Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Unilife Corp | unis-8k_20170622.htm |

Exhibit 99.1

Case 17-10805-LSS Doc 229 Filed 06/22/17 Page 1 of 14 UNITED STATES BANKRUPTCY COURT DISTRICT OF DELAWARE In re Unilife Corporation, et al. [1Sect ion 1746) that this report and the attached documents are true and correct to the best of my knowledge and belief. Signature of Debtor Date Signature of Joint Debtor Date /s/ John Ryan June 22,2017 Signature of Authorized Individual* Date John Ryan President and Chief Executive Officer Printed Name of Authorized Individual Title of Authorized Individual *Authorized individual must be an officer, director or shareholder if debtor is a corporation; a partner if debtor is a partnership; a manager or member if debtor is a limited liability company. [1] The debtors' names are abbreviated in this report as follows: Unilife Corporation – UC Unilife Medical Solutions, Inc. – UMS Unilife Cross Farm LLC – UCF [2] Post-petition, the Debtor began keeping its books on a cash basis. Accordingly, the Statement of Operations (MOR-2) and the Schedule of Cash Receipts and Disbursements (MOR-1) present the same information. [3] No tax returns, including IRS Form 6123, were filed during the period. 1

Case 17-10805-LSS Doc 229 Filed 06/22/17 Page 2 of 14 In re Unilife Corporation, et al. [1] Case No. 17-10805 Reporting Period: May 1 to May 31, 2017 SCHEDULE OF CASH RECEIPTS AND DISBURSEMENTS Amounts reported should be per the debtor's books, not the bank statement. The beginning cash should be the ending cash from the prior month or, if this is the first report, the amount should be the balance on the date the petition was filed. The amounts reported in the "CURRENT MONTH - ACTUAL" column must equal the sum of the four bank account columns. The amounts reported in the "PROJECTED" columns should be taken from the SMALL BUSINESS INITIAL REPORT (FORM I R-1). Attach copies of the bank statements and the cash disbursements journal. The total disbursements listed in the disbursements journal must equal the total disbursements reported on this page. A bank reconciliation must be attached for each account. [See MOR-1 (CON'T)] BANK ACCOUNTS CURRENT MONTH CUMULATIVE FILING TO DATE UC UMS UCF CONSOLIDATED CONSOLDATED OPERATING TING PAYROLL UTILITY OTHER OPERATING OTHER ACTUAL PROJECTED [1] ACTUAL PROJECTED [1] CASH BEGINNING OF MONTH $ 253,971 $ 136,162 $ 2,096,722 $ - $ -$ 35,278 $ (2) $ - $ 2,522,131 $ 1,639,160 $ 1,918,421 $ 1,664,064 RECEIPTS CASH SALES - - - - - - - - - - - - ACCOUNTS RECEIVABLE - - 440,780 - - - - - 440,780 – 446,780 - LOANS AND ADVANCES 1,500,00 - - - - - - - 1,500,00 1,500,00 2,500,00 2,500,00 SALE OF ASSETS - - - - - - - - - - - - OTHER (ATTACHED LIST) - - 53,052 - - - - - 53,052 232,603 88,724, 232,603 TRANSFERS (FROM DIP ACCTS) 400,000 – 1,500,000 844,665 39,845 - - - 2,784,510 – 3,987,173 - TOTAL RECEIPTS 1,900,000 – 1,993,832 844,665 39,845 - - - 4,778,342 1,732,603 7,022,677 2,732,603 DISIMBURSEMENTS NET PAYROLL & PAYROLL TAXES - - - 844,665 - - - - 844,665 889,801 1,253,144 1,352,061 SALES, USE, & OTHER TAXES - - - - - - - - - - 2,000 – INVENTORY PURCHASES - - - - - - - - - - - - SECURED/RENTAL/LEASES - - 174,445 - - - - - 174,445 227,026 174,445 227,026 INSURANCE - - 22,104 - - - - - 22,104 28,400 39,847 46,150 ADMINISTRATIVE - - 103,335 - - - - - 103,335 277,051 103,335 538,612 SELLING - - 17,820 - - - - - 17,820 – 17,820 – OTHER (ATTACH LIST) 5,237 – 9,414 - - - 295 – 14,947 478,555 24,687 761,888 OWNER DRAW* - - - - - - - - - - - - TRANSFERS (TO DIP ACCTS) 1,500,00 – 1,284,510 - - - - - 2,784,510 – 3,987,173 – PROFESSIONAL FEES 443,333 - - - - - - - 443,333 948,333 443,333 948,333 U.S. TRUSTEE QUARTERLY FEES - - - - - - - - - - - - COURT COSTS - - - - - - - - - - - - TOTAL DISBURSEMENTS 1,984,570 – 1,611,630 844,665 - - 295 – 4,405,160 2,849,166 6,045,785 3,874,070 NET CASH FLOW (48,570) – 382,202 – 39,845 – (295) – 373,182 (1,116,562) 976, 892 (1,141,465) (RECEIPTS LESS DISIMBURSEMENTS) CASH – END OF MONTH $ 205,401 $ 136,162 $ 2,478,924 $ - $ 39,845 $ 35,278 $ 35,278 $ (297) $ - $ 2,895,313 $ 522,598 $ 2,895,313 $ 522, 598 *COMPENSATION TO SOLE PROPRIETORS FOR SERVICES RENDERED TO BANKRUPTCY ESTATE [1] PROJECTIONS PER AMENDED DIP BUDGET THE FOLLOWING SECTION MUST BE COMPLETED DISIMBURSEMENTS FOR CALCULATING U.S. TRUSTEE QUARTERLY FEES: (FROM CURRENT MONTH ACTUAL COLUMN) TOTAL DISBURSEMENTS $ 4,405,160 LESS TRANSFERS TO DEBTOR IN POSSESSION ACCOUNTS $ 2,784,510 PLUS ESTATE DISBURSEMENTS MADE BY OUTSIDE SOURCES (i.e. from escrow accounts

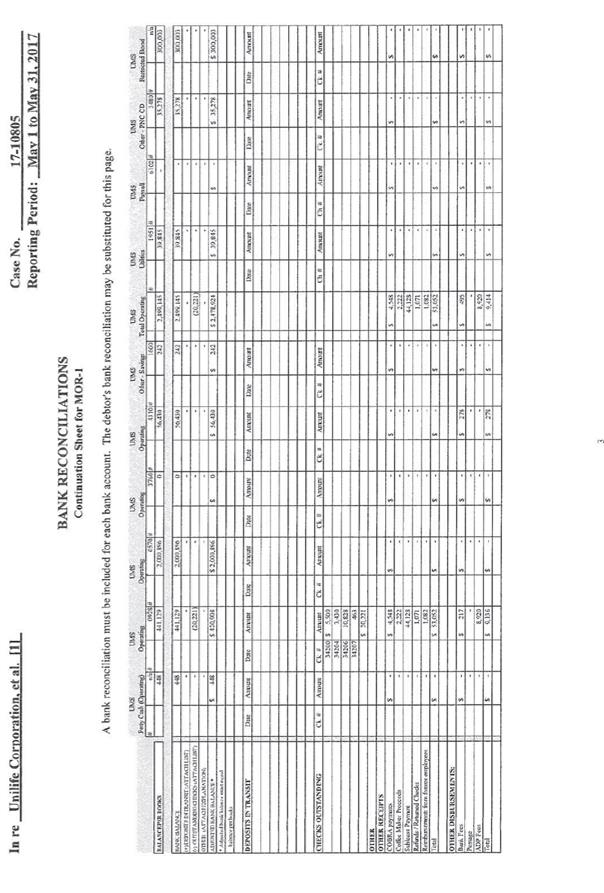

In re Unilife Corporation, et al. [1] Case No. 17-10805 Reporting Period: May 1 to May 3, 2017 BANK RECONCILIATIONS Continuation Sheet for MOR-1 a bank reconciliation must be included for each bank account. The debtor’s bank reconciliation may be substituted for this page. UMS Petty Cash (Operating) UMS Operating UMS Operating UMS Operating UMS Operating UMS Other – Savings UMS Total Operating UMS Utilities UMS Payroll UMS Other – PNC CD UMS Restricted Bond # n/a # 0928 # 0570 # 3760 # 4310 # 1066 # 1951 # 6102 # 3480 # n/a BALANCE PER BOOKS 448 441,129 2,000,896 0 56,430 242 2,499,145 39,845 – 35,278 300,003 BANK BALANCE 448 441,129 2,000,896 0 56,430 242 2,499,145 39,845 – 35,278 300,003 (+)DEPOSITS IN TRANSIT (ATTACH LIST) - - - - - - - - - - - (-)OUTSTANDING CHECKS (ATTACH LIST) – (20,221) - - - - (20,221) - - - - OTHER (ATTACH EXPLANATION) - - - - - - - - - - - ADJUSTED BANK BALANCE * $448 $420,908 $2,000,896 $0 $56,430 $242 $2,478,924 $39,845 $– $35,278 $300,003 *Adjusted bank balance must equal balance per books DEPOSITS IN TRANSIT Date Amount Date Amount Date Amount Date Amount Date Amount Date Amount Date Amount Date Amount Date Amount Date Amount CHECKS OUTSTANDING Ck. # Amount Ck. # Amount Ck. # Amount Ck. # Amount Ck. # Amount Ck. # Amount Ck. # Amount Ck. # Amount Ck. # Amount Ck. # Amount 34200 $5,500 34204 3,430 34206 10,828 34207 463 $20221 OTHER OTHER RECEIPTS COBRA payments $- $4,548 $- $- $- $- $4,548 $- $- $- $- Coffe Maker Proceeds - 2,222 - - - - 2,222 - - - - Sublease Payment – 44,128 - - - - 44,128 - - - - Refunds / Returned Checks – 1,071 - - - - 1,071 - - - - Reimbursements from former employees – 1,082 - - - - 1,082 - - - - Total $- $53,052 $- $- $- $- $53,052 $- $- $- $- OTHER DISBURSEMENTS: Bank Fees $- $217 $- $- $278 $- $495 $- $- $- $- Postage - - - - - - - - - - - ADP Fees – 8,920 - - - - 8,920 - - - - Total $- $9,136 $- $- $278 $- $9,414 $- $- $- $- Case 17-10805-LSS Doc 229 Filed 06/22/17 Page 3 of 14

3

In re Unilife Corporation, et al. [1] Case No. 17-10805 Reporting Period: May 1 to May 3, 2017 BANK RECONCILIATIONS Continuation Sheet for MOR-1 a bank reconciliation must be included for each bank account. The debtor’s bank reconciliation may be substituted for this page. UC Operating UC Operating UC Operating UC Total Operating UC Other – AMEX CD UCF Operating UCF Restricted Escrow # 2022 # 6509 # 1693 # 1589-4 # 1933 # 0600 BALANCE PER BOOKS $201,370 $3,789 $242 205,401 $136,162 $(297) $1,923,095 BANK BALANCE 201,370 3,789 242 205,401 136,162 (297) 1,923,095 (+)DEPOSITS IN TRANSIT (ATTACH LIST) - - - - - - - (-)OUTSTANDING CHECKS (ATTACH LIST) - - - - - - - OTHER (ATTACH EXPLANATION) - - - - - - - ADJUSTED BANK BALANCE * $201,370 $3,789 $242 205,401 $136,162 $(297) $1,923,095 *Adjusted bank balance must equal balance per books DEPOSITS IN TRANSIT Date Amount Date Amount Date Amount Date Amount Date Amount Date Amount Ck. # Amount Ck. # Amount Ck. # Amount Ck. # Amount Ck. # Amount Ck. # Amount OTHER OTHER RECEIPTS Interest $- $- $- $- $- $- $- Refund from ADP - - - - - - - Total $- $- $- $- $- $- $- OTHER DISBURSEMENTS Bank Fees $156 $- $- $156 $- $295 $- Postage - - - - - - - ADP Fees - - - - - - - Patent Filing Fees 5,081 - - 5,081 - - - Total $5,237 $- $- $5,237 $- $295 $- Case 17-10805-LSS Doc 229 Filed 06/22/17 Page 4 of 14

4

In re unilife corporation, et al. [1] case no. 17-10805 reporting period: may 1 to may 31, 2017 Schedule of professional fees and expenses paid this schedule is to include all retained professional payments from case inception to current month payee period covered payor check number date amount paid fees & expenses year-to-date fees & expenses professional fee escrow account [1] 04/12/17 – 04/30/17 unilife corporation wire 05/16/17 $ 413,333 ssg capital advisors 04/12/17 – 04/30/17 unilife corporation wire 05/16/17 30,000 total $ 443,333

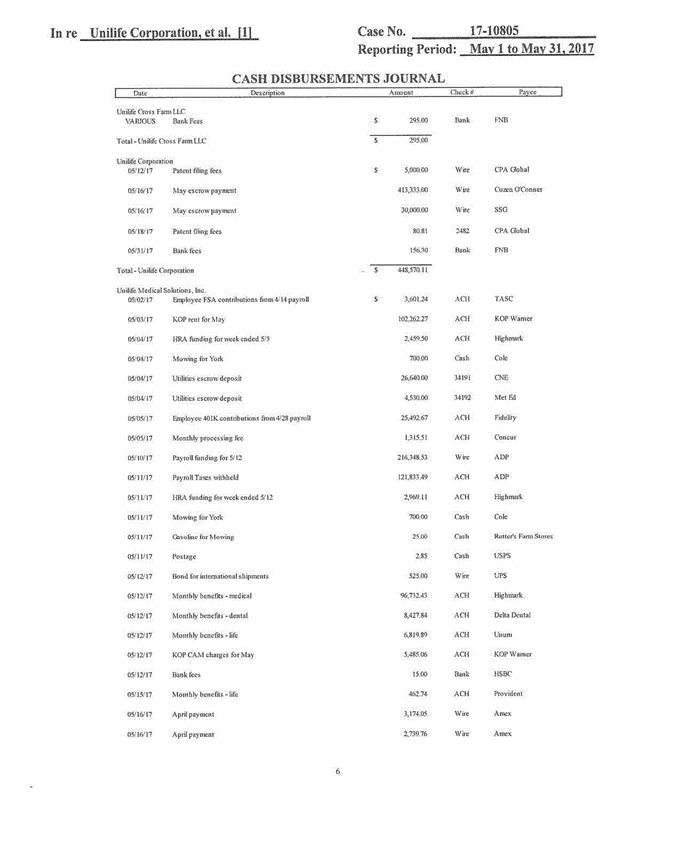

In re Unilife Corporation et al. [1] Case No. 17-10805Reporting Period: May 1 to May 31, 2017CASH DISBURSEMENTS JOURNALDate Description Amount Check # PayeeUnilife Cross Farm LLCVARIOUS Bank Fees $ 295.00 Bank FNBTotal – Unilife Cross Farm LLC $ 295.00Unilife Corporation05/12/17 Patent filing fees $ 5,000.00 Wire CPA Global05/16/17 May escrow payment 413,333.00 Wire Cozen O’Conner05/16/17 May escrow payment 30,000.000 Wire SSG05/18/17 Patent filing fees 80.81 2482 CPA Global05/31/17 Bank fees 156.30 Bank FNBTotal - Unilife Corporation $ 448,570.11Unilife Medical Solutions, Inc.05/02/17 Employee FSA contributions from 4/14 payroll $3,601.24 ACH TASC05/13/17 KOP rent for May 102,262.27 ACH KOP Warner05/04/17 HRA funding for week ended 5/5 2,459.50 ACH Highmark05/04/17 Mowing for York 700.00 Cash Cole05/04/17 Utilities escrow deposit 26,640.00 34191 CNE05/04/17 Utilities escrow deposit 4,530.00 34192 Met Ed05/05/17 Employee 401K contributions from 4/28 payroll 25,492.67 ACH Fidelity05/05/17 Monthly processing fee 1,315.51 ACH Concur05/10/17 Payroll funding for 5/12 216,348.53 Wire ADP05/11/17 Payroll Taxes withheld 121,833.49 ACH ADP05/11/17 HRA funding for week ended 5/12 2,969.11 ACH Highmark05/11/17 Mowing for York 700.00 Cash Cole05/11/17 Gasoline for Mowing 25.00 Cash Rutter’s Farm Stores05/11/17 Postage 2.85 Cash USPS05/12/17 Bond for international shipments 525.00 Wire UPS05/12/17 Monthly benefits - medical 96,732.43 ACH Highmark05/12/17 Monthly benefits - dental 8,427.84 ACH Delta Dental05/12/17 KOP CAM charges for May 5,485.06 ACH KOP Warner05/12/17 Bank fees 15.00 Bank HSBC05/15/17 Monthly benefits - life 462.74 ACH Provident05/16/17 April payment 3,174.05 Wire Amex05/16/17 April payment 2,739.76 Wire Amex

Inreunilifecorporation,etal.[1]caseno.17-10805reportingperiod:May1toMay31,2017CASHDISBURSEMENTSJOURNAL(CONTINUED)DateDescriptionAmountCheck#Payee 05/17/17CADsoftwaremaintenance954.00ACHFisherUnitech 05/17/17KOPrentandCAMchargesforAprilstubperiod66,698.00ACHKOPWarner 05/17/17HRAfundingforweekended5/19713.68ACHHighmark 05/18/17Telephoneservice13,278.54341938x8Inx. 05/18/17Websitehosting350.0034194BlackMesh 05/18/17Sewer3,724.0034195ConewagoTwp 05/18/17CADsoftwaremaintanance10,600.0034196DesighPoint 05/18/17SAPhostingmonhtlyfee5,104.6734197FreudenburgIT 05/18/17ITstorage226.8134198IronMountain 05/18/17Internetservicemonthlyfee7,971,2034199Level3 05/18/17SAPsupportservice5,500.0034200Niche 05/18/17Wasteremoval610.7434201Republic 05/18/17Waterservice251.6434202YorkWater 05/18/17Waterservice166.5734203YorkWater 05/19/17Firewallprotectionsoftware2,541.88WireContinentalResoursces 05/19/17Employee 401K contributions from 5/12 payroll 25,048.99 ACH Fidelity 05/24/17 Payroll funding for 5/26 211,805.15 Wire ADP 05/24/17 Mowing for York 1,400.00 Cash Cole 05/25/17 HRA funding for week ended 5/26 366.26 ACH Highmark 05/25/17 Payroll Taxes withheld 117,675.18 ACH ADP 05/25/17 Materials for customer programs 3,430.00 34204 Azzur Labs 05/25/17 Monthly insurance funding due 6/1 21,579.02 34205 Chubb 05/25/17 NSAI audit fee 10,2828.18 34206 NSAI 05/25/17 Monthly benefits – life 462.74 34207 Provident 05/25/17 Materials for customer programs 14,390.00 34208 ICO Mold 05/26/17 Monthly processing fee 8,919.93 ACH ADP 05/26/17 Bank fees 263.00 Bank HSBC 05/31/17 Payroll Taxes 3,445.86 ACH ADP 05/31/17 Bank fees 216.56 FNB Total – Unilife Medical Solutions, Inc. $1,171,784.54 Total Disbursements $ 1,620, 649.65

In re Unilife Corporation, et al. [1]Case No. 17-10805Reporting Perriod: May 1 to May 31, 2017BALANCE SHEET(MOR-3)$ IN 000S ASSETS UC UMS UCF Eliminatious Consolidated CURRENT ASSETS Period Petition Period Petition Period Petition Period Petition Period Petition Unrestricted Cash And Equivalents $ 342 $ 140 $2,534 $ 1,778 $ (0) $ 0 $ - $ - $ 2,876 $ 1,918 Restricted Cash and Cash Equivalents (see continuation sheet) - - 340 300 1,923 2,120 ----2,263 2,420 Accounts Receivable(Net) - - - - - - - - - - Inventories - - 95 95 - - - - 95 95 Prepaid Expenses 319 396 292 825 51 78 - - 662 1,299 Professional Retainers 319 396 - - - - - - 398 398 Other Current Assets (attach schedule) - - 251 251 - - - 251 251 TOTAL CURRENT ASSETS 1,059 934 4,230 4,358 1,974 2,198 - - 7,263 7,489 PRAPERTY AND EQUIPMENT Real Property and Improvements - - - - 47,614 47,614 - - 47,614 47,614 Machinery and Equipment - - 58,843 58,843 - - - - 58,843 58,843 Furniture, Fixtures and Office Equipment - - 1,347 1,347 39 39 - - 1,386 1,386 Leasehold Improvements - - 437 437 - - - - 437 437 Vehicles - - 32 32 - - - - 32 32 Less Accumulated Depreciation & Impairment - - (51,726) (50,781) (5,217) (5,037) - - (56,943) (55,818) TOTAL PROPERTY & EQUIPMENT - - 8,934 9,879 42,435 42,615 - - 51,369 52,494 OTHER ASSETS Loans to Insiders* - - - - - - - - - - Other Assets (attach schedule) - - - - - - - - - - TOTAL OTHER ASSETS - - - - - - - - - - TOTAL ASSETS 1,059 934 13,164 14,237 44,409 44,813 - - 58,632 59,984

LIABILITIES AND OWNER EQUITY LIABILITIES NOT SUBJECT TO COMPROMISE(Postpetition) UC Period Petition UMS Period Petition UCF Period Petition Eliminations Period Petition Consolidated Period Petition Accounts Payable 115 - 193 - - - - - 309 - Taxes Payable (refer to FORM MOR-4) - - 93 - - - - - 93 - Wages Payable - - 195 - - - - - 195 - Notes Payable (Intercompany) (1,850) - 1,850 - - - - - - - Rent/ Leases – Building/Equipment - - - - - - - - - - Secured Debt/ Adequate Protection Payments 2500 - - - - - - - 2,500 - Professional Fees - - - - - - - - - Amounts Due to Insiders* - - - - - - - - - Other Postpetition Liabilities(attach schedule) - - - - - - - - - - TATAL POSTPETITION LIABILITIES 765 2,332 - - - - - 3,097 - LIABILITIES SUBJECT TO COMPROMISE (Pre-Petition_ Secured Debt [1] 130,804 130,804 133,554 133,554 100,530 100,623 (217,399) (217,492) 174,489 147,489 Priority Debt [2] - - 306 385 16 16 - - 321 401 Unsecured Debt [3],[4] 5,032 5,032 262,437 262,437 43,326 43,326 - - 310,795 310,795 TOTAL PRE-PETITION LIABILITIES 135,836 135,836 396,297 396,376 143,872 143,965 (217,399) (217,492) 458,606 458,685 TOTAL LIABILITIES 136,602 135,836 398,628 396,376 143,872 143,965 (217,399) (217,492) 461,703 485,685 OWNER EQUITY Common Stock (1,264) (1,264) (11) (11) - - - - (1,275) (1,275) Treasury Stock - - (819) (819) - - - - (819) (819) Additional Paid-In Capital 278,277 278,277 (29,607) (29,607) (86,772) (86,772) - - 161,898 161,898 Accumulated other Comprehensive Income-Pre-Petition - - (128) (128) - - - - (128) (128) Retained Earnings – Pre-Petition (411,915) (411,915) (351,574) (351,574) (12,380) (12,380) (217,399) 217,492 (558,470) (558,377) Retained Earnings – Post-Petition (641) - (3,310) - (311) - - - (4,265) - Adjustments to Owner Equity (attach schedule) - - - - - - - - - - Postpetition Contributions (Distributions) Draws) (attach schedule) - - - - - - - - - NET OWNER EQUITY (135,543) (134,902) (385,449) (382,139) (99,463) (99,152) 217,399 217,492 (403,056) (398,701) Total Liabilities And Owners’ Equity $ 1,059 $ 934 $ 13,179 $ 14,237 $ 44,409 $ 44,813 $ - $ - $ 58,647 $ 59,984 *”Insider” is defined in 11 U.S.C Section 101(31). [1] Cross Farm LLC paid the monthly mortgage payment on Cross Farm Lane from the escrow account under control of FNB. [2] Paid certain priority wage claims per Court Order. [3] Consolidated pre-petition unsecured debt includes uneliminated intercompany payable claims, As per bankruptcy schedules, net intercompany receivables booked at $0. [4] Added $253,999 in pre-petition invoices to the scheduled amount of UMS pre-petition unsecured debt. Reduced scheduled UMS pre-petition unsecured debt by $17, 743.01 for post-petition amounts included in pre-petition balance for for Chubb & Son. Further reduces scheduled amount of UMS pre-petition debt for severance overstated by $18,846.

In re Unilife Corporation, et al. [1] Case no. 17-10805 Reporting Period: May 1 to May 31, 2017 Balance Sheet (MOR-3) (Continuation Sheet) Other current Assets Assets Book Value at end of current reporting month book value on petition date 250,511.20 250,511.20 Security deposits other assets Liabilities and owner equity Book Value at end of current reporting month book value on petition date Other postpetition liabilities adjustments to owner equity postpetition contributions (distributions) (draws) Case 17-10805-lss doc 229 filed 06/22/17 page 9 of 14 9

In re Unilife Corporation, et al. [1] Case no. 17-10805 Reporting Period: May 1 to May 31, 2017 Status of postpetition taxes (MOR-4) the beginning tax liability should be the ending liability from the prior month or, if this is the first report, the amount should be zero. Attach photocopies of IRS form 6123 or payment receipt to verify payment or deposit of federal payroll taxes. Attach photocopies of any tax returns filed during the reporting period. Beginning tax liability amount withheld or accrued amount paid date paid check no. or eft ending tax liability federal withholding Fica-employee Unemployment income other: total federal taxes $ 29,639 11,877 11,877 12 - - 53,405 $ 134,029 52,146 52,103 37 - - 238,315 $ 177,239 46,342 46,342 43 - - 209,966 5/12/17; 5/26/17 5/26/17 5/26/17 5/26/17 Wire wire wire wire $ 46,429 17,681 17,639 5 - - 81,754 State and local Withholding sales excise unemployment real property personal property other: state disability insurance total state and local total taxes 7,202 - - 122 - - 187 7,511 $ 60,917 32,233 - - 549 - - 715 33,497 $ 271,812 28,384 - - 482 - - 676 29,543 $ 239,509 5/12/17; 5/26/17 5/12/17; 5/26/17 5/12/17; 5/26/17 Wire wire wire 11,051 - - 189 - - 226 11,466 $ 93,200 Summary of unpaid postpetition debts (MOR-4) Attach aged listing of accounts payable. Unilife corporation: Number of days past due current 0-30 31-60 61-90 over 90 total accounts payable wages payable taxes payable rent/leases-building rent/leases-equipment secured debt/adequate protection payments professional fees amounts due to insiders* other: other: total postpetition debts 2,462 - - - - - - - - - 2,462 102,002 - - - - - - - - - 102,002 11,006 - - - - - - - - - 11,006 - - - - - - - - - - - - - - - - - - - - - - 115,470 - - - - - - - - - 115,470 unilife medical solutions, inc.: Number of days past due current 0-30 31-60 61-90 over 90 total accounts payable wages payable taxes payable rent/leases-building rent/leases-equipment secured debt/adequate protection payments professional fees amounts due to insiders* other: other: total postpetition debts 15,689 195,084 93,220 - - - - - - - 303,993 142,367 - - - - - - - - - 142,367 35,224 - - - - - - - - - 35,224 - - - - - - - - - - - - - - - - - - - - - - 193,280 195,084 93,220 - - - - - - - - 481,584 *”insider” is defined in 11 u.s.c. section 101(31). Case 17-10805-lss doc 229 filed 06/22/17 page 10 of 14 10

Case 17-10805-LSS Doc 229 Filed 06/22/17 Page 11 of 14

Case 17-10805-LSS Doc 229 Filed 06/22/17 Page 11 of 14

In re Unilife Corporation, et al. [1] Case No. 17-10805 Reporting Period: May 1 to May 31, 2017 ACCOUNTS RECEIVABLE RECONCILIATION AND AGING (MOR-5) Accounts Receivable Reconciliation Amount Total Accounts Receivable at the beginning of the reporting period $1,190,480 + Amounts billed during the period - - Amounts collected during the period (440,780) Total Accounts Receivable at the end of the reporting period 749,699 Accounts Receivable Aging Amount 0 – 30 days old 718,766 31 – 60 days old – 61 – 90 days old – 91 + days old 30,934 Total Accounts Receivable 749,699 Amount considered uncollectible (Bad Debt) (30,934) Accounts Receivable (Net) $718,766 Debtor Questionnaire Must be completed each month Yes No 1. Have any assets been sold or transferred outside the normal course of business this reporting period? If yes, provide an explanation below. X 2. Have any funds been disbursed from any account other than a debtor in possession account this reporting period? If yes, provide an explanation below. X 3. Have all postpetition tax returns been timely filed? If no, provide an explanation below X 4. Are workers compensation, general liability and other necessary insurance coverages in effect? If no, provide an explanation below. X 5. Has any bank account been opened during the reporting period? If yes, provide documentation identifying the opened account(s). If an investment account has been opened provide the required documentation pursuant to the Delaware Local Rule 4001-3. X

Case 17-10805-LSS Doc 229 Filed 06/22/17 Page 12 of 14 First National Bank 4140 E. State Street Heritage, PA 16148 ADDRESS SERVICE REQUESTED UNILIFE CORPORATION DENNIS P PYERS DAVID A BOYLE UTILITY ESCROW ACCOUNT 250 CROSS FARM LN YORK PA 17406-6200 Statement Ending 05/31/2017 UNILIFE CORPORATION Page 1 of 2 Primary Account Number 1951 Managing Your Accounts Online www.fnb-online.com By Phone 1 800-555-5455 By Mail 4140 E. State Street Hermitage, PA 16148 Summary of Accounts Account Type Account Number Balance This Statement Business Interest Checking 1951 $39,845.31 BUSINESS INTEREST CHECKING – 95281951 Account Summary Interest Summary Date Description Amount 05/01/2017 balance last statement $0.00 Annual Percentage Yield Earned 0.01% 2 Credit(s) This Period $39,845.31 Interest Days 31 0 Debit(s) This Period $0.00 Interest Earned $0.31 5/31/2017 Balance This Statement $39,845.31 Interest Paid This Period $0.31 Interest paid Year-to-Date $0.31 Average Available Balance $35,989.03 Account Activity Post Date Description Debits Credits Balance 05/01/2017 Balance Last Statement $0.00 05/04/2017 011966 EB INTERNET XFER FROM BUSINESS ANALYSI $39,845.00 $39,845.00 05/31/2017 INTEREST $0.31 $39,845.31 05/31/2017 Balance this Statement $39,845.31 Daily Balances Date Amount Date Amount 05/04/2017 $39,845.00 05/31/2017 $39,845.31 Equal housing lender member FDIC