Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ENCORE CAPITAL GROUP INC | a201706128-kx701williambla.htm |

WILLIAM BLAIR GROWTH STOCK

CONFERENCE

Ashish Masih

Tuesday, June 13, 2017

Exhibit 99.1

SAFE HARBOR

1

The statements in this presentation that are not historical facts, including, most

importantly, those statements preceded by, or that include, the words “will,” “may,”

“believe,” “projects,” “expects,” “anticipates” or the negation thereof, or similar

expressions, constitute “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995 (the “Reform Act”). These

statements may include, but are not limited to, statements regarding our future

operating results, shareholder return, capital deployment and growth. For all

“forward-looking statements,” the Company claims the protection of the safe harbor

for forward-looking statements contained in the Reform Act. Such forward-looking

statements involve risks, uncertainties and other factors which may cause actual

results, performance or achievements of the Company and its subsidiaries to be

materially different from any future results, performance or achievements expressed

or implied by such forward-looking statements. These risks, uncertainties and other

factors are discussed in the reports filed by the Company with the Securities and

Exchange Commission, including its most recent report on Form 10-K, and its

subsequent reports on Form 10-Q, as they may be amended from time to time. The

Company disclaims any intent or obligation to update these forward-looking

statements.

2

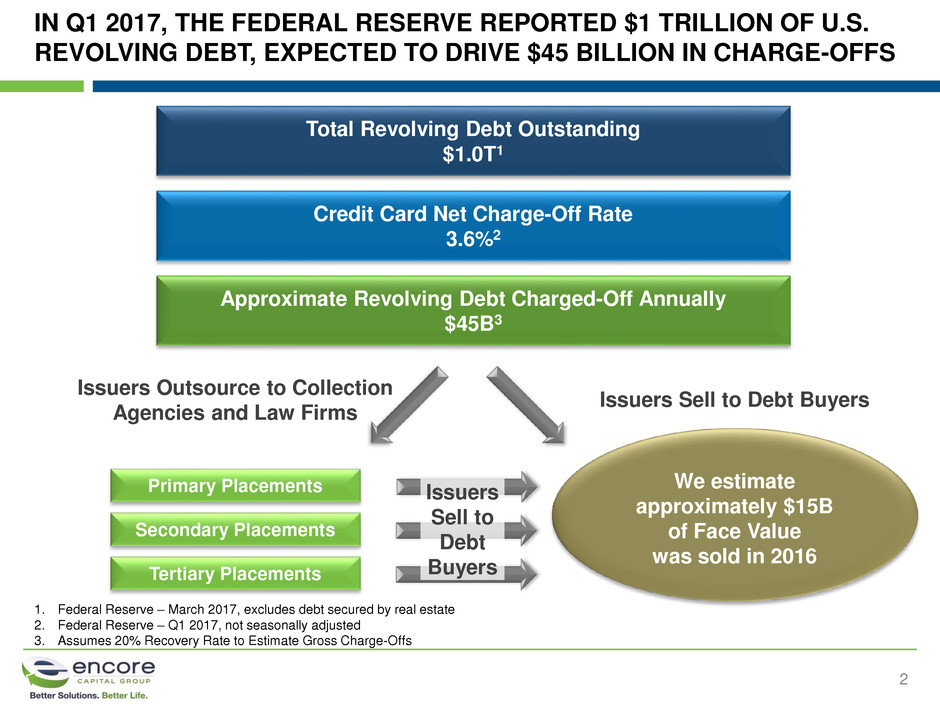

Total Revolving Debt Outstanding

$1.0T1

Credit Card Net Charge-Off Rate

3.6%2

Approximate Revolving Debt Charged-Off Annually

$45B3

Issuers Outsource to Collection

Agencies and Law Firms

Issuers Sell to Debt Buyers

Primary Placements

Secondary Placements

Tertiary Placements

We estimate

approximately $15B

of Face Value

was sold in 2016

Issuers

Sell to

Debt

Buyers

1. Federal Reserve – March 2017, excludes debt secured by real estate

2. Federal Reserve – Q1 2017, not seasonally adjusted

3. Assumes 20% Recovery Rate to Estimate Gross Charge-Offs

IN Q1 2017, THE FEDERAL RESERVE REPORTED $1 TRILLION OF U.S.

REVOLVING DEBT, EXPECTED TO DRIVE $45 BILLION IN CHARGE-OFFS

ENCORE IS A TOP-TIER, GLOBAL PLAYER IN THE CONSUMER DEBT

PURCHASING AND RECOVERY INDUSTRY

3

15

Countries &

Puerto Rico1

1/5

U.S.

Consumers

1/8

U.K.

Consumers

1/10

Colombian

Consumers

Scale

Global Reach

~100M

Consumer

Accounts

$1.7B

2016

Collections

$5.8B

Estimated

Remaining

Collections

$0.9B

2016

Deployed

Capital

$9.8B

2016

Face Value of

Debt Purchased

1. Includes countries where the Company has operations or has purchased portfolios

WE HAVE GROWN OUR GLOBAL FOOTPRINT CONSIDERABLY SINCE

WE BEGAN BUYING DEBT IN THE LATE 1990’S

4

OUR SUPERIOR ANALYTICS AND DECISION SCIENCE ALLOW US TO

BETTER UNDERSTAND CONSUMERS

5

Hardship strategies

and removal from the

collections process

Remind consumers

through legal

messaging

Enforce legal contract

through formal

channels

Significant discounts

and many small

payments

Payment plans and

opportunities to build

longer relationships

Strong partnership

and recovery

opportunities

Willingness

to Pay

Ability to Pay

Low

High

High Low

Encore’s individual underwriting approach to portfolio valuation

accommodates our specialized operational strengths

WE MAINTAIN A SIGNIFICANT FOCUS ON DRIVING OPERATIONAL

EFFICIENCIES AND REDUCING COSTS

6

Overall Cost to Collect*

47.6%

43.7%

42.2%

40.0%

39.1%

38.6%

39.2%

38.5%

30%

35%

40%

45%

50%

2009 2010 2011 2012 2013 2014 2015 2016

⃰ Cost to Collect is defined and provided in Encore’s annual and quarterly filings with the SEC.

OUR ISSUER CERTIFICATION PROGRAM IS A KEY DIFFERENTIATOR

7

Cycle I:

Request for

Information

Cycle II:

On-Site

Audit

Cycle III:

Post On-Site

Follow-up

Requests

Cycle IV:

Audit Report

Received

Approval/

Certification

“Encore by far is the most transparent, prepared, and buttoned up of any debt buyer

we’ve audited. You have raised and set a new bar in the industry.”

- Top 5 Credit Card Issuer

In 2016, Encore successfully completed 41 audits and is approved by all major domestic

issuers

• The certifications received through these audits are a prerequisite for purchasing debt from issuers

• Encore has achieved certification from all major domestic issuers who sell their charged-off accounts

Issuer Review/Audit Process

8

Total Estimated Remaining Collections

0

1,000

2,000

3,000

4,000

5,000

6,000

March 2013 March 2014 March 2015 March 2016 March 2017

United States Europe Other

1,911

4,758

5,080

$M 5,665

5,849

ERC CONTINUES TO GROW, WITH END OF Q1 REPRESENTING OUR

HIGHEST LEVEL TO DATE

9

0

2,000

4,000

6,000

8,000

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Initial

Projections

Actual Cash

Collections

($MM)

Cumulative Collections - U.S. Core

Note: U.S. Core market is defined as all non-bankruptcy direct from issuer unsecured credit card and personal installment loan sales

ACTUAL CASH COLLECTIONS EXCEED OUR INITIAL PROJECTIONS

Our persistent focus on risk management and compliance has

become a competitive advantage

Our access to capital positions us well to benefit from

improving market conditions

Operational scale and cost leadership drive strong

profitability through the cycle

Our global operations enable us to refine collection

strategies to improve liquidations

Extensive investment in data analytics and behavioral science

underpins our pricing accuracy

ENCORE IS A GLOBAL MARKET LEADER IN THE DEBT PURCHASING

AND RECOVERY INDUSTRY

10

1

5

2

3

4