Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 PRESS RELEASE - NEXTIER OILFIELD SOLUTIONS INC. | exhibit991pressrelease.htm |

| EX-10.3 - EXHIBIT 10.3 - NEXTIER OILFIELD SOLUTIONS INC. | exhibit103amendmentandwaiv.htm |

| EX-10.2 - EXHIBIT 10.2 - NEXTIER OILFIELD SOLUTIONS INC. | exhibit102commitmentletter.htm |

| EX-10.1 - EXHIBIT 10.1 - NEXTIER OILFIELD SOLUTIONS INC. | exhibit101purchaseagreement.htm |

| 8-K - 8-K 1.01 ROCKPILE ACQUISITION - NEXTIER OILFIELD SOLUTIONS INC. | form8-kprojectbison.htm |

0

Acquisition of RockPile Energy

May 18, 2017

1

Forward Looking Statements

Cautionary Statement Regarding Forward-Looking Statements

This presentation contains forward-looking statements which are protected as forward-looking statements under the Private Securities Litigation Reform

Act of 1995 that are not limited to historical facts, but reflect Keane Group, Inc.’s (“Keane” or the "Company") current beliefs, expectations or intentions

regarding future events, including statements about the proposed acquisition by Keane of RockPile Energy Services, LLC (“RockPile”) (the “proposed

transaction”). Words such as "may," "will," "could," "should," "expect," "plan," "project," "intend," "anticipate," "believe," "estimate," "predict," "potential,"

"pursuant," "target," "continue," and similar expressions are intended to identify such forward-looking statements. The statements in this presentation that

are not historical statements, including statements regarding the expected timetable for completing the proposed transaction, benefits and synergies of

the proposed transaction, costs and other anticipated financial impacts of the proposed transaction; capitalization and debt of Keane in connection with

the proposed transaction, the combined company's plans, objectives, future opportunities for the combined company and services, future financial

performance and operating results and any other statements regarding Keane’s future expectations, beliefs, plans, objectives, financial conditions,

assumptions or future events or performance that are not historical facts, are forward-looking statements within the meaning of the federal securities

laws. These statements are subject to numerous risks and uncertainties, many of which are beyond Keane’s control, which could cause actual results to

differ materially from the results expressed or implied by the statements. These risks and uncertainties include, but are not limited to: the timing to

consummate the proposed transaction; satisfaction of the conditions to closing of the proposed transaction may not be satisfied or that the closing of the

proposed transaction otherwise does not occur; the risk that a regulatory approval that may be required for the proposed transaction is not obtained or is

obtained subject to conditions that are not anticipated; the diversion of management time on transaction-related issues; the ultimate timing, outcome and

results of integrating the operations of Keane and RockPile; the effects of the business combination of Keane and RockPile, including the combined

company's future financial condition, results of operations, strategy and plans; potential adverse reactions or changes to business relationships resulting

from the announcement or completion of the proposed transaction; expected synergies and other benefits from the proposed transaction and the ability of

Keane to realize such synergies and other benefits; expectations regarding regulatory approval of the transaction; results of litigation, settlements and

investigations; actions by third parties, including governmental agencies; volatility in customer spending and in oil and natural gas prices, which could

adversely affect demand for Keane’s and RockPile’s services and their associated effect on rates, utilization, margins and planned capital expenditures;

global economic conditions; excess availability of pressure pumping equipment, including as a result of low commodity prices, reactivation or

construction; liabilities from operations; decline in, and ability to realize, backlog; equipment specialization and new technologies; adverse industry

conditions; adverse credit and equity market conditions; difficulty in building and deploying new equipment; difficulty in integrating acquisitions; shortages,

delays in delivery and interruptions of supply of equipment, supplies and materials; weather; loss of, or reduction in business with, key customers; legal

proceedings; ability to effectively identify and enter new markets; governmental regulation; and ability to retain management and field personnel.

Additional information concerning factors that could cause actual results to differ materially from those in the forward-looking statements is contained from

time to time in Keane’s Securities and Exchange (“SEC”) filings, including the most recently filed Forms 10-Q and 10-K. Keane’s filings may be obtained

by contacting Keane or the SEC or through Keane’s web site at http://www.keanegrp.com or through the SEC's Electronic Data Gathering and Analysis

Retrieval System (EDGAR) at http://www.sec.gov. Keane undertakes no obligation to publicly update or revise any forward-looking statement.

Nothing in this presentation shall constitute a solicitation to buy or an offer to sell shares of Keane's common stock. In addition, certain information with

respect to RockPile has been included in this presentation for illustrative purposes only.

2

Acquisition Summary

Overview Keane to acquire all shares of RockPile in a cash and stock transaction

Consideration

Fixed consideration of $284.5mm comprised of:

– $135mm cash (additional term loan and cash on balance sheet)1

– $123mm stock (fixed amount of 8,684,210 common shares issued to seller)2

– $26.5mm CAPEX for 30,000 new HHP (~$880 per HHP)

– $9mm in deposits previously paid by seller to be reimbursed by Keane at closing3

Contingent consideration of up to $20mm via Contingent Value Right (“CVR”)4

Valuation Approximately $1,000 per HHP for 245,000 HHP and bundled wireline units5

Combined

Ownership

Sponsor and Management 64.7%, Public 27.5%, RockPile 7.8%

Governance White Deer, existing RockPile majority owner, will receive one board observer right

Approvals Standard regulatory approvals and other closing conditions

Timing Expected to close by July 31, 2017

1 Excludes transaction fees and deposit on new frac fleet on order. 2 Based on Keane stock price as of market close 5/17/2017. Actual value amount of stock consideration to be

determined upon transaction closing. Newly issued shares subject to a 6-month lockup. 3 Remaining $17.5mm to be paid over the build cycle. 4 CVR shall mature on nine month

anniversary of closing date. Subject to certain conditions, payment amount will be equal to the difference between (i) $19.00 and (ii) the trading price of Keane's common stock

during a trading period ending on the nine-month maturity date of the right. 5 Valuation based on total fixed consideration of $284.5mm, less value attributable to ancillary assets

(cementing and workover) and estimated acquired working capital. Total purchased horsepower of 245,000 HHP includes 30,000 HHP on order by RockPile with dedicated customer

commencing in Q4 2017.

3

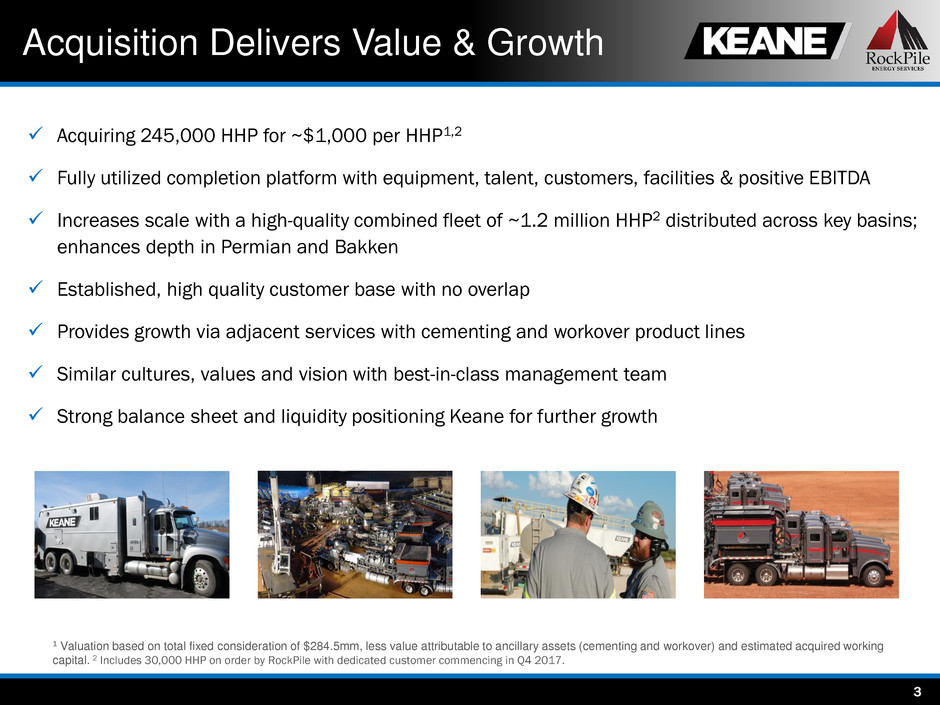

Acquisition Delivers Value & Growth

Acquiring 245,000 HHP for ~$1,000 per HHP1,2

Fully utilized completion platform with equipment, talent, customers, facilities & positive EBITDA

Increases scale with a high-quality combined fleet of ~1.2 million HHP2 distributed across key basins;

enhances depth in Permian and Bakken

Established, high quality customer base with no overlap

Provides growth via adjacent services with cementing and workover product lines

Similar cultures, values and vision with best-in-class management team

Strong balance sheet and liquidity positioning Keane for further growth

1 Valuation based on total fixed consideration of $284.5mm, less value attributable to ancillary assets (cementing and workover) and estimated acquired working

capital. 2 Includes 30,000 HHP on order by RockPile with dedicated customer commencing in Q4 2017.

4

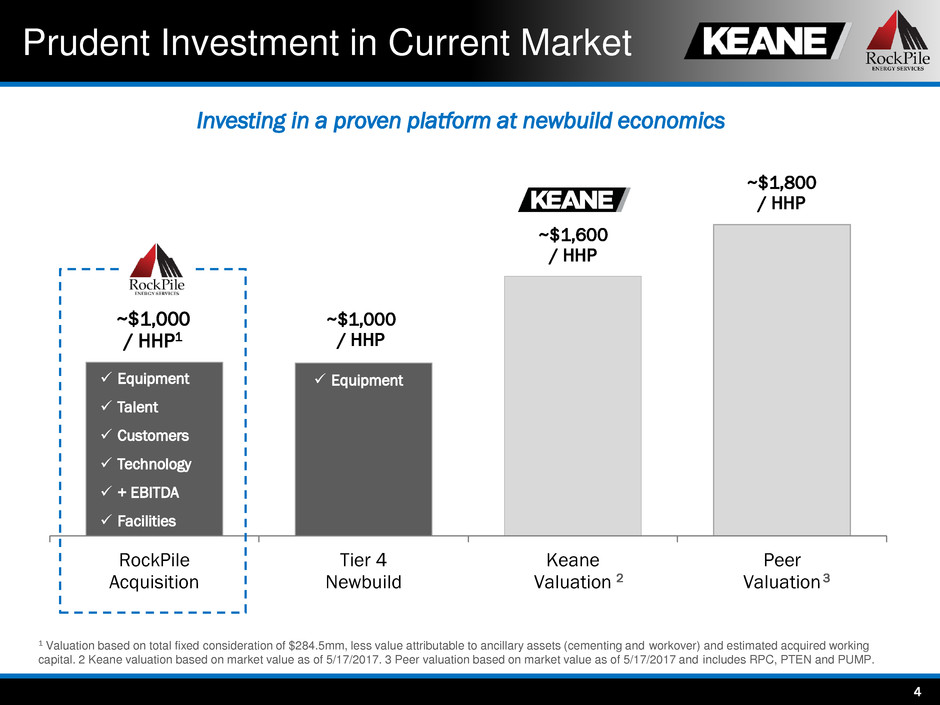

Prudent Investment in Current Market

1 Valuation based on total fixed consideration of $284.5mm, less value attributable to ancillary assets (cementing and workover) and estimated acquired working

capital. 2 Keane valuation based on market value as of 5/17/2017. 3 Peer valuation based on market value as of 5/17/2017 and includes RPC, PTEN and PUMP.

Investing in a proven platform at newbuild economics

RockPile

Acquisition

Tier 4

Newbuild

Keane

Valuation

Peer

Valuation

Facilities

+ EBITDA

Technology

Customers

Talent

Equipment

~$1,000

/ HHP1

~$1,000

/ HHP

~$1,600

/ HHP

~$1,800

/ HHP

Equipment

2 3

5

Keane Company Overview

944,000

Hydraulic Horsepower

23

Wireline Trucks

78%

Utilized

58%

Bundled

About Keane Group

High quality fleet of modern completions

equipment

Blue-chip customer relationships

Focus on high-efficiency completions

Reputation for best-in-class service quality

and industry-leading safety

Diversified footprint with exposure across key

basins

Best-in-class management team with

extensive industry experience

Engineered solutions expand value

proposition and differentiate offering

Note: Asset statistics as of quarter ended March 31, 2017.

7

Coiled Tubing Units

Maintaining

optionality

14

Cementing Units

Maintaining

Optionality

6

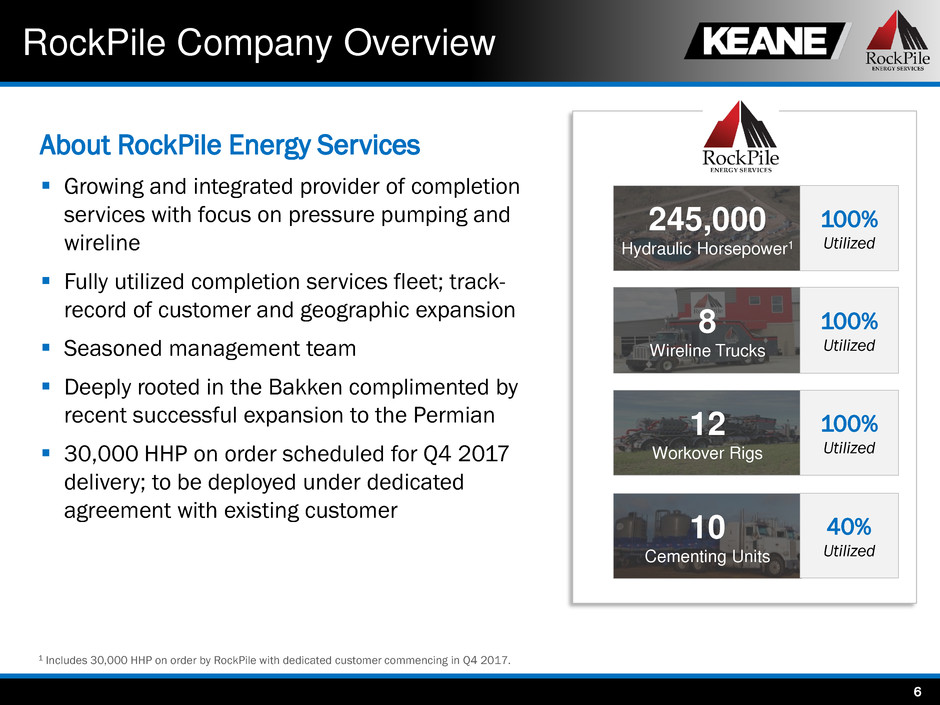

RockPile Company Overview

245,000

Hydraulic Horsepower1

8

Wireline Trucks

12

Workover Rigs

10

Cementing Units

1 Includes 30,000 HHP on order by RockPile with dedicated customer commencing in Q4 2017.

100%

Utilized

100%

Utilized

100%

Utilized

40%

Utilized

About RockPile Energy Services

Growing and integrated provider of completion

services with focus on pressure pumping and

wireline

Fully utilized completion services fleet; track-

record of customer and geographic expansion

Seasoned management team

Deeply rooted in the Bakken complimented by

recent successful expansion to the Permian

30,000 HHP on order scheduled for Q4 2017

delivery; to be deployed under dedicated

agreement with existing customer

7

The New Keane: Assets & Capital

~1,200,000

Hydraulic Horsepower

31

Wireline Trucks

7

Coiled Tubing Units

12

Workover Rigs

24

Cementing Units

Pro-forma Discussion

Cash balance for quarter ended March 31, 2017

reduced by $21.6mm1 of cash funding from Keane

balance sheet with remaining portion from expansion

of term loan facility

Additional $135mm in term loans with existing lender

Net debt of $228mm; maintains low leverage profile

given EBITDA generation of combined business

Liquidity in excess of $210mm

Potential to further expand revolver commitment post-

closing, further increasing liquidity position

Pro-forma capitalization position

1 $21.6mm use of cash includes $9mm for new fleet CAPEX, $12.6mm of estimated transaction fees and expenses.

In $ millions

Pro-forma

3/31/17

Cash 64.2$

Senior Secured Term Loan 150.0$

Additional Term Loan 135.0

Total Term Debt 285.0

Capital Leases 7.4

T tal Debt 292.4$

Net Debt 228.2$

Liquidity

Cash 64.2$

Revolver Borrowing Base 147.2

Total Liquidity 211.4$

8

Enhanced Profile through Combination

SCOOP / STACK

Keane: ~90,000 HHP

1 Includes 30,000 HHP on order by RockPile with dedicated customer commencing in Q4 2017. 2 Springtown Equipment Center.

Acquisition deepens asset position in the prolific Permian and Bakken basins

Marcellus / Utica

Keane: ~270,000 HHP

Bakken:

Keane: ~170,000 HHP

RockPile: ~145,000 HHP

Combined: ~315,000 HHP

Springtown2

Keane: ~100,000 HHP

Permian:

Keane: ~315,000 HHP

RockPile: ~100,000 HHP

Combined: ~415,000 HHP

23%

35%

8%26%

8%

Permian

Marcellus / Utica

~1,200,000 HHP

1

Pro-forma

SCOOP / STACK

Bakken

Springtown2