Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - MIDSOUTH BANCORP INC | mslq206302017er-8kex991.htm |

| 8-K - MIDSOUTH BANCORP FORM 8-K - MIDSOUTH BANCORP INC | form8-kxjuly252017.htm |

2Q17 Update

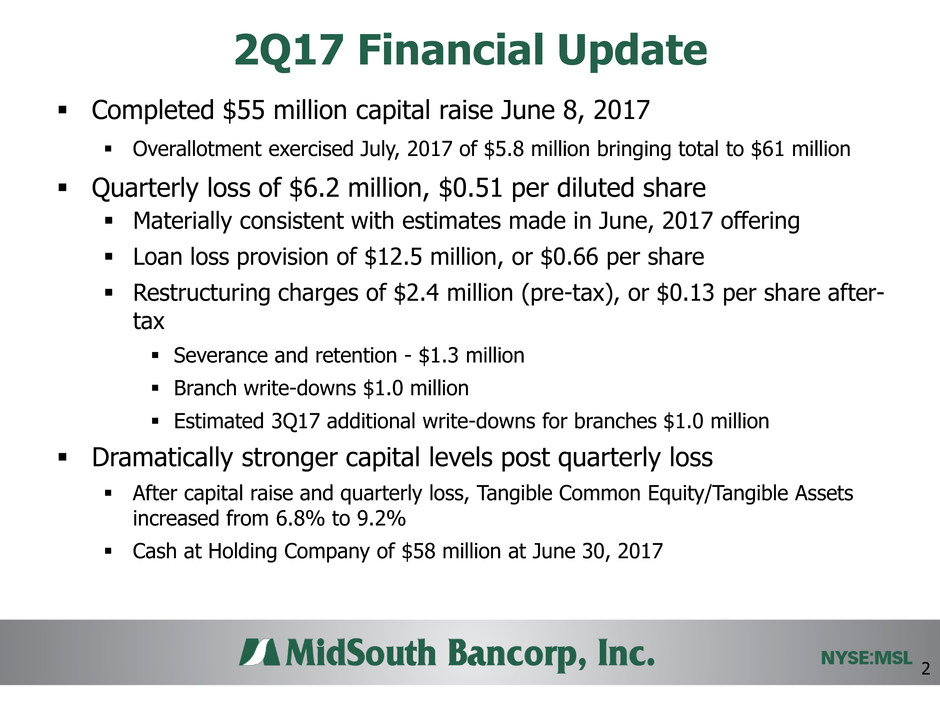

2Q17 Financial Update

Completed $55 million capital raise June 8, 2017

Overallotment exercised July, 2017 of $5.8 million bringing total to $61 million

Quarterly loss of $6.2 million, $0.51 per diluted share

Materially consistent with estimates made in June, 2017 offering

Loan loss provision of $12.5 million, or $0.66 per share

Restructuring charges of $2.4 million (pre-tax), or $0.13 per share after-

tax

Severance and retention - $1.3 million

Branch write-downs $1.0 million

Estimated 3Q17 additional write-downs for branches $1.0 million

Dramatically stronger capital levels post quarterly loss

After capital raise and quarterly loss, Tangible Common Equity/Tangible Assets

increased from 6.8% to 9.2%

Cash at Holding Company of $58 million at June 30, 2017

2

2Q17 Financial Update (cont’d)

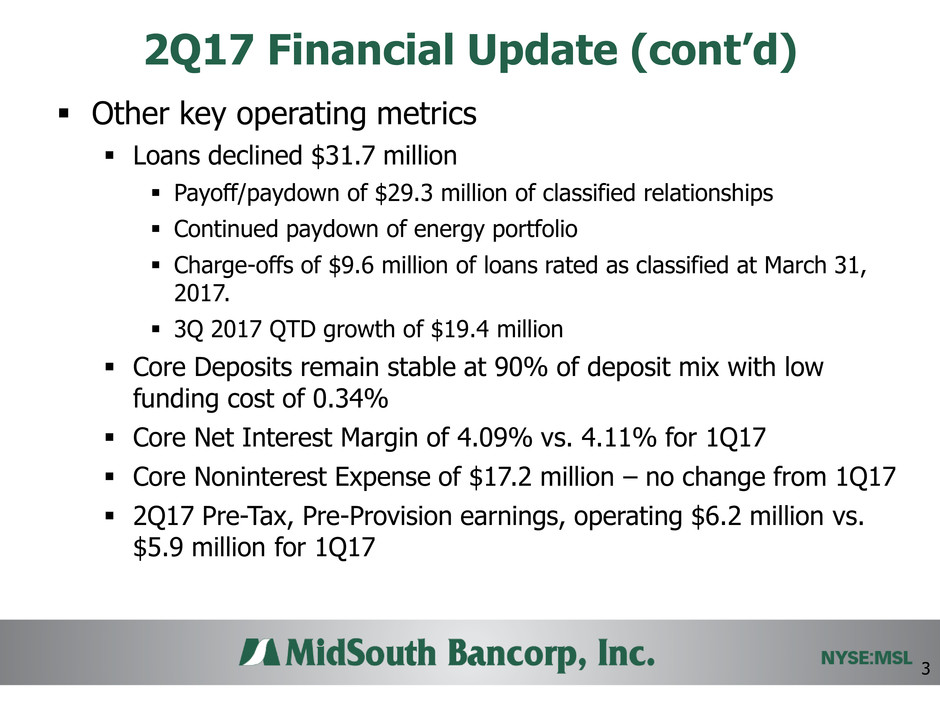

Other key operating metrics

Loans declined $31.7 million

Payoff/paydown of $29.3 million of classified relationships

Continued paydown of energy portfolio

Charge-offs of $9.6 million of loans rated as classified at March 31,

2017.

3Q 2017 QTD growth of $19.4 million

Core Deposits remain stable at 90% of deposit mix with low

funding cost of 0.34%

Core Net Interest Margin of 4.09% vs. 4.11% for 1Q17

Core Noninterest Expense of $17.2 million – no change from 1Q17

2Q17 Pre-Tax, Pre-Provision earnings, operating $6.2 million vs.

$5.9 million for 1Q17

3

2Q17 Developments

Completed management transition and reorganization

Completed 3rd party review of loan portfolio

Announced realignment of branch network

Closing of 7 branches and sale of 2 branches

Commenced discussions with regulators regarding repayment of SBLF

Entered into Written Agreement with OCC on July 19, 2017

No new or unanticipated provisions - agreement is consistent with

disclosures made during capital raise

Asset Quality, Risk Management, Strategic Planning, ALLL

No lending or funding restrictions

Implementation of provisions over next 90 days with assistance of

regulatory advisory firm

4

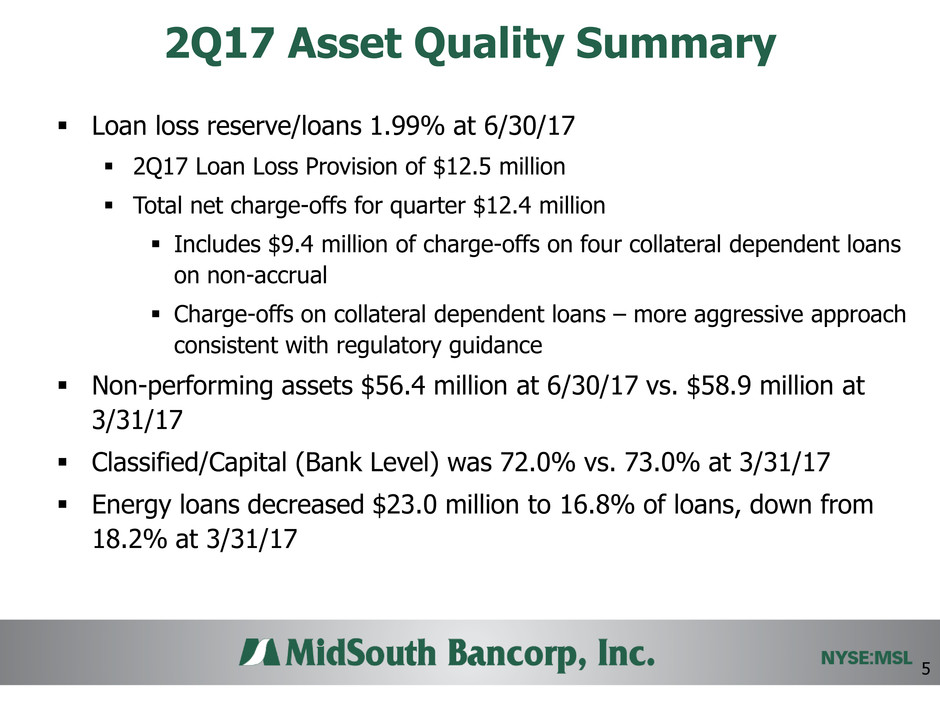

2Q17 Asset Quality Summary

Loan loss reserve/loans 1.99% at 6/30/17

2Q17 Loan Loss Provision of $12.5 million

Total net charge-offs for quarter $12.4 million

Includes $9.4 million of charge-offs on four collateral dependent loans

on non-accrual

Charge-offs on collateral dependent loans – more aggressive approach

consistent with regulatory guidance

Non-performing assets $56.4 million at 6/30/17 vs. $58.9 million at

3/31/17

Classified/Capital (Bank Level) was 72.0% vs. 73.0% at 3/31/17

Energy loans decreased $23.0 million to 16.8% of loans, down from

18.2% at 3/31/17

5

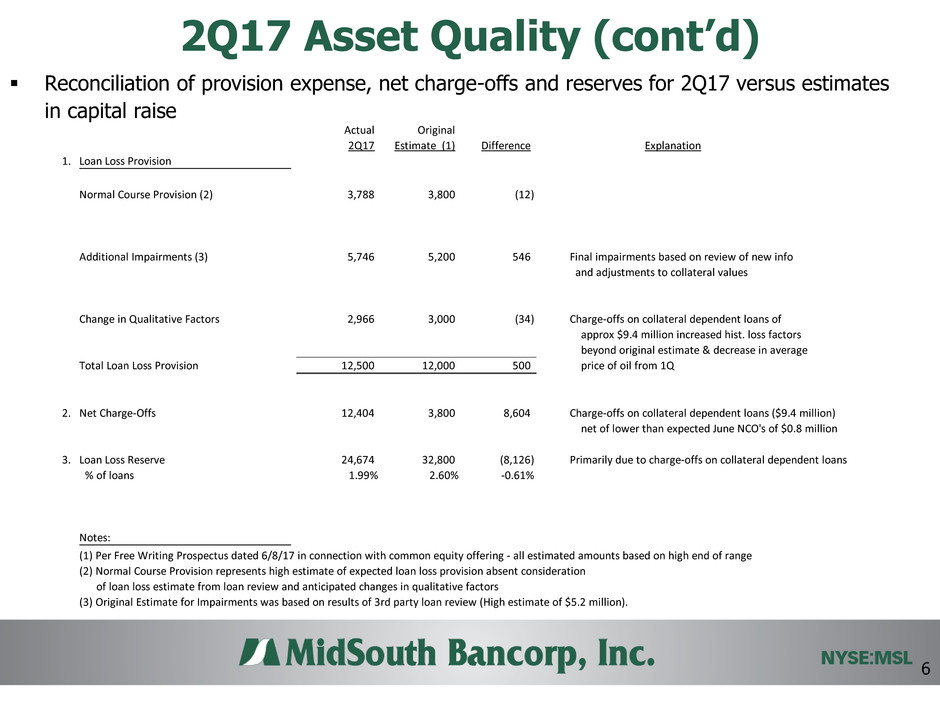

2Q17 Asset Quality (cont’d)

Reconciliation of provision expense, net charge-offs and reserves for 2Q17 versus estimates

in capital raise

6

Actual Original

2Q17 Estimate (1) Difference Explanation

1. Loan Loss Provision

Normal Course Provision (2) 3,788 3,800 (12)

Additional Impairments (3) 5,746 5,200 546 Final impairments based on review of new info

and adjustments to collateral values

Change in Qualitative Factors 2,966 3,000 (34) Charge-offs on collateral dependent loans of

approx $9.4 million increased hist. loss factors

beyond original estimate & decrease in average

Total Loan Loss Provision 12,500 12,000 500 price of oil from 1Q

2. Net Charge-Offs 12,404 3,800 8,604 Charge-offs on collateral dependent loans ($9.4 million)

net of lower than expected June NCO's of $0.8 million

3. Loan Loss Reserve 24,674 32,800 (8,126) Primarily due to charge-offs on collateral dependent loans

% of loans 1.99% 2.60% -0.61%

Notes:

(1) Per Free Writing Prospectus dated 6/8/17 in connection with common equity offering - all estimated amounts based on high end of range

(2) Normal Course Provision represents high estimate of expected loan loss provision absent consideration

of loan loss estimate from loan review and anticipated changes in qualitative factors

(3) Original Estimate for Impairments was based on results of 3rd party loan review (High estimate of $5.2 million).

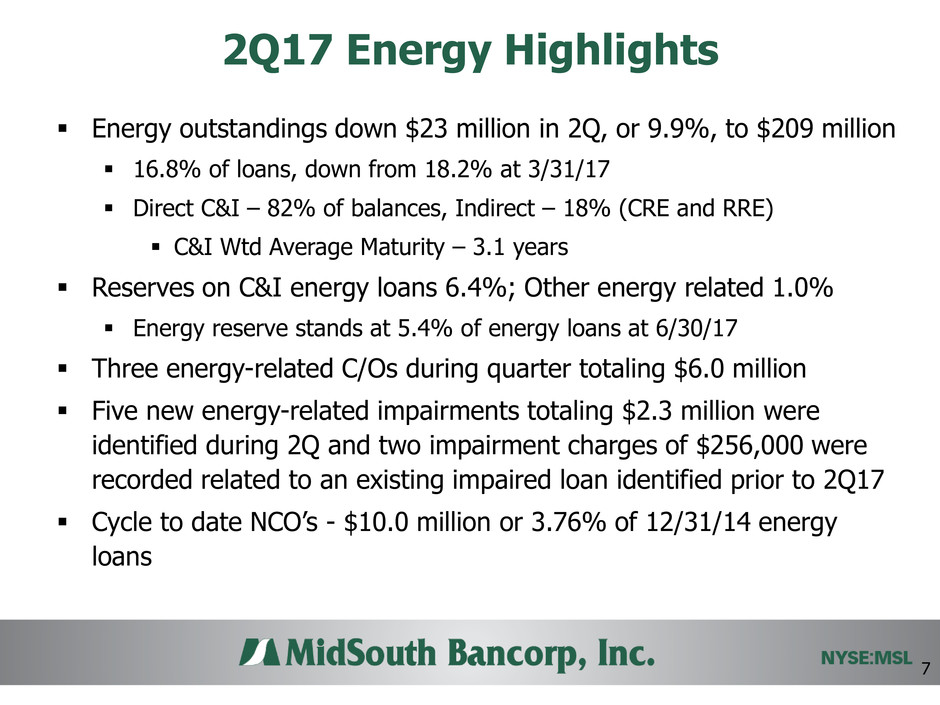

2Q17 Energy Highlights

Energy outstandings down $23 million in 2Q, or 9.9%, to $209 million

16.8% of loans, down from 18.2% at 3/31/17

Direct C&I – 82% of balances, Indirect – 18% (CRE and RRE)

C&I Wtd Average Maturity – 3.1 years

Reserves on C&I energy loans 6.4%; Other energy related 1.0%

Energy reserve stands at 5.4% of energy loans at 6/30/17

Three energy-related C/Os during quarter totaling $6.0 million

Five new energy-related impairments totaling $2.3 million were

identified during 2Q and two impairment charges of $256,000 were

recorded related to an existing impaired loan identified prior to 2Q17

Cycle to date NCO’s - $10.0 million or 3.76% of 12/31/14 energy

loans

7

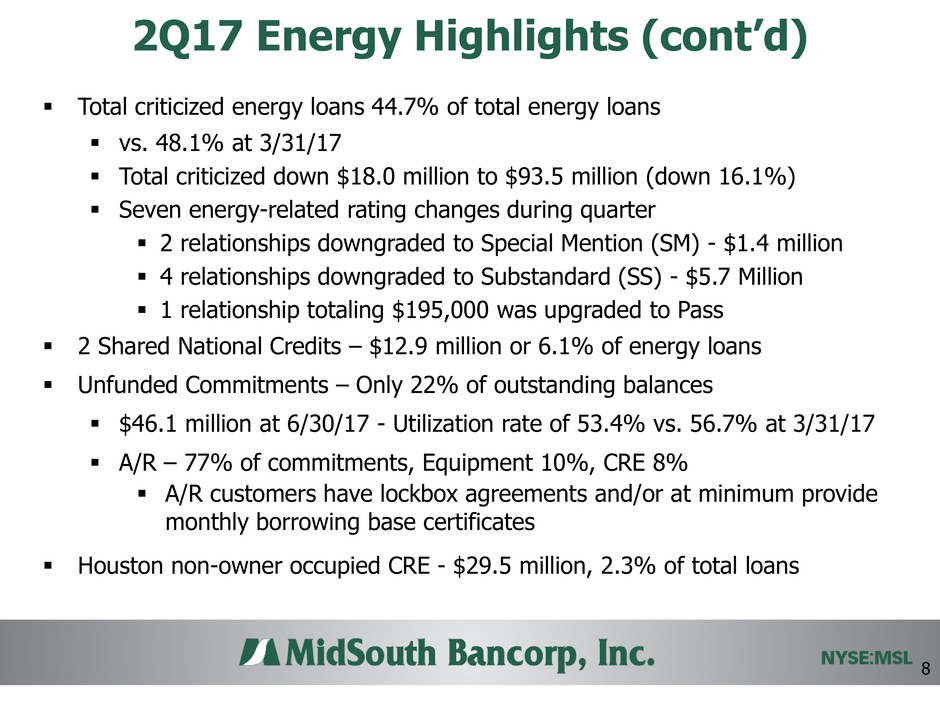

2Q17 Energy Highlights (cont’d)

Total criticized energy loans 44.7% of total energy loans

vs. 48.1% at 3/31/17

Total criticized down $18.0 million to $93.5 million (down 16.1%)

Seven energy-related rating changes during quarter

2 relationships downgraded to Special Mention (SM) - $1.4 million

4 relationships downgraded to Substandard (SS) - $5.7 Million

1 relationship totaling $195,000 was upgraded to Pass

2 Shared National Credits – $12.9 million or 6.1% of energy loans

Unfunded Commitments – Only 22% of outstanding balances

$46.1 million at 6/30/17 - Utilization rate of 53.4% vs. 56.7% at 3/31/17

A/R – 77% of commitments, Equipment 10%, CRE 8%

A/R customers have lockbox agreements and/or at minimum provide

monthly borrowing base certificates

Houston non-owner occupied CRE - $29.5 million, 2.3% of total loans

8

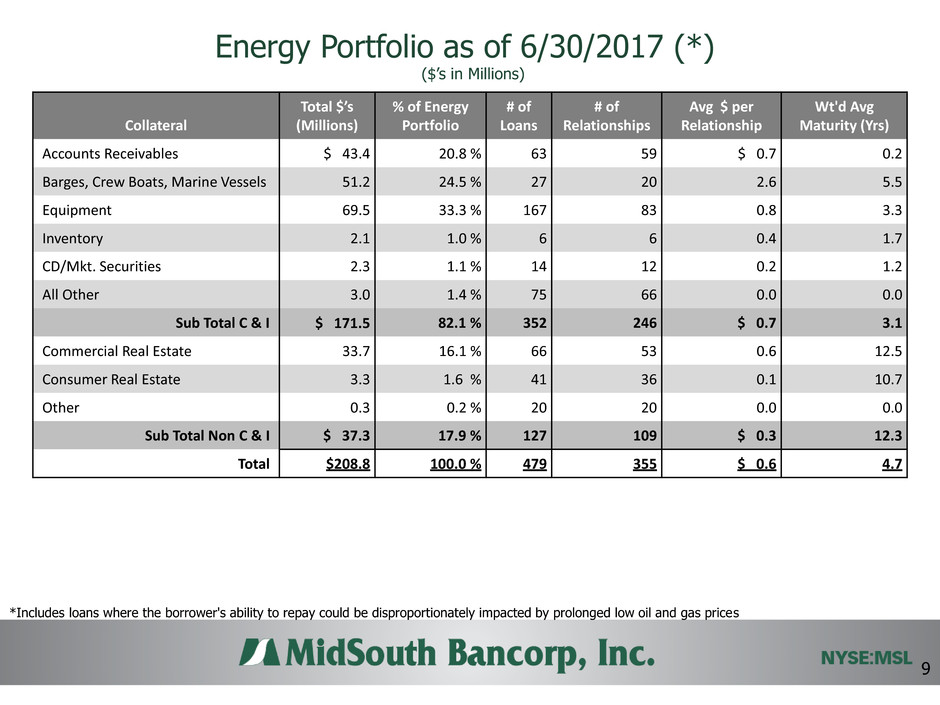

Energy Portfolio as of 6/30/2017 (*)

*Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices

($’s in Millions)

9

Collateral

Total $’s

(Millions)

% of Energy

Portfolio

# of

Loans

# of

Relationships

Avg $ per

Relationship

Wt'd Avg

Maturity (Yrs)

Accounts Receivables $ 43.4 20.8 % 63 59 $ 0.7 0.2

Barges, Crew Boats, Marine Vessels 51.2 24.5 % 27 20 2.6 5.5

Equipment 69.5 33.3 % 167 83 0.8 3.3

Inventory 2.1 1.0 % 6 6 0.4 1.7

CD/Mkt. Securities 2.3 1.1 % 14 12 0.2 1.2

All Other 3.0 1.4 % 75 66 0.0 0.0

Sub Total C & I $ 171.5 82.1 % 352 246 $ 0.7 3.1

Commercial Real Estate 33.7 16.1 % 66 53 0.6 12.5

Consumer Real Estate 3.3 1.6 % 41 36 0.1 10.7

Other 0.3 0.2 % 20 20 0.0 0.0

Sub Total Non C & I $ 37.3 17.9 % 127 109 $ 0.3 12.3

Total $208.8 100.0 % 479 355 $ 0.6 4.7

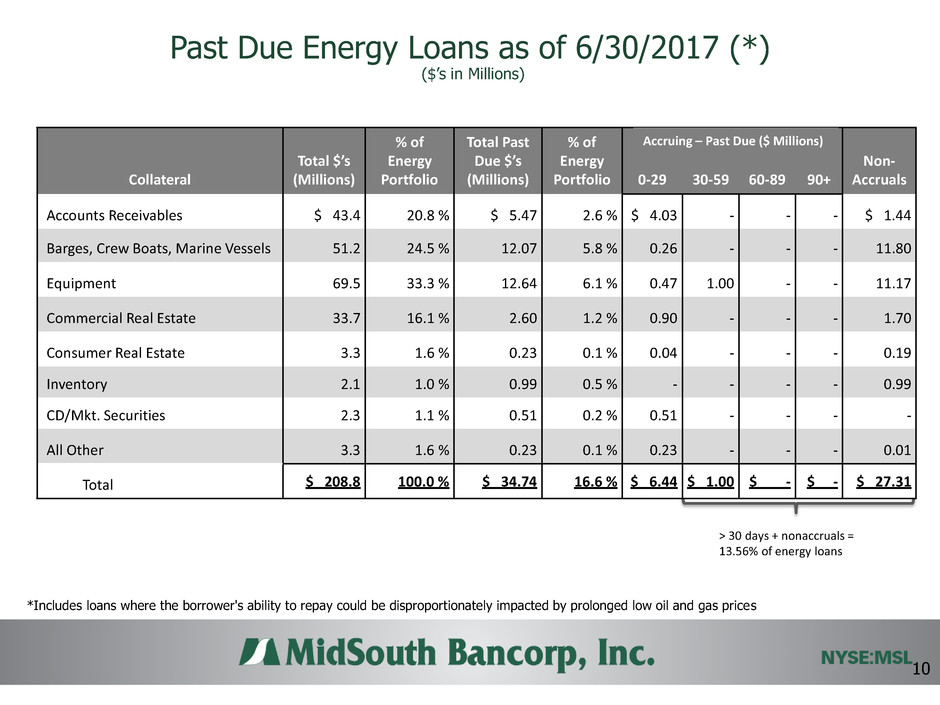

Past Due Energy Loans as of 6/30/2017 (*)

*Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices

> 30 days + nonaccruals =

13.56% of energy loans

($’s in Millions)

10

Collateral

Total $’s

(Millions)

% of

Energy

Portfolio

Total Past

Due $’s

(Millions)

% of

Energy

Portfolio

0-29

30-59

60-89

90+

Non-

Accruals

Accounts Receivables $ 43.4 20.8 % $ 5.47 2.6 % $ 4.03 - - - $ 1.44

Barges, Crew Boats, Marine Vessels 51.2 24.5 % 12.07 5.8 % 0.26 - - - 11.80

Equipment 69.5 33.3 % 12.64 6.1 % 0.47 1.00 - - 11.17

Commercial Real Estate 33.7 16.1 % 2.60 1.2 % 0.90 - - - 1.70

Consumer Real Estate 3.3 1.6 % 0.23 0.1 % 0.04 - - - 0.19

Inventory 2.1 1.0 % 0.99 0.5 % - - - - 0.99

CD/Mkt. Securities 2.3 1.1 % 0.51 0.2 % 0.51 - - - -

All Other 3.3 1.6 % 0.23 0.1 % 0.23 - - - 0.01

Total $ 208.8 100.0 % $ 34.74 16.6 % $ 6.44 $ 1.00 $ - $ - $ 27.31

Accruing – Past Due ($ Millions)

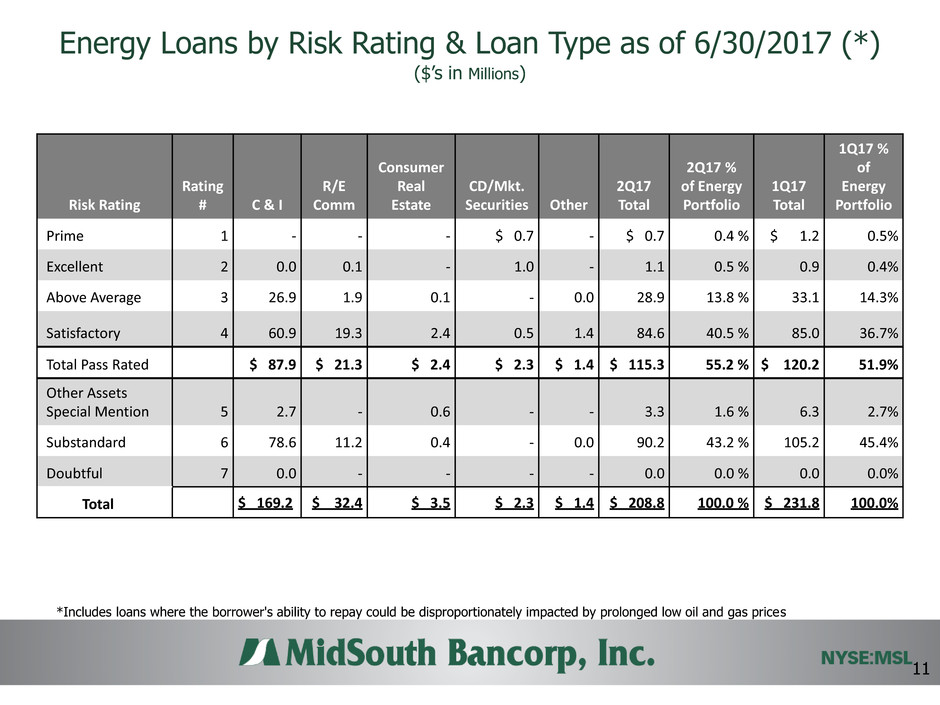

Energy Loans by Risk Rating & Loan Type as of 6/30/2017 (*)

($’s in Millions)

*Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices

11

Risk Rating

Rating

# C & I

R/E

Comm

Consumer

Real

Estate

CD/Mkt.

Securities Other

2Q17

Total

2Q17 %

of Energy

Portfolio

1Q17

Total

1Q17 %

of

Energy

Portfolio

Prime 1 - - - $ 0.7 - $ 0.7 0.4 % $ 1.2 0.5%

Excellent 2 0.0 0.1 - 1.0 - 1.1 0.5 % 0.9 0.4%

Above Average 3 26.9 1.9 0.1 - 0.0 28.9 13.8 % 33.1 14.3%

Satisfactory 4 60.9 19.3 2.4 0.5 1.4 84.6 40.5 % 85.0 36.7%

Total Pass Rated $ 87.9 $ 21.3 $ 2.4 $ 2.3 $ 1.4 $ 115.3 55.2 % $ 120.2 51.9%

Other Assets

Special Mention 5 2.7 - 0.6 - - 3.3 1.6 % 6.3 2.7%

Substandard 6 78.6 11.2 0.4 - 0.0 90.2 43.2 % 105.2 45.4%

Doubtful 7 0.0 - - - - 0.0 0.0 % 0.0 0.0%

Total $ 169.2 $ 32.4 $ 3.5 $ 2.3 $ 1.4 $ 208.8 100.0 % $ 231.8 100.0%

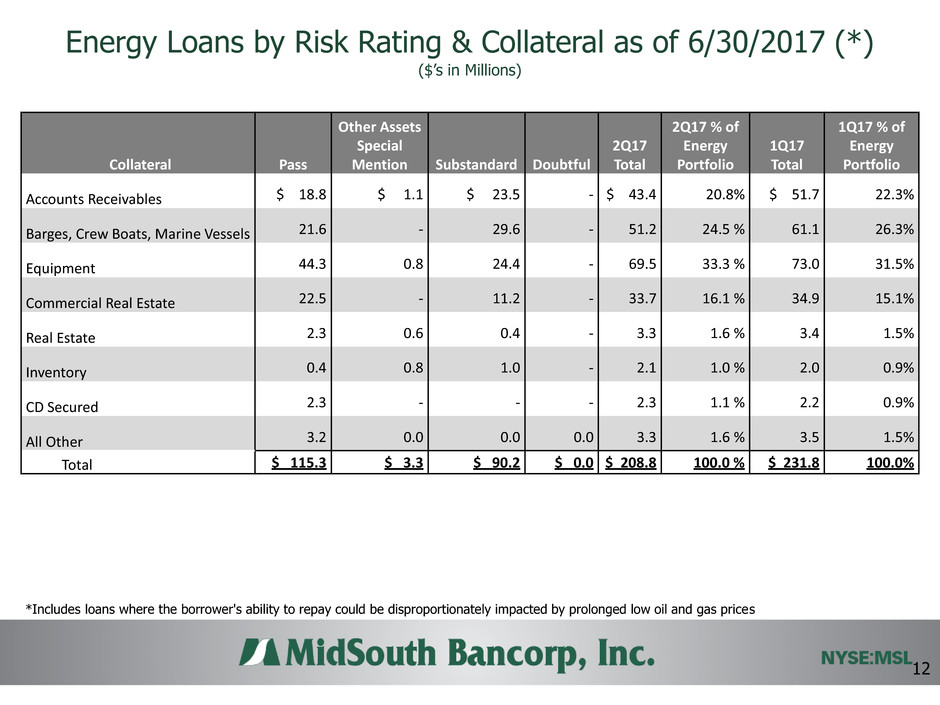

Energy Loans by Risk Rating & Collateral as of 6/30/2017 (*)

($’s in Millions)

*Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices

12

Collateral

Pass

Other Assets

Special

Mention

Substandard

Doubtful

2Q17

Total

2Q17 % of

Energy

Portfolio

1Q17

Total

1Q17 % of

Energy

Portfolio

Accounts Receivables $ 18.8 $ 1.1 $ 23.5 - $ 43.4 20.8% $ 51.7 22.3%

Barges, Crew Boats, Marine Vessels 21.6 - 29.6 - 51.2 24.5 % 61.1 26.3%

Equipment 44.3 0.8 24.4 - 69.5 33.3 % 73.0 31.5%

Commercial Real Estate 22.5 - 11.2 - 33.7 16.1 % 34.9 15.1%

Real Estate 2.3 0.6 0.4 - 3.3 1.6 % 3.4 1.5%

Inventory 0.4 0.8 1.0 - 2.1 1.0 % 2.0 0.9%

CD Secured 2.3 - - - 2.3 1.1 % 2.2 0.9%

All Other 3.2 0.0 0.0 0.0 3.3 1.6 % 3.5 1.5%

Total $ 115.3 $ 3.3 $ 90.2 $ 0.0 $ 208.8 100.0 % $ 231.8 100.0%

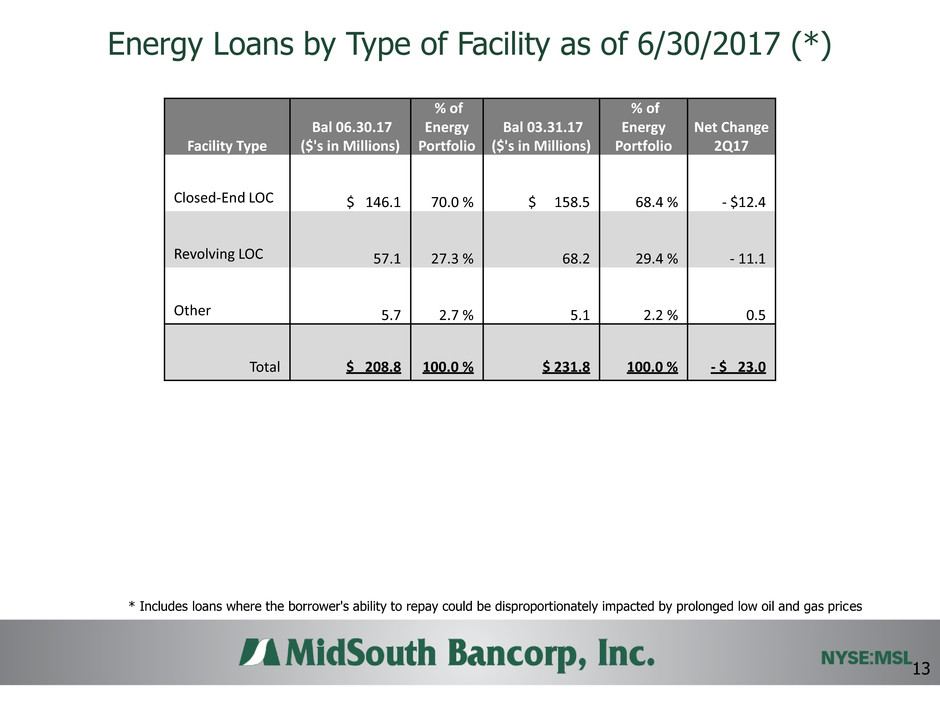

Energy Loans by Type of Facility as of 6/30/2017 (*)

* Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices

13

Facility Type

Bal 06.30.17

($'s in Millions)

% of

Energy

Portfolio

Bal 03.31.17

($'s in Millions)

% of

Energy

Portfolio

Net Change

2Q17

Closed-End LOC $ 146.1 70.0 % $ 158.5 68.4 % - $12.4

Revolving LOC 57.1 27.3 % 68.2 29.4 % - 11.1

Other 5.7 2.7 % 5.1 2.2 % 0.5

Total $ 208.8 100.0 % $ 231.8 100.0 % - $ 23.0

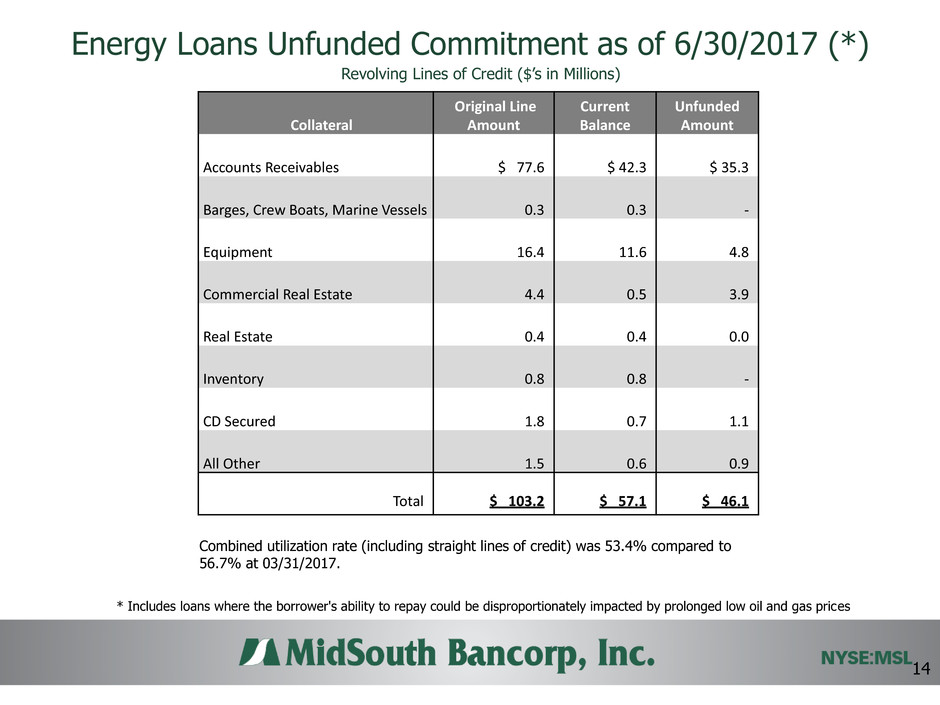

Energy Loans Unfunded Commitment as of 6/30/2017 (*)

* Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices

Combined utilization rate (including straight lines of credit) was 53.4% compared to

56.7% at 03/31/2017.

Revolving Lines of Credit ($’s in Millions)

14

Collateral

Original Line

Amount

Current

Balance

Unfunded

Amount

Accounts Receivables $ 77.6 $ 42.3 $ 35.3

Barges, Crew Boats, Marine Vessels 0.3 0.3 -

Equipment 16.4 11.6 4.8

Commercial Real Estate 4.4 0.5 3.9

Real Estate 0.4 0.4 0.0

Inventory 0.8 0.8 -

CD Secured 1.8 0.7 1.1

All Other 1.5 0.6 0.9

Total $ 103.2 $ 57.1 $ 46.1

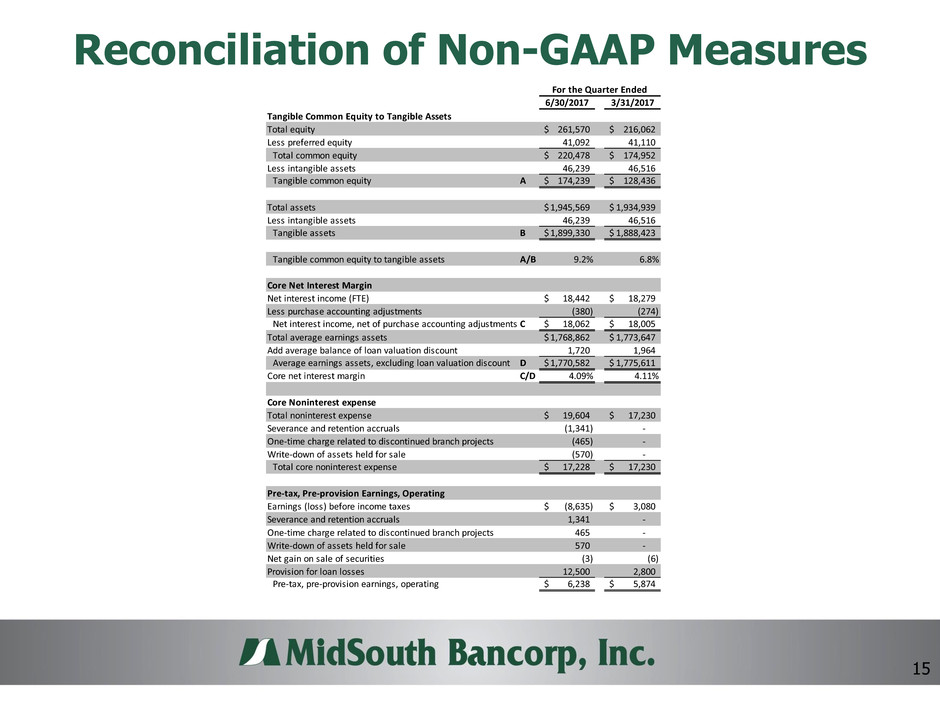

Reconciliation of Non-GAAP Measures

15

6/30/2017 3/31/2017

Tangible Common Equity to Tangible Assets

Total equity 261,570$ 216,062$

Less preferred equity 41,092 41,110

Total common equity 220,478$ 174,952$

Less intangible assets 46,239 46,516

Tangible common equity A 174,239$ 128,436$

Total assets 1,945,569$ 1,934,939$

Less intangible assets 46,239 46,516

Tangible assets B 1,899,330$ 1,888,423$

Tangible common equity to tangible assets A/B 9.2% 6.8%

Core Net Interest Margin

Net interest income (FTE) 18,442$ 18,279$

Less purchase accounting adjustments (380) (274)

Net interest income, net of purchase accounting adjustments C 18,062$ 18,005$

Total average earnings assets 1,768,862$ 1,773,647$

Add average balance of loan valuation discount 1,720 1,964

Average earnings assets, excluding loan valuation discount D 1,770,582$ 1,775,611$

Core net interest margin C/D 4.09% 4.11%

Core Noninterest expense

Total noninterest expense 19,604$ 17,230$

Severance and retention accruals (1,341) -

One-time charge related to discontinued branch projects (465) -

Write-down of assets held for sale (570) -

Total core noninterest expense 17,228$ 17,230$

Pre-tax, Pre-provision Earnings, Operating

Earnings (loss) before income taxes (8,635)$ 3,080$

Severance and retention accruals 1,341 -

One-time charge related to discontinued branch projects 465 -

Write-down of assets held for sale 570 -

Net gain on sale of securities (3) (6)

Provision for loan losses 12,500 2,800

Pre-tax, pre-provision earnings, operating 6,238$ 5,874$

For the Quarter Ended