Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CCUR Holdings, Inc. | v466995_ex99-1.htm |

| 8-K - 8-K - CCUR Holdings, Inc. | v466995_8k.htm |

Exhibit 99.2

© 2017 Concurrent Q3 Fiscal 2017 Investor Conference Call Derek Elder, President & CEO Emory Berry, Chief Financial Officer May 15, 2017 Confidential & Proprietary Information

© 2017 Concurrent Safe Harbor Certain statements made or incorporated by reference in this release may constitute "forward - looking statements" within the meaning of the federal securities laws . Statements regarding future events and developments and the company's future performance, including, but not limited to, management's expectations, beliefs, plans, estimates, or projections relating to the future, are forward - looking statements within the meaning of these laws . All forward - looking statements are subject to certain risks and uncertainties that could cause actual events to differ materially from those projected . The risks and uncertainties which could affect our financial condition or results of operations include, without limitation : the potential consolidation of the markets that we serve ; U . S . Government sequestration ; European austerity measures ; the impact of the U . K . exiting the European Union ; delays or cancellations of customer orders ; non - renewal of maintenance and support service agreements with customers ; changes in product demand ; economic conditions ; various inventory risks due to changes in market conditions ; margins of the content delivery business to capture new business ; our ability to obtain regulatory approval for the sale of the European operations of our Real - Time business within the timeframe anticipated or at all ; our ability to reinvest the net proceeds from the sale of our Real - Time segment in a manner that we believe will generate an adequate return to our remaining business ; fluctuations and timing of large content delivery orders ; risks associated with our operations in the People’s Republic of China ; uncertainties relating to the development and ownership of intellectual property ; uncertainties relating to our ability and the ability of other companies to enforce their intellectual property rights ; the pricing and availability of equipment, materials and inventories ; the concentration of our customers ; failure to effectively manage change ; delays in testing and introductions of new products ; the impact of reductions in force on our operations ; rapid technology changes ; system errors or failures ; reliance on a limited number of suppliers and failure of components provided by those suppliers ; uncertainties associated with international business activities, including foreign regulations, trade controls, taxes, tariffs and currency fluctuations ; the impact of competition on the pricing of content delivery products ; failure to effectively service the installed base ; the entry of new, well - capitalized competitors into our markets ; the success of new content delivery products, including acceptance of our new storage solutions ; the success of our relationships with technology and channel partners ; capital spending patterns by a limited customer base ; the current challenging macroeconomic environment ; continuing unevenness of the global economic recovery ; global terrorism ; privacy concerns over data collection ; our ability to utilize net operating losses to offset cash taxes in the event of an ownership change as defined by the Internal Revenue Service ; earthquakes, tsunamis, floods and other natural disasters in areas in which our customers and suppliers operate ; the process of evaluation of strategic alternatives ; and the availability of debt or equity financing to support our liquidity needs . Other important risk factors are discussed in Concurrent's Form 10 - K filed August 30 , 2016 with the Securities and Exchange Commission ("SEC"), and in subsequent filings of periodic reports with the SEC . The risk factors discussed in the Form 10 - K and subsequently filed periodic reports under the heading "Risk Factors" are specifically incorporated by reference in this press release . Forward - looking statements are based on current expectations and speak only as of the date of such statements . Concurrent undertakes no obligation to publicly update or revise any forward - looking statement, whether as a result of future events, new information, or otherwise . 2

© 2017 Concurrent Total revenue of $15 million Content Delivery segment revenue of $7.5 million Gross margins improve 530 basis points to 56.8% $1.7 million GAAP net loss Adjusted EBITDA loss of $1 million, including $1.1 million in Real - Time sale transaction costs Q3 Fiscal 2017 Financial Highlights 3 Cash flow from operations of $0.6 million; Cash and ST Investments of $18.2 million; no debt

© 2017 Concurrent Transformation of Concurrent: Creating A Focused Leader in Video Media Storage & Delivery Confidential & Proprietary Information

© 2017 Concurrent Acquired by Battery Ventures Asset Purchase Price: $35 Million Trailing 12 Month Revenue of $32.5 Million Maximized Valuation of Our Real - Time Business Segment Transformation of Concurrent * Sources: Frost & Sullivan, Coughlin Associates $3.7 Billion Market Growing at 10%/Year* Concurrent is an Early Established Leader Strong Progress in FY 2017 Transition of CFO to Warren Sutherland Focused on Maximizing Video Media Delivery & Storage Opportunity 5

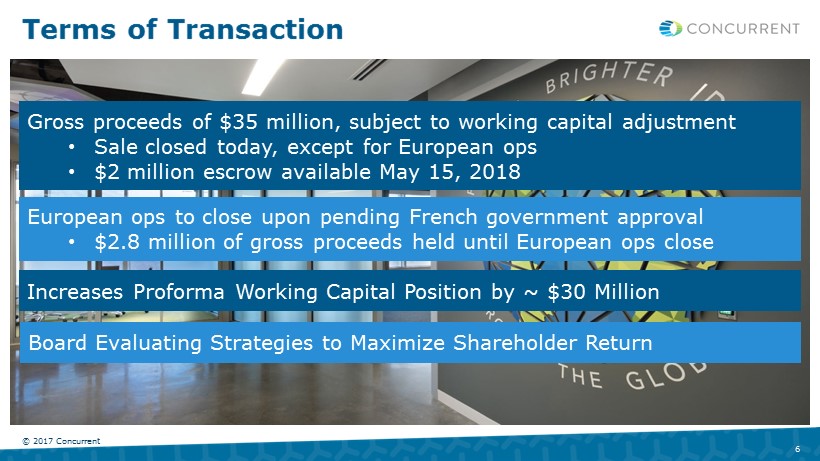

© 2017 Concurrent Terms of Transaction 6 Gross proceeds of $35 million, subject to working capital adjustment • Sale closed today, except for European ops • $2 million escrow available May 15, 2018 European ops to close upon pending French government approval • $2.8 million of gross proceeds held until European ops close Board Evaluating Strategies to Maximize Shareholder Return Increases Proforma Working Capital Position by ~ $30 Million

© 2017 Concurrent Addressing rapidly growing $3.7 billion market* Unique, valued added media storage solutions Proven go - to - market model; blue - chip customer base Proven leadership team in place executing growth strategy Exceptional balance sheet favored by target market, dividend policy Compelling Investment Opportunity * Sources: Frost & Sullivan, Coughlin Associates 7

© 2017 Concurrent Large & Growing Market Opportunity By 2020, video will account for 79% of all global Internet traffic* Over 290 exabytes (290,000,000,000 gigabytes) of new video storage will be used for digital archiving and transcoding by 2021** Video file types will continue to change and grow – Standard Definition(SD) to High Definition(HD) to 4K and 8K, and virtual reality 8 *Source: Cisco Visual Networking Index (VNI) Complete Forecast for 2015 to 2020 **Source: Frost & Sullivan, Coughlin Associates

© 2017 Concurrent Large & Growing Market Opportunity Video content storage and delivery systems today use inflexible, closed architectures . Delivery systems today are unable to scale to growing demand for media storage nor flexible enough for rapidly changing media business models. Modern and open, agile, video storage and delivery architectures are needed to handle these changes Concurrent is uniquely positioned to capitalize on this $3.7 billion market opportunity** 9 *Source: Cisco Visual Networking Index (VNI) Complete Forecast for 2015 to 2020 **Source: Frost & Sullivan, Coughlin Associates

© 2017 Concurrent Mukul Krishna Frost & Sullivan December 2016 “There is a lack of dedicated Media & Entertainment storage providers – from shooting to post - production, to management, and publishing. A 4K movie requires a couple, if not many, petabytes of storage capacity for production. Post - production requires a couple more petabytes, while management and distribution require additional storage sources.” There is an increased demand for intelligent storage solutions. More clients are demanding reliable storage solutions that manage data with policy - based provisions, without compromising the software logic necessary to administrate video content. An aspect that can limit the growth rate in the near future is the lack of intelligent storage. Intelligent storage must be able to allow different workflows facilitating the movement and storage of higher video and photography resolutions without slowing down business processes.” What the Experts Say 10

© 2017 Concurrent AQUARI Solution for the Media and Entertainment Market Invaluable content captured on tapes not available online Average 10 - 20 petabyte each – equates to 1 - 2 million hours of high definition video storage *Estimate of major broadcasters & content owners (not including any Pay - TV Operators). Photo provided curtesy of FERMILAB ALWAYS INTEGRATED ALWAYS AVAILABLE ALWAYS ACCESSIBLE ALWAYS GROWING 11

© 2017 Concurrent Concurrent is a Well - Recognized Brand in the Media & Entertainment Segment PBs OF VIDEO STORAGE Large 50 - 100 PB Medium 20 - 40 PB Small 2 - 10 PB Average 10 - 20 PB Mostly archive storage * Estimate of major broadcasters & content owners (not including any Pay - TV Operators) NUMBER OF BROADCASTERS* USA 175 Europe 100 APAC 100 South America 50 Middle East 20 Africa 20 12

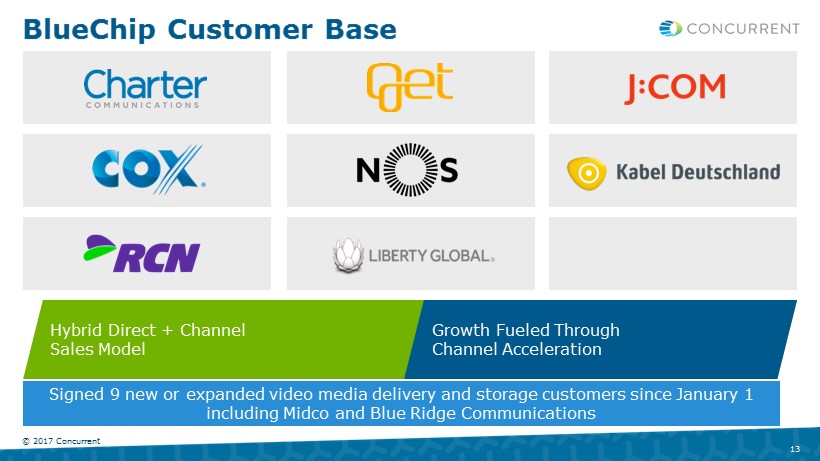

© 2017 Concurrent Hybrid Direct + Channel Sales Model BlueChip Customer Base 13 Growth Fueled Through Channel Acceleration Signed 9 new or expanded video media delivery and storage customers since January 1 including Midco and Blue Ridge Communications

© 2017 Concurrent Milestones to Judge Our Progress 14 New Partnerships • Technology • Channels New Account & Design Wins Expanded Customer Relationships

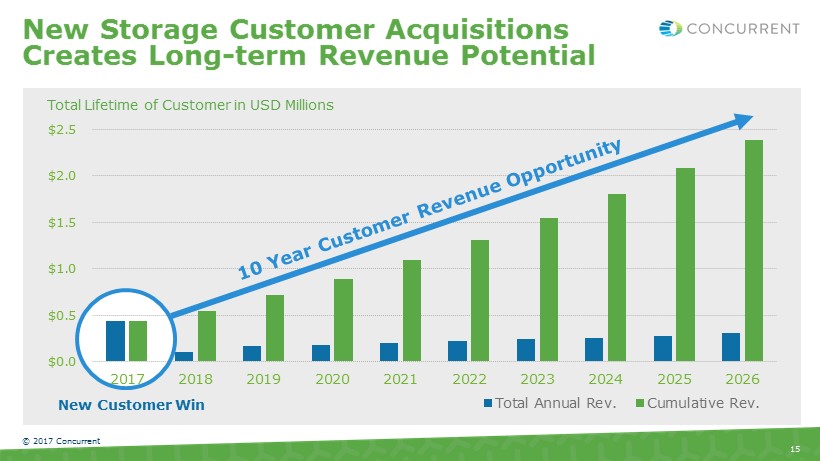

© 2017 Concurrent New Storage Customer Acquisitions Creates Long - term Revenue Potential 15 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 Total Annual Rev. Cumulative Rev. New Customer Win Total Lifetime of Customer in USD Millions

© 2017 Concurrent Leadership with Proven Track Record 16 DEREK ELDER Chief Executive Officer • 25 - year career in technology leadership roles with ARRIS Group, Cisco, Tropic Networks • Lead ARRIS DOCSIS BU to >50% mkt share, $1.2B revenue, in highly competitive environment • Emma Bowen Foundation Celeno , Zenverge Boards; Patent holder. NACD Board Governance Fellow. MBA Penn State SCOTT RYAN Senior Vice President, Products • 25 - year career in technology leadership roles with EMC, Nortel • Two - time venture capital backed CEO; sold last company to EMC • MBA Vanderbilt CLAY McCREERY Senior Vice President, Worldwide Sales & Service • 20 - year career in media technology sales leadership with ARRIS Group, C - COR • Senior Vice President at ARRIS; Led Team Responsible for > $1B Annual Revenue WARREN SUTHERLAND Chief Financial Officer • 16 - year career in high - tech and fin - tech finance and operations with private and public companies • CPA • Auditor with Arthur Anderson • Masters in Accountancy, University of Georgia

© 2017 Concurrent Addressing rapidly growing $3.7 billion market* Unique, valued added media storage solutions Proven go - to - market model; blue - chip customer base Proven leadership team in place executing growth strategy Exceptional balance sheet favored by target market, dividend policy Compelling Investment Opportunity * Sources: Frost & Sullivan, Coughlin Associates 17

© 2017 Concurrent Q&A