Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CAESARS HOLDINGS, INC. | d322134d8k.htm |

Exhibit 99.1

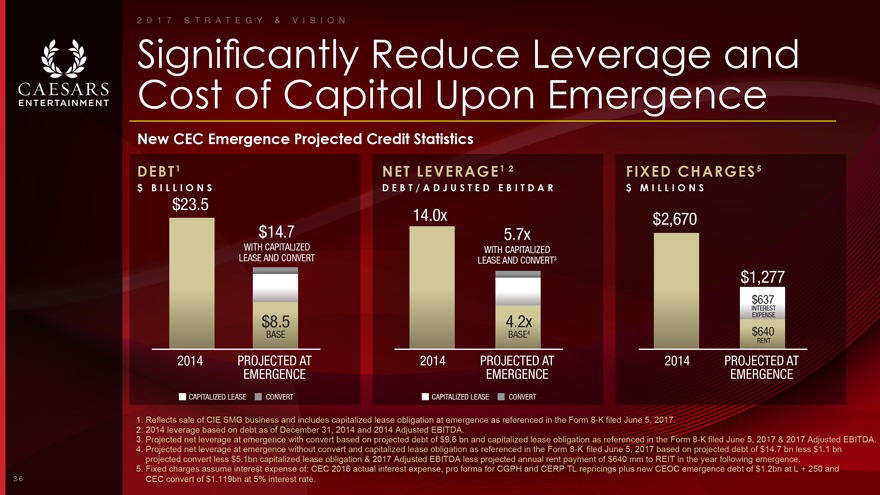

2 0 1 7 S T R A T E G Y & V I S I O N Significantly Reduce Leverage andCost of Capital Upon Emergence New CEC Emergence Projected Credit StatisticsDEBT1 NET LEVERAGE1 2 FIXED CHARGES5$ B I L L I O N S D E B T / A D J U S T E D E B I T D A R $ M I L L I O N S$23.5$ 4 14.0x $2,6701 .7 5.7xWITH CAPITALIZED WITH CAPITALIZED LEASE AND CONVERT LEASE AND CONVERT3$1,277$637INTEREST EXPENSE$8.5 4.2xBASE BASE4 $640 RENT2014 PROJECTED AT 2014 PROJECTED AT 2014 PROJECTED AT EMERGENCE EMERGENCE EMERGENCECAPITALIZED LEASE CONVERT CAPITALIZED LEASE CONVERT Reflects sale of CIE SMG business and includes capitalized lease obligation at emergence as referenced in the Form 8-K filed June 5, 2017.2014 leverage based on debt as of December 31, 2014 and 2014 Adjusted EBITDA.Projected net leverage at emergence with convert based on projected debt of $9.6 bn and capitalized lease obligation as referenced in the Form 8-K filed June 5, 2017 & 2017 Adjusted EBITDA. Projected net leverage at emergence without convert and capitalized lease obligation as referenced in the Form 8-K filed June 5, 2017 based on projected debt of $14.7 bn less $1.1 bn projected convert less $5.1bn capitalized lease obligation & 2017 Adjusted EBITDA less projected annual rent payment of $640 mm to REIT in the year following emergence. Fixed charges assume interest expense of: CEC 2016 actual interest expense, pro forma for CGPH and CERP TL repricings plus new CEOC emergence debt of $1.2bn at L + 250 and CEC convert of $1.119bn at 5% interest rate.36