Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - SYNTHESIS ENERGY SYSTEMS INC | exh_992.htm |

| 8-K - FORM 8-K - SYNTHESIS ENERGY SYSTEMS INC | f8k_060217.htm |

Exhibit 99.1

Synthesis Energy Systems, Inc. Clean - Economic - Sustainable Global Energy AUSTRALIAN FUTURE ENERGY OVERVIEW – MAY 2017

SES Forward - looking Statements 2 This presentation includes “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . All statements other than statements of historical fact are forward - looking statements . Forward - looking statements are subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected . Among those risks, trends and uncertainties are our ability to successfully raise additional capital to continue as a going concern ; the ability of Batchfire and AFE management to successfully grow and develop their Australian assets and operations, including Callide and Pentland ; the ability of our project with Yima to produce earnings and pay dividends ; our ability to develop and expand business of the TSEC joint venture in the joint venture territory ; our ability to develop our power business unit and our other business verticals, including DRI steel, through our marketing arrangement with Midrex Technologies, and renewables ; our ability to successfully develop the SES licensing business ; the ability of the ZZ Joint Venture to retire existing facilities and equipment and build another SGT facility ; the economic conditions of countries where we are operating ; events or circumstances which result in an impairment of our assets ; our ability to reduce operating costs ; our ability to make distributions and repatriate earnings from our Chinese operations ; our ability to successfully commercialize our technology at a larger scale and higher pressures ; commodity prices, including in particular natural gas, crude oil, methanol and power ; the availability and terms of financing ; our customers’ and/or our ability to obtain the necessary approvals and permits for future projects ; our ability to estimate the sufficiency of existing capital resources ; the sufficiency of internal controls and procedures ; and our results of operations in countries outside of the U . S . , where we are continuing to pursue and develop projects . Although SES believes that in making such forward - looking statements our expectations are based upon reasonable assumptions, such statements may be influenced by factors that could cause actual outcomes and results to be materially different from those projected by us . SES cannot assure you that the assumptions upon which these statements are based will prove to have been correct .

Australian Future Energy (AFE) Overview 3 • $US 1B + resource ownership & clean energy project opportunity. • Differentiated by unique lower emissions from SES syngas production technology. • Large pipeline (circa $US 10B) projects under evaluation today and down - selecting two initial projects for advancement. • SES technology enables low cost production from lower cost lower rank coals and biomass. • Increasing NGCC power generation & LNG export commitments creating gas shortages & increasing prices on domestic supply. • AFE developing agrichemicals and synthetic natural gas businesses for local and Asian export markets. • AFE developing coal and biomass resource businesses for direct local and export market sales. • AFE projects to be environmentally “class leading” with low carbon dioxide syngas production.

AFE Background • Australian Future Energy Pty Ltd (AFE) was formed in November 2014 by Edek Choros and Synthesis Energy Systems Inc. (SES) • Edek Choros is a coal mining veteran with over 25 years of successful professional experience in coal mining and mine development in Australia and the USA. • SES is a NASDAQ listed, global energy and technology company, owning proprietary technology for producing valuable synthesis gas from coal and renewable resources. • SES technology offers unique benefits which allows for low cost syngas from conversion of high ash coals (~20% to 50% ash) as well as in combination with renewable resources such as biomass. • SES technology has been installed in 5 projects in China consisting of 12 SES syngas systems and two of which SES developed and owns equity interest.

SES Ownership Structure – Australia April 2017 5 Choros SES, Inc AFE Directors and Others AFE Pty Ltd Great Northern Energy Pty Ltd SPV Batchfire Resources Callide Coal Operation Pentland, 270MM ton resource Other Batchfire Shareholders Others 88.6% SES 11.4% SES ~40% Future AFE Project Companies SPV SPV Choros ~45% Other ~15%

AFE Strategy AFE is building a large - scale vertically integrated business in Australia based on developing, building and owning equity interests in financially attractive and environmentally responsible projects that produce agrichemicals and energy products from local coal and renewable resources and acquiring ownership positions in local coal and biomass resources for its projects and for selling into local and export markets . 6

AFE Business Model • Exclusive rights in Australia to SES unique syngas generation technology through which AFE receives shared licensed fee income with SES. • Securing investment into financially attractive projects and delivering financial results through its equity ownership in the projects developed by AFE. • Generating income from AFE ownership in coal and biomass resource businesses which sell these resources to both local and export markets. • Securing long term, coal and/or biomass supply agreements to provide low cost secure feedstock supply for its projects. • Together with SES, advancing the low - carbon coal conversion capability of SES technology via blended coal/biomass resource utilization and licensing this capability to other parties in Australia. 7

AFE Business Model Diagram Mining and coal processing operations Coal resources Export thermal coal Syngas Production & Purification Synthetic Natural Gas (SNG) Low Emission Power Fertilizer Urea By - products: Ash (Cement) Steam, Sulphur Coal Biomass Pelletizing Biomass resources Export Biomass Methanol Hydrogen 8

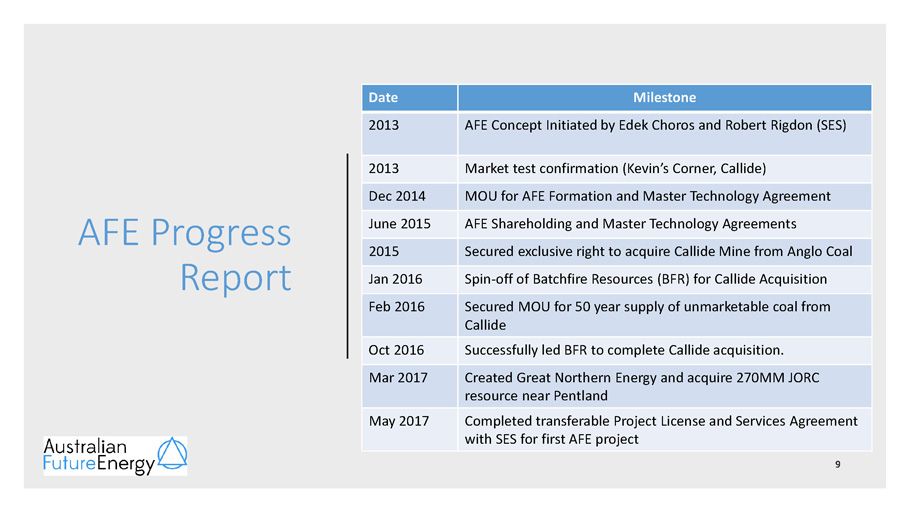

AFE Progress Report Date Milestone 2013 AFE Concept Initiated by Edek Choros and Robert Rigdon (SES) 2013 Market test confirmation (Kevin’s Corner, Callide) Dec 2014 MOU for AFE Formation and Master Technology Agreement June 2015 AFE Shareholding and Master Technology Agreements 2015 Secured exclusive right to acquire Callide Mine from Anglo Coal Jan 2016 Spin - off of Batchfire Resources (BFR) for Callide Acquisition Feb 2016 Secured MOU for 50 year supply of unmarketable coal from Callide Oct 2016 Successfully led BFR to complete Callide acquisition. Mar 2017 Created Great Northern Energy and acquire 270MM JORC resource near Pentland May 2017 Completed transferable Project License and Services Agreement with SES for first AFE project

Australia Market Outlook NG & LNG 10 • LNG Exports of ~28 MM tonnes of LNG in 2015; likely over 40 million tonnes in 2016 and forecast of 64 million tonnes in 2017 and over 70 million tonnes in 2018. • Further, decommissioning of coal fired power plants shifting more demand to NG. • Increase of A$4 - 6/GJ to approximately A$8 - 10/GJ poses dramatic impact on both major industrial users (e.g. fertilizers, alumina refineries) and there are prospects for some plant closures. • B ase - load power generation will face a significant increase in the short run marginal cost to around $32/MWh for a $4/GJ wholesale gas price increase. • AFE has opportunity to produce SNG in Queensland locations for the domestic gas market. • While a long term price forecast post - 2022 is difficult to provide, AFE believes it is reasonable to assume a real price ex - plant of A$8.00/GJ (2017). Source: Oakley Greenwood, “Gas Price Trends Report”, Feb 2016

Australia Market Outlook Urea 11 • Import replacement & export market opportunities for AFE • Urea most commonly made from NG. • Local Urea demand is ~ 2Mt pa & local manufacturer is Incitec Pivot (IPL) via Brisbane plant producing around 0.3Mt (NG based). • Fertilizer consumption in South Asia has been increasing at a fast pace. It is the second largest fertilizer consuming region in the world. Its share in world consumption of nitrogen is 19.8%. Nitrogen, is expected to grow at 1.7% pa during 2014 to 2018. • AFE will supply the domestic market based on delinking cost from NG plus freight advantage over importing urea from overseas. • AFE will also supply export market in Asia with AFE projects at/near existing port facilities. • Market price AFE assuming USD$260/tonne for projects 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 (1) Australian Urea Consumption, kt Imports Consumption Source: (1) FAOSTAT and FAO report, “World Fertilizer Trends and Outlook to 2018”: Year 2014 2015 2016 2017 2018 Nitrogen (N) 113.15 115.1 116.51 117.95 119.42 (1) World demand for fertilizer nutrients, 2014 - 2018, Mt

Fertilizer (Urea) plus SNG Project Overview 12 Urea/SNG & By - Products Coal Power O&M plus Other Urea 88% SNG 10% By - Products 2% Preliminary Assumptions ($ AUD) • Total Installed Cost ~A$2.5B • Products: Urea 1.6MM MT/a; SNG 10.5 PJ/a • Coal rate: ~2.3MM MT/a • NPV (10%) ~ A$2B; IRR + 15% (ungeared) • Urea ~A$350/MT; SNG A$8/GJ; Coal ~A$35/MT 1GJ = .9478MMBTU Note: Preliminary indicative profile for Urea + SNG project. Pre - Tax Margin Source: AFE Internal Data

AFE Project Pipeline ~US$10B Under Evaluation • P1 Agrichemicals Urea and By - Product SNG • P2 Agrichemicals Urea and By - Product SNG • P3 Agrichemicals Urea and By - Product SNG • P1 Synthesis Gas for Aluminum Manufacturing • P2 Synthesis Gas for Aluminum Manufacturing • Great Northern Energy - Pentland Resource • Biomass Pelletizing • Coal to SNG - Asia • SNG Based Power Generation Locations: Primarily Queensland East Coast but also South Australia and New South Wales 13

Initial Advice Statement to QLD Initial offtake commitments PDP and FEED (10 months) Start Permitting Process Definitive Agreements EPC Contract Project 2 Project Funding – Const. Start Plan Overview & Key Milestones IM Prep and initiate fund raise $20MM Initial Advice Statement to QLD Initial offtake commitments Secure sites Close funding Set up Project Cos 2 SPV PDP and FEED (10 months) Start Permitting Process Definitive Agreements EPC Contract Project 1 Project Funding – Const. Start 14 18 to 24 Months Not to scale

AFE Organization Top Line AFE Board of Directors Stephen Lonie – Chairman Robert Rigdon (SES) - Deputy Chairman Edek Choros – AFE Executive Director Richard Barker – Director Industry Experienced Professionals • Australian and International Project Development • Clean Energy and Coal Industry • Large Scale EPC • Financing and Debt structuring • Environmental Modeling & Project Permitting • Technology Application and Design Edek Choros Executive Director & CEO Ron Higson COO Kerry Parker CFO SES Technical Team Francis Lau - CTO SES Technologies Jim Devine External Affairs Luke Gracias Environment Pat Larkin Chief Eng.

16 An AFE Success Story • Created by AFE and spun - out in 2016 • Acquired Callide Coal Mine • Open pit thermal coal mine and associated processing infrastructure • Produced 7.6 million tonnes (Mt) of coal in 2014 • Two adjacent power stations under long term contracts. • Local and export market sales • Adjusting mine operation for lower strip ratio coal • Lowering production costs and increasing profitability • Potential for expansion • SES 11.4% shareholder with meaningful dividend potential

AFE Directors’ profiles Edek Choros – Executive Director • Geologist with over 25 years of professional experience in coal exploration, mine design, mine planning and management of “tu rn around” operations for a number of coal mines in Australia and the USA • Founder, CEO and MD of Millennium Coal Pty Ltd – company founded in 1999, and which developed a very successful hard coking coal mine in Bowen Basin in Queensland, which in 2004 was sold to Excel Coal Ltd • Founder, CEO and MD of Ambre Energy Ltd – company founded in 2005 and currently owns and operates two large coal mines in the US A and is developing the Millennium Bulk Terminal at Longview on the USA west coast to export coal to Asia • Founder of Australian Future Energy Pty Ltd – company formed in 2014 to develop large scale coal gasification projects convertin g waste coal to urea and SNG • Founder of Batchfire Resources Pty Ltd (spin - out of AFE) company formed in 2015 to acquire the Callide mine from Anglo American . Stephen Lonie - Chairman • Chartered Accountant having over 30 years with KPMG in Australia where he Queensland Managing Partner and was responsible for Queensland management consulting and corporate finance practices • Currently on several boards of public and private companies in Queensland, was the former chairman of an ASX listed company, for mer Chairman of CS Energy and formerly Deputy Chairman of Ambre Fuels (a CTL company) • Has a great understanding of the Coal To Liquid (CTL) industry and has a very strong personal interest to see the CTL industr y d eveloped in Australia 17

AFE Directors’ profiles Richard Barker – Independent Director • 25+ years of investment banking and corporate finance, including mergers and acquisitions, valuations and general corporate g uid ance • Strong and broad contact network • Former Managing Director and co - head of the metals & mining investment group for RBC Capital Markets • Former CEO of a publicly traded company, with a strong understanding of ASX listed company issues • Significant investment banking experience Robert Rigdon – Director and Deputy Chairman AFE • Former CEO of SES and current Vice Chairman • Former leader in GE’s gasification business including manager of gasification engineering, director of IGCC commercializatio n, director of gasification industrials and chemicals • 23 years at Texaco (ChevronTexaco) in worldwide power & gasification group as project development leader, engineering manager , p roject director and vice - president gasification technology. Specialist in chemical plant operations, reliability engineering and gas tu rbine, steam turbine, compressor design, application and operations. • BS Mech engineering, Lamar University; Beaumont, Texas 1981 18