Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - KEYCORP /NEW/ | keycorp2q17earningsrelease.htm |

| 8-K - 8-K - KEYCORP /NEW/ | keycorp2q17er8-k.htm |

| EX-99.3 - EXHIBIT 99.3 - KEYCORP /NEW/ | keycorp2q17erex993.htm |

KeyCorp

Second Quarter 2017 Earnings Review

July 20, 2017

Beth E. Mooney

Chairman and

Chief Executive Officer

Don Kimble

Chief Financial Officer

FORWARD-LOOKING STATEMENTS AND ADDITIONAL

INFORMATION

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not

limited to, KeyCorp’s expectations or predictions of future financial or business performance or conditions. Forward-looking statements are typically

identified by words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “plan,” “predict,” “project,” “forecast,”

“guidance,” “goal,” “objective,” “prospects,” “possible” or “potential,” by future conditional verbs such as “assume,” “will,” “would,” “should,” “could” or

“may”, or by variations of such words or by similar expressions. These forward-looking statements are subject to numerous assumptions, risks and

uncertainties, which change over time. Forward-looking statements speak only as of the date they are made and we assume no duty to update

forward-looking statements. Actual results may differ materially from current projections.

In addition to factors previously disclosed in KeyCorp’s reports filed with the SEC and those identified elsewhere in this communication, the following

factors, among others, could cause actual results to differ materially from forward-looking statements or historical performance: difficulties and delays

in integrating the First Niagara business or fully realizing cost savings and other benefits; changes in asset quality and credit risk; the inability to

sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer acceptance of KeyCorp’s products and

services; customer borrowing, repayment, investment and deposit practices; customer disintermediation; the introduction, withdrawal, success and

timing of business initiatives; competitive conditions; the inability to realize cost savings or revenues or to implement integration plans and other

consequences associated with mergers, acquisitions and divestitures; economic conditions; and the impact, extent and timing of technological

changes, capital management activities, and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms.

Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results.

This presentation also includes certain non-GAAP financial measures related to “tangible common equity,” “Common Equity Tier 1,” “pre-provision net

revenue,” “cash efficiency ratio,” and certain financial measures excluding notable items, including merger-related charges. Management believes

these measures may assist investors, analysts and regulators in analyzing Key’s financials. Although Key has procedures in place to ensure that

these measures are calculated using the appropriate GAAP or regulatory components, they have limitations as analytical tools and should not be

considered in isolation, or as a substitute for analysis of results under GAAP. For more information on these calculations and to view the

reconciliations to the most comparable GAAP measures, please refer to the appendix of this presentation or page 89 of our Form 10-Q dated March

31, 2017.

GAAP: Generally Accepted Accounting Principles

2

3

Investor Highlights – 2Q17

Positive

Operating

Leverage

Strong Risk

Management

Disciplined

Capital

Management

Increased common dividend by 12%

Repurchased $94 MM in common shares(c)

No objection from the Federal Reserve on 2017

capital plan, which includes:

− Two common share dividend increases (up 11% in

4Q17 and an additional 14% in 2Q18, to $.12), subject

to Board approval

− Common share repurchase program of up to $800 MM

Maintained credit discipline, strong asset quality

NCOs to average loans of .31%

Nonperforming loans down 12% from 1Q17;

.59% of PE loans

Positive operating leverage vs. PY (+10%)(a) and

PQ (+2%)(a)

Revenue growth reflects core business

momentum and value from the First Niagara

acquisition

Achieved $400 MM in cost savings

Cash efficiency ratio improved to 59%(a); ROTCE

of 13%(a)

(a) Non-GAAP measure and excludes notable items (one-time gain in merchant services, purchase accounting finalization, merger-related charges and charitable

contribution in 2Q17; merger-related charges in prior periods); see Appendix for detail on merger-related charges and reconciliations

(b) Non-GAAP measure: see Appendix for reconciliation

(c) Common share repurchase amount includes repurchases to offset issuances of common shares under our employee compensation plans

59.4%

12.9%

2Q17 Notable Items

$ millions Pre-tax Impact

Merchant services gain $ 64

Purchase accounting finalization 43

Merger-related charges (44)

Charitable contribution (20)

Net impact of $43 MM, or $0.02 per share

59.3%

13.8%

Reported(b) Adjusted for Notable Items(a)

Y

o

Y

O

p

e

r

a

t

i

n

g

L

e

v

e

r

a

g

e

C

a

s

h

E

f

f

i

c

i

e

n

c

y

R

O

T

C

E

+10%+20%

First Niagara

Drivers of 2Q Results and Recent Investments

4

• Strong client retention and deposit growth

• Achieved $400 MM in cost savings

− Plans to achieve incremental $50 MM by early 2018

• Progress on revenue synergies

− Commercial mortgage banking, payments,

residential mortgage

Fee-based Businesses

• Investment banking and debt placement fees: record

$575 MM (TTM)

• Cards and payments income: record $270 MM (TTM)

Merchant Services

• Repositioned merchant services business

− Acquired remaining ownership from joint venture

− Expands and deepens client base

− Improves client experience

Financial Wellness: HelloWallet

• Acquired industry-leading personal finance software

platform, a core component of Key’s financial

wellness offering

− Promotes and strengthens ability to support clients’

financial wellness

− Provides enhanced client insights and an improved

ability to tailor recommendations

$353

$575

2Q14 2Q15 2Q16 2Q17

Investment Banking & Debt Placement Fees

(TTM)

TTM = Trailing twelve months

$400

million

First Niagara

cost savings

achieved

$164

$270

2Q14 2Q15 2Q16 2Q17

Cards & Payments Income

(TTM)

3-yr. CAGR: +18%

Investments in talent, products and capabilities driving growth

3-yr. CAGR: +18%

5

Financial Review

64.8% 64.9%

63.3%

60.4% 59.4%

2Q16 3Q16 4Q16 1Q17 2Q17

6

Financial Highlights

EOP = End of Period

(a) Non-GAAP measure: see Appendix for reconciliation

(b) Notable items include one-time gain in merchant services, purchase

accounting finalization, merger-related charges and charitable

contribution in 2Q17 and merger-related charges in prior periods; see

Appendix for detail on merger-related charges

EPS – assuming dilution $ .36 $ .27 $ .23 33 % 57 %

Impact of notable items(a),(b) on EPS .02 (.05) (.04)

Cash efficiency ratio(a) 59.3 % 65.8 % 69.0 % (650) bps (970) bps

Cash efficiency –excl. notable items(a), (b) 59.4 60.4 64.8 (100) (540)

Return on average tangible common equity 13.80 10.98 7.94 282 586

ROTCE – excl. notable items(a), (b) 12.86 12.87 9.09 (1) 377

Common Equity Tier 1(a), (d) 9.97 % 9.91 % 11.10 % 6 bps (113) bps

Tier 1 risk-based capital(d) 10.79 10.74 11.41 5 (62)

Tangible common equity to tangible assets(a) 8.56 8.51 9.95 5 (139)

NCOs to average loans .31 % .27 % .28 % 4 bps 3 bps

NPLs to EOP portfolio loans(e) .59 .67 1.00 (8) (41)

Allowance for loan and lease losses to EOP loans 1.01 1.01 1.38 - (37)

Capital(c)

Asset

Quality

Profitability

Continuing operations, unless otherwise noted 2Q17 1Q17 2Q16 LQ ∆ Y/Y ∆

(c) From consolidated operations

(d) 6-30-17 ratios are estimated

(e) Nonperforming loan balances exclude $835 million, $812 million, and $11 million of

purchased credit impaired loans at June 30, 2017, March 31, 2017, and June 30,

2016, respectively

Cash Efficiency Ratio(a)

excl. notable items(b)

9.1%

11.1%

12.5% 12.9% 12.9%

2Q16 3Q16 4Q16 1Q17 2Q17

ROTCE(a)

excl. notable items(b)

0.28%

0.23%

0.34%

0.27% 0.31%

2Q16 3Q16 4Q16 1Q17 2Q17

NCOs to Avg. Loans

$0

$30

$60

$90

3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17

$10

$20

$30

$40

3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17

7

Loans

$ in billions

Average Commercial & Industrial Loans

Total Average Loans

ConsumerCommercial

$ in billions

vs. Prior Year

Highlights

Average loans up 41% from 2Q16

– Growth primarily reflects impact of FNFG

– C&I continues to be a driver

$87

$61

$33

$41

vs. Prior Quarter

Average loans up .4% from 1Q17

C&I growth (+2%) more than offset lower

consumer loan balances

– Strength in middle market lending

– Consumer loans primarily reflect continued

decline in the home equity portfolio

Average deposit balances up .7% from 1Q17

– Core deposit growth in CDs, NOW and

MMDA, partially offset by a decline in

escrow deposits

$30.7

$54.4

$6.9

$10.8

.00%

.10%

.20%

.30%

.40%

.50%

.60%

.70%

$25

$45

$65

$85

$105

3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17

8

2Q17 Average Deposit Mix

Average deposit growth of 39% from 2Q16

– Growth primarily reflects impact of FNFG

– Core retail and commercial deposit growth

Average Deposits(a)

(a) Excludes deposits in foreign office

(b) Consumer includes retail banking, small business, and private banking

Cost of total deposits(a)

CDs and other time deposits

Savings

Noninterest-bearing

NOW and MMDA

Total average deposits(a)

Highlights

Deposits

$ in billions

$ in billions

vs. Prior Year

vs. Prior Quarter

$103

60%

40%

Commercial and corporate

Consumer(b)

$74

.19%

.26%

Deposit cost up 3 bps from 1Q17

– Contractual commercial rate increases

– Growth in higher-yielding deposit products

$92

2.76%

3.30%

2.97%

2.0%

2.5%

3.0%

3.5%

4.0%

$0

$200

$400

$600

$800

$1,000

3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17

NIM Change vs. Prior Quarter 1Q17: 3.13%

PAA finalization .14

Higher earning asset yields .06

PAA (2Q vs. 1Q) .01

Funding cost (.03)

Loan fees (.01)

Total change .17

2Q17: 3.30%

Net interest income up $11 MM from 1Q17, excl. PAA

– Reflects higher earning asset yields, offset by

funding cost and loan fees

9TE = Taxable equivalentPAA = Purchase accounting accretion

(a) 3Q16 Net interest income included $6 million of merger-related charges; see Appendix for detail on merger-related charges

Net interest income (TE), excl. PAA NIM (TE)

2Q17 net interest income includes $42 MM, or 14 bps,

related to purchase accounting finalization

Excluding impact of PAA, 2Q17 net interest income

was $887 MM and net interest margin was 2.97%

Net interest income up $282 MM from 2Q16, excl. PAA

– Largely driven by the impact of FNFG, and higher

earnings asset yields and balances

Net Interest Income and Margin

Net Interest Income & Net Interest Margin Trend (TE) Highlights

$ in millions; continuing operations

vs. Prior Year

vs. Prior Quarter

Purchase accounting accretion (PAA)

$605

$987

(a)

NIM (TE); excl. PAAx

$53 $100

$19

2Q16 3Q16 4Q16 1Q17 2Q17

NIM – reported 2.76% 2.85% 3.12% 3.13% 3.30%

PAA - .06 .19 .18 .19

PAA refinement/ finalization - - .11 - .14

NIM – excl. PAA 2.76 2.79 2.82 2.95 2.97

NII – reported ($MM) $ 605 $ 788 $ 948 $ 929 $ 987

PAA - 19 58 53 58

PAA refinement/ finalization - - 34 - 42

$37 MM related to contractual maturities;

$21 MM related to prepayments

FNFG loan mark at 6/30/17: $345 MM ($274 MM purchased

performing, $71 MM purchased credit impaired)

Purchased credit impaired accretable yield at 6/30/17: $137 MM

10

Noninterest Income

Noninterest Income

$ in millions Up / (Down) 2Q17 vs. 2Q16 vs. 1Q17

Trust and investment services income $ 134 $ 24 $ (1)

Investment banking and debt

placement fees

135 37 8

Service charges on deposit accounts 90 22 3

Operating lease income and other

leasing gains

30 12 7

Corporate services income 55 2 1

Cards and payments income 70 18 5

Corporate-owned life insurance 33 5 3

Consumer mortgage income 6 3 -

Mortgage servicing fees 15 5 (3)

Net gains (losses) from principal

investing

- (11) (1)

Other income 85 63 54

Total noninterest income $ 653 $ 180 $ 76

Notable items(a) 61 61 61

Total noninterest income, excluding

notable items(b)

$ 592 $ 119 $ 15

Highlights

Noninterest income up $119 MM from 2Q16, excl.

notable items(a),(b)

‒ Reflects the impact of FNFG, as well as

business momentum

‒ Strength in investment banking and debt

placement fees from higher commercial

mortgage banking, underwriting and

advisory fees

Noninterest income up $15 MM from 1Q17, excl.

notable items(a),(b)

‒ Continued growth in fee-based businesses,

including investment banking and debt

placement fees and cards and payments

income

‒ Higher operating lease income and other

leasing gains

(a) Notable items include $64 MM one-time gain in merchant services and $(3) MM associated with purchase accounting finalization

(b) Non-GAAP measure

vs. Prior Year

vs. Prior Quarter

2Q17 notable items of $61 MM include: $64 MM

one-time gain in merchant services and $(3) MM

associated with purchase accounting finalization

$ in millions Up / (Down) 2Q17 vs. 2Q16 vs. 1Q17

Personnel $ 551 $ 124 $ (5)

Net occupancy 78 19 (9)

Computer processing 55 10 (5)

Business services, professional fees 45 5 (1)

Equipment 27 6 -

Operating lease expense 21 7 2

Marketing 30 8 9

FDIC assessment 21 13 1

Intangible asset amortization 22 15 -

OREO expense, net 3 1 1

Other expense 142 36 (11)

Total noninterest expense $ 995 $ 244 $ (18)

Merger-related charges(a) 44 (1) (37)

Other notable items(a) 16 16 16

Total noninterest expense, excluding

notable items(a),(c) $ 935 $ 229 $ 3

11

Noninterest Expense

Noninterest Expense

(a) Notable items of $60 MM in 2Q17 (merger-related charges, charitable contribution and purchase accounting finalization), $45 MM in 2Q16

(merger-related charges) and $81 MM in 1Q17 (merger-related charges); see Appendix for detail on merger-related charges

(b) Charitable contribution and the impact from finalization of purchase accounting in other expense

(c) Non-GAAP measure

Highlights

Noninterest expense up $229 MM, excl. notable

items(a),(c)

– Primarily reflects impact of FNFG

– Higher incentive compensation (stronger capital

markets performance)

vs. Prior Year

vs. Prior Quarter

Notable items:

Achieved $400 MM of annual run rate cost savings

Noninterest expense up $3 MM, excl. notable

items(a),(c)

– Reflects normal seasonal trends, including

increased marketing

$ in millions 2Q17 2Q16 1Q17

Merger-related charges $44 $45 $81

Charitable contribution(b) 20

Purchase accounting finalization(b) (4)

$60 $45 $81

$43

$66

$52

$66

.28% .31%

.00%

.20%

.40%

.60%

.80%

1.00%

$0

$30

$60

$90

$120

3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17

$619

$507

1.00% .59%

.00%

.40%

.80%

1.20%

1.60%

2.00%

$0

$200

$400

$600

$800

3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17

12

Nonperforming Loans(a)

Net Charge-offs & Provision for Credit Losses

NPLs NPLs to period-end loans

NCOs Provision for credit

losses

NCOs to average loans

$ in millions

Credit Quality

Highlights

Portfolios continue to perform well

Net loan charge-offs of $66 MM

– 31 basis points of average loans, below

targeted range

Nonperforming loans down 12% from 1Q17 and

represent 59 bps of period-end loans

Allowance for Loan and Lease Losses

Allowance for loan and

lease losses to NPLs

Allowance for loan

and lease losses

$ in millions

$854 $870

138%

172%

0%

50%

100%

150%

200%

250%

$600

$700

$800

$900

3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17

$ in millions

(a) Nonperforming loan balances exclude $835 million, $812 million, and $11 million of purchased credit impaired loans at June 30, 2017, March 31, 2017, and June

30, 2016, respectively

13

Strong capital position with Common Equity

Tier 1 ratio of 9.97%(b) at 6/30/17

Increased common dividend 12% in 2Q17

Repurchased $94 MM(c) in common shares during

2Q17

No objection from the Federal Reserve on 2017

capital plan, which includes:

− Two common share dividend increases (4Q17 and

2Q18), subject to Board approval

− Common share repurchase program of up to $800 MM

Tangible Common Equity to Tangible Assets(a)

Highlights

(a) Non-GAAP measure: see Appendix for reconciliation

(b) 6-30-17 figures are estimated

(c) Common share repurchase amount includes repurchases to offset issuances of common shares under our employee compensation plans

11.10%

9.97%

6.00%

8.00%

10.00%

12.00%

3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17

9.95%

8.56%

0.00%

2.50%

5.00%

7.50%

10.00%

3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17

Common Equity Tier 1(a), (b)

Capital

Outlook and Expectations

Average Balance

Sheet

• Loans: low-end of $87.0 B - $88.0 B range for FY17 average balances

• Deposits: FY17 average balances in the range of $102.5 B - $103.0 B

Net Interest Income

• Net interest income expected to be in the range of $3.8 B - $3.9 B

– Reflects consistent decline in purchase accounting accretion (approx. $100 MM remaining in 2H17)

• Outlook includes no additional rate increases in 2017

Noninterest Income • Expected to be in the range of $2.35 B - $2.45 B

Noninterest

Expense

• Expected to be in the range of $3.7 B - $3.8 B

– Includes impact of merchant services and HelloWallet

Credit Quality • Net charge-offs to average loans below targeted range of 40 – 60 bps

• Provision expected to slightly exceed net charge-offs to provide for loan growth

Taxes • GAAP tax rate in the range of 26% - 28%

14(a) Guidance provided does not include merger-related charges

FY 2017(a)

Positive operating

leverage

Long-term Targets

Cash efficiency ratio:

<60%

Moderate risk profile:

Net charge-offs to avg. loans

targeted range of 40-60 bps

ROTCE:

13-15%

15

Appendix

2Q17 1Q17 4Q16 3Q16 2Q16 1Q16 4Q15

Net interest income - - - $ (6) - - -

Operating lease income and other leasing

gains

- - - $ (2) - - -

Other income - - $ 9 (10) - - -

Noninterest income - - $ 9 $ (12) - - -

Personnel expense $ 31 $ 30 $ 80 $ 97 $ 35 $ 16 -

Net Occupancy $ (1) $ 5 $ 29 - - - -

Business services and professional fees 6 5 22 $ 32 $ 5 $ 7 $ 5

Computer processing 2 5 38 15 - - -

Marketing 6 6 13 9 3 1 -

All other non-personnel - 30 25 36 2 - 1

Total non-personnel expense $ 13 $ 51 $ 127 $ 92 $ 10 $ 8 $ 6

Total merger-related charges $ 44 $ 81 $ 198 $ 207 $ 45 $ 24 $ 6

EPS impact $ (.03) $ (.05) $ (.11) $ (.14) $ (.04) $ (.02) -

16

FNFG Merger-related Charges

$ in millions

Increase / (Decrease)

Agriculture Automotive

Business Products

Business Services

Construction

Consumer

Discretionary

Consumer

Services

Equipment

Finance

Healthcare

Materials/

ExtractionMedia

Oil & Gas

Other

Public Sector

Real Estate

Technology

Transportation

Utilities

17

Loan Portfolio Detail, at 6/30/17

Commercial LoansTotal Loans

C&I

$40

CRE

$18

Outstanding

Balances

Average

Loan Size

Average

FICO

2008/

prior

vintage

First lien $ 7,356 59 % $ 72,576 773 22 %

Second lien 5,049 41 46,407 769 38

Total home equity $ 12,405

Fixed

44%Variable56%

Combined weighted-average LTV at

origination: 71%

$875 million in lines outstanding (7% of the

total portfolio) come to end of draw period

by 4Q19

Commercial Real Estate

Diversified Portfolio by Industry

Focused on relationships with CRE

owners

Aligned with targeted industry verticals

Primarily commercial mortgage;

selective approach to construction

Criticized non-accruals: 0.2% of period-

end balances(a)

6/30/2007 6/30/2017

Commercial mortgage

Construction

51% 87%

Home Equity

$ in billions 6/30/17 % of total

loans

Commercial and industrial $ 40.9 47

Commercial real estate 17.0 20

Commercial lease financing 4.7 5

Total Commercial $ 62.6 72

Residential mortgage $ 5.5 6

Home equity 12.4 14

Consumer direct 1.8 2

Credit card 1.0 1

Consumer indirect 3.1 4

Total Consumer $ 23.9 28

Total commercial loans:

Tables may not foot due to rounding

(a) Loan and lease outstandings; excludes purchase credit impaired loans from the First Niagara acquisition

18

Average Total Investment Securities Highlights

Average AFS securities

Investment Portfolio

Portfolio composed primarily of GNMA and GSE-

backed MBS and CMOs; primarily fixed rate

Continue to position portfolio for regulatory

liquidity requirements:

– Reinvesting cash flows into High Quality

Liquid Assets, including GNMA securities

(49% of 2Q17 average balances)

Portfolio used for funding and liquidity

management

– Securities cash flows of $1.4 billion in

2Q17 and $1.5 billion in 1Q17

– Reinvested all of 2Q17 cash flows

Average portfolio life at 6/30/17 of 4.2 years

(4.3 years at 3/31/17)

(a) Yield is calculated on the basis of amortized cost

(b) Includes end-of-period held-to-maturity and available-for-sale securities

Average yield(a)

Average HTM securities

2.06%

.00%

1.00%

2.00%

3.00%

4.00%

5.00%

$0.0

$10.0

$20.0

$30.0

3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17

$28.5

$ in billions

Securities to Total Assets(b)

19%

21%

10%

15%

20%

25%

3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17

$19.2

2.02%

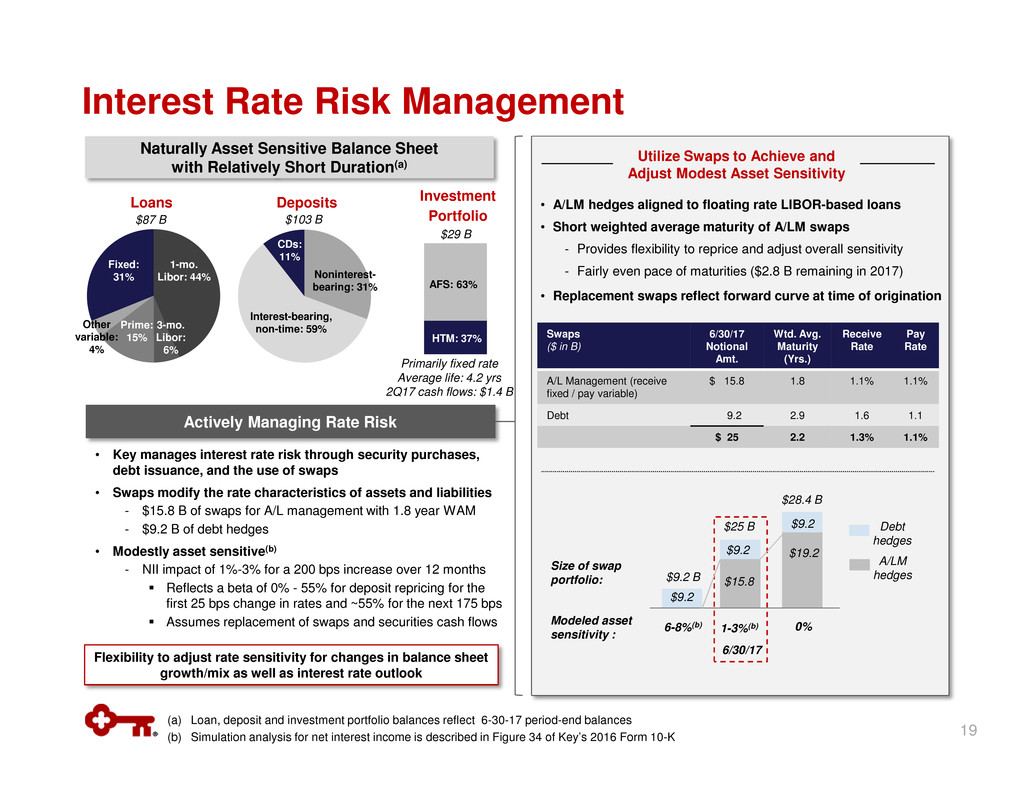

Interest Rate Risk Management

Naturally Asset Sensitive Balance Sheet

with Relatively Short Duration(a)

Actively Managing Rate Risk

$15.8

$19.2$9.2

$9.2

Size of swap

portfolio:

Modeled asset

sensitivity : 1-3%

(b) 0%6-8%(b)

$9.2

Loans

1-mo.

Libor: 44%

Fixed:

31%

Deposits

Flexibility to adjust rate sensitivity for changes in balance sheet

growth/mix as well as interest rate outlook

Debt

hedges

A/LM

hedges

Noninterest-

bearing: 31%

Interest-bearing,

non-time: 59%

CDs:

11%

• Key manages interest rate risk through security purchases,

debt issuance, and the use of swaps

• Swaps modify the rate characteristics of assets and liabilities

- $15.8 B of swaps for A/L management with 1.8 year WAM

- $9.2 B of debt hedges

• Modestly asset sensitive(b)

- NII impact of 1%-3% for a 200 bps increase over 12 months

Reflects a beta of 0% - 55% for deposit repricing for the

first 25 bps change in rates and ~55% for the next 175 bps

Assumes replacement of swaps and securities cash flows

6/30/17

Swaps

($ in B)

6/30/17

Notional

Amt.

Wtd. Avg.

Maturity

(Yrs.)

Receive

Rate

Pay

Rate

A/L Management (receive

fixed / pay variable)

$ 15.8 1.8 1.1% 1.1%

Debt 9.2 2.9 1.6 1.1

$ 25 2.2 1.3% 1.1%

$25 B

19

(a) Loan, deposit and investment portfolio balances reflect 6-30-17 period-end balances

(b) Simulation analysis for net interest income is described in Figure 34 of Key’s 2016 Form 10-K

3-mo.

Libor:

6%

Prime:

15%

Other

variable:

4%

Utilize Swaps to Achieve and

Adjust Modest Asset Sensitivity

• A/LM hedges aligned to floating rate LIBOR-based loans

• Short weighted average maturity of A/LM swaps

- Provides flexibility to reprice and adjust overall sensitivity

- Fairly even pace of maturities ($2.8 B remaining in 2017)

• Replacement swaps reflect forward curve at time of origination

Investment

Portfolio

Primarily fixed rate

Average life: 4.2 yrs

2Q17 cash flows: $1.4 B

AFS: 63%

HTM: 37%

$29 B

$87 B $103 B

$9.2 B

$28.4 B

20

Credit Quality Trends

Criticized Outstandings(a) to Period-end Total LoansDelinquencies to Period-end Total Loans

(a) Loan and lease outstandings; excludes purchase credit impaired loans from the First Niagara acquisition

(b) From continuing operations

(c) Nonperforming loan balances exclude $835 million, $812 million, $865 million, $959 million, and $11 million of purchased credit impaired loans

at June 30, 2017, March 31, 2017, December 31, 2016, September 30, 2016, and June 30, 2016, respectively

30 – 89 days delinquent 90+ days delinquent

.33%

.39%

.11%

.10%

.00%

.25%

.50%

3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17

3.6%

3.1%

.0%

2.0%

4.0%

6.0%

3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17

Metric(b) 2Q17 1Q17 4Q16 3Q16 2Q16

Delinquencies to EOP total loans: 30-89 days .39 % .36 % .47 % .37 % .33 %

Delinquencies to EOP total loans: 90+ days .10 .09 .10 .06 .11

NPLs to EOP portfolio loans(c) .59 .67 .73 .85 1.00

NPAs to EOP portfolio loans + OREO + Other NPAs(c) .64 .72 .79 .89 1.03

Allowance for loan losses to period-end loans 1.01 1.01 1.00 1.01 1.38

Allowance for loan losses to NPLs 171.6 151.8 137.3 119.6 138.0

Continuing operations Continuing operations

Period-

end loans

Average

loans

Net loan

charge-

offs

Net loan

charge-offs(b) /

average loans

(%)

Nonperforming

loans(c)

Ending

allowance(d)

Allowance /

period-end

loans(d) (%)

Allowance /

NPLs

(%)

6/30/17 2Q17 2Q17 2Q17 6/30/17 6/30/17 6/30/17 6/30/17

Commercial and industrial(a) $ 40,914 $ 40,666 $ 38 .37% $ 178 $ 528 1.29% 296.63%

Commercial real estate:

Commercial Mortgage 14,813 15,096 3 .08 34 144 .97 423.53

Construction 2,168 2,204 - - 4 28 1.29 700.00

Commercial lease financing(e) 4,737 4,690 1 .09 11 40 .84 363.64

Real estate – residential mortgage 5,517 5,509 3 .22 58 9 .16 15.52

Home equity 12,405 12,473 4 .13 208 42 .34 20.19

Credit cards 1,049 1,044 10 3.84 2 44 4.19 N/M

Consumer direct loans 1,755 1,743 6 1.38 2 25 1.42 N/M

Consumer indirect loans 3,145 3,077 1 .13 10 10 .32 100.00

Continuing total(f) $ 86,503 $ 86,502 $ 66 .31% $ 507 $ 870 1.01% 171.60%

Discontinued operations 1,436 1,459 2 .55 5 21 1.46 420.00

Consolidated total $ 87,939 $ 87,961 $ 68 .31% $ 512 $ 891 1.01% 174.02%

Credit Quality by Portfolio

Credit Quality

$ in millions

21

(a) 6-30-17 ending loan balance includes $118 million of commercial credit card balances; average loan balance includes $117 million of assets from

commercial credit cards

(b) Net loan charge-off amounts are annualized in calculation

(c) 6-30-17 NPL amount excludes $835 million of purchased credit impaired loans

(d) 6-30-17 allowance by portfolio is estimated

(e) Commercial lease financing includes receivables held as collateral for a secured borrowing of $47 million at June 30, 2017. Principal reductions are

based on the cash payments received from these related receivables.

(f) 6-30-17 ending loan balance includes purchased loans of $17.8 billion, of which $835 million were purchased credit impaired

N/M = Not meaningful

GAAP to Non-GAAP Reconciliation

22

(a) For the three months ended June 30, 2017, March 31, 2017, and June 30, 2016, intangible assets exclude $33 million, $38 million, and $36 million, respectively,

of period-end purchased credit card receivables

(b) Net of capital surplus.

(c) June 30, 2017, amount is estimated.

Three months ended

6-31-17 3-31-17 6-30-16

Tangible common equity to tangible assets at period end

Key shareholders' equity (GAAP) $15,253 $14,976 11,313$

Less: Intangible assets (a) 2,866 2,751 1,074

Preferred Stock (b) 1,009 1,009 281

Tangible common equity (non-GAAP) $11,378 $11,216 9,958$

Total assets (GAAP) $135,824 $134,476 101,150$

Less: Intangible assets (a) 2,866 2,751 1,074

Tangible common equity to tangible assets ratio (non-GAAP) $132,958 $131,725 100,076$

Tangible common equity to tangible assets ratio (non-GAAP) 8.56% 8.51% 9.95%

Common Equity Tier 1 at period end

Key shareholders' equity (GAAP) $15,253 $14,976 11,313$

Less: Preferred Stock (b) 1,009 1,009 281

Common Equity Tier 1 capital before adjustments and deductions 14,244 13,967 11,032

Less: Goodwill, net of deferred taxes 2,417 2,379 1,031

Intangible assets, net of deferred taxes 252 194 30

Deferred tax assets 11 11 1

Net unrealized gains (losses) on available-for-sale securities, net of deferred taxes (144) (179) 129

Accumulated gains (losses) on cash flow hedges, net of deferred taxes (64) (76) 77

Amounts in accumulated other comprehensive income (loss) attributed to pension and

postretirement benefit costs, net of deferred taxes (334) (335) (362)

Total Common Equity Tier 1 capital (c) 12,106$ 11,973$ 10,126$

Net risk-weighted assets (regulatory) (c) 121,484$ 120,852$ 91,195$

Common Equity Tier 1 ratio (non-GAAP) (c) 9.97% 9.91% 11.10%

Notable Items

Merger-related charges (44)$ (81)$ (45)$

Unwind of merchant services joint venture 64 - -

Purchase accounting refinement, net 43 - -

Charitable contribution (20) - -

Total notable items 43$ (81)$ (45)$

Income taxes 16 (30) (17)

Total notable items after tax 27$ (51)$ (28)$

Pre-provision net revenue excluding notable items

Net interest income (GAAP) 973$ 918$ 597$

Plus: Taxable-equivalent adjustment 14 11 8

Noninterest income 653 577 473

Less: Noninterest expense 995 1,013 751

Pre-provision net revenue from continuing operations 645$ 493$ 327$

Plus: Notable items (43) 81 45

Pre-provision net revenue from continuing operations excluding notable items (non-GAAP) 602$ 574$ 372$

$ in millions

Three months ended

6-30-17 3-31-17 12-31-16 9-30-16 6-30-16

Average tangible common equity

Average Key shareholders' equity (GAAP) 15,200$ 15,184$ 14,901$ 13,552$ 11,147$

Less: Intangible assets (average) (a) 2,756 2,772 2,874 2,255 1,076

Preferred Stock (average) 1,025 1,480 1,274 648 290

Average tangible common equity (non-GAAP) 11,419$ 10,932$ 10,753$ 10,649$ 9,781$

Return on average tangible common equity from continuing operations

Net income (loss) from continuing operations attributable to Key common shareholders (GAAP) 393$ 296$ 213$ 165$ 193$

Plus: Notable items, after tax (27) 51 124 132 28

Net income (loss) from continuing operations attributable to Key common shareholders excl. notable items 366$ 347$ 337$ 297$ 221$

Average tangible common equity (non-GAAP) 11,419 10,932 10,753 10,649 9,781

Return on average tangible common equity from continuing operations (non- GAAP) 13.80% 10.98% 7.88% 6.16% 7.94%

Return on average tangible common equity from continuing operations excl. notable items (non- GAAP) 12.86% 12.87% 12.47% 11.22% 9.09%

Cash efficiency ratio

Noninterest expense (GAAP) 995$ 1,013$ 1,220$ 1,082$ 751$

Less: Intangible asset amortization 22 22 27 13 7

Adjusted noninterest expense (non-GAAP) 973$ 991$ 1,193$ 1,069$ 744$

Less: Notable items (b) 60 81 207 189 45

Adjusted noninterest expense excluding notable items (non-GAAP) 913$ 910$ 986$ 880$ 699$

Net interest income (GAAP) 973$ 918$ 938$ 780$ 597$

Plus: Taxable-equivalent adjustment 14 11 10 8 8

Noninterest income 653 577 618 549 473

Total taxable-equivalent revenue (non-GAAP) 1,640$ 1,506$ 1,566$ 1,337$ 1,078$

Plus: Notable items (c) (103) - (9) 18 -

Adjusted total taxable-equivalent revenue excl. notable items (non-GAAP) 1,537$ 1,506$ 1,557$ 1,355$ 1,078$

Cash efficiency ratio (non-GAAP) 59.3% 65.8% 76.2% 80.0% 69.0%

Cash efficiency ratio excluding notable items (non-GAAP) 59.4% 60.4% 63.3% 64.9% 64.8%

Change 2Q17 vs.

Operating Leverage excluding notable items 2Q17 1Q17 2Q16 1Q17 2Q16

Total revenue (TE) 1,640$ 1,506$ 1,078$

Less: Notable items (c) 103 - -

Total revenue (TE) excluding notable items 1,537 1,506$ 1,078$ 2.1% 42.6%

Noninterest expense 995$ 1,013$ 751$

Less: Notable items (b) 60 81 45

Noninterest expense excluding notable items 935$ 932$ 706$ .3% 32.4%

Operating leverage excluding notable items (non-GAAP) (d) 1.8% 10.2%

Three months ended

GAAP to Non-GAAP Reconciliation (continued)

23

(a) For the three months ended June 30, 2017, March 31, 2017, and June 30, 2016, average intangible assets exclude $36 million, $40 million, and $38 million, respectively, of average

purchased credit card receivables

(b) Notable items for the three months ended June 30, 2017, includes $44 million of merger-related expense, $20 million charitable contribution, and a credit of $4 million related to

purchase accounting finalization; notable items in prior periods are comprised of merger-related charges

(c) Notable items for the three months ended June 30, 2017, includes $64 million related to the merchant services gain and $39 million related to purchase accounting finalization; notable

items in prior periods are comprised of merger-related charges

(d) Operating leverage excluding notable items is calculated as the difference in the change in total revenue (TE) excluding notable items from the change in noninterest expense excluding

notable items

$ in millions