Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ManpowerGroup Inc. | man-063017x8k.htm |

| EX-99.1 - EXHIBIT 99.1 - ManpowerGroup Inc. | ex063017991pressrelease.htm |

ManpowerGroup Second Quarter Results | July 24, 2017

Exhibit 99.2

ManpowerGroup July 2017 2

FORWARD-LOOKING STATEMENT

This presentation contains statements, including financial projections, that are forward-

looking in nature. These statements are based on managements’ current expectations or

beliefs, and are subject to known and unknown risks and uncertainties regarding

expected future results. Actual results might differ materially from those projected in the

forward-looking statements. Additional information concerning factors that could cause

actual results to materially differ from those in the forward-looking statements is contained

in the ManpowerGroup Inc. Annual Report on Form 10-K dated December 31, 2016,

which information is incorporated herein by reference, and such other factors as may be

described from time to time in the Company’s SEC filings. Any forward-looking

statements in this presentation speak only as of the date hereof. The Company assumes

no obligation to update or revise any forward-looking statements.

ManpowerGroup July 2017 3

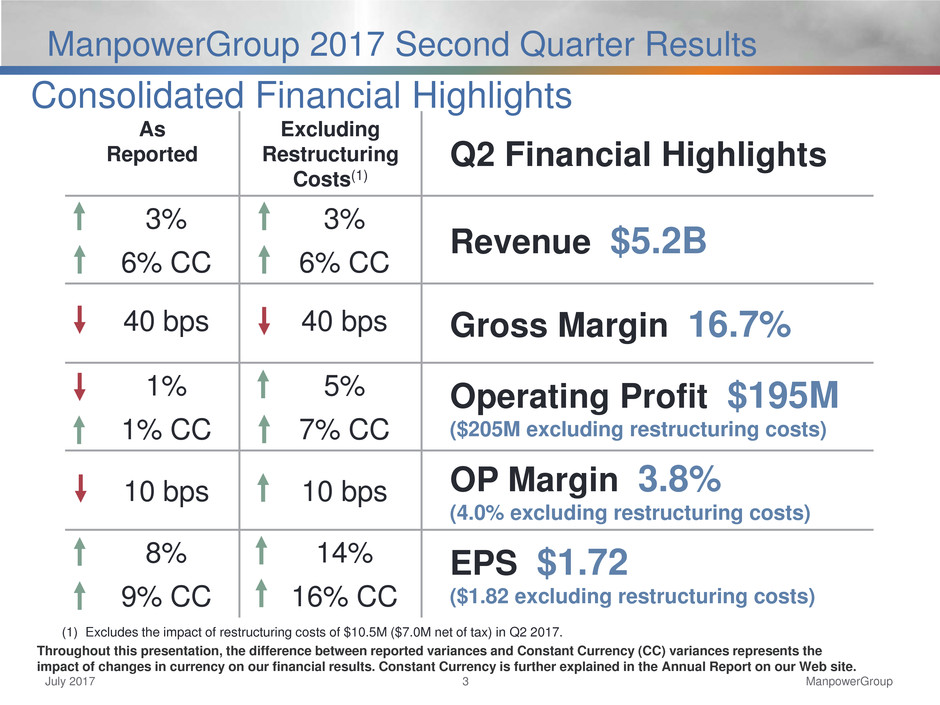

ManpowerGroup 2017 Second Quarter Results

Throughout this presentation, the difference between reported variances and Constant Currency (CC) variances represents the

impact of changes in currency on our financial results. Constant Currency is further explained in the Annual Report on our Web site.

As

Reported

Excluding

Restructuring

Costs(1)

Q2 Financial Highlights

3% 3%

Revenue $5.2B

6% CC 6% CC

40 bps

40 bps

Gross Margin 16.7%

1% 5% Operating Profit $195M

($205M excluding restructuring costs) 1% CC 7% CC

10 bps 10 bps OP Margin 3.8%

(4.0% excluding restructuring costs)

8% 14% EPS $1.72

($1.82 excluding restructuring costs) 9% CC 16% CC

(1) Excludes the impact of restructuring costs of $10.5M ($7.0M net of tax) in Q2 2017.

Consolidated Financial Highlights

ManpowerGroup July 2017 4

ManpowerGroup 2017 Second Quarter Results

EPS Bridge – Q2 vs. Guidance Midpoint

ManpowerGroup July 2017 5

ManpowerGroup 2017 Second Quarter Results

Consolidated Gross Margin Change

17.1%

16.7%

Q2 2016 Staffing Right Management /

Solutions

Currency Q2 2017

-0.3%

-0.2%

+0.1%

ManpowerGroup July 2017 6

ManpowerGroup 2017 Second Quarter Results

2%

4% CC

0%

2% CC

5%

6% CC

-24%

-22% CC

0%

2% CC

Growth

█ Manpower █ Experis █ ManpowerGroup Solutions █ Right Management █ ManpowerGroup – Total

Business Line Gross Profit – Q2 2017

$543M

63%

$175M

20%

$108M

13%

$36M

4%

$862M

ManpowerGroup July 2017 7

ManpowerGroup 2017 Second Quarter Results

SG&A Expense Bridge – Q2 YoY

(in millions of USD)

656.6

664.7 667.1

Q2 2016 Currency Acquisitions Operational

Impact

Q2 2017

Excluding

Restructuring Costs

Restructuring

Costs

Q2 2017

-15.7

+5.8

+10.5

+1.8

13.2%

% of Revenue

12.7%

% of Revenue % of Revenue

12.9%

ManpowerGroup July 2017 8

ManpowerGroup 2017 Second Quarter Results

As

Reported

Excluding

Restructuring

Costs(1)

Q2 Financial Highlights

2% 2%

Revenue $1.1B

1% CC 1% CC

7% 19%

OUP $58M

7% CC 19% CC

40 bps 100 bps OUP Margin 5.4%

Operating Unit Profit (OUP) is the measure that we use to evaluate segment performance. OUP is

equal to segment revenues less direct costs and branch and national headquarters operating costs.

Americas Segment

(20% of Revenue)

(1) Excludes the impact of restructuring costs of $6.3M in Q2 2017.

ManpowerGroup July 2017 9

ManpowerGroup 2017 Second Quarter Results

Revenue Growth - CC Revenue Growth

% of Segment

Revenue

Americas – Q2 Revenue Growth YoY

Average Daily

Revenue Growth - CC

-7%

11%

8%

6%

-7%

14%

20%

6%

US

Mexico

Argentina

Other

64%

13%

5%

18%

-7%

18%

23%

ManpowerGroup July 2017 10

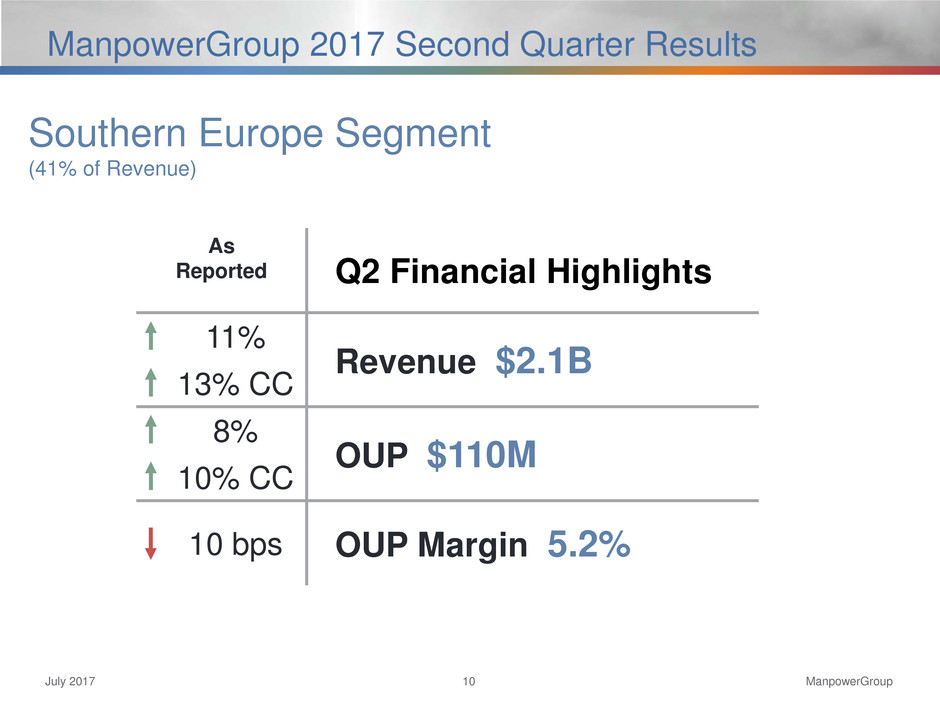

ManpowerGroup 2017 Second Quarter Results

As

Reported Q2 Financial Highlights

11%

Revenue $2.1B

13% CC

8%

OUP $110M

10% CC

10 bps OUP Margin 5.2%

Southern Europe Segment

(41% of Revenue)

ManpowerGroup July 2017 11

ManpowerGroup 2017 Second Quarter Results

Southern Europe – Q2 Revenue Growth YoY

Revenue Growth - CC Revenue Growth

% of Segment

Revenue

(1)

(1) On an organic basis, revenue for Spain decreased 2% (+1% in CC).

Average Daily

Revenue Growth - CC

8%

22%

7%

10%

11%

25%

9%

10%

France

Italy

Spain

Other

64%

17%

7%

12%

11%

29%

14%

ManpowerGroup July 2017 12

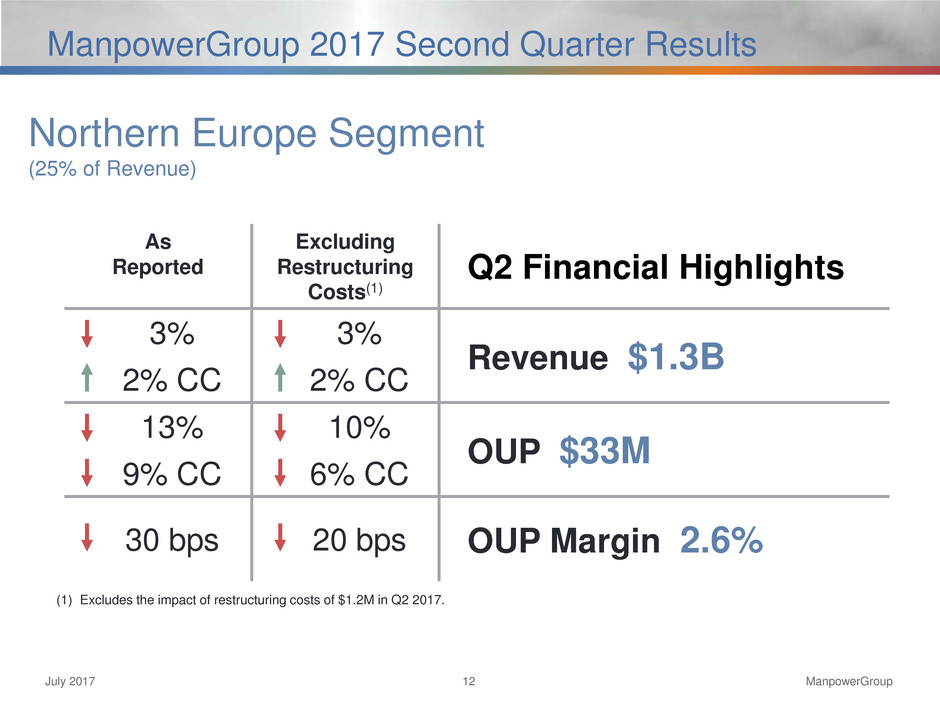

ManpowerGroup 2017 Second Quarter Results

As

Reported

Excluding

Restructuring

Costs(1)

Q2 Financial Highlights

3% 3%

Revenue $1.3B

2% CC 2% CC

13% 10%

OUP $33M

9% CC 6% CC

30 bps 20 bps OUP Margin 2.6%

(1) Excludes the impact of restructuring costs of $1.2M in Q2 2017.

Northern Europe Segment

(25% of Revenue)

ManpowerGroup July 2017 13

ManpowerGroup 2017 Second Quarter Results

-20%

7%

2%

16%

0%

11%

-10%

10%

7%

18%

3%

7%

UK

Germany

Nordics

Netherlands

Belgium

Other

30%

21%

21%

13%

8%

7%

-8%

16%

16%

20%

7%

Northern Europe – Q2 Revenue Growth YoY

Revenue Growth - CC Revenue Growth

% of Segment

Revenue

(1) On an organic basis, revenue for the Nordics was flat (+5% in CC), and the Netherlands increased 7% (+10% in CC).

(1)

(1)

Average Daily

Revenue Growth - CC

ManpowerGroup July 2017 14

ManpowerGroup 2017 Second Quarter Results

As

Reported Q2 Financial Highlights

5%

Revenue $643M

5% CC

5%

OUP $23M

6% CC

0 bps OUP Margin 3.6%

APME Segment

(13% of Revenue)

ManpowerGroup July 2017 15

ManpowerGroup 2017 Second Quarter Results

2%

-4%

13%

5%

-5%

12%

Japan

Australia/NZ

Other

34%

23%

43%

3%

-2%

APME – Q2 Revenue Growth YoY

Revenue Growth - CC Revenue Growth

% of Segment

Revenue

Average Daily

Revenue Growth - CC

ManpowerGroup July 2017 16

ManpowerGroup 2017 Second Quarter Results

As

Reported

Excluding

Restructuring

Costs(1)

Q2 Financial Highlights

22% 22%

Revenue $57B

20% CC 20% CC

41% 27%

OUP $8M

41% CC 27% CC

500 bps 140 bps OUP Margin 14.8%

Right Management Segment

(1% of Revenue)

(1) Excludes the impact of restructuring costs of $2.0M in Q2 2017.

ManpowerGroup July 2017 17

ManpowerGroup 2017 Second Quarter Results

Cash Flow Summary – 6 Months YTD

(in millions of USD) 2017 2016

Net Earnings 191 187

Non-cash Provisions and Other 92 96

Change in Operating Assets/Liabilities (135) (21)

Capital Expenditures (26) (31)

Free Cash Flow 122 231

Change in Debt (4) (21)

Acquisitions of Businesses, including Contingent

Considerations, net of cash acquired (34) (44)

Other Equity Transactions 18 (1)

Repurchases of Common Stock (116) (291)

Dividends Paid (62) (61)

Effect of Exchange Rate Changes 48 -

Other 3 3

Change in Cash (25) (184)

ManpowerGroup July 2017 18

ManpowerGroup 2017 Second Quarter Results

Balance Sheet Highlights

Total Debt

(in millions of USD)

Total Debt to

Total Capitalization

Total Debt

Net Debt (Cash)

-221 -231 125

227

109

318

516 468

855 825 834 891

-300

0

300

600

900

2013 2014 2015 2016 Q1 Q2

2017

15% 14%

24% 25% 25% 26%

0%

10%

20%

30%

2013 2014 2015 2016 Q1 Q2

2017

ManpowerGroup July 2017 19

ManpowerGroup 2017 Second Quarter Results

(1) The $600M agreement requires that we comply with a Leverage Ratio (net Debt-to-EBITDA) of not greater than 3.5 to 1 and a Fixed Charge Coverage

Ratio of not less than 1.5 to 1, in addition to other customary restrictive covenants. As defined in the agreement, we had a net Debt-to-EBITDA ratio of

0.84 and a fixed charge coverage ratio of 5.09 as of June 30, 2017. As of June 30, 2017, there were $0.8M of standby letters of credit issued under the

agreement.

(2) Represents subsidiary uncommitted lines of credit & overdraft facilities, which total $297.7M. Total subsidiary borrowings are limited to $300M due to

restrictions in our Revolving Credit Facility, with the exception of Q3 when subsidiary borrowings are limited to $600M.

Interest

Rate

Maturity

Date

Total

Outstanding

Remaining

Available

Euro Notes - €350M 4.505% Jun 2018 400 -

Euro Notes - €400M 1.913% Sep 2022 454 -

Revolving Credit Agreement 2.22% Sep 2020 - 599

Uncommitted lines and Other Various Various 37 261

Total Debt 891 860

Debt and Credit Facilities – June 30, 2017

(in millions of USD)

(2)

(1)

ManpowerGroup July 2017 20

ManpowerGroup 2017 Second Quarter Results

Third Quarter Outlook

Revenue Total Up 5-7% (Up 4-6% CC)

Americas Down 2-4% (Down 2-4% CC)

Southern Europe Up 12-14% (Up 10-12% CC)

Northern Europe Up 2-4% (Up 1-3% CC)

APME Up 2-4% (Up 5-7% CC)

Right Management Down 16-18% (Down 16-18% CC)

Gross Profit Margin 16.5 – 16.7%

Operating Profit Margin 4.0 – 4.2%

Tax Rate 37.0%

EPS $1.90 – $1.98 (favorable $0.02 currency)

ManpowerGroup July 2017 21

ManpowerGroup 2017 Second Quarter Results

Strong performance in the second quarter, with improving top line growth and solid

bottom line performance. Continued slow growth environment but improving economic

and labor market outlook in many parts of the world, particularly in Europe.

Our extensive portfolio of services and solutions bridges the gap between supply and

demand. We help companies engage productive and skilled talent where and when

they need them, and we help individuals find meaningful and sustainable employment

while acquiring additional skills and work experience.

Much of our progress in innovation, efficiency, and new service offerings will be

enabled by leveraging technology and strengthening our digital capabilities. Our

investments in these areas are helping to build relationships with clients and

candidates while improving our productivity.

Key Take Aways