Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - HORTON D R INC /DE/ | d343762dex993.htm |

| EX-99.2 - EX-99.2 - HORTON D R INC /DE/ | d343762dex992.htm |

| EX-99.1 - EX-99.1 - HORTON D R INC /DE/ | d343762dex991.htm |

| 8-K - FORM 8-K - HORTON D R INC /DE/ | d343762d8k.htm |

Proposal to Forestar Group Inc. June 5, 2017 Sandalwood, Bay Area, California Foothills Estates, Las Vegas, Nevada Tamarron, Houston, Texas Waterleigh, Orlando, Florida Daves Creek Reserve Atlanta, Georgia Catherine Crest Seattle, Washington Exhibit 99.4

This presentation may include “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. Although D.R. Horton believes any such statements are based on reasonable assumptions, there is no assurance that actual outcomes will not be materially different. Factors that may cause the actual results to be materially different from the future results expressed by the forward-looking statements include, but are not limited to: our ability to enter into mutually satisfactory definitive transaction agreements with Forestar, obtain any requisite approval from Forestar stockholders, and satisfy any conditions to closing of such proposed transaction; other risks related to the completion of the proposed transaction and actions related thereto; the cyclical nature of the homebuilding industry and changes in economic, real estate and other conditions; constriction of the credit markets, which could limit our ability to access capital and increase our costs of capital; reductions in the availability of mortgage financing provided by government agencies, changes in government financing programs, a decrease in our ability to sell mortgage loans on attractive terms or an increase in mortgage interest rates; the risks associated with our land and lot inventory; home warranty and construction defect claims; the effects of a health and safety incident; the effects of negative publicity; supply shortages and other risks of acquiring land, building materials and skilled labor; the impact of an inflationary, deflationary or higher interest rate environment; reductions in the availability of performance bonds; increases in the costs of owning a home; the effects of governmental regulations and environmental matters on our homebuilding operations; the effects of governmental regulations on our financial services operations; our significant debt and our ability to comply with related debt covenants, restrictions and limitations; competitive conditions within the homebuilding and financial services industries; our ability to effect our growth strategies, acquisitions or investments successfully; the effects of the loss of key personnel; and information technology failures and data security breaches. Additional information about issues that could lead to material changes in performance is contained in D.R. Horton’s annual report on Form 10-K and our most recent quarterly report on Form 10-Q, both of which are filed with the Securities and Exchange Commission. Forward-Looking Statements

Proposed Transaction Overview

Proposed Transaction Overview D.R. Horton (“DHI”) is proposing to purchase 75% of the outstanding shares of Forestar (“FOR”) for $16.25 per share The approximately 10.7 million shares that DHI does not acquire will remain publicly traded FOR would become a large-scale, national land developer through a mutually beneficial relationship with DHI Together, FOR and DHI would identify land development opportunities to expand FOR’s platform across DHI’s broad national footprint DHI would acquire a large portion of FOR’s developed lots at market prices As the nation’s leading homebuilder with operations in all of FOR’s major markets, DHI is well-positioned to help FOR maximize returns in its existing communities FOR would remain a public company with ability to fund near term growth through existing cash and redeploying capital generated from efficiently selling FOR’s current assets. FOR would opportunistically access capital markets to support its growth as the scale of the business increases FOR would be led by new Executive Chairman Don Tomnitz, who was DHI’s CEO for over 15 years, and would be supported by a best in class management team and board of directors FOR stockholders would have the right to elect either cash or to retain their shares. Cash and stock elections would be prorated so that after the transaction, DHI would own 75% of outstanding FOR shares and existing stockholders would own 25%

Strategic Rationale of Combination Land development and homebuilding are highly related, but fundamentally different businesses As the nation’s largest homebuilder on pace to close approximately 45,000 homes in fiscal 2017, DHI has an immense appetite for finished lots DHI is committed to owning no more than a 2 to 3 year supply of lots and supplementing the rest of its land pipeline through lot option purchase agreements with land developers Most land developers lack the scale and access to capital to be consistent suppliers of a significant portion of lots to DHI across its national footprint In partnership with DHI, FOR would become a national, well-capitalized land development company, selling lots directly to DHI and other builders FOR would benefit from DHI’s network of markets, long-tenured employees and land seller and business relationships to rapidly accelerate growth FOR remaining a public company is essential to ensuring access to growth capital as the business scales

Operational Overview Operational terms of the relationship between DHI and FOR would be outlined and agreed to in the Master Supply Agreement FOR would be led by an experienced management team incented to maximize value for FOR’s stockholders FOR would be led by Executive Chairman Donald Tomnitz, who was DHI’s Chief Executive Officer for over 15 years The future FOR would benefit from a focused strategy and the continuity of its experienced professionals New land deals would be sourced in two ways: FOR’s existing land acquisition and development professionals DHI’s experienced local teams that span 78 markets All new land deals would be approved by the new FOR investment committee Lots would be developed by FOR and then sold to DHI and other builders at market prices

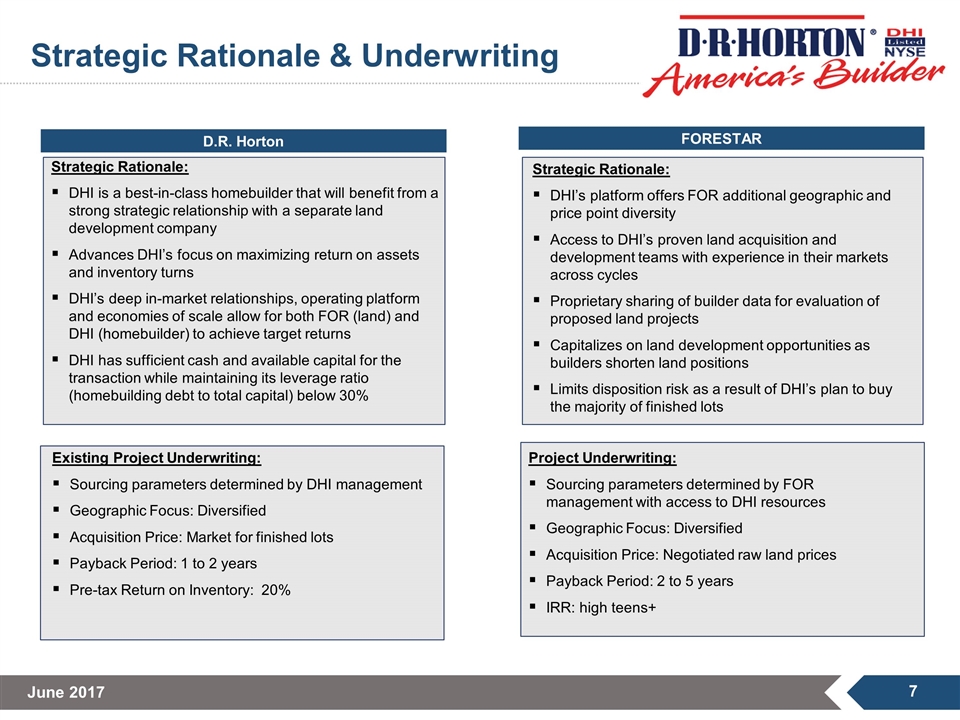

Strategic Rationale: DHI is a best-in-class homebuilder that will benefit from a strong strategic relationship with a separate land development company Advances DHI’s focus on maximizing return on assets and inventory turns DHI’s deep in-market relationships, operating platform and economies of scale allow for both FOR (land) and DHI (homebuilder) to achieve target returns DHI has sufficient cash and available capital for the transaction while maintaining its leverage ratio (homebuilding debt to total capital) below 30% Strategic Rationale: DHI’s platform offers FOR additional geographic and price point diversity Access to DHI’s proven land acquisition and development teams with experience in their markets across cycles Proprietary sharing of builder data for evaluation of proposed land projects Capitalizes on land development opportunities as builders shorten land positions Limits disposition risk as a result of DHI’s plan to buy the majority of finished lots FORESTAR D.R. Horton Strategic Rationale & Underwriting Existing Project Underwriting: Sourcing parameters determined by DHI management Geographic Focus: Diversified Acquisition Price: Market for finished lots Payback Period: 1 to 2 years Pre-tax Return on Inventory: 20% Project Underwriting: Sourcing parameters determined by FOR management with access to DHI resources Geographic Focus: Diversified Acquisition Price: Negotiated raw land prices Payback Period: 2 to 5 years IRR: high teens+

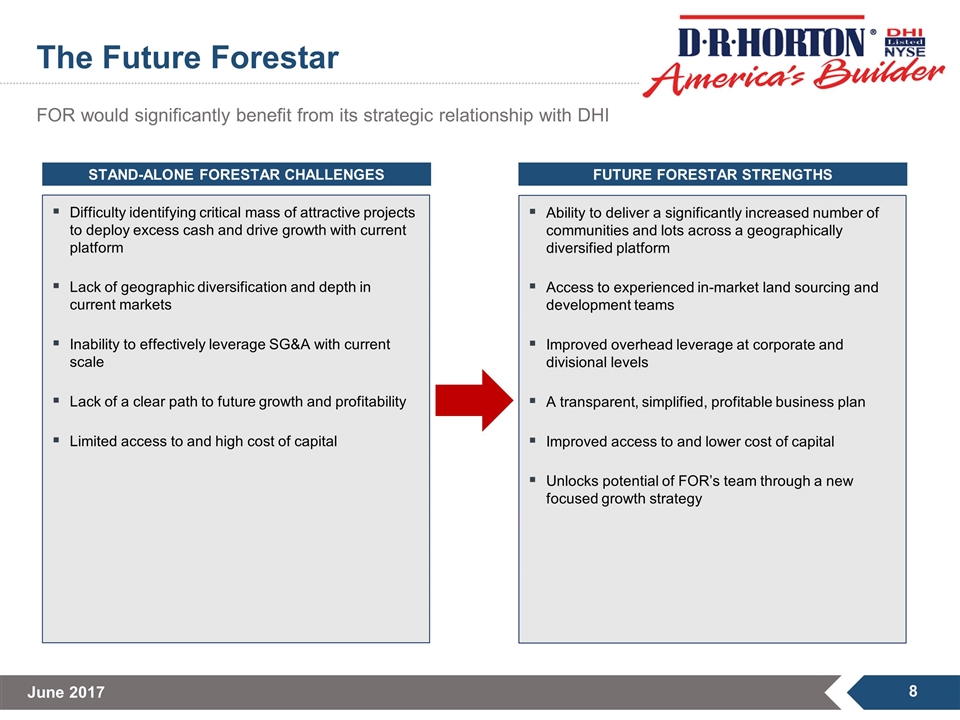

STAND-ALONE FORESTAR CHALLENGES FUTURE FORESTAR STRENGTHS Difficulty identifying critical mass of attractive projects to deploy excess cash and drive growth with current platform Lack of geographic diversification and depth in current markets Inability to effectively leverage SG&A with current scale Lack of a clear path to future growth and profitability Limited access to and high cost of capital Ability to deliver a significantly increased number of communities and lots across a geographically diversified platform Access to experienced in-market land sourcing and development teams Improved overhead leverage at corporate and divisional levels A transparent, simplified, profitable business plan Improved access to and lower cost of capital Unlocks potential of FOR’s team through a new focused growth strategy FOR would significantly benefit from its strategic relationship with DHI The Future Forestar

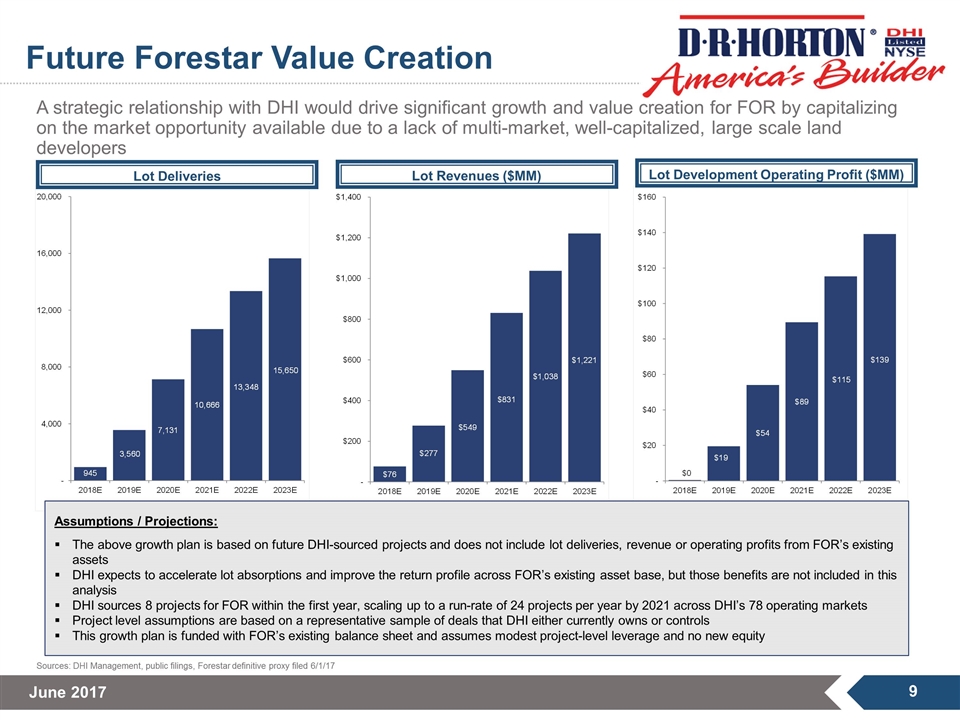

A strategic relationship with DHI would drive significant growth and value creation for FOR by capitalizing on the market opportunity available due to a lack of multi-market, well-capitalized, large scale land developers Sources: DHI Management, public filings, Forestar definitive proxy filed 6/1/17 Future Forestar Value Creation Lot Deliveries Lot Revenues ($MM) Lot Development Operating Profit ($MM) Assumptions / Projections: The above growth plan is based on future DHI-sourced projects and does not include lot deliveries, revenue or operating profits from FOR’s existing assets DHI expects to accelerate lot absorptions and improve the return profile across FOR’s existing asset base, but those benefits are not included in this analysis DHI sources 8 projects for FOR within the first year, scaling up to a run-rate of 24 projects per year by 2021 across DHI’s 78 operating markets Project level assumptions are based on a representative sample of deals that DHI either currently owns or controls This growth plan is funded with FOR’s existing balance sheet and assumes modest project-level leverage and no new equity

Letter to Forestar Board of Directors

Proposed Master Supply Agreement Promotes FOR’s acquisition, development and sale of lots to DHI and other builders FOR and DHI teams would collaborate on new lot development opportunities across DHI’s broad national footprint FOR and DHI teams would each source and present potential lot development opportunities for evaluation For potential lot development opportunities sourced by FOR, 50% of lots would be offered to DHI on market terms; if DHI declines offer, FOR may market and sell the lots to other builders DHI would present potential lot development opportunities to FOR with up to 100% of the lots to be sold to DHI; if the parties fail to agree on terms, DHI will retain the opportunity Approval of independent directors would be required as appropriate

Proposed Stockholders Agreement Customary terms for this type of investment including: Permits DHI to nominate a number of members of FOR’s board of directors commensurate with DHI’s equity ownership The FOR board of directors would include at least three independent directors Provides DHI customary controlling shareholder consent rights at any time it owns more than 30% of the outstanding FOR equity Establishes an investment committee for decisions regarding property acquisitions and certain debt incurrences by FOR

D.R. Horton Overview

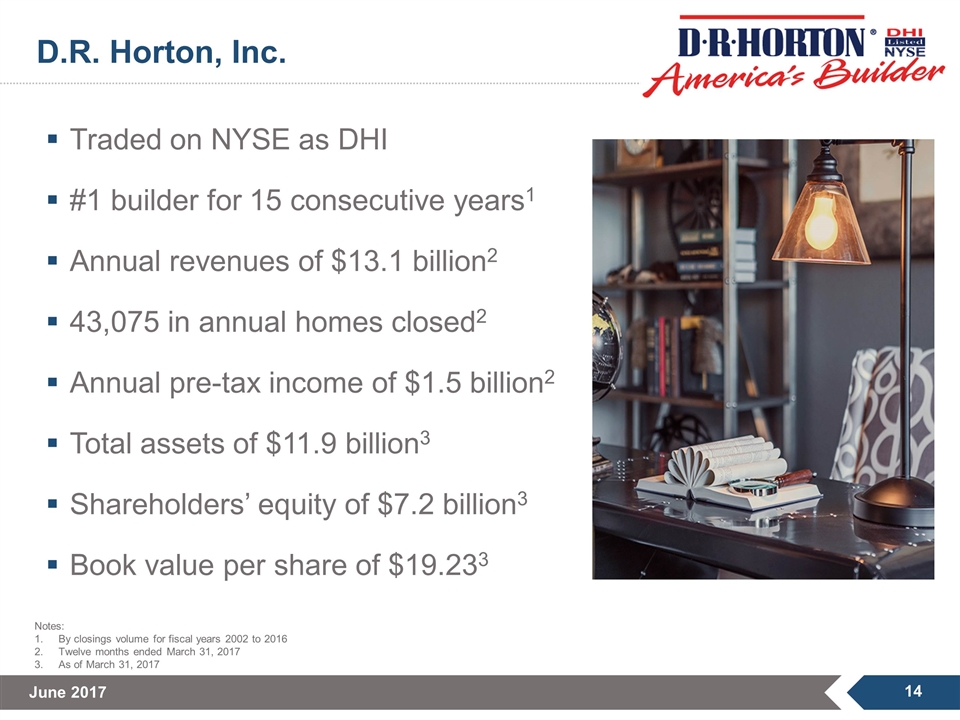

Traded on NYSE as DHI #1 builder for 15 consecutive years1 Annual revenues of $13.1 billion2 43,075 in annual homes closed2 Annual pre-tax income of $1.5 billion2 Total assets of $11.9 billion3 Shareholders’ equity of $7.2 billion3 Book value per share of $19.233 D.R. Horton, Inc. Notes: By closings volume for fiscal years 2002 to 2016 Twelve months ended March 31, 2017 As of March 31, 2017

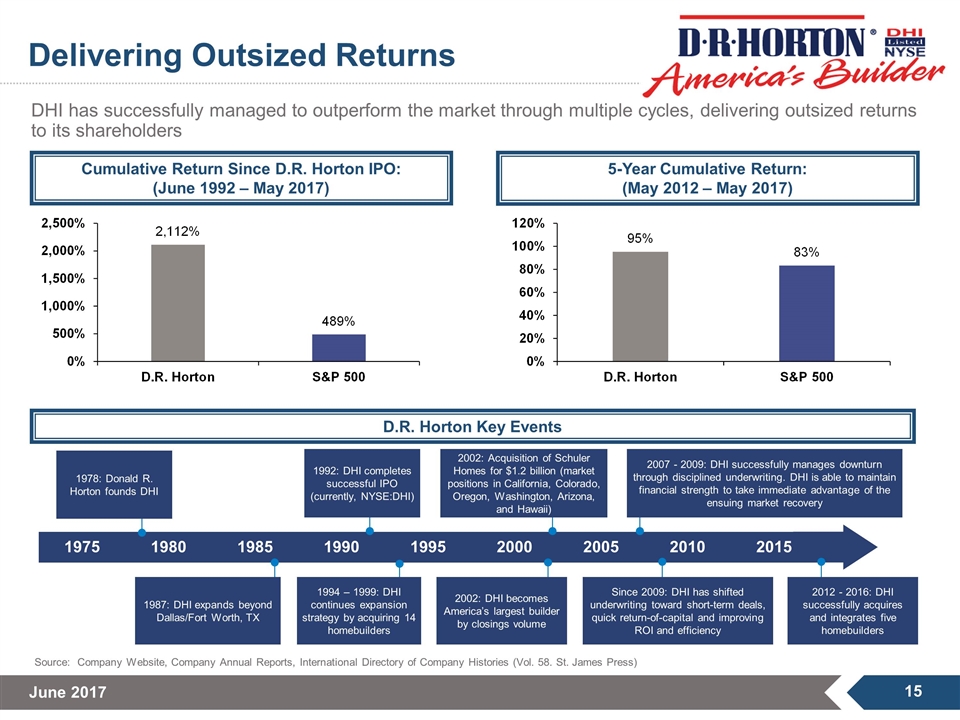

5-Year Cumulative Return: (May 2012 – May 2017) D.R. Horton Key Events 1975 1980 1985 1990 1995 2000 2005 2010 2015 DHI has successfully managed to outperform the market through multiple cycles, delivering outsized returns to its shareholders 2002: DHI becomes America’s largest builder by closings volume 1994 – 1999: DHI continues expansion strategy by acquiring 14 homebuilders 1987: DHI expands beyond Dallas/Fort Worth, TX 1978: Donald R. Horton founds DHI 1992: DHI completes successful IPO (currently, NYSE:DHI) 2002: Acquisition of Schuler Homes for $1.2 billion (market positions in California, Colorado, Oregon, Washington, Arizona, and Hawaii) Since 2009: DHI has shifted underwriting toward short-term deals, quick return-of-capital and improving ROI and efficiency 2007 - 2009: DHI successfully manages downturn through disciplined underwriting. DHI is able to maintain financial strength to take immediate advantage of the ensuing market recovery Source: Company Website, Company Annual Reports, International Directory of Company Histories (Vol. 58. St. James Press) Cumulative Return Since D.R. Horton IPO: (June 1992 – May 2017) Delivering Outsized Returns 2012 - 2016: DHI successfully acquires and integrates five homebuilders

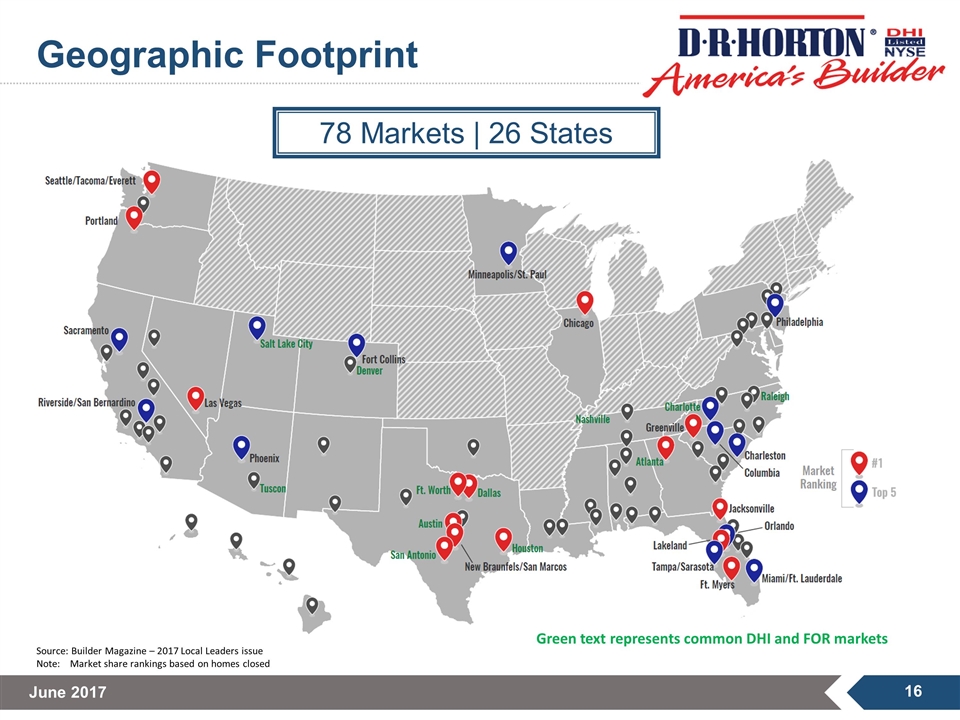

Geographic Footprint Source: Builder Magazine – 2017 Local Leaders issue Note: Market share rankings based on homes closed Green text represents common DHI and FOR markets 78 Markets | 26 States

Average employee tenure: Executive Team and Region Presidents – over 20 years Division Presidents and City Managers – over 13 years Management Tenure & Experience

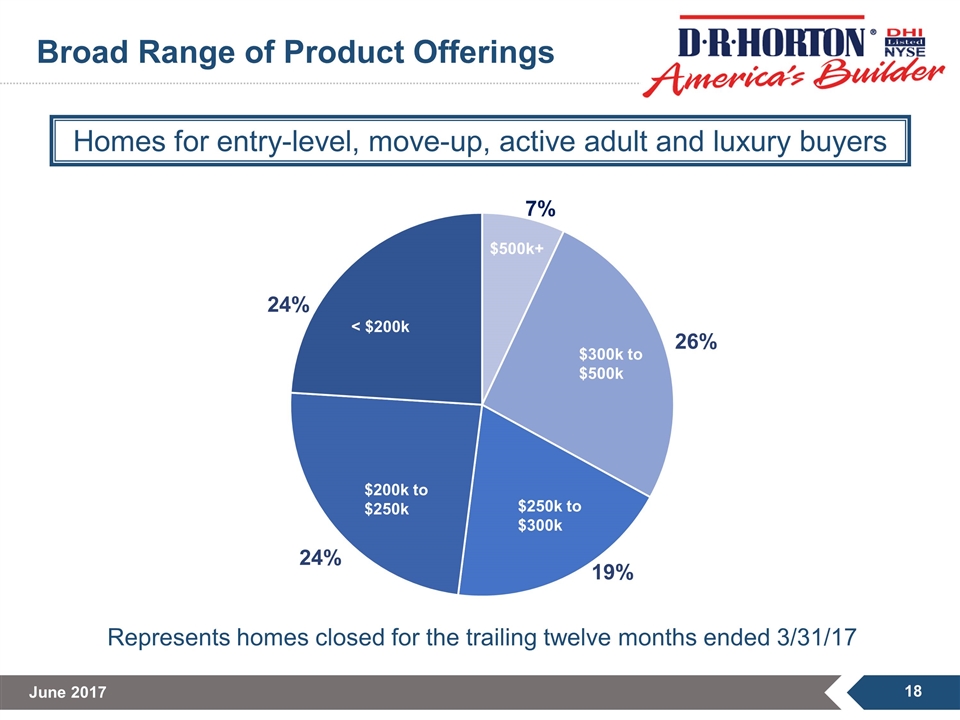

Homes for entry-level, move-up, active adult and luxury buyers < $200k $500k+ Represents homes closed for the trailing twelve months ended 3/31/17 7% Broad Range of Product Offerings

The heart of our business Offered across all 78 markets and 26 states we operate in 67% of homes closed and 70% of home sales revenue Average selling price of $311,000 Introduced in July 2016 as carefree affordable living for active adults Currently in 10 markets and 8 states Low-maintenance lifestyle Expect to have available in approximately 1/3 of our 78 markets by the end of the year Introduced in 2014, targeted at the true entry-level buyer Currently in 55 markets and 18 states 29% of homes closed and 22% of home sales revenue Average selling price of $220,000 Introduced in 2013, focused on the higher-end move up and luxury buyer Currently in 43 markets and 18 states 4% of homes closed and 8% of home sales revenue Average selling price of $617,000 Family of Brands DHI targets the entire spectrum of homebuyers from entry-level to luxury through its suite of respected brands Note:Based on Q2 FY 2017 results

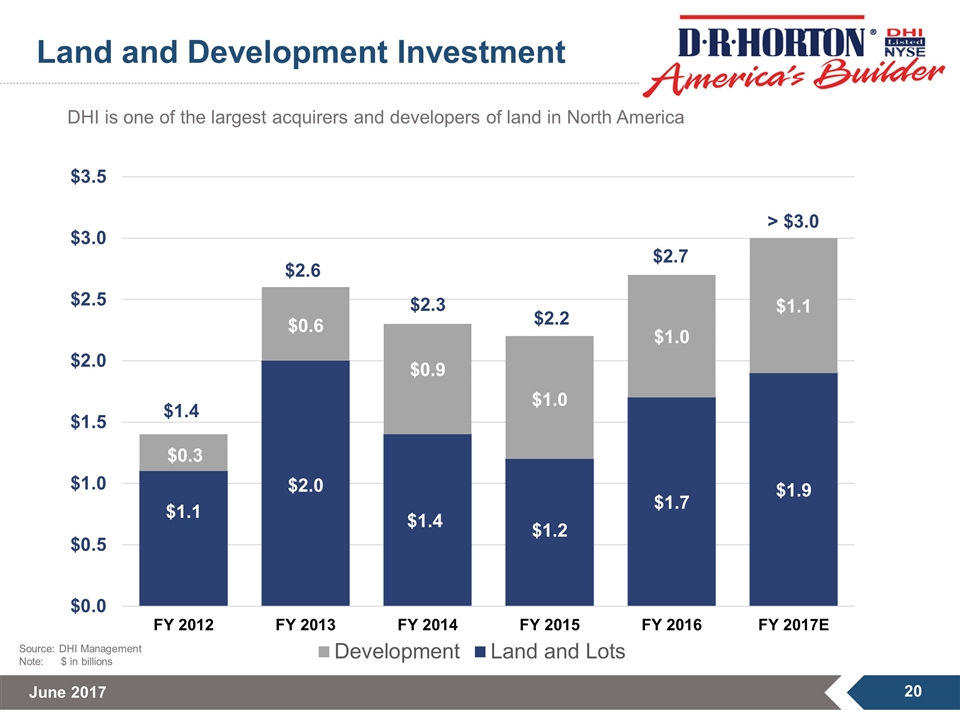

Source: DHI Management Note:$ in billions Land and Development Investment DHI is one of the largest acquirers and developers of land in North America

Additional Information In connection with the possible completion of D.R. Horton’s proposed transaction with Forestar, it is expected that the parties would cause the filing with the SEC of a registration statement on Form S-4 that would include a proxy statement/prospectus to be distributed to Forestar stockholders. SECURITY HOLDERS ARE ADVISED TO READ THE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The registration statement, proxy statement/prospectus and other relevant documents will be available at no cost at the SEC’s website at http://www.sec.gov and on D.R. Horton’s website at investor.drhorton.com. Copies may also be obtained at no cost by contacting D.R. Horton’s Investor Relations department by telephone at (817) 390-8200 or by email at InvestorRelations@drhorton.com. D.R. Horton and its directors and certain of its executive officers may be deemed to be participants in any solicitation in connection with the proposed transaction with Forestar. Information regarding D.R. Horton’s directors and executive officers is available in D.R. Horton’s proxy statement for the 2017 Annual Meeting of Stockholders, filed with the SEC on December 9, 2016. Other information regarding D.R. Horton participants in any proxy solicitation in connection with the proposed transaction and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC. As of the date hereof, the D.R. Horton participants do not own any securities of Forestar. This document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.