Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - REX ENERGY CORP | d409623dex991.htm |

| 8-K - FORM 8-K - REX ENERGY CORP | d409623d8k.htm |

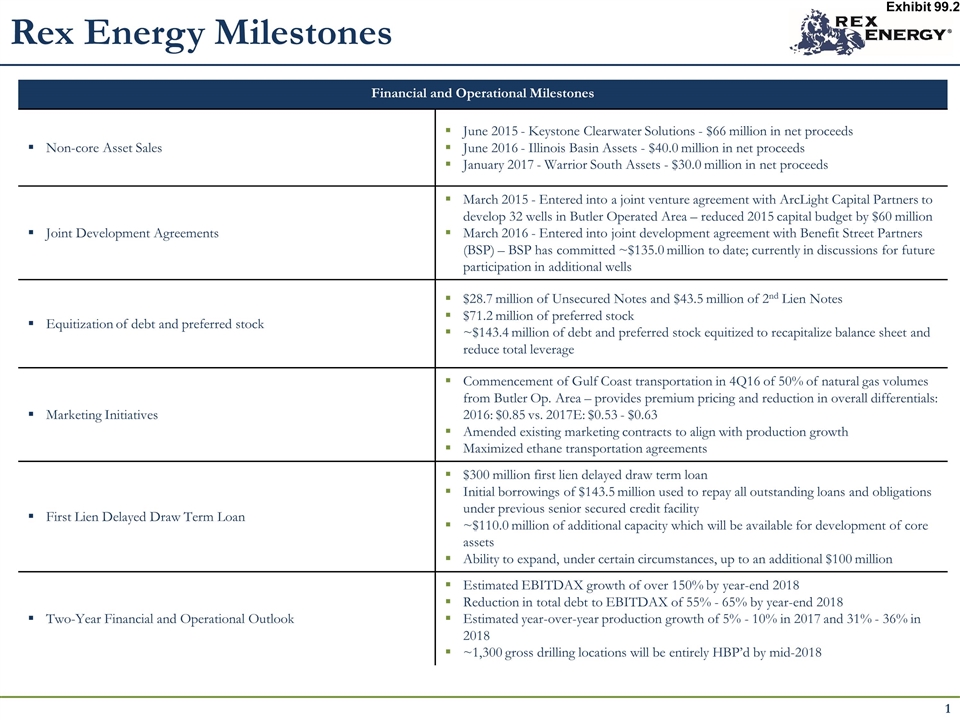

Rex Energy Milestones Financial and Operational Milestones Non-core Asset Sales June 2015 - Keystone Clearwater Solutions - $66 million in net proceeds June 2016 - Illinois Basin Assets - $40.0 million in net proceeds January 2017 - Warrior South Assets - $30.0 million in net proceeds Joint Development Agreements March 2015 - Entered into a joint venture agreement with ArcLight Capital Partners to develop 32 wells in Butler Operated Area – reduced 2015 capital budget by $60 million March 2016 - Entered into joint development agreement with Benefit Street Partners (BSP) – BSP has committed ~$135.0 million to date; currently in discussions for future participation in additional wells Equitization of debt and preferred stock $28.7 million of Unsecured Notes and $43.5 million of 2nd Lien Notes $71.2 million of preferred stock ~$143.4 million of debt and preferred stock equitized to recapitalize balance sheet and reduce total leverage Marketing Initiatives Commencement of Gulf Coast transportation in 4Q16 of 50% of natural gas volumes from Butler Op. Area – provides premium pricing and reduction in overall differentials: 2016: $0.85 vs. 2017E: $0.53 - $0.63 Amended existing marketing contracts to align with production growth Maximized ethane transportation agreements First Lien Delayed Draw Term Loan $300 million first lien delayed draw term loan Initial borrowings of $143.5 million used to repay all outstanding loans and obligations under previous senior secured credit facility ~$110.0 million of additional capacity which will be available for development of core assets Ability to expand, under certain circumstances, up to an additional $100 million Two-Year Financial and Operational Outlook Estimated EBITDAX growth of over 150% by year-end 2018 Reduction in total debt to EBITDAX of 55% - 65% by year-end 2018 Estimated year-over-year production growth of 5% - 10% in 2017 and 31% - 36% in 2018 ~1,300 gross drilling locations will be entirely HBP’d by mid-2018 Exhibit 99.2

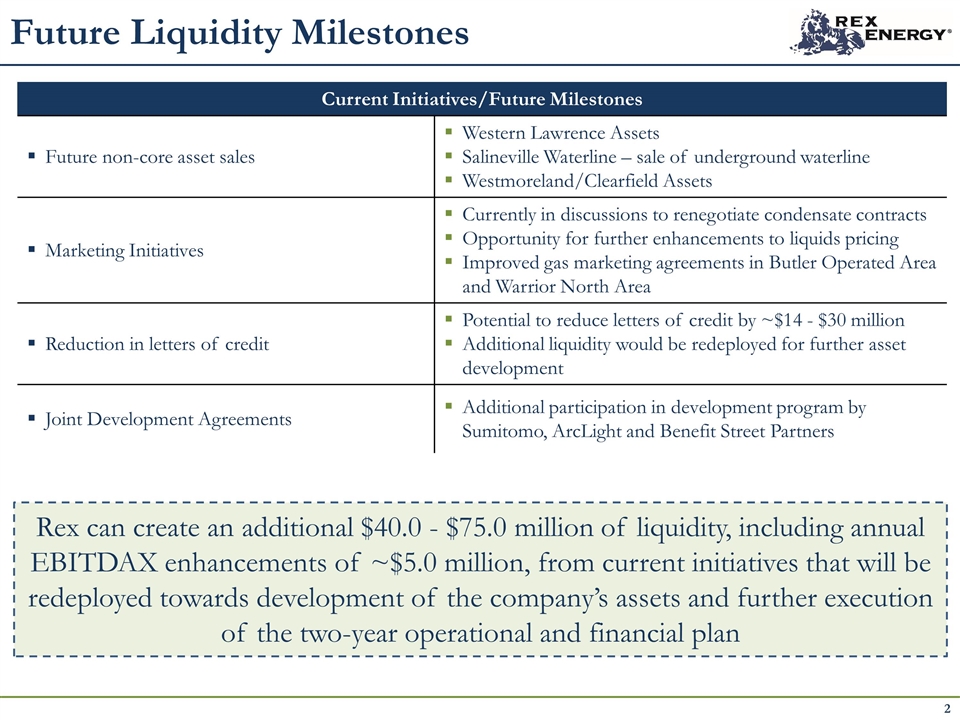

Future Liquidity Milestones Current Initiatives/Future Milestones Future non-core asset sales Western Lawrence Assets Salineville Waterline – sale of underground waterline Westmoreland/Clearfield Assets Marketing Initiatives Currently in discussions to renegotiate condensate contracts Opportunity for further enhancements to liquids pricing Improved gas marketing agreements in Butler Operated Area and Warrior North Area Reduction in letters of credit Potential to reduce letters of credit by ~$14 - $30 million Additional liquidity would be redeployed for further asset development Joint Development Agreements Additional participation in development program by Sumitomo, ArcLight and Benefit Street Partners Rex can create an additional $40.0 - $75.0 million of liquidity, including annual EBITDAX enhancements of ~$5.0 million, from current initiatives that will be redeployed towards development of the company’s assets and further execution of the two-year operational and financial plan

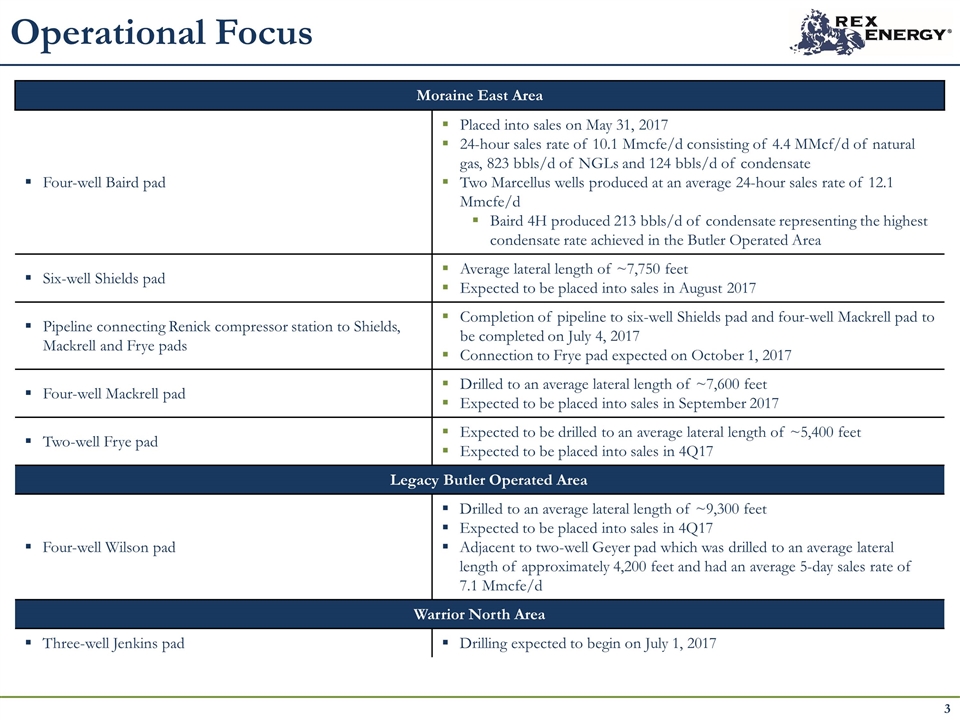

Operational Focus Moraine East Area Four-well Baird pad Placed into sales on May 31, 2017 24-hour sales rate of 10.1 Mmcfe/d consisting of 4.4 MMcf/d of natural gas, 823 bbls/d of NGLs and 124 bbls/d of condensate Two Marcellus wells produced at an average 24-hour sales rate of 12.1 Mmcfe/d Baird 4H produced 213 bbls/d of condensate representing the highest condensate rate achieved in the Butler Operated Area Six-well Shields pad Average lateral length of ~7,750 feet Expected to be placed into sales in August 2017 Pipeline connecting Renick compressor station to Shields, Mackrell and Frye pads Completion of pipeline to six-well Shields pad and four-well Mackrell pad to be completed on July 4, 2017 Connection to Frye pad expected on October 1, 2017 Four-well Mackrell pad Drilled to an average lateral length of ~7,600 feet Expected to be placed into sales in September 2017 Two-well Frye pad Expected to be drilled to an average lateral length of ~5,400 feet Expected to be placed into sales in 4Q17 Legacy Butler Operated Area Four-well Wilson pad Drilled to an average lateral length of ~9,300 feet Expected to be placed into sales in 4Q17 Adjacent to two-well Geyer pad which was drilled to an average lateral length of approximately 4,200 feet and had an average 5-day sales rate of 7.1 Mmcfe/d Warrior North Area Three-well Jenkins pad Drilling expected to begin on July 1, 2017

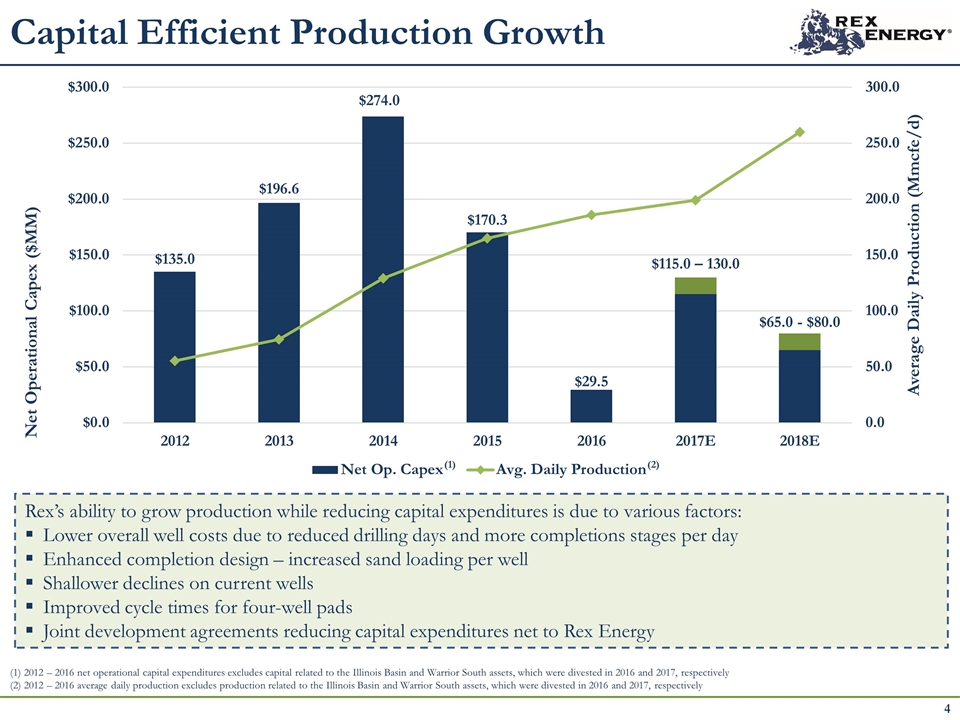

Capital Efficient Production Growth (2) (1) 2012 – 2016 net operational capital expenditures excludes capital related to the Illinois Basin and Warrior South assets, which were divested in 2016 and 2017, respectively (2) 2012 – 2016 average daily production excludes production related to the Illinois Basin and Warrior South assets, which were divested in 2016 and 2017, respectively (1) Rex’s ability to grow production while reducing capital expenditures is due to various factors: Lower overall well costs due to reduced drilling days and more completions stages per day Enhanced completion design – increased sand loading per well Shallower declines on current wells Improved cycle times for four-well pads Joint development agreements reducing capital expenditures net to Rex Energy

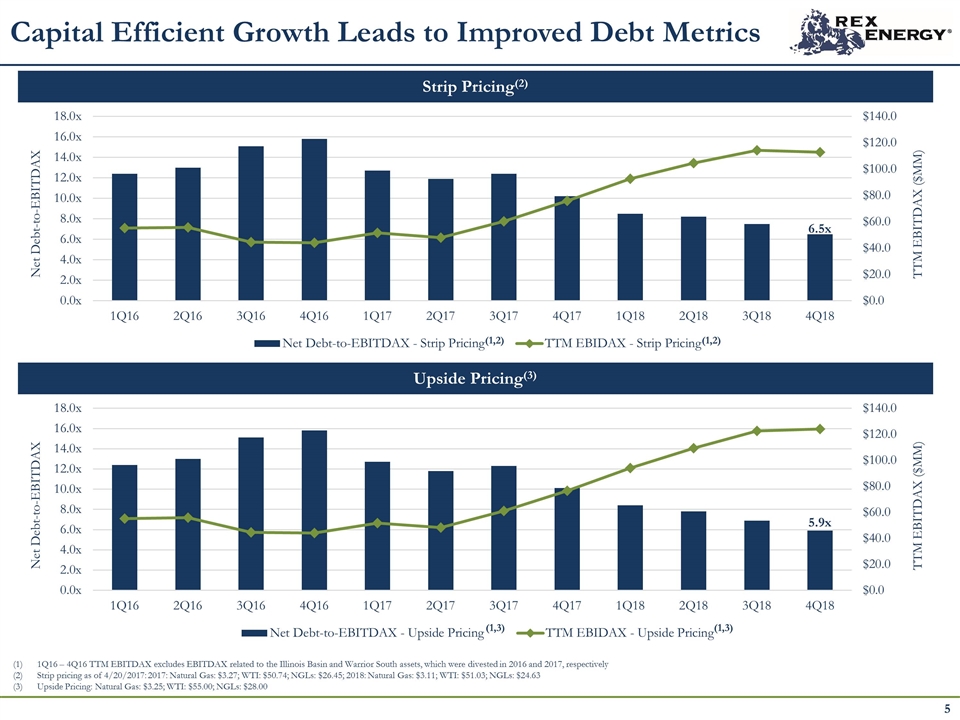

Capital Efficient Growth Leads to Improved Debt Metrics 1Q16 – 4Q16 TTM EBITDAX excludes EBITDAX related to the Illinois Basin and Warrior South assets, which were divested in 2016 and 2017, respectively Strip pricing as of 4/20/2017: 2017: Natural Gas: $3.27; WTI: $50.74; NGLs: $26.45; 2018: Natural Gas: $3.11; WTI: $51.03; NGLs: $24.63 Upside Pricing: Natural Gas: $3.25; WTI: $55.00; NGLs: $28.00 (1,2) (1,2) (1,3) (1,3) Strip Pricing(2) Upside Pricing(3)

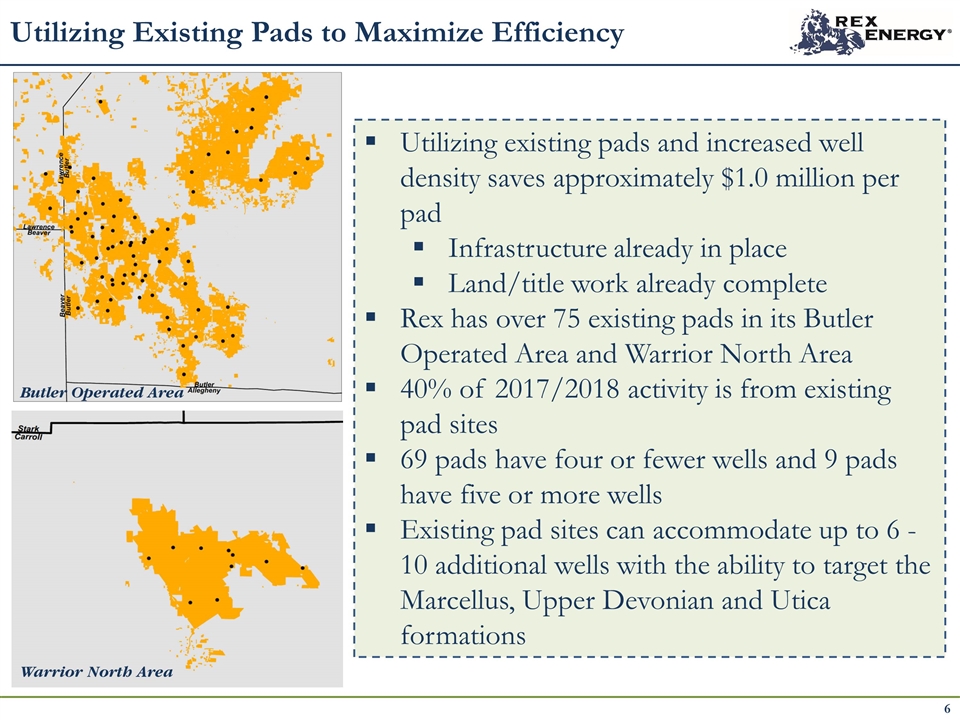

Utilizing Existing Pads to Maximize Efficiency Utilizing existing pads and increased well density saves approximately $1.0 million per pad Infrastructure already in place Land/title work already complete Rex has over 75 existing pads in its Butler Operated Area and Warrior North Area 40% of 2017/2018 activity is from existing pad sites 69 pads have four or fewer wells and 9 pads have five or more wells Existing pad sites can accommodate up to 6 - 10 additional wells with the ability to target the Marcellus, Upper Devonian and Utica formations Butler Operated Area Warrior North Area