Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - SELECT BANCORP, INC. | v471200_ex99-1.htm |

| 8-K - 8-K - SELECT BANCORP, INC. | v471200_8k.htm |

Merger of Select Bancorp, Inc. and Premara Financial, Inc. July 20, 2017 Exhibit 99.2

In connection with the proposed merger, Select Bancorp, Inc. (“SLCT”) will file with the Securities and Exchange Commission (“SEC”) a registration statement on Form S - 4 that will contain a joint proxy statement/prospectus of SLCT and Premara Financial, Inc. (“PARA”). SLCT will file with the SEC other relevant materials in connection with the proposed merger, and SLCT and PAR A will mail the joint proxy statement/prospectus to their respective shareholders when it becomes available. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. SHAREHOLDERS OF BOTH SLCT AND PARA ARE STRONGLY URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED MERGER WHEN THEY BECOME AVAILABLE AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION REGARDING SLCT, PARA AND THE PROPOSED MERGER. A free copy of the joint proxy statement/prospectus, as well as other filings containing information about SLCT, may be obtai ned after their respective filing by SLCT at the SEC’s internet site ( http://www.sec.gov ). Free copies of the joint proxy statement/prospectus may also be obtained, when available and without charge, by directing a written request to either (i) Se lec t Bancorp, Inc., 700 W. Cumberland Street, Dunn, NC 28443, Attention: Mark Jeffries, EVP and Chief Financial Officer, or (ii) Premara Financial, Inc., 13024 Ballantyne Corporate Pl, Suite 100, Charlotte, NC 28277, Attention: David P. Barksdale, President and CEO. SLCT, PARA and their respective directors and officers may be deemed to be “participants” in the solicitation of proxies from th e shareholders of SLCT and PARA in connection with the proposed merger. Information about the directors and executive officers of SLCT and their ownership of SLCT common stock is set forth in SLCT’s definitive proxy statement filed with the SEC on Marc h 31, 2017, and available at the SEC’s internet site ( http://www.sec.gov ) and from SLCT at the address set forth above. Additional information regarding the interests of these participants and other person who may be deemed participants in the proxy solicitation may be obtained by reading the joint proxy statement/prospectus regarding the proposed merger when it becomes available. Additional Information about the Merger and Where to Find It 2

This presentation contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. You can identify forward - looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “continue,” “could,” “future” or the negative of those te rms or words of similar meaning. You should read statements that contain these words carefully because they discuss our future expectations or state other “forward - looking” information. These forward - looking statements involve a number of risks and uncertainties, may of which are difficult to predict. SLCT and PARA caution readers that any forward - looking statement is not a guarantee of future performance and that actual results could differ materially from those contained in the forward - looking statement. Such forward - looking statements include, but are not limited to, statements about the benefits of the proposed merger involving SLCT and PARA, SLCT’s and PARA’s plans, objectives, expectations and intentions, the expected timing of completion of the transaction, the pro - forma condition of the combined company, and other statements that are not historical facts. In addition to the risks set forth in SLCT’s Form 10 - Q filed with the SEC on May 10, 2017, risk and uncertainties that c ould cause results or expectations to differ materially include: the ability to obtain the requisite SLCT and PARA shareholder approvals; the risk the SLCT or PARA may be unable to obtain governmental and regulatory approvals required for the merger, or required governmental and regulatory approvals may delay the merger; the risk that a condition to closing of the merger ma y not be satisfied; the time necessary to consummate the proposed merger may be longer than expected; the risk that the businesses will not be integrated successfully; the risk that the cost savings and any other synergies from the merger may no t b e fully realized or may take longer than expected; disruption from the proposed transaction may make it more difficult to maintain relationships with customers and employees; the diversion of management time on merger - related issues; general worldwide economic conditions and related uncertainties; the effect of changes in governmental regulations; and other factors . Each forward - looking statement speaks only as of the date of the particular statement and, except as may be required by law, neither SLCT nor PARA undertakes any obligation to publicly update any forward - looking statement, whether as a result of new information , future events or otherwise. Cautionary Statement Regarding Forward - Looking Statements 3

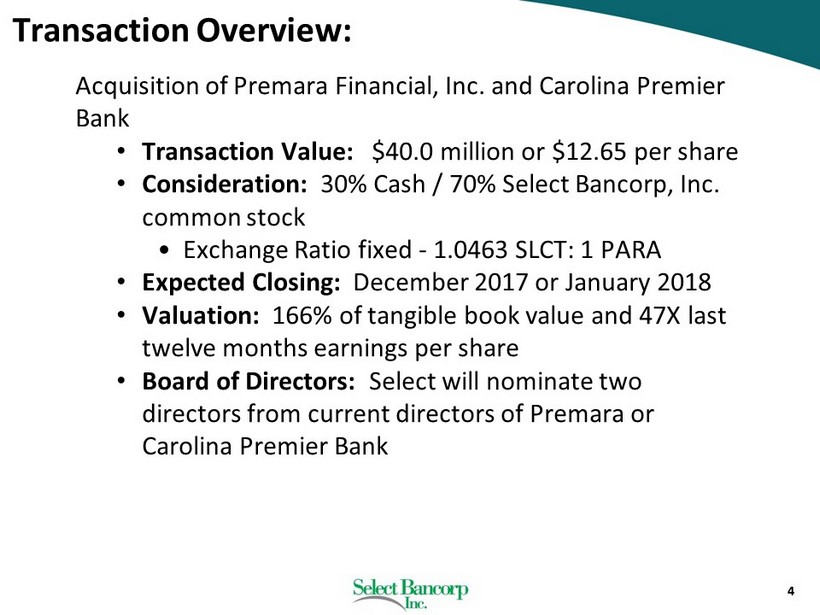

Transaction Overview : Acquisition of Premara Financial, Inc. and Carolina Premier Bank • Transaction Value: $40.0 million or $12.65 per share • Consideration: 30% Cash / 70% Select Bancorp, Inc. common stock • Exchange Ratio fixed - 1.0463 SLCT: 1 PARA • Expected Closing: December 2017 or January 2018 • Valuation: 166% of tangible book value and 47X last twelve months earnings per share • Board of Directors: Select will nominate two directors from current directors of Premara or Carolina Premier Bank 4

Strategic Rationale 5 Unique Opportunity x Build a community bank serving North Carolina Market Expansion x Add Charlotte and Rock Hill to the growth markets served by Select x Serve five of the largest 10 NC markets: Burlington, Charlotte, Fayetteville, Raleigh, Wilmington Common Culture x ‘Common Sense,’ customer - focused banking Financially Attractive x Immediate EPS accretion x Anticipated cost savings of approximately 40% of existing Premara noninterest expense x Expected internal rate of return in excess of 20% Scale x Creates $1.0 + billion balance sheet x Diversifies lending markets x Access to broader and deeper deposit markets x Leverage leadership and infrastructure across larger asset base

Geographic Footprint – Room to Grow Wilmington Select’s 13 Branches in Central & Eastern North Carolina plus Carolina Premier’s four branches: Charlotte NC, Rock Hill, Blacksburg and Six Mile SC 6

Proforma Profile: 7 Assets Liabilities and Equity Cash and Investments 147,568$ Deposits 888,176$ Net Loans 903,934 Borrowings 68,873 Goodwill 22,592 Trust Preferred 12,372 Other Intangibles 2,012 Other Liabilities 38,744 OREO 933 Total Liabilities 1,008,166 Other Assets 62,700 Equity 131,574 Total Assets 1,139,739$ Total Liabilities and Equity 1,139,739$ Select Bancorp, Inc. Proforma Balance Sheet at March 31, 2017 ($, millions) Select Bancorp, Inc. NASDAQ: SLCT $11.89 (close July 20, 2017) Proforma Shares outstanding: 14,007,214 Proforma Market capitalization: $166.6 million Headquarters: Dunn, NC

Summary Fin ancial Impact : 8 • Estimated cost savings of approximately 40% of Premara’s expense base, or approximately $3.6 million, pre - tax • One - time transaction - related charges of approximately $2.8 million (after - tax) • Core deposit intangible created of approximately $1.3 million Assumptions • Projected EPS accretive in 2018 and beyond • Internal rate of return estimated in excess of 20% Earnings • Anticipated return to pre - transaction book value in approximately 4.2 years Book Value • Projected minimum capital ratios well in excess of regulatory minimums • No added capital is needed Capital

27