Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AAC Holdings, Inc. | d403103d8k.htm |

Exhibit 99.1

INVESTOR PRESENTATION

MAY

2017

IMPORTANT PRESENTATION INFORMATION

Notice to We use market data and industry forecasts and projections throughout this presentation, including data from publicly available information and industry publications.

These sources generally state that the information they provide has been obtained from sources believed to be reliable, but that the accuracy and completeness of the Investors information are not guaranteed. The forecasts and projections are based

on industry surveys and the preparers’ experience in the industry, and there can be no assurance that any of the forecasts or projections will be achieved. We believe that the surveys and market research others have performed are reliable, but

we have not independently investigated or verified this information. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements

contained in this presentation.

Forward-Looking Some of the statements made in this presentation constitute forward-looking statements within the meaning of

federal securities laws. Forward-looking statements reflect our current views with respect to future events and performance. In some cases you can identify forward-looking statements by terminology such as “may,” Statements “might,

“will,” “should,” “could” or the negative thereof. Generally, the words “anticipate,” “believe,” “continues,” “expect,” “intend,” “estimate,”

“project,” “plan” and similar expressions identify forward-looking statements. In particular, statements about our pipeline, industry growth opportunities, disclosure of key performance indicators, business growth strategy and

financial guidance in this presentation are forward-looking statements.

We have based these forward-looking statements on our current expectations, assumptions,

estimates and projections. While we believe these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks, uncertainties and other factors, many of

which are outside of our control, which could cause our actual results, performance or achievements to differ materially from any results, performance or achievements expressed or implied by such forward-looking statements. For additional discussion

of risks, uncertainties and other factors, see the section titled “Risk Factors” in our Annual Report on Form 10-K and other filings with the Securities and Exchange Commission (the “SEC”).

Risks, uncertainties and other factors include, without limitation: (i) our inability to operate our facilities; (ii) our reliance on our sales and

marketing program to continuously attract and enroll clients; (iii) a reduction in reimbursement rates by certain third-party payors for inpatient and outpatient services and point of care and definitive lab testing; (iv) our failure to

successfully achieve growth through acquisitions and de novo expansions; (v) uncertainties regarding the timing of the closing of acquisitions; (vi) our failure to achieve anticipated financial results from prior acquisitions;

(vii) the possibility that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the acquisitions; (viii) a disruption in our ability to perform definitive drug testing services;

(ix) maintaining compliance with applicable regulatory authorities, licensure and permits to operate our facilities and lab; (x) a disruption in our business and reputation and potential economic consequences with the civil securities

claims brought by shareholders; (xi) our inability to agree on conversion and other terms for the balance of convertible debt; (xii) our inability to meet our covenants in our loan documents; (xiii) our inability to obtain senior

lender consent to exceed the current $50 million limit in unsecured subordinated debt; (xiv) our inability to integrate newly acquired facilities; and (xv) general economic conditions, as well as other risks discussed in the

“Risk Factors” section of the Company’s Annual Report on Form 10-K and other filings with the SEC.

Given

these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. These risks and uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking

statements. These forward-looking statements are made only as of the date of this presentation. We do not undertake and specifically decline any obligation to update any such statements or to publicly announce the results of any revisions to any

such statements to reflect future events or developments.

2

PRESENTERS 3

Founder and CEO of Foundations Recovery Network

Michael T.

Cartwright At Foundations, opened notable treatment facilities including the Canyon in

Chairman Malibu, La Paloma

in Memphis and Michael’s House in Palm Springs

(since 2011) Started Moments of Change & Lifestyle Intervention, two of the

leading

Chief Executive Officer national industry conferences

(since 2013) Author of Believable Hope

michael@contactaac.com

20+

years of management experience

Founder and Managing Member of Private Capital Securities, a boutique

Kirk R. Manz investment banking firm

Chief Financial

Officer Former Vice President at Piper Jaffray and Fixed Income Specialist with

(since 2011) Stephens Inc.

kmanz@contactaac.com Co-founder and CEO of four communications companies including Igaea, an

international VoIP Company

23+ years management

experience

INDUSTRY PRIMER

4

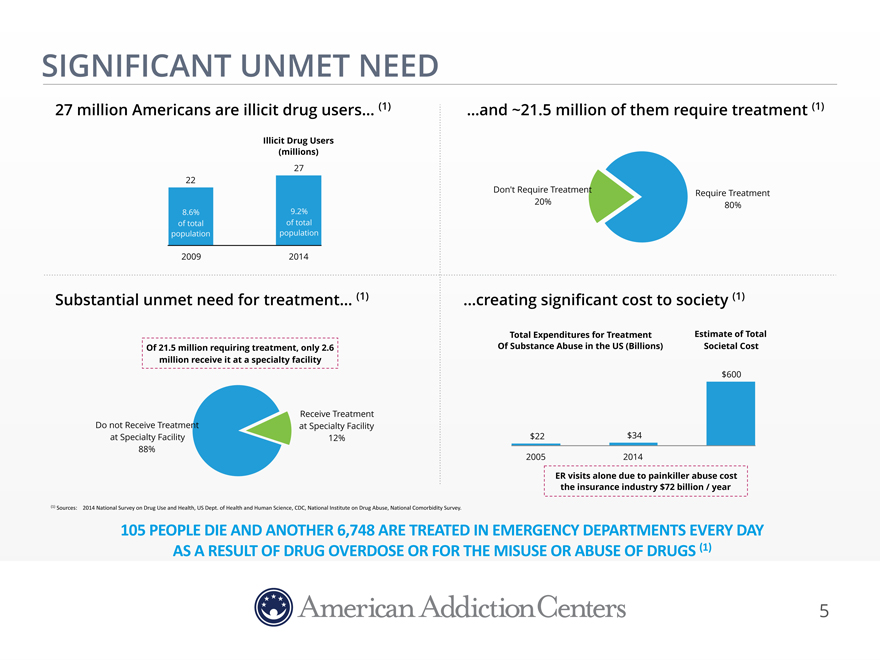

SIGNIFICANT UNMET NEED

27 million Americans are illicit drug users… (1) …and ~21.5 million of them require treatment (1)

Illicit Drug Users

(millions)

27

22

Don’t Require TreatmentRequire Treatment

20%80%

8.6% 9.2%

of total of total

population population

2009 2014

Substantial unmet need for treatment… (1) creating significant cost to society (1)

Total Expenditures for TreatmentEstimate of Total

Of 21.5 million requiring treatment,

only 2.6 Of Substance Abuse in the US (Billions) Societal Cost

million receive it at a specialty facility

$600

Receive Treatment

Do not Receive Treatment at Specialty Facility

at Specialty

Facility 12% $22$34

88%

20052014

ER visits alone due to painkiller abuse cost

the insurance industry $72 billion / year

(1)$Sources:$$$$2014$National$Survey$on$Drug$Use$and$Health,$US$Dept.$of$Health$and$Human$Science,$CDC,

$National$Institute$on$Drug$Abuse,$National$Comorbidity$Survey.$$

ARE

TREATED IN EMERGENCY DEPARTMENTS EVERY DAY

OR FOR THE MISUSE OR ABUSE OF DRUGS (1)

5

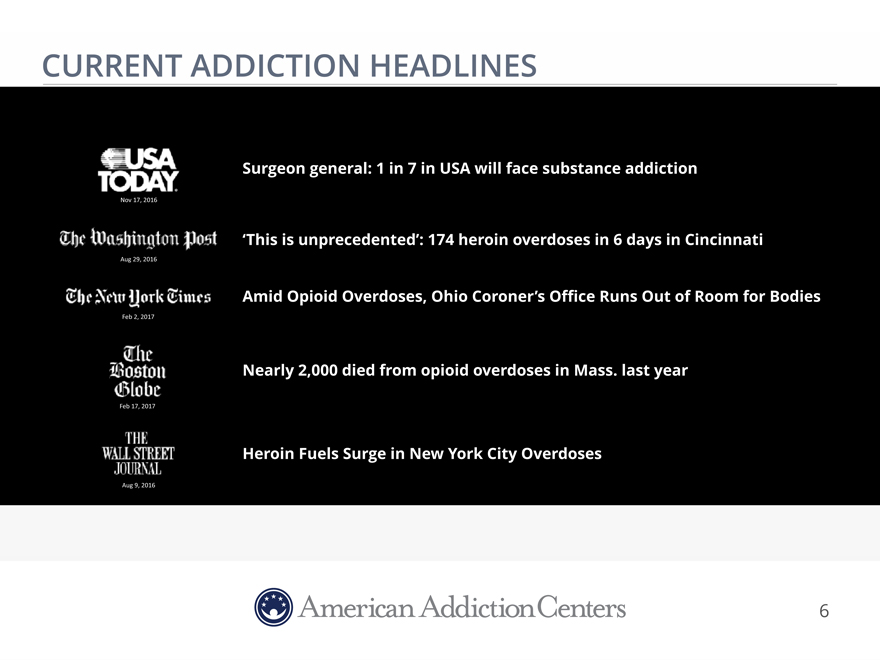

CURRENT ADDICTION HEADLINES

Surgeon general: 1 in 7 in USA will face substance addiction

Nov 17, 2016

‘This is unprecedented’: 174 heroin overdoses in 6 days in Cincinnati

Aug 29, 2016

Amid Opioid Overdoses, Ohio Coroner’s Office Runs Out of

Room for Bodies

Feb$2,$2017

Nearly 2,000 died from opioid overdoses in Mass.

last year

Feb$17,$2017

Heroin Fuels Surge in New York City Overdoses

Aug 9, 2016

6

TYPES OF TREATMENT SERVICES

Residential Inpatient Treatment Outpatient Treatment

Hospital Residential

Treatment Center Sober Living Outpatient Center

(Supportive Housing for Outpatient)

High Acuity Low Acuity

Diagnostic Services

Laboratory

7

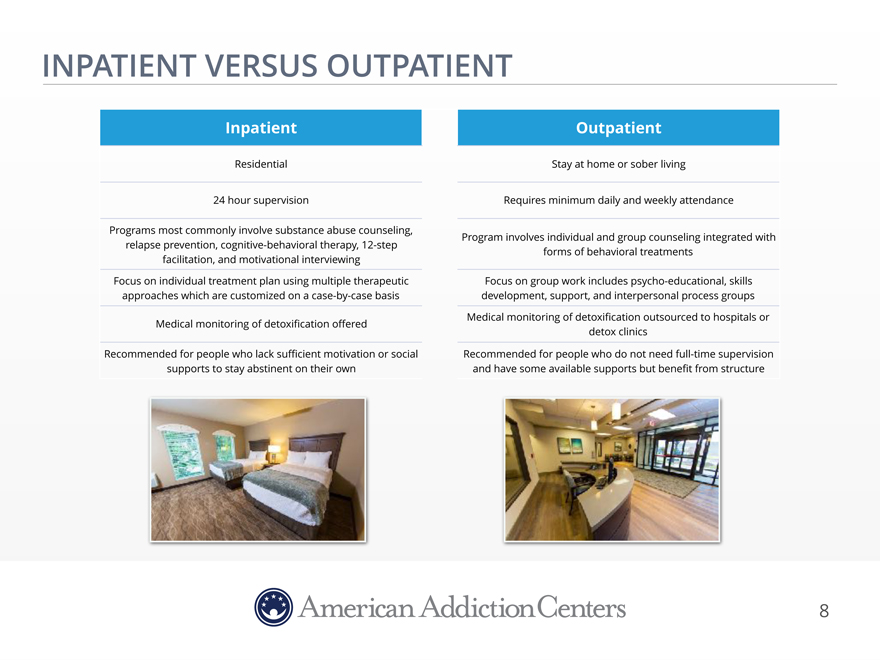

INPATIENT VERSUS OUTPATIENT

Inpatient Outpatient

Residential Stay at home or

sober living

24 hour supervision Requires minimum daily and weekly attendance

Programs most commonly involve substance abuse counseling, Program involves individual and group counseling integrated with

relapse prevention, cognitive-behavioral therapy, 12-step forms of behavioral treatments

facilitation, and motivational interviewing

Focus on individual

treatment plan using multiple therapeutic Focus on group work includes psycho-educational, skills

approaches which are customized on a case-by-case basis development, support, and interpersonal process groups

Medical monitoring of detoxification offered Medical monitoring of detoxification outsourced to hospitals or

detox clinics

Recommended for people who lack sufficient motivation or

social Recommended for people who do not need full-time supervision

supports to stay abstinent on their own and have

some available supports but benefit from structure

8

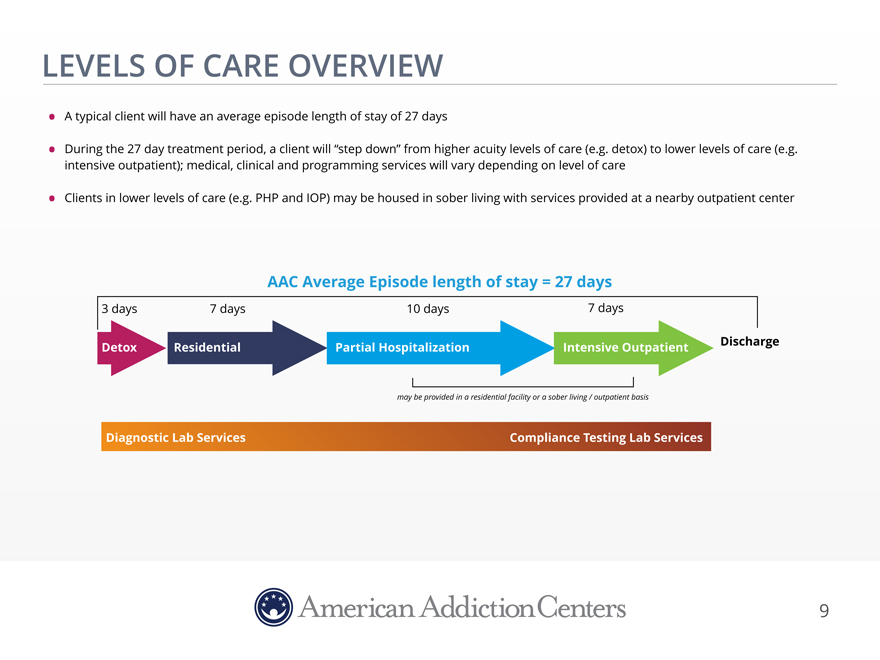

LEVELS OF CARE OVERVIEW

A

typical client will have an average episode length of stay of 27 days

During the 27 day treatment period, a client will “step down” from higher acuity

levels of care (e.g. detox) to lower levels of care (e.g. intensive outpatient); medical, clinical and programming services will vary depending on level of care

Clients in lower levels of care (e.g. PHP and IOP) may be housed in sober living with services provided at a nearby outpatient center

AAC Average Episode length of stay = 27 days

3 days 7 days 10 days 7 days

Detox Residential Partial Hospitalization Intensive Outpatient Discharge

may be provided in a

residential facility or a sober living / outpatient basis

Diagnostic Lab Services Compliance Testing Lab Services

9

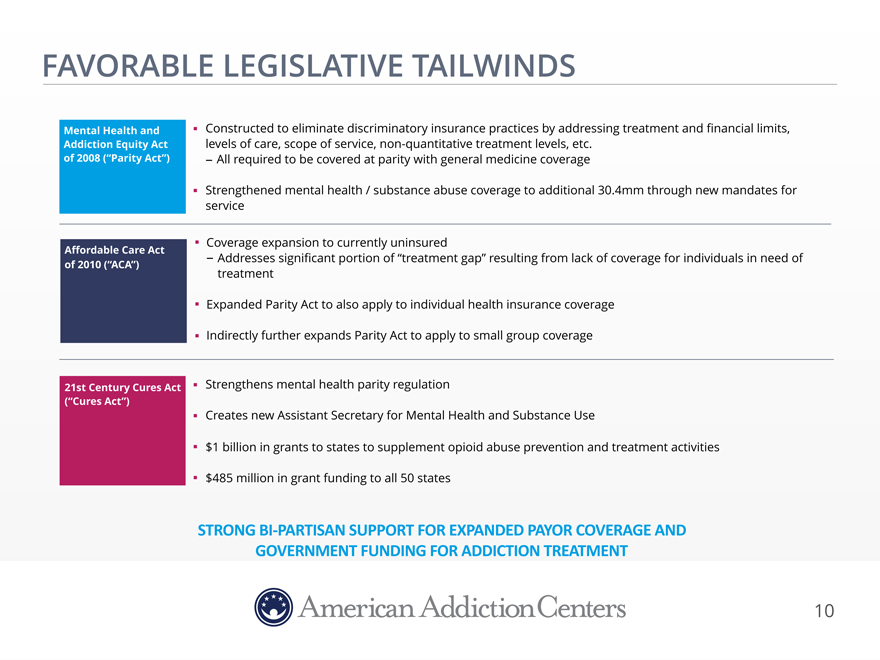

FAVORABLE LEGISLATIVE TAILWINDS

Mental Health and Constructed to eliminate discriminatory insurance practices by addressing treatment and financial limits,

Addiction Equity Act levels of care, scope of service, non-quantitative treatment levels, etc.

of 2008 (“Parity Act”) - All required to be covered at parity with general medicine coverage

Strengthened mental health / substance abuse coverage to additional 30.4mm through new mandates for

service

Coverage expansion to currently uninsured

Affordable Care Act - Addresses significant portion of “treatment gap” resulting from lack of coverage for individuals in need of

of 2010 (“ACA”) treatment

Expanded

Parity Act to also apply to individual health insurance coverage

Indirectly further expands Parity Act to apply to small group coverage

21st Century Cures Act Strengthens mental health parity regulation

(“Cures Act”)

Creates new Assistant

Secretary for Mental Health and Substance Use

$1 billion in grants to states to supplement opioid abuse prevention and treatment

activities

$485 million in grant funding to all 50 states

STRONG$BI-PARTISAN$SUPPORT$FOR$EXPANDED$PAYOR$COVERAGE$AND$

GOVERNMENT FUNDING FOR ADDICTION TREATMENT

10

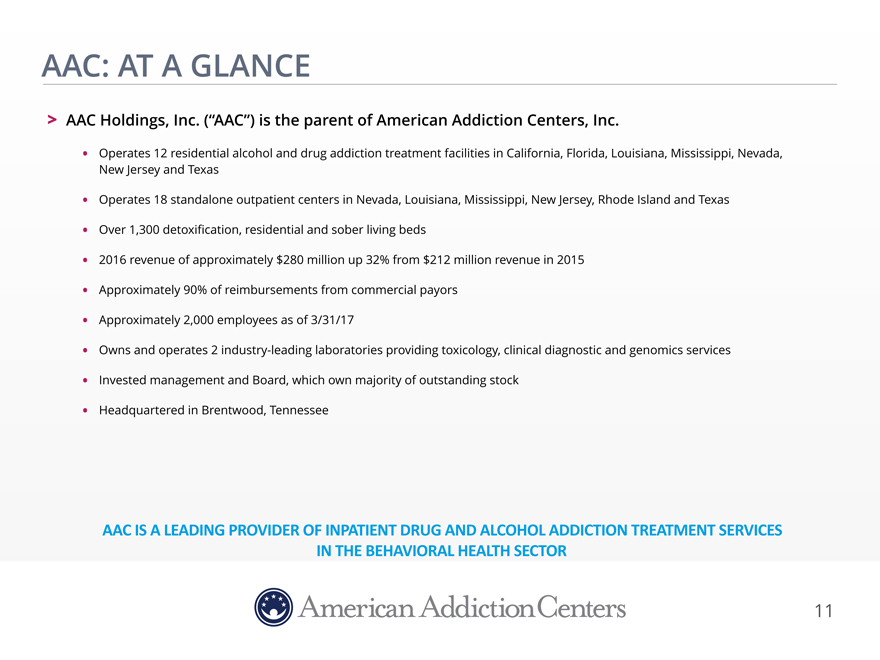

AAC: AT A GLANCE

AAC

Holdings, Inc. (“AAC”) is the parent of American Addiction Centers, Inc.

Operates 12 residential alcohol and drug addiction treatment facilities in

California, Florida, Louisiana, Mississippi, Nevada, New Jersey and Texas

Operates 18 standalone outpatient centers in Nevada, Louisiana, Mississippi, New Jersey,

Rhode Island and Texas

Over 1,300 detoxification, residential and sober living beds

2016 revenue of approximately $280 million up 32% from $212 million revenue in 2015

Approximately 90% of reimbursements from commercial payors

Approximately

2,000 employees as of 3/31/17

Owns and operates 2 industry-leading laboratories providing toxicology, clinical diagnostic and genomics services

Invested management and Board, which own majority of outstanding stock

Headquartered in

Brentwood, Tennessee

AAC IS A LEADING PROVIDER OF INPATIENT DRUG AND ALCOHOL ADDICTION TREATMENT SERVICES IN THE BEHAVIORAL HEALTH SECTOR

11

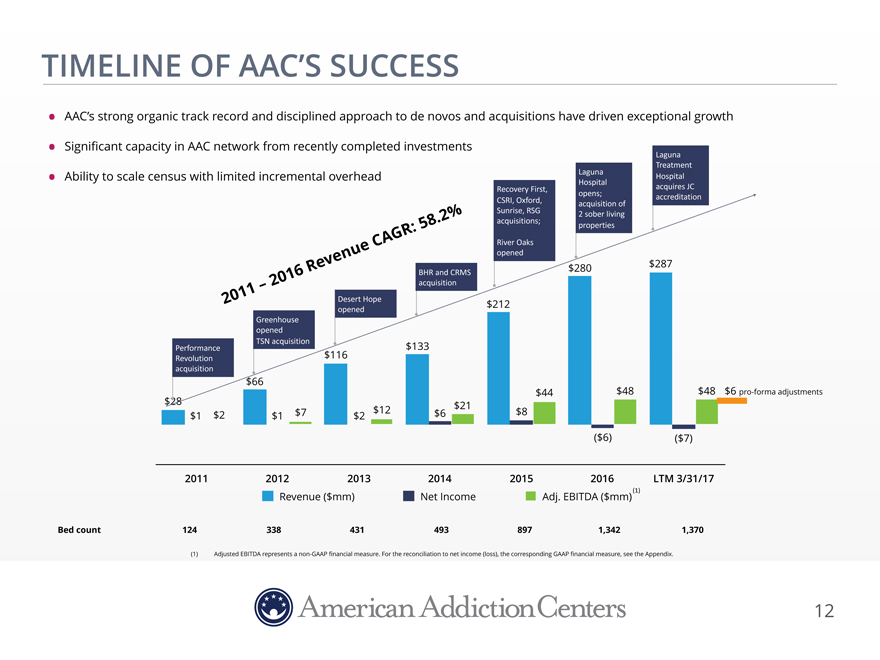

TIMELINE OF AAC’S SUCCESS

AAC’s strong organic track record and disciplined approach to de novos and acquisitions have driven exceptional growth

Significant capacity in AAC network from recently completed investments Laguna

Treatment

LagunaHospital$

Ability to scale census with limited incremental overhead

Hospital$

Recovery$First,$acquires$JC$

opens;$accreditation

CSRI,$Oxford,$acquisition$of$

Sunrise, RSG$2 sober living

:58.2%acquisitions;$properties

eCAG RRiver$Oaks$

Revenuopened$287

016BHR and$CRMS$$$280

acquisition

2011– 2Desert Hope$$212

opened

Greenhouse

opened

Performance$TSN$acquisition$133

Revolution$$116

acquisition

$66

$44$48$48 $6 pro-forma adjustments

$28$21

$1$2$1 $7$2 $12$6$8

($6)($7)

201120122013201420152016LTM 3/31/17

Revenue ($mm)Net IncomeAdj. EBITDA ($mm) (1)

Bed

count 1243384314938971,3421,370

(1)Adjusted EBITDA represents a non-GAAP financial measure. For the

reconciliation to net income (loss), the corresponding GAAP financial measure, see the Appendix.

12

Confidential

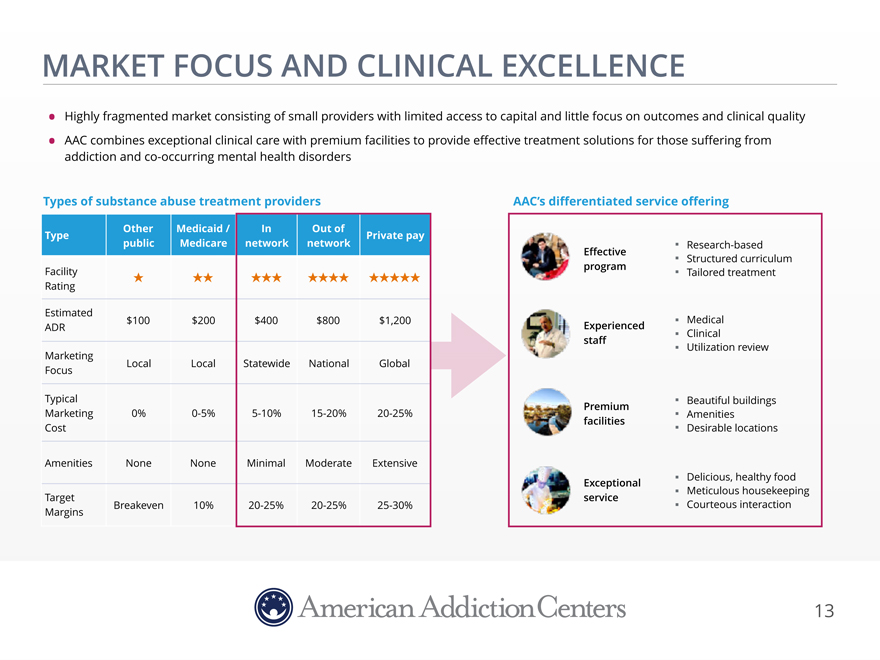

MARKET FOCUS AND CLINICAL EXCELLENCE

Highly fragmented market consisting of small providers with limited access to capital and little focus on outcomes and clinical quality

AAC combines exceptional clinical care with premium facilities to provide effective treatment solutions for those suffering from

addiction and co-occurring mental health disorders

Types of substance abuse treatment providers AAC’s differentiated service offering

OtherMedicaid /InOut of

Type Private pay

publicMedicarenetworknetwork Research-based

Effective Structured curriculum

Facility program Tailored treatment

Rating

Estimated $100 $200$400$800$1,200 Medical

ADR Experienced Clinical

staff Utilization review

Marketing

Focus Local

LocalStatewideNationalGlobal

Typical Beautiful buildings

Premium

Marketing 0% 0-5%5-10%15-20%20-25% Amenities

facilities

Cost Desirable locations

Amenities None NoneMinimalModerateExtensive

Exceptional Delicious, healthy food

Target service

Meticulous housekeeping

Margins Breakeven

10%20-25%20-25%25-30% Courteous interaction

13

BEST-IN-CLASS SALES AND

MARKETING ENGINE

Multi-faceted Sales and Marketing

2+ million AAC site

Outside Sales Multimedia 24 / 7visits per month

Call Center

65+ Professionals 100+ Direct

Professionals 100+ Professionalsper 30,000+ month phone calls

Short Form TV

Hospitals Unions ReferLong FormalsTV

SEO(1)

EAPs/LAPs 1,000+ admissions

PPC(2)

First Responders per

month

Lead Gen Sites(3)

Billboards

Print Revenue from

delivering targeted

leads to third-parties

(1)$Search$Engine$Optimization$$$(2) Pay Per Click (3)$Lead$Generation$Web$Sites

AAC’S MARKETING KNOWLEDGE AND INFRASTRUCTURE CANNOT BE REPLICATED

WITHOUT SUBSTANTIAL CAPITAL AND TIME; SIGNIFICANT COMPETITIVE ADVANTAGE

14

STRONG, NATIONAL DEMAND FOR SERVICES

The majority of AAC patients travel to an AAC facility via airplane

Unique national service

offering offers strong insulation against traditional local healthcare market risks

Map of over 30,000 AAC alumni

15

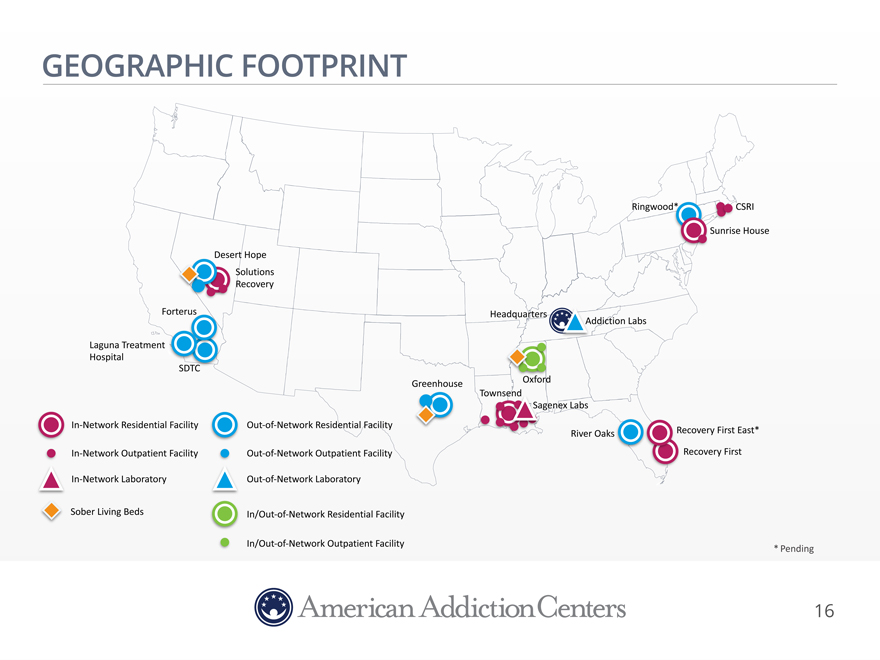

GEOGRAPHIC FOOTPRINT

Ringwood CSRI

Sunrise$House

Desert Hope Solutions$ Recovery

Forterus Headquarters ddiction$Labs Laguna Treatment$ Hospital

SD

Greenhouse Oxford Townsend agenex$Labs In-Network$Residential$Facility Out-of-Network$Residential$Facility

River$Oaks Recovery$First East*

In-Network$Outpatient Facility Out-of-Network$Outpatient Facility Recovery$First

In-Network$Laboratory Out-of-Network$Laboratory

Sober Living Beds In/Out-of-Network$Residential$Facility

In/Out-of-Network$Outpatient Facility $

* Pending

16

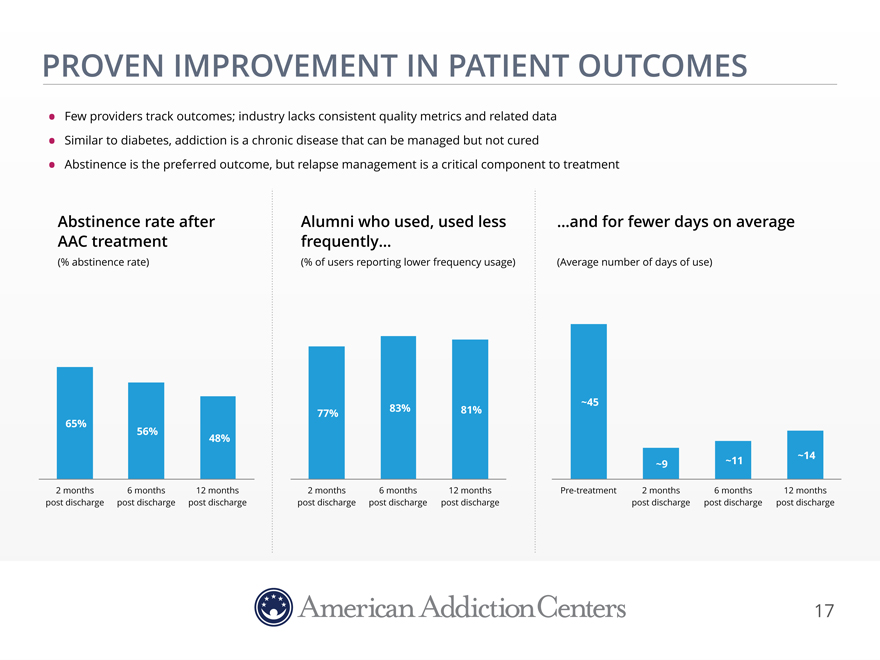

PROVEN IMPROVEMENT IN PATIENT OUTCOMES

Few providers track outcomes; industry lacks consistent quality metrics and related data

Similar to diabetes, addiction is a chronic disease that can be managed but not cured

Abstinence is the preferred outcome, but relapse management is a critical component to treatment

Abstinence rate after Alumni who used, used less…and for fewer days on average

AAC treatment frequently…

(% abstinence

rate) (% of users reporting lower frequency usage)(Average number of days of use)

77%83%81%~45

65%

56%48%

~9~11~14

2 months 6 months 12 months2 months6 months12 monthsPre-treatment2 months6 months12 months

post discharge post discharge post dischargepost

dischargepost dischargepost dischargepost dischargepost dischargepost discharge

17

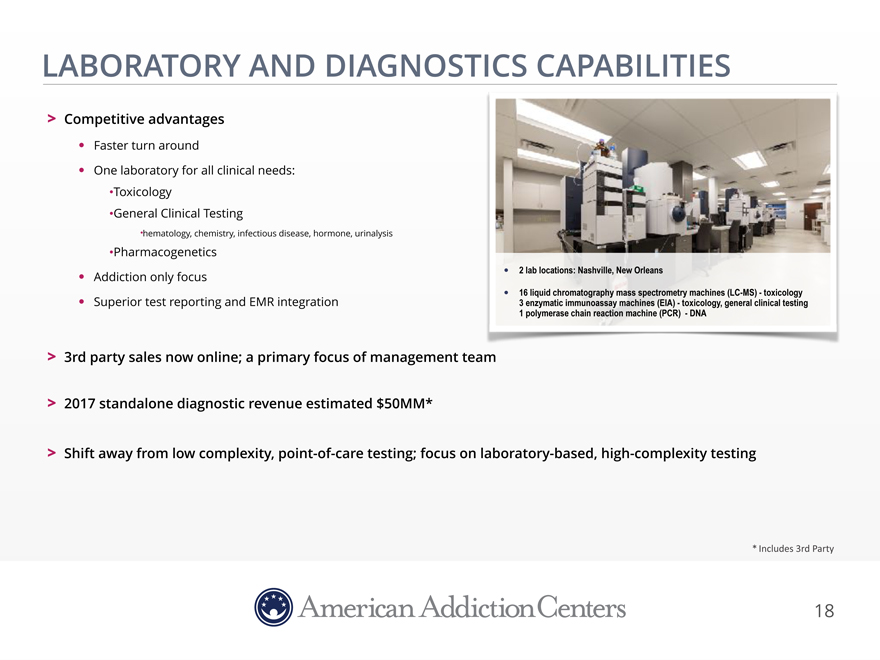

LABORATORY AND DIAGNOSTICS CAPABILITIES

Competitive advantages

Faster turn around

One laboratory for all clinical needs:

Toxicology

General Clinical Testing

hematology, chemistry, infectious disease, hormone, urinalysis

Pharmacogenetics

Addiction only focus 2 lab locations: Nashville, New Orleans

16 liquid chromatography mass spectrometry machines (LC-MS)—toxicology

Superior test reporting and EMR integration 3 enzymatic immunoassay machines (EIA)—toxicology, general clinical testing 1 polymerase chain reaction machine (PCR) —DNA

3rd party sales now online; a primary focus of management team

2017

standalone diagnostic revenue estimated $50MM*

Shift away from low complexity,

point-of-care testing; focus on laboratory-based, high-complexity testing

*$Includes$3rd$Party

18

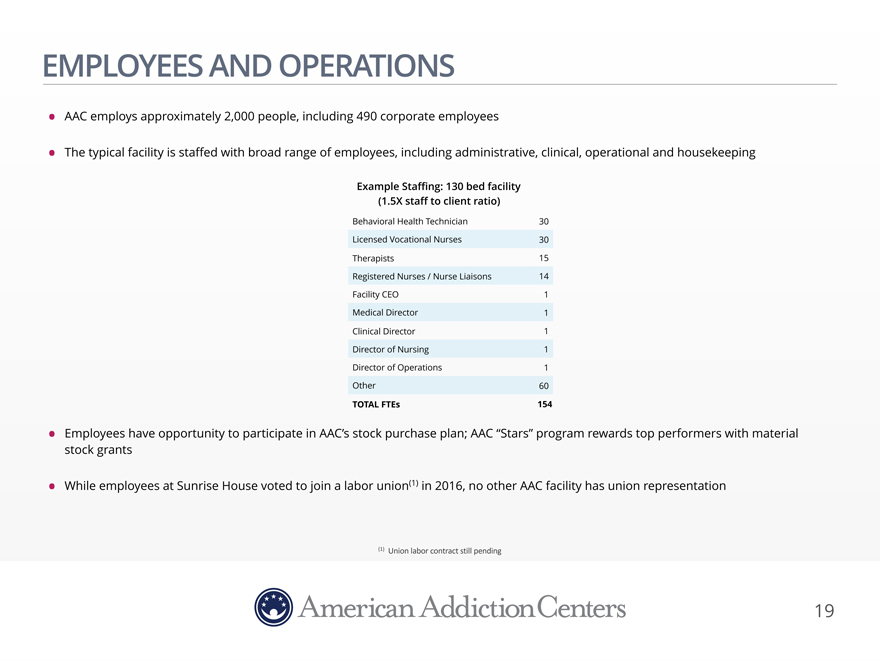

EMPLOYEES AND OPERATIONS

AAC employs approximately 2,000 people, including 490 corporate employees

The

typical facility is staffed with broad range of employees, including administrative, clinical, operational and housekeeping

Example Staffing: 130 bed facility

(1.5X staff to client ratio)

Behavioral Health Technician 30 Licensed Vocational Nurses 30 Therapists 15 Registered Nurses / Nurse Liaisons 14 Facility CEO 1

Medical Director 1 Clinical Director 1 Director of Nursing 1 Director of Operations 1 Other 60

TOTAL FTEs 154

Employees have opportunity to participate in AAC’s stock purchase plan; AAC “Stars” program rewards top performers with material stock grants

While employees at Sunrise House voted to join a labor union(1) in 2016, no other AAC facility has union representation

(1) Union$labor contract still$pending

19

COMPLIANCE PROGRAM

AAC’s compliance program reviews regulatory compliance procedures and policies across its facilities

Executive management is responsible for oversight and operation of the compliance program

Periodic and comprehensive training programs to all personnel

All AAC

treatment facilities are licensed under applicable state laws and accredited by the primary accrediting bodies in the industry

All treatment facilities have

obtained or in process of obtaining accreditation from CARF and/or The Joint Commission

Both labs hold CLIA certificates of accreditation, certifying them for

complex testing, are accredited by COLA and participate in the CAP proficiency program

Sentinel events unfortunately occur in the substance abuse treatment

industry

AAC’s sentinel event rate is approximately 10% of the industry average (1)

(1) According to SAMHSA, during 2010 and 2011, deaths occurred while in treatment at a rate of one death for every 422 client discharges. AAC experienced 1 death per 4,252 client

discharges from 2011—2015

20

RECENT EXPENSE REDUCTION INITIATIVES

Work Force Reduction—approximately $8.6MM in expected annualized savings

5% work force

reduction completed in February 2017

108 positions eliminated across the Company

Expected $8.6MM of annualized savings ($8.2MM of the $8.6MM will be recognized in fiscal year 2017)

Positions eliminated included:

Non-essential positions

at the corporate office

Achievement of synergies at recently acquired facilities (e.g., Solutions, Townsend, and Sunrise House)

Reductions to align staffing levels with occupancy

21

RECENT DEVELOPMENTS AND COMPANY UPDATES

Laguna Joint Commission accreditation on February 14th

AAC benefitting from 50%+ increase in

census in first 90 days

Oxford expansion of 48 residential and detox beds

Represents $7.5 million annual revenue and $1.5 million AEBITDA opportunity (85% occupancy @ $500 ADR and 20% net margin)

New Orleans East Hospital progress

36 leased hospital beds pending licensure

Pending consolidation of Southern Florida operations (Summer 2017)

Consolidation of Recovery

First West Palm and Recovery First will provide more efficient operations and stronger financial performance

AAC has assumed the operating leases and assets of the

former Recovery Place located in Ft. Lauderdale

Clients and staff will transition from Recovery First West Palm to new Ft. Lauderdale location by July 1st

Represents a net pick up of 19 in-network beds

22

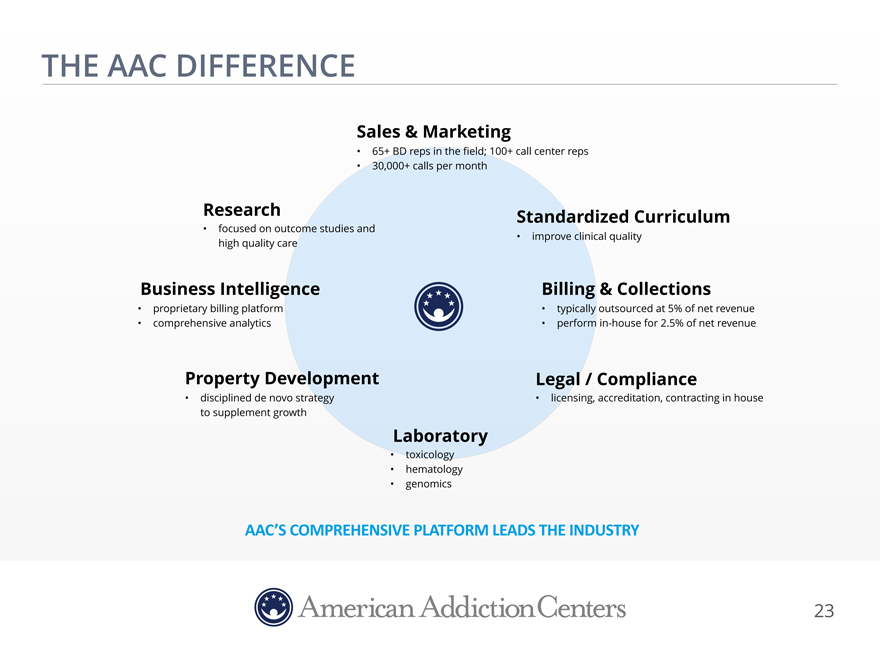

THE AAC DIFFERENCE

Sales & Marketing

65+ BD reps in the field; 100+ call center reps

30,000+ calls per month

Research Standardized Curriculum

focused on outcome studies and

improve clinical quality high quality care

Business Intelligence Billing & Collections

proprietary billing platform typically

outsourced at 5% of net revenue comprehensive analytics perform in-house for 2.5% of net revenue

Property Development Legal

/ Compliance

disciplined de novo strategy licensing, accreditation, contracting in house to supplement growth

Laboratory

toxicology hematology genomics

AAC’S COMPREHENSIVE PLATFORM LEADS THE INDUSTRY

23

GREENHOUSE

FINANCIAL

UPDATE

24

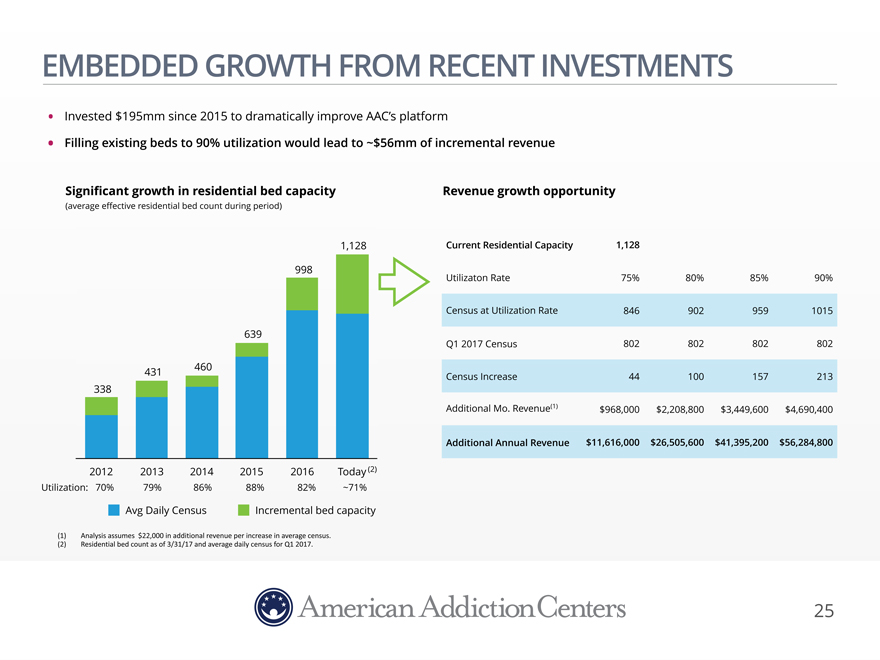

EMBEDDED GROWTH FROM RECENT INVESTMENTS

Invested $195mm since 2015 to dramatically improve AAC’s platform

Filling existing beds

to 90% utilization would lead to ~$56mm of incremental revenue

Significant growth in residential bed capacity

(average effective residential bed count during period)

1,128

998

639

431 460

338

2012 2013 2014 2015 2016 Today (2)

Utilization: 70% 79% 86% 88% 82% ~71%

Avg Daily Census Incremental bed capacity

(1)$

Analysis$assumes$$$22,000$in$additional$revenue$per$increase$in$average$census.

(2)$ Residential$bed$count as$of$3/31/17$and$average$daily$census$for$Q1$2017.

Revenue growth opportunity

Current Residential Capacity 1,128

Utilizaton Rate 75% 80% 85% 90%

Census at Utilization Rate 846 902 959 1015

Q1 2017 Census 802 802 802 802

Census Increase 44 100 157 213

Additional Mo. Revenue(1) $968,000 $2,208,800 $3,449,600 $4,690,400

Additional Annual Revenue

$11,616,000 $26,505,600 $41,395,200 $56,284,800

25

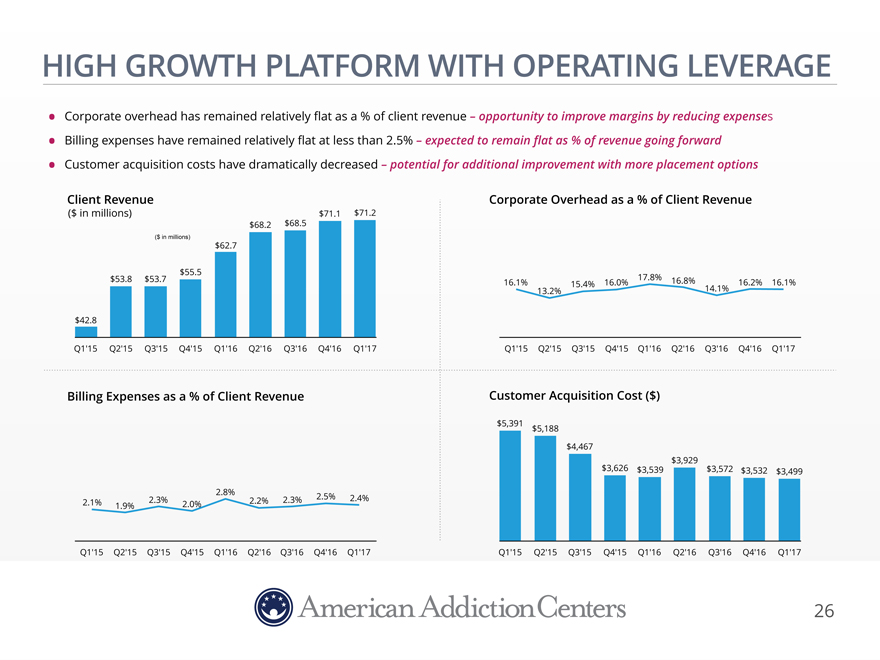

HIGH GROWTH PLATFORM WITH OPERATING LEVERAGE

Corporate overhead has remained relatively flat as a % of client revenue – opportunity to improve margins by reducing expenses

Billing expenses have remained relatively flat at less than 2.5% – expected to remain flat as % of revenue going forward

Customer acquisition costs have dramatically decreased – potential for additional improvement with more placement options

Client Revenue Corporate Overhead as a % of Client Revenue

($ $71.1 $71.2

$68.2 $68.5

($ in millions)

$62.7

$55.5

$53.8 $53.716.1%15.4% 16.0%17.8%16.8%16.2%16.1%

13.2%14.1%

$42.8

Q1’15 Q2’15 Q3’15 Q4’15 Q1’16 Q2’16 Q3’16 Q4’16 Q1’17Q1’15 Q2’15 Q3’15

Q4’15Q1’16Q2’16 Q3’16 Q4’16Q1’17

Billing Expenses as a % of Client Revenue Customer Acquisition Cost ($)

$5,391 $5,188

$4,467

$3,929

$3,626$3,539$3,572 $3,532$3,499

2.8%2.5%

2.1% 1.9% 2.3% 2.0%2.2% 2.3%2.4%

Q1’15 Q2’15 Q3’15 Q4’15 Q1’16 Q2’16 Q3’16 Q4’16 Q1’17 Q1’15 Q2’15 Q3’15

Q4’15Q1’16Q2’16 Q3’16 Q4’16Q1’17

26

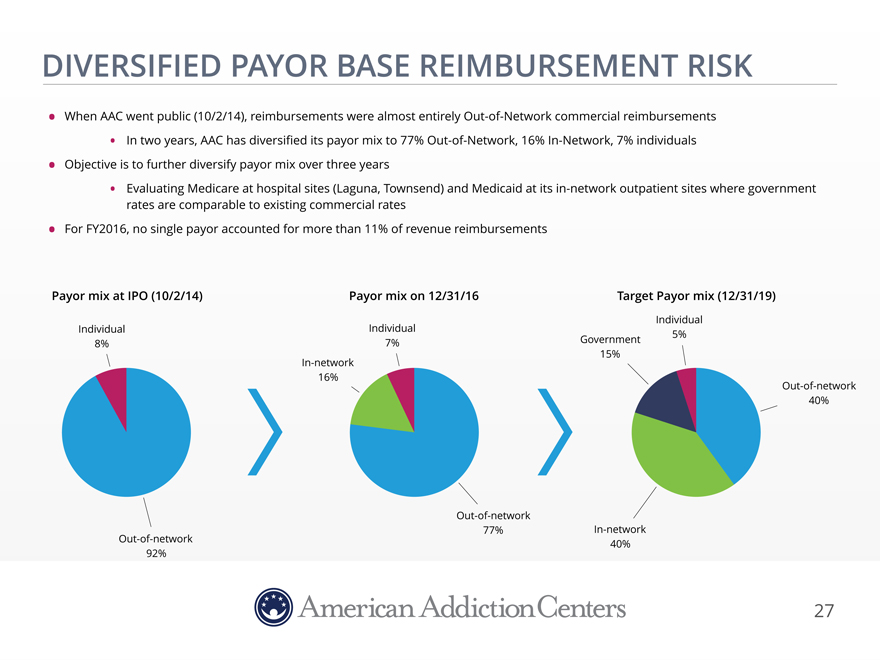

DIVERSIFIED PAYOR BASE REIMBURSEMENT RISK

When AAC went public (10/2/14), reimbursements were almost entirely Out-of-Network commercial

reimbursements

In two years, AAC has diversified its payor mix to 77%

Out-of-Network, 16% In-Network, 7% individuals

Objective is to further diversify payor mix over three years

Evaluating Medicare at hospital sites (Laguna, Townsend) and Medicaid at its in-network outpatient

sites where government

rates are comparable to existing commercial rates

For

FY2016, no single payor accounted for more than 11% of revenue reimbursements

Payor mix at IPO (10/2/14) Payor mix on 12/31/16

Individual

Individual Individual5%

8% 7%Government

15%

In-network

16%

Out-of-network

40%

Out-of-network

77%In-network

Out-of-network 40%

92%

27

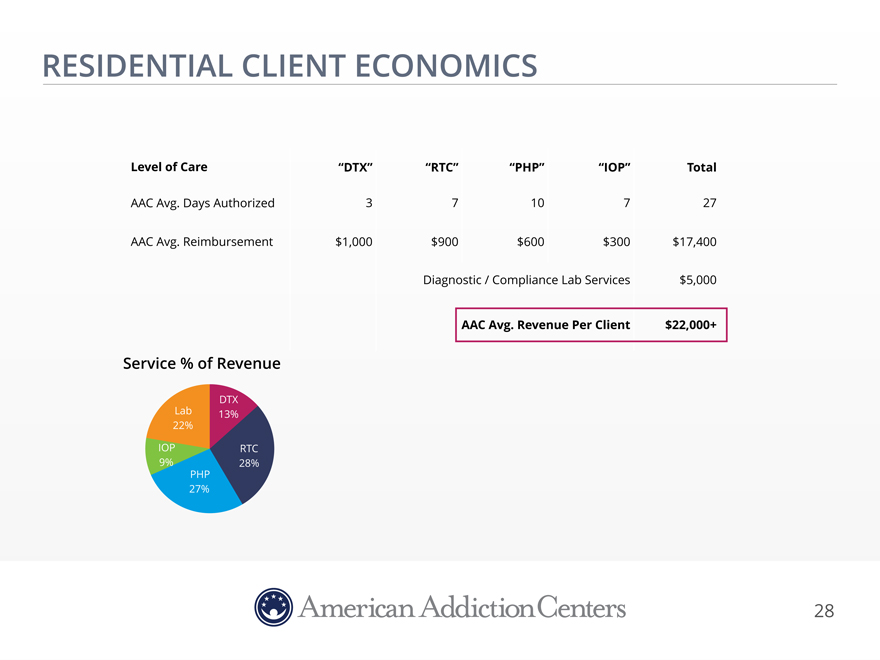

RESIDENTIAL CLIENT ECONOMICS

Level of Care “DTX”“RTC”“PHP”“IOP”Total

AAC Avg. Days Authorized 3 710727

AAC Avg.

Reimbursement $1,000 $900$600$300$17,400

Diagnostic / Compliance Lab Services$5,000

AAC Avg. Revenue Per Client$22,000+

Service % of Revenue

DTX

Lab 13%

22%

IOP RTC

9% 28%

PHP

27%

28

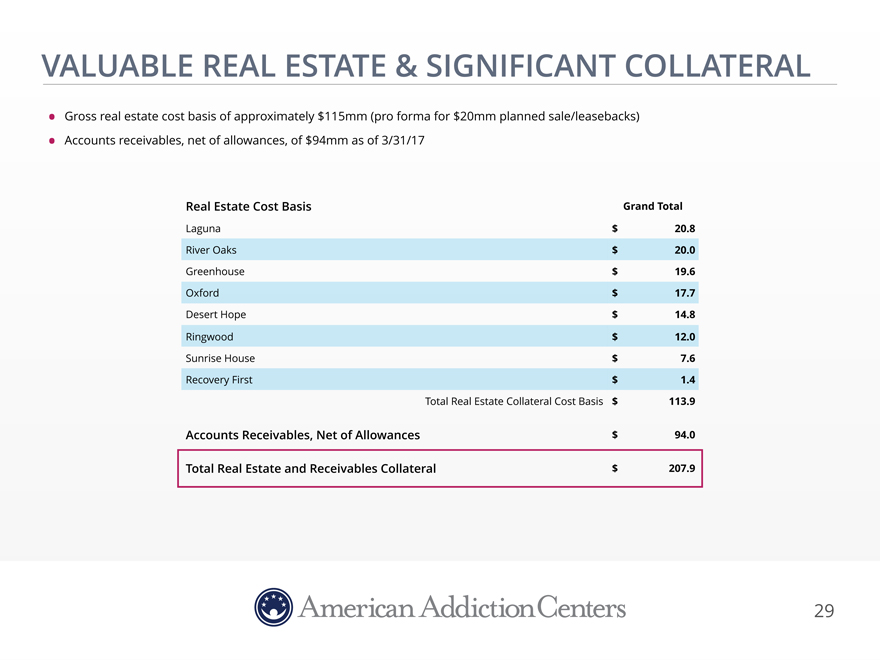

VALUABLE REAL ESTATE & SIGNIFICANT COLLATERAL

Gross real estate cost basis of approximately $115mm (pro forma for $20mm planned sale/leasebacks)

Accounts receivables, net of allowances, of $94mm as of 3/31/17

Real Estate Cost Basis Grand

Total

Laguna $ 20.8 River Oaks $ 20.0 Greenhouse $ 19.6 Oxford $ 17.7 Desert Hope $ 14.8 Ringwood $ 12.0 Sunrise House $ 7.6 Recovery First $ 1.4 Total Real Estate

Collateral Cost Basis $ 113.9

Accounts Receivables, Net of Allowances $ 94.0

Total Real Estate and Receivables Collateral $ 207.9

29

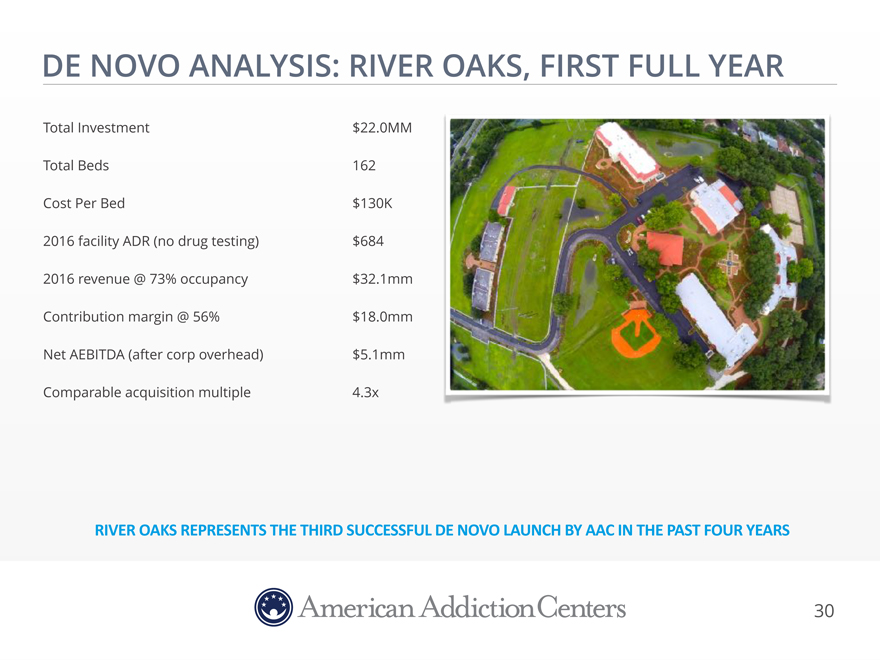

DE NOVO ANALYSIS: RIVER OAKS, FIRST FULL YEAR

Total Investment $22.0MM Total Beds 162 Cost Per Bed $130K 2016 facility ADR (no drug testing) $684 2016

revenue @ 73% occupancy $32.1mm Contribution margin @ 56% $18.0mm Net AEBITDA (after corp overhead) $5.1mm Comparable acquisition multiple 4.3x

RIVER OAKS REPRESENTS THE THIRD SUCCESSFUL DE NOVO LAUNCH BY AAC IN THE PAST FOUR YEARS

30

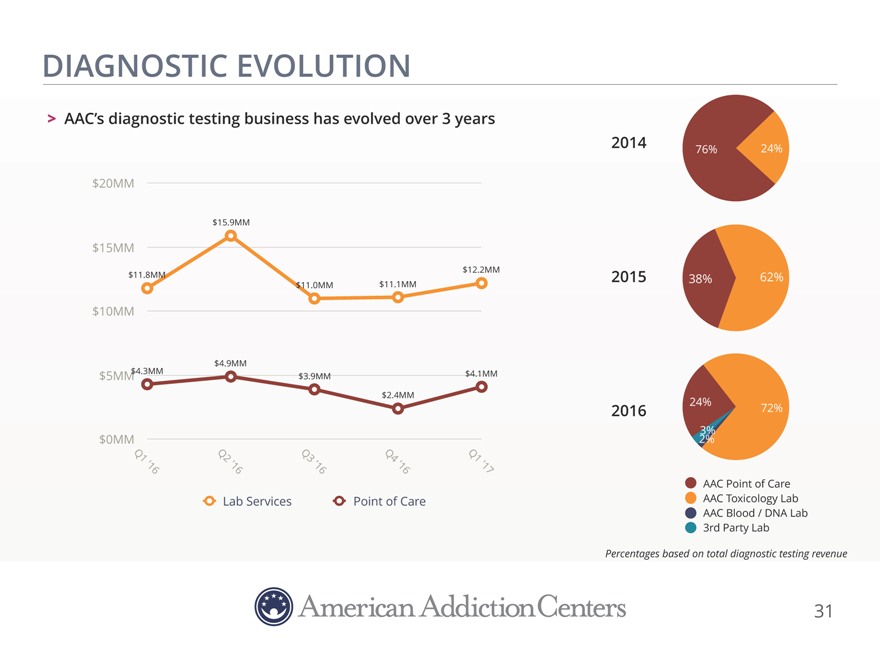

DIAGNOSTIC EVOLUTION

AAC’s diagnostic testing business has evolved over 3 years

2014 76% 24%

$20MM

$15.9MM

$15MM

$12.2MM $11.8MM $11.1MM 2015 38% 62% $11.0MM

$10MM

$4.9MM

$4.3MM $4.1MM $5MM $3.9MM

$2.4MM

24%

2016 72%

3% $0MM 2%

Q1 Q2 Q3 Q4 Q1

‘16 ‘16 ‘16 ‘16 ‘17

AAC Point of Care

Lab Services Point of Care AAC Toxicology Lab AAC Blood / DNA Lab 3rd Party

Lab

Percentages based on total diagnostic testing revenue

31

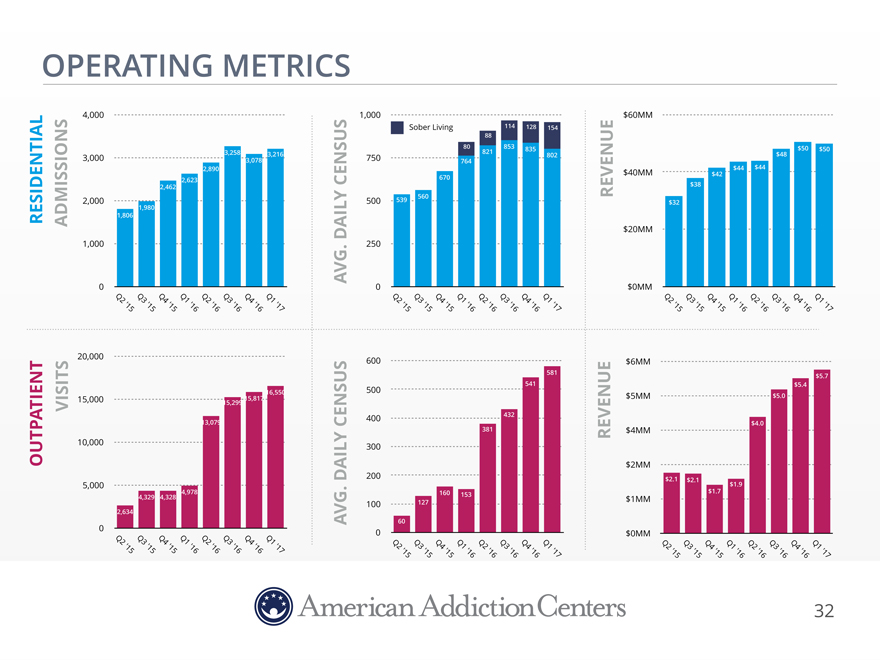

OPERATING METRICS

4,000 1,000$60MM

Sober Living114128154

88

80853835$50 $50

3,000 3,258 3,0783,216750821802$48

764

2,890$40MM$42 $44 $44

2,623 670

2,462 $38

2,000 500539560$32

1,980

RESIDENTIAL ADMISSIONS 1,806

CENSUSREVENUE

DAILY$20MM

1,000 .250

AVG

0 0$0MM

Q2 Q3 Q4 Q1 Q2 Q3 Q4Q1Q2Q3 Q4 Q1Q2Q3Q4Q1Q2Q3 Q4 Q1 Q2 Q3 Q4 Q1

‘15

‘15 ‘15 ‘16 ’16 ‘16 ‘16’17’15’15 ‘15 ‘16’16’16’16’17’15’15 ‘15 ‘16 ‘16 ‘16 ‘16 ‘17

20,000 600$6MM

581$5.7

541$5.4

16,550500$5MM

15,000 15,299 15,817$5.0

400432

VISITS 13,079CENSUS$4.0

381$4MM

OUTPATIENT 10,000 300REVENUE

$2MM

DAILY200$2.1$2.1

5,000 $1.9

4,978 .160 153$1.7

4,329 4,328 $1MM

100127

2,634

AVG60

0 0$0MM

Q2 ‘15 Q3 ‘15 Q4 ‘15 Q1 ‘16 Q2 ‘16 Q3 ‘16 Q4 ‘16 Q1 ‘17Q2 ‘15Q3 ‘15 Q4 ‘15 Q1 ‘16 Q2 ‘16Q3

‘16Q4 ‘16Q1 ‘17Q2Q3 Q4 Q1 Q2 Q3 Q4 Q1

‘15’15 ‘15 ‘16 ‘16 ‘16 ‘16 ‘17

32

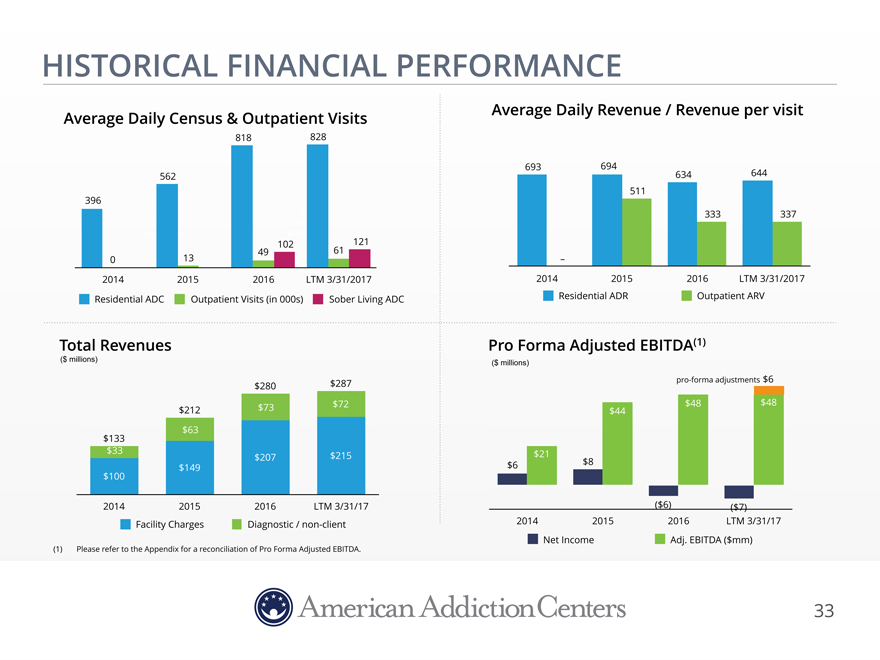

HISTORICAL FINANCIAL PERFORMANCE

Average Daily Census & Outpatient Visits

818 828

562

396

102 121

0 13 49 61

2014 2015 2016 LTM 3/31/2017

Residential ADC Outpatient Visits (in 000s) Sober Living ADC

Total Revenues

($ millions)

$280 $287

$212 $73 $72

$63

$133

$33 $207 $215

$149

$100

2014 2015 2016 LTM 3/31/17

Facility Charges Diagnostic / non-client

(1) Please refer to the Appendix for a reconciliation

of Pro Forma Adjusted EBITDA.

33

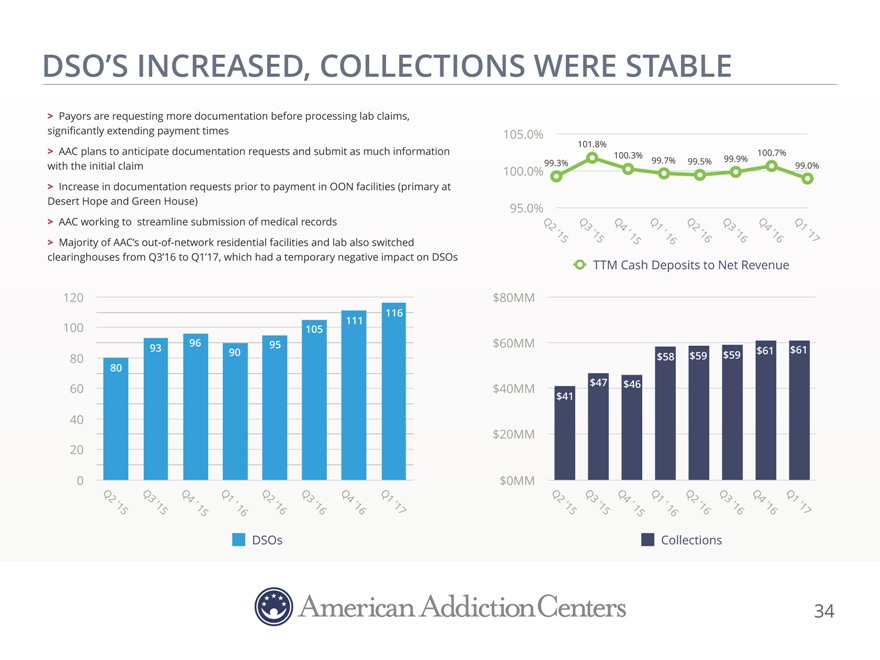

DSO’S INCREASED, COLLECTIONS WERE STABLE

Payors are requesting more documentation before processing lab claims,

significantly extending

payment times 105.0%

101.8%

AAC plans to anticipate

documentation requests and submit as much information 100.3%100.7%

with the initial claim 100.0% 99.3%99.7%99.5%99.9%99.0%

Increase in documentation requests prior to payment in OON facilities (primary at

Desert Hope

and Green House) 95.0%

AAC working to streamline submission of medical records Q2Q3Q4Q1Q2Q3Q4Q1

Majority of AAC’s out-of-network residential facilities and lab also switched

‘15’15’ 15’ 16’16’16’16’17

clearinghouses from Q3’16 to Q1’17, which had a temporary negative impact on

DSOs TTM Cash Deposits to Net Revenue

120 $80MM

116

100 105111

93969095$60MM$61$61

80 $58$59$59

80

60 $40MM$47$46

$41

40

$20MM

20

0 $0MM

Q2 Q3Q4Q1 ‘Q2Q3Q4Q1Q2Q3Q4 ‘Q1

‘Q2Q3Q4Q1

‘15 ’15’ 1516’16’16’16’17’15’151516’16’16’16’17

DSOsCollections

34

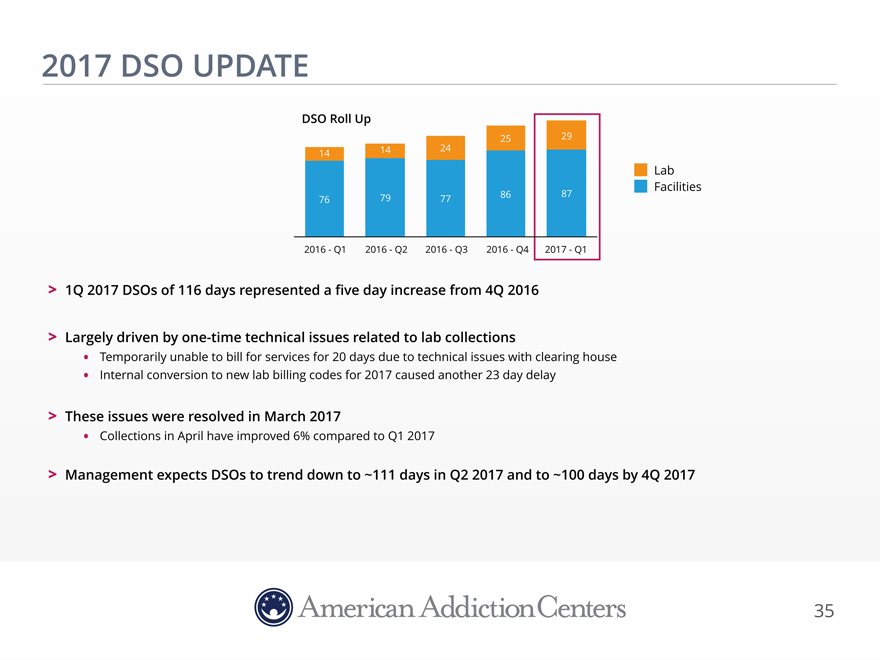

2017 DSO UPDATE

DSO Roll

Up

25 29

14 24 14

Lab Facilities

79 86 87

76 77

2016—Q1 2016—Q2 2016—Q3 2016—Q4 2017—Q1

1Q 2017 DSOs of 116 days represented a five day increase from 4Q 2016

Largely driven by one-time technical issues related to lab collections

Temporarily unable to bill for services for 20 days due to technical issues

with clearing house

Internal conversion to new lab billing codes for 2017 caused another 23 day delay

These issues were resolved in March 2017

Collections in April have improved 6% compared to Q1

2017

Management expects DSOs to trend down to ~111 days in Q2 2017 and to ~100 days by 4Q 2017

35

DESERT HOPE

APPENDIX

36

APPENDIX: NON-GAAP FINANCIAL MEASURES Adjusted EBITDA and Adjusted Pro Forma Adjusted EBITDA, (herein collectively referred to as “Non-GAAP Disclosures”) are “non-GAAP financial measures” as defined under the rules and regulations promulgated by the U.S. Securities and Exchange Commission, which is defined below. Management believes the Non- GAAP Disclosures provide investors with additional meaningful financial information that should be considered when assessing our underlying business performance and trends. We believe the Non-GAAP Disclosures also enhance investors’ ability to compare period-to-period financial results. The Non-GAAP Disclosures should not be considered as measures of financial performance under U.S. generally accepted accounting principles (“GAAP”). The items excluded from the Non-GAAP Disclosures are significant components in understanding and assessing our financial performance and should not be considered as an alternative to net income (loss) or other financial statement items presented in the condensed consolidated financial statements. Because the Non-GAAP Disclosures are not a measure determined in accordance with GAAP, the Non-GAAP Disclosures may not be comparable to other similarly titled measures of other companies. Management defines Adjusted EBITDA as net income (loss) adjusted for interest expense, depreciation and amortization expense, income tax expense (benefit), stock-based compensation and related tax reimbursements, litigation settlement and California matter related expense, acquisition-related expense (which includes professional services for accounting, legal, valuation services and licensing expenses), de novo start-up and other expenses, facility closure operating losses and expense (associated with The Academy and FitRx), gain on contingent consideration associated with our acquisition of Townsend, and bargain purchase gain associated with our acquisition of Sunrise House in the fourth quarter of 2015. Management defines Adjusted Pro Forma EBITDA as net income (loss) adjusted for interest expense, depreciation and amortization expense, income tax expense (benefit), stock-based compensation and related tax reimbursements, litigation settlement and California matter related expense, acquisition-related expense (which includes professional services for accounting, legal, valuation services and licensing expenses), de novo start-up and other expenses, facility closure operating losses and expense (associated with The Academy and FitRx), gain on contingent consideration associated with our acquisition of Townsend, bargain purchase gain associated with our acquisition of Sunrise House in the fourth quarter of 2015, increased rent expense based upon contemplated sale/leaseback, effect of Q1 2017 workforce reduction, and run rate adjustment for Solutions acquisition. 37 Confidential

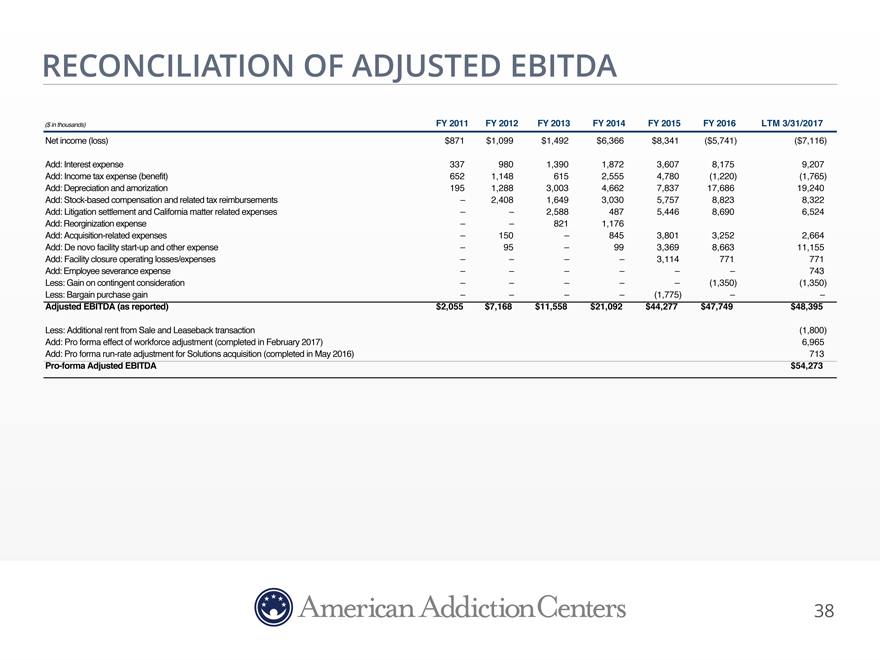

RECONCILIATION OF ADJUSTED EBITDA

($ in thousands) FY 2011 FY 2012FY 2013FY 2014FY 2015FY 2016LTM 3/31/2017

Net income (loss) $871 $1,099$1,492$6,366$8,341($5,741)($7,116)

Add: Interest expense 337 9801,3901,8723,6078,1759,207

Add: Income tax

expense (benefit) 652 1,1486152,5554,780(1,220)(1,765)

Add: Depreciation and amorization 195

1,2883,0034,6627,83717,68619,240

Add: Stock-based compensation and related tax reimbursements – 2,4081,6493,0305,7578,8238,322

Add: Litigation settlement and California matter related expenses – –2,5884875,4468,6906,524

Add: Reorginization expense – –8211,176

Add:

Acquisition-related expenses – 150–8453,8013,2522,664

Add: De novo facility start-up and

other expense – 95–993,3698,66311,155

Add: Facility closure operating losses/expenses –

–––3,114771771

Add: Employee severance expense – –––––743

Less: Gain on contingent consideration – ––––(1,350)(1,350)

Less: Bargain purchase gain – –––(1,775)––

Adjusted EBITDA (as reported) $2,055 $7,168$11,558$21,092$44,277$47,749$48,395

Less: Additional rent from Sale and Leaseback transaction (1,800)

Add:

Pro forma effect of workforce adjustment (completed in February 2017) 6,965

Add: Pro forma run-rate

adjustment for Solutions acquisition (completed in May 2016) 713

Pro-forma Adjusted

EBITDA $54,273

38

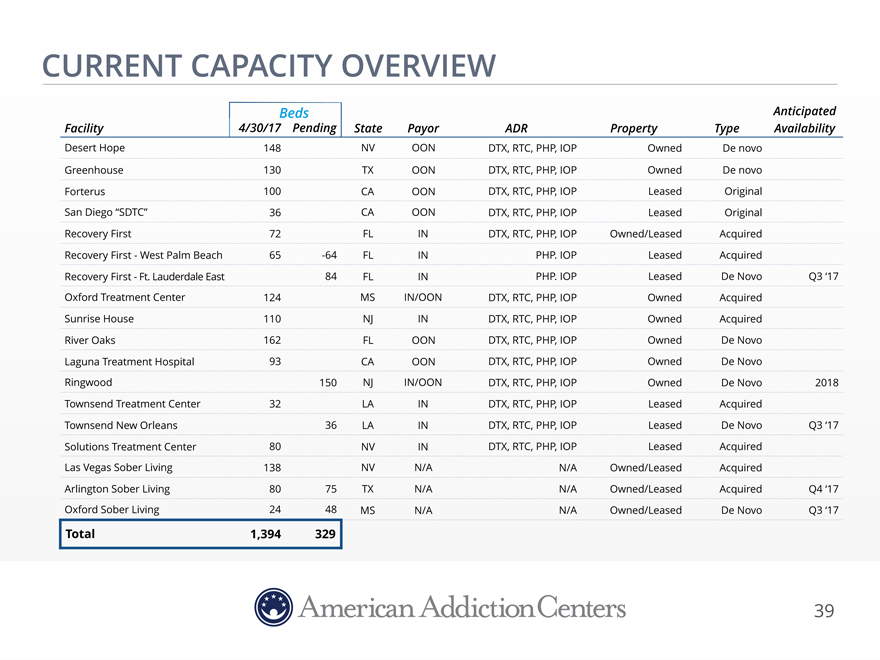

CURRENT CAPACITY OVERVIEW

Beds Anticipated

Facility 4/30/17

PendingStatePayorADRPropertyTypeAvailability

Desert Hope 148 NVOONDTX, RTC, PHP, IOPOwnedDe novo

Greenhouse 130 TXOONDTX, RTC, PHP, IOPOwnedDe novo

Forterus 100 CAOONDTX, RTC, PHP, IOPLeasedOriginal

San

Diego “SDTC” 36 CAOONDTX, RTC, PHP, IOPLeasedOriginal

Recovery First 72 FLINDTX, RTC, PHP,

IOPOwned/LeasedAcquired

Recovery First—West Palm Beach 65 -64FLINPHP. IOPLeasedAcquired

Recovery First—Ft. Lauderdale East 84FLINPHP. IOPLeasedDe NovoQ3 ‘17

Oxford Treatment Center 124 MSIN/OONDTX, RTC, PHP, IOPOwnedAcquired

Sunrise House 110 NJINDTX, RTC, PHP, IOPOwnedAcquired

River Oaks 162 FLOONDTX, RTC, PHP, IOPOwnedDe Novo

Laguna Treatment Hospital 93 CAOONDTX, RTC, PHP, IOPOwnedDe Novo

Ringwood 150NJIN/OONDTX, RTC, PHP, IOPOwnedDe Novo2018

Townsend

Treatment Center 32 LAINDTX, RTC, PHP, IOPLeasedAcquired

Townsend New Orleans 36LAINDTX, RTC, PHP, IOPLeasedDe

NovoQ3 ‘17

Solutions Treatment Center 80 NVINDTX, RTC, PHP, IOPLeasedAcquired

Las Vegas Sober Living 138 NVN/AN/AOwned/LeasedAcquired

Arlington Sober

Living 80 75TXN/AN/AOwned/LeasedAcquiredQ4 ‘17

Oxford Sober Living 24 48MSN/AN/AOwned/LeasedDe NovoQ3 ‘17

Total 1,394 329

39