Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - BOSTON OMAHA Corp | d375000dex992.htm |

| EX-23.3 - EX-23.3 - BOSTON OMAHA Corp | d375000dex233.htm |

| EX-23.2 - EX-23.2 - BOSTON OMAHA Corp | d375000dex232.htm |

| EX-1.1 - EX-1.1 - BOSTON OMAHA Corp | d375000dex11.htm |

| S-1/A - S-1/A - BOSTON OMAHA Corp | d375000ds1a.htm |

Exhibit 10.7

OFFICE LEASE

between

TR PRESIDENTS PLACE CORP., a Delaware corporation

Landlord

and

UNITED CASUALTY & SURETY INSURANCE COMPANY, a Massachusetts corporation

Tenant

Presidents Place

1250 Hancock Street

Quincy, Massachusetts

TABLE OF CONTENTS

| PAGE | ||||

| ARTICLE I REFERENCE DATA AND EXHIBITS |

1 | |||

| 1.1 DATA |

1 | |||

| 1.2 EFFECT OF REFERENCE TO DATA |

4 | |||

| 1.3 EXHIBITS |

4 | |||

| 1.4 CERTAIN DEFINITIONS |

4 | |||

| ARTICLE II DEMISED PREMISES; APPURTENANT RIGHTS AND RESERVATIONS |

9 | |||

| 2.1 LEASE OF DEMISED PREMISES |

9 | |||

| 2.2 RIGHT TO USE COMMON AREAS |

9 | |||

| 2.3 RIGHT TO USE PARKING SPACES |

9 | |||

| 2.4 LANDLORD RESERVATIONS |

9 | |||

| ARTICLE III TERM |

10 | |||

| 3.1 TERM |

10 | |||

| 3.2 OPTION TO EXTEND |

10 | |||

| ARTICLE IV RENT |

12 | |||

| 4.1 MONTHLY FIXED RENT PAYMENTS |

12 | |||

| 4.2 ADJUSTMENT FOR OPERATING EXPENSES ALLOCABLE TO THE DEMISED PREMISES |

12 | |||

| 4.3 ADJUSTMENT FOR REAL ESTATE TAXES ALLOCABLE TO THE DEMISED PREMISES |

12 | |||

| 4.4 STATEMENTS; DUE DATES OF ADDITIONAL PAYMENTS |

13 | |||

| 4.5 PERIOD OF ACCOUNTING |

15 | |||

| 4.6 UTILITY CHARGES |

15 | |||

| 4.7 ABATEMENT PERIOD |

15 | |||

| ARTICLE V CONSTRUCTION; ADDITIONS AND ALTERATIONS |

15 | |||

| 5.1 LEASEHOLD IMPROVEMENTS |

15 | |||

| 5.2 AS-IS CONDITION |

16 | |||

| 5.3 TENANT’S DELAYS AND SUBSTANTIAL COMPLETION OF WORK |

16 | |||

| 5.4 ALTERATIONS AND ADDITIONS |

17 | |||

| 5.5 GENERAL PROVISIONS APPLICABLE TO CONSTRUCTION |

18 | |||

| 5.6 REPRESENTATIVES |

18 | |||

i

TABLE OF CONTENTS

| PAGE | ||||

| ARTICLE VI LANDLORD’S COVENANTS; INTERRUPTIONS AND DELAYS |

19 | |||

| 6.1 LANDLORD COVENANTS |

19 | |||

| 6.1.1 Services Furnished by Landlord |

19 | |||

| 6.1.2 Additional Services Available to Tenant |

20 | |||

| 6.1.3 Roof, Exterior, Floor Slab and Common Facility Repairs |

20 | |||

| 6.1.4 Quiet Enjoyment |

20 | |||

| 6.2 INTERRUPTIONS AND DELAYS IN SERVICES AND REPAIRS |

21 | |||

| ARTICLE VII TENANT’S COVENANTS |

21 | |||

| 7.1 PAYMENTS |

21 | |||

| 7.2 REPAIR |

22 | |||

| 7.3 USE |

22 | |||

| 7.4 HAZARDOUS SUBSTANCES |

22 | |||

| 7.5 OBSTRUCTIONS; ITEMS VISIBLE FROM EXTERIOR; RULES AND REGULATIONS |

24 | |||

| 7.6 SAFETY APPLIANCES; LICENSES |

24 | |||

| 7.7 ASSIGNMENT; SUBLEASE |

24 | |||

| 7.8 INDEMNITY; INSURANCE |

27 | |||

| 7.9 PERSONAL PROPERTY AT TENANT’S RISK |

28 | |||

| 7.10 FLOOR LOAD |

28 | |||

| 7.11 PERSONAL PROPERTY TAXES |

29 | |||

| 7.12 COMPLIANCE WITH INSURANCE REGULATIONS |

29 | |||

| 7.13 AMERICANS WITH DISABILITIES ACT |

29 | |||

| 7.14 PATRIOT ACT |

30 | |||

| ARTICLE VIII CASUALTY AND TAKING |

31 | |||

| 8.1 LANDLORD TO REPAIR OR REBUILD |

31 | |||

| 8.2 RIGHT TO TERMINATE IN EVENT OF CASUALTY |

31 | |||

| 8.3 TERMINATION IN EVENT OF TAKING |

31 | |||

| 8.4 LANDLORD RESERVES AWARD |

32 | |||

| 8.5 ABATEMENT OF RENT |

32 | |||

| ARTICLE IX DEFAULT OF TENANT |

32 | |||

ii

TABLE OF CONTENTS

| PAGE | ||||

| 9.1 EVENTS OF DEFAULT |

32 | |||

| 9.2 REMEDIES |

33 | |||

| 9.3 WAIVER OF TRIAL BY JURY |

34 | |||

| 9.4 LANDLORD’S SELF-HELP RIGHTS |

35 | |||

| ARTICLE X HOLDING OVER AND SUCCESSORS |

35 | |||

| 10.1 HOLDING OVER |

35 | |||

| 10.2 SUCCESSORS |

35 | |||

| ARTICLE XI MISCELLANEOUS |

36 | |||

| 11.1 SUBORDINATION |

36 | |||

| 11.2 ATTORNMENT |

37 | |||

| 11.3 SECURITY DEPOSIT |

37 | |||

| 11.4 VOTING CONTROL OF TENANT |

37 | |||

| 11.5 WAIVER; ACCEPTANCE OF PARTIAL PAYMENTS |

38 | |||

| 11.6 PARTNERSHIP |

38 | |||

| 11.7 NOTICE |

38 | |||

| 11.8 ACCORD AND SATISFACTION |

38 | |||

| 11.9 ENTIRE AGREEMENT |

39 | |||

| 11.10 FORCE MAJEURE |

39 | |||

| 11.11 CAPTIONS, ETC. |

39 | |||

| 11.12 GENDER AND NUMBER |

39 | |||

| 11.13 BROKERAGE |

39 | |||

| 11.14 PARTIAL INVALIDITY |

40 | |||

| 11.15 LEGAL EXPENSES |

40 | |||

| 11.16 NOTICE OF LEASE |

40 | |||

| 11.17 YIELD UP |

40 | |||

| 11.18 STATUS CERTIFICATE |

40 | |||

| 11.19 WAIVER OF SUBROGATION |

41 | |||

| 11.20 ADJUSTMENTS TO RENTABLE AREA |

41 | |||

| 11.21 CONFIDENTIAL INFORMATION |

41 | |||

iii

TABLE OF CONTENTS

| PAGE | ||||

| 11.22 APPLICABLE LAW |

42 | |||

| 11.23 CUMULATIVE REMEDIES |

42 | |||

| 11.24 SUBMISSION NOT AN OFFER |

42 | |||

| 11.25 SIGNAGE |

42 | |||

| 11.26 CORPORATE AUTHORITY |

42 | |||

| 11.27 LIMITATION ON LANDLORD’S LIABILITY |

42 | |||

| 11.28 APPLICABLE INTEREST; LATE CHARGE |

43 | |||

| ARTICLE XII EXCULPATION |

43 | |||

iv

LEASE

This Lease (the “Lease”) is made and entered into this 10th day of November, 2011, by and between TR Presidents Place Corp., a Delaware corporation (“Landlord”), and United Casualty & Surety Insurance Company, a Massachusetts corporation (“Tenant”).

W I T N E S S E T H:

In consideration of the rents on the part of Tenant to be paid, the mutual promises contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

ARTICLE I

Reference Data and Exhibits

| 1.1 Data. |

||

| NAME AND LOCATION OF PROPERTY: | Presidents Place - 1250 Hancock Street, Quincy, Massachusetts 02169, more particularly shown on Exhibit A, attached hereto. | |

| LANDLORD: | TR Presidents Place Corp., a Delaware corporation | |

| LANDLORD’S ADDRESS: | c/o LPC Realty Advisors, Inc. 120 North LaSalle Street, Suite 1750 Chicago, Illinois 60602 Attn.: Jenifer Ratcliffe, President

c/o Lincoln Property Company President’s Place 1250 Hancock Street Quincy, MA 02169

And

Holland & Knight LLP 131 South Dearborn Street, 30th Floor Chicago, Illinois 60603 Attn.: James T. Mayer | |

| LANDLORD’S REPRESENTATIVE: | Brian Lantz c/o LPC Realty Advisors, Inc. 120 North LaSalle Street, Suite 1750 Chicago, Illinois 60602 | |

| TENANT: | United Casualty & Surety Insurance Company | |

| TENANT’S ADDRESS: | 170 Milk Street, 5th Floor Boston, MA 02109 (until Term Commencement Date - and thereafter at the Demised Premises) | |

| FOR NOTICES TO TENANT: | 1250 Hancock Street, Suite 803N Quincy, Massachusetts 02169 (after Term Commencement Date) | |

| with a copy to:

Alan L. Packer, Esq. Packer and Movitz, P.C. 195 Worcester Street, Suite 203 Wellesley Hills, MA 02481 | ||

| TENANT’S REPRESENTATIVE: | Todd S. Carrigan, President | |

| SCHEDULED COMPLETION DATE: | April 1, 2012 | |

| TERM COMMENCEMENT DATE: | April 1, 2012 | |

| TERM: | Sixty-four (64) months | |

| ANNUAL FIXED RENT: | ||

| Months |

Rate p/s/f |

Annual Fixed Rent |

Monthly Installments | |||||

| 1-64* | $18.50/rsf | $58,367.50 | $4,863.96 | |||||

| The Annual Fixed Rent is subject to escalation on account of escalation for Tenant’s pro-rata increases in Operating Expenses and Real Estate Taxes in accordance with Article IV.

* Notwithstanding anything contained in this Lease to the contrary, Tenant’s monthly installments of Annual Fixed Rent shall be abated during months 1 through 4 of the Term (the “Abatement Period”), pursuant to the terms of Section 4.7 herein. | ||||||||

2

| RENT COMMENCEMENT DATE: | August 1, 2012 | |

| SECURITY DEPOSIT: | $4,863.96 | |

| COMMERCIAL GENERAL LIABILITY INSURANCE LIMITS: | $2,000,000 combined single limit for Bodily Injury and Property Damage | |

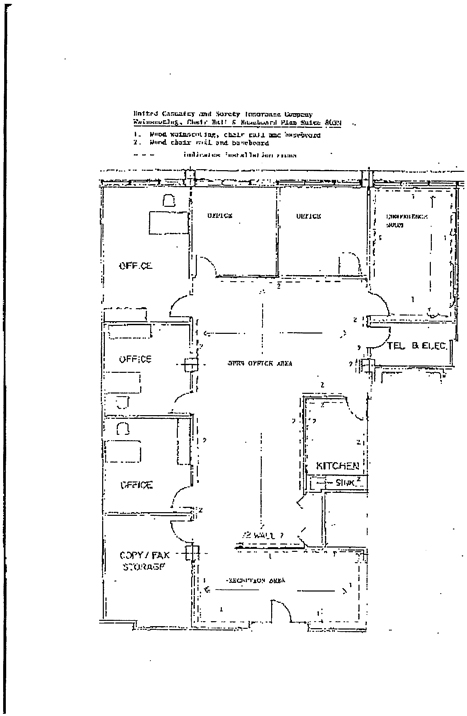

| DEMISED PREMISES: | Approximately 3,155 rentable square feet (“RSF”) on the eighth (8th ) floor of the Commercial Building’s north tower as shown on Exhibit B, as presently known and numbered as Suite 803N. | |

| PERMITTED USE: | Business office use consistent with the uses of a first class office building. | |

| PARKING: | Tenant shall be entitled to use three (3) reserved parking spaces (in the locations shown on the Parking Plan attached hereto as Exhibit F) and seven (7) unreserved parking spaces at no cost to Tenant; provided, however, that the signage for the reserved spaces shall be at | |

| BASE OPERATING EXPENSE AMOUNT: | Tenant’s sole cost. | |

| The actual Operating Expenses for the calendar year 2012. | ||

| BASE REAL ESTATE TAX AMOUNT: | The Real Estate Taxes for fiscal year 2012, which commenced on July 1, 2011. | |

| TENANT’S PRO RATA SHARE OF OPERATING EXPENSES: | Initially .9038%, subject to adjustment in accordance with Sections 1.4(h) and 11.20. | |

| TENANT’S PRO RATA SHARE OF TAXES: | Initially .9038%, subject to adjustment in accordance with Section 11.20. | |

| TENANT IMPROVEMENTS: | Landlord shall construct the initial leasehold improvements in accordance with the terms and provisions of Article V, at no additional cost to Tenant, except to the extent specifically otherwise provided in Article V. | |

3

| BROKERS: | Lincoln Property Company, CSE Inc. (“Lincoln Property Company”), whose fee shall be paid by Landlord. Lincoln Property Company shall be entitled to compensation in accordance with its existing agreement with Landlord. Payment of compensation to the Broker shall be 50% on lease execution and the balance on the first to occur of (i) the date Tenant first pays Fixed Rent or (ii) the date Tenant first occupies the Demised Premises for the conduct of business. |

1.2 Effect of Reference to Data. Each reference in this Lease to any of the titles contained in Section 1.1 shall be construed to incorporate the data stated under that title and execution of this Lease by Landlord and Tenant shall be construed to mean agreement to be bound by all of the terms in Section 1.1, together with all of the terms contained in each and every Article, Section, Addendum, Exhibit and Rider of this Lease, and further such execution shall be construed to be a representation by each that the execution has been duly authorized by the entity whom the Landlord and Tenant purport to represent.

1.3 Exhibits. The exhibits below in this Section 1.3 are incorporated in this Lease by reference and are to be construed as a part of this Lease:

| EXHIBIT A | Site Plan showing the Property | |

| EXHIBIT B | Floor Plan, including the Demised Premises | |

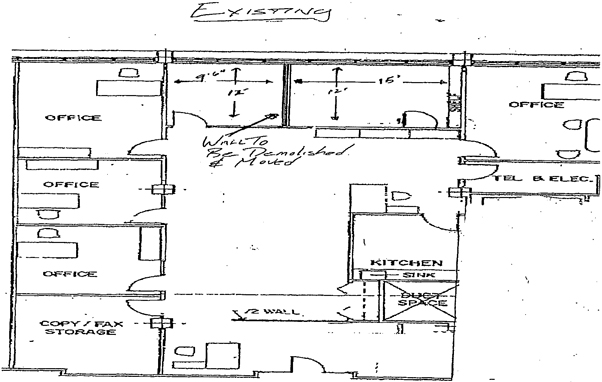

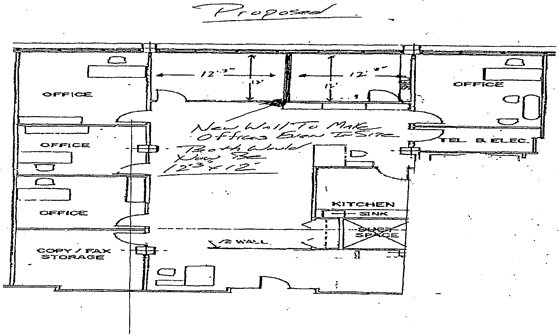

| EXHIBIT C | Diagram of Wall Relocation | |

| EXHIBIT D | Janitorial Specifications | |

| EXHIBIT E | Rules and Regulations | |

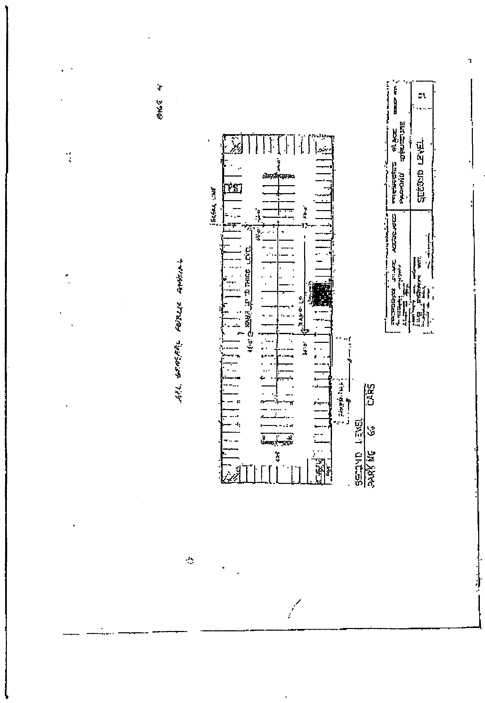

| EXHIBIT F | Parking Plan | |

| EXHIBIT G | Wainscoting, Chair Rail and Baseboard Plan | |

1.4 Certain Definitions. Each reference in this Lease to any of the following terms shall be construed to incorporate the data stated for that term in this Article I:

(a) Base Year: For Operating Expenses during the Term, “Base Year” shall mean the calendar year 2012. For Real Estate Taxes during the Term, “Base Year” shall mean the fiscal year 2012, which commenced on July 1, 2011. Landlord shall provide Tenant with statements of the Operating Expenses and Real Estate Taxes for the Base Year in accordance with the provisions of Section 4.5. The actual Operating Expenses incurred for calendar year 2012 shall be extrapolated on an item-by-item basis to the estimated Operating Expenses that would have been incurred if the Commercial Building were ninety-five percent (95%) occupied for such year and the amount thus extrapolated shall, for the purposes of this Lease, be the Base Operating Expenses over and above which escalation is payable.

4

(b) Commercial Building: That certain multi-use commercial building with a north tower and a south tower located at Hancock, Coddington, Washington Street and Faxon Avenue in Quincy, Massachusetts, being a portion of the project known as Presidents Place, as shown on Exhibit A attached hereto, and comprising three hundred forty-nine thousand and eighty-five (349,085) rentable square feet (the “Total Rentable Area of the Commercial Building”).

(c) Commercial Building Land: The land upon which the Commercial Building is located, including any additions and less any deletions thereto resulting from the change of any abutting street line.

(d) Commencement Date: April 1, 2012.

(e) Common Areas: All those portions of the Property which are not a part of the rentable area of the Demised Premises or part of the rentable area of the demised premises of other tenants of the Commercial Building, including, but not limited to, mechanical areas, common lobbies, corridors, stairways, elevators, loading platforms, common walkways and driveways, and, if the Demised Premises include less than the leasable area of any floor, the common toilets, corridors and elevator lobby of such floor.

(f) Lease Year: The term “Lease Year”, as used herein, shall mean the twelve (12) month period commencing on the Commencement Date or a successive twelve (12) month period included in the Term commencing on the anniversary of that day, but if the Commencement Date is not the first day of a month, the first Lease Year shall commence on the first day of the first full calendar month following the Commencement Date and if the expiration of the Term or the earlier termination of the Lease does not coincide with the termination of such a twelve (12) month period, the term “Lease Year” shall mean the portion of such twelve (12) month period before such expiration or termination.

(g) Operating Expenses: The cost of operation, maintenance and repair of the Property, excluding the cost of special services rendered to tenants (including Tenant) for which a separate charge is made, but including, without limitation, the following: premiums for insurance carried with respect to the Property (including public liability insurance, insurance against loss in case of fire or casualty including loss of one year’s Annual Fixed Rent and Additional Rent which may be due under this Lease and other leases of space in the Commercial Building, and including such insurance as may be required by any mortgagee of the Property); compensation and all fringe benefits, workers’ compensation insurance premiums and payroll taxes paid to, for or with respect to all persons engaged in the operation, maintenance, or cleaning of the Property; all utility charges not billed directly to tenants by the utility or Landlord (excluding utility charges separately chargeable to tenants for additional or special services); cost

5

of building and cleaning supplies and equipment; cost of maintenance, cleaning and repairs, including cost of painting, replacement of wallcoverings and carpets for Common Areas only, and replacement of lighting fixture components; cost of maintenance-related machinery and fixtures (each of which shall be amortized on a straight line basis over such item’s useful life in accordance with generally accepted accounting principles (“GAAP”) or Internal Revenue Code (“IRC”) guidelines); cost of snow removal, care of landscaping, and grounds maintenance; cost of seasonal decorations; payments under service contracts with independent contractors; management fees; interest on working capital borrowed by Landlord in anticipation of receipts by tenants; amortization of the cost of new or replacement capital items for Common Areas, (each of which shall be amortized on a straight line basis over such item’s useful life in accordance with either GAAP or IRC guidelines); with reasonable interest on the unamortized amount (such amortization and interest thereon being referred to herein as the “Charge Off’) that are installed for the purpose of reducing Landlord’s operating costs or are required by law or determined, in Landlord’s reasonable judgment, to be necessary in order to prevent injury to persons or damage to property or otherwise to alleviate the risk to life or safety due to a dangerous condition or to prevent deterioration or further deterioration of a condition which can not reasonably be repaired by ordinary maintenance procedures; if the Commercial Building shares Common Areas or facilities with another building or buildings not presently part of the Property, the Commercial Building’s pro rata share (as reasonably determined by Landlord) of the cost of cleaning, operating, managing (including the cost of the management office for such buildings and facilities), maintaining and repairing such Common Areas and facilities; cost of professional consultants, including legal, accounting, promotion, engineering, mechanical, and other consultants reasonably required by Landlord; and all other reasonable and necessary expenses paid in connection with the operation, cleaning, maintenance, lighting, heating and ventilation of the Property; provided that, if during any portion of the calendar year for which Operating Expenses are being computed, less than ninety-five percent (95%) of the total Rentable Area of the Commercial Building was occupied by tenants, actual Operating Expenses incurred shall be extrapolated by Landlord on an item-by-item basis to the estimated Operating Expenses that would have been incurred if the Commercial Building were ninety-five percent (95%) occupied for such year, and such extrapolated amount shall, for the purposes hereof, be deemed to be the Operating Expenses for such year; and all other expenses customarily incurred in connection with the operation and maintenance of comparable office buildings in the greater Quincy/Braintree submarket of the Metropolitan Boston area.

The following shall not be deemed Operating Expenses:

| (i) | any cost representing an amount paid to any person, firm, corporation or other entity related to or affiliated with Landlord, which amount is in excess of the amount which would have reasonably been paid in the absence of such relationship for comparable work or services for comparable buildings in the greater Quincy/Braintree area; |

6

| (ii) | cost of improvements, if any, required to bring the Common Areas into compliance with the present provisions of the ADA (as defined in Section 7.13),; but any improvements required to be made pursuant to legal requirements affecting or governing the operation and maintenance of the Property hereinafter enacted or promulgated shall be deemed Operating Expenses, and to the extent same constitutes a capital cost or capital expenditure, it shall be amortized on a straight line basis over such item’s useful life in accordance with either GAAP or IRC guidelines; |

| (iii) | costs incurred by Landlord with respect to goods and services (including utilities sold and supplied to tenants and occupants of the Commercial Building) to the extent that Landlord is entitled to reimbursement for such costs other than through the Operating Expense pass-through provisions of such tenants’ leases; |

| (iv) | costs incurred by Landlord for the repair of damage to the Commercial Building and/or to the Commercial Building Land to the extent that Landlord is reimbursed by insurance or condemnation proceeds or by tenants, warrantors or other third parties; |

| (v) | costs incurred with respect to the installation of tenant improvements made for other tenants in the Commercial Building or incurred in renovating or otherwise improving, decorating, painting or redecorating vacant space for tenants or other occupants of the Commercial Building; |

| (vi) | salaries and bonuses of officers and executives of Landlord above the level of Building Manager; |

| (vii) | tax penalties and interest incurred as a result of Landlord’s negligence or inability or unwillingness to make tax payments when due, so long as such penalties or interest do not result from Tenant’s breach of the Lease or Tenant’s failure to make timely payment of any sum due under the Lease; |

| (viii) | brokerage commissions, finders’ fees, attorneys’ fees and other costs incurred by Landlord in leasing or attempting to lease space in the Building; |

(h) Operating Expenses Allocable to the Demised Premises: For any calendar year within the Term or fraction of a calendar year at the beginning or end thereof commencing in calendar year 2012, Tenant’s share of Operating Expenses for the Property for such period (such expense for any partial calendar year being pro-rated), shall be computed by multiplying Operating Expenses for the Property by a fraction, the numerator of which is the rentable area of the Demised Premises and the denominator of which is the Total Rentable Area of the Commercial Building, and shall be paid by Tenant pursuant to the terms of Article IV; provided, however, that the denominator of such fraction may reasonably be adjusted by Landlord on an item-by-item basis to reflect the fact that in accordance with their respective leases, Tenant and other tenants in the Commercial Building do not receive certain of the services which constitute the basis for the calculation of Operating Expenses Allocable to the Demised Premises. The purpose of this Section is to allow Landlord to collect for its actual expenses, but in no event shall Tenant be charged for services it does not receive but only certain other tenants do.

7

(i) Parking Garage: The Presidents Place Parking Garage, a multi-level parking structure located on the Parking Garage Land, as shown on Exhibit A attached hereto. The cost of operation, maintenance and repair of the Parking Garage is included as part of Operating Expenses.

(j) Parking Garage Land: The land upon which the Parking Garage is located, including any additions and less any deletions thereto resulting from the change of any abutting street line, as shown on Exhibit A attached hereto.

(k) Property: The Commercial Building, Commercial Building Land, Parking Garage, and Parking Garage Land, as such terms are defined in the Article I.

(l) Real Estate Taxes Allocable to the Demised Premises: For any calendar year within the Term or fraction of a calendar year at the beginning or end thereof, Tenant’s share of Real Estate Taxes for the Property, computed by multiplying Real Estate Taxes for the Property by a fraction, the numerator of which is the rentable area of the Demised Premises and the denominator of which is the Total Rentable Area of the Commercial Building, to be paid by Tenant pursuant to the terms of Article IV; provided, however, that the denominator of such fraction may be adjusted by Landlord pursuant to the provisions of Section 11.20 hereof.

(m) Real Estate Taxes for the Property: All taxes and special assessments of every kind and nature assessed by any governmental authority on the Property which Landlord shall become obligated to pay because of or in connection with the ownership, leasing and operation of all or any part of the Property and reasonable expenses of any proceeding for abatement of taxes. Abatement proceedings are pending with respect to the Base Tax Year. If the Real Estate Taxes are abated, then the increase, if any, shall be determined on the basis of the Base Real Estate Tax Amount as abated. The amount of special taxes or special assessments to be included shall be limited to the amount of the installment (plus any interest, other than penalty interest, payable thereon) of such special tax or special assessment required to be paid during the year in respect of which such taxes are being determined, pro rated to the extent such year in respect of which such taxes are being determined, pro rated to the extent such year is only partially within the Term. There shall be excluded from such taxes all income, estate, succession, inheritance and transfer taxes; provided, however, that if at any time during the Term the present system of ad valorem taxation of real property shall be changed so that a capital levy, franchise, income, profits, sales, rental, use and occupancy, or other tax or charge shall in whole or in part be substituted for such ad valorem tax and levied against, or be payable by, Landlord with respect to the Property, such tax or charge shall be included in the term “Real Estate Taxes for the Property”.

(n) Rules and Regulations: The Rules and Regulations set forth on Exhibit E, as may be amended or restated by Landlord from time to time.

8

ARTICLE II

Demised Premises; Appurtenant Rights and Reservations

2.1 Lease of Demised Premises. Landlord demises and leases to Tenant and Tenant rents from Landlord, upon and subject to and with the benefit of the terms, covenants, conditions, and provisions hereinafter set forth, the Demised Premises.

2.2 Right to Use Common Areas. Tenant shall have, as appurtenant to the Demised Premises, the right to use in common with Landlord and all others to whom Landlord may from time to time grant rights, and subject to the rights reserved to Landlord in this Article II and the Rules and Regulations: (a) the common lobbies, toilets, corridors, stairways, elevators and loading platforms of the Commercial Building, and the pipes, ducts, conduits, wires and appurtenant meters and equipment serving the Demised Premises, and (b) common walkways and driveways necessary for access to the Commercial Building. Tenant agrees to abide by such Rules and Regulations and to use its best efforts to cause its concessionaires, others, employees, agents, customers and invitees to conform thereto.

2.3 Right to Use Parking Spaces. Tenant shall have, as appurtenant to the Demised Premises, solely to the extent of the number of unreserved and reserved Parking Spaces set forth in Article I hereof, the right to use, subject to the rights reserved to Landlord in this Article II and the Rules and Regulations, the number of parking spaces as set forth in Article I hereof. Tenant understands and agrees that the Parking Spaces to which Tenant is entitled are unreserved, that other persons have rights to the use of unreserved spaces in the Parking Garage and that availability to Tenant shall be on “first come” basis in common with others entitled to the use of the Parking Garage. The use of the spaces allocated to Tenant shall be at no additional cost to Tenant, except that Tenant shall pay its pro-rata share set forth in Article I of any increased costs attributable to the operation, maintenance and repair of the Parking Garage.

2.4 Landlord Reservations. After reasonable notice to Tenant, Landlord shall have the right from time to time, without unreasonable interference with Tenant’s use: (a) to construct other buildings or improvements on the Property and to relocate the various buildings and Common Areas shown on the site plan, and to make other reasonable changes from time to time in any of the common facilities or the Property; (b) to install, use, maintain, repair, replace and relocate for service to the Demised Premises and/or other parts of the Commercial Building, pipes, ducts, conduits, wires and appurtenant fixtures, whenever located in the Demised Premises or Commercial Building, (c) to enter onto the Demised Premises for the purpose of carrying out its maintenance and repair obligations hereunder, (d) to alter or relocate any other common facility, provided that substitutions are substantially equivalent or better, (e) to remove, at Tenant’s expense, any alterations, additions, signs, curtains, blinds, shades, awnings, aerials, flagpoles, or other items or structures of any kind or nature not consented to by Landlord in writing or otherwise permitted hereunder, and (f) to show the Demised Premises to prospective tenants during the nine (9) months preceding expiration of the Term or any Option Term, if applicable, and to prospective purchasers and mortgagees upon twenty-four (24) hours prior

9

notice. No action by Landlord hereunder shall subject Landlord to any liability, nor shall Tenant be entitled to any compensation or diminution or abatement of rent, nor shall such changes of Common Areas or construction or relocation of buildings be deemed actual or constructive eviction. All Common Areas and facilities not within the Demised Premises, which Tenant may be permitted to use and occupy, are to be used and occupied subject to such right on the part of Landlord.

ARTICLE III

Term

3.1 Term. Tenant shall have and hold the Demised Premises for a period commencing on the Commencement Date, and continuing for the Initial Term unless sooner terminated as provided in this Lease, except that if the Commencement Date shall be a date other than the first day of a calendar month, the Term of the Lease shall also include the first fractional month.

3.2 Option to Extend.

(a) Tenant shall have one (1) option to further extend the Term of this Lease (the “Option to Extend”) for one (1) additional term of five (5) years (the “Extension Term”). Tenant must exercise the Option to Extend at least nine (9) months prior to the Expiration Date by giving written notice to Landlord (the “Extension Notice”). The Fixed Rent payable by Tenant to Landlord for the first year of the Extension Term (“Initial Fixed Rent”) and for subsequent years during the Extension Term (“Subsequent Years Fixed Rent”) (such rent to increase by agreed, fixed amounts every year over the term of the Extension Term) shall be the then Fair Market Rent (as defined hereafter). Notwithstanding anything contained herein to the contrary, the Initial Fixed Rent and Subsequent Years Fixed Rent for the entire Extension Term shall all be determined within fifteen (15) business days following Tenant’s delivery of the Extension Notice, pursuant to paragraph (b) below.

(b) The term “Fair Market Rent” shall mean the Initial Fixed Rent and the Subsequent Years Fixed Rent, expressed as an annual rent per square foot of rentable area, which Landlord would have received from leasing the Demised Premises for the Extension Term to any person or entity unaffiliated with Tenant, assuming that such space were to be delivered in its “as-is” condition, and taking into account the prevailing market rate for comparable space in the Commercial Building and comparable buildings in the greater Quincy/Braintree submarket of the metropolitan Boston area (as evidenced by recent lease transactions in the past six (6) months), taking into account the size of the Demised Premises, the length of the extension term, annual market fixed rent escalations, annual operating expense escalations and the credit of Tenant. The Fair Market Rent, the Initial Fixed Rent and the Subsequent Years Fixed Rent shall not be reduced by reason of any costs or expenses saved by Landlord by reason of Landlord not having to find a new tenant for such premises (including, without limitation, brokerage commissions, costs of improvements, rent concessions or lost rental income during any vacancy period).

10

Within fifteen (15) business days following Tenant’s delivery of the Extension Notice to Landlord, Landlord shall deliver to Tenant in writing Landlord’s opinion as to the Fair Market Rent, the Initial Fixed Rent and the Subsequent Years Fixed Rent for the Demised Premises for the Extension Term (“Landlord’s Offer”) and Tenant shall have fifteen (15) days following receipt of Landlord’s Offer to either accept or reject such offer (“Fifteen Day Period”). If Tenant accepts Landlord’s Offer, then Tenant shall notify Landlord in writing of such acceptance and the parties shall promptly execute an amendment to Lease evidencing the Fair Market Rent, the Initial Fixed Rent, and the Subsequent Years Fixed Rent for the Extension Term and any other material terms relating to such Extension Term. In the event Tenant fails to object in writing to Landlord’s determination of the Fair Market Rent, the Initial Fixed Rent and the Subsequent Years Fixed Rent for the Demised Premises for the Extension Term prior to the expiration of the Fifteen Day Period, as provided above, such determination shall be deemed conclusive and binding upon the parties for the purposes of the Option to Extend set forth herein. If Tenant rejects the Landlord’s Offer and Tenant is not able to obtain Landlord’s consent to an alternative determination of Fair Market Rent, the Initial Fixed Rent and the Subsequent Years Fixed Rent for the Demised Premises for the Extension Term within the Fifteen Day Period, then Landlord and Tenant shall each designate a licensed Massachusetts real estate broker with at least five (5) years of experience in leasing space in comparable commercial buildings located in the greater Quincy/Braintree submarket of the metropolitan Boston area, and notify the other party of the identity of its broker within ten (10) business days following the expiration of the Fifteen Day Period (“Broker Selection Period”). Within thirty (30) days following the end of the Broker Selection Period, each broker shall submit their written opinion as to the Fair Market Rent, the Initial Fixed Rent and the Subsequent Years Fixed Rent for the Demised Premises for the Extension Term, taking into account the criteria set forth above. If a party fails to appoint a representative within the Broker Selection Period, the determination of the sole broker appointed shall apply. Each party shall pay the fees and expenses of its own broker and shall share equally the fees and expenses of a referee (subject to the Landlord Referee Share Limit below), if one is required. If two brokers are appointed and the determinations are capable of direct comparison and the higher determination is less than one hundred five percent (105%) of the lower one, the Fair Market Rent shall be the average of the determinations. If the determinations are not sufficiently similar in approach to ascertain that they are within 105% of one another or they are similar in approach but further apart, the experts shall, within five (5) business days of the last broker’s determination, attempt to mutually select a disinterested, licensed Massachusetts appraiser skilled in determining rental rates for similar commercial buildings in the Quincy/Braintree submarket of the metropolitan Boston area as a referee. If they cannot agree on a referee, either party may ask the President of the Greater Boston Real Estate Board to appoint a referee possessing the qualifications above for them. The referee, selected by either means, must have the same type of qualifications as the brokers, except that the referee must not have been employed regularly or as a consultant during the prior twelve (12) month period by either Landlord or Tenant. Within thirty (30) days of his or her appointment, the referee must determine the Fair Market Rent within the range of the two (2) brokers’ determinations, and that determination shall be established as the Fair Market Rent for the Extension Term. Notwithstanding anything contained in this Section 3.2 to the contrary, Landlord’s share of the cost for the referee shall not exceed Two Thousand and 00/100 Dollars ($2,000.00) (“Landlord Referee Share Limit”), and Tenant shall be solely responsible for the cost of Landlord’s share of the referee that exceeds such Landlord Referee Share Limit.

11

Should the Term be extended hereunder, Tenant shall execute an amendment modifying this Lease within ten (10) business days after Landlord presents same to Tenant, which agreement shall set forth the Fair Market Rent, the Initial Fixed Rent and the Subsequent Years Fixed Rent for the Demised Premises for the Extension Term, and the other economic terms and provisions in effect during the Extension Term. Should Tenant fail to execute the amendment within ten (10) business days after presentation of same by Landlord, time being of the essence, Tenant’s right to extend the Term of the Lease shall, at Landlord’s sole option, terminate, and Landlord shall be permitted to lease the Demised Premises to any other person or entity upon whatever terms and conditions are acceptable to Landlord in its sole discretion.

ARTICLE IV

Rent

4.1 Monthly Fixed Rent Payments. Tenant shall pay to Landlord, without notice, offset, abatement, deduction or demand, equal monthly installments of the Annual Fixed Rent (sometimes hereinafter referred to as “Fixed Rent”), in advance, on the first day of each full calendar month of the Term commencing on the Rent Commencement Date, and the corresponding fraction of said equal monthly installment for any fraction of a calendar month at the beginning or the end of the Term, by check made payable to Landlord’s order, submitted to the property manager at the Commercial Building, or at such other place or to such other person as Landlord shall from time to time designate by written notice to Tenant.

4.2 Adjustment for Operating Expenses Allocable to the Demised Premises. If, with respect to any calendar year within the Term or fraction of a calendar year at the beginning or end thereof, the Operating Expenses Allocable to the Demised Premises (as defined in Section 1.4(h) hereinabove) for a full calendar year exceed the Base Operating Expense Amount set forth in Article I hereof (or for a fractional year, the Base Operating Expense Amount as pro rated), then Tenant shall pay to Landlord, as Additional Rent, the amount of such excess in accordance with the terms of Section 4.4.

4.3 Adjustment for Real Estate Taxes Allocable to the Demised Premises. If, with respect to any fiscal year within the Term or fraction of a fiscal year at the beginning or end thereof, the Real Estate Taxes Allocable to the Demised Premises for a full fiscal year exceed the Base Real Estate Tax Amount set forth in Article I hereof (or for such fractional year, the Base Real Estate Tax Amount as pro rated), then Tenant shall pay to Landlord, as Additional Rent, the amount of such excess in accordance with the terms of Section 4.4.

12

4.4 Statements; Due Dates of Additional Payments.

(a) Not later than ninety (90) days after the end of the first calendar year of the Term, or fraction thereof ending December 31, and for each succeeding calendar year during the Term or fraction thereof at the end of the Term, Landlord shall render to Tenant statements, in reasonable detail and according to generally accepted accounting practices consistently applied, showing for the preceding calendar year or fraction thereof, as the case may be, the Operating Expenses Allocable to the Demised Premises, and the Real Estate Taxes Allocable to the Demised Premises. Said statements shall also show for the preceding year or fraction thereof, the amounts already paid by Tenant as Additional Rent and the amounts remaining due from Tenant for the calendar year or other period covered by each statement. Within thirty (30) days after the date of delivery of such statements, Tenant shall pay to Landlord, as Additional Rent, the balance of the amounts, if any, required to be paid to Landlord pursuant to Sections 4.2 and 4.3. In addition, following the delivery to Tenant of each statement referred to above, effective as of the first day of January prior to the delivery of such statements, and on the first day of each month thereafter during the Term, Tenant shall pay to Landlord, on account toward Tenant’s share of increases in Operating Expenses for the Property and Real Estate Taxes for the Property, one-twelfth (1/12) of the total annualized amount that Tenant was required to pay with respect to the preceding year, or portion thereof, as shown on the most recent statements delivered by Landlord to Tenant. If the amount paid by Tenant as an estimate exceeds the actual amount due, Landlord shall credit such excess against future rental obligations.

(b) Except as otherwise specifically provided herein, any sum, amount, item or charge designated or considered as Additional Rent in this Lease shall be paid by Tenant to Landlord on the first (1st) day of the month following the date on which Landlord notifies Tenant of the amount payable or on the tenth (10th) day after the giving of such notice, whichever shall be later. Any such notice shall specify in reasonable detail the basis of such Additional Rent. Fixed Rent and Additional Rent shall be paid by Tenant to Landlord without offset or deduction. Tenant shall remain liable for the payment of its share increases in Operating Expenses for the Property and its share of increases in Real Estate Taxes for the Property relating to the last calendar year or part of a calendar year included in the Term, notwithstanding that Landlord has failed to provide a copy of any statement or notice required in this Lease or failed to provide such copy or notice within the time provided herein, or that the Term has expired and Tenant has vacated the Demised Premises prior to the determination of the amount so payable by Tenant.

(c) As used herein, the term “Additional Rent” shall mean the charges referred to as such in this Lease and any other monetary liabilities and obligations which Tenant herein assumes or agrees to pay. Landlord shall have all the remedies for non-payment of Additional Rent as are applicable to Annual Fixed Rent hereunder.

(d) In the event the Operating Expenses Allocable to the Demised Premises or the Real Estate Taxes Allocable to the Demised Premises increases (on a per square foot basis) by more than five percent (5%) in any calendar year or fiscal year, as applicable, within the Term,

13

Tenant may audit Landlord’s books, records and statements with respect to Landlord’s calculation of Operating Expenses Allocable to the Demised Premises and Real Estate Taxes Allocable to the Demised Premises in order to verify the accuracy thereof provided that:

| (i) | Tenant notifies Landlord, within ninety (90) days after its receipt of the statement detailing its Operating Expenses Allocable to the Demises Premises and Real Estate Taxes Allocable to the Demised Premises for the calendar year or fiscal year in question, of its intent to perform an audit; |

| (ii) | Such audit will be conducted only during regular business hours at an office where Landlord maintains Operating Expenses and Real Estate Tax records in reasonable proximity to Quincy, MA; |

| (iii) | Tenant agrees not to divulge, either directly or indirectly, the results of the audit to any third party, unless required by law to do so; and |

| (iv) | The audit shall be performed at Tenant’s sole cost and expense by a certified public accountant (expressly excluding any accountants paid on a contingency basis) reasonably approved by Landlord. |

| (v) | Tenant must commence the audit within thirty (30) days after Landlord’s receipt of notice of Tenant’s intent to conduct said audit. Tenant shall deliver to Landlord a copy of the results of such audit within fifteen (15) days of its receipt by Tenant, but no later than sixty (60) days after commencement thereof. Tenant’s failure to comply with the time frames set forth above shall constitute a waiver of its right to perform an audit for the calendar or fiscal year in question. Landlord shall have the right to have its accountant re-audit the Operating Expenses Allocable to the Demised Premises or Real Estate Taxes Allocable to the Demised Premises to confirm the accuracy of Tenant’s audit, provided said re-audit is completed within sixty (60) days of Landlord’s receipt of the result of Tenant’s audit. If there is a dispute between the two audits which the parties cannot resolve within thirty (30) days of Tenant’s receipt of the results of Landlord’s audit, the two auditors shall within ten (10) days thereafter choose a third auditor (who shall be a certified public accountant licensed in Massachusetts and located in the greater Boston metropolitan area), who shall be charged with the task of auditing the records in dispute, which audit is to be completed within thirty (30) days of the retention of said auditor. The cost of said auditor shall be borne equally by the parties. No audit shall be conducted at any time that Tenant is in default of any of the terms of this Lease. No subtenant shall have any right to conduct an audit and no assignee shall conduct an audit for any period during which such assignee was not in possession of the Demised Premises. Landlord shall reimburse Tenant for any overcharge or, at Landlord’s election, credit same to the charges due from Tenant under this Lease. The foregoing provisions shall survive the termination or expiration of this Lease. |

14

4.5 Period of Accounting. Landlord shall have the right from time to time to change the periods of accounting to any other annual period, and upon any such change, all items referred to in said Sections 4.2 and 4.3 shall be appropriately apportioned. In all statements rendered under Sections 4.2, and 4.3, amounts for periods partially within and partially without the accounting periods shall be approximately apportioned, and any items which are not determinable at the time of a statement shall be included therein on the basis of Landlord’s estimate and with respect thereto Landlord shall render promptly after determination a supplemental statement or statements and appropriate adjustment shall be made according thereto. All statements shall be prepared on an accrual basis of accounting.

4.6 Utility Charges. Tenant’s electrical service including, without limitation, for lighting and heat pumps, shall be separately metered and billed directly by the utility company to Tenant, and Tenant shall pay to the utility company all amounts so billed when due.

4.7 Abatement Period. Notwithstanding anything contained to the contrary in this Lease, Tenant shall not be responsible for payments of any Fixed Rent or Additional Rent for the Demised Premises during the Abatement Period. If at any time during the Abatement Period a default by Tenant occurs and such default is not cured within any applicable grace or cure period, then Tenant shall immediately pay to Landlord a lump sum payment equal to the Fixed Rent which would have accrued under Section 1.1 of this Lease from the Commencement Date through and including the last day of the month of Tenant’s default, after expiration of any applicable grace or cure period, and thereafter Tenant shall pay Landlord the abated Fixed Rent on a monthly basis in accordance with Section 4.1 of this Lease.

ARTICLE V

Construction; Additions and Alterations

5.1 Leasehold Improvements. Landlord shall, at its sole cost and expense, construct certain tenant improvements to the Demised Premises, which shall be limited to: (i) the installation of new carpeting and new VCB; (ii) repainting walls and other painted surfaces of the Demised Premises; (iii) the demolition and relocation of one demising wall, as shown on Exhibit C; (iv) the installation of wainscoting, chair railing and wood bases in the reception area and conference room as shown on Exhibit G; (v) the installation of vertical blinds in all office interior and exterior windows and frosted film on the front entry door; (vi) the refinishing of the Kitchen and countertops, the installation of new wood floors up to the Flooring Allowance set forth herein, plus the installation of a new sink, faucet and base and upper cabinets; (vii) the installation of chair rails and wood baseboards throughout the open office area, as shown on Exhibit G; (viii) the repair of water damaged walls and replacement of water damaged wood sills; and (ix) the repair of any leaking windows or roofs in the Demised Premises, inclusive of costs, supplies, architectural and engineering fees, and construction oversight fees (collectively, the “Work”). With respect to item (vi) above, Landlord shall contribute an amount not to exceed

15

Ten and 00/100 Dollars ($10.00) per rentable square foot of the Kitchen towards the installation of new floors in the Kitchen only, including costs of materials and construction oversight fees (the “Flooring Allowance”). If the cost to install the new flooring exceeds the Flooring Allowance (“Excess Flooring Costs”), Tenant shall pay Landlord, as additional rent, an amount equal to the Excess Flooring Costs within ten (10) days after Tenant’s receipt of Landlord’s written demand therefor; provided, however, if the cost of installing the flooring is less than the Flooring Allowance, Tenant shall not be entitled to any credit or payment for the unused portion therof. The Work to be performed by Landlord in the Demised Premises shall be performed in a good workmanlike manner using Building Standard materials (defined herein), in accordance with Building Standard specifications for the quantity and quality of materials to be used in the construction of the Work and in accordance with all applicable laws, codes or ordinances. Landlord shall use reasonable efforts to complete the Work by the Commencement Date, but (a) Tenant shall have no claim against Landlord for failure to complete such work by the Commencement Date; and (b) this Lease shall not be voidable as a result thereof; provided, however, so long as there has been no Tenant Delay, the Commencement Date shall be delayed by the number of days substantial completion has been delayed. Any additional improvements to the Demised Premises other than the Work, including, without limitation, (i) installation of low voltage cabling, (ii) connection of any office furniture, and (iii) the purchase and installation of security system equipment and wiring, shall be made by Tenant, at the sole cost and expense of Tenant, subject to all of the provisions of this Lease. “Building Standard”, as used herein, shall mean those brands, materials, finishes, techniques and methods selected by Landlord for completion of the Work.

Tenant and Landlord’s representative shall convene a pre-construction meeting at the Property prior to commencing the Work described hereinabove, where Landlord shall provide Tenant with samples of all Building Standard materials and finishes to be used in the Work. Tenant reserves the right to reject the Landlord’s selection of Building Standard materials and finishes and choose alternate materials and finishes, subject to the terms and conditions of Section 5.3 below; provided, however, that, to the extent the costs of any non-Building Standard materials selected by Tenant exceed the costs of Landlord’s Building Standard materials, such excess costs shall be borne solely by Tenant.

5.2 As-Is Condition. Except for the Work, the Demised Premises are being leased in their “as is” condition, without warranty or representation by Landlord. Tenant acknowledges that it has inspected the Demised Premises and, except for the Work, has found the same to be satisfactory.

5.3 Tenant’s Delays and Substantial Completion of Work.

(a) If, as a result of any Tenant Delay, as defined below, the substantial completion of the Demised Premises, as defined below, is delayed in the aggregate for more than ninety (90) days after the Commencement Date, Landlord may (but shall not be required to) at any time thereafter terminate this Lease by giving written notice of such termination to Tenant and thereupon this Lease shall terminate without further liability or obligation on the part of either party, except that Tenant shall pay to Landlord the cost theretofore incurred by Landlord in performing the Work, plus an amount equal to Landlord’s out-of-pocket expenses incurred in connection with this Lease, including, without limitation, brokerage and legal fees.

16

(b) Notwithstanding anything to the contrary contained in this Article 5, if Landlord shall be delayed in substantially completing the Work for any reason set forth in the following subparagraphs (i) through (iii) (“Tenant Delay”) then neither the Commencement Date of the Term of the Lease nor the payment of rent thereunder shall be affected or deferred on account of such delay:

(i) Tenant’s request for or use of unique materials, finishes or installations or construction procedures which are different from that which is standard or customary for the Commercial Building, or resulting in the Work taking longer to complete under standard construction procedures (e.g., without use of overtime or additional shifts and without necessitating other measures to expedite long lead time items) than originally projected by Landlord at the execution of this Lease (i.e., when Landlord developed its schedule for construction of the Work);

(ii) Tenant’s changes in the Work (notwithstanding Landlord’s approval of any such changes); or

(iii) any other act, omission or delay by Tenant, its agents or contractors or persons employed by any of such persons delaying substantial completion of the Work.

The phrases “substantial completion” or “substantially complete” shall mean that the Work has been completed except for such incomplete items as would not materially interfere with the use of the Demised Premises for the Permitted Use (but excluding items not included in the Work which are required for use of the Demised Premises for such purposes). The Work shall be deemed to be substantially complete on the date on which the Work would have been substantially complete but for Tenant Delay.

5.4 Alterations and Additions.

(a) All of Tenant’s installation of furnishings and alterations and additions to the Demised Premises, whether prior to or during the Term, shall be made only with the prior written consent of Landlord. Landlord shall not be deemed unreasonable for withholding approval of any installation of furnishings, alterations, and additions (including any changes to the initial leasehold improvements to be performed by Landlord pursuant to Section 5.1) which (i) involve or might affect any structural or exterior elements of the Commercial Building, any area or element outside of the Demised Premises, or any facility serving any area of the Commercial Building outside of the Demised Premises, or (ii) will be visible from the outside of the Commercial Building or which will give the Commercial Building’s exterior a non-uniform appearance (e.g. lighting, window coverings, ceiling treatments, etc.), or (iii) will delay

17

completion of the Demised Premises, or (iv) will require unusual expense to readapt the Demised Premises to normal office use on Lease termination or increase the cost of construction or of insurance or taxes on the Commercial Building unless Tenant first gives assurance reasonably acceptable to Landlord for payment of such increased cost and that such readaptation will be made prior to such termination without expense to Landlord. Any initial leasehold improvements specifically referenced as part of the Work in Section 5.1 hereinabove shall be deemed approved by Landlord for the purposes of this Section 5.4. Tenant shall make no alterations or additions to the electric system serving the Demised Premises nor connect additional electric fixtures, appliances or equipment to the Building’s electric distribution system without Landlord’s prior written consent in each instance.

(b) All of Tenant’s alterations and additions and installation of furnishings shall be coordinated with any work being performed by Landlord, in such a manner as to maintain harmonious labor relations and not to damage the Property or interfere with the Commercial Building’s operation. All such alterations, additions and installation of furnishings shall be made at Tenant’s expense and shall be performed by contractors or workers first approved by Landlord. Tenant shall require any construction contractor retained by it to perform work at the Demised Premises to carry and maintain, at no expense to Landlord, insurance with such coverage and in such amounts as Landlord shall reasonably request. Evidence of such coverage shall be furnished to Landlord prior to the performance of work by such contractor. Alterations and additions shall become a part of the Commercial Building, except such items as by writing at the time of approval the parties agree either shall be removed by Tenant on termination of this Lease, or shall be removed or left at Tenant’s election. Landlord may permit Tenant access for installation of furnishings in the Demised Premises prior to the Term if such installation can be done without material interference with the operation of the Commercial Building or the completion of the Demised Premises.

5.5 General Provisions Applicable to Construction. All construction work required or permitted by this Lease, whether by Landlord or by Tenant, shall be done in a good and workmanlike manner and in compliance with all applicable laws and all lawful ordinances, regulations and orders of governmental authority and Landlord’s insurance carrier. Either party may inspect the work of the other at reasonable times and promptly shall give notice of observed defects.

5.6 Representatives. Each party authorizes the other to rely in connection with their respective rights and obligations under this Article V upon approval and other actions on the party’s behalf by the Representative named in Article I or any person hereinafter designated in substitution or addition by written notice to the party relying.

18

ARTICLE VI

Landlord’s Covenants: Interruptions and Delays

6.1 Landlord Covenants. Landlord covenants during the Term and any Option Term(s), if applicable, as follows:

6.1.1 Services Furnished by Landlord. To furnish the following facilities and services, all of which shall conform to standards appropriate for the maintenance and operation of a first-class office building and parking garage in the Quincy/Braintree area:

(a) Heating, ventilation and air conditioning (“HVAC”) (as appropriate for the season of the year) suitable for business office operations during “HVAC Hours”, defined to be the hours between 7:00 a.m. and 6:00 p.m. on weekdays and 8:00 a.m. to 1:00 p.m. on Saturdays; provided, however, that Landlord shall not be responsible if the normal operation of the Building HVAC system shall fail to provide conditioned air at reasonable temperatures, pressures or degrees of humidity, or at reasonable volumes, in any portion of the Demised Premises which shall have an electrical load or a human occupancy factor in excess of those normally attributable to the Permitted Use (Tenant understands and agrees that although the building HVAC system will provide the conditioned air as aforesaid, the circulation of the conditioned air within the Demised Premises shall be by means of heat pumps and Tenant shall be responsible for and shall pay the energy costs attributable to the operation of the heat pumps, which costs shall be on Tenant’s separate meter);

(b) If Tenant desires HVAC services to be furnished to part or all of the Demised Premises at any time other than during HVAC Hours, to furnish those services at Tenant’s expense and to be paid by Tenant as Additional Rent, which shall be the cost to Landlord of furnishing such heating or air conditioning, provided that Tenant requests the services not later than 4:30 p.m. on the day prior to the day on which the services are required;

(c) To furnish (i) full passenger elevator service during HVAC Hours; (ii) availability of at least one elevator for use by those having business in the Demised Premises and a specific need to use said elevator for access thereto on a 24-hour-a-day basis, either as service or self-service elevators, as Landlord may elect; and (iii) reasonable use of the Commercial Building freight elevator at all reasonable times.

(d) To furnish the Demised Premises with access to water (for ordinary drinking, cleaning, and toilet purposes) and sewage disposal services;

(e) To furnish electrical service for Tenant’s office uses, the cost of which shall be borne by Tenant as determined by a separate electric meter installed at Tenant’s cost;

(f) To furnish cleaning and janitorial services for normal office use for the Demised Premises on a regular basis, in accordance with the standards provided in Exhibit D;

19

(g) To furnish reasonable twenty-four hour per day manned security services to prevent unauthorized access to the Commercial Building. Notwithstanding the foregoing, Tenant and those of its employees (or other approved personnel and independent contractors) as Tenant may from time to time designate, shall have access to the Demised Premises at all times, and Landlord shall furnish to Tenant (for use by such of Tenant’s employees, approved personnel and independent contractors as Tenant, from time to time, may determine) such card access devices or identifying badges or other such procedures as Landlord may deem advisable to afford such access consistent with applicable security measures and procedures. Tenant shall furnish to Landlord a personnel list and identification photographs of its employees, approved personnel and independent contractors who are permitted access to the Demised Premises, and such other information as Landlord may reasonably request, which information shall be updated from time to time by Tenant, to enable Landlord or the security service reasonably to identify those personnel of Tenant who are entitled to access. Landlord shall not be responsible for the denial of access to those persons not reasonably identifiable as approved personnel of Tenant. Tenant shall be responsible, as Additional Rent, for the cost of any lost or damaged identification devices or cards.

If the services provided for in this Article are curtailed, whether by operation of applicable law, by the need for repairs, alterations or improvements, by war, by labor difficulties, by shortages of fuel, electricity or other necessary supplies, or by any other cause beyond Landlord’s reasonable control, Landlord shall not be liable to Tenant or to anyone claiming under Tenant for any damages (including but not limited to consequential damages) which may result therefrom.

6.1.2 Additional Services Available to Tenant. To furnish, through Landlord’s employees or independent contractors, at Tenant’s expense, reasonable additional building operation services which are usual and customary in comparable office buildings in the greater Quincy/Braintree area upon reasonable advance request of Tenant at reasonable and equitable rates from time to time established by Landlord.

6.1.3 Roof, Exterior, Floor Slab and Common Facility Repairs. Except as otherwise provided in Article VIII, to make such repairs to the roof, exterior walls, floor slabs, windows, downspouts, and Common Areas and facilities, as may be necessary to keep them in condition comparable to comparable buildings in the greater Quincy/Braintree area, the expense of which shall be included as Operating Expenses in accordance with Section 4.3.

6.1.4 Quiet Enjoyment. That Tenant, upon paying the rent and performing the tenant obligations in this Lease, shall peacefully and quietly have, hold and enjoy the Demised Premises, subject to all of the terms and provisions hereof.

6.1.5. No Tenant Relocation. Landlord hereby acknowledges and agrees that Landlord shall not relocate the Tenant from the Demised Premises to another premises in the Building at any time during the Term or the Extension Term for any reason without the Tenant’s express prior written consent and agreement.

20

6.2 Interruptions and Delays in Services and Repairs. Landlord shall not be liable to Tenant for any compensation or reduction of rent by reason of inconvenience or annoyance or for loss of business arising from the necessity of Landlord or its agents entering the Demised Premises for any of the purposes in this Lease authorized, or for repairing the Demised Premises or any portion of the Commercial Building however the necessity may occur. In case Landlord is prevented or delayed from making any repairs, alterations or improvements, or furnishings any services or performing any other covenant or duty to be performed on Landlord’s part, by reason of any cause reasonably beyond Landlord’s control, including without limitation the causes set forth in Section 11.10 hereof as being reasonably beyond Landlord’s control, Landlord shall not be liable to Tenant therefor, nor, except as expressly otherwise provided in Section 8.1, shall Tenant be entitled to any abatement or reduction of rent by reason thereof, nor shall the same give rise to a claim in Tenant’s favor that such failure constitutes actual or constructive, total or partial, eviction from the Demised Premises.

Landlord reserves the right to stop any service or utility system when necessary, as determined in Landlord’s sole discretion, by reason of accident or emergency, or until necessary repairs have been completed; provided, however, that in each instance of stoppage, Landlord shall exercise reasonable efforts to eliminate the cause thereof. Except in case of emergency repairs, Landlord will give Tenant reasonable advance notice of any contemplated stoppage and will use reasonable efforts to avoid unnecessary inconvenience to Tenant by reason thereof.

ARTICLE VII

Tenant’s Covenants

Tenant covenants during the Term [and any Option Term(s), if applicable,] as follows:

7.1 Payments.

(a) Tenant shall pay when due all Fixed Rent and Additional Rent and all charges for utility services rendered to the Demised Premises and, as further Additional Rent, all charges for additional services rendered pursuant to Sections 6.1.1(b) and 6.1.2.

(b) If any installment of Fixed Rent or payment of Additional Rent or any such charge for utility services, except those utility services which are separately metered, is paid after the date the same was due, it shall bear interest from the due date at the rate set forth in Section 11.28 hereof, but not in excess of the maximum rate allowable by law, the payment of which interest shall be Additional Rent hereunder, except that no interest shall be payable on the first occasion in each Lease Year when a payment of Additional Rent is not made when due, provided such payment is made no later than twenty (90) days following notice of such failure, but interest and late charges shall be applicable to any subsequent failure to pay.

21

7.2 Repair. Except as otherwise provided in Articles VI and VIII, Tenant shall maintain the Demised Premises in good order, repair and condition, reasonable wear and tear only excepted, and all glass in windows (except glass in exterior walls unless the damage thereto is attributable to Tenant’s negligence or misuse) and doors of the Demised Premises whole and in good condition with glass of the same quality as that injured or broken. When used in this Article, the term “maintain” or “maintenance” shall include repairs and, when necessary, replacements, and the material and workmanship used in performing any maintenance shall be at least equal in quality and class to the original work.

7.3 Use.

(a) From the Commencement Date, Tenant shall continuously use and occupy the Demised Premises only for the Permitted Use, and shall not injure or deface the Property, nor permit in the Demised Premises any auction sale, vending machine, or inflammable fluids or chemicals, or nuisance, or the emission from the Demised Premises of any objectionable noise or odor, nor use or devote the Demised Premises or any part thereof for any purpose other than the Permitted Use, nor any use thereof which is inconsistent with the maintenance of the Commercial Building as an office building of the first class in the quality of its maintenance, use and occupancy, or which is improper, offensive, contrary to law or ordinance or liable to invalidate or increase the premiums for any insurance on the Commercial Building or its contents or liable to render necessary any alteration or addition to the Commercial Building.

(b) Tenant shall promptly observe and comply, and shall from time to time make all repairs, alterations or modifications required to comply, with all present and future laws, ordinances, requirements, orders, directives, rules and regulations of Federal, state, city and town governments and all other governmental authorities or any national or local Board of Fire Insurance Underwriters affecting the Property or the Demised Premises or Tenant’s use thereof. Tenant shall indemnify and hold harmless Landlord, its successors and assigns, from and against any and all penalties or damages charged to or imposed upon Landlord or for any violation of any such laws, ordinances, rules or regulations. Tenant shall not use, or permit the use of, the Demised Premises for any purpose which would cause the premiums on Landlord’s fire and casualty insurance to be increased or create a forfeiture or prevent renewal of such insurance.

(c) Tenant shall be responsible, at its own cost and expense, for obtaining, prior to the commencement of its operations at the Demised Premises, any and all licenses, permits, inspection fees and renewals thereof required by any governmental or other authority having jurisdiction, for the operation and maintenance of the Demised Premises for the Permitted Use.

7.4 Hazardous Substances.

(a) Tenant shall not: (i) dump, flush, or in any way introduce any hazardous substances or any other toxic substances into the septic, sewage or other waste disposal system serving the Property; or (ii) generate, store, use or dispose of hazardous or toxic substances in, on or about the Property, or any other location, unless such activities are in complete compliance with any and all Applicable Environmental Laws and valid permits issued to the Tenant or the Landlord and regulating such activity which permits shall have been validly issued. Nothing herein shall prohibit Tenant’s use of fluids or chemicals of the type and in quantities customary for normal office use, maintenance of office equipment, and cleaning.

22

(b) The term “hazardous substances” as used herein, shall have the same meanings as defined and used in any and all applicable environmental laws or other laws involving treatment, storage and disposal of hazardous and/or medical wastes, and all laws regulating medical or other research, which laws include, but are not limited to: (i) the Comprehensive Environmental Response, Compensation and Liability Act, 42 U.S.C. §6901 et seq.; (ii) the Resource Conservation and Recovery Act, 49 U.S.C. §9202, et seq.; (iii) the provisions of 42 U.S.C. §2001, et seq., regulating radioactive materials, including any source, special nuclear or by product material, as therein defined; (iv) the Medical Waste Tracking Act of 1988, 42 U.S.C. §6999, et seq.; (v) the Clean Air Act, 49 U.S.C. §7401, et seq.; (vi) the Occupational Safety and Health Administration Act; (vii) the Public Health Service Act, 42 U.S.C. §201 et seq.; (viii) the Federal Clean Water Act, 33 U.S.C. §1251 et seq.; (ix) Massachusetts General Laws Chapters 21C and 21E; (x) the State Sanitary Code, Chapter VIII, 105 C.M.R. 480.00; (xi) regulations of the Massachusetts Water Resources Authority, 360 C.M.R. 10.00, et seq.; (xii) the Massachusetts Clean Water Act, M.G.L. c.21 §§26-Ds; (xiii) Regulation of Health Care Facilities and Clinical Laboratories, M.G.L. c.111 and c.111D; and (xiv) the Massachusetts “Right to Know” Law, M.G.L. c.111F; all as amended or hereafter amended, together with any other environmental laws hereafter enacted, and the regulations adopted and publications promulgated pursuant to said Acts.

(c) Tenant shall provide Landlord with written notice immediately upon Tenant’s obtaining knowledge of any release, or threat of release, of any hazardous substance on or about the Demised Premises, and shall, at its own cost and expense, take all actions (to the extent and at the time or from time to time) as shall be necessary or advisable for the clean-up of the Property in accordance with all Applicable Environmental Laws and in all events in a manner satisfactory to Landlord and its mortgagee(s). Any costs, damages, liabilities, losses, claims, expenses (including attorneys’ fees and disbursements) which are incurred by Landlord in connection with any such release shall be paid, as Additional Rent hereunder, by Tenant to Landlord within ten (10) days after notice to the Tenant of any amounts so incurred and without the requirement that Landlord wait for the ultimate outcome of any litigation, claim, contest or other proceeding in which Tenant may become involved.

(d) Notwithstanding anything to the contrary contained herein, or in any other document, Tenant shall and hereby does indemnify, save, defend (with counsel approved by Landlord) and hold harmless the Landlord, its successors and assigns, and the officers, directors, shareholders, employees, agents and attorneys of any of them, from and against any and all liability, loss, claim, action, damage, judgment, cost or other expense (including without limitation attorneys’ fees and disbursements) arising out of, claimed on account-of, or in any manner predicated upon the presence or release of hazardous substances (i) on or about the Demised Premises other than any such presence or release caused directly by Landlord and without any fault or negligence on the part of Tenant, or the failure of Tenant to comply with the terms and provisions of any and all Applicable Environmental Laws pertaining to such hazardous substances or other environmental matters or (ii) on or about the Property, but only to the extent attributable to such fault, neglect or failure of Tenant. The foregoing indemnification shall survive the termination of this Lease.

23

(e) As used herein, the term “Applicable Environmental Laws” shall mean all applicable federal, state, county or local statues, laws, regulations, rules, ordinances, codes, standards, orders, licenses or permits of any governmental authorities relating to environmental matters.

7.5 Obstructions; Items Visible From Exterior; Rules and Regulations. Tenant shall not obstruct in any manner any portion of the Commercial Building not hereby leased or the Parking Garage or any portion thereof or of the Commercial Building Land or Parking Garage Land used by Tenant in common with others. Tenant shall not, without prior consent of Landlord, permit the placing of any signs, curtains, blinds, shades, awnings, and lighting which are not in conformity with other signs, curtains, blinds, shades, awnings, and lighting in the Commercial Building, aerials or flagpoles, or which are visible from outside the Demised Premises. Tenant shall comply with all Rules and Regulations of general applicability to all tenants and occupants of which it shall have had written notice for the care and use of the Property and its facilities and approaches. Landlord shall not be liable to Tenant for the failure of other occupants of the Commercial Building to conform to such Rules and Regulations.

7.6 Safety Appliances; Licenses. Tenant shall keep the Demised Premises equipped with all safety appliances required by law or ordinance or any other regulation of any public authority because of any use made by Tenant of the Demised Premises, and shall procure all licenses and permits so required because of Tenant’s use and, if requested by Landlord, Tenant shall do any work so required because of such use, it being understood that the foregoing provisions shall not be construed to broaden in any way Tenant’s Permitted Use. Landlord shall keep the Common Areas equipped with such safety appliances as may be required by any law or ordinance enacted or promulgated or amended after the date hereof, the cost of which shall be included as an Operating Expense. Landlord shall deliver the Demised Premises to Tenant equipped with all safety installations (including sprinklers, strobe lights and fire alarm/detection systems) required by any applicable governmental authority to achieve code compliance for general office use, to the extent in effect as of the Commencement Date; provided, however, that any safety appliances not required to achieve code compliance upon the Commencement Date, or otherwise required as a result of Tenant’s particular use of the Demised Premises during the Term (as set forth above) shall be the responsibility of Tenant, at Tenant’s sole cost.

7.7 Assignment; Sublease.

(a) Tenant shall not assign, mortgage, pledge or otherwise transfer this Lease or sublease, or permit occupancy of the Demised Premises or any part thereof by anyone other than Tenant, whether voluntarily or by operation of law, without on each occasion obtaining the prior written consent of Landlord, which consent shall not be unreasonably withheld or delayed, it being understood that any assignment or sublease made without such consent shall be void.

24

Tenant’s right to sublease or assign shall be limited to one transfer only and there shall be no further assignment, subletting or transfer permitted hereunder. No consent by the Landlord shall be construed to relieve Tenant from obtaining consent of Landlord to any further assignment, subletting or other transfer. Tenant shall reimburse Landlord promptly, as Additional Rent, for reasonable legal and other expense incurred by Landlord in connection with any request by Tenant for consent to any assignment or subletting.