Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Discover Financial Services | d367869d8k.htm |

William Blair 37th Annual Growth Stock Conference David Nelms Chairman & Chief Executive Officer June 15, 2017 ©2017 DISCOVER FINANCIAL SERVICES Exhibit 99.1

Notice The following slides are part of a presentation by Discover Financial Services (the "Company") and are intended to be viewed as part of that presentation. No representation is made that the information in these slides is complete. This presentation is available on the Company’s website (www.discover.com) and the SEC’s website (www.sec.gov). Throughout these materials, direct-to-consumer deposits are referred to as DTC deposits or direct deposits. DTC, or direct, deposits are deposit products that we offer to customers through direct marketing, internet origination and affinity relationships. DTC, or direct, deposits include certificates of deposits, money market accounts, online savings and checking accounts, and IRA certificates of deposit. The presentation contains forward-looking statements. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made, which reflect management’s estimates, projections, expectations or beliefs at that time, and which are subject to risks and uncertainties that may cause actual results to differ materially. For a discussion of certain risks and uncertainties that may affect the future results of the Company, please see "Special Note Regarding Forward-Looking Statements," "Risk Factors," "Business – Competition," "Business – Supervision and Regulation" and "Management’s Discussion and Analysis of Financial Condition and Results of Operations" in the Company’s Annual Report on Form 10-K for the year ended December 31, 2016, and under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2017, which are filed with the SEC and available at the SEC's website. The Company does not undertake to update or revise forward-looking statements as more information becomes available. We own or have rights to use the trademarks, trade names and service marks that we use in conjunction with the operation of our business, including, but not limited to: Discover®, PULSE®, Cashback Bonus®, Discover Cashback Checking®, Discover it®, Freeze ItSM, Discover® Network and Diners Club International®. All other trademarks, trade names and service marks included in this presentation are the property of their respective owners.

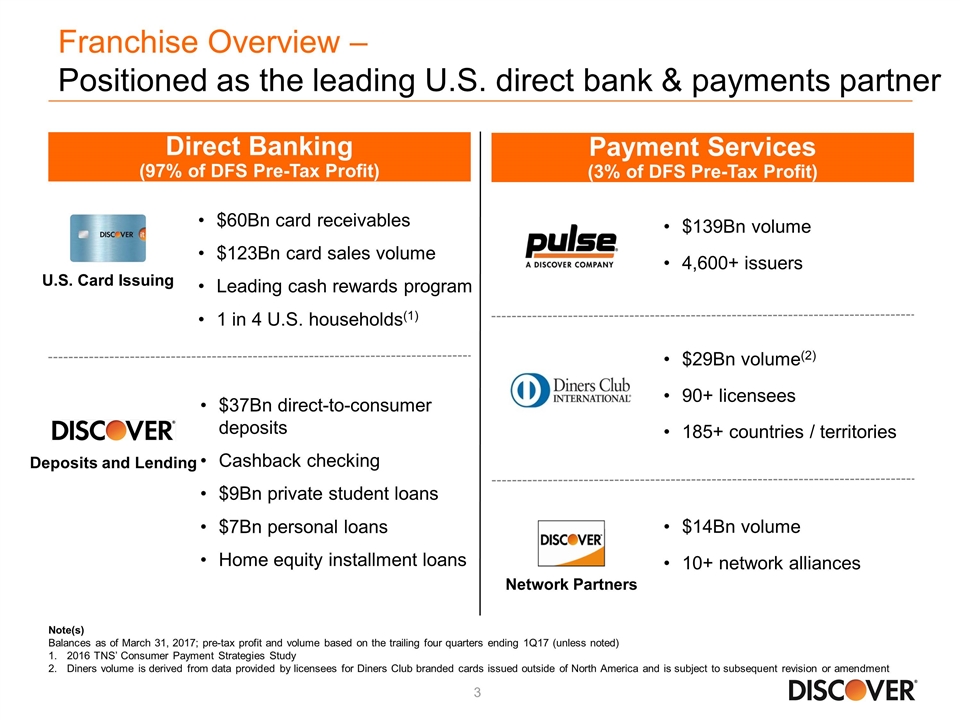

Franchise Overview – Positioned as the leading U.S. direct bank & payments partner Note(s) Balances as of March 31, 2017; pre-tax profit and volume based on the trailing four quarters ending 1Q17 (unless noted) 2016 TNS’ Consumer Payment Strategies Study Diners volume is derived from data provided by licensees for Diners Club branded cards issued outside of North America and is subject to subsequent revision or amendment Direct Banking (97% of DFS Pre-Tax Profit) Payment Services (3% of DFS Pre-Tax Profit) U.S. Card Issuing $60Bn card receivables $123Bn card sales volume Leading cash rewards program 1 in 4 U.S. households(1) Deposits and Lending $37Bn direct-to-consumer deposits Cashback checking $9Bn private student loans $7Bn personal loans Home equity installment loans $14Bn volume 10+ network alliances $139Bn volume 4,600+ issuers $29Bn volume(2) 90+ licensees 185+ countries / territories Network Partners

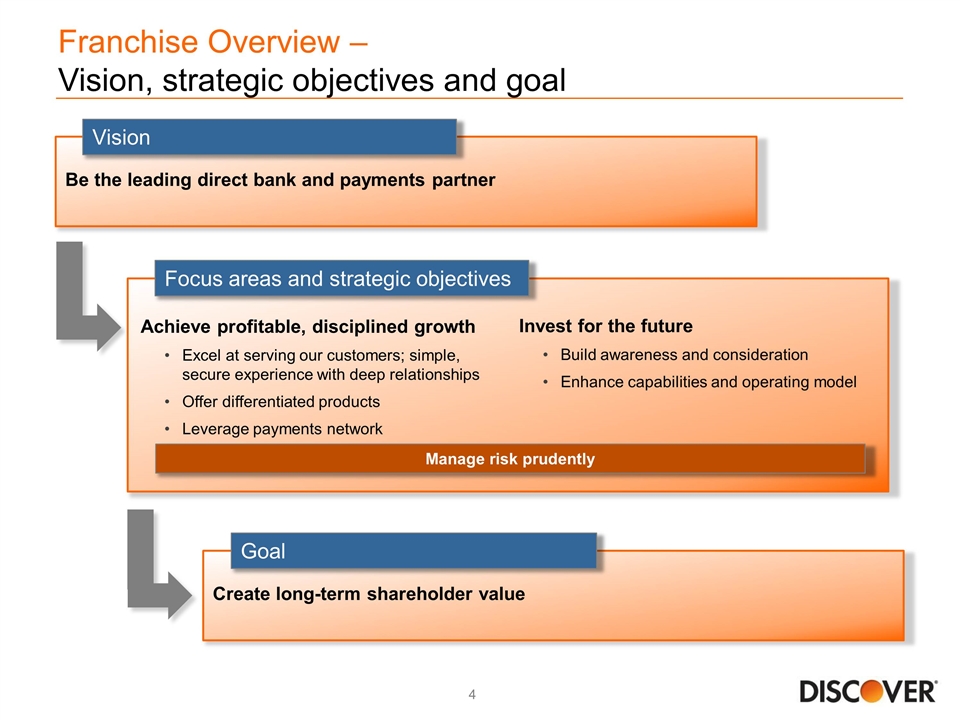

Be the leading direct bank and payments partner Franchise Overview – Vision, strategic objectives and goal Vision Create long-term shareholder value Goal Focus areas and strategic objectives Invest for the future Build awareness and consideration Enhance capabilities and operating model Achieve profitable, disciplined growth Excel at serving our customers; simple, secure experience with deep relationships Offer differentiated products Leverage payments network Manage risk prudently

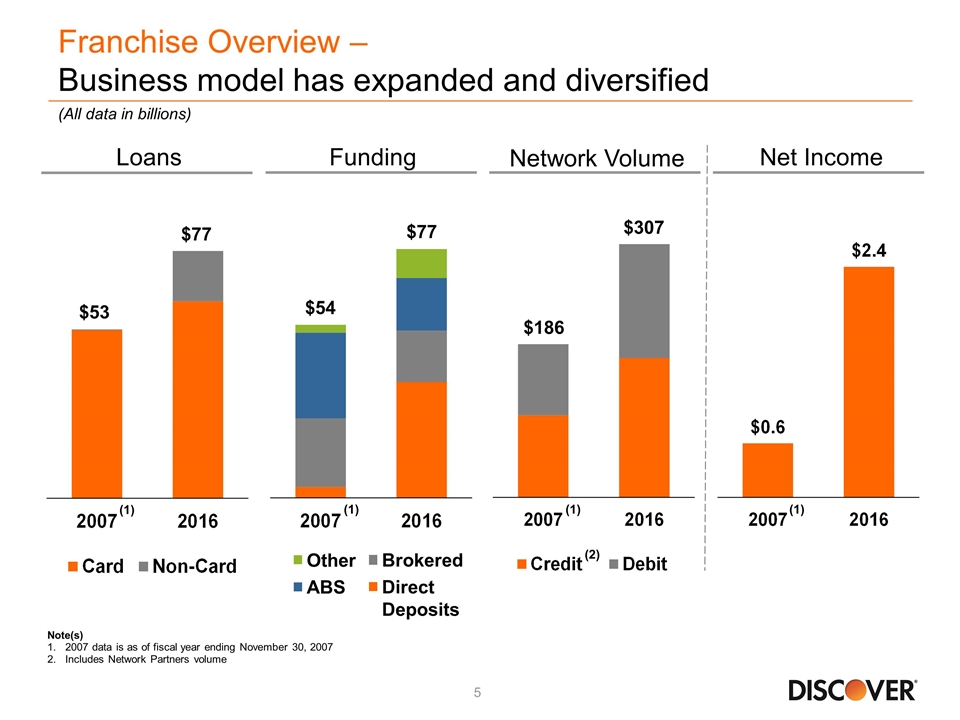

Franchise Overview – Business model has expanded and diversified Loans Funding Network Volume Other ABS Brokered Direct Deposits Note(s) 2007 data is as of fiscal year ending November 30, 2007 Includes Network Partners volume Net Income (All data in billions) $53 $77 $54 $77 $186 $307 (2) (1) (1) (1) (1)

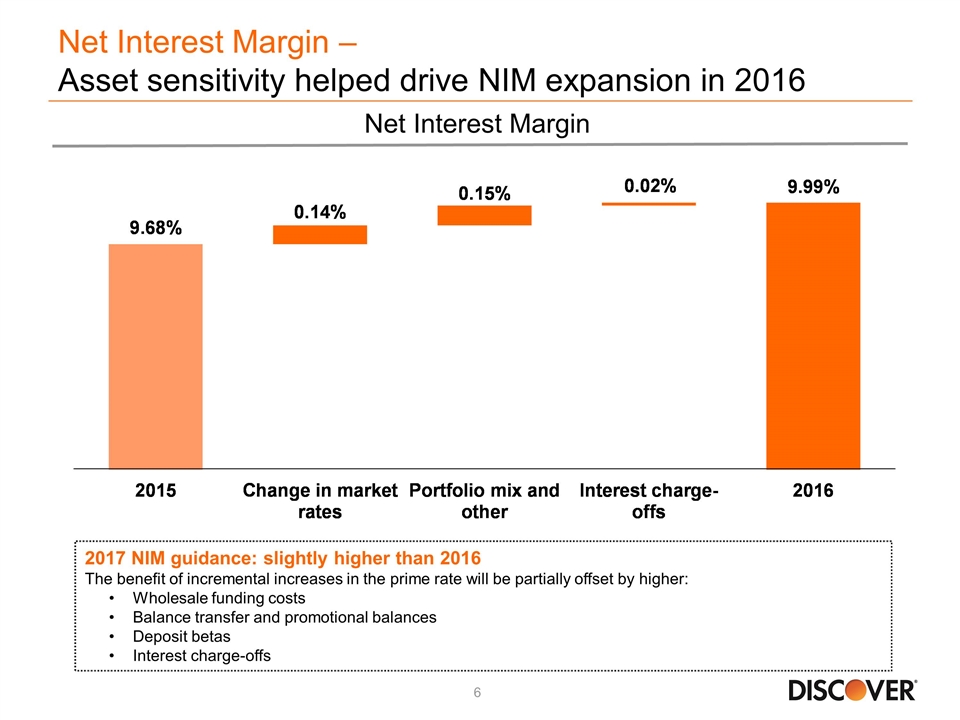

Net Interest Margin – Asset sensitivity helped drive NIM expansion in 2016 Net Interest Margin 2017 NIM guidance: slightly higher than 2016 The benefit of incremental increases in the prime rate will be partially offset by higher: Wholesale funding costs Balance transfer and promotional balances Deposit betas Interest charge-offs

Payments – Leverage payments assets to support card issuing Merchant funded rewards Emerging technologies Flexibility and control Brand recognition

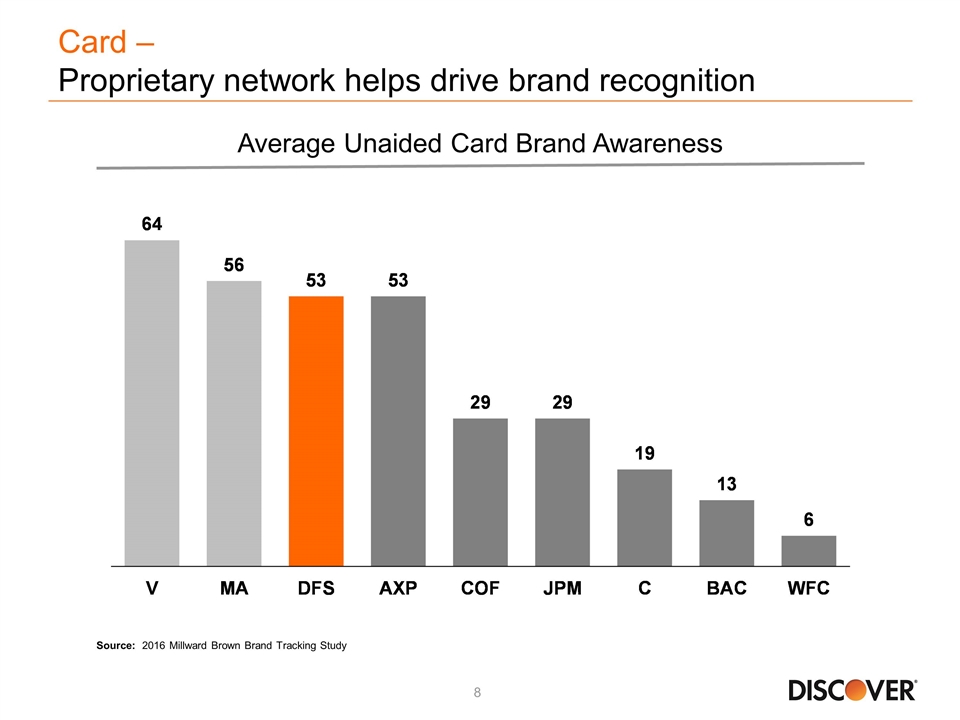

Card – Proprietary network helps drive brand recognition Source: 2016 Millward Brown Brand Tracking Study Average Unaided Card Brand Awareness

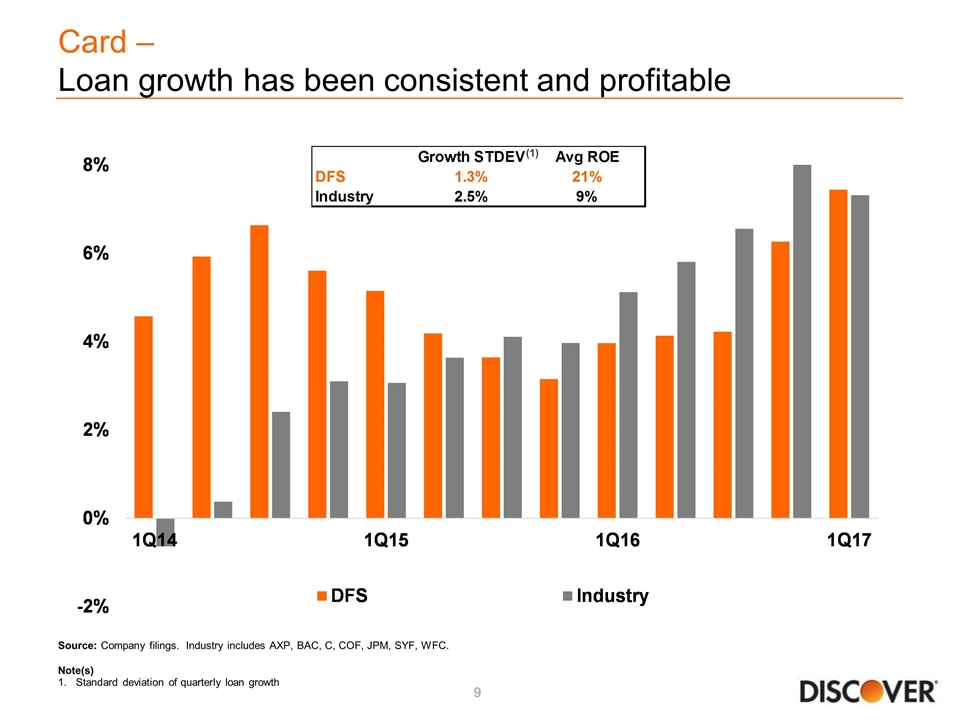

Card – Loan growth has been consistent and profitable Source: Company filings. Industry includes AXP, BAC, C, COF, JPM, SYF, WFC. Note(s) Standard deviation of quarterly loan growth (1)

Card – Recognized leader in customer satisfaction and loyalty Note(s) “Recommend to a Friend” is the percentage of survey participants who strongly / somewhat agree with the statement “I would recommend to a friend” among cardholders who say they use that brand’s card most often to make purchases “Consideration” is the percentage of survey participants saying either “it would be my first choice” or “I would seriously consider it” among general population Brand Strength Customer Satisfaction Source: 2016 Brand Health Tracker Study, Millward Brown

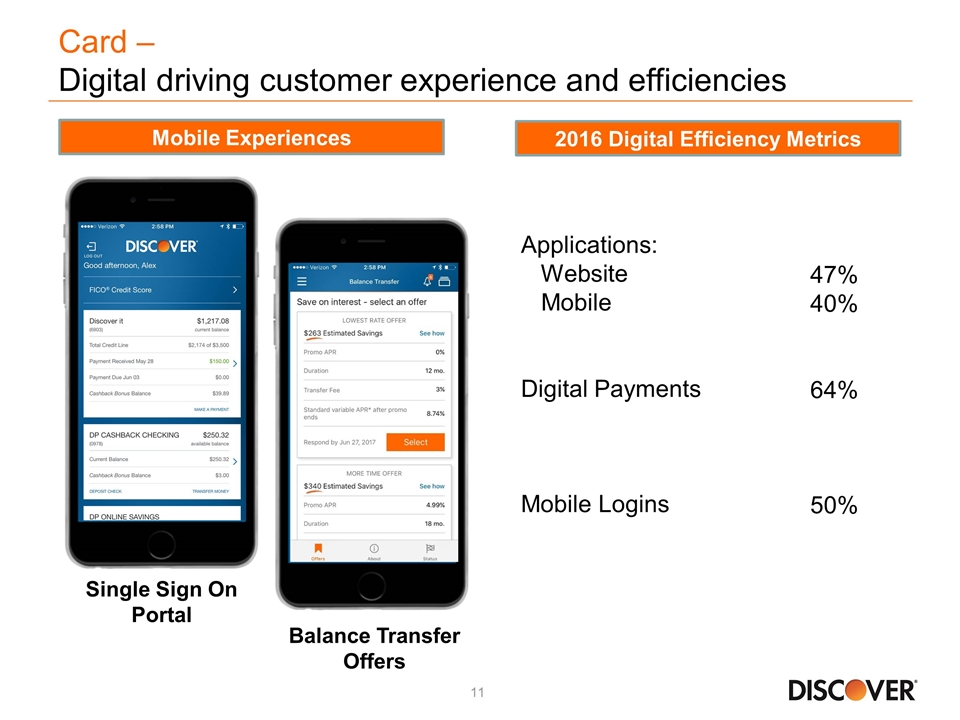

Card – Digital driving customer experience and efficiencies Applications: Website Mobile Digital Payments Mobile Logins 47% 40% 64% 50% Balance Transfer Offers Single Sign On Portal Mobile Experiences 2016 Digital Efficiency Metrics

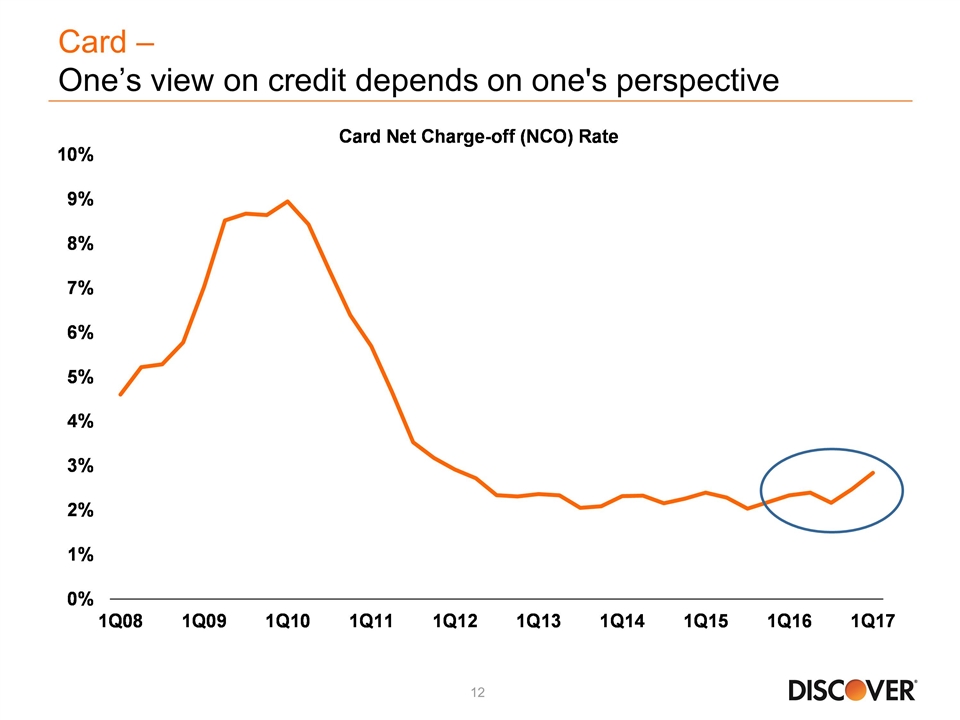

Card – One’s view on credit depends on one's perspective

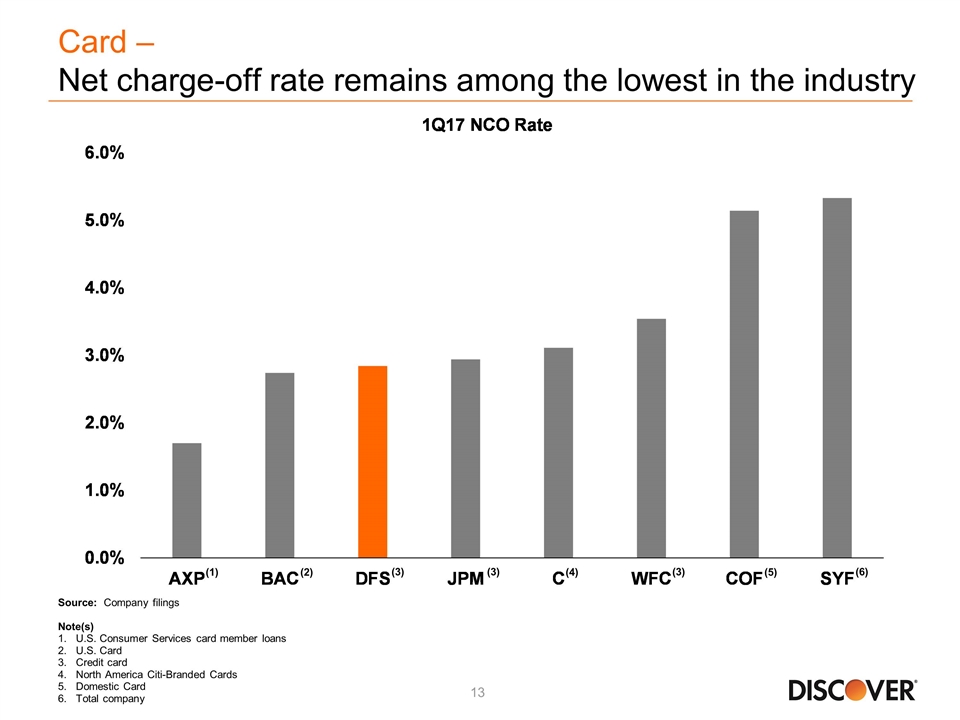

Card – Net charge-off rate remains among the lowest in the industry Source: Company filings Note(s) U.S. Consumer Services card member loans U.S. Card Credit card North America Citi-Branded Cards Domestic Card Total company (1) (2) (4) (5) (6) (3) (3) (3)

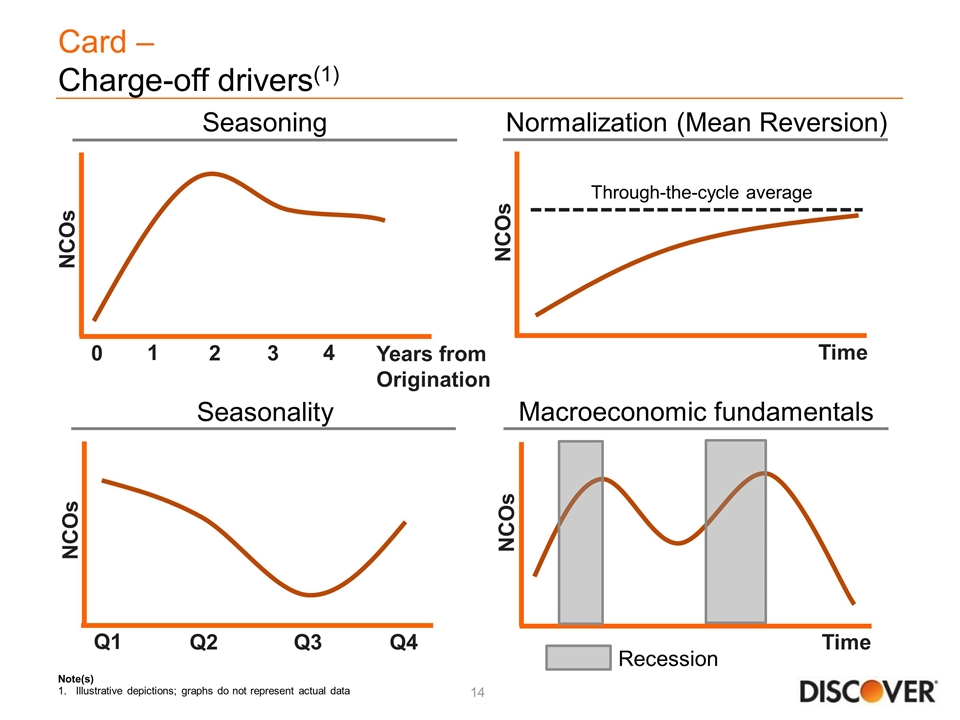

Card – Charge-off drivers(1) Seasonality Seasoning Normalization (Mean Reversion) Macroeconomic fundamentals NCOs NCOs Through-the-cycle average Time Time Recession 1 2 3 0 NCOs Years from Origination 4 Q1 Q2 Q3 Q4 NCOs Note(s) Illustrative depictions; graphs do not represent actual data

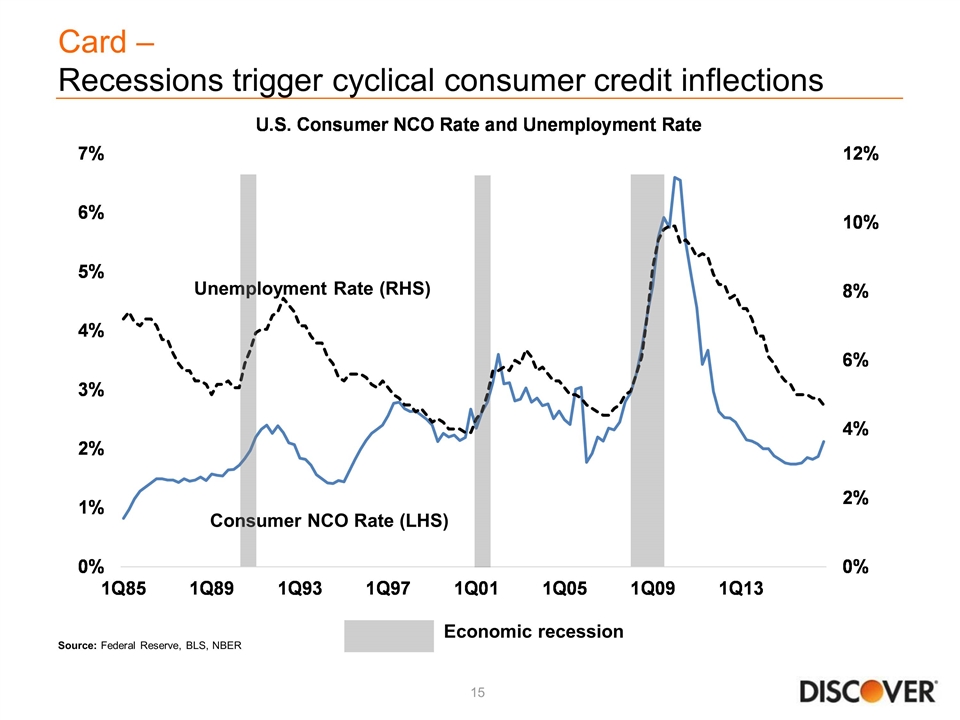

Card – Recessions trigger cyclical consumer credit inflections Consumer NCO Rate (LHS) Unemployment Rate (RHS) Economic recession Source: Federal Reserve, BLS, NBER

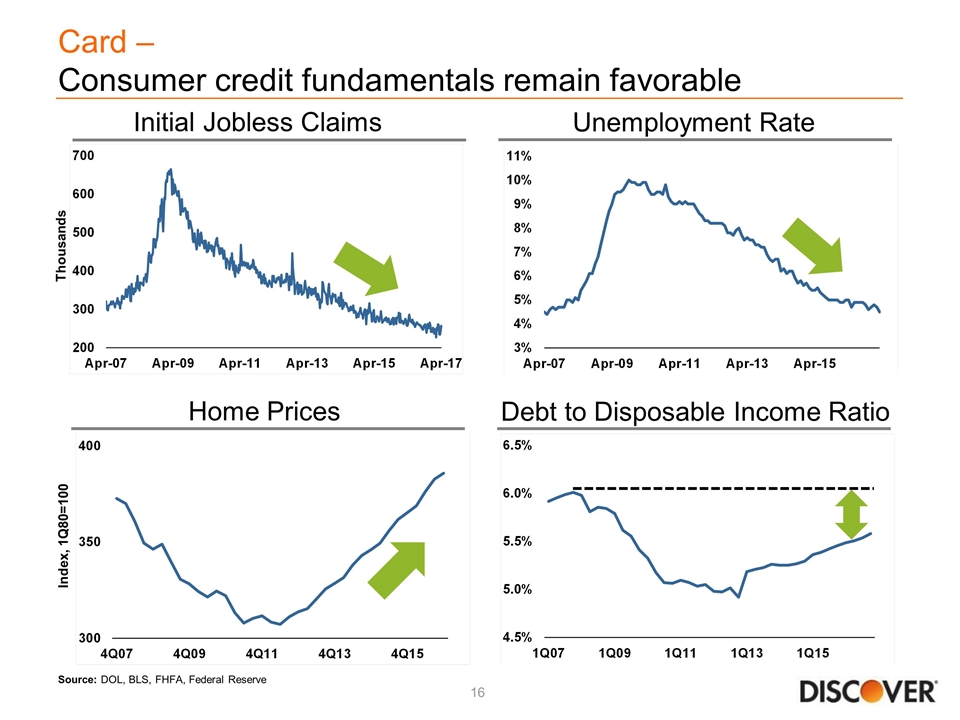

Card – Consumer credit fundamentals remain favorable Initial Jobless Claims Unemployment Rate Home Prices Debt to Disposable Income Ratio Source: DOL, BLS, FHFA, Federal Reserve Index, 1Q80=100 Thousands

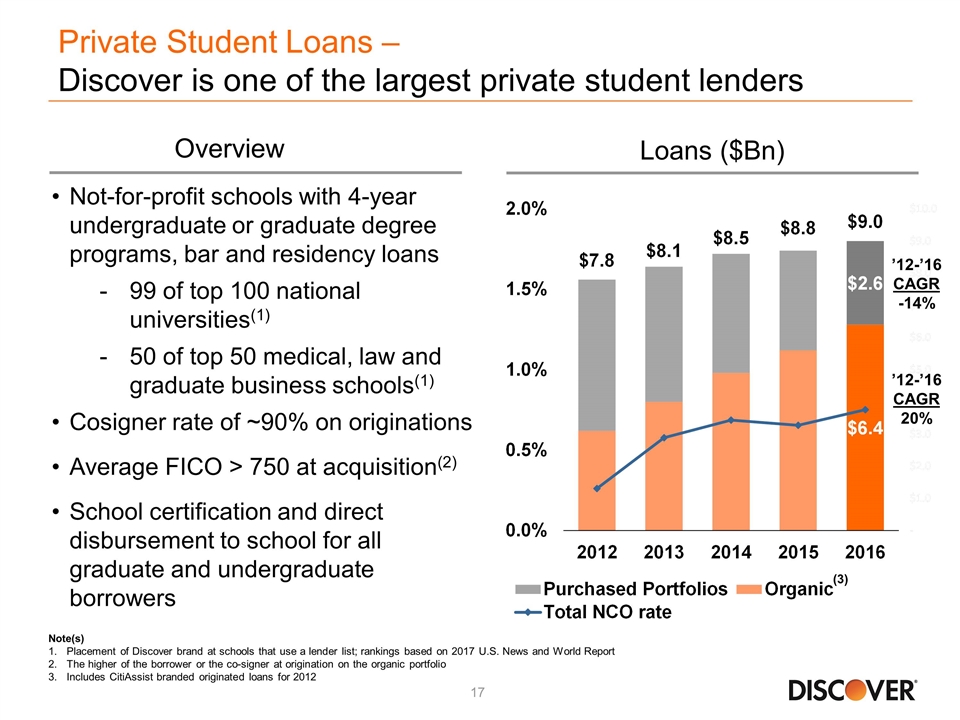

Private Student Loans – Discover is one of the largest private student lenders Overview Not-for-profit schools with 4-year undergraduate or graduate degree programs, bar and residency loans 99 of top 100 national universities(1) 50 of top 50 medical, law and graduate business schools(1) Cosigner rate of ~90% on originations Average FICO > 750 at acquisition(2) School certification and direct disbursement to school for all graduate and undergraduate borrowers Note(s) Placement of Discover brand at schools that use a lender list; rankings based on 2017 U.S. News and World Report The higher of the borrower or the co-signer at origination on the organic portfolio Includes CitiAssist branded originated loans for 2012 Loans ($Bn) ’12-’16 CAGR -14% ’12-’16 CAGR 20% (3)

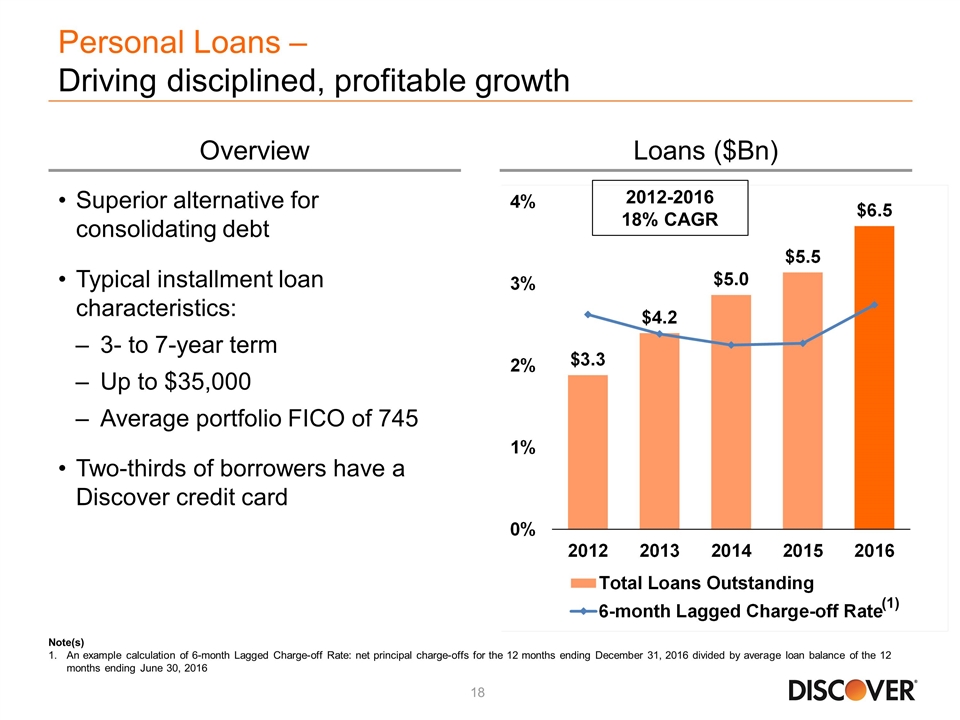

Personal Loans – Driving disciplined, profitable growth Overview Loans ($Bn) Superior alternative for consolidating debt Typical installment loan characteristics: 3- to 7-year term Up to $35,000 Average portfolio FICO of 745 Two-thirds of borrowers have a Discover credit card 2012-2016 18% CAGR (1) Note(s) An example calculation of 6-month Lagged Charge-off Rate: net principal charge-offs for the 12 months ending December 31, 2016 divided by average loan balance of the 12 months ending June 30, 2016

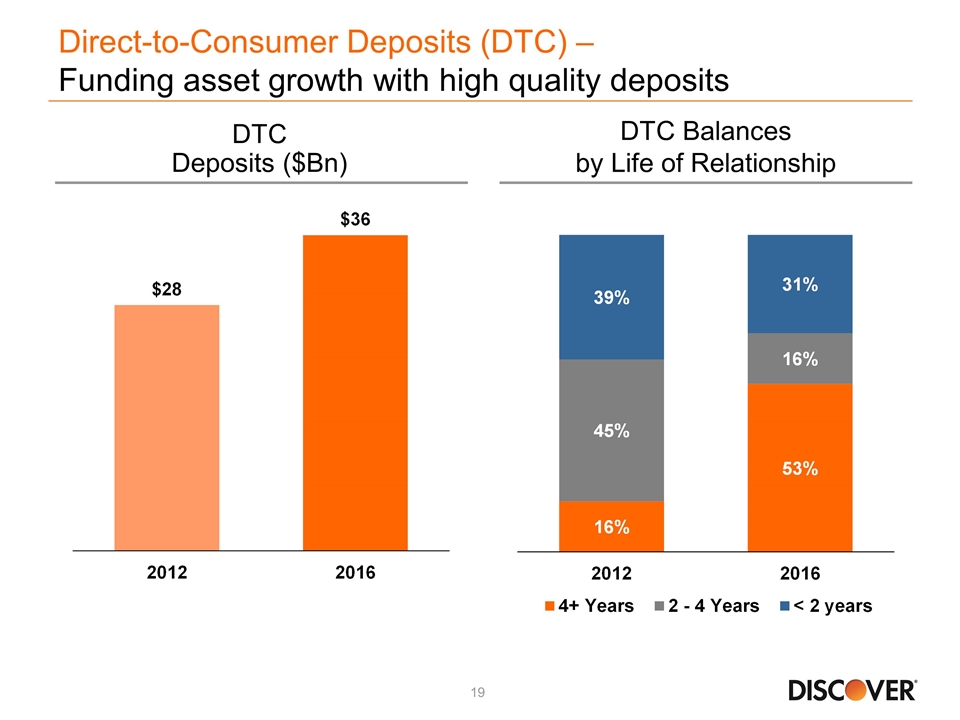

Direct-to-Consumer Deposits (DTC) – Funding asset growth with high quality deposits DTC Deposits ($Bn) DTC Balances by Life of Relationship

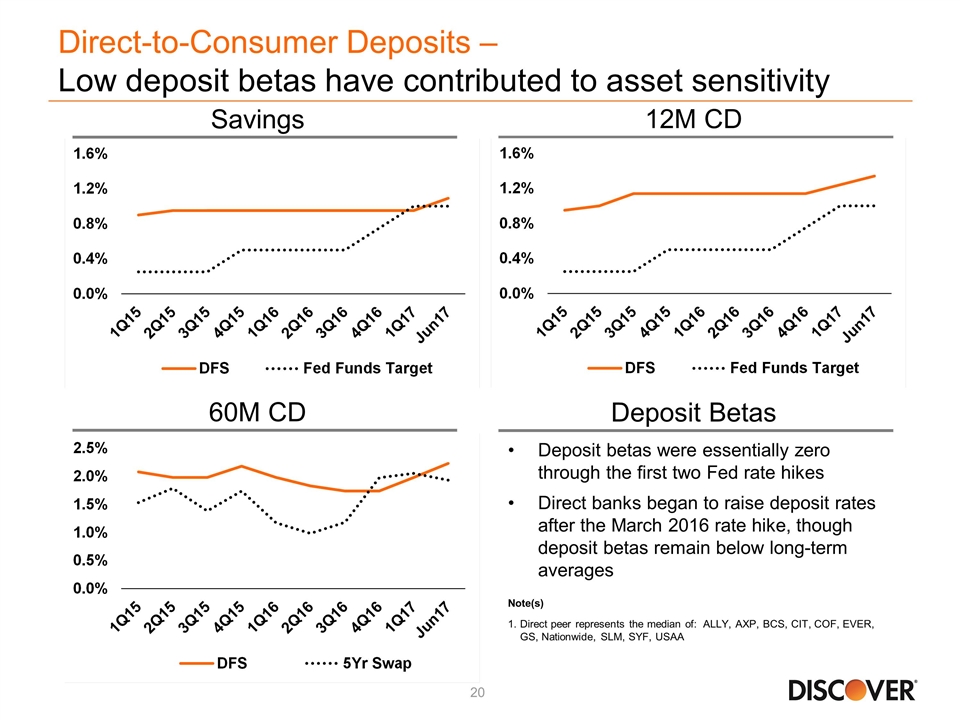

Direct-to-Consumer Deposits – Low deposit betas have contributed to asset sensitivity Savings 12M CD 60M CD Deposit Betas Deposit betas were essentially zero through the first two Fed rate hikes Direct banks began to raise deposit rates after the March 2016 rate hike, though deposit betas remain below long-term averages Note(s) Direct peer represents the median of: ALLY, AXP, BCS, CIT, COF, EVER, GS, Nationwide, SLM, SYF, USAA

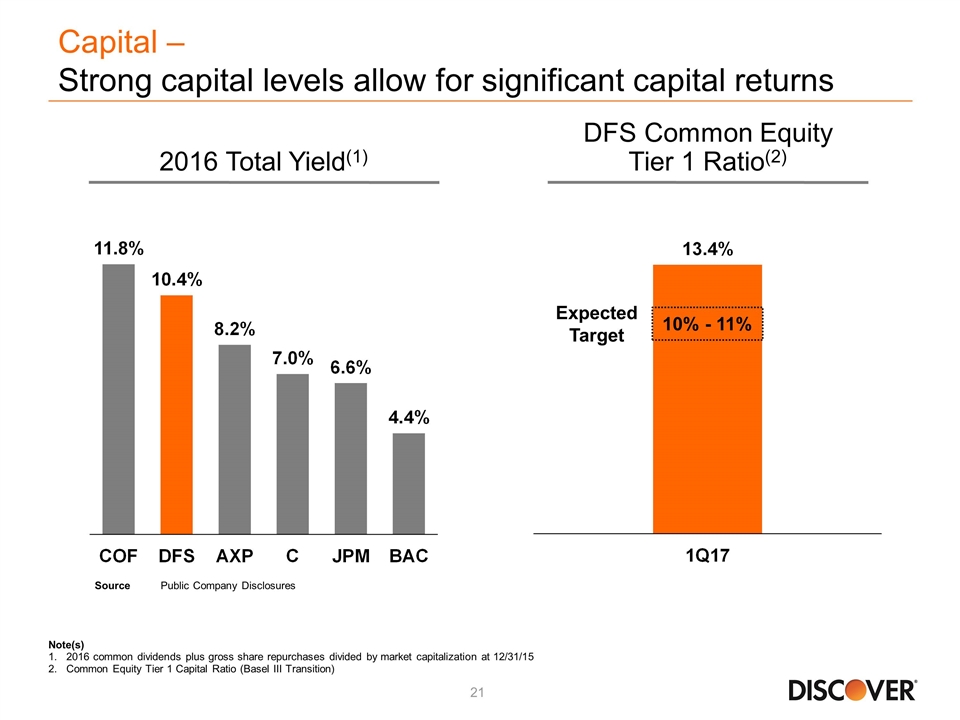

Capital – Strong capital levels allow for significant capital returns Note(s) 2016 common dividends plus gross share repurchases divided by market capitalization at 12/31/15 Common Equity Tier 1 Capital Ratio (Basel III Transition) DFS Common Equity Tier 1 Ratio(2) 10% - 11% 2016 Total Yield(1) SourcePublic Company Disclosures Expected Target