Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TIER REIT INC | form8-k06052017.htm |

COMPANY

PRESENTATION

JUNE 2017

Exhibit 99.1

Significant value creation opportunities

Proven execution

Experienced management team

WHY

TIER?

Focused strategy

High-quality portfolio

Austin I Dallas I Houston I Charlotte I Nashville I Atlanta I Denver 2

3

Domain 7

FOCUSED

STRATEGY

Delivered 2015

4

Value Creation

Proven track record in publicly-

traded real estate companies

Successful history of investing &

creating value in target markets

Ability to complete complex

transactions

Demonstrated path toward long-

term value creation

Seven Target Growth Markets

High-quality, Class A office

properties

High-growth, demand-driven

markets

Amenity-rich, high-density

submarkets – TIER1 submarkets

Emphasis on LIVE.WORK.PLAY

environments

Targeted Approach

TIER ONE Property Services

Unparalleled customer service &

operational excellence

Operating & developing to highest

sustainability standards

A leader in BOMA 360

designations

Significant LEED & Energy Star

certifications

Focus + Strategy

5950 Sherry Lane, Dallas

Experience + Innovation

Domain 8, Austin

Service + Sustainability

Bank of America Plaza, Charlotte

5

Seven Target Growth Markets

TIER REIT targets high-growth, demand-driven TIER1 submarkets that will

benefit most from population and office-using employment growth

Denver

Houston

Austin

Atlanta

Nashville

Dallas

Charlotte

CBD

The Domain

Southwest

The Galleria

Katy Freeway West

Westchase

Uptown

SouthPark

Preston Center

Plano Legacy

Uptown

Current market location

Midtown

Buckhead

CBD / LoDo

Platte River

Cherry Creek

CBD

West End

The Gulch

Target growth market

6

Houston Update

Eldridge Place

9% of leases expire through 1Q’19

Attractive rental rates relative to

recent deliveries

33% of Houston NOI in 1Q’17

BriarLake Plaza

3% of leases expire through 1Q’19

Highest rents in Westchase

submarket

50% of Houston NOI in 1Q’17

Loop Central

8% of leases expire through 1Q’19

Moderate price point driving

current tenant demand

17% of Houston NOI in 1Q’17

Known move-outs

Lease Expirations (SF in 000s)

Other expirations

Minimal lease expirations through March 20191 with tenant activity accelerating

0

100

200

300

400

500

600

0

100

200

300

400

500

600

0

100

200

300

400

500

600

1 Reflects leases expiring between June 2017 and March 2019

7

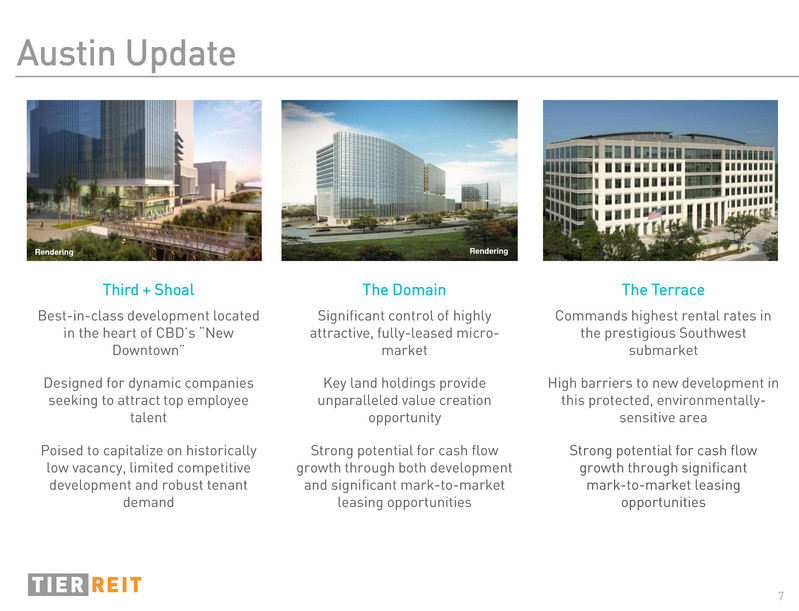

Austin Update

Third + Shoal

Best-in-class development located

in the heart of CBD’s “New

Downtown”

Designed for dynamic companies

seeking to attract top employee

talent

Poised to capitalize on historically

low vacancy, limited competitive

development and robust tenant

demand

The Domain

Significant control of highly

attractive, fully-leased micro-

market

Key land holdings provide

unparalleled value creation

opportunity

Strong potential for cash flow

growth through both development

and significant mark-to-market

leasing opportunities

The Terrace

Commands highest rental rates in

the prestigious Southwest

submarket

High barriers to new development in

this protected, environmentally-

sensitive area

Strong potential for cash flow

growth through significant

mark-to-market leasing

opportunities

Rendering Rendering

8

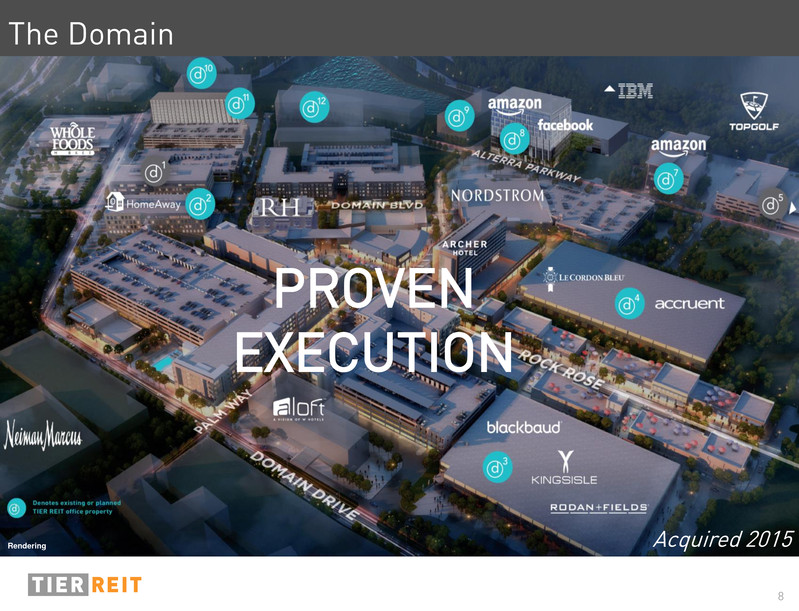

Acquired 2015

PROVEN

EXECUTION

The Domain

Rendering

9

Strategic Plan

Positioned for growth &

long-term value creation for stockholders

Recycling Strengthening Growing

10

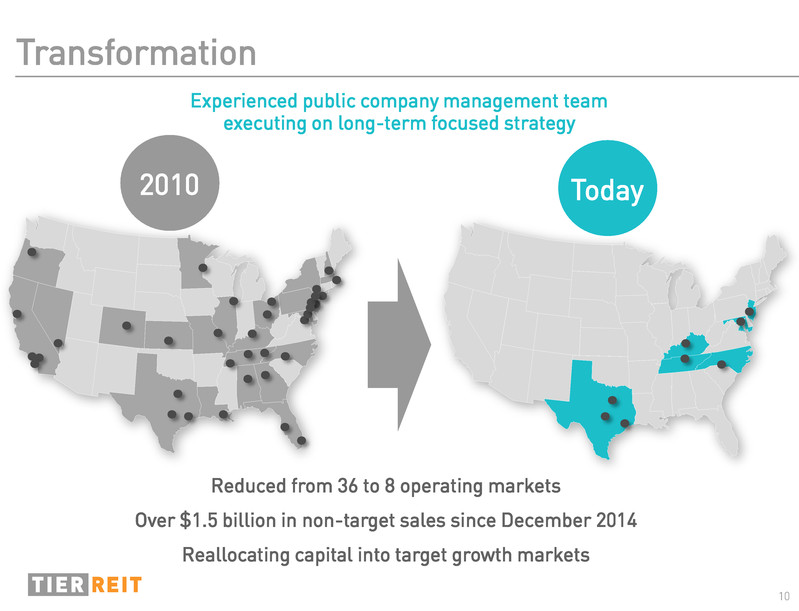

Transformation

Experienced public company management team

executing on long-term focused strategy

Reduced from 36 to 8 operating markets

Over $1.5 billion in non-target sales since December 2014

Reallocating capital into target growth markets

2010 Today

11

Strengthening Results

• Sold over $1.5B of assets

• Sharpened focus to eight operating markets2

• Increased target market NOI from 42% to 85%

• 97% secured to 82% unsecured

• 9.6x to 7.3x Net Debt to EBITDA

• Reduced borrowing cost from 5.6% to 3.5%2

• Completed spend of deferred capital

• Achieved full dividend coverage during 2016

• On track for increased coverage in 2017

• 90.2% occupancy at 3.31.17

• Renewed 138K SF of 2017 Houston expirations

Results1 Objective

Strengthening

Dispose of

Non-Target

Assets

Strengthen

Balance

Sheet

Maintain

Occupancy

Manage

Capital

Expenditures

Refresh

Board of

Directors

• Non-executive chairman

• All directors new since 2014; 5 of 6 independent

• Significant public company, REIT and real estate

experience, providing competitive advantage

1 Since September 2014

2 Pro forma for the pending disposition of Fifth Third Columbus

12

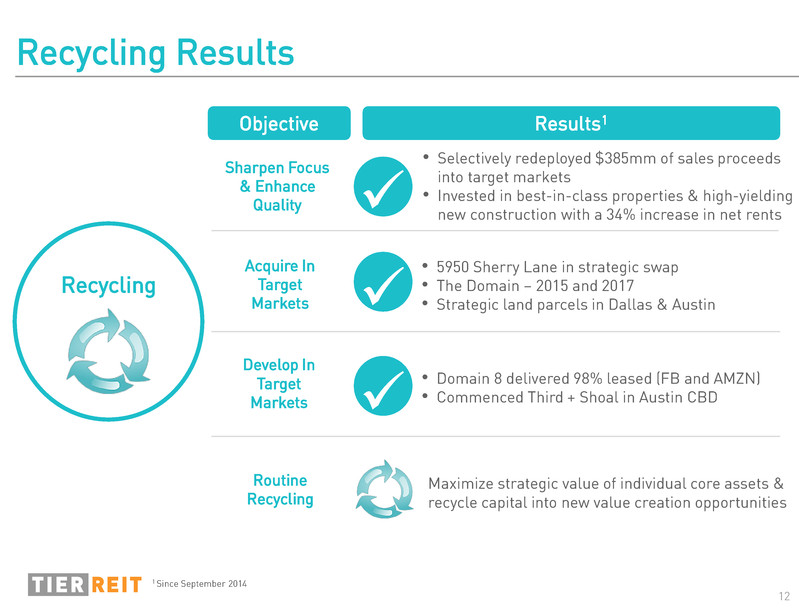

Recycling Results

• Selectively redeployed $385mm of sales proceeds

into target markets

• Invested in best-in-class properties & high-yielding

new construction with a 34% increase in net rents

• Domain 8 delivered 98% leased (FB and AMZN)

• Commenced Third + Shoal in Austin CBD

• 5950 Sherry Lane in strategic swap

• The Domain – 2015 and 2017

• Strategic land parcels in Dallas & Austin

Results1 Objective

Sharpen Focus

& Enhance

Quality

Develop In

Target

Markets

Acquire In

Target

Markets

Routine

Recycling

Maximize strategic value of individual core assets &

recycle capital into new value creation opportunities

Recycling

1 Since September 2014

13

CREATING

VALUE

Bank of America Plaza

Redevelopment to deliver 2017

14

The Domain

Austin, Texas

Creating Value: Development of Domain 8

Primary Tenants

Value

creation:

$11mm to $14mm1

1 Development potential incremental value calculated using stabilized NOI from development and a 5.5%-6.0% exit capitalization rate less actual

development costs, at ownership share

Domain 8 (Rendering) Domain 8

Quick Facts

291K SF with 12 stories

Pedestal parking 3.7/1,000

Walk to Whole Foods, Rock Rose,

Domain NORTHSIDE Shops

Development begins

201

7

2015 2016 2017

Delivery

Timeline

Leasing hits 94% Delivery at 98% leased

d

8

15

CBD

Austin, Texas

Creating Value: Development of Third + Shoal

Potential

value creation:

$22mm to $27mm1

1 Development potential incremental value calculated using stabilized NOI from development and a 5.5%-6.0% exit capitalization rate less budgeted

development costs, at ownership share

Development & lease

negotiations begin

201

7

2017 2018

Delivery

Timeline

Delivery

Third + Shoal (Rendering) Third + Shoal (Rendering)

Quick Facts

345K SF with 29 stories

Pedestal parking 2.5/1,000

Located in the heart of CBD’s

“New Downtown”

Special Features

Two 26’ clear height loft-style floors

4K SF rooftop terrace & eleven outdoor

balconies overlooking Lady Bird Lake

Bike valet & storage with direct access to

Austin bikeways and trails

16

Domain 12 (Rendering)

Creating Value: Future Development

Domain 11 & 12, Austin, TX

~640K net rentable SF

~8.5%+ est. development yield

Legacy District, Plano, TX

~570K net rentable SF in two phase

~8.5%+ est. development yield

1 Development potential incremental value calculated using stabilized NOI from above developments and a 5.5%-6.0% exit capitalization rate less

estimated development costs

Legacy District (Rendering)

Potential

value creation:

$285mm to $375mm1

Domain 9, 10, D & G, Austin, TX

~660K net rentable SF in three phases

Domain 9 & 10 currently in design

Opportunity to create ~$5.95 to $7.80/share of incremental value through future development

Domain 9 (Rendering)

17

Creating Value: Redevelopment

Re-energizing the intersection of Trade & Tryon - the “Main & Main” of Charlotte’s CBD

1 Redevelopment potential incremental value calculated using estimated NOI from new ~25K SF of retail space less prior rate and $2/SF estimated

value for remainder of building and a 6.0%-7.0% exit capitalization rate less budgeted redevelopment costs

$25mm redevelopment scheduled to

deliver in 2017

Featuring new entrance, lobby, and

~25K SF of new retail space

including signature dining &

entertainment

Executed leases on 58% of

new retail space

Net occupancy up over 640 bps

& rental rates up over 9.5%

since redevelopment announced

Bank of America Plaza

Potential

incremental

value creation:

$7mm to $12mm1

18

Mark-to-Market Rents

Creating Value: Leasing

Stabilize Occupancy at 93%

The Terrace

Eldridge Place

In-place rents 14%-24% below market

for tenants expiring through 2019

Opportunity to lease up to 350K SF

of vacant space

1 Mark-to-market potential incremental value calculated using incremental estimated NOI from re-leasing SF expiring through 2019 at Bank of America

Plaza, The Terrace, and Domain 4 at current market rates (less estimated $2/SF for Bank of America rate attributed to redevelopment) and a 6.0%-

7.0% NOI exit capitalization rate less $40/SF estimated leasing capital

2 Stabilized occupancy potential incremental value calculated using estimated NOI generated from increasing occupancy of Two BriarLake Plaza,

Eldridge Place, and Burnett Plaza at 90% NOI margins of current market rates and a 6.0%-7.0% NOI exit capitalization rate less $40/SF estimated

leasing capital

Bank of America Plaza BriarLake Plaza

Potential

incremental

value creation:

$185mm to $220mm1,2

19

BALANCE

SHEET

BriarLake Plaza

Phase II delivered 2014

20

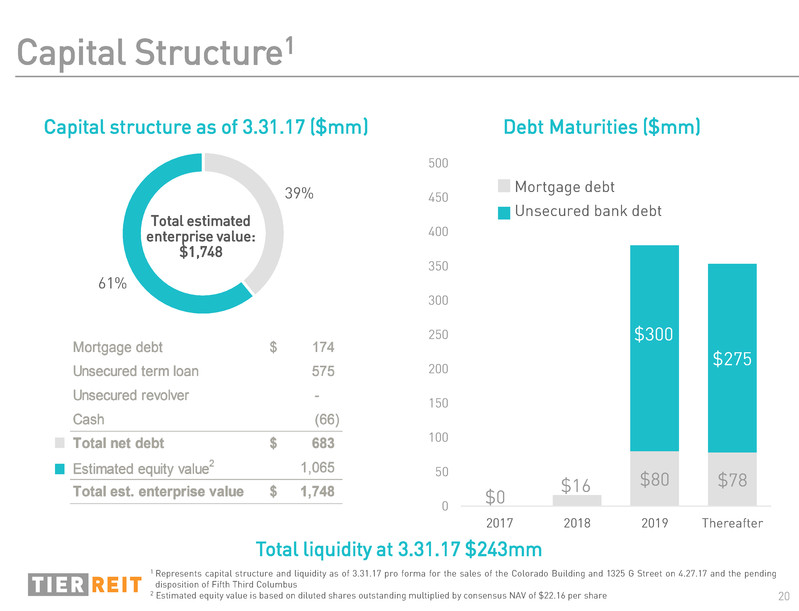

Capital structure as of 3.31.17 ($mm)

1 Represents capital structure and liquidity as of 3.31.17 pro forma for the sales of the Colorado Building and 1325 G Street on 4.27.17 and the pending

disposition of Fifth Third Columbus

2 Estimated equity value is based on diluted shares outstanding multiplied by consensus NAV of $22.16 per share

Capital Structure1

39%

61%

Total estimated

enterprise value:

$1,748

Debt Maturities ($mm)

$0

$16 $80 $78

$275

0

50

100

150

200

250

300

350

400

450

500

2017 2018 2019 Thereafter

$300

Mortgage debt

Unsecured bank debt

Total liquidity at 3.31.17 $243mm

21

1 Represents portfolio and capital structure as of 3Q’14 and 1Q’17 pro forma for the sales of the Colorado Building and 1325 G Street on 4.27.17 and the

pending disposition of Fifth Third Columbus

2 EBITDA and NOI reflect annualized adjusted 3Q’14 EBITDA and NOI, and annualized and adjusted 1Q’17 EBITDA and NOI pro forma for the sales of the

Colorado Building and 1325 G Street on 4.27.17 and the pending disposition of Fifth Third Columbus

Credit Statistics

Credit statistics

9.30.141 3.31.171

Long-

Term

Targets

Net debt / annualized adj. EBITDA2 9.6x 6.8x <6.5x

Net debt / total est. enterprise value 53% 39% <40%

Mortgage debt / total est. enterprise value 53% 10% <20%

Fixed charge coverage 1.5x 2.9x >3.0x

Unencumbered NOI / total NOI2 3% 82% >65%

22

Future Capital Warehouse

Recycling

500 East Pratt

Woodcrest

Louisville Portfolio

Funding source for selective acquisitions and development opportunities

Estimated capital

of ~$175mm, plus

routine recycling

23

ADDITIONAL

INFORMATION

5950 Sherry Lane

Acquired 2014

24

Experienced Management Team

Significant real estate & public company experience spanning 30+ years

Jim Sharp

EVP

Capital Markets

Bill Reister

EVP & Chief

Investment Officer

Heath Johnson

Managing Director

Asset Management

Dallas Lucas

EVP & Chief

Financial Officer

Scott Fordham

President & Chief

Executive Officer

Scott McLaughlin

Senior Vice President

Investor Relations

Our team is 100% committed to optimizing the value of TIER’s common stock

through execution of our strategic plan or pursuing other strategic alternatives,

including public or private execution

25

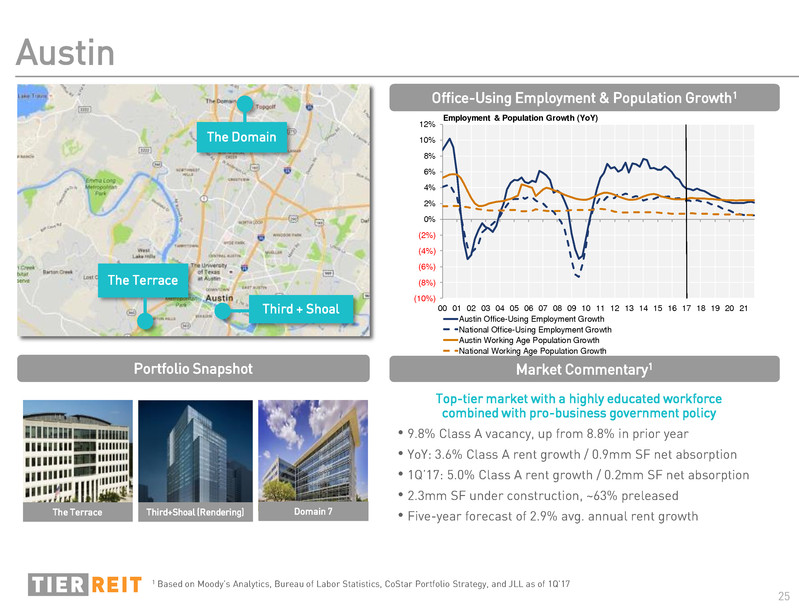

Top-tier market with a highly educated workforce

combined with pro-business government policy

• 9.8% Class A vacancy, up from 8.8% in prior year

• YoY: 3.6% Class A rent growth / 0.9mm SF net absorption

• 1Q’17: 5.0% Class A rent growth / 0.2mm SF net absorption

• 2.3mm SF under construction, ~63% preleased

• Five-year forecast of 2.9% avg. annual rent growth

Austin

The Domain

The Terrace

Third + Shoal

The Terrace Domain 7

Office-Using Employment & Population Growth1

Portfolio Snapshot

Sources: Moody's Analytics; BLS; CoStar Portfolio Strategy As of 17Q1

(10%)

(8%)

(6%)

(4%)

(2%)

0%

2%

4%

6%

8%

10%

12%

00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21

Austin Office-Using Employment Growth

National Office-Using Employment Growth

Austin Working Age Population Growth

National Working Age Population Growth

Employment & Population Growth (YoY)

Market Commentary1

1 Based on Moody’s Analytics, Bureau of Labor Statistics, CoStar Portfolio Strategy, and JLL as of 1Q’17

Third+Shoal (Rendering)

26

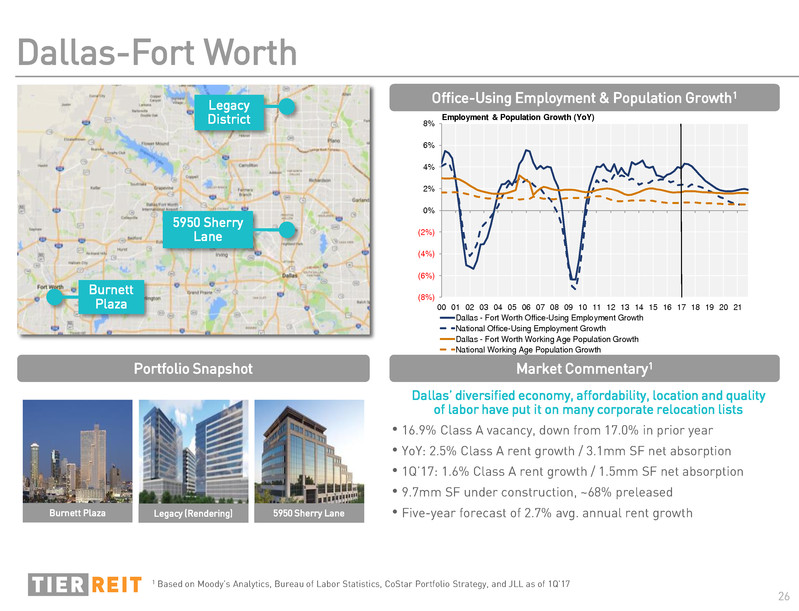

Dallas’ diversified economy, affordability, location and quality

of labor have put it on many corporate relocation lists

• 16.9% Class A vacancy, down from 17.0% in prior year

• YoY: 2.5% Class A rent growth / 3.1mm SF net absorption

• 1Q’17: 1.6% Class A rent growth / 1.5mm SF net absorption

• 9.7mm SF under construction, ~68% preleased

• Five-year forecast of 2.7% avg. annual rent growth

Dallas-Fort Worth

Burnett Plaza 5950 Sherry Lane Legacy (Rendering)

5950 Sherry

Lane

Burnett

Plaza

Legacy

District

1 Based on Moody’s Analytics, Bureau of Labor Statistics, CoStar Portfolio Strategy, and JLL as of 1Q’17

Office-Using Employment & Population Growth1

Portfolio Snapshot

Sources: Moody's Analytics; BLS; CoStar Portfolio Strategy As of 17Q1

(8%)

(6%)

(4%)

(2%)

0%

2%

4%

6%

8%

00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21

Dallas - Fort Worth Office-Using Employment Growth

National Office-Using Employment Growth

Dallas - Fort Worth Working Age Population Growth

National Working Age Population Growth

Employment & Population Growth (YoY)

Market Commentary1

27

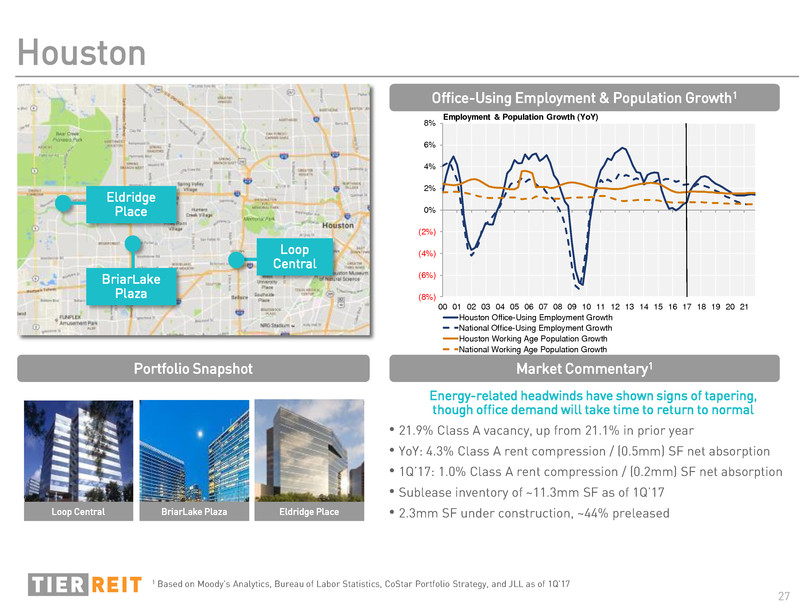

Houston

Energy-related headwinds have shown signs of tapering,

though office demand will take time to return to normal

• 21.9% Class A vacancy, up from 21.1% in prior year

• YoY: 4.3% Class A rent compression / (0.5mm) SF net absorption

• 1Q’17: 1.0% Class A rent compression / (0.2mm) SF net absorption

• Sublease inventory of ~11.3mm SF as of 1Q’17

• 2.3mm SF under construction, ~44% preleased

BriarLake

Plaza

Loop

Central

Eldridge

Place

BriarLake Plaza Loop Central Eldridge Place

Office-Using Employment & Population Growth1

Portfolio Snapshot

Sources: Moody's Analytics; BLS; CoStar Portfolio Strategy As of 17Q1

(8%)

(6%)

(4%)

(2%)

0%

2%

4%

6%

8%

00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21

Houston Office-Using Employment Growth

National Office-Using Employment Growth

Houston Working Age Population Growth

National Working Age Population Growth

Employment & Population Growth (YoY)

Market Commentary1

1 Based on Moody’s Analytics, Bureau of Labor Statistics, CoStar Portfolio Strategy, and JLL as of 1Q’17

28

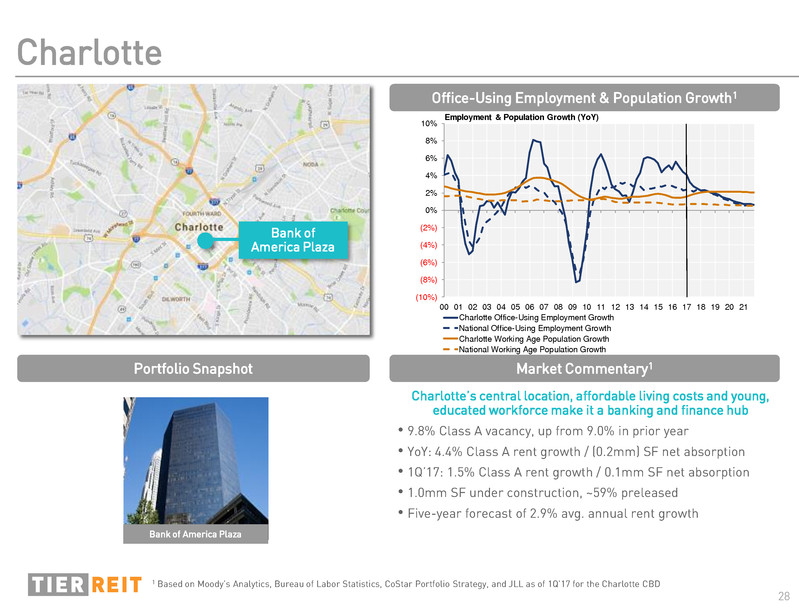

Charlotte’s central location, affordable living costs and young,

educated workforce make it a banking and finance hub

• 9.8% Class A vacancy, up from 9.0% in prior year

• YoY: 4.4% Class A rent growth / (0.2mm) SF net absorption

• 1Q’17: 1.5% Class A rent growth / 0.1mm SF net absorption

• 1.0mm SF under construction, ~59% preleased

• Five-year forecast of 2.9% avg. annual rent growth

Charlotte

Bank of

America Plaza

Bank of America Plaza

Office-Using Employment & Population Growth1

Portfolio Snapshot

Sources: Moody's Analytics; BLS; CoStar Portfolio Strategy As of 17Q1

(10%)

(8%)

(6%)

(4%)

(2%)

0%

2%

4%

6%

8%

10%

00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21

Charlotte Office-Using Employment Growth

National Office-Using Employment Growth

Charlotte Working Age Population Growth

National Working Age Population Growth

Employment & Population Growth (YoY)

Market Commentary1

1 Based on Moody’s Analytics, Bureau of Labor Statistics, CoStar Portfolio Strategy, and JLL as of 1Q’17 for the Charlotte CBD

29

Nashville

Office-Using Employment & Population Growth1

Nashville's economic diversity, mix of private and public

industry, and low costs of business fuel office demand

• 8.3% Class A vacancy, up from 4.6% in prior year

• YoY: 0.8% Class A rent growth / 1.0mm SF net absorption

• 1Q’17: 1.1% Class A rent growth / (0.4mm) SF net absorption

• 1.7mm SF under construction, ~53% preleased

• Five-year forecast of 3.2% avg. annual rent growth

Plaza at

MetroCenter

Plaza at MetroCenter

Portfolio Snapshot

Sources: Moody's Analytics; BLS; CoStar Portfolio Strategy As of 17Q1

(10%)

(8%)

(6%)

(4%)

(2%)

0%

2%

4%

6%

8%

10%

00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21

Nashville Office-Using Employment Growth

National Office-Using Employment Growth

Nashville Working Age Population Growth

National Working Age Population Growth

Employment & Population Growth (YoY)

Market Commentary1

1 Based on Moody’s Analytics, Bureau of Labor Statistics, CoStar Portfolio Strategy, and JLL as of 1Q’17

30

Forward-Looking Statements

This presentation contains forward-looking statements, including discussion and analysis of the financial condition of us and our

subsidiaries and other matters. These forward-looking statements are not historical facts but are the intent, belief or current

expectations of our management based on their knowledge and understanding of our business and industry. Words such as “may,” “will”,

“anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “would,” “could,” “should,” “opportunities,” “objectives,”

“strategies,” “goals,” “vision,” “mission,” and variations of these words and similar expressions are intended to identify forward-looking

statements. We intend that such forward-looking statements be subject to the safe harbor provisions created by Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements are not guarantees of future

performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and

could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. Forward-looking

statements that were true at the time made may ultimately prove to be incorrect or false. We caution you not to place undue reliance on

forward-looking statements, which reflect our management's view only as of the date of this presentation. We undertake no obligation to

update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future

operating results.

Factors that could cause actual results to differ materially from any forward-looking statements made in the presentation include but are

not limited to: (i) market disruptions and economic conditions experienced by the economy or real estate industry as a whole and the local

economic conditions in the markets in which our properties are located; (ii) our ability to renew expiring leases and lease vacant spaces at

favorable rates or at all; (iii) the inability of tenants to continue paying their rent obligations due to bankruptcy, insolvency or a general

downturn in their business; (iv) the availability of cash flow from operating activities to fund distributions and capital expenditures; (v) our

ability to raise capital in the future by issuing additional equity or debt securities, selling our assets or otherwise to fund our future capital

needs; (vi) the availability and terms of financing, including the impact of higher interest rates on the cost and/or availability of financing;

(vii) our ability to strategically acquire, develop or dispose of assets on favorable terms or at all; (viii) our level of debt and the terms and

limitations imposed on us by our debt agreements; (ix) our ability to retain our executive officers and other key personnel; (x) unfavorable

changes in laws or regulations impacting our business or our assets; and (xi) factors that could affect our ability to qualify as a real estate

investment trust. The forward-looking statements should be read in light of these and other risk factors identified in the “Risk Factors”

section of our most recent Form 10-K and Form 10-Q, as filed with the Securities and Exchange Commission.

The modeling, projections, analyses, and other forward-looking information prepared by CoStar Portfolio Strategy, LLC (“CoStar”) and

presented herein are based on financial and other information from public and proprietary sources, as well as various assumptions

concerning future events and circumstances that are speculative, uncertain and subject to change without notice. Actual results and

events may differ materially from the projections presented.

All CoStar materials set forth herein (“CoStar Materials”) speak only as of the date referenced and may have materially changed since

such date. CoStar does not purport that the CoStar Materials herein are comprehensive, and, while they are believed to be accurate, the

CoStar Materials are not guaranteed to be free from error, omission or misstatement. CoStar has no obligation to update any of the

CoStar Materials included in this document. All CoStar Materials are provided “as is,” without any guarantees, representations or

warranties of any kind, including implied warranties of merchantability, non-infringement, title and fitness for a particular purpose. To the

maximum extent permitted by law, CoStar disclaims any and all liability in the event any CoStar Materials prove to be inaccurate,

incomplete or unreliable. CoStar does not sponsor, endorse, offer or promote an investment in the securities of TIER REIT, Inc. You should

not construe any of the CoStar Materials as investment, tax, accounting or legal advice.

Significant value creation opportunities

INVESTMENT

RATIONALE

Austin I Dallas I Houston I Charlotte I Nashville I Atlanta I Denver 32

www.tierreit.com

ir@tierreit.com

972.483.2400

Proven execution

Experienced management team

Focused strategy

High-quality portfolio