Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ASHFORD HOSPITALITY TRUST INC | ahtinvestorpresentation8-k.htm |

Company Presentation – June 2017

Safe Harbor

2

In keeping with the SEC's "Safe Harbor" guidelines, certain statements made during this presentation could be

considered forward-looking and subject to certain risks and uncertainties that could cause results to differ

materially from those projected. When we use the words "will likely result," "may," "anticipate," "estimate,"

"should," "expect," "believe," "intend," or similar expressions, we intend to identify forward-looking statements.

Such forward-looking statements include, but are not limited to, our business and investment strategy, our

understanding of our competition, current market trends and opportunities, projected operating results, and

projected capital expenditures.

These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause

actual results to differ materially from those anticipated including, without limitation: general volatility of the

capital markets and the market price of our common stock; changes in our business or investment strategy;

availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the

market in which we operate, interest rates or the general economy, and the degree and nature of our

competition. These and other risk factors are more fully discussed in the Company's filings with the Securities

and Exchange Commission.

EBITDA is defined as net income before interest, taxes, depreciation and amortization. EBITDA yield is defined as

trailing twelve month EBITDA divided by the purchase price. A capitalization rate is determined by dividing the

property's net operating income by the purchase price. Net operating income is the property's funds from

operations minus a capital expense reserve of either 4% or 5% of gross revenues. Hotel EBITDA flow-through is the

change in Hotel EBITDA divided by the change in total revenues. EBITDA, FFO, AFFO, CAD and other terms are

non-GAAP measures, reconciliations of which have been provided in prior earnings releases and filings with the

SEC.

This overview is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy or sell,

any securities of Ashford Hospitality Trust, Inc. or any of its respective affiliates, and may not be relied upon in

connection with the purchase or sale of any such security.

Strategic Overview

3

Opportunistic platform focused

on upper-upscale, full-service

hotels

Superior long-term total

shareholder return performance

Targets moderate debt levels of

55-60% net debt/gross assets

Attractive dividend yield

Targets cash level of 25-35% of

total equity market cap

Highest insider ownership

Recent Developments

4

Performance

Q1 2017 Earnings Release:

• RevPAR growth for all hotels not under renovation of 4.5%

• Hotel EBITDA margin for all hotels not under renovation increased 91 bps

• Hotel EBITDA flow-through for all hotels not under renovation of 61%

Value-Add

In May 2017, announced the redevelopment and acquisition of the fee interest in the conference

facility at Renaissance Nashville

In May 2017, converted the brand managed DFW Marriott to Remington managed

Capital Markets

In May 2017, completed the refinancing of the Renaissance Nashville and Westin Princeton with a

new floating rate loan totaling $181 million at LIBOR+3.00% & completed the refinancing of the

Atlanta Indigo for $16 million at LIBOR+2.90%

• Next hard debt maturity is a $96 million loan that matures in January 2018

Governance

Announced enhancements to corporate governance policies

Asset Recycling

Sold two low RevPAR, high capex full-service hotels (Renaissance Portsmouth & Embassy Suites

Syracuse)

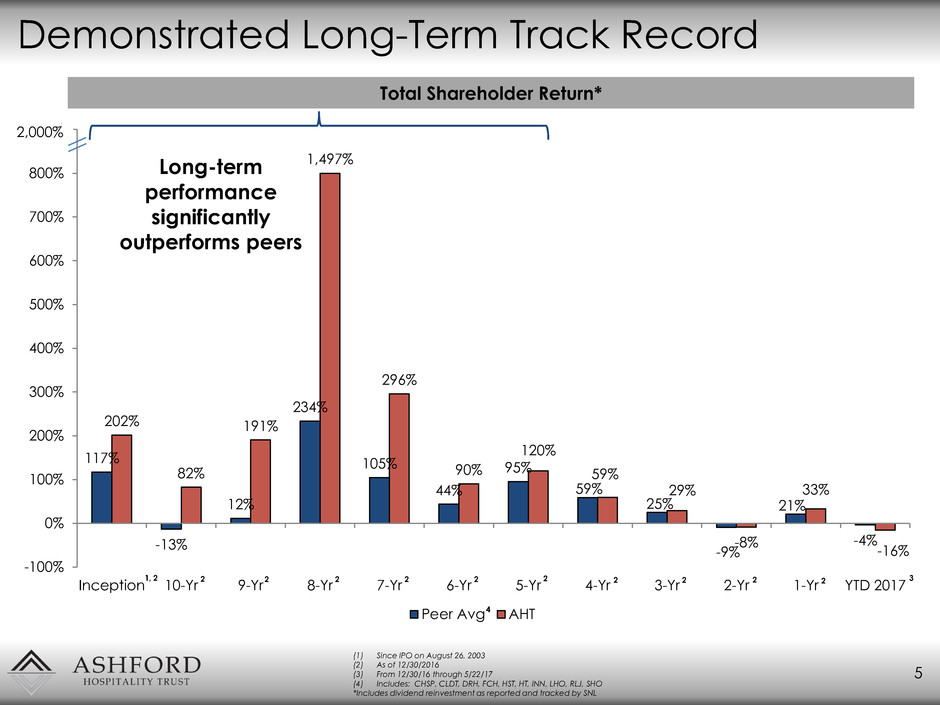

117%

-13%

12%

234%

105%

44%

95%

59%

25%

-9%

21%

-4%

202%

82%

191%

1,497%

296%

90%

120%

59%

29%

-8%

33%

-16%

-100%

0%

100%

200%

300%

400%

500%

600%

700%

800%

900%

Inception 10-Yr 9-Yr 8-Yr 7-Yr 6-Yr 5-Yr 4-Yr 3-Yr 2-Yr 1-Yr YTD 2017

Peer Avg AHT

Demonstrated Long-Term Track Record

5

(1) Since IPO on August 26, 2003

(2) As of 12/30/2016

(3) From 12/30/16 through 5/22/17

(4) Includes: CHSP, CLDT, DRH, FCH, HST, HT, INN, LHO, RLJ, SHO

*Includes dividend reinvestment as reported and tracked by SNL

Total Shareholder Return*

Long-term

performance

significantly

outperforms peers

1, 2

2,000

2 2 2 2 2 2 2 2 2 2 3

4

Disciplined Capital Management

6

Capital Markets Activity

$218

$153

$305

$574

$75 $88

$147

$86 $111

$18

$97 $81

$45

$52

$0

$100

$200

$300

$400

$500

$600

$700

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Common Raises Common Buybacks

Common Share Buybacks

During Global Financial Crisis

• 73.6 million shares

• Approximately 50% of shares outstanding

• Aggregate buyback approximately $3.26/share

Track record of increasing shareholder returns by capitalizing upon

cyclical changes and advantageous pricing situations

19.1%

7.6%

6.1%

3.6%

2.8% 2.5% 2.5% 2.3%

2.0% 1.7% 1.6%

1.1% 0.8%

0.5% 0.4%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

18.0%

20.0%

AHT HT APLE CLDT FCH REIT

Avg

CHSP RLJ PEB INN HST DRH SHO XHR LHO

Highest Insider Ownership

7

REIT average includes: APLE, HT, RLJ, CLDT, FCH, CHSP, INN, HST, PEB, DRH, SHO, LHO, XHR

REIT Source: Latest proxy and other company filings.

(1) As of 5/22/2017

(2) Includes direct interests, indirect interests, and interests of related parties

Insider Ownership

Most highly aligned management team among the lodging

REIT sector

1,2

7.5%

7.0%

6.8% 6.7%

6.4% 6.3% 6.3% 6.3%

6.1%

5.9%

5.6%

4.7%

4.5% 4.4% 4.3%

3.6%

3.3%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

AHT CLDT CHSP PK APLE LHO RLJ AHP XHR HT REIT

Avg

PEB DRH HST SHO INN FCH

Di

v

id

en

d

Y

iel

d

Attractive Dividend Yield

8

Source: Company filings and market data

(1) As of 5/22/2017

(2) Annualized based on most recent dividend announcement

(3) Includes: APLE, HT, RLJ, CLDT, FCH, CHSP, INN, HST, PEB, DRH, SHO, LHO, XHR, PK

Dividend Yield1

Highest dividend yield in the industry

2 2 3

9 Current Hotels

High Quality, Geographically Diverse Portfolio

Le Pavillon Hotel

New Orleans, LA

Lakeway Resort & Spa

Austin, TX

Hilton Costa Mesa

Costa Mesa, CA

Marriott Fremont

Fremont, CA

Le Meridien Minneapolis

Minneapolis, MN Chicago Silversmith

Chicago, IL

Hilton Back Bay

Boston, MA

The Churchill

Washington, D.C.

W Atlanta Downtown

Atlanta, GA

Crowne Plaza Key West

Key West, FL

Marriott Sugar Land

Sugar Land, TX

Hilton Santa Fe

Santa Fe, NM

Renaissance Nashville

Nashville, TN

Westin Princeton

Princeton, NJ

Marriott Beverly Hills

Beverly Hills, CA

Embassy Suites Portland

Portland, OR

Marriott Gateway

Arlington, VA

Top 25

74%

Top 50

18%

Other

8%

Portfolio Overview

10

TTM Hotel EBITDA as of March 31, 2017 for the 121 owned hotels as of May 22, 2017

Hotel EBITDA in thousands

Hotel EBITDA by Brand Hotel EBITDA by Manager

Hotel EBITDA by MSA Hotel EBITDA by Chainscale

Top Ten Metro Areas

Marriott

57%

Hilton

27%

Hyatt

4%

IHG

6%

Independent

6%

Upscale

34%

Upper-Upscale

54%

Luxury

5%

Upper-Midscale

3%

Independent

4%

Marriott

33%

Hilton

6%

Hyatt

3%

Remington

58%

Interstate

<1%

TTM Hotel % of

EBITDA Total

Washington DC $47,137 9.9%

San Fran/Oakland, CA $34,543 7.3%

Los Angeles, CA $33,475 7.0%

Atlanta, GA $32,733 6.9%

New York/New Jersey $30,435 6.4%

Nashville, TN $26,735 5.6%

DFW, TX $25,743 5.4%

Boston, MA $25,620 5.4%

Minn./St. Paul, MN $16,905 3.6%

Tampa, FL $12,142 2.6%

Total Portfolio $475,510 100.0%

11

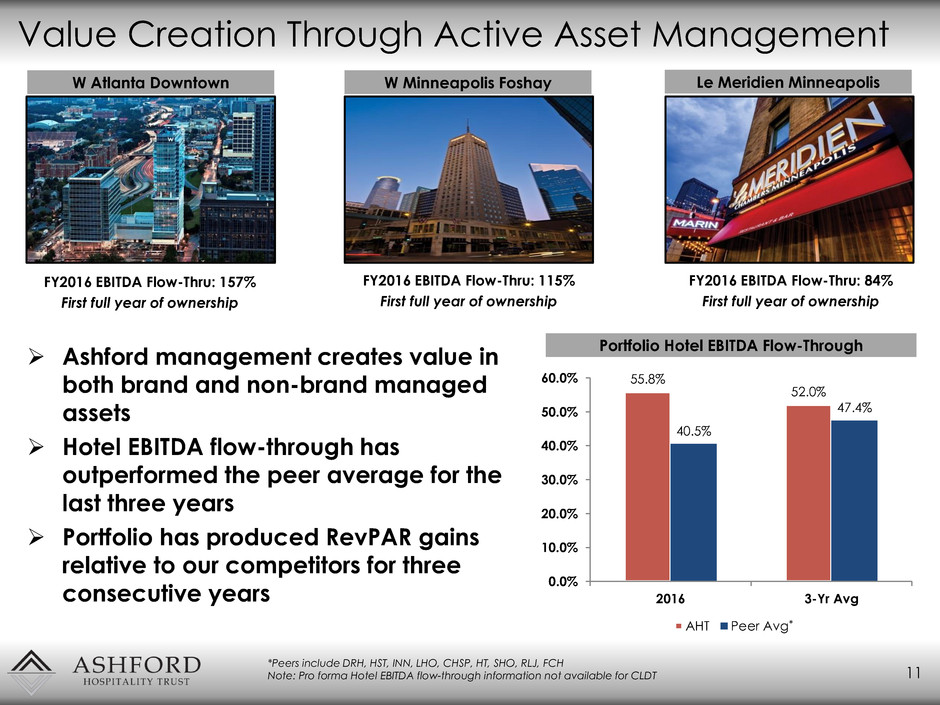

Value Creation Through Active Asset Management

55.8%

52.0%

40.5%

47.4%

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

60.0%

2016 3-Yr Avg

AHT Peer Avg

Portfolio Hotel EBITDA Flow-Through

*Peers include DRH, HST, INN, LHO, CHSP, HT, SHO, RLJ, FCH

Note: Pro forma Hotel EBITDA flow-through information not available for CLDT

*

Ashford management creates value in

both brand and non-brand managed

assets

Hotel EBITDA flow-through has

outperformed the peer average for the

last three years

Portfolio has produced RevPAR gains

relative to our competitors for three

consecutive years

W Atlanta Downtown W Minneapolis Foshay Le Meridien Minneapolis

FY2016 EBITDA Flow-Thru: 157%

First full year of ownership

FY2016 EBITDA Flow-Thru: 115%

First full year of ownership

FY2016 EBITDA Flow-Thru: 84%

First full year of ownership

52%

58% 59%

42% 46%

47%

63%

47%

22%

53%

60% 59%

68% 70%

47% 56%

44%

68%

-200%

-175%

-150%

-125%

-100%

-75%

-50%

-25%

0%

25%

50%

75%

100%

2008 2009 2010 2011 2012 2013 2014 2015 2016 YTD Q1

2017

Non-Remington Remington

Competitive Advantage – Affiliated Manager

Affiliated property manager benefits - Remington outperformed in

EBITDA flow-through 8 out of the last 10 years including YTD Q1 2017

12 NOTE: Remington managed hotels as compared to Non-Remington managed hotels owned by Ashford Trust

Hotel EBITDA Flow-Through

Superior management of downside risk and cash flow loss

-800

-808%

334%

300

Case Study - Aggressive Asset Management

13

Acquired the W Atlanta Downtown in

July 2015

237 keys, 9,000 sq. ft. of meeting

space

Close proximity to the downtown and

midtown demand generators:

Centennial Olympic Park, the Atlanta

Aquarium, and Mercedes Benz

Stadium

Replaced unprofitable restaurant

manager and re-positioned restaurant

New management of the on-premise

digital billboard

Renegotiated valet parking agreement

Eliminated operational loss at Bliss Spa

through restructuring

Full year 2016 (first full year of

ownership) EBITDA flow-thru of 157%,

and EBITDA growth of 27%

W Atlanta – Atlanta, GA

Hotel Overview

Implemented Strategies

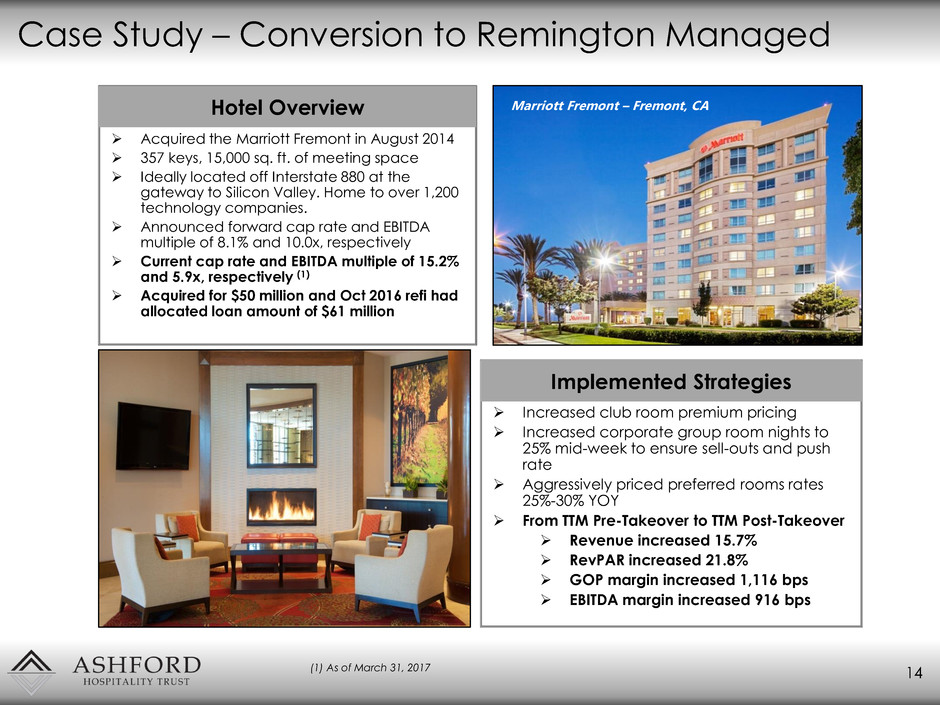

Case Study – Conversion to Remington Managed

14

Acquired the Marriott Fremont in August 2014

357 keys, 15,000 sq. ft. of meeting space

Ideally located off Interstate 880 at the

gateway to Silicon Valley. Home to over 1,200

technology companies.

Announced forward cap rate and EBITDA

multiple of 8.1% and 10.0x, respectively

Current cap rate and EBITDA multiple of 15.2%

and 5.9x, respectively (1)

Acquired for $50 million and Oct 2016 refi had

allocated loan amount of $61 million

Increased club room premium pricing

Increased corporate group room nights to

25% mid-week to ensure sell-outs and push

rate

Aggressively priced preferred rooms rates

25%-30% YOY

From TTM Pre-Takeover to TTM Post-Takeover

Revenue increased 15.7%

RevPAR increased 21.8%

GOP margin increased 1,116 bps

EBITDA margin increased 916 bps

Marriott Fremont – Fremont, CA Hotel Overview

Implemented Strategies

(1) As of March 31, 2017

Case Study – Brand Conversion

15

The Marriott Beverly Hills officially

opened on July 1, 2015

Invested $21mm, net of key money

from Marriott*

Prior to the conversion, the hotel had

June 2015 TTM NOI of $5.6mm

FY2016 NOI of $10.3mm

Received an award from Marriott

International for renovation excellence

FY2016 performance (first full year since

conversion):

• Total revenue growth of 52%

• Room rate growth of 31%

• Hotel EBITDA flow-through of 53%

• A gain of 3,760 bps in market share

Marriott Beverly Hills – Beverly Hills, CA

Hotel Overview

Implemented Strategies

* Not all of this capital was incremental. Hotel was in need of a renovation. “Refresh” capital requirements per Crowne

standards were estimated to be $8mm.

Renaissance Nashville: Participating in redevelopment of $400 million Nashville Convention Center. Consisting

of a 26-story Class A office tower, 235,000 square feet of high-end retail, 350 residential units and museum.

Spending $20 million to upgrade and increase ownership of meeting space (75,000 square feet)

Marriott Crystal Gateway: Spending $30M: all guestrooms, lobby & restaurant, addition of M Club, new and

expanded fitness center, adding 6 keys and additional meeting space

Hilton Boston Back Bay: Spending $11M on guestroom and lobby renovation

Hyatt Regency Savannah: Extensive food and beverage repositioning and full lobby renovation nearly

complete

Marriott Dallas DFW: Converted from brand to franchise managed (Remington). Comprehensive ballroom and

meeting space renovation in summer 2017

Embassy Suites Santa Clara: Spending $10M on guestrooms, lobby renovation, and fitness area

Ritz Carlton Atlanta: Spending $21M on extensive guestroom renovation scheduled for Q4, expanding Ritz

Carlton Club Lounge, expanded/updated gift shop into upscale retail market

Engaged expense consultant: Charged with examining all contracted services in certain hotels and

negotiating improved terms to drive profit at existing operations

Exploring Outdoor Advertising: Working with several consultants to explore outdoor advertising (Wall wraps,

video boards, and free-standing) to monetize underutilized outdoor space

16

Asset Management Initiatives - Upcoming

$95.7

$5.4

$96.4

$256.0

$533.0

$710.7

$1,462.9

$630.1

$0.0

$200.0

$400.0

$600.0

$800.0

$1,000.0

$1,200.0

$1,400.0

$1,600.0

2017 2018 2019 2020 2021 Thereafter

Fixed-Rate Floating-Rate

Debt Maturities and Leverage

Target Net Debt/Gross Assets of 50-60%

Maintain mix of fixed and floating rate debt (Currently 88% floating & 12% fixed)

Ladder maturities

Exclusive use of property-level, non-recourse debt

All floating rate debt has interest rate caps

17

As of March 31, 2017

(1) Assumes extension options are exercised

(2) Pro forma for the refinancing of the Renaissance Nashville & Westin Princeton and Hotel Indigo Atlanta

Note: All debt yield statistics are based on EBITDA to principal.

Debt Maturity Schedule (mm)(1) (2)

Debt Yield:

15.0%

Debt Yield:

12.5%

Debt Yield:

15.3%

Debt Yield:

11.5%

Debt Yield:

11.3%

Capital Structure and Net Working Capital

Appropriate use of leverage

Current net working capital of approximately $4.40 per share(1)

All debt is non-recourse, property level mortgage debt

Targeted cash balance of 25% to 30% of equity market capitalization

Provides flexibility for opportunistic investments & working capital needs and a

hedge against unfavorable economic shocks

18

(1) As of March 31, 2017; Figures in millions except per share values

(2) Pro forma for the refinancing of the Renaissance Nashville & Westin Princeton and Hotel Indigo Atlanta

(3) At market value as of May 22, 2017

Enterprise Value (1) Net Working Capital (1)

Stock Price (As of May 22, 2017) $6.43

Fully Diluted Shares Outstanding 117.1

Equity Value $753.2

Plus: Preferred Equity 553.1

Plus: Debt (2) 3,788.0

Total Market Capitalization $5,094.4

Less: Net Working Capital (515.8)

Total Enterprise Value $4,578.5

Cash & Cash Equivalents (2) $359.6

Restricted Cash 165.1

Investment in Securities 50.4

Accounts Receivable, net 59.7

Prepaid Expenses 25.0

Due From Affiliates, net (12.2)

Due from Third Party Hotel Managers 15.9

Market V lue of Ashford, Inc. Investment (3) 30.6

Total Current Assets $694.2

Accounts Payable, net & Accrued Expenses $152.6

Dividends Payable 25.8

Tot l Current Liabilities $178.4

Net Working Capital $515.8

Corporate Governance Enhancements

19

Modification of the Company’s Equity Incentive Plan:

Requires stock ownership by directors and officers

Requires minimum vesting periods

Modification of the Company’s By-Laws:

Reduced to 30% of outstanding shares to call a special meeting

Modification of the Company’s Stock Ownership Guidelines:

Increases the required share ownership for directors (3x to 4x)

Investor Feedback:

Shared with Board at quarterly board meetings

Separation of Chairman and CEO roles:

Effective February 2017

Board of Directors Diversity Matrix

Professional Experience Geography Independence Age Ethnicity Tenure

Real Estate /

Hospitality

C-Suite

Executive

Entrepreneurship Legal

South-

West

West

Coast

North-

East

South-

East

Independent 25-40 41-55 56-70

White /

Caucasian

Middle

Eastern/

South Asia

Years

Monty J.

Bennett 14

Benjamin

J. Ansell,

M.D.

8

Fred

Kleisner 1

Amish

Gupta

3

Kamal

Jafarnia 4

Philip S.

Payne 14

Alan L.

Tallis 4

20

Key Takeaways

21

Opportunistic platform focused on upper-upscale, full-

service hotels

Aligned management team with a long track record

of creating shareholder value

Highest dividend yield in the industry

Company Presentation – June 2017