Attached files

EXHIBIT 2.2

SHARE EXCHANGE AGREEMENT

THIS SHARE EXCHANGE AGREEMENT (this "Agreement"), dated as of May 12, 2017 (this "Agreement") is entered into by and among, Green Vision Biotechnology Corp., a corporation organized under the laws of the State of Nevada ("GVBT"), Woodhead Investment Limited, a limited company organized under the laws of the British Virgin Islands (“Woodhead”) and Harcourt Capital Limited, a limited company organized under the laws of the British Virgin Islands (“Harcourt”) (Woodhead and Harcourt are collectively referred to herein as the "Shareholders"). GVBT and the Shareholders are referred to singularly as a "Party" and collectively as the "Parties."

WITNESSETH:

WHEREAS, Harcourt owns 6% of the issued and outstanding shares of Lutu International Biotechnology Limited ("Lutu International");

WHEREAS, Woodhead owns 5% of the issued and outstanding shares of Lutu International;

WHEREAS, Lutu International is the ultimate holding company of Shanxi Green Biotechnology Industry Limited, a Wholly Foreign-Owned Enterprise registered in the People’s Republic of China, which is in the business of fertilizer manufacturing located in Jinzhong Prefecture-Level City of Shanxi Province, the People’s Republic of China;

WHEREAS, GVBT wishes to acquire all of the issued and outstanding shares of capital stock of Lutu International with the purpose of owning and operating Lutu International as GVBT' s wholly-owned subsidiary;

WHEREAS, GVBT and the Shareholders propose to enter into this Agreement which provides, among other things, that the Shareholders will deliver the Lutu International Shares owned by each of them to GVBT in exchange for a total of 11 million shares of GVBT's common stock (the "Share Exchange") as described in Section 2.01 of this Agreement, on the terms and conditions set forth herein and such additional items as more fully described in this Agreement.

NOW, THEREFORE, in consideration, of the promises and of the mutual representations, warranties and agreements set forth herein, the Parties hereto agree as follows:

| 1 |

ARTICLE I

DEFINITIONS

Section 1.01. Definitions. The following terms shall have the following respective meanings:

|

"Business Day" |

a day (other than a Saturday) on which banks in Nevada are open for business throughout their normal business hours; |

|

|

|

|

"Affiliate" |

with respect to any Party, a Person that directly or indirectly controls, is controlled by, or is under common control of such Party. For the purpose of this definition, "control" means (i) ownership of more than ten percent (10%) of the voting shares of a Person or (ii) the right or ability to direct the management or policies of a Person through ownership of voting shares or other securities, pursuant to a written agreement or otherwise; |

|

|

|

|

"Closing" |

the closing of the transactions contemplated by this Agreement; |

|

|

|

|

"Completion" |

completion of acquisition of the Lutu International Shares held by Woodhead and Harcourt by GVBT from Woodhead and Harcourt and issuance of the Exchange Shares (as such term is defined below) in accordance with the terms and conditions of this Agreement; |

|

|

|

|

"Encumbrance" |

any mortgage, charge, pledge, lien, (otherwise than arising by statute or operation of law), equities, hypothecation or other encumbrance, priority or security interest, preemptive right deferred purchase, title retention, leasing, sale-and-repurchase or sale-and-leaseback arrangement whatsoever over or in any property, assets or rights of whatsoever nature and includes any agreement for any of the same and reference to "Encumbrances" shall be construed accordingly; |

|

|

|

|

"Exchange Act" |

the US Securities Exchange Act of 1934; |

|

|

|

|

“Lutu International Shares” |

all of the issued and outstanding shares of Lutu International; |

|

|

|

|

"Person" |

any individual, firm, company, government, state or agency of a state or any joint venture, association or partnership (whether or not having separate legal personality); |

|

|

|

|

"SEC" |

the US Securities and Exchange Commission; |

|

|

|

|

"Securities Act" |

the US Securities Act of 1933; |

|

|

|

|

"United States Dollars" |

or "US$" United States dollars; |

|

|

|

|

"US" |

United States of America; |

| 2 |

Section 1.02. Rules of Construction.

(a) Unless the context otherwise requires, as used in this Agreement: (i) "including" means "including, without limitation"; (ii) words in the singular include the plural; (iii) words in the plural include the singular; (iv) words applicable to one gender shall be construed to apply to each gender; (v) the terms "hereof," "herein," "hereby," "hereto" and derivative or similar words refer to this entire Agreement, including the Schedules hereto; (vi) the terms "Article," "Section" and "Schedule" shall refer to the specified Article, Section or Schedule of or to this Agreement and references to paragraphs shall refer to the relevant paragraph of a specified Schedule and (vii) the term "day" shall refer to calendar days.

(b) Titles and headings to Articles and Sections are inserted for convenience of reference only, and are not intended to be a part of or to affect the meaning or interpretation of this Agreement.

ARTICLE II

THE SHARE EXCHANGE

Section 2.01 Share Exchange.

(a) Subject to and upon the terms and conditions of this Agreement, on the Closing Date (as defined hereafter), GVBT shall acquire 5 shares of Lutu International from Woodhead and 6 shares of Lutu International from Harcourt with all of such interests acquired being free from all Encumbrances together with all rights now or hereafter attaching thereto.

(b) In exchange for the delivery of the Lutu International Shares held by Harcourt and Woodhead, GVBT shall provide the following to the Shareholders at the closing, a total of 11 million shares of GVBT's common stock (the "Exchange Shares"), allocated as follows:

|

|

Woodhead |

5,000,000 |

|

|

Harcourt |

6,000,000 |

| 3 |

provided, however, that the Exchange Shares to be issued to any particular Shareholder shall be issued to any affiliate, trustee, legal entity or representative as directed by such Shareholder.

(c) The Share Exchange shall take place upon the terms and conditions provided for in this Agreement and in accordance with applicable law. If the Closing does not occur as set forth in Section 2.02 of this Agreement due to one Party's failure to perform, then the other Party may terminate the Agreement.

Section 2.02. Closing Location. The Closing of the Share Exchange and the other transactions contemplated by this Agreement will occur as soon as possible (the "Closing Date"), at the offices of Booth Udall Fuller, PLC, 1255 W. Rio Salado Parkway, Tempe, Arizona.

Section 2.03. Shareholder's Closing Documents. At the Closing, the Shareholders will tender to GVBT:

(a) Original certificates issued in the name of the Shareholder or Shareholders representing all of the Lutu International Shares they own respectively, duly endorsed for transfer by the Shareholders, with either a medallion signature guarantee or notarization of such endorsement, and marked "cancelled for transfer" or as otherwise directed by GVBT or its counsel, in accordance with the laws of the Cayman Islands;

(b) One (1) new certificate issued by Lutu International in the name of GVBT representing the Lutu International Shares;

(c) A certified copy of the register of shareholders of Lutu International showing GVBT as the registered owner of the Lutu International Shares;

(d) A resolution from the Shareholders certifying that the conditions in Section 8.01(b) have been satisfied;

(e) a Certificate of Non-U.S. Person in the form attached to this Agreement as Exhibit “A” from Woodhead and as Exhibit “B” from Harcourt; and

| 4 |

(f) certified copies of resolutions of the Board of Directors of each of Woodhead and Harcourt in a form satisfactory to GVBT, acting reasonably, authorizing the execution and delivery by each of them of this Agreement.

Section 2.04. GVBT's Closing Documents. At the Closing, GVBT will tender to the Shareholders:

(a) A certified copy(ies) of resolutions of the Board of Directors of GVBT in a form satisfactory to the Shareholders, acting reasonably, authorizing:

|

|

(i) |

the execution and delivery of this Agreement by GVBT; and |

|

|

|

|

|

(ii) |

the issuance of the Exchange Shares to the Shareholders. |

(b) Share certificates, registered in the name of the Shareholders representing the Exchange Shares to be issued to them respectively; and

(c) A certificate executed by a duly appointed officer of GVBT certifying that the conditions in Section 9.01(b) have been satisfied.

ARTICLE III

REPRESENTATIONS AND WARRANTIES

Section 3.01. Each Party represents and warrants to the other Party that each of the warranties it makes is accurate in all respects and not misleading as at the date of this Agreement.

Section 3.02. Each Party undertakes to disclose in writing to the other Party anything which is or may constitute a breach of or be inconsistent with any of the warranties immediately upon the same coming to its notice at the time of and after Completion.

Section 3.03. Each Party agrees that each of the warranties it makes shall be construed as a separate and independent warranty and (except where expressly provided to the contrary) shall not be limited or restricted by reference to or inference from the terms of any other warranty or any other term of this Agreement.

| 5 |

Section 3.04. Each Party acknowledges that the restrictions contained in Section 11.01 shall continue to apply after the Closing without limit in time.

Section 3.05 Each party acknowledges and agrees that GVBT desires to acquire all the Lutu International Shares held by the Shareholders and Able Lead Holdings Limited and that GVBT is a party to other agreements related to such acquisition.

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF GVBT

Section 4.01. Organization, Standing and Authority; Foreign Qualification. GVBT is a corporation duly organized, validly existing and in good standing under the laws of the State of Nevada and has all requisite corporate power and authority to own, lease and operate its properties and to conduct its business as presently conducted and as proposed to be conducted and is duly qualified or licensed as a foreign corporation in good standing in each jurisdiction in which the character of its properties or the nature of its business activities require such qualification.

Section 4.02. Corporate Authorization. The execution, delivery and performance by GVBT of this Agreement and the consummation of the transactions contemplated hereby have been duly authorized by all necessary corporate action on the part of GVBT, and this Agreement constitutes a valid and binding agreement of GVBT. The Exchange Shares to be issued in accordance with this Agreement shall be duly authorized and, upon such issuance, will be validly issued, fully paid and non-assessable.

Section 4.03. Capitalization. GVBT's authorized capital stock, as of the Closing Date upon issuance of the Exchange Shares, shall consist of 750,000,000 authorized shares of common stock, of which 160,790,000 common shares shall be issued and outstanding (including the Exchange Shares). All of such issued and outstanding shares of GVBT's common stock and preferred stock are duly authorized, validly issued, fully paid and non-assessable. There are no outstanding options, warrants, agreements or rights to subscribe for or to purchase, or commitments to issue, shares of GVBT's common stock or any other security of GVBT or any plan for any of the foregoing. GVBT is not obligated to register the resale of any of its common stock on behalf of any shareholder of GVBT under the Securities Act.

Section 4.04. Subsidiaries. GVBT's does not have any subsidiaries.

Section 4.05. Articles of Incorporation and Bylaws. GVBT has heretofore delivered, or prior to Closing GVBT shall deliver, to the Shareholders true, correct and complete copies of its Articles of Incorporation, certified by the Secretary of State of the State of Nevada and Bylaws or comparable instruments, certified by GVBT's corporate secretary.

| 6 |

Section 4.06. No Conflict. The execution, delivery and performance of this Agreement and the completion of the transactions contemplated herein will not:

(a) violate any provision of the Articles of Incorporation, Bylaws or other charter or organizational document of GVBT;

(b) violate, conflict with or result in the breach of any of the terms of, result in any modification of the effect of, otherwise give any other contracting party the right to terminate, or constitute (or with notice or lapse of time or both constitute) a default under, any contract to which GVBT is a party or by or to which either of its assets or properties, may be bound or subject;

(c) violate any order, judgment, injunction, award or decree of any court, arbitrator or governmental or regulatory body against, or binding upon, or any agreement with, or condition imposed by, any governmental or regulatory body, foreign or domestic, binding upon GVBT or upon the securities, assets or business of GVBT;

(d) violate any statute, law or regulation of any jurisdiction as such statute, law or regulation relates to GVBT or to the securities, properties or business of GVBT; or

(e) result in the breach of any of the terms or conditions of, constitute a default under, or otherwise cause an impairment of, any permit or license held by GVBT.

Section 4.07. Litigation. There is no litigation, suit, proceeding, action or claim at law or in equity, pending or to GVBT's best knowledge threatened against or affecting GVBT or involving any of GVBT's property or assets, before any court, agency, authority or arbitration tribunal, including, without limitation, any product liability, workers' compensation or wrongful dismissal claims, or claims, actions, suits or proceedings relating to toxic materials, hazardous substances, pollution or the environment. GVBT is not subject to or in default with respect to any notice, order, writ, injunction or decree of any court, agency, authority or arbitration tribunal.

Section 4.08. Compliance with Laws. To the best knowledge of GVBT, it has complied with all laws, municipal bylaws, regulations, rules, orders, judgments, decrees and other requirements and policies imposed by any governmental authority applicable to it, its properties or the operation of its business, except where the failure to comply will not have a material adverse effect on the business, properties, financial condition or earnings of GVBT.

| 7 |

Section 4.09. True and Correct Copies. All documents furnished or caused to be furnished to the Shareholders by GVBT are true and correct copies, and there are no amendments or modifications thereto except as set forth in such documents.

Section 4.10. Contracts.

(a) Except for the contracts set forth on Schedule 4.10, and except as described in GVBT’s Form 10-K for the year ended January 31, 2017, filed with the SEC, and excluding any obligation referenced in this Agreement or related transactions and agreements between GVBT and Able Lead Holdings Limited, GVBT is not a party to any:

(i) contracts with any current or former officer, director, employee, consultant, agent or other representative having more than three (3) months to run from the date hereof or providing for an obligation to pay and/or accrue compensation of $100,000 or more per annum, or providing for the payment of fees or other consideration in excess of $100,000 in the aggregate to any officer or director of GVBT, or to any other entity in which GVBT has an interest;

(ii) contracts for the purchase or sale of equipment or services that contain an escalation, renegotiation or re-determination clause or that can be cancelled without liability, premium or penalty only on ninety (90) days' or more notice;

(iii) contracts for the sale of any of its assets or properties or for the grant to any person of any preferential rights to purchase any of its or their assets or properties;

(iv) contracts (including, without limitation, leases of real property) calling for an aggregate purchase price or payments in any one (1) year of more than $100,000 in any one case (or in the aggregate, in the case of any related series of contracts);

(v) contracts relating to the acquisition by GVBT of any operating business of, or the disposition of any operating business by, any other person;

(vi) executory contracts relating to the disposition or acquisition of any investment or of any interest in any person;

(vii) joint venture contracts or agreements;

| 8 |

(viii) contracts under which GVBT agrees to indemnify any party, other than in the ordinary course of business or in amounts not in excess of $100,000 or to share tax liability of any party;

(ix) contracts containing covenants of GVBT not to compete in any line of business or with any person in any geographical area or covenants of any other person not to compete with GVBT in any line of business or in any geographical area;

(x) contracts for or relating to computers, computer equipment, computer software or computer services; or

(xi) contracts relating to the borrowing of money by GVBT or the direct or indirect guarantee by GVBT of any obligation for, or an agreement by GVBT to service, the repayment of borrowed money, or any other contingent obligations in respect of indebtedness of any other Person, including, without limitation:

(A) any contract with respect to lines of credit;

(B) any contract to advance or supply funds to any other person other than in the ordinary course of business;

(C) any contract to pay for property, products or services of any other person even if such property, products or services are not conveyed, delivered or rendered;

(D) any keep-well, make-whole or maintenance of working capital or earnings or similar contract; or

(E) any guarantee with respect to any lease or other similar periodic payments to be made by any other person; and

(xii) any other material contract whether or not made in the ordinary course of business.

Section 4.11. Operations of GVBT. During the last ninety (90) days prior to the date hereof, GVBT has not:

(a) Except for the share exchange agreement between Able Lead Holdings Limited and GVBT, and except as provided in GVBT’s filings with the SEC, amended its Articles of Incorporation or Bylaws or merged with or into or consolidated with any other person or entity, subdivided or in any way reclassified any shares of its capital stock or changed or agreed to change in any manner the rights of its outstanding capital stock or the character of its business;

| 9 |

(b) except for the issuance of 11,000,000 (11 million) shares of common stock in anticipation of the Share Exchange and except for the share exchange agreement between Able Lead Holdings Limited and GVBT; issued, reserved for issuance, sold or redeemed, repurchased or otherwise acquired, or issued options or rights to subscribe to, or entered into any contract or commitment to issue, sell or redeem, repurchase or otherwise acquire, any shares of its capital stock or any bonds, notes, debentures or other evidence or indebtedness;

(c) declared or paid any dividends or declared or made any other distributions of any kind to its shareholders; or

(d) made any loan or advance to any of its shareholders or to any of its directors, officers or employees, consultants, agents or other representatives, or made any other loan or advance, otherwise than in the ordinary course of business.

Section 4.12. Material Information. This Agreement, the Schedules attached hereto and all other information provided, in writing, by GVBT or representatives thereof to the Shareholders, taken as a whole, do not contain any untrue statement of a material fact or omit to state a material fact necessary to make any statement contained herein or therein not misleading. There are no facts or conditions which have not been disclosed to the Shareholders in writing which, individually or in the aggregate, could have a material adverse effect on GVBT or a material adverse effect on the ability of GVBT to perform any of its obligations pursuant to this Agreement.

Section 4.13. Brokerage. No broker or finder has acted, directly or indirectly, for GVBT nor did GVBT incur any finder's fee or other commission, in connection with the transactions contemplated by this Agreement.

ARTICLE V

REPRESENTATIONS AND WARRANTIES OF THE SHAREHOLDERS

The Shareholders represent to GVBT as follows:

Section 5.01. Organization, Standing and Authority; Foreign Qualification. (a) Lutu International is a corporation duly organized, validly existing and in good standing under the laws of Cayman Islands and has all requisite corporate power and authority to own, lease and operate its respective properties and to conduct its respective business as presently conducted and as proposed to be conducted and is duly qualified or licensed as a foreign corporation in good standing in each jurisdiction in which the character of its properties or the nature of its business activities require such qualification.

| 10 |

Section 5.02. Authorization. The execution, delivery and performance by the Shareholders of this Agreement and the consummation of the transactions contemplated hereby have been duly authorized by all necessary actions, as the case may be, on the part of the Shareholders. The Shareholders have duly executed and delivered this Agreement and this Agreement constitutes a valid and binding agreement of the Shareholders. The Lutu International Shares to be transferred to GVBT in accordance with this Agreement have been duly authorized and validly issued, fully paid and non-assessable. Upon transfer of the Lutu International Shares, no Encumbrance shall exist thereon.

Section 5.03. Capitalization.

(a) Lutu International’s current total share capital is allocated as follows:

|

|

Able Lead Holdings Limited |

89 shares |

89% |

|

|

Harcourt |

6 shares |

6% |

|

|

Woodhead |

5 shares |

5% |

(b) All of such issued and outstanding shares of capital stock of Lutu International are duly authorized, validly issued, fully paid and non-assessable. There are no outstanding options, warrants, agreements or rights to subscribe for or to purchase, or commitments to issue, shares of capital stock in Lutu International or any other security of Lutu International or any plan for any of the foregoing.

(c) Lutu International Shares are not subject to any option, right of first refusal, whether by contract, agreement, applicable law, regulation or statute, as the case may be.

(d) In the loan agreement under which Able Lead Holdings Limited is obligated in the amount of USD $4.43 million (the “Outstanding Loan”), Lutu International Shares owned by Able Lead Holdings Limited and the shares of its subsidiaries are secured to the Outstanding Loan. Pursuant to the terms of the loan agreement, Able Lead Holdings Limited is not allowed to transfer or otherwise dispose Lutu International Shares owned by it before the loan security is released.

| 11 |

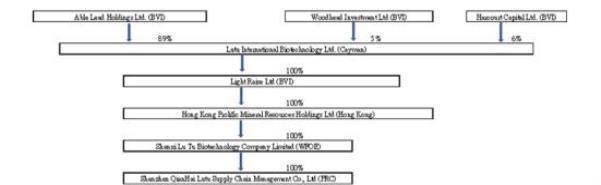

Section 5.04. Subsidiaries.

Lutu International owns Light Raise Limited, a BVI corporation as a direct subsidiary. Lutu International owns Hong Kong Prolific Mineral Resources Limited (a Hong Kong SAR corporation), Shanxi Lutu Biotechnology Limited (a PRC corporation) and Shenzhen QianHai Lutu Supply Chain Management Co., Ltd (a PRC Corporation) as indirect subsidiaries. The shareholding structure of Lutu International and its subsidiaries is as follows:

Section 5.05. Sale of Exchange Shares. Upon completion of the purchase and sale of the Exchange Shares, the Shareholders shall be the beneficial and record holder of the Exchange Shares.

Section 5.06. Investment Risk. The Shareholders understand that an investment in GVBT includes a high degree of risk, have such knowledge and experience in financial and business matters, investments, securities and private placements as to be capable of evaluating the merits and risks of their investment in the Exchange Shares, are in a financial position to hold the Exchange Shares for an indefinite period of time, and are able to bear the economic risk of, and withstand a complete loss of such investment in the Exchange Shares.

Section 5.07. Cooperation. If required by applicable securities laws or order of a securities regulatory authority, stock exchange or other regulatory authority, the Shareholders will execute, deliver, file and otherwise assist GVBT in filing such reports, undertakings and other documents as may be required with respect to the issuance of the Exchange Shares.

Section 5.08. Tax Advice. The Shareholders are solely responsible for obtaining such legal, including tax, advice as it considers necessary or appropriate in connection with the execution, delivery and performance by them of this Agreement and the transactions contemplated herein.

Section 5.09. Investment Representations. All of the acknowledgements, representations, warranties and covenants set out in Exhibit “A” and Exhibit “B” hereto are true and correct as of the date hereof and as of the Closing Date as for the Shareholders.

| 12 |

Section 5.10. No Conflict. The execution, delivery and performance of this Agreement and the completion of the transactions contemplated herein will not:

(a) violate any provision of the Articles or Certificate of Incorporation, Bylaws or other charter or organizational document of Lutu International, Harcourt or Woodhead;

(b) violate, conflict with or result in the breach of any of the terms of, result in any modification of the effect of, otherwise give any other contracting party the right to terminate, or constitute (or with notice or lapse of time or both constitute) a default under, any contract to which Lutu International or the Shareholders is a party or by or to which their assets or properties, including the Lutu International Shares, may be bound or subject;

(c) violate any order, judgment, injunction, award or decree of any court, arbitrator or governmental or regulatory body against, or binding upon, or any agreement with, or condition imposed by, any governmental or regulatory body, foreign or domestic, binding upon Lutu International or the Shareholders or upon the securities, assets or business of Lutu International and/or the Shareholders;

(d) violate any statute, law or regulation of any jurisdiction as such statute, law or regulation relates to Lutu International and/or the Shareholders or to the securities, properties or business of Lutu International and/or the Shareholders; or

(e) result in the breach of any of the terms or conditions of, constitute a default under, or otherwise cause an impairment of, any permit or license held by Lutu International and/or the Shareholders.

Section 5.11. Organizational Documents.

(a) The Shareholders have heretofore delivered to GVBT true, correct and complete copies of Lutu International's Articles of Incorporation or Association (or such similar organizational documents).

(b) The minute books of Lutu International accurately reflect all actions taken at all meetings and consents in lieu of meetings of its respective members or owners, and all actions taken at all meetings and consents in lieu of meetings of its managing members from the date of incorporation to the date hereof.

| 13 |

Section 5.12. Compliance with Laws. To the best of the Shareholders' knowledge, neither Lutu International nor the Shareholders are in violation of any applicable order, judgment, injunction, award or decree nor are they in violation of any federal, provincial, state, local, municipal or foreign law, ordinance or regulation or any other requirement of any governmental or regulatory body, court or arbitrator, other than those violations which, in the aggregate, would not have a material adverse effect on Lutu International or the Shareholders and have not received written notice that any violation is being alleged.

Section 5.13. Material Information. This Agreement, the Schedules attached hereto and all other information provided in writing by the Shareholders or representatives thereof to GVBT, taken as a whole, do not contain any untrue statement of a material fact or omit to state a material fact necessary to make any statement contained herein or therein not misleading. There are no facts or conditions which have not been disclosed to GVBT in writing which, individually or in the aggregate, could have a material adverse effect on Lutu International and/or the Shareholders or a material adverse effect on the ability of the Shareholders to perform any of their obligations pursuant to this Agreement.

Section 5.14. Actions and Proceedings. There are no outstanding orders, judgments, injunctions, awards or decrees of any court, governmental or regulatory body or arbitration tribunal against or involving Lutu International or the Shareholders. There are no actions, suits or claims or legal, regulatory, administrative or arbitration proceedings pending or, to the knowledge of the Shareholders, threatened against or involving Lutu International or the Shareholders, their respective assets or the Lutu International Shares.

Section 5.15. Operations. Except as contemplated by this Agreement, since its date of incorporation, Lutu International has not:

(a) amended its Certificate or Articles of Association or Bylaws (or similar document) or merged with or into or consolidated with any other person or entity, subdivided or in any way reclassified any of its ownership interests or changed or agreed to change in any manner the rights of its ownership interests or the character of its business;

(b) issued, reserved for issuance, sold or redeemed, repurchased or otherwise acquired, or issued options or rights to subscribe to, or entered into any contract or commitment to issue, sell or redeem, repurchase or otherwise acquire, any ownership interests or any bonds, notes, debentures or other evidence or indebtedness; or

(c) made any loan or advance to any manager, officer, director or employee, consultant, agent or other representative.

| 14 |

Section 5.16. Brokerage. The Shareholders shall pay any brokerage, finder's fee or other commission owed in connection with the transactions contemplated by this Agreement.

Section 5.16 Non – U.S. Person

(a) Each of Woodhead and Harcourt hereby represent, warrant, acknowledge and covenant to GVBT (which representations, warranties, acknowledgments and covenants shall be true and correct on the date hereof and at the Closing, with the same force and effect as if they had been made as at such dates and which shall survive the Closing) and acknowledges that GVBT and its counsel, are relying thereon, that Woodhead and Harcourt are not residents of the US and by virtue thereof is a “non-U.S. person” as defined in Regulation S (and as set forth in Exhibit “A” and Exhibit “B” attached hereto, which are incorporated herein in their entirety) and confirm that the purchase of the Exchange Shares by Woodhead and Harcourt is not in violation of any applicable laws of its jurisdiction of residence, and each of Woodhead and Harcourt have properly complied with and duly executed the Certificate of Non-U.S. Person attached to this Agreement as Exhibit “A” and Exhibit “B” indicating the means by which each of Woodhead and Harcourt is a “non-U.S. Person” and confirm the truth and accuracy of all statements made by each of Woodhead and Harcourt in such certificates.

(b) Woodhead and Harcourt acknowledge that any resale of the Exchange Shares will be subject to resale restrictions contained in the securities legislation applicable to Woodhead and Harcourt. Woodhead and Harcourt acknowledge that the Exchange Shares will be subject to statutory hold periods during which these securities may not be resold in the United States unless a further statutory exemption is available to Woodhead and Harcourt or an appropriate discretionary order is obtained pursuant to applicable securities laws.

(c) Woodhead and Harcourt hereby acknowledge that in addition to a legend referring to the restrictions on resale described above, a legend will be placed upon the certificates representing the Exchange Shares and any securities issuable in exchange therefor or in substitution thereof as follows:

THE SECURITIES OFFERED HEREBY HAVE NOT BEEN REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933 (THE "U.S. SECURITIES ACT") OR ANY STATE SECURITIES LAWS, AND ARE BEING OFFERED AND SOLD IN RELIANCE ON EXEMPTIONS FROM THE REGISTRATION REQUIREMENTS OF THE U.S. SECURITIES ACT. THESE SECURITIES ARE RESTRICTED SECURITIES (AS DEFINED UNDER RULE 144 UNDER THE U.S. SECURITIES ACT) AND MAY NOT BE SOLD, TRANSFERRED, PLEDGED, HYPOTHECATED OR OTHERWISE DISPOSED OF FOR VALUE EXCEPT IN ACCORDANCE WITH THE PROVISIONS OF REGULATION S PROMULGATED UNDER THE U.S. SECURITIES ACT, PURSUANT TO REGISTRATION UNDER THE U.S. SECURITIES ACT, OR PURSUANT TO AN AVAILABLE EXEMPTION FROM REGISTRATION THEREUNDER.

| 15 |

DURING THE PERIOD ENDING [ONE YEAR AFTER THE CLOSING] (THE "RESTRICTED PERIOD"), THESE SECURITIES MAY NOT BE OFFERED OR SOLD, DIRECTLY OR INDIRECTLY WITHIN THE UNITED STATES, TO A U.S. PERSON (AS DEFINIED IN REGULATION S UNDER THE U.S. SECURITIES ACT), OR FOR THE ACOUNT OR BENEFIT OF A U.S. PERSON, EXCEPT PURSUANT TO REGISTRATION UNDER THE U.S. SECURITIES ACT, OR PURSUANT TO AN AVAILABLE EXEMPTION FROM REGISTRATION THEREUNDER. DURING THE RESTRICTED PERIOD HEDGING TRANSACTIONS INVOLVING THESE SECURITIES MAY NOT BE CONDUCTED UNLESS SUCH TRANSACTIONS ARE MADE IN COMPLIANCE WITH THE U.S. SECURITES ACT.

ARTICLE VI

COVENANTS AND AGREEMENTS OF SHAREHOLDERS

Section 6.01. Conduct of Businesses in the Ordinary Course. From the date of this Agreement to the Closing Date, the Shareholders shall cause Lutu International to conduct its respective business substantially in the manner in which it is currently conducted.

Section 6.02. Preservation of Permits and Services. From the date of this Agreement to the Closing Date, the Shareholders shall cause Lutu International to use its best efforts to preserve any permits and licenses in full force and effect and to keep available the services, and preserve the goodwill, of its present managers, officers, employees, agents, and consultants.

Section 6.03. Conduct Pending the Closing Date. From the date of this Agreement to the Closing Date: (a) the Shareholders shall cause Lutu International to use its best efforts to conduct its affairs in such a manner so that, except as otherwise contemplated or permitted by this Agreement, the representations and warranties contained in Article V shall continue to be true and correct on and as of the Closing Date as if made on and as of the Closing Date; and (b) the Shareholders shall promptly notify GVBT of any event, condition or circumstance that would constitute a violation or breach of this Agreement by the Shareholders.

Section 6.04. Corporate Examinations and Investigations. Prior to the Closing Date, GVBT shall be entitled, through its employees and representatives, to make such reasonable investigation of the assets, liabilities, properties, business and operations of Lutu International, and such examination of the books, records, tax returns, results of operations and financial condition of Lutu International. Any such investigation and examination shall be conducted at reasonable times and under reasonable circumstances and the Shareholders and their employees and representatives, including without limitation, their counsel and independent public accountants, shall cooperate fully with such representatives in connection with such reasonable review and examination.

| 16 |

ARTICLE VII

COVENANTS AND AGREEMENTS OF GVBT

Section 7.01. Conduct of Businesses in the Ordinary Course. From the date of this Agreement to the Closing Date, GVBT shall conduct its businesses substantially in the manner in which it is currently conducted and shall not enter into any contract described in Section 4.10, or undertake any of the actions specified in Sections 4.11, subject to the exclusions therein.

Section 7.02. Litigation. From the date of this Agreement to the Closing Date, GVBT shall notify the Shareholder of any actions or proceedings of the type described in Section 4.07 that are threatened or commenced against GVBT or against any officer, director, employee, properties or assets of GVBT and of any requests for information or documentary materials by any governmental or regulatory body in connection with the transactions contemplated hereby.

Section 7.03. Conduct of GVBT Pending the Closing. From the date hereof through the Closing Date:

(a) GVBT shall use its best efforts to conduct its affairs in such a manner so that, except as otherwise contemplated or permitted by this Agreement, the representations and warranties contained in Article IV shall continue to be true and correct on and as of the Closing Date as if made on and as of the Closing Date; and

(b) GVBT shall promptly notify the Shareholder of any event, condition or circumstance occurring from the date hereof through the Closing Date that would constitute a violation or breach of this Agreement by GVBT.

Section 7.04. Corporate Examinations and Investigations. Prior to the Closing Date, the Shareholders shall be entitled, through employees and representatives, to make any investigation of the assets, liabilities, properties, business and operations of GVBT; and such examination of the books, records, tax returns, results of operations and financial condition of GVBT. Any such investigation and examination shall be conducted at reasonable times and under reasonable circumstances and GVBT and its employees and representatives shall cooperate fully with such representatives in connection with such reasonable review and examination.

| 17 |

ARTICLE VIII

CONDITIONS PRECEDENT TO THE OBLIGATION OF GVBT TO CLOSE

The obligations of GVBT to be performed by it at the Closing pursuant to this Agreement are subject to the fulfillment on or before the Closing Date, of each of the following conditions, any one or more of which may be waived by it, to the extent permitted by law:

Section 8.01. Representations and Covenants.

(a) The representations and warranties of the Shareholders contained in this Agreement shall be true and correct on and as of the Closing Date with the same force and effect as though made on and as of the Closing Date, except that any of such representations and warranties that are given as of a particular date and relate solely to a particular date or period shall be true as of such date or period; and

(b) The Shareholder shall have performed and complied with all covenants and agreements required by this Agreement to be performed or complied with by him on or before the Closing Date. The Shareholders shall have delivered to GVBT a certificate, dated the Closing Date, and signed by the Shareholders to the foregoing effect.

Section 8.02. Governmental Permits and Approvals.

(a) All approvals, authorizations, consents, permits and licenses from governmental and regulatory bodies required for the transactions contemplated by this Agreement and to permit the business currently carried on by Lutu International to continue to be carried on substantially in the same manner immediately following the Closing Date shall have been obtained and shall be in full force and effect, and GVBT shall have been furnished with appropriate evidence, reasonably satisfactory to them, of the granting of such approvals, authorizations, consents, permits and licenses; and

(b) There shall not have been any action taken by any court, governmental or regulatory body then prohibiting or making illegal on the Closing Date the transactions contemplated by this Agreement.

Section 8.03. Third Party Consents. All consents, permits and approvals from parties to contracts with Lutu International that may be required in connection with the performance by the Shareholders hereunder or the continuance of such contracts in full force and effect after the Closing Date, shall have been obtained.

| 18 |

Section 8.04. Litigation. No action, suit or proceeding shall have been instituted and be continuing or be threatened by any person to restrain, modify or prevent the carrying out of the transactions contemplated hereby, or to seek damages in connection with such transactions, or that has or could have a material adverse effect on Lutu International, the Shareholders, or on the Lutu International Shares.

Section 8.05 Closing Documents. The Shareholders shall have executed and delivered the documents described in Section 2.03 above.

ARTICLE IX

CONDITIONS PRECEDENT TO THE OBLIGATION OF THE

SHAREHOLDERS TO CLOSE

The obligations of the Shareholders to be performed by them at the Closing pursuant to this Agreement are subject to the fulfillment, on or before the Closing Date, of each the following conditions, any one or more of which may be waived by him, to the extent permitted by law:

Section 9.01. Representations and Covenants.

(a) The representations and warranties of GVBT contained in this Agreement shall be true and correct on and as of the Closing Date with the same force and effect as though made on and as of the Closing Date, except that any of such representations and warranties that are given as of a particular date and relate solely to a particular date or period shall be true as of such date or period; and

(b) GVBT shall have performed and complied with all covenants and agreements required by this Agreement to be performed or complied with by it on or before the Closing Date. GVBT shall have delivered to the Shareholders a certificate dated the Closing Date, and signed by an authorized signatory of GVBT to the foregoing effect.

Section 9.02. Governmental Permits and Approvals.

(a) All approvals, authorizations, consents, permits and licenses from governmental and regulatory bodies required for the transactions contemplated by this Agreement and to permit the business currently carried on by GVBT to continue to be carried on substantially in the same manner immediately following the Closing Date shall have been obtained and shall be in full force and effect, and the Shareholders shall have been furnished with appropriate evidence, reasonably satisfactory to them, of the granting of such approvals, authorizations, consents, permits and licenses; and

| 19 |

(b) There shall not have been any action taken by any court, governmental or regulatory body then prohibiting or making illegal on the Closing Date the transactions contemplated by this Agreement.

Section 9.03. Litigation. No action, suit or proceeding shall have been instituted and be continuing or be threatened by any person to restrain, modify or prevent the carrying out of the transactions contemplated hereby, or to seek damages in connection with such transactions, or that has or could have a material adverse effect on GVBT.

Section 9.04. Closing Documents. GVBT shall have executed and delivered the documents described in Section 2.04 above.

ARTICLE X

TERMINATION

Section 10.01. Termination.

(a) Notwithstanding anything to the contrary in this Agreement, this Agreement may be terminated and the Share Exchange and the other transactions contemplated by this Agreement shall be abandoned at any time prior to the Closing:

(i) by mutual written consent of the Shareholders and GVBT;

(ii) by either the Shareholders or GVBT in the event that a temporary restraining order, preliminary or permanent injunction or other judicial order preventing the consummation of the Share Exchange or any of the other transactions contemplated hereby shall have become final and non-appealable; provided , that , the party seeking to terminate this Agreement pursuant to this clause (ii) shall have used all commercially reasonable efforts to have such order, injunction or other order vacated;

(iii) by GVBT if GVBT is not then in material breach of this Agreement and if there shall have been any breach by the Shareholders (which has not been waived) of one or more of its representations or warranties, covenants or agreements set forth in this Agreement, which breach or breaches (A) would give rise to the failure of a condition set forth in Article VIII, and (B) shall not have been cured within thirty (30) days following receipt by the Shareholders of written notice of such breach, or such longer period in the event that such breach cannot reasonably be expected to be cured within such 30‑day period and the Shareholders are diligently pursuing such cure;

(iv) by the Shareholder if the Shareholders are not then in material breach of this Agreement and if there shall have been any breach by GVBT (which has not been waived) of one or more of its representations or warranties, covenants or agreements set forth in this Agreement, which breach or breaches (A) would give rise to the failure of a condition set forth in Article IX, and (B) shall not have been cured within thirty (30) days following receipt by GVBT of written notice of such breach; or

| 20 |

(b) In the event of termination by the Shareholders or GVBT pursuant to this Section 10.01, written notice thereof shall forthwith be given to the other Party and the transactions contemplated by this Agreement shall be terminated, without further action by any Party.

Section 10.02. Effect of Termination. If this Agreement is terminated and the transactions contemplated hereby are abandoned as described in Section 10.01, this Agreement shall become null and void and of no further force and effect, except for the provisions of (i) Section 10.01 and this Section 10.02. Nothing in this Section 10.02 shall be deemed to release any Party from any liability for any breach by such Party of the terms, conditions, covenants and other provisions of this Agreement or to impair the right of any Party to compel specific performance by any other Party of its obligations under this Agreement.

ARTICLE XI

POST-CLOSING COVENANTS

Section 11.01 Shareholders' Covenants . The Shareholders, jointly and severally, hereby covenant with GVBT and promises as follows:

(a) To maintain the books, records, accounting and financial statements of Lutu International and all operations related to its mining operations, in accordance with applicable accounting principles and practices.

(b) To maintain all of the legal requirements that permit Lutu International to continue its operations under all applicable laws and regulations of Cayman Islands.

(c) Not to incur any debt by Lutu International in any event whatsoever, except with the prior written consent of the Board of Directors of GVBT.

ARTICLE XII

MISCELLANEOUS

Section 12.01. Public Notices.

The Parties agree that all notices to third parties and all other publicity concerning the transactions contemplated by this Agreement shall be jointly planned and coordinated and no Party shall act unilaterally in this regard without the prior approval of the others, such approval not to be unreasonably withheld.

| 21 |

Section 12.02. Notices.

Any notice or other writing required or permitted to be given hereunder or for the purposes hereof shall be sufficiently given if delivered or faxed to the Party to whom it is given or, if mailed, by prepaid registered mail addressed to such Party at:

if to Woodhead, at:

PO Box 957,

Road Town, Tortola,

British Virgin Islands

if to Harcourt, at:

PO Box 957,

Road Town, Tortola,

British Virgin Islands

if to GVBT, at:

GVBT Corp.

c/o W. Scott Lawler, Esq.

Booth Udall Fuller PLC

1255 W Rio Salado Pkwy #215

Tempe, AZ 85281

or at such other address as the Party to whom such writing is to be given shall have last notified to the Party giving the same in the manner provided in this article. Any notice mailed shall be deemed to have been given and received on the fifth Business Day next following the date of its mailing unless at the time of mailing or within five (5) Business Days thereafter there occurs a postal interruption which could have the effect of delaying the mail in the ordinary and usual course, in which case any notice shall only be effectively given if actually delivered or sent by telecopy. Any notice delivered or faxed to the Party to whom it is addressed shall be deemed to have been given and received on the Business Day next following the day it was delivered or faxed.

| 22 |

Section 12.03. Severability.

If a court of competent jurisdiction determines that any one or more of the provisions contained in this Agreement is invalid, illegal or unenforceable in any respect in any jurisdiction, the validity, legality and enforceability of such provision or provisions shall not in any way be affected or impaired thereby in any other jurisdiction and the validity, legality and enforceability of the remaining provisions contained herein shall not in any way be affected or impaired thereby, unless in either case as a result of such determination this Agreement would fail in its essential purpose.

Section 12.04. Entire Agreement.

This Agreement constitutes the entire agreement between the Parties and supersedes all prior agreements and understandings, oral or written, by and between any of the Parties with respect to the subject matter hereof.

Section 12.05. Further Assurances.

The Parties shall with reasonable diligence, do all such things and provide all such reasonable assurances as may be required to consummate the transactions contemplated by this Agreement, and each Party shall provide such further documents or instruments required by the other Party as may be reasonably necessary or desirable to give effect to the purpose of this Agreement and carry out its provisions whether before or after the date of Share Issuance Closing or the date of Share Exchange Closing.

Section 12.06. Waiver.

Except as provided in this Article, no action taken or inaction pursuant to this Agreement will be deemed to constitute a waiver of compliance with any warranties, conditions or covenants contained in this Agreement and will not operate or be construed as a waiver of any subsequent breach, whether of a similar or dissimilar nature. No waiver of any right under this Agreement shall be binding unless executed in writing by the Party to be bound thereby.

Section 12.07. Counterparts.

This Agreement may be executed in as many counterparts as may be necessary or by facsimile and each such counterpart agreement or facsimile so executed shall be deemed to be an original and such counterparts and facsimile copies together shall constitute one and the same instrument and shall be valid and enforceable.

| 23 |

IN WITNESS WHEREOF the Parties hereto have set their hand and seal as of the day and year first above written.

|

Green Vision Biotechnology Corp., a Nevada corporation |

| |

|

| ||

|

By: |

/s/ Ma Wai Kin |

|

|

Name: |

Ma Wai Kin |

|

|

Title: |

President |

|

|

| ||

|

Woodhead Investment Limited, a British Virgin Islands corporation |

| |

|

| ||

|

By: |

/s/ Ho Irene Yuk Hay |

|

|

Name: |

Ho Irene Yuk Hay |

|

|

Title: |

Director |

|

|

| ||

|

Harcourt Capital Limited, a British Virgin Islands corporation |

| |

|

| ||

|

By: |

/s/ Lam Ching Wan |

|

|

Name: |

Lam Ching Wan |

|

|

Title: |

Director |

|

| 24 |

EXHIBIT “A”

CERTIFICATE OF NON-U.S. PERSON

Woodhead Investment Limited (the “Subscriber”) covenants, represents and warrants to Green Vision Biotechnology Corp. (the “Issuer”) that:

1. The representations and warranties contained herein are made by the Subscriber with the intent that they may be relied upon by the Issuer in determining the Subscriber’s suitability as a purchaser of shares of its capital stock (the “Shares”).

2. The Subscriber has received and read the Issuer’s annual report for the year ended January 31, 2017, and any amendments to such report (the “Annual Report”) and the Subscriber is familiar with all terms and provisions thereof.

3. The Subscriber confirms that the purchase of the Shares occurred in an “offshore transaction” in that:

(a) The Subscriber is not an “entity” in the United States

(b) At the time the Share Exchange Agreement between Subscriber and Issuer (the “Share Exchange Agreement”) was entered into, and as of the effective date of the Share Exchange Agreement, the Subscriber was outside of the United States.

(c) The Subscriber is not a U.S. Person. For purposes hereof, "U.S. Person" means:

(i) any natural person resident in the United States;

(ii) any partnership or corporation organized or incorporated under the laws of the United States;

(iii) any estate of which any trustee is a U.S. Person;

(iv) any trust of which any trustee is a U.S. Person;

(v) any agency or branch of a foreign entity located in the United States;

(vi) any non-discretionary account or similar account (other than an estate or trust) held by a dealer or other fiduciary organized, incorporated, or (if any individual) resident in the United States; and

(vii) any partnership or corporation if:

(a) organized or incorporated under the laws of any foreign jurisdiction; and

(b) formed by a U.S. Person principally for the purpose of investing in securities not registered under the Securities Act, unless it is organized or incorporated, and owned by accredited investors (as defined in Rule 501(1) under the Securities Act) who are not natural persons, estates or trusts.

| 25 |

4. The Subscriber has previously been advised that the Subscriber would have an opportunity to review all the pertinent facts concerning the Issuer, and to obtain any additional information which they might request, to the extent possible or obtainable, without unreasonable effort and expense, in order to verify the accuracy of the information contained in the Annual Report.

5. The Subscriber has personally communicated or been offered the opportunity to communicate with an executive officer of the Issuer to discuss the business and financial affairs of the Issuer, its products and activities, and its plans for the future. The Subscriber acknowledges that if the Subscriber would like to further avail itself of the opportunity to ask additional questions of the Issuer, the Issuer will make arrangements for such an opportunity on request.

6.The Subscriber has been advised that no accountant or attorney engaged by the Issuer is acting as its representative, accountant, or attorney.

May 12, 2017

Date

/s/ Ho Irene Yuk Hay

Duly authorized signatory for Subscriber

Ho Irene Yuk Hay, Director

(Print name of Subscriber)

| 26 |

EXHIBIT “B”

CERTIFICATE OF NON-U.S. PERSON

Harcourt Capital Limited (the “Subscriber”) covenants, represents and warrants to Green Vision Biotechnology Corp. (the “Issuer”) that:

1. The representations and warranties contained herein are made by the Subscriber with the intent that they may be relied upon by the Issuer in determining the Subscriber’s suitability as a purchaser of shares of its capital stock (the “Shares”).

2. The Subscriber has received and read the Issuer’s annual report for the year ended January 31, 2017, and any amendments to such report (the “Annual Report”) and the Subscriber is familiar with all terms and provisions thereof.

3. The Subscriber confirms that the purchase of the Shares occurred in an “offshore transaction” in that:

(a) The Subscriber is not an “entity” in the United States

(b) At the time the Share Exchange Agreement between Subscriber and Issuer (the “Share Exchange Agreement”) was entered into, and as of the effective date of the Share Exchange Agreement, the Subscriber was outside of the United States.

(c) The Subscriber is not a U.S. Person. For purposes hereof, "U.S. Person" means:

(i) any natural person resident in the United States;

(ii) any partnership or corporation organized or incorporated under the laws of the United States;

(iii) any estate of which any trustee is a U.S. Person;

(iv) any trust of which any trustee is a U.S. Person;

(v) any agency or branch of a foreign entity located in the United States;

(vi) any non-discretionary account or similar account (other than an estate or trust) held by a dealer or other fiduciary organized, incorporated, or (if any individual) resident in the United States; and

(vii) any partnership or corporation if:

(a) organized or incorporated under the laws of any foreign jurisdiction; and

(b) formed by a U.S. Person principally for the purpose of investing in securities not registered under the Securities Act, unless it is organized or incorporated, and owned by accredited investors (as defined in Rule 501(1) under the Securities Act) who are not natural persons, estates or trusts.

| 27 |

4. The Subscriber has previously been advised that the Subscriber would have an opportunity to review all the pertinent facts concerning the Issuer, and to obtain any additional information which they might request, to the extent possible or obtainable, without unreasonable effort and expense, in order to verify the accuracy of the information contained in the Annual Report.

5. The Subscriber has personally communicated or been offered the opportunity to communicate with an executive officer of the Issuer to discuss the business and financial affairs of the Issuer, its products and activities, and its plans for the future. The Subscriber acknowledges that if the Subscriber would like to further avail itself of the opportunity to ask additional questions of the Issuer, the Issuer will make arrangements for such an opportunity on request.

6.The Subscriber has been advised that no accountant or attorney engaged by the Issuer is acting as its representative, accountant, or attorney.

May 12, 2017

Date

/s/ Lam Ching Wan

Duly authorized signatory for Subscriber

Lam Ching Wan, Director

(Print name of Subscriber)

|

28 |