Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - SYNTHESIS ENERGY SYSTEMS INC | exh_991.htm |

| 8-K - FORM 8-K - SYNTHESIS ENERGY SYSTEMS INC | f8k_060217.htm |

Exhibit 99.2

Synthesis Energy Systems, Inc. Clean - Economic - Sustainable Global Energy June 2017 Growth With Blue Skies

SES Forward - looking Statements This presentation includes “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . All statements other than statements of historical fact are forward - looking statements . Forward - looking statements are subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected . Among those risks, trends and uncertainties are our ability to successfully raise additional capital to continue as a going concern ; the ability of Batchfire and AFE management to successfully grow and develop their Australian assets and operations, including Callide and Pentland ; the ability of our project with Yima to produce earnings and pay dividends ; our ability to develop and expand business of the TSEC joint venture in the joint venture territory ; our ability to develop our power business unit and our other business verticals, including DRI steel, through our marketing arrangement with Midrex Technologies, and renewables ; our ability to successfully develop the SES licensing business ; the ability of the ZZ Joint Venture to retire existing facilities and equipment and build another SGT facility ; the economic conditions of countries where we are operating ; events or circumstances which result in an impairment of our assets ; our ability to reduce operating costs ; our ability to make distributions and repatriate earnings from our Chinese operations ; our ability to successfully commercialize our technology at a larger scale and higher pressures ; commodity prices, including in particular natural gas, crude oil, methanol and power ; the availability and terms of financing ; our customers’ and/or our ability to obtain the necessary approvals and permits for future projects ; our ability to estimate the sufficiency of existing capital resources ; the sufficiency of internal controls and procedures ; and our results of operations in countries outside of the U . S . , where we are continuing to pursue and develop projects . Although SES believes that in making such forward - looking statements our expectations are based upon reasonable assumptions, such statements may be influenced by factors that could cause actual outcomes and results to be materially different from those projected by us . SES cannot assure you that the assumptions upon which these statements are based will prove to have been correct . 2

SES: Investment Opportunity Summary Superior and proven technology • 30 years of R&D development • 5 commercial facilities built with 12 gasification systems • Replaces expensive natural gas • Opportunity to capitalize on ten years of investment Current Assets • Batchfire Resources ~11% • Australian Future Energy (AFE) ~40% • Yima JV Plant 25% • Tianwo - SES Clean Energy Technologies Co. JV 35% Robust global pipeline of opportunities • Technology & Licensing • Equity Platforms – First project license signed, AFE Guided by industry leaders • Fortune 100 engineering & business backgrounds – management and BOD ©2017 Synthesis Energy Systems, Inc., All Rights Reserved Tomorrow’s Global Clean Energy Opportunity Today 3 NASDAQ: SYMX As of June 1, 2017 Market Cap $60.3 MM Shares Outstanding 87.3 MM Public Float 47.6 MM % Officers and Directors 4.3% % Held by Institutions 23.7%

CO 2 Low Grade Coal Biomass Syngas Processing Syngas (CO+ H 2 ) SULFUR Ash iGAS Power Low Value Feedstock SES Gasification Processing $3 - 6 per MMBTU Cost of Syngas (1) High Value End Products MSW Industrial Fuels Chemicals & Fertilizers SNG DRI for Steel Production Diesel & Naphtha 4 H2 for Cleaner Fuels SES Gasification Technology (SGT) • High efficiency conversion to syngas (CO & H 2 ) • Syngas can be converted to multiple useful products alternatively made from natural gas • Economic alternative to expensive natural gas • Clean use of coal – greener solution ©2017 Synthesis Energy Systems, Inc., All Rights Reserved Superior Economics, Environmentally Responsible, Proven Proprietary Technology Notes: (1) SES economics based on internal data, (2) Assumptions on Slide 15 Coal Power, Chemicals & Other Labor & Maint . Sulfur Sales Capital Recovery (~25% IRR) ( 2)

• Proven commercial technology » ~$ 200MM R&D: Gas Technology Institute (GTI) » ~$ 200MM Commercialization & Investment: SES » >$300MM Investment and Debt: Chinese Partners & Customers • Twelve commercial - scale gasification systems built over the past 10 years • Technology license for first AFE project signed May 2017 • Over 50 Coals, biomass, and wastes successfully converted to syngas, including feedstocks from US, Europe, China and Australia • Technology performance validated at commercial scale Tons/day Low Pressure Coal (<5 bar) Mid Pressure Coal (5 - 15 bar) High Pressure Coal (15 - 55 bar) Biomass SGT: The Road to Commercialization U - GAS® SGT 5 ©2017 Synthesis Energy Systems, Inc., All Rights Reserved R&D Early Commercialization Final Commercialization 2015 - 16 SES - Tianwo Chalco Seven SGT systems for fuel gas (China)

Best Performance Moderate Performance Worst Performance SGT is the Superior Gasification Technology Slag Non-slag Dry Feed Slurry Feed Cost Factors Capital Cost Low Capital Cost Operating Cost Lowest Operating Cost Performance Factors Carbon Conversion Best in class Cold Gas Efficiency Best in class Feedstock Properties Low Quality, Fine Coal & Lignite Unmatched range for Biomass, MSW, Other Wastes 2 coal and renewable feeds Environmental Factors Relative Environmental Impact Low water usage, no tars / oils Commercialized Gasification Technology Comparison 1 SES Gasification Technology (SGT) Fluid Bed Moving & Fixed Bed Entrained Flow Notes: 1) Analyses based on SES internal results and publicly available information for other technologies 2) For Biomass & Waste contents > 50% of total feed 6

SGT: Greener Solution Minimal air pollutants (coal reaction vs burning) • SO x , No x and Particulate Matter near natural gas levels • Lower cost of electricity than natural gas in many parts of the world Reduced water consumption • >30% less water consumption than coal burning technologies • Lower water consumption than competing gasification technologies Transition technology – simple modifications • Add in Biomass or MSW to reduce carbon footprint • Modify to capture carbon when carbon utilization technologies are ready Setting a New Paradigm for Responsible Coal 7 ©2017 Synthesis Energy Systems, Inc., All Rights Reserved Affordable Power Generation with Minimal Air Pollutants Reduced Water Consumption Transition Technology – easily modified to reduce and capture carbon in the future

8 Project Year Gasifier Systems Product Syngas Capacity (nm3/hr) Pressure Cost SES Role Zao Zhuang 2008 - 2014 2 Methanol 20,000 3 Bar $40MM (1) 100% Equity, Technology & Equipment Yima 2012 - present 3 Methanol 90,000 10 Bar $250MM (1) 25% Equity, Technology & Equipment Chalco Shandong 2015 - present 2 Fuel 80,000 3 Bar $30MM (2) Technology & Equipment (3) Chalco Shanxi 2016 - present 1 Fuel 28,000 3 Bar $15MM (2) Technology & Equipment (3) Chalco Henan 2016 - present 4 Fuel 120,000 3 Bar $60MM (2) Technology & Equipment (3) SES Project History (1) Total plant cost – including syngas processing (2) Estimated cost based on turnkey contract value – actual costs unknown (3) Technology and equipment provided through SES’s Tianwo - SES Joint Venture ©2017 Synthesis Energy Systems, Inc., All Rights Reserved

Operating Structure Licensing Proprietary Equipment Sales Technology Engineering & Services O&M for SES Projects SES Technologies SES Capital Development Packaged Products SES Asset Management Financing & Capital Management Project Investment Holdings Project Development & EPCM • SGT Licensing & Equipment Sales • SGT Process Design • SGT Equipment Design • Packaging Design & Manufacturing • Facilities Operations • Acquisition Due Diligence • Project Development • Project Management • Acquisition Funding • Project Development & Equity Funding • Equity Management • Debt Financing Management Existing Emerging Future Capital - Lite, High Margin Business Royalties, Engineering Fees, Equipment & Product Sales Specialized Services Operating, & Management Fees Capital Intensive, High Cash Flow Potential Energy Project Income, IPO, MLP/ Distribution, Levered Equity, and project disposition 9 ©2017 Synthesis Energy Systems, Inc., All Rights Reserved

Success Story: Australian Future Energy Partnership established 2014, SES Ownership Position: ~40% Differentiated by SES syngas production technology • Unique lower emissions • Low - cost production from lower cost, lower rank coals and biomass $10 billion pipeline of projects under evaluation • Technology Licensing and Equipment Supply – SES • Equity Participation – AFE AFE development goals: • Multi project agrichemicals and synthetic natural gas businesses for local and Asian export markets • Coal and biomass resource businesses for direct local and export market sales • Projects to be environmentally “class leading” with low carbon dioxide syngas production Local management: deeply experienced group of Australian coal and financing industry executives Note: (1) The JORC Code is the Australasian Code, overseen by the global Committee for Mineral Reserves International Reporting Standards (CRIRSCO) Project Coal Resource: • Great Northern Energy Pty Ltd • AFE’s wholly owned subsidiary • Acquired 270 million ton JORC (1) compliant coal resource lease near Pentland , Queensland, Q2 2017 10 ©2017 Synthesis Energy Systems, Inc., All Rights Reserved Resource Ownership & Clean Energy Project Platform

Several project opportunities identified, totaling approximately $10 billion in installed costs (1) • Multiple locations, multiple end products • Technology and equipment, and equity ownership for long - term recurring revenues AFE currently down - selecting two initial projects for advancement Signed SES Technology License for first project, May 2017 • First project will be ~$2 billion total installed cost, expected to generate ~$ 150 million top - line revenue for SES from technology and equipment related sales • Additional dividend income via SES’s direct or indirect ownership share in project which can generate annual project level revenues of ~$600 million (2) • Attractive margins, due to low production cost basis of SES technology • AFE expected to carry project forward into development, design and construction, pending necessary government approvals and funding 2nd AFE Technology License and equipment order expected late 2017 or 2018 • Combined, initial two AFE projects, when signed, represent potential to generate ~$300 million in orders for technology licensing and equipment related sales alone Initial Markets: • Agrichemicals - Urea • Substitute Natural Gas (SNG) • Synthesis Gas 11 ©2017 Synthesis Energy Systems, Inc., All Rights Reserved Notes: (1) Identified projects vary somewhat in project capacity and in end products, (2) AFE internal calculations February 2017, based upon currently proposed product slate and current commodity pricing AFE: Initial Two Clean Energy Projects Multiple Large - scale Project Opportunities in Australia

Assets: • Yima JV Plant – Henan Province » 25% SES, 75% Yima Coal Industry Group – Joint Venture » 330,000 metric tons per year production capacity » 3 SGT Systems, 10 bar operation » Plant is currently operational • China Regional JV: Tianwo - SES Clean Energy Technologies Co. » Sino - Foreign JV: SES 35%, Suzhou THVOW Technology Co., Ltd 65% – a leading Chinese process equipment manufacturer » First customer: Aluminum Corporation of China – 3 industrial fuel supply plants with 7 total SGT systems » Territory includes China and five Asian Regions Project Development Opportunities Under Evaluation: • Dongying City industrial park pipeline hydrogen projects to supply local refineries for cleaner transportation fuels, with China Environment State Investment Co., Ltd. • 160MW iGAS syngas - to - power distributed power plant, using local coal feedstock, with state - owned Dengfeng Power Group Co., Ltd. • Silk Road global alliance with China Coal Research Institute, a subsidiary of China Coal Technology and Engineering Group Corp. • Restructured Zao Zhuang (ZZ) Joint Venture project with Weijiao Group – evaluating new ZZ syngas facility in Zhouwu Industrial Park in Shandong Province 12 ©2017 Synthesis Energy Systems, Inc., All Rights Reserved New China Focus Follows 10 Years of Technology Deployment Success at Commercial Scale Goal of self - funding and generating positive cash flow from assets and future opportunities Note: Yima JV plant pictured

13 ©2017 Synthesis Energy Systems, Inc., All Rights Reserved SES’s iGAS Packaged Product For Electricity Production Large global demand for power > 900 GW required for China & India to reach EU electric power per capita standard (1 ) iGAS product features: • Standard configurations (40,80,160,+ MW) • Clean power , meeting World Bank standards • Highly deployable , distributed power scale • Attractive economics • SGT license , proprietary equipment , and Engineering, Procurement, Construction Management (EPCM) • Industry - leading g as t urbines General Electric LM2500 Solar Turbines Titan 130 Notes: (1 ) Source: International Energy Agency Statistics, (2) Capital costs estimated for projects in China and Pakistan, costs may vary based on specific locations and sites Typical Project Economics 80MW 160MW Coal Price ($/MMBTU) $1.50 $1.50 Capex ($/kw) (2) $2,150 $1,980 COE ($/kWh, RMB/kWh) (with 12% CAPEX recovery) 0.057, 0.35 0.054, 0.33 Standard Configurations 40MW 80MW 160MW Pressure (barg) 35 - 50 40 - 50 40 - 50 No. Operating SGT Gasifiers 1 2 4 No. Gas Turbines 2 (ST Titan 130) 2 (GE LM2500) 4 (GE LM2500) No. Steam Turbines 1 1 1

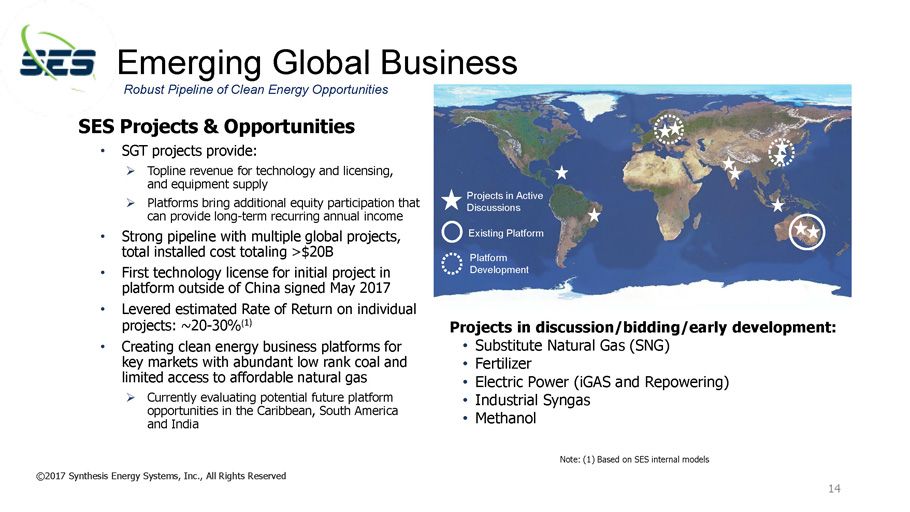

Emerging Global Business Projects in discussion/bidding/early development: • Substitute Natural Gas (SNG) • Fertilizer • Electric Power ( iGAS and Repowering) • Industrial Syngas • Methanol SES Projects & Opportunities • SGT projects provide: » Topline revenue for technology and licensing, and equipment supply » Platforms bring additional equity participation that can provide long - term recurring annual income • Strong pipeline with multiple global projects, total i nstalled c ost totaling >$20B • First technology license for initial project in platform outside of China signed May 2017 • Levered estimated Rate of Return on individual projects: ~20 - 30 % ( 1) • Creating clean energy business platforms for key markets with abundant low rank coal and limited access to affordable natural gas » Currently evaluating potential future platform opportunities in the Caribbean, South America and India 14 ©2017 Synthesis Energy Systems, Inc., All Rights Reserved Robust Pipeline of Clean Energy Opportunities Note: (1 ) Based on SES internal models Platform Development Projects in Active Discussions Existing Platform

SES Value Creation Potential – Examples 15 • ~$75 - $100 MM order value (top line revenue) (1)(2) • Order (contribution) margins of 20 - 30% • Revenue stream flows to SES during 24+ month development, construction and startup cycle (3) Technology & Equipment Single Example Project – Clean Syngas Island $500MM Assuming 3 Example Projects / Year Technology & Equipment + Equity Participation ©2017 Synthesis Energy Systems, Inc., All Rights Reserved Assumptions: Total Plant Investment ~$500MM, 25% levered return Coal Cost - $30/ton, $1.50/MMBTU Syngas Sale Price - $5/MMBTU Debt/Equity – 60/40 Interest Rate and Term: 10%, 10 years Depreciation – 20 years, Tax Rate – 25% Construction Period – 2 years from financial closure Operating Life – 20 years SES Value Technology & Equipment Equity Participation = + Notes: (1) Assumes project not in Tianwo - SES JV territory (2) SES order value is dependent upon site location and end product slate. Example project is assuming clean syngas island in Southeast Asia (3) Cash payments for license fee, engineering fee, and equ ipm ent supply are expected during this period and will be defined by contract. Revenue recognition will occur according to SES revenue reco gni tion policy

16 SES Pipeline Projects Notes: (1) List of active projects in current SES pipeline, it is not expected that all projects will follow through to compl eti on, but it is also anticipated that new projects will be identified that are not known at this time. Project names are not included to protect confidential information, (2) Capital costs are preliminary estimates by either SES or by the customers, (3) SES equity participation is shown in areas where it is highly likely (platforms), SES equity participation is possible on ne arly all projects if desired, (4) Technology and Equipment for projects in China will be provided through SES’S JV (Tianwo - SES) of which SES owns 35% ©2017 Synthesis Energy Systems, Inc., All Rights Reserved Location (1) Product Estimated Cape x (2) SES Expected Scope (3) Total Plant (MMUSD) South America SNG $1,500 Technology & Equipment Australia Urea, SNG $2,000 Technology & Equipment + Equity Participation Australia Urea, SNG $2,000 Technology & Equipment + Equity Participation Australia Urea, SNG $2,000 Technology & Equipment + Equity Participation Asia SNG $2,500 Technology & Equipment + Equity Participation Australia Fuel Gas $2,000 Technology & Equipment + Equity Participation Australia Fuel Gas $2,000 Technology & Equipment + Equity Participation Caribbean SNG $1,800 Technology & Equipment + EPCM Caribbean Fuel Gas $1,700 Technology & Equipment + EPCM India Fuel Gas $310 Technology & Equipment India Ammonia $592 Technology & Equipment Southeast Asia Fuel Gas $37 Technology & Equipment Poland Chemicals $200 Technology & Equipment + Equity Participation Poland Fuel Gas $2,000 Technology & Equipment North America Power $200 Technology & Equipment South Africa SNG $1,900 Technology & Equipment South America Methanol $500 Technology & Equipment + Equity Participation South America Methanol $100 Technology & Equipment + Equity Participation South America Power $400 Technology & Equipment China (4) Multiple Projects $2,000 Technology & Equipment

Batchfire Resources: An AFE Success Story Australian company created by AFE and spun - out in 2016 Acquired Callide Coal Mine, Central Queensland, October 2016 • Open pit thermal coal mine and associated processing infrastructure • Mature and significantly sized coal producer: » ~230 million tonnes (Mt) of recoverable reserves (1) » ~850 Mt of resources (1) • Produced 7.6 Mt of coal in 2014 • Two adjacent power stations under long - term contracts • Local and export market sales • Adjusting mine operation for lower strip ratio coal • Lowering production costs and increasing profitability • Potential for expansion SES ~11% shareholder with meaningful dividend potential 17 ©2017 Synthesis Energy Systems, Inc., All Rights Reserved Note: (1) Information provided by Batchfire Resources

Why Synthesis Energy Systems Now 18 • Superior and proven technology » 5 Projects built, with 12 SGT Systems; >$700MM total invested over 40 years (1) » Fully commercialized clean energy solution • Positioned to grow globally » AFE is SES’s first successful resource ownership and clean energy multi project platform, a strong and repeatable model, with technology license and equipment orders, and expected ownership participation in projects » SES’s business development strategy has opened up into commercially viable international markets: Eastern Europe, South America, India and the Caribbean • SES near - term performance drivers » Flawless execution on AFE projects; first license signed, second license forthcoming » AFE currently planning to develop two equity projects – each with a potential to bring equity ownership to SES » Continued advancement of key global SES pipeline project opportunities in multiple countries » Continued development of additional emerging opportunities in regional platforms • Guided by industry leaders » Fortune 100 engineering & business backgrounds – management and BOD ©2017 Synthesis Energy Systems, Inc., All Rights Reserved Superior Economics, Environmentally Responsible, Proven Technology Notes: (1) ~ $200MM SES; ~$ 200MM GTI R&D; >$ 3 00MM Chinese partner and customer investments, (2) SES projections based on current opportunity status

Appendix • Leadership Bios • Vertical Markets • SGT China JV Plants • Licensed SGT Projects • World Coal Reserves 19

SES Leadership: Management DeLome Fair, President and Chief Executive Officer • Appointed SES’s chief executive in February 2016. Joined the SES executive team as SVP, Gasification Technology in December 2014. 25 years’ gasification and IGCC technology expertise in energy and petrochemical industries Francis Lau, Senior Vice President and Chief Technology Officer • 36 - year tenure at the Gas Technology Institute, with six years serving as GTI’s Executive Director of Gasification and Gas Processing Center Chris Raczkowski, President – Asia • 25 - year clean energy technology executive experience, managing investment, deployment, commercialization and operations in China and Southeast Asia David Hiscocks , Corporate Controller • 23 - year accounting and finance experience, including extensive worldwide tenure with Transocean and its prior merged companies. Texas CPA Wade A. Taber, Vice President of Engineering • 19 - year gasification engineering career, with most recent 9 - year tenure as GE’s Senior Engineering Manager – Components/Technology Innovation Dr. John Winter, Chief Engineer • 30+ year career in petrochemical industry career includes 15+ gasification technology research, engineering design, technical services, and plant operations Donald Huang, SES China Managing Director • One of the original SES team members in China, with extensive GM and project development experience including gov’t approvals and financing Khee Yoong Lee, Director of Commercial Development for China • 10+ year career in project development related to the power, energy, and chemical industries 20 ©2017 Synthesis Energy Systems, Inc., All Rights Reserved

SES Leadership: Board of Directors Lorenzo Lamadrid , Chairman • Ten - year tenure as Chairman of SES. Since 2001, Managing Director of Globe Development Group Robert W. Rigdon , Vice Chairman • Served as President and CEO from 2009 until February 2016, with an eight - year tenure with SES Harry Rubin, Director • Broad executive and financial management background, with a particular focus on acquisitions and divestitures Denis Slavich, Director • 35+ year career in large scale power generation development, with cross border transaction expertise Ziwang Xu, Director • Financial and investment banking executive, manages CXC China Sustainable Growth Fund Charles M. Brown, Director • Led 20 different operating businesses and more than two dozen factories around the world DeLome Fair, Director • SES’s President and CEO. One of the world’s leading experts in clean energy gasification technology commercialization and IGCC power generation technology 21 ©2017 Synthesis Energy Systems, Inc., All Rights Reserved

SGT: Well - positioned for Large Energy Markets 22 ©2017 Synthesis Energy Systems, Inc., All Rights Reserved Advanced Technology Cleanly, Economically, and Sustainably Answers Demand, Brings Energy Independence Note: (1) GE press release reference to GE’s “The Rise of Distributed Power” White Paper, Feb 2014 • Power SGT: SES’s reliable and efficient iGAS power for affordable clean power for the developing world. Fast - growing distributed power capacity additions projected to outpace electricity demand by 40% in developing regions. (1) Positive project economics when power > $60 per megawatt - hour. • Industrial Fuels: Syngas SGT: economically advantaged clean coal natural gas replacement markets include industry, aluminum , and ceramics. • Industrial Fuels: H2 SGT: high - purity pipeline hydrogen (H2) for cleaner transportation fuels. Replaces costlier and more time - intensive H2 derived from methanol - cracking. • Substitute Natural Gas SGT: clean syngas for conversion into pipeline natural gas, with superior environmental performance and lower cost for substitute natural gas (SNG). • DRI for Steel Production SGT: advancing developments with global partner Midrex Technologies, Inc., a subsidiary of Kobe Steel Limited, for coal gasification - based Direct Reduced Iron (DRI) facilities which will combine SGT with the MXCOL™ DRI technology. • Agrichemicals SGT : ammonia for nitrogen fertilizer and ammonium nitrate product are required to produce large quantities of ammonia for agricultural fertilizers, critical to improved and sustainable food sources. SGT is the perfect fit to produce th ese and myriad additional chemical building blocks. • Transportation Fuels SGT: Clean syngas conversion of local energy sources such as coal and biomass into gasoline and diesel products for regions where crude oil is expensive or scarce, or refining capacities cannot keep up with demand. Total available market for all verticals is estimated by SES at over 10,000 Yima - sized gasification systems worldwide

SGT China JV Plants 23 Yima JV – 3 SGT Systems ©2017 Synthesis Energy Systems, Inc., All Rights Reserved Yima JV Plant – Henan Province • 25% SES, 75% Yima Coal Industry Group – Joint Venture • Higher pressure, 10 bar operation • 377,000 metric tons per year (MPTY) nameplate methanol design capacity – at full production rates, 365 days per year • Mature plant expected to be capable of producing ~330,000 MPTY – includes planned and forced outages based on customary Chinese operating practices for coal - to - chemical plants ZZ Demonstration Plant – Shandong Province • Commercial proof - of - concept SGT demonstration plant and feedstock test facility • 90K TPY design capacity • Syngas/coke oven gas to methanol operating plant • Proven successful operation on waste coals with ash content > 55% WT • Operation commenced in 2008; the gasification plant ceased operations in 2014 ZZ Demonstration Plant – 2 SGT Systems

Licensed SGT Projects • Aluminum Corporation of China (CHALCO): • China’s largest alumina and primary aluminum producer and the world’s second largest alumina producer • SGT economically advantaged clean coal NG replacement projects • 3 industrial fuel supply plants • Secured by China JV Tianwo - SES partner, Suzhou THVOW Technology Co., Ltd. 24 Chalco Shandong – 2 SGT Systems Chalco Shanxi – 1 SGT System Commissioning 4/2016 ©2017 Synthesis Energy Systems, Inc., All Rights Reserved Chalco Henan – 4 SGT Systems

USA Total: 237.3 Bituminous & Anthracite: 108.5 Sub - bituminous & Lignite: 128.8 Africa Total: 31.8 Bit & Anthracite: 31.6 Sub - bituminous & Lignite: 0.2 India Total: 60.6 Bit & Anthracite (high ash): 56.1 Sub - bituminous & Lignite: 4.5 Australia Total: 76.4 Bit & Anthracite: 37.1 Sub - bituminous & Lignite: 39.3 Russia Total: 157.0 Bituminous & Anthracite: 49.1 Sub - bituminous & Lignite: 107.9 China Total: 114.5 Bit & Anthracite: 62.2 Sub - bit & Lignite: 52.3 Vietnam Total: 1.2 Bit & Anthracite: 1.2 Turkey Total: 8.7 Bit & Anthracite: 0.3 Sub - bit & Lignite: 8.4 Pakistan Total: 2.1 Sub - bit & Lignite: 2.1 Indonesia Total: 28.0 Sub - bit & Lignite: 28.0 Brazil Total: 6.6 Bituminous & Anthracite: 0.0 Sub - bituminous & Lignite: 6.6 World Coal Reserves Total: 891.5 Billion Tonnes Bituminous & Anthracite: 403.2 Sub - bituminous & Lignite: 488.3 World Coal Reserves Billion Tonnes • More than 50% of recoverable global coal resources are untapped sub - bituminous and close - to - surface lignite (brown) coal • Renewable biomass and municipal wastes are alternative SGT feedstocks Source: BP Statistical Review of World Energy June 2016 25 ©2017 Synthesis Energy Systems, Inc., All Rights Reserved

Nasdaq: SYMX synthesisenergy.com Growth With Blue Skies Investor Relations: MDC GROUP Contact: David Castaneda, (414) 351 - 9758 IR@synthesisenergy.com