Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NEWPARK RESOURCES INC | a2017q18k-investorpresenta.htm |

N E W P A R K R E S O U R C E S P R E S E N TAT I O N

J U N E 2 0 1 7

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act that are

based on management's current expectations, estimates and projections. All statements that address expectations or projections

about the future, including Newpark's strategy for growth, product development, market position, expected expenditures and

future financial results are forward-looking statements. Words such as “will”, “may”, “could”, “would”, “anticipates”, “believes”,

“estimates”, “expects”, “plans”, “intends”, and similar expressions are intended to identify these forward-looking statements but

are not the exclusive means of identifying them. These forward-looking statements reflect the current views of our management;

however, various risks, uncertainties, contingencies and other factors, some of which are beyond our control, are difficult to

predict and could cause our actual results, performance or achievements to differ materially from those expressed in, or implied

by, these statements, including the success or failure of our efforts to implement our business strategy. We assume no obligation

to update, amend or clarify publicly any forward-looking statements, whether as a result of new information, future events or

otherwise, except as required by securities laws. Many factors, including those discussed more fully elsewhere in this presentation

and in documents filed with the Securities and Exchange Commission by Newpark, particularly its Annual Report on Form 10-K for

the year ended December 31, 2016, as well as others, could cause results to differ materially from those expressed in, or implied

by, these statements. These risk factors include, but are not limited to, risks related to the worldwide oil and natural gas industry,

our customer concentration and reliance on the U.S. exploration and production market, risks related to our international

operations, the cost and continued availability of borrowed funds including noncompliance with debt covenants, operating

hazards present in the oil and natural gas industry, our ability to execute our business strategy and make successful business

acquisitions and capital investments, the availability of raw materials and skilled personnel, our market competition, compliance

with legal and regulatory matters, including environmental regulations, the availability of insurance and the risks and limitations of

our insurance coverage, potential impairments of long-lived intangible assets, technological developments in our industry, risks

related to severe weather, particularly in the U.S. Gulf Coast, cybersecurity breaches or business system disruptions and risks

related to the fluctuations in the market value of our common stock. Newpark’s filings with the Securities and Exchange

Commission can be obtained at no charge at www.sec.gov, as well as through its website at www.newpark.com.

F O R W A R D L O O K I N G S TAT E M E N T S

2

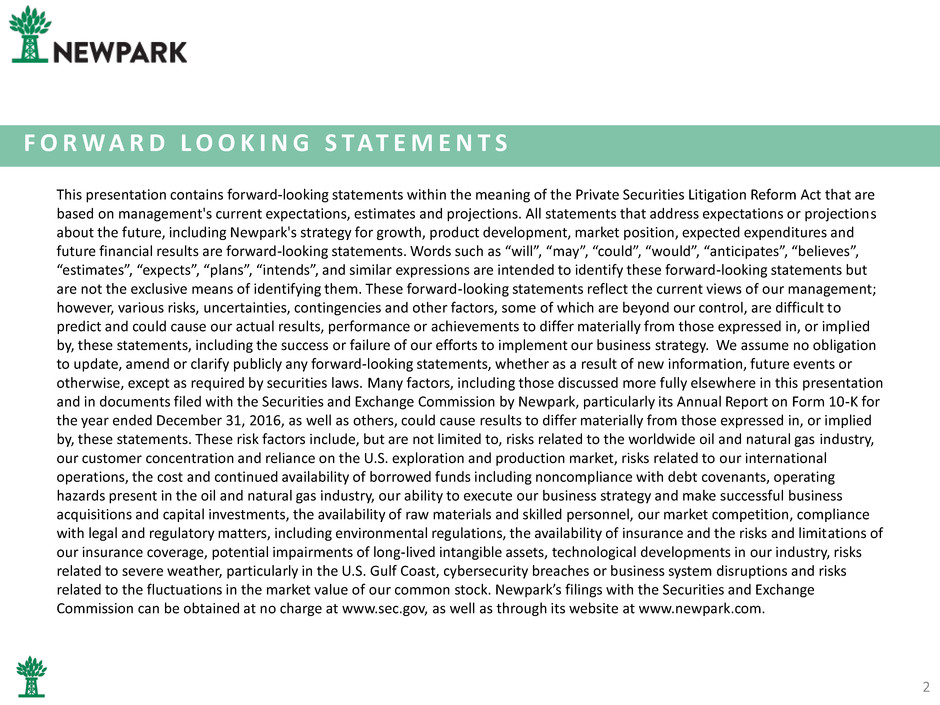

$984

$1,042

$1,118

$677

$471

$159

$115

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

2012 2013 2014 2015 2016 2017

86%

14%

First Quarter 2017 - Revenue by Segment

Two Operating Segments:

Fluids Systems

Oil and Gas exploration

Mats and Integrated Services

Oil and Gas exploration

Electrical transmission and

distribution

Pipeline

Petrochemical

Construction

Key geographic markets:

North America

EMEA

Latin America

Asia Pacific

R

e

ve

n

u

e

s

($

m

ill

io

n

s)

Consolidated Revenues

Fluids Systems Mats and Integrated Services

C O M P A N Y O V E R V I E W

3

Full Year

First Quarter

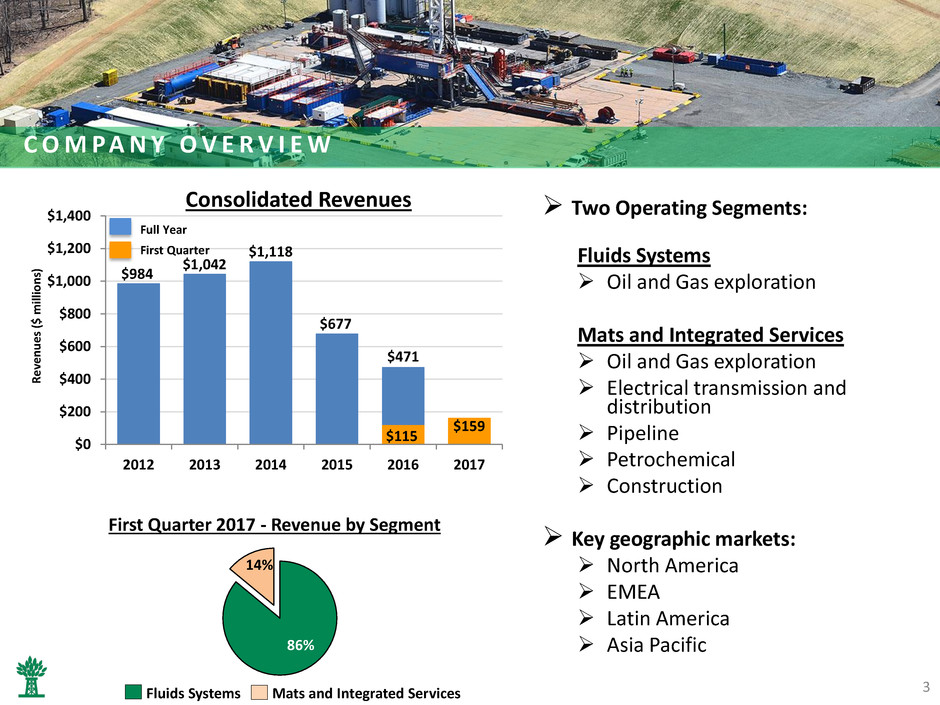

Revenue by Region

G L O B A L S T R E N G T H

4

67%

57%

45%

54%

7%

8%

7%

12%

8%

7%

9%

6%

18%

28%

39%

28%

2014 2015 2016 Q1 2017

U.S. Canada

Latin America EMEA/APAC

S T R E N G T H E N E D B Y O U R I N V E S T M E N T S

Mats: Completed Manufacturing 2015

and Technology Center 2016

Elevated capital campaign completed

Infrastructure investments open new

markets and significantly enhance our

competitiveness

Reflects our commitment to be the global

leader in fluids and mats technology

5

Fluids: Gulf of Mexico Deepwater Shorebase

Completed 2017

Fluids: Manufacturing Facility & Distribution Center

Completed 2016

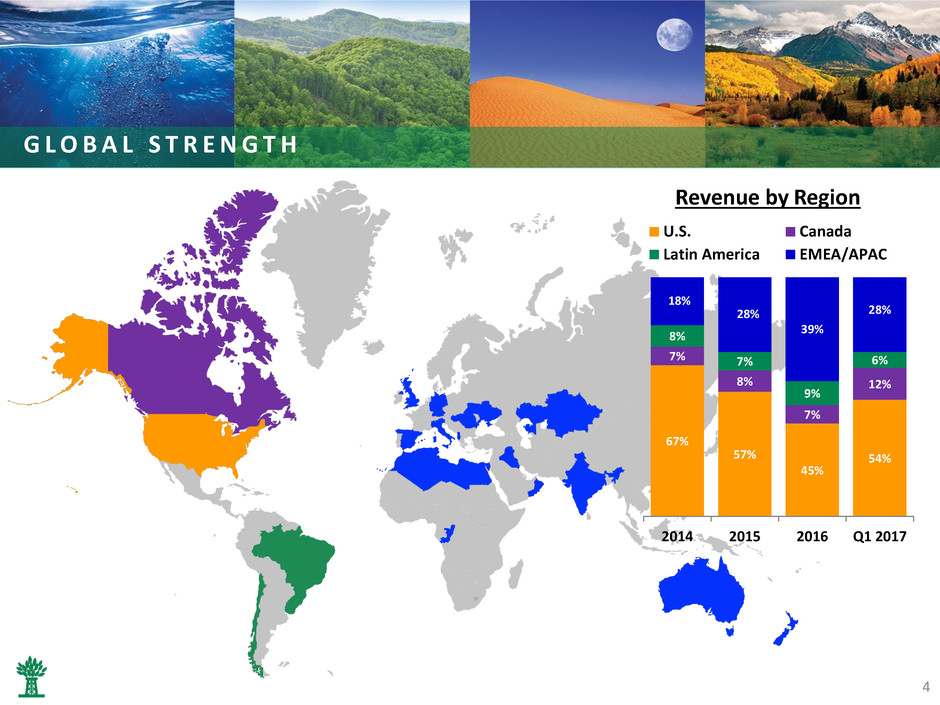

48%

14%

31%

7%

U.S. Canada EMEA/APAC Latin America

Largest independent drilling

fluids provider

3rd largest drilling fluids

company worldwide*

Seek to capitalize on

competitive diversions to drive

further market share gains

Expanding global market share,

leveraging IOC/NOC

relationships

$862

$926 $965

$581

$395

$99

$136

$0

$200

$400

$600

$800

$1,000

$1,200

2012 2013 2014 2015 2016 2017

Re

ve

n

u

e

s

($

m

il

lio

n

s)

Total Segment Revenues

First Quarter 2017 Revenue by Region

*Based on company data

F L U I D S S Y S T E M S - O V E R V I E W

6

Full Year

First Quarter

F L U I D S S Y S T E M S - T E C H N O L O G Y

7

Proven drilling fluid systems designed to

enhance wellsite performance

Evolution® high-performance, water-based

technology for global applications

Fusion™ brine fluid system creates a

unique enhancement for shale basins

Kronos™ deepwater drilling fluid systems

offers operators a consistent fluid across a

wide temperature and pressure spectrum

Fluids Development

Driving continued advancements in

technology, bringing new chemistries to

enhance drilling efficiencies in challenging

environments

2,283

2,114

2,241

1,170

639

1,037

10%

11%

12%

13%

14%

15%

16%

-

500

1,000

1,500

2,000

2,500

2012 2013 2014 2015 2016 First Quarter

2017

NAM Rig Count Market Share

$615

$654

$687

$352

$183

$50

$85

$0

$100

$200

$300

$400

$500

$600

$700

$800

2012 2013 2014 2015 2016 2017

Revenues impacted by drilling

activity and operators reducing

well expenditures

Service quality, focus and

organizational alignment driving

share gains in the market

Hold #2 market share position in

U.S. land*

Focused on expanding presence

in GOM

Shorebase facility now fully

operational

(1) Source: BHI and company data

Re

ve

n

u

e

(

$

m

il

lio

n

s)

North American Revenues

NAM Rig Count & Market Share(1)

*Based on company data

F L U I D S S Y S T E M S – N O R T H A M E R I C A

8

Full Year

First Quarter

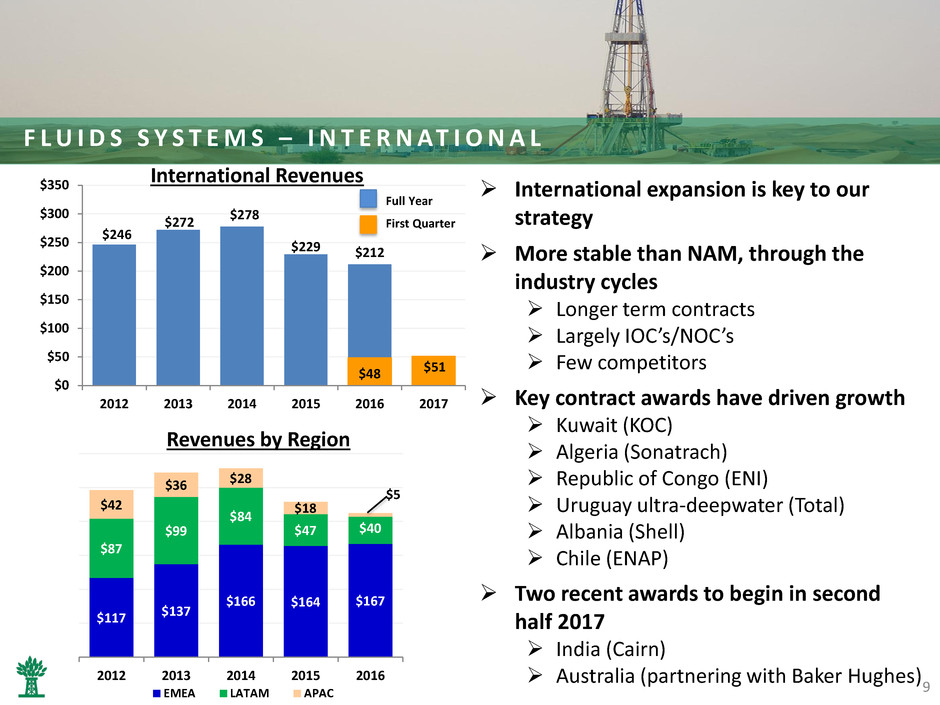

$246

$272

$278

$229 $212

$48 $51

$0

$50

$100

$150

$200

$250

$300

$350

2012 2013 2014 2015 2016 2017

$117 $137

$166 $164 $167

$87

$99

$84

$47 $40

$42

$36 $28

$18

$5

2012 2013 2014 2015 2016

EMEA LATAM APAC

International expansion is key to our

strategy

More stable than NAM, through the

industry cycles

Longer term contracts

Largely IOC’s/NOC’s

Few competitors

Key contract awards have driven growth

Kuwait (KOC)

Algeria (Sonatrach)

Republic of Congo (ENI)

Uruguay ultra-deepwater (Total)

Albania (Shell)

Chile (ENAP)

Two recent awards to begin in second

half 2017

India (Cairn)

Australia (partnering with Baker Hughes)

International Revenues

Revenues by Region

F L U I D S S Y S T E M S – I N T E R N AT I O N A L

9

Full Year

First Quarter

$122

$116

$153

$96

$76

$16

$23

$0

$20

$40

$60

$80

$100

$120

$140

$160

$180

2012 2013 2014 2015 2016 2017

Leading provider of engineered worksite

solutions

Patented technology, service capability and

size of composite mat rental fleet provide

competitive advantage

Recent completion of R&D Center is critical

to drive innovation and expansion of

product offering

Established core rental business in NAM

exploration market, where mats reduce

operator’s costs and improve environmental

protection during drilling and completion

phase

Revenues include rentals and sale of DURA-

BASE composite mats

Total Segment Revenues

R

e

ve

n

u

e

s

($

m

ill

io

n

s)

M AT S & I N T E G R AT E D S E R V I C E S - O V E R V I E W

10

Full Year

First Quarter

Diversifying beyond the wellsite

Accelerate penetration of non-

exploration markets, both domestically

and internationally

Larger addressable market

Similar value drivers as exploration

market

Innovate and commercialize

differentiated system enhancements,

including EPZ Grounding System™ for

the utility industry

M AT S & I N T E G R AT E D S E R V I C E S – S T R AT E G Y A N D S Y S T E M S

11

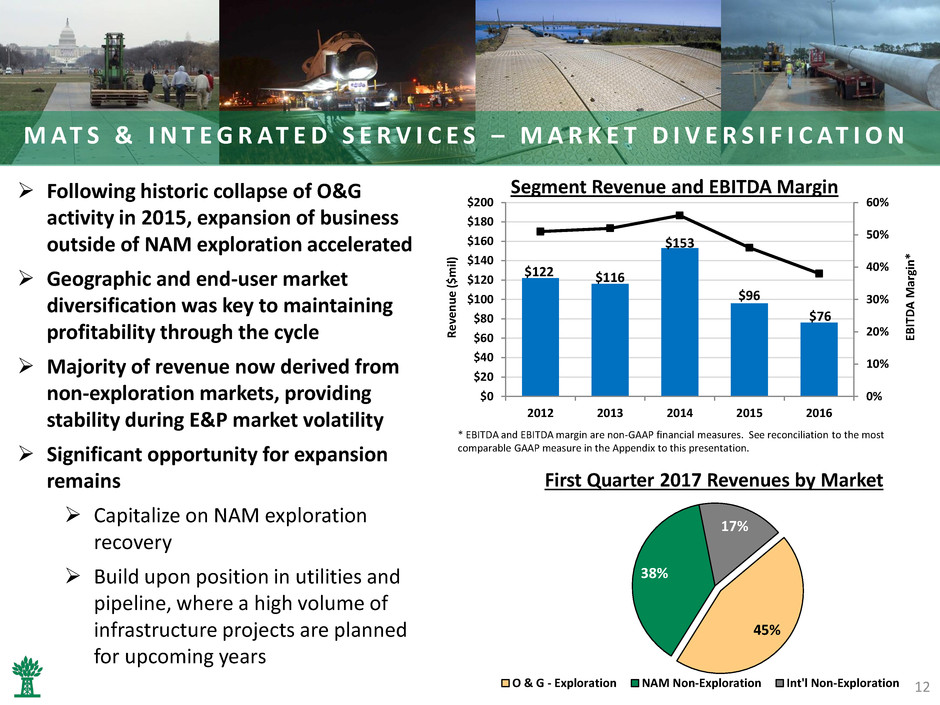

M AT S & I N T E G R AT E D S E R V I C E S – M A R K E T D I V E R S I F I C AT I O N

12

$122 $116

$153

$96

$76

0%

10%

20%

30%

40%

50%

60%

$0

$20

$40

$60

$80

$100

$120

$140

$160

$180

$200

2012 2013 2014 2015 2016

R

e

ve

n

u

e

($

m

il)

EB

IT

D

A

M

ar

gi

n

*

* EBITDA and EBITDA margin are non-GAAP financial measures. See reconciliation to the most

comparable GAAP measure in the Appendix to this presentation.

45%

38%

17%

O & G - Exploration NAM Non-Exploration Int'l Non-Exploration

First Quarter 2017 Revenues by Market

Following historic collapse of O&G

activity in 2015, expansion of business

outside of NAM exploration accelerated

Geographic and end-user market

diversification was key to maintaining

profitability through the cycle

Majority of revenue now derived from

non-exploration markets, providing

stability during E&P market volatility

Significant opportunity for expansion

remains

Capitalize on NAM exploration

recovery

Build upon position in utilities and

pipeline, where a high volume of

infrastructure projects are planned

for upcoming years

Segment Revenue and EBITDA Margin

F I N A N C I A L F O C U S

Short-Term Actions

Focused on managing cost structure

as NAM activity levels improve

Continuing efforts to optimize

working capital

Limit capital investments beyond

growth/diversification projects

Long-term Focus

Continue investing in strategic

projects

IOC/deepwater focus in fluids

Aggressively pursue non-E&P

market expansion in mats

Selectively seek to strengthen core

competencies, including expanding

technology portfolio

$256

$183 $182 $179

$156 $157

$209

$117

$97

$71 $68

$87

20%

23%

26%

29%

32%

35%

$0

$50

$100

$150

$200

$250

$300

2012 2013 2014 2015 2016 First Quarter

2017

Total Debt Net Debt Debt to Book Capital Ratio

Capital Structure

Protecting the Balance Sheet

Issued $100m of 5 year convertible bonds in Dec

2016, and retired $78m of debt

$90m Revolving credit facility provides additional

liquidity

13

A P P E N D I X

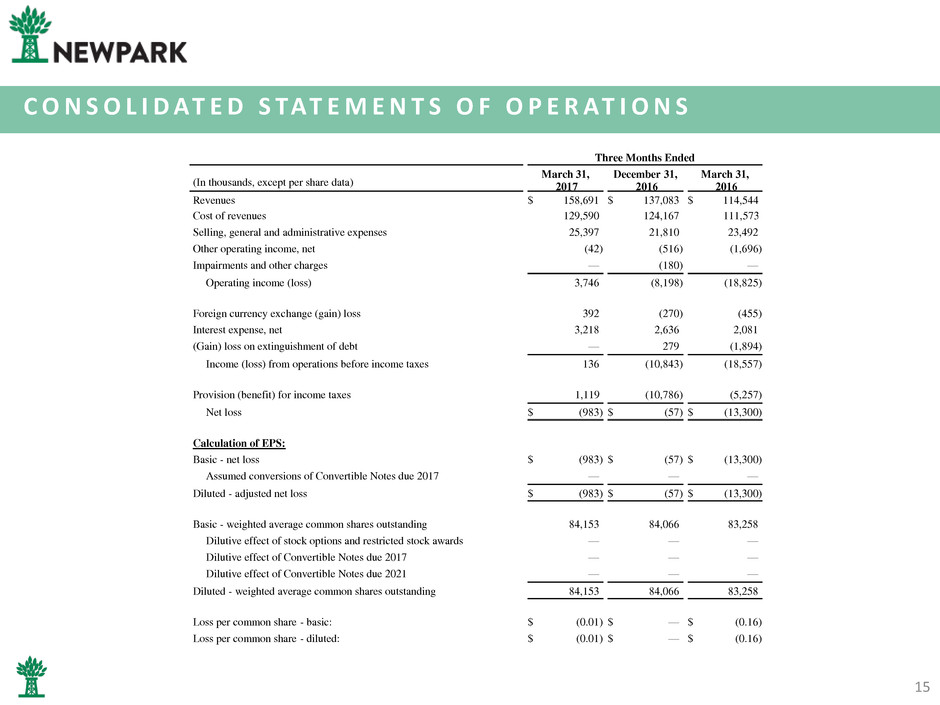

C O N S O L I D AT E D S TAT E M E N T S O F O P E R AT I O N S

15

Three Months Ended

(In thousands, except per share data)

March 31,

2017

December 31,

2016

March 31,

2016

Revenues $ 158,691 $ 137,083 $ 114,544

Cost of revenues 129,590 124,167 111,573

Selling, general and administrative expenses 25,397 21,810 23,492

Other operating income, net (42 ) (516 ) (1,696 )

Impairments and other charges — (180 ) —

Operating income (loss) 3,746 (8,198 ) (18,825 )

Foreign currency exchange (gain) loss 392 (270 ) (455 )

Interest expense, net 3,218 2,636 2,081

(Gain) loss on extinguishment of debt — 279 (1,894 )

Income (loss) from operations before income taxes 136 (10,843 ) (18,557 )

Provision (benefit) for income taxes 1,119 (10,786 ) (5,257 )

Net loss $ (983 ) $ (57 ) $ (13,300 )

Calculation of EPS:

Basic - net loss $ (983 ) $ (57 ) $ (13,300 )

Assumed conversions of Convertible Notes due 2017 — — —

Diluted - adjusted net loss $ (983 ) $ (57 ) $ (13,300 )

Basic - weighted average common shares outstanding 84,153 84,066 83,258

Dilutive effect of stock options and restricted stock awards — — —

Dilutive effect of Convertible Notes due 2017 — — —

Dilutive effect of Convertible Notes due 2021 — — —

Diluted - weighted average common shares outstanding 84,153 84,066 83,258

Loss per common share - basic: $ (0.01 ) $ — $ (0.16 )

Loss per common share - diluted: $ (0.01 ) $ — $ (0.16 )

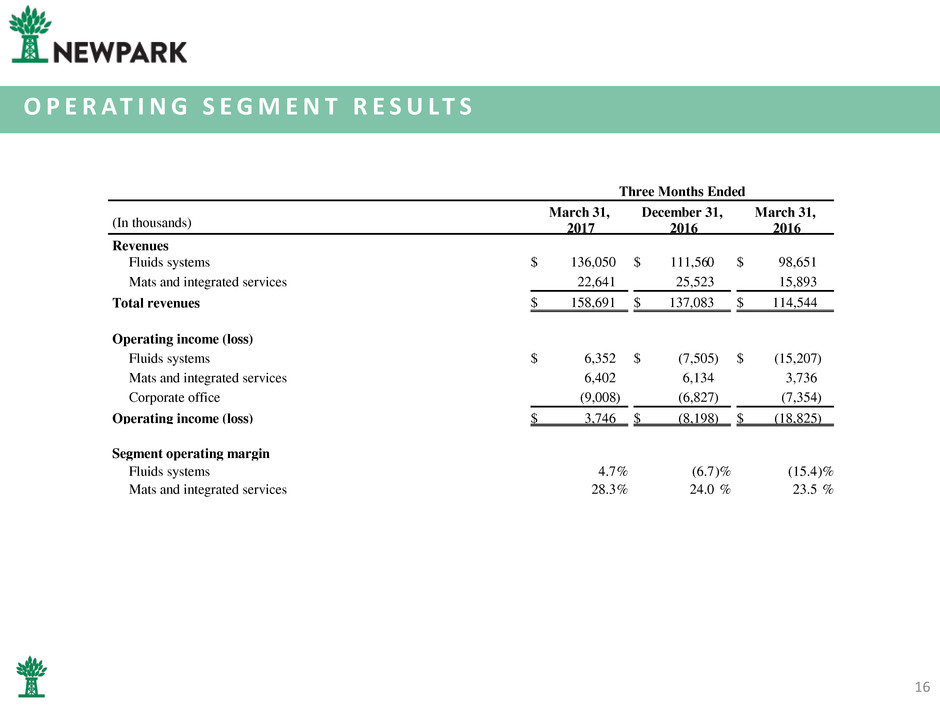

O P E R AT I N G S E G M E N T R E S U LT S

16

Three Months Ended

(In thousands)

March 31,

2017

December 31,

2016

March 31,

2016

Revenues

Fluids systems $ 136,050 $ 111,560 $ 98,651

Mats and integrated services 22,641 25,523 15,893

Total revenues $ 158,691 $ 137,083 $ 114,544

Operating income (loss)

Fluids systems $ 6,352 $ (7,505 ) $ (15,207 )

Mats and integrated services 6,402 6,134 3,736

Corporate office (9,008 ) (6,827 ) (7,354 )

Operating income (loss) $ 3,746 $ (8,198 ) $ (18,825 )

Segment operating margin

Fluids systems 4.7 % (6.7 )% (15.4 )%

Mats and integrated services 28.3 % 24.0 % 23.5 %

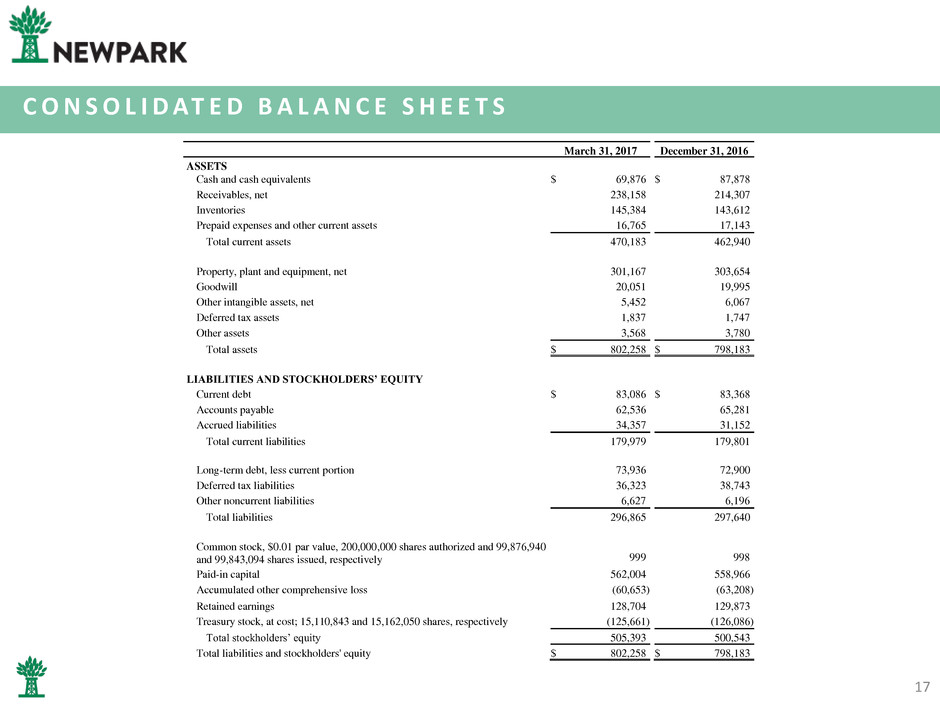

C O N S O L I D AT E D B A L A N C E S H E E T S

17

March 31, 2017 December 31, 2016

ASSETS

Cash and cash equivalents $ 69,876 $ 87,878

Receivables, net 238,158 214,307

Inventories 145,384 143,612

Prepaid expenses and other current assets 16,765 17,143

Total current assets 470,183 462,940

Property, plant and equipment, net 301,167 303,654

Goodwill 20,051 19,995

Other intangible assets, net 5,452 6,067

Deferred tax assets 1,837 1,747

Other assets 3,568 3,780

Total assets $ 802,258 $ 798,183

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current debt $ 83,086 $ 83,368

Accounts payable 62,536 65,281

Accrued liabilities 34,357 31,152

Total current liabilities 179,979 179,801

Long-term debt, less current portion 73,936 72,900

Deferred tax liabilities 36,323 38,743

Other noncurrent liabilities 6,627 6,196

Total liabilities 296,865 297,640

Common stock, $0.01 par value, 200,000,000 shares authorized and 99,876,940

and 99,843,094 shares issued, respectively 999

998

Paid-in capital 562,004 558,966

Accumulated other comprehensive loss (60,653 ) (63,208 )

Retained earnings 128,704 129,873

Treasury stock, at cost; 15,110,843 and 15,162,050 shares, respectively (125,661 ) (126,086 )

Total stockholders’ equity 505,393 500,543

Total liabilities and stockholders' equity $ 802,258 $ 798,183

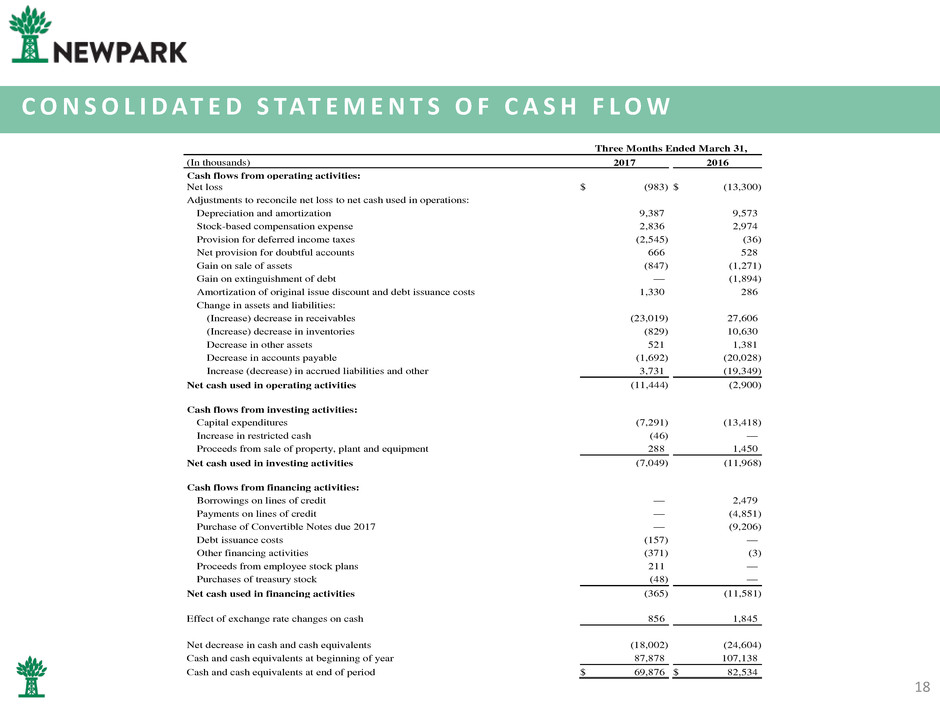

C O N S O L I D AT E D S TAT E M E N T S O F C A S H F L O W

18

Three Months Ended March 31,

(In thousands) 2017 2016

Cash flows from operating activities:

Net loss $ (983 ) $ (13,300 )

Adjustments to reconcile net loss to net cash used in operations:

Depreciation and amortization 9,387 9,573

Stock-based compensation expense 2,836 2,974

Provision for deferred income taxes (2,545 ) (36 )

Net provision for doubtful accounts 666 528

Gain on sale of assets (847 ) (1,271 )

Gain on extinguishment of debt — (1,894 )

Amortization of original issue discount and debt issuance costs 1,330 286

Change in assets and liabilities:

(Increase) decrease in receivables (23,019 ) 27,606

(Increase) decrease in inventories (829 ) 10,630

Decrease in other assets 521 1,381

Decrease in accounts payable (1,692 ) (20,028 )

Increase (decrease) in accrued liabilities and other 3,731 (19,349 )

Net cash used in operating activities (11,444 ) (2,900 )

Cash flows from investing activities:

Capital expenditures (7,291 ) (13,418 )

Increase in restricted cash (46 ) —

Proceeds from sale of property, plant and equipment 288 1,450

Net cash used in investing activities (7,049 ) (11,968 )

Cash flows from financing activities:

Borrowings on lines of credit — 2,479

Payments on lines of credit — (4,851 )

Purchase of Convertible Notes due 2017 — (9,206 )

Debt issuance costs (157 ) —

Other financing activities (371 ) (3 )

Proceeds from employee stock plans 211 —

Purchases of treasury stock (48 ) —

Net cash used in financing activities (365 ) (11,581 )

Effect of exchange rate changes on cash 856 1,845

Net decrease in cash and cash equivalents (18,002 ) (24,604 )

Cash and cash equivalents at beginning of year 87,878 107,138

Cash and cash equivalents at end of period $ 69,876 $ 82,534

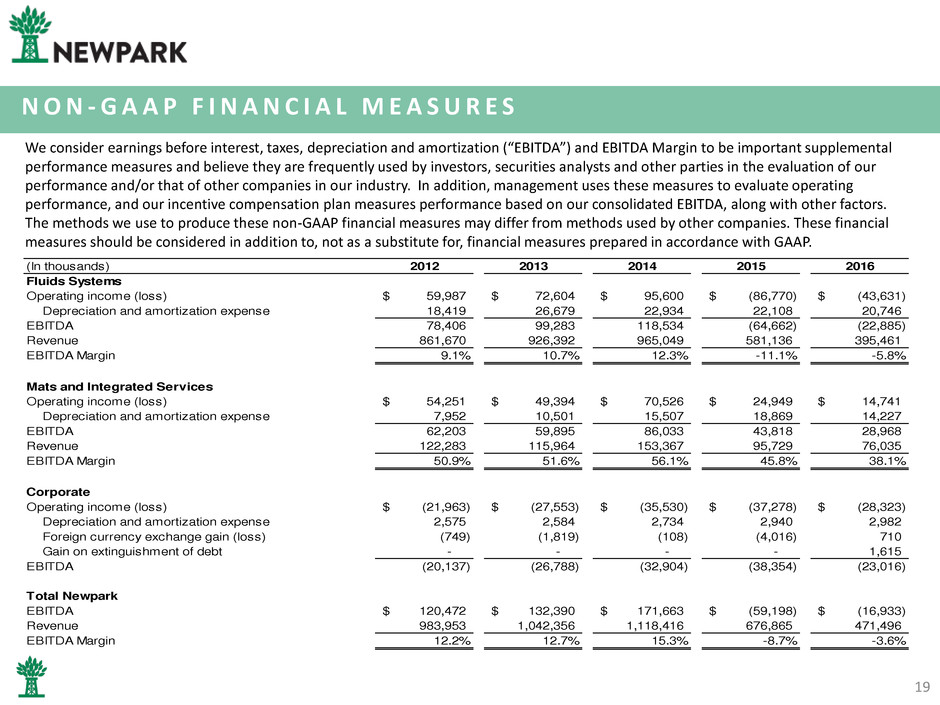

N O N - G A A P F I N A N C I A L M E A S U R E S

19

We consider earnings before interest, taxes, depreciation and amortization (“EBITDA”) and EBITDA Margin to be important supplemental

performance measures and believe they are frequently used by investors, securities analysts and other parties in the evaluation of our

performance and/or that of other companies in our industry. In addition, management uses these measures to evaluate operating

performance, and our incentive compensation plan measures performance based on our consolidated EBITDA, along with other factors.

The methods we use to produce these non-GAAP financial measures may differ from methods used by other companies. These financial

measures should be considered in addition to, not as a substitute for, financial measures prepared in accordance with GAAP.

(In thousands) 2012 2013 2014 2015 2016

Fluids Systems

Operating income (loss) 59,987$ 72,604$ 95,600$ (86,770)$ (43,631)$

Depreciation and amortization expense 18,419 26,679 22,934 22,108 20,746

EBITDA 78,406 99,283 118,534 (64,662) (22,885)

Revenue 861,670 926,392 965,049 581,136 395,461

EBITDA Margin 9.1% 10.7% 12.3% -11.1% -5.8%

Mats and Integrated Services

Operating income (loss) 54,251$ 49,394$ 70,526$ 24,949$ 14,741$

Depreciation and amortization expense 7,952 10,501 15,507 18,869 14,227

EBITDA 62,203 59,895 86,033 43,818 28,968

Revenue 122,283 115,964 153,367 95,729 76,035

EBITDA Margin 50.9% 51.6% 56.1% 45.8% 38.1%

Corporate

Operating income (loss) (21,963)$ (27,553)$ (35,530)$ (37,278)$ (28,323)$

Depreciation and amortization expense 2,575 2,584 2,734 2,940 2,982

Foreign currency exchange gain (loss) (749) (1,819) (108) (4,016) 710

Gain on extinguishment of debt - - - - 1,615

EBITDA (20,137) (26,788) (32,904) (38,354) (23,016)

Total Newpark

EBITDA 120,472$ 132,390$ 171,663$ (59,198)$ (16,933)$

Revenue 983,953 1,042,356 1,118,416 676,865 471,496

EBITDA Margin 12.2% 12.7% 15.3% -8.7% -3.6%

E X P E R I E N C E D L E A D E R S H I P

• Paul Howes President & CEO

• Gregg Piontek Vice President & CFO

• Mark Airola SVP, GC & Admin Officer

• Bruce Smith President

Fluids Systems

• Matthew Lanigan President

Mats & Integrated Services

• Ida Ashley Vice President, Human Resources

20

M A N A G E M E N T B I O G R A P H I E S

Paul L. Howes, President & CEO: Paul L. Howes joined our Board of Directors and was appointed as our Chief Executive Officer in

March 2006. In June 2006, Mr. Howes was also appointed as our President. Mr. Howes’ career has included experience in the defense

industry, chemicals and plastics manufacturing, and the packaging industry. Following the sale of his former company in October 2005

until he joined our Board of Directors in March 2006, Mr. Howes was working privately as an inventor and engaging in consulting and

private investing activities. From 2002 until October 2005, he served as President and Chief Executive Officer of Astaris LLC, a primary

chemicals company headquartered in St. Louis, Missouri, with operations in North America, Europe and South America. Prior to this,

from 1997 until 2002, he served as Vice President and General Manager, Packaging Division, for Flint Ink Corporation, a global ink

company headquartered in Ann Arbor, Michigan with operations in North America, Europe, Asia Pacific and Latin America.

Mr. Howes is also actively engaged in energy industry trade associations. He currently holds the Chairman position on the General

Membership Committee for the American Petroleum Institute (API); and, is a contributing member to the API Board of Directors and

Executive Committee. Additionally, he is a member of the Board of Directors of the National Ocean Industries Association (NOIA).

Gregg S. Piontek, VP & CFO: Gregg joined Newpark in April 2007 and served as Vice President, Controller and Chief Accounting

Officer from April 2007 to October 2011. Prior to joining Newpark, Mr. Piontek was Vice President and Chief Accounting Officer of

Stewart & Stevenson LLC from 2006 to 2007, where he served as the lead executive financial officer for the asset acquisition from

Stewart & Stevenson Services, Inc. and $150 million public debt offering. From 2001 to 2006, Mr. Piontek held the positions of

Assistant Corporate Controller and Division Controller for Stewart & Stevenson Services, Inc. Prior to that, Mr. Piontek served in

various financials roles at General Electric and CNH Global N.V., after beginning his career as an auditor for Deloitte & Touche LLP. Mr.

Piontek is a Certified Public Accountant and holds a bachelor degree in Accountancy from Arizona State University and a Master of

Business Administration degree from Marquette University.

Mark J. Airola, Sr. VP, GC & Admin Officer: Mark joined Newpark in October 2006 as its Vice President, General Counsel and Chief

Administrative Officer. Mr. Airola was named Senior Vice President in February of 2011. Prior to joining Newpark, Mr. Airola was

Assistant General Counsel and Chief Compliance Officer for BJ Services Company, a leading provider of pressure pumping and other

oilfield services to the petroleum industry, serving as an executive officer since 2003. From 1988 to 1995, he held the position of

Senior Litigation Counsel at Cooper Industries, Inc., a global manufacturer of electrical products and tools, with initial responsibility

for managing environmental regulatory matters and litigation and subsequently managing the company’s commercial litigation.

21

Bruce C. Smith, Executive VP and President Fluids Systems: Bruce joined Newpark in April 1998 as Vice President, International.

Since October 2000, he has served as President of its subsidiary Newpark Drilling Fluids, L.P. Prior to joining Newpark, Mr. Smith was

the Managing Director of the U.K. operations of M-I Swaco, a competitor of Newpark Drilling Fluids, where he was responsible for

two business units, including their drilling fluids unit.

Matthew Lanigan, President Mats and Integrated Services: Matthew joined Newpark in April 2016, as President of Newpark Mats

& Integrated Services. Matthew began his professional career at ExxonMobil in Australia working on rigs as a Drilling & Completions

Engineer, progressing from there to Offshore Production Engineer and as a Marketer for Crude & LPG. While pursuing his MBA, he

accepted a position with GE in the Plastics division where he rose to the role of Chief Marketing Officer before transferring to the

Capital division of GE, based in the UK. His first opportunity to work in the United States came with the Enterprise Client Group of

GE's Capital division, where he worked in leadership roles in Sales & Marketing. In 2011, he was appointed as the Director of

Commercial Excellence for Asia Pacific, based in Australia. In addition to growing revenue and market share, key responsibilities for

this role included developing cross-organizational synergies and market entry strategies.

Ida Ashley, VP, Human Resources: Ida joined Newpark in March 2015 as Vice President, Human Resources. Ida has over 20 years of

experience in Human Resources, 17 of which were specific to Oilfield Services where she specialized in Employee Relations, Mergers

& Acquisitions and International HR programs. Ida has worked in a variety of HR leadership roles in Smith International, M-I SWACO

and Schlumberger. Her role prior to joining Newpark was VP of HR, North America in Schlumberger. Originating from Smith

International, she had the unique opportunity to lead the HR integration project team during the Schlumberger/Smith merger from

August 2010 – December 2012. Ida earned her Masters of Science in Human Resources from Houston Baptist University in 2000 and

her Bachelors of Arts in Modern Languages from Texas A&M in 1991.

M A N A G E M E N T B I O G R A P H I E S

22

F O CU S E D ON C U S TOME R ’ S N E E D S