Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - CAESARS HOLDINGS, INC. | a2017q2cecex312cfosection3.htm |

| EX-32.2 - EXHIBIT 32.2 - CAESARS HOLDINGS, INC. | a2017q2cecex322cfosection9.htm |

| EX-32.1 - EXHIBIT 32.1 - CAESARS HOLDINGS, INC. | a2017q2cecex321ceosection9.htm |

| EX-31.1 - EXHIBIT 31.1 - CAESARS HOLDINGS, INC. | a2017q2cecex311ceosection3.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM 10-Q

_________________________

(Mark One)

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended June 30, 2017

or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to __________

Commission File No. 1-10410

_________________________

CAESARS ENTERTAINMENT CORPORATION

(Exact name of registrant as specified in its charter)

_________________________

Delaware | 62-1411755 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

One Caesars Palace Drive, Las Vegas, Nevada | 89109 | |

(Address of principal executive offices) | (Zip Code) | |

(702) 407-6000

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

_________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | o | Accelerated filer | x |

Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | o |

Emerging growth company | o | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

Class | Outstanding at August 1, 2017 |

Common stock, $0.01 par value | 149,146,067 |

CAESARS ENTERTAINMENT CORPORATION

INDEX

Page | ||

Item 1. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 1. | ||

Item 1A. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

2

PART I—FINANCIAL INFORMATION

Item 1. Unaudited Financial Statements

CAESARS ENTERTAINMENT CORPORATION

CONSOLIDATED CONDENSED BALANCE SHEETS

(UNAUDITED)

(In millions) | June 30, 2017 | December 31, 2016 | |||||

Assets | |||||||

Current assets | |||||||

Cash and cash equivalents ($1,126 and $1,157 attributable to our VIEs) | $ | 1,515 | $ | 1,513 | |||

Restricted cash ($2,904 and $3,040 attributable to our VIEs) | 2,973 | 3,113 | |||||

Receivables, net ($81 and $76 attributable to our VIEs) | 158 | 160 | |||||

Due from affiliates ($30 and $64 attributable to our VIEs) | 30 | 64 | |||||

Prepayments and other current assets ($79 and $61 attributable to our VIEs) | 167 | 118 | |||||

Inventories ($3 and $7 attributable to our VIEs) | 15 | 20 | |||||

Total current assets | 4,858 | 4,988 | |||||

Property and equipment, net ($2,534 and $2,537 attributable to our VIEs) | 7,431 | 7,446 | |||||

Goodwill ($206 and $206 attributable to our VIEs) | 1,608 | 1,608 | |||||

Intangible assets other than goodwill ($183 and $191 attributable to our VIEs) | 400 | 433 | |||||

Restricted cash ($5 and $5 attributable to our VIEs) | 104 | 5 | |||||

Deferred charges and other assets ($232 and $240 attributable to our VIEs) | 392 | 414 | |||||

Total assets | $ | 14,793 | $ | 14,894 | |||

Liabilities and Stockholders’ Deficit | |||||||

Current liabilities | |||||||

Accounts payable ($110 and $143 attributable to our VIEs) | $ | 187 | $ | 215 | |||

Due to affiliates ($36 and $94 attributable to our VIEs) | 56 | 112 | |||||

Accrued expenses and other current liabilities ($342 and $312 attributable to our VIEs) | 726 | 664 | |||||

Accrued restructuring and support expenses | 8,408 | 6,601 | |||||

Interest payable ($11 and $14 attributable to our VIEs) | 63 | 67 | |||||

Current portion of long-term debt ($22 and $21 attributable to our VIEs) | 48 | 89 | |||||

Total current liabilities | 9,488 | 7,748 | |||||

Long-term debt ($2,255 and $2,254 attributable to our VIEs) | 6,744 | 6,749 | |||||

Deferred income taxes | 1,825 | 1,722 | |||||

Deferred credits and other liabilities ($34 and $33 attributable to our VIEs) | 93 | 93 | |||||

Total liabilities | 18,150 | 16,312 | |||||

Commitments and contingencies (Note 8) | |||||||

Stockholders’ deficit | |||||||

Caesars stockholders’ deficit | (5,155 | ) | (3,177 | ) | |||

Noncontrolling interests | 1,798 | 1,759 | |||||

Total stockholders’ deficit | (3,357 | ) | (1,418 | ) | |||

Total liabilities and stockholders’ deficit | $ | 14,793 | $ | 14,894 | |||

See accompanying Notes to Consolidated Condensed Financial Statements.

3

CAESARS ENTERTAINMENT CORPORATION

CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS

(UNAUDITED)

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

(In millions, except per share data) | 2017 | 2016 | 2017 | 2016 | |||||||||||

Revenues | |||||||||||||||

Casino | $ | 554 | $ | 553 | $ | 1,086 | $ | 1,091 | |||||||

Food and beverage | 197 | 200 | 393 | 401 | |||||||||||

Rooms | 238 | 235 | 481 | 464 | |||||||||||

Other | 149 | 136 | 278 | 258 | |||||||||||

Less: casino promotional allowances | (136 | ) | (132 | ) | (273 | ) | (272 | ) | |||||||

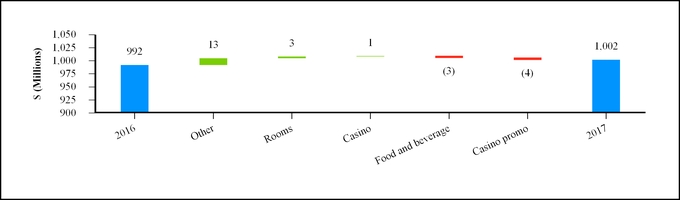

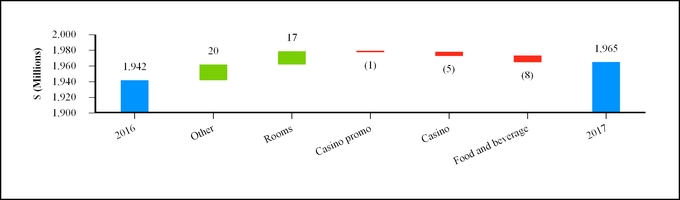

Net revenues | 1,002 | 992 | 1,965 | 1,942 | |||||||||||

Operating expenses | |||||||||||||||

Direct | |||||||||||||||

Casino | 280 | 279 | 563 | 564 | |||||||||||

Food and beverage | 96 | 100 | 189 | 193 | |||||||||||

Rooms | 64 | 63 | 127 | 122 | |||||||||||

Property, general, administrative, and other | 251 | 276 | 485 | 526 | |||||||||||

Depreciation and amortization | 96 | 103 | 198 | 215 | |||||||||||

Corporate expense | 40 | 40 | 73 | 81 | |||||||||||

Other operating costs | 18 | 20 | 15 | 42 | |||||||||||

Total operating expenses | 845 | 881 | 1,650 | 1,743 | |||||||||||

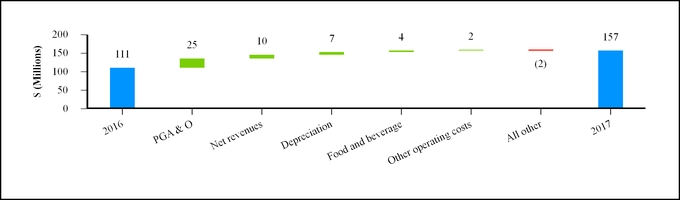

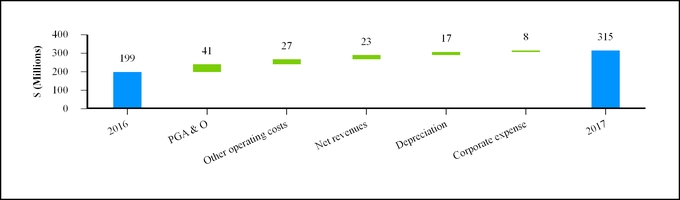

Income from operations | 157 | 111 | 315 | 199 | |||||||||||

Interest expense | (142 | ) | (150 | ) | (289 | ) | (301 | ) | |||||||

Restructuring of CEOC and other | (1,410 | ) | (2,026 | ) | (1,873 | ) | (2,263 | ) | |||||||

Loss from continuing operations before income taxes | (1,395 | ) | (2,065 | ) | (1,847 | ) | (2,365 | ) | |||||||

Income tax provision | (31 | ) | (3 | ) | (103 | ) | (10 | ) | |||||||

Loss from continuing operations, net of income taxes | (1,426 | ) | (2,068 | ) | (1,950 | ) | (2,375 | ) | |||||||

Discontinued operations, net of income taxes | — | 25 | — | 58 | |||||||||||

Net loss | (1,426 | ) | (2,043 | ) | (1,950 | ) | (2,317 | ) | |||||||

Net income attributable to noncontrolling interests | (16 | ) | (34 | ) | (38 | ) | (68 | ) | |||||||

Net loss attributable to Caesars | $ | (1,442 | ) | $ | (2,077 | ) | $ | (1,988 | ) | $ | (2,385 | ) | |||

Loss per share - basic and diluted | |||||||||||||||

Basic and diluted loss per share from continuing operations | $ | (9.68 | ) | $ | (14.42 | ) | $ | (13.42 | ) | $ | (16.79 | ) | |||

Basic and diluted earnings per share from discontinued operations | — | 0.17 | — | 0.40 | |||||||||||

Basic and diluted loss per share | $ | (9.68 | ) | $ | (14.25 | ) | $ | (13.42 | ) | $ | (16.39 | ) | |||

Weighted-average common stock outstanding | 149 | 146 | 148 | 146 | |||||||||||

See accompanying Notes to Consolidated Condensed Financial Statements.

4

CAESARS ENTERTAINMENT CORPORATION

CONSOLIDATED CONDENSED STATEMENTS OF STOCKHOLDERS’ EQUITY/(DEFICIT)

(UNAUDITED)

Caesars Stockholders’ Equity/(Deficit) | |||||||||||||||||||||||||||||||

(In millions) | Common Stock | Treasury Stock | Additional Paid-in- Capital | Accumulated Deficit | Accumulated Other Comprehensive Income/(Loss) | Total Caesars Stockholders’ Equity/(Deficit) | Noncontrolling Interests | Total Equity/(Deficit) | |||||||||||||||||||||||

Balance as of December 31, 2015 | $ | 1 | $ | (21 | ) | $ | 8,190 | $ | (7,184 | ) | $ | 1 | $ | 987 | $ | 1,246 | $ | 2,233 | |||||||||||||

Cumulative effect adjustment for stock-based compensation (1) | — | — | 1 | (1 | ) | — | — | — | — | ||||||||||||||||||||||

Net income/(loss) | — | — | — | (2,385 | ) | — | (2,385 | ) | 68 | (2,317 | ) | ||||||||||||||||||||

Stock-based compensation | — | (5 | ) | 24 | — | — | 19 | — | 19 | ||||||||||||||||||||||

CIE stock transactions, net | — | — | (15 | ) | — | — | (15 | ) | (5 | ) | (20 | ) | |||||||||||||||||||

Change in noncontrolling interest, net of distributions and contributions | — | — | — | — | — | — | (8 | ) | (8 | ) | |||||||||||||||||||||

Other | — | — | — | — | — | — | (3 | ) | (3 | ) | |||||||||||||||||||||

Balance as of June 30, 2016 | $ | 1 | $ | (26 | ) | $ | 8,200 | $ | (9,570 | ) | $ | 1 | $ | (1,394 | ) | $ | 1,298 | $ | (96 | ) | |||||||||||

Balance as of December 31, 2016 | $ | 1 | $ | (29 | ) | $ | 7,605 | $ | (10,753 | ) | $ | (1 | ) | $ | (3,177 | ) | $ | 1,759 | $ | (1,418 | ) | ||||||||||

Net income/(loss) | — | — | — | (1,988 | ) | — | (1,988 | ) | 38 | (1,950 | ) | ||||||||||||||||||||

Stock-based compensation | — | (8 | ) | 18 | — | — | 10 | — | 10 | ||||||||||||||||||||||

Change in noncontrolling interest, net of distributions and contributions | — | — | — | — | — | — | 1 | 1 | |||||||||||||||||||||||

Balance as of June 30, 2017 | $ | 1 | $ | (37 | ) | $ | 7,623 | $ | (12,741 | ) | $ | (1 | ) | $ | (5,155 | ) | $ | 1,798 | $ | (3,357 | ) | ||||||||||

____________________

(1) | Adoption of Accounting Standards Update No. 2016-09, Compensation-Stock Compensation. See Note 12. |

See accompanying Notes to Consolidated Condensed Financial Statements.

5

CAESARS ENTERTAINMENT CORPORATION

CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS

(UNAUDITED)

Six Months Ended June 30, | |||||||

(In millions) | 2017 | 2016 | |||||

Cash flows provided by operating activities | $ | 220 | $ | 231 | |||

Cash flows from investing activities | |||||||

Acquisitions of property and equipment, net of change in related payables | (164 | ) | (98 | ) | |||

Return of investment from discontinued operations | — | 115 | |||||

Proceeds from the sale and maturity of investments | 26 | 24 | |||||

Payments to acquire investments | (18 | ) | (8 | ) | |||

Other | — | (1 | ) | ||||

Cash flows provided by/(used in) investing activities | (156 | ) | 32 | ||||

Cash flows from financing activities | |||||||

Proceeds from long-term debt and revolving credit facilities | 285 | 80 | |||||

Debt issuance costs and fees | (8 | ) | — | ||||

Repayments of long-term debt and revolving credit facilities | (348 | ) | (221 | ) | |||

Repurchase of CIE shares | — | (43 | ) | ||||

Distributions to noncontrolling interest owners | (26 | ) | (13 | ) | |||

Other | (6 | ) | 2 | ||||

Cash flows used in financing activities | (103 | ) | (195 | ) | |||

Cash flows from discontinued operations | |||||||

Cash flows from operating activities | — | 135 | |||||

Cash flows from investing activities | — | (8 | ) | ||||

Cash flows from financing activities | — | (115 | ) | ||||

Net cash from discontinued operations | — | 12 | |||||

Change in cash, cash equivalents, and restricted cash classified as held for sale | — | (9 | ) | ||||

Net increase/(decrease) in cash, cash equivalents, and restricted cash | (39 | ) | 71 | ||||

Cash, cash equivalents, and restricted cash, beginning of period | 4,631 | 1,394 | |||||

Cash, cash equivalents, and restricted cash, end of period | $ | 4,592 | $ | 1,465 | |||

Supplemental Cash Flow Information: | |||||||

Cash paid for interest | $ | 272 | $ | 290 | |||

Cash paid for income taxes | — | 46 | |||||

Non-cash investing and financing activities: | |||||||

Change in accrued capital expenditures | (9 | ) | (8 | ) | |||

See accompanying Notes to Consolidated Condensed Financial Statements.

6

CAESARS ENTERTAINMENT CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS

(UNAUDITED)

In this filing, the name “CEC” refers to the parent holding company, Caesars Entertainment Corporation, exclusive of its consolidated subsidiaries and variable interest entities, unless otherwise stated or the context otherwise requires. The words “Company,” “Caesars,” “Caesars Entertainment,” “we,” “our,” and “us” refer to Caesars Entertainment Corporation, inclusive of its consolidated subsidiaries and variable interest entities, unless otherwise stated or the context otherwise requires.

This Form 10-Q should be read in conjunction with our Annual Report on Form 10-K for the year ended December 31, 2016 (“2016 Annual Report”).

We also refer to (i) our Consolidated Condensed Financial Statements as our “Financial Statements,” (ii) our Consolidated Condensed Statements of Operations and Comprehensive Income as our “Statements of Operations,” and (iii) our Consolidated Condensed Balance Sheets as our “Balance Sheets.”

Note 1 - Description of Business

Organization

CEC is primarily a holding company with no independent operations of its own. CEC owns 100% of Caesars Entertainment Resort Properties, LLC (“CERP”) and an interest in Caesars Growth Partners, LLC (“CGP”). CERP and CGP own a total of 12 casino properties in the United States, eight of which are in Las Vegas. These eight casino properties represented 65% and 66% of consolidated net revenues for the three and six months ended June 30, 2017, respectively.

CEC also holds a majority interest in Caesars Entertainment Operating Company, Inc. (“CEOC”). The results of CEOC and its subsidiaries are no longer consolidated with Caesars subsequent to CEOC and certain of its United States subsidiaries (the “Debtors”) voluntarily filing for reorganization in January 2015 under Chapter 11 of the United States Bankruptcy Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the Northern District of Illinois in Chicago (the “Bankruptcy Court”).

Caesars Enterprise Services, LLC

Caesars Enterprise Services, LLC (“CES”) is a services joint venture formed by CERP, CEOC, and a subsidiary of CGP (Caesars Growth Properties Holdings, LLC, or “CGPH”) (collectively, the “Members”). CES provides certain corporate and administrative services for the Members’ casino properties and related entities, including substantially all of the casino properties owned by CEOC and casinos owned by unrelated third parties. CES manages certain assets for the casino properties to which it provides services, and it employs certain of the corresponding employees. CES owns, licenses or controls other assets and uses them to provide services to the Members. Under the terms of the Omnibus License and Enterprise Services Agreement, CEC and its operating subsidiaries continue to have access to the services historically provided to us by CEOC and its employees, its trademarks, and its programs.

Reportable Segments

We view each casino property as an operating segment and currently aggregate all such casino properties into two reportable segments based on management’s view, which aligns with their ownership and underlying credit structures: CERP and CGP.

On September 23, 2016, Caesars Interactive Entertainment (“CIE”), a wholly owned subsidiary of CGP, sold its social and mobile games business (the “SMG Business”) and retained only its World Series of Poker (“WSOP”) and regulated online real money gaming businesses. The SMG Business represented the majority of CIE’s operations and is classified as discontinued operations for all periods presented (see Note 14).

Announced Merger with Caesars Acquisition Company

Caesars Acquisition Company (“CAC”) was formed on February 25, 2013 to make an equity investment in CGP, a joint venture between CAC and certain subsidiaries of CEC, and directly owns 100% of the voting membership units of CGP and serves as CGP’s managing member. Certain subsidiaries of CEC hold 100% of the non-voting membership units of CGP.

CEC and CAC entered into the Amended and Restated Agreement and Plan of Merger, dated as of July 9, 2016, as amended by the First Amendment to Amended and Restated Agreement and Plan of Merger, dated as of February 20, 2017 (as amended, the “Merger Agreement”). Pursuant to the Merger Agreement, among other things, CAC will merge with and into CEC, with CEC as

7

CAESARS ENTERTAINMENT CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

the surviving company (the “Merger”). Subject to the terms and conditions of the Merger Agreement, upon consummation of the Merger, each share of CAC common stock issued and outstanding immediately prior to the effective date of the Merger will be converted into, and become exchangeable for, 1.625 (the “Exchange Ratio”) shares of CEC common stock.

CEC’s registration statement on Form S-4 filed with the Securities and Exchange Commission (“SEC”) on March 13, 2017, as amended by Amendment No. 1 to such registration statement on Form S-4 filed with the SEC on June 5, 2017 and Amendment No. 2 to such registration statement on Form S-4 filed with the SEC on June 20, 2017 (as amended, the “Registration Statement”), was declared effective by the SEC on June 23, 2017. Special meetings of CEC and CAC stockholders were held on July 25, 2017, where the stockholders agreed to:

• | adopt the Merger Agreement and approve the Merger; |

• | approve the issuance of shares of CEC common stock: |

◦ | to CAC stockholders in the Merger, |

◦ | to creditors of the Debtors in connection with CEOC’s emergence, and |

◦ | under the approximately $1.1 billion in face value of 5.00% convertible senior notes due 2024 to be issued by CEC to certain creditors of the Debtors in connection with the Debtors’ emergence (the “CEC Convertible Notes”); |

• | approve, on a non-binding, advisory basis, the Merger-related compensation for CEC’s named executive officers and certain of CAC’s named executive officers; |

• | approve amendments to CEC’s certificate of incorporation to: |

◦ | increase the number of authorized shares of CEC common stock from 1,250,000,000 to 2,000,000,000, |

◦ | allow for cumulative voting in the election of individuals to the CEC board of directors, and |

◦ | implement, over a number of years, the declassification of the CEC board of directors; and |

• | approve the CEC 2017 Performance Incentive Plan. |

We expect the Merger to be accounted for as a transaction among entities under common control, which will result in CAC being consolidated into Caesars at book value as an equity transaction for all periods presented.

Going Concern

Management assesses CEC’s ability to continue as a going concern on a quarterly basis, and the following information reflects the results of our assessment of CEC’s ability to continue as a going concern.

Overview

As a result of the following circumstances, we have substantial doubt about CEC’s ability to continue as a going concern:

• | we have limited unrestricted cash available to meet the financial commitments of CEC, primarily resulting from significant expenditures made to (1) defend against the litigation matters disclosed below and (2) support a plan of reorganization for CEOC (the “Restructuring”); |

• | we have made material future commitments to support the Restructuring described below; and |

• | we are a defendant in litigation relating to certain CEOC transactions dating back to 2010 and other legal matters (see Note 3) that could result in one or more adverse rulings against us if the Restructuring is not completed. |

CEC does not currently have sufficient cash to meet its financial commitments to support the Restructuring that are due when CEOC ultimately emerges from bankruptcy or to satisfy the potential obligations that would arise in the event of an adverse ruling on one or all of the litigation matters disclosed below. The completion of the Merger is expected to allow CEC to fulfill its financial

8

CAESARS ENTERTAINMENT CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

commitments in support of the Restructuring. However, if the Merger is not completed for any reason, CEC would still be liable for many of these obligations.

CEC entered into the CIE Proceeds and Reservation Rights Agreement (as amended on October 7, 2016) with CIE, CEOC and CAC (the “CIE Proceeds Agreement”), which allows for up to $235 million of the proceeds from the sale of the SMG Business to be distributed to CEC in order to pay certain fees in support of the Restructuring, including the payment to CEOC described below (“CEC Expense Amounts”). As of June 30, 2017, $81 million remained available to CEC under this agreement. After taking into account the cash available to pay the CEC Expense Amounts under the CIE Proceeds Agreement and other sources of liquidity, CEC expects to have sufficient cash to meet its ongoing obligations as they come due for at least 12 months beyond the issuance date of these financial statements. However, there are restrictions governing when and how the cash designated for CEC Expense Amounts can be used (see Note 2). Upon completion of the Merger, CEC also expects to gain access to the remaining proceeds from the sale of the SMG Business, which will be used to fund its other commitments in support of the Restructuring.

If CEC is unable to access additional sources of cash when needed, in the event of a material adverse ruling on one or all of the litigation matters disclosed below, or if CEOC does not emerge from bankruptcy on a timely basis on terms and under circumstances satisfactory to CEC, it is likely that CEC would seek reorganization under Chapter 11 of the Bankruptcy Code.

We believe that CERP and CGP’s cash and cash equivalents, their cash flows from operations, and/or financing available under their separate revolving credit facilities will be sufficient to meet their normal operating requirements, to fund planned capital expenditures, and to fund debt service during the next 12 months and the foreseeable future.

CEOC Reorganization

On January 13, 2017, the Debtors filed an amended plan of reorganization (the “Third Amended Plan”) with the Bankruptcy Court that replaces all previously filed plans. CEC, CAC, the Debtors and CEOC’s major creditor groups have agreed to support the Third Amended Plan. The Bankruptcy Court confirmed the Third Amended Plan on January 17, 2017.

As part of the Third Amended Plan, it is anticipated that CEOC will be divided into two companies - OpCo and PropCo. OpCo will operate CEOC’s properties and facilities. PropCo will hold certain of CEOC’s real property assets and related fixtures and will lease those assets to OpCo. It is anticipated that OpCo will be a wholly owned consolidated subsidiary of CEC subsequent to CEOC’s emergence and will contract with another subsidiary of CEC to manage the facilities to be leased from PropCo. PropCo will be a separate entity and will not be consolidated by CEC.

Although the Third Amended Plan has been confirmed by the Bankruptcy Court, we must still obtain regulatory approval in three of the jurisdictions in which we have gaming operations in order for CEOC to successfully emerge from bankruptcy. The Third Amended Plan remains subject to completion of (i) the Merger, which was approved by CEC's shareholders on July 25, 2017; (ii) certain financing transactions, including raising $1.2 billion of capital for OpCo (the terms of which were committed to on April 4, 2017) and (iii) various other closing conditions. In addition, CEOC continues to complete the formation of PropCo and related entities and take such other steps necessary to enable PropCo to carry out the transactions contemplated under the Third Amended Plan and commence operations on the Effective Date (as defined below), which includes securing an anticipated $1.8 billion to $2.2 billion of commercial mortgage backed securities.

In connection with the Third Amended Plan, the following agreements with respect to the CEOC reorganization were either entered into or amended, as needed (collectively, the “RSAs”):

(a) | Sixth Amended and Restated Restructuring Support and Forbearance Agreement, dated October 4, 2016, with certain parties holding claims under CEOC’s first lien notes (the “First Lien Bond RSA”); |

(b) | Second Amended Restructuring Support and Forbearance Agreement, dated October 4, 2016, with certain parties holding claims under CEOC’s first lien credit agreement (the “First Lien Bank RSA”); |

(c) | Restructuring Support, Forbearance and Settlement Agreement, dated October 4, 2016, with certain parties holding claims under CEOC’s second lien note agreements (the “Second Lien RSA”); |

(d) | Amendment No. 1 to First Amended and Restated Restructuring Support and Forbearance Agreement, dated October 4, 2016, with certain parties holding claims under CEOC’s subsidiary guaranteed notes (the “SGN RSA”); |

9

CAESARS ENTERTAINMENT CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

(e) | First Amended and Restated Restructuring Support, Settlement, and Contribution Agreement, dated July 9, 2016, with CEOC (the “CEC RSA”); |

(f) | Amended and Restated Restructuring Support Agreement, dated July 9, 2016, with CAC and CEOC (the “CAC RSA”); and |

(g) | Restructuring Support and Settlement Agreement, dated June 22, 2016, with the unsecured claimholders’ committee in the Chapter 11 cases (the “UCC RSA”). |

The “Effective Date” of the Restructuring (the material terms of which are contained in the RSAs and the Third Amended Plan) is the date upon which all required conditions of the Restructuring have been satisfied or waived and on which the CEOC reorganization and related transactions become effective.

As a result of the Bankruptcy Court’s confirmation of the Third Amended Plan, we believe it is probable that certain obligations described in the Third Amended Plan and the RSAs will ultimately be settled, and therefore, we have accrued the items that are estimable in accrued restructuring and support expenses on the Balance Sheets, as described in the table below. During 2017, we updated our accruals primarily for changes in the fair value of our accrued restructuring and support expenses. For the three and six months ended June 30, 2017, we recorded $1.4 billion and $1.9 billion, respectively, in restructuring of CEOC and other in the Statements of Operations, which increased our total accrual to $8.4 billion as of June 30, 2017.

We estimated the total consideration we expect to provide in support of the Restructuring, which includes a combination of cash, CEC common stock, and CEC Convertible Notes (as defined below). Accrued restructuring and support expenses does not include the consideration that will be issued as part of the acquisition of OpCo (as defined below), which will be recorded when the transaction is consummated.

Accrued Restructuring and Support Expenses | |||||||

Accrued as of | |||||||

(In millions) | June 30, 2017 | December 31, 2016 | |||||

Forbearance fees and other payments to creditors | $ | 995 | $ | 970 | |||

Bank Guaranty Settlement | 768 | 734 | |||||

Issuance of CEC common stock | 4,383 | 2,936 | |||||

Issuance of CEC Convertible Notes | 1,910 | 1,600 | |||||

PropCo Call Right | 193 | 131 | |||||

Payment of creditor expenses, settlement charges, and other fees | 159 | 195 | |||||

Payment to CEOC | — | 35 | |||||

Total accrued | $ | 8,408 | $ | 6,601 | |||

The amounts disclosed above are reported net of payments totaling $69 million and $34 million during the six months ended June 30, 2017 and the year ended December 31, 2016, respectively.

Forbearance Fees and Other Payments to Creditors. CEC has agreed to pay certain fees in exchange for CEOC’s major creditors agreeing to forebear from exercising their rights and remedies under certain of CEOC’s credit agreements and to stay all pending litigation.

Bank Guaranty Settlement. In 2014, CEOC amended its senior secured credit facilities (the “Bank Amendment”) resulting in, among other things, a modification of CEC’s guarantee under the senior secured credit facilities such that CEC’s guarantee was limited to a guarantee of collection (“CEC Collection Guarantee”) with respect to obligations owed to the lenders who consented to the Bank Amendment. The CEC Collection Guarantee requires the creditors to exhaust all rights and remedies at law and in equity that the creditors or their agents may have against CEOC or any of its subsidiaries and its and their respective property to collect, or obtain payment of, the guaranteed amounts. Pursuant to the Third Amended Plan, the CEOC creditors have agreed to eliminate the CEC Collection Guarantee, and we recorded $768 million as an estimate of the liability based on the terms of the agreement.

10

CAESARS ENTERTAINMENT CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

Issuance of CEC Common Stock. CEC will issue CEC common stock for the settlement of claims and potential claims and is obligated to repurchase at least $1.0 billion worth of the issued shares at a fixed price. As of June 30, 2017, our accrual includes the $1.0 billion repurchase obligation plus the estimated fair value of $3.4 billion for the net shares that we expect to issue after satisfying the repurchase obligation, which is subject to remeasurement on a quarterly basis. Additionally, we have accrued a liability for the fair value associated with the creditors’ right to require CEC to repurchase up to $200 million worth of the newly-issued CEC common stock.

CEC’s majority stockholders, the Sponsors (as defined in Note 15), have agreed that their CEC common stock shall be contributed to CEC as part of the Restructuring and for the settlement of claims and potential claims. Therefore, our accrual also includes the fair value of the shares held by the Sponsors. We will reduce the estimate of our obligation upon receipt of the shares from the Sponsors, with an offsetting amount recorded to equity, which is expected to occur on the Effective Date. See Note 7 for additional information on fair value measurements and how this value was determined.

Issuance of CEC Convertible Notes. CEC will issue approximately $1.1 billion in face value of CEC Convertible Notes to the CEOC creditors for the settlement of claims and potential claims, and our accrual represents the estimated fair value of the notes to be issued (see Note 7).

PropCo Call Right Agreement. PropCo will have a call right for up to five years to purchase the real property assets associated with Harrah’s Atlantic City and Harrah’s Laughlin from CERP and Harrah’s New Orleans from CGP (subject to the terms of the CERP and CGPH credit agreements) (the “PropCo Call Right”). Our accrual represents the estimated fair value of the call right related to Harrah's Atlantic City, Harrah's Laughlin, and Harrah’s New Orleans. See Note 7.

Payment of Creditor Expenses, Settlement Charges, and Other Fees. Pursuant to the Third Amended Plan, CEC has agreed to pay certain professional fees incurred by CEOC’s creditors and has agreed to pay other ancillary fees and settlement amounts.

Payment to CEOC. In addition, and separate from the transactions and agreements described above, because there was not a comprehensive out-of-court restructuring of CEOC's debt securities or a prepackaged or prearranged in-court restructuring with requisite voting support from each of the first and second lien secured creditor classes by February 15, 2016, a debt agreement entered into by CEOC in 2014 contemplates an additional payment to CEOC of $35 million from CEC. During the first quarter of 2015, we accrued this liability in accrued restructuring and support expenses on the Balance Sheet, which was paid during the second quarter of 2017 using a portion of the proceeds from the sale of the SMG Business.

Other Commitments Under the Third Amended Plan

The following represents other commitments or potential obligations to which CEC has agreed as part of the Third Amended Plan and certain of the RSAs, none of which have been accrued as of June 30, 2017.

• | Purchase 100% of OpCo common stock for $700 million; |

• | Issuance of CEC common stock in exchange for OpCo preferred stock; |

• | PropCo has right of first refusal on the real property assets associated with all new domestic non-Las Vegas gaming facility opportunities, with CEC or OpCo leasing such properties; and |

• | Guarantee of OpCo’s payment obligations to PropCo under the leases of the CEOC Properties. |

The acquisitions of OpCo equity represent future investment transactions and will be recorded when (or if) the transactions are consummated. The PropCo right of first refusal is not a financial obligation that would require accrual. The guarantee of OpCo’s payment relates to OpCo commitments that do not yet exist, and thus does not give rise to an obligation for CEC as of June 30, 2017.

11

CAESARS ENTERTAINMENT CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

Liquidity

Cash and Available Revolver Capacity | |||||||||||||||

June 30, 2017 | |||||||||||||||

(In millions) | CERP | CGP | CES | Other | |||||||||||

Cash and cash equivalents | $ | 264 | $ | 1,035 | $ | 91 | $ | 125 | |||||||

Revolver capacity | 270 | 160 | — | — | |||||||||||

Revolver capacity drawn or committed to letters of credit | — | — | — | — | |||||||||||

Total | $ | 534 | $ | 1,195 | $ | 91 | $ | 125 | |||||||

Consolidated cash and cash equivalents, excluding restricted cash, as shown in the table above include amounts held by CERP, CGP, and CES, which are not readily available to CEC. “Other” reflects CEC and certain of its direct subsidiaries, including its insurance captives.

CEC is primarily a holding company with no independent operations, employees, or material debt issuances of its own. Its primary assets as of June 30, 2017, consist of $125 million in cash and cash equivalents and its ownership interests in CEOC, CERP, and CGP. CEC’s cash and cash equivalents includes $93 million held by its insurance captives. Provisions included in certain debt arrangements entered into by CERP and CGP (and/or their respective subsidiaries) substantially restrict the ability of CERP, CGP, and their subsidiaries to provide dividends to CEC. In addition, CEC does not receive any financial benefit from CEOC during CEOC’s bankruptcy, as all earnings and cash flows are retained by CEOC for the benefit of its creditors.

CEC has no requirement to fund the operations of CERP, CGP, or their subsidiaries. Accordingly, CEC cash outflows are primarily used for corporate development opportunities and other corporate-level activity, including defending itself in the litigation in which it has been named as a defendant (see Note 3). As described previously, as of June 30, 2017, CEC had $81 million remaining under the CIE Proceeds Agreement from which it is able to fund certain eligible CEC Expense Amounts. Otherwise, CEC is generally limited to raising additional capital through borrowings or equity transactions because it has no operations of its own and the restrictions on its subsidiaries under lending arrangements generally prevent the distribution of cash from the subsidiaries to CEC, except for certain restricted payments that CERP and CGPH are authorized to make in accordance with their lending arrangements.

Litigation

In addition to financial commitments described above, we have the following outstanding uncertainties for which we have not accrued any amounts, all of which are described in Note 3:

• | Litigation commenced by Wilmington Savings Fund Society, FSB on August 4, 2014 (the “Delaware Second Lien Lawsuit”); |

• | Litigation commenced by parties on September 3, 2014 and October 2, 2014 (the “Senior Unsecured Lawsuits”); |

• | Litigation commenced by UMB Bank on November 25, 2014 (the “Delaware First Lien Lawsuit”); |

• | Demands for payment made by Wilmington Savings Fund Society, FSB on February 13, 2015 (the “February 13 Notice”); |

• | Demands for payment made by BOKF, N.A., on February 18, 2015 (the “February 18 Notice”); |

• | Litigation commenced by BOKF, N.A. on March 3, 2015 (the “New York Second Lien Lawsuit”); |

• | Litigation commenced by UMB Bank on June 15, 2015 (the “New York First Lien Lawsuit”); and |

• | Litigation commenced by Wilmington Trust, National Association on October 20, 2015 (the “New York Senior Notes Lawsuit”). |

Report of Bankruptcy Examiner

The Bankruptcy Court engaged an examiner to investigate possible claims CEOC might have against CEC and/or other entities and individuals. On March 15, 2016, the examiner released his report, which identifies a variety of potential claims against CEC

12

CAESARS ENTERTAINMENT CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

and certain individuals related to a number of transactions dating back to 2009. Most of the examiner’s findings are premised on his view that CEOC was “insolvent” at the time of the applicable transactions and that CEOC did not receive fair value for assets transferred. The examiner’s report includes his conclusions on the relative strengths of these possible claims, many of which are described in Note 3. The examiner calculates an estimated range of potential damages for these potential claims from $3.6 billion to $5.1 billion, and such calculation does not account for probability of success, likelihood of collection, or the time or cost of litigation.

While this report was prepared at the request of the Bankruptcy Court, none of the findings included therein are legally binding on the Bankruptcy Court or any party. CEC contests many of the examiner’s findings, including his findings that CEOC was insolvent at relevant times, that there were breaches of fiduciary duty, that CEOC did not receive fair value for assets transferred, that there were fraudulent transfers, and as to the calculation of damages. CEC believes that each of the challenged transactions was undertaken to provide CEOC with the liquidity and resources required to sustain it and provide time to recover from significant market challenges. In any event, under the terms of the Restructuring, all such matters will be resolved pursuant to CEOC’s Plan of Reorganization.

Note 2 — Basis of Presentation and Principles of Consolidation

Basis of Presentation and Use of Estimates

The accompanying unaudited consolidated condensed financial statements of Caesars have been prepared under the rules and regulations of the SEC applicable for interim periods, and therefore, do not include all information and footnotes necessary for complete financial statements in conformity with accounting principles generally accepted in the United States (“GAAP”). The results for the interim periods reflect all adjustments (consisting primarily of normal recurring adjustments) that management considers necessary for a fair presentation of financial position, results of operations, and cash flows. The results of operations for our interim periods are not necessarily indicative of the results of operations that may be achieved for the entire 2017 fiscal year.

Reclassifications

For the three and six months ended June 30, 2016, $4 million and $9 million, respectively, was reclassified from food and beverage revenues to other revenues, and certain other immaterial prior year amounts have also been reclassified to conform to the current year’s presentation. The financial results related to the SMG Business were classified as discontinued operations for all periods presented effective beginning in the third quarter of 2016 (see Note 14).

Cash, Cash Equivalents, and Restricted Cash

We adopted Accounting Standards Update (“ASU”) No. 2016-18, Statement of Cash Flows: Restricted Cash, during the fourth quarter of 2016, and retrospectively applied the amendments. Prior to adopting ASU No. 2016-18, our consolidated statements of cash flows reported changes in restricted cash as investing activities and excluded restricted cash from the beginning and ending balances of cash and cash equivalents. The effect on prior periods of adopting the new guidance includes: (i) increases in cash, cash equivalents, and restricted cash balances to $1.5 billion and $1.4 billion as of June 30, 2016 and December 31, 2015, respectively; and (ii) a decrease of $107 million in cash flows provided by investing activities for the six months ended June 30, 2016.

The following table provides a reconciliation of cash, cash equivalents, and restricted cash reported on the Balance Sheets that sum to amounts reported on the consolidated statements of cash flows.

(In millions) | June 30, 2017 | December 31, 2016 | |||||

Cash and cash equivalents | $ | 1,515 | $ | 1,513 | |||

Restricted cash, current portion | 2,973 | 3,113 | |||||

Restricted cash, non-current portion | 104 | 5 | |||||

Total cash, cash equivalents, and restricted cash | $ | 4,592 | $ | 4,631 | |||

Other Operating Costs

Other operating costs primarily include write-downs, reserves, and project opening costs, net of recoveries and acquisition and integration costs. During the first quarter of 2017, CEC was reimbursed $19 million for amounts related to the joint venture development in Korea that were deemed uncollectible and written off in 2015.

13

CAESARS ENTERTAINMENT CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

Consolidation of Subsidiaries and Variable Interest Entities

Our consolidated financial statements include the accounts of Caesars Entertainment and its subsidiaries after elimination of all intercompany accounts and transactions.

We consolidate all subsidiaries in which we have a controlling financial interest and variable interest entities (“VIEs”) for which we or one of our consolidated subsidiaries is the primary beneficiary. Control generally equates to ownership percentage, whereby (1) affiliates that are more than 50% owned are consolidated; (2) investments in affiliates of 50% or less but greater than 20% are generally accounted for using the equity method where we have determined that we have significant influence over the entities; and (3) investments in affiliates of 20% or less are generally accounted for using the cost method.

Consolidation of CGP

Effective in 2013, CGP was determined to be a VIE, and Caesars was determined to be the primary beneficiary. CAC is the sole voting member of CGP and holds a material noncontrolling interest in CGP. Common control exists between CAC and Caesars through the majority beneficial ownership of both by Hamlet Holdings (as defined in Note 15). Neither CAC nor CGP guarantees any of CEC’s debt, and neither the creditors nor the beneficial holders of CGP have recourse to the general credit of CEC.

CGP generated net revenues of $434 million and $435 million for the three months ended June 30, 2017 and 2016, respectively, and $855 million and $860 million for the six months ended June 30, 2017 and 2016, respectively. Net income attributable to Caesars related to CGP was $6 million for the three months ended June 30, 2017. Net loss attributable to Caesars related to CGP was $16 million for the three months ended June 30, 2016, and $4 million and $12 million for the six months ended June 30, 2017 and 2016, respectively.

Our consolidated restricted cash includes amounts held by CGP of $2.9 billion and $3.0 billion as of June 30, 2017 and December 31, 2016, respectively. As of June 30, 2017, the majority of the balance is restricted under the terms of the CIE Proceeds Agreement, which requires a portion of the proceeds from the sale of the SMG Business be deposited into the CIE escrow account (the "CIE Escrow Account"). Up to $235 million may be distributed from the CIE Escrow Account to CEC in order to pay the CEC Expense Amounts only: (i) pursuant to the terms of the term sheet included in the CIE Proceeds Agreement and the agreement entered into among Wilmington Trust, National Association, CIE and CEOC, governing the CIE Escrow Account, (ii) with the joint written consent of CIE and CEOC, or (iii) pursuant to an order of a court of competent jurisdiction.

CGP consolidates into its financial statements the accounts of any variable interest entity for which it is determined to be the primary beneficiary. Caesars Baltimore Investment Company, LLC (“CBIC”) is wholly-owned and consolidated by CGP. CBIC indirectly holds interests in CBAC Borrower, LLC (“CBAC”), owner of the Horseshoe Baltimore Casino, through its ownership interest in CR Baltimore Holdings (“CRBH”), a variable interest entity. The counterparty that owns the minority interest in CRBH is restricted from transferring its interest in CRBH without prior consent from CBIC. As a result, CBIC has been determined to be the primary beneficiary of CRBH, and therefore, consolidates CRBH into its financial statements. Under the existing terms of the agreement, the transfer restrictions are expected to expire in the third quarter of 2017, at which time CBIC would no longer be considered the primarily beneficiary and would deconsolidate CRBH. CBIC would then record its interest in CRBH at fair value and account for it as an equity method investment from that point forward.

CRBH generated net revenues of $141 million and net loss attributable to Caesars of $1 million for the six months ended June 30, 2017. As of June 30, 2017, CRBH had total assets and liabilities of $375 million and $369 million, respectively.

Consolidation of CES

A steering committee acts in the role of a board of managers for CES with each Member entitled to appoint one representative to the steering committee. Each Member, through its representative, is entitled to a single vote on the steering committee; accordingly, the voting power of the Members does not equate to their ownership percentages. Therefore, we determined that CES was a VIE, and we concluded that CEC is the primary beneficiary because our combined economic interest in CES, through our subsidiaries, represents a controlling financial interest.

Expenses incurred by CES are allocated to the casino properties directly or to the Members according to their allocation percentages, subject to annual review (see Note 15). Therefore, CES is a "pass-through" entity that serves as an agent on behalf of the Members at a cost-basis, and is contractually required to fully allocate its costs. CES is designed to have no operating cash flows of its own, and any net income or loss is generally immaterial and is typically subject to allocation to the Members in the subsequent period.

14

CAESARS ENTERTAINMENT CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

Consolidation Considerations for CEOC

CEOC’s filing for reorganization was a reconsideration event for Caesars Entertainment to reevaluate whether consolidation of CEOC continued to be appropriate. We concluded that CEOC is a VIE and that we are not the primary beneficiary; therefore, we no longer consolidate CEOC. Subsequent to the deconsolidation, we account for our investment in CEOC as a cost method investment of zero due to the negative equity associated with CEOC’s underlying financial position. CEOC’s ownership interest in CES was $29 million and $33 million as of June 30, 2017 and December 31, 2016, respectively, and is accounted for as noncontrolling interest.

Transactions with CEOC are treated as related party transactions for Caesars Entertainment. These transactions include items such as casino management fees paid to CEOC, insurance expenses related to insurance coverage provided to CEOC by Caesars Entertainment, and rent payments by CEOC to CERP under the Octavius Tower lease agreement. See Note 15 for additional information on related party transactions and on the carrying amounts and classification of assets and liabilities that relate to our variable interest in CEOC.

Note 3 — Litigation

Litigation

Noteholder Disputes

On August 4, 2014, Wilmington Savings Fund Society, FSB, solely in its capacity as successor Indenture Trustee for the 10.00% Second-Priority Senior Secured Notes due 2018 (the “10.00% Second-Priority Notes”), on behalf of itself and, it alleges, derivatively on behalf of CEOC, filed a lawsuit (the “Delaware Second Lien Lawsuit”) in the Court of Chancery in the State of Delaware against CEC and CEOC, CGP, CAC,CERP, CES, Eric Hession, Gary Loveman, Jeffrey D. Benjamin, David Bonderman, Kelvin L. Davis, Marc C. Rowan, David B. Sambur, and Eric Press. The lawsuit alleges claims for breach of contract, intentional and constructive fraudulent transfer, breach of fiduciary duty, aiding and abetting breach of fiduciary duty, and corporate waste. The lawsuit seeks (1) an award of money damages; (2) to void certain transfers, the earliest of which dates back to 2010; (3) an injunction directing the recipients of the assets in these transactions to return them to CEOC; (4) a declaration that CEC remains liable under the parent guarantee formerly applicable to the 10.00% Second-Priority Notes; (5) to impose a constructive trust or equitable lien on the transferred assets; and (6) an award to plaintiffs for their attorneys’ fees and costs. CEC believes this lawsuit is without merit and is defending itself vigorously. A motion to dismiss this action was filed by CEC and other defendants in September 2014, and the motion was argued in December 2014. During the pendency of its Chapter 11 bankruptcy proceedings, the action has been automatically stayed with respect to CEOC. The motion to dismiss with respect to CEC was denied on March 18, 2015. In a Verified Supplemental Complaint filed on August 3, 2015, the plaintiff stated that due to CEOC’s bankruptcy filing, the continuation of all claims was stayed pursuant to the bankruptcy except for Claims II, III, and X. These are claims against CEC only, for breach of contract in respect of the release of the parent guarantee formerly applicable to the CEOC 10.00% Second-Priority Notes, for declaratory relief in respect of the release of this guarantee, and for violations of the Trust Indenture Act in respect of the release of this guarantee. Fact discovery in the case is complete, and cross-motions for summary judgment have been filed by the parties. On January 26, 2017, the Bankruptcy Court entered an agreed order staying this proceeding (and others). The stay will remain in effect until the earlier of (a) the Effective Date, (b) the termination of the restructuring support agreement with the Official Committee of Second Priority Noteholders or (c) further order of the Bankruptcy Court.

On September 3, 2014, holders of approximately $21 million of CEOC 6.50% Senior Unsecured Notes due 2016 and 5.75% Senior Unsecured Noted due 2017 (collectively, the “Senior Unsecured Notes”) filed suit in federal district court in Manhattan against CEC and CEOC, claiming broadly that an August 12, 2014 Note Purchase and Support Agreement between CEC and CEOC (on the one hand) and certain other holders of the Senior Unsecured Notes (on the other hand) impaired their own rights under the Trust Indenture Act of 1939 and the indentures governing the Senior Unsecured Notes. The lawsuit seeks both declaratory and monetary relief. On October 2, 2014, a holder of CEOC’s 6.50% Senior Unsecured Notes due 2016 purporting to represent a class of all persons who held these Notes from August 11, 2014 to the present filed a substantially similar suit in the same court, against the same defendants, relating to the same transactions. Both lawsuits (the “Senior Unsecured Lawsuits”) were assigned to the same judge. The claims against CEOC have been automatically stayed during its Chapter 11 bankruptcy proceedings. The court denied a motion to dismiss both lawsuits with respect to CEC. The parties have completed fact discovery with respect to both plaintiffs' claims against CEC. On October 23, 2015, plaintiffs in the Senior Unsecured Lawsuits moved for partial summary judgment, and on December 29, 2015, those motions were denied. On December 4, 2015, plaintiff in the action brought on behalf of holders of CEOC’s 6.50% Senior Unsecured Notes moved for class certification and briefing has been completed. The judge presiding over

15

CAESARS ENTERTAINMENT CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

these cases thereafter retired, and a new judge was appointed to preside over these lawsuits. That judge set a new summary judgment briefing schedule, and the parties filed cross-motions for summary judgment, which remain pending. On January 26, 2017, the Bankruptcy Court entered an agreed order staying this proceeding (and others). The stay will remain in effect until the earlier of (a) the Effective Date, (b) the termination of the restructuring support agreement with the Official Committee of Second Priority Noteholders or (c) further order of the Bankruptcy Court.

On November 25, 2014, UMB Bank (“UMB”), as successor indenture trustee for CEOC's 8.50% Senior Secured Notes due 2020 (the “8.50% Senior Secured Notes”), filed a verified complaint (the “Delaware First Lien Lawsuit”) in Delaware Chancery Court against CEC, CEOC, CERP, CAC, CGP, CES, and against individual past and present Board members Loveman, Benjamin, Bonderman, Davis, Press, Rowan, Sambur, Hession, Colvin, Kleisner, Swann, Williams, Housenbold, Cohen, Stauber, and Winograd, alleging generally that defendants improperly stripped CEOC of certain assets, wrongfully effected a release of CEC’s parent guarantee of the 8.50% Senior Secured Notes and committed other wrongs. Among other things, UMB asked the court to appoint a receiver over CEOC. In addition, the suit pleads claims for fraudulent conveyances/transfers, insider preferences, illegal dividends, declaratory judgment (for breach of contract as regards to the parent guarantee and also as to certain covenants in the bond indenture), tortious interference with contract, breach of fiduciary duty, usurpation of corporate opportunities, and unjust enrichment, and seeks monetary, equitable and declaratory relief. The lawsuit has been automatically stayed with respect to CEOC during its Chapter 11 bankruptcy process. Pursuant to the First Lien Bond RSA, the lawsuit also has been stayed in its entirety, with the consent of all of the parties to it.

On February 13, 2015, Caesars Entertainment received a Demand For Payment of Guaranteed Obligations (the “February 13 Notice”) from Wilmington Savings Fund Society, FSB, in its capacity as successor Trustee for CEOC’s 10.00% Second-Priority Notes. The February 13 Notice alleges that CEOC’s commencement of its voluntary Chapter 11 bankruptcy case constituted an event of default under the indenture governing the 10.00% Second-Priority Notes; that all amounts due and owing on the 10.00% Second-Priority Notes therefore immediately became payable; and that Caesars Entertainment is responsible for paying CEOC’s obligations on the 10.00% Second-Priority Notes, including CEOC’s obligation to timely pay all principal, interest, and any premium due on these notes, as a result of a parent guarantee provision contained in the indenture governing the notes that the February 13 Notice alleges is still binding. The February 13 Notice accordingly demands that Caesars Entertainment immediately pay Wilmington Savings Fund Society, FSB, cash in an amount of not less than $3.7 billion, plus accrued and unpaid interest (including without limitation the $184 million interest payment due December 15, 2014 that CEOC elected not to pay) and accrued and unpaid attorneys’ fees and other expenses. The February 13 Notice also alleges that the interest, fees and expenses continue to accrue.

On February 18, 2015, Caesars Entertainment received a Demand For Payment of Guaranteed Obligations (the “February 18 Notice”) from BOKF, N.A. (“BOKF”), in its capacity as successor Trustee for CEOC’s 12.75% Second-Priority Senior Secured Notes due 2018 (the “12.75% Second-Priority Notes”). The February 18 Notice alleges that CEOC’s commencement of its voluntary Chapter 11 bankruptcy case constituted an event of default under the indenture governing the 12.75% Second-Priority Notes; that all amounts due and owing on the 12.75% Second-Priority Notes therefore immediately became payable; and that CEC is responsible for paying CEOC’s obligations on the 12.75% Second-Priority Notes, including CEOC’s obligation to timely pay all principal, interest and any premium due on these notes, as a result of a parent guarantee provision contained in the indenture governing the notes that the February 18 Notice alleges is still binding. The February 18 Notice therefore demands that CEC immediately pay BOKF cash in an amount of not less than $750 million, plus accrued and unpaid interest, accrued and unpaid attorneys’ fees, and other expenses. The February 18 Notice also alleges that the interest, fees and expenses continue to accrue.

In accordance with the terms of the applicable indentures, CEC is not subject to the above-described guarantees. As a result, we believe the demands for payment are meritless.

On March 3, 2015, BOKF filed a lawsuit (the “New York Second Lien Lawsuit”) against CEC in federal district court in Manhattan, in its capacity as successor trustee for CEOC’s 12.75% Second-Priority Notes. On June 15, 2015, UMB filed a lawsuit (the “New York First Lien Lawsuit”) against CEC, also in federal district court in Manhattan, in its capacity as successor trustee for CEOC’s 11.25% Senior Secured Notes due 2017, 8.50% Senior Secured Notes due 2020, and 9.00% Senior Secured Notes due 2020. Plaintiffs in these actions allege that CEOC’s filing of its voluntary Chapter 11 bankruptcy case constitutes an event of default under the indentures governing these notes, causing all principal and interest to become immediately due and payable, and that CEC is obligated to make those payments pursuant to parent guarantee provisions in the indentures governing these notes that plaintiffs allege are still binding. Both plaintiffs bring claims for violation of the Trust Indenture Act of 1939, breach of contract, breach of duty of good faith and fair dealing and for declaratory relief and BOKF brings an additional claim for intentional

16

CAESARS ENTERTAINMENT CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

interference with contractual relations. The cases were both assigned to the same judge presiding over the other Parent Guarantee Lawsuits (as defined below) that are taking place in Manhattan. CEC filed its answer to the BOKF complaint on March 25, 2015, and to the UMB complaint on August 10, 2015. On June 25, 2015, and June 26, 2015, BOKF and UMB, respectively, moved for partial summary judgment, specifically on their claims alleging a violation of the Trust Indenture Act of 1939, seeking both declaratory relief and damages. On August 27, 2015, those motions were denied. The court, on its own motion, certified its order with respect to the interpretation of the Trust Indenture Act for interlocutory appeal to the United States Court of Appeals for the Second Circuit, and on December 22, 2015, the appellate court denied our motion for leave to appeal. On November 20, 2015, BOKF and UMB again moved for partial summary judgment. These motions likewise were denied. The judge presiding over these cases thereafter retired, and a new judge was appointed to preside over these lawsuits. That judge set a new summary judgment briefing schedule, and the parties submitted cross-motions for summary judgment, which remain pending. On January 26, 2017, the Bankruptcy Court entered an agreed order staying this proceeding (and others). The stay will remain in effect until the earlier of (a) the Effective Date, (b) the termination of the restructuring support agreement with the Official Committee of Second Priority Noteholders or (c) further order of the Bankruptcy Court.

On October 20, 2015, Wilmington Trust, National Association (“Wilmington Trust”), filed a lawsuit (the “New York Senior Notes Lawsuit” and, together with the Delaware Second Lien Lawsuit, the Delaware First Lien Lawsuit, the Senior Unsecured Lawsuits, the New York Second Lien Lawsuit, and the New York First Lien Lawsuit, the “Parent Guarantee Lawsuits”) against CEC in federal district court in Manhattan in its capacity as successor indenture trustee for CEOC’s 10.75% Senior Notes due 2016 (the “10.75% Senior Notes”). Plaintiff alleges that CEC is obligated to make payment of amounts due on the 10.75% Senior Notes pursuant to a parent guarantee provision in the indenture governing those notes that plaintiff alleges is still in effect. Plaintiff raises claims for violations of the Trust Indenture Act of 1939, breach of contract, breach of the implied duty of good faith and fair dealing, and for declaratory judgment, and seeks monetary and declaratory relief. CEC filed its answer to the complaint on November 23, 2015. As with the other parent guaranty lawsuits taking place in Manhattan, the judge presiding over these cases thereafter retired, and a new judge was appointed to preside over these lawsuits. That judge set a new summary judgment briefing schedule, and the parties submitted cross-motions for summary judgment, which remain pending. On January 26, 2017, the Bankruptcy Court entered an agreed order staying this proceeding (and others). The stay will remain in effect until the earlier of (a) the Effective Date, (b) the termination of the restructuring support agreement with the Official Committee of Second Priority Noteholders or (c) further order of the Bankruptcy Court.

We believe that the claims and demands described above against CEC are without merit and we intend to defend the Company vigorously. The claims against CEOC have been stayed due to the Chapter 11 process and, as described above, the actions against CEC have now also been stayed. See additional disclosure relating to CEOC’s Chapter 11 filing in Note 1. In the event that the litigation stays are ever lifted, we believe that the Noteholder Disputes and the Parent Guarantee Lawsuits present a reasonably possible likelihood of an adverse outcome. Should these matters ultimately be resolved through litigation outside of the financial restructuring of CEOC (the “Financial Restructuring”) and should a court find in favor of the claimants in some or all of the Noteholder Disputes, such determination would likely lead to a CEC reorganization under Chapter 11 of the Bankruptcy Code (see Note 1). We are not able to estimate a range of reasonably possible losses should any of the Noteholder Disputes ultimately be resolved against us, although they could potentially exceed $11 billion.

Employee Benefit Obligations

In December 1998, Hilton Hotels Corporation (“Hilton”) spun-off its gaming operations as Park Place Entertainment Corporation (“Park Place”). In connection with the spin-off, Hilton and Park Place entered into various agreements, including an Employee Benefits and Other Employment Allocation Agreement dated December 31, 1998 (the “Allocation Agreement”) whereby Park Place assumed or retained, as applicable, certain liabilities and excess assets, if any, related to the Hilton Hotels Retirement Plan (the “Hilton Plan”) based on the benefits of Hilton employees and Park Place employees. CEOC is the ultimate successor to Park Place under this Allocation Agreement. In 2013, a lawsuit was settled relating to the Hilton Plan, which retroactively and prospectively increased total benefits to be paid under the Hilton Plan. In 2009, we received a letter from Hilton, notifying us of a lawsuit related to the Hilton Plan that alleged that CEC had a potential liability for the additional claims under the terms of the Allocation Agreement.

On December 24, 2014, Hilton, the Plan Administrator of the Hilton Plan, and a representative of the Plan Administrator (the “Hilton Parties”) sued CEC and CEOC in federal court in Virginia primarily under the Employee Retirement Income Security Act (“ERISA”), and also under state contract and unjust enrichment law theories, for monetary and equitable relief in connection with this ongoing dispute. On April 14, 2015, the federal court dismissed the Hilton Parties’ unjust enrichment claim with prejudice

17

CAESARS ENTERTAINMENT CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

and ordered that the remainder of the case be transferred to the Bankruptcy Court based upon its relationship to the CEOC bankruptcy case.

On June 9, 2016, CEC, CEOC and the Hilton Parties entered into a settlement of the Hilton Parties’ claims (the “Settlement Agreement”). Under the settlement, Hilton will receive a general unsecured claim in CEOC’s bankruptcy case for an amount equal to $51 million plus 31.75% of amounts paid by Hilton to the Hilton Plan due after July 16, 2016. For periods following the effective date of CEOC’s plan of reorganization, CEC shall assume certain of CEOC’s obligations under the Allocation Agreement. In exchange, Hilton shall turn over to CEC the distributions on account of $24.5 million of Hilton’s claim in the CEOC bankruptcy. On June 21, 2016, the parties sought approval of the Settlement Agreement. The CEOC Bankruptcy Court approved the Settlement Agreement on July 19, 2016. The settlement amount is fully accrued in liabilities subject to compromise at CEOC, and the Settlement Agreement is subject to the effectiveness of CEOC’s plan of reorganization.

National Retirement Fund

In January 2015, a majority of the Trustees of the National Retirement Fund (“NRF”), a multi-employer defined benefit pension plan, voted to expel the five indirect subsidiaries of CEC which were required to make contributions to the legacy plan of the NRF (the “Five Employers”). The NRF contended that the financial condition of the Five Employers’ controlled group (the “CEC Controlled Group”) and CEOC’s then-potential bankruptcy presented an “actuarial risk” to the plan because, depending on the outcome of any CEOC bankruptcy proceedings, CEC might no longer be liable to the plan for any partial or complete withdrawal liability. As a result, the NRF claimed that the expulsion of the Five Employers constituted a complete withdrawal of the CEC Controlled Group from the plan. CEOC, in its bankruptcy proceedings, has to date not rejected the contribution obligations to the NRF of any of its subsidiary employers. The NRF has advised the CEC Controlled Group (which includes CERP) that the expulsion of the Five Employers has triggered a joint and several withdrawal liability with a present value of approximately $360 million, payable in 80 quarterly payments of about $6 million.

Prior to the NRF’s vote to expel the Five Employers, the Five Employers reiterated their commitments to remain in the plan and not seek rejection of any collective bargaining agreement in which the obligation to contribute to NRF exists. The Five Employers were current with respect to pension contributions at the time of their expulsion, and are current with respect to pension contributions as of today pursuant to the Standstill Agreement referred to below.

We have opposed the various NRF expulsion actions.

On January 8, 2015, prior to the NRF’s vote to expel the Five Employers, CEC filed an action in the United States District Court for the Southern District of New York (the “S.D.N.Y.”) against the NRF and its Board of Trustees, seeking a declaratory judgment that they did not have the authority to expel the Five Employers and thus allegedly trigger withdrawal liability for the CEC Controlled Group (the “CEC Action”). On December 25, 2015, the District Judge entered an order dismissing the CEC Action on the ground that CEC’s claims in this action must first be arbitrated under ERISA. CEC has appealed this decision to the United States Court of Appeals for the Second Circuit. Oral argument on this appeal was heard on January 30, 2017, and the Second Circuit has reserved decision on this appeal.

On March 6 and March 27, 2015, CEOC and certain of its subsidiaries filed in the CEOC bankruptcy proceedings two motions to void (a) the purported expulsion of the Five Employers and based thereon the alleged triggering of withdrawal liability for the non-debtor members of the CEC Controlled Group, and (b) a notice and payment demand for quarterly payments of withdrawal liability subsequently made by the NRF to certain non-debtor members of the CEC Controlled Group, respectively, on the ground that each of these actions violated the automatic stay (the “362 Motions”). On November 12, 2015, Bankruptcy Judge Goldgar issued a decision denying the 362 Motions on the ground that the NRF’s actions were directed at non-debtors and therefore did not violate the automatic stay. CEOC has appealed this decision to the federal district court in Chicago.

On March 6, 2015, CEOC commenced an adversary proceeding against the NRF and its Board of Trustees in the Bankruptcy Court (the “Adversary Proceeding”). On March 11, 2015, CEOC filed a motion in that Adversary Proceeding to extend the automatic stay in the CEOC bankruptcy proceedings to apply to the NRF’s expulsion of the Five Employers (the “105 Motion”). Judge Goldgar has not yet decided the 105 Motion.

On March 20, 2015, CEC, CEOC and CERP, on behalf of themselves and others, entered into a Standstill Agreement with the NRF and its Board of Trustees that, among other things, stayed each member of the CEC Controlled Group’s purported obligation to commence making quarterly payments of withdrawal liability and instead required the Five Employers to continue making

18

CAESARS ENTERTAINMENT CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

monthly contribution payments to the NRF, unless and until each of the 362 Motions and the 105 Motion had been denied. As the 105 Motion has not yet been decided, the Standstill Agreement remains in effect.

If both the 105 Motion and CEC’s appeal of the CEC Action are denied, then CEC could be required to pay to the NRF joint and several withdrawal liability with a present value of approximately $360 million, payable in 80 quarterly payments of about $6 million each while CEC simultaneously arbitrates whether the NRF and its Board of Trustees had the authority to expel the Five Employers and trigger withdrawal liability for the CEC Controlled Group.

On March 18, 2015, before the Standstill Agreement was executed, the NRF and its fund manager commenced a collection action in the S.D.N.Y. against CEC, CERP and all non-debtor members of the CEC Controlled Group for the payment of the first quarterly payment of withdrawal liability, which the NRF contended was due on March 15, 2015 (the “NRF Action”). On December 25, 2015, the District Judge entered an Order adopting the Magistrate Judge’s recommendation to deny defendants’ motion to dismiss over the defendants’ objections on the ground that the defendants’ arguments must first be arbitrated under ERISA. On February 26, 2016, the NRF and its fund manager filed a motion for summary judgment against CEC and CERP for payment of the first quarterly payment of withdrawal liability and for interest, liquidated damages, attorneys’ fees and costs. On November 7, 2016, the District Judge entered an Order adopting the Magistrate Judge’s recommendation to grant partial summary judgment to the NRF Action plaintiffs over CEC and CERP’s objections on the ground that CEC and CERP’s further arguments must also first be arbitrated under ERISA. CEC and CERP filed a Notice of Appeal to protect their rights in response to this Order. Subsequently, the District Judge determined that no final order or judgment was entered, and thus the Notice of Appeal was premature. Accordingly, the parties stipulated to the dismissal of the appeal without prejudice to any party’s rights to appeal a final appealable judgment that may later be entered in the case.

On December 5, 2016, an interlocutory judgment was entered against CEC and CERP comprising the first quarterly payment of withdrawal liability referred to above, interest and liquidated damages under ERISA. On December 19, 2016, a CEC and CERP filed a motion to certify a final judgment under Rule 54(b) of the Federal Rules of Civil Procedure for immediate appeal and to stay the NRF Action plaintiffs’ motions to amend and for summary judgment, as described below. On January 11, 2017, the District Court granted the motion to certify a final judgment under Rule 54(b) in the amount of $9 million, but denied the motion for a stay, and a judgment in that amount was entered the next day. CEC has appealed this decision to the Second Circuit, and has bonded the judgment pending appeal. On February 3, 2017, the NRF Action plaintiffs filed a motion for an order permitting plaintiffs to execute on the Rule 54(b) judgment immediately, which CEC and CERP opposed. The district court has not yet ruled on this motion.

On December 23, 2016, the NRF Action plaintiffs filed a motion to amend their complaint to add claims for the second through eighth quarterly payments of withdrawal liability, which the NRF Action plaintiffs contended were past due, as well as for injunctive relief requiring the defendants to pay all further quarterly payments as they purportedly became due. Also on December 23, 2016, the NRF Action plaintiffs simultaneously filed a motion for summary judgment against CEC and CERP for payment of the second through eighth quarterly payments of withdrawal liability, for interest, liquidated damages, attorneys’ fees and costs, and for injunctive relief requiring the defendants to pay all further quarterly payments as they purportedly became due. The magistrate judge has not yet ruled on these motions.

On March 13, 2017, CEC, CERP, CEOC (on behalf of itself and each of the Debtors and its other direct and indirect subsidiaries), the Five Employers, the NRF, the NRF’s Legacy Plan, the NRF’s Trustees, and others entered into a Settlement Agreement (the “NRF Settlement Agreement”). Under the NRF Settlement Agreement, on the effective date of the Debtors’ reorganization plan, CEC would pay $45 million to the NRF (the “NRF Payments”) in three different baskets: (1) a settlement basket consisting of $10 million as litigation settlement and $5 million for legal fee reimbursement; (2) a contribution basket consisting of $15 million, which sum will grow at 3.1% per year, and which, beginning 17.5 years after the plan effective date, will be applied to offset the first $8 million of contributions from the Five Employers to the Legacy Plan annually until completely utilized; and (3) a withdrawal liability basket of $15 million, which does not grow, to be applied if there is a partial or complete withdrawal at any time after the plan effective date. Upon the NRF Payments being made, mutual releases will be exchanged between the CEC-affiliated parties and the NRF-affiliated parties to the Settlement Agreement. On March 20, 2017, the Debtors moved for the Settlement Agreement to be approved by the Bankruptcy Court. On April 19, 2017, the Bankruptcy Court approved the NRF Settlement Agreement, and all actions and appeals relating to the CEC Action, the 362 Motions, the Adversary Proceeding and the NRF Action have been stayed.

19

CAESARS ENTERTAINMENT CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS (CONTINUED)

(UNAUDITED)

As of both December 31, 2016 and June 30, 2017, the Company had accrued $30 million related to the litigation settlement, the legal fee reimbursement, and the withdrawal liability in accrued expenses and other current liabilities on the Balance Sheets. The payment related to the contribution basket will be accounted for as a prepayment toward future pension contributions.

Other Matters