Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - BRINKS CO | ex991q22017.htm |

| 8-K - 8-K - BRINKS CO | july2017form8-k2q2017earni.htm |

S ECU RE LOG IST ICS. WORLDW ID E.

Second

Quarter

J u l y 26 , 2017

Exhibit 99.2

Safe Harbor Statement and Non-GAAP Results

These materials contain forward-looking information. Words such as "anticipate," "assume," "estimate," "expect," “target” "project," "predict," "intend," "plan,"

"believe," "potential," "may," "should" and similar expressions may identify forward-looking information. Forward-looking information in these materials

includes, but is not limited to information regarding: 2017 non-GAAP outlook, including revenue, organic growth, operating profit, operating profit margin,

earnings per share, capital expenses and adjusted EBITDA; 2019 non-GAAP financial targets, including revenue, organic growth, operating profit, adjusted

EBITDA and earnings per share; results from improvement initiatives; closing of the Temis acquisition and the impact of completed acquisitions including

synergies.

Forward-looking information in this document is subject to known and unknown risks, uncertainties and contingencies, which are difficult to predict or quantify,

and which could cause actual results, performance or achievements to differ materially from those that are anticipated. These risks, uncertainties and

contingencies, many of which are beyond our control, include, but are not limited to: our ability to improve profitability and execute further cost and

operational improvement and efficiencies in our core businesses; our ability to improve service levels and quality in our core businesses; market volatility and

commodity price fluctuations; seasonality, pricing and other competitive industry factors; investment in information technology and its impact on revenue and

profit growth; our ability to maintain an effective IT infrastructure and safeguard confidential information; our ability to effectively develop and implement

solutions for our customers; risks associated with operating in foreign countries, including changing political, labor and economic conditions, regulatory issues,

currency restrictions and devaluations, restrictions on and cost of repatriating earnings and capital, and restrictive government actions, including

nationalization; labor issues, including negotiations with organized labor and work stoppages; the strength of the U.S. dollar relative to foreign currencies and

foreign currency exchange rates; our ability to identify, evaluate and complete acquisitions and other strategic transactions (including those in the home

security industry) and to successfully integrate acquired companies; costs related to dispositions and market exits; our ability to obtain appropriate insurance

coverage, positions taken by insurers relative to claims and the financial condition of insurers; safety and security performance and loss experience; employee

and environmental liabilities in connection with former coal operations, including black lung claims ; the impact of the Patient Protection and Affordable Care

Act on legacy liabilities and ongoing operations; funding requirements, accounting treatment, and investment performance of our pension plans, the VEBA and

other employee benefits; changes to estimated liabilities and assets in actuarial assumptions; the nature of hedging relationships and counterparty risk; access

to the capital and credit markets; our ability to realize deferred tax assets; the outcome of pending and future claims, litigation, and administrative proceedings;

public perception of our business and reputation; changes in estimates and assumptions underlying critical accounting policies; the promulgation and adoption

of new accounting standards, new government regulations and interpretation of existing standards and regulations.

This list of risks, uncertainties and contingencies is not intended to be exhaustive. Additional factors that could cause our results to differ materially from those

described in the forward-looking statements can be found under "Risk Factors" in Item 1A of our Annual Report on Form 10-K for the period ended December

31, 2016, and in our other public filings with the Securities and Exchange Commission. The forward-looking information discussed today and included in these

materials is representative as of today only and The Brink's Company undertakes no obligation to update any information contained in this document.

These materials are copyrighted and may not be used without written permission from Brink's.

Today’s presentation is focused primarily on non-GAAP results. Detailed reconciliations of non-GAAP to GAAP results are included in the appendix and in the

First Quarter 2017 Earnings Release available in the Quarterly Results section of the Brink’s website: www.brinks.com.

2

CEO Overview

Doug Pertz

CEO Overview

4

SECOND-QUARTER HIGHLIGHTS

• Strong improvement in revenue, operating profit, earnings and cash flow

• Profit growth in North and South America led by U.S., Mexico, Brazil and Argentina

• Execution of 3-year strategic plan gaining traction

• 4 acquisitions completed YTD through 7/26; Temis expected to close in 4Q, more in pipeline

• 2017 non-GAAP EPS guidance raised to $2.95 - $3.05 per share

o Includes $.09 from completed acquisitions

• 2019 non-GAAP adjusted EBITDA target raised to $560 million

o Includes $60 million from completed acquisitions

Note: See detailed reconciliations of non-GAAP to GAAP results included in the Second Quarter 2017 Earnings Release available in the Quarterly Results section of the Brink’s website:

www.brinks.com

Second-Quarter 2017 Non-GAAP Results

5

Continued Momentum in Second Quarter

($ in millions)

$717

$760

2016 2017

REVENUE

($ Millions)

+6% Organic

$39

$60

2016 2017

5.5%

Margin

OPERATING PROFIT

7.9%

Margin

+ 52%

ADJUSTED EBITDA

$70

$91

0

20

40

60

80

100

2016 2017

9.7%

Margin

12%

Margin

($ Millions)

+31%

EPS

+64%

$0.39

$0.64

2016 2017

($ Millions)

Note: See detailed reconciliations of non-GAAP to GAAP results included in the Second Quarter 2017 Earnings Release available in the Quarterly Results section of the Brink’s website:

www.brinks.com

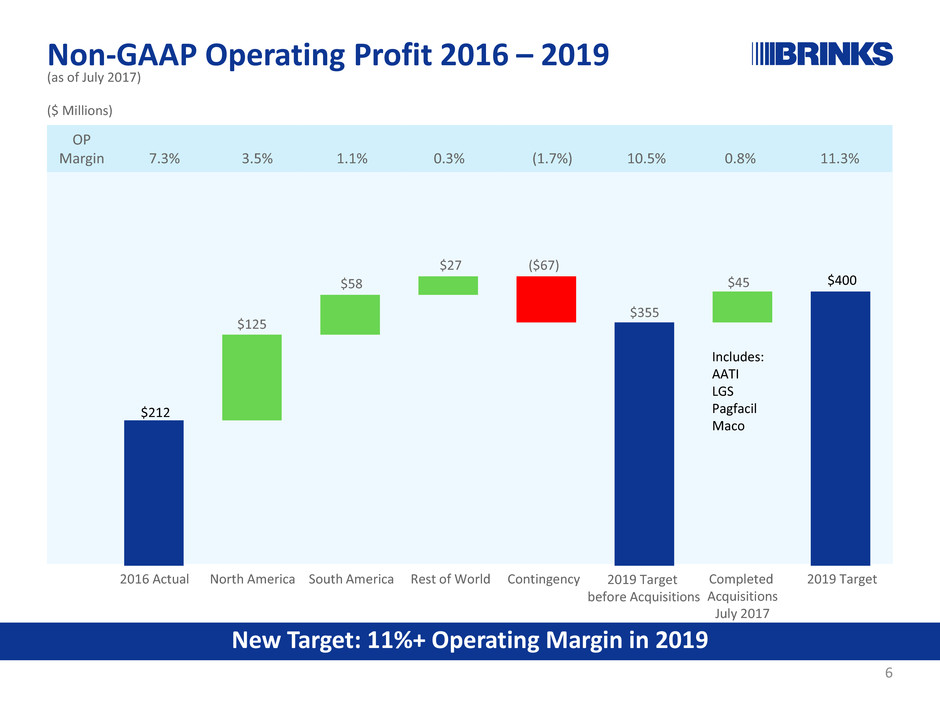

Non-GAAP Operating Profit 2016 – 2019

6

New Target: 11%+ Operating Margin in 2019

($ Millions)

2016 Actual Rest of World Contingency 2019 TargetNorth America South America

$212

$400

$125

$58

$27 ($67)

$355

$45

Completed

Acquisitions

July 2017

OP

Margin 7.3% 3.5% 1.1% 0.3% (1.7%) 10.5% 0.8% 11.3%

(as of July 2017)

Includes:

AATI

LGS

Pagfacil

Maco

2019 Target

before Acquisitions

7

Sales, Marketing &

Intelligent Safes

Global Breakthrough Initiatives

• “Next generation” trucks starting to come on-line in U.S.

• Lower R&M expenses beginning to have an impact in U.S. and Mexico

• Expect to convert 60% of U.S. routes by end of 2019

• Lower labor costs beginning to have impact in U.S., Mexico and Canada

• Installed high-speed money processing machines in Chicago, Brooklyn; several

more locations by year-end 2017

• CompuSafe® service ramping up in U.S., Mexico, Brazil and several other

countries

• Recycler pilots in progress, expect relatively small impact from additional sales

in 2017

• Successfully working with union in Mexico to drive labor efficiency

Reduced Crew Size

Fleet Investments

Network

Optimization

Labor

Management

APG – Accelerate Profitable Growth

Acquisition Update:

• “Core – Core” – Core businesses in Core Markets

• 4 completed YTD through 7/26

• Expected to be accretive in 2017

• Expect significant accretion in 2019

• Temis France expected to close in 4Q

• Robust pipeline of additional opportunities

Expected impact of completed acquisitions on 2019 non-

GAAP targets:

• +$175 million revenue

• +$45 million operating profit

• +$60 million adjusted EBITDA

• +$.45 EPS

8

Executing Our Plan to Acquire Core Business in Core Markets

U.S.

(AATI)

Brazil

(PagFacil)

Argentina

(Maco)

Chile

(LGS)

Synergistic, Accretive Acquisitions in Our Core Markets

France

(Temis

announced

7/25)

Maco Accelerates Profitable Growth (APG)

• $209 million expected purchase price

• $90 million LTM revenue, $24 million LTM

adjusted EBITDA

• Significant consolidation synergies expected

• ~6x Adjusted EBITDA post-integration (8.7x

pre-integration)

• Solidifies #2 position in Argentina

• Strong customer base, increased route density

• Expected to be slightly accretive in 2017,

significant contribution in 2019

9

Core Acquisition in High-Margin Market

Brink's

Brink’s Maco

Prosegur

Loomis

Growing Share…in a Growing Market

Source: Internal estimates

Argentina

Ron Domanico

Financial Review

Value Creation Strategy – Brink’s Building Blocks

GROWTH (APG)

• Grow Organically

• Pursue Adjacencies

• Introduce Differentiated

Service (IDS)

• Make Acquisitions

MARGINS (CTG)

• Pricing

• Lean Cost Structure

• Optimize Procurement

• Operating Leverage

• Corporate Cost Discipline

• Interest, Taxes, EPS

RETURNS (ROI)

• Capital Structure

• Financial Leverage

• Capital Expenditures

• Accretive Acquisitions

• Shareholder Returns

CREDIBILITY

• Reduce Complexity

• Increase Transparency

• Set Aggressive Targets

• Meet / Exceed Goals

11

($ Millions)

0% 6%

Organic

Adjusted

2016 RevenueCurrency Acq/Disp

2016

Revenue

2017

Revenue

0%% Change

Note: See detailed reconciliations of non-GAAP to GAAP results included in the Second Quarter 2017 Earnings Release available in the Quarterly Results section of the Brink’s

website: www.brinks.com. Amounts may not add due to rounding.

$717 $717

$760

( $3 ) $3

$43

Non-GAAP Revenue: Second Quarter 2017 vs 2016

12

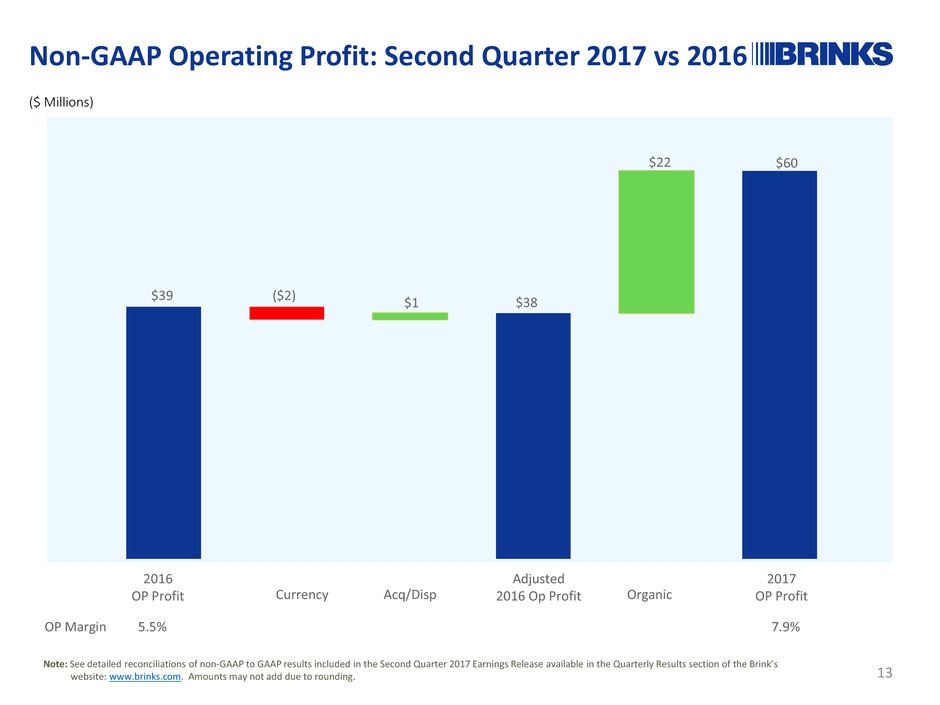

5.5% 7.9%

Organic

Adjusted

2016 Op ProfitCurrency Acq/Disp

2016

OP Profit

2017

OP Profit

OP Margin

$39 $38

$60

($2) $1

$22

Non-GAAP Operating Profit: Second Quarter 2017 vs 2016

13

Note: See detailed reconciliations of non-GAAP to GAAP results included in the Second Quarter 2017 Earnings Release available in the Quarterly Results section of the Brink’s

website: www.brinks.com. Amounts may not add due to rounding.

($ Millions)

$60

$33

$91

$34

$25

($7)

($19)

($2)

($ Millions, except EPS)

EPS

2017 $0.64

2016 $0.39

Net Interest & Other TaxesOp Profit

Income from

Continuing Ops D&A

Minority

Interest

Interest Exp.

&Taxes

Adjusted

EBITDA

($1) ($6)$21 $13 $1_ $7 $21

vs

2016

Non-GAAP Results – Second Quarter

14

Note: See detailed reconciliations of non-GAAP to GAAP results included in the Second Quarter 2017 Earnings Release available in the Quarterly Results section of the Brink’s

website: www.brinks.com. Amounts may not add due to rounding.

$72

$113

2016 2017

5.1%

Margin

OPERATING PROFIT

7.5%

Margin

+ 57%

First-Half 2017 Non-GAAP Results

15

A Strong First Half

$1,405

$1,500

2016 2017

REVENUE

($ Millions)

+7% Organic

ADJUSTED EBITDA

$132

$174

2016 2017

9.4%

Margin

11.6%

Margin

($ Millions)

+32%

EPS

+73%

$0.70

$1.21

2016 2017

($ Millions)

Note: See detailed reconciliations of non-GAAP to GAAP results included in the Second Quarter 2017 Earnings Release available in the Quarterly Results section of the Brink’s website:

www.brinks.com

2015 Actual 2016 Actual 2017 Outlook

Capital Expenditures

16

($ Millions)

CAPITAL EXPENDITURES 2015 – 2017

CompuSafe®

Facility

Equipment /

Other

IT

Armoured

Vehicle

D&A $132 $127 ~$145

Reinvestment Ratio1 0.9 1.1

TBD

$124

Total Before

CompuSafe®

$137

$180

Total Before

CompuSafe®

CompuSafe®

1. See Non-GAAP reconciliation in Appendix

$106

Total Before

CompuSafe®

$116

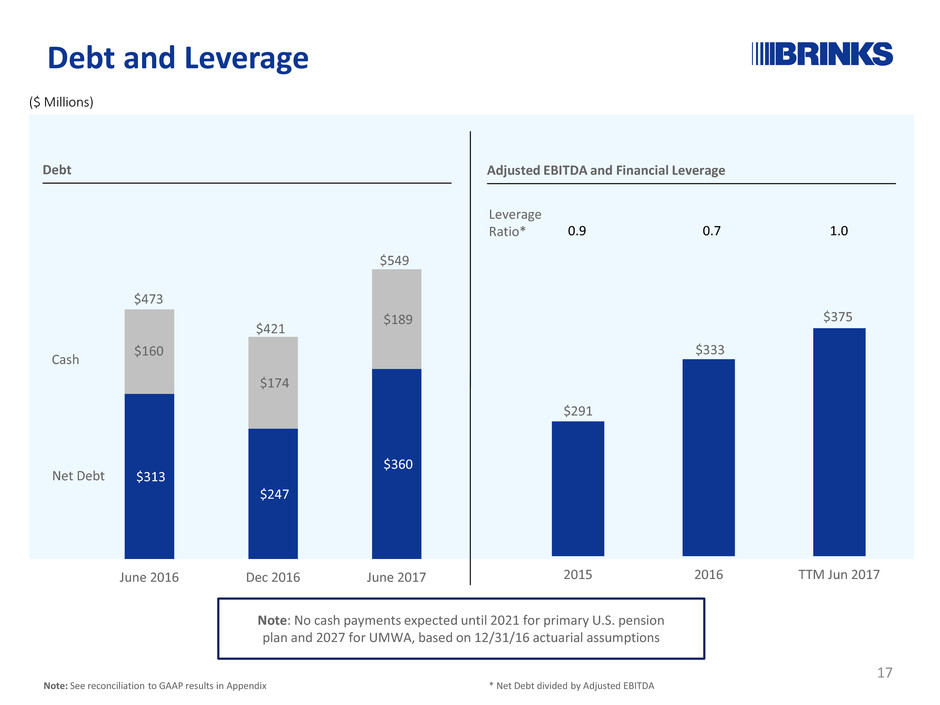

($ Millions)

Leverage

Ratio* 0.9 0.7 1.0

Note: No cash payments expected until 2021 for primary U.S. pension

plan and 2027 for UMWA, based on 12/31/16 actuarial assumptions

Cash

Net Debt

Note: See reconciliation to GAAP results in Appendix

Debt Adjusted EBITDA and Financial Leverage

* Net Debt divided by Adjusted EBITDA

$291

$333

$375

2015 2016 TTM Jun 2017

$313

$247

$360

$160

$174

$189

June 2016 Dec 2016 June 2017

$473

$421

$549

Debt and Leverage

17

($ Millions, except share price)

Multiple

9.9%Margin 12.5%

Multiple 6.1x 10.0x

Source: Most recent trailing 12 months and publicly available peer

financial information

Share Price $28.49 $67.00

Adj. EBITDA

Brink’s

Peers

Note: See detailed reconciliations of non-GAAP to GAAP results included in the First Quarter 2017 Earnings

Release and the Second Quarter 2017 Earning Release available in the Quarterly Results section of the Brink’s

website: www.brinks.com. Amounts may not add due to rounding.

Adjusted EBITDA

18

$161

$253

$124

$122

TTM June 2016 TTM June 2017

$375

$284

5.7x

7x

10.0x

Dec 2015 Dec 2016 Jun 2017

Trailing 12 Months Multiple

8.6x

11.8x

7.8x

Peer A Peer B Peer C

Depreciation &

Amortization

/Other

Op Profit

2017 Non-GAAP Guidance Increased

2016 Results

Prior 2017

Guidance

(4/26/2017) Organic Currency Acquisitions (1)

Updated

2017

Guidance

(7/26/2017)

Increase vs

2016

Revenue $2,908 $3,036 ‒ $92 $52 $3,180 9%

Operating Profit $212 $235-$245 $20 $5 $10 $270-$280 ~30%

Operating Margin 7.3% 7.8%-8.2% 8.5%-8.8% 1.2-1.5 pts.

Adjusted EBITDA $333 $370-$380 $20 $5 $20 $415-$425 ~26%

EPS $2.24 $2.55-$2.65 $.26 $.05 $.09 $2.95-$3.05 ~34%

19

Increase

1. Completed acquisitions as of 7/26/2017

($ Millions, except EPS)

Note: See detailed reconciliations of non-GAAP to GAAP results included in the First Quarter 2017 Earnings Release and the Second Quarter 2017 Earning Release available in the Quarterly

Results section of the Brink’s website: www.brinks.com. Amounts may not add due to rounding.

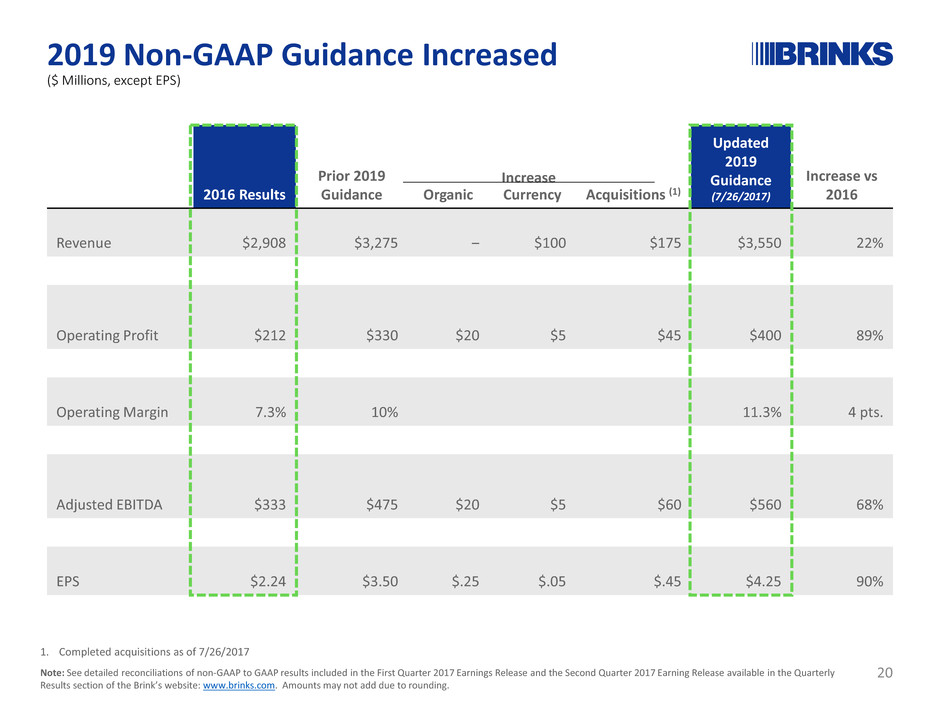

2019 Non-GAAP Guidance Increased

2016 Results

Prior 2019

Guidance Organic Currency Acquisitions (1)

Updated

2019

Guidance

(7/26/2017)

Increase vs

2016

Revenue $2,908 $3,275 ‒ $100 $175 $3,550 22%

Operating Profit $212 $330 $20 $5 $45 $400 89%

Operating Margin 7.3% 10% 11.3% 4 pts.

Adjusted EBITDA $333 $475 $20 $5 $60 $560 68%

EPS $2.24 $3.50 $.25 $.05 $.45 $4.25 90%

20

Increase

($ Millions, except EPS)

1. Completed acquisitions as of 7/26/2017

Note: See detailed reconciliations of non-GAAP to GAAP results included in the First Quarter 2017 Earnings Release and the Second Quarter 2017 Earning Release available in the Quarterly

Results section of the Brink’s website: www.brinks.com. Amounts may not add due to rounding.

Conclusion

$163

$212

$270 - $280

$4005.5%

7.3%

8.5% - 8.8%

11.3%

2015 2016 2017 2019

Continued Improvement Expected in 2017 &

Beyond

Non-GAAP Operating Profit

Margin

2017 Non-GAAP Outlook

• Revenue $3.2 billion (6% organic growth)

• Operating profit $270 - $280 million; margin 8.5% - 8.8%

• Adjusted EBITDA $415 to $425 million

• EPS $2.95- $3.05

($ Millions, except % and per share amounts)

2019 Non-GAAP Targets

• 8% annual revenue growth to $3.6 billion

• Operating profit $400 million; margin 11.3%

• Adjusted EBITDA $560 million

• $4.25 EPS

Target

Note: See detailed reconciliations of non-GAAP to GAAP results included in the First Quarter 2017 Earnings Release and the Second Quarter 2017 Earnings release available in the Quarterly Results

section of the Brink’s website: www.brinks.com. 22

Guidance

+ +

Why Brink’s?

Brink’s has the right leadership, the right strategy and the financial strength to drive

superior shareholder returns.

Market

Strength

• Premier global brand

with unmatched

footprint and

customers in 100+

countries

• Strong market

position

People

• New leadership with

proven track record

• Customer-driven

employees

• Continuous

improvement culture

Strategy and

Resources

• Solid strategy

• Industry’s strongest

balance sheet

Questions?

Appendix

Non-GAAP Reconciliation — Net Debt

The Brink’s Company and subsidiaries

Non-GAAP Reconciliations — Net Debt (Unaudited)

(In millions)

a) Restricted cash borrowings are related to cash borrowed under lending arrangements used in the process of managing customer cash supply chains, which is currently

classified as restricted cash and not available for general corporate purposes.

b) Title to cash received and processed in certain of our secure Cash Management Services operations transfers to us for a short period of time. The cash is generally credited to

customers’ accounts the following day and we do not consider it as available for general corporate purposes in the management of our liquidity and capital resources and in

our computation of Net Debt.

Net Debt is a supplemental non-GAAP financial measure that is not required by, or presented in accordance with GAAP. We use Net Debt as a measure of our financial leverage.

We believe that investors also may find Net Debt to be helpful in evaluating our financial leverage. Net Debt should not be considered as an alternative to Debt determined in

accordance with GAAP and should be reviewed in conjunction with our consolidated balance sheets. Set forth above is a reconciliation of Net Debt, a non-GAAP financial

measure, to Debt, which is the most directly comparable financial measure calculated and reported in accordance with GAAP, as of June 30, 2017, December 31, 2016 and June

30, 2016.

26

June 30, December 31, June 30,

(In millions) 2017 2016 2016

Debt:

Short-term borrowings $ 175.7 162.8 77.2

Long-term debt 399.4 280.4 405.3

Total Debt 575.1 443.2 482.5

Restricted cash borrowings(a) (26.1) (22.3) (9.2)

Total Debt without restricted cash borrowings 549.0 420.9 473.3

Less:

Cash and cash equivalents 207.1 183.5 169.6

Amounts held by Cash Management Services operations(b) (18.4) (9.8) (9.6)

Cash and cash equivalents available for general corporate purposes 188.7 173.7 160.0

Net Debt $ 360.3 247.2 313.3

Non-GAAP Reconciliation — Other

The Brink’s Company and subsidiaries

Non-GAAP Reconciliations — Other Amounts (Unaudited)

(In millions)

Amounts Used to Calculate Reinvestment Ratio

Property and Equipment Acquired During the Period

Full-Year

2015

Full Year

2016

Capital expenditures — GAAP 101.1 112.2

Capital leases — GAAP 18.9 29.4

Total Property and equipment acquired 120.0 141.6

Venezuela property and equipment acquired (4.3) (5.0)

Total property and equipment acquired excluding Venezuela 115.7 136.6

Depreciation

Depreciation and amortization — GAAP 139.9 131.6

Amortization (4.2) (3.6)

Venezuela depreciation (3.9) (0.7)

Reorganization and Restructuring - (0.8)

Depreciation — Non-GAAP 131.8 126.5

Reinvestment Ratio 0.9 1.1

27