Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - NEXTIER OILFIELD SOLUTIONS INC. | a201610kexhibit321.htm |

| EX-31.2 - EXHIBIT 31.2 - NEXTIER OILFIELD SOLUTIONS INC. | a201610kexhibit312.htm |

| EX-31.1 - EXHIBIT 31.1 - NEXTIER OILFIELD SOLUTIONS INC. | a201610kexhibit311.htm |

| EX-23.2 - EXHIBIT 23.2 - NEXTIER OILFIELD SOLUTIONS INC. | a201610kexhibit232kpmgcons.htm |

| EX-23.1 - EXHIBIT 23.1 - NEXTIER OILFIELD SOLUTIONS INC. | a201610kexhibit231kpmgcons.htm |

| EX-21.1 - EXHIBIT 21.1 - NEXTIER OILFIELD SOLUTIONS INC. | a201610kexhibit211signific.htm |

| EX-10.23 - EXHIBIT 10.23 - NEXTIER OILFIELD SOLUTIONS INC. | a201610kexhibit1023keanefo.htm |

| EX-10.4 - EXHIBIT 10.4 - NEXTIER OILFIELD SOLUTIONS INC. | a201610kexhibit104keaneequ.htm |

| EX-10.2 - EXHIBIT 10.2 - NEXTIER OILFIELD SOLUTIONS INC. | a201610kexhibit102keaneter.htm |

| EX-3.2 - EXHIBIT 3.2 - NEXTIER OILFIELD SOLUTIONS INC. | a201610kexhibit32bylaws.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, DC 20549 |

FORM 10-K |

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-37988

Keane Group, Inc.

(Exact Name of Registrant as Specified in its Charter)

Delaware | 38-4016639 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

2121 Sage Road, Suite 370, Houston, TX | 77056 |

(Address of principal executive offices) | (Zip code) |

Registrant’s telephone number, including area code: (713) 960-0381

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange On Which Registered |

Common Stock, $0.01, par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

_______________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ¨ |

Non-accelerated filer | x (do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2016, the last business day of the registrant’s most recent second quarter, there was no public market for the registrant’s common equity.

As of March 20, 2017, the registrant had 103,128,019 shares of common stock outstanding.

TABLE OF CONTENTS

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS AND INFORMATION

This Annual Report on Form 10-K contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, which are subject to risks and uncertainties. All statements other than statements of historical facts contained in this Annual Report on Form 10-K, including statements regarding our future operating results and financial position, business strategy and plans and objectives of management for future operations, are forward-looking statements. Our forward-looking statements are generally accompanied by words such as “may,” “should,” “expect,” “believe,” “plan,” “anticipate,” “could,” “intend,” “target,” “goal,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential,” or “continue” or the negative of these terms or other similar expressions. Any forward-looking statements contained in this Annual Report on Form 10-K speak only as of the date on which we make them and are based upon our historical performance and on current plans, estimates and expectations. Except as required by law, we have no obligation to update any forward-looking statements. Forward-looking statements contained in this Annual Report on Form 10-K include, but are not limited to, statements about:

• the competitive nature of the industry in which we conduct our business;

• general business and economic conditions;

• crude oil and natural gas commodity prices;

• demand for services in our industry;

• our ability to successfully integrate the Acquired Trican Operations (as defined herein);

• our business strategy;

• pricing pressures and competitive factors;

• the effect of a loss of, or the financial distress of, one or more key customers;

• our ability to obtain or renew customer contracts;

• the effect of a loss of, or interruption in operations of, one or more key suppliers;

• the market price and availability of materials or equipment;

• increased costs as a result of being a public company;

• planned acquisitions and future capital expenditures;

• technology;

• financial strategy, liquidity or capital required for our ongoing operations and acquisitions, and our ability to raise additional capital;

• our ability to service our debt obligations;

• our ability to obtain permits, approvals and authorizations from governmental and third parties, and the effects of government regulation;

• legal proceedings and effect of external investigations;

• our ability or intention to pay dividends;

• our future operating results; and

• our plans, objectives, expectations and intentions.

We caution you that the foregoing list may not contain all of the forward-looking statements made in this Annual Report on Form 10-K.

You should not rely upon forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this Annual Report on Form 10-K primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, results of operations and prospects. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors described in the section entitled “Item 1A. Risk Factors” and elsewhere in this Annual Report on Form 10-K. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Annual Report on Form 10-K. We cannot assure you that the results, events and circumstances reflected in any forward-looking statements will be achieved or occur, and actual results, events or circumstances could differ materially from those described in such forward-looking statements. The forward-looking statements made in this Annual Report on Form 10-K relate only to events

1

as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this Annual Report on Form 10-K to reflect events or circumstances after the date of this Annual Report on Form 10-K or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

This Annual Report on Form 10-K includes market and industry data and certain other statistical information based on third-party sources including independent industry publications, government publications and other published independent sources, such as content and estimates provided by Coras Research, LLC as of December 2016. Coras Research, LLC is not a member of the FINRA or the SIPC and is not a registered broker dealer or investment advisor. Although we believe these third-party sources are reliable as of their respective dates, we have not independently verified the accuracy or completeness of this information. Some data is also based on our own good faith estimates which are supported by our management’s knowledge of and experience in the markets and businesses in which we operate.

While we are not aware of any misstatements regarding any market, industry or similar data presented herein, such data involves risks and uncertainties and is subject to change based on various factors, including those discussed above and in “Item 1A. Risk Factors” in this Annual Report on Form 10-K.

This Annual Report on Form 10-K includes references to utilization of hydraulic fracturing assets. Utilization for our own fleets, as used in this Annual Report on Form 10-K, is defined as the ratio of the number of deployed fleets to the number of total fleets. For the purposes of this Annual Report on Form 10-K, we consider one of our fleets deployed if the fleet has been put in service at least one day during the period for which we calculate utilization. Furthermore, we define active fleets as fleets available for deployment. As a result, as additional fleets are incrementally deployed, our utilization rate increases.

We define industry utilization as the ratio of the total industry demand of hydraulic horsepower to the total available capacity of hydraulic horsepower, in each case as reported by an independent industry source. Our method for calculating the utilization rate for our own fleets or the industry may differ from the method used by other companies or industry sources which could, for example, be based off a ratio of the total number of days a fleet is put in service to the total number of days in the relevant period.

As used in this Annual Report on Form 10-K, capacity in the hydraulic fracturing business refers to the total number of hydraulic horsepower, regardless of whether such hydraulic horsepower is active and deployed, active and not deployed or inactive. While the equipment and amount of hydraulic horsepower required for a customer project varies, we calculate our total number of fleets, as used in this Annual Report on Form 10-K, by dividing our total hydraulic horsepower by 40,000 hydraulic horsepower.

We believe that our measures of utilization, based on the number of deployed fleets, provide an accurate representation of existing, available capacity for additional revenue generating activity.

As used in this Annual Report on Form 10-K, references to cannibalization of parked equipment refer to the removal of parts and components (such as the engine or transmission of a fracturing pump) from an idle hydraulic fracturing fleet in order to service an active hydraulic fracturing fleet.

BASIS OF PRESENTATION IN THIS ANNUAL REPORT ON FORM 10-K

On January 25, 2017, we consummated an initial public offering (“IPO”), in which we issued and sold 15,700,000 shares of common stock of Keane and the selling stockholder (as defined below) sold 15,074,000 shares. Our business prior to the IPO was conducted through Keane Group Holdings, LLC and its consolidated subsidiaries (“Keane Group”). To effectuate the IPO, we completed a series of transactions that resulted in a reorganization of

2

our business. Specifically, among other transactions, we effected the Organizational Transactions further described under “Item 1. Business–Initial Public Offering and Organizational Transactions.”

Unless otherwise indicated, or the context otherwise requires, for periods prior to the completion of the IPO, (i) the historical financial data in this Annual Report on Form 10-K and (ii) the operating and other non-financial data disclosed in “Item 6. Selected Financial Data” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” (collectively, the “Financial Statement Sections”) reflect the consolidated business and operations of Keane Group.

3

PART I

References Within This Annual Report

As used in Part I of this Annual Report on Form 10-K, unless the context otherwise requires, references to (i) the terms “Company,” “Keane,” “we,” “us” and “our” refer to Keane Group Holdings, LLC and its consolidated subsidiaries for periods prior to our IPO, and, for periods as of and following the IPO, Keane Group, Inc. and its consolidated subsidiaries; (ii) the term “Keane Group” refers to Keane Group Holdings, LLC and its consolidated subsidiaries; (iii) the term “Trican Parent” refers to Trican Well Service Ltd. and, where appropriate, its subsidiaries; (iv) the term “Trican U.S.” refers to Trican Well Service L.P.; (v) the term “Trican” refers to Trican Parent and Trican U.S., collectively; and (vi) the terms “Sponsor” or “Cerberus” refer to Cerberus Capital Management, L.P. and its respective controlled affiliates and investment funds.

Item 1. Business

Initial Public Offering and Organizational Transactions

On January 25, 2017, we consummated an IPO of 30,774,000 shares of our common stock at a public offering price of $19.00 per share, of which 15,700,000 shares were offered by us and 15,074,000 shares were offered by the selling stockholder. We received $260.3 million in net proceeds after deducting $19.4 million of underwriting discounts and commissions associated with the shares sold by us and $18.6 million of underwriting discounts and commissions payable by us associated with the shares sold by the selling stockholder. The net proceeds were used to (i) fully repay our existing balance of approximately $99 million under our 2016 Term Loan Facility (as defined herein), and, in addition, approximately $13.8 million of prepayment premium related to such repayment and (ii) repay $50.0 million of our Notes (as defined herein), and, in addition, approximately $0.5 million of prepayment premium related to such repayment. The remaining $97.0 million is to be used for general corporate purposes. We did not receive any of the proceeds from the sale of shares of common stock sold by the selling stockholder.

Keane is a holding company with no direct operations. In connection with the IPO, we completed a series of organizational transactions, including the following:

• | Certain entities affiliated with our Sponsor, certain members of the Keane family, Trican and certain members of our management, whom we refer to as our “Existing Owners,” contributed all of their direct and indirect equity interests in Keane Group Holdings, LLC to Keane Investor Holdings LLC (“Keane Investor”); |

• | Keane Investor contributed all of its equity interests in Keane Group to Keane in exchange for common stock of Keane; and |

• | our independent directors received grants of restricted stock of Keane in substitution for their interests in Keane Group. |

As a result of these transactions, certain other transactions completed in connection with the IPO (collectively, the “Organizational Transactions”) and the IPO, (i) Keane is a holding company with no material assets other than its ownership of Keane Group and its subsidiaries, (ii) an aggregate of 72,354,019 shares of our common stock are owned by Keane Investor and our independent directors, and Keane Investor entered into the Stockholders’ Agreement (as defined herein) with Keane, (iii) our Existing Owners became holders of equity interests in our controlling stockholder, Keane Investor (and holders of Keane Group’s Class B and Class C Units became holders of Class B and Class C Units in Keane Investor) and (iv) the capital stock of Keane consists of (y) common stock, entitled to one vote per share on all matters submitted to a vote of stockholders and (z) undesignated and unissued preferred stock.

4

Our Company

We are one of the largest pure-play providers of integrated well completion services in the U.S., with a focus on complex, technically demanding completion solutions. Our primary service offerings include horizontal and vertical fracturing, wireline perforation and logging and engineered solutions, as well as other value-added service offerings. With approximately 944,250 hydraulic horsepower spread across 23 hydraulic fracturing fleets and 23 wireline trucks located in the Permian Basin, the Marcellus Shale/Utica Shale, the SCOOP/STACK Formation, the Bakken Formation and other active oil and gas basins, we provide industry-leading completion services with a strict focus on health, safety and environmental stewardship and cost-effective customer-centric solutions. Our company prides itself on our outstanding employee culture, our efficiency and our ability to meet and exceed the expectations of our customers and communities in which we operate.

We provide our services in conjunction with onshore well development, in addition to stimulation operations on existing wells, to exploration and production (“E&P”) customers with some of the highest quality and safety standards in the industry. We believe our proven capabilities enable us to deliver cost-effective solutions for increasingly complex and technically demanding well completion requirements, which include longer lateral segments, higher pressure rates and proppant intensity, and multiple fracturing stages in challenging high-pressure formations.

We operate in the most active unconventional oil and natural gas basins in the U.S., including the Permian Basin, the Marcellus Shale/Utica Shale, the SCOOP/STACK Formation and the Bakken Formation. We are one of the largest providers of hydraulic fracturing services in the Permian Basin, the Marcellus Shale/Utica Shale and the Bakken Formation by total hydraulic horsepower deployed.

Our completion services are designed in partnership with our customers to enhance both initial production rates and estimated ultimate recovery from new and existing wells. We seek to deploy our assets with well-capitalized customers that have long-term development programs that enable us to maximize operational efficiencies and the return on our assets. We believe our integrated approach increases efficiencies and provides potential cost savings for our customers, allowing us to broaden our relationships with existing customers and attract new ones. In addition, our technical team and engineering center, which is located in The Woodlands, Texas, provides us the ability to supplement our service offerings with engineered solutions specifically tailored to address customers’ completion requirements and challenges.

We believe the demand for our services will increase over the medium and long-term as a result of a number of favorable industry trends. While drilling and completion activity has improved along with a rebound in commodity prices from their lows in early 2016 of $26.19 per barrel (based on the Cushing WTI Spot Oil Price (“WTI”)) and $1.49 per million British Thermal Units (“mmBtu”) for natural gas, we believe there are long-term fundamental demand and supply trends that will benefit our company. We believe demand for our services will grow from:

• increases in customer drilling budgets focused in our core service areas;

• increases in the percentage of rigs that are drilling horizontal wells;

• increases in the length of the typical horizontal wellbore;

• increases in the number of fracture stages in a typical horizontal wellbore; and

• increases in pad drilling and simultaneous fracturing/wireline operations.

We believe demand and pricing for our services will be further enhanced by a reduction in available hydraulic fracturing equipment as a result of:

• cannibalization of parked equipment and increased maintenance costs;

• aging of existing fleets given the limited investment since the industry downturn in late 2014;

• | increased customer focus on well-capitalized, safe and efficient service providers that can meet or exceed their requirements; and |

5

• reduced access to capital for fleet acquisition, maintenance and deployment.

Pricing levels for our industry’s services are driven primarily by asset utilization. With the downturn in commodity prices from late 2014 into 2016, per Coras Research, LLC, asset utilization across the hydraulic fracturing industry declined from 77% at the end of 2014 to 60% at the end of 2016. As of December 31, 2016, of our total 23 hydraulic fracturing fleets, 13 fleets, or 56% of our total fleets, were deployed. We believe our asset utilization rate reflects the quality of our assets and services.

In addition, due to lack of investment in maintenance and aging equipment, per Coras Research, LLC, approximately 89% of active industry equipment was deployed as of December 31, 2016. As of December 31, 2016, we had 16 active hydraulic fracturing fleets, of which 13 fleets, or 87%, were deployed. As of February 28, 2017, we had 16 active hydraulic fracturing fleets, all of which were deployed. Based on current pricing for component parts and labor, we believe our remaining seven inactive fleets can be made operational at a cost of less than $2.0 million per fleet.

Our History

Our company was founded in 1973 by the Keane family in Lewis Run, Pennsylvania. We have been well regarded as a customer-focused operator that prioritizes safety, the environment and our relationship with the communities in which we operate. We are committed to maintaining conservative financial policies and a disciplined approach to asset deployment, adding new capacity with customers with significant capital budgets and steady development programs rather than on a speculative basis.

We have developed what we believe is an industry-leading, completions-focused platform by emphasizing health, safety and environmental stewardship as our highest priority, implementing an efficient cost structure focused on disciplined cost controls, establishing a sophisticated supply chain and investing in state-of-the-art systems and leveraging technology and infrastructure to support growth. Through these initiatives, our platform has demonstrated the ability to scale with an increase in activity. For example, in 2013, we organically entered into the Bakken Formation, where we remain one of the most active service providers, and, in 2014, we successfully recruited and integrated over 450 employees into our business, resulting in a 74% increase in our employee base.

We believe that our ability to identify, execute and integrate acquisitions is a competitive advantage. We have demonstrated the ability to grow both organically and through opportunistic acquisitions. From 2010 to 2014, we organically added seven hydraulic fracturing fleets deployed across the Marcellus Shale/Utica Shale, the Bakken Formation and the Permian Basin. We have also completed three acquisitions that have diversified our geographic presence and service line capabilities. In April 2013, we acquired the wireline technologies division of Calmena Energy Services, which provided us with wireline operations capabilities in the U.S. In December 2013, we acquired the assets of Ultra Tech Frac Services to establish a presence in the Permian Basin. In March 2016, we completed the opportunistic acquisition of Trican’s U.S. oilfield service operations resulting in the expansion of our hydraulic fracturing operations to the current 23 fleets and establishing Keane as one of the largest pure-play providers of integrated well completion services in the U.S. with approximately 944,250 hydraulic horsepower. This acquisition added high quality equipment, provided increased scale in key operating basins, expanded our customer base and offered significant cost reduction opportunities. We implemented a plan to achieve over $80 million of annualized cost savings as a result of facility consolidations, head count rationalization and procurement savings. The Trican transaction also enhanced our access to proprietary technology and engineering capabilities that have improved our ability to provide integrated services solutions. We intend to continue to evaluate potential acquisitions on an opportunistic basis that would complement our existing service offerings or expand our geographic capabilities.

Our Competitive Strengths

We believe that technical expertise, fleet capability, equipment quality and robust preventive maintenance programs, integrated solutions, experience, scale in leading basins and health, safety and environmental (“HSE”) performance are the primary differentiating factors within the industry. We specialize in providing customized completion solutions to our customers that increase efficiency, improve safety and lower their overall cost.

6

Accordingly, we believe the following strengths differentiate us from many of our competitors and contribute to our ongoing success:

Multi-Basin Service Provider with Close Proximity to Our Customers.

We provide our services in several of the most active basins in the U.S., including the Permian Basin, the Marcellus Shale/Utica Shale, the SCOOP/STACK Formation, the Bakken Formation and the Eagle Ford Shale. These regions are expected to account for approximately 87% of all new horizontal wells anticipated to be drilled between 2017 and 2020. In addition, the high-density of our operations in the basins in which we are most active provides us the opportunity to leverage our fixed costs and to quickly respond with what we believe are highly efficient, integrated solutions that are best suited to address customer requirements.

In particular, we are one of the largest providers in the Permian Basin and the Marcellus Shale/Utica Shale, the most prolific and cost-competitive oil and natural gas basins in the United States, respectively. According to Spears & Associates, the Permian Basin and the Marcellus Shale/Utica Shale are expected to account for the greatest crude oil and natural gas production growth in the U.S. through 2020 based on forecasted rig counts. These basins have experienced a recovery in activity since the spring of 2016, representing approximately 59% of the increase in U.S. rig count from its May 2016 low of 404 to 658 as of December 2016.

Our Houston, Texas-based headquarters, eight field offices and numerous management and sales offices are in close proximity to unconventional resource plays which allows us to take a hands-on approach to customer relationships at multiple levels within our organization, anticipate our customers’ needs and efficiently deploy our assets.

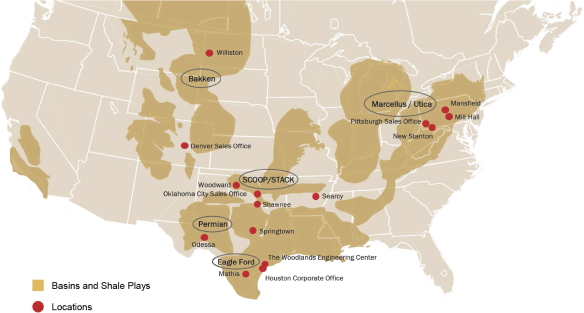

The below map represents our areas of operation:

Customer-Tailored Approach.

We seek to develop long-term partnerships with our customers by investing significant time and effort educating them on our value proposition and maintaining a continuous dialogue as we deliver ongoing service. We believe our direct line of communication with our customers at the senior management level as well as with key operational managers in the field provides us with the ability to address issues quickly and efficiently and is highly valued by our customers. In November 2016, we received Shell Global Solutions International’s annual Well Services Performance Award in recognition of our Permian Basin team’s exceptional 2016 performance and customer service in hydraulic fracturing and wireline services.

7

In connection with the Trican transaction, we acquired our Engineered Solutions Center, which we believe provides value-added capabilities to both our new and existing customers. We believe our Engineered Solutions Center enables us to support our customers’ technical specifications with a focus on reducing costs and increasing production. As pressure pumping complexity increases and the need for comprehensive, solution-driven approaches grows, our Engineered Solutions Center is able to meet our customers’ business objectives cost-effectively by offering flexible design solutions that package our services with new and existing product offerings. Our Engineered Solutions Center is focused on providing (1) economical and effective fracture designs, (2) enhanced fracture stimulation methods, (3) next-generation fluids and technologically advanced diverting agents, such as MVP Frac™ and TriVert™, which we received the right to use as part of the Trican transaction, (4) dust control technologies and (5) customized solutions to individual customer and reservoir requirements.

Track Record of Providing Safe and Reliable Solutions.

Safety is our highest priority and we believe we are among the safest service providers in the industry. For example, we achieved a total recordable incident rate (“TRIR”), which we believe is a reliable measure of safety performance, that is substantially less than the industry average from 2013 to 2016. We believe we have an industry leading behavior-based safety program to ensure each employee understands the importance of safety. Depending on job requirements, each new employee goes through a rigorous on-boarding and training program, is assigned a dedicated mentor, is routinely subject to our “Fit for Duty” verification program and periodically attends safety and technical certification programs. Our customers seek to protect their field employees, contractors and communities in which they serve as well as minimize the risk of disproportionately high costs that can result from an HSE incident. As a result, our customers demand robust HSE programs from their service providers and view safety records as a key criterion for vendor selection. We believe our safety and training record creates a competitive advantage by enhancing our ability to develop long-term relationships with our customers, allowing us to qualify to tender bids on more projects than many of our competitors and enabling us to attract and retain employees.

Modern, High-Quality Asset Base and Robust Maintenance Program.

We have invested in modern equipment, including dual-fuel fracturing pumps, Tier IV engines, stainless steel fluid ends, dry friction reducer and dry guar, to enhance our efficiency and safety. In addition, our high-quality, heavy-duty hydraulic fracturing and wireline fleets reduce operational downtime and maintenance costs while enhancing our ability to provide reliable, safe and consistent service to our customers. We have approximately 944,250 total hydraulic horsepower and can deploy up to 23 hydraulic fracturing fleets. As of December 31, 2016, we had 13 hydraulic fracturing fleets and eight wireline trucks deployed. We believe we have a robust preventative maintenance program for both our active and inactive fleets which allows us to respond to customer demand in a timely, safe and cost-efficient manner, and we continue to invest in and stock critical parts and components. From April 1, 2016 to December 31, 2016, we commissioned seven hydraulic fracturing fleets to service customers at a total cost of approximately $11.0 million, including capital expenditures. In addition, based on current pricing for component parts and labor, we believe our remaining inactive hydraulic fleets can be made operational at a cost of less than $2.0 million per fleet. Based upon our recent deployment experience, we believe it takes up to 45 days to activate and staff a single well completions fleet including hydraulic fracturing and wireline crews, allowing us to quickly and cost-effectively respond to an increase in customer demand. Our conservative financial profile and continued investment in our assets and fleets should enable us to maintain an efficient operating cost structure as we begin to redeploy assets, ensuring our operators have safe, well-maintained equipment to service our customers.

Flexible Supply Chain Management Capabilities.

Our sophisticated logistics network is comprised of strategically-located field offices, proppant storage facilities and proprietary last-mile transportation solutions. We have a dedicated supply chain team that manages sourcing and logistics to ensure flexibility and continuity of supply in a cost-effective manner across all areas of operation. We maintain multi-year relationships with industry-leading suppliers of proppant and have contracted secure supply at pricing reflecting current market conditions for the majority of our expected demand through 2020, based on existing job designs. We currently have a network of 1,046 modern railcars, which are being leased to us on a multi-year basis, and which provides us with valuable and flexible logistical support for our operations. Our logistics infrastructure also includes access to eight third-party unit train facilities, which improve railcar turn times

8

and reduce transit costs, and approximately 50 transload facilities. In addition, we own over 120 pneumatic sand-hauling trucks for last-mile transportation to the well site, which gives us the ability to access and deliver proppant where and when needed. We believe our supply chain and logistics network provide us with a competitive advantage by allowing us to quickly respond during periods of increased demand for our services.

Strong Balance Sheet and Disciplined Use of Capital.

We believe our balance sheet strength represents a significant competitive advantage, allowing us to pro-actively maintain our fleet while also pursuing opportunistic initiatives to further grow and expand our base business with new and existing customers. Our customers seek to employ well-capitalized service providers that are in the best position to meet their service requirements and their financial obligations, and, as a result, we intend to continue to maintain a strong balance sheet.

We adjust our capital expenditures based on prevailing industry conditions, the availability of capital and other factors as needed. Throughout the industry downturn that began in 2014, we have prioritized continued investment in our robust maintenance program to ensure our fleet of equipment can be deployed efficiently as demand recovers. At December 31, 2016, we had $48.9 million on an actual basis and $146.1 million of cash on an as adjusted basis after giving effect to the IPO and the use of net proceeds received by us in connection with the IPO. Additionally, we had $40.3 million of availability under our 2016 ABL Facility (as defined herein), providing us with the means to fund deployment of inactive fleets and grow our operations. After giving effect to the ABL Refinancing Transaction (as defined herein), we would have had $50.4 million of availability under our New ABL Facility (as defined herein) as of December 31, 2016 on an as adjusted basis. As of February 28, 2017, we had $90.3 million of availability under our New ABL Facility. We intend to continue to prioritize maintenance, upgrades, refurbishments and acquisitions, in a disciplined and diligent manner, carefully evaluating these investments based on their ability to maintain or improve our competitive position and strengthen our financial profile while creating value for our shareholders.

Best-in-Class Management Team with Extensive Industry Experience.

The members of our management team are seasoned operating, financial and administrative executives with extensive experience in and knowledge of the oilfield services industry. Our management team is led by our Chairman and Chief Executive Officer, James C. Stewart, who has over 30 years of industry experience. Each member of our management team brings significant leadership and operational experience with long tenures in the industry and respective careers at highly regarded companies, including Schlumberger Limited, Halliburton, Baker Hughes, Weatherford International, Marathon Oil, Anadarko Petroleum and General Electric. The members of our executive management team provide us with valuable insight into our industry and a thorough understanding of customer requirements.

Our Strategy

Our principal business objective is to increase shareholder value by profitably growing our business while safely providing best-in-class completion services. We expect to achieve this objective through:

Efficiently Capitalizing on Industry Recovery.

Hydraulic fracturing represents the largest cost of completing a shale oil or gas well and is a mission-critical service required for the continued development of U.S. shale resources. Upon a recovery in demand for oilfield services in the U.S., the hydraulic fracturing sector is expected to have among the highest growth rates among oilfield service providers. Industry reports have forecasted that the North American onshore stimulation sector, which includes hydraulic fracturing, will increase at a compound annual growth rate, a measure of growth rate for selected points in time, of 10% from 2006 to 2020 and of 30% from 2016 through 2020. As a well-capitalized provider operating in the most active unconventional oil and natural gas basins in the U.S., we believe that our business is well positioned to capitalize efficiently on an industry recovery. We have invested significant resources and capital to develop a market leading platform with demonstrated capabilities and technical skills that is well equipped to address increased demand from our customers. We believe that our rigorous preventative maintenance program provides us with a well-maintained hydraulic fracturing fleet and the ability to deploy inactive fleets

9

efficiently. Based upon our recent experience and current pricing for components and labor, we believe it will take approximately 45 days to activate a single hydraulic fracturing fleet, allowing us to quickly and cost-effectively respond to an increase in customer demand at a cost of less than $2.0 million per fleet. We also believe we can incrementally deploy each of our wireline trucks in less than 30 days at a nominal cost.

Developing and Expanding Relationships with Existing and New Customers.

We target well-capitalized customers that we believe will be long-term participants in the development of conventional and unconventional resources in the U.S., value safe and efficient operations, have the financial stability and flexibility to weather industry cycles and seek to develop a long-term relationship with us. We believe our high-quality fleets, diverse completion service offerings, engineering and technology solutions and geographic footprint with basin density in some of the most active basins position us well to expand and develop relationships with our existing and new customers. These qualities, combined with our past performance, have resulted in the renewal and new award of service contracts by our customers and by an expansion of the basins in which we operate for these customers. We believe these arrangements will provide us an attractive revenue stream while leaving us the ability to deploy our remaining fleets as industry demand and pricing continue to recover. We have invested in our sales organization, nearly tripling its headcount over the past two years. Together with our sales team, our Chief Executive Officer and our President and Chief Financial Officer are deeply involved with our commercial sales effort, fostering connectivity throughout a customer’s organization to further develop the relationship. We believe this level of senior management engagement differentiates us from many of our larger integrated peers.

Continuing Our Industry Leading Safety Performance and Focus on the Environment.

We are committed to maintaining and improving the safety, reliability, efficiency and environmental impact of our operations, which we believe is key to attracting new customers and maintaining relationships with our current customers, regulators and the communities in which we operate. As a result of our strong emphasis on training and safety protocols, we have one of the best safety records and reputations in the industry which helps us to attract and retain employees. We have maintained a strong safety record even as our employee base increased by 574% over the past four years. From the beginning of 2013 to 2016, our TRIR and lost time incident rate (“LTIR”) dropped by approximately 69% and 75%, respectively, and, for the year ended December 31, 2016, our TRIR and LTIR statistics were 0.22 and 0.06, respectively. We believe we are among the safest service providers in the industry. For example, we achieved a TRIR, which we believe is a reliable measure of safety performance, that is substantially less than the industry average from 2013 to 2016. In addition, all of our field-based management are provided financial incentives to satisfy safety standards and customer expectations, which we believe motivates them to continually maintain a focus on quality and safety. We work diligently to meet or exceed applicable safety and environmental requirements from our customers and regulatory agencies, and we intend to continue to enhance our safety monitoring function as our business grows and operating conditions change. For example, we have made investments in more efficient engines and dual-fuel kits to comply with customer requirements to reduce emissions and noise at well site. In 2016, the U.S. Environmental Protection Agency (the “EPA”) and the Department of Transportation’s National Highway Traffic Safety Administration jointly finalized standards for new on-road medium- and heavy-duty vehicles and engines that would improve fuel efficiency and cut carbon emissions. In accordance with the new standards, all of the Company’s hydraulic fracturing fleets with model years from 2018 onwards will have Tier IV engines. In addition, we have also invested in spill prevention equipment and remediation systems and dust control technology, which we believe allows us to meet or exceed the latest Occupational Safety and Health Administration (“OSHA”) requirements and standards. We have also deployed high-grade cameras to remotely monitor high-risk zones in our field operations, which we believe helps reduce safety risks to our employees. We believe that our commitment to maintaining a culture that prioritizes safety and the environment is critical to the long-term success and growth of our business.

Investing Further in Our Robust Maintenance Program.

We have in place a rigorous preventative maintenance program to continuously maintain our fleets, resulting in less downtime, reduced equipment failure in demanding conditions, lower operating costs and overall safer and more reliable operations. Due to our strong balance sheet, we have been able to sustain investment in maintenance, including preemptive purchases of key components and upgrades to our fleets throughout the downturn. We believe

10

that the quality of our fleets and our maintenance program enhance our ability to both secure contracts with new customers and to service our existing customers reliably and efficiently. Our active fleet uptime is reinforced by preventive maintenance on our equipment, allowing us to minimize the negative impact to our customers from equipment failure. In addition, we continue to monitor advances in hydraulic fracturing and wireline technology and make strategic purchases to enhance our existing capabilities.

Maintaining a Conservative Balance Sheet to Preserve Operational and Strategic Flexibility.

We carefully manage our liquidity by continuously monitoring cash flow, capital spending and debt capacity. Our focus on maintaining our financial strength and flexibility provides us with the ability to execute our strategy through industry volatility and commodity price cycles, as evidenced by our recent completion of the Trican transaction and continued investment in our robust maintenance program. We intend to maintain a conservative approach to managing our balance sheet to preserve operational and strategic flexibility. At December 31, 2016, we had $48.9 million and $146.1 million of cash on hand on an actual basis and on an as adjusted basis after giving effect to the use of net proceeds received by us in connection with the IPO, respectively. Additionally, we had $40.3 million of availability under our 2016 ABL Facility, providing us with the means to fund deployment of fleets and grow our operations. After giving effect to the ABL Refinancing Transaction, we would have had $50.4 million of availability under our New ABL Facility as of December 31, 2016 on an as adjusted basis. As of February 28, 2017, we had $90.3 million of availability under our New ABL Facility.

We have further described our outstanding balances and current activities for our Notes, our 2016 Term Loan Facility and the recent New Term Loan Facility (as defined herein) with Owl Rock closed on March 15, 2017, in Note 8 (Long- Term Debts) and Note 25 (Subsequent Events) of Keane Group’s financial statements included in Part II, “Item 8. Financial Statements and Supplementary Data,” of this Annual Report on Form 10-K.

Continued Evaluation of Consolidation Opportunities that Strengthen Capabilities and Create Value.

We believe that our ability to identify, execute and integrate acquisitions is a competitive advantage. Since 2011, we have completed three acquisitions that have diversified our geographic presence and service line capabilities. In April 2013, we acquired the wireline technologies division of Calmena Energy Services to expand our wireline operations capabilities in the U.S. In December 2013, we acquired the assets of Ultra Tech Frac Services to establish a presence in the Permian Basin. In March 2016, we completed the Trican transaction, creating a leading independent provider of hydraulic fracturing services in the United States. This acquisition added high quality equipment, provided increased scale in key operating basins, expanded our customer base and offered significant cost reduction opportunities. To date we have identified and implemented a plan to achieve over $80 million of annualized cost savings as a result of facility consolidations, head count rationalization and procurement savings. The Trican transaction also provided us access to proprietary technology and engineering capabilities that have enhanced our ability to provide integrated services solutions. We intend to continue to evaluate potential acquisitions on an opportunistic basis that would complement our existing service offerings or expand our geographic capabilities and allow us to earn an appropriate return on invested capital.

Our Industry

Our industry provides oilfield services to North American onshore oil and natural gas exploration and production companies. Demand for our industry’s services is predominantly influenced by the completion of hydraulic fracturing stages in unconventional wells in North America, and is driven by several factors including rig count, well count, service intensity and the timing and style of well completions. Ultimately, these drivers depend primarily on the level of drilling activity by oil and natural gas companies, which, in turn, depends largely on the current and anticipated prices of crude oil, natural gas and natural gas liquids.

Impact of Current and Anticipated Prices for Crude Oil, Natural Gas and Natural Gas Liquids

Oil and natural gas prices began to decline drastically beginning late in the second half of 2014 and remained low through early 2016. This decline, sustained by global oversupply of oil and natural gas, drove our industry into a downturn. Following a trough in early 2016, oil prices and natural gas prices have recovered to $53.75 and $3.71,

11

respectively, or approximately 105%, and 149% respectively, as of December 31, 2016, from their lows in early 2016 of $26.19 and $1.49, respectively. U.S. rig count has recovered to 658, or approximately 63%, as of December 31, 2016, from its low of 404 in early 2016. Recent events, including declines in North American production and agreements by OPEC members to reduce oil production quotas, have provided upward momentum for energy prices. We believe that recent increases in oil and natural gas prices, as well as moderate relief from the global oversupply of oil and domestic oversupply of natural gas, should increase demand for our services and create a more stable demand environment than has been experienced in the prior 24 months.

The US Energy Information Administration (the “EIA”) projects that the average WTI spot price will increase through 2040 from growing demand and the development of more costly oil resources. The EIA anticipates continued growth in the long-term U.S. domestic demand for natural gas, supported by various factors, including (i) expectations of continued growth in the U.S. gross domestic product; (ii) an increased likelihood that regulatory and legislative initiatives regarding domestic carbon emissions policy will drive greater demand for cleaner burning fuels such as natural gas; (iii) increased acceptance of natural gas as a clean and abundant domestic fuel source that can lead to greater energy independence of the U.S. by reducing its dependence on imported petroleum; (iv) the emergence of low-cost natural gas shale developments; and (v) continued growth in electricity generation from intermittent renewable energy sources, primarily wind and solar energy, for which natural-gas-fired generation is a logical back-up power supply source. We believe that as the prices of oil and natural gas increase, exploration and production activity will increase, driving an increased demand for our services.

Shale Resources in North America

The combined application of hydraulic fracturing and directional drilling technologies and their refinement continues to provide additional resource potential with new multi-billion barrel fields of oil and trillions of cubic feet of natural gas discovered over last five years. As of 2014, the EIA identified 59 billion barrels of recoverable tight oil and 610 trillion cubic feet of recoverable shale gas within the United States, ranking it second to Russia globally in shale oil resources. We believe that this inventory, which has increased materially due to technological innovation, should create multi-decade demand for our industry’s services.

In addition, we believe that U.S. unconventional shale resources will continue to capture an increasing share of global capital spending on oil and natural gas resources as a result of their competitive positioning on the global cost curve and the relatively low level of political and legal risk in North America as compared to other regions. From 2015 to 2016, demand for global liquids, or oil and natural gas liquid products, increased by approximately 1.8 million barrels per day according to the EIA. The EIA further expects global liquids demand to increase by approximately 1.6 million barrels per day from 2016 to 2017. Similarly, natural gas demand in North America is expected to increase by approximately 1.5 billion cubic feet per day by 2018, largely based upon growth in industrial and household demand, an increase in natural gas exports and continued substitution of gas for coal by utilities and industry. Furthermore, Spears & Associates estimates that capital expenditures for drilling and completion in the contiguous United States will increase by 38% over the next two years, which we believe would benefit our industry.

Increases in Horizontal Drilling Activity and Stages Per Well.

Over the past decade, oil and gas companies have focused on exploiting the vast resource potential available across many of North America’s unconventional resource plays through the application of horizontal drilling and completion technologies, including the use of multi-stage hydraulic fracturing, in order to increase recovery of oil and natural gas. In turn, E&P companies are focused on utilizing drilling and completion equipment and techniques that optimize cost and efficiency. As E&P companies have continued to refine the methodology used to recover oil and natural gas from wells, they have generally favored increases in both the number of hydraulic fracturing stages per well, with growth in per well stage count of approximately 75% between 2012 and 2016, and the amount of proppant used per stage, with growth in proppant per stage of approximately 54% from 2012 to 2016. Both of these secular trends have driven incremental demand for our industry’s services for each completed well due to requirements for larger amounts of equipment. For example, despite a 67% decline in the number of wells drilled from the 2014 to 2016 and excluding the acquisition of the Acquired Trican Operations, we have increased the volume of work our company has performed by 42% during the same period as measured by stage count.

12

Many industry experts predict a significant recovery in drilling activity in 2017 and 2018. According to Spears & Associates, total U.S. drilling rig count is expected to reach approximately 823 and 982 in 2017 and 2018, respectively, with approximately 79% expected to be drilling wells with horizontal laterals. Due to improvements in technology, including increased lateral lengths and tighter spacing between stages, drilling rigs have become more efficient in recent years. From 2012 to 2016, average wells per horizontal drilling rig have increased from 13.6 wells per rig to 21.1 wells per rig, respectively, and average stages per horizontal well have increased from 16.3 stages per well to 28.5 stages per well, respectively.

Demand for our industry’s services is also influenced by the natural decline in productivity of shale oil and gas wells over time. The amount of hydrocarbons produced from a typical shale oil and gas well declines more quickly than a conventional well, with production from a shale well generally falling substantially in the first year. New wells are required to be brought online relatively quickly to replace production lost from the natural decline. As a result of the high average production decline rates and current demand forecasts, we believe that a large number of wells will need to be drilled and completed on a continuous basis to offset production declines.

In addition, according to the EIA, an estimated 5,379 drilled but uncompleted (“DUC”) wells were in backlog as of December 2016, which we believe will provide a near-term source of demand for completion related services. The decline in commodity prices that began in late 2014 resulted in many E&P companies delaying the completion or fracturing of drilled wells, which represents approximately 36% of the total cost of a well. In connection with the increase and stabilization of the price of oil, E&P companies have recently begun to work through their DUC inventory in select basins, such as the Permian Basin and Bakken Formation, allowing us to deploy additional resources to such basins as a result.

Decline in Number of Service Providers, Deployable Capacity and Skilled Labor as a Result of Cyclical Downturn

From late 2009 through late 2014, there was a rapid increase in the demand for fracturing services. This growth in demand was met with an influx of new companies providing such services and a large increase in deployable hydraulic fracturing equipment. Since late 2014, the significant decline in demand for hydraulic fracturing services and resulting overcapacity in the market have led to industry consolidation and attrition, with the estimated number of service providers shrinking from a peak of 54 service providers in 2014 to 39 service providers as of December 31, 2016. As of December 31, 2016, based on estimated deployable capacity, there were six large providers with over 1 million horsepower, 10 medium-sized providers, including us, with between 300,000 and 1 million horsepower, and 23 smaller providers with less than 300,000 horsepower. We believe industry consolidation will position our company to succeed as demand for our industry’s services continues to increase.

We also believe that the financial distress of many of our competitors has caused them to significantly lower maintenance spending, and instead remove existing parts and components from idle equipment to service active equipment, which has reduced, and will continue to reduce, the amount of deployable equipment. While the total supply of deployable equipment, as compared to marketed equipment, is opaque, industry analysts estimate that total marketed and deployable capacity has declined between 25% and 50% from its peak. Due to the significant wear and tear on working equipment from high service intensity, the potential cost for other providers to redeploy older, idle fleets may be as much as $10 million to $20 million per fleet, depending on the level of previous use and preventative maintenance spend, as well as the amount of time spent idle. We believe these significant redeployment costs may drive the permanent retirement of older equipment by some of our competitors. As demand for our industry’s services increases, we believe we will benefit from our rigorous preventative maintenance program in contrast to many of our competitors’ underinvestment in, and resulting loss of, deployable equipment.

Finally, in addition to the reduction in number of service providers and deployable hydraulic fracturing equipment, headcount of total oilfield service employees in our industry is estimated to have decreased by 46% from its 2014 peak to 2016. We believe that companies that have remained relatively active during the industry downturn, such as ours, will benefit from retaining and developing skilled personnel as demand for our industry’s services increases.

Segments

13

We are organized into two reportable segments, consisting of Completion Services, including our hydraulic fracturing and wireline divisions; and Other Services, including our coiled tubing, cementing and drilling divisions. This segmentation is based on the primary end markets we serve, our customer base, the complementary nature of our services, our management structure and the financial information that is reviewed by the chief operating decision maker in deciding how to allocate resources and assess performance. We evaluate the performance of these segments based on equipment utilization, revenue, segment gross profit, gross margin and resulting synergistic efficiency of utilization. We monitor our cost of services using such metrics as cost of operations per stage for divisions in our Completion Services segment and cost of operations per working day for divisions in our Other Services segment. For further information on our operating segments, please see Note 21 (Business Segments) to the consolidated financial statements included in Part II, “Item 8. Financial Statements and Supplementary Data,” of this Annual Report on Form 10-K and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Completion Services Segment

Hydraulic Fracturing. We provide hydraulic fracturing and related well stimulation services to E&P companies, particularly to those operating in unconventional oil and natural gas reservoirs and requiring technically and operationally advanced services. Hydraulic fracturing services are performed to enhance production of oil and natural gas from formations with low permeability and restricted flow of hydrocarbons. Our customers benefit from our expertise in fracturing of horizontal and vertical oil- and natural gas-producing wells in shale and other unconventional geological formations.

The process of hydraulic fracturing involves pumping a highly viscous, pressurized fracturing fluid—typically a mixture of water, chemicals and guar—into a well casing or tubing in order to fracture underground mineral formations. These fractures release trapped hydrocarbon particles and free a channel for the oil or natural gas to flow freely to the wellbore for collection. Fracturing fluid mixtures include proppant which become lodged in the cracks created by the hydraulic fracturing process, “propping” them open to facilitate the flow of hydrocarbons upward through the well. Proppant generally consists of raw sand, resin-coated sand or ceramic particles. The fracturing fluid is engineered to lose viscosity, or “break,” and is subsequently removed from the formation, leaving the proppant suspended in the mineral fractures. Once our customer has flushed the fracturing fluids from the well using a controlled flow-back process, the customer manages fluid and water removal.

Our technologically advanced fleets consist of mobile hydraulic fracturing units and other auxiliary heavy equipment to perform fracturing services. Our hydraulic fracturing units consist primarily of high-pressure hydraulic pumps, diesel engines, radiators and other supporting equipment that are typically mounted on flat-bed trailers. We refer to the group of units and other equipment, such as blenders, data vans, sand storage, tractors, manifolds and high pressure fracturing iron, which are necessary to perform a typical fracturing job as a “fleet,” and the personnel assigned to each fleet as a “crew.” We have 23 hydraulic fracturing fleets, of which 13 were deployed as of December 31, 2016 with crews ranging from 24 to 55 employees each.

An important element of hydraulic fracturing services is determining the proper fracturing fluid, proppant and injection program to maximize results. Our field engineering personnel provide technical evaluation and job design recommendations for customers as an integral element of our hydraulic fracturing service. Technological developments in the industry over the past several years have focused on proppant density control, liquid gel concentration capabilities, computer design and monitoring of jobs and clean-up properties for fracturing fluids.

We provide our services in several of the most active basins in the U.S., including the Permian Basin, the Marcellus Shale/Utica Shale, the SCOOP/STACK Formation, the Bakken Formation and the Eagle Ford Shale. These regions are expected to account for approximately 87% of all new horizontal wells anticipated to be drilled between 2017 and 2020.

Wireline Technologies. Our wireline services involve the use of a single truck equipped with a spool of wireline that is unwound and lowered into oil and natural gas wells to convey specialized tools or equipment for well completion, well intervention, pipe recovery and reservoir evaluation purposes. We typically provide our wireline services in conjunction with our hydraulic fracturing services in “plug-and-perf” well completions to maximize efficiency for our customers. “Plug-and-perf” is a multi-stage well completion technique for cased-hole wells that

14

consists of pumping a plug and perforating guns to a specified depth. Once the plug is set, the zone is perforated and the tools are removed from the well, a ball is pumped down to isolate the zones below the plug and the hydraulic fracturing treatment is applied. The ball-activated plug diverts fracturing fluids through the perforations into the formation. Our ability to provide both the wireline and hydraulic fracturing services required for a “plug-and-perf” completion increases efficiencies for our customers by reducing downtime between each process, which in turn allows us to complete more stages in a day and ultimately reduces the number of days it takes our customer to complete a well. We have 23 wireline units, of which eight were deployed as of December 31, 2016 with crews of approximately 10 to 12 employees each.

Other Services Segment

Coiled Tubing. We provide various coiled tubing services to facilitate well servicing and workover operations as well as the completion of horizontal wells. Coiled tubing services involve the use of a flexible, continuous metal pipe spooled on a large reel which is then lowered into oil and natural gas wells to perform various workover applications, including wellbore clean outs and maintenance, nitrogen services, thru-tubing fishing, and formation stimulation using acid and other chemicals. Advantages of utilizing coiled tubing over a more costly workover rig include: (i) the smaller size and mobility of a coiled tubing unit compared to a workover rig, (ii) the ability to perform workover applications without having to “shut-in” the well during such operations, (iii) the ability to reel continuous coiled tubing in and out of a well significantly faster than conventional pipe, and (iv) the ability to direct fluids into a wellbore with more precision. Larger diameter coiled tubing units have recently been utilized for horizontal well completion applications such as (i) the drill out of temporary isolation plugs that separate frac zones, (ii) the clean out of the well for final production after the hydraulic fracturing job has been completed and (iii) in conjunction with hydraulic fracturing operations to stimulate zones not requiring high pressures or significant proppant volume.

Drilling, Cementing, Acidizing and Nitrogen Services. We are also equipped to offer our customers drilling, cementing, acidizing and nitrogen-based well stimulation services.

Equipment

We have approximately 944,250 hydraulic horsepower and can deploy up to 23 fleets, of which 13 fleets were deployed as of December 31, 2016. Our hydraulic fracturing equipment consists of modern units specially designed to handle well completions with long lateral segments and multiple fracturing stages in high-pressure and unconventional formations. We also maintain a fleet of 23 wireline units (of which eight were deployed as of December 31, 2016), seven coiled tubing units, 14 cementing units and two fit-for-purpose Schramm rigs for top-hole air drilling.

Each hydraulic fracturing fleet also includes the necessary blending units, manifolds, data vans and other ancillary equipment. We have the flexibility to allocate pressure pumps and other equipment among our fleets as needed to satisfy customer demand.

Our hydraulic fracturing equipment is comprised of components sourced from manufacturers including Caterpillar, Inc., Cummins, Inc. and Gardner Denver, Inc. and was assembled by various North American companies including Surefire Industries, LLC and UE Manufacturing, LLC. We historically have purchased the majority of our wireline, coiled tubing and cementing units from System One MFG Inc., Surefire Industries, LLC and Peerless Limited, respectively. Our company is not dependent on any one company for the source of our components and assembly of our equipment. We believe our equipment is in good condition and suitable for our current operations.

Customers

Our customers primarily include major integrated and large independent oil and natural gas exploration and production companies. For the year ended December 31, 2016, our top three customers, Shell Exploration & Production, XTO Energy and Seneca Resources Corporation, collectively accounted for approximately 48% of total revenues. For the year ended December 31, 2015, our top four customers, EQT Production Company, Shell Exploration & Production, XTO Energy and Southwestern Energy Company, collectively accounted for

15

approximately 90% of total revenues. During the year ended December 31, 2016 and 2015, on an actual basis, no other customers accounted for 10% or more of our revenues.

Suppliers

We purchase the materials used in our hydraulic fracturing, wireline and other services from various suppliers. In March 2016, in connection with the Trican transaction, Keane received the right to use certain Trican proprietary fracking-related fluids as of the closing date of the Trican transaction, such as MVP Frac™ and TriVert™ (the “Fracking Fluids”), for Keane’s pressure pumping services to its customers, which license does not allow Keane to manufacture the Fracking Fluids but allows Keane to purchase the Fracking Fluids from Trican’s suppliers.

During the year ended December 31, 2016, we purchased approximately 5% to 10% of our materials or equipment, as a percentage of overall costs, from Gardner Denver. During the year ended December 31, 2015, we purchased approximately 5% to 10% of our materials or equipment, as a percentage of overall costs, from Surefire Industries, LLC, Santrol, D & I Silica LLC and Precision Additives Inc.

We purchase a wide variety of raw materials, parts and components that are manufactured and supplied for our operations. We are not dependent on any single source of supply for those parts, supplies or materials. To date, we have generally been able to obtain the equipment, parts and supplies necessary to support our operations on a timely basis. While we believe that we will be able to make satisfactory alternative arrangements in the event of any interruption in the supply of these materials and/or products by one of our suppliers, we may not always be able to make alternative arrangements in the event of any interruption or shortage in the supply of certain of our materials. In addition, certain materials for which we do not currently have long-term supply agreements, such as guar (which experienced a shortage and significant price increase in 2012), could experience shortages and significant price increases in the future. As a result, we may be unable to mitigate any future supply shortages and our results of operations, prospects and financial condition could be adversely affected.

Competition

The markets in which we operate are highly competitive. We provide services in various geographic regions across the United States, and our competitors include many large and small oilfield service providers, including some of the largest integrated service companies. Our integrated hydraulic fracturing and wireline services compete with large, integrated oilfield service companies such as Halliburton Company, Schlumberger Limited and Baker Hughes Incorporated, as well as other companies such as RPC, Inc., Superior Energy Services, Inc., C&J Energy Services, Inc., Basic Energy Services, Inc. and FTS International, Inc. Our hydraulic fracturing services also compete with Calfrac Well Services Ltd., U.S. Well Services, Patterson-UTI Energy, Inc., ProPetro Services, Inc. and Liberty Oilfield Services. In addition, the business segments in which we compete are highly fragmented. We also compete regionally with a significant number of smaller service providers.

We believe that the principal competitive factors in the markets we serve are technical expertise, equipment capacity, work force competency, efficiency, safety record, reputation, experience and price. Additionally, projects are often awarded on a bid basis, which tends to create a highly competitive environment. While we seek to be competitive in our pricing, we believe many of our customers elect to work with us based on safety, performance and quality of our crews, equipment and services. We seek to differentiate ourselves from our competitors by delivering the highest-quality services and equipment possible, coupled with superior execution and operating efficiency in a safe working environment.

Cyclical Nature of Industry

We operate in a highly cyclical industry. The key factor driving demand for our services is the level of drilling activity by E&P companies, which in turn depends largely on current and anticipated future crude oil and natural gas prices and production depletion rates. Global supply and demand for oil and the domestic supply and demand for natural gas are critical in assessing industry outlook. Demand for oil and natural gas is cyclical and subject to large, rapid fluctuations. Producers tend to increase capital expenditures in response to increases in oil and natural gas prices, which generally results in greater revenues and profits for oilfield service companies such as ours. Increased capital expenditures also ultimately lead to greater production, which historically has resulted in increased supplies

16

and reduced prices which in turn tend to reduce demand for oilfield services. For these reasons, the results of our operations may fluctuate from quarter to quarter and year to year, and these fluctuations may distort comparisons of results across periods.

Employees

As of December 31, 2016, we employed 1,401 people, of which approximately 72% were compensated on an hourly basis. Our future success will depend partially on our ability to attract, retain and motivate qualified personnel. Our employees are not covered by collective bargaining agreements, nor are they members of labor unions. We consider our relationship with our employees to be satisfactory.

Seasonality

Weather conditions affect the demand for, and prices of, oil and natural gas and, as a result, demand for our services. Demand for oil and natural gas is typically higher in the fourth and first quarters resulting in higher prices. Due to these seasonal fluctuations, results of operations for individual quarterly periods may not be indicative of the results that may be realized on an annual basis.

Insurance

Our operations are subject to hazards inherent in the oil and natural gas industry, including accidents, blowouts, explosions, craterings, fires, oil spills and hazardous materials spills. These conditions can cause personal injury or loss of life, damage to or destruction of property, equipment, the environment and wildlife, and interruption or suspension of operations, among other adverse effects. In addition, claims for loss of oil and natural gas production and damage to formations can occur in the well services industry. If a serious accident were to occur at a location where our equipment and services are being used, it could result in our being named as a defendant to a lawsuit asserting significant claims.

Despite our efforts to maintain high safety standards, we from time to time have suffered accidents in the past and we anticipate that we could experience accidents in the future. In addition to the property and personal losses from these accidents, the frequency and severity of these incidents affect our operating costs and insurability, as well as our relationships with customers, employees and regulatory agencies. Any significant increase in the frequency or severity of these incidents, or the general level of compensation awards, could adversely affect the cost of, or our ability to obtain, workers’ compensation and other forms of insurance, and could have other adverse effects on our financial condition and results of operations.

We carry a variety of insurance coverages for our operations, and we are partially self-insured for certain claims, in amounts that we believe to be customary and reasonable. However, our insurance may not be sufficient to cover any particular loss or may not cover all losses. Historically, insurance rates have been subject to various market fluctuations that may result in less coverage, increased premium costs, or higher deductibles or self-insured retentions.

Our insurance includes coverage for commercial general liability, damage to our real and personal property, damage to our mobile equipment, pollution liability (covering both third-party liabilities and first-party site specific property damage), workers’ compensation and employer’s liability, auto liability and other specialty risks. Our insurance includes various limits and deductibles or self-insured retentions, which must be met prior to, or in conjunction with, recovery. Specifically, our commercial general liability policy provides for a limit of $2 million per occurrence and $4 million per project in the aggregate. Our excess liability program is structured in three layers: the lead policy provides for a limit of $5 million per occurrence and $5 million in the aggregate, with a $10,000 self-insured retention per incident; the second layer provides for a limit of $20 million per occurrence and $20 million in the aggregate, with a $10,000 self-insured retention per incident; and the third layer provides for a limit of $50 million per occurrence and $50 million in the aggregate, with a $10,000 self-insured retention per incident.

To cover potential pollution risks, our commercial generally liability policy is endorsed with sudden and accidental coverage and our excess liability policies provide additional limits of liability for covered sudden and accidental pollution losses. Additionally, we maintain a contractors’ pollution liability program that provides for a

17

total limit of $20 million per incident and $20 million in the aggregate with a self-insured retention of $100,000 per incident for both sudden and gradual pollution liability. We also maintain $100 million in excess insurance over the contractors’ pollution liability policy for sudden pollution incidents.

In addition, we maintain site specific pollution insurance that provides for a limit of $10 million per incident and $10 million in the aggregate with a $100,000 deductible per incident for both on and off-site clean-up as well as third-party property damage and bodily injury. Our site-specific pollution coverage affords third-party liability and first party clean-up coverage. Our contractors’ pollution liability insurance covers liabilities associated with our hydraulic fracturing operations in the field, while our site-specific pollution insurance covers liabilities arising from insured locations. The insured locations are properties that we own or lease.

Environmental Regulation