Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SIGNET JEWELERS LTD | form8k.htm |

Exhibit 99.1

Signet Investor Conferences Supplement Michele Santana, CFOMay 31 – June 1, 2017

Forward Looking Statements & Other Disclosure Matters Forward-Looking Statements – This presentation contains statements which are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements, based upon management's beliefs and expectations as well as on assumptions made by and data currently available to management, include statements regarding, among other things, Signet's results of operation, financial condition, liquidity, prospects, growth, strategies and the industry in which Signet operates. The use of the words "expects," "intends," "anticipates," "estimates," "predicts," "believes," "should," "potential," "may," "forecast," "objective," "plan," or "target," and other similar expressions are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance and are subject to a number of risks and uncertainties, including but not limited to Signet’s expectations, including timing, regarding the anticipated closings of the various credit portfolio transactions, the entry into the servicing agreement as contemplated by the preliminary agreement, the success of discussions with capital providers to achieve full outsourcing, statements about the benefits of the credit portfolio sales including future financial and operating results, Signet’s or the other parties’ ability to satisfy the requirements for consummation of the agreements relating to the credit portfolio transactions, including due to regulatory or legal impediments, the outcome of Signet’s conversion of its accounting methodology, the effect of regulatory conditions on the credit purchase agreements and credit program agreements, general economic conditions, regulatory changes following the United Kingdom’s announcement to exit from the European Union, a decline in consumer spending, the merchandising, pricing and inventory policies followed by Signet, the reputation of Signet and its brands, the level of competition in the jewelry sector, the cost and availability of diamonds, gold and other precious metals, regulations relating to customer credit, seasonality of Signet’s business, financial market risks, deterioration in customers’ financial condition, exchange rate fluctuations, changes in Signet’s credit rating, changes in consumer attitudes regarding jewelry, management of social, ethical and environmental risks, security breaches and other disruptions to Signet’s information technology infrastructure and databases, inadequacy in and disruptions to internal controls and systems, changes in assumptions used in making accounting estimates relating to items such as extended service plans and pensions, risks related to Signet being a Bermuda corporation, the impact of the acquisition of Zale Corporation on relationships, including with employees, suppliers, customers and competitors, and our ability to successfully integrate Zale Corporation’s operations and to realize synergies from the transaction.For a discussion of these and other risks and uncertainties which could cause actual results to differ materially from those expressed in any forward-looking statement, see the “Risk Factors” section of Signet's Fiscal 2017 Annual Report on Form 10-K filed with the SEC on March 16, 2017. Signet undertakes no obligation to update or revise any forward-looking statements to reflect subsequent events or circumstances, except as required by law.

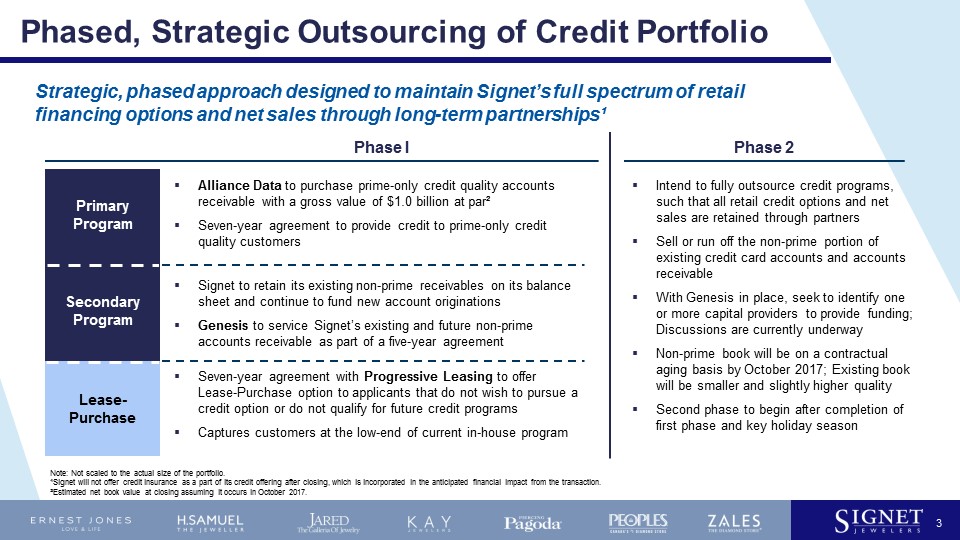

Secondary Program Lease- Purchase Primary Program Phased, Strategic Outsourcing of Credit Portfolio Seven-year agreement with Progressive Leasing to offer Lease-Purchase option to applicants that do not wish to pursue a credit option or do not qualify for future credit programsCaptures customers at the low-end of current in-house program Phase 2 Alliance Data to purchase prime-only credit quality accounts receivable with a gross value of $1.0 billion at par²Seven-year agreement to provide credit to prime-only credit quality customers Note: Not scaled to the actual size of the portfolio. ¹Signet will not offer credit insurance as a part of its credit offering after closing, which is incorporated in the anticipated financial impact from the transaction.²Estimated net book value at closing assuming it occurs in October 2017. 3 Phase I Signet to retain its existing non-prime receivables on its balance sheet and continue to fund new account originations Genesis to service Signet’s existing and future non-prime accounts receivable as part of a five-year agreement Intend to fully outsource credit programs, such that all retail credit options and net sales are retained through partnersSell or run off the non-prime portion of existing credit card accounts and accounts receivableWith Genesis in place, seek to identify one or more capital providers to provide funding; Discussions are currently underwayNon-prime book will be on a contractual aging basis by October 2017; Existing book will be smaller and slightly higher qualitySecond phase to begin after completion of first phase and key holiday season Strategic, phased approach designed to maintain Signet’s full spectrum of retail financing options and net sales through long-term partnerships¹

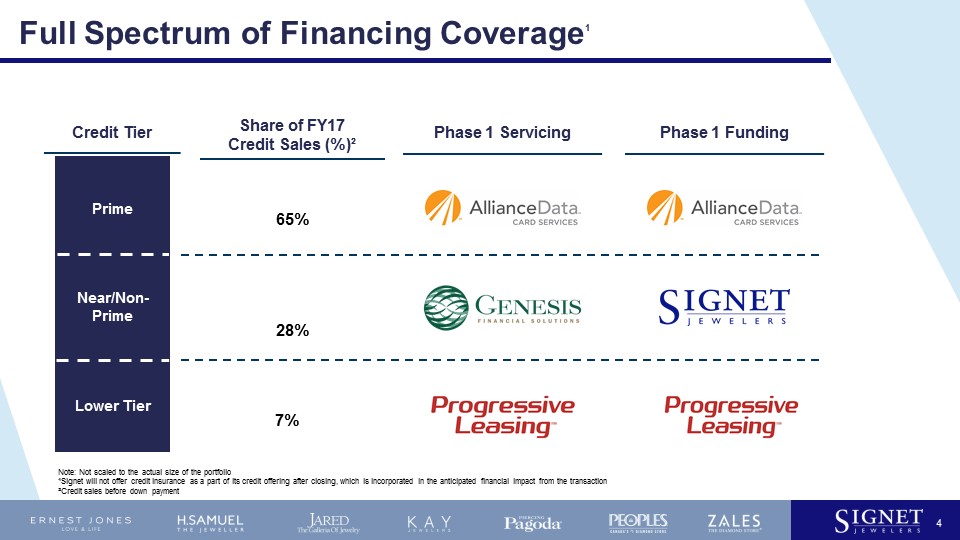

Prime Near/Non-Prime Note: Not scaled to the actual size of the portfolio¹Signet will not offer credit insurance as a part of its credit offering after closing, which is incorporated in the anticipated financial impact from the transaction²Credit sales before down payment 4 Credit Tier Share of FY17 Credit Sales (%)² 65% 28% 7% Phase 1 Servicing Phase 1 Funding Lower Tier Full Spectrum of Financing Coverage1

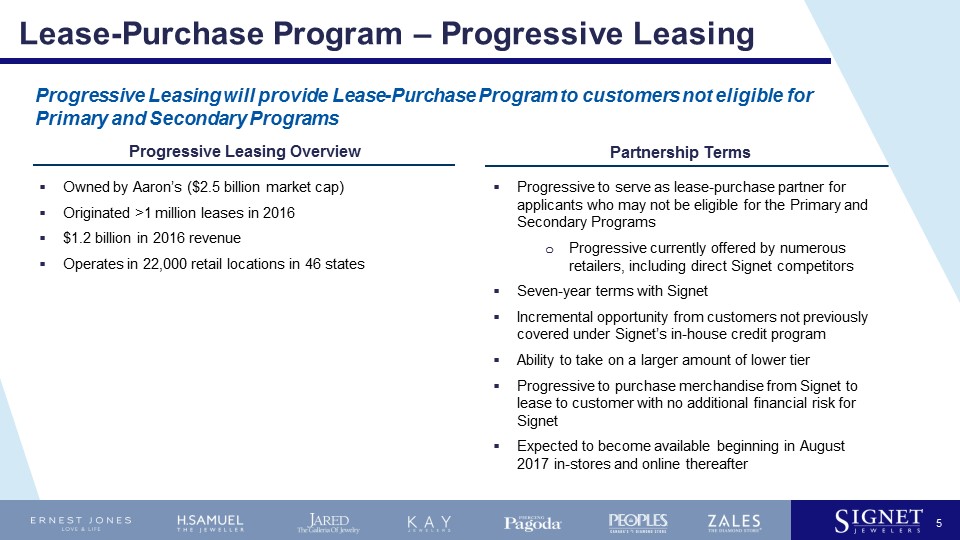

Lease-Purchase Program – Progressive Leasing Owned by Aaron’s ($2.5 billion market cap)Originated >1 million leases in 2016$1.2 billion in 2016 revenueOperates in 22,000 retail locations in 46 states Progressive to serve as lease-purchase partner for applicants who may not be eligible for the Primary and Secondary ProgramsProgressive currently offered by numerous retailers, including direct Signet competitorsSeven-year terms with SignetIncremental opportunity from customers not previously covered under Signet’s in-house credit programAbility to take on a larger amount of lower tierProgressive to purchase merchandise from Signet to lease to customer with no additional financial risk for SignetExpected to become available beginning in August 2017 in-stores and online thereafter Progressive Leasing will provide Lease-Purchase Program to customers not eligible for Primary and Secondary Programs 5 Progressive Leasing Overview Partnership Terms

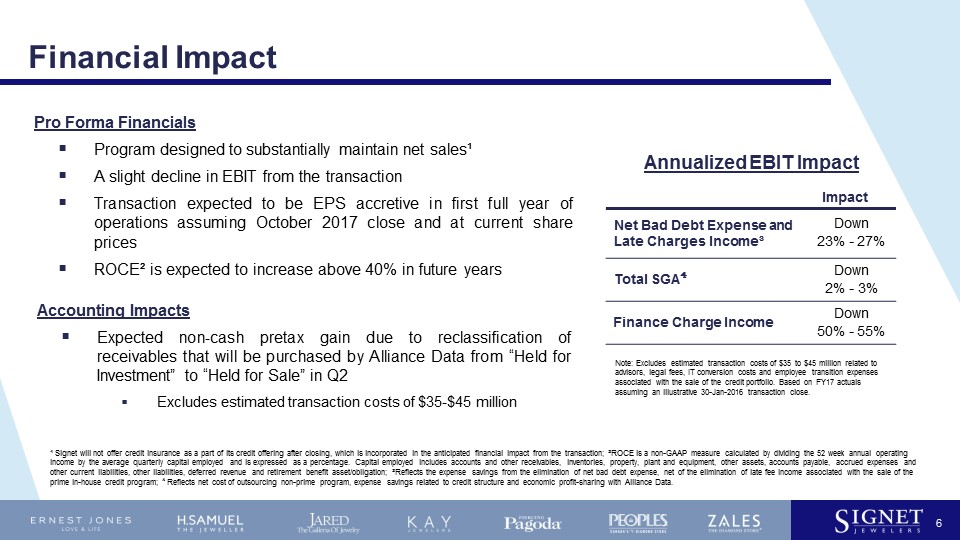

Pro Forma FinancialsProgram designed to substantially maintain net sales¹A slight decline in EBIT from the transactionTransaction expected to be EPS accretive in first full year of operations assuming October 2017 close and at current share pricesROCE² is expected to increase above 40% in future years Financial Impact ¹ Signet will not offer credit insurance as a part of its credit offering after closing, which is incorporated in the anticipated financial impact from the transaction; ²ROCE is a non-GAAP measure calculated by dividing the 52 week annual operating income by the average quarterly capital employed and is expressed as a percentage. Capital employed includes accounts and other receivables, inventories, property, plant and equipment, other assets, accounts payable, accrued expenses and other current liabilities, other liabilities, deferred revenue and retirement benefit asset/obligation; ³Reflects the expense savings from the elimination of net bad debt expense, net of the elimination of late fee income associated with the sale of the prime in-house credit program; ⁴ Reflects net cost of outsourcing non-prime program, expense savings related to credit structure and economic profit-sharing with Alliance Data. Accounting Impacts Expected non-cash pretax gain due to reclassification of receivables that will be purchased by Alliance Data from “Held for Investment” to “Held for Sale” in Q2Excludes estimated transaction costs of $35-$45 million 6 Impact Net Bad Debt Expense and Late Charges Income³ Down 23% - 27% Total SGA⁴ Down 2% - 3% Finance Charge Income Down 50% - 55% Note: Excludes estimated transaction costs of $35 to $45 million related to advisors, legal fees, IT conversion costs and employee transition expenses associated with the sale of the credit portfolio. Based on FY17 actuals assuming an illustrative 30-Jan-2016 transaction close. Annualized EBIT Impact

Financial Guidance Fiscal 2018 Same store sales Down low-to-mid single-digit % EPS $7.00 to $7.40 Effective tax rate 24% to 25% Weighted average common shares 74 million to 75 million Capital expenditures $260 million to $275 million Net square footage change -1% to 0% FY guidance excludes the impact from the credit transactionGross margin expected to leverage; SGA expected to deleverageContinued incremental capital and operating investments in long-term OmniChannel growth 7

8 Reaffirmed FY 2018 Guidance Guidance anticipates ongoing retail industry softness; Signet has a number of initiatives underway to deliver EPS growth Q1: Largely in-line with Signet’s expectations and factored into guidanceSequential improvement Feb - April when normalized for Mother’s Day performanceMother’s Day: Solid, positive comp performance over the Mother’s Day selling period, driven by:New, more targeted and simple promotional strategy, which we continue to evaluateStrong underlying e-commerce run rate that continues to perform very wellSynergies: On-track to achieve $70 million for the full year, $50 million to benefit gross marginGross margin drivers: Merchandise margin (sourcing, pricing, discount controls, mix); Store occupancySGA drivers:Organizational redesign: Corporate headcount reduction benefitting corporate payrollStore costs: Labor model optimizationAdvertising: Lower expense on lower sales; More ROI focused w/ reallocation from traditional to digitalShare repurchases: Buybacks to assist on EPS and factored into guidanceFootprint optimization: Net contribution increase from more profitable off-mall openings, despite net store closuresBridal: Currently testing to roll out new product in Q4 to increase style assortment in key price pointsFashion: Currently testing to roll out new product in Q4 as fashion jewelry increases in popularity; Shifting advertising and marketing dollars to digital and social to target millennials

Distribute 70%-80% of free cash flow in form of dividends and buybacks, excluding one-time proceeds from the credit portfolio transaction and reflected in FY18 guidanceFlexibility to repurchase shares in advance of the close of the credit portfolio transaction – $511 million remaining on current authorizationAdjusted leverage ratio goal between 3.0x to 3.5x following repayment of $600 million securitization facilityPlans to repurchase additional shares using proceeds from credit transaction Capital Allocation 9 Strong balance sheet that provides flexibility to fund business strategy and assist on EPS