Attached files

| file | filename |

|---|---|

| EX-99.1 - JOINT PRESS RELEASE - HORIZON BANCORP INC /IN/ | hb_8k0614ex991.htm |

| EX-10.1 - VOTING AGREEMENT - HORIZON BANCORP INC /IN/ | hb_8k0614ex101.htm |

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - HORIZON BANCORP INC /IN/ | hb_8k0614ex21.htm |

| 8-K - HORIZON BANCORP INC /IN/ | hb_8k0614.htm |

Exhibit 99.2

Filed by Horizon Bancorp pursuant to

Rule 425 under the Securities Act of 1933 and deemed filed

Pursuant to Rule 14a-12 of the Securities Exchange Act of 1934

Subject Company: Wolverine Bancorp, Inc.

Commission File No. 001-35034

Horizon Enters Great Lakes Bay Region and Troy, Michigan Through Acquisition of Wolverine Bancorp

FORWARD LOOKING STATEMENTS This presentation may contain forward-looking statements regarding the financial performance, business prospects, growth and operating strategies of Horizon Bancorp and its affiliates (collectively, “Horizon” or “HBNC”). For these statements, Horizon claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Statements in the presentation materials should be considered in conjunction with the other information available about Horizon, including the information in the filings we make with the Securities and Exchange Commission. Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future performance. The forward-looking statements are based on management’s expectations and are subject to a number of risks and uncertainties. We have tried, wherever possible, to identify such statements by using words such as “anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,” “will” and similar expressions in connection with any discussion of future operating or financial performance. Although management believes that the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties that could cause actual results to differ materially include risk factors relating to the banking industry and the other factors detailed from time to time in Horizon’s reports filed with the Securities and Exchange Commission, including those described in Horizon’s Annual Report on Form 10-K. Undue reliance should not be placed on the forward-looking statements, which speak only as of the date hereof. Horizon does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions that may be made to update any forward-looking statement to reflect the events or circumstances after the date on which the forward-looking statement is made, or reflect the occurrence of unanticipated events, except to the extent required by law. Disclosures

ADDITIONAL INFORMATION FOR SHAREHOLDERS In connection with the proposed merger, Horizon will file with the SEC a Registration Statement on Form S-4 that will include a Proxy Statement of Wolverine Bancorp, Inc. (“Wolverine” or “WBKC”) and a Prospectus of Horizon (the “proxy statement/prospectus”), as well as other relevant documents concerning the proposed transaction. SHAREHOLDERS AND INVESTORS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The proxy statement/prospectus and other relevant materials (when they become available), and any other documents Horizon has filed with the SEC, may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents Horizon has filed with the SEC from Horizon at www.horizonbank.com under the tab “About Us – Investor Relations – Documents – SEC Filings.” Alternatively, these documents, when available, can be obtained free of charge from Horizon upon written request to Horizon Bancorp, Attn: Dona Lucker, Shareholder Relations Officer, 515 Franklin Square, Michigan City, Indiana 46360 or by calling (219) 874-9272. The information available through Horizon’s website is not and shall not be deemed part of this presentation or incorporated by reference into other filings Horizon makes with the SEC. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. Horizon and Wolverine and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Wolverine in connection with the proposed merger. Information about the directors and executive officers of Horizon is set forth in Horizon’s Annual Report on Form 10-K filed with the SEC on February 28, 2017, and in the proxy statement for Horizon’s 2017 annual meeting of shareholders, as filed with the SEC on March 17, 2017. Additional information regarding the interests of these participants and any other persons who may be deemed participants in the transaction may be obtained by reading the proxy statement/prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph. Disclosures

* Wolverine Bancorp, Inc. Summary Company Profile Headquartered in Midland, Michigan (also known as the Great Lakes Bay Region)Strategic position in key Michigan marketsStrong profitability metrics with an LTM ROAA of 1.21%Solid asset quality with NPA’s of total assets of 1.60% and LLR’s of gross loans of 2.69%2nd in deposit market share in Midland MSATroy, MI loan production office (“LPO”) provides access to attractive Oakland County market Financial Highlights Financial Highlights Financial Highlights Financial Highlights ($000s) 2015 2016 LTM 3/31 Assets $417,813 $434,435 $379,325 Loans 324,674 329,932 324,680 Deposits 281,701 280,548 271,110 Net Income 3,186 4,353 4,718 ROAA 0.89% 1.14% 1.21% TCE/TA 14.48% 14.04% 16.47% NPAs/Assets 1.79% 1.49% 1.60% Pro-forma Financial Highlights(1) Pro-forma Financial Highlights(1) Locations 67 Assets $3,721 Million Loans $2,610 Million Deposits $2,864 Million Pending WBKC BranchesWBKC LPOHBNC BranchesHBNC LPOsPending LFYC Branches Financials as of 3/31/2017 reflect pending Lafayette Community Bancorp (“LFYC”) and Wolverine acquisition, excluding merger adjustments Wolverine

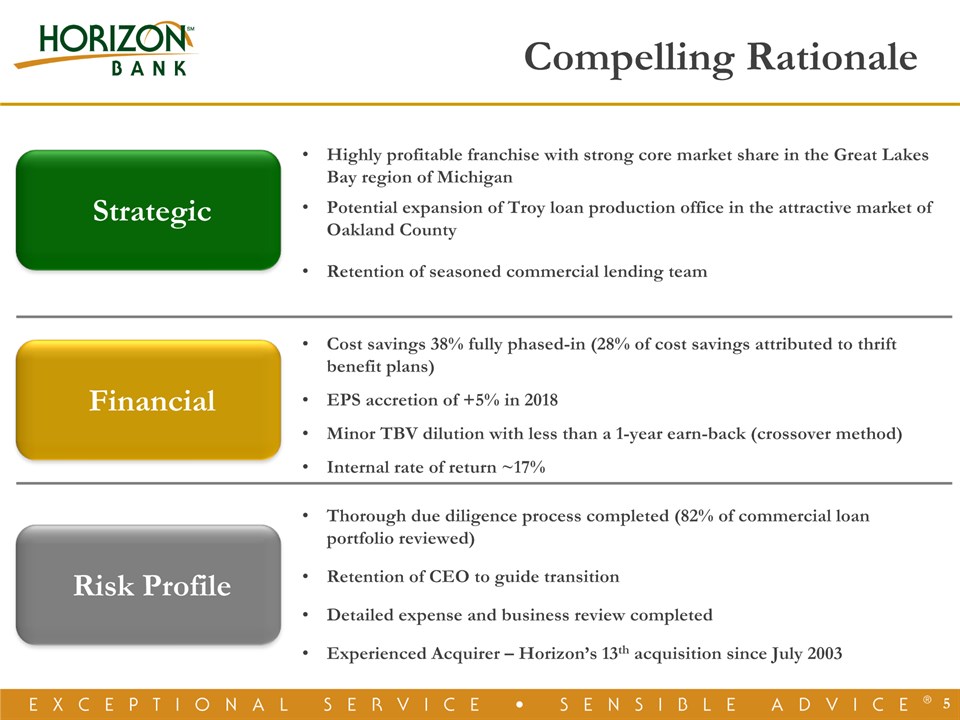

* Compelling Rationale Strategic Financial Highly profitable franchise with strong core market share in the Great Lakes Bay region of MichiganPotential expansion of Troy loan production office in the attractive market of Oakland CountyRetention of seasoned commercial lending team Cost savings 38% fully phased-in (28% of cost savings attributed to thrift benefit plans)EPS accretion of +5% in 2018Minor TBV dilution with less than a 1-year earn-back (crossover method)Internal rate of return ~17% Risk Profile Thorough due diligence process completed (82% of commercial loan portfolio reviewed) Retention of CEO to guide transitionDetailed expense and business review completedExperienced Acquirer – Horizon’s 13th acquisition since July 2003

* Wolverine’s Premier Market Midland Deposit Market Share – 6/30/2016 Midland Deposit Market Share – 6/30/2016 Midland Deposit Market Share – 6/30/2016 Midland Deposit Market Share – 6/30/2016 Rank Institution (ST) Deposits ($000s) Market Share 1 Chemical Financial Corp. (MI) $1,051,615 67.1% 2 Wolverine Bancorp Inc. (MI) 251,526 16.0% 3 Comerica Inc. (TX) 107,299 6.8% 4 Huntington Bancshares Inc. (OH) 51,075 3.3% 5 Fifth Third Bancorp (OH) 39,437 2.5% 6 Isabella Bank Corp. (MI) 34,233 2.2% 7 PNC Financial Services Group (PA) 33,154 2.1% Total Institutions 1,568,339 100% Ranked 2nd in the Midland MSA by deposits in 2016Wolverine has an loan production office (“LPO”) in Oakland County, which has a population of 1.25 million and a median HH income greater than $70KThe Great Lakes Bay Region, (“GLBR”) has a population of just over 500,000The GLBR is a magnet for great companies in advanced manufacturing, research, health care, professional services, agribusiness and more Median HH Income 2017(1) Market Commentary Source: SNL Financial; Great Lake Bay Sites Website

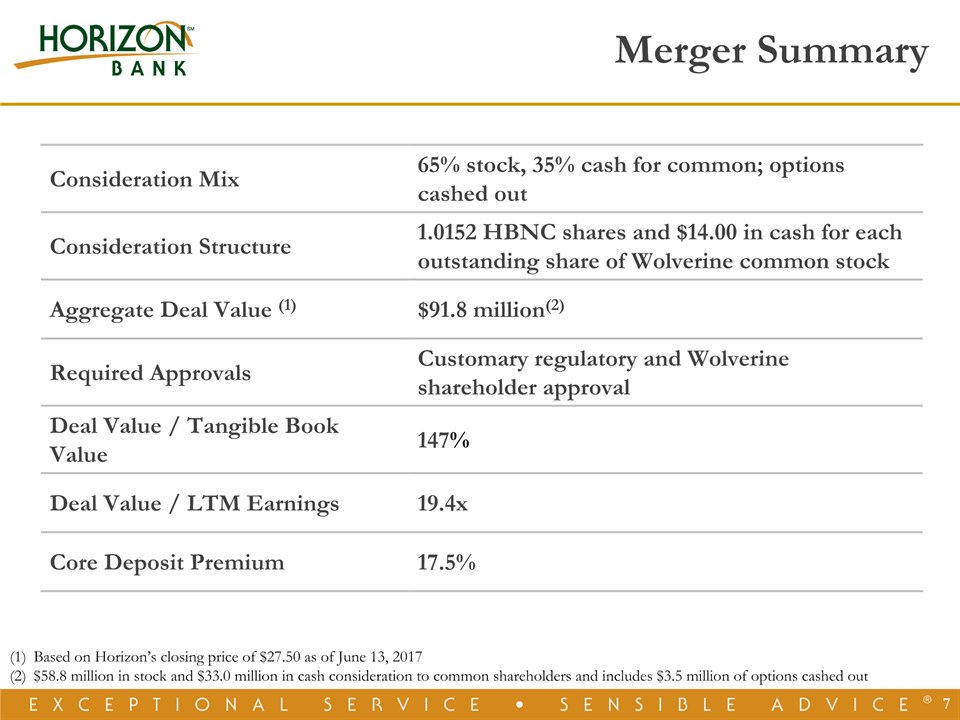

* Merger Summary Consideration Mix 65% stock, 35% cash for common; options cashed out Consideration Structure 1.0152 HBNC shares and $14.00 in cash for each outstanding share of Wolverine common stock Aggregate Deal Value (1) $91.8 million(2) Required Approvals Customary regulatory and Wolverine shareholder approval Deal Value / Tangible Book Value 147% Deal Value / LTM Earnings 19.4x Core Deposit Premium 17.5% Based on Horizon’s closing price of $27.50 as of June 13, 2017$58.8 million in stock and $33.0 million in cash consideration to common shareholders and includes $3.5 million of options cashed out

* Transaction Assumptions Category Assumption Cost saves(1) 38% fully phased-in, 50% realized in 2017 1x after-tax charges $4.6 million Gross credit mark $4.3 million Core deposit intangibles $2.0 million or 1.5% of core deposits Pro forma franchise enhancements None modeled, however, opportunities exist through increased lending limit and market penetration Minimum equity requirement Transaction consideration subject to downward adjustment should Wolverine’s equity at closing fall below May 31st, 2017 balance, excluding merger related charges and other certain adjustments Thrift benefit plan expense cost saves as a percentage of total cost saves – ESOP 17%, stock option and awards 11%.

A Company on the Move * Assets ($ Mil.) $721 $3,721(1) Loans($ Mil.) $548 $2,610(1) Deposits($ Mil.) $489 $2,864(1) OrganicExpan.(11) St. JosephS. BendElkhart Lake County Kalamazoo Indianapolis Carmel Ft. WayneGrand Rapids Noblesville, IN(2)Columbus, Ohio(3) M&A(13) Anchor Mortgage Alliance American Trust Heartland 1st MortgageSummitPeoples FarmersLaPorteCNB BargersvilleLafayetteWolverine 12% CAGR 12% CAGR 13% CAGR Financials as of 3/31/2017 reflect pending Lafayette Community Bancorp and Wolverine acquisition, excluding merger adjustments Planned new office for 2017Loan Production Office located in Dublin, Ohio

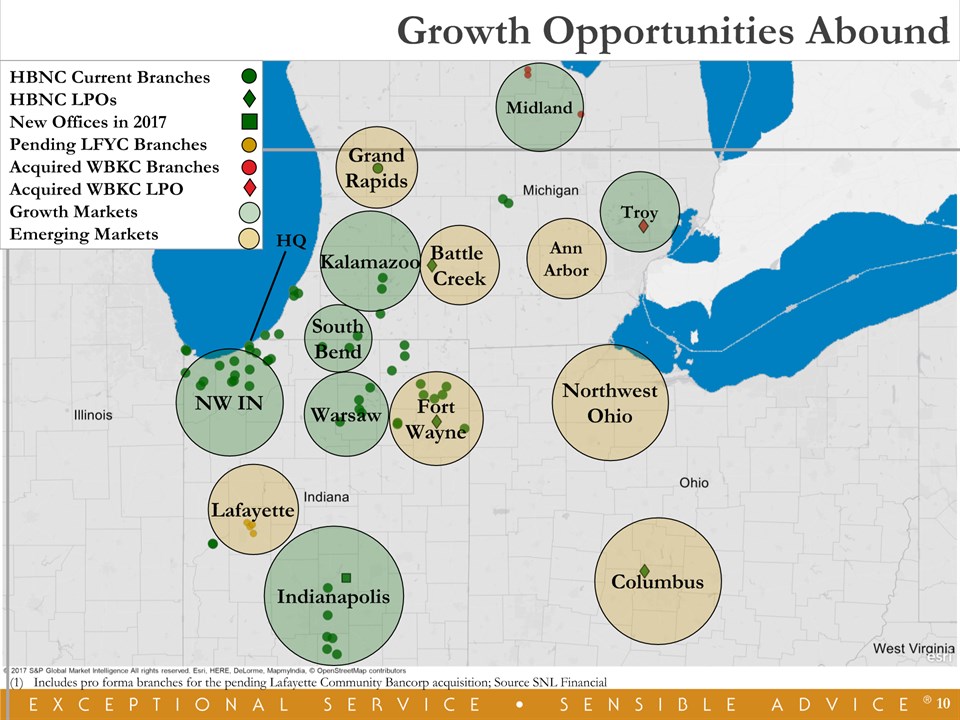

Battle Creek Indianapolis Columbus FortWayne * GrandRapids Troy NorthwestOhio Lafayette Kalamazoo SouthBend Warsaw NW IN HQ Growth Opportunities Abound Includes pro forma branches for the pending Lafayette Community Bancorp acquisition; Source SNL Financial HBNC Current BranchesHBNC LPOsNew Offices in 2017Pending LFYC BranchesAcquired WBKC BranchesAcquired WBKC LPOGrowth MarketsEmerging Markets AnnArbor Midland

If you have questions please contact:Mark SecorChief Financial Officer515 Franklin SquareMichigan City, IN 46360(219) 873-2611