Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SEARS HOMETOWN & OUTLET STORES, INC. | a51917-8k.htm |

1

SHO Performance and Strategy Update

May 24, 2017 Annual Meeting of Stockholders

2

2016 FINANCIAL RESULTS OVERVIEW

3

2016 Performance

($Millions) 2016 2015 2014

NET SALES 2,070$ 2,288$ 2,356$

Cost of sales and occupancy 1,661 1,769 1,803

Gross margin 409 519 553

Margin rate 19.7% 22.7% 23.5%

Selling and administrative 459 546 547

Selling and administrative expense % of sales 22.2% 23.9% 23.2%

Impairment of goodwill, property and equipment 9 4 168

Depreciation and amortization 13 11 9

Gain on the sale of assets (25) - -

Operating loss (48)$ (42)$ (171)$

NET LOSS (132)$ (27)$ (169)$

Net loss (132)$ (27)$ (169)$

Income tax (benefit) expense 81 (15) (3)

Other income (1) (3) (3)

Interest expense 4 3 4

Operating loss (48) (42) (171)

Depreciation and amortization 13 11 9

Gain on the sale of assets (25) - -

Impairment of goodwill, property and equipment 9 4 168

Severance and transition costs - 1 -

Initial franchise revenues net of provision for losses (1) 25 (4)

IT transformation investments 15 11 -

Accelerated closure of under-performing stores 17 - -

ADJUSTED EBITDA (19)$ 9$ 2$

FISCAL YEAR

4

Earnings Review

Results Overview (FY 2016 v. FY 2015):

Comparable store sales decreased 4.4%

Continued pricing pressure, particularly in Outlet, drove gross margin

decrease of 292 bps to 19.7%

Adjusted EBITDA decreased $27.9 million to $(18.5) million

Short-term borrowings decreased $41.5 million to $26.8 million at year-end

2016 compared to $68.3 million at year-end 2015

Performance Drivers:

Hyper-competitive promotional environment pushing down average selling

prices

Shift in customers choosing to purchase directly online with competitors

Accelerated the closure of 109 locations in the fourth quarter of 2016 to

make the best use of capital and lower costs resulting in store closing

charges of $17.7 million and approximately $25 million in net proceeds from

inventory liquidation

Sold San Leandro facility for $26.1 million resulting in gain of $25.2 million

5

Progress on Key Strategic Initiatives

Hometown Transactional Websites

Expanded our capabilities as an ecommerce retailer with the launch of three new transactional

websites for our Hometown segment in the third quarter and further enhanced the websites in

the fourth quarter with the ability to apply for the Sears credit card online with instant approval

and use at check-out

Lease-to-Own Program

Revenue up 20.5% due to increased emphasis on the program and execution of a new

contract with our Lease-to-Own services provider

America’s Appliance Experts

Converted 290 stores to AAE format in 2016 bringing total conversions to 470 stores since the

launch of the program in 2015. Since conversion, these stores have outperformed non-AAE

stores in Home Appliances (“HA”) sales and total sales by 346 bps and 190 bps, respectively;

additional 150 – 200 AAE conversions are planned for 2017

Outlet Sourcing

Completed renegotiation of all non-SHC HA supplier contracts through the first quarter of 2017

to significantly reduce the effective product costs of Outlet Out-of-Box appliances

IT Transformation and Operational Independence

In 2016, we (1) launched our Hometown transactional websites, (2) transitioned

human resources, payroll, and select finance functionalities, (3) paid commissions directly to

our dealers and franchisees, and (4) are now able to purchase directly via electronic data

interchange with many of our suppliers

6

2016 Sales Performance

Hometown

Home appliances comp sales were down 3.4%, impacted by average ticket erosion due to aggressive manufacturer sponsored

promotions

Lawn and garden experienced a 4.9% decline due to unfavorable weather conditions impacting the spring power lawn

equipment category and less snowfall resulting in lower sales of power snow removal equipment

Tools were down 2.5% impacted by reduced marketing spend by the Craftsman brand specific to direct response television

advertising and increased competitor promotional activity in the fourth quarter of 2016

Outlet

Home appliances were down 3.4% as the hyper-competitive environment for New-in-Box appliances drove down the average

ticket for Out-of-Box appliances by 5.9% in 2016.

Lawn and garden experienced an 8.5% decline due to unfavorable weather conditions and inventory availability in Outlet-

oriented mowers and tractors

Tools were down 0.5%, impacted by declines in Portable Power Tools and Mechanic’s Tool sets

-10.0%

-8.0%

-6.0%

-4.0%

-2.0%

0.0%

Hometown Outlet Consolidated

Per

cen

tag

e C

han

ge

2016 Comparable Store Sales

(Major Categories Performance)

Home Appliances Lawn and Garden Tools

-4.2%

-4.9%

-4.4%

-5.0%

-4.0%

-3.0%

Hometown Outlet Consolidated

Per

cen

tag

e C

han

ge

2016 Comparable Store Sales

(All Categories)

7

2016 Home Appliances Sales

We continued to see an increase in unit sales, but sales were

impacted by average ticket erosion due to the competitive promotional

pricing in the market

* Excluding accessories

Hometown Outlet Consolidated

HA Comparable Store Sales:

Dollars -3.4% -3.4% -3.4%

Units* 0.6% 0.6% 0.6%

HA Average Ticket:*

2016 vs 2015 -3.7% -5.9% -4.5%

2015 vs 2014 -0.5% -1.9% -0.8%

8

2016 Gross Margin Rate Performance

Hometown

Decrease primarily driven by $15.1M of store-closing costs, lower margin on

merchandise sales, higher occupancy costs due to an increase of the number of

Company-operated stores, and higher shrink

Outlet

Decrease primarily driven by lower gross profit rate on merchandise sales due to price

reductions needed to maintain competitiveness of Out-of-Box product in more

promotional environment for New-in-Box appliances, higher occupancy costs due to

more Company-operated locations, higher shrink expenses and $1.0M of closing store

costs

* Non-Core items include occupancy costs, store closing costs, and shrink

Hometown Outlet Consolidated

Gr ss Margin Rate:

2016 20.4% 18.2% 19.7%

2015 22.6% 22.9% 22.7%

YOY Change (bps) (216) (466) (292)

Impact of Non-Core Items* (bps):

2016 (285) (957) (490)

2015 (124) (645) (274)

9

Amendments to Agreements with Sears Holdings (SHC)

Primary SHO Benefits

Extension of services and merchandise agreement pricing through

February 1, 2020

Rights to operate transactional web-sites (in pre-defined territories for

Hometown Segment formats

Increased commissions on Protection Agreement sales

SHC will provide Supply Chain Services for SHO Purchased Products

upon implementation of our Business Process Outsourcing project

All remaining SHO stores available as customer pick-up locations on

Sears.com

Please refer to our 8-K filling dated 5/17/16 for details regarding the Amendments

10

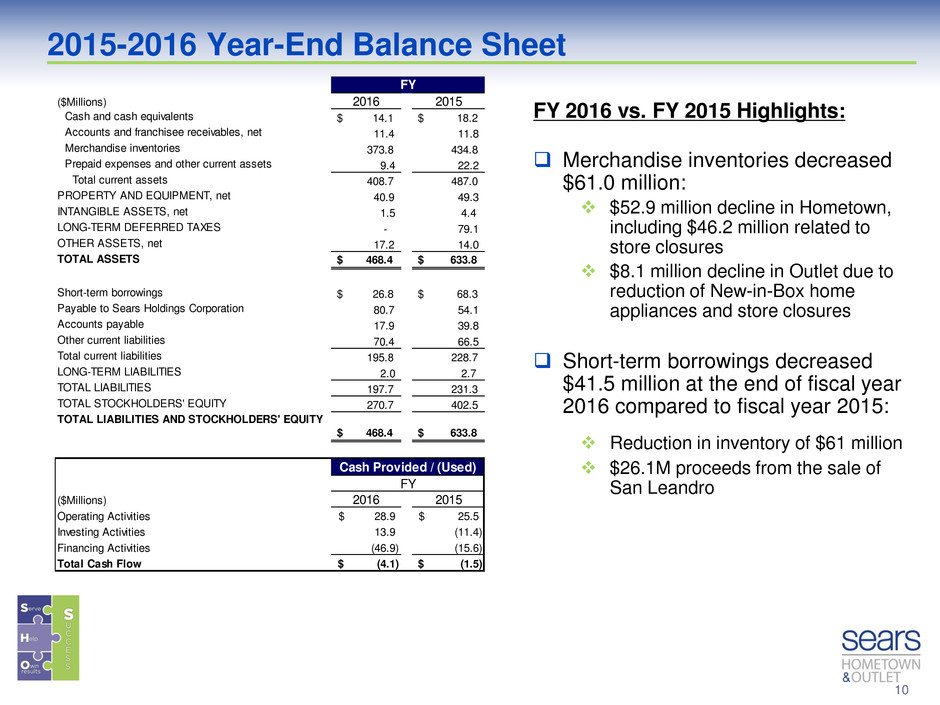

2015-2016 Year-End Balance Sheet

FY 2016 vs. FY 2015 Highlights:

Merchandise inventories decreased

$61.0 million:

$52.9 million decline in Hometown,

including $46.2 million related to

store closures

$8.1 million decline in Outlet due to

reduction of New-in-Box home

appliances and store closures

Short-term borrowings decreased

$41.5 million at the end of fiscal year

2016 compared to fiscal year 2015:

Reduction in inventory of $61 million

$26.1M proceeds from the sale of

San Leandro

($Millions) 2016 2015

Cash and cash equivalents $ 14.1 $ 18.2

Accounts and franchisee receivables, net 11.4 11.8

Merchandise inventories 373.8 434.8

Prepaid expenses and other current assets 9.4 22.2

Total current assets 408.7 487.0

PROPERTY AND EQUIPMENT, net 40.9 49.3

INTANGIBLE ASSETS, net 1.5 4.4

LONG-TERM DEFERRED TAXES - 79.1

OTHER ASSETS, net 17.2 14.0

TOTAL ASSETS $ 468.4 $ 633.8

Short-term borrowings $ 26.8 $ 68.3

Payable to Sears Holdings Corporation 80.7 54.1

Accounts payable 17.9 39.8

Other current liabilities 70.4 66.5

Total current liabilities 195.8 228.7

LONG-TERM LIABILITIES 2.0 2.7

TOTAL LIABILITIES 197.7 231.3

TOTAL STOCKHOLDERS' EQUITY 270.7 402.5

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

$ 468.4 $ 633.8

($Millions) 2016 2015

Operating Activities 28.9$ 25.5$

Investing Activities 13.9 (11.4)

Financing Activities (46.9) (15.6)

Total Cash Flow (4.1)$ (1.5)$

Cash Provided / (Used)

FY

FY

11

SHO STRATEGY

12

SHO Strategy

SHO’s strategy is based on our fundamental belief

that SHO has two key competitive advantages that

can serve to enable the transformation of our business

model

SHO operates a large store base in rural America, with the

advantages of local ownership, a national brand, large

merchandise assortments, competitive prices and the ability to

assemble, deliver and install what we sell

SHO is by a wide margin the largest retailer of Outlet As-Is

appliances in the industry, with a network of product repair and

re-distribution capabilities that are difficult/costly to replicate

The key headwinds facing SHO are well understood

and provide guidance to the strategic initiatives we are

pursuing

13

SHO Strategy

Headwinds

Hyper-competitive promotional environment in Home Appliances is

eroding average selling prices and pressuring margin rates

Value proposition of Outlet As-Is appliances is being impacted by the price compression

in competitors’ New-in-Box appliances

Manufacturer sponsored promotional margin support is being directed to their name

brands and the Kenmore brand is not receiving the same levels of support

15-20% of the Home Appliance market has moved to direct online

purchases (based on manufacturers’ feedback/estimates) and until the

end of Q3 2016 SHO was unable to participate in the online channel in

our largest business, the Hometown Segment

We are perceived by potential investors, manufacturers, vendors and

financial institutions as being tied to SHC given our historical reliance on

them for services, systems and inventory

While there are many mutually beneficial aspects of this relationship, we firmly believe we

need to demonstrate the capabilities and capacity to operate independently

Appliances are

71.5% of SHO’s

Total Business

51.1% of SHO’s

Appliance Sales

in 2016 were

Kenmore

The Hometown

Segment

generates 69.5%

of SHO’s Total

Sales

14

SHO Strategy

The strategy we are pursuing is designed to address

the headwinds impacting our current business and

develop new customer channels to grow the business

Win

Online

Improve Core

Business Margins

Develop New

Customer Growth

Channels

Reduce Reliance on

SHC

SearsHometown

Stores.com Launch

and Development

SearsOutlet.com

Growth

Store Portfolio

Optimization

America’s Appliance

Experts

Outlet As-Is Appliance

Sourcing Improvement

Kenmore Strategic

Relationship

Lease-to-Own

Commercial Sales

Program

IT Systems

Transformation and

Business Process

Outsourcing

15

STORE PORTFOLIO

16

As of year-end 2016, SHO and its independent dealers and franchisees

operated a total of 1,020 stores across all 50 states, Puerto Rico, and

Bermuda.

Store Portfolio

During the past year we opened 18 new Hometown Dealer stores

We will continue to open new Hometown Dealer stores as part of our go-

forward strategy

New Dealer stores are productive and, on average, produce positive EBITDA

in the first year of operations

We will continue to focus our openings in closed Sears full-line store markets

where SHC chooses not to maintain a store presence

Year one Dealer store sales in closed Sears trade areas are 70% higher than openings in other

trade areas over the past 3 years and these stores generally have higher EBITDA

871

149

2016 Year End Store Count

38

789

44

Hometown

112

37

Outlet

17

For the 2016 fiscal year we closed 160 store locations

149 Hometown

11 Outlet

In the 4th quarter, we elected to accelerate the closing of 109 stores producing

insufficient financial returns

The closings resulted in one time charges of $16.2M in Q4 and $17.7M Full-Year

Store Portfolio

(millions)

Quarter 4 Fiscal Year

Count 109 160

139.0$ 181.2$

(9.9)$ (11.3)$

34.0$ 54.9$

Sales

Adjusted EBITDA

Inventory @ Cost

18

For fiscal 2017, we have initial plans to open 20-25 new Dealer

Hometown stores

We will continue to proactively evaluate our store portfolio and close

locations that generate unsatisfactory economic returns

The Hardware Stores and Home Appliance Showrooms are largely unprofitable

formats, impacted by a group of stores with unacceptable performance primarily driven

by high occupancy costs

Closing the unprofitable locations will improve EBITDA and reduce inventory working

capital

Store Portfolio

2

21

12

5 5

2 1

0

5

10

15

20

25

2017 2018 2019 2020 2021 2022 2023

HAS Stores by Lease End Year

2 2

8

3

7

1

2

1

0

2

4

6

8

10

2017 2018 2019 2020 2021 2022 2023 Owned

AHS Stores by Lease End Year

19

Average ticket decline in home appliances, driven by competitive pricing

pressures, has led to New-in-Box appliance pricing eroding the value

proposition of Outlet As-Is appliances

This has a direct impact on sales and margins in the Outlet business, since As-Is appliances

represent greater than 75% of Outlet appliance sales

As a result, we have a group of Outlet stores which are generating insufficient

economic returns and are weighing down the financial performance of this

business segment

We expect to close the unprofitable locations as leases expire, or earlier as conditions warrant,

to improve EBITDA and reduce inventory working capital

Store Portfolio

33

27 26

20

22

6

8

5

2

0

5

10

15

20

25

30

35

2017 2018 2019 2020 2021 2022 2023 2024 Owned

Outlet Stores by Lease End Year

20

LEASE-TO-OWN

21

U.S. Lease-to-Own industry is a ≈$10B market and is forecast to continue

growing through 2020

Appliance segment accounts for ≈$4B

This market is dominated by two companies with ≈63% combined market share:

Aaron’s and Rent-A-Center

SHO views this as an opportunity to take meaningful share, as we are currently a

very small part of this industry and have a customer value proposition unique in

the Lease-to-Own market

SHO offers a full assortment of new products (e.g. appliances, mattresses, furniture, lawn and garden,

tools) across most major brands, offers leasing customers the same retail price offered to other

customers, charges no leasing origination or administrative fees, provides multiple payment options,

operates locally owned stores well positioned in rural markets, and has trained sales personnel that offer

superior product knowledge and customer service

SHO’s product leasing sales grew 20.5% in 2016, and increased the percentage

of total sales by 45 bps to 2.33%

Lease-to-Own

Sources: Daedal Research – The US Rent-To-Own Market: Size, Trends & Forecasts (Aug ‘16); 2015 Aaron’s and Rent-

A-Center Annual Reports Appliance Balance-of-Sale Reporting

22

Lease-to-Own

Operating Tactics:

Negotiated and implemented a new agreement with an industry leading third-party leasing

provider

Includes volume based incentives for all Lease-to-Own sales completed by SHO

Dedicated field training staff for SHO supported by the leasing provider

Expanded leasing training program in all stores

Initiated rewards-incentive program for all store personnel (funded by leasing provider)

Launched inclusion of Lease-to-Own messaging in all print marketing

Deployed digital marketing plan to compete for share of voice with primary leasing competition

Deployed new in-store and exterior signing package (funded by leasing provider)

Integrated instant-approval product leasing capabilities into new SearsHometown.com websites

New point-of-sale and Outlet website integration will occur upon completion of IT

Transformation Project

Q1 2017

Leasing Sales

+82.8% and

Leasing Share

+263 bps YOY

23

Lease-to-Own

Lease-to-Own is a compelling growth channel for SHO, as Lease-to-Own sales are

more profitable and we view them as largely incremental to our current customer base:

Higher Protection Agreement penetration

No third party credit fees

Higher average ticket

Revenue share from third party leasing provider

31% of SHO leasing customers have repeat lease transactions with us within 12 months

2017 forecasted margin impact from revenue sharing: $3.0M to $3.5M

Through Q1 SHO is on a trajectory to more than double our Lease-to-Own sales in

2017; we believe this can be developed into a $200M channel by YE 2019

24

AMERICA’S APPLIANCE EXPERTS

25

America’s Appliance Experts

Initiative: Expand and optimize the America’s

Appliance Expert strategy, implementing a

comprehensive program designed to reinvent

the Home Appliance business, reinforcing SHO

as the market experts in our local communities

• Focus on market leading brands with significant

or emerging share

• Improve home appliance sales

• Improve home appliance margin rate

• Increase store owner income

We Are Here!

Wave 9: 6 stores completed in February 2017

Wave 10: 72 stores completed in March 2017

Wave 11: 76 stores completed in May 2017

Wave 12: 50 stores forecasted for August 2017 completion

2017: Waves 9-12

204 Stores

2016: Waves 5-8

290 Stores

2015: Waves 1-4

180 Stores

December 2014:

Pilot Dekalb, IL

180 Stores converted

YE 2015

470 Stores converted

YE 2016

Forecasting 674 Stores converted, 79% of

Hometown Segment store base by YE 2017

26

America’s Appliance Experts

The execution of the America’s Appliance Experts strategy continues to

drive growth in market leading brands, improvement in sales, adjusted

margin and other key performance indicators

2016 AAE Results:

The America’s Appliance Experts strategy improved the customer

experience with a customer satisfaction score of 93.9% in AAE stores

Home Appliance comparable sales exceeded the Non-AAE stores by

+603bps

Total comparable sales exceeded the Non-AAE stores by +305bps

The Home Appliance adjusted margin rate in the AAE stores was

+120bps higher than the Non-AAE stores

The AAE stores also outperformed the Non-AAE stores in other key

performance indicators, including Home Appliance average ticket

(+3.8%), Protection Agreement attachment rate (+83bps) and Sears

Card share (+301bps)

Fiscal 2016 - waves 1-4, waves 5-8 since inception

27

SEARSHOMETOWNSTORES.COM

28

SearsHometownStores.com

Reached an agreement with SHC in May 2016 to secure eCommerce

rights for our Hometown segment

Developed and launched three new transactional websites at the end of

Q3 2016, three months ahead of schedule

Since launch through the first quarter of 2017, the sites have received

over 5.2M visitors

While behind our initial projections, online sales are steadily growing

both in dollars and as a percent of sales

W

ee

k 3

9

W

ee

k 4

0

W

ee

k 4

1

W

ee

k 4

2

W

ee

k 4

4

W

ee

k 4

5

W

ee

k 4

6

W

ee

k 4

7

W

ee

k 4

8

W

ee

k 4

9

W

ee

k 5

0

W

ee

k 5

1

W

ee

k 5

2

W

ee

k

1

W

ee

k

2

W

ee

k

3

W

ee

k

4

W

ee

k

5

W

ee

k

6

W

ee

k

7

W

ee

k

8

W

ee

k

9

W

ee

k 1

0

W

ee

k 1

1

W

ee

k 1

2

W

ee

k 1

3

SearsHometownStores.com Sales

S

H

S

.c

o

m

%

o

f

S

tore

Sale

s

SHS.com Sales

Trend line

29

2016 SearsHometownStores.com Opportunities

Our agreements with SHC limit our e-commerce capabilities and marketing to zip codes

representing 75% of each store’s historical sales. Currently 28% of customers adding products to

cart are not permitted to transact

SearsHometownStores.com

SearsHometownStores.com Improvements

We have tested free delivery online for home appliances with promising results. Free delivery

online will roll-out nationally in Q2 2017

We launched free shipping for orders over $49 and sales of shippable items have increased

significantly to pre-launch trends

Developed the capability to apply for a Sears card at checkout and use the same day

Product leasing functionality was added to the site in February 2017. Our presentation of

leasing payment options at the item level is unique for a site which is not primarily in the

Rent/Lease-to-Own business. We are experiencing a rapid increase in online leasing

penetration

30

SEARSOUTLET.COM

31

SearsOutlet.com is a unique website, with opportunities and facing challenges uncommon to other

online retailers.

SearsOutlet.com sells unique, single quantity items

Individual item conditions require images for each individual product

Individual item pricing requires the ability to display multiple prices for the same model by location

Over 70,000 unique home appliances are listed online at any given time

SearsOutlet.com fulfills the majority of transactions from our Outlet retail sales floors

SearsOutlet.com

Source: 1. http://www.statista.com/statistics

$

32

SearsOutlet.com

2016 SearsOutlet.com Opportunities

Increased competitive promotional pricing in the market for New-in-Box products

National Delivery (75+ miles) for home appliances was suspended for the majority of stores

and available only for limited categories in other stores from December 2015 to December

2016 due to logistic challenges resulting in poor financial performance in this channel.

Revenue from this fulfilment type dropped 35% YOY

SearsOutlet.com Improvements

National Delivery was relaunched with improved logistical execution in December 2016 for all

stores and product categories. Since re-launch through the end of Q1 2017, national delivery

revenue increased 19.1% YOY

Marketplace expansion has continued to grow rapidly. eBay revenue grew 776% YOY and

SHO launched on Amazon.com in March 2017

Revised pricing strategies and launched significantly improved product condition sorting tools

Sears.com Pick-up Location

At the beginning of the fiscal year, Sears Outlet stores were activated as a pick up point for

orders on Sears.com

SHO recognizes sales and margin on these orders with a commission paid to SHC. This new

revenue channel is expected to add $8-$10M of additional online originated sales in 2017

33

COMMERCIAL SALES PROGRAM

34

Commercial Sales Program

Commercial sales of home-related products to contractors and property managers

is a multi-billion dollar industry

SHO’s strength in appliances creates an opportunity to service a large segment of this

industry that we have not targeted in the past

Opportunity to service local rural markets that are not well supported by

commercial sales competitors by offering:

Competitive pricing

Local ownership with superior customer service

Physical location in the community

Local assembly, delivery and installation capability

Commercial sales program grew by 279% in 2016, adding $20M of incremental

sales, driven by increasing store program participation to 39% vs. 17% in 2015

35

Commercial Sales Program

Building on 2016 momentum, Q1 2017 Commercial Sales grew almost 50% to LY

and store participation continues to increase

Operating Tactics:

Improved the structural foundation of the program through enhanced operational processes

Implemented new commercial delivery and installation capabilities

Implemented an efficient sales quote process that ensures a profitable pricing structure

Developed and launched new financing options

Growing sales leads nationally through relationship with a third-party lead provider, while

simultaneously directly engaging local businesses

Improve store participation by providing additional training on B2B selling, and simplifying

core processes through the new point-of-sale and ERP system launch

Increase brand exposure through participation in trade shows with residential contractors,

apartment / multi-family managers, and property management companies

Integrating commercial sales capabilities into the Hometown segment websites, allowing

commercial customers the ability to access product, pricing, quotes, and sales support

online

We believe we can develop Commercial Sales into a $100M channel by YE 2019

36

OUTLET AS-IS APPLIANCE SOURCING

37

Outlet As-Is Appliance Sourcing

Aggressive pricing on New-in-Box appliances, driven by competitors and

supported by manufacturers, has impacted the value proposition for As-Is

appliances

The aggressive pricing on New-in-Box appliances has driven a material

decline in average unit selling price in our Outlet business

Deeper discounts are required to maintain the value proposition for As-Is

appliances, delivering unacceptable margin

Outlet Margin Improvement Initiatives:

All non-SHC Home Appliance manufacturers with whom we do business

have agreed to improve cost and/or provide subsidies consistent with the

support provided to retailers of New-in-Box appliances. This should improve

the value proposition and margin for As-Is appliances

Completed a new agreement to purchase repaired “sales floor ready” As-Is

appliances from a major retailer at attractive margins

2017 Forecast Margin Impact: $7.0M - $9.0M

Outlet Segment

2013 2014 2015 2016

Total Revenue $610.0 $663.7 $657.5 $630.5

Total Margin Rate 25.6% 23.7% 22.9% 18.2%

Appliance Average Unit Price $594.31 $580.53 $567.84 $535.00

38

KENMORE STRATEGIC RELATIONSHIP

39

Kenmore Strategic Relationship

SHO and the SHC Kenmore Business have developed a strong relationship that

is focused on:

Improving the profitability of the Kenmore brand across the Hometown and

Outlet Segments

Growing sales and market share in the Kenmore brand

Kenmore Profitability Improvement:

In 2017 Kenmore will provide material incremental subsidy to the Hometown

Segment to support promotional pricing and item transitions, consistent with

the type of support traditionally provided by other national appliance brands

Grow Kenmore Market Share:

Kenmore has positioned additional financial incentives that can be earned

quarterly in 2017 by achieving predetermined Hometown Segment sales and

Kenmore share targets

To improve the performance in the Outlet Segment in 2017, Kenmore has

offered meaningful royalty rebates to encourage the sale of Kenmore New-

in-Box appliances in Outlet

2017 Forecast Incremental Margin Impact: $3.0M - $5.0M

40

IT TRANSFORMATION AND BUSINESS PROCESS

OUTSOURCING

41

Our ability to improve profitability and achieve long-term growth is dependent upon systems

capabilities which evolve the customer experience, improve efficiencies in our processes

and eliminates many of our dependencies on SHC

SHO is migrating from our current systems environment provided through our agreements

with SHC, to new systems primarily provided by NetSuite, Just Enough, and Ultimate

Software

IT Transformation and Business Process Outsourcing

Strategic Fit

• Enables SHO

e-commerce websites

and omni-channel

platform

• Customized IT

Systems and

Business Processes

to support SHO

specific business

needs which may

differ from SHC

• Fosters a lean,

efficient home office

Service Levels

• True 3rd party service

providers

• Ability to rapidly adapt

and modify business

processes and

systems

• Access to continued

technology

enhancements

• Integrated systems

resulting in efficiencies

with suppliers and

service providers

Infrastructure

• Largely cloud-based,

asset-light approach

• Modern, best-in-class

technology

• Ability to choose most

cost-effective partners

• Shifts burden to

maintain IT systems to

a third-party

42

IT Transformation and Business Process Outsourcing

We have made considerable progress toward the implementation of our new Information

Technology platforms

We have significantly reduced (and will continue reducing) our reliance on existing SHC

systems

We expect this change will:

Provide greater strategic and operational flexibility

Reduce total cost of ownership over the term of the agreement

Reduce elements of risk relating to our relationship with SHC

Enable a robust omni-channel experience for both Hometown and Outlet

What has been accomplished so far?

Hometown ecommerce sites launched

Email marketing capabilities internalized

Merchandise procurement and purchasing capabilities developed and utilized

64 Vendors EDI Certified (10,000+ Purchase Orders Complete)

Human Resources and Payroll systems converted

Direct payment of commission payments to Dealers and Franchisees

Portions of finance and accounting (Accounts Receivable/Payable) transitioned

Role-based security access

Cloud based single sign-on

43

IT Transformation and Business Process Outsourcing

2017 Project Status – What’s Next:

Q2: New point-of-sale hardware deployment

Q2/Q3: Complete testing (Data, Systems Integration and User Acceptance)

Q3/Q4: Anticipated store deployment of new ERP and POS software and project

largely completed

Migrated many business support services previously provided by SHC to third party

providers or, on a limited-basis, internally into SHO

We plan to continue several mutually advantageous elements of our operating

relationship with SHC beyond the current term of our agreements, but have the

flexibility to further reduce or eliminate the relationship if necessary

SHO has made a significant IT investment in the future of our business:

2015 - $10.9 million

2016 - $15.0 million

2017 – Anticipate similar spend to prior year

We do not expect further material investments after 2017

44

Cautionary Statement

This presentation includes forward-looking statements. Statements preceded or followed by, or

that otherwise include, the words “believes,” “expects,” “anticipates,” “intends,” “project,”

“estimates,” “plans,” “forecast,” “is likely to,” and similar expressions or future or conditional verbs

such as “will,” “may,” “would,” “should,” and “could” are generally forward-looking in nature and

not historical facts. The forward-looking statements are subject to significant risks and

uncertainties that may cause our actual results, performance, timing, and achievements in the

future to be materially different from the future results, future performance, future timing, and

future achievements expressed or implied by the forward-looking statements. The forward-looking

statements include, without limitation, information concerning our future financial performance,

business strategy, plans, goals, beliefs, expectations, and objectives. The forward-looking

statements are based upon the current beliefs and expectations of our management.

The following factors, among others, could cause our actual results, performance, and

achievements to differ materially from those expressed in the forward-looking statements, and

one or more of the differences could have a material adverse effect on our ability to operate our

business and could have a material adverse effect on our results of operations, financial

condition, liquidity, and cash flows: the possible material adverse effects on us if SHC’ financial

condition were to significantly deteriorate, including if as a consequence SHC were to choose to

seek the protection of the U.S. bankruptcy laws; our ability to offer merchandise and services that

our customers want, including those branded with the Kenmore, Craftsman, and Diehard marks

(the “KCD Marks”); (continued on next slide)

45

Cautionary Statement

the Amended and Restated Merchandising Agreement between SHC and us provides that (1) if a

third party that is not an affiliate of SHC acquires the rights to one or more (but less than all) of

the KCD Marks SHC may terminate our rights to buy merchandise branded with any of the

acquired KCD Marks and (2) if a third party that is not an affiliate of SHC acquires the rights to all

of the KCD Marks SHC may terminate the Merchandising Agreement in its entirety, over which

events we have no control; the sale by SHC and its subsidiaries to other retailers that compete

with us of major home appliances and other products branded with one of the KCD Marks; the

willingness and ability of SHC to fulfill its contractual obligations to us; our ability to successfully

manage our inventory levels and implement initiatives to improve inventory management and

other capabilities; competitive conditions in the retail industry; worldwide economic conditions and

business uncertainty, the availability of consumer and commercial credit, changes in consumer

confidence, tastes, preferences and spending, and changes in vendor relationships; the fact that

our past performance generally, as reflected on our historical financial statements, may not be

indicative of our future performance as a result of, among other things, the consolidation of

Hometown and Outlet into a single business entity, the Separation, and operating as a standalone

business entity; the impact of increased costs due to a decrease in our purchasing power

following our separation from SHC in October 2012 (the “Separation”), and other losses of

benefits (such as a more effective and productive business relationship with SHC) that were

associated with having been wholly owned by SHC and its subsidiaries prior to the Separation;

our continuing reliance on SHC for most products and services that are important to the

successful operation of our business, and our potential need to rely on SHC for some products

and services beyond the expiration, or earlier termination by SHC, of our agreements with SHC;

(continued on next slide)

46

Cautionary Statement

the willingness of SHC’ appliance, lawn and garden, tools, and other vendors to continue to

supply to SHC, on terms (including vendor payment terms for SHC’ merchandise purchases) that

are acceptable to it and to us, merchandise that we would need to purchase from SHC to ensure

continuity of merchandise supplies for our businesses; the willingness of SHC’ appliance, lawn

and garden, tools, and other vendors to continue to pay to SHC merchandise-related subsidies

and allowances and cash discounts (some of which SHC is obligated to pay to us); our ability to

obtain the resolution, on commercially reasonable terms, of existing disputes and, when they

arise, future disputes with SHC regarding many of the material terms and conditions of our

agreements with SHC; our ability to establish information, merchandising, logistics, and other

systems separate from SHC that would be necessary to ensure continuity of merchandise

supplies for our businesses if vendors were to reduce, or cease, their merchandise sales to SHC

or if SHC were to reduce, or cease, its merchandise sales to us; if SHC’ sales of major appliances

and lawn and garden merchandise to its retail customers decline SHC’ sales to us of outlet-value

merchandise could decline; our ability to establish a more effective and productive business

relationship with SHC, particularly in light of the existence of pending, and the likelihood of future,

disputes with respect to the terms and conditions of our agreements with SHC; most of our

agreements related to the Separation and our continuing relationship with SHC were negotiated

while we were a subsidiary of SHC, and we may have received different terms from unaffiliated

third parties (including with respect to merchandise-vendor and service-provider indemnification

and defense for negligence claims and claims arising out of failure to comply with contractual

obligations); (continued on next slide)

47

Cautionary Statement

our reliance on SHC to provide computer systems to process transactions with our customers

(including the point-of-sale system for the stores we operate and the stores that our dealers and

franchisees operate, which point-of-sale system captures, among other things, credit-card

information supplied by our customers) and others, quantify our results of operations, and

manage our business (“SHO’s SHC-Supplied Systems”); SHO’s SHC-Supplied Systems could be

subject to disruptions and data/security breaches (Kmart, owned by SHC, announced in October

2014 that its payment-data systems had been breached), and SHC could be unwilling or unable

to indemnify and defend us against third-party claims and other losses resulting from such

disruptions and data/security breaches, which could have one or more material adverse effects

on SHO; limitations and restrictions in the Senior ABL Facility and related agreements governing

our indebtedness and our ability to service our indebtedness; our ability to obtain additional

financing on acceptable terms; our dependence on the ability and willingness of our independent

dealers and franchisees to operate their stores profitably and in a manner consistent with our

concepts and standards; our ability to sell profitably online all of our merchandise and services;

our dependence on sources outside the U.S. for significant amounts of our merchandise

inventories; fixed-asset impairment for long-lived assets; our ability to attract, motivate, and retain

key executives and other employees; our ability to maintain effective internal controls as a

publicly held company; our ability to realize the benefits that we expect to achieve from the

Separation; litigation and regulatory trends challenging various aspects of the franchisor-

franchisee relationship in the fast-food industry could expand to challenge or adversely affect our

relationships with our independent dealers and franchisees; low trading volume of our common

stock due to limited liquidity or a lack of analyst coverage; and the impact on our common stock

and our overall performance as a result of our principal stockholders’ ability to exert control over

us. (continued on next slide)

48

Cautionary Statement

The foregoing factors should not be understood as exhaustive and should be read in conjunction

with the other cautionary statements, including the “Risk Factors,” that are included in our Annual

Report on Form 10-K for our fiscal year ended January 28, 2017 and in our other filings with the

Securities and Exchange Commission and our other public announcements. While we believe

that our forecasts and assumptions are reasonable, we caution that actual results may differ

materially. If one or more of these or other risks or uncertainties materialize, or if our underlying

assumptions prove to be incorrect, actual results may vary materially from what we projected.

Consequently, actual events and results may vary significantly from those included in or

contemplated or implied by our forward-looking statements. The forward-looking statements

included in this presentation are made only as of the date of this presentation. We undertake no

obligation to publicly update or review any forward-looking statement made by us or on our

behalf, whether as a result of new information, future developments, subsequent events or

circumstances, or otherwise, except as required by law.

49