Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - B. Riley Financial, Inc. | s106295_ex99-1.htm |

| 8-K - 8-K - B. Riley Financial, Inc. | s106295_8k.htm |

Exhibit 99.2

Confidential May 2017 A Diversified Provider of Financial & Business Advisory Services NASDAQ:RILY

2 Safe Harbor Statement FORWARD LOOKING STATEMENTS Statements in this presentation that are not descriptions of historical facts are forward - looking statements that are based on management’s current expectations and assumptions and are subject to risks and uncertainties . If such risks or uncertainties materialize or such assumptions prove incorrect, our business, operating results, financial condition and stock price could be materially negatively affected . In some cases, you can identify forward - looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” “will,” “would” or the negative of these terms or other comparable terminology . You should not place undue reliance on such forward - looking statements, which are based on the information currently available to us and speak only as of the date of this presentation . Because these forward - looking statements involve known and unknown risks and uncertainties, there are important factors that could cause actual results, events or developments to differ materially from those expressed or implied by these forward - looking statements, including our plans, objectives, expectations, intentions and other factors set forth in the sections entitled “Risk Factors” in our Annual Report on Form 10 - K for the fiscal year ended December 31 , 2016 and in our Quarterly Report on Form 10 - Q for the fiscal quarter ended March 31 , 2017 . Risk factors that could cause actual results to differ from those contained in the forward - looking statements include but are not limited to risks related to : our completed acquisition of United Online, Inc . and the anticipated acquisitions of FBR & Co . , Inc . , the parent company of FBR Capital Markets & Co . (“FBR”), and Wunderlich Investment Company, Inc . , the parent company of Wunderlich Securities, Inc , (“ Wunderlich ”), including the ability to achieve expected cost savings or other acquisition benefits, in each case within expected time - frames or at all ; the possibility that our proposed acquisitions of FBR and Wunderlich do not close when expected or at all ; our ability to promptly and effectively integrate our business with that of FBR and/or Wunderlich if such transactions close ; the reaction to the FBR acquisition and the Wunderlich acquisition of our, FBR's and Wunderlich's customers, employees and counterparties ; the diversion of management time on acquisition - related issues ; volatility in our revenues and results of operations ; changing conditions in the financial markets ; our ability to generate sufficient revenues to achieve and maintain profitability ; the short term nature of our engagements ; the accuracy of our estimates and valuations of inventory or assets in “guarantee” based engagements ; competition in the asset management business ; potential losses related to our auction or liquidation engagements ; our dependence on communications, information and other systems and third parties ; potential losses related to purchase transactions in our auction and liquidations business ; the potential loss of financial institution clients ; potential losses from or illiquidity of our proprietary investments ; changing economic and market conditions ; potential liability and harm to our reputation if we were to provide an inaccurate appraisal or valuation ; potential mark - downs in inventory in connection with purchase transactions ; failure to successfully compete in any of our segments ; loss of key personnel ; our ability to borrow under our credit facilities as necessary ; failure to comply with the terms of our credit agreements ; and our ability to meet future capital requirements . We undertake no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise . We have filed a registration statement (including a prospectus) with the SEC for the offering to which this presentation relates . Before you invest in such offering, you should read the prospectus in that registration statement, the prospectus supplement for the offering and other documents we have filed with the SEC for more complete information about us and the offering . You may get these documents for free by visiting EDGAR on the SEC website at www . sec . gov . Alternatively, we will arrange to send you the prospectus if you request it by calling 1 - 888 - 295 - 0155 . In particular, you should review the preliminary prospectus supplement that we have prepared in connection with the offering and the financial information included or incorporated by reference therein before you invest .

3 Issuer B. Riley Financial, Inc. (“B. Riley”, “RILY”, or the “Company”) Security Senior Unsecured Notes Proposed Ticker / Exchange RILYZ / NASDAQ Offering Size $25,000,000 (1) Notes Offered 1,000,000 (1) Overallotment Option 15% Par Value $25.00 Coupon 7.500% (1) Maturity / No Call Period 10 Years / 3 Years Use of Proceeds If the Wunderlich Merger is consummated, a portion of the net proceeds from this offering will be used to fund a portion of the Wunderlich Merger. The remaining net proceeds from this offering, if any, will be used for general corporate purposes Expected Pricing Date 5/23/2017 Bookrunning Managers FBR, B. Riley, Wunderlich , Incapital Co - Managers Boenning & Scattergood , Inc., William Blair, Wedbush ___________________________ (1) Actual offering size and pricing may differ materially from the figures shown; offering size and pricing to be determined by neg otiations between the Company and the underwriters Transaction Summary

4 ___________________________ (1) For a definition of Adjusted EBITDA & Pro Forma Adjusted EBITDA and a reconciliation to GAAP financial measures, please see the Appendix. (2) I ncludes the $25m bond offering to which this presentation relates. TTM Adj. EBITDA includes B. Riley and FBR & Co. for the time period of 4/1/16 – 3/31/17 . (3) Includes estimated interest expense on the $25m bond offering and incurred interest expense for the time period of 4/1/16 – 3/31/17 . TTM Adj. EBITDA includes B. Riley and FBR & Co. for the time period of 4/1/16 – 3/31/17 . » Strong capitalization at B. Riley with $113 million in cash & securities owned as of 3/31/17 ▪ Net cash and securities balances will fluctuate based upon short - term liquidation investment opportunities » B. Riley: TTM 3/31/17 Adj . EBITDA of $63 million; $ 15 million of Adj. EBITDA in 1Q17 (1) ▪ Pro forma (w/ FBR) - TTM 3/31/17 Adjusted EBITDA of $58 million (1) ▪ Excludes Wunderlich EBITDA contribution and potential cost synergies from combination » Pro forma (w/ FBR) TTM 3/31/17 Debt / Adj . EBITDA 0.9x (1,2) ; Pro forma (w/ FBR) TTM 3/31/17 Adj . EBITDA / Interest Expense of 12.7x (1,3) Clean Balance Sheet with Strong Cash Flows » Combination of diversified core businesses with multiple high - margin revenue streams ▪ Recently announced acquisitions of FBR & Co. (“ FBR”) and Wunderlich Investment Company, Inc. (“ Wunderlich ”) will drive scale and fits B. Riley’s business model ▪ Liquidations and investment banking offer a natural business cycle hedge and significant operating leverage above their break - even levels ▪ Appraisal, Asset Management and Internet Services offers steady, predictable revenue irrespective of the economic cycle ▪ United Online, Inc. (“United” or “UNTD”) provides steady cash flows and compelling risk - adjusted returns » Complementary capabilities in financial advisory and valuations ▪ Enhanced deal flow opportunities from a large platform with broad relationships ▪ Significant, expandable business relationship synergies promote ability to cross - sell core services across business units Attractive, Synergistic Model » Upswing in Equity Capital Markets activity after challenging 2016 environment; at the same time, there has been significant consolidation of small and mid - sized broker - dealers ▪ In the past 20 years, the number of broker - dealers has decreased by roughly 30% » GA Liquidations outlook is favorable as retailers face pressure due to secular shift from stores to online shopping ▪ Online sales and Amazon growth expected to continue fueling retailer pressures for years Favorable Market Dynamics Key Investment Highlights

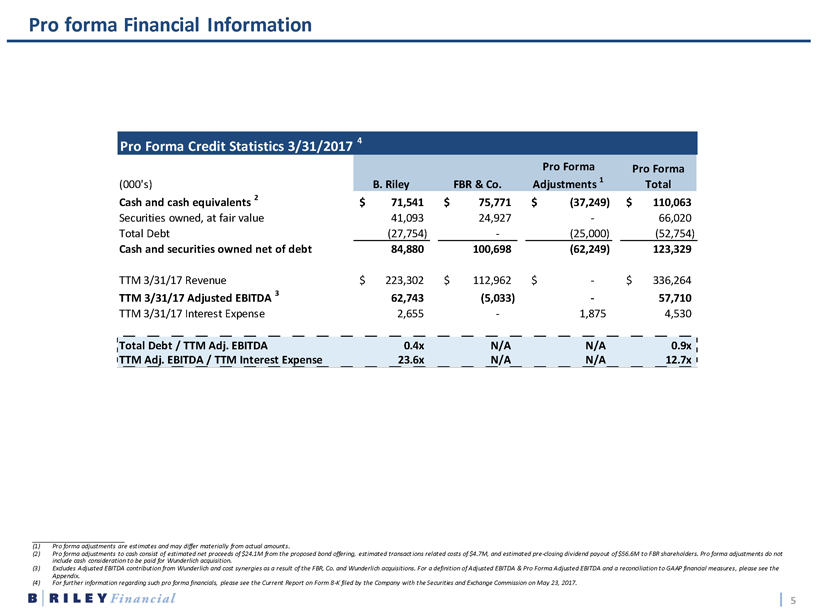

5 Pro forma Financial Information ___________________________ (1) Pro forma adjustments are estimates and may differ materially from actual amounts . (2) Pro forma adjustments to cash consist of estimated net proceeds of $24.1M from the proposed bond offering, estimated transact ion s related costs of $4.7M, and estimated pre - closing dividend payout of $56.6M to FBR shareholders. Pro forma adjustments do not include cash consideration to be paid for Wunderlich acquisition. (3) Excludes Adjusted EBITDA contribution from Wunderlich and cost synergies as a result of the FBR, Co. and Wunderlich acquisitions. For a definition of Adjusted EBITDA & Pro Forma Adjusted EBITDA and a reconciliation to GAAP financial measures , please see the Appendix . (4) For further information regarding such pro forma financials, please see the Current Report on Form 8 - K filed by the Company with the Securities and Exchange Commission on May 23, 2017. Pro Forma Credit Statistics 3/31/2017 4 (000's) B. Riley FBR & Co. Pro Forma Adjustments 1 Pro Forma Total Cash and cash equivalents 2 71,541$ 75,771$ (37,249)$ 110,063$ Securities owned, at fair value 41,093 24,927 - 66,020 Total Debt (27,754) - (25,000) (52,754) Cash and securities owned net of debt 84,880 100,698 (62,249) 123,329 TTM 3/31/17 Revenue 223,302$ 112,962$ -$ 336,264$ TTM 3/31/17 Adjusted EBITDA 3 62,743 (5,033) - 57,710 TTM 3/31/17 Interest Expense 2,655 - 1,875 4,530 Total Debt / TTM Adj. EBITDA 0.4x N/A N/A 0.9x TTM Adj. EBITDA / TTM Interest Expense 23.6x N/A N/A 12.7x

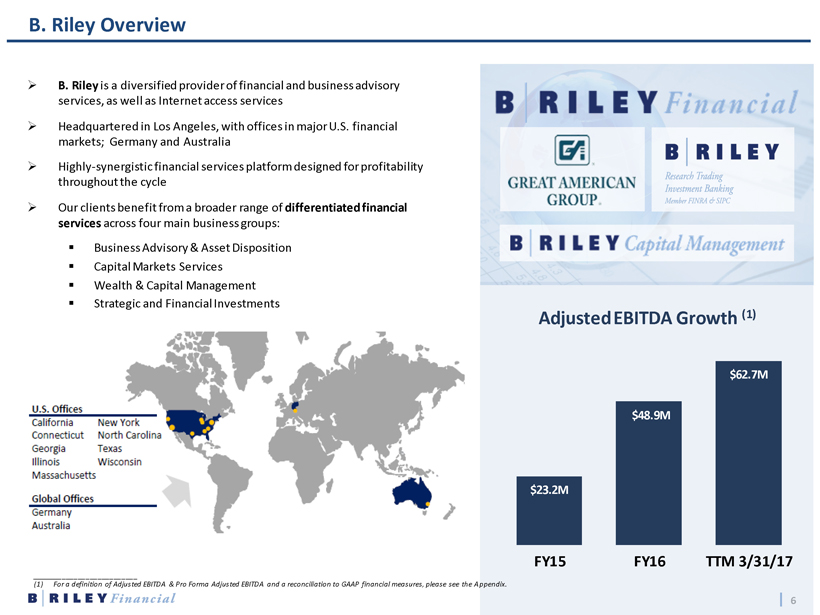

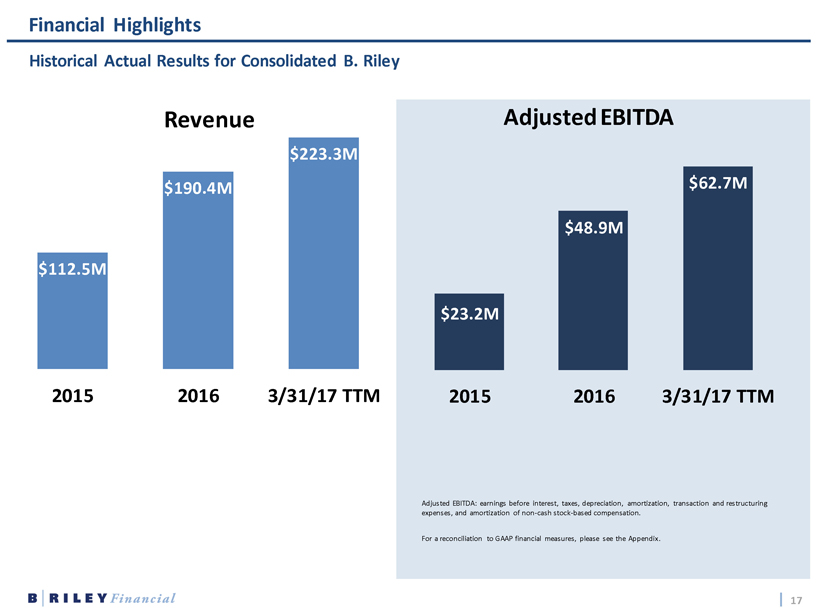

6 » B. Riley is a diversified provider of financial and business advisory services, as well as Internet access services » Headquartered in Los Angeles, with offices in major U.S. financial markets; Germany and Australia » Highly - synergistic financial services platform designed for profitability throughout the cycle » Our clients benefit from a broader range of differentiated financial services across four main business groups: ▪ Business Advisory & Asset Disposition ▪ Capital Markets Services ▪ Wealth & Capital Management ▪ Strategic and Financial Investments $23.2M $48.9M $62.7M FY15 FY16 TTM 3/31/17 Adjusted EBITDA Growth (1) B. Riley Overview ___________________________ (1) For a definition of Adjusted EBITDA & Pro Forma Adjusted EBITDA and a reconciliation to GAAP financial measures, please see the A ppe ndix .

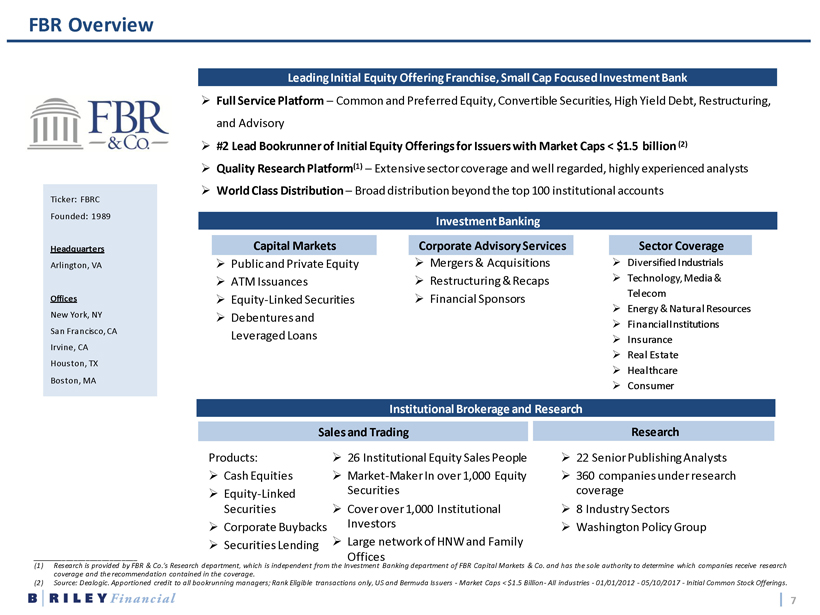

7 Ticker: FBRC Founded: 1989 Headquarters Arlington, VA Offices New York, NY San Francisco, CA Irvine, CA Houston, TX Boston, MA » Mergers & Acquisitions » Restructuring & Recaps » Financial Sponsors Corporate Advisory Services » Public and Private Equity » ATM Issuances » Equity - Linked Securities » Debentures and Leveraged Loans » Diversified Industrials » Technology, Media & Telecom » Energy & Natural Resources » Financial Institutions » Insurance » Real Estate » Healthcare » Consumer Sector Coverage Products: » Cash Equities » Equity - Linked Securities » Corporate Buybacks » Securities Lending Research » 26 Institutional Equity Sales People » Market - Maker In over 1,000 Equity Securities » Cover over 1,000 Institutional Investors » Large network of HNW and Family Offices » 22 Senior Publishing Analysts » 360 companies under research coverage » 8 Industry Sectors » Washington Policy Group » Full Service Platform – Common and Preferred Equity, Convertible Securities, High Yield Debt, Restructuring, and Advisory » #2 Lead Bookrunner of Initial Equity Offerings for Issuers with Market Caps < $1.5 billion (2) » Quality Research Platform (1) – Extensive sector coverage and well regarded, highly experienced analysts » World Class Distribution – Broad distribution beyond the top 100 institutional accounts FBR Overview ___________________________ (1) Research is provided by FBR & Co.’s Research department, which is independent from the Investment Banking department of FBR Capital Markets & Co. and has the sole authority to determine which companies receive research coverage and the recommendation contained in the coverage . (2) Source: Dealogic . Apportioned credit to all bookrunning managers; Rank Eligible transactions only, US and Bermuda Issuers - Market Caps < $1.5 Billion - All industries - 01/01/2012 - 0 5/10/2017 - Initial Common Stock Offerings. Capital Markets Sales and Trading Research Leading Initial Equity Offering Franchise, Small Cap Focused Investment Bank Investment Banking Institutional Brokerage and Research

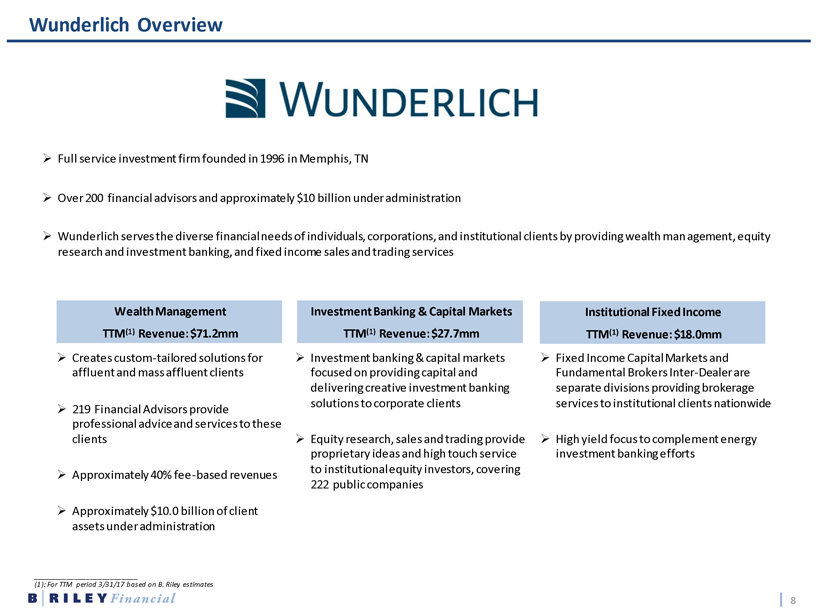

8 » Full service investment firm founded in 1996 in Memphis, TN » Over 200 financial advisors and approximately $10 billion under administration » Wunderlich serves the diverse financial needs of individuals, corporations, and institutional clients by providing wealth man age ment, equity research and investment banking, and fixed income sales and trading services Wunderlich Overview ___________________________ (1): For TTM period 3/31/17 based on B. Riley estimates Wealth Management TTM (1) Revenue: $71.2mm » Creates custom - tailored solutions for affluent and mass affluent clients » 219 Financial Advisors provide professional advice and services to these clients » Approximately 40% fee - based revenues » Approximately $10.0 billion of client assets under administration Investment Banking & Capital Markets TTM (1) Revenue: $27.7mm » Investment banking & capital markets focused on providing capital and delivering creative investment banking solutions to corporate clients » Equity research, sales and trading provide proprietary ideas and high touch service to institutional equity investors, covering 222 public companies Institutional Fixed Income TTM (1) Revenue: $18.0mm » Fixed Income Capital Markets and Fundamental Brokers Inter - Dealer are separate divisions providing brokerage services to institutional clients nationwide » High yield focus to complement energy investment banking efforts

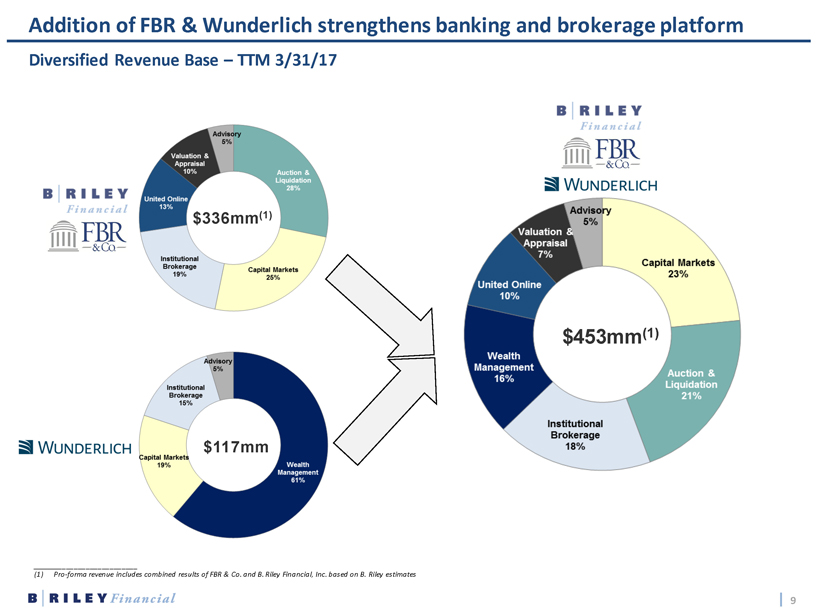

9 Diversified Revenue Base – TTM 3/31/17 $ 336mm (1) $117mm $ 453mm (1) Addition of FBR & Wunderlich strengthens banking and brokerage platform ___________________________ (1) Pro - forma revenue includes combined results of FBR & Co. and B. Riley Financial, Inc. based on B. Riley estimates

10 Combined Company will be a leading provider of small cap research coverage » 712 combined companies under coverage ▪ 554 covered by B. Riley’s 37 publishing analysts (1) ▪ 222 covered by Wunderlich’s 12 publishing analysts ▪ 64 overlapping names, representing 9% overlap » Both firms specialize in small and mid cap coverage ▪ Median market cap in B. Riley‘s coverage: $1.4b ▪ Median market cap in Wunderlich’s coverage: $1.2b » Minimal institutional client overlap to broaden distribution 554 222 712 Financial Services & Real Estate 20% TMT 28% Energy & Natural Resources 21% Consumer 23% Diversified Industrials 8% Financial Services & Real Estate 20% TMT 23% Energy & Natural Resources 14% Healthcare 9% Consumer 19% Diversified Industrials 11% Insurance 4% Financial Services & Real Estate 20% TMT 24% Energy & Natural Resources 15% Healthcare 7% Consumer 20% Diversified Industrials 11% Insurance 3% Complementary Institutional Brokerage Platforms ___________________________ (1) Pro - forma for FBR acquisition Note: 64 overlapping companies. Sectors based on FBR’s research practices; based on B. Riley estimates

11 » Wunderlich Wealth Management is focused on serving the financial needs of individual investors, professional corporations, qualified retirement plans, foundations and endowments . ▪ 219 Financial Advisors with 15+ years average industry experience ▪ $10 billion in assets under administration; 37,000 active accounts ▪ Locations in 17 states across the nation » Services provided include: ▪ Investment guidance, including access to proprietary and third - party research and market commentary ▪ Comprehensive wealth management solutions, including financial planning, retirement planning, income - generating investments, trusts, lending resources, and fiduciary services Complementary to existing B. Riley Wealth Management platform Wunderlich to Provide Substantial AUM Growth to Wealth Management ___________________________ Based on B. Riley estimates

12 Retail Liquidations Auction Services » Four decades of experience helping clients liquidate and realize returns from excess inventories & underperforming assets » Experience in some of largest liquidations including: ▪ Target Canada, Borders Books, Radio Shack, Circuit City ▪ Hancock Fabrics, Aeropostale , Masters DIY » Global expertise in retail liquidations including the following countries: ▪ United States ▪ Canada ▪ United Kingdom ▪ Germany ▪ Netherlands ▪ Australia » GA provides auction services to help clients dispose of assets quickly and efficiently at the best market prices » Serving a full range of industries : from construction, manufacturing and aerospace, to healthcare, food & beverage, and consumer products » GA leverages web technologies, real - time digital communications and proven marketing expertise to reach qualified buyers from around the world Select Retail Deals Select Auction Deals Great American Group: A Pioneer, with Four Decades of Experience

13 Bank Clients Corporations Appraised 354 467 488 552 603 645 646 715 927 1,035 1,098 1,220 1,305 1,309 1,269 1,275 Illustrative Clients Annual Appraisal Units » Over 20 years of experience; business started in 1997 » Provides appraisals to financial institutions & corporations for estimated liquidation value of assets » Valuation services: fairness opinions, financial reporting, corporate tax & risk management » High touch - point team of appraisers, project managers and business developers » 900+ unique company visits per year » Business model: recurring revenue from quarterly appraisals and fixed fees from valuation & advisory services ▪ Essential, required services for asset - based lenders » Steady topline and adjusted EBITDA growth Great American Group Valuation & Appraisal: Leading ABL Appraisal Practice Appraisal Services

14 Provider of asset based financing to liquidity constrained companies SELECT TRANSACTIONS Great American Capital Partners » GACP manages a direct lending fund ($150+ million) focused on providing financing to asset - rich companies seeking capital in add ition to traditional debt » Proprietary business leveraging GA’s deep experience in liquidation values and asset appraisals across a spectrum of industries » Typical loans are senior secured, first or second lien loans; may be issued in combination with first - out senior bank ABL lender s » Underwriting analysis based upon recovery from liquidating assets typically in bankruptcy process

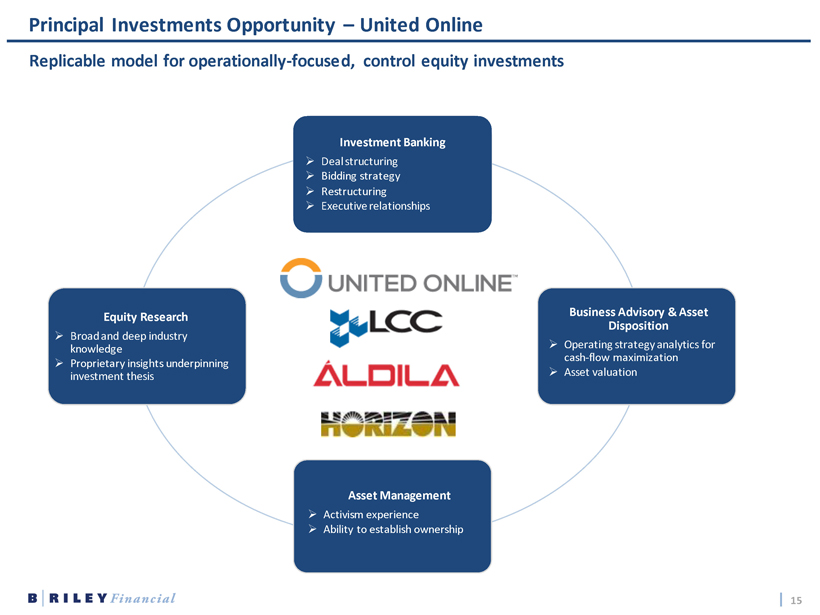

15 Investment Banking » Deal structuring » Bidding strategy » Restructuring » Executive relationships Business Advisory & Asset Disposition » Operating strategy analytics for cash - flow maximization » Asset valuation Asset Management » Activism experience » Ability to establish ownership Equity Research » Broad and deep industry knowledge » Proprietary insights underpinning investment thesis Principal Investments Opportunity – United Online Replicable model for operationally - focused, control equity investments

FINANCIAL OVERVIEW

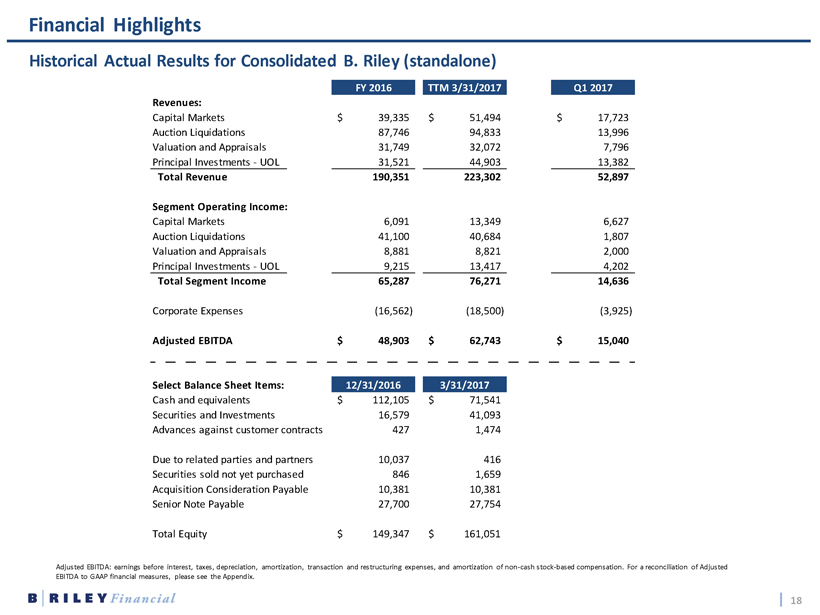

17 Financial Highlights $112.5M $190.4M $223.3M 2015 2016 3/31/17 TTM Revenue $23.2M $48.9M $62.7M 2015 2016 3/31/17 TTM Adjusted EBITDA Adjusted EBITDA: earnings before interest, taxes, depreciation, amortization, transaction and restructuring expenses, and amortization of non - cash stock - based compensation. For a reconciliation to GAAP financial measures, please see the Appendix . Historical Actual Results for Consolidated B. Riley

18 Financial Highlights Historical Actual Results for Consolidated B. Riley (standalone) Adjusted EBITDA: earnings before interest, taxes, depreciation, amortization, transaction and restructuring expenses, and amortization of non - cash stock - based compensation. For a reconciliation of Adjusted EBITDA to GAAP financial measures, please see the Appendix. FY 2016 TTM 3/31/2017 Q1 2017 Revenues: Capital Markets 39,335$ 51,494$ 17,723$ Auction Liquidations 87,746 94,833 13,996 Valuation and Appraisals 31,749 32,072 7,796 Principal Investments - UOL 31,521 44,903 13,382 Total Revenue 190,351 223,302 52,897 Segment Operating Income: Capital Markets 6,091 13,349 6,627 Auction Liquidations 41,100 40,684 1,807 Valuation and Appraisals 8,881 8,821 2,000 Principal Investments - UOL 9,215 13,417 4,202 Total Segment Income 65,287 76,271 14,636 Corporate Expenses (16,562) (18,500) (3,925) Adjusted EBITDA 48,903$ 62,743$ 15,040$ Select Balance Sheet Items: 12/31/2016 3/31/2017 Cash and equivalents 112,105$ 71,541$ Securities and Investments 16,579 41,093 Advances against customer contracts 427 1,474 Due to related parties and partners 10,037 416 Securities sold not yet purchased 846 1,659 Acquisition Consideration Payable 10,381 10,381 Senior Note Payable 27,700 27,754 Total Equity 149,347$ 161,051$

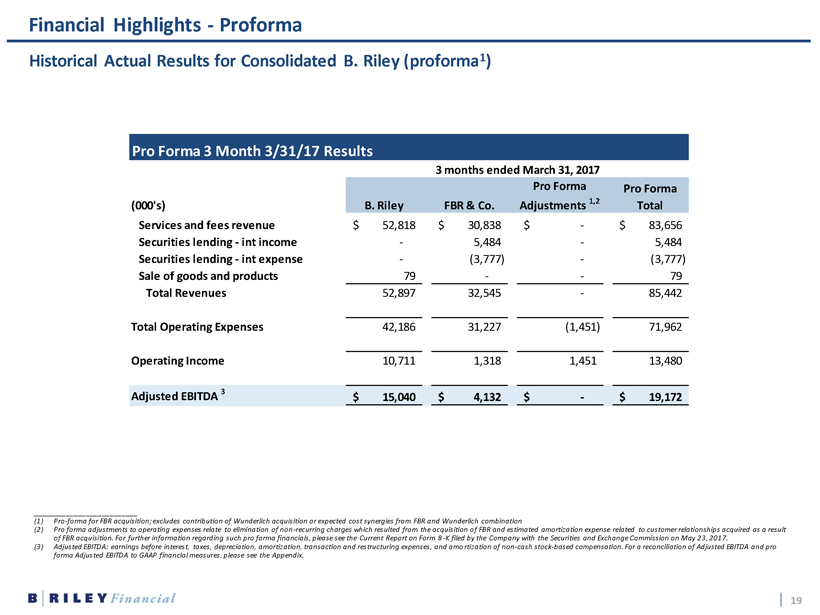

19 Financial Highlights - Proforma Historical Actual Results for Consolidated B. Riley (proforma 1 ) ___________________________ (1) Pro - forma for FBR acquisition; excludes contribution of Wunderlich acquisition or expected cost synergies from FBR and Wunderlich combination (2) Pro forma adjustments to operating expenses relate to elimination of non - recurring charges which resulted from the acquisition o f FBR and estimated amortization expense related to customer relationships acquired as a result of FBR acquisition. For further information regarding such pro forma financials, please see the Current Report on Form 8 - K filed by the Company with the Securities and Exchange Commission on May 23, 2017. (3) Adjusted EBITDA: earnings before interest, taxes, depreciation, amortization, transaction and restructuring expenses, and amo rti zation of non - cash stock - based compensation. For a reconciliation of Adjusted EBITDA and pro forma Adjusted EBITDA to GAAP financial measures, please see the Appendix. Pro Forma 3 Month 3/31/17 Results 3 months ended March 31, 2017 (000's) B. Riley FBR & Co. Pro Forma Adjustments 1,2 Pro Forma Total Services and fees revenue 52,818$ 30,838$ -$ 83,656$ Securities lending - int income - 5,484 - 5,484 Securities lending - int expense - (3,777) - (3,777) Sale of goods and products 79 - - 79 Total Revenues 52,897 32,545 - 85,442 Total Operating Expenses 42,186 31,227 (1,451) 71,962 Operating Income 10,711 1,318 1,451 13,480 Adjusted EBITDA 3 15,040$ 4,132$ -$ 19,172$

20 Key Takeaways » B. Riley / FBR / Wunderlich : combined research coverage of over 700 companies; broad investment banking coverage » Strong momentum in capital markets at all three companies, particularly during the last 6 months » Substantial wealth management advising over $10 billion in assets » Steady cash flow businesses (United Online, Appraisals, Wealth Management) provide steady, predictable cash flow and downside pr otection » Favorable secular trends for GA retail liquidation business; Amazon expected to continue to exert pressure on retailers for y ear s » Strong balance sheet; significant cash and securities balances » Low pro forma leverage and strong interest coverage Acquisitions of FBR & Wunderlich to create a leader in financial services and advisory

APPENDIX

22 Non - GAAP Financial Measures ___________________________ (1) FY 2016 amount Includes insurance recoveries and fair value adjustments. B. Riley Financial Standalone Results (000's) FY 2015 FY 2016 Q1 2017 Net Income 11,805 21,526 14,021 Provision (benefit) for income taxes 7,688 14,321 (3,849) Interest expense (income), net 817 1,678 659 Depreciation and amortization 848 4,306 2,042 Share based compensation 2,043 3,567 907 Transaction related costs - 1,236 886 Restructuring costs and other 1 - 2,269 374 Total Adjustments 11,396 27,377 1,019 Adjusted EBITDA 23,201$ 48,903$ 15,040$

23 Non - GAAP Financial Measures (Continued) ___________________________ (1) Pro forma for FBR acquisition; excludes contribution of Wunderlich acquisition or expected cost synergies from FBR and Wunderlich combination. (2) Pro forma adjustments to operating expenses relate to elimination of non - recurring charges which resulted from the acquisition o f FBR and estimated amortization expense related to customer relationships acquired as a result of FBR acquisition . (3) Pro forma adjustments to income tax provision are based on the impact of a combined federal and state statutory tax rate of 40.0% on the pro forma income that is subject t o i ncome taxes after accounting for the net income allocated to non - controlling interests . (4) Includes insurance recoveries and fair value adjustments. Pro Forma 3 Month 3/31/17 Results (000's) B. Riley FBR & Co. Pro Forma Adjustments 1,2,3 Pro Forma Total Net Income 14,021 1,266 710 15,997 Provision (benefit) for income taxes (3,849) 52 741 (3,056) Interest expense (income), net 659 - - 659 Depreciation and amortization 2,042 861 179 3,082 Share based compensation 907 948 - 1,855 Transaction related costs 886 840 (1,630) 96 Restructuring costs and other 374 164 - 538 Total Adjustments 1,019 2,866 (710) 3,175 Adjusted EBITDA 15,040$ 4,132$ -$ 19,172$ Pro Forma TTM 3/31/17 Results (000's) B. Riley FBR & Co. Pro Forma Adjustments 1,2,3 Pro Forma Total Net Income 35,299 (59,283) 51,521 27,537 Provision (benefit) for income taxes 10,306 44,935 (50,605) 4,636 Interest expense (income), net 2,208 - - 2,208 Depreciation and amortization 6,145 4,821 714 11,680 Share based compensation 4,037 2,444 - 6,481 Transaction related costs 2,105 990 (1,630) 1,465 Restructuring costs and other 4 2,643 1,060 - 3,703 Total Adjustments 27,444 54,250 (51,521) 30,173 Adjusted EBITDA 62,743$ (5,033)$ -$ 57,710$

24 Bryant Riley Chairman & CEO B. Riley Financial, Inc. brriley@brileyco.com Tel (310) 966 - 1444 Phillip Ahn COO & CFO B. Riley Financial, Inc. pahn@brileyfin.com Tel (818) 746 - 9194 Liolios Group Investor Relations Scott Liolios or Matt Glover Newport Beach, CA 92660 Tel (949) 574 - 3860 RILY@liolios.com 11100 Santa Monica Blvd ., Suite 800 Los Angeles , CA 90025 Tel (310) 966 - 1444 www.brileyfin.com Contact Us