Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Polaris Inc. | a51592071ex99_1.htm |

| 8-K - POLARIS INDUSTRIES INC. 8-K - Polaris Inc. | a51592071.htm |

Exhibit 99.2

Second Quarter 2017 Earnings Results July 20, 2017 POLARIS INDUSTRIES INC.

SAFE HARBOR & NON-GAAP MEASURES 2 Q2'17 Earnings Except for historical information contained herein, the matters set forth in this presentation, including management’s expectations regarding 2017 future sales, shipments, net income, and net income per share, and operational initiatives are forward-looking statements that involve certain risks and uncertainties that could cause actual results to differ materially from those forward-looking statements. Potential risks and uncertainties include such factors as the Company’s ability to successfully implement its manufacturing operations expansion initiatives, product offerings, promotional activities and pricing strategies by competitors; economic conditions that impact consumer spending; acquisition integration costs; product recalls, warranty expenses; impact of changes in Polaris stock price on incentive compensation plan costs; foreign currency exchange rate fluctuations; environmental and product safety regulatory activity; effects of weather; commodity costs; uninsured product liability claims; uncertainty in the retail and wholesale credit markets; performance of affiliate partners; changes in tax policy and overall economic conditions, including inflation, consumer confidence and spending and relationships with dealers and suppliers. Investors are also directed to consider other risks and uncertainties discussed in documents filed by the Company with the Securities and Exchange Commission. The Company does not undertake any duty to any person to provide updates to its forward-looking statements. The data source for retail sales figures included in this presentation is registration information provided by Polaris dealers in North America and compiled by the Company or Company estimates. The Company must rely on information that its dealers supply concerning retail sales, and other retail sales data sources and this information is subject to revision.This presentation contains certain non-GAAP financial measures, consisting of “adjusted” sales, gross profit, operating expenses, net income and net income per diluted share as measures of our operating performance. Management believes these measures may be useful in performing meaningful comparisons of past and present operating results, to understand the performance of its ongoing operations and how management views the business. Reconciliations of adjusted non-GAAP measures to reported GAAP measures for Q2 are included on slide 3 and Q2 year-to-date are included in the appendix contained in this presentation. These measures, however, should not be construed as an alternative to any other measure of performance determined in accordance with GAAP.

Q2 NON-GAAP DISCLOSURE 3 Q2'17 Earnings Reconciliation of GAAP "Reported" Results to Non-GAAP "Adjusted" Results (In Thousands, Except Per Share Data; Unaudited) Key Definitions: Throughout this presentation, the word “Adjusted” is used to refer to GAAP results excluding: TAP inventory step-up purchase accounting, TAP integration expenses, impacts associated with the Victory Motorcycles® wind down and manufacturing network realignment costs.Adjustments: (1) Represents adjustments for the wind down of Victory Motorcycles, including wholegoods, accessories and apparel (2) Represents adjustments for TAP acquisition inventory step-up and TAP integration expenses (3) Represents adjustments for manufacturing network realignment costs (4) The Company used its estimated statutory tax rate of 37.1% for the non-GAAP adjustments, except for the non-deductible items2016 Reclassified Results: 2016 sales and gross profit results for ORV/Snowmobiles, Motorcycles and Aftermarket are reclassified for the new Aftermarket reporting segment. Reported GAAP Measures Reported GAAP Measures 2017 Adjustments(4) 2017 Adjustments(4) Adjusted Measures Adjusted Measures Three months ended June 30, Three months ended June 30, Three months ended June 30, Three months ended June 30, Three months ended June 30, Three months ended June 30, 2017 2017 2016 2016 % Change VictoryWind Down(1) VictoryWind Down(1) TAP(2) TAP(2) Realignment(3) Realignment(3) Total Total 2017 2017 2016 2016 % Change Sales ORV/Snowmobiles $ 845,508 $ 799,332 6 % — — — — $ 845,508 $ 799,332 6 % Motorcycles 197,997 228,392 (13 )% $ (6,157 ) — — $ (6,157 ) 191,840 228,392 (16 )% Global Adj. Markets 97,022 90,959 7 % — — — — 97,022 90,959 7 % Aftermarket 224,393 12,094 1,755 % — — — — 224,393 12,094 1,755 % Total sales 1,364,920 1,130,777 21 % (6,157 ) — — (6,157 ) 1,358,763 1,130,777 20 % Gross profit ORV/Snowmobiles 266,150 228,494 16 % — — — — 266,150 228,494 16 % % of sales 31.5 % 28.6 % +289 bps 31.5 % 28.6 % +289 bps Motorcycles 21,116 38,915 (46 )% 8,852 — — 8,852 29,968 38,915 (23 )% % of sales 10.7 % 17.0 % -637 bps 15.6 % 17.0 % -142 bps Global Adj. Markets 21,216 23,952 (11 )% — — 4,303 4,303 25,519 23,952 7 % % of sales 21.9 % 26.3 % -447 bps 26.3 % 26.3 % -3 bps Aftermarket 59,918 2,982 1,909 % — 53 — 53 59,971 2,982 1,911 % % of sales 26.7 % 24.7 % +205 bps 26.7 % 24.7 % +207 bps Corporate (18,014 ) (9,840 ) — — — — (18,014 ) (9,840 ) Total gross profit 350,386 284,503 23 % 8,852 53 4,303 13,208 363,595 284,503 28 % Gross profit % 25.7 % 25.2 % +51 bps 26.8 % 25.2 % +160 bps Operating expenses 270,347 187,965 44 % (1,999 ) (3,714 ) — (5,713 ) 264,634 187,965 41 % Other expense (income), net (2,152 ) 1,805 NM — — — — (2,152 ) 1,805 NM Net income $ 62,041 $ 71,166 (13 )% $ 6,820 $ 2,368 $ 2,705 $ 11,893 $ 73,934 $ 71,166 4 % Diluted EPS $ 0.97 $ 1.09 (11 )% $ 0.11 $ 0.04 $ 0.04 $ 0.19 $ 1.16 $ 1.09 6 %

Scott W. Wine, Chairman & CEO Second Quarter 2017 Earnings Results July 20, 2017 POLARIS INDUSTRIES INC.

Q2 SUMMARY 5 Q2'17 Earnings Q2 Slightly Ahead of Plan – Raising Sales Guidance and Lower End of EPS Guidance Range Foundational improvements gaining momentumOperational execution offset impact of major headwinds:Competitive ORV industryORV retail sales building momentum SxS retail up slightly in Q2; RZR sales up for first time in 6 quarters; ORV share remains challengedIndian Motorcycle retail up 17% - share gains acceleratingSlingshot weakness continues; Victory wind down progressing wellInternational and PG&A outperformingAdjacent markets / Aftermarket business growth on planTAP integration on track * See GAAP/Non-GAAP Reconciliation on Slide #3

NORTH AMERICAN POWERSPORTS RETAIL SALES Polaris N.A. retail down 3% for Q2 2017 vs. Q2 2016Indian Motorcycle retail was up 17% - two new motorcycles launchedORV retail down, but improved sequentiallyNorth American Industry up slightlySxS growth driven by new products; ATVs weakOil & gas/ag industry challenges ongoing (# vehicle units) POLARIS INDUSTRY Off-Road Vehicles low-single digits % mid-single digits % (estimated) Side-by-Sides ATVs low-single digits % high-single digits % Motorcycles low-single digits % mid-single digits % (900cc & above) Indian Slingshot high-teens % significantly Snowmobiles(season-end Mar’17) (off-season) (off-season) SxS Retail Turned Positive After 6 Quarter Decline Driven by RZR Q2’17 Retail Sales by Business (vs. Q2’16) Polaris Retail Sales Q2'17 Earnings 6 Year-Over-Year Retail % Change (units)

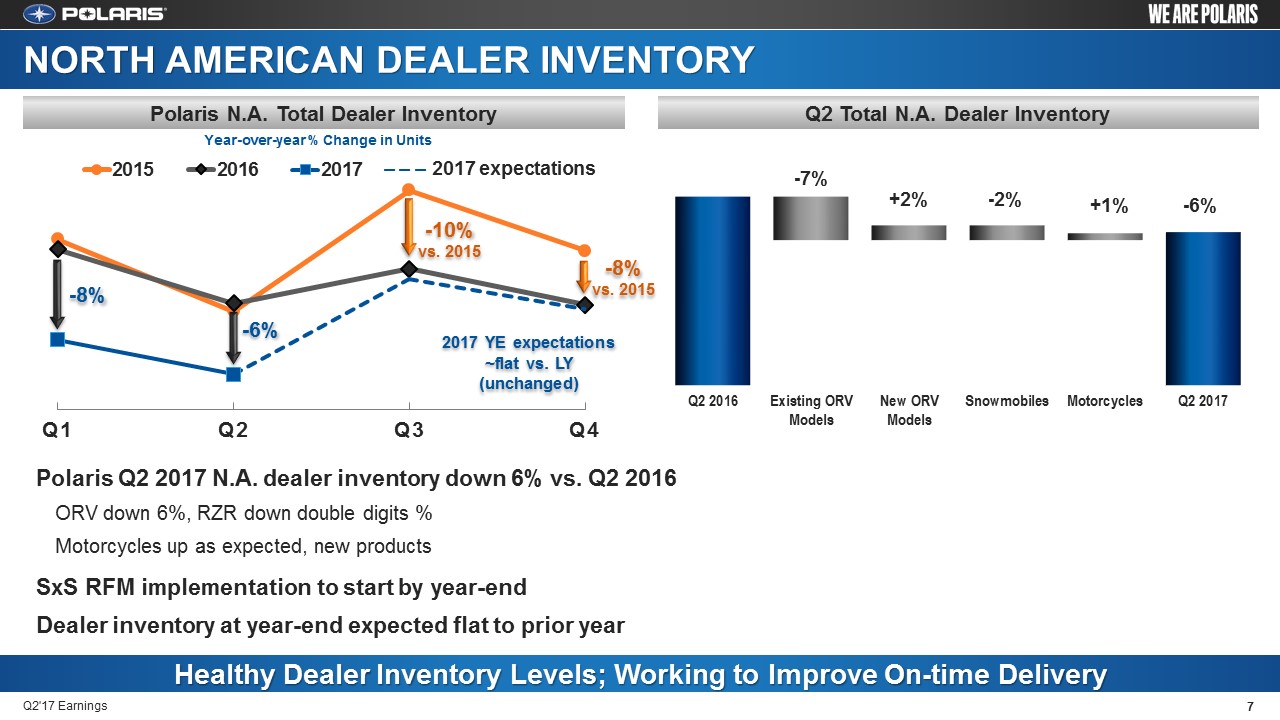

Polaris Q2 2017 N.A. dealer inventory down 6% vs. Q2 2016ORV down 6%, RZR down double digits %Motorcycles up as expected, new productsSxS RFM implementation to start by year-endDealer inventory at year-end expected flat to prior year Healthy Dealer Inventory Levels; Working to Improve On-time Delivery Q2 Total N.A. Dealer Inventory Polaris N.A. Total Dealer Inventory NORTH AMERICAN DEALER INVENTORY -6% Q2'17 Earnings 7 2017 YE expectations ~flat vs. LY(unchanged) -6% Year-over-year % Change in Units -7% +2% -2% +1% -10%vs. 2015 -8%vs. 2015 -8% – – – 2017 expectations

CRUSHING THE COMPETITIONWON OVER 3/4 OF ALL RACES33 Championship Wins106 Podium Finishes RACING DOMINATING THE FLAT TRACK9 Championship Wins out of 10 Races23 Podium Finishes out of 30 Racing Success a Reflection of Product Expertise Indian Motorcycle Polaris RZR Q2'17 Earnings 8

TRANSAMERICAN AUTO PARTS (TAP) UPDATE 9 Q2'17 Earnings Acquisition Performing as Expected $209 million in sales in Q2; $411 million year-to-dateOperating performance on plan, integration progressing as expectedOpened four new 4Wheel Parts Stores year-to-dateCost synergies of ~$20 million by 2019; slightly ahead of planFull-year sales expectation of $775 to $800 million (unchanged)

Mike Speetzen, EVP Finance & CFO Second Quarter 2017 Earnings Results July 20, 2017 POLARIS INDUSTRIES INC.

Q2 2017 Sales and Income Q2 reported sales were $1,365 million, up 21% from Q2 2016; Reported net income was $62 million, down 13% from prior yearAdjusted* sales were up 20% finishing ahead of expectationsAcquisition of Transamerican Auto Parts (TAP) added $209 million of sales in Q2 2017Q2 2016 includes Victory sales of $54 million ORV/Snowmobile sales up 6%; Motorcycles down 13% (up 10% excluding Victory); Global Adjacent Markets up 7%; Aftermarket up significantly (TAP)Adjusted* earnings reported at $1.16 per diluted share, up 6% from prior year (GAAP earnings per share at $0.97, down 11%)Adjusted* gross profit margin up 160 bps: VIP, product mix, promo (GAAP gross profit margin up 51 bps) Results Slightly Ahead of Expectations on an Adjusted* Basis Q2 2017 Net Income Q2 2017 Sales ($ millions) ($ millions) Q2'17 Earnings 11 * See GAAP/Non-GAAP Reconciliation on Slide #3

Sales Guidance by Segment (1) Adjusted* Earnings Per Share Guidance Q2'17 Earnings Total Company Adjusted* Sales Guidance Full Year Sales Guidance Increased & EPS Guidance Narrowed 2017 FULL YEAR SALES GUIDANCE Powersports market improving globallyOrganic** revenue expectations flat to +2%TAP FY’17 = incremental $665 to $690, unchangedVictory wind down / FX = ~($175) + $120M non-recurring warranty, legal and other recall related costs+ TAP accretive in 2017 approx. 25¢ to 30¢+ VIP positive+ Lower tax rate+ Share count– Higher R&D expense– Higher promotional costs– Higher variable compensation costs– Negative FX impact ($ millions) +12% to +14%$5,050 to $5,150(increased) +25% to +29%$4.35 to $4.50(narrowed) *See appendix for discussion regarding non-GAAP adjustments excluded from 2017 guidance**Organic revenue excludes TAP, Victory sales and the effects of FX ORV/SNOW APPROX. FLAT MOTORCYCLES HIGH-TEENS % (Victory included in 2016 #’s) MID-SINGLE DIGITS %(2) (Victory excluded in 2016 #’s) ADJACENT MARKETS MID-SINGLE DIGITS % AFTERMARKET SIGNIFICANTLY (1) Includes respective PG&A. 2016 sales, for comparison purposes, have been reclassified to account for the new Aftermarket segment which included aftermarket brands previously reported in their respective segments(2) On a comparable basis, motorcycle expectations is “Up mid-single digits %” in 2017 after adjusting for Victory wholegood, accessories and apparel sales reported in 2016 12

GROSS PROFIT MARGIN GUIDANCE Adjusted* Gross Profit 2017 Guidance Gross Profit Q2 2017 GM Growth Drivers+ VIP+ One-time warranty+ Acquisitions– Quality feature adds – Promos / Incentives– FX Q2 2017 Gross Margin Improvement Driven Primarily by VIP & Product Mix Q2'17 Earnings 13 Increase up to ~180 bps KEY: Improvement Headwind Neutral Adjusted* GM by Segment Q2 2016 Q2 2017 ORV/Snow 28.6% 31.5% Motorcycles* 17.0% 15.6% Adjacent Markets* 26.3% 26.3% Aftermarket* 24.7% 26.7% Adjusted* GM by Segment 2017Expectations ORV/Snow Motorcycles Adjacent Markets Aftermarket *See appendix for discussion regarding non-GAAP adjustments excluded from 2017 guidance GM Growth Drivers+ Product Mix+ VIP+ Acquisitions– Promos / Incentives

OFF-ROAD VEHICLES (ORV) / SNOWMOBILES Q2 2017 ORV/Snow Segment Sales ORV up 6% in Q2 2017 vs. Q2 2016Growth in all product linesPG&A up 5%ORV average selling price up 3% in Q2’172017 Guidance: Approx. Flat (increased)PII ORV improving worldwidePromotional levels remain elevated Regaining Footing as Leading Powersports Manufacturer Q2'17 Earnings 14 6%$846 ORV PG&A Snow $799 ORV PG&A Snow 5% 22% 6% % ∆ ($ millions) (1) 2016 sales, for comparison purposes, have been reclassified to account for the new Aftermarket segment which included aftermarket brands previously reported in their respective segments Reclassified(1) THE MOSTEXPANSIVELINE-UP OF CUSTOMIZABLEOFF-ROADVEHICLESIN THEINDUSTRY

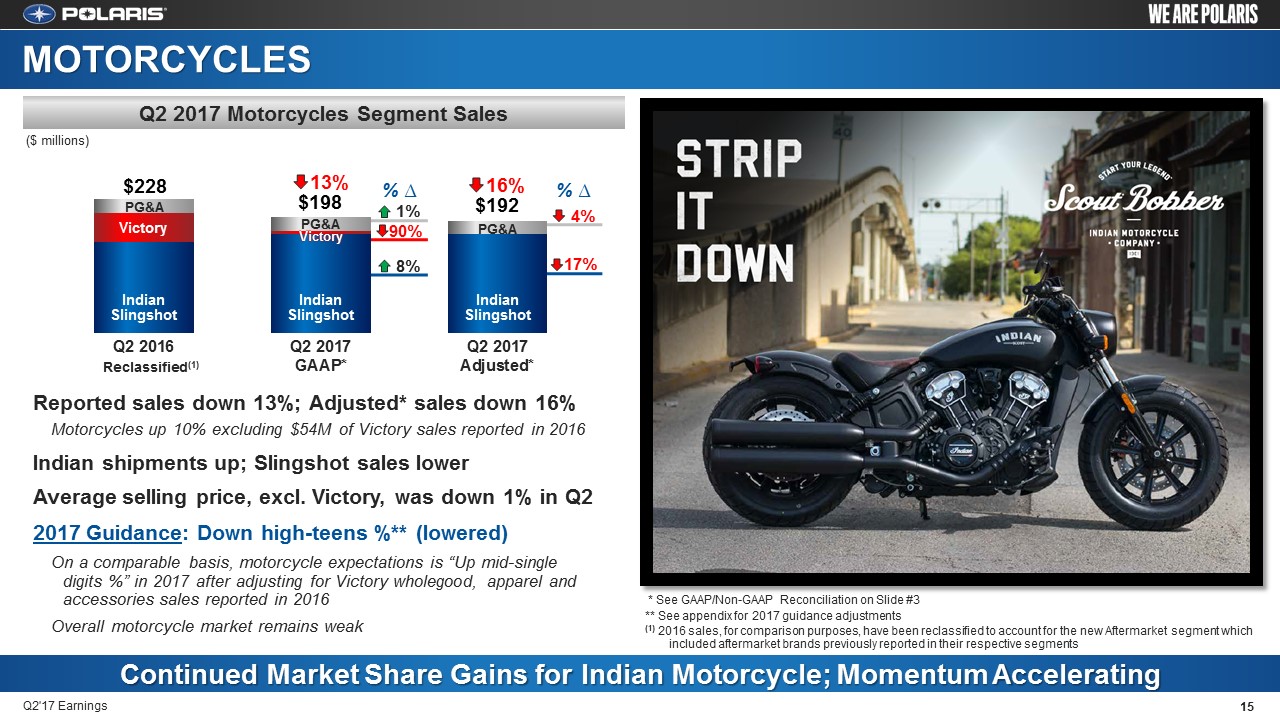

4% 17% 1% 90% 8% Reported sales down 13%; Adjusted* sales down 16%Motorcycles up 10% excluding $54M of Victory sales reported in 2016Indian shipments up; Slingshot sales lowerAverage selling price, excl. Victory, was down 1% in Q22017 Guidance: Down high-teens %** (lowered)On a comparable basis, motorcycle expectations is “Up mid-single digits %” in 2017 after adjusting for Victory wholegood, apparel and accessories sales reported in 2016Overall motorcycle market remains weak % ∆ MOTORCYCLES Q2 2017 Motorcycles Segment Sales Continued Market Share Gains for Indian Motorcycle; Momentum Accelerating Q2'17 Earnings 15 16%$192 PG&A $228 PG&A IndianSlingshot IndianSlingshot ($ millions) Victory * See GAAP/Non-GAAP Reconciliation on Slide #3** See appendix for 2017 guidance adjustments(1) 2016 sales, for comparison purposes, have been reclassified to account for the new Aftermarket segment which included aftermarket brands previously reported in their respective segments Reclassified(1) PG&A IndianSlingshot % ∆ 13%$198 Victory

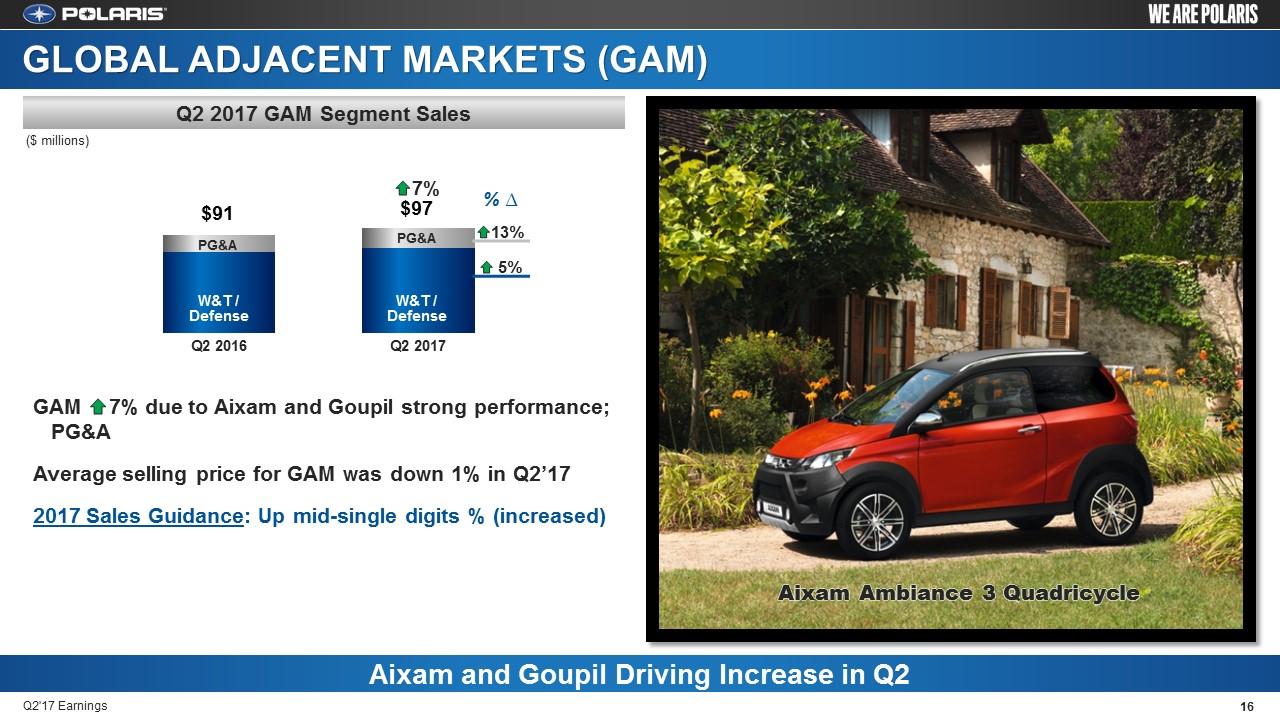

13% 5% GLOBAL ADJACENT MARKETS (GAM) Q2 2017 GAM Segment Sales GAM 7% due to Aixam and Goupil strong performance; PG&AAverage selling price for GAM was down 1% in Q2’172017 Sales Guidance: Up mid-single digits % (increased) Aixam and Goupil Driving Increase in Q2 Q2'17 Earnings 16 7%$97 PG&A $91 PG&A % ∆ W&T /Defense W&T /Defense ($ millions) Aixam Ambiance 3 Quadricycle

AFTERMARKET Q2 2017 Aftermarket Segment Sales TAP added $209 million to Q2 salesIntegration on plan, moving Pro Armor® production to TAP facility2017 Sales Guidance: Up significantly from TAP sales (unchanged) TAP Performing Well; Integration on Track Q2'17 Earnings 17 ($ millions) Significantly $209 Other AftermarketBrands Reclassified* *2016 sales, for comparison purposes, have been reclassified to account for the new Aftermarket segment which included aftermarket brands previously reported in their respective segments $12 First Minnesota StoreGrand Opening July 22nd Brooklyn Park, MN

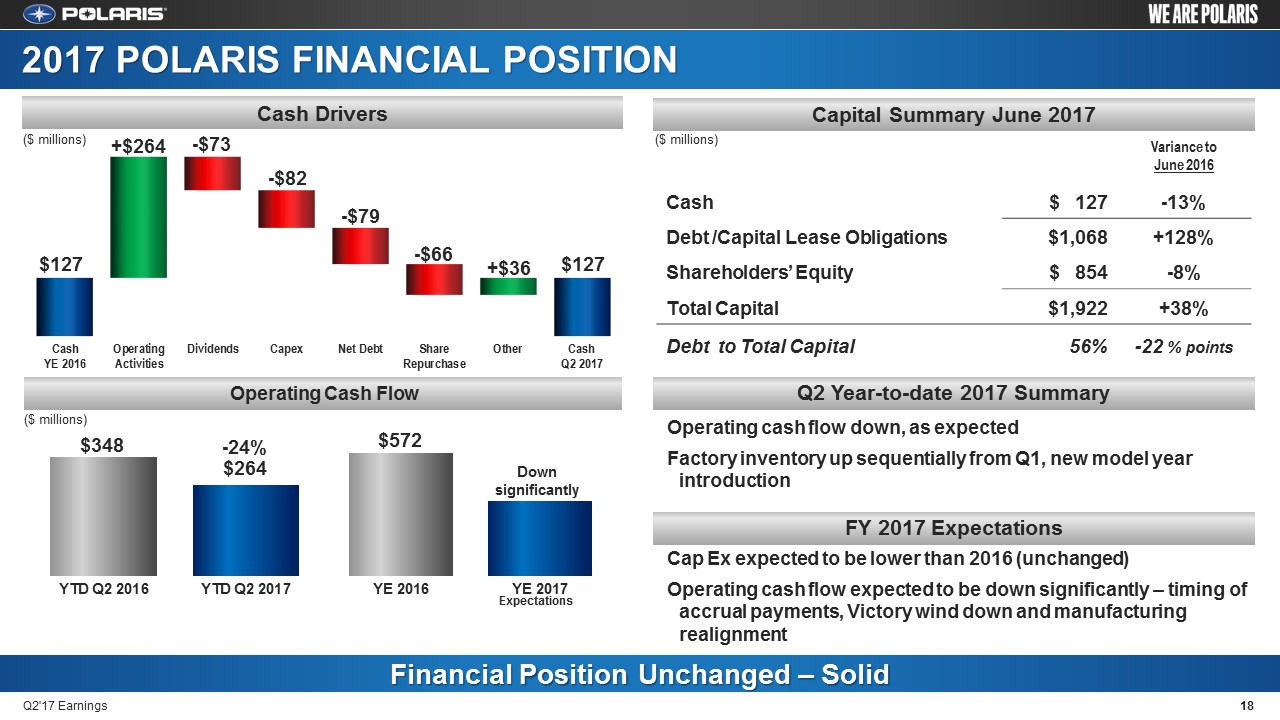

2017 POLARIS FINANCIAL POSITION 18 Q2'17 Earnings Capital Summary June 2017 Cash Drivers Variance toJune 2016 Cash $ 127 -13% Debt /Capital Lease Obligations $1,068 +128% Shareholders’ Equity $ 854 -8% Total Capital $1,922 +38% Debt to Total Capital 56% -22 % points 2015Operating cash flow down, as expectedFactory inventory up sequentially from Q1, new model year introductionCap Ex expected to be lower than 2016 (unchanged)Operating cash flow expected to be down significantly – timing of accrual payments, Victory wind down and manufacturing realignment Operating Cash Flow Financial Position Unchanged – Solid ($ millions) ($ millions) ($ millions) Q2 Year-to-date 2017 Summary FY 2017 Expectations Down significantly Expectations +$264 -$73 -$82 -$79 -$66 +$36

Retail Credit Wholesale Credit PA Receivables 19 Q2'17 Earnings Income from Financial Services Portfolio Remains Healthy INCOME FROM FINANCIAL SERVICES Polaris Acceptance (PA) receivables down, trending with dealer inventoryQ2 income from financial services down – lower wholesale and retail incomeFY 2017 Guidance: Income from financial services down about 10% (unchanged) $20 6%$19 9%$1,078 $1,180 ($ millions) ($ millions) Approval Rate Penetration Rate WholesaleCredit Retail Financing Retail Financing

Scott W. Wine, Chairman & CEO Second Quarter 2017 Earnings Results July 20, 2017 POLARIS INDUSTRIES INC.

21 Q2'17 Earnings CLOSING COMMENTS 2nd Half Performance Expected Up Significantly on a Year-over-year Basis Powersports market outlook improved globally; remains highly competitive Polaris ORV business, particularly SxS, regaining footingIndian Motorcycle market share gains continueSafety and Quality processes/results improvingCost & Productivity initiatives gaining traction; VIP savings acceleratingDealer show will kickoff 2nd half: product news, quality, dealer relations

Thank You Questions? POLARIS INDUSTRIES INC.

APPENDIX Q2 2017 SUPPLEMENTAL SALES PERFORMANCE (PG&A / INTERNATIONAL)Q2 YEAR-TO-DATE NON-GAAP DISCLOSURE2017 GUIDANCE ADJUSTMENTS2017 OTHER FULL YEAR EXPECTATIONS

International** Core Parts, Garments & Accessories (PG&A)* 24 Q2'17 Earnings Q2 2017 SUPPLEMENTAL SALES PERFORMANCE Motorcycles Global Adjacent Markets (GAM) 2% Snowmobiles Motorcycles Global Adjacent Markets (GAM) Apparel LatinAmerica 20% 11% 11% 19% 9% 11% Q2 Sales 4% to 193 Million Q2 Sales 12% to $191 Million ∆ from Q2'16 ∆ from Q2'16 *Based on GAAP reporting; does not include Aftermarket **Based on GAAP reporting

Q2 YEAR-TO-DATE NON-GAAP DISCLOSURE 25 Q2'17 Earnings Reconciliation of GAAP "Reported" Results to Non-GAAP "Adjusted" Results (In Thousands, Except Per Share Data; Unaudited) Reported GAAP Measures Reported GAAP Measures 2017 Adjustments(3) 2017 Adjustments(3) Adjusted Measures Adjusted Measures Six months ended June 30, Six months ended June 30, Six months ended June 30, Six months ended June 30, Six months ended June 30, Six months ended June 30, 2017 2017 2016 2016 % Change VictoryWind Down(1) VictoryWind Down(1) TAP(2) TAP(2) Realignment(3) Realignment(3) Total Total 2017 2017 2016 2016 % Change Sales ORV/Snowmobiles $ 1,569,611 $ 1,507,435 4 % — — — — $ 1,569,611 $ 1,507,435 4 % Motorcycles 318,286 413,659 (23 )% $ (1,053 ) — — $ (1,053 ) 317,233 413,659 (23 )% Global Adj. Markets 188,577 165,068 14 % — — — — 188,577 165,068 14 % Aftermarket 442,228 27,611 1,502 % — — — — 442,228 27,611 1,502 % Total sales 2,518,702 2,113,773 19 % (1,053 ) — — (1,053 ) 2,517,649 2,113,773 19 % Gross profit ORV/Snowmobiles 479,109 434,481 10 % — — — — 479,109 434,481 10 % % of sales 30.5 % 28.8 % +170 bps 30.5 % 28.8 % +170 bps Motorcycles 1,235 66,174 (98 )% 47,415 — — 47,415 48,650 66,174 (26 )% % of sales 0.4 % 16.0 % -1,561 bps 15.3 % 16.0 % -66 bps Global Adj. Markets 49,314 44,335 11 % — — 4,303 4,303 53,617 44,335 21 % % of sales 26.2 % 26.9 % -71 bps 28.4 % 26.9 % +157 bps Aftermarket 101,482 7,681 1,221 % — 12,950 — 12,950 114,432 7,681 1,390 % % of sales 22.9 % 27.8 % -487 bps 25.9 % 27.8 % -194 bps Corporate (38,263 ) (20,590 ) — — — — (38,263 ) (20,590 ) Total gross profit 592,877 532,081 11 % 47,415 12,950 4,303 64,668 657,545 532,081 24 % Gross profit % 23.5 % 25.2 % -163 bps 26.1 % 25.2 % +95 bps Operating expenses 512,179 377,895 36 % (8,016 ) (7,017 ) — (15,033 ) 497,146 377,895 32 % Other expense (income), net 9,456 1,886 401 % (13,000 ) — — (13,000 ) (3,544 ) 1,886 NM Net income $ 59,130 $ 118,055 (50 )% $ 47,841 $ 12,551 $ 2,705 $ 63,097 $ 122,227 $ 118,055 4 % Diluted EPS $ 0.92 $ 1.80 (49 )% $ 0.75 $ 0.20 $ 0.04 $ 0.99 $ 1.91 $ 1.80 6 % Key Definitions: Throughout this presentation, the word “Adjusted” is used to refer to GAAP results excluding: TAP inventory step-up purchase accounting, TAP integration expenses, impacts associated with the Victory Motorcycles® wind down and manufacturing network realignment costs.Adjustments: (1) Represents adjustments for the wind down of Victory Motorcycles, including wholegoods, accessories and apparel (2) Represents adjustments for TAP acquisition inventory step-up and TAP integration expenses (3) Represents adjustments for manufacturing network realignment costs (4) The Company used its estimated statutory tax rate of 37.1% for the non-GAAP adjustments, except for the non-deductible items2016 Reclassified Results: 2016 sales and gross profit results for ORV/Snowmobiles, Motorcycles and Aftermarket are reclassified for the new Aftermarket reporting segment.

2017 GUIDANCE ADJUSTMENTS 26 Q2'17 Earnings 2017 guidance excludes the pre-tax effect of TAP inventory step-up purchase accounting of approx. $15 million, acquisition integration costs of approx. $15 million, manufacturing network realignment costs of approx. $10 million to $15 million and the impacts associated with the Victory wind down which is estimated to be in the range of $80 million to $90 million. 2017 adjusted sales guidance excludes any Victory wholegood, accessories and apparel sales and corresponding promotional costs as the Company is in the process of exiting the brand. The Company has not provided reconciliations of guidance for adjusted diluted net income per share, in reliance on the unreasonable efforts exception provided under Item 10(e)(1)(i)(B) of Regulation S-K. The Company is unable, without unreasonable efforts, to forecast certain items required to develop meaningful comparable GAAP financial measures. These items include costs associated with the Victory wind down that are difficult to predict in advance in order to include in a GAAP estimate.

2017 OTHER FULL YEAR EXPECTATIONS 27 Q2'17 Earnings Gross Margins: increase up to 180 bps (unchanged)Adjusted operating expenses: increase in the 60 to 70 bps range, as a percent of sales (lowered) Increased R&D – up high-teens % excluding TAP; quality & innovationHigher variable compensation costsTAP operating expenseIncome from financial services: down ~10% due to lower dealer inventory levels and lower retail credit income (unchanged)Interest expense: more than double due to TAP acquisition funding (unchanged)Income taxes: approximately 34.0% of pretax profits (lowered)Supplemental:International sales: up over 2016 (increased)PG&A: up mid-single digits % (increased)Diluted shares outstanding: down 1% to 2% (improved)

28 Q2'17 Earnings