Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - FIRST DATA CORP | d397619dex991.htm |

| 8-K - 8-K - FIRST DATA CORP | d397619d8k.htm |

May 29, 2017 First Data Acquisition of CardConnect Exhibit 99.2

R: 0 G: 169 B: 224 R: 192 G: 19 B: 36 R: 162 G: 173 B: 0 R: 251 G: 79 B: 20 R: 0 G: 65 B: 101 R: 97 G: 99 B: 101 Cautionary Statement Regarding Forward-Looking Statements This communication contains forward-looking information relating to First Data and the proposed acquisition of CardConnect by First Data that involves substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. These forward-looking statements generally include statements that are predictive in nature and depend upon or refer to future events or conditions, and include words such as “believes,” “plans,” “anticipates,” “projects,” “estimates,” “expects,” “intends,” “strategy,” “future,” “opportunity,” “may,” “will,” “should,” “could,” “potential,” or similar expressions. Forward-looking statements in this communication include, among other things, statements about the potential benefits of the proposed acquisition; First Data’s and CardConnect’s plans, objectives, expectations and intentions; the financial condition, results of operations and business of First Data and CardConnect; industry, business strategy, goals and expectations concerning First Data’s and CardConnect’s market position, future operations, future performance and profitability; and the anticipated timing of closing of the acquisition. Risks and uncertainties include, among other things, risks related to the satisfaction of the conditions to closing of the acquisition (including the failure to obtain necessary regulatory approval) in the anticipated timeframe or at all, including uncertainties as to how many CardConnect stockholders will tender their shares in the tender offer and the possibility that the acquisition does not close; the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement, including in circumstances which would require First Data or CardConnect to pay a termination fee or other expenses; risks related to the potential impact of the announcement or consummation of the proposed transaction on First Data’s or CardConnect’s important relationships, including with employees, suppliers and customers; disruption from the transaction making it more difficult to maintain business and operational relationships; negative effects of this announcement or the consummation of the proposed acquisition on the market price of First Data’s or CardConnect’s common stock and on First Data’s or CardConnect’s operating results; significant transaction costs; the risk of litigation and/or regulatory actions related to the proposed acquisition; the possibility that competing offers will be made; and risks related to the ability to realize the anticipated benefits of the acquisition, including the possibility that the expected benefits from the proposed acquisition will not be realized or will not be realized within the expected time period. Other factors that may cause actual results to differ materially include those that will be set forth in the Schedule TO, Schedule 14D-9 and other tender offer documents filed by First Data, Merger Sub and CardConnect. Many of these factors are beyond First Data’s and CardConnect’s control. A further description of risks and uncertainties relating to First Data and CardConnect can be found in their Annual Reports on Form 10-K for the fiscal year ended December 31, 2016 and in their subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, all of which are filed with the SEC and available at www.sec.gov. Unless otherwise required by applicable law, each of First Data and CardConnect disclaims any intention or obligation to update forward-looking statements contained in this communication as the result of new information or future events or developments. R: 0 G: 169 B: 224 R: 0 G: 65 B: 101 R: 0 G: 127 B: 168 R: 0 G: 65 B: 125 R: 109 G: 220 B: 225 R: 251 G: 79 B: 20

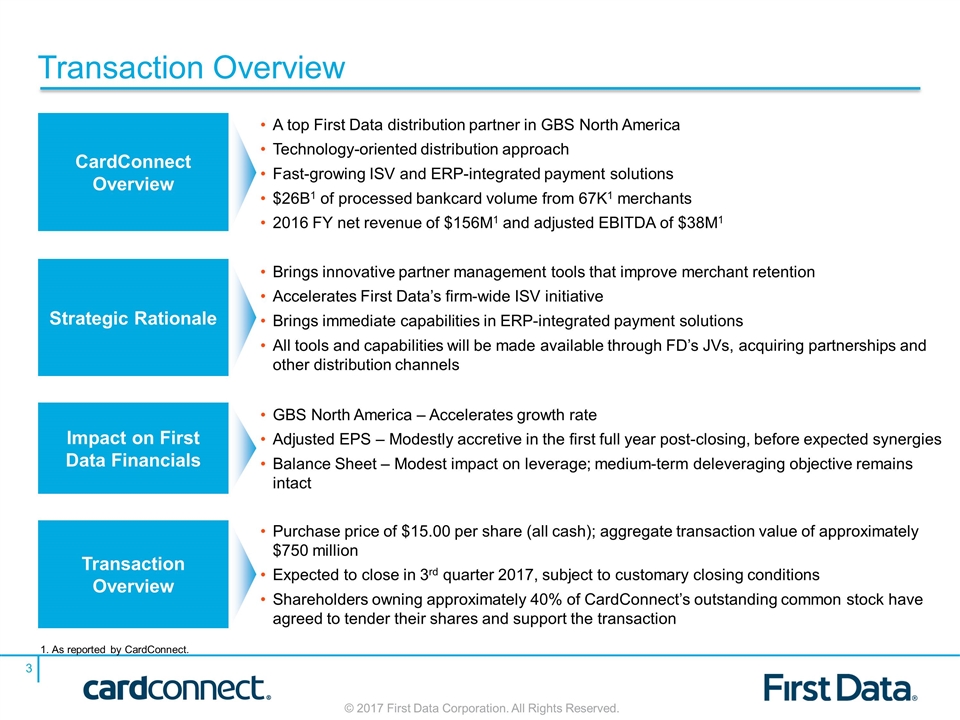

Transaction Overview R: 0 G: 169 B: 224 R: 162 G: 173 B: 0 R: 251 G: 79 B: 20 R: 0 G: 65 B: 101 R: 97 G: 99 B: 101 R: 0 G: 169 B: 224 R: 0 G: 127 B: 168 R: 0 G: 65 B: 125 R: 109 G: 220 B: 225 R: 251 G: 79 B: 20 CardConnect Overview A top First Data distribution partner in GBS North America Technology-oriented distribution approach Fast-growing ISV and ERP-integrated payment solutions $26B1 of processed bankcard volume from 67K1 merchants 2016 FY net revenue of $156M1 and adjusted EBITDA of $38M1 R: 192 G: 19 B: 36 R: 0 G: 65 B: 101 Strategic Rationale Brings innovative partner management tools that improve merchant retention Accelerates First Data’s firm-wide ISV initiative Brings immediate capabilities in ERP-integrated payment solutions All tools and capabilities will be made available through FD’s JVs, acquiring partnerships and other distribution channels Impact on First Data Financials GBS North America – Accelerates growth rate Adjusted EPS – Modestly accretive in the first full year post-closing, before expected synergies Balance Sheet – Modest impact on leverage; medium-term deleveraging objective remains intact Transaction Overview Purchase price of $15.00 per share (all cash); aggregate transaction value of approximately $750 million Expected to close in 3rd quarter 2017, subject to customary closing conditions Shareholders owning approximately 40% of CardConnect’s outstanding common stock have agreed to tender their shares and support the transaction As reported by CardConnect.

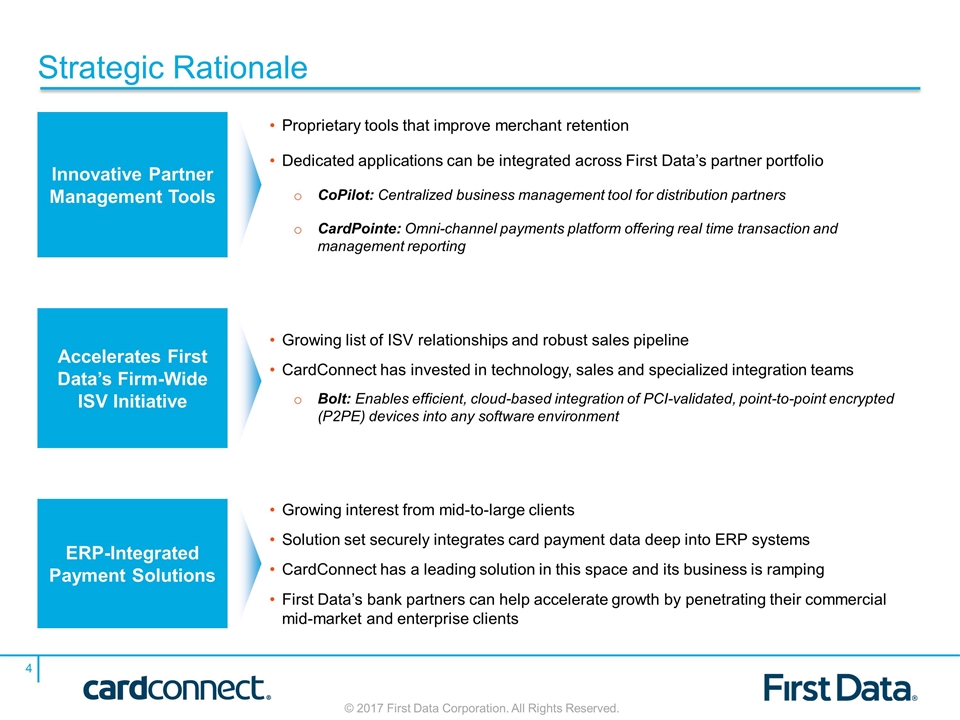

Innovative Partner Management Tools Proprietary tools that improve merchant retention Dedicated applications can be integrated across First Data’s partner portfolio CoPilot: Centralized business management tool for distribution partners CardPointe: Omni-channel payments platform offering real time transaction and management reporting R: 0 G: 169 B: 224 R: 192 G: 19 B: 36 R: 162 G: 173 B: 0 R: 251 G: 79 B: 20 R: 0 G: 65 B: 101 R: 97 G: 99 B: 101 R: 0 G: 169 B: 224 R: 0 G: 65 B: 101 R: 0 G: 127 B: 168 R: 0 G: 65 B: 125 R: 109 G: 220 B: 225 R: 251 G: 79 B: 20 ERP-Integrated Payment Solutions Growing interest from mid-to-large clients Solution set securely integrates card payment data deep into ERP systems CardConnect has a leading solution in this space and its business is ramping First Data’s bank partners can help accelerate growth by penetrating their commercial mid-market and enterprise clients Strategic Rationale Accelerates First Data’s Firm-Wide ISV Initiative Growing list of ISV relationships and robust sales pipeline CardConnect has invested in technology, sales and specialized integration teams Bolt: Enables efficient, cloud-based integration of PCI-validated, point-to-point encrypted (P2PE) devices into any software environment

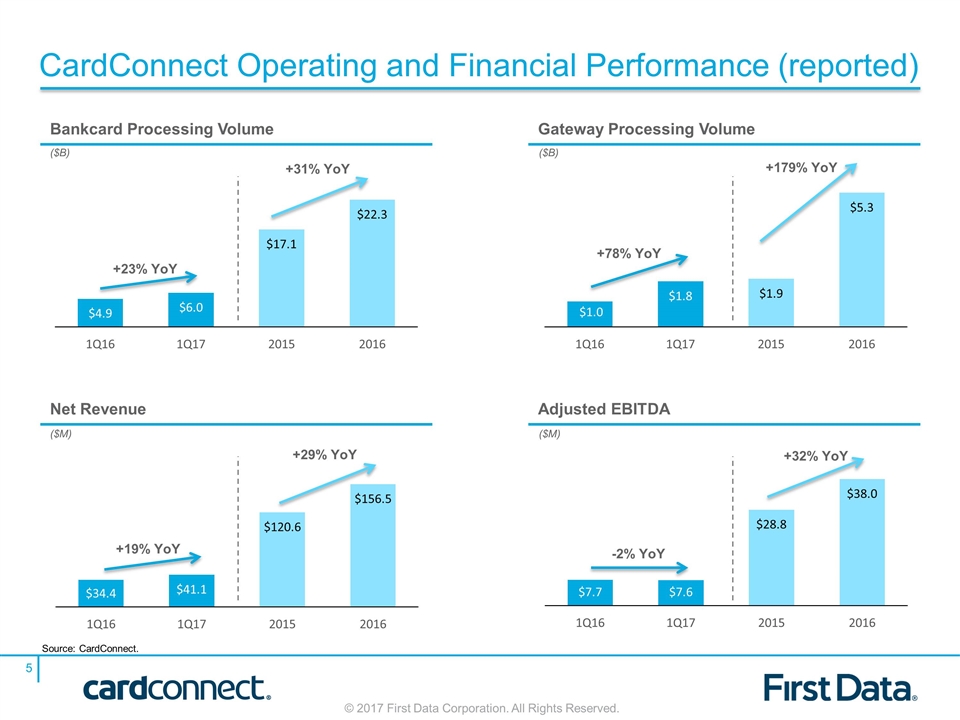

CardConnect Operating and Financial Performance (reported) Bankcard Processing Volume Gateway Processing Volume Net Revenue Adjusted EBITDA ($B) ($B) ($M) +29% YoY +31% YoY +32% YoY +23% YoY +78% YoY -2% YoY +19% YoY +179% YoY ($M) Source: CardConnect.

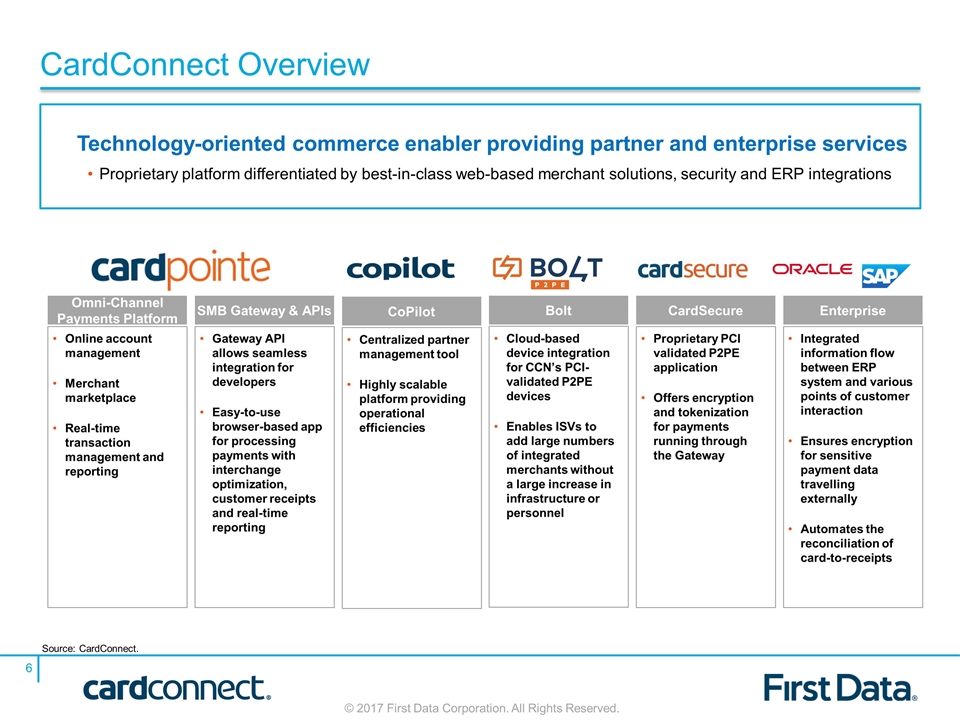

CardConnect Overview Technology-oriented commerce enabler providing partner and enterprise services Proprietary platform differentiated by best-in-class web-based merchant solutions, security and ERP integrations CoPilot Centralized partner management tool Highly scalable platform providing operational efficiencies Omni-Channel Payments Platform Online account management Merchant marketplace Real-time transaction management and reporting SMB Gateway & APIs Gateway API allows seamless integration for developers Easy-to-use browser-based app for processing payments with interchange optimization, customer receipts and real-time reporting CardSecure Proprietary PCI validated P2PE application Offers encryption and tokenization for payments running through the Gateway Enterprise Integrated information flow between ERP system and various points of customer interaction Ensures encryption for sensitive payment data travelling externally Automates the reconciliation of card-to-receipts Bolt Cloud-based device integration for CCN’s PCI-validated P2PE devices Enables ISVs to add large numbers of integrated merchants without a large increase in infrastructure or personnel Source: CardConnect.

Conclusion R: 0 G: 169 B: 224 R: 192 G: 19 B: 36 R: 162 G: 173 B: 0 R: 251 G: 79 B: 20 R: 0 G: 65 B: 101 R: 97 G: 99 B: 101 R: 0 G: 169 B: 224 R: 0 G: 65 B: 101 R: 0 G: 127 B: 168 R: 0 G: 65 B: 125 R: 109 G: 220 B: 225 R: 251 G: 79 B: 20 A fast-growing, technology-oriented commerce enabler that is a long-standing First Data distribution partner Brings innovative tools that will help improve merchant retention Accelerates First Data’s firm-wide ISV initiative Brings First Data immediate capabilities in ERP-integrated payment solutions Solutions are highly complementary and synergistic to First Data’s distribution partners and bank partners Modestly accretive to adjusted EPS in the first full year post-closing, before expected synergies Modest impact on leverage; medium-term deleveraging objective remains intact

R: 0 G: 169 B: 224 R: 192 G: 19 B: 36 R: 162 G: 173 B: 0 R: 251 G: 79 B: 20 R: 0 G: 65 B: 101 R: 97 G: 99 B: 101 Additional Information and Where to Find it The tender offer for the outstanding shares of CardConnect (the “Company”) referenced in this communication has not yet commenced. This announcement is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of the Company, nor is it a substitute for the tender offer materials that First Data Corporation (“First Data”) and its acquisition subsidiary will file with the U.S. Securities and Exchange Commission (the “SEC”) upon commencement of the tender offer. At the time the tender offer is commenced, First Data and its acquisition subsidiary will file tender offer materials on Schedule TO, and the Company will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the tender offer. The tender offer materials (including an Offer to Purchase, a related Letter of Transmittal and certain other tender offer documents) and the Solicitation/Recommendation Statement will contain important information. Holders of shares of the Company are urged to read these documents when they become available because they will contain important information that holders of the Company securities should consider before making any decision regarding tendering their securities. The Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as well as the Solicitation/Recommendation Statement, will be made available to all holders of shares of the Company at no expense to them. The tender offer materials and the Solicitation/Recommendation Statement will be made available for free at the SEC’s web site at www.sec.gov. Additional copies may be obtained for free by contacting First Data, 225 Liberty Street, 29th Floor, New York, New York 10281, Attention: Investor Relations. In addition to the Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as well as the Solicitation/Recommendation Statement, First Data and the Company file annual, quarterly and special reports and other information with the SEC. You may read and copy any reports or other information filed by First Data or the Company at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. First Data’s and the Company’s filings with the SEC are also available to the public from commercial document-retrieval services and at the website maintained by the SEC at http://www.sec.gov. R: 0 G: 169 B: 224 R: 0 G: 65 B: 101 R: 0 G: 127 B: 168 R: 0 G: 65 B: 125 R: 109 G: 220 B: 225 R: 251 G: 79 B: 20