Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K ANNUAL MEETING RESULTS - MIDSOUTH BANCORP INC | midsouth-form8xkxsharehold.htm |

Annual Shareholder Meeting

May 24, 2017

2

Certain statements contained herein are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933

and Section 21E of the Securities Exchange Act of 1934 and subject to the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995, which involve risks and uncertainties. These statements include, among others, the expected performance of

new hires, performance in non-energy related lending, expected loan loss provision and other financial results.

Actual results may differ materially from the results anticipated in these forward-looking statements. Factors that might cause such a

difference include, among other matters, changes in interest rates and market prices that could affect the net interest margin, asset

valuation, and expense levels; changes in local economic and business conditions, including, without limitation, changes related to the

oil and gas industries, that could adversely affect customers and their ability to repay borrowings under agreed upon terms, adversely

affect the value of the underlying collateral related to their borrowings, and reduce demand for loans; the timing and ability to reach

any agreement to restructure nonaccrual loans; increased competition for deposits and loans which could affect compositions, rates

and terms; the timing and impact of future acquisitions, the success or failure of integrating operations, and the ability to capitalize on

growth opportunities upon entering new markets; loss of critical personnel and the challenge of hiring qualified personnel at

reasonable compensation levels; legislative and regulatory changes, including changes in banking, securities and tax laws and

regulations and their application by our regulators, changes in the scope and cost of FDIC insurance and other coverage; and other

factors discussed under the heading “Risk Factors” in MidSouth’s Annual Report on Form 10-K for the year ended December 31, 2016

filed with the SEC on March 16, 2017 and in its other filings with the SEC.

MidSouth does not undertake any obligation to publicly update or revise any of these forward-looking statements, whether to reflect

new information, future events or otherwise, except as required by law.

Forward Looking Statements

3

Headquarters: Lafayette, LA Total Assets: $1.9 billion

Founded: 1985 Gross Loans: $1.3 billion

Offices: 57 branch locations Total Deposits: $1.6 billion

Geography: 26 parishes / counties in Louisiana and Texas Total Shareholders’ Equity: $216.1 million

Tangible Common Equity: $128.4 million

Tangible Common Equity / Tangible Assets: 6.80%

Tier I Leverage Ratio: 10.27%

Total RBC Ratio: 14.40%

LTM Net Income / LTM EPS: $9.6 million / $0.56

LTM Efficiency Ratio: 72.5%

LTM ROAA: 0.50%

LTM ROATCE: 5.46%

Market Capitalization: $160.8 million

Total Common Shares Outstanding: 11,383,914 shares

Average Daily Trading Volume: 19,207 shares

Insider Ownership: 20.8%

Institutional Ownership: 37.0%

Q1 2017 Common Dividends per Share: $0.09

Note: Financial information as of March 31, 2017; market data as of May 18, 2017; Source: SNL Financial

Company Profile

Company Overview

Branch Footprint

Financial Highlights

Market Information

4

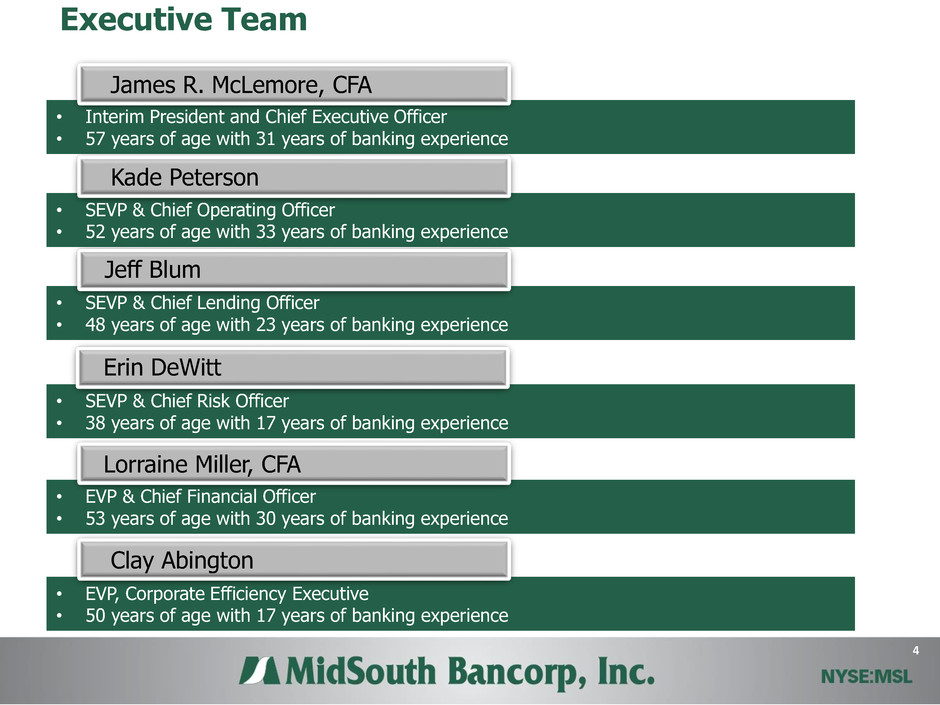

Executive Team

• Interim President and Chief Executive Officer

• 57 years of age with 31 years of banking experience

James R. McLemore, CFA

• SEVP & Chief Operating Officer

• 52 years of age with 33 years of banking experience

Kade Peterson

• SEVP & Chief Lending Officer

• 48 years of age with 23 years of banking experience

Jeff Blum

• SEVP & Chief Risk Officer

• 38 years of age with 17 years of banking experience

Erin DeWitt

• EVP & Chief Financial Officer

• 53 years of age with 30 years of banking experience

Lorraine Miller, CFA

• EVP, Corporate Efficiency Executive

• 50 years of age with 17 years of banking experience

Clay Abington

5

Performance - Results matter… Long-term, we aspire to above average

performance in shareholder return, customer service and employee

engagement

Focus - do a few things very well and capitalize on them

Urgency- motivated to action with solid information and mature decision

making

Balance- Lines of Business, Concentrations, Risks/Reward, Geography

Fairness- treat all stakeholders fairly – shareholders, customers, employees

Transparency and Credibility- everyone rowing the same direction through

alignment and communication of vision to tactics

Empowerment with Accountability- Employ talented people and allow

them to do their job. Hold them accountable for results

New Roles, New Leadership, New Direction

Guiding Principles

“Independence is earned and not a God-given right”

6

Peer Groups – Comparative Metrics

(1) Peer group is Major Exchange Banks with Total Assets $1.0 Billion - $4.0 Billion and Research Analyst Coverage of 3+ Analysts (43 Banks); Source: SNL Financial

0.90

0.98

0.56

0.49

0.00

0.20

0.40

0.60

0.80

1.00

1.20

2015Y 2016Y

ROAA (%)

8.77

9.21

5.16

4.34

0.00

1.00

2.00

3.00

4.00

5.00

6.00

7.00

8.00

9.00

10.00

2015Y 2016Y

ROAE (%)

3.71 3.72

4.34

4.14

0.00

1.00

2.00

3.00

4.00

5.00

2015Y 2016Y

Net Interest Margin (%)

64.8 63.8

68.4

72.0

0.0

20.0

40.0

60.0

80.0

100.0

2015Y 2016Y

Efficiency Ratio (%)

0.75 0.72

2.82

3.34

0.00

0.50

1.00

1.50

2.0

2.50

3.00

3.50

4.0

2015Y 2016Y

NPAs / Assets (%)

9.11 9.10

6.60 6.67

0.00

2.00

4.00

6. 0

8.00

10.00

12.00

2015Y 2016Y

TCE / TA (%)

Peer Group Median MSL

7

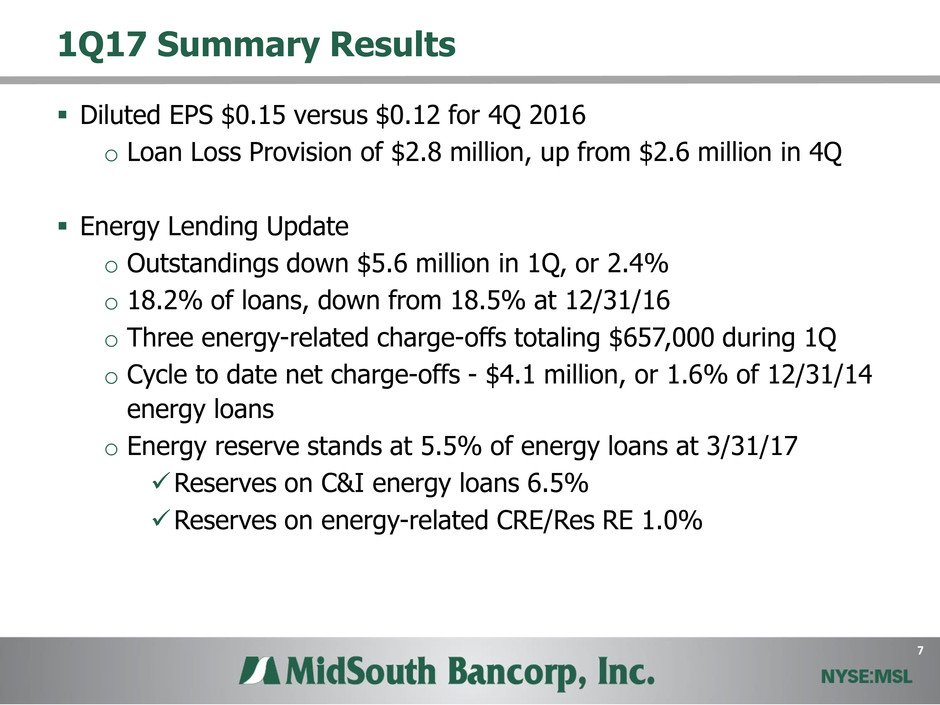

1Q17 Summary Results

Diluted EPS $0.15 versus $0.12 for 4Q 2016

o Loan Loss Provision of $2.8 million, up from $2.6 million in 4Q

Energy Lending Update

o Outstandings down $5.6 million in 1Q, or 2.4%

o 18.2% of loans, down from 18.5% at 12/31/16

o Three energy-related charge-offs totaling $657,000 during 1Q

o Cycle to date net charge-offs - $4.1 million, or 1.6% of 12/31/14

energy loans

o Energy reserve stands at 5.5% of energy loans at 3/31/17

Reserves on C&I energy loans 6.5%

Reserves on energy-related CRE/Res RE 1.0%

8

Attractive Core Deposits

Total deposits at 3/31/17 - $1.573 Billion

Interest

bearing

checking

31%

Money

market &

savings

32%

Time deposits

10%

Non-interest

bearing

checking

27%

Deposits by Type

Lafayette

30%

New Iberia -

Breaux Bridge

14%

Houma -

Thibodaux -

Morgan City

4%

Baton Rouge

5%

Alexandria -

Many -

Natchitoches -

Shreveport

22%

Lake Charles-

Sulphur-Jennings

7%

Houston -

Beaumont -

College Station

9%

Dallas - Fort

Worth - Tyler -

Texarkana

8%

Deposits by Region

LA 82% TX 18%

Q1 ‘17 Cost of Total Deposits: 0.24%

9

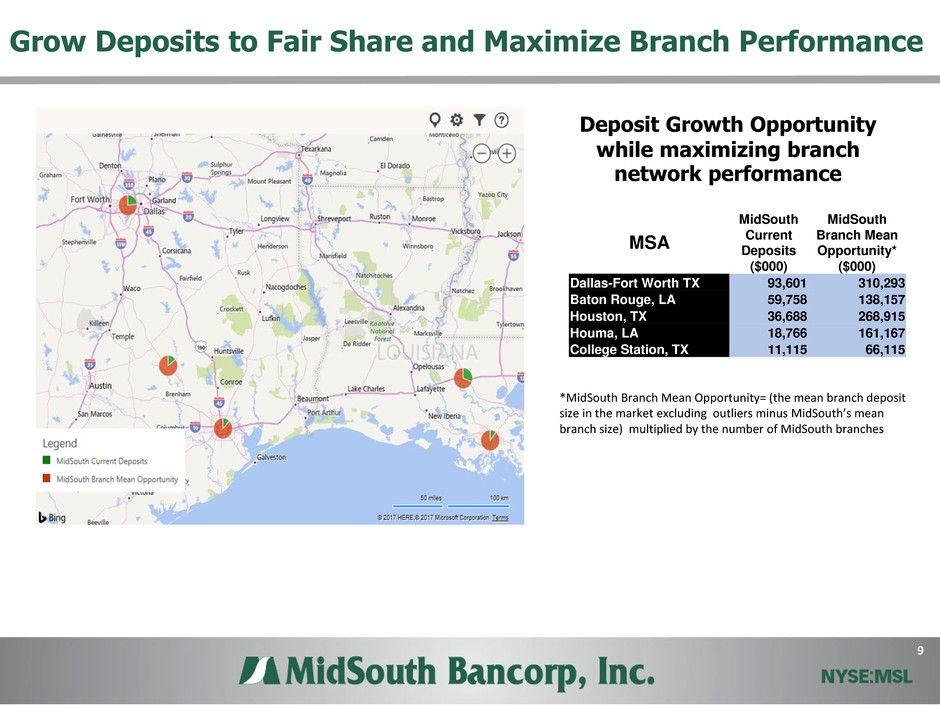

Grow Deposits to Fair Share and Maximize Branch Performance

MSA

MidSouth

Current

Deposits

($000)

MidSouth

Branch Mean

Opportunity*

($000)

Dallas-Fort Worth TX 93,601 310,293

Baton Rouge, LA 59,758 138,157

Houston, TX 36,688 268,915

Houma, LA 18,766 161,167

College Station, TX 11,115 66,115

*MidSouth Branch Mean Opportunity= (the mean branch deposit

size in the market excluding outliers minus MidSouth’s mean

branch size) multiplied by the number of MidSouth branches

Deposit Growth Opportunity

while maximizing branch

network performance

10

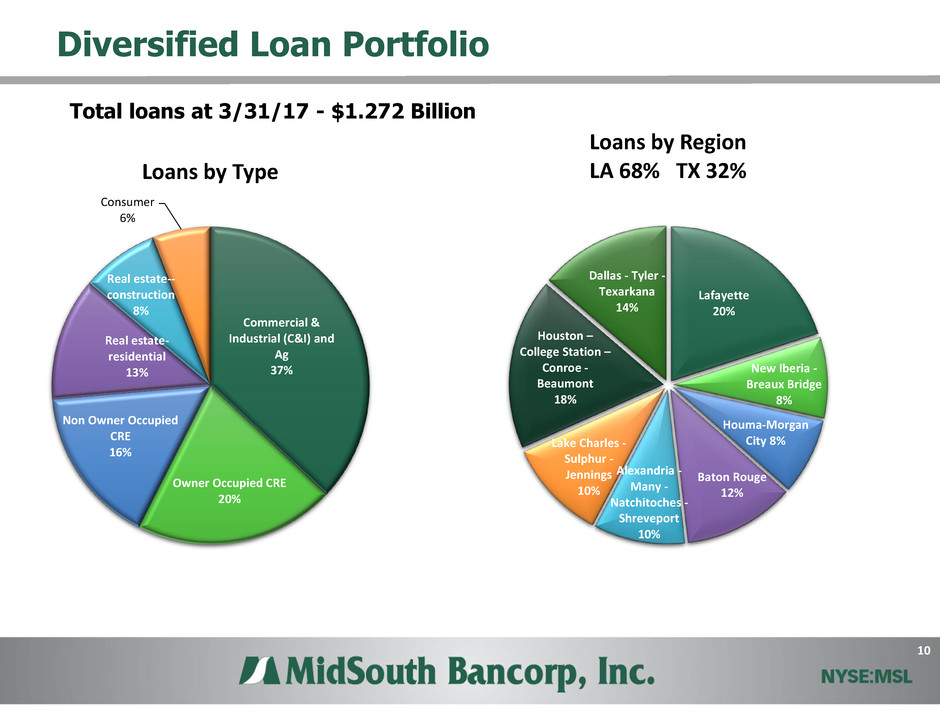

Diversified Loan Portfolio

Total loans at 3/31/17 - $1.272 Billion

Commercial &

Industrial (C&I) and

Ag

37%

Owner Occupied CRE

20%

Non Owner Occupied

CRE

16%

Real estate-

residential

13%

Real estate--

construction

8%

Consumer

6%

Loans by Type

Lafayette

20%

New Iberia -

Breaux Bridge

8%

Houma-Morgan

City 8%

Baton Rouge

12%

Alexandria -

Many -

Natchitoches -

Shreveport

10%

Lake Charles -

Sulphur -

Jennings

10%

Houston –

College Station –

Conroe -

Beaumont

18%

Dallas - Tyler -

Texarkana

14%

Loans by Region

LA 68% TX 32%

11

• Risk Reduction

• Energy/problem credit resolution

• Strengthen underwriting

• Efficiently manage capital position

• Focus on Relationship Banking

• Focus on quality loan growth throughout our markets

• Capitalize on lending opportunities in Houston, Dallas, Lake Charles,

Baton Rouge markets

• Tune the franchise for performance*

• Branch Structure

• Lines of business/products/expenses

• Improve and mature processes

• Improve efficiency of operations with a focus on excellent customer service

• Leverage technology to improve processes and customer experience

Short term Priorities

*some expense/revenue enhancement benefits will be redeployed to other initiatives

12

• Attractive long-term play with competitive leadership team

motivated to succeed

• Valuable core deposit franchise with low cost of funds

• Opportunity to gain deposit fair share in high growth markets

• Diversified loan portfolio with growth opportunities in dynamic

markets

• Many short-term initiatives to improve competitive position and

tune for performance

• Capital structure

• Branch network

• Products & Services

• Process improvement

Investment Highlights