Attached files

| file | filename |

|---|---|

| EX-99.1 - CAROLINA FINANCIAL CORP | e17297_ex99-1.htm |

| 8-K - CAROLINA FINANCIAL CORP | e17297_caro-8k.htm |

Investor Presentation N A S D A Q : C A RO June 12, 201 7 Acquisition of First South Bancorp Inc. (FSBK) by Carolina Financial Corporation (CARO)

2 Disclaimer Certain statements in this presentation contain “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 , such as statements relating to future plans and expectations, and are thus prospective . Such forward - looking statements include but are not limited to statements with respect to plans, objectives, expectations, and intentions and other statements that are not historical facts, and other statements identified by words such as “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “targets,” and “projects,” as well as similar expressions . Such statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from future results expressed or implied by such forward - looking statements . Although we believe that the assumptions underlying the forward - looking statements are reasonable, any of the assumptions could prove to be inaccurate . Therefore, we can give no assurance that the results contemplated in the forward - looking statements will be realized . The inclusion of this forward - looking information should not be construed as a representation by Carolina Financial Corporation (“Carolina Financial” or the “Company”) or any person that such future events, plans, or expectations will occur or be achieved . In addition to factors previously disclosed in the reports filed by Carolina Financial with the Securities and Exchange Commission (the “SEC”), additional risks and uncertainties may include, but are not limited to : the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive merger agreement between Carolina Financial and First South ; the outcome of any legal proceedings that may be instituted against Carolina Financial or First South ; the failure to obtain necessary regulatory approvals (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction), and shareholder approvals or to satisfy any of the other conditions to the transaction on a timely basis or at all ; the possibility that the anticipated benefits of the transaction are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where Carolina Financial and First South do business ; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events ; diversion of management’s attention from ongoing business operations and opportunities ; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction ; Carolina Financial’s ability to complete the acquisition and integration of First South successfully ; credit risk associated with commercial real estate, commercial business and construction lending ; interest risk involving the effect of a change in interest rates on both of Carolina Financial’s and First South’s earnings and the market value of the portfolio equity ; liquidity risk affecting each bank’s ability to meet its obligations when they come due ; price risk focusing on changes in market factors that may affect the value of traded instruments ; transaction risk arising from problems with service or product delivery ; compliance risk involving risk to earnings or capital resulting from violations of or nonconformance with laws, rules, regulations, prescribed practices, or ethical standards ; strategic risk resulting from adverse business decisions or improper implementation of business decisions ; reputation risk that adversely affects earnings or capital arising from negative public opinion ; cybersecurity risk related to the dependence of Carolina Financial and First South on internal computer systems and the technology of outside service providers, as well as the potential impacts of third - party security breaches, which subjects each company to potential business disruptions or financial losses resulting from deliberate attacks or unintentional events . Additional factors that could cause our results to differ materially from those described in the forward - looking statements can be found in the reports (such as our Annual Report on Form 10 - K, Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K) filed with the SEC and available at the SEC’s Internet site (http : //www . sec . gov) . All subsequent written and oral forward - looking statements concerning the Company or any person acting on its behalf is expressly qualified in its entirety by the cautionary statements above . We do not undertake any obligation to update any forward - looking statement to reflect circumstances or events that occur after the date the forward - looking statements are made .

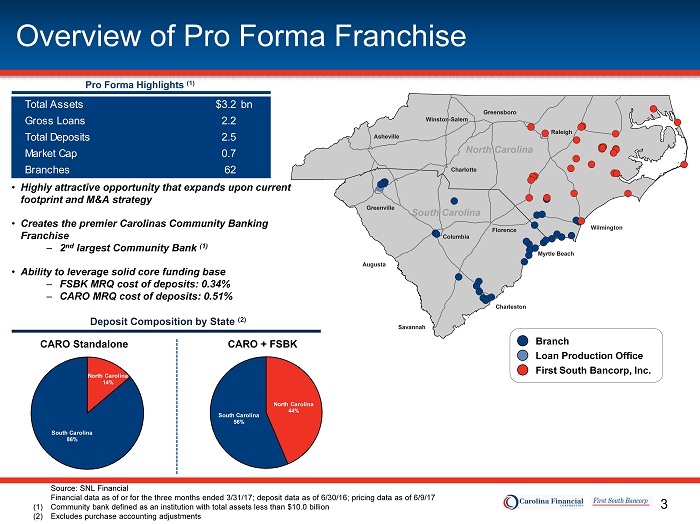

3 North Carolina 44% South Carolina 56% North Carolina 14% South Carolina 86% Overview of Pro Forma Franchise Source: SNL Financial Financial data as of or for the three months ended 3/31/17; deposit data as of 6/30/16; pricing data as of 6/9/17 (1) Community bank defined as an institution with total assets less than $10.0 billion (2) Excludes purchase accounting adjustments Pro Forma Highlights (1 ) Deposit Composition by State (2) CARO Standalone CARO + FSBK • Highly attractive opportunity that expands upon current footprint and M&A strategy • Creates the premier Carolinas Community Banking Franchise ‒ 2 nd largest Community Bank (1) • Ability to leverage solid core funding base ‒ FSBK MRQ cost of deposits: 0.34% ‒ CARO MRQ cost of deposits: 0.51% North Carolina South Carolina Wilmington Myrtle Beach Winston-Salem Greensboro Asheville Charlotte Raleigh Florence Columbia Greenville Augusta Savannah Charleston Branch Loan Production Office First South Bancorp, Inc. Total Assets $3.2bn Gross Loans 2.2 Total Deposits 2.5 Market Cap 0.7 Branches 62

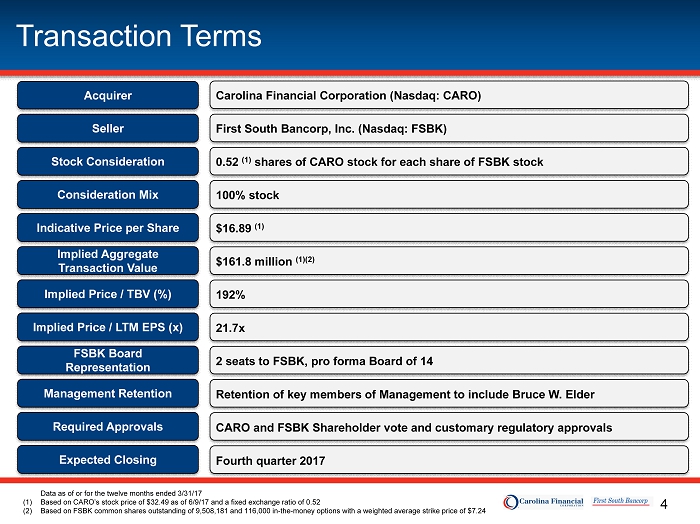

4 Transaction Terms Consideration Mix Implied Price / TBV (%) Required Approvals $161.8 million (1)(2) 100% stock CARO and FSBK Shareholder vote and customary regulatory approvals Implied Aggregate Transaction Value FSBK Board Representation Expected Closing Fourth quarter 2017 Retention of key members of Management to include Bruce W. Elder 192% $16.89 (1) Indicative Price per Share 0.52 (1) shares of CARO stock for each share of FSBK stock Stock Consideration First South Bancorp, Inc. (Nasdaq: FSBK) Seller Carolina Financial Corporation (Nasdaq: CARO) Acquirer Implied Price / LTM EPS (x) 21.7x Data as of or for the twelve months ended 3/31/17 (1) Based on CARO’s stock price of $32.49 as of 6/9/17 and a fixed exchange ratio of 0.52 (2) Based on FSBK common shares outstanding of 9,508,181 and 116,000 in - the - money options with a weighted average strike price of $7 .24 Management Retention 2 seats to FSBK, pro forma Board of 14

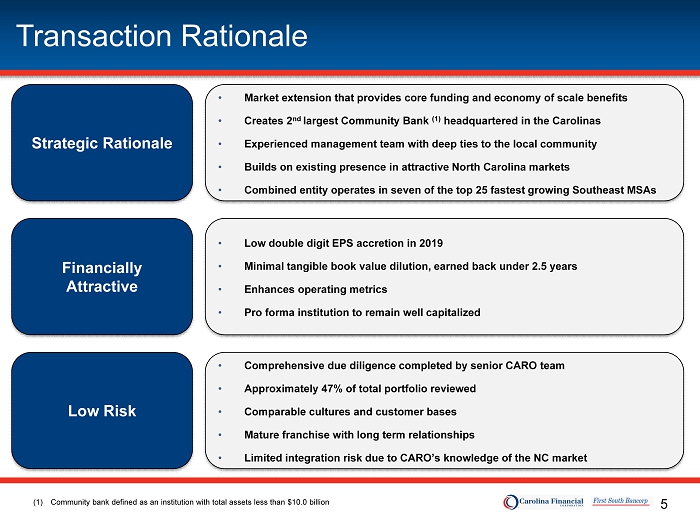

5 • Low double digit EPS accretion in 2019 • Minimal tangible book value dilution, earned back under 2.5 years • Enhances operating metrics • Pro forma institution to remain well capitalized • Comprehensive due diligence completed by senior CARO team • Approximately 47% of total portfolio reviewed • Comparable cultures and customer bases • Mature franchise with long term relationships • Limited integration risk due to CARO’s knowledge of the NC market • Market extension that provides core funding and economy of scale benefits • Creates 2 nd largest Community Bank (1) headquartered in the Carolinas • Experienced management team with deep ties to the local community • Builds on existing presence in attractive North Carolina markets • Combined entity operates in seven of the top 25 fastest growing Southeast MSAs Transaction Rationale Low Risk Financially Attractive Strategic Rationale (1) Community bank defined as an institution with total assets less than $10.0 billion

6 Key Factors in a Successful M&A Transaction Conservative and Achievable Results Retention of Key Employees with Minimal Turnover Material, Immediate and Lasting EPS Accretion TBV Earn back Period under 2.5 years x x x x Well Capitalized Pro Forma Company x

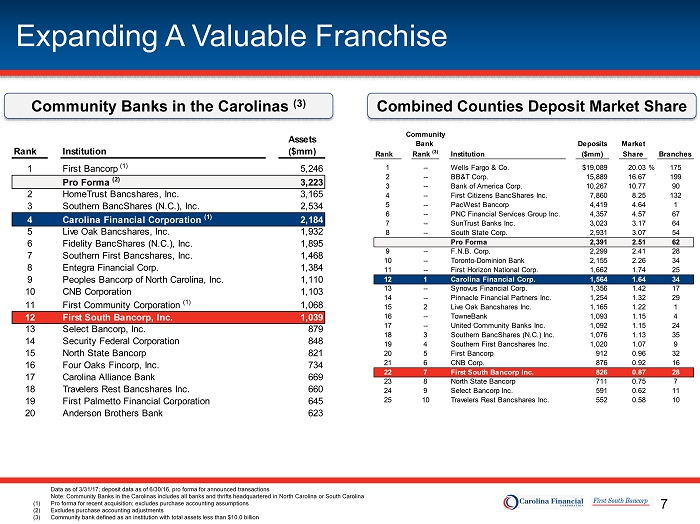

7 Expanding A Valuable Franchise Data as of 3/31/17; deposit data as of 6/30/16, pro forma for announced transactions Note: Community Banks in the Carolinas includes all banks and thrifts headquartered in North Carolina or South Carolina (1) Pro forma for recent acquisition; excludes purchase accounting assumptions (2) Excludes purchase accounting adjustments (3) Community bank defined as an institution with total assets less than $10.0 billion Community Banks in the Carolinas (3) Combined Counties Deposit Market Share Community Bank Deposits Market Rank Rank (3) Institution ($mm) Share Branches 1 -- Wells Fargo & Co. $19,089 20.03% 175 2 -- BB&T Corp. 15,889 16.67 199 3 -- Bank of America Corp. 10,267 10.77 90 4 -- First Citizens BancShares Inc. 7,860 8.25 132 5 -- PacWest Bancorp 4,419 4.64 1 6 -- PNC Financial Services Group Inc. 4,357 4.57 67 7 -- SunTrust Banks Inc. 3,023 3.17 64 8 -- South State Corp. 2,931 3.07 54 Pro Forma 2,391 2.51 62 9 -- F.N.B. Corp. 2,299 2.41 28 10 -- Toronto-Dominion Bank 2,155 2.26 34 11 -- First Horizon National Corp. 1,662 1.74 25 12 1 Carolina Financial Corp. 1,564 1.64 34 13 -- Synovus Financial Corp. 1,356 1.42 17 14 -- Pinnacle Financial Partners Inc. 1,254 1.32 29 15 2 Live Oak Bancshares Inc. 1,165 1.22 1 16 -- TowneBank 1,093 1.15 4 17 -- United Community Banks Inc. 1,092 1.15 24 18 3 Southern BancShares (N.C.) Inc. 1,076 1.13 35 19 4 Southern First Bancshares Inc. 1,020 1.07 9 20 5 First Bancorp 912 0.96 32 21 6 CNB Corp. 876 0.92 16 22 7 First South Bancorp Inc. 826 0.87 28 23 8 North State Bancorp 711 0.75 7 24 9 Select Bancorp Inc. 591 0.62 11 25 10 Travelers Rest Bancshares Inc. 552 0.58 10 Assets Rank Institution ($mm) 1 First Bancorp (1) 5,246 Pro Forma (2) 3,223 2 HomeTrust Bancshares, Inc. 3,165 3 Southern BancShares (N.C.), Inc. 2,534 4 Carolina Financial Corporation (1) 2,184 5 Live Oak Bancshares, Inc. 1,932 6 Fidelity BancShares (N.C.), Inc. 1,895 7 Southern First Bancshares, Inc. 1,468 8 Entegra Financial Corp. 1,384 9 Peoples Bancorp of North Carolina, Inc. 1,110 10 CNB Corporation 1,103 11 First Community Corporation (1) 1,068 12 First South Bancorp, Inc. 1,039 13 Select Bancorp, Inc. 879 14 Security Federal Corporation 848 15 North State Bancorp 821 16 Four Oaks Fincorp, Inc. 734 17 Carolina Alliance Bank 669 18 Travelers Rest Bancshares Inc. 660 19 First Palmetto Financial Corporation 645 20 Anderson Brothers Bank 623

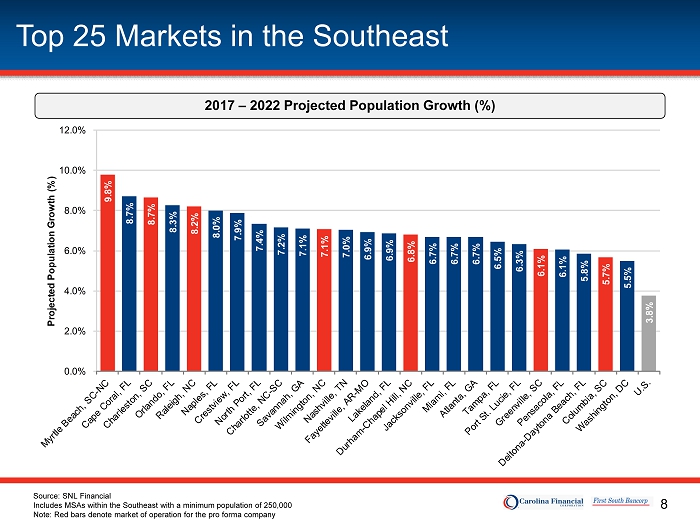

8 Top 25 Markets in the Southeast 9.8% 8.7% 8.7% 8.3% 8.2% 8.0% 7.9% 7.4% 7.2% 7.1% 7.1% 7.0% 6.9% 6.9% 6.8% 6.7% 6.7% 6.7% 6.5% 6.3% 6.1% 6.1% 5.8% 5.7% 5.5% 3.8% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% Projected Population Growth (%) Source: SNL Financial Includes MSAs within the Southeast with a minimum population of 250,000 Note: Red bars denote market of operation for the pro forma company 2017 – 2022 Projected Population Growth (%)

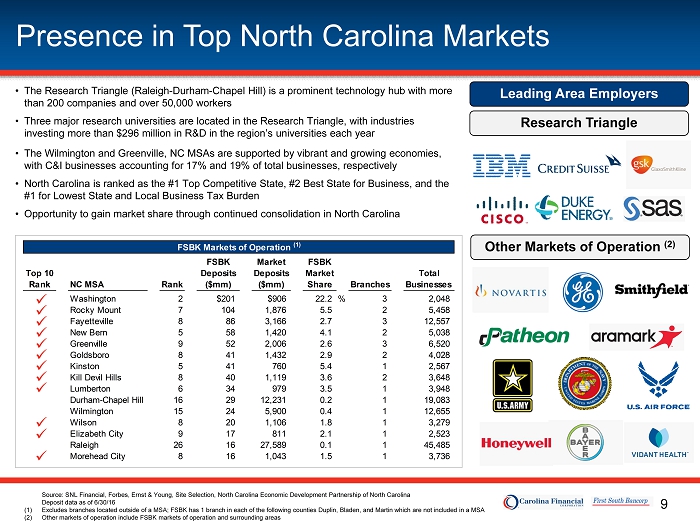

9 FSBK Markets of Operation (1) FSBK Market FSBK Top 10 Deposits Deposits Market Total Rank NC MSA Rank ($mm) ($mm) Share Branches Businesses Washington 2 $201 $906 22.2 % 3 2,048 Rocky Mount 7 104 1,876 5.5 2 5,458 Fayetteville 8 86 3,166 2.7 3 12,557 New Bern 5 58 1,420 4.1 2 5,038 Greenville 9 52 2,006 2.6 3 6,520 Goldsboro 8 41 1,432 2.9 2 4,028 Kinston 5 41 760 5.4 1 2,567 Kill Devil Hills 8 40 1,119 3.6 2 3,648 Lumberton 6 34 979 3.5 1 3,948 Durham-Chapel Hill 16 29 12,231 0.2 1 19,083 Wilmington 15 24 5,900 0.4 1 12,655 Wilson 8 20 1,106 1.8 1 3,279 Elizabeth City 9 17 811 2.1 1 2,523 Raleigh 26 16 27,589 0.1 1 45,485 Morehead City 8 16 1,043 1.5 1 3,736 Presence in Top North Carolina Markets x x x x x x x x x x x x • The Research Triangle (Raleigh - Durham - Chapel Hill) is a prominent technology hub with more than 200 companies and over 50,000 workers • Three major research universities are located in the Research Triangle, with industries investing more than $296 million in R&D in the region’s universities each year • The Wilmington and Greenville, NC MSAs are supported by vibrant and growing economies, with C&I businesses accounting for 17% and 19% of total businesses, respectively • North Carolina is ranked as the #1 Top Competitive State, #2 Best State for Business, and the #1 for Lowest State and Local Business Tax Burden • Opportunity to gain market share through continued consolidation in North Carolina Research Triangle Other Markets of Operation (2) Leading Area Employers Source: SNL Financial, Forbes, Ernst & Young, Site Selection, North Carolina Economic Development Partnership of North Caroli na Deposit data as of 6/30/16 (1) Excludes branches located outside of a MSA; FSBK has 1 branch in each of the following counties Duplin, Bladen, and Martin wh ich are not included in a MSA (2) Other markets of operation include FSBK markets of operation and surrounding areas

10 Expected Financial Impact (1) Tangible book value earn back period calculated using the crossover method Assumptions / Current Estimates Financial Impact • 1.8% gross loan credit mark • 26% in cost savings • $23.7 million pre - tax one - time transaction costs • Revenue synergies identified but not modeled • Low double digit EPS accretion with full realization of cost savings • Tangible book value earn back under 2.5 years (1) • Pro forma capital ratios will remain well capitalized • IRR greater than 20.0%

11 Credit Due Diligence Credit Due Diligence Process • Experienced credit review team of CARO bankers, comprised of CARO senior management • Reviewed 47% of FSBK’s total loan portfolio ‒ Reviewed 69% of loans greater than $300 thousand (60% of total loan portfolio) ‒ Reviewed 51% of non accrual loans (less than 0.5% of total loan portfolio) ‒ Reviewed 59% of watchlist and criticized loans, excluding nonaccrual loans (6% of total loan portfolio) • FSBK has OREO totaling $3.1 million as of 3/31/17

12 Summary • Creates significant value to CARO and FSBK shareholders through economies of scale • Establishes the 2 nd largest Community Bank (1) headquartered in the Carolinas • Carolina Financial will have strong banking teams in seven of the fastest growing markets in the Southeast • Complimentary community banking overarching philosophies • Financially attractive combination • Premier core deposit franchise (1) Community bank defined as an institution with total assets less than $10.0 billion

13 Appendix

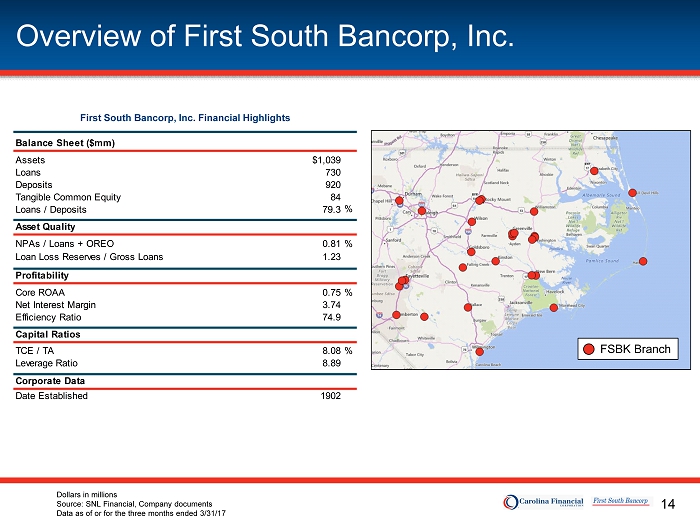

14 Overview of First South Bancorp, Inc. First South Bancorp, Inc. Financial Highlights Dollars in millions Source: SNL Financial, Company documents Data as of or for the three months ended 3/31/17 FSBK Branch Balance Sheet ($mm) Assets $1,039 Loans 730 Deposits 920 Tangible Common Equity 84 Loans / Deposits 79.3 % Asset Quality NPAs / Loans + OREO 0.81% Loan Loss Reserves / Gross Loans 1.23 Profitability Core ROAA 0.75% Net Interest Margin 3.74 Efficiency Ratio 74.9 Capital Ratios TCE / TA 8.08% Leverage Ratio 8.89 Corporate Data Date Established 1902

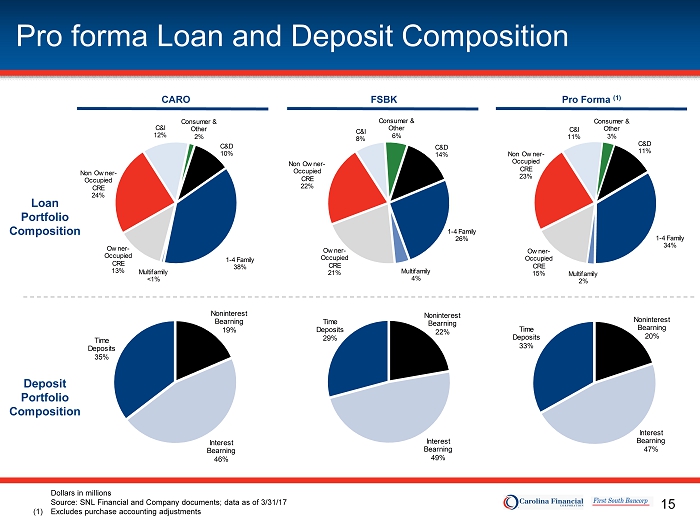

15 C&D 14% 1 - 4 Family 26% Multifamily 4% Owner - Occupied CRE 21% Non Owner - Occupied CRE 22% C&I 8% Consumer & Other 6% C&D 11% 1 - 4 Family 34% Multifamily 2% Owner - Occupied CRE 15% Non Owner - Occupied CRE 23% C&I 11% Consumer & Other 3% C&D 10% 1 - 4 Family 38% Multifamily <1% Owner - Occupied CRE 13% Non Owner - Occupied CRE 24% C&I 12% Consumer & Other 2% Pro forma Loan and Deposit Composition CARO FSBK Pro Forma (1) Loan Portfolio Composition Deposit Portfolio Composition Dollars in millions Source: SNL Financial and Company documents; data as of 3/31/17 (1) Excludes purchase accounting adjustments Noninterest Bearning 19% Interest Bearning 46% Time Deposits 35% Noninterest Bearning 22% Interest Bearning 49% Time Deposits 29% Noninterest Bearning 20% Interest Bearning 47% Time Deposits 33%