Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - VISA INC. | vex991earningsrelease63017.htm |

| 8-K - 8-K - VISA INC. | form8-kearningsrelease63017.htm |

Visa Inc.

Fiscal Third Quarter 2017

Financial Results

July 20, 2017

EHIBIT 99.2

Fiscal Third Quarter 2017 Financial Results2

This presentation contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 that relate to, among

other things, our future operations, prospects, developments, strategies, business growth and financial outlook for fiscal full-year 2017. Forward-looking

statements generally are identified by words such as "believes," "estimates," "expects," "intends," "may," "projects," “outlook”, "could," "should," "will,"

"continue" and other similar expressions. All statements other than statements of historical fact could be forward-looking statements, which speak only as

of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are

beyond our control and are difficult to predict.

Actual results could differ materially from those expressed in, or implied by, our forward-looking statements due to a variety of factors, including, but not

limited to:

• increased oversight and regulation of the global payments industry and our business;

• impact of government-imposed restrictions on payment systems;

• outcome of tax and litigation matters;

• increasingly intense competition in the payments industry, including competition for our clients and merchants;

• proliferation and continuous evolution of new technologies and business models;

• our ability to maintain relationships with our clients, merchants and other third parties;

• brand or reputational damage;

• management changes;

• impact of global economic, political, market and social events or conditions;

• exposure to loss or illiquidity due to settlement guarantees;

• uncertainty surrounding the impact of the United Kingdom’s withdrawal from the European Union;

• cyber security attacks, breaches or failure of our networks;

• failure to maintain interoperability with Visa Europe’s systems;

• our ability to successfully integrate and manage our acquisitions and other strategic investments; and

• other factors described in our filings with the U.S. Securities and Exchange Commission, including our Annual Report on Form 10-K for the year

ended September 30, 2016, and our subsequent reports on Forms 10-Q and 8-K.

Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Forward-Looking Statements

Fiscal Third Quarter 2017 Financial Results3

Strong Fiscal Third Quarter Results

Returned approximately $2.1 billion of capital to shareholders

in the form of share repurchases and dividends

GAAP net income of $2.1 billion or $0.86 per share

Net operating revenue of $4.6 billion, an increase of 26%,

driven by inclusion of Europe and continued growth in

payments volume, cross-border volume and processed

transactions

Fiscal Third Quarter 2017 Financial Results4

Quarter ended March – Excludes Europe Co-badge Payments Volume*

Payments Volume

US$ in billions, nominal, except percentages

INTL

558

INTL

958

INTL

445

INTL

572

INTL 113

INTL

386

U.S.

694

U.S.

776

U.S.

334

U.S.

404

U.S.

359

U.S.

372

1,252

1,734

780

976

473

758

INTL = International

Total Visa Inc. Credit Debit

YOY Change

(constant) 38% 25% 58%

YOY Change

(nominal)

25% 60%38%

Note: On occasion, previously submitted volume information may be updated to reflect revised client submissions or other adjustments. Prior period updates are not material. Figures

may not recalculate exactly due to rounding. Percentage changes and totals are calculated based on unrounded numbers. Constant dollar growth rates exclude the impact of foreign

currency fluctuations against the U.S. dollar in measuring performance.

2016

2017

* As a result of EU regulation changes, effective with the quarter ended December 31, 2016, Europe co-badge volume is no longer included in reported volume.

Fiscal Third Quarter 2017 Financial Results5

Quarter ended June – Excludes Europe Co-badge Payments Volume*

Payments Volume

US$ in billions, nominal, except percentages

YOY Change

(constant) 38% 24% 62%

YOY Change

(nominal) 23% 63%38%

Note: The Company did not include Visa Europe’s payments volume from the acquisition date, June 21, 2016, through June 30, 2016 as the impact was immaterial. Current quarter

payments volume and other select metrics are provided in the operational performance data supplement in the press release to provide more recent operating data. Service revenues

continue to be recognized based on payments volume in the prior quarter. On occasion, reported payments volume information may be updated to reflect revised client submissions

or other adjustments. Prior period updates are not material. Figures may not recalculate exactly due to rounding. Percentage changes and totals are calculated based on unrounded

numbers. Constant dollar growth rates exclude the impact of foreign currency fluctuations against the U.S. dollar in measuring performance.

INTL

420

INTL

457

INTL 109 INTL 127

U.S.

575

U.S.

631

U.S.

277

U.S.

313

U.S.

298

U.S.

319

INTL

600

INTL

1,021

INTL

476

INTL

604

INTL 123

INTL

417

U.S.

749

U.S.

840

U.S.

376

U.S.

446

U.S.

374

U.S.

393

1,349

1,860

852

1,050

497

811

INTL = International

Total Visa Inc. Credit Debit

2016

2017

* As a result of EU regulation changes, effective with the quarter ended December 31, 2016, Europe co-badge volume is no longer included in reported volume.

Fiscal Third Quarter 2017 Financial Results6

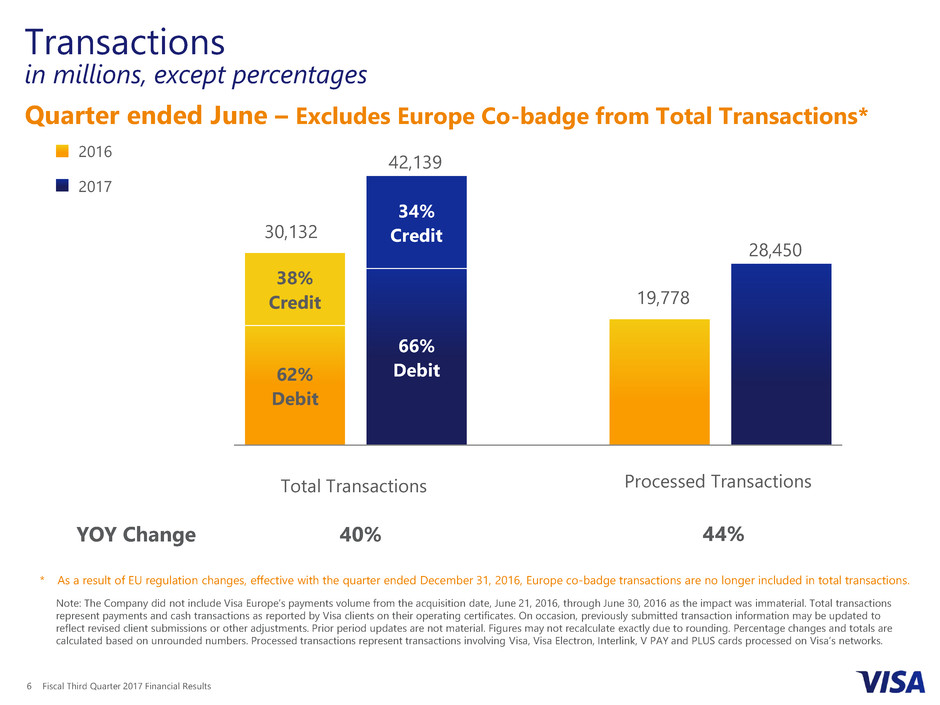

Quarter ended June – Excludes Europe Co-badge from Total Transactions*

Transactions

in millions, except percentages

Note: The Company did not include Visa Europe’s payments volume from the acquisition date, June 21, 2016, through June 30, 2016 as the impact was immaterial. Total transactions

represent payments and cash transactions as reported by Visa clients on their operating certificates. On occasion, previously submitted transaction information may be updated to

reflect revised client submissions or other adjustments. Prior period updates are not material. Figures may not recalculate exactly due to rounding. Percentage changes and totals are

calculated based on unrounded numbers. Processed transactions represent transactions involving Visa, Visa Electron, Interlink, V PAY and PLUS cards processed on Visa’s networks.

Credit

38%

YOY Change 40% 44%

Debit

62%

Credit

38%

62%

Debit

66%

Debit

38%

Credit

34%

Credit30,132

42,139

19,778

28,450

Processed TransactionsTotal Transactions

2016

2017

* As a result of EU regulation changes, effective with the quarter ended December 31, 2016, Europe co-badge transactions are no longer included in total transactions.

Fiscal Third Quarter 2017 Financial Results7

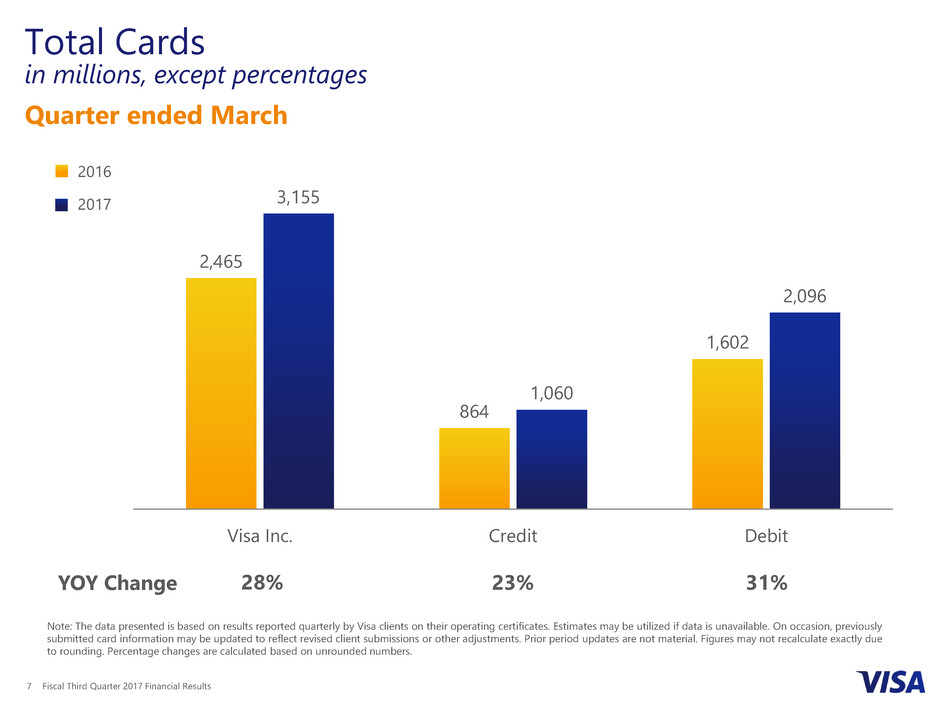

Quarter ended March

Total Cards

in millions, except percentages

2,465

864

1,602

3,155

1,060

2,096

Visa Inc. Credit Debit

Note: The data presented is based on results reported quarterly by Visa clients on their operating certificates. Estimates may be utilized if data is unavailable. On occasion, previously

submitted card information may be updated to reflect revised client submissions or other adjustments. Prior period updates are not material. Figures may not recalculate exactly due

to rounding. Percentage changes are calculated based on unrounded numbers.

YOY Change 23% 31%28%

2016

2017

Fiscal Third Quarter 2017 Financial Results8

4,469

(839)

3,630

5,712

(1,147)

4,565

Gross

Revenues

Client

Incentives

Net Operating

Revenues

Fiscal 2016

Fiscal 2017

Revenue – Q3 2017

US$ in millions, except percentages

YOY

Change 37% 26%28%

Fiscal 2017 % of

Gross Revenues 20% 80%

Note: The Company did not include Visa Europe’s financial results in its unaudited consolidated statements of operations from the acquisition date, June 21, 2016, through June 30,

2016 as the impact was immaterial. Figures may not recalculate exactly due to rounding. Percentage changes are calculated based on unrounded numbers.

Fiscal Third Quarter 2017 Financial Results9

Revenue Detail – Q3 2017

US$ in millions, except percentages

1,635

1,541

1,084

209

1,948 1,984

1,571

209

Service Revenues Data Processing

Revenues

International

Transaction Revenues

Other Revenues

Fiscal 2016

Fiscal 2017

YOY

Change 29% 45%19% —

Note: The Company did not include Visa Europe’s financial results in its unaudited consolidated statements of operations from the acquisition date, June 21, 2016, through June 30,

2016 as the impact was immaterial. Figures may not recalculate exactly due to rounding. Percentage changes are calculated based on unrounded numbers.

Fiscal Third Quarter 2017 Financial Results10

Operating Margin – Q3 2017

US$ in millions, except percentages

3,630

3,202

428

1,173

2,457

1,541

3,024

Reported GAAP Fiscal 2016 Adjusted non-GAAP Fiscal 2016 Reported GAAP Fiscal 2017

Net Operating

Revenue

4,565

12%

68% 66%

Note: The Company did not include Visa Europe’s financial results from the acquisition date, June 21, 2016, through June 30, 2016 as the impact was immaterial. Adjusted non-GAAP

financial measures exclude the impact of certain significant items related to the acquisition of Visa Europe. There were no comparable adjustments for fiscal third quarter 2017. Refer

to the accompanying financial tables for further details and a reconciliation of the non-GAAP measures presented. Operating margin is calculated as operating income divided by net

operating revenues. Figures may not recalculate exactly due to rounding. Percentage changes are calculated based on unrounded numbers.

31% 23%— (2) ppt

26% NM(52%) 54 ppt

YOY Change

(Reported GAAP)

YOY Change

(Adjusted non-GAAP)

Operating

Income

Operating

Expenses

Operating

Margin

NM - Not meaningful

Fiscal Third Quarter 2017 Financial Results11

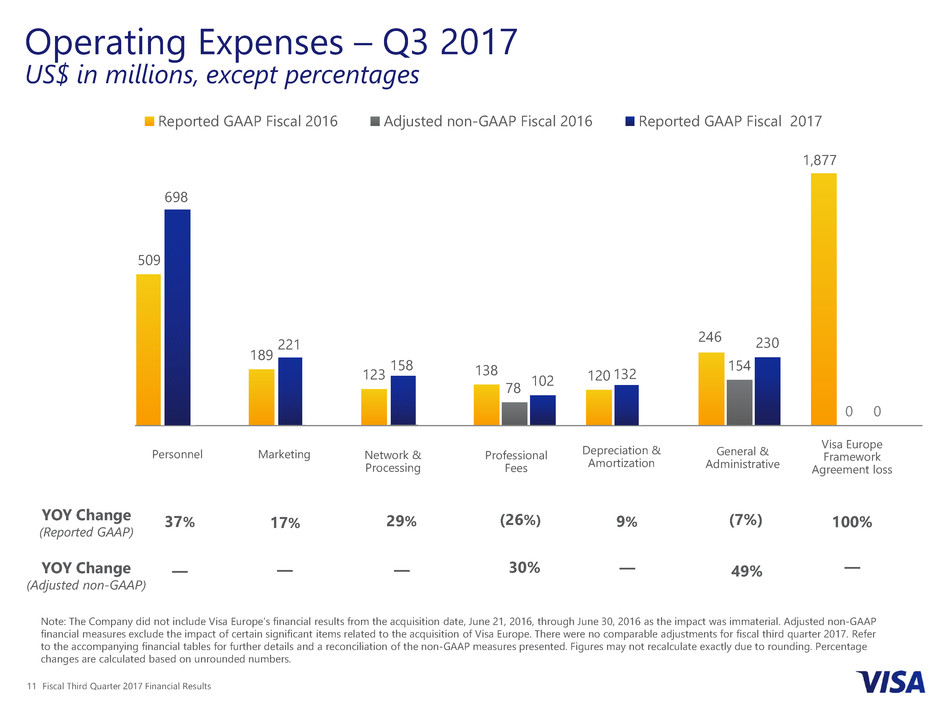

Operating Expenses – Q3 2017

US$ in millions, except percentages

509

189

123 138 120

246

1,877

78

154

0

102

230

0

Reported GAAP Fiscal 2016 Adjusted non-GAAP Fiscal 2016 Reported GAAP Fiscal 2017

698

Note: The Company did not include Visa Europe’s financial results from the acquisition date, June 21, 2016, through June 30, 2016 as the impact was immaterial. Adjusted non-GAAP

financial measures exclude the impact of certain significant items related to the acquisition of Visa Europe. There were no comparable adjustments for fiscal third quarter 2017. Refer

to the accompanying financial tables for further details and a reconciliation of the non-GAAP measures presented. Figures may not recalculate exactly due to rounding. Percentage

changes are calculated based on unrounded numbers.

29%17% (26%) 9% (7%)YOY Change

(Reported GAAP)

37%

Personnel Marketing Network &

Processing

Professional

Fees

Visa Europe

Framework

Agreement loss

100%

Depreciation &

Amortization

General &

Administrative

YOY Change

(Adjusted non-GAAP)

— — — — —30% 49%

221

158

132

Fiscal Third Quarter 2017 Financial Results12

Other Financial Results and Highlights

• Cash, cash equivalents and available-for-sale investment securities of $12.2

billion at the end of the fiscal third quarter

• Adjusted free cash flow of $3.3 billion for the fiscal third quarter

• Capital expenditures of $195 million during the fiscal third quarter

See appendix for reconciliation of adjusted free cash flow to the closest comparable U.S. GAAP financial measure.

Fiscal Third Quarter 2017 Financial Results13

Financial Outlook for Fiscal Full-Year 2017

Annual net revenue

growth Approximately 20% on a nominal dollar basis, including approximately 2.0 ppts of negative foreign currency impact

Client incentives as a

percent of gross

revenues

20.0% to 20.5% range

Annual operating

margin Mid 60s

Effective tax rate Mid 40s on a GAAP basis and approximately 30% on an

adjusted, non-GAAP basis

Annual diluted class A

common stock

earnings per share

growth

Low double-digits on a GAAP nominal dollar basis and

approximately 20% on an adjusted, non-GAAP nominal dollar

basis (see note below), both including approximately 2.5 ppts

of negative foreign currency impact

Note: The financial outlook for fiscal full-year 2017 includes Visa Europe integration expenses of approximately $60 million for the full-year. Differences in our financial outlook for fiscal

full-year 2017 GAAP and non-GAAP financial measures relate to the one-time, non-recurring items that are included in the accompanying reconciliation. Annual adjusted diluted class A

common stock earnings per share growth is derived from adjusted full-year 2016 earnings per share results of $2.84. Refer to the accompanying financial tables for further details and a

reconciliation of the adjusted fiscal full-year 2016 results.

Appendix

Fiscal Third Quarter 2017 Financial Results15

Calculation of Adjusted Free Cash Flow

US$ in millions

A-

Management believes that presentation of adjusted free cash flow is useful to measure the Company’s generation of cash available to first

re-invest in the business and then return excess cash to shareholders through stock buybacks and cash dividends. During the three months

ended June 30, 2017, the Company generated adjusted free cash flow of $3.3 billion, and returned $2.1 billion to investors through stock

buybacks of $1.7 billion, and dividends paid of $394 million. During the nine months ended June 30, 2017, the company generated

adjusted free cash flow of $5.9 billion, and returned $6.3 billion(1) to investors through stock buybacks of $5.1 billion, and dividends paid of

$1.2 billion. The Company defines adjusted free cash flow as cash provided by operating activities adjusted to reflect capital investments

made in the business. Adjusted free cash flow is a non-GAAP performance measure and should not be relied upon as a substitute for

measures calculated in accordance with U.S. GAAP. The following table reconciles as-reported net cash provided by operating activities to

non-GAAP adjusted free cash flow.

(1) Funds returned to investors were greater than adjusted free cash flow funded by liquidity sources available to the Company such as cash on hand and the Company’s investment

portfolio.