Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SUPERIOR INDUSTRIES INTERNATIONAL INC | d397782d8k.htm |

Superior Industries International, Inc. 18th Annual B. Riley and Co. Institutional Investor Conference May 25, 2017 Exhibit 99.1

Forward-Looking Statements This webcast and presentation contain statements that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that do not relate solely to historical or current facts and can generally be identified by the use of future dates or words such as "may," "should," "could," “will,” "expects," "seeks to," "anticipates," "plans," "believes," "estimates," "intends," "predicts," "projects," "potential" or "continue" or the negative of such terms and other comparable terminology. These statements also include, but are not limited to, the 2018 targets, the Company’s consummation the acquisition of UNIWHEELS AG, and the Company’s strategic and operational initiatives, product mix and overall cost improvement and are based on current expectations, estimates, and projections about the Company's business based, in part, on assumptions made by management. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements due to numerous factors, risks, and uncertainties discussed in the Company's Securities and Exchange Commission filings and reports, including the Company's Annual Report on Form 10-K for the year-ended December 25, 2016, Quarterly Reports on Form 10-Q and other reports from time to time filed with the Securities and Exchange Commission. You are cautioned not to unduly rely on such forward looking statements when evaluating the information presented in this press release. Such forward-looking statements speak only as of the date on which they are made and the Company does not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this webcast and presentation. Use of Non-GAAP Financial Measures In addition to the results reported in accordance with GAAP, this presentation refers to “Adjusted EBITDA,” which we have defined as earnings before interest, taxes, depreciation, amortization, restructuring charges and impairments of long-lived assets and investments. Management believes the use of non-GAAP financial measures are useful to both management and investors in their analysis of the Company’s financial position and results of operations. Further, management uses non-GAAP financial measures for planning and forecasting future periods. This non-GAAP financial information is provided as additional information for investors and is not in accordance with or an alternative to GAAP. These non-GAAP measures may be different from similar measures used by other companies. For reconciliations of non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with GAAP, see the Company's Securities and Exchange Commission filings and reports, including the Company's Annual Report on Form 10-K for the year-ended December 25, 2016 and Quarterly Reports on Form 10-Q. Securities Laws This presentation is neither an offer to sell nor a solicitation of an offer to buy any securities and shall not constitute an offer, solicitation or sale in any jurisdiction in which such offer, solicitation or sale would be unlawful. Non-GAAP Financial Measures and Forward-Looking Statements

Strategic Update On March 23, 2017 Superior announced that it was commencing a tender offer for 100% of the outstanding shares of UNIWHEELS AG UNIWHEELS is the third largest supplier of aluminum wheels to European automotive OEMs, as well as Europe’s leading manufacturer of aluminum wheels for the automotive aftermarket Transaction is to be financed with approximately $670 million of newly funded debt, $150 million of Convertible Preferred Equity and a new $160 million revolving credit facility. Following completion of the transaction and reflecting its new capital structure, Superior anticipates that it will reduce its annual dividend from $0.72 per share to $0.36 per share On May 23, 2017 Superior announced that approximately 92.3% of UNIWHEELS shares of common stock had been validly tendered The UNIWHEELS acquisition is expected to close on May 30, 2017

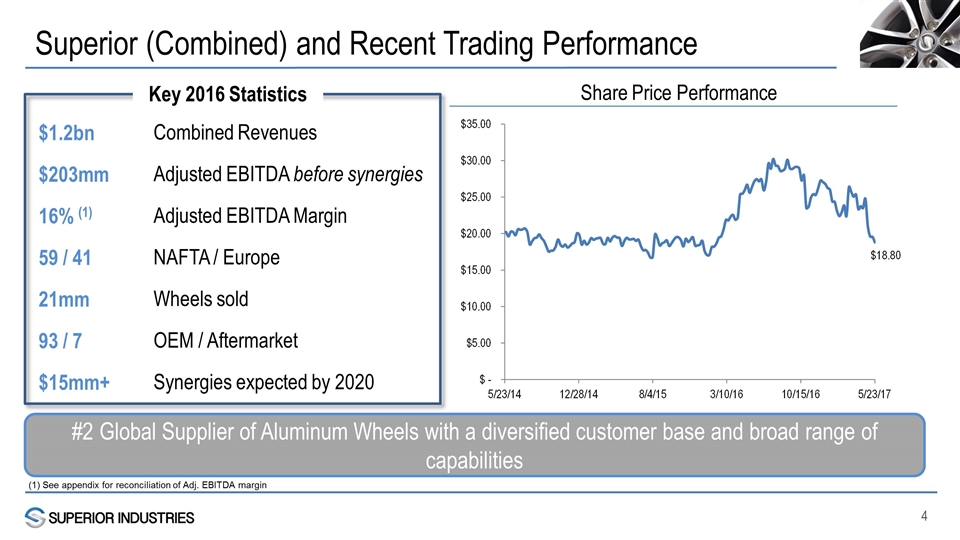

Superior (Combined) and Recent Trading Performance Combined Revenues Adjusted EBITDA before synergies Adjusted EBITDA Margin NAFTA / Europe Wheels sold OEM / Aftermarket Synergies expected by 2020 $1.2bn $203mm 16% (1) 59 / 41 21mm 93 / 7 $15mm+ #2 Global Supplier of Aluminum Wheels with a diversified customer base and broad range of capabilities Share Price Performance Key 2016 Statistics (1) See appendix for reconciliation of Adj. EBITDA margin

Superior Investment Thesis Range of Product Diameter Capabilities Breadth of Technology Competitive Footprint Global Supplier Sophisticated Painting and Finishing Patented Lightweighting Technologies #1 North American OEM Supplier #3 European OEM Supplier #1 European Aftermarket Supplier Globally Competitive Manufacturing Footprint Capable of Addressing Market Needs Recently Opened Plants in Both Mexico and Poland #2 Globally Further Expansion Opportunities in North America, Europe, or other Geographies Solid foundation for growth

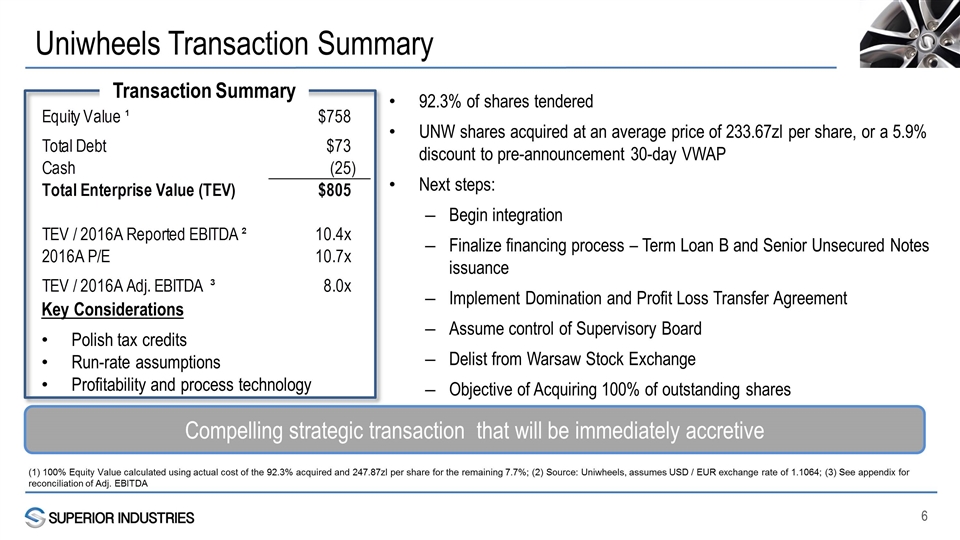

Uniwheels Transaction Summary 92.3% of shares tendered UNW shares acquired at an average price of 233.67zl per share, or a 5.9% discount to pre-announcement 30-day VWAP Next steps: Begin integration Finalize financing process – Term Loan B and Senior Unsecured Notes issuance Implement Domination and Profit Loss Transfer Agreement Assume control of Supervisory Board Delist from Warsaw Stock Exchange Objective of Acquiring 100% of outstanding shares Compelling strategic transaction that will be immediately accretive (1) 100% Equity Value calculated using actual cost of the 92.3% acquired and 247.87zl per share for the remaining 7.7%; (2) Source: Uniwheels, assumes USD / EUR exchange rate of 1.1064; (3) See appendix for reconciliation of Adj. EBITDA Key Considerations Polish tax credits Run-rate assumptions Profitability and process technology Transaction Summary

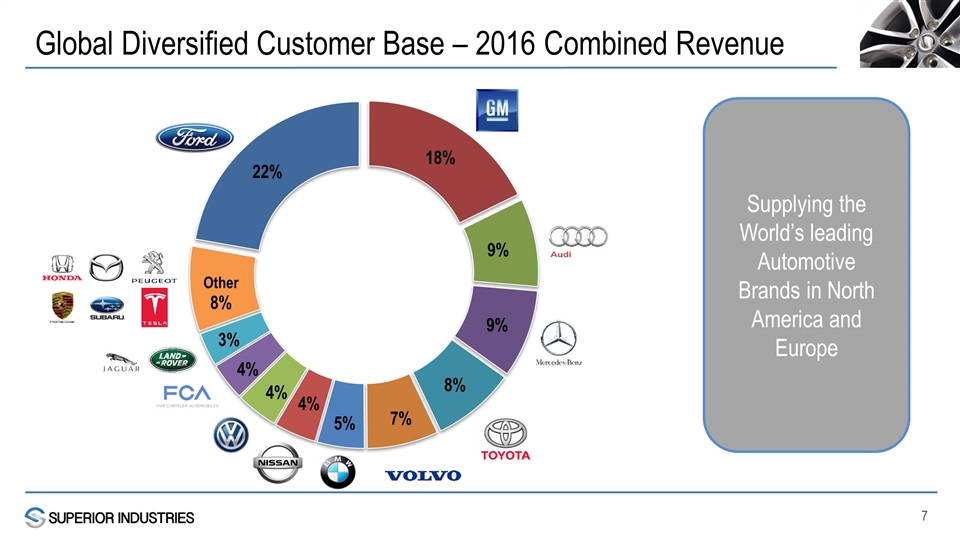

Global Diversified Customer Base – 2016 Combined Revenue Supplying the World’s leading Automotive Brands in North America and Europe

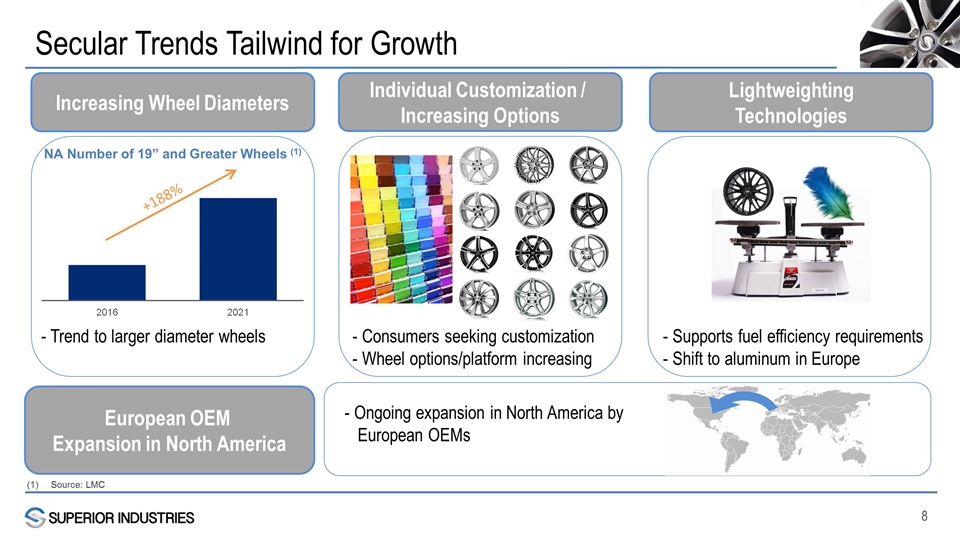

Secular Trends Tailwind for Growth Increasing Wheel Diameters Individual Customization / Increasing Options Lightweighting Technologies +188% NA Number of 19” and Greater Wheels (1) - Trend to larger diameter wheels - Consumers seeking customization - Wheel options/platform increasing European OEM Expansion in North America - Supports fuel efficiency requirements - Shift to aluminum in Europe - Ongoing expansion in North America by European OEMs Source: LMC

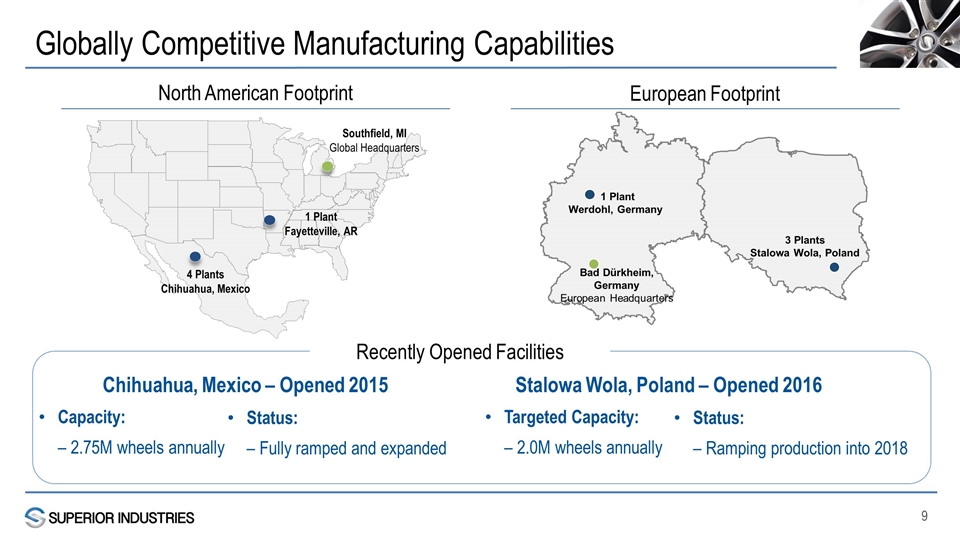

Globally Competitive Manufacturing Capabilities 3 Plants Stalowa Wola, Poland 1 Plant Werdohl, Germany Bad Dürkheim, Germany European Headquarters 4 Plants Chihuahua, Mexico 1 Plant Fayetteville, AR Southfield, MI Global Headquarters North American Footprint European Footprint Chihuahua, Mexico – Opened 2015 Capacity: – 2.75M wheels annually Status: – Fully ramped and expanded Stalowa Wola, Poland – Opened 2016 Targeted Capacity: – 2.0M wheels annually Status: – Ramping production into 2018 Recently Opened Facilities

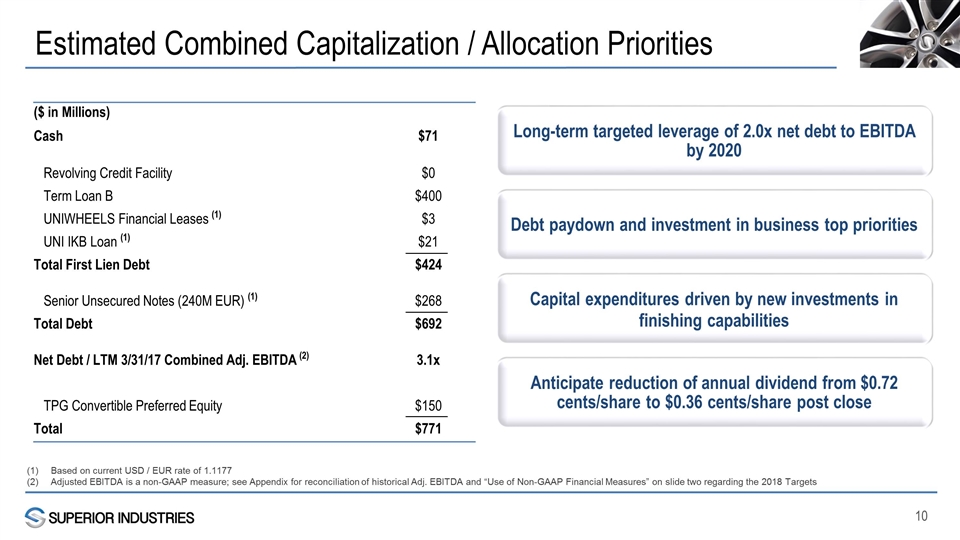

Estimated Combined Capitalization / Allocation Priorities ($ in Millions) Cash $71 Revolving Credit Facility $0 Term Loan B $400 UNIWHEELS Financial Leases (1) $3 UNI IKB Loan (1) $21 Total First Lien Debt $424 Senior Unsecured Notes (240M EUR) (1) $268 Total Debt $692 Net Debt / LTM 3/31/17 Combined Adj. EBITDA (2) 3.1x TPG Convertible Preferred Equity $150 Total $771 Based on current USD / EUR rate of 1.1177 Adjusted EBITDA is a non-GAAP measure; see Appendix for reconciliation of historical Adj. EBITDA and “Use of Non-GAAP Financial Measures” on slide two regarding the 2018 Targets Capital expenditures driven by new investments in finishing capabilities Debt paydown and investment in business top priorities Long-term targeted leverage of 2.0x net debt to EBITDA by 2020 Anticipate reduction of annual dividend from $0.72 cents/share to $0.36 cents/share post close

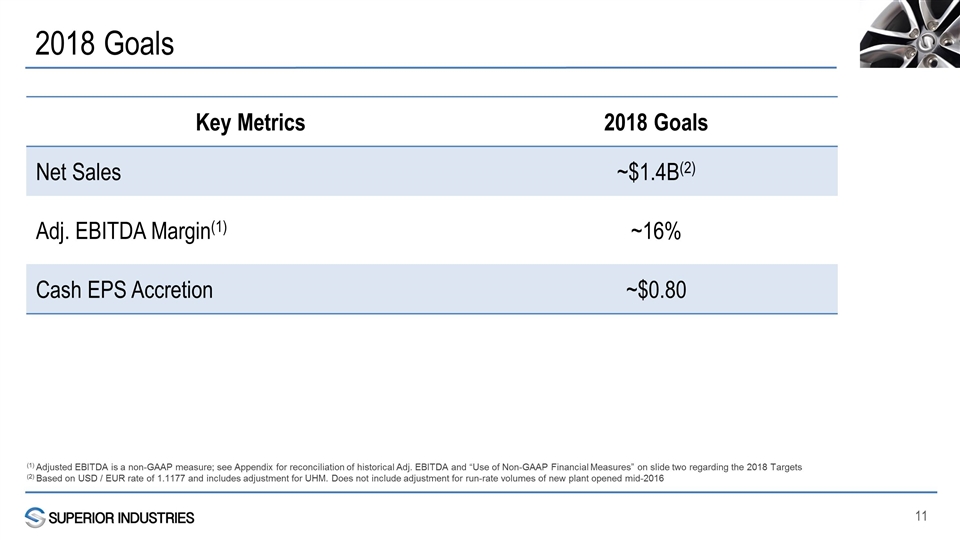

2018 Goals (1) Adjusted EBITDA is a non-GAAP measure; see Appendix for reconciliation of historical Adj. EBITDA and “Use of Non-GAAP Financial Measures” on slide two regarding the 2018 Targets (2) Based on USD / EUR rate of 1.1177 and includes adjustment for UHM. Does not include adjustment for run-rate volumes of new plant opened mid-2016 Key Metrics 2018 Goals Net Sales ~$1.4B(2) Adj. EBITDA Margin(1) ~16% Cash EPS Accretion ~$0.80

Appendix

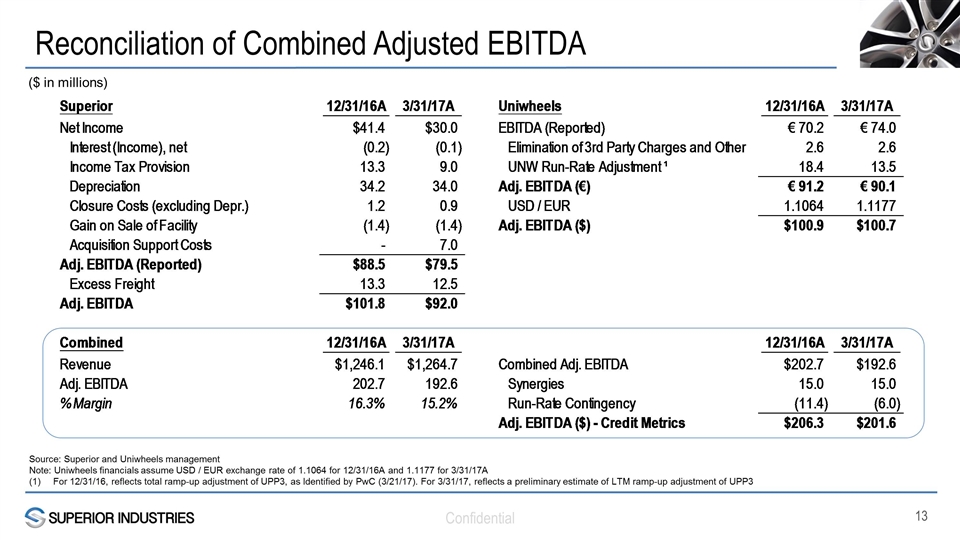

Reconciliation of Combined Adjusted EBITDA Confidential Source: Superior and Uniwheels management Note: Uniwheels financials assume USD / EUR exchange rate of 1.1064 for 12/31/16A and 1.1177 for 3/31/17A For 12/31/16, reflects total ramp-up adjustment of UPP3, as Identified by PwC (3/21/17). For 3/31/17, reflects a preliminary estimate of LTM ramp-up adjustment of UPP3 1 ($ in millions)

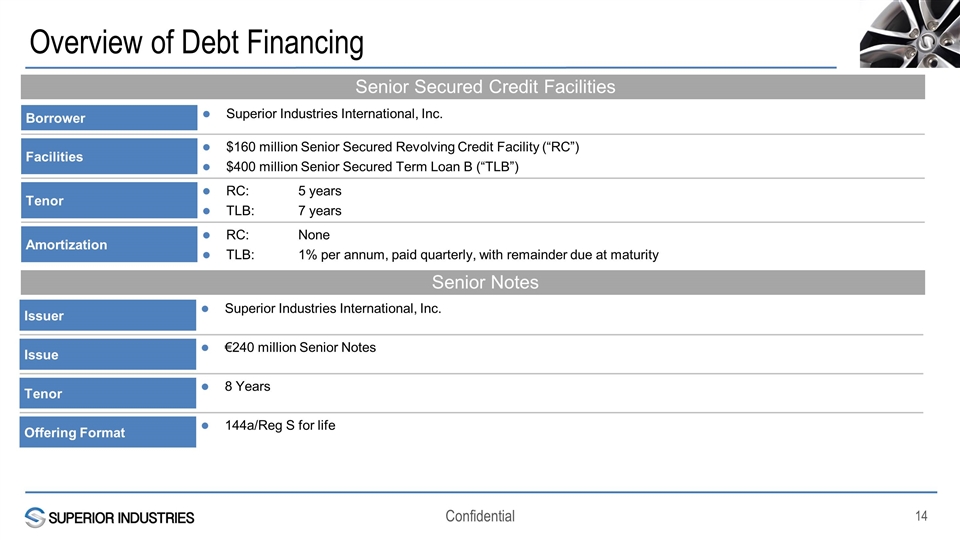

Overview of Debt Financing Confidential Borrower Superior Industries International, Inc. Facilities $160 million Senior Secured Revolving Credit Facility (“RC”) $400 million Senior Secured Term Loan B (“TLB”) Tenor RC:5 years TLB:7 years Amortization RC:None TLB:1% per annum, paid quarterly, with remainder due at maturity Senior Secured Credit Facilities Senior Notes Issuer Superior Industries International, Inc. Issue €240 million Senior Notes Tenor 8 Years Offering Format 144a/Reg S for life

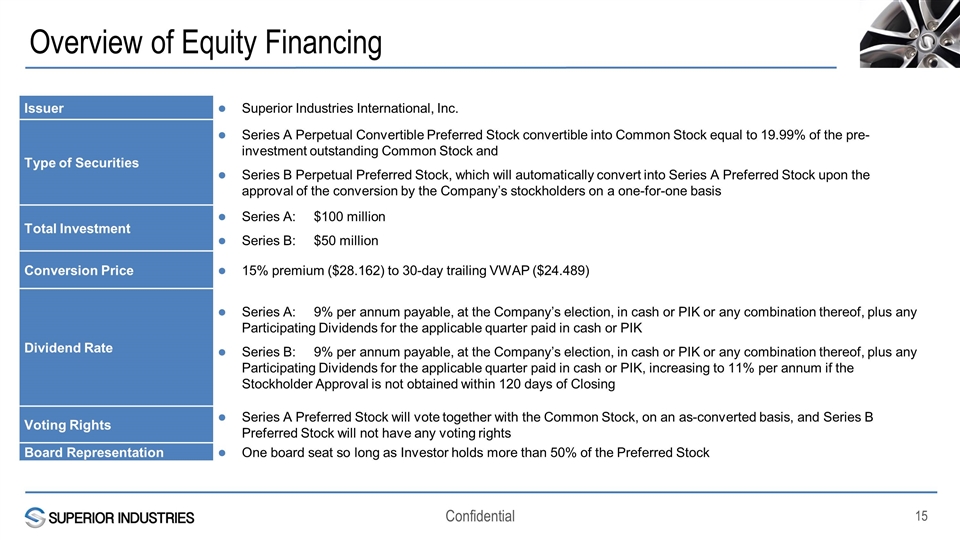

Overview of Equity Financing Confidential Issuer Superior Industries International, Inc. Type of Securities Series A Perpetual Convertible Preferred Stock convertible into Common Stock equal to 19.99% of the pre-investment outstanding Common Stock and Series B Perpetual Preferred Stock, which will automatically convert into Series A Preferred Stock upon the approval of the conversion by the Company’s stockholders on a one-for-one basis Total Investment Series A:$100 million Series B: $50 million Conversion Price 15% premium ($28.162) to 30-day trailing VWAP ($24.489) Dividend Rate Series A:9% per annum payable, at the Company’s election, in cash or PIK or any combination thereof, plus any Participating Dividends for the applicable quarter paid in cash or PIK Series B: 9% per annum payable, at the Company’s election, in cash or PIK or any combination thereof, plus any Participating Dividends for the applicable quarter paid in cash or PIK, increasing to 11% per annum if the Stockholder Approval is not obtained within 120 days of Closing Voting Rights Series A Preferred Stock will vote together with the Common Stock, on an as-converted basis, and Series B Preferred Stock will not have any voting rights Board Representation One board seat so long as Investor holds more than 50% of the Preferred Stock