Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - SUPERIOR INDUSTRIES INTERNATIONAL INC | d525981dex312.htm |

| EX-32.1 - EX-32.1 - SUPERIOR INDUSTRIES INTERNATIONAL INC | d525981dex321.htm |

| EX-31.1 - EX-31.1 - SUPERIOR INDUSTRIES INTERNATIONAL INC | d525981dex311.htm |

| EX-23 - EX-23 - SUPERIOR INDUSTRIES INTERNATIONAL INC | d525981dex23.htm |

| EX-21 - EX-21 - SUPERIOR INDUSTRIES INTERNATIONAL INC | d525981dex21.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

Commission file number: 1-6615

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 95-2594729 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| 26600 Telegraph Road, Suite 400 Southfield, Michigan |

48033 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s Telephone Number, Including Area Code: (248) 352-7300

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $0.01 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if the disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☒ | |||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the registrant’s $0.01 par value common equity held by non-affiliates as of the last business day of the registrant’s most recently completed second quarter was $486,960,608, based on a closing price of $19.55. On February 28, 2018, there were 24,917,025 shares of common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s 2018 Proxy Statement, to be filed with the Securities and Exchange Commission within 120 days after the close of the registrant’s fiscal year, are incorporated by reference into Part III of this Form 10-K.

Table of Contents

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

ANNUAL REPORT ON FORM 10-K

| PART I | PAGE | |||||

| Item 1 | 1 | |||||

| Item 1A | 7 | |||||

| Item 1B | 20 | |||||

| Item 2 | 20 | |||||

| Item 3 | 20 | |||||

| Item 4 | 20 | |||||

| Item 4A | 21 | |||||

| PART II |

||||||

| Item 5 | 23 | |||||

| Item 6 | 25 | |||||

| Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

27 | ||||

| Item 7A | 49 | |||||

| Item 8 | 52 | |||||

| Item 9 | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure. |

103 | ||||

| Item 9A | 103 | |||||

| Item 9B | 104 | |||||

| PART III |

||||||

| Item 10 | 105 | |||||

| Item 11 | 105 | |||||

| Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. |

105 | ||||

| Item 13 | Certain Relationships and Related Transactions, and Director Independence. |

105 | ||||

| Item 14 | 105 | |||||

| PART IV |

||||||

| Item 15 | 106 | |||||

| Schedule II | 110 | |||||

| SIGNATURES |

||||||

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements made by us or on our behalf. We have included or incorporated by reference in this Annual Report on Form 10-K (including in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”) and from time to time our management may make statements that may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Exchange Act of 1933 and Section 21E of the Securities Act of 1934. These forward-looking statements are based upon management’s current expectations, estimates, assumptions and beliefs concerning future events and conditions and may discuss, among other things, anticipated future performance (including sales and earnings), expected growth, future business plans and costs and potential liability for environmental-related matters. Any statement that is not historical in nature is a forward-looking statement and may be identified by the use of words and phrases such as “expects,” “anticipates,” “believes,” “will,” “will likely result,” “will continue,” “plans to” and similar expressions. These statements include our belief regarding general automotive industry and market conditions and growth rates, as well as general domestic and international economic conditions.

Readers are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements are necessarily subject to risks, uncertainties and other factors, many of which are outside the control of the company, which could cause actual results to differ materially from such statements and from the company’s historical results and experience. These risks, uncertainties and other factors include, but are not limited to, those described in Part I, Item 1A, “Risk Factors” and Part II - Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Annual Report on Form 10-K and elsewhere in the Annual Report and those described from time to time in our other reports filed with the Securities and Exchange Commission.

Readers are cautioned that it is not possible to predict or identify all of the risks, uncertainties and other factors that may affect future results and that the risks described herein should not be considered to be a complete list. Any forward-looking statement speaks only as of the date on which such statement is made, and the company undertakes no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Table of Contents

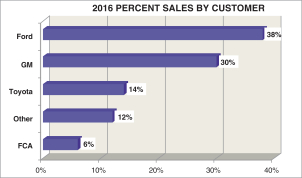

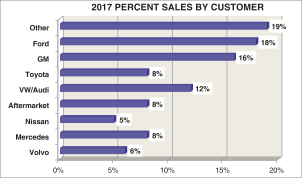

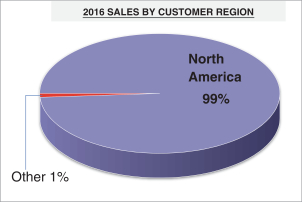

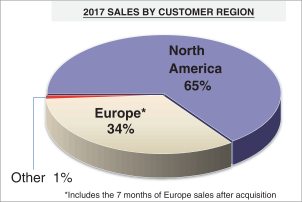

Description of Business and Industry

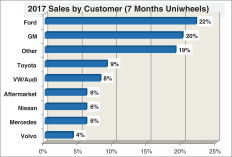

The principal business of Superior Industries International, Inc. (referred to herein as the “company” or “we,” “us” and “our”) is the design and manufacture of aluminum wheels for sale to original equipment manufacturers (“OEMs”) and aftermarket customers. We believe we are the #1 North American aluminum wheel supplier, the #3 European OEM supplier and #1 European aftermarket supplier. Our OEM aluminum wheels are primarily sold for factory installation, as either standard equipment or optional equipment, on approximately 180 vehicle models manufactured by Audi, BMW, Fiat Chrysler Automobiles N.V. (“FCA”), Ford, General Motors (“GM”), Jaguar-Land Rover, Mercedes-Benz, Mitsubishi, Nissan, Subaru, Tesla, Toyota, Volkswagen and Volvo. North America and Europe represent the principal markets for our products but we have a global presence and opportunities with North American, European and Asian OEMs. The following chart below included twelve months of proforma sales for our European operations for informational purposes. All of the other charts in this document include seven months of sales for our European operations, which aligns with the acquisition date. On May 30, 2017, we acquired a majority interest in Uniwheels AG (“Uniwheels”), which is also referred to as our “European operations.”

|

CUSTOMER SALES PERCENTAGES FOR 2016 AND 2017 ASSUMING 12 MONTHS OF UNIWHEELS

|

|

|

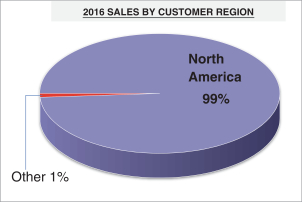

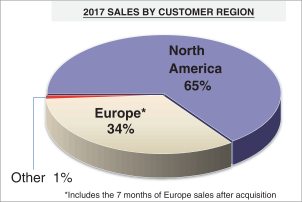

With the acquisition of our European operations in 2017, we diversified our customer base from predominately North American to include Europe and North America. The following chart demonstrates the shift in diversification of our business from 2016 to 2017.

|

DIVERSIFICATION

|

|

|

1

Table of Contents

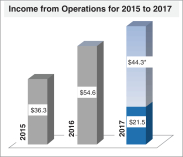

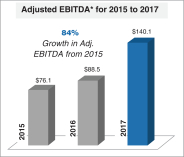

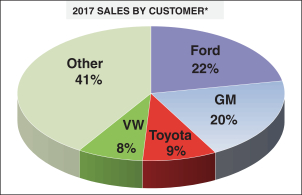

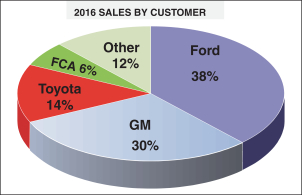

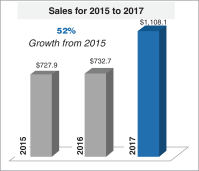

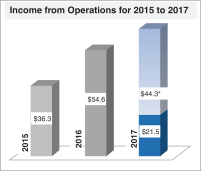

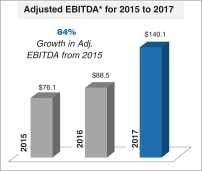

Uniwheels is a European supplier of OEM aluminum wheels and also a supplier of European aftermarket aluminum wheels. As a result of the acquisition, we have expanded into the European market, broadened our product portfolio and acquired a significant customer share with European OEMs, including Audi, Jaguar-Land Rover, Mercedes Benz and Volvo. The acquisition is not only complementary in terms of customers, market coverage and product offerings but also very much aligned with our strategic direction with a focus on larger diameter wheels, premium finishes, luxury brands and specialty wheels for high performance motorsport racing vehicles, all providing enhanced opportunity for higher value added business. With the acquisition, our global reach encompasses sales to nine of the ten largest OEMs in the world with sales surpassing $1.1 billion. The following charts show key highlights of 2017 and sales by major customer based on seven months of Uniwheels. The chart includes net income from operations and Adjusted EBITDA, which is a key metric we use to measure operating performance but is not calculated according to GAAP.

|

SALES BY CUSTOMER AND PROFITABILITY

|

|

|

| ||

| * Income from operations in 2017 includes $44.3 million in costs related to acquisition costs and integration costs. |

* See the Non-GAAP Financial Measures section of this annual report for a reconciliation of our Adjusted EBIDA to income from operations. |

Historically, the focus of the Company was on providing wheels for relatively high-volume programs with lower degrees of competitive differentiation. In order to improve our strategic position and better serve our customers, we are augmenting our product portfolio with wheels containing higher technical content and greater differentiation. We believe this direction is consistent with current trends in the market and needs of our customers. To achieve this objective, we have invested and continue to invest in new manufacturing capabilities in order to produce more sophisticated finishes and larger diameter products, which typically provide higher value in the market. The acquisition of our European operations and the construction of a new finishing facility align with this strategic mission. We have constructed a physical vapor deposition (“PVD”) finishing facility, which we believe will establish us as the first OEM automotive wheel manufacturer to have this capability in-house in North America and Europe. PVD is a wheel coating process that creates bright chrome-like surfaces in an environmentally friendly manner.

Demand for our products is mainly driven by light-vehicle production levels in North America and Europe. The North American light-vehicle production level in 2017 was 17.0 million vehicles, a 4.7 percent decrease from 2016. Despite this decrease, the 2017 North American production level was one of the highest in the history of the industry. In Europe, the passenger car and light duty truck vehicle production level in 2017 was 18.7 million vehicles, a 0.3 percent increase over 2016. We track annual production rates based on information from Ward’s Automotive Group, as well as other sources. The majority of our customers’ wheel programs are awarded to suppliers two or three years in advance. Our purchase orders with OEMs are typically specific to a particular vehicle model.

Raw Materials

The raw materials used in manufacturing our products are readily available and are obtained through numerous suppliers with whom we have established trade relations. Purchased aluminum accounted for the vast majority of

2

Table of Contents

our total raw material requirements during 2017. Our aluminum requirements are met through purchase orders with major producers, with physical supply primarily obtained from in-country production locations. Generally, aluminum purchase orders are fixed as to minimum and maximum quantities, which the producers must supply and we must purchase during the term of the orders. During 2017, we were able to successfully secure aluminum commitments from our primary suppliers to meet production requirements, and we anticipate being able to source aluminum requirements to meet our expected level of production in 2018. We procure other raw materials through numerous suppliers with whom we have established trade relationships. We also enter into commodity forward contracts and swaps covering up to twelve months aftermarket production volume in which the aluminum price is linked to the London Metal Exchange (LME) index. Moreover, in both our North American and European businesses, OEM wheel sale prices are adjusted for fluctuating aluminum commodity prices based on changes in commodity indices.

When market conditions warrant, we may also enter into purchase commitments to secure the supply of certain commodities used in the manufacture of our products, such as aluminum, natural gas and other raw materials.

Customer Dependence

We have proven our ability to be a consistent producer of high quality aluminum wheels with the capability to meet our customers’ price, quality, delivery and service requirements. We strive to continually enhance our relationships with our customers through continuous improvement programs, not only through our manufacturing operations but in the engineering, design, development and quality areas as well. These key business relationships have resulted in multiple vehicle supply contract awards with our key customers in the past few years.

Ford and GM were our only customers individually accounting for more than 10 percent of our consolidated trade sales in 2017. Net sales to these customers, as well as Toyota, in 2017, 2016 and 2015 were as follows (dollars in millions):

| 2015 | 2016 | 2017 | ||||||||||||||||||||||

| Percent of Net Sales |

Dollars | Percent of Net Sales |

Dollars | Percent of Net Sales |

Dollars | |||||||||||||||||||

| Ford |

44 | % | $ | 315.1 | 38 | % | $ | 271.4 | 22 | % | $ | 248.8 | ||||||||||||

| GM |

24 | % | $ | 175.6 | 30 | % | $ | 216.4 | 20 | % | $ | 217.5 | ||||||||||||

| Toyota |

14 | % | $ | 104.5 | 14 | % | $ | 98.4 | 9 | % | $ | 103.8 | ||||||||||||

In addition, sales to Nissan and Volkswagen Group (“VW”), which includes Audi, exceeded 5 percent of sales during 2017, and sales to Mercedes and Volvo for the seven months following the acquisition of Uniwheels exceeded 5 percent during 2017 on an annualized basis. The loss of all or a substantial portion of our sales to Ford, GM, Toyota, Nissan, VW, Mercedes or Volvo would have a significant adverse effect on our financial results. See also Item 1A, “Risk Factors” of this Annual Report.

Foreign Operations

We manufacture a significant portion of our North American products in Mexico that are sold both in the United States and Mexico. Net sales of wheels manufactured in our Mexico operations in 2017 totaled $608.0 million and represented 83.0 percent of our total net sales in North America. We anticipate that the portion of our products produced in Mexico versus the United States will remain comparable in 2018. Net property, plant and equipment used in our operations in Mexico totaled $214.5 million at December 31, 2017. The overall cost for us to manufacture wheels in Mexico currently is lower than in the United States, due to lower labor costs as a result of lower prevailing wage rates.

Similarly, we manufacture the majority of our products for the European market in Poland, which are sold throughout Europe. Net sales of wheels manufactured in our Poland operations for the seven months following

3

Table of Contents

the acquisition were $220.4 million and represented 58.7 percent of our total net sales in Europe in 2017. Net property, plant and equipment used in our operations in Poland totaled $227.3 million at December 31, 2017. Similar to our Mexican operations, the overall cost to manufacture wheels in Poland is substantially lower than in both the United States and Germany at the present time due principally to lower labor costs.

Cost of manufacturing our product in Mexico, Germany and Poland may be affected by changes in cost structures, tariffs imposed by the United States, trade protection laws, policies and other regulations affecting trade and investments, social, political, labor, or general economic conditions. Other factors that can affect the business and financial results of our Mexican, German, Polish and U.S. operations include, but are not limited to, currency effects of the Peso, Euro and Zloty currencies, availability and competency of personnel and tax regulations. See also Item 1A, “Risk Factors - Our international operations and international trade agreements make us vulnerable to risks associated with doing business in foreign countries that can affect our business, financial condition and results of operations” and Item 1A, “Risk Factors - Fluctuations in foreign currencies may adversely impact our financial condition.”

Net Sales Backlog

Our customers typically award programs several years before actual production is scheduled to begin. Each year, the automotive manufacturers introduce new models, update existing models and discontinue certain models. In this process, we may be selected as the supplier on a new model, we may continue as the supplier on an updated model or we may lose a new or updated model to a competitor. The Company’s estimated net sales may be impacted by various assumptions, including new program vehicle production levels, customer price reductions, currency exchange rates and program launch timing. Our customers may terminate the awarded programs at any time or reduce order levels. Therefore, expected net sales information does not represent firm commitments or firm orders. We estimate that we have been awarded programs covering approximately 89 percent of our manufacturing capacity over the next three years.

Competition

Competition in the market for aluminum wheels is based primarily on delivery, overall customer service, price, quality and technology. We are the largest producer of aluminum wheels for OEM installations in North America and one of the largest in Europe. We currently supply approximately 20 percent and 14 percent of the aluminum wheels installed on passenger cars and light-duty trucks in North America and Europe, respectively.

Competition is global in nature with a significant volume of exports from Asia into North America. There are several competitors with facilities in North America but we estimate that we have more than twice the North American production capacity of any competitor. Some of the key competitors in North America include Central Motor Wheel of America (“CMWA”), CITIC Dicastal Co., Ltd., Prime Wheel Corporation, and Ronal. In 2017, the European Union renewed a tariff on aluminum wheels from China, which lessens the competitive pressures from Chinese competitors in that market. Key European competitors include Ronal (Switzerland), Borbet (Germany) and CMS (Turkey). The accessories market, by contrast, is heavily fragmented. We are the leading manufacturer of alloy wheels in the European aftermarket. Key competitors include Alcar (Austria), Brock (Germany), Borbet (Germany), ATU (Germany) and Mak (Italy). See also Item 1A, “Risk Factors” of this Annual Report.

Steel and other types of wheels also compete with our products. According to Ward’s Automotive Group, the aluminum wheel penetration rate on passenger cars and light-duty trucks in North America was 87 percent for the 2017 model year and 81 percent for the 2016 model year, compared to 79 percent for the 2015 model year. The aluminum wheel penetration rate on passenger cars and light-duty trucks in Europe was 70 percent in 2017. We expect the aluminum wheel penetration rate to continue to increase. However, several factors can affect this rate including price, fuel economy requirements and styling preference. Although aluminum wheels currently are more costly than steel, aluminum is a lighter material than steel, which is desirable for fuel efficiency and generally viewed as aesthetically superior to steel and, thus, more desirable to the OEMs and their customers.

4

Table of Contents

Research and Development

Our policy is to continuously review, improve and develop our engineering capabilities to satisfy our customer requirements in the most efficient and cost-effective manner available. We strive to achieve this objective by attracting and retaining top engineering talent and by maintaining the latest state-of-the-art computer technology to support engineering development. Fully developed engineering centers located in Fayetteville, Arkansas, and in Lüdenscheid, Germany support our research and development manufacturing needs. We also have a technical sales function at our corporate headquarters in Southfield, Michigan that maintains a complement of engineering staff located near some of our largest customers’ headquarters and engineering and purchasing offices.

Research and development costs (primarily engineering and related costs), which are expensed as incurred, are included in cost of sales in our consolidated income statements. Research and development costs during each of the last three years were $7.7 million in 2017, $3.8 million in 2016 and $2.6 million in 2015.

Government Regulation

Safety standards in the manufacture of vehicles and automotive equipment have been established under the National Traffic and Motor Vehicle Safety Act of 1966, as amended. We believe that we are in compliance with all federal standards currently applicable to OEM suppliers and to automotive manufacturers.

Environmental Compliance

Our manufacturing facilities, like most other manufacturing companies, are subject to solid waste, water and air pollution control standards mandated by federal, state and local laws. Violators of these laws are subject to fines and, in extreme cases, plant closure. We believe our facilities are in material compliance with all presently applicable standards. However, costs related to environmental protection may grow due to increasingly stringent laws and regulations. The cost of environmental compliance was approximately $0.6 million in 2017, $0.4 million in 2016 and $0.7 million in 2015. We expect that future environmental compliance expenditures will approximate these levels and will not have a material effect on our consolidated financial position or results of operations. However, climate change legislation or regulations restricting emission of “greenhouse gases” could result in increased operating costs and reduced demand for the vehicles that use our products. See also Item 1A, “Risk Factors - We are subject to various environmental laws” of this Annual Report.

In response to climate change, the reduction of greenhouse gas emissions is on the agenda of the European authorities. As a result, the EU has made a commitment in an EU Directive to reduce emissions by at least 20 percent by the year 2020 (measured on 1990 levels). Passenger cars have been identified as a key causal factor in emissions. A central element of the regulation is an average CO2 emissions target of 95g CO2 / km per new car registration. From 2025 this target has been further tightened to an average of between 68 and 78g CO2 / km. This value should be reached by means of improvements to engine technology and innovative technologies in terms of weight reduction.

Employees

As of December 31, 2017, we had approximately 7,800 full-time employees and 350 contract employees compared to 4,189 full-time employees and 682 contract employees at December 31, 2016. None of our employees in North America are covered by a collective bargaining agreement. Uniwheels’ subsidiary, Uniwheels Production (Germany) GmbH (“UPG”), is a member of the employers’ association for the metal and electronic industry in North Rhine-Westphalia (METALL NRW Verband der Metall und Elektro-Industrie North Rhine-Westphalia e.V.) and is subject to various collective bargaining agreements for the metal and electronic industry in North Rhine-Westphalia entered into by the employers’ association with the trade union IG Metall. These collective bargaining agreements include provisions relating to wages, holidays, and partial retirement. It is estimated that approximately 410 employees of Uniwheels employed at UPG in Germany were unionized

5

Table of Contents

and/or subject to collective bargaining agreements in 2017. UPG and Uniwheels Automotive (Germany) GmbH (operating a joint workers council) operate a statutory workers council and Uniwheels Production (Poland) Sp. z o.o. (“UPP”) operates a voluntary workers council. The increase in employees in 2017 was due to the acquisition of the Uniwheels business in Europe. See Item 7, “Management’s Discussion and Analysis of Financial Conditions and Results of Operations.”

Fiscal Year End

The fiscal year of 2017 consisted of the 53-week period ended December 31, 2017 and the 2016 and 2015 fiscal years consisted of the 52-week periods ended on December 25, 2016 and December 27, 2015, respectively. Historically, our fiscal year ended on the last Sunday of the calendar year. Uniwheels, our European operation acquired on May 30, 2017, is reported on a calendar year end. These fiscal periods align as of December 31, 2017. Beginning in 2018, both our North American and European operations will be on a calendar fiscal year with each month ending on the last day of the calendar month. For convenience of presentation, all fiscal years are referred to as beginning as of January 1, and ending as of December 31, but actually reflect our financial position and results of operations for the periods described above.

Segment Information

As a result of the Uniwheels acquisition, the company expanded into the European market and extended its customer base to include the principal European OEMs. As a consequence, we have realigned our executive management structure, organization and operations to focus on our performance in our North American and European regions. Accordingly, we have concluded that our North American and European businesses represent separate operating segments in view of significantly different markets and customers within each of these regions. Financial information about our operating segments is contained in Note 6, “Business Segments” in the Notes to Consolidated Financial Statements in Item 8, “Financial Statements and Supplementary Data” of this Annual Report.

Seasonal Variations

The automotive industry is cyclical and varies based on the timing of consumer purchases of vehicles, which in turn varies based on a variety of factors such as general economic conditions, availability of consumer credit, interest rates and fuel costs. While there have been no significant seasonal variations in the past few years, production schedules in our industry can vary significantly from quarter to quarter to meet the scheduling demands of our customers. Typically, our aftermarket business experiences two seasonal peaks, which require substantially higher levels of production. The higher demand for aftermarket wheels from our customers occurs in March and September leading into the spring and winter peak consumer selling seasons.

History

We were initially incorporated in Delaware in 1969. Our entry into the OEM aluminum wheel business in 1973 resulted from our successful development of manufacturing technology, quality control and quality assurance techniques that enabled us to satisfy the quality and volume requirements of the OEM market for aluminum wheels. The first aluminum wheel for a domestic OEM customer was a Mustang wheel for Ford Motor Company. We reincorporated in California in 1994, and in 2015, we moved our headquarters from Van Nuys, California to Southfield, Michigan and reincorporated in Delaware. On May 30, 2017, we acquired a majority interest in Uniwheels, which is a European supplier of OEM and aftermarket aluminum wheels. Our stock is traded on the New York Stock Exchange under the symbol “SUP.”

Available Information

Our Annual Report on Form 10-K, quarterly reports on Form 10-Q and any amendments thereto are available, without charge, on or through our website, www.supind.com, under “Investors,” as soon as reasonably

6

Table of Contents

practicable after they are filed electronically with the Securities and Exchange Commission (“SEC”). The public may read and copy any materials filed with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website, www.sec.gov, which contains these reports, proxy and information statements and other information regarding the company. Also included on our website, www.supind.com, under “Investor,” is our Code of Conduct, which, among others, applies to our Chief Executive Officer (“CEO”), Chief Financial Officer and Chief Accounting Officer. Copies of all SEC filings and our Code of Conduct are also available, without charge, upon request from Superior Industries International, Inc., Shareholder Relations, 26600 Telegraph Road, Suite 400, Southfield, Michigan 48033.

The content on any website referred to in this Annual Report on Form 10-K is not incorporated by reference in this Annual Report on Form 10-K.

The following discussion of risk factors contains “forward-looking” statements, which may be important to understanding any statement in this Annual Report or elsewhere. The following information should be read in conjunction with Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”)” and Item 8, “Financial Statements and Supplementary Data” of this Annual Report.

Our business routinely encounters and addresses risks and uncertainties. Our business, results of operations and financial condition could be materially adversely affected by the factors described below. Discussion about the important operational risks that our business encounters can also be found in the MD&A section and in the business description in Item 1, “Business” of this Annual Report. Below, we have described our present view of the most significant risks and uncertainties we face. Additional risks and uncertainties not presently known to us, or that we currently do not consider significant, could also potentially impair our business, results of operations and financial condition. Our reactions to these risks and uncertainties as well as our competitors’ reactions will affect our future operating results.

Risks Relating to Our Company

Efforts to integrate our Europe segment, including substantial integration expenses and the additional indebtedness incurred to finance our acquisition of Uniwheels, could disrupt our business and adversely impact our stock price and future business and results of operations.

Since the acquisition of Uniwheels (now referred to as our “Europe segment,” “Europe business” or “Europe operations”) on May 30, 2017 (the “Acquisition”), we have made significant strides toward integrating the two companies. However, the continuing integration of our Europe segment with our North America segment will be a complex and time-consuming process that may not be successful. The company has a limited history of integrating a significant acquisition into its business and the integration process may produce unforeseen operating difficulties and expenditures. The primary areas of focus for successfully combining our Europe segment with our North American operations may include, among others: retaining and integrating management and other key employees; realizing overall improvement in the design, engineering, start-up and production of wheel programs; aligning customer interface across the combined business; integrating information, communications and other systems; and managing the growth of the combined company. Our integration efforts could disrupt our business in the following ways, among others, and any of the following could adversely affect our business, harm our financial condition, results of operations or business prospects:

| • | the attention of management may be directed toward the completion of the integration and other transaction-related considerations and may be diverted from the day-to-day business operations of Superior, and matters related to the Acquisition may require commitments of time and resources that could otherwise have been devoted to other opportunities that might have been beneficial to us; |

7

Table of Contents

| • | our employees may experience uncertainty regarding their future roles in the combined company, which might adversely affect our ability to retain, recruit and motivate key personnel; and |

| • | customers, suppliers and other third parties with business relationships with Superior may decide not to renew or may decide to seek to terminate, change and/or renegotiate their relationships with Superior as a result of the Acquisition, whether pursuant to the terms of their existing agreements with Superior or otherwise. |

There are a large number of processes, policies, procedures, operations, technologies and systems that must be integrated with the rest of our operations, including purchasing, accounting and finance, sales, billing, payroll, manufacturing, marketing and employee benefits. While we expect to incur integration and restructuring costs and other transaction-related costs following completion of the Acquisition that currently are estimated to range between $5.0 million and $7.0 million, many of the expenses that will be incurred, especially with respect to manufacturing operations are, by their nature, difficult to estimate accurately. These expenses could, particularly in the near term, exceed the savings that we expect to achieve from elimination of duplicative expenses and the realization of economies of scale and cost savings. Although we expect that the realization of efficiencies related to the integration of the businesses will offset incremental transaction, Acquisition-related and restructuring costs over time, we cannot give any assurance that this net benefit will be achieved in the near term, or at all.

Even if we successfully integrate our Europe segment with our North American operations, there can be no assurance that we will realize the anticipated benefits. The Acquisition is expected to result in various benefits for the combined company including, among others, business growth opportunities and synergies in operations, purchasing and administration. Increased competition and/or deterioration in business conditions may limit our ability to expand this business. As such, we may not be able to realize the synergies, business opportunities and growth prospects anticipated in connection with the Acquisition.

The automotive industry is cyclical and volatility in the automotive industry could adversely affect our financial performance.

The majority of our sales are made in European and domestic U.S. markets. Therefore, our financial performance depends largely on conditions in the European and U.S. automotive industry, which in turn can be affected significantly by broad economic and financial market conditions. Consumer demand for automobiles is subject to considerable volatility as a result of consumer confidence in general economic conditions, levels of employment, prevailing wages, fuel prices and the availability and cost of consumer credit. There can be no guarantee that the improvements in recent years will be sustained or that reductions from current production levels will not occur in future periods. Demand for aluminum wheels can be further affected by other factors, including pricing and performance comparisons to competitive materials such as steel. Finally, the demand for our products is influenced by shifts of market share between vehicle manufacturers and the specific market penetration of individual vehicle platforms being sold by our customers.

A limited number of customers represent a large percentage of our sales. The loss of a significant customer or decrease in demand could adversely affect our operating results.

Ford, GM and Toyota, together, represented 82 percent of our sales in 2016 and just more than half of our total consolidated combined sales in 2017. Despite the decrease in the combined percentage of our three largest customers in 2017, a loss of a significant customer or decrease in demand still remains a risk. Our OEM customers are not required to purchase any minimum amount of products from us. Increasingly global procurement practices, the pace of new vehicle introduction and demand for price reductions may make it more difficult to maintain long-term supply arrangements with our customers, and there are no guarantees that we will be able to negotiate supply arrangements with our customers on terms acceptable to us in the future. The contracts we have entered into with most of our customers provide that we will manufacture wheels for a particular vehicle model, rather than manufacture a specific quantity of products. Such contracts range from one

8

Table of Contents

year to the life of the model (usually three to five years), typically are non-exclusive and do not require the purchase by the customer of any minimum number of wheels from us. Therefore, a significant decrease in consumer demand for certain key models or group of related models sold by any of our major customers, or a decision by a manufacturer not to purchase from us, or to discontinue purchasing from us, for a particular model or group of models, could adversely affect our results of operations and financial condition.

We operate in a highly competitive industry.

The automotive component supply industry is highly competitive, both domestically and internationally. Competition is based on a number of factors, including price, technology, quality, delivery and overall customer service and available capacity to meet customer demands. Some of our competitors are companies, or divisions or subsidiaries of companies, which are larger and have greater financial and other resources than we do. We cannot ensure that our products will be able to compete successfully with the products of these competitors. In particular, our ability to increase manufacturing capacity typically requires significant investments in facilities, equipment and personnel. Our operating facilities are at full or near to full capacity levels which may cause us to incur labor costs at premium rates in order to meet customer requirements, experience increased maintenance expenses or require us to replace our machinery and equipment on an accelerated basis. Furthermore, the nature of the markets in which we compete has attracted new entrants, particularly from low cost countries. As a result, our sales levels and margins continue to be adversely affected by pricing pressures reflective of significant competition from producers located in low-cost foreign markets, such as China. Such competition with lower cost structures poses a significant threat to our ability to compete internationally and domestically. These factors have led to our customers awarding business to foreign competitors in the past, and they may continue to do so in the future. In addition, any of our competitors may foresee the course of market development more accurately, develop products that are superior to our products, have the ability to produce similar products at a lower cost or adapt more quickly to new technologies or evolving customer requirements. Consequently, our products may not be able to compete successfully with competitors’ products.

We experience continual pressure to reduce costs.

The vehicle market is highly competitive at the OEM level, which drives continual cost-cutting initiatives by our customers. Customer concentration, relative supplier fragmentation and product commoditization have translated into continual pressure from OEMs to reduce the price of our products. It is possible that pricing pressures beyond our expectations could intensify as OEMs pursue restructuring and cost-cutting initiatives. If we are unable to generate sufficient production cost savings in the future to offset such price reductions, our gross margin, rate of profitability and cash flows could be adversely affected. In addition, changes in OEMs’ purchasing policies or payment practices could have an adverse effect on our business. Our OEM customers typically attempt to qualify more than one wheel supplier for the programs we participate in and for programs we may bid on in the future. As such, our OEM customers are able to negotiate favorable pricing or may decrease wheel orders. Such actions may result in decreased sales volumes and unit price reductions for our company, resulting in lower revenues, gross profit, operating income and cash flows.

We may be unable to successfully implement cost-saving measures or achieve expected benefits under our plans to improve operations.

As part of our ongoing focus to provide high quality products, we continually analyze our business to further improve our operations and identify cost-cutting measures. We may be unable to successfully identify or implement plans targeting these initiatives, or fail to realize the benefits of the plans we have already implemented, as a result of operational difficulties, a weakening of the economy or other factors. Cost reductions may not fully offset decreases in the prices of our products due to the time required to develop and implement cost reduction initiatives. Additional factors such as inconsistent customer ordering patterns, increasing product complexity and heightened quality standards are making it increasingly more difficult to reduce our costs. It is possible that as we incur costs to implement improvement strategies, the impact on our financial position, results of operations and cash flow may be negative.

9

Table of Contents

Interruption in our production capabilities could result in increased freight costs or contract cancellations.

In the last six months of 2016, we experienced significant operating inefficiencies primarily in one of our manufacturing facilities. The inefficiencies stemmed from a variety of issues that reduced production rates. Contributing factors to the inefficiencies included an electricity outage and unanticipated equipment reliability issues which reduced finished goods and work-in-process inventories. We also experienced several new product launches and significant ramp-up in demand for newer products for which unusually high scrap rates were occurring. Lower than normal production yields coupled with the loss of inventory safety stock resulted in a series of expedited shipments to customers. The higher than normal costs included approximately $13 million in freight expediting costs and additional costs related to the production inefficiencies. In 2017, we were able to reduce the expedited shipping costs to less than $1 million and have made strides toward improving the production inefficiencies at this plant. However, headcount at this plant remained at elevated levels in 2017 to ensure we could meet new product launches, better serve our customers and avoid expedited shipping charges.

An interruption in production capabilities at any of our facilities as a result of equipment failure, interruption of raw materials or other supplies, labor disputes or other reasons could result in our inability to produce our products, which would reduce our sales and operating results for the affected period and harm our customer relationships. We have, from time to time, undertaken significant re-tooling and modernization initiatives at our facilities, which in the past have caused, and in the future may cause, unexpected delays and plant underutilization, and such adverse consequences may continue to occur as we continue to modernize our production facilities. In addition, we generally deliver our products only after receiving the order from the customer and thus typically do not hold large inventories. In the event of a production interruption at any of our manufacturing facilities, even if only temporary, or if we experience delays as a result of events that are beyond our control, delivery times to our customers could be severely affected. Any significant delay in deliveries to our customers could lead to premium freight costs and other performance penalties, as well as contract cancellations, and cause us to lose future sales and expose us to other claims for damages. Our manufacturing facilities are also subject to the risk of catastrophic loss due to unanticipated events such as fires, earthquakes, explosions or violent weather conditions. We have in the past, and may in the future, experience plant shutdowns or periods of reduced production which could have a material adverse effect on our results of operations or financial condition.

Similarly, it also is possible that our customers may experience production delays or disruptions for a variety of reasons, which could include supply-chain disruption for parts other than wheels, equipment breakdowns or other events affecting vehicle assembly rates that impact us, work stoppages or slow-downs at factories where our products are consumed, or even catastrophic events such as fires, disruptive weather conditions or natural disasters. Such disruptions at the customer level may cause the affected customer to halt or limit the purchase of our products.

We may be unable to successfully launch new products and/or achieve technological advances.

In order to effectively compete in the automotive supply industry, we must be able to launch new products and adopt technology to meet our customers’ demands in a timely manner. However, we cannot ensure that we will be able to install and certify the equipment needed for new product programs in time for the start of production, or that the transitioning of our manufacturing facilities and resources under new product programs will not impact production rates or other operational efficiency measures at our facilities. In addition, we cannot ensure that our customers will execute the launch of their new product programs on schedule. We are also subject to the risks generally associated with new product introductions and applications, including lack of market acceptance, delays in product development and failure of products to operate properly. Further, changes in competitive technologies may render certain of our products obsolete or less attractive. Our ability to anticipate changes in technology and to successfully develop and introduce new and enhanced products on a timely basis will be a significant factor in our ability to remain competitive. Our failure to successfully and timely launch new products or adopt new technologies, or a failure by our customers to successfully launch new programs, could adversely affect our results. We cannot ensure that we will be able to achieve the technological advances that may be necessary for us to remain competitive or that certain of our products will not become obsolete.

10

Table of Contents

Our international operations and international trade agreements make us vulnerable to risks associated with doing business in foreign countries that can affect our business, financial condition and results of operations.

We manufacture a substantial portion of our products in Mexico, Germany and Poland and we sell our products internationally. Accordingly, unfavorable changes in foreign cost structures, trade protection laws, tariffs on aluminum, regulations and policies affecting trade and investments and social, political, labor or economic conditions in a specific country or region, among other factors, could have a negative effect on our business and results of operations. Legal and regulatory requirements differ among jurisdictions worldwide. Violations of these laws and regulations could result in fines, criminal sanctions, prohibitions on the conduct of our business and damage to our reputation. Although we have policies, controls and procedures designed to ensure compliance with these laws, our employees, contractors, or agents may violate our policies.

Changes in North American and European Union (EU) social, political, regulatory and economic conditions or in laws and policies governing foreign trade, manufacturing, development and investment in the countries where we currently develop and sell products could adversely affect our business. A significant portion of our business activities are conducted in Mexico. Current leadership in the U.S. federal government is not supportive of certain existing international trade agreements, including the North American Free Trade Agreement (“NAFTA”). If the U.S. withdraws from or materially modifies NAFTA or certain other international trade agreements, our business, financial condition and results of operations could be adversely affected. In addition, proposals to institute a border adjustment of 20 percent for imports could have a negative impact on our operations.

Fluctuations in foreign currencies may adversely impact our financial condition.

Due to the growth of our operations outside of the United States, we have experienced increased exposure to foreign currency gains and losses in the ordinary course of our business. As a result, fluctuations in the exchange rate between the U.S. dollar, the Mexican peso, the Euro, the Polish Zloty and any currencies of other countries in which we conduct our business may have a material impact on our financial condition, as cash flows generated in foreign currencies may be used, in part, to service our U.S. dollar-denominated liabilities, or vice versa.

Fluctuations in foreign currency exchange rates may also affect the value of our foreign assets as reported in U.S. dollars, and may adversely affect reported earnings and, accordingly, the comparability of period-to-period results of operations. Changes in currency exchange rates may affect the relative prices at which we and our foreign competitors sell products in the same market. In addition, changes in the value of the relevant currencies may affect the cost of certain items required in our operations. We cannot ensure that fluctuations in exchange rates will not otherwise have a material adverse effect on our financial condition or results of operations or cause significant fluctuations in quarterly and annual results of operations.

Our business requires us to settle transactions between currencies in both directions - i.e., peso to U.S. dollar, Euro to U.S. Dollar, Euro to Zloty and vice versa for all transactions. To the greatest extent possible, we attempt to match the timing and magnitude of transaction settlements between currencies to create a “natural hedge.” Based on the current business model and levels of production and sales activity, the net imbalance between currencies depends on specific circumstances. While changes in the terms of the contracts with our customers will be creating an imbalance between currencies that we are hedging with foreign currency forward contracts, there can be no assurances that our hedging program will effectively offset the impact of the imbalance between currencies or that the net transaction balance will not change significantly in the future.

To manage this risk, we may enter into foreign currency forward and option contracts with financial institutions to protect against foreign exchange risks associated with certain existing assets and liabilities, certain firmly committed transactions and forecasted future cash flows. We have a program to hedge a portion of our material foreign exchange exposures, typically for up to 42 months. However, we may choose not to hedge certain foreign exchange exposures for a variety of reasons including, but not limited to, accounting considerations and the prohibitive economic cost of hedging particular exposures. There is no guarantee that our hedge program will effectively mitigate our exposures to foreign exchange changes which could have material adverse effects on our cash flows and results of operations.

11

Table of Contents

Our substantial indebtedness could adversely affect our financial condition

We have a significant amount of new indebtedness. As of December 31, 2017, our total debt was $707.9 million ($683.6 million, net of unamortized debt issuance costs of $24.3 million), and we had availability of $157.2 million under the Senior Secured Credit Facilities, as well as 30.0 million Euros under a European revolving line of credit. The interest expense on the significant amount of new indebtedness will be significantly higher than historical interest expense and could adversely affect our financial condition.

Subject to the limits contained in the Credit Agreement governing the Senior Secured Credit Facilities and the indenture governing the Notes (the “Indenture”) and our other debt instruments, we may be able to incur substantial additional debt from time to time to finance working capital, capital expenditures, investments or acquisitions, or for other purposes. If we do so, the risks related to our high level of debt could intensify.

In addition, the Indenture and the Credit Agreement governing the Senior Secured Credit Facilities contain restrictive covenants that will limit our ability to engage in activities that may be in our long-term best interest. Our failure to comply with those covenants could result in an event of default which, if not cured or waived, could result in the acceleration of all our debt.

We may not be able to generate sufficient cash to service all of our indebtedness, including the Notes, and may be forced to take other actions to satisfy our obligations under our indebtedness, which may not be successful.

Our ability to make scheduled payments or to refinance our debt obligations depends on our financial and operating performance, which is subject to prevailing economic, industry and competitive conditions and to certain financial, business, economic and other factors beyond our control. We may not be able to maintain a sufficient level of cash flow from operating activities to permit us to pay the principal, premium, if any, and interest on the Notes and our other indebtedness.

If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay capital expenditures, sell assets, seek additional capital or seek to restructure or refinance our indebtedness, including the Notes. Our ability to restructure or refinance our debt will depend on the condition of the capital and credit markets and our financial condition at such time. Any refinancing of our debt could be at higher interest rates and may require us to comply with more onerous covenants, which could further restrict our business operations and limit our financial flexibility. In addition, any failure to make payments of interest and principal on our outstanding indebtedness on a timely basis would likely result in a reduction of our credit rating, which could harm our ability to incur additional indebtedness. These alternative measures may not be successful and may not permit us to meet our scheduled debt service obligations. In the absence of such cash flows and resources, we could face substantial liquidity problems and might be required to sell material assets or operations to attempt to meet our debt service and other obligations. The Credit Agreement governing the Senior Secured Credit Facilities and the Indenture will restrict our ability to conduct asset sales and/or use the proceeds from asset sales. We may not be able to consummate these asset sales to raise capital or sell assets at prices and on terms that we believe are fair and any proceeds that we do receive may not be adequate to meet any debt service obligations then due. For more information on the Indenture, see Exhibit 4.2 to this Annual Report on Form 10-K. If we cannot meet our debt service obligations, the holders of our debt may accelerate our debt and, to the extent such debt is secured, foreclose on our assets. In such an event, we may not have sufficient assets to repay all of our debt.

The terms of the Credit Agreement governing the Senior Secured Credit Facilities and the Indenture will, and the documents governing other debt that we may incur in the future may, restrict our current and future operations, particularly our ability to respond to changes or to take certain actions.

The Indenture and the Credit Agreement governing the Senior Secured Credit Facilities, and the documents governing other debt that we may incur in the future may, contain a number of restrictive covenants that impose

12

Table of Contents

significant operating and financial restrictions on us and may limit our ability to engage in acts that may be in our long-term best interests, including restrictions on our ability to:

| • | incur additional indebtedness and guarantee indebtedness; |

| • | create or incur liens; |

| • | engage in mergers or consolidations or sell all or substantially all of our assets; |

| • | sell, transfer or otherwise dispose of assets; |

| • | make investments, acquisitions, loans or advances or other restricted payments; |

| • | pay dividends or distributions, repurchase our capital stock or make certain other restricted payments; |

| • | prepay, redeem, or repurchase any subordinated indebtedness; |

| • | designate our subsidiaries as unrestricted subsidiaries; |

| • | enter into agreements which limit the ability of our non-guarantor subsidiaries to pay dividends or make other payments to us; and |

| • | enter into certain transactions with our affiliates. |

In addition, the restrictive covenants in the Credit Agreement governing the Senior Secured Credit Facilities require us to maintain specified financial ratios and satisfy other financial condition tests to the extent subject to certain financial covenant conditions. Our ability to meet those financial ratios and tests can be affected by events beyond our control. We may not meet those ratios and tests.

A breach of the covenants or restrictions under the Indenture governing the Notes or under the Credit Agreement governing the Senior Secured Credit Facilities could result in an event of default under the applicable indebtedness. Such a default may allow the creditors under such facility to accelerate the related debt, which may result in the acceleration of any other debt to which a cross-acceleration or cross-default provision applies. In addition, an event of default under the Credit Agreement governing our Senior Secured Credit Facilities would permit the lenders under our revolving credit facility to terminate all commitments to extend further credit under that facility. Furthermore, if we were unable to repay the amounts due and payable under the Senior Secured Credit Facilities, those lenders could proceed against the collateral granted to them to secure that indebtedness. We have pledged substantially all of our assets as collateral under the Senior Secured Credit Facilities. In the event our lenders or holders of the Notes accelerate the repayment of our borrowings, we may not have sufficient assets to repay that indebtedness or be able to borrow sufficient funds to refinance it. Even if we are able to obtain new financing, it may not be on commercially reasonable terms or on terms acceptable to us. As a result of these restrictions, we may be:

| • | limited in how we conduct our business; |

| • | unable to raise additional debt or equity financing to operate during general economic or business downturns; or |

| • | unable to compete effectively or to take advantage of new business opportunities. These restrictions, along with restrictions that may be contained in agreements evidencing or governing other future indebtedness, may affect our ability to grow or pursue other important initiatives in accordance with our growth. |

Our variable rate indebtedness subjects us to interest rate risk, which could cause our debt service obligations to increase significantly.

Borrowings under our Senior Secured Credit Facilities are at variable rates of interest and expose us to interest rate risk. If interest rates increase, our debt service obligations on the variable rate indebtedness could increase even though the amount borrowed remains the same, and our net income and cash flows, including cash available

13

Table of Contents

for servicing our indebtedness, would correspondingly decrease. As of December 31, 2017, approximately $386.8 million of our debt was variable rate debt. Our anticipated annual interest expense on $386.8 million variable rate debt at the current rate of 6.05 percent would be $23.4 million. In the future, we may enter into interest rate swaps that involve the exchange of floating for fixed rate interest payments in order to reduce interest rate volatility. However, we may not maintain interest rate swaps with respect to all of our variable rate indebtedness, and any swaps we enter into may not fully mitigate our interest rate risk.

We are subject to taxation related risks in multiple jurisdictions.

We are a U.S.-based multinational company subject to tax in multiple U.S. and foreign tax jurisdictions. Significant judgment is required in determining our global provision for income taxes, deferred tax assets or liabilities and in evaluating our tax positions on a worldwide basis. While we believe our tax positions are consistent with the tax laws in the jurisdictions in which we conduct our business, it is possible that these positions may be overturned by jurisdictional tax authorities, which may have a significant impact on our global provision for income taxes. Tax laws are dynamic and subject to change as new laws are passed and new interpretations of the law are issued or applied. We are also subject to ongoing tax audits. These audits can involve complex issues, which may require an extended period of time to resolve and can be highly subjective. Tax authorities may disagree with certain tax reporting positions taken by us and, as a result, assess additional taxes against us. We regularly assess the likely outcomes of these audits in order to determine the appropriateness of our tax provision.

On December 22, 2017, the Tax Cuts and Jobs Act (the “Tax Reform”) was signed into law. The newly enacted Tax Reform, among other things, contains significant changes to corporate taxation, including the reduction of the corporate tax rate from 35 percent to 21 percent, a one-time transition tax on offshore earnings at reduced tax rates regardless of whether earnings are repatriated, the elimination of U.S. tax on foreign dividends (subject to certain important exceptions), new taxes on certain foreign earnings, a new minimum tax related to payments to foreign subsidiaries and affiliates, immediate deductions for certain new investments and the modification or repeal of many business deductions and credits.

The changes effected by the Tax Reform required us to remeasure existing net deferred tax liabilities using the lower rate in the period of enactment. We have reported provisional amounts for the income tax effects of Tax Reform for which the accounting is incomplete but a reasonable estimate could be determined. Based on a continued analysis of the estimates and further guidance on the application of the law, it is anticipated that additional revisions may occur throughout the allowable measurement period.

In addition, governmental tax authorities are increasingly scrutinizing the tax positions of companies. Many countries in the European Union, as well as a number of other countries and organizations such as the Organization for Economic Cooperation and Development, are actively considering changes to existing tax laws that, if enacted, could increase our tax obligations in countries where we do business. The impact of tax reform in the US or other foreign tax law changes could result in an overall tax rate increase to our business.

Increases in the costs and restrictions on availability of raw materials could adversely affect our operating margins and cash flow.

Generally, we obtain our raw materials, supplies and energy requirements from various sources. Although we currently maintain alternative sources, our business is subject to the risk of price increases and periodic delays in delivery. Fluctuations in the prices of raw materials may be driven by the supply/demand relationship for that commodity or governmental regulation. In addition, if any of our suppliers seek bankruptcy relief or otherwise cannot continue their business as anticipated, the availability or price of raw materials could be adversely affected.

Although we are able to periodically pass certain aluminum cost increases on to our customers, we may not be able to pass along all changes in aluminum costs, or there may be a delay in passing the aluminum costs onto our

14

Table of Contents

customers. Our customers are not obligated to accept energy or other supply cost increases that we may attempt to pass along to them. This inability to pass on these cost increases to our customers could adversely affect our operating margins and cash flow, possibly resulting in lower operating income and profitability.

Aluminum and alloy pricing may have a material effect on our operating margins and results of operations.

The cost of aluminum is a significant component in the overall cost of a wheel and in our selling prices to OEM customers. The price for aluminum we purchase is adjusted monthly based primarily on changes in certain published market indices, but the timing of such adjustments is based on specific customer agreements and can vary from monthly to quarterly. As a result, the timing of aluminum price adjustments flowing through sales rarely will match the timing of such changes in cost and can result in fluctuations to our gross profit. This is especially true during periods of frequent increases or decreases in the market price of aluminum.

The aluminum we use to manufacture wheels also contains additional alloy materials, including silicon. The cost of alloying materials also is a component of the overall cost of a wheel. The price of the alloys we purchase is also based on certain published market indices; however, most of our customer agreements do not provide price adjustments for changes in market prices of alloying materials. Increases or decreases in the market prices of these alloying materials could have a material effect on our operating margins and results of operations.

There is a risk of discontinuation of anti-dumping duty from China which may increase the competitive pressure from Chinese producers, primarily in the aftermarket.

In 2010, the European Commission imposed provisional anti-dumping duties of 22.3 percent on imports of aluminum road wheels from China after a complaint of unfair competition from European manufacturers. The European Commission argued that the EU manufacturers had suffered a significant decrease in production and sales, and a loss of market share, as well as price depression due to cheaper imports from China. On January 23, 2017, the European Commission decided to maintain the anti-dumping duties (Commission Implementing Regulation (EU) 2017/109) for another five year period. The anti-dumping duties protect the EU producers until January 24, 2022. After this date, the competitive pressures from Chinese producers, which have cost advantages, primarily in the aftermarket, may adversely affect the company’s assets, financial condition and results of operations or prospects.

We are subject to various environmental laws.

We incur costs to comply with applicable environmental, health and safety laws and regulations in the ordinary course of our business. We cannot ensure that we have been or will be at all times in complete compliance with such laws and regulations. Failure to be in compliance with such laws and regulations could result in material fines or sanctions. Additionally, changes to such laws or regulations may have a significant impact on our cash flows, financial condition and results of operations.

We are also subject to various foreign, federal, state and local environmental laws, ordinances and regulations, including those governing discharges into the air and water, the storage, handling and disposal of solid and hazardous wastes, the remediation of soil and groundwater contaminated by hazardous substances or wastes and the health and safety of our employees. The nature of our current and former operations and the history of industrial uses at some of our facilities expose us to the risk of liabilities or claims with respect to environmental and worker health and safety matters which could have a material adverse effect on our financial health. In addition, some of our properties are subject to indemnification and/or cleanup obligations of third parties with respect to environmental matters. However, in the event of the insolvency or bankruptcy of such third parties, we could be required to bear the liabilities that would otherwise be the responsibility of such third parties.

Further, changes in legislation or regulation imposing reporting obligations on, or limiting emissions of greenhouse gases from, or otherwise impacting or limiting our equipment and operations or from the vehicles that use our products could adversely affect demand for those vehicles or require us to incur costs to become compliant with such regulations.

15

Table of Contents

We are from time to time subject to litigation, which could adversely impact our financial condition or results of operations.

The nature of our business exposes us to litigation in the ordinary course of our business. We are exposed to potential product liability and warranty risks that are inherent in the design, manufacture and sale of automotive products, the failure of which could result in property damage, personal injury or death. Accordingly, individual or class action suits alleging product liability or warranty claims could result. Although we currently maintain what we believe to be suitable and adequate product liability insurance in excess of our self-insured amounts, we cannot assure you that we will be able to maintain such insurance on acceptable terms or that such insurance will provide adequate protection against potential liabilities. In addition, if any of our products prove to be defective, we may be required to participate in a recall. A successful claim brought against us in excess of available insurance coverage, if any, or a requirement to participate in any product recall, could have a material adverse effect on our results of operations or financial condition. We cannot give assurance that any current or future claims will not adversely affect our cash flows, financial condition or results of operations.

Our business involves extensive product development activities leading to the creation of new products. In the case of new products, there is a risk that wheels under development may not be ready by the start of production (“SOP”) and/or may fail to meet the customer’s specifications. In any such case, warranty or compensation claims might be raised, or litigation might be commenced, against the company. Moreover, the company could lose its reputation of an entrepreneur actively developing new and innovative solutions, which in turn could affect the volume of orders, particularly orders for new designs.

Moreover, there are risks related to civil liability under supply contracts (civil liability clauses in contracts with customers, contractual risks related to civil liability for causing delay in production launch, etc.). If we fail to ensure production launch as and when required by the customer, thus jeopardizing production processes at the customer’s facilities, this could lead to increased costs, giving rise to recourse claims against, or causing loss of orders by the company. This could also have an adverse effect on our assets, financial condition, results of operations or prospects.

We may be unable to attract and retain key personnel.

Our success depends, in part, on our ability to attract, hire, train and retain qualified managerial, engineering, sales and marketing personnel. We face significant competition for these types of employees in our industry. We may be unsuccessful in attracting and retaining the personnel we require to conduct our operations successfully. In addition, key personnel may leave us and compete against us. Our success also depends to a significant extent on the continued service of our senior management team. We may be unsuccessful in replacing key managers who either resign or retire. The loss of any member of our senior management team or other experienced senior employees could impair our ability to execute our business plans and strategic initiatives, cause us to lose customers and experience reduced net sales, or lead to employee morale problems and/or the loss of other key employees. In any such event, our financial condition, results of operations, internal control over financial reporting or cash flows could be adversely affected.

Furthermore, in order to remain competitive and retain our Europe segment employees, the company may be forced to increase its labor costs at a faster pace than it historically has done. Labor costs represent a considerable part of the cost of our Europe segment’s products. Though the workforce currently costs less in Poland than in other EU member states, the difference should decrease over time as the Polish economy is catching up with the average of the EU.

If the company fails to attract an adequate number of qualified employees and to retain such employees at salaries prevailing in the industry and increase labor efficiency and effectiveness (particularly with respect to our Europe segment’s manufacturing and production in Poland and Germany), this may have a material adverse effect on the company’s assets, financial condition, results of operations or prospects.

16

Table of Contents

We may be unable to maintain effective internal control over financial reporting.

Management is responsible for establishing and maintaining adequate internal control over financial reporting. Many of our key controls rely on maintaining personnel with an appropriate level of accounting knowledge, experience and training in the application of U.S. GAAP in order to operate effectively. Material weaknesses or deficiencies may cause our financial statements to contain material misstatements, unintentional errors or omissions and late filings with regulatory agencies may occur. As part of the integration, we will be aligning the control framework in 2018 to ensure our Europe segment has adequate internal control over financial reporting, as such term is defined in Exchange Act Rule 13a-15(f). If the Europe segment is unable to implement the control framework in 2018, we will not have adequate control over financial reporting for the consolidated company.

A disruption in our information technology systems, including a disruption related to cybersecurity, could adversely affect our financial performance.