Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DELCATH SYSTEMS, INC. | d407690d8k.htm |

Delcath Annual Shareholder Meeting (NASDAQ: DCTH) June 5, 2017 Exhibit 99.1

Forward-looking Statements This presentation contains forward-looking statements, within the meaning of the federal securities laws, related to future events and future financial performance which include statements about our expectations, beliefs, plans, objectives, intentions, goals, strategies, assumptions and other statements that are not historical facts. Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions, which could cause actual results to differ materially from expected results, performance or achievements expressed or implied by statements made herein. Our actual results could differ materially from those anticipated in forward-looking statements for many reasons, including, but not limited to, uncertainties relating to: our ability to repay and comply with the obligations under our senior secured convertible notes, the timing and results of future clinical trials including without limitation the OM, HCC, ICC, and mCRC trials in the Company’s Clinical Development Program, clinical adoption, use and resulting sales, if any, for the CHEMOSAT system in Europe, our ability to obtain reimbursement for the CHEMOSAT system in various markets, including without limitation Germany and the United Kingdom and the impact on sales, if any, of reimbursement in these markets including ZE reimbursement in the German market, our ability to successfully commercialize the Melphalan/HDS system and the potential of the Melphalan/HDS system as a treatment for patients with primary and metastatic disease in the liver, the Company's ability to satisfy the remaining requirements of the FDA's Complete Response Letter relating to the ocular melanoma indication and the timing of the same, approval of the Melphalan/HDS system by the U.S. FDA, the impact of presentations and abstracts at major medical meetings and congresses (SSO, ASCO, CIRSE, ESMO, EADO, RSNA) and future clinical results consistent with the data presented, approval of the current or future Melphalan/HDS system for delivery and filtration of melphalan or other chemotherapeutic agents for various indications in the U.S. and/or in foreign markets, actions by the FDA or other foreign regulatory agencies, our ability to successfully enter into strategic partnership and distribution arrangements in foreign markets and the timing and revenue, if any, of the same, uncertainties relating to the timing and results of research and development projects, and uncertainties regarding our ability to obtain financial and other resources for any clinical trials, research, development, and commercialization activities. These factors, and others, are discussed from time to time in our filings with the Securities and Exchange Commission including the section entitled ‘‘Risk Factors’’ in our most recent Annual Report on Form 10-K and our Reports on Form 10-Q and Form 8-K.

2016/2017 Highlights 2016 revenue increased 18% to $2.0 million; Q1 2017 increased 100% to $0.74 million; National reimbursement coverage in Germany under ZE system; 2016 SPA agreement and initiation of Phase 3 Trial in treatment of patients with ocular melanoma liver metastases 2017 SPA agreement with the U.S. Food and Drug Administration (FDA) for pivotal trial of in treatment of patients with intrahepatic cholangiocarcinoma (ICC); Publication in AJCO of results from single-center retrospective review finding that investigational percutaneous hepatic perfusion (PHP) with Melphalan/HDS offered promising results with a doubling of overall survival and significantly longer progression-free survival (PFS) and hepatic progression-free survival (HPFS) compared with other targeted therapies

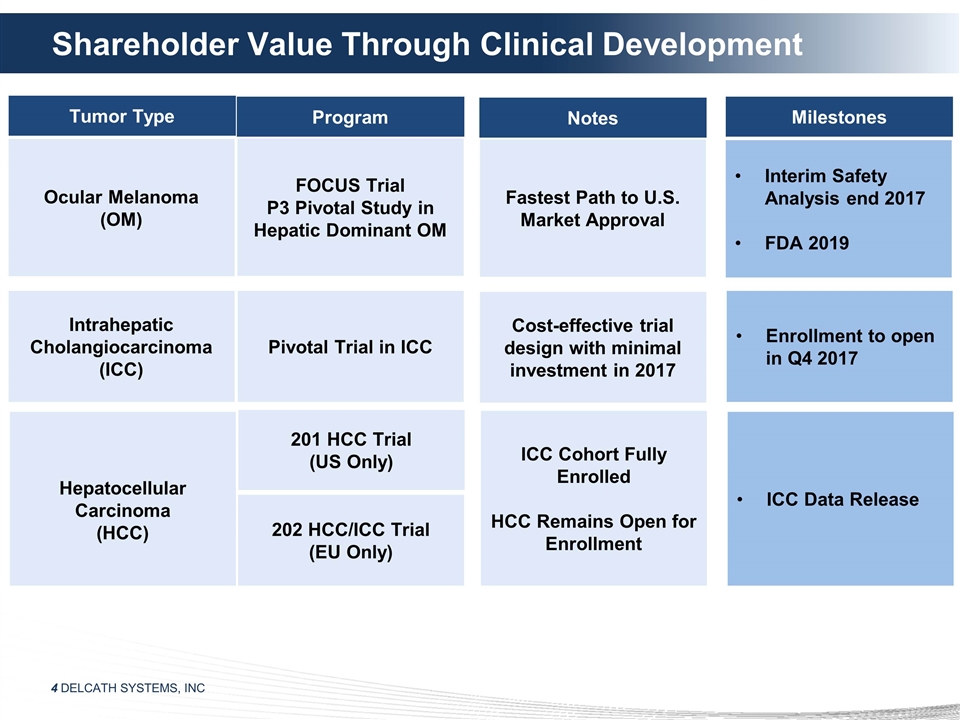

Shareholder Value Through Clinical Development Program Tumor Type Milestones 201 HCC Trial (US Only) 202 HCC/ICC Trial (EU Only) ICC Data Release FOCUS Trial P3 Pivotal Study in Hepatic Dominant OM Interim Safety Analysis end 2017 FDA 2019 Ocular Melanoma (OM) Hepatocellular Carcinoma (HCC) Intrahepatic Cholangiocarcinoma (ICC) Pivotal Trial in ICC Enrollment to open in Q4 2017 Notes ICC Cohort Fully Enrolled HCC Remains Open for Enrollment Fastest Path to U.S. Market Approval Cost-effective trial design with minimal investment in 2017

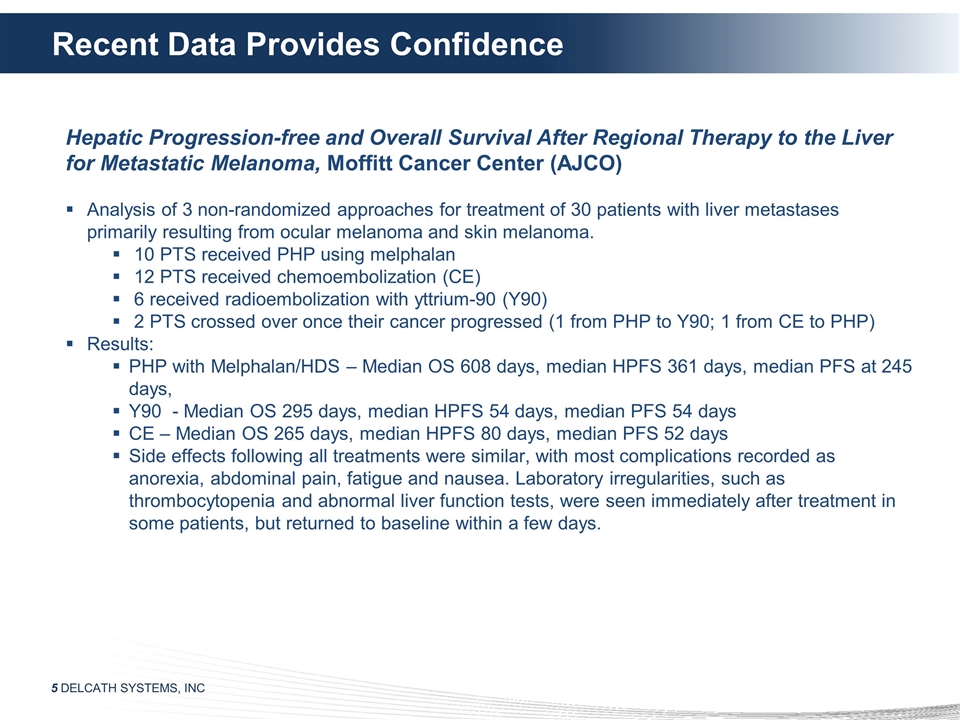

Recent Data Provides Confidence Hepatic Progression-free and Overall Survival After Regional Therapy to the Liver for Metastatic Melanoma, Moffitt Cancer Center (AJCO) Analysis of 3 non-randomized approaches for treatment of 30 patients with liver metastases primarily resulting from ocular melanoma and skin melanoma. 10 PTS received PHP using melphalan 12 PTS received chemoembolization (CE) 6 received radioembolization with yttrium-90 (Y90) 2 PTS crossed over once their cancer progressed (1 from PHP to Y90; 1 from CE to PHP) Results: PHP with Melphalan/HDS – Median OS 608 days, median HPFS 361 days, median PFS at 245 days, Y90 - Median OS 295 days, median HPFS 54 days, median PFS 54 days CE – Median OS 265 days, median HPFS 80 days, median PFS 52 days Side effects following all treatments were similar, with most complications recorded as anorexia, abdominal pain, fatigue and nausea. Laboratory irregularities, such as thrombocytopenia and abnormal liver function tests, were seen immediately after treatment in some patients, but returned to baseline within a few days.

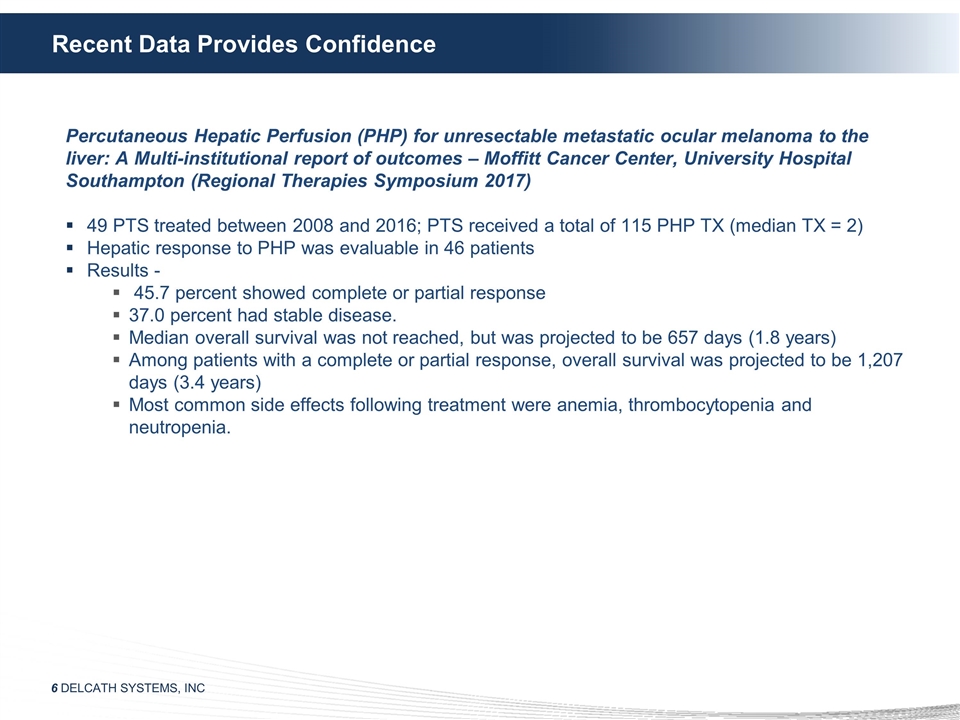

Recent Data Provides Confidence Percutaneous Hepatic Perfusion (PHP) for unresectable metastatic ocular melanoma to the liver: A Multi-institutional report of outcomes – Moffitt Cancer Center, University Hospital Southampton (Regional Therapies Symposium 2017) 49 PTS treated between 2008 and 2016; PTS received a total of 115 PHP TX (median TX = 2) Hepatic response to PHP was evaluable in 46 patients Results - 45.7 percent showed complete or partial response 37.0 percent had stable disease. Median overall survival was not reached, but was projected to be 657 days (1.8 years) Among patients with a complete or partial response, overall survival was projected to be 1,207 days (3.4 years) Most common side effects following treatment were anemia, thrombocytopenia and neutropenia.

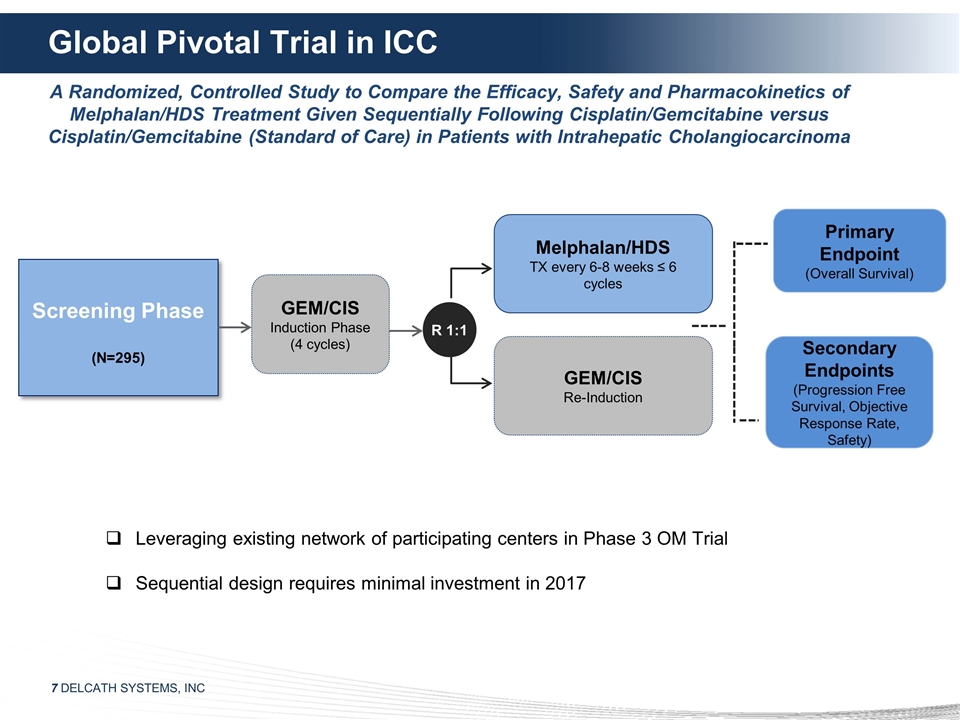

Global Pivotal Trial in ICC Melphalan/HDS TX every 6-8 weeks ≤ 6 cycles GEM/CIS Re-Induction Primary Endpoint (Overall Survival) Secondary Endpoints (Progression Free Survival, Objective Response Rate, Safety) Screening Phase (N=295) R 1:1 Leveraging existing network of participating centers in Phase 3 OM Trial Sequential design requires minimal investment in 2017 A Randomized, Controlled Study to Compare the Efficacy, Safety and Pharmacokinetics of Melphalan/HDS Treatment Given Sequentially Following Cisplatin/Gemcitabine versus Cisplatin/Gemcitabine (Standard of Care) in Patients with Intrahepatic Cholangiocarcinoma GEM/CIS Induction Phase (4 cycles)

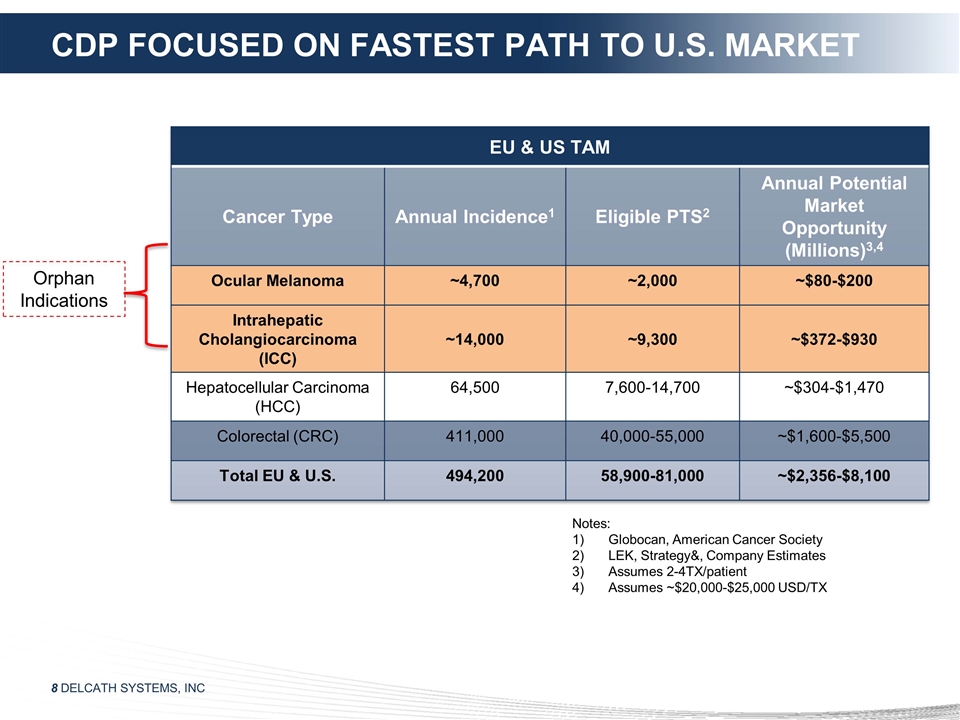

CDP FOCUSED ON FASTEST PATH TO U.S. MARKET EU & US TAM Cancer Type Annual Incidence1 Eligible PTS2 Annual Potential Market Opportunity (Millions)3,4 Ocular Melanoma ~4,700 ~2,000 ~$80-$200 Intrahepatic Cholangiocarcinoma (ICC) ~14,000 ~9,300 ~$372-$930 Hepatocellular Carcinoma (HCC) 64,500 7,600-14,700 ~$304-$1,470 Colorectal (CRC) 411,000 40,000-55,000 ~$1,600-$5,500 Total EU & U.S. 494,200 58,900-81,000 ~$2,356-$8,100 Notes: Globocan, American Cancer Society LEK, Strategy&, Company Estimates Assumes 2-4TX/patient Assumes ~$20,000-$25,000 USD/TX Orphan Indications

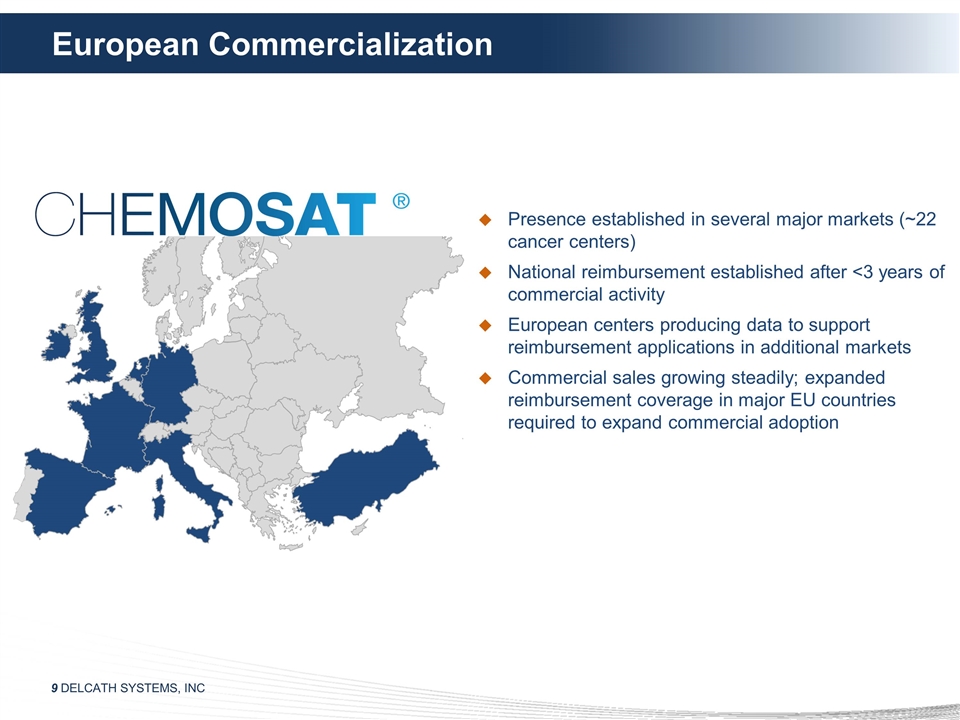

European Commercialization Presence established in several major markets (~22 cancer centers) National reimbursement established after <3 years of commercial activity European centers producing data to support reimbursement applications in additional markets Commercial sales growing steadily; expanded reimbursement coverage in major EU countries required to expand commercial adoption

European Commercialization ~400 commercial procedures performed EU Physicians opting to retreat patients as familiarity/confidence grows UK Patient received record 8th TX in March 2017; SPIRE Southampton performed >100 TX Established network of treating centers participating in pivotal trials Data from EU experience providing steady flow of supporting abstracts and publications

Convertible Note $35.0 million senior secured convertible notes issued June 2016 subject to certain equity conditions Provided resources necessary for advancement of CDP where we believe shareholder value will be realized Recently executed warrant repurchase agreements with note holders; agreement for ~$7.9 million paid to holders in exchanged for warrant cancellation $12.6 million released; $11.8 million restricted cash remaining and scheduled to be released throughout 2017 Repayment using common shares began in December 2016; amortization is scheduled to continue through December 2017 Repayment in $2.5 million installments to the holders Anticipate repayment via shares at 15% discount to the lower of: Average of three lowest VWAPS from prior 20 trading days, or VWAP of the common stock on the trading day immediately preceding the installment date

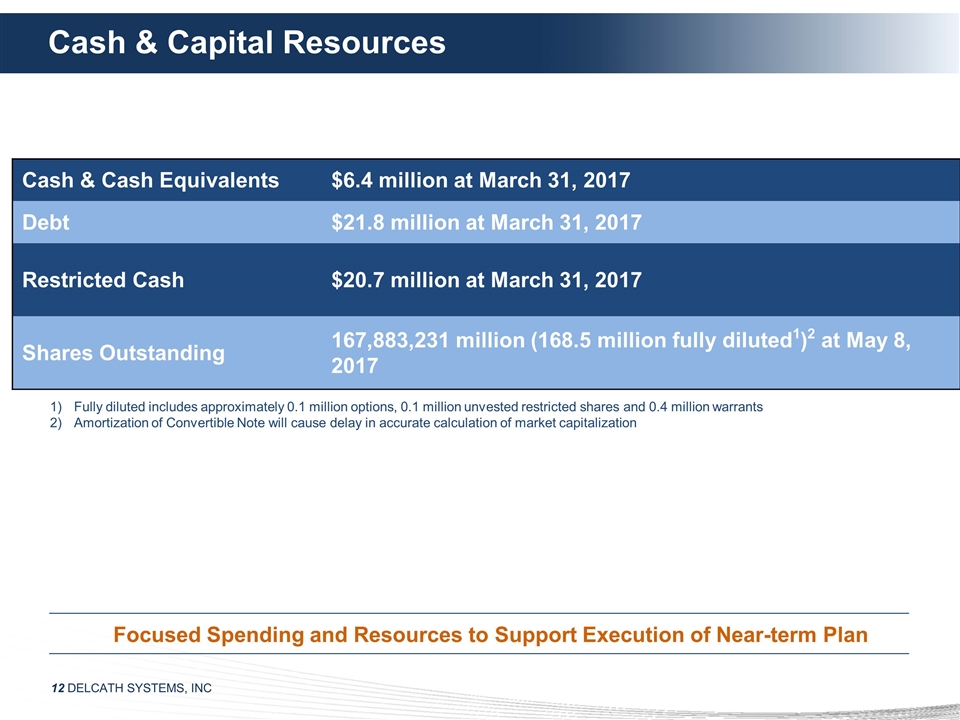

Cash & Capital Resources Cash & Cash Equivalents $6.4 million at March 31, 2017 Debt $21.8 million at March 31, 2017 Restricted Cash $20.7 million at March 31, 2017 Shares Outstanding 167,883,231 million (168.5 million fully diluted1)2 at May 8, 2017 Fully diluted includes approximately 0.1 million options, 0.1 million unvested restricted shares and 0.4 million warrants Amortization of Convertible Note will cause delay in accurate calculation of market capitalization Focused Spending and Resources to Support Execution of Near-term Plan