Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CHARTER FINANCIAL CORP | chfn-8k07312017.htm |

This presentation may contain certain forward-looking statements

regarding our prospective performance and strategies within the

meaning of Section 27A of the Securities Act of 1933, as amended and

Section 21E of the Securities Exchange Act of 1934, as amended. We

intend such forward-looking statements to be covered by the Safe

Harbor Provision for forward-looking statements contained in the

Private Securities Litigation Reform Act of 1995, and are including

this statement for purposes of said safe harbor provision. Forward-

looking statements can be identified by the use of words such as

“estimate,” “project,” “believe,” “intend,” “anticipate,” “plan,”

“seek,” “expect” and words of similar meaning. These forward-

looking statements include, but are not limited to:

• statements of our goals, intentions and expectations;

• statements regarding our business plans, prospects, growth and

operating strategies;

• statements regarding the asset quality of our loan and investment

portfolios; and

• estimates of our risks and future costs and benefits.

These forward-looking statements are based on current beliefs and

expectations of our management and are inherently subject to significant

business, economic and competitive uncertainties and contingencies, many

of which are beyond our control. In addition, these forward-looking

statements are subject to assumptions with respect to future business

strategies and decisions that are subject to change.

The following factors, among others, could cause actual results to differ

materially from the anticipated results or other expectations expressed in

the forward-looking statements:

• general economic conditions, either nationally or in our market

areas, that are worse than expected;

• competition among depository and other financial institutions

FORWARD-LOOKING STATEMENT

• changes in the interest rate environment that reduce our margins

or reduce the fair value of financial instruments;

• adverse changes in the securities markets;

• changes in laws or government regulations or policies affecting

financial institutions, including changes in regulatory fees and

capital requirements;

• our ability to enter new markets successfully and capitalize on

growth opportunities;

• our ability to successfully identify, acquire, and integrate future

acquisitions;

• our incurring higher than expected loan charge-offs with respect

to assets acquired in FDIC-assisted acquisitions;

• changes in consumer spending, borrowing and savings habits;

• changes in accounting policies and practices, as may be adopted

by the bank regulatory agencies and the Financial Accounting

Standards Board; and

• changes in our organization, compensation and benefit plans.

Because of these and other uncertainties, our actual future results may

be materially different from the results indicated by these forward-looking

statements. Readers are cautioned not to place undue reliance on the

forward-looking statements contained herein, which speak only as of

the date of this presentation. Except as required by applicable law or

regulation, we do not undertake, and specifically disclaim any obligation to

update any forward-looking statements that may be made from time to

time by or on behalf of the Company. Please see “Risk Factors” beginning

on page 19 of the Company’s Prospectus dated February 11, 2013.

2

NASDAQ: CHFN

Recent Price1 (07/21/2017): $17.76

Shares Outstanding (06/30/2017): 15.1 Million

Market Capitalization2: $268.4 Million

Price/Tangible Book Value3: 148.99%

Estimated P/E4 19.7x

Dividend Yield5: 1.58%

Total Assets (06/30/2017): $1.5 Billion

1 - Source: Bloomberg

2 - Based on July 21, 2017 closing market price and June 30, 2017 shares outstanding.

3 - Based on July 21, 2017 closing market price, June 30, 2017 shares outstanding and June 30, 2017

tangible book value.

4 - Based on July 21, 2017 closing market price, June 30, 2017 shares outstanding and LTM $1.04

earnings/share.

5 - Based on July 21, 2017 closing market price

MARKET PROFILE

3

• Founded in 1954 in West Point, Georgia

• Pending Resurgens Bancorp acquisition

• Acquired Community Bank of the South

with four Metro Atlanta branches on

April 15, 2016

• History of organic and acquisitive growth

• Approximately 340 FTE’s servicing 59,000

checking accounts

• 20 Branches (22 including Resurgens)

• 9 Branches (11 including Resurgens) in

Atlanta Metropolitan Statistical Areas

(“MSA”)

CORPORATE PROFILE

June 30, 2017

Total Assets: $1.5 Billion

Total Net Loans: $1.0 Billion

Total Deposits: $1.2 Billion

Total Capital: $212.1 Million

4

Strategic Direction

• Small Town Mutual Thrift (1954 – 2000)

• MHC 20% (2001 – 2008)

• Raised $39 Million in capital

• Buybacks and dividends (dividend waiver) totaling $85 Million

• Financial Crisis (2009 – 2012)

• Three assisted bank acquisitions

• Two Atlanta MSA

• Supplemental capital raises to 40% public

• Financial Recovery (2013 – 2015)

• Full conversion

• Capital raised $143 Million

• Buybacks

• Bought back 35.6% of outstanding stock

• Growth (2016 – Current)

• Acquisitions to build earnings and improve markets

5

z

• Focus on strategic growth

• M&A execution experience … 6 transactions both assisted & unassisted; one

additional pending

• Maintained conservative credit

• Built strong retail deposit franchise

• History of rewarding shareholders

OVERVIEW OF MANAGEMENT TEAM

TOP EXECUTIVES

(Banking/CharterBank)

NAME POSITION EXPERIENCE

ROBERT L. JOHNSON CHAIRMAN & CEO 35/33

LEE W. WASHAM PRESIDENT 33/17

CURTIS R. KOLLAR SENIOR VICE-PRESIDENT & CFO 30/26

6

RECENT ACCOMPLISHMENTS

• Continued North Atlanta Expansion

• Pending Acquisition of Resurgens

• Acquisition of Community Bank of the South (“CBS”) (2016)

• Buckhead Branch (2017)

• Norcross Branch/LPO (2008)

• Growing into an earnings & markets-driven stock

• Consecutive quarterly dividend increases

• Strong credit quality

• Near-complete leverage of thrift conversion capital

7

MARKET CONDITIONS

• Atlanta MSA employment growing at 3.3%

• I-85 corridor legacy markets energized with

automotive & logistics-related job growth

• Most markets have significant

manufacturing, university or military influences

• Active regional M&A market

8

DEPOSIT HIGHLIGHTS

9

• As of June 30, 2017

• 58,962 checking accounts

• 50,379 active debit cards

• 2.7%* gross fee yield on checking account balances

• Bank card revenue 42.4% of deposit fees

• 62.5% checking accounts accept electronic

statements

• 47 bps cost of deposits

* Annualized fees divided by average checking account balances

CHECKING FEES

10

* Annualized fees

Note: Unless otherwise noted, the above chart displays information based on Charter’s fiscal year end, which is September 30.

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

$0

$2,000,000

$4,000,000

$6,000,000

$8,000,000

$10,000,000

$12,000,000

$14,000,000

Accounts$

Do

lla

rs

Total Checking Fees Total # Checking Accounts

CHECKING FEES

11

• 2000 – Total checking

accounts 5,000

• 2017 – Total checking

accounts 59,000

* Annualized fees

Note: Unless otherwise noted, the above chart displays information based on Charter’s fiscal year end, which is September 30.

20%

25%

30%

35%

40%

45%

50%

55%

60%

$0

$2,000,000

$4,000,000

$6,000,000

$8,000,000

$10,000,000

$12,000,000

$14,000,000

% Bank Card Fees of Total Checking Fees Total Checking Fees

CHECKING FEES

12

($ Millions)

Note: Unless otherwise noted, the above chart displays information based on Charter’s fiscal year end, which is September 30.

$0.0

$2.0

$4.0

$6.0

$8.0

$10.0

$12.0

$14.0

FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 YTD 2017 Annualized

Total Checking Fees Bank Card Fees & Other NSF Fees

SWIPE AND DRIVE

13

*Based on SNL Financial ranking as of June 2016

• Growth of CHFN’s Atlanta MSA deposit base

to $578 million

• $712 million deposits pro forma with Resurgens

ranking 8th* among community banks

(under $10.0 billion assets)

• Opened Buckhead branch February 2017

• CHFN loans at 51% in Atlanta MSA

• Pro Forma loans including Resurgens 56%

14

INCREASING POSITION IN

ATLANTA METRO MARKET

CAPITAL LEVERAGE STRATEGY

Holding Company CET1 of 16.40% at June 30,

2017; 13.63% Pro Forma with Resurgens

• M&A

• Organic growth

• Adding loan producers

• Cash dividends

15

Reduced outstanding shares by approximately 35.6%

EFFECTIVE STOCK BUYBACKS

16

-

3.00

6.00

9.00

12.00

15.00

18.00

21.00

24.00

27.00

30.00

-

3

6

9

12

15

18

21

24

27

30

33

$ Do

llar

sMi

llio

ns

Shares Outstanding Stock Price

Continued Positioning in the Atlanta

Metro Market

17

• Will rank 8th in deposit market share among community banks in Atlanta MSA with less than $10.0 billion in assets1 and

20th overall

• CHFN’s Atlanta MSA pro forma loans will increase to 56% or $662 million2

• Atlanta MSA proportion of CHFN’s deposits will increase to 54% or $712 million2

(1) Assets as of March 31, 2017, deposit data as of June 30, 2016

(2) Loans and Deposits as of June 30, 2017

Source: SNL Financial

(1)

Institution (ST) 2016 Rank

Number of

Branches

June 2016

Total Deposits in

Market ($000)

Total

Market

Share (%)

Fidelity Southern Corp. (GA) 9 46 2,927,509 1.92

Brand Group Holdings Inc. (GA) 12 7 1,910,125 1.25

Atlantic Capital Bcshs Inc. (GA) 13 1 1,427,057 0.93

Hamilton State Bancshares (GA) 14 24 1,317,796 0.86

State Bank Finl Corp. (GA) 15 7 1,232,279 0.81

United Bank Corp. (GA) 17 14 901,260 0.59

Renasant Corp. (MS) 18 18 892,067 0.58

Pro Forma Entity 11 710,282 0.46

Charter Financial Corp. (GA) 22 9 583,345 0.38

Resurgens Bancorp (GA) 50 2 126,937 0.08

Market Total 1260 152,829,823

PRO FORMA LOANS

18

CharterBank Resurgens Combined

Note: Regulatory data shown, does not include purchase accounting adjustments

Source: SNL Financial

June 30, 2017

C&D

13.8%

1-4 Fam

21.3%

HELOC

3.2%

OwnOcc CRE

17.0%

Other CRE

29.4%

Multifam

2.5%

C&I

7.4%

Consr & Other

5.3%

C&D

18.3%

1-4 Fam

18.5%

HELOC

6.5%

OwnOcc CRE

23.9%

Other CRE

16.8%

Multifam

2.4%

C&I

13.5%

Consr & Other

0.2%

C&D

14.3%

1-4 Fam

21.0%

HELOC

3.6%

OwnOcc CRE

17.8%

Other CRE

28.0%

Multifam

2.5%

C&I

8.1%

Consr & Other

4.7%

Composition Composition Composition

Loan Type ($000) % of Total Loan Type ($000) % of Total Loan Type ($000) % of Total

Constr & Dev 143,980 13.8% Constr & Dev 24,808 18.3% Constr & Dev 168,788 14.3%

1-4 Family Residential 222,832 21.3% 1-4 Family Residential 25,028 18.5% 1-4 Family Residential 247,860 21.0%

Home Equity 33,708 3.2% Home Equity 8,801 6.5% Home Equity 42,509 3.6%

Owner - Occ CRE 178,046 17.0% Owner - Occ CRE 32,452 23.9% Owner - Occ CRE 210,498 17.8%

Other CRE 307,731 29.4% Other CRE 22,732 16.8% Other CRE 330,463 28.0%

Multifamily 26,220 2.5% Multifamily 3,302 2.4% Multifamily 29,522 2.5%

Commercial & Industrial 77,344 7.4% Commercial & Industrial 18,245 13.5% Commercial & Industrial 95,589 8.1%

Consr & Other 55,712 5.3% Consr & Other 234 0.2% Consr & Other 55,946 4.7%

Total Loans $1,045,573 100.0% Total Loans $135,304 100.0% Total Loans $1,181,175 100.0%

PRO FORMA DEPOSITS

19

June 30, 2017

CharterBank Resurgens Combined

Note: Regulatory data shown, does not include purchase accounting adjustments

Source: SNL Financial

Non Int.

Bearing

16.2%

NOW & Other

Trans

26.2%

MMDA & Sav

26.0%

Time < $100k

15.5%

Time > $100k

16.0%

Non Int.

Bearing

19.1%

NOW & Other

Trans

9.2%

MMDA & Sav

34.8%

Time < $100k

10.7%

Time > $100k

26.2%

Non Int.

Bearing

16.5%

NOW & Other

Trans

24.5%

MMDA & Sav

26.9%

Time < $100k

15.1%

Time > $100k

17.0%

Composition Composition Composition

Deposit Type ($000) % of Total Deposit Type ($000) % of Total Deposit Type ($000) % of Total

Non Interest Bearing 195,437 16.2% Non Interest Bearing 25,523 19.1% Non Interest Bearing 220,960 16.5%

NOW & Other Trans 316,524 26.2% NOW & Other Trans 12,259 9.2% NOW & Other Trans 328,783 24.5%

MMDA & Sav 314,284 26.0% MMDA & Sav 46,459 34.8% MMDA & Sav 360,743 26.9%

Time Deposits < $100k 187,648 15.5% Time Deposits < $100k 14,330 10.7% Time Deposits < $100k 201,978 15.1%

Ti e Deposits > $100k 193,581 16.0% Ti e Deposits > $100k 35,049 26.2% Ti e Deposits > $100k 228,630 17.0%

Total Deposits $1,207,474 100.0% Total Deposits $133,620 100.0% Total Deposits $1,341,094 100.0%

Loans / Deposits 86.6% Loans / Deposits 101.3% Loans / Deposits 88.1%

RESURGENS TRANSACTION SUMMARY

20

• Drives high-teens % EPS accretion and overall shareholder value

• Infills two attractive “in-town” submarkets to CHFN’s growing Atlanta

presence

• CHFN’s broader product line, higher lending limits and expected

retention of Resurgens’ leadership team create opportunities for growth

and synergies across CHFN’s Atlanta market system

• Pro forma institution remains well capitalized and poised to deliver

continued balance sheet and earnings growth

• Consistent with CHFN’s disciplined capital management and growth

strategy

Key Attributes Resurgens Rationale

Franchise Aspects:

• High-growth metro market? Attractive “in-town” infill in the attractive Atlanta MSA

• Complementary culture? Similar culture, efficient transition

• Attractive core deposit base?

Good core mix includes $38mm of

checking deposits with $27mm non-

interest bearing; 60 bps deposit cost

Fundamentals:

• Accretive to EPS day 1? Immediate EPS Accretion1

• TBV earn back period within 5 years? Less than 4 years

• Conservative credit marks? 1.5% of total loans

• Good IRR? +20% IRR2

Resurgens Transaction Meets M&A

Disciplines

21

(1) Excludes one-time merger costs

(2) Based on 14 P/E terminal value

TRANSACTION TERMS & ASSUMPTIONS

22

Resurgens Bancorp

Transaction Value1 $26.3 million

Consideration 100% Cash

Price/TBV 168.6%

Price/LTM EPS2 18.9x

Required

Approvals

Customary regulatory

and shareholder

approval

Expected Closing September 2017

Estimated

Cost Savings:

25% of Resurgens LTM non-

interest expense

Revenue

Synergies:

None assumed

Transaction

Expenses:

$2.7 million, pretax

Core Deposit

Intangible:

$1.0 million

Fair Value

Marks:

1.5% aggregate mark on total

loans

(1) Based on shares outstanding, options, and warrants

(2) Based on LTM tax-effected net income at 34% of $1.4 million

RESURGENS TRANSACTION HIGHLIGHTS

23

• Two branches with more than $130 million of deposits and loans in

highly desirable in-town Atlanta sub-markets

• Energetic management team with capacity to expand market share

• Attractive core deposit mix

• History of consistent earnings

• Solid credit

• Strong IRR

• Compelling EPS accretion

RESURGENS TRANSACTION RATIONALE

24

• Deploys CHFN’s capital, operating capacity and proven M&A expertise in

growing, attractive metro areas

• Ambitious team with proven C&I and ability to grow Atlanta further

• Infills desirable submarkets supporting prior Atlanta acquisition and

Buckhead de novo branch

Strategic

Rationale

Financially

Attractive

• Conservative credit mark after comprehensive due diligence

• De-conversion from same system in most recent prior acquisition

• Simple operations

• Significant management team retention

Low Risk

Integration

• High-teens (%) EPS accretion

• Adds to CHFN’s operating and capital leverage

• Moderate TBV Dilution Payback Period

• Clean credit profile

• +20% IRR

1

(1) Based on 14 P/E terminal value

FINANCIAL INFORMATION

25

Total Loans, Net

Net Income $11.9 million

Fully Diluted EPS1 $0.78

Total Deposits $1.2 billion

• ALL as a % of Nonperforming Loans – 586.83%

• ALL as a % of Total Loans – 1.04%

• Continued advances in core earnings

Asset Quality 0.26% NPA

16.40%

$1.0 billion

1 - Diluted net income per share for the nine months ended June 30, 2017 was computed by dividing net income by weighted average

shares outstanding plus potential common shares resulting from dilutive stock options and unvested restricted shares, determined using the

treasury stock method.

• Basic EPS up 48% from June 2016

• Bank Common Equity Tier 1 of 15.69%

Basic EPS $0.83

FISCAL 2017 YTD (9 Months Ended June 2017)

RESULTS AND DEVELOPMENTS

26

ROA 1.08%

• Total Loans, Net up 4% from June 2016

• Total Deposits up 3% from June 2016

Holding Company

Common Equity Tier 1

Note: Unless otherwise noted, the above chart displays information based on Charter’s fiscal year end, which is September 30.

1 - Core deposits consist of transaction accounts, money market accounts, and savings accounts.

BALANCE SHEET HIGHLIGHTS

27

($ Millions) 2012 2013 2014 2015 2016 Q3 2017

Total Assets $1,032,220 $1,089,406 $1,010,361 $1,027,079 $1,438,389 $1,480,122

Loans, net 593,904 579,854 606,367 714,761 994,052 1,032,107

Securities 189,379 215,118 188,743 184,404 206,336 187,655

Total Liabilities $889,699 $815,628 $785,406 $822,149 $1,235,240 $1,268,042

Retail Deposits 779,397 745,900 717,192 703,278 1,125,067 1,157,450

Core1 456,292 475,426 486,248 505,154 784,705 813,025

Time 323,105 270,475 230,944 198,124 340,362 344,425

Total Borrowings 81,000 60,000 55,000 62,000 56,588 56,690

Total Equity $142,521 $273,778 $224,955 $204,931 $203,150 $212,080

32.1%

Note: Core Deposits = Transaction, Savings & Money Market Accounts

Wholesale Funding = Wholesale Deposits, Borrowings & TRUPS

($ Millions)

DEPOSIT GROWTH

28

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

Core Deposits Retail CD's Wholesale Funding

48%

27%

25% 26%

30%

44%

30%

41%

29%

43%

13%

44%

$1,021

$825

$1,035

$881

11%

37%

52%

$811

8%

59%

33%

$687

$801

12%

25%

63%

$772

7%

30%

63%

$1,218

64%

28%

8%

7%

28%

65%

$1,251

Average cost of deposits for the three

months ended June 30, 2017:

0.47%

DEPOSIT MIX – June 30, 2017

29

Time

Deposits

(Excluding

Wholesale

Deposits)

29%Savings &

Money

Market

25%

Transaction

Accounts

43%

Wholesale

Time

Deposits

3%

$672.8

$714.8

$679.9 $701.4

$993.8 $994.1 $990.6 $1,007.6

$1,032.1

$300.0

$400.0

$500.0

$600.0

$700.0

$800.0

$900.0

$1,000.0

$1,100.0

Jun-15 Sep-15 Dec-15 Mar-16 Jun-16 Sep-16 Dec-16 Mar-17 Jun-17

($ Millions)

NET LOANS OUTSTANDING

30

1-4 Family

21%

Comm RE -

Owner Occupied

17%

Comm RE - Non

Owner Occupied

Other

34%

Comm RE -

Hotels

6%

Comm RE

Multifamily

3%

Commercial

& Industrial

8%

Consumer &

Other

4%

Real Estate

Construction

7%

Note: Unless otherwise noted, the above chart displays information based on Charter’s fiscal year end, which is September 30.

[1] Due to the early termination of the FDIC loss share agreements in the fourth quarter of fiscal 2015, ratios for fiscal year ended 2016, include

all previously covered assets with the exception of FAS ASC 310-30 loans that are excluded from nonperforming loans due to the ongoing

recognition of accretion income established at the time of acquisition. Ratios for periods prior to September 30, 2015, represent non-covered data

only.

LOAN MIX – June 30, 2017

31

Asset quality ratios[1]: At

2012 2013 2014 2015 2016 6/30/17

NPAs / Total Assets (%) 0.69% 0.49% 0.65% 0.73% 0.45% 0.26%

COs / Average Loans (%) 0.86 0.32 0.08 0.00 -0.13% -0.17

ALLL Loans / NPLs (x) 2.38x 2.80x 2.00x 2.30x 2.78x 5.87x

Allowance / Total Loans (%) 1.87% 1.70% 1.55% 1.30% 1.03% 1.04%

Note: Unless otherwise noted, the above chart displays information based on Charter’s fiscal year end, which is September 30.

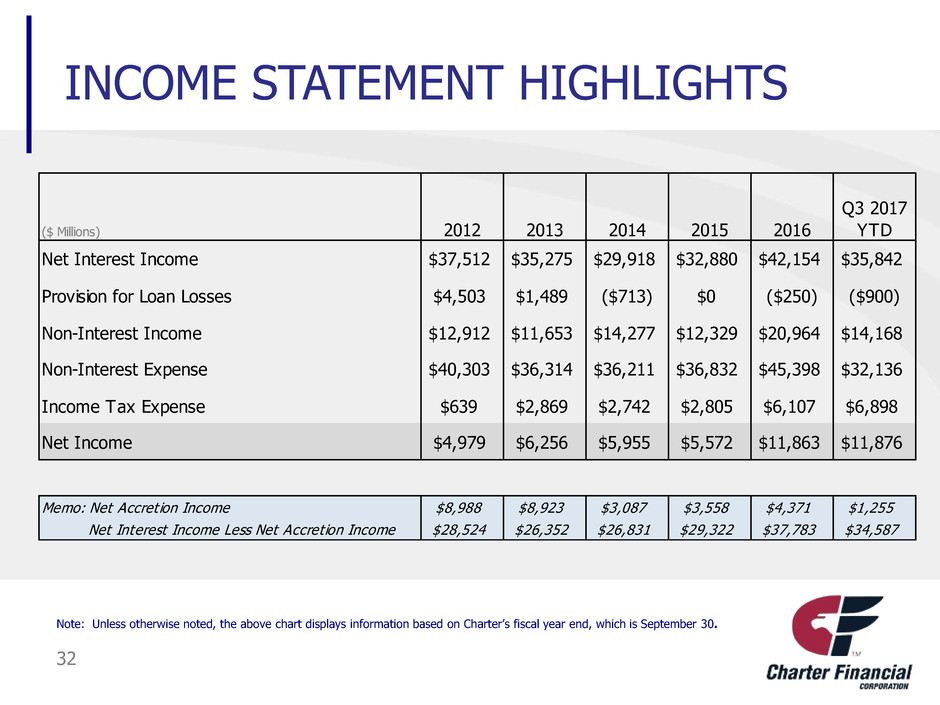

INCOME STATEMENT HIGHLIGHTS

32

Q3 2017

($ Millions) 2012 2013 2014 2015 2016 YTD

Net Interest Income $37,512 $35,275 $29,918 $32,880 $42,154 $35,842

Provision for Loan Losses $4,503 $1,489 ($713) $0 ($250) ($900)

Non-Interest Income $12,912 $11,653 $14,277 $12,329 $20,964 $14,168

Non-Interest Expense $40,303 $36,314 $36,211 $36,832 $45,398 $32,136

Income Tax Expense $639 $2,869 $2,742 $2,805 $6,107 $6,898

Net Income $4,979 $6,256 $5,955 $5,572 $11,863 $11,876

Memo: Net Accretion Income $8,988 $8,923 $3,087 $3,558 $4,371 $1,255

Net Interest Income Less Net Accretion Income $28,524 $26,352 $26,831 $29,322 $37,783 $34,587

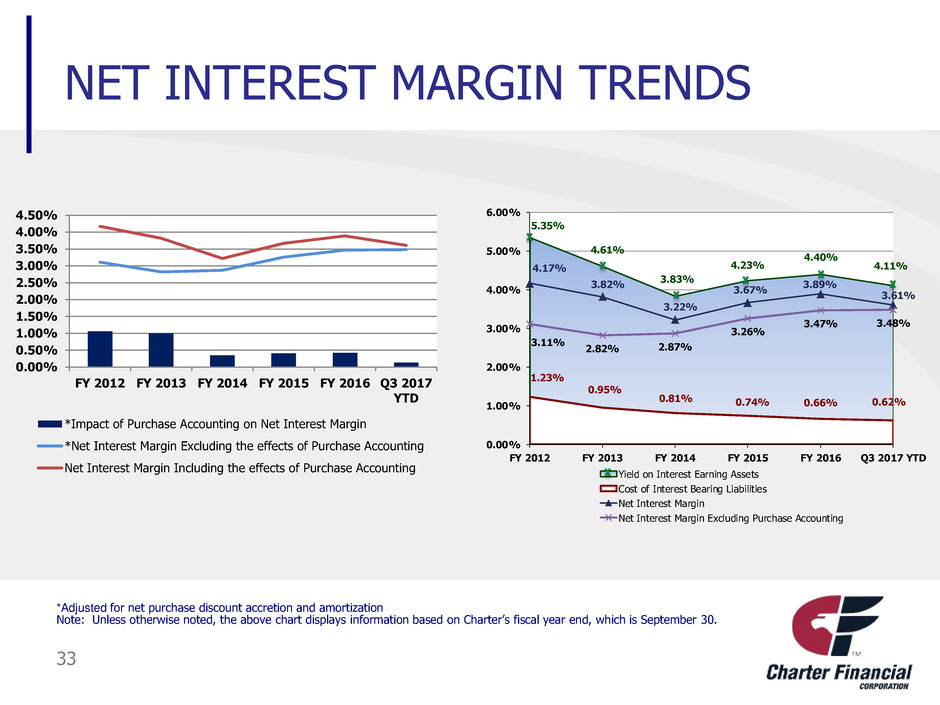

5.35%

4.61%

3.83%

4.23%

4.40%

4.11%

1.23%

0.95%

0.81% 0.74% 0.66% 0.62%

4.17%

3.82%

3.22%

3.67%

3.89%

3.61%

3.11%

2.82% 2.87%

3.26%

3.47% 3.48%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 Q3 2017 YTD

Yield on Interest Earning Assets

Cost of Interest Bearing Liabilities

Net Interest Margin

Net Interest Margin Excluding Purchase Accounting

*Adjusted for net purchase discount accretion and amortization

Note: Unless otherwise noted, the above chart displays information based on Charter’s fiscal year end, which is September 30.

33

NET INTEREST MARGIN TRENDS

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

4.50%

FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 Q3 2017

YTD

*Impact of Purchase Accounting on Net Interest Margi

*Net Interest Margin Excluding the effects of Purchase Accounting

Net Interest Margin Including the effects of Purchase Accounting

($ Millions)

* Adjusted for net purchase discount accretion and amortization; loss share buyout;

recoveries on purchased loans, and acquisition deal costs

34

OPERATING LEVERAGE

$39.9

$38.0

$41.3

$44.1

$55.1

$48.5

101%

96%

88% 83%

75%

66%

80% 77%

82% 81%

72%

63%

30%

40%

50%

60%

70%

80%

90%

100%

110%

120%

130%

140%

150%

160%

$0.0

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 YTD 2017

Adjusted Net Operating Revenue* Adjusted Efficiency Ratio* Efficiency Ratio

$20

$30

$40

$50

$60

$70

$80

$90

$100

$110

FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 YTD 2017

Annualized

Net Operating Rev nue Adjusted Net Operating Revenue* G&A Expenses

Note: Unless otherwise noted, the above chart displays information based on Charter’s fiscal year end, which is September 30.

($ Millions)

35

NONINTEREST INCOME

Noninterest Income adjusted for FDIC purchase accounting accretion

*Other includes BOLI, Brokerage Commissions, Gain/Loss on Sale of Securities

$0

$5

$10

$15

$20

$25

FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 Q3 YTD 2017

Recovery on Purchase Accounting Loans

Other*

1-4 Loan Gain on Sale

Deposit Fees

$11.5

21.8%

66.7%61.2%

30.4%

64.9%

27.5%

$14.5

57.2%

15.5%$14.8

71.0%

18.1%

$21.0

$11.6 10.1%

10.9%

7.6%

11.5%

8.4%

17.2%

68.1%

12.8%

1.8%

17.3%

$14.2

Note: Unless otherwise noted, the above chart displays information based on Charter’s fiscal year end, which is September 30.

($ Millions)

36

NONINTEREST EXPENSE

FY 2016 - Noninterest Expense includes $4.2 million of deal costs.

$0

$5

$10

$15

$20

$25

$30

$35

$40

$45

$50

FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 Q3 YTD 2017

Marketing

Professional Services

Occupancy & Furn. and Equip.

Other

Salaries and Benefits

22.4%

17.9%

50.8%48.0%

21.7%

21.6%

54.6%

14.1%

22.7%

$36.2

56.5%

11.9%

23.3%

$36.8

23.2%

56.2%

13.3%

$45.4

$40.3

$36.3

58.3%

21.4%

13.4%

$32.1

Accelerating EPS growth

Capacity for additional operating and capital leverage

Focused on organic growth

Strategic M&A potential

Favorable credit quality

Track record of returns to shareholders with annualized total

return since:

2013 stock conversion approximately 16%*

37

INVESTMENT MERITS

*Source: Bloomberg with dividends reinvested

INVESTOR CONTACTS

1233 O. G. Skinner Drive

West Point, Georgia 31833

1-800-763-4444

www.charterbk.com

38

Robert L. Johnson

Chairman and Chief Executive Officer

bjohnson@charterbank.net

(706) 645-3249

Lee W. Washam

President

lwasham@charterbank.net

(706) 645-3630

Curtis R. Kollar

Senior Vice President and

Chief Financial Officer

ckollar@charterbank.net

(706) 645-3237

39

APPENDIX

INTEREST RATE RISK

BANK NET PORTFOLIO VALUE

At June 30, 2017

40

(1) Assumes an instantaneous uniform change in interest rates at all maturities.

(2) NPV is the difference between the present value of an institution's assets and liabilities.

(3) Present value of assets represents the discounted present value of incoming cash flows on interest-earning assets.

(4) NPV ratio represents NPV divided by the present value of assets.

Change in Interest

Rates (bp) (1) Estimated NPV (2)

Estimated

Increase

(Decrease)

in NPV

Percentage

Change in

NPV

NPV Ratio as a

Percent of

Present Value of

Assets (3)(4)

Increase (Decrease)

in NPV Ratio as a

Percent of Present

Value of Assets (3)(4)

(dollars in thousands)

300 $292,328 $6,959 2.4% 19.9% 0.3%

200 $290,905 $5,536 1.9% 19.8% 0.4%

100 $288,657 $3,288 1.2% 19.6% 0.2%

— $285,369 — — 19.4% —

(100) $265,055 ($20,314) (7.1%) 18.0% (1.4%)