Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CAMDEN NATIONAL CORP | a8k_investorpresentation05.htm |

Piper Jaffray

Financial Institutions

Conference

Gregory Dufour | President & Chief Executive Officer

Deborah Jordan | Chief Operating & Financial Officer

May 15 - 17, 2017

0

Forward Looking Statements

1

This presentation contains certain statements that may be considered forward-looking statements under the Private Securities Litigation

Reform Act of 1995 and other federal securities laws, including certain plans, exceptions, goals, projections, and statements, which are

subject to numerous risks, assumptions, and uncertainties. Forward-looking statements can be identified by the use of the words

“believe,” “expect,” “anticipate,” “intend,” “estimate,” “assume,” “plan,” “target,” or “goal” or future or conditional verbs such as “will,”

“may,” “might,” “should,” “could” and other expressions which predict or indicate future events or trends and which do not relate to

historical matters. Forward-looking statements should not be relied on, because they involve known and unknown risks, uncertainties and

other factors, some of which are beyond the control of Camden National Corporation (the “Company”). These risks, uncertainties and

other factors may cause the actual results, performance or achievements of the Company to be materially different from the anticipated

future results, performance or achievements expressed or implied by the forward-looking statements.

The following factors, among others, could cause the Company’s financial performance to differ materially from the Company’s goals,

plans, objectives, intentions, expectations and other forward-looking statements: weakness in the United States economy in general and

the regional and local economies within the New England region and Maine, which could result in a deterioration of credit quality, an

increase in the allowance for loan losses or a reduced demand for the Company’s credit or fee-based products and services; changes in

trade, monetary, and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System;

inflation, interest rate, market, and monetary fluctuations; competitive pressures, including continued industry consolidation and the

increased financial services provided by non-banks; volatility in the securities markets that could adversely affect the value or credit

quality of the Company’s assets, impairment of goodwill, the availability and terms of funding necessary to meet the Company’s liquidity

needs, and could lead to impairment in the value of securities in the Company's investment portfolio; changes in information technology

that require increased capital spending; changes in consumer spending and savings habits; changes in tax, banking, securities and

insurance laws and regulations; and changes in accounting policies, practices and standards, as may be adopted by the regulatory

agencies as well as the Financial Accounting Standards Board ("FASB"), and other accounting standard setters.

You should carefully review all of these factors, and be aware that there may be other factors that could cause differences, including the

risk factors listed in the Company’s filings with the SEC, including our Annual Report on Form 10-K for the year ended December 31, 2016,

as updated by the Company's quarterly reports on Form 10-Q and other filings with the Securities and Exchange Commission. You should

carefully review the risk factors described therein and should not place undue reliance on our forward-looking statements.

These forward-looking statements were based on information, plans and estimates at the date of this report, and we undertake no

obligation to update any forward-looking statements to reflect changes in underlying assumptions or factors, new information, future

events or other changes, except to the extent required by applicable law or regulation.

Camden National Corporation

• Camden National is the largest

bank headquartered in Northern

New England

• $3.9 billion in assets

• 60 branches (Maine) and 2 loan

offices (New Hampshire and

Massachusetts)

• Market cap over $650 million

• Average daily share volume of

45,000

• Analyst Coverage

• Piper Jaffrey (overweight)

• KBW (outperform)

2

1st Quarter 2017

Financial Highlights

• Strong earnings performance

o Net income of $10.1 million

o Return on tangible equity: 14.37%(a)

o Return on assets: 1.05%

o Efficiency ratio: 58.00%(a)

o Tangible common equity ratio: 7.74%(a)

• Solid growth

o Total loans $2.6 billion; annualized growth rate of 8%

o Total deposits $2.9 billion; annualized growth rate of 8%

o Mortgage banking income up 16% over fourth quarter 2016

3

(a) This is a non-GAAP measure. Refer to the Form 10-Q filed on 5/5/17 for the three months ended March 31, 2017 for the reconciliation of non-GAAP to GAAP financial

measures.

Why Camden National?

Organic franchise growth, opportunistic acquisitions

4

Credit:

• Strong credit culture and

history

• Disciplined structure and

process

• Low nonperforming assets

Culture:

• Experienced, consistent

leadership

• Strong community-spirit

• Continued branch

optimization

• Simple product sets

Focused:

• Gaining market share

• Adherence to strategic plan

• Opportunistically reviewing

complementary acquisitions

• Solid core funding and sticky

deposit base

Consistent Performance:

• Profitability achieved through

organic growth

• Improved productivity

• Disciplined expense structure

• Diversified revenue stream

Strong Performance to

Northeast Bank Peer Group

5

Source: SNL Financial. Camden National Corporation’s peer group consists of the following: Arrow Financial Corporation (AROW), Bar Harbor Bankshares (BHB), Berkshire Hills

Bancorp, Inc. (BHLB), Boston Private Financial Holdings, Inc. (BPFH), Brookline Bancorp, Inc. (BRKL), Century Bancorp, Inc. (CNBKA), Community Bank System, Inc. (CBU),

Enterprise Bancorp, Inc. (EBTC), Financial Institutions, Inc. (FISI), First Bancorp, Inc. (FNLC), First Connecticut Bancorp, Inc. (FBNK), Hingham Institution for Savings (HIFS),

Independent Bank Corp. (INDB), Merchants Bancshares, Inc. (MBVT), Meridian Bancorp, Inc. (EBSB), NBT Bancorp Inc. (NBTB), Tompkins Financial Corporation (TMP), TrustCo

Bank Corp NY (TRST), United Financial Bancorp, Inc. (UBNK), and Washington Trust Bancorp, Inc. (WASH).

Performance Ratios (%) CNC Peer Median Peer Average

ROAA 1.03 0.87 0.87

ROAE 10.22 9.05 9.24

Net Interest Margin (Reported) 3.18 3.14 3.15

Efficiency Ratio (Reported) 58.00 60.70 58.38

Loans / Deposits 90.06 100.06 96.72

Capital Ratios (%)

Total Risk Based Capital 14.05 12.93 13.51

Tangible Equity / Tangible Assets 7.74 8.06 8.06

Leverage 8.90 9.08 8.97

Market Ratios

Current Market Price ($) 44.04

Price / LTM EPS (x) 16.56 19.92 19.64

Price / TBV (%) 230.08 205.56 213.17

Current Dividend Yield (%) 2.09 2.30 2.13

3/31/2017

Focused on Building Market Share:

Asset Growth History

6

Successful track record of growing the franchise through combination of

organic growth and acquisitions (42% organic growth over 20 year horizon).

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

$4,500

1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016

United Corp.

$54 million

Key Bank

4 Branches

$54 million

KSB

Bancorp

$179 million

Union Bankshares

$565 million

Bank of

America

14 Branches

$287 million

Branch

Sale

5 Branches

$46 million

The Bank of Maine

$816 million

Through 12/31/16

Organic Growth: $1,399 million

Acquired Growth: $1,955 million

Total Growth CAGR: 10.7%

Focused on Building Market Share:

Market Expansion

The Bank of Maine (SBM

Financial)

• October 2015 – simultaneous

close and conversion

• Deposits: $687 million

• Loans: $615 million

• Expansion into high growth

Southern Maine market

• Widens mortgage banking

reach to Massachusetts

• Positions bank as the largest

community bank in Northern

New England

7

Core Market

Acquired

Market

Growth Target

Expansion Strategies

• Introduced MortgageTouch, an online mortgage

application

• Hired two additional commercial lenders in New

Hampshire

• Announced opening of a Portsmouth, New Hampshire

loan production office (site TBD)

• Hired wealth management business developer for the

Southern Maine/New Hampshire markets

• Finalized closing of one branch

8

Focused on Building Market Share:

Deposit Opportunity in Maine

9

Source: SNL Financial. Deposit market share data as of June 2016.

Average Funding: $3.5 billion

Average Funding Cost: 0.53%

Average Deposit Cost: 0.30%

Deposits and Funding

3/31/17

STATE OF MAINE

($ in millions)

Rank Institution Deposits Branches

Market

Share %

1 Toronto-Dominion Bank $3,463 48 12.9

2 KeyCorp 3,353 50 12.5

3 Camden National Corp. 2,793 63 10.4

4 Bangor Bancorp MHC 2,458 56 9.2

5 Bank of America Corp. 1,805 16 6.7

Other Banks 12,919 253 48.2

Total for State of Maine $26,791 486

CUMBERLAND AND YORK COUNTY

($ in millions)

Rank Institution Deposits Branches

Market

Share %

1 KeyCorp $2,519 20 20.3

2 Toronto-Dominion Bank 2,052 25 16.5

3 Bank of America Corp. 1,774 16 14.3

4 Kennebunk Savings Bank 861 13 6.9

5 Peoples United 856 17 6.9

10 Camden National Corp. 382 7 3.1

Other Banks 3,958 85 32.0

Total Cumberland/York County $12,402 183

Checking

32%

Saving/Money

Market 28%

CDs 13%

Borrowings

27%

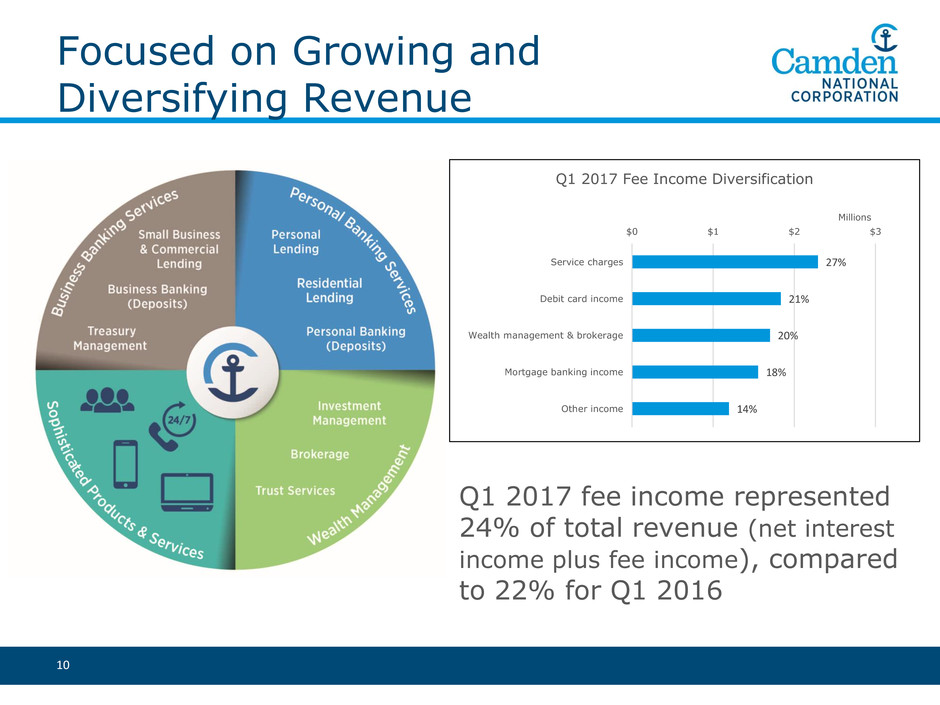

Focused on Growing and

Diversifying Revenue

Q1 2017 fee income represented

24% of total revenue (net interest

income plus fee income), compared

to 22% for Q1 2016

10

14%

18%

20%

21%

27%

$0 $1 $2 $3

Other income

Mortgage banking income

Wealth management & brokerage

Debit card income

Service charges

Millions

Q1 2017 Fee Income Diversification

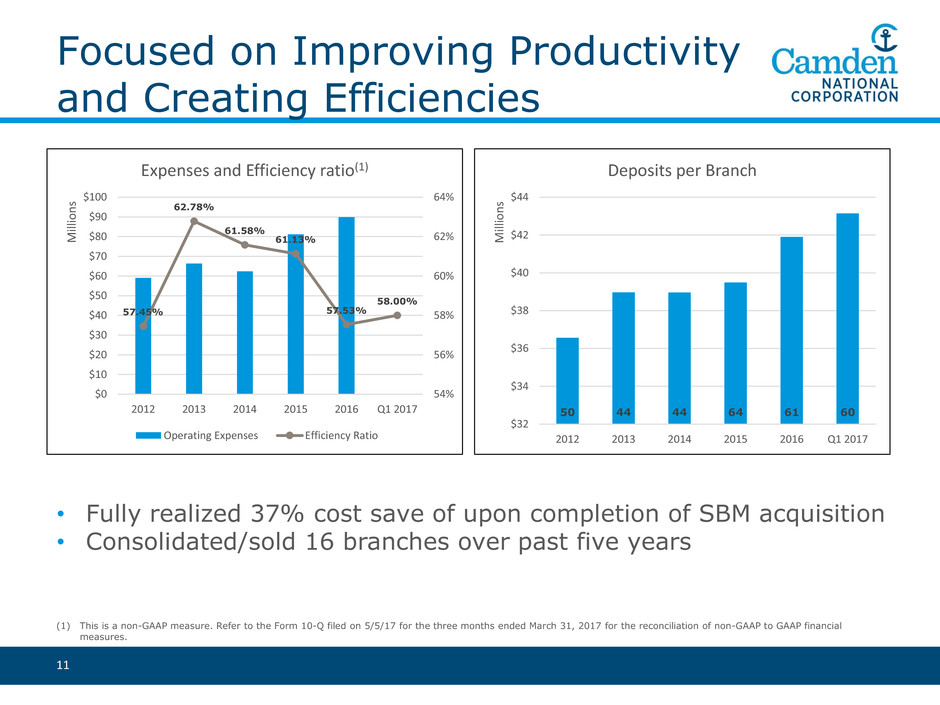

Focused on Improving Productivity

and Creating Efficiencies

11

• Fully realized 37% cost save of upon completion of SBM acquisition

• Consolidated/sold 16 branches over past five years

50 44 44 64 61 60

$32

$34

$36

$38

$40

$42

$44

2012 2013 2014 2015 2016 Q1 2017

Mill

io

n

s

Deposits per Branch

(1) This is a non-GAAP measure. Refer to the Form 10-Q filed on 5/5/17 for the three months ended March 31, 2017 for the reconciliation of non-GAAP to GAAP financial

measures.

57.45%

62.78%

61.58%

61.13%

57.53%

58.00%

54%

56%

58%

60%

62%

64%

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

$100

2012 2013 2014 2015 2016 Q1 2017

Mill

io

n

s

Expenses and Efficiency ratio(1)

Operating Expenses Efficiency Ratio

Balanced Loan Mix &

Strong Credit Culture

12

3/31/17

Average Loans: $2.6 billion

Average Yield: 4.15%

• Internal lending limit of $37 million

• Four Credit Relationships over $25

million

1. Assisted Living

2. Insurance

3. Hospital

4. Business Office

• Commercial Diversification

$349 million Nonresidential Building

Operator

$222 million Hotels and Motels

$155 million Apartment Building

Operators

Commercial

15%

Commercial

Real Estate

41%

Residential

Mortgages

31%

Home

Equity/Consumer

13%

Q1 2017 2016 2015 2014

Nonp rforming assets / tota assets 0.68% 0.67% 0.66% 0.82%

30-89 days past due loans / total loans 0.26% 0.24% 0.40% 0.18%

Provision for loan losses / average loans

(annualized)

0.09% 0.21% 0.10% 0.13%

Net charge-offs / average loans

(annualized)

0.00% 0.13% 0.10% 0.16%

Historical Credit Metrics

Note: Peer Group defined as publicly traded banks and thrifts headquartered in the United States with total assets between $1.5 billion and $7.0 billion, excluding merger targets.

Source: SNL Financial

13

NPAs / Assets NCOs / Average Loans

Loan Loss Reserves / Gross Loans Nonaccrual Loans / Loans

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

'07 '08 '09 '10 '11 '12 '13 '14 '15 '16 Q1 '17

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

'07 '08 '09 '10 '11 '12 '13 '14 '15 '16 Q1 '17

0.00%

0.25%

0.50%

0.75%

1.00%

1.25%

'07 '08 '09 '10 '11 '12 '13 '14 '15 '16 Q1 '17

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

'07 '08 '09 '10 '11 '12 '13 '14 '15 '16 Q1 '17

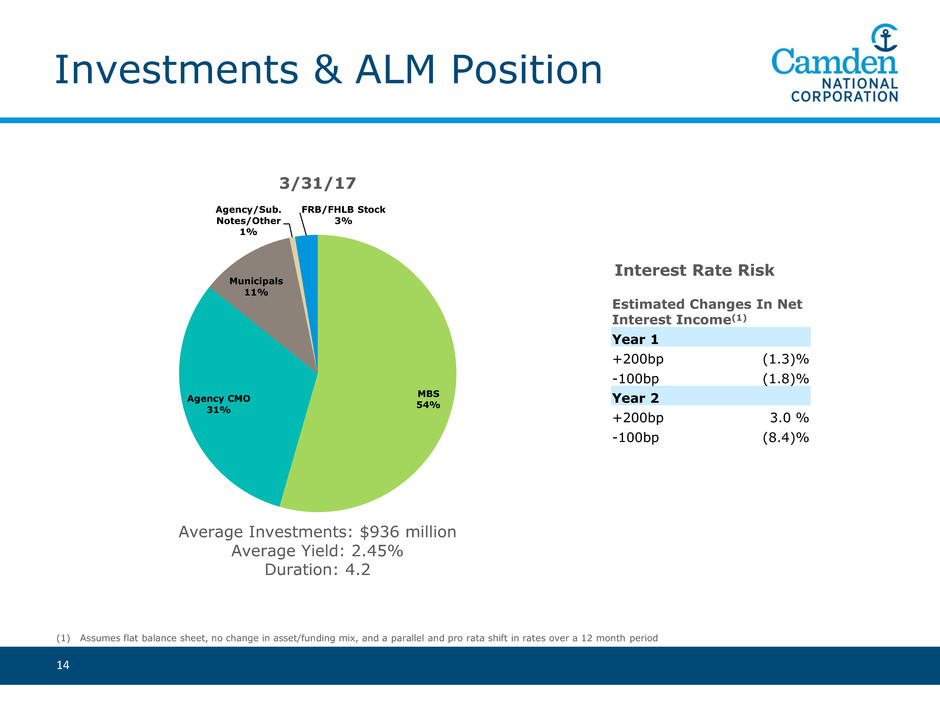

Investments & ALM Position

Interest Rate Risk

Estimated Changes In Net

Interest Income(1)

Year 1

+200bp (1.3)%

-100bp (1.8)%

Year 2

+200bp 3.0 %

-100bp (8.4)%

Average Investments: $936 million

Average Yield: 2.45%

Duration: 4.2

3/31/17

MBS

54%

Agency CMO

31%

Municipals

11%

Agency/Sub.

Notes/Other

1%

FRB/FHLB Stock

3%

14

(1) Assumes flat balance sheet, no change in asset/funding mix, and a parallel and pro rata shift in rates over a 12 month period

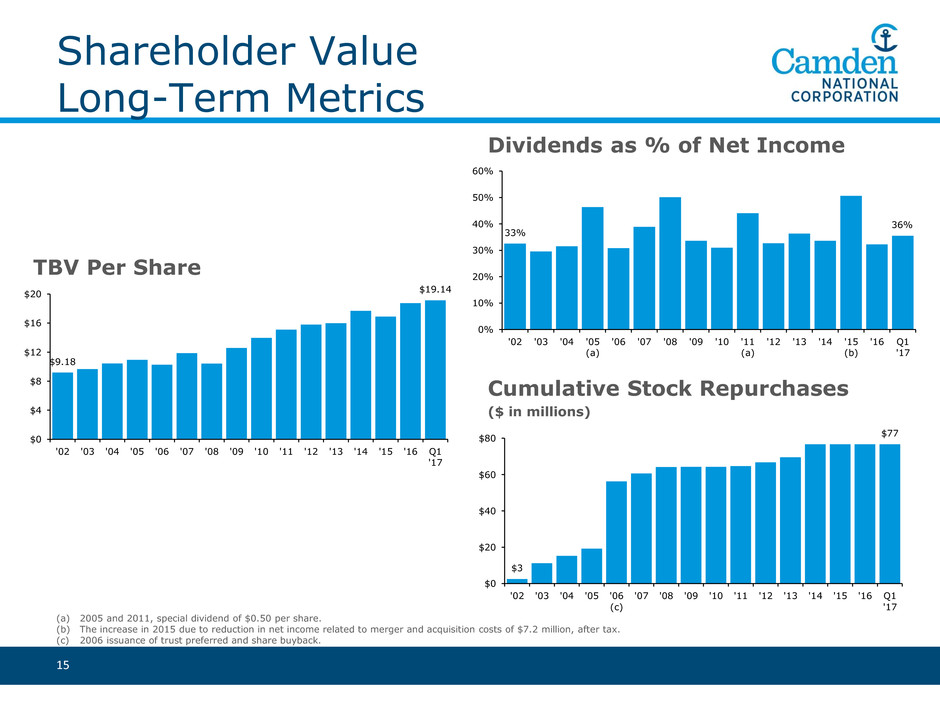

Shareholder Value

Long-Term Metrics

15

(a) 2005 and 2011, special dividend of $0.50 per share.

(b) The increase in 2015 due to reduction in net income related to merger and acquisition costs of $7.2 million, after tax.

(c) 2006 issuance of trust preferred and share buyback.

Dividends as % of Net Income

Cumulative Stock Repurchases

($ in millions)

TBV Per Share

$9.18

$19.14

$0

$4

$8

$12

$16

$20

'02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 Q1

'17

$3

$77

$0

$20

$40

$60

$80

'02 '03 '04 '05 '06

(c)

'07 '08 '09 '10 '11 '12 '13 '14 '15 '16 Q1

'17

33%

36%

0%

10%

20%

30%

40%

50%

60%

'02 '03 '04 '05

(a)

'06 '07 '08 '09 '10 '11

(a)

'12 '13 '14 '15

(b)

'16 Q1

'17

Shareholder Value

15 Year Total Return

16

Source: SNL Financial

• Stock price appreciation of 175.47%

• Average dividend yield of 2.81%

331%

209%

153%

-50%

0%

50%

100%

150%

200%

250%

300%

350%

400%

May-02 May-03 May-04 May-05 May-06 May-07 May-08 May-09 May-10 May-11 May-12 May-13 May-14 May-15 May-16

Investment Summary

Proven Management Team

• Delivered on previous acquisition commitments

• Diverse experience from community and large bank perspectives

Strong Market Share and Brand Recognition

• 140+ year operating history

• 3rd overall deposit market share in Maine

• #2 mortgage originator in Maine, with 6.4% of all mortgage

originations in the state

Quality Growth

• Consistent long-term growth both organically and through acquisitions

• Expanded presence in higher growth Southern Maine markets and

enhanced scale, density, and deposit costs in existing markets

Strong Fundamental Operating Metrics

• Historically strong credit quality with nonperforming assets

consistently less than 1% of total assets

• Efficiency ratio, ROAA and ROAE superior to peers

17

18

Appendix

Seasoned Management Team

19

Name Position Age

Years of

Banking

Experience

Year joined

Camden

Greg Dufour President and CEO 57 25+ 2001

Debbie Jordan, CPA COO & CFO 51 20+ 2008

Joanne Campbell EVP Risk Management 54 30+ 1996

Edmund Hayden EVP Chief Credit Officer 61 30+ 2015

Tim Nightingale EVP Senior Loan Officer 59 30+ 2000

June Parent EVP Retail Banking 53 25+ 1995

Renee Smyth SVP Chief Marketing Officer 46 15+ 2015

Edward Walbridge SVP Human Resources 56 15+ 2016

Mary Beth Haut Director of Wealth Management 53 30+ 2016

Financial Highlights

20

3/31/17

vs.

3/31/16

Change

(in million’s) 3/31/17 3/31/16

Loans $2,645 $2,493 6%

Investment Securities 943 910 4%

Total Assets 3,938 3,763 5%

Deposits 2,937 2,675 10%

Borrowings 557 659 (15%)

Shareholders’ Equity 398 375 6%

Tier 1 Leverage Ratio 8.90% 8.42% -

Balance Sheet

Net Income and Key Ratios

Financial Highlights

21

3/31/17 3/31/16(a)

Net Income (in millions) $10.1 $8.6

Diluted Earnings per Share $0.64 $0.56

Return on Tangible Equity(b) 14.37% 13.56%

Return on Assets 1.05% 0.93%

Efficiency Ratio(b) 58.00% 61.18%

Net Interest Margin (Fully-Taxable

Equivalent)

3.18% 3.35%

(a) Per share data adjusted to reflect the three-for-two stock split effective September 30, 2016.

(b) This is a non-GAAP measure. Refer to the Form 10-Q filed on 5/5/17 for the three months ended March 31, 2017 for the reconciliation of non-GAAP to GAAP financial

measures.

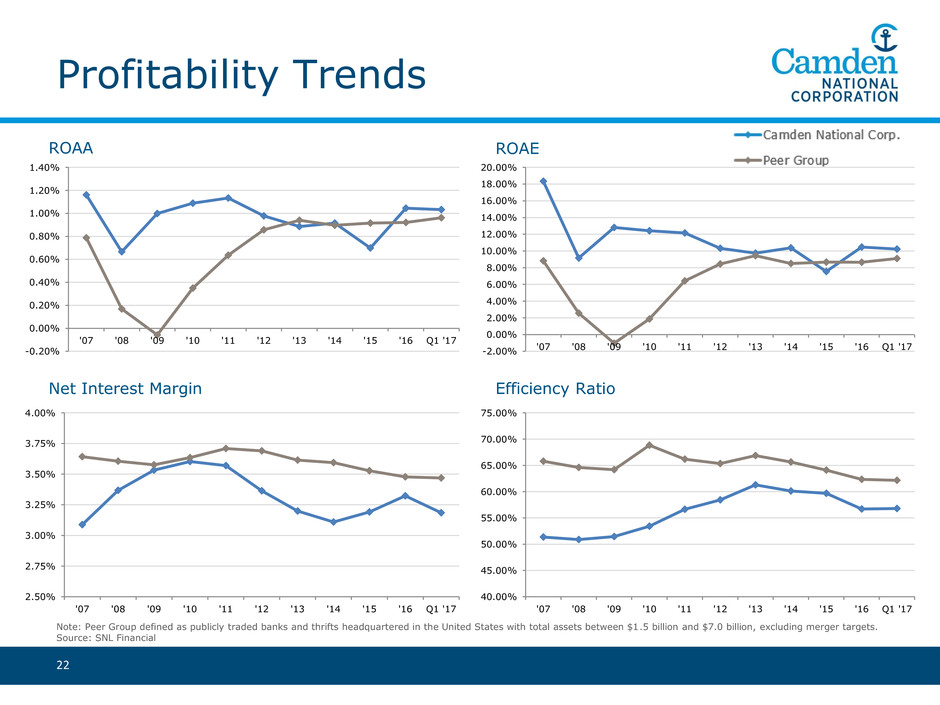

Profitability Trends

Note: Peer Group defined as publicly traded banks and thrifts headquartered in the United States with total assets between $1.5 billion and $7.0 billion, excluding merger targets.

Source: SNL Financial

22

ROAA ROAE

Net Interest Margin Efficiency Ratio

-0.20%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

1.40%

'07 '08 '09 '10 '11 '12 '13 '14 '15 '16 Q1 '17

2.50%

2.75%

3.00%

3.25%

3.50%

3.75%

4.00%

'07 '08 '09 '10 '11 '12 '13 '14 '15 '16 Q1 '17

-2.00%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

16.00%

18.00%

20.00%

'07 '08 '09 '10 '11 '12 '13 '14 '15 '16 Q1 '17

40.00%

45.00%

50.00%

55.00%

60.00%

65.00%

70.00%

75.00%

'07 '08 '09 '10 '11 '12 '13 '14 '15 '16 Q1 '17

Mortgage Banking Activity

23

Top 15 Lenders Originations Rank % of Total

Bangor Savings Bank 810 1 9.2%

Camden National Bank 562 2 6.4%

Residential Mortgage Services Inc. 446 3 5.1%

TD Bank, N.A. 418 4 4.8%

Key Bank 413 5 4.7%

Quicken Loans 403 6 4.6%

First, N.A. 305 7 3.5%

Kennebec Savings Bank 277 8 3.1%

Norway Savings Bank 230 9 2.6%

Machias Savings Bank 220 10 2.5%

Bank of America 196 11 2.2%

Kennebunk Savings Bank 167 12 1.9%

Gorham Savings Bank 154 13 1.8%

Bath Savings Institution 149 14 1.7%

Saco & Biddeford Savings Inst. 142 15 1.6%

Total for All Lenders 8,796 100.0%

Three Months Ended March 31, 2017

Source: MRS, Inc.

Data obtained from registry of deeds throughout the state of Maine.

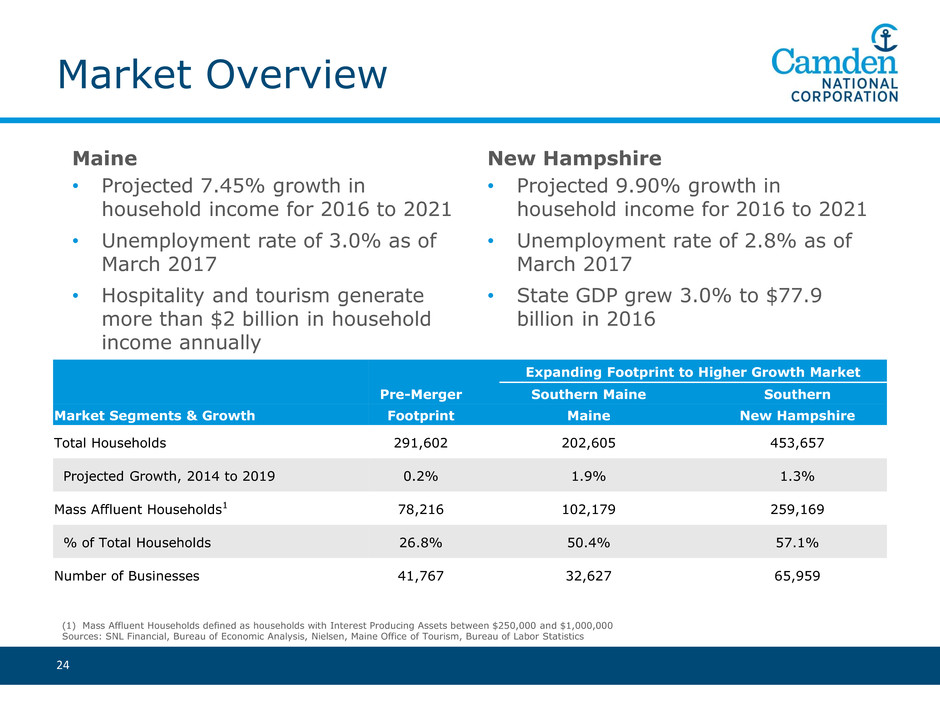

Market Overview

Maine

• Projected 7.45% growth in

household income for 2016 to 2021

• Unemployment rate of 3.0% as of

March 2017

• Hospitality and tourism generate

more than $2 billion in household

income annually

New Hampshire

• Projected 9.90% growth in

household income for 2016 to 2021

• Unemployment rate of 2.8% as of

March 2017

• State GDP grew 3.0% to $77.9

billion in 2016

(1) Mass Affluent Households defined as households with Interest Producing Assets between $250,000 and $1,000,000

Sources: SNL Financial, Bureau of Economic Analysis, Nielsen, Maine Office of Tourism, Bureau of Labor Statistics

24

Expanding Footprint to Higher Growth Market

Pre-Merger Southern Maine Southern

Market Segments & Growth Footprint Maine New Hampshire

Total Households 291,602 202,605 453,657

Projected Growth, 2014 to 2019 0.2% 1.9% 1.3%

Mass Affluent Households1 78,216 102,179 259,169

% of Total Households 26.8% 50.4% 57.1%

Number of Businesses 41,767 32,627 65,959