Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Surgery Partners, Inc. | d401994d8k.htm |

Exhibit 99.1

Bridge

Presentation

May 2017

Legal Disclaimer This document has been prepared solely for use of the recipient. You agree to hold the Information contained herein in strict confidence and may not reproduce, distribute or disclose this Information, in whole or in part. Forward-Looking Statements This presentation contains _forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements contained in this presentation other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans, and our objectives for future operations are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as may,will, should, could, would, expects, plans, anticipates, believes, estimates, projects, predicts, potential, or the negative of those terms, and similar expressions and comparable terminology intended to identify forward-looking statements. These forward-looking statements include, without limitation, statements regarding the future financial position of Surgery Partners, Inc. and its subsidiaries (the Company ), National Surgical Healthcare ( NSH ) and its subsidiaries including financial targets, business strategy, plans and objectives for future operations and future operating results. These statements reflect the Company s current views with respect to future events and are based on assumptions and subject to risks and uncertainties. These include, without limitation, risks and uncertainties related to any potential transaction such as the following: the timing of such transaction; uncertainties as to whether our shareholders will approve a transaction; the effects of disruption from a transaction; the risk of shareholder litigation in connection with a transaction; and other business effects, including the effects of industry, economic or political conditions outside of our control. These risks and uncertainties also include, without limitation: reductions in payments from, or inability to contract with, government healthcare programs managed care organizations and private third-party payors, failure to fully integrate the operations of Surgery Partners and legacy Symbion, failure to fully integrate the operations of Surgery Partners and NSH, changes in the regulatory, economic and other conditions of the states where our surgical facilities are located, and other factors set forth under Risk Factors and Management s Discussion and Analysis of Financial Condition and Results of Operations in the Company s Annual Report on Form 10-K for fiscal year 2016 ( 10-K ) filed with the Securities and Exchange Commission (the SEC ) as well as other information we file with the SEC. The Company cautions investors not to place considerable reliance on the forward-looking statements contained in this presentation. You should read the Company s annual and quarterly reports, when available, and any and all other filings with the SEC, available at www.sec.gov, for a discussion of these and other risks and uncertainties. The forward-looking statements contained in this presentation speak only as of the date of the presentation, and the Company undertakes no obligation to update or revise any forward-looking statements for any reason, except as required by law. The business of the Company and NSH is subject to substantial risks and uncertainties, including those referenced above. Investors, potential investors, and others should give careful consideration to these risks and uncertainties. Data and Information Contained in this Presentation. This presentation also contains estimates, projections and other information concerning the Company’s and NSH s industry, business and the market for their products and services, as well as data regarding market research, estimates and forecasts. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances reflected in this information. Certain data in this presentation was obtained from various external sources, and neither the Company nor its affiliates, advisers or representatives has verified such data with independent sources. Accordingly, neither the Company nor any of its affiliates, advisers or representatives makes any representations as to the accuracy or completeness of that data or to update such data after the date of this presentation. Such data involves risks and uncertainties and is subject to change based on various factors. The trademarks included herein are the property of the owners thereof and are used for reference purposes only. Such use should not be construed as an endorsement of the products or services of such owners. Non-GAAP Financial Measures This presentation contains certain non-GAAP financial measures, including EBITDA and Adjusted EBITDA. A non-GAAP financial measure is defined as a numerical measure of a company s financial performance that excludes or includes amounts so as to be different than the most directly comparable measure calculated and presented in accordance with GAAP in the statements of income, balance sheets or statements of cash flow of the company. We present non-GAAP financial measures when we believe that the additional information is useful and meaningful to investors. Non-GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similar measures presented by other companies. The presentation of non-GAAP financial measures is not intended to be a substitute for, and should not be considered in isolation from, the financial measures reported in accordance with GAAP. For additional information about our non-GAAP financial measures, and a reconciliation of certain non-GAAP financial measures to the comparable GAAP measures, see the Company s 10-K, Quarterly Reports on Form 10-Q and other information we file with the SEC.

| 2 |

Legal Disclaimer Important Notice Regarding Information Contained in this Presentation. This Bridge Presentation (this Presentation ) is intended to facilitate discussions with representatives of certain institutions regarding a potential syndicated financing for Surgery Partners, Inc. and its subsidiaries which, as part of a possible transaction, may acquire National Surgical Healthcare. You should not rely on the information contained in this Presentation and this Presentation does not purport to be all-inclusive or to contain all of the information that a prospective participant may consider material or desirable in making its decision to become a lender. In all cases, prospective participants should conduct their own investigation and analysis of the Company, their assets, financial condition and prospects, and of the data set forth in this Presentation. The information contained in this Presentation is provided subject to the terms and conditions set forth in the Notice to and Undertaking by Recipients that follows. The information contained herein must be kept strictly confidential and may not be reproduced or distributed, in whole or in part, in any format without the Company s prior written consent. Notice to and Undertaking by Recipients This Presentation has been prepared solely for informational purposes from information supplied by or on behalf of the Company, and is being furnished by Jefferies Finance LLC (the Arranger ) to you in your capacity as a prospective lender (the “Recipient”) in considering the proposed Senior Unsecured Bridge Loan described in this Presentation (the “Bridge Loan”). ACCEPTANCE OF THIS PRESENTATION CONSTITUTES AN AGREEMENT TO BE BOUND BY THE TERMS OF THIS NOTICE AND UNDERTAKING BY RECIPIENTS (THIS NOTICE AND UNDERTAKING ). IF THE RECIPIENT IS NOT WILLING TO ACCEPT THIS PRESENTATION AND OTHER EVALUATION MATERIAL (AS DEFINED HEREIN) ON THE TERMS SET FORTH IN THIS NOTICE AND UNDERTAKING, IT MUST RETURN THIS PRESENTATION AND ANY OTHER EVALUATION MATERIAL TO THE ARRANGER IMMEDIATELY WITHOUT MAKING ANY COPIES THEREOF, EXTRACTS THEREFROM OR USE THEREOF AND, IF APPLICABLE, IMMEDIATELY TERMINATE ACCESS TO THE RELATED EXTERNAL DATA SITE. THIS PRESENTATION DOES NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY ANY SECURITIES OR ANY LOANS OF THE COMPANY OR ANY FINANCIAL INSTRUMENTS RELATED THERETO. THE INFORMATION IN THIS PRESENTATION IS CURRENT ONLY AS OF THE DATE ON ITS COVER. FOR ANY TIME AFTER THE COVER DATE OF THIS PRESENTATION, THE INFORMATION, INCLUDING INFORMATION CONCERNING THE COMPANY S BUSINESS, FINANCIAL CONDITION, RESULTS OF OPERATIONS AND PROSPECTS, MAY HAVE CHANGED. THE DELIVERY OF THIS PRESENTATION SHALL NOT, UNDER ANY CIRCUMSTANCES, CREATE ANY IMPLICATION THAT THERE HAVE BEEN NO CHANGES IN THE COMPANY S AFFAIRS AFTER THE DATE OF THIS PRESENTATION. THE COMPANY AND THE ARRANGER HAVE NOT AUTHORIZED ANY PERSON TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS ABOUT THE COMPANY IN CONNECTION WITH THIS PRESENTATION THAT IS NOT CONTAINED IN THIS PRESENTATION. IF ANY INFORMATION HAS BEEN OR IS GIVEN OR ANY REPRESENTATIONS HAVE BEEN OR ARE MADE TO THE RECIPIENT OUTSIDE OF THIS PRESENTATION, SUCH INFORMATION OR REPRESENTATIONS SHOULD NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE COMPANY OR THE ARRANGER. I. Confidentiality As used herein: (a) “Evaluation Material” refers to this Presentation and any other information regarding the Company or its affiliates or the Bridge Loan furnished or communicated to the Recipient by or on behalf of the Company in connection with the Bridge Loan (whether prepared or communicated by the Arranger or the Company, their respective advisors or otherwise) and (b) “Internal Evaluation Material” refers to all memoranda, notes, and other documents and analyses developed by the Recipient or its Representatives (as defined below) using any of the information specified under the definition of Evaluation Material. By accepting this Presentation, the Recipient acknowledges that the Company considers the Evaluation Material to include confidential, sensitive and proprietary information and agrees for the benefit of the Company, the Arranger and their respective affiliates that it shall keep the Evaluation Material and Internal Evaluation Material confidential and shall not distribute the Evaluation Material to any third parties and will use the same solely for the purpose of evaluating the Bridge Loan; provided however that (i) the Recipient may make any disclosure of such information to which the Company and the Arranger give their prior written consent and (ii) only to the extent required in connection with an evaluation of participation in the Bridge Loan, any of such information may be disclosed to the Recipient, its affiliates and their respective partners, directors, officers, employees, agents, advisors and other representatives who need to know such information solely in connection with the Recipient s evaluation of the Bridge Loan (collectively, “Representatives”) (it being understood that such Representatives shall be informed by the Recipient of the confidential nature of such information and shall be directed by the Recipient to treat such information in accordance with the terms of this Notice and Undertaking). The Recipient agrees to be responsible for any breach of this Notice and Undertaking that results from the actions or omissions of its Representatives. The Recipient shall be permitted to disclose the Evaluation Material and Internal Evaluation Material in the event that it is required by law or regulation or requested by any governmental agency or other regulatory authority (including any self-regulatory organization having or claiming to have jurisdiction) or in connection with any legal proceedings. The Recipient agrees that it will promptly notify the Company and the Arranger as soon as practical in the event of any such disclosure (other than at the request of a regulatory authority), and give them the opportunity to object to such disclosure and seek a protective order unless such notification shall be prohibited by applicable law or legal process. The Recipient shall have no obligation hereunder with respect to any Evaluation Material or Internal Evaluation Material to the extent that such information (i) is or becomes publicly available other than as a result of a disclosure by the Recipient or its Representatives in violation of this agreement, or (ii) was within the Recipient’s possession prior to its being furnished pursuant hereto or becomes available to the Recipient on a non-confidential basis from a source other than the Company, the Arranger or their respective representatives, provided that the source of such information was not known by theRecipient to be bound by a confidentiality agreement with or other contractual, legal or fiduciary obligation of confidentiality to the Company, the Arranger or any other party with respect to such information. In the event that the Recipient decides not to participate in the transaction described herein or upon request of the Arranger or the Company, the Recipient shall as soon as practicable return all Evaluation Material (other than Internal Evaluation Material) to the Arranger or certify in writing to the Arranger that the Recipient has destroyed all copies of the Evaluation Material (including Internal Evaluation Material) unless prohibited from doing so by the Recipient’s internal policies and procedures, implemented by the Recipient to comply with applicable law or regulation. With regard to any maintained Evaluation Material (including Internal Evaluation Material), the confidentiality obligations of the Recipient hereunder shall continue in full force and effect with respect to any such Evaluation Material. The Recipient will take all reasonable measures to protect the secrecy of and avoid disclosure or use of this Presentation in order to prevent it from falling into the public domain or the possession of persons other than those authorized hereby to have such information. The Recipient shall promptly notify the Company of any misuse or misappropriation of this Presentation which may come to its attention. The Company reserves the right to require the return of this Presentation at any time. II. Information The Recipient acknowledges and agrees that (i) the Arranger received the Evaluation Material from third party sources (including the Company) and it is provided to the Recipient for informational purposes only, (ii) the Arranger, Bain Capital Private Equity, LP ( Bain ), the Company and their respective affiliates bear no responsibility (and shall not be liable) for the accuracy or completeness (or lack thereof) of the Evaluation Material or any information contained therein, (iii) no representation or warranty (express or implied) regarding the Evaluation Material is made by the Arranger, Bain, the Company or any of their respective affiliates, (iv) none of the Arranger, Bain, the Company or any of their respective affiliates have made any independent verification as to the accuracy or completeness of the Evaluation Material, (v) the Arranger, Bain, the Company and their respective affiliates shall have no obligation to update or supplement any Evaluation Material or otherwise provide additional information, (vi) the Arranger, Bain, the Company and their respective affiliates shall not have any liability related to the use of the contents hereof, the Evaluation Materials or any related marketing materials by the Recipient or any of its Representatives, (vii) the Arranger, Bain, the Company and their respective affiliates shall not have any liability related to the unauthorized misuse of this Presentation, the Evaluation Materials or any related marketing materials by any Recipient or any of its Representatives. In addition, the Recipient acknowledges and agrees that the Arranger may offer interests in the Bridge Loan for the account of the Lead Arranger and its affiliates. The Evaluation Material has been prepared to assist interested parties in making their own evaluation of the Company and the Bridge Loan and does not purport to be all-inclusive or to contain all of the information, or a discussion of all or any of the risks, that a prospective participant may consider material or desirable in making its decision to become a lender. The Recipient should take such steps as it deems necessary to assure that it has the information it considers material or desirable in making its decision to become a lender and should perform its own independent investigation and analysis of the Bridge Loan or the transactions contemplated thereby and the creditworthiness of the Company. The Recipient represents that it is sophisticated and experienced in extending credit to entities similar to the Company and that it has made its own independent investigations and appraisal of the business, financial condition, prospects, creditworthiness, status and affair of the Company or any other person that it considers necessary.

| 3 |

Legal Disclaimer II. Information (cont d) In addition, the Evaluation Material is summary in nature, is subject to change or amendment and is not intended to provide the entire basis for credit or any other evaluation. The information and data contained herein are not a substitute for the Recipient’s independent evaluation and analysis and should not be considered as a recommendation by the Arranger or any of their respective affiliates that any Recipient enter into the Bridge Loan. The Recipient acknowledges that each Arranger s activities in connection with the Bridge Loan are undertaken by such Arranger as a principal on an arms-length basis and no Arranger has any fiduciary, advisory or similar responsibilities in favor of the Recipient in connection with the Bridge Loan or the process related thereto. The Evaluation Material may include certain forward-looking statements, estimates and projections provided by the Company (collectively, forward-looking statements ). Statements that are not historical facts, including statements accompanied by words such as believe, expect, estimate, intend, or plan, are intended to identify forward-looking statements and convey the uncertainty of future events or outcomes. These forward-looking statements reflect various estimates and assumptions by the Company concerning future events and anticipated results and may involve elements of subjective judgment and analysis and should not be viewed as facts. These forward-looking statements are based on management of the Company s analysis of the information available at the time this Presentation was prepared on assumptions and perspectives that may be unique to the management of the Company. These forward-looking statements are subject to risks, uncertainties and assumptions. The Recipient is cautioned not to put undue reliance on such forward-looking statements. No representations or warranties (express or implied) are made by the Company, Bain, the Arranger or any of their respective affiliates as to the accuracy of any such forward-looking statements, and such forward-looking statements should not be relied upon as a representation as to the future and no assurances are given that projected results will be realized. Whether or not any such forward-looking statements are in fact achieved will depend upon future events some of which are not within the control of the Company. Accordingly, actual results may vary from the projected results and such variations may be material. The Company assumes no obligation to, and expressly disclaims any obligation to, update or revise any such forward-looking statement, to reflect actual results, changes in assumptions or changes in other factors affecting these forward-looking statements. Statements contained herein describing documents and agreements are summaries only and such summaries are qualified in their entirety by reference to such documents and agreements. III. The Arranger The Arranger (together with its affiliates) is a full service financial institution engaged in various activities, which may include loan and securities trading, commercial and investment banking, financial advisory, investment management, investment research, principal investment, hedging, financing and brokerage activities. The Arranger and/or one of its affiliates may have, from time to time, performed, and may in the future perform, various financial advisory and investment banking services for the Company and/or its affiliates. In the ordinary course of its various business activities, the Arranger and/or its affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers, and such investment and securities activities may involve assets, securities and/or instruments of the Company and/or its affiliates. The Arranger and/or its affiliates may also make investment recommendations and/or publish or express independent research views in respect of such securities or instruments and may at any time hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments. The Arranger and/or one or more of its affiliates may provide loans under the Bridge Loan for their own accounts and such loans may comprise, individually or in the aggregate, a substantial portion of the Bridge Loan. Certain of such affiliates may commit, subject to certain terms and conditions, to provide such loans prior to commencement of the syndication of the Bridge Loan, at a price and on terms agreed between such affiliates and the Company. In connection with the Bridge Loan, the Company will pay certain fees, including commitment fees, to the Arranger, as well as fees or discounts payable or given to the Arranger and/or certain of its affiliates in consideration for their respective commitments to provide loans, which commitments were made to the Company in advance of the commencement of the general syndication of the Bridge Loan. IV. General It is understood that unless and until a definitive agreement regarding the Bridge Loan between the parties thereto has been executed, the Recipient will be under no legal obligation of any kind whatsoever with respect to the Bridge Loan by virtue of this Notice and Undertaking. The Recipient agrees that money damages would not be a sufficient remedy for breach of this Notice and Undertaking, and that in addition to all other remedies available at law or in equity, the Company and the Arranger shall be entitled to equitable relief, including injunction and specific performance, without proof of actual damages. The loans made under the Bridge Loan are not securities under the applicable United States federal securities laws and regulations, and you will not have the protection of such laws and regulations with respect to your purchase and sale of such loans and the Company will not be required to provide you with any information other than as may be required under the definitive documentation governing the Bridge Loan. Additionally, the loans made under the Bridge Loan will not be listed on a securities exchange or any automated dealer quotation system. You may not be able to assign your commitments or loans under the Bridge Loan at a particular time or at a price favorable to you. There are no assurances as to the level of liquidity of the market for the commitments or the loans under the Bridge Loan. This Notice and Undertaking embody the entire understanding and agreement between the Recipient and the Arranger for the benefit of the Company, the Arranger and their respective affiliates with respect to the Evaluation Material and the Internal Evaluation Material and supersede all prior understandings and agreements between the Recipient and the Arranger relating thereto. The terms and conditions of this Notice and Undertaking shall apply until such time, if any, that the Recipient becomes a party to the definitive agreements regarding the Bridge Loan, and thereafter the provisions of such definitive agreements relating to confidentiality shall govern. If you do not enter into the Bridge Loan, the application of this Notice and Undertaking shall terminate with respect to all Evaluation Material and Internal Evaluation Material on the date falling two years after the date of this Presentation. This Notice and Undertaking and the Special Notice shall be governed by and construed in accordance with the law of the State of New York. You agree to submit to the jurisdiction of the courts of the State of New York, the courts of the United States of America for the Southern District of New York and appellate courts from any thereof in connection with this Notice and Undertaking. The Recipient acknowledges and agrees that the Evaluation Material does not provide any tax advice relating to an investment in the Bridge Loan and that the Recipient has consulted with its own tax advisor with respect to its decision to invest in the Bridge Loan. V. MNPI The Company has represented that the information contained in this Presentation is either publicly available or does not constitute material non-public information concerning the Company, its subsidiaries, affiliates or its or their respective securities ( MNPI ). [The Recipient of this Presentation has stated that it does not wish to receive MNPI and acknowledges that other lenders have received a Presentation that contains additional information concerning the Company, its subsidiaries, affiliates or its or their respective securities that may be MNPI.] Neither the Company nor the Arranger takes any responsibility for the Recipient’s decision to limit the scope of the information it has obtained in connection with its evaluation of the Company and the Bridge Loan. Notwithstanding the Recipient’s desire to abstain from receiving MNPI and the Company s representation that there is no such MNPI in this Presentation, the Recipient acknowledges that (1) certain of the individuals listed as contacts in this Presentation may be in receipt of MNPI or otherwise have access to information that is provided to lenders or potential lenders who desire to receive MNPI and that if the Recipient chooses to communicate with any such individuals the Recipient assumes the risk of receiving MNPI, (2) information obtained as a result of becoming a lender may include such MNPI and (3) it has developed compliance procedures regarding the use of MNPI and that it will handle such MNPI in accordance with applicable law, including federal and state securities laws.

| 4 |

Presenters Mike Doyle Chief Executive Officer Chief Executive Officer and Director since 2009 Previously served as President and Chief Operating Officer since 2004 when Surgery Partners was formed More than 20 years of healthcare experience with both an extensive management background Mike began his career as a clinician and brings a wealth of practical experience Teresa Sparks Chief Financial Officer Executive Vice President and Chief Financial Officer since Symbion acquisition in November 2014 Previously served as Senior Vice President and Chief Financial Officer of Symbion (2007 to November 2014) and Corporate Controller (1996 through 2007) More than 20 years of healthcare experience with an extensive management background Previously served as Assistant Controller for HealthWise

| 5 |

Agenda Transaction Overview Surgery Partners Acquisition Overview New Surgery Partners Key Credit Highlights Financial Overview Q&A Appendix

| 6 |

Transaction Overview

| 7 |

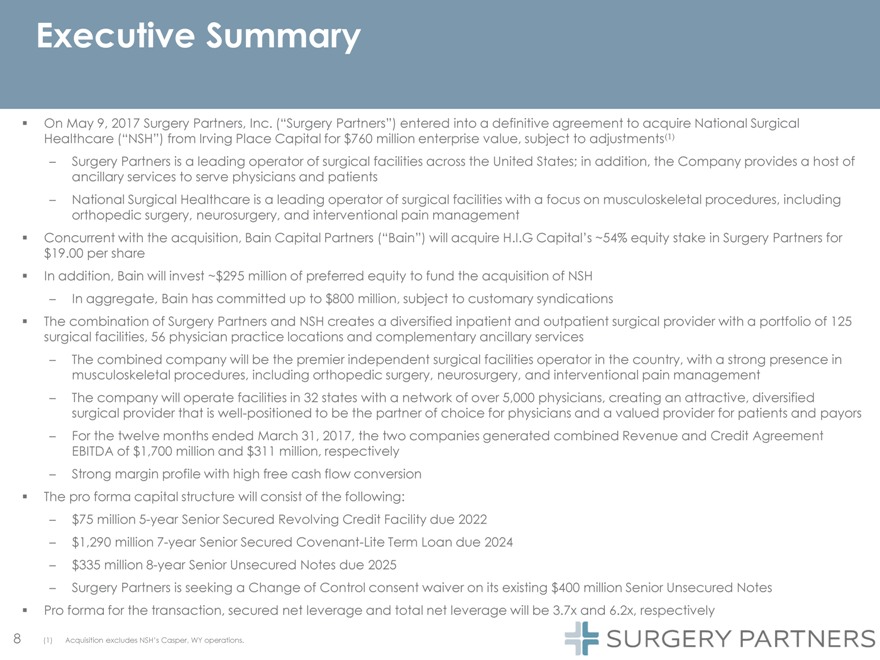

Executive Summary On May 9, 2017 Surgery Partners, Inc. ( Surgery Partners ) entered into a definitive agreement to acquire National Surgical Healthcare ( NSH ) from Irving Place Capital for $760 million enterprise value, subject to adjustments(1) Surgery Partners is a leading operator of surgical facilities across the United States; in addition, the Company provides a host of ancillary services to serve physicians and patients National Surgical Healthcare is a leading operator of surgical facilities with a focus on musculoskeletal procedures, including orthopedic surgery, neurosurgery, and interventional pain management Concurrent with the acquisition, Bain Capital Partners ( Bain ) will acquire H.I.G Capital s ~54% equity stake in Surgery Partners for $19.00 per share In addition, Bain will invest ~$295 million of preferred equity to fund the acquisition of NSH In aggregate, Bain has committed up to $800 million, subject to customary syndications The combination of Surgery Partners and NSH creates a diversified inpatient and outpatient surgical provider with a portfolio of 125 surgical facilities, 56 physician practice locations and complementary ancillary services The combined company will be the premier independent surgical facilities operator in the country, with a strong presence in musculoskeletal procedures, including orthopedic surgery, neurosurgery, and interventional pain management The company will operate facilities in 32 states with a network of over 5,000 physicians, creating an attractive, diversified surgical provider that is well-positioned to be the partner of choice for physicians and a valued provider for patients and payors For the twelve months ended March 31, 2017, the two companies generated combined Revenue and Credit Agreement EBITDA of $1,700 million and $311 million, respectively Strong margin profile with high free cash flow conversion The pro forma capital structure will consist of the following: $75 million 5-year Senior Secured Revolving Credit Facility due 2022 $1,290 million 7-year Senior Secured Covenant-Lite Term Loan due 2024 $335 million 8-year Senior Unsecured Notes due 2025 Surgery Partners is seeking a Change of Control consent waiver on its existing $400 million Senior Unsecured Notes Pro forma for the transaction, secured net leverage and total net leverage will be 3.7x and 6.2x, respectively (1) Acquisition excludes NSH s Casper, WY operations.

| 8 |

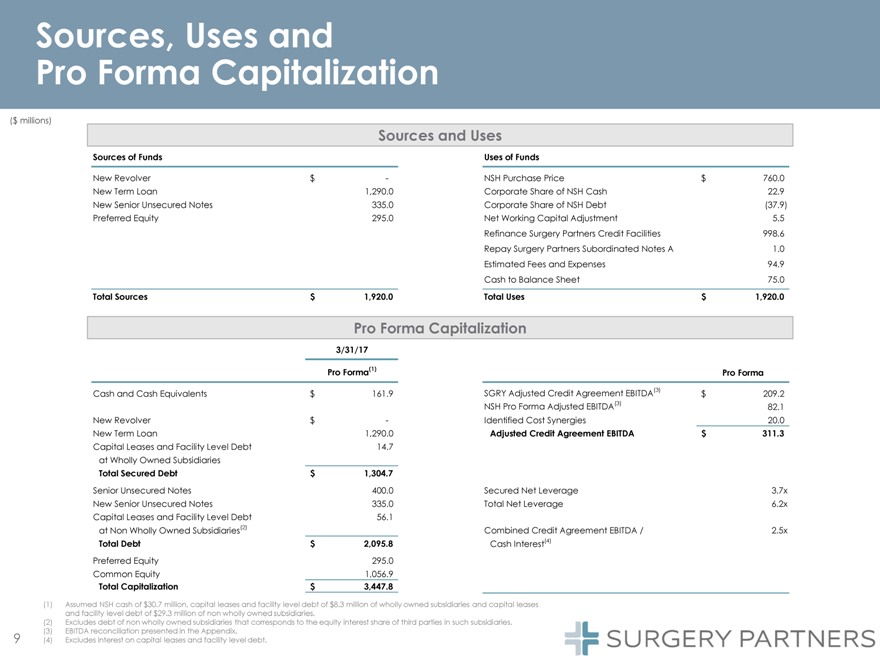

Sources, Uses and Pro Forma Capitalization ($ millions) Sources and Uses Sources of Funds Uses of Funds New

Revolver $- NSH Purchase Price $760.0 New Term Loan 1,290.0 Corporate Share of NSH Cash 22.9 New Senior Unsecured Notes 335.0 Corporate Share of NSH Debt (37.9) Preferred Equity 295.0 Net Working Capital Adjustment 5.5Refinance Surgery Partners

Credit Facilities 998.6 Repay Surgery Partners Subordinated Notes A 1.0 Estimated Fees and Expenses 94.9Cash to Balance Sheet 75.0 Total Sources $ 1,920.0 Total Uses $1,920.0 Pro Forma Capitalization 3/31/17Pro Forma(1)Pro Forma Cash and Cash

Equivalents $161.9 SGRY Adjusted Credit Agreement EBITDA(3) $209.2NSH Pro Forma Adjusted EBITDA(3) 82.1 New Revolver $- Identified Cost Synergies 20.0 New Term Loan 1,290.0 Adjusted Credit Agreement EBITDA $311.3 Capital Leases and Facility Level

Debt 14.7at Wholly Owned Subsidiaries Total Secured Debt $ 1,304.7 Senior Unsecured Notes 400.0 Secured Net Leverage 3.7x New Senior Unsecured Notes 335.0 Total Net Leverage 6.2x Capital Leases and Facility Level Debt 56.1at Non Wholly Owned

Subsidiaries(2)Combined Credit Agreement EBITDA / 2.5x Total Debt $2,095.8 Cash Interest(4)Preferred Equity 295.0 Common Equity 1,056.9 Total Capitalization $3,447.8 (1) Assumed NSH cash of $30.7 million, capital leases and facility level debt

of $8.3 million of wholly owned subsidiaries and capital leases and facility level debt of $29.3 million of non wholly owned subsidiaries. (2)Excludes debt of non wholly owned subsidiaries that corresponds to the equity interest share of third

parties in such subsidiaries. (3)EBITDA reconciliation presented in the Appendix. (4) Excludes interest on capital leases and facility level debt.

9

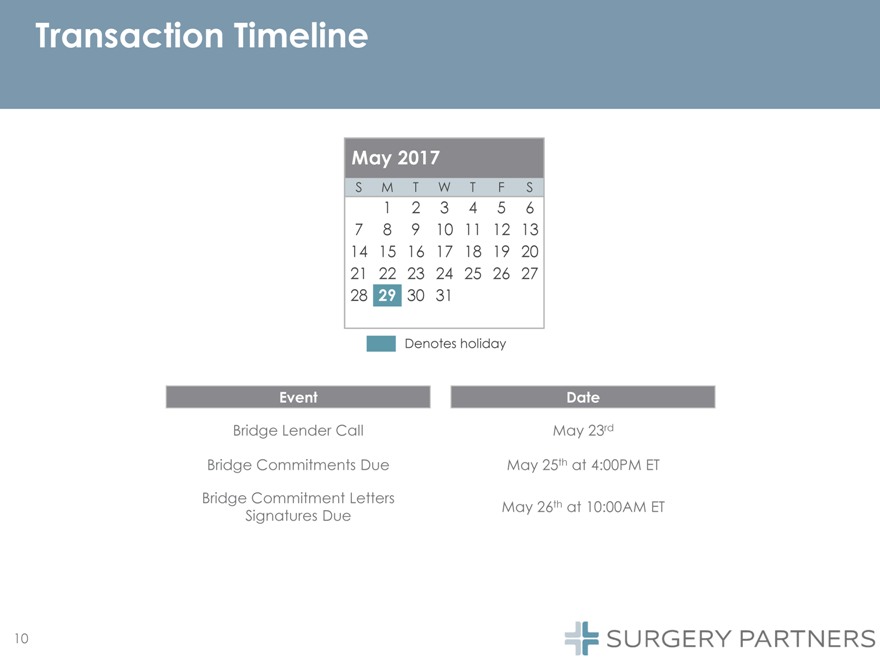

Transaction Timeline May 2017 SMTWTFS12345 6 78910 111213 141516 171819 20 2122232422627282930 31 Denotes

holiday Event Date Bridge Lender Call May 23rd Bridge Commitments Due May 25th at 4:00PM ET Bridge Commitment Letters May 26th at 10:00AM ET Signatures Due

10

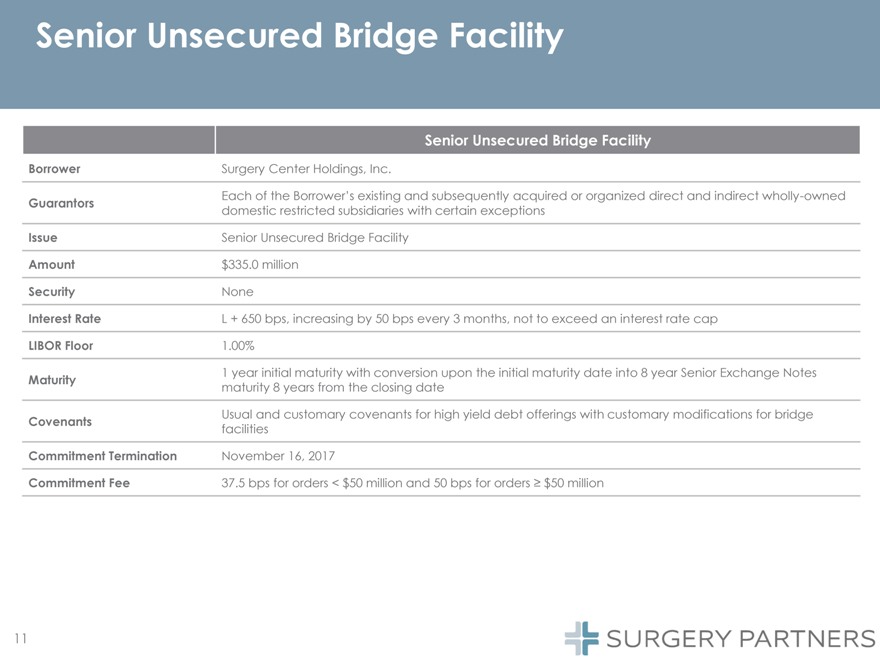

Senior Unsecured Bridge Facility Senior Unsecured Bridge Facility Borrower Surgery Center Holdings, Inc.

Guarantors Each of the Borrower s existing and subsequently acquired or organized direct and indirect wholly-owned domestic restricted subsidiaries with certain exceptions IssueSenior Unsecured Bridge Facility Amount $335.0 million Security None

Interest Rate L + 650 bps, increasing by 50 bps every 3 months, not to exceed an interest rate cap LIBOR Floor 1.00% Maturity1 year initial maturity with conversion upon the initial maturity date into 8 year Senior Exchange Notes maturity 8 years

from the closing date Covenants Usual and customary covenants for high yield debt offerings with customary modifications for bridge facilities Commitment Termination November 16, 2017 Commitment Fee 37.5 bps for orders < $50 million and 50

bps for orders e $50 million

11

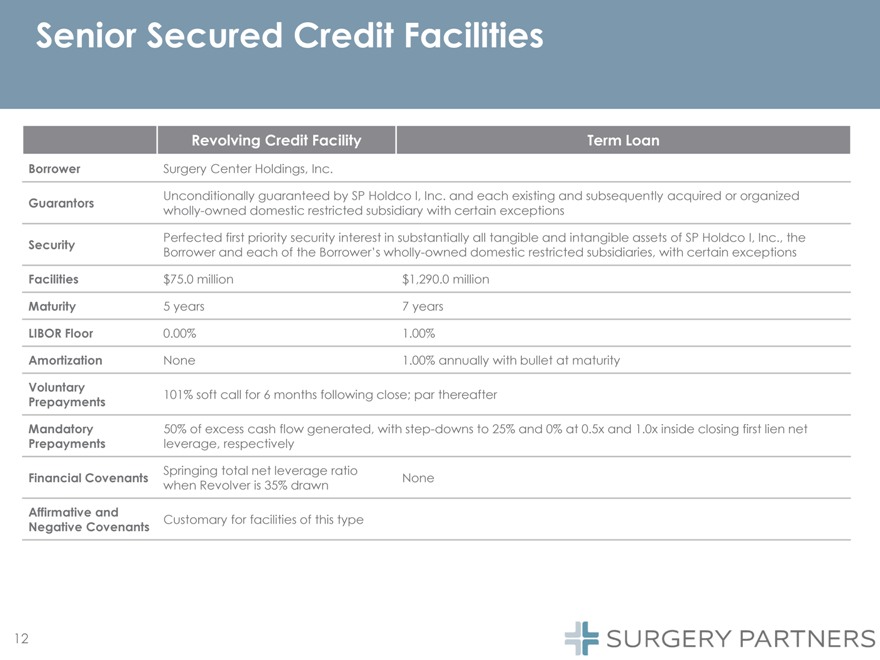

Senior Secured Credit Facilities Revolving Credit Facility Term Loan Borrower Surgery Center Holdings, Inc.

Guarantors Unconditionally guaranteed by SP Holdco I, Inc. and each existing and subsequently acquired or organized wholly-owned domestic restricted subsidiary with certain exceptions Security Perfected first priority security interest in

substantially all tangible and intangible assets of SP Holdco I, Inc., the Borrower and each of the Borrower s wholly-owned domestic restricted subsidiaries, with certain exceptions Facilities $75.0 million $1,290.0 million Maturity 5 years 7 years

LIBOR Floor 0.00% 1.00% Amortization None 1.00% annually with bullet at maturity Voluntary Prepayments 101% soft call for 6 months following close; par thereafter Mandatory 50% of excess cash flow generated, with step-downs to 25% and 0% at 0.5x and

1.0x inside closing first lien net repayments leverage, respectively Springing total net leverage ratio Financial Covenants None when Revolver is 35% drawn Affirmative and Negative Covenants Customary for facilities of this type

12

Surgery Partners

13

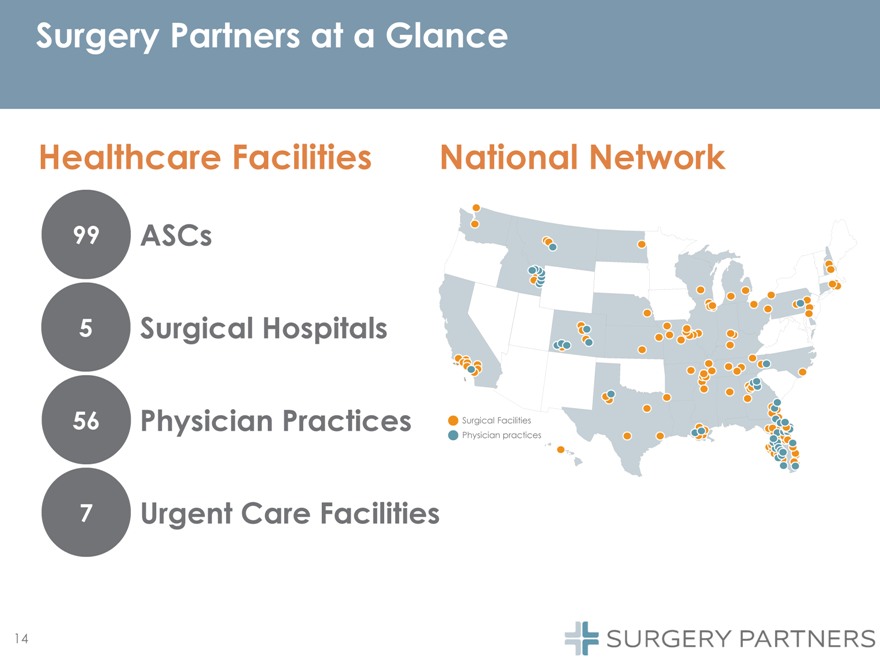

Surgery Partners at a Glance Healthcare Facilities National Network 99 ASCs 5 Surgical Hospitals 56 Physician

Practices Surgical Facilities Physician practices 7 Urgent Care Facilities

14

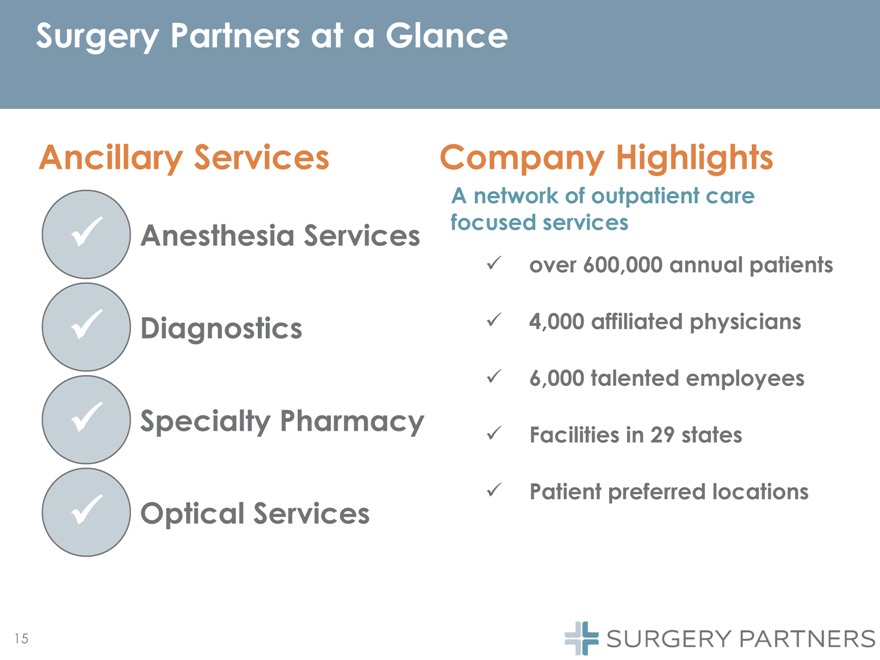

Surgery Partners at a Glance Ancillary Services Anesthesia Services Diagnostics Specialty Pharmacy Optical

Services Company Highlights A network of outpatient care focused services over 600,000 annual patients 4,000 affiliated physicians 6,000 talented employees Facilities in 29 states Patient preferred locations

15

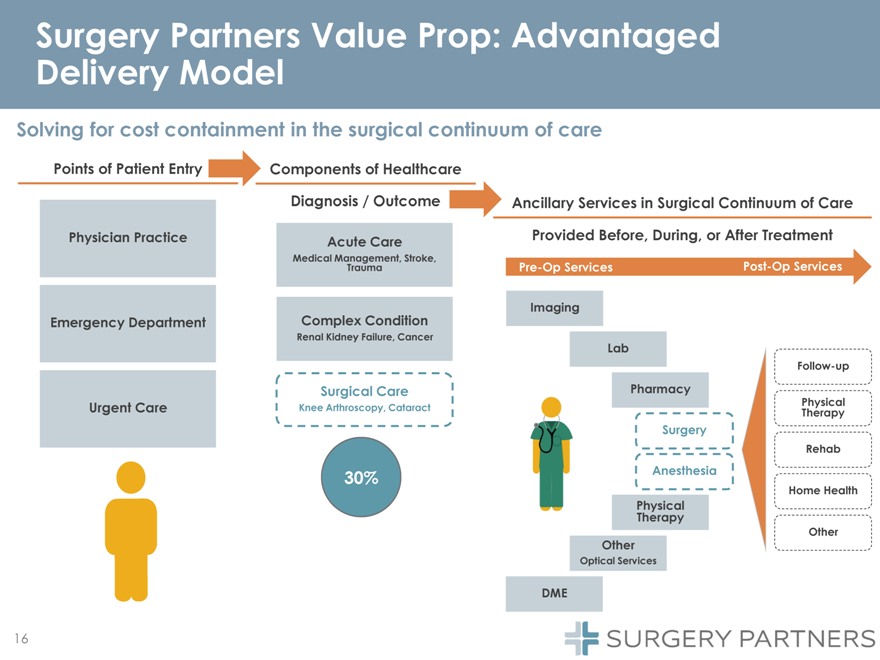

Surgery Partners Value Prop: Advantaged Delivery Model Solving for cost containment in the surgical continuum

of care Points of Patient Entry Components of Healthcare Diagnosis / Outcome Ancillary Services in Surgical Continuum of Care Physician Practice Acute Care Provided Before, During, or After Treatment Medical Management, Stroke, Trauma Pre-Op

Services Post-Op Services Complex Condition Imaging Emergency Department Renal Kidney Failure, Cancer Lab Follow-up Surgical Care Pharmacy Physical Urgent Care Knee Arthroscopy, Cataract Therapy Surgery Rehab 30% Anesthesia Home Health Physical

Therapy Other Other Optical Services DME

16

Acquisition Overview

17

Strategic Combination Expands on Outpatient Capabilities in Healthcare Delivery Surgery Partners has agreed to

acquire National Surgical Healthcare in a transaction valued at $760 million 125 surgical facilities across 32 states Largest standalone, independent surgical services company in the United States ~$1.7 billion Expanded musculoskeletal capabilities

in complex combined LTM revenue procedures as well as continuum of care breadth industry Payor-focused needs for engagement cost of higher strategy acuity to cases address ~$311 million combined LTM Furthers vertical integration of ancillary

surgical Adjusted Credit services across a broader footprint Agreement EBITDA Shared patient first mentality among companies ~$20 million of Strong cash flow and deleveraging profile identified cost synergies

18

Partnering with a World-Class Shareholder with Long-Standing Track Record of Success Bain Capital has agreed to

acquire the outstanding Common Stock held by H.I.G. Capital and partner with Surgery Partners as the Company s largest shareholder Select Healthcare Investments Established in 1984, Bain Capital is one of the world’s leading private investment

firms managing approximately $75 billion in assets under management Bain Capital s competitive advantage is grounded in a people-intensive, value-added investment approach that has enabled the firm to deliver industry-leading returns for investors

Healthcare has been a cornerstone of Bain s investment strategy with a dedicated healthcare industry team of 20+ professionals and over 50 healthcare investments This transaction represents a strategic investment behind the secular trends and

dynamics in healthcare favoring low-cost providers

19

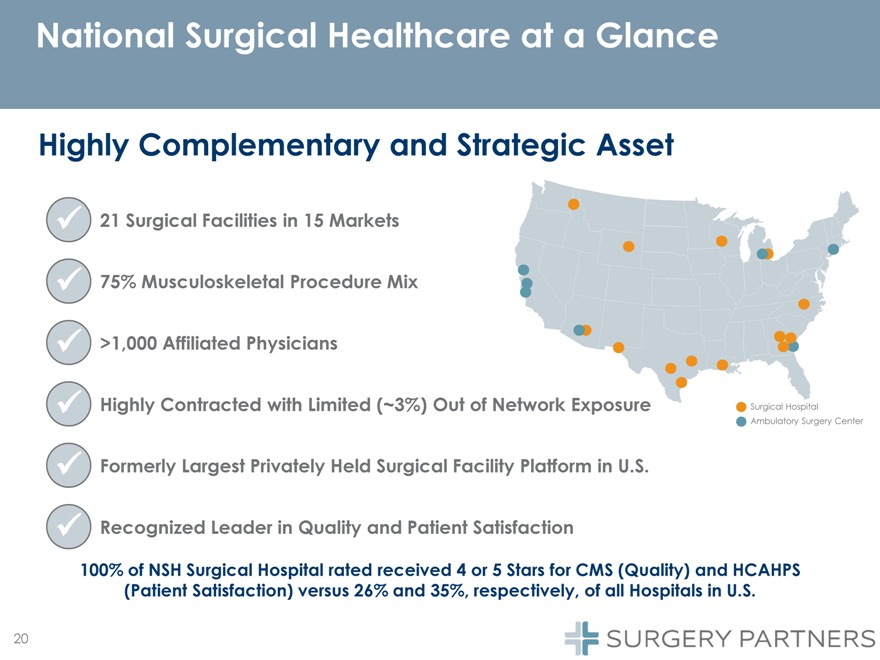

National Surgical Healthcare at a Glance Highly Complementary and Strategic Asset 21 Surgical Facilities in 15

Markets 75% Musculoskeletal Procedure Mix >1,000 Affiliated Physicians Highly Contracted with Limited (~3%) Out of Network Exposure Surgical Hospital Ambulatory Surgery Center Formerly Largest Privately Held Surgical Facility Platform in U.S.

Recognized Leader in Quality and Patient Satisfaction 100% of NSH Surgical Hospital rated received 4 or 5 Stars for CMS (Quality) and HCAHPS (Patient Satisfaction) versus 26% and 35%, respectively, of all Hospitals in U.S.

20

The New Surgery Partners

21

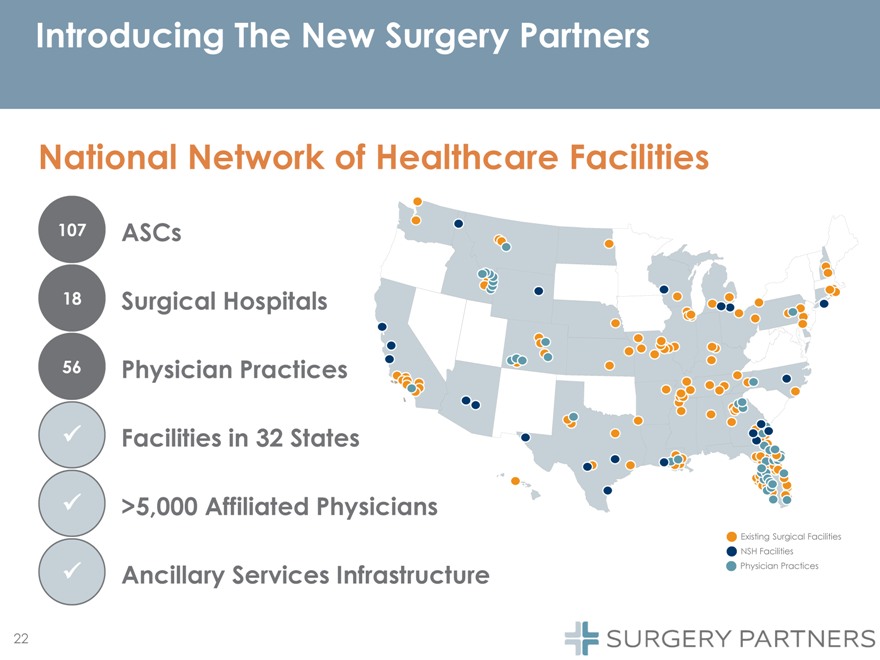

Introducing The New Surgery Partners National Network of Healthcare Facilities 107 ASCs Surgical Hospitals

Physician Practices [Graphic Appears Here] Facilities in 32 States >5,000 Affiliated Physicians Existing Surgical Facilities NSH Facilities Ancillary Services Infrastructure Physician Practices

22

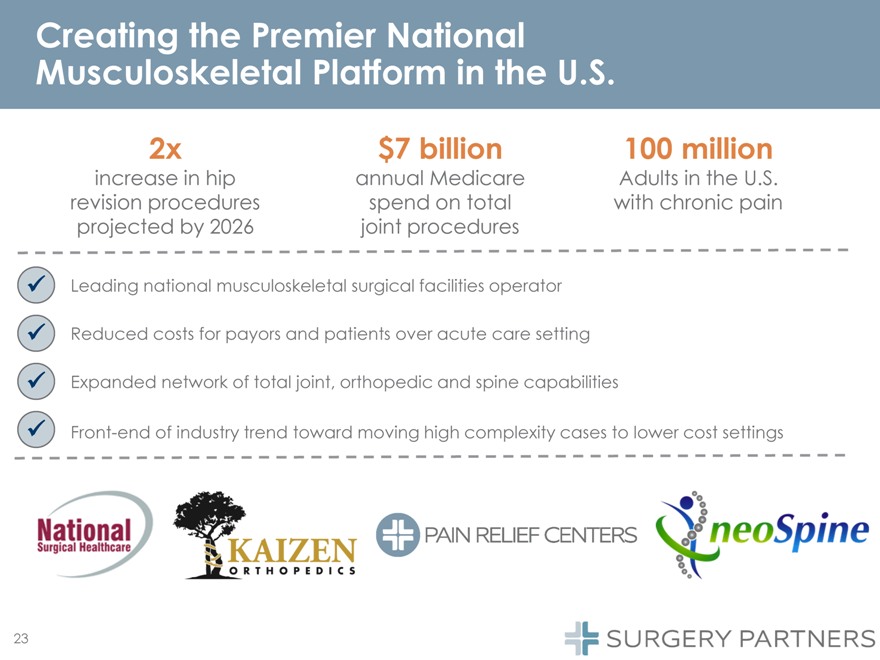

Creating the Premier National Musculoskeletal Platform in the U.S. 2x $7 billion 100 million increase in

hip annual Medicare Adults in the U.S. revision procedures spend on total with chronic pain projected by 2026 joint procedures Leading national musculoskeletal surgical facilities operator Reduced costs for payors and patients over acute care

setting Expanded network of total joint, orthopedic and spine capabilities Front-end of industry trend toward moving high complexity cases to lower cost settings

23

Key Credit Highlights

24

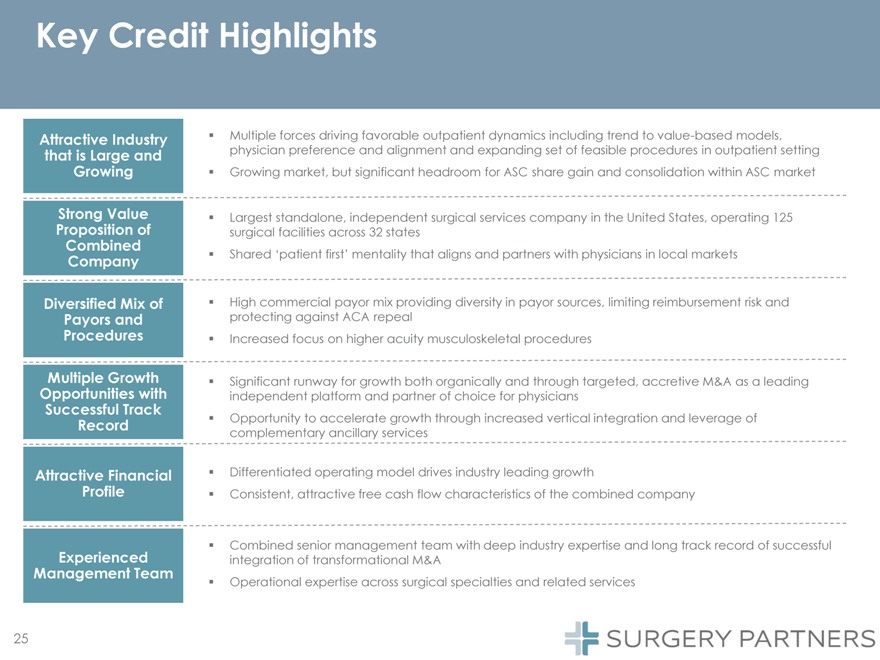

Key Credit Highlights Attractive Industry Multiple forces driving favorable outpatient dynamics including trend

to value-based models, that is Large and physician preference and alignment and expanding set of feasible procedures in outpatient setting Growing Growing market, but significant headroom for ASC share gain and consolidation within ASC market Strong

Value Largest standalone, independent surgical services company in the United States, operating 125 Proposition of surgical facilities across 32 states Combined Company Shared patient first mentality that aligns and partners with physicians in local

markets Diversified Mix of High commercial payor mix providing diversity in payor sources, limiting reimbursement risk and Payors and protecting against ACA repeal Procedures Increased focus on higher acuity musculoskeletal procedures Multiple

Growth Significant runway for growth both organically and through targeted, accretive M&A as a leading Opportunities with independent platform and partner of choice for physicians Successful Track Record Opportunity to accelerate growth through

increased vertical integration and leverage of complementary ancillary services Attractive Financial Differentiated operating model drives industry leading growth Profil Consistent, attractive free cash flow characteristics of the combined company

Combined senior management team with deep industry expertise and long track record of successful Experienced integration of transformational M&A Management Team Operational expertise across surgical specialties and related services

25

Attractive Industry: Rapidly Evolving Healthcare Market Key trends in the increasingly dynamic US healthcare

market have produced an attractive backdrop for companies focused on high quality, outpatient care Value proposition of the low cost / high quality outpatient setting increasingly resonates with payors, physicians, and patients Market continues to

migrate to value-based care and bundled payment models High-deductible health plans and increased price transparency drive consumers to influence where they receive care Improving technology and techniques are shifting higher acuity cases to

outpatient settings Managed care organizations continue to show willingness to direct patients to appropriate setting of care

26

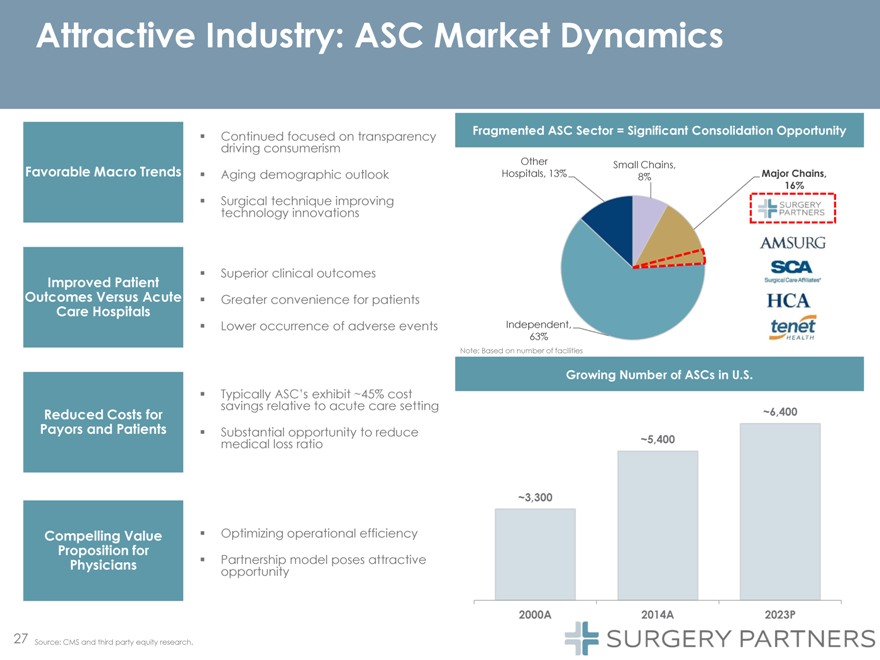

Attractive Industry: ASC Market Dynamics Favorable Macro Trends Improved Patient Outcomes Versus Acute Care

Hospitals Reduced Costs for Payors and Patients Compelling Value Proposition for Physicians Source: CMS and third party equity research.

27

Continued focused on transparency driving consumerism Aging demographic outlook Surgical technique improving

technology innovations Superior clinical outcomes Greater convenience for patients Lower occurrence of adverse events Typically ASC s exhibit ~45% cost savings relative to acute care setting Substantial opportunity to reduce medical loss ratio

Optimizing operational efficiency Partnership model poses attractive opportunity Fragmented ASC Sector = Significant Consolidation Opportunity OtherSmall Chains, Hospitals, 13% 8% Major Chains, 16% Independent, 63% Note: Based on number of

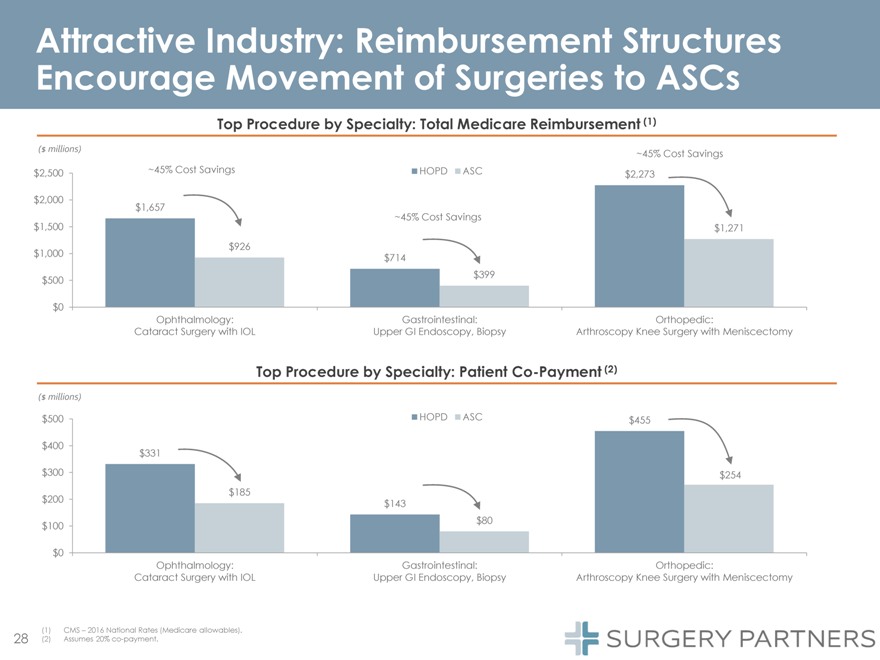

facilities Growing Number of ASCs in U.S. ~6,400 ~5,400 ~3,300 2000A 2014A 2023P Attractive Industry: Reimbursement Structures Encourage Movement of Surgeries to ASCs Top Procedure by Specialty: Total Medicare Reimbursement (1) ($ millions)

~45% Cost Savings $2,500 ~45% Cost Savings HOPD ASC $2,273 $2,000 $1,657 ~45% Cost Savings $1,500 $1,271 $926 $1,000 $714 $399 $500 $0 Ophthalmology: Gastrointestinal: Orthopedic: Cataract Surgery with IOL Upper GI Endoscopy, Biopsy Arthroscopy Knee

Surgery with Meniscectomy Top Procedure by Specialty: Patient Co-Payment (2) ($ millions) $500 HOPD ASC $455 $400 $331 $300 $254 $185 $200 $143 $80 $100 $0 Ophthalmology: Gastrointestinal: Orthopedic: Cataract Surgery with IOL Upper GI

Endoscopy, Biopsy Arthroscopy Knee Surgery with Meniscectomy (1) CMS 2016 National Rates (Medicare allowables). (2) Assumes 20% co-payment.

28

Attractive Industry: Win-Win-Win Value Proposition A Physician-Centric Value Proposition Designed to Drive High

Quality Patient Care in a Low Cost Setting Convenient, comfortable and cost-efficient settings Patients Superior clinical outcomes and increasing patient satisfaction while reducing costs Flexible approach to physician engagement: employment,

partnership, affiliation Physicians Convenient and efficient surgical facilities Differentiated care delivery model enhancing care coordination, quality, outcomes Outpatient care at significantly lower cost than general acute care hospitals Payors

OIG estimates $12bn Medicare savings shifting outpatient surgery to an ASC setting

29

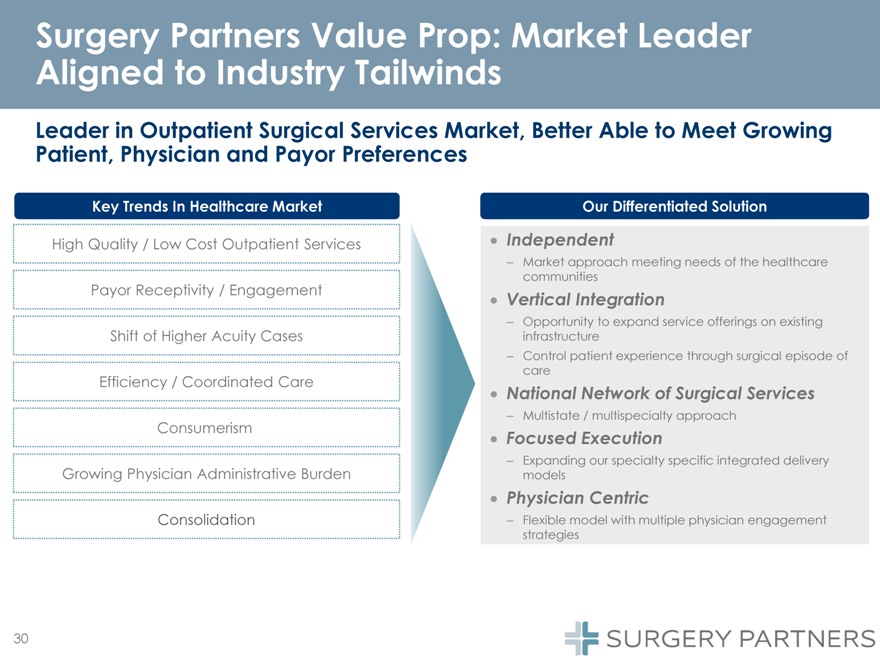

Surgery Partners Value Prop: Market Leader Aligned to Industry Tailwinds Leader in Outpatient Surgical Services

Market, Better Able to Meet Growing Patient, Physician and Payor Preferences Key Trends In Healthcare Market Our Differentiated Solution High Quality / Low Cost Outpatient Services Independent Market approach meeting needs of the healthcare

communities Payor Receptivity / Engagement Vertical Integration Opportunity to expand service offerings on existing Shift of Higher Acuity Cases infrastructure Control patient experience through surgical episode of care Efficiency / Coordinated Care

ational Network of Surgical ServicesMultistate / multispecialty approach Consumerism Focused Execution Expanding our specialty specific integrated delivery Growing Physician Administrative Burden models Physician Centric Consolidation Flexible model

with multiple physician engagement strategies

30

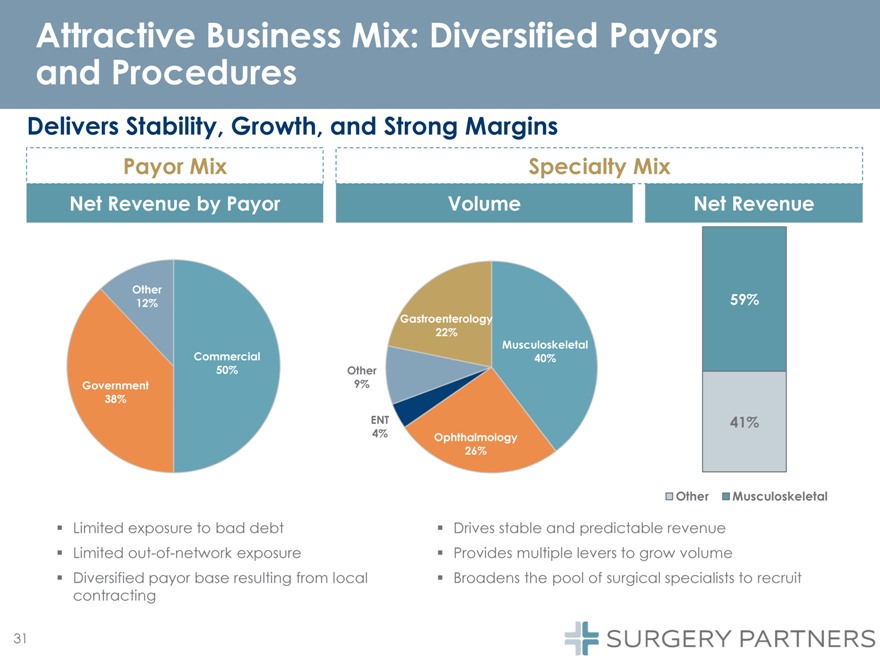

Attractive Business Mix: Diversified Payors and Procedures Delivers Stability, Growth, and Strong Margins Payor

Mix Net Revenue by Payor Other 12% Commercial 50% Other Government 9% 38% ENT 4% Limited exposure to bad debt Limited out-of-network exposure Diversified payor base resulting from local contracting Specialty Mix Volume Net Revenue 59%

Gastroenterology 22% Musculoskeletal 40% 41% Ophthalmology 26% Other Musculoskeletal Drives stable and predictable revenue Provides multiple levers to grow volume Broadens the pool of surgical specialists to recruit

31

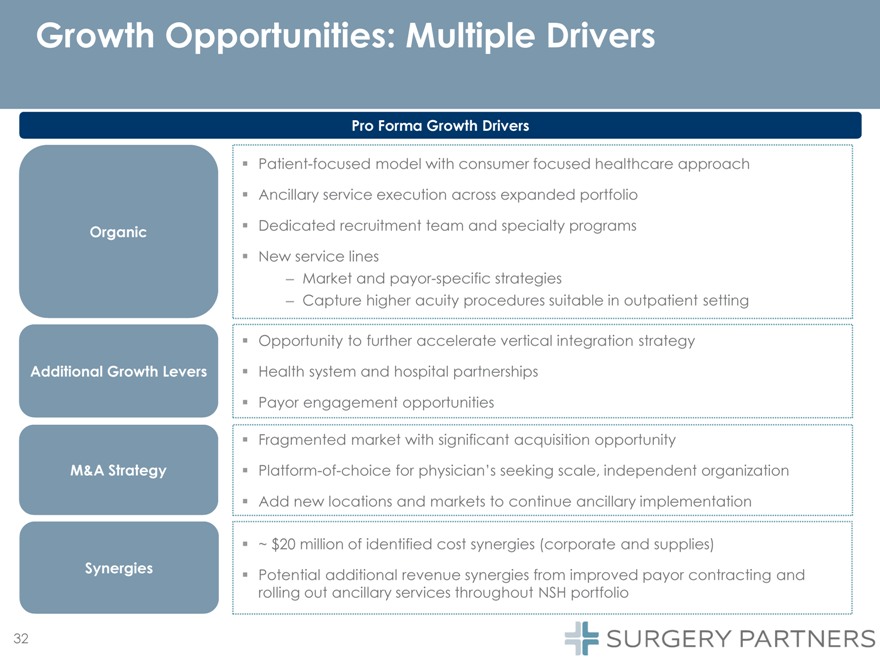

Growth Opportunities: Multiple Drivers Pro Forma Growth Drivers Patient-focused model with consumer focused

healthcare approach Ancillary service execution across expanded portfolio Organic Dedicated recruitment team and specialty programs New service lines Market and payor-specific strategies Capture higher acuity procedures suitable in outpatient

setting Opportunity to further accelerate vertical integration strategy Additional Growth Levers Health system and hospital partnerships Payor engagement opportunities Fragmented market with significant acquisition opportunity M&A Strategy

Platform-of-choice for physician s seeking scale, independent organization Add new locations and markets to continue ancillary implementation~ $20 million of identified cost synergies (corporate and supplies) Synergies Potential additional revenue

synergies from improved payor contracting and rolling out ancillary services throughout NSH portfolio

32

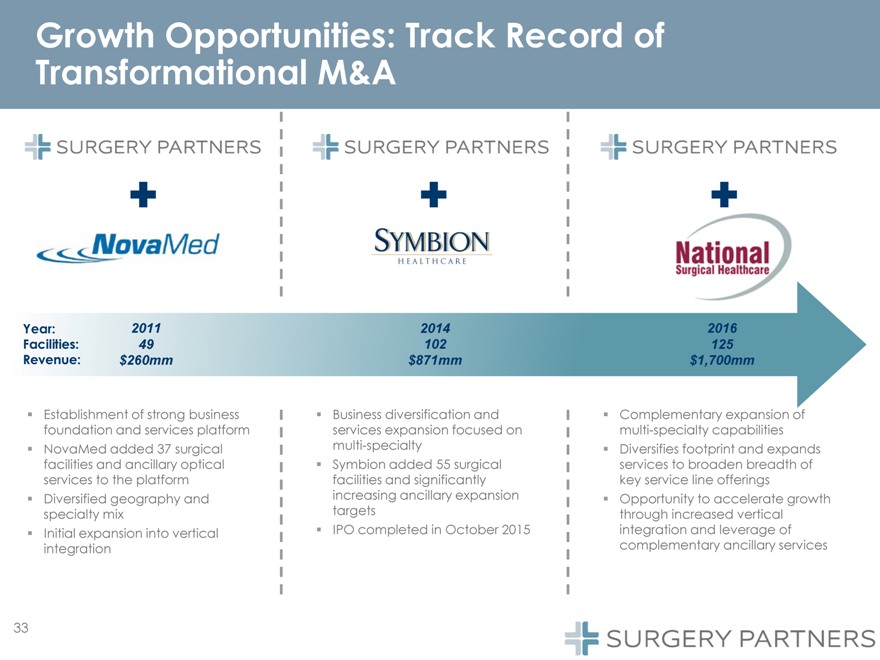

Growth Opportunities: Track Record of Transformational M&A 2016 Future Year: 2011 2014 2016 Facilities: 49

102 125 Revenue: $260mm $871mm $1,700mm Establishment of strong business Business diversification and Complementary expansion of foundation and services platform services expansion focused on multi-specialty capabilities NovaMed added 37 surgical

multi-specialty Diversifies footprint and expands facilities and ancillary optical Symbion added 55 surgical services to broaden breadth of services to the platform facilities and significantly key service line offerings Diversified geography and

increasing ancillary expansion Opportunity to accelerate growth specialty mix targets through increased vertical Initial expansion into vertical IPO completed in October 2015 integration and leverage of integration complementary ancillary services

33

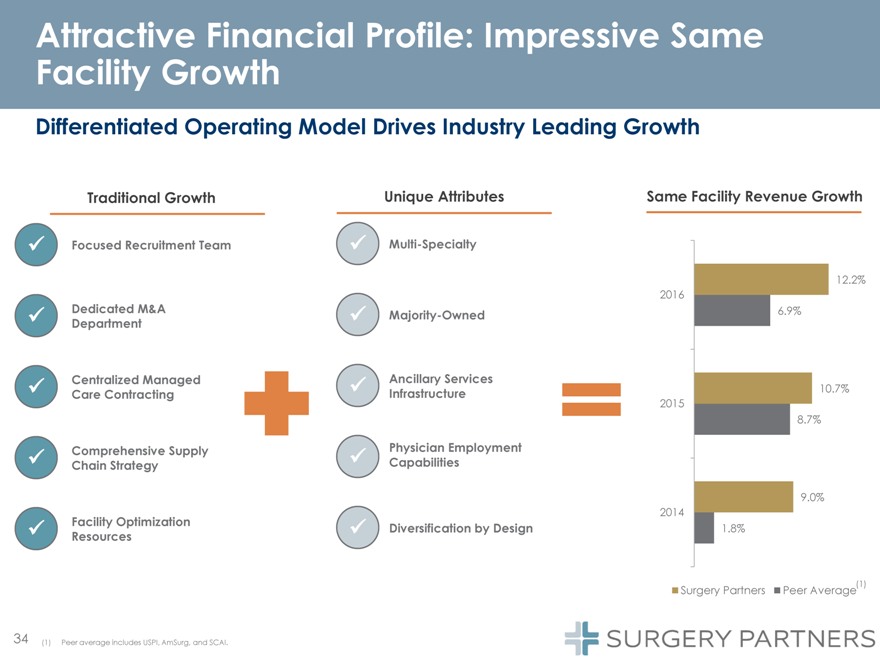

Attractive Financial Profile: Impressive Same Facility Growth Differentiated Operating Model Drives Industry

Leading Growth Traditional Growth Focused Recruitment Team Dedicated M&A Department Centralized Managed Care Contracting Comprehensive Supply Chain Strategy Facility Optimization Resources (1) Peer average includes USPI, AmSurg, and SCAI.

Unique Attributes Same Facility Revenue Growth Multi-Specialty 12.2% 2016 Majority-Owned 6.9% Ancillary Services Infrastructure 10.7% 2015 8.7% Physician Employment Capabilities 9.0% 2014 Diversification by Design 1.8% Surgery Partners Peer

Average(1)

34

Management Team: Deep Industry Expertise and Successful Track Record Precedent Strategic M&AExperienced

Management Team Track Record of Successful Integration of Transformational M&A Differentiated Organic Growth Strategy Operational Expertise Across Surgical Specialties and Related Services Long History of Delivering Financial Results and Driving

Shareholder Value

35

Financial Overview

36

Key Financial Highlights Differentiated operating model: Unique focus on ancillary services Strong financial

performance: Industry leading same-facility growth Successful execution of physician engagement strategy including physician recruitment and employment Revenue and EBITDA growth driven by same-facility growth, synergy realization and in- market

practice development growth High free cash flow conversion for both Surgery Partners and NSH averaging 86% and 87%, respectively Significant scale, diversification and value creation from transformational acquisitions Significantly accelerate future

growth potential Result in best-in-class management team with historical track record of successful execution Roadmap for future growth leverages core competencies: Multi-specialty focus Majority ownership Ancillary services penetration Ongoing

in-market physician practice development Opportunistic surgical facility acquisitions

37

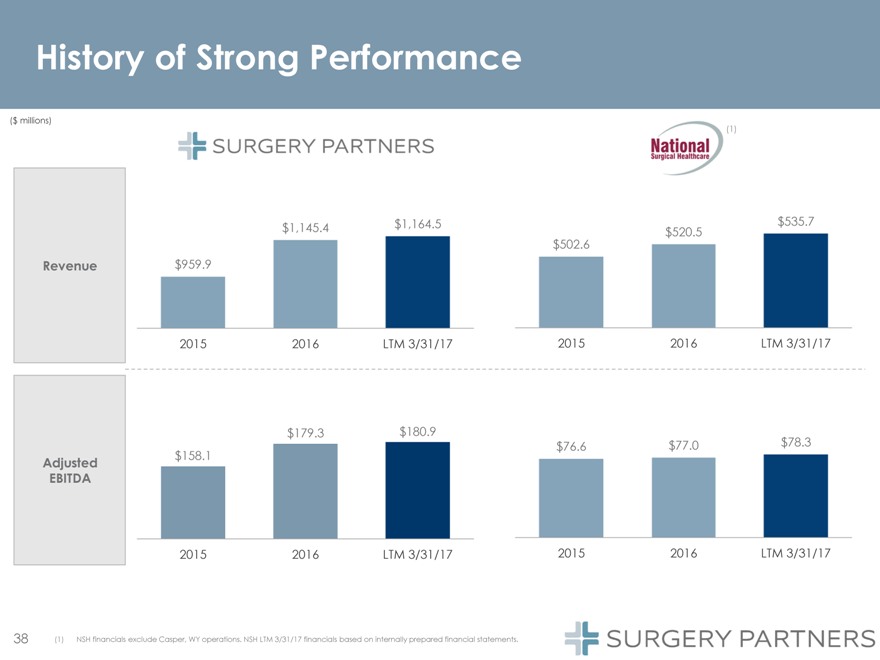

History of Strong Performance ($ millions) (1) $1,164.5 $535.7 $1,145.4 $520.5 $502.6 Revenue $959.9 2015

2016 LTM 3/31/17 2015 2016 LTM 3/31/17 $179.3 $180.9 $76.6 $77.0 $78.3 Adjusted $158.1 EBITDA 2015 2016 LTM 3/31/17 2015 2016 LTM 3/31/17 (1) NSH financials exclude Casper, WY operations. NSH LTM 3/31/17 financials based on internally prepared

financial statements.

38

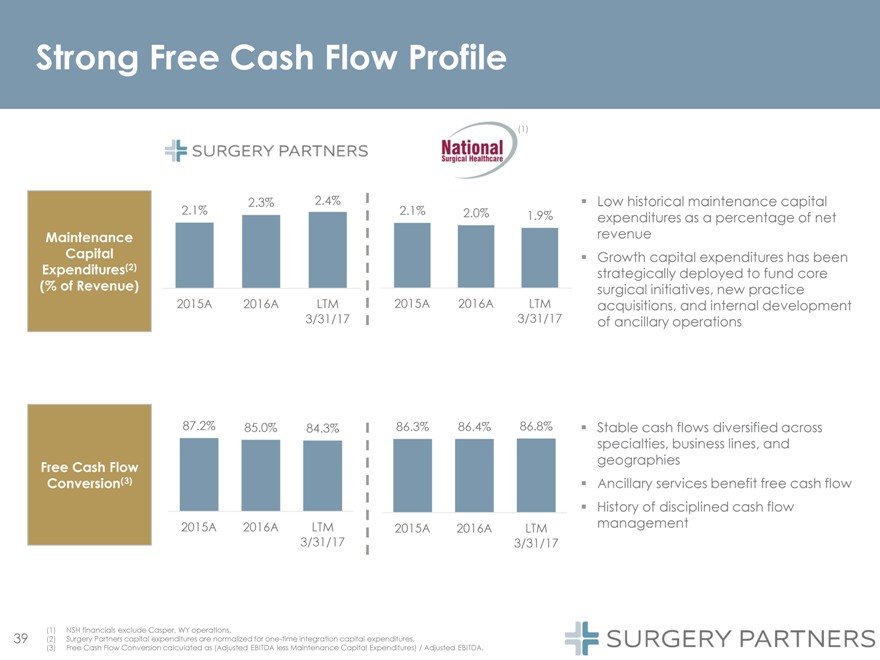

Strong Free Cash Flow Profile [Graphic Appears Here] 2.3% 2.4% 2.1% 2.1% 2.0% 1.9% Maintenance Capital

Expenditures(2) (% of Revenue) 2015A 2016A LTM 2015A 2016A LTM 3/31/17 3/31/17 87.2% 85.0% 84.3% 86.3% 86.4% 86.8% Free Cash Flow Conversion(3) 2015A 2016A LTM 2015A 2016A LTM 3/31/17 3/31/17 Low historical maintenance capital expenditures as a

percentage of net revenue Growth capital expenditures has been strategically deployed to fund core surgical initiatives, new practice acquisitions, and internal development of ancillary operations Stable cash flows diversified across specialties,

business lines, and geographies Ancillary services benefit free cash flow History of disciplined cash flow management (1) NSH financials exclude Casper, WY operations. (2) Surgery Partners capital expenditures are normalized for one-time

integration capital expenditures. (3) Free Cash Flow Conversion calculated as (Adjusted EBITDA less Maintenance Capital Expenditures) / Adjusted EBITDA.

39

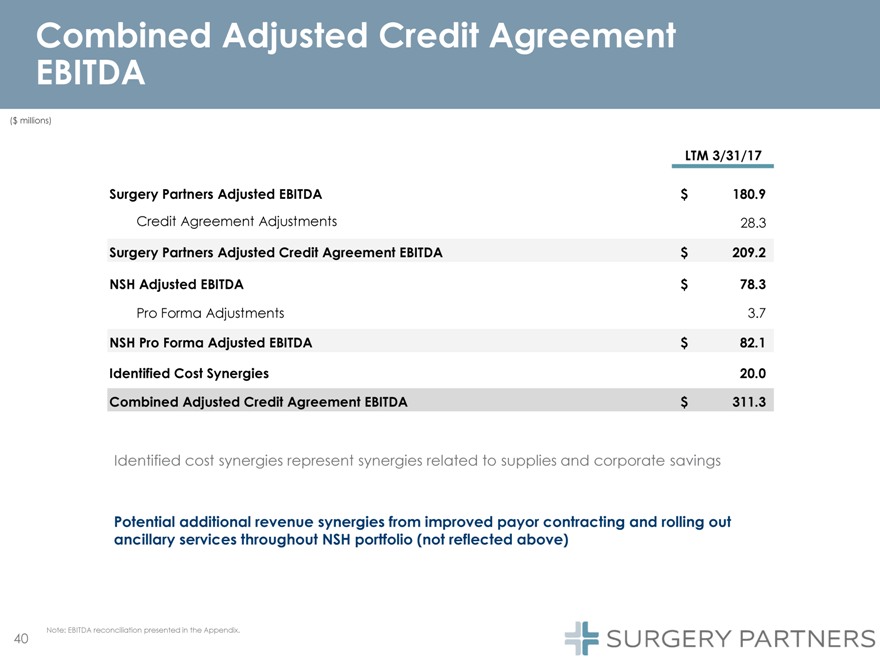

Combined Adjusted Credit Agreement EBITDA ($ millions) LTM 3/31/17 Surgery Partners Adjusted EBITDA $180.9

Credit Agreement Adjustments 28.3 Surgery Partners Adjusted Credit Agreement EBITD $209.2 NSH Adjusted EBITDA $78.3 Pro Forma Adjustments 3.7 NSH Pro Forma Adjusted EBITDA $82.1 Identified Cost Synergies 20.0 Combined Adjusted Credit Agreement

EBITDA $311.3 Identified cost synergies represent synergies related to supplies and corporate savings Potential additional revenue synergies from improved payor contracting and rolling out ancillary services throughout NSH portfolio (not reflected

above) Note: EBITDA reconciliation presented in the Appendix.

40

Q&A

41

Appendix

42

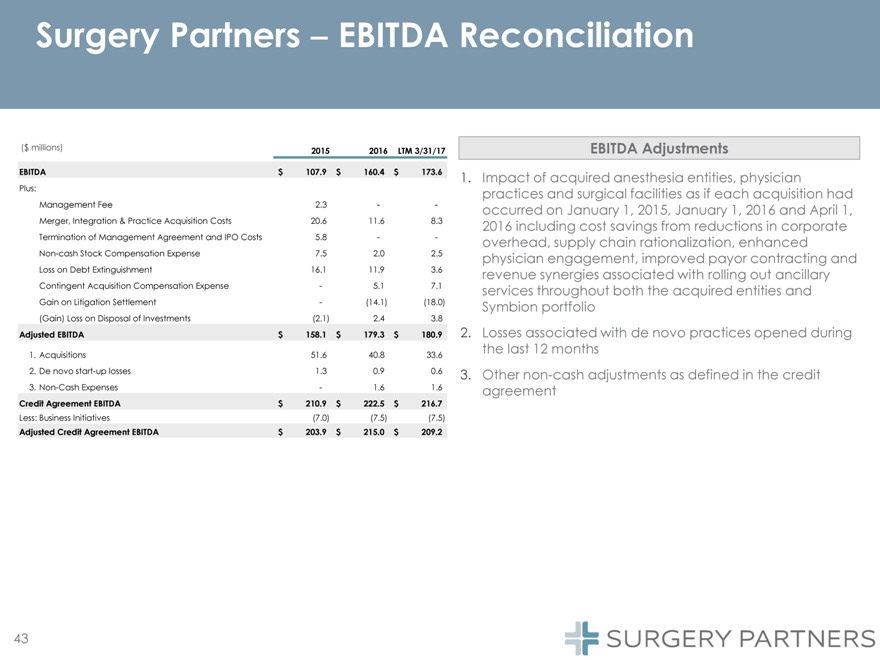

Surgery Partners EBITDA Reconciliation ($ millions) 20152016 LTM 3/31/17 EBITDA Adjustments EBITDA $ 107.9

$160.4 $173.6 1.Impact of acquired anesthesia entities, physician Plus: practices and surgical facilities as if each acquisition had Management Fee 2.3 occurred on January 1, 2015, January 1, 2016 and April 1, Merger,

Integration & Practice Acquisition Costs 20.611.6 8.32016 including cost savings from reductions in corporate Termination of Management Agreement and IPO Costs 5.8overhead, supply chain rationalization, enhanced Non-cash Stock Compensation

Expense 7.52.0 2.5 physician engagement, improved payor contracting and Loss on Debt Extinguishment 16.1 1.9 3.6 revenue synergies associated with rolling out ancillary Contingent Acquisition Compensation Expense 5.1 7.1 services throughout both the

acquired entities and Gain on Litigation Settlement (14.1) (18.0) Symbion portfolio (Gain) Loss on Disposal of Investments (2.1) 2.4 3.8 Adjusted EBITDA $ 158.1 $ 179.3 $ 180.9 2. Losses associated with de novo practices opened during

1. Acquisitions 51.6 40.8 33.6 the last 12 months 2. De novo start-up losses 1.3 0.9 0.6 3. Other non-cash adjustments as defined in the credit 3. Non-Cash Expenses 1.6 1.6 agreement Credit Agreement EBITDA $ 210.9 $222.5 $216.7 Less: Business

Initiatives (7.0) (7.5) (7.5) Adjusted Credit Agreement EBITDA $ 203.9 $215.0 $209.2

43

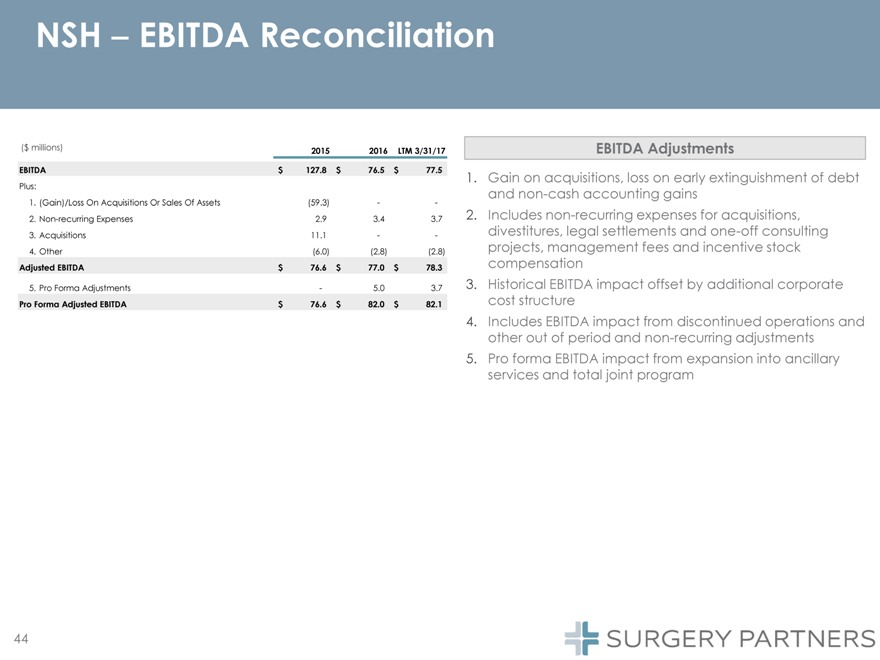

NSH EBITDA Reconciliation ($millions) 2015 2016 LTM 3/31/17 EBITDA $127.8 $76.5 $ 77.5 Plus: 1. (Gain)/Loss On

Acquisitions Or Sales Of Assets (59.3) -2. Non-recurring Expenses 2.9 3.4 3.7 3. Acquisitions 11.1 - 4. Other (6.0) (2.8) (2.8) Adjusted EBITDA $76.6 $77.0 $78.3 5. Pro Forma Adjustments 5.0 3.7 Pro Forma Adjusted EBITDA $76.6

$82.0 $82.1 EBITDA Adjustments Gain on acquisitions, loss on early extinguishment of debt and non-cash accounting gains Includes non-recurring expenses for acquisitions, divestitures, legal settlements and one-off consulting projects, management

fees and incentive stock compensation Historical EBITDA impact offset by additional corporate cost structure Includes EBITDA impact from discontinued operations and other out of period and non-recurring adjustments Pro forma EBITDA impact from

expansion into ancillary services and total joint program

44