselling any of our shares. We cannot assure you that there will be a market for our common stock in the future.

We do not anticipate paying any cash dividends to our common shareholders.

We presently do not anticipate that we will pay dividends on any of our common stock in the foreseeable future. If payment of dividends does occur at some point in the future, it would be contingent upon our revenues and earnings, if any, capital requirements, and general financial condition. The payment of any common stock dividends will be within the discretion of our board of directors. We presently intend to retain all earnings after paying the interest for the preferred stock, if any, to implement our business plan; accordingly, we do not anticipate the declaration of any dividends for common stock in the foreseeable future.

Volatility in our common share price may subject us to securities litigation.

The market for our common stock is characterized by significant price volatility as compared to seasoned issuers, and we expect that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may, in the future, be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert management’s attention and resources.

The elimination of monetary liability against our directors, officers and employees under Nevada law and the existence of indemnification rights of our directors, officers and employees may result in substantial expenditures by our company and may discourage lawsuits against our directors, officers and employees.

Our Articles of Incorporation contain a specific provision that eliminates the liability of our directors and officers for monetary damages to our company and shareholders. Further, we are prepared to give such indemnification to our directors and officers to the extent provided for by Nevada law. The foregoing indemnification obligations could result in our company incurring substantial expenditures to cover the cost of settlement or damage awards against directors and officers, which we may be unable to recoup. These provisions and resultant costs may also discourage our company from bringing a lawsuit against directors and officers for breaches of their fiduciary duties, and may similarly discourage the filing of derivative litigation by our shareholders against our directors and officers even though such actions, if successful, might otherwise benefit our company and shareholders.

Our business is subject to changing regulations related to corporate governance and public disclosure that have increased both our costs and the risk of noncompliance.

Because our common stock is publicly traded, we are subject to certain rules and regulations of federal, state and financial market exchange entities charged with the protection of investors and the oversight of companies whose securities are publicly traded. These entities, including the Public Company Accounting Oversight Board, the SEC and FINRA, have issued requirements and regulations and continue to develop additional regulations and requirements in response to corporate scandals and laws enacted by Congress, most notably the Sarbanes-Oxley Act of 2002. Our efforts to comply with these regulations have resulted in, and are likely to continue resulting in, increased general and administrative expenses and diversion of management time and attention from revenue-generating activities to compliance activities. Because new and modified laws, regulations and standards are subject to varying interpretations in many cases due to their lack of specificity, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies. This evolution may result in continuing uncertainty regarding compliance matters and additional costs necessitated by ongoing revisions to our disclosure and governance practices.

14

Item 1B. Unresolved Staff Comments.

Not applicable.

Item 2. Properties

Our principal executive offices are located at 7458 Allison Place, Chilliwack, British Columbia, Canada. The office is currently provided to us at no cost by Devon Loosdrecht, our CEO, president, chief financial officer, treasurer and sole director. We believe our current premises are adequate for our current limited operations and we do not anticipate that we will require any additional premises in the foreseeable future. We anticipate that we will continue to utilize these premises so long as the space requirements of our company do not require a larger facility. We do not own any real property.

Item 3. Legal Proceedings

We know of no material pending legal proceedings to which our company is a party or of which any of our properties is the subject. In addition, we do not know of any such proceedings contemplated by any governmental authorities.

We know of no material proceedings in which any of our directors, officers or affiliates, or any registered or beneficial stockholder, is a party adverse to our company or has a material interest adverse to our company.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

Our common stock is quoted under the symbol “GRMX” on the OTCPink quotation system operated by OTC Markets Group, Inc. The criteria for quotation includes that we remain current in our SEC reporting. Currently, no market makers make a market in our stock and no active market exists for our securities. There is no assurance that a regular trading market will develop, or if developed, that it will be sustained. Therefore, a shareholder may be unable to resell securities in our company. Trading in stocks quoted on the OTCPink is often thin and is characterized by wide fluctuations in trading prices due to many factors that may be unrelated or have little to do with a company's operations or business prospects. We cannot assure you that there will be a market for our common stock in the future.

The following quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission, and may not represent actual transactions:

15

| Fiscal Year Ending April 30, 2017 and 2016 | ||

| Quarter Ended | High $ | Low $ |

| April 30, 2017 | 1.42 | 0.26 |

| January 30, 2017 | n/a | n/a |

| October 31, 2016 | 0.60 | 0.36 |

| July 31, 2016 | n/a | n/a |

| April 30, 2016 | n/a | n/a |

| January 30, 2016 | n/a | n/a |

| October 31, 2015 | n/a | n/a |

| July 31, 2015 | n/a | n/a |

Transfer Agent

Our shares of common stock are issued in registered form. The transfer agent and registrar for our common stock is currently Action Stock Transfer Corp., located at 2469 E Fort Union Blvd, Suite 214, Salt Lake City, UT 84121.

Holders of Our Common Stock

As of July 31, 2017, we had 35,690,434 shares of our common stock issued and outstanding, held by 17 holders of record.

Dividends

There are no restrictions in our Articles of Incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where after giving effect to the distribution of the dividend:

| 1. |

we would not be able to pay our debts as they become due in the usual course of business, or; | |

| 2. |

our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution. |

We have not declared any dividends and we do not plan to declare any dividends in the foreseeable future.

Securities Authorized for Issuance under Equity Compensation Plans

We currently do not have any equity compensation plans.

Recent Sales of Unregistered Securities

Since the beginning of our fiscal year ended April 30, 2017, we have not sold any equity securities that were not registered under the Securities Act of 1933 that were not previously reported in a quarterly report on Form 10-Q or in a current report on Form 8-K.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

None.

Item 6. Selected Financial Data

Not applicable.

16

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with our audited annual financial statements and the related notes thereto for the year ended April 30, 2017 which appear elsewhere in this annual report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward looking statements. See “Risk Factors”.

Our audited financial statements are stated in United States dollars and are prepared in accordance with United States generally accepted accounting principles.

Overview

We were incorporated under the laws of the State of Nevada on April 9, 2014. Following incorporation, we commenced the business of a mineral exploration company. However, as we were unable to raise sufficient funds to pursue our exploration program, we are now seeking new business opportunities with established business entities to effect a merger or other form of business combination with our company. We anticipate that any new acquisition or business opportunity that we may be party to will require additional financing. There can be no assurance, however, that we will be able to acquire the financing necessary to enable us to pursue our plan of operation and enter into such an agreement. If our company requires additional financing and we are unable to obtain such funds, our business will fail.

Results of Operations for the Years Ended April 30, 2017 and 2016

We generated no revenues for the years April 30, 2017 and 2016. We do not expect to generate revenues until we have established a new business plan and operations and successfully implemented such business plan.

We incurred operating expenses of $150,326 for the year ended April 30, 2017, compared with operating expenses of $52,628 for the year ended April 30, 2016. The most significant changes in operating expenses comprised the following:

- Consulting fees increased to $26,584 (2016 - $nil) due largely to payments made to our President, CEO & CFO, Devon Loosdrecht for executive consulting;

- Legal fees increased to $33,064 (2016 - $23,618) for legal fees related to the arrangement agreement with Garmatex Technologies and various subscription agreements for the year ending April 30, 2017;

- Foreign exchange increased to $26,584 (2016 - $3) due in majority to the Secured and Subordinated loan agreement with Garmatex Technologies which was maintained in Canadian currency and which recognized an exchange loss on settlement at March 8, 2107;

- Investor relations fees increased to $7,484 (2016 - $nil) was due in majority to the signing of an agreement with CoreIR, per the press release filed on May 17, 2017, as well as increased press release costs relating to the Arrangement Agreement and Master Sublicense Agreement with Garmatex Technologies Inc. and;

- Transfer agent and filing fees increased to $28,652 (2016 – $3,005) due largely to the increased number of subscriptions completed during the period ending April 30, 2017, the name change, stock split, and symbol change relating to the terms of the Arrangement Agreement, and the cancellation fee charged for changing transfer agents of record.

We incurred other interest of $2,442 for the year ended April 30, 2017, as compared to $2,180 for the year ended April 30, 2016. Our other expense for 2017 consisted of interest income of $22,074 (2016 - $nil) to reflect the interest accrued on the Secured and Subordinated loan agreement with Garmatex Technologies Inc. Interest expense for 2017 and 2016 included $2,442 and $2,180, respectively, to reflect the interest accrued on promissory notes issued during the periods. Also included in other expenses for 2017 included accretion of debt discounts of $548 (2016 - $nil) and an impairment on notes receivable of $770,161 (2016 - $nil) to reflect amounts related party notes receivable uncertain to be recovered.

17

We incurred a net loss of $901,403 for the year ended April 30, 2017, as compared with a net loss of $54,808 for the prior year which is directly related to the comparatively increased operating expenses in 2017 and the impairment loss recorded on notes receivable of $770,161.

Liquidity and Capital Resources

As of April 30, 2017, we had cash of $27,880 (2016-$51) and working capital deficit of $(3,030) (2016 - $(7,949)).

Operating Activities

Operating activities used $85,269 in cash for the year ended April 30, 2017 as compared to $13,707 for the prior year ended April 30, 2016. The increase in cash used was attributable to the overall increase in operating expenses and partially offset by the increase in accounts payable and accruals for the year ended April 30, 2017.

Investing Activities

Investing activities used cash of $406,513 for the year ended April 30, 2017 as compared to $nil for the year ended April 30, 2016. This was solely due to funds loaned to Garmatex Technologies under the Secured and Subordinated Loan Agreement.

Financing Activities

Financing activities provided cash of $519,611 for the year ended April 30, 2017, as compared to $13,700 for the year ended April 30, 2016. Cash was mostly comprised of $103,751 (2016 - $13,700) in proceeds from notes payable and $413,284 (2016 - $nil) in proceeds for capital stock subscriptions for the year ended April 30, 2017.

Plan of Operations

We expect that we will require $160,000 to $320,000, in addition to our current cash, to fund our operating expenditures for the next twelve months. Projected working capital requirements for the next twelve months are as follows:

Estimated Working Capital Expenditures During the Next Twelve Months

| Operating expenditures | |

| Transaction costs associated with proposed | |

| Garmatex Arrangement | $10,000 to $20,000 |

| General and administrative | |

| (including professional fees) | $150,000 to $300,000 |

| Total | $160,000 to $320,000 |

General and administrative expenses are expected to include the fees and travel costs we expect to pay in connection with completion of the Garmatex acquisition. In the event that it is successfully completed, we will need to re-assess our 12 month capital requirements in order to reflect our new business activities.

We have issued various promissory notes and private placement agreements to meet our short-term demands. In the past year, we have raised $103,751 in proceeds from the sale of promissory notes and $413,284 in proceeds from capital stock subscriptions, the terms of which are provided in the notes to the financial statements accompanying this annual report. While this source of bridge financing has been helpful in the short term to meet our financial obligations, we will need additional financing to fund our operations and implement our business plan.

18

Based upon our current financial condition, we do not expect to have sufficient cash to operate our business at the current level for the next twelve months. We intend to fund future operations through new business sales and debt and/or equity financing arrangements, which may be insufficient to fund expenditures or other cash requirements. We plan to seek additional financing in a private equity offering to secure funding for operations. There can be no assurance that we will be successful in raising additional funding. If we are not able to secure additional funding, the implementation of our future business plan will be impaired. There can be no assurance that such additional financing will be available to us on acceptable terms or at all.

Outstanding Share Data

As of July 31, 2017, there were 35,690,434 shares of common stock outstanding. In addition, as of July 31, 2017, there 2,095,217 share purchase warrants outstanding and 500,000 shares of common stock were issuable upon conversion of the convertible loan in the aggregate principal amount of $100,000 at the conversion price of $0.20 per share.

Going Concern

Our financial statements have been prepared assuming that we will continue as a going concern which contemplates the realization of assets and satisfaction of liabilities in the normal course of business. We have incurred cumulative losses of $1,010,671 for the period April 9, 2014 (inception date) through April 30, 2017, expect to incur further losses in the development of our new business and have been dependent on funding operations through the issuance of convertible debt and private sale of equity securities. These conditions raise substantial doubt about our ability to continue as a going concern. Management’s plans include continuing to finance operations through the private or public placement of debt and/or equity securities and the reduction of expenditures. However, no assurance can be given at this time as to whether we will be able to achieve these objectives.

In its report on our financial statements for the year ended April 30, 2017, our independent registered public accounting firm included an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern. Our financial statements do not include any adjustments that might be necessary should we be unable to continue as a going concern.

Critical Accounting Policies

In December 2001, the SEC requested that all registrants list their most “critical accounting polices” in the Management Discussion and Analysis. The SEC indicated that a “critical accounting policy” is one which is both important to the portrayal of a company’s financial condition and results, and requires management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain.

Development Stage Activities and Operations:

We are in the development stage and have had no revenues. A development stage company is defined as one in which all efforts are devoted substantially to establishing a new business and even if planned principal operations have commenced, revenues are insignificant.

Recently Issued Accounting Pronouncements

For fiscal years beginning after December 15, 2016:

In November 2015, the FASB issued ASC 2015-17 “Income Taxes (Topic 740) – Balance Sheet Classification of Deferred Taxes” guidance simplifying the presentation of deferred tax liabilities and assets requiring that deferred tax liabilities and assets be classified as noncurrent in a classified statement of financial position. Early adoption permitted.

In August 2014, the FASB issued ASC 2014-15 “Presentation of Financial Statements – Going Concern (Subtopic 205-40) – Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern” new guidance which provides details on when and how to disclose going concern uncertainties. The new standard requires management to perform interim and annual assessments of an entity’s ability to continue as a going concern within one year and to provide certain footnote disclosures if conditions or events raise substantial doubt about an entity’s ability to continue as a going concern. Early adoption is permitted.

For fiscal years beginning after December 15, 2017:

19

In August 2016, the Financial Accounting Standards Board (“FASB”) issued ASC 2016-15 “Statement of Cash Flows (Topic 230) – Classification of Certain Cash Receipts and Cash Payments”. These amendments are intended to provide guidance for each of the eight issues included, to reduce the current and potential future diversity in practice. Early adoption is permitted including in an interim period.

In January 2016, the FASB issued ASC 2016-01 “Financial Instruments – Overall (Subtopic 825-10) – Recognition and Measurement of Financial Assets and Liabilities” a new standard related primarily to accounting for equity investments, financial liabilities where the fair value option has been elected, and the presentation and disclosure requirements for financial instruments. There will no longer be an available-for-sale classification and therefore, no changes in fair value will be reported in other comprehensive income for equity securities with readily determinable fair values. Early adoption is permitted.

We are currently evaluating the impact of the above standards on our consolidated financial statements. Other recent accounting pronouncements issued by the FASB, including its Emerging Issues Task Force, the American Institute of Certified Public Accountants, and the Securities and Exchange Commission did not or are not believed by management to have a material impact on our present or future consolidated financial statements.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have, or are reasonably likely to have, a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to our stockholders.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Not applicable.

Item 8. Financial Statements and Supplementary Data

Index to Financial Statements Required by Article 8 of Regulation S-X:

Audited Financial Statements:

20

GARMATEX HOLDINGS LTD.

(formerly known as Oaxaca

Resources Corp.)

CONSOLIDATED FINANCIAL STATEMENTS

April 30, 2017 and 2016

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Stockholders and Board of Directors of Garmatex Holdings Ltd. (formerly Oaxaca Resources Corp.)

We have audited the accompanying consolidated balance sheet of Garmatex Holdings Ltd. (the “Company”) as at April 30, 2017 and the related consolidated statements of operations, stockholders’ deficit and cash flows for the year then ended. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform an audit to obtain reasonable assurance whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, based on our audit, these financial statements present fairly, in all material respects, the financial position of the Company as at April30,2017and the results of its operations and its cash flows for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, to date the Company has reported losses since inception from operations and requires additional funds to meet its obligations and fund the costs of its operations. These factors raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in this regard are described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ DMCL

DALE MATHESON CARR-HILTON LABONTE LLP

CHARTERED PROFESSIONAL

ACCOUNTANTS

Vancouver, Canada

July 28, 2017

F-1

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders’

Garmatex Holdings Ltd. (formerly Oaxaca Resources Corp.)

Chilliwack, British Columbia, Canada

We have audited the accompanying consolidated balance sheet of Garmatex Holdings Ltd. (formerly Oaxaca Resources Corp.) (the "Company") as of April 30, 2016 and the consolidated related statements of operations, changes in stockholders’ deficit and cash flow for the year then ended. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States of America). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Garmatex Holdings Ltd. (formerly Oaxaca Resources Corp.) as of April 30, 2016 and the results of their operations and their cash flow for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

/s/ MaloneBailey, LLP

www.malonebailey.com

Houston, Texas

August 10, 2016

F-2

GARMATEX HOLDINGS LTD.

(formerly known as Oaxaca

Resources Corp.)

CONSOLIDATED BALANCE SHEETS

| April 30, | April 30, | |||||

| ASSETS | 2017 | 2016 | ||||

| Current | ||||||

| Cash | $ | 27,880 | $ | 51 | ||

| Prepaid expenses | 3,844 | - | ||||

| Due from related party – Note 5 | 85 | 79,776 | ||||

| Total current assets | 31,809 | 79,827 | ||||

| Sublicenses – Note 4 | 1 | - | ||||

| Total assets | $ | 31,810 | $ | 79,827 | ||

| LIABILITIES | ||||||

| Current | ||||||

| Accounts payable and accrued liabilities | $ | 34,155 | $ | 8,000 | ||

| Notes payable – Note 6 | 4,209 | 79,776 | ||||

| Due to related party – Note 5 | 2,576 | - | ||||

| Total current liabilities | 40,940 | 87,776 | ||||

| Long term liabilities | ||||||

| Accrued interest payable – Note 6 | - | 3,659 | ||||

| Notes payable – Note 6 | 40,700 | 40,700 | ||||

| Total long-term liabilities | 40,700 | 44,359 | ||||

| Total liabilities | 81,640 | 132,135 | ||||

| STOCKHOLDERS’ DEFICIT | ||||||

| Preferred stock, $0.001 par value 10,000,000 shares authorized, none issued and outstanding | - | - | ||||

| Common stock, $0.001 par value – Note 7 1,125,000,000 shares authorized 35,627,934 and 31,500,000 shares issued and outstanding, respectively | 35,628 | 31,500 | ||||

| Additional paid in capital | 906,459 | 25,460 | ||||

| Obligation to issue shares – Note 7 | 18,754 | - | ||||

| Accumulated deficit | (1,010,671 | ) | (109,268 | ) | ||

| Total stockholders’ deficit | (49,830 | ) | (52,308 | ) | ||

| Total liabilities and stockholders’ deficit | $ | 31,810 | $ | 79,827 |

The accompanying notes are an integral part of these consolidated financial statements

F-3

GARMATEX HOLDINGS LTD.

(formerly known as Oaxaca

Resources Corp.)

CONSOLIDATED STATEMENTS OF OPERATIONS

| Year Ended | Year Ended | |||||

| April 30, 2017 | April 30, 2016 | |||||

| Operating expenses | ||||||

| Audit and accounting fees | $ | 27,423 | $ | 25,358 | ||

| Bank charges | 935 | 144 | ||||

| Consulting fees | 26,584 | - | ||||

| Foreign exchange | 23,954 | 3 | ||||

| Legal fees | 33,064 | 23,618 | ||||

| Office expenses | 1,461 | 500 | ||||

| Investor relations | 7,484 | - | ||||

| Marketing and social media | 769 | - | ||||

| Transfer and filing fees | 28,652 | 3,005 | ||||

| Operating loss | (150,326 | ) | (52,628 | ) | ||

| Other income (expense) | ||||||

| Accretion expense – Note 6 | (548 | ) | - | |||

| Impairment on notes receivable – Note 5 | (770,161 | ) | - | |||

| Interest income – Note 5 | 22,074 | - | ||||

| Interest expense – Note 6 | (2,442 | ) | (2,180 | ) | ||

| Total other expense | (751,077 | ) | (2,180 | ) | ||

| Net and comprehensive loss | $ | (901,403 | ) | $ | (54,808 | ) |

| Basic net loss per common share- basic and diluted | $ | (0.03 | ) | $ | (0.02 | ) |

| Weighted average number of common shares outstanding – basic and diluted | 33,991,813 | 31,745,900 |

The accompanying notes are an integral part of these consolidated financial statements

F-4

GARMATEX HOLDINGS LTD.

(formerly known as Oaxaca

Resources Corp.)

CONSOLIDATED STATEMENT OF STOCKHOLDERS’

EQUITY (DEFICIT)

For the years ended April 30, 2017 and April 30, 2016

| Additional | ||||||||||||||||||

| Paid in | Obligation to | Accumulated | ||||||||||||||||

| Common Shares | Capital | Issue Shares | Deficit | Total | ||||||||||||||

| Number | Amount | |||||||||||||||||

| Balance, April 30, 2015 | 37,500,000 | $ | 37,500 | $ | (15,000 | ) | $ | - | $ | (54,460 | ) | $ | (31,960 | ) | ||||

| Capital stock returned to treasury: | (6,000,000 | ) | (6,000 | ) | 6,000 | - | - | - | ||||||||||

| Capital contribution: | - | - | 34,460 | - | - | 34,460 | ||||||||||||

| Net loss: | - | - | - | - | (54,808 | ) | (54,808 | ) | ||||||||||

| Balance, April 30, 2016 | 31,500,000 | 31,500 | 25,460 | - | (109,268 | ) | (52,308 | ) | ||||||||||

| Shares issued for cash received by Garmatex | 875,000 | 875 | 271,017 | - | - | 271,892 | ||||||||||||

| Shares issued for note payable | 250,000 | 250 | 79,526 | - | - | 79,776 | ||||||||||||

| Shares issued for cash | 2,877,934 | 2,878 | 391,652 | - | - | 394,530 | ||||||||||||

| Share issued for convertible debt | 125,000 | 125 | 38,804 | - | - | 38,929 | ) | |||||||||||

| Subscription received | - | - | - | 18,754 | - | 18,754 | ) | |||||||||||

| Beneficial conversion feature | - | - | 100,000 | - | - | 100,000 | ||||||||||||

| Net loss | - | - | - | - | (901,403 | ) | (901,403 | ) | ||||||||||

| Balance, April 30, 2017 | 35,627,934 | $ | 35,628 | $ | 906,459 | $ | 18,754 | $ | (1,010,671 | ) | $ | (49,830 | ) | |||||

The accompanying notes are an integral part of these consolidated financial statements

F-5

GARMATEX HOLDINGS LTD.

(formerly knowns as Oaxaca

Resources Corp.)

CONSOLIDATED STATEMENT OF CASH FLOWS

| Year Ended | Year Ended | |||||

| April 30, 2017 | April 30, 2016 | |||||

| Cash flows used in operating activities | ||||||

| Net loss | $ | (901,403 | ) | $ | (54,808 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||

| Capital contribution for expenses paid by related party | - | 34,460 | ||||

| Impairment on notes receivable | 770,161 | - | ||||

| Accretion of debt discount | 548 | - | ||||

| Unrealized foreign exchange | 1,602 | - | ||||

| Changes in operating assets and liabilities: | ||||||

| Prepaid expenses | (3,844 | ) | 250 | |||

| Interest receivable | (84 | ) | - | |||

| Accounts payable and accrued liabilities | 45,399 | 4,211 | ||||

| Accrued interest | 2,442 | 2,180 | ||||

| Net cash used in operating activities | (85,179 | ) | (13,707 | ) | ||

| Cash flows from investing activities | ||||||

| Advanced to related party | (406,513 | ) | - | |||

| Net cash used in investing activities: | (406,513 | ) | - | |||

| Cash flows from financing activities | ||||||

| Due to/from related party | 2,576 | - | ||||

| Notes payable | 103,661 | 13,700 | ||||

| Capital stock issued for cash | 394,530 | - | ||||

| Common stock subscriptions received | 18,754 | - | ||||