Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AMEDISYS INC | d414588d8k.htm |

| EX-99.1 - EX-99.1 - AMEDISYS INC | d414588dex991.htm |

Amedisys Second Quarter 2017 Earnings Call Supplemental Slides July 27, 2017 Exhibit 99.2

This presentation may include forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based upon current expectations and assumptions about our business that are subject to a variety of risks and uncertainties that could cause actual results to differ materially from those described in this presentation. You should not rely on forward-looking statements as a prediction of future events. Additional information regarding factors that could cause actual results to differ materially from those discussed in any forward-looking statements are described in reports and registration statements we file with the SEC, including our Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, copies of which are available on the Amedisys internet website http://www.amedisys.com or by contacting the Amedisys Investor Relations department at (225) 292-2031. We disclaim any obligation to update any forward-looking statements or any changes in events, conditions or circumstances upon which any forward-looking statement may be based except as required by law. www.amedisys.com NASDAQ: AMED We encourage everyone to visit the Investors Section of our website at www.amedisys.com, where we have posted additional important information such as press releases, profiles concerning our business and clinical operations and control processes, and SEC filings. Forward-looking statements

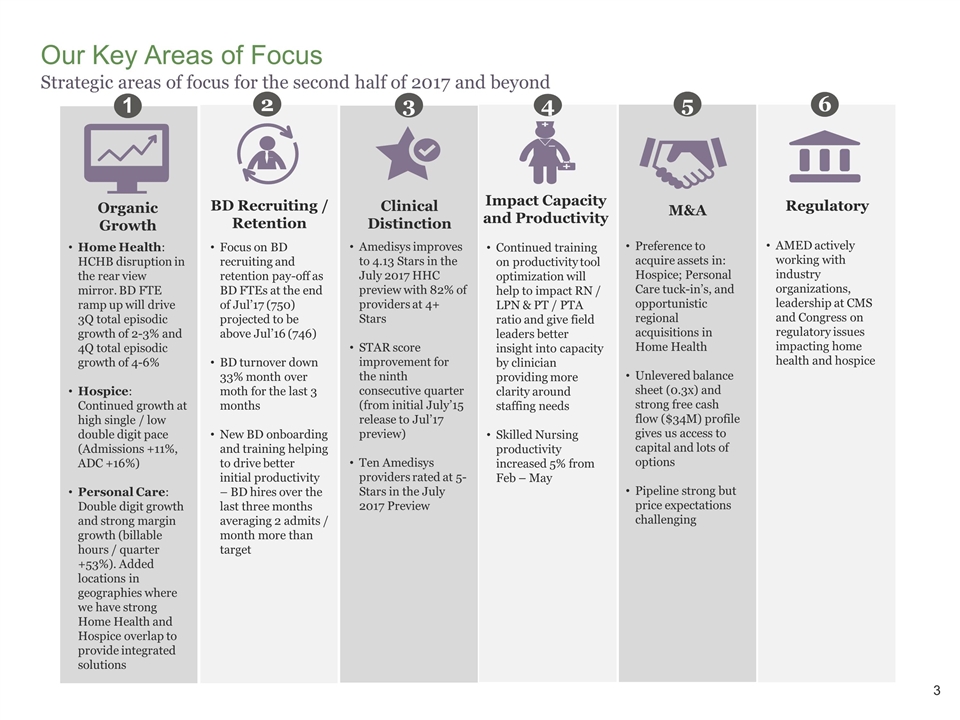

Our Key Areas of Focus Strategic areas of focus for the second half of 2017 and beyond Home Health: HCHB disruption in the rear view mirror. BD FTE ramp up will drive 3Q total episodic growth of 2-3% and 4Q total episodic growth of 4-6% Hospice: Continued growth at high single / low double digit pace (Admissions +11%, ADC +16%) Personal Care: Double digit growth and strong margin growth (billable hours / quarter +53%). Added locations in geographies where we have strong Home Health and Hospice overlap to provide integrated solutions 1 Organic Growth Amedisys improves to 4.13 Stars in the July 2017 HHC preview with 82% of providers at 4+ Stars STAR score improvement for the ninth consecutive quarter (from initial July’15 release to Jul’17 preview) Ten Amedisys providers rated at 5-Stars in the July 2017 Preview 3 Clinical Distinction Continued training on productivity tool optimization will help to impact RN / LPN & PT / PTA ratio and give field leaders better insight into capacity by clinician providing more clarity around staffing needs Skilled Nursing productivity increased 5% from Feb – May 4 Impact Capacity and Productivity Preference to acquire assets in: Hospice; Personal Care tuck-in’s, and opportunistic regional acquisitions in Home Health Unlevered balance sheet (0.3x) and strong free cash flow ($34M) profile gives us access to capital and lots of options Pipeline strong but price expectations challenging 5 M&A 2 BD Recruiting / Retention Focus on BD recruiting and retention pay-off as BD FTEs at the end of Jul’17 (750) projected to be above Jul’16 (746) BD turnover down 33% month over moth for the last 3 months New BD onboarding and training helping to drive better initial productivity – BD hires over the last three months averaging 2 admits / month more than target 6 Regulatory AMED actively working with industry organizations, leadership at CMS and Congress on regulatory issues impacting home health and hospice

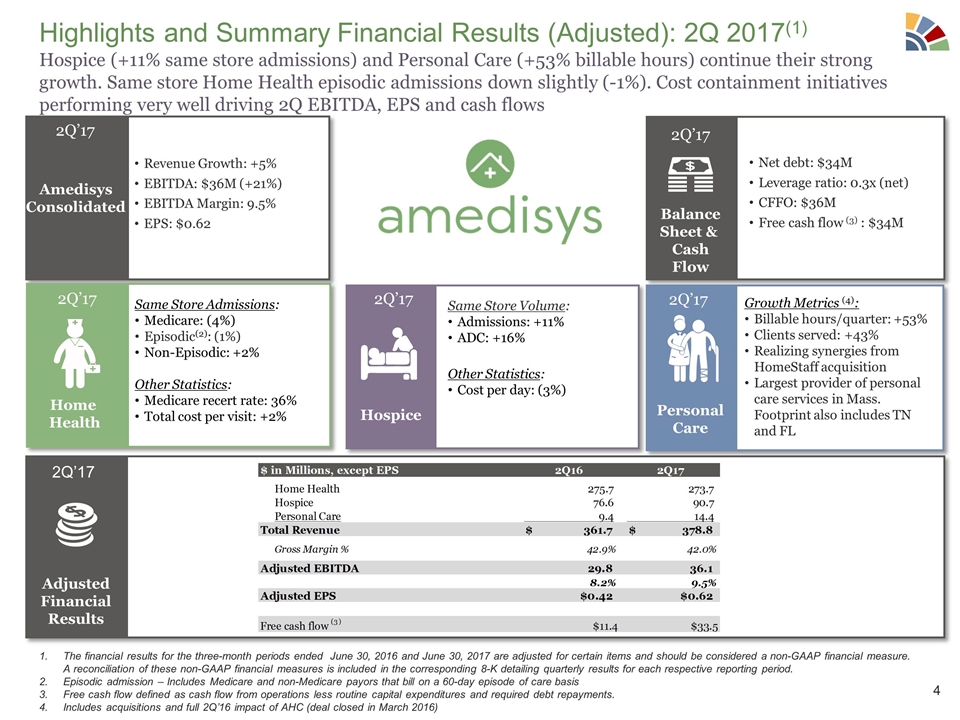

Highlights and Summary Financial Results (Adjusted): 2Q 2017(1) Hospice (+11% same store admissions) and Personal Care (+53% billable hours) continue their strong growth. Same store Home Health episodic admissions down slightly (-1%). Cost containment initiatives performing very well driving 2Q EBITDA, EPS and cash flows Amedisys Consolidated Revenue Growth: +5% EBITDA: $36M (+21%) EBITDA Margin: 9.5% EPS: $0.62 2Q’17 Net debt: $34M Leverage ratio: 0.3x (net) CFFO: $36M Free cash flow (3) : $34M Balance Sheet & Cash Flow 2Q’17 Same Store Admissions: Medicare: (4%) Episodic(2): (1%) Non-Episodic: +2% Other Statistics: Medicare recert rate: 36% Total cost per visit: +2% Home Health Growth Metrics (4): Billable hours/quarter: +53% Clients served: +43% Realizing synergies from HomeStaff acquisition Largest provider of personal care services in Mass. Footprint also includes TN and FL Personal Care Same Store Volume: Admissions: +11% ADC: +16% Other Statistics: Cost per day: (3%) Hospice 2Q’17 2Q’17 2Q’17 Adjusted Financial Results 2Q’17 The financial results for the three-month periods ended June 30, 2016 and June 30, 2017 are adjusted for certain items and should be considered a non-GAAP financial measure. A reconciliation of these non-GAAP financial measures is included in the corresponding 8-K detailing quarterly results for each respective reporting period. Episodic admission – Includes Medicare and non-Medicare payors that bill on a 60-day episode of care basis Free cash flow defined as cash flow from operations less routine capital expenditures and required debt repayments. Includes acquisitions and full 2Q’16 impact of AHC (deal closed in March 2016)

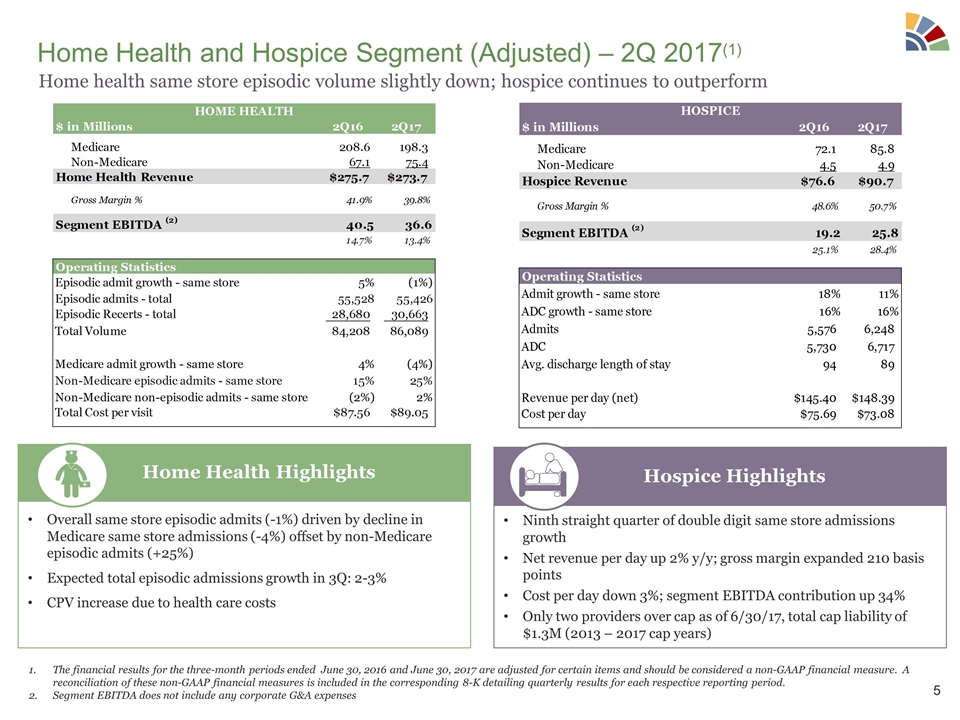

Home Health and Hospice Segment (Adjusted) – 2Q 2017(1) Overall same store episodic admits (-1%) driven by decline in Medicare same store admissions (-4%) offset by non-Medicare episodic admits (+25%) Expected total episodic admissions growth in 3Q: 2-3% CPV increase due to health care costs Home Health Highlights Ninth straight quarter of double digit same store admissions growth Net revenue per day up 2% y/y; gross margin expanded 210 basis points Cost per day down 3%; segment EBITDA contribution up 34% Only two providers over cap as of 6/30/17, total cap liability of $1.3M (2013 – 2017 cap years) Hospice Highlights The financial results for the three-month periods ended June 30, 2016 and June 30, 2017 are adjusted for certain items and should be considered a non-GAAP financial measure. A reconciliation of these non-GAAP financial measures is included in the corresponding 8-K detailing quarterly results for each respective reporting period. Segment EBITDA does not include any corporate G&A expenses Home health same store episodic volume slightly down; hospice continues to outperform

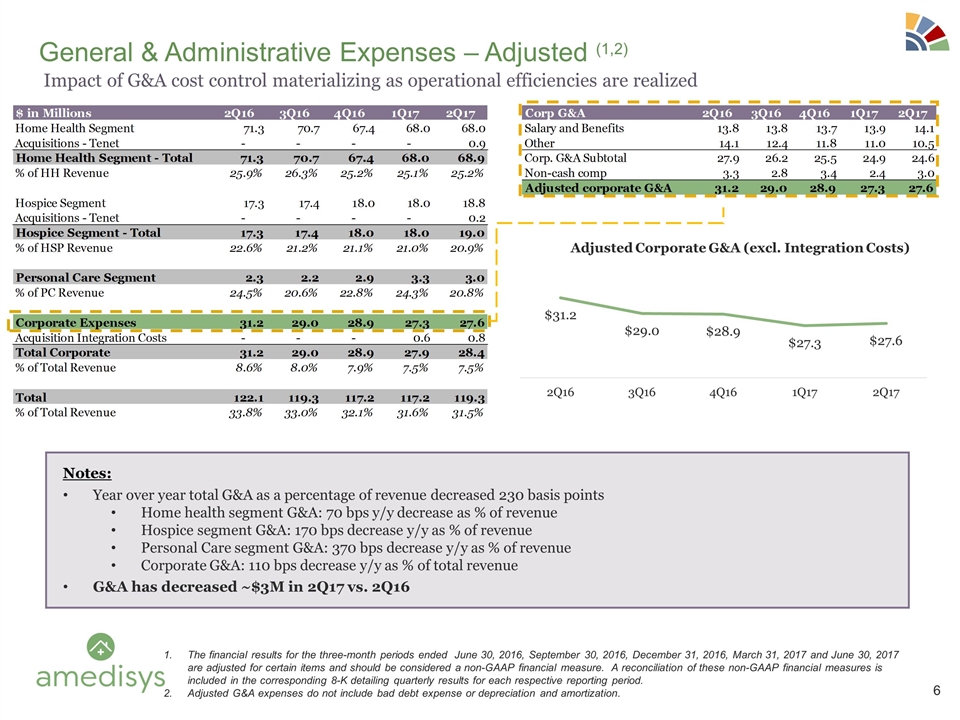

General & Administrative Expenses – Adjusted (1,2) Notes: Year over year total G&A as a percentage of revenue decreased 230 basis points Home health segment G&A: 70 bps y/y decrease as % of revenue Hospice segment G&A: 170 bps decrease y/y as % of revenue Personal Care segment G&A: 370 bps decrease y/y as % of revenue Corporate G&A: 110 bps decrease y/y as % of total revenue G&A has decreased ~$3M in 2Q17 vs. 2Q16 The financial results for the three-month periods ended June 30, 2016, September 30, 2016, December 31, 2016, March 31, 2017 and June 30, 2017 are adjusted for certain items and should be considered a non-GAAP financial measure. A reconciliation of these non-GAAP financial measures is included in the corresponding 8-K detailing quarterly results for each respective reporting period. Adjusted G&A expenses do not include bad debt expense or depreciation and amortization. Impact of G&A cost control materializing as operational efficiencies are realized

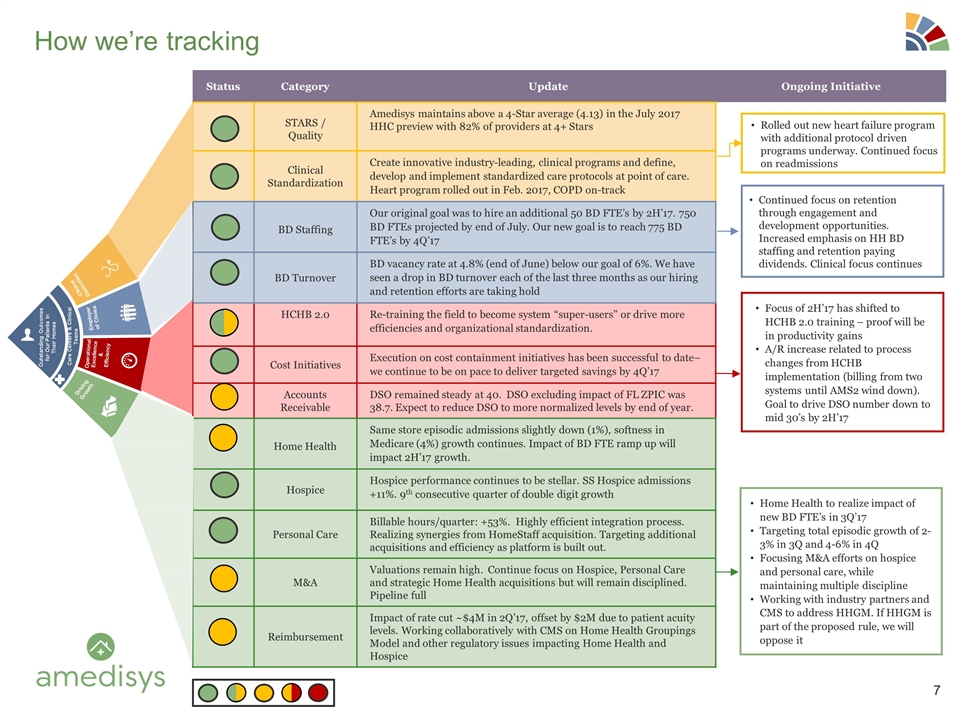

Status Category Update Ongoing Initiative STARS / Quality Amedisys maintains above a 4-Star average (4.13) in the July 2017 HHC preview with 82% of providers at 4+ Stars Clinical Standardization Create innovative industry-leading, clinical programs and define, develop and implement standardized care protocols at point of care. Heart program rolled out in Feb. 2017, COPD on-track BD Staffing Our original goal was to hire an additional 50 BD FTE’s by 2H’17. 750 BD FTEs projected by end of July. Our new goal is to reach 775 BD FTE’s by 4Q’17 BD Turnover BD vacancy rate at 4.8% (end of June) below our goal of 6%. We have seen a drop in BD turnover each of the last three months as our hiring and retention efforts are taking hold HCHB 2.0 Re-training the field to become system “super-users” or drive more efficiencies and organizational standardization. Cost Initiatives Execution on cost containment initiatives has been successful to date– we continue to be on pace to deliver targeted savings by 4Q’17 Accounts Receivable DSO remained steady at 40. DSO excluding impact of FL ZPIC was 38.7. Expect to reduce DSO to more normalized levels by end of year. Home Health Same store episodic admissions slightly down (1%), softness in Medicare (4%) growth continues. Impact of BD FTE ramp up will impact 2H’17 growth. Hospice Hospice performance continues to be stellar. SS Hospice admissions +11%. 9th consecutive quarter of double digit growth Personal Care Billable hours/quarter: +53%. Highly efficient integration process. Realizing synergies from HomeStaff acquisition. Targeting additional acquisitions and efficiency as platform is built out. M&A Valuations remain high. Continue focus on Hospice, Personal Care and strategic Home Health acquisitions but will remain disciplined. Pipeline full Reimbursement Impact of rate cut ~$4M in 2Q’17, offset by $2M due to patient acuity levels. Working collaboratively with CMS on Home Health Groupings Model and other regulatory issues impacting Home Health and Hospice How we’re tracking Clinical Distinction Employer of Choice Operational Excellence & Efficiency Driving Growth Outstanding Outcomes for Our Patients In Their Homes Care Centers & Clinical Teams Rolled out new heart failure program with additional protocol driven programs underway. Continued focus on readmissions Continued focus on retention through engagement and development opportunities. Increased emphasis on HH BD staffing and retention paying dividends. Clinical focus continues Home Health to realize impact of new BD FTE’s in 3Q’17 Targeting total episodic growth of 2-3% in 3Q and 4-6% in 4Q Focusing M&A efforts on hospice and personal care, while maintaining multiple discipline Working with industry partners and CMS to address HHGM. If HHGM is part of the proposed rule, we will oppose it Focus of 2H’17 has shifted to HCHB 2.0 training – proof will be in productivity gains A/R increase related to process changes from HCHB implementation (billing from two systems until AMS2 wind down). Goal to drive DSO number down to mid 30’s by 2H’17

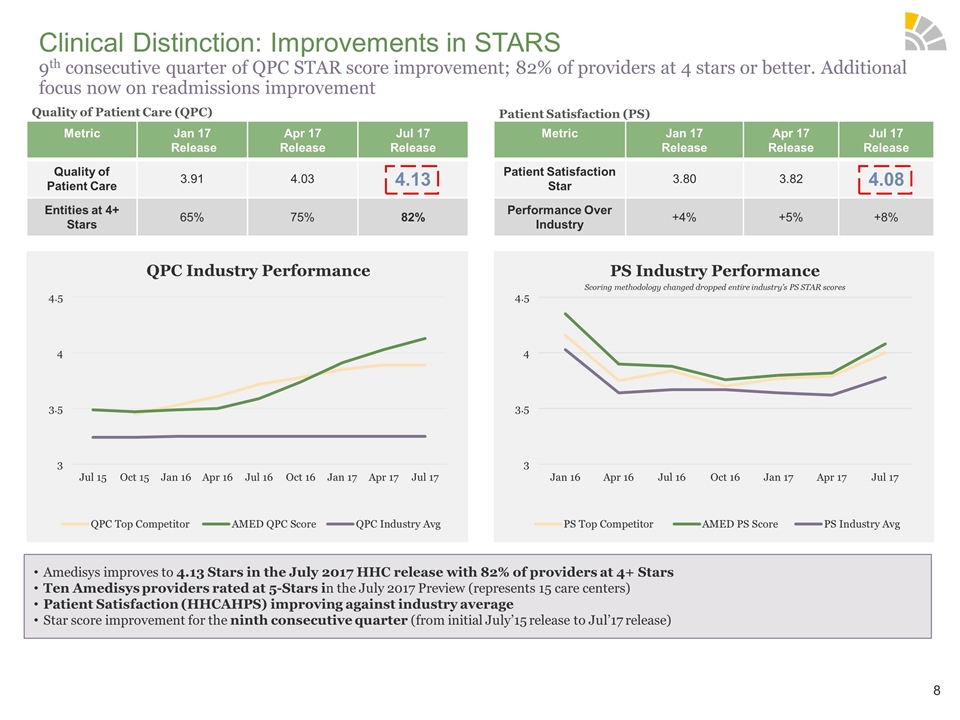

Clinical Distinction: Improvements in STARS 9th consecutive quarter of QPC STAR score improvement; 82% of providers at 4 stars or better. Additional focus now on readmissions improvement Metric Jan 17 Release Apr 17 Release Jul 17 Release Quality of Patient Care 3.91 4.03 4.13 Entities at 4+ Stars 65% 75% 82% Metric Jan 17 Release Apr 17 Release Jul 17 Release Patient Satisfaction Star 3.80 3.82 4.08 Performance Over Industry +4% +5% +8% Quality of Patient Care (QPC) Patient Satisfaction (PS) QPC Industry Performance PS Industry Performance Scoring methodology changed dropped entire industry’s PS STAR scores Amedisys improves to 4.13 Stars in the July 2017 HHC release with 82% of providers at 4+ Stars Ten Amedisys providers rated at 5-Stars in the July 2017 Preview (represents 15 care centers) Patient Satisfaction (HHCAHPS) improving against industry average Star score improvement for the ninth consecutive quarter (from initial July’15 release to Jul’17 release)

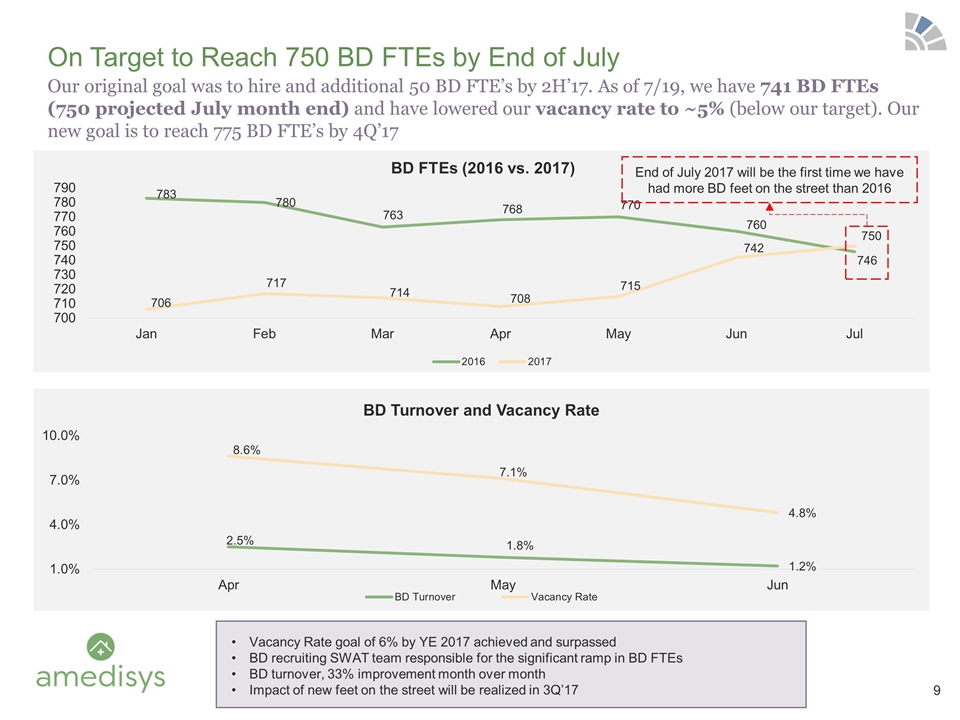

Our original goal was to hire and additional 50 BD FTE’s by 2H’17. As of 7/19, we have 741 BD FTEs (750 projected July month end) and have lowered our vacancy rate to ~5% (below our target). Our new goal is to reach 775 BD FTE’s by 4Q’17 On Target to Reach 750 BD FTEs by End of July End of July 2017 will be the first time we have had more BD feet on the street than 2016 Vacancy Rate goal of 6% by YE 2017 achieved and surpassed BD recruiting SWAT team responsible for the significant ramp in BD FTEs BD turnover, 33% improvement month over month Impact of new feet on the street will be realized in 3Q’17

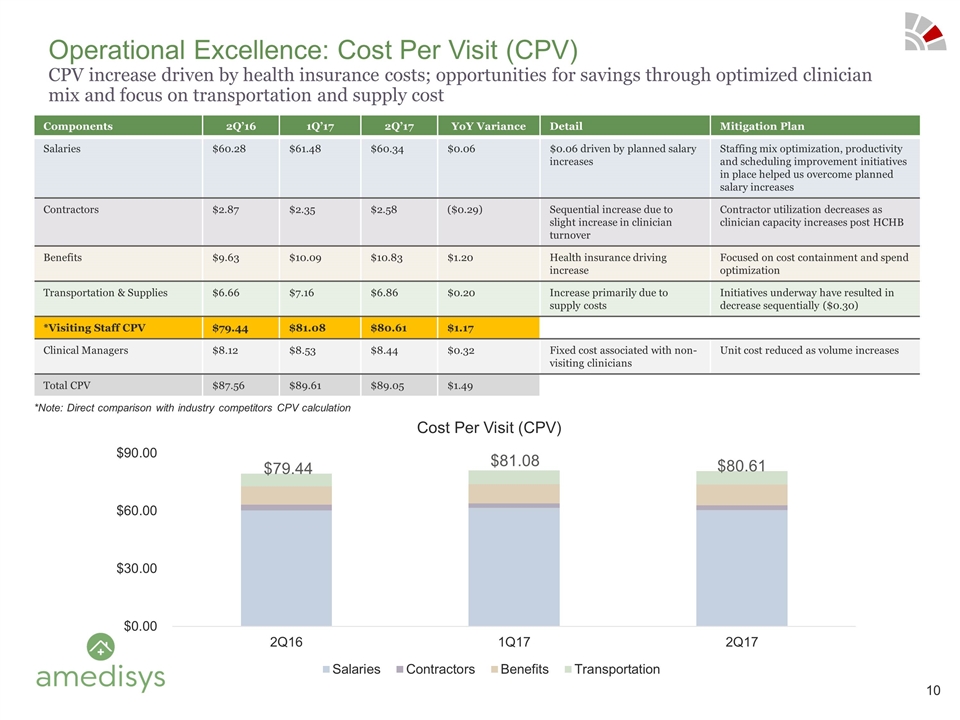

Components 2Q’16 1Q’17 2Q’17 YoY Variance Detail Mitigation Plan Salaries $60.28 $61.48 $60.34 $0.06 $0.06 driven by planned salary increases Staffing mix optimization, productivity and scheduling improvement initiatives in place helped us overcome planned salary increases Contractors $2.87 $2.35 $2.58 ($0.29) Sequential increase due to slight increase in clinician turnover Contractor utilization decreases as clinician capacity increases post HCHB Benefits $9.63 $10.09 $10.83 $1.20 Health insurance driving increase Focused on cost containment and spend optimization Transportation & Supplies $6.66 $7.16 $6.86 $0.20 Increase primarily due to supply costs Initiatives underway have resulted in decrease sequentially ($0.30) *Visiting Staff CPV $79.44 $81.08 $80.61 $1.17 Clinical Managers $8.12 $8.53 $8.44 $0.32 Fixed cost associated with non-visiting clinicians Unit cost reduced as volume increases Total CPV $87.56 $89.61 $89.05 $1.49 Operational Excellence: Cost Per Visit (CPV) CPV increase driven by health insurance costs; opportunities for savings through optimized clinician mix and focus on transportation and supply cost *Note: Direct comparison with industry competitors CPV calculation $79.44 $81.08 $80.61

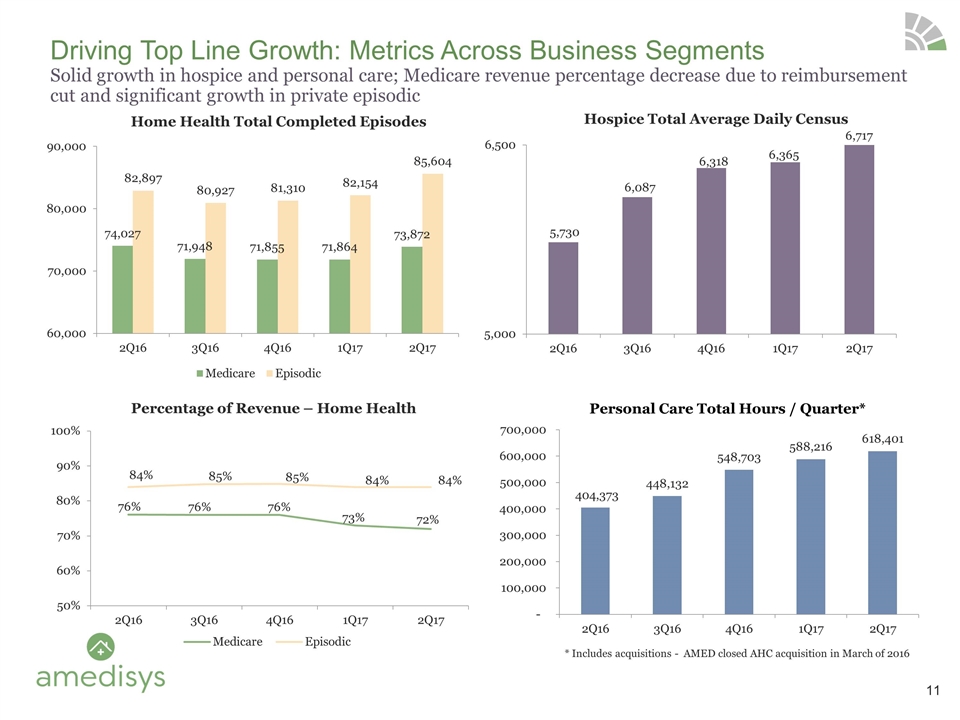

Driving Top Line Growth: Metrics Across Business Segments Solid growth in hospice and personal care; Medicare revenue percentage decrease due to reimbursement cut and significant growth in private episodic 234 Opportunities Prospected 45 Opportunities Under Review 13 Active Processes Personal Care Total Hours / Quarter* * Includes acquisitions - AMED closed AHC acquisition in March of 2016

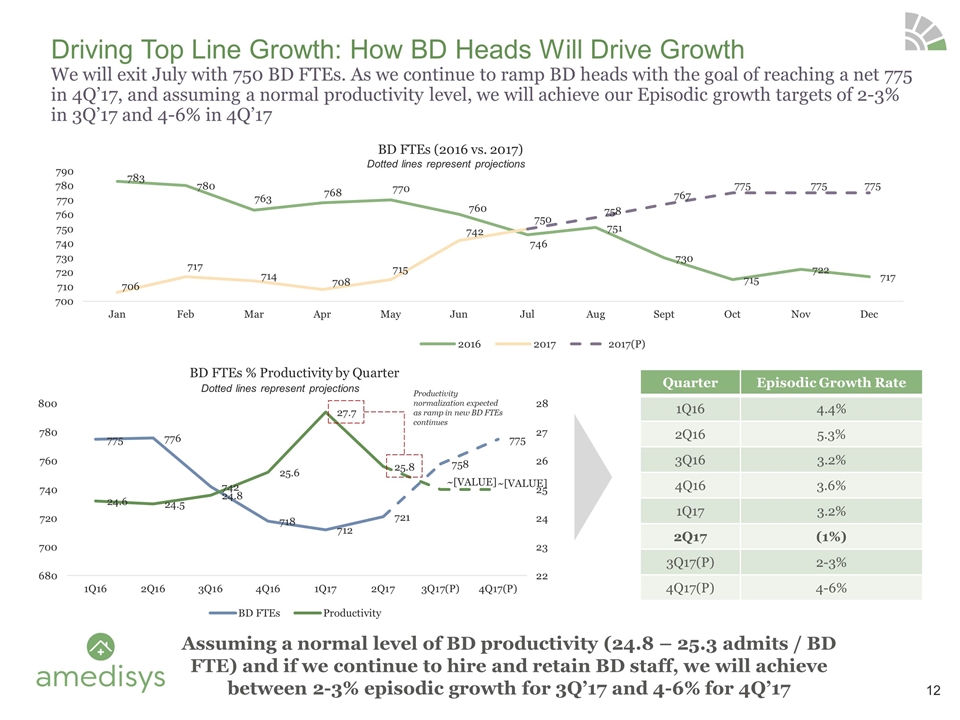

Driving Top Line Growth: How BD Heads Will Drive Growth We will exit July with 750 BD FTEs. As we continue to ramp BD heads with the goal of reaching a net 775 in 4Q’17, and assuming a normal productivity level, we will achieve our Episodic growth targets of 2-3% in 3Q’17 and 4-6% in 4Q’17 Quarter Episodic Growth Rate 1Q16 4.4% 2Q16 5.3% 3Q16 3.2% 4Q16 3.6% 1Q17 3.2% 2Q17 (1%) 3Q17(P) 2-3% 4Q17(P) 4-6% Assuming a normal level of BD productivity (24.8 – 25.3 admits / BD FTE) and if we continue to hire and retain BD staff, we will achieve between 2-3% episodic growth for 3Q’17 and 4-6% for 4Q’17 Productivity normalization expected as ramp in new BD FTEs continues Dotted lines represent projections Dotted lines represent projections

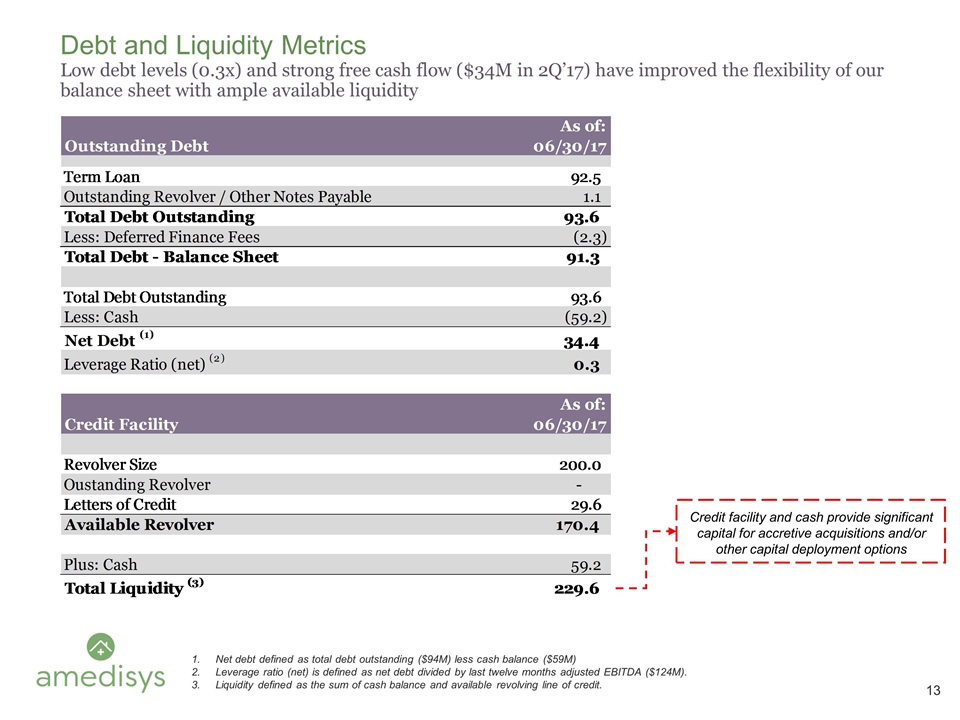

Debt and Liquidity Metrics Low debt levels (0.3x) and strong free cash flow ($34M in 2Q’17) have improved the flexibility of our balance sheet with ample available liquidity Net debt defined as total debt outstanding ($94M) less cash balance ($59M) Leverage ratio (net) is defined as net debt divided by last twelve months adjusted EBITDA ($124M). Liquidity defined as the sum of cash balance and available revolving line of credit. Credit facility and cash provide significant capital for accretive acquisitions and/or other capital deployment options

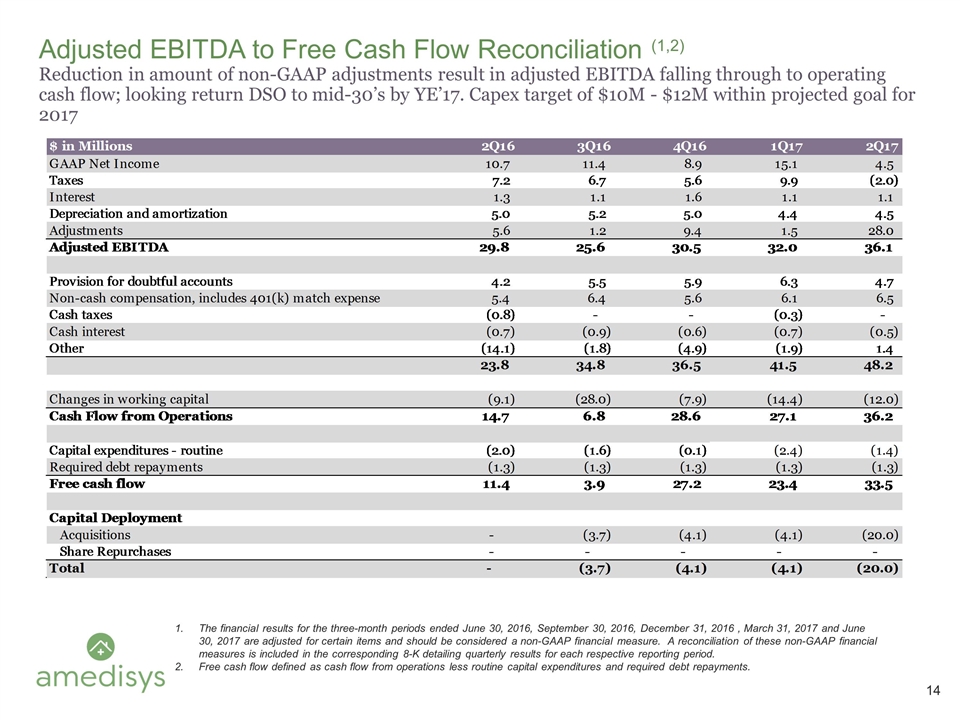

Adjusted EBITDA to Free Cash Flow Reconciliation (1,2) Reduction in amount of non-GAAP adjustments result in adjusted EBITDA falling through to operating cash flow; looking return DSO to mid-30’s by YE’17. Capex target of $10M - $12M within projected goal for 2017 The financial results for the three-month periods ended June 30, 2016, September 30, 2016, December 31, 2016 , March 31, 2017 and June 30, 2017 are adjusted for certain items and should be considered a non-GAAP financial measure. A reconciliation of these non-GAAP financial measures is included in the corresponding 8-K detailing quarterly results for each respective reporting period. Free cash flow defined as cash flow from operations less routine capital expenditures and required debt repayments.

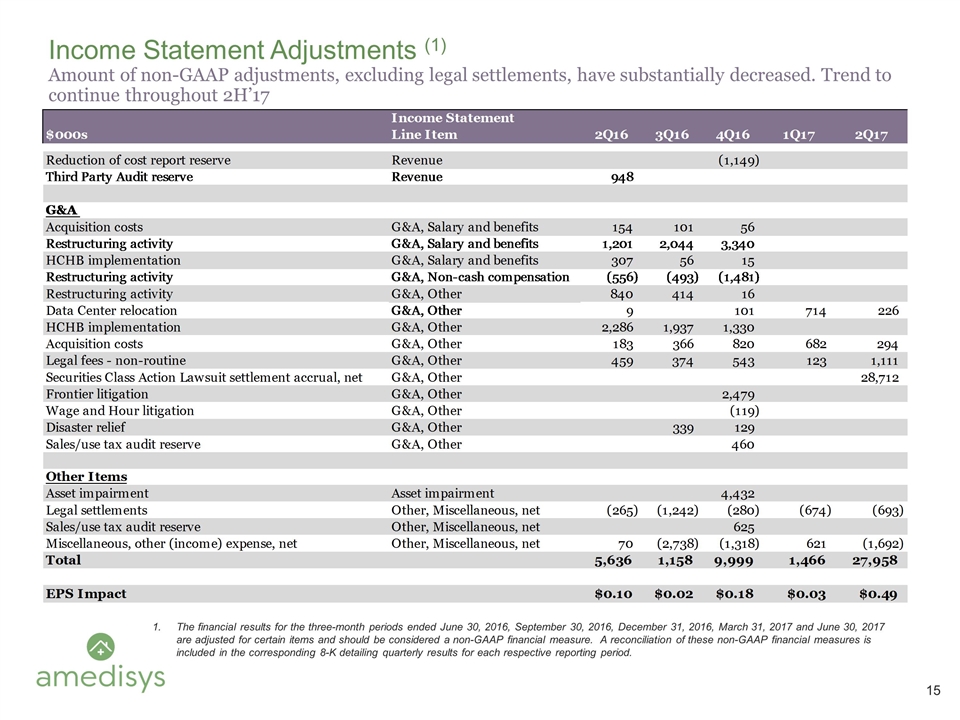

Income Statement Adjustments (1) Amount of non-GAAP adjustments, excluding legal settlements, have substantially decreased. Trend to continue throughout 2H’17 The financial results for the three-month periods ended June 30, 2016, September 30, 2016, December 31, 2016, March 31, 2017 and June 30, 2017 are adjusted for certain items and should be considered a non-GAAP financial measure. A reconciliation of these non-GAAP financial measures is included in the corresponding 8-K detailing quarterly results for each respective reporting period.

Home Health Groupings Model (HHGM) It is still early and we lack needed data to draw firm conclusions, but here is what we know: What it is / Issues: HHGM is a total payment redesign for Home Health with the stated intent of better aligning resources and outcomes with reimbursement HHGM has an effective date of January 1, 2019 HHGM shifts payment from a 60 day episode to two 30 day periods and eliminates therapy visit thresholds currently used to adjust reimbursement. This potentially discourages home health providers from taking care of higher acuity patients requiring therapy as part of their treatment HHGM is a product of the Affordable Care Act and the previous administration HHGM was created in a non-budget neutral manner HHGM was crafted and proposed by CMS without meaningful input from home health providers Providing the industry only 60 days to comment on a total payment redesign, after no prior collaboration with the industry, seems to run counter to the current administration’s goal of transparency and reducing the regulatory burden for clinicians, providers, and patients in a way that increases quality of care and decreases costs Impact of HHGM: We have just seen the proposed rule and are not in a position yet to comment on the impact to Amedisys and our patients as the proposed rule is a complete redesign of the home health payment system We will need a significant amount of information and data from CMS in order to properly model the impact of the proposed rule in our geographies: Our very early review indicates that the reimbursement impact could vary significantly between states and regions Our ask: CMS should partner with home health providers to test HHGM or any payment reform CMS should provide access to the required data to model the impact of HHGM Amedisys remains fully committed to working closely with the Administration and CMS leadership to develop viable solutions that fulfill the goal of aligning reimbursement with resource use without compromising access to high-quality care