Attached files

| file | filename |

|---|---|

| 8-K - 8-K INVESTOR PRESENTATION - RLJ ENTERTAINMENT, INC. | rlje-8k_20170621.htm |

June 2017

This presentation includes “forward-looking statements” that involve risks and uncertainties within the meaning of the United States Private Securities Litigation Reform Act of 1995. Words such as “will,” “should,” “could,” “may,” “might,” “expect,” “plan,” “possible,” “potential,” “predict,” “anticipate,” “believe,” “estimate,” “continue,” “future,” “intend,” “project” or similar expressions are intended to identify such forward-looking statements and may include statements regarding industry prospects, future results of operations or financial position, and statements of our intent, belief and current expectations about our strategic direction, prospective and future results and condition. RLJ Entertainment’s actual results may differ from its expectations, estimates and projections and consequently, you should not rely on these forward looking statements as predictions of future events. Important factors that could cause or contribute to differences from expectations, estimates and projections include those discussed in “Risk Factors” in our Annual Report on Form 10-K filed on March 23, 2017, our subsequent Quarterly Reports on Form 10-Q and other reports we file from time to time with the Securities and Exchange Commission. All forward-looking statements should be evaluated with the understanding of inherent uncertainty. The inclusion of such forward-looking statements should not be regarded as a representation that contemplated future events, plans or expectations will be achieved. Unless otherwise required by law, we undertake no obligation to release publicly any updates or revisions to any such forward-looking statements that may reflect events or circumstances occurring after the date of this presentation. You are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date made. SAFE HARBOR

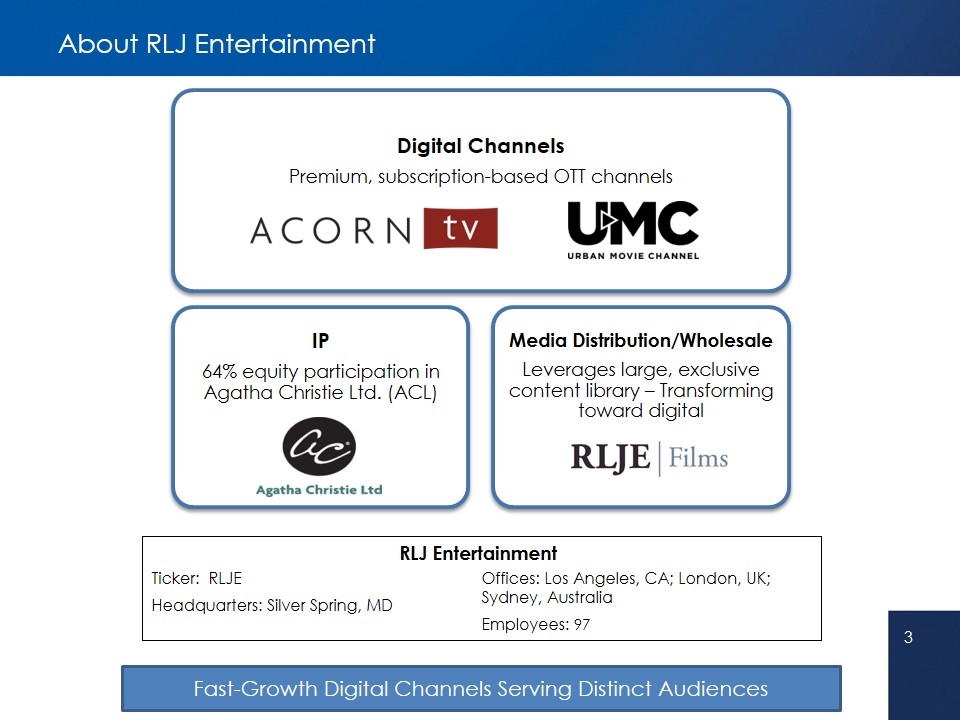

Ticker: RLJE Headquarters: Silver Spring, MD Offices: Los Angeles, CA; London, UK; Sydney, Australia Employees: 97 About RLJ Entertainment Fast-Growth Digital Channels Serving Distinct Audiences RLJ Entertainment IP 64% equity participation in Agatha Christie Ltd. (ACL) Media Distribution/Wholesale Leverages large, exclusive content library – Transforming toward digital Digital Channels Premium, subscription-based OTT channels

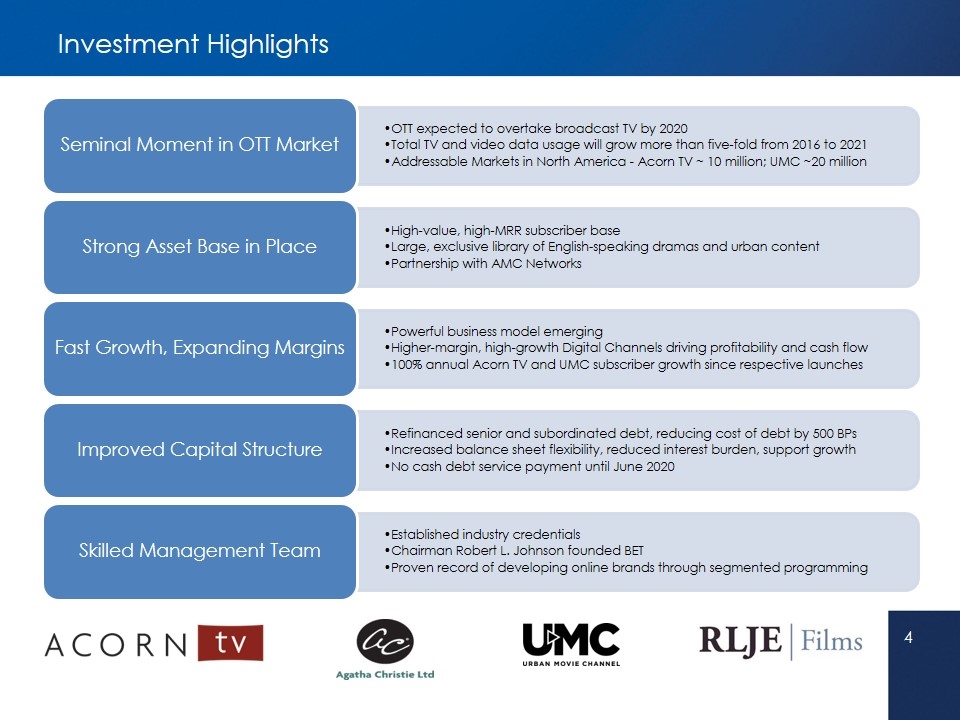

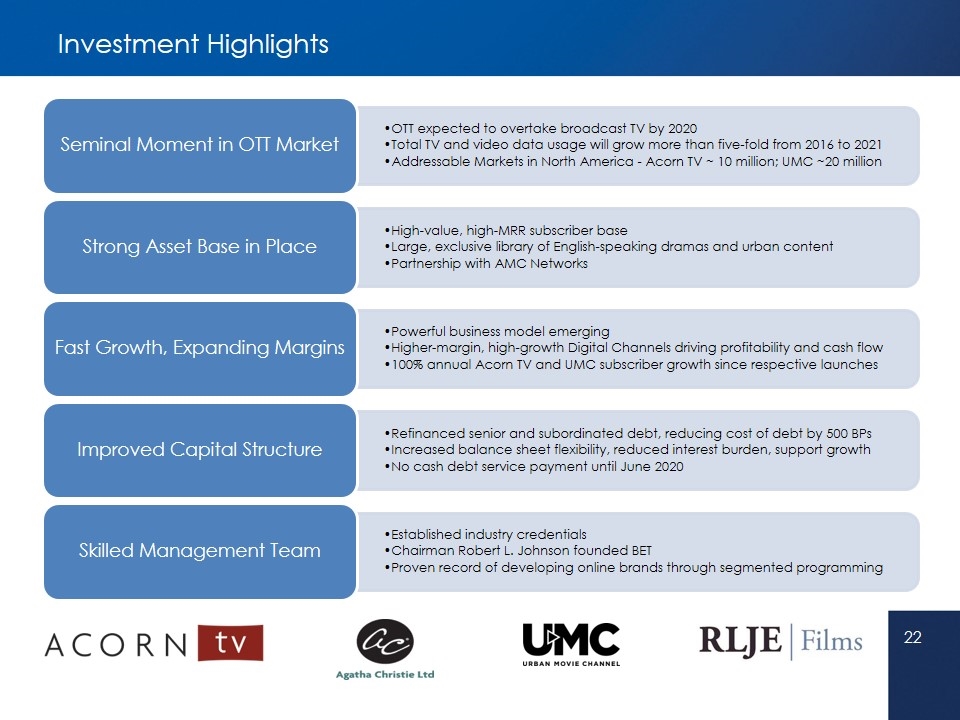

Investment Highlights Seminal Moment in OTT Market Fast Growth, Expanding Margins 100% annual Acorn TV and UMC subscriber growth since respective launches Skilled Management Team Established industry credentials Proven record of developing online brands through segmented programming Strong Asset Base in Place High-value, high-MRR subscriber base Large, exclusive library of English-speaking dramas and urban content Partnership with AMC Networks Total TV and video data usage will grow more than five-fold from 2016 to 2021 Improved Capital Structure Refinanced senior and subordinated debt, reducing cost of debt by 500 BPs Increased balance sheet flexibility, reduced interest burden, support growth Addressable Markets in North America - Acorn TV ~ 10 million; UMC ~20 million OTT expected to overtake broadcast TV by 2020 Higher-margin, high-growth Digital Channels driving profitability and cash flow No cash debt service payment until June 2020 Chairman Robert L. Johnson founded BET Powerful business model emerging

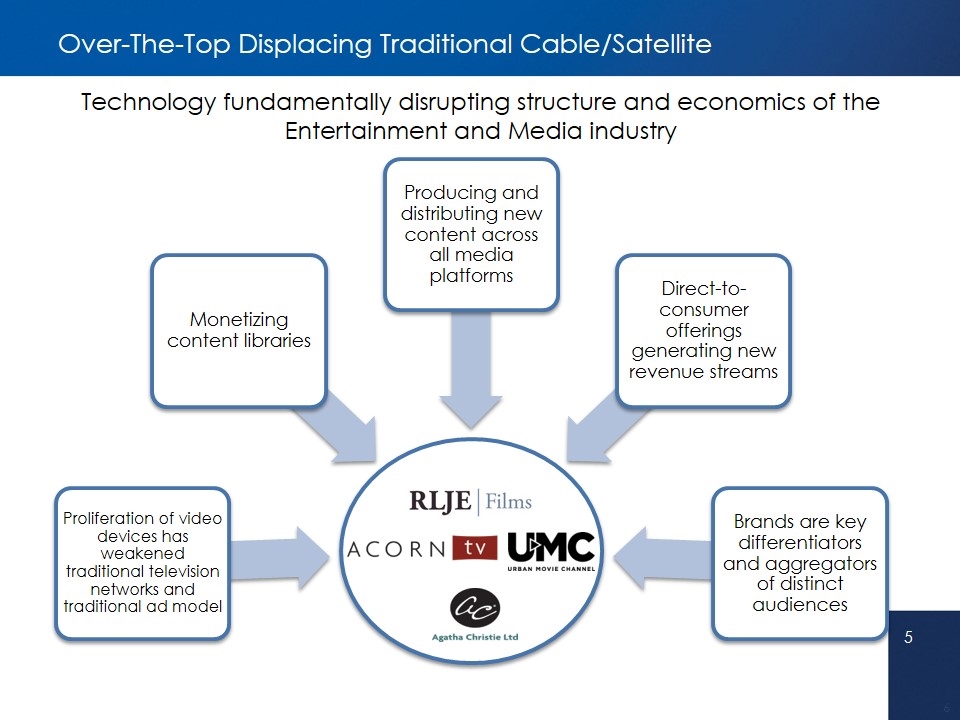

Over-The-Top Displacing Traditional Cable/Satellite Technology fundamentally disrupting structure and economics of the Entertainment and Media industry 6 5 Monetizing content libraries Producing and distributing new content across all media platforms Direct-to-consumer offerings generating new revenue streams Brands are key differentiators and aggregators of distinct audiences Proliferation of video devices has weakened traditional television networks and traditional ad model

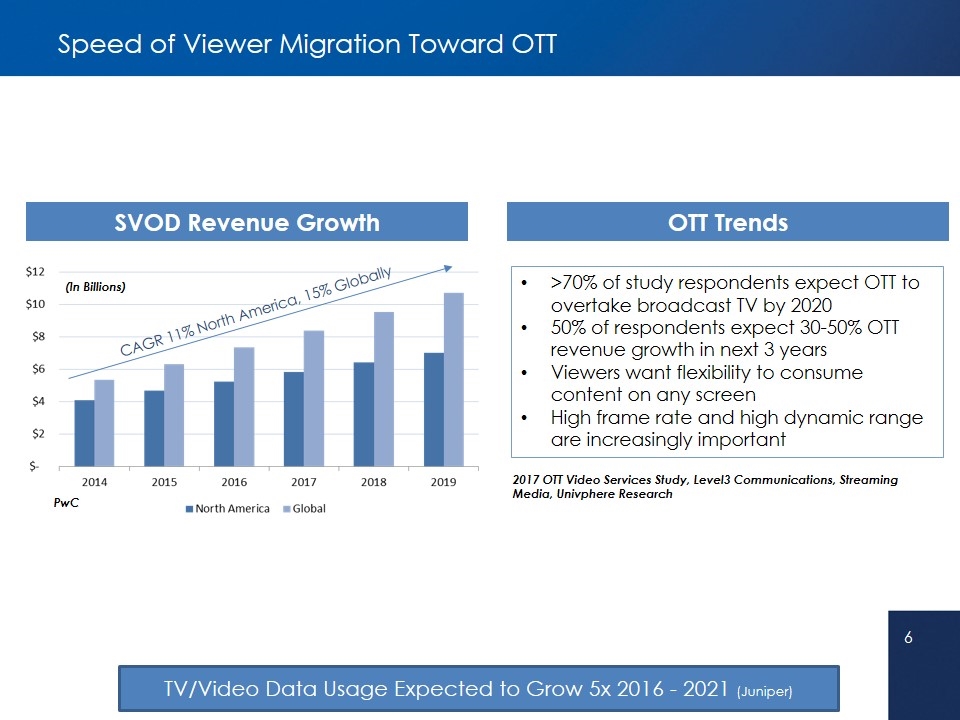

Speed of Viewer Migration Toward OTT SVOD Revenue Growth (In Billions) OTT Trends 2017 OTT Video Services Study, Level3 Communications, Streaming Media, Univphere Research >70% of study respondents expect OTT to overtake broadcast TV by 2020 50% of respondents expect 30-50% OTT revenue growth in next 3 years Viewers want flexibility to consume content on any screen High frame rate and high dynamic range are increasingly important PwC CAGR 11% North America, 15% Globally TV/Video Data Usage Expected to Grow 5x 2016 - 2021 (Juniper)

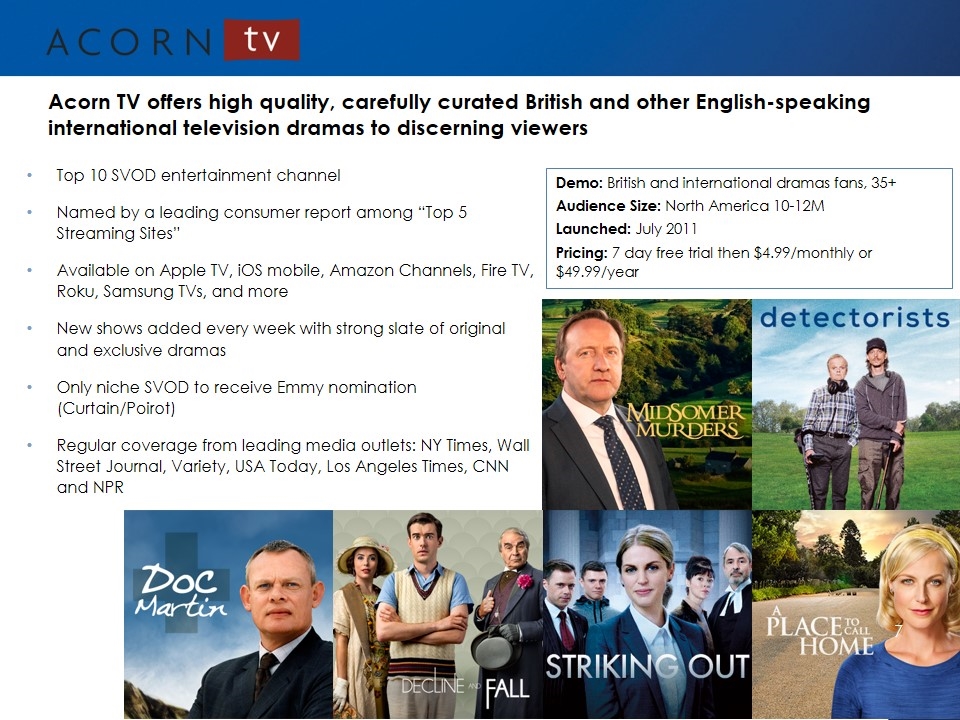

Top 10 SVOD entertainment channel Named by a leading consumer report among “Top 5 Streaming Sites” Available on Apple TV, iOS mobile, Amazon Channels, Fire TV, Roku, Samsung TVs, and more New shows added every week with strong slate of original and exclusive dramas Only niche SVOD to receive Emmy nomination (Curtain/Poirot) Regular coverage from leading media outlets: NY Times, Wall Street Journal, Variety, USA Today, Los Angeles Times, CNN and NPR Acorn TV offers high quality, carefully curated British and other English-speaking international television dramas to discerning viewers Demo: British and international dramas fans, 35+ Audience Size: North America 10-12M Launched: July 2011 Pricing: 7 day free trial then $4.99/monthly or $49.99/year

100% YOY Subscriber Growth Since 2011 Launch

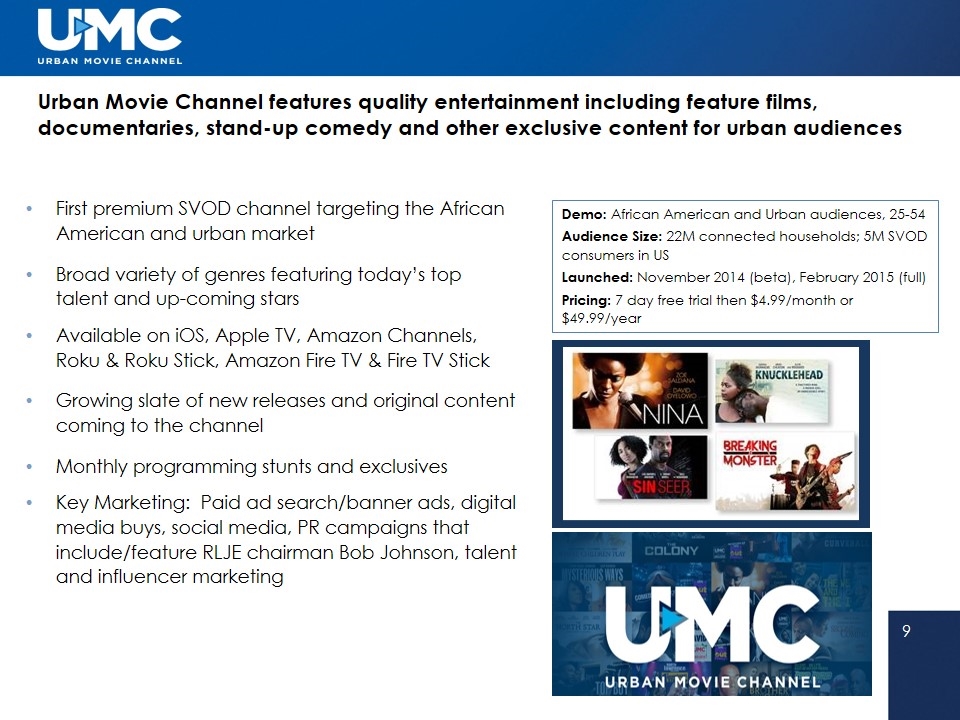

First premium SVOD channel targeting the African American and urban market Broad variety of genres featuring today’s top talent and up-coming stars Available on iOS, Apple TV, Amazon Channels, Roku & Roku Stick, Amazon Fire TV & Fire TV Stick Growing slate of new releases and original content coming to the channel Monthly programming stunts and exclusives Key Marketing: Paid ad search/banner ads, digital media buys, social media, PR campaigns that include/feature RLJE chairman Bob Johnson, talent and influencer marketing Demo: African American and Urban audiences, 25-54 Audience Size: 22M connected households; 5M SVOD consumers in US Launched: November 2014 (beta), February 2015 (full) Pricing: 7 day free trial then $4.99/month or $49.99/year Urban Movie Channel features quality entertainment including feature films, documentaries, stand-up comedy and other exclusive content for urban audiences

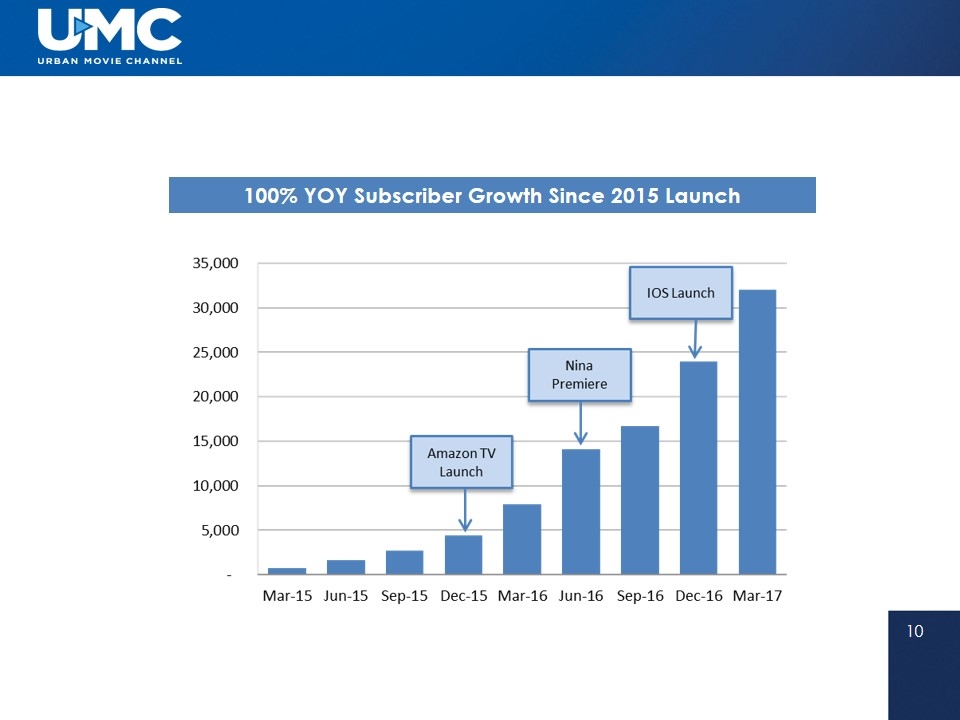

100% YOY Subscriber Growth Since 2015 Launch

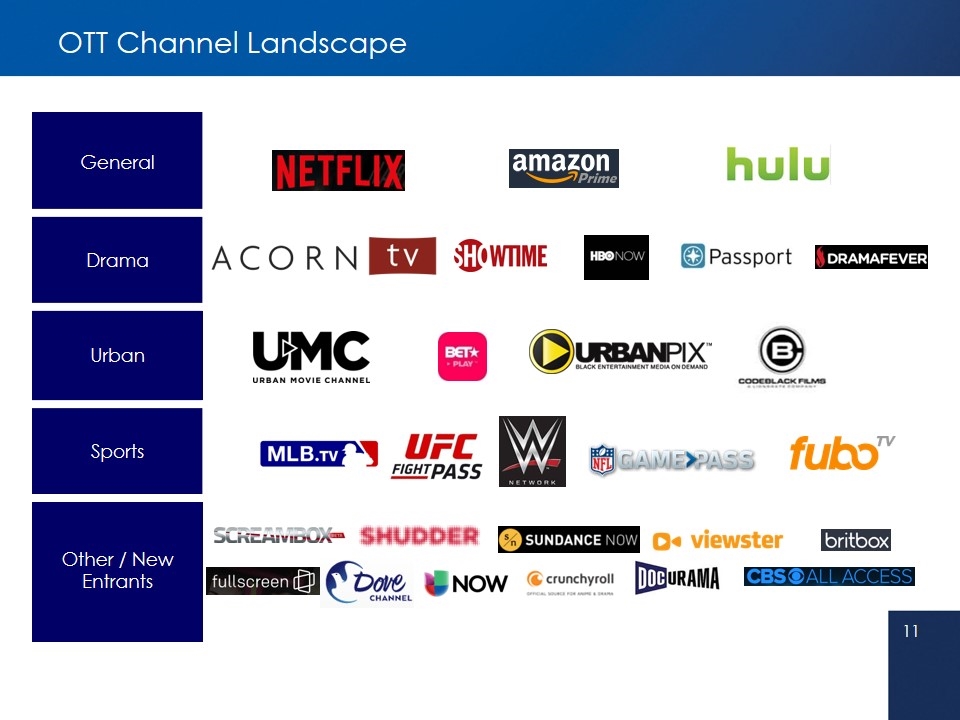

General Drama Urban Sports Other / New Entrants OTT Channel Landscape

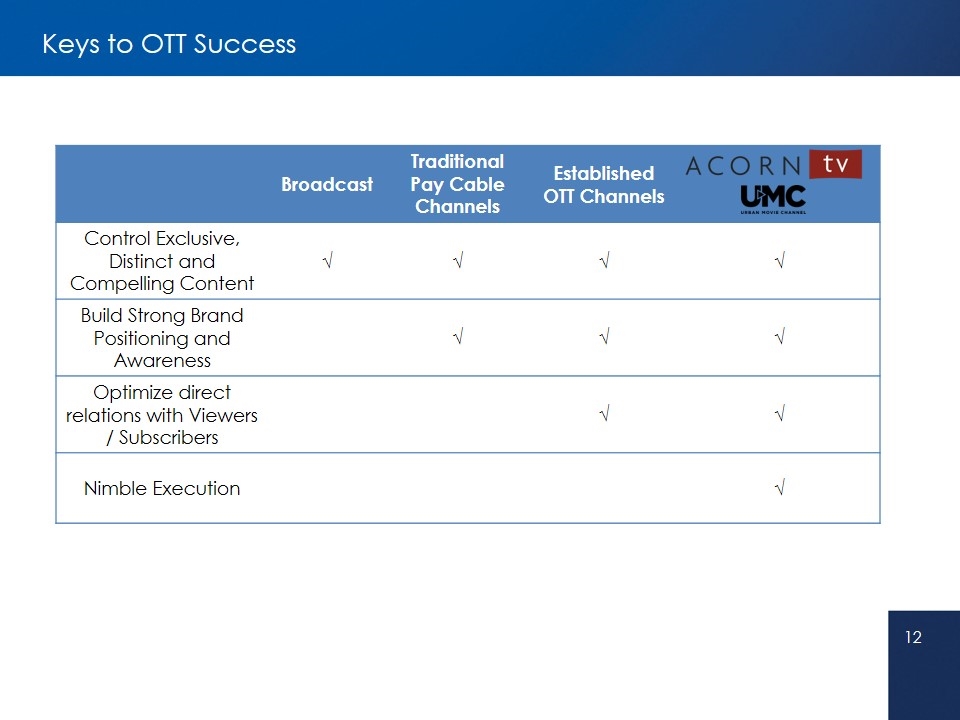

Keys to OTT Success Broadcast Traditional Pay Cable Channels Established OTT Channels Control Exclusive, Distinct and Compelling Content √ √ √ √ Build Strong Brand Positioning and Awareness √ √ √ Optimize direct relations with Viewers / Subscribers √ √ Nimble Execution √

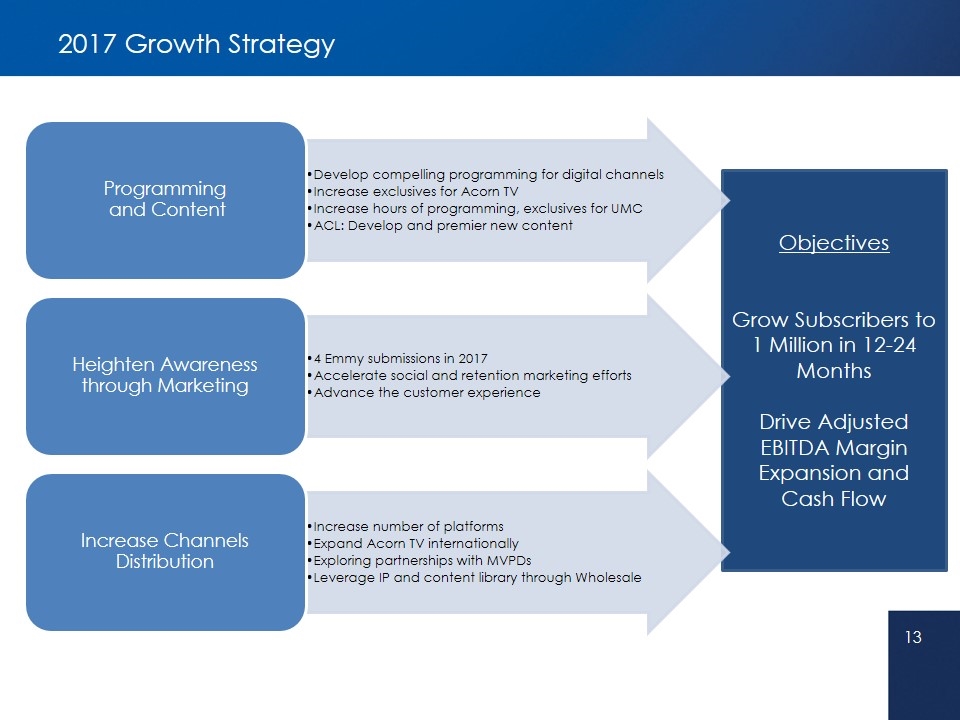

2017 Growth Strategy Objectives Grow Subscribers to 1 Million in 12-24 Months Drive Adjusted EBITDA Margin Expansion and Cash Flow Programming and Content Develop compelling programming for digital channels Increase exclusives for Acorn TV Heighten Awareness through Marketing 4 Emmy submissions in 2017 Increase Channels Distribution Increase hours of programming, exclusives for UMC ACL: Develop and premier new content Accelerate social and retention marketing efforts Advance the customer experience Increase number of platforms Expand Acorn TV internationally Exploring partnerships with MVPDs Leverage IP and content library through Wholesale

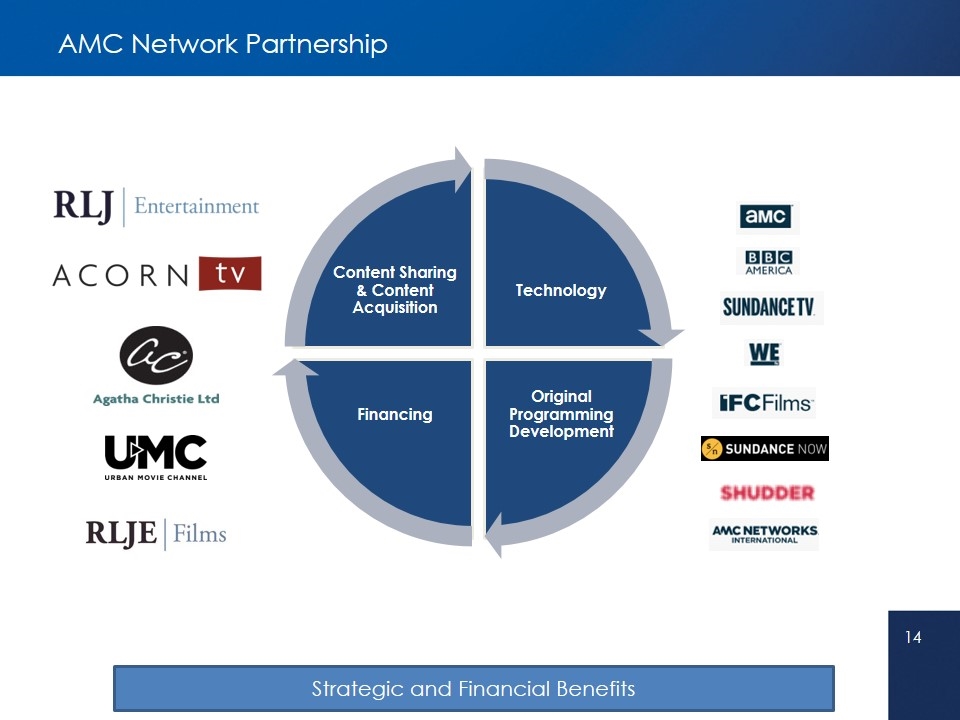

AMC Network Partnership Strategic and Financial Benefits Technology Original Programming Development Content Sharing & Content Acquisition Financing

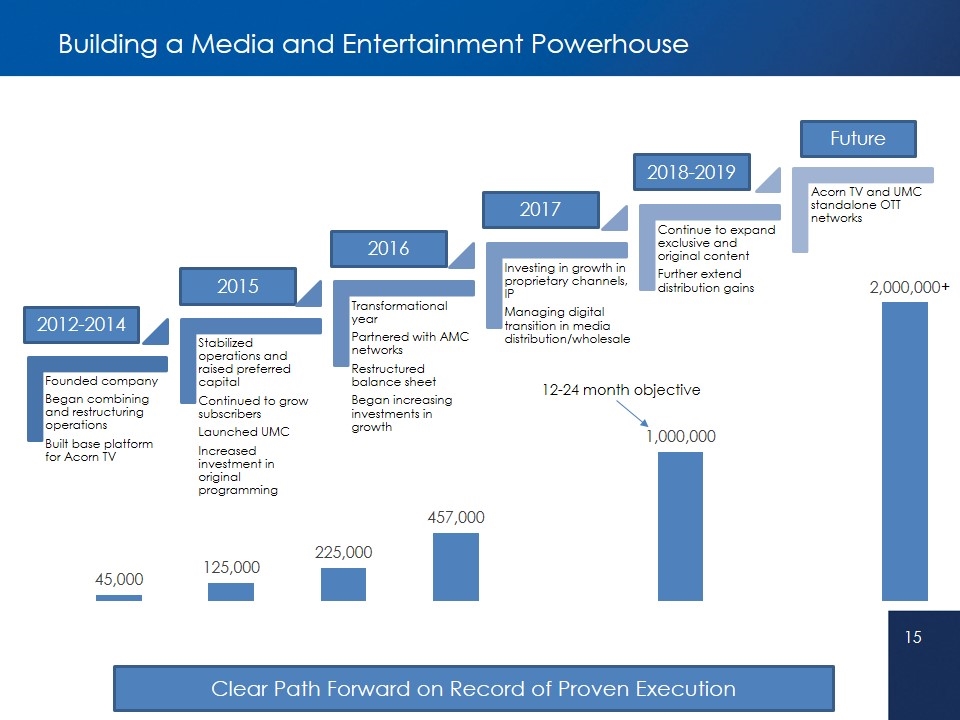

Building a Media and Entertainment Powerhouse 2012-2014 2015 2016 2017 2018-2019 Future 12-24 month objective Clear Path Forward on Record of Proven Execution + Founded company Began combining and restructuring operations Built base platform for Acorn TV Transformational year Partnered with AMC networks Restructured balance sheet Began increasing investments in growth Investing in growth in proprietary channels, IP Managing digital transition in media distribution/wholesale Stabilized operations and raised preferred capital Continued to grow subscribers Launched UMC Increased investment in original programming Continue to expand exclusive and original content Further extend distribution gains Acorn TV and UMC standalone OTT networks

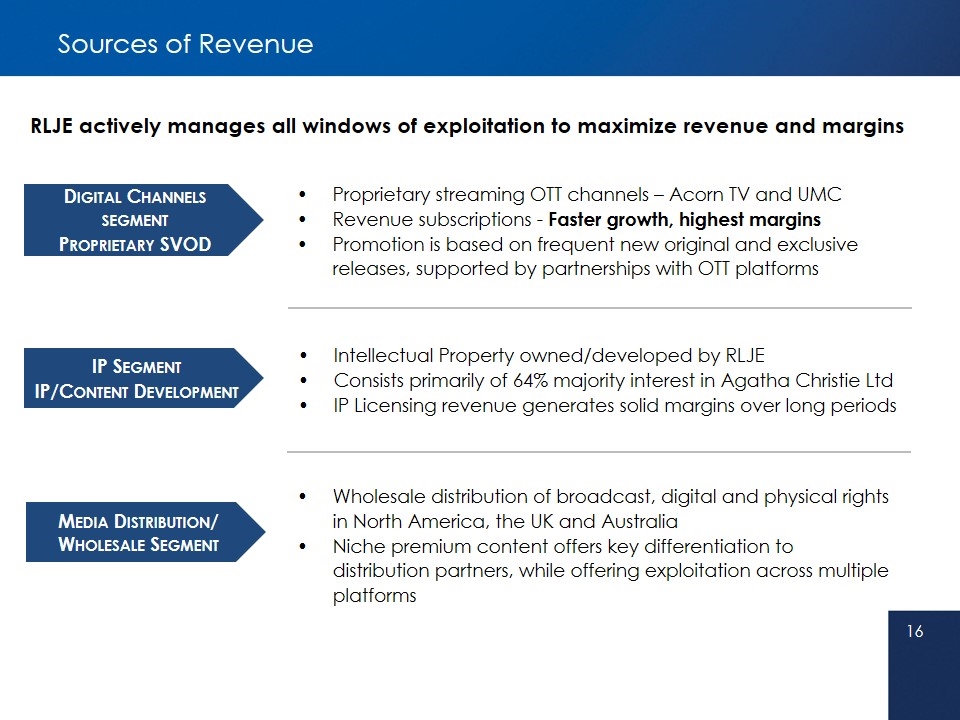

Sources of Revenue Media Distribution/ Wholesale Segment IP Segment IP/Content Development Intellectual Property owned/developed by RLJE Consists primarily of 64% majority interest in Agatha Christie Ltd IP Licensing revenue generates solid margins over long periods Wholesale distribution of broadcast, digital and physical rights in North America, the UK and Australia Niche premium content offers key differentiation to distribution partners, while offering exploitation across multiple platforms RLJE actively manages all windows of exploitation to maximize revenue and margins Proprietary streaming OTT channels – Acorn TV and UMC Revenue subscriptions - Faster growth, highest margins Promotion is based on frequent new original and exclusive releases, supported by partnerships with OTT platforms Digital Channels segment Proprietary SVOD

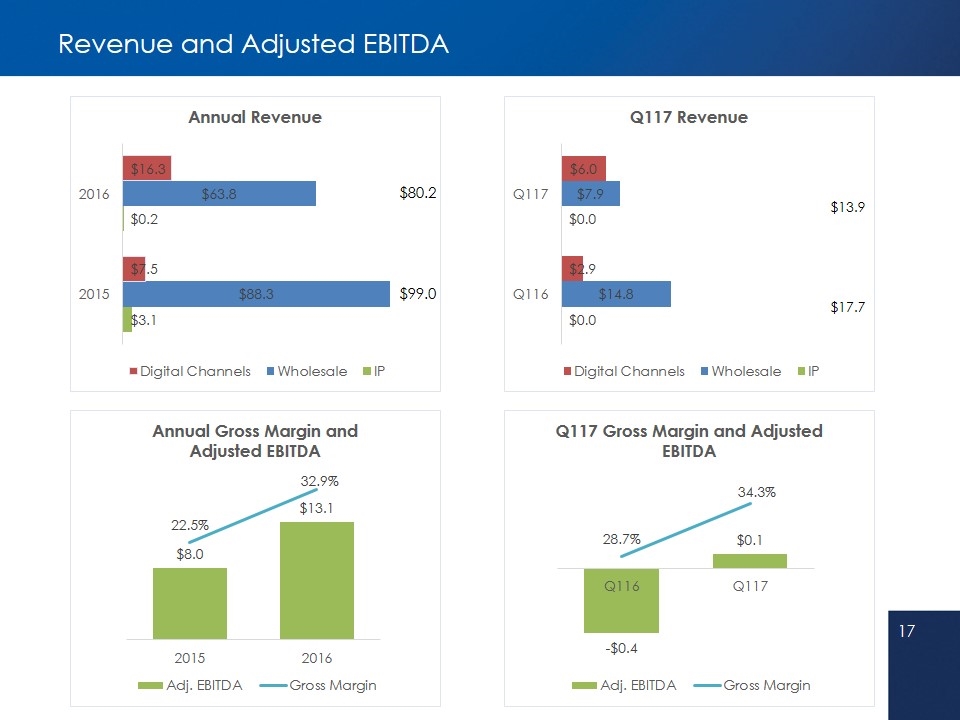

Revenue and Adjusted EBITDA $99.0 $80.2 $17.7 $13.9

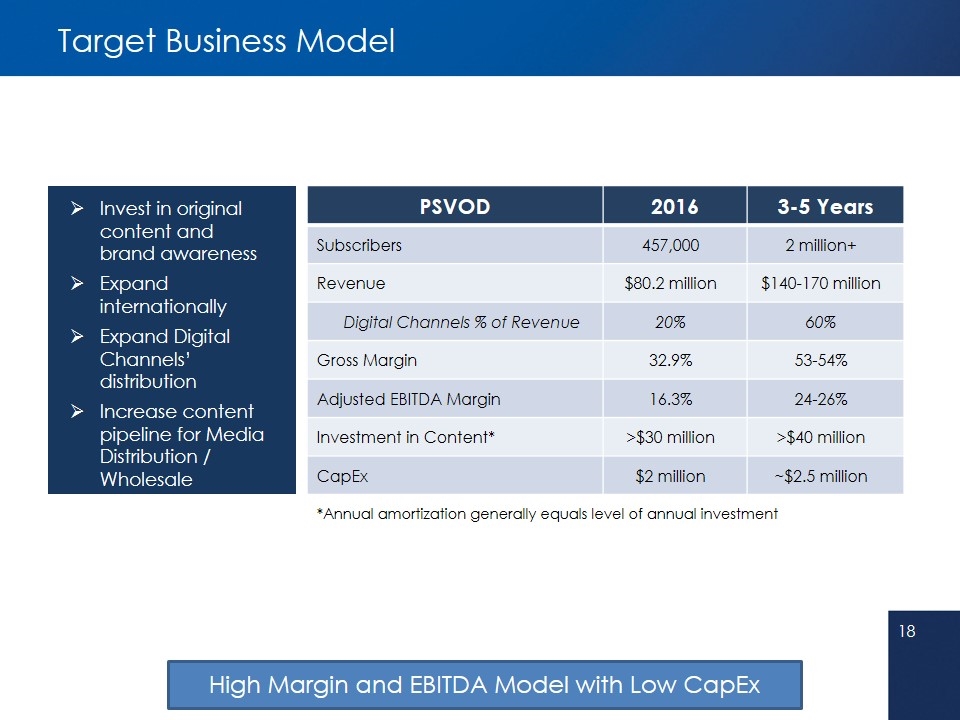

Target Business Model PSVOD 2016 3-5 Years Subscribers 457,000 2 million+ Revenue $80.2 million $140-170 million Digital Channels % of Revenue 20% 60% Gross Margin 32.9% 53-54% Adjusted EBITDA Margin 16.3% 24-26% Investment in Content* >$30 million >$40 million CapEx $2 million ~$2.5 million High Margin and EBITDA Model with Low CapEx *Annual amortization generally equals level of annual investment Invest in original content and brand awareness Expand internationally Expand Digital Channels’ distribution Increase content pipeline for Media Distribution / Wholesale

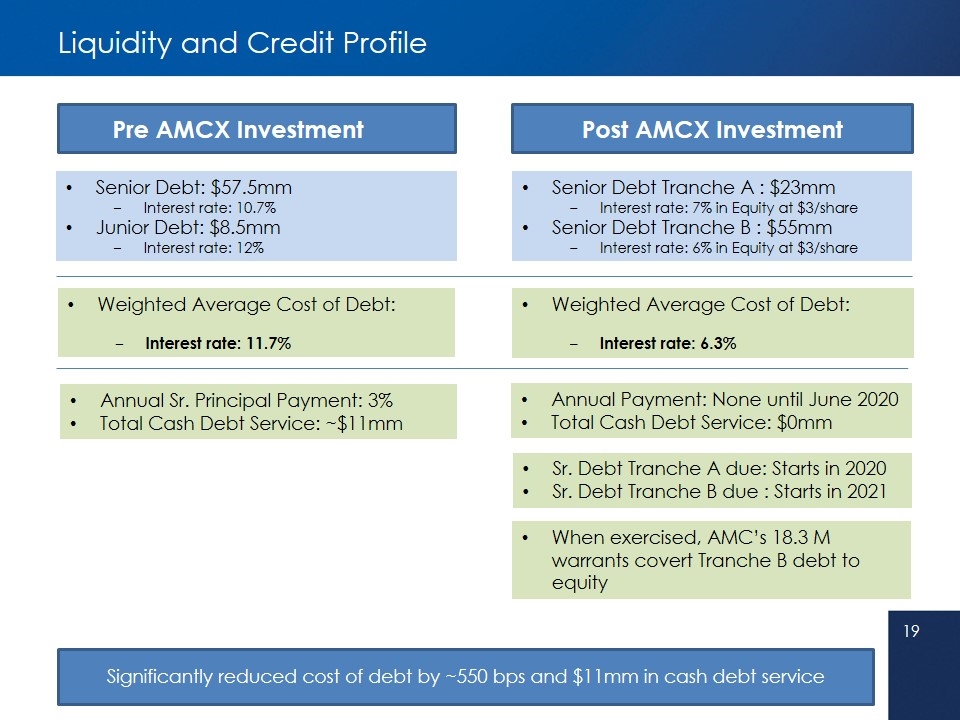

Liquidity and Credit Profile Pre AMCX Investment Post AMCX Investment Senior Debt: $57.5mm Interest rate: 10.7% Junior Debt: $8.5mm Interest rate: 12% Weighted Average Cost of Debt: Interest rate: 11.7% Senior Debt Tranche A : $23mm Interest rate: 7% in Equity at $3/share Senior Debt Tranche B : $55mm Interest rate: 6% in Equity at $3/share Weighted Average Cost of Debt: Interest rate: 6.3% Annual Sr. Principal Payment: 3% Total Cash Debt Service: ~$11mm Sr. Debt Tranche A due: Starts in 2020 Sr. Debt Tranche B due : Starts in 2021 Significantly reduced cost of debt by ~550 bps and $11mm in cash debt service When exercised, AMC’s 18.3 M warrants covert Tranche B debt to equity Annual Payment: None until June 2020 Total Cash Debt Service: $0mm

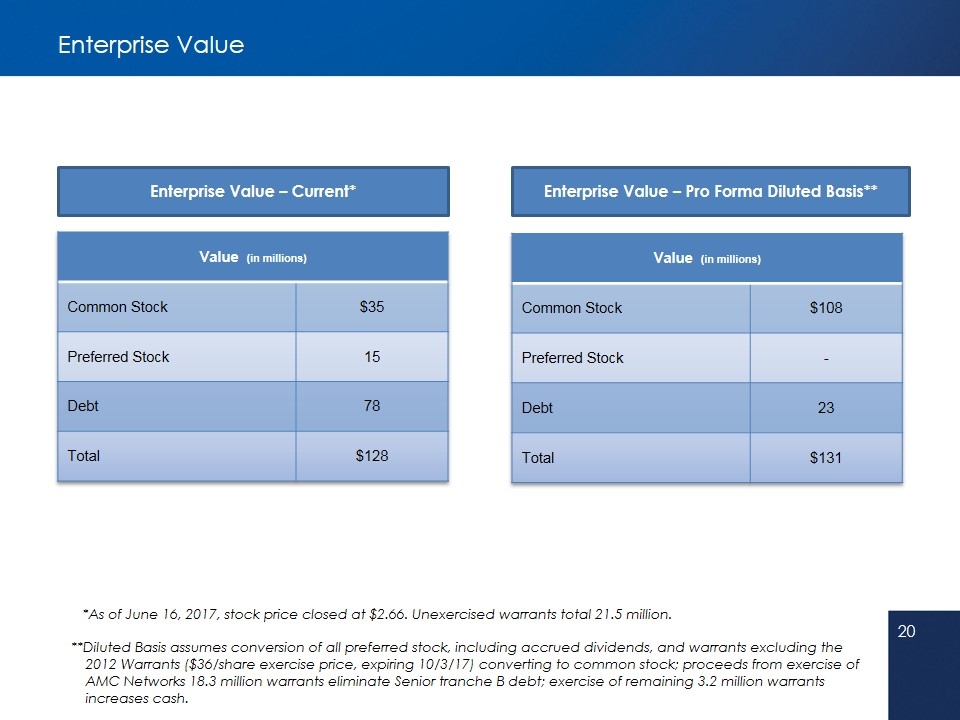

Enterprise Value *As of June 16, 2017, stock price closed at $2.66. Unexercised warrants total 21.5 million. **Diluted Basis assumes conversion of all preferred stock, including accrued dividends, and warrants excluding the 2012 Warrants ($36/share exercise price, expiring 10/3/17) converting to common stock; proceeds from exercise of AMC Networks 18.3 million warrants eliminate Senior tranche B debt; exercise of remaining 3.2 million warrants increases cash. Enterprise Value – Current* Value (in millions) Common Stock $35 Preferred Stock 15 Debt 78 Total $128 Enterprise Value – Pro Forma Diluted Basis** Value (in millions) Common Stock $108 Preferred Stock - Debt 23 Total $131

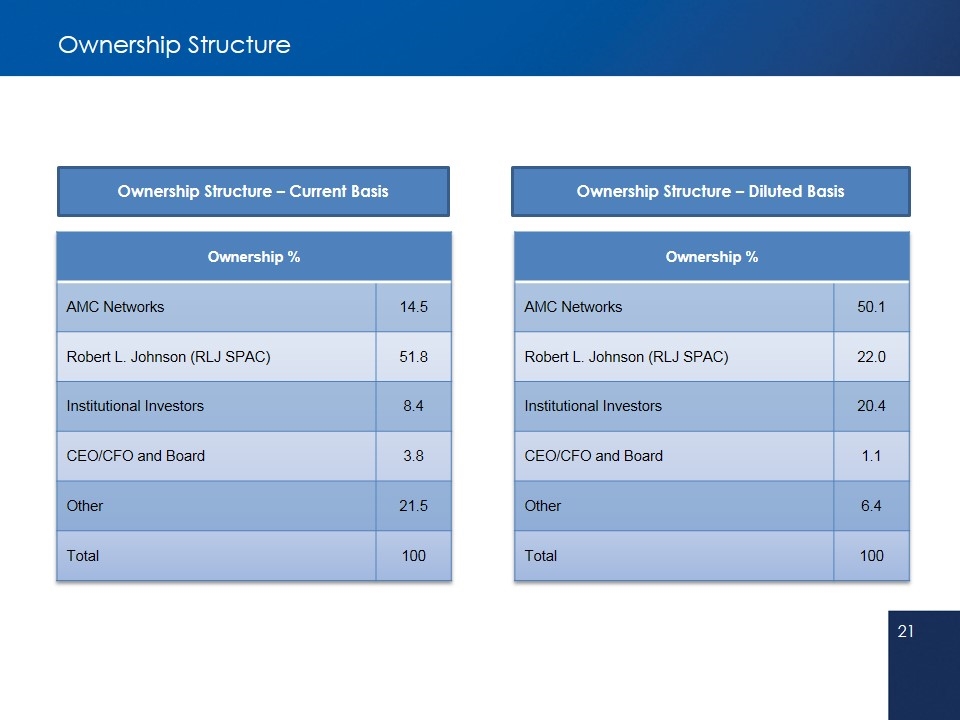

Ownership Structure Ownership Structure – Current Basis Ownership Structure – Diluted Basis Ownership % AMC Networks 50.1 Robert L. Johnson (RLJ SPAC) 22.0 Institutional Investors 20.4 CEO/CFO and Board 1.1 Other 6.4 Total 100 Ownership % AMC Networks 14.5 Robert L. Johnson (RLJ SPAC) 51.8 Institutional Investors 8.4 CEO/CFO and Board 3.8 Other 21.5 Total 100

Investment Highlights Seminal Moment in OTT Market Fast Growth, Expanding Margins 100% annual Acorn TV and UMC subscriber growth since respective launches Skilled Management Team Established industry credentials Proven record of developing online brands through segmented programming Strong Asset Base in Place High-value, high-MRR subscriber base Large, exclusive library of English-speaking dramas and urban content Partnership with AMC Networks Total TV and video data usage will grow more than five-fold from 2016 to 2021 Improved Capital Structure Refinanced senior and subordinated debt, reducing cost of debt by 500 BPs Increased balance sheet flexibility, reduced interest burden, support growth Addressable Markets in North America - Acorn TV ~ 10 million; UMC ~20 million OTT expected to overtake broadcast TV by 2020 Higher-margin, high-growth Digital Channels driving profitability and cash flow No cash debt service payment until June 2020 Chairman Robert L. Johnson founded BET Powerful business model emerging

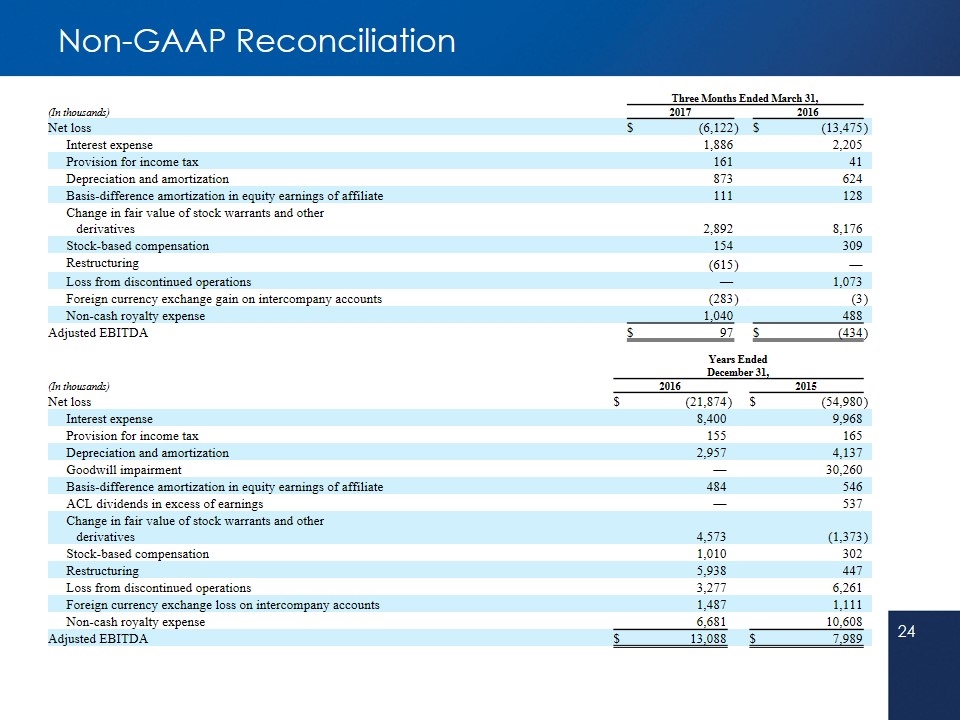

Non-GAAP Reconciliation Three Months Ended March 31, (In thousands) 2017 2016 Net loss $ (6,122 ) $ (13,475 ) Interest expense 1,886 2,205 Provision for income tax 161 41 Depreciation and amortization 873 624 Basis-difference amortization in equity earnings of affiliate 111 128 Change in fair value of stock warrants and other derivatives 2,892 8,176 Stock-based compensation 154 309 Restructuring (615 ) — Loss from discontinued operations — 1,073 Foreign currency exchange gain on intercompany accounts (283 ) (3 ) Non-cash royalty expense 1,040 488 Adjusted EBITDA $ 97 $ (434 ) Years Ended December 31, (In thousands) 2016 2015 Net loss $ (21,874 ) $ (54,980 ) Interest expense 8,400 9,968 Provision for income tax 155 165 Depreciation and amortization 2,957 4,137 Goodwill impairment — 30,260 Basis-difference amortization in equity earnings of affiliate 484 546 ACL dividends in excess of earnings — 537 Change in fair value of stock warrants and other derivatives 4,573 (1,373 ) Stock-based compensation 1,010 302 Restructuring 5,938 447 Loss from discontinued operations 3,277 6,261 Foreign currency exchange loss on intercompany accounts 1,487 1,111 Non-cash royalty expense 6,681 10,608 Adjusted EBITDA $ 13,088 $ 7,989 24